dnut-202201020001857154FY2021FALSE0.0625http://fasb.org/us-gaap/2021-01-31#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2021-01-31#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2021-01-31#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2021-01-31#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2021-01-31#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2021-01-31#LongTermDebtAndCapitalLeaseObligationsP1YP1YP1YP1YP1Y00018571542021-01-042022-01-0200018571542021-07-04iso4217:USD00018571542022-03-04xbrli:shares00018571542022-01-0200018571542021-01-030001857154us-gaap:ProductMember2021-01-042022-01-020001857154us-gaap:ProductMember2019-12-302021-01-030001857154us-gaap:ProductMember2018-12-312019-12-290001857154us-gaap:RoyaltyMember2021-01-042022-01-020001857154us-gaap:RoyaltyMember2019-12-302021-01-030001857154us-gaap:RoyaltyMember2018-12-312019-12-2900018571542019-12-302021-01-0300018571542018-12-312019-12-29iso4217:USDxbrli:shares0001857154us-gaap:CommonStockMember2018-12-300001857154us-gaap:AdditionalPaidInCapitalMember2018-12-300001857154dnut:ReceivablesFromStockholderNotesReceivableMember2018-12-300001857154us-gaap:AccumulatedTranslationAdjustmentMember2018-12-300001857154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-12-300001857154us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-300001857154us-gaap:RetainedEarningsMember2018-12-300001857154us-gaap:NoncontrollingInterestMember2018-12-3000018571542018-12-300001857154srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2018-12-300001857154srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:NoncontrollingInterestMember2018-12-300001857154srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-300001857154us-gaap:RetainedEarningsMember2018-12-312019-12-290001857154us-gaap:NoncontrollingInterestMember2018-12-312019-12-290001857154us-gaap:AccumulatedTranslationAdjustmentMember2018-12-312019-12-290001857154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-12-312019-12-290001857154us-gaap:AdditionalPaidInCapitalMember2018-12-312019-12-290001857154dnut:ReceivablesFromStockholderNotesReceivableMember2018-12-312019-12-290001857154us-gaap:CommonStockMember2019-12-290001857154us-gaap:AdditionalPaidInCapitalMember2019-12-290001857154dnut:ReceivablesFromStockholderNotesReceivableMember2019-12-290001857154us-gaap:AccumulatedTranslationAdjustmentMember2019-12-290001857154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-290001857154us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-290001857154us-gaap:RetainedEarningsMember2019-12-290001857154us-gaap:NoncontrollingInterestMember2019-12-2900018571542019-12-290001857154us-gaap:RetainedEarningsMember2019-12-302021-01-030001857154us-gaap:NoncontrollingInterestMember2019-12-302021-01-030001857154us-gaap:AccumulatedTranslationAdjustmentMember2019-12-302021-01-030001857154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-302021-01-030001857154us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-302021-01-030001857154us-gaap:AdditionalPaidInCapitalMember2019-12-302021-01-030001857154dnut:ReceivablesFromStockholderNotesReceivableMember2019-12-302021-01-030001857154us-gaap:CommonStockMember2021-01-030001857154us-gaap:AdditionalPaidInCapitalMember2021-01-030001857154dnut:ReceivablesFromStockholderNotesReceivableMember2021-01-030001857154us-gaap:AccumulatedTranslationAdjustmentMember2021-01-030001857154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-030001857154us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-030001857154us-gaap:RetainedEarningsMember2021-01-030001857154us-gaap:NoncontrollingInterestMember2021-01-030001857154us-gaap:RetainedEarningsMember2021-01-042022-01-020001857154us-gaap:NoncontrollingInterestMember2021-01-042022-01-020001857154us-gaap:AccumulatedTranslationAdjustmentMember2021-01-042022-01-020001857154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-042022-01-020001857154us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-042022-01-020001857154us-gaap:CommonStockMember2021-01-042022-01-020001857154us-gaap:AdditionalPaidInCapitalMember2021-01-042022-01-020001857154dnut:ReceivablesFromStockholderNotesReceivableMember2021-01-042022-01-020001857154us-gaap:CommonStockMember2022-01-020001857154us-gaap:AdditionalPaidInCapitalMember2022-01-020001857154dnut:ReceivablesFromStockholderNotesReceivableMember2022-01-020001857154us-gaap:AccumulatedTranslationAdjustmentMember2022-01-020001857154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-020001857154us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-020001857154us-gaap:RetainedEarningsMember2022-01-020001857154us-gaap:NoncontrollingInterestMember2022-01-02dnut:segmentdnut:storednut:country0001857154dnut:CompanyOwnedShopsMember2022-01-020001857154us-gaap:FranchiseMember2022-01-020001857154dnut:CompanyOwnedShopsMemberdnut:KrispyKremeUSAndCanadaMember2022-01-020001857154dnut:CompanyOwnedShopsMemberdnut:KrispyKremeInternationalMember2022-01-020001857154dnut:InsomniaCookiesHoldingsLLCInsomniaCookiesMemberdnut:CompanyOwnedShopsMember2022-01-020001857154us-gaap:FranchiseMemberdnut:KrispyKremeUSAndCanadaMember2022-01-020001857154us-gaap:FranchiseMemberdnut:KrispyKremeInternationalMember2022-01-020001857154dnut:KrispyKremeUSAndCanadaMember2022-01-020001857154dnut:KrispyKremeInternationalMember2022-01-020001857154dnut:InsomniaCookiesHoldingsLLCInsomniaCookiesMember2022-01-020001857154us-gaap:IPOMember2021-07-012021-07-010001857154us-gaap:CommonStockMemberus-gaap:IPOMember2021-07-010001857154dnut:KrispyKremeHoldingsIncKKHIMemberus-gaap:SecuredDebtMemberdnut:TermLoanFacilityMember2021-06-100001857154dnut:KrispyKremeHoldingsIncKKHIMemberus-gaap:SecuredDebtMemberdnut:TermLoanFacilityMember2021-06-172021-06-170001857154dnut:KrispyKremeHoldingsIncKKHIMemberus-gaap:SecuredDebtMemberdnut:TermLoanFacilityMember2021-06-17xbrli:pure0001857154us-gaap:SecuredDebtMemberdnut:TermLoanFacilityMember2021-07-072021-07-070001857154us-gaap:SecuredDebtMemberdnut:TermLoanFacilityMember2021-07-070001857154us-gaap:NoncontrollingInterestMember2021-06-282021-06-2800018571542021-06-282021-06-2800018571542021-06-302021-06-300001857154us-gaap:NotesPayableOtherPayablesMember2021-07-040001857154us-gaap:NotesPayableOtherPayablesMember2021-04-052021-07-0400018571542021-04-052021-07-040001857154dnut:ExecutiveOfficersSharesRepurchasedAtPricePaidByUnderwritersMember2021-07-052021-08-170001857154dnut:ExecutiveOfficersShareRepurchasedForPaymentOfWithholdingTaxesMember2021-07-052021-08-170001857154us-gaap:OverAllotmentOptionMember2021-08-022021-08-0200018571542021-07-012021-08-020001857154us-gaap:ShippingAndHandlingMember2021-01-042022-01-020001857154us-gaap:ShippingAndHandlingMember2019-12-302021-01-030001857154us-gaap:ShippingAndHandlingMember2018-12-312019-12-290001857154us-gaap:FranchiseMember2021-01-042022-01-020001857154us-gaap:AdvertisingMember2021-01-042022-01-020001857154us-gaap:AdvertisingMember2019-12-302021-01-030001857154us-gaap:AdvertisingMember2018-12-312019-12-290001857154dnut:GiftCardsMember2022-01-020001857154dnut:GiftCardsMember2021-01-030001857154dnut:BreakageRevenueMember2022-01-020001857154dnut:BreakageRevenueMember2021-01-030001857154dnut:CustomerLoyaltyProgramMember2022-01-020001857154dnut:CustomerLoyaltyProgramMember2021-01-030001857154srt:MinimumMemberus-gaap:BuildingMember2021-01-042022-01-020001857154us-gaap:BuildingMembersrt:MaximumMember2021-01-042022-01-020001857154srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2021-01-042022-01-020001857154srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2021-01-042022-01-020001857154srt:MinimumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-01-042022-01-020001857154us-gaap:SoftwareAndSoftwareDevelopmentCostsMembersrt:MaximumMember2021-01-042022-01-020001857154srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201602Member2018-12-310001857154srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201602Member2018-12-312018-12-310001857154us-gaap:AccountingStandardsUpdate201602Member2018-12-3100018571542018-12-310001857154dnut:KrispyKremeCanadaShops2021Member2021-10-040001857154dnut:KrispyKremeCanadaShops2021Member2021-10-042021-10-040001857154dnut:KrispyKremeCanadaShopsMember2021-10-040001857154dnut:KrispyKremeUnitedStatesShops2021Member2021-01-042021-04-04dnut:acquiredBusiness0001857154dnut:KrispyKremeUnitedStatesShops2021Member2021-04-040001857154dnut:KrispyKremeCanadaShops2021Memberdnut:USAndCanadaSegmentMember2021-04-040001857154dnut:KrispyKremeUnitedStatesShops2021Memberdnut:USAndCanadaSegmentMember2021-04-040001857154dnut:KrispyKremeUSAndCanada2021Member2021-04-040001857154dnut:KrispyKremeCanadaShops2021Memberdnut:USAndCanadaSegmentMember2022-01-020001857154dnut:KrispyKremeUnitedStatesShops2021Memberdnut:USAndCanadaSegmentMember2022-01-020001857154dnut:KrispyKremeUSAndCanada2021Member2022-01-020001857154dnut:KrispyKremeCanadaShops2021Memberdnut:USAndCanadaSegmentMember2021-01-030001857154dnut:KrispyKremeUnitedStatesShops2021Memberdnut:USAndCanadaSegmentMember2021-01-030001857154dnut:KrispyKremeUSAndCanada2021Member2021-01-030001857154dnut:KrispyKremeUSAndCanada2021Member2021-01-042022-01-020001857154dnut:KrispyKremeDoughnutJapanCoLtdKKJapanMember2022-01-020001857154dnut:KrispyKremeDoughnutJapanCoLtdKKJapanMember2020-12-082020-12-080001857154dnut:KrispyKremeDoughnutJapanCoLtdKKJapanMember2020-12-080001857154dnut:KrispyKremeDoughnutJapanCoLtdKKJapanMember2019-12-302021-01-030001857154dnut:KrispyKremeUnitedStatesShops2020Member2019-12-302021-01-030001857154dnut:KrispyKremeUnitedStatesShops2020Member2021-01-030001857154dnut:MarketDevelopmentSegmentMemberdnut:KrispyKremeDoughnutJapanCoLtdKKJapanMember2021-01-030001857154dnut:KrispyKremeUnitedStatesShops2020Memberdnut:USAndCanadaSegmentMember2021-01-030001857154dnut:KKJapanAndKKUSShopsMember2021-01-030001857154dnut:KKJapanAndKKUSShopsMember2019-12-302021-01-030001857154dnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMember2019-11-190001857154dnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMember2019-11-192019-11-190001857154dnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMember2018-12-312019-12-290001857154dnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMember2019-12-302021-01-030001857154dnut:WKSKrispyKremeMember2019-11-180001857154dnut:WKSKrispyKremeMemberdnut:WKSHoldingsCorporationWKSHoldingsMember2019-11-180001857154dnut:WKSKrispyKremeMember2019-11-182019-11-180001857154dnut:WKSKrispyKremeMember2019-11-180001857154dnut:WKSHoldingsCorporationWKSHoldingsMember2019-11-180001857154dnut:WKSKrispyKremeMember2019-12-302021-01-030001857154dnut:WestwardDoughLLCMemberdnut:WKSKrispyKremeMember2019-11-180001857154dnut:WKSKrispyKremeMember2018-12-312019-12-290001857154dnut:KrispyKremeUnitedStatesShops2019Member2018-12-312019-12-290001857154dnut:KrispyKremeUnitedStatesShops2019Member2019-12-290001857154dnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMemberdnut:InternationalSegmentMember2019-12-290001857154dnut:WKSKrispyKremeMemberdnut:USAndCanadaSegmentMember2019-12-290001857154dnut:KrispyKremeUnitedStatesShops2019Memberdnut:USAndCanadaSegmentMember2019-12-290001857154dnut:KKMexicoWKSKrispyKremeAndOtherKKUSShopsMember2019-12-290001857154dnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMemberdnut:InternationalSegmentMember2021-01-030001857154dnut:WKSKrispyKremeMemberdnut:USAndCanadaSegmentMember2021-01-030001857154dnut:KrispyKremeUnitedStatesShops2019Memberdnut:USAndCanadaSegmentMember2021-01-030001857154dnut:KKMexicoWKSKrispyKremeAndOtherKKUSShopsMember2021-01-030001857154dnut:KKMexicoWKSKrispyKremeAndOtherKKUSShopsMember2018-12-312019-12-290001857154us-gaap:LandMember2022-01-020001857154us-gaap:LandMember2021-01-030001857154us-gaap:BuildingMember2022-01-020001857154us-gaap:BuildingMember2021-01-030001857154us-gaap:LeaseholdImprovementsMember2022-01-020001857154us-gaap:LeaseholdImprovementsMember2021-01-030001857154us-gaap:MachineryAndEquipmentMember2022-01-020001857154us-gaap:MachineryAndEquipmentMember2021-01-030001857154us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-01-020001857154us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-01-030001857154us-gaap:ConstructionInProgressMember2022-01-020001857154us-gaap:ConstructionInProgressMember2021-01-030001857154dnut:USAndCanadaSegmentMember2019-12-290001857154dnut:InternationalSegmentMember2019-12-290001857154dnut:MarketDevelopmentSegmentMember2019-12-290001857154dnut:USAndCanadaSegmentMember2019-12-302021-01-030001857154dnut:InternationalSegmentMember2019-12-302021-01-030001857154dnut:MarketDevelopmentSegmentMember2019-12-302021-01-030001857154dnut:USAndCanadaSegmentMember2021-01-030001857154dnut:InternationalSegmentMember2021-01-030001857154dnut:MarketDevelopmentSegmentMember2021-01-030001857154dnut:USAndCanadaSegmentMember2021-01-042022-01-020001857154dnut:InternationalSegmentMember2021-01-042022-01-020001857154dnut:MarketDevelopmentSegmentMember2021-01-042022-01-020001857154dnut:USAndCanadaSegmentMember2022-01-020001857154dnut:InternationalSegmentMember2022-01-020001857154dnut:MarketDevelopmentSegmentMember2022-01-020001857154us-gaap:TradeNamesMember2022-01-020001857154us-gaap:TradeNamesMember2021-01-030001857154us-gaap:FranchiseRightsMember2022-01-020001857154us-gaap:FranchiseRightsMember2021-01-030001857154us-gaap:CustomerRelationshipsMember2022-01-020001857154us-gaap:CustomerRelationshipsMember2021-01-030001857154dnut:ReacquiredFranchiseRightsMember2022-01-020001857154dnut:ReacquiredFranchiseRightsMember2021-01-030001857154us-gaap:ComputerSoftwareIntangibleAssetMember2022-01-020001857154us-gaap:ComputerSoftwareIntangibleAssetMember2021-01-030001857154us-gaap:SecuredDebtMemberdnut:A2019FacilityMember2022-01-020001857154us-gaap:SecuredDebtMemberdnut:A2019FacilityMember2021-01-030001857154us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberdnut:A2019FacilityMember2022-01-020001857154us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberdnut:A2019FacilityMember2021-01-030001857154dnut:PriorFacilityMember2019-05-310001857154us-gaap:SecuredDebtMemberdnut:PriorFacilityMember2019-05-310001857154us-gaap:RevolvingCreditFacilityMemberdnut:PriorFacilityMember2019-05-310001857154us-gaap:SecuredDebtMemberdnut:PriorFacilityAmendmentOneMember2019-05-310001857154us-gaap:RevolvingCreditFacilityMemberdnut:PriorFacilityAmendmentOneMember2019-05-310001857154dnut:PriorFacilityAmendmentTwoMemberus-gaap:SecuredDebtMember2019-05-310001857154dnut:PriorFacilityAmendmentThreeMemberus-gaap:SecuredDebtMember2019-05-310001857154dnut:PriorFacilityMember2019-06-012019-06-300001857154dnut:A2019FacilityMember2019-06-300001857154us-gaap:SecuredDebtMemberdnut:A2019FacilityMember2019-06-300001857154us-gaap:RevolvingCreditFacilityMemberdnut:A2019FacilityMember2019-06-300001857154us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberdnut:A2019FacilityMember2019-06-300001857154dnut:A2019FacilityMember2022-01-020001857154dnut:A2019FacilityMember2021-01-030001857154dnut:AlternateBaseRateFederalFundsRateMemberdnut:A2019FacilityMember2021-01-042022-01-020001857154dnut:AlternateBaseRateOneMonthLIBORMemberdnut:A2019FacilityMember2021-01-042022-01-020001857154us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMemberdnut:A2019FacilityMember2021-01-042022-01-020001857154us-gaap:LondonInterbankOfferedRateLIBORMemberdnut:A2019FacilityMembersrt:MaximumMember2021-01-042022-01-020001857154us-gaap:BaseRateMembersrt:MinimumMemberdnut:A2019FacilityMember2021-01-042022-01-020001857154us-gaap:BaseRateMemberdnut:A2019FacilityMembersrt:MaximumMember2021-01-042022-01-020001857154us-gaap:LondonInterbankOfferedRateLIBORMemberdnut:A2019FacilityMember2021-01-042022-01-020001857154us-gaap:LondonInterbankOfferedRateLIBORMemberdnut:A2019FacilityMember2019-12-302021-01-030001857154us-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberdnut:A2019FacilityMember2021-01-042022-01-020001857154us-gaap:RevolvingCreditFacilityMemberdnut:A2019FacilityMembersrt:MaximumMember2021-01-042022-01-020001857154us-gaap:RevolvingCreditFacilityMemberdnut:A2019FacilityMember2021-01-042022-01-020001857154us-gaap:RevolvingCreditFacilityMemberdnut:A2019FacilityMember2019-12-302021-01-030001857154us-gaap:RevolvingCreditFacilityMemberdnut:A2019FacilityMember2018-12-312019-12-290001857154us-gaap:SubsequentEventMemberdnut:A2019FacilityMember2022-03-110001857154us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberdnut:A2019FacilityMember2021-07-072021-07-070001857154us-gaap:SecuredDebtMemberdnut:TermLoanFacilityMember2021-01-042022-01-02dnut:day0001857154dnut:KrispyKremeHoldingsIncKKHIMemberus-gaap:SecuredDebtMemberdnut:TermLoanFacilityMember2021-01-042022-01-020001857154us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-042022-01-020001857154us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-12-302021-01-030001857154us-gaap:SellingGeneralAndAdministrativeExpensesMember2018-12-312019-12-290001857154us-gaap:OperatingExpenseMember2021-01-042022-01-020001857154us-gaap:OperatingExpenseMember2019-12-302021-01-030001857154us-gaap:OperatingExpenseMember2018-12-312019-12-2900018571542021-12-31dnut:property00018571542021-12-012021-12-310001857154us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-01-020001857154us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-01-020001857154us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-01-020001857154us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-01-020001857154us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-01-020001857154us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-01-020001857154us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-01-020001857154us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-01-020001857154us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-01-020001857154us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-01-020001857154us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-01-020001857154us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-01-020001857154us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-01-030001857154us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-01-030001857154us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-01-030001857154us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-01-030001857154us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-01-030001857154us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-01-030001857154us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-01-030001857154us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-01-030001857154us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-01-030001857154us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-01-030001857154us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-01-030001857154us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-01-030001857154us-gaap:CommodityContractMemberus-gaap:NondesignatedMember2022-01-022022-01-02utr:gal0001857154us-gaap:CommodityContractMemberus-gaap:NondesignatedMember2021-01-032021-01-030001857154us-gaap:CommodityContractMemberus-gaap:NondesignatedMember2022-01-020001857154us-gaap:CommodityContractMemberus-gaap:NondesignatedMember2021-01-030001857154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2016-11-300001857154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2018-05-310001857154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2018-11-300001857154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2019-06-300001857154us-gaap:InterestRateContractMember2019-06-300001857154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2020-02-290001857154us-gaap:DesignatedAsHedgingInstrumentMemberdnut:InterestRateContractFebruary2020SwapAgreementMember2020-02-290001857154us-gaap:DesignatedAsHedgingInstrumentMemberdnut:InterestRateContractNewInterestRateSwapAgreementMember2020-02-290001857154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2022-01-020001857154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2021-01-030001857154us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2022-01-020001857154us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2021-01-030001857154us-gaap:ForeignExchangeContractMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMember2022-01-020001857154us-gaap:ForeignExchangeContractMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMember2021-01-030001857154us-gaap:CommodityContractMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMember2022-01-020001857154us-gaap:CommodityContractMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMember2021-01-030001857154us-gaap:NondesignatedMember2022-01-020001857154us-gaap:NondesignatedMember2021-01-030001857154us-gaap:ForeignExchangeContractMemberdnut:AccruedLiabilitiesCurrentMemberus-gaap:NondesignatedMember2022-01-020001857154us-gaap:ForeignExchangeContractMemberdnut:AccruedLiabilitiesCurrentMemberus-gaap:NondesignatedMember2021-01-030001857154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMemberdnut:AccruedLiabilitiesCurrentMember2022-01-020001857154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMemberdnut:AccruedLiabilitiesCurrentMember2021-01-030001857154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMemberdnut:DeferredCreditsAndOtherLiabilitiesNoncurrentMember2022-01-020001857154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMemberdnut:DeferredCreditsAndOtherLiabilitiesNoncurrentMember2021-01-030001857154us-gaap:DesignatedAsHedgingInstrumentMember2022-01-020001857154us-gaap:DesignatedAsHedgingInstrumentMember2021-01-030001857154us-gaap:InterestRateContractMemberdnut:InterestIncomeExpenseMember2021-01-042022-01-020001857154us-gaap:InterestRateContractMemberdnut:InterestIncomeExpenseMember2019-12-302021-01-030001857154us-gaap:InterestRateContractMemberdnut:InterestIncomeExpenseMember2018-12-312019-12-290001857154us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2021-01-042022-01-020001857154us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2019-12-302021-01-030001857154us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2018-12-312019-12-290001857154us-gaap:CommodityContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2021-01-042022-01-020001857154us-gaap:CommodityContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2019-12-302021-01-030001857154us-gaap:CommodityContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2018-12-312019-12-290001857154dnut:A401kPlanMember2021-01-042022-01-020001857154dnut:A401kPlanMemberdnut:MatchingContributionTrancheOneMember2021-01-042022-01-020001857154dnut:A401kPlanMemberdnut:MatchingContributionTrancheTwoMember2021-01-042022-01-020001857154dnut:KKUKAndIrelandContributionPlansMember2021-01-042022-01-020001857154dnut:InsomniaCookiesContributionPlanMember2021-01-042022-01-020001857154dnut:AustraliaPlanMember2021-01-042022-01-020001857154dnut:NewZealandPlanMember2021-01-042022-01-020001857154dnut:CanadaPlanMember2021-01-042022-01-020001857154srt:ExecutiveOfficerMemberdnut:A401kMirrorPlanMemberus-gaap:NonqualifiedPlanMember2022-01-020001857154srt:ExecutiveOfficerMemberdnut:A401kMirrorPlanMemberus-gaap:NonqualifiedPlanMember2021-01-030001857154dnut:MexicoSeniorityPremiumPlanMember2021-01-042022-01-020001857154dnut:MexicoTerminationIndemnityPlanMember2021-01-042022-01-020001857154dnut:RestrictedStockUnitsRSUsFiftyFourMonthVestingMember2021-01-042022-01-020001857154dnut:RestrictedStockUnitsRSUsSixtyMonthVestingPeriodMember2021-01-042022-01-020001857154dnut:RestrictedStockUnitsRSUsSixtyMonthVestingPeriodMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-042022-01-020001857154dnut:RestrictedStockUnitsRSUsSixtyMonthVestingPeriodMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-01-042022-01-020001857154us-gaap:ShareBasedCompensationAwardTrancheThreeMemberdnut:RestrictedStockUnitsRSUsSixtyMonthVestingPeriodMember2021-01-042022-01-020001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeIncKKIMember2019-12-290001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeIncKKIMember2019-12-302021-01-030001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeIncKKIMember2021-01-030001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeIncKKIMember2021-01-042022-01-020001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeIncKKIMember2022-01-020001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeHoldingUKLtdKKUKMember2019-12-290001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeHoldingUKLtdKKUKMember2019-12-302021-01-030001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeHoldingUKLtdKKUKMember2021-01-030001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeHoldingUKLtdKKUKMember2021-01-042022-01-020001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeHoldingUKLtdKKUKMember2022-01-020001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:InsomniaCookiesHoldingsLLCInsomniaCookiesMember2019-12-290001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:InsomniaCookiesHoldingsLLCInsomniaCookiesMember2019-12-302021-01-030001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:InsomniaCookiesHoldingsLLCInsomniaCookiesMember2021-01-030001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:InsomniaCookiesHoldingsLLCInsomniaCookiesMember2021-01-042022-01-020001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:InsomniaCookiesHoldingsLLCInsomniaCookiesMember2022-01-020001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeHoldingsPtyLtdKKAustraliaMember2019-12-290001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeHoldingsPtyLtdKKAustraliaMember2019-12-302021-01-030001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeHoldingsPtyLtdKKAustraliaMember2021-01-030001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeHoldingsPtyLtdKKAustraliaMember2021-01-042022-01-020001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeHoldingsPtyLtdKKAustraliaMember2022-01-020001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMember2019-12-290001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMember2019-12-302021-01-030001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMember2021-01-030001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMember2021-01-042022-01-020001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMember2022-01-020001857154us-gaap:RestrictedStockUnitsRSUMember2021-01-042022-01-020001857154us-gaap:RestrictedStockUnitsRSUMember2019-12-302021-01-030001857154us-gaap:RestrictedStockUnitsRSUMember2018-12-312019-12-290001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeIncKKIMember2018-12-312019-12-290001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeHoldingUKLtdKKUKMember2018-12-312019-12-290001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:InsomniaCookiesHoldingsLLCInsomniaCookiesMember2018-12-312019-12-290001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMember2018-12-312019-12-290001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeHoldingsPtyLtdKKAustraliaMember2018-12-312019-12-290001857154us-gaap:EmployeeStockOptionMember2021-01-042022-01-020001857154us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-042022-01-020001857154us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-01-042022-01-020001857154us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2021-01-042022-01-020001857154us-gaap:EmployeeStockOptionMemberdnut:KrispyKremeIncKKIMember2021-01-042022-01-020001857154us-gaap:EmployeeStockOptionMemberdnut:KrispyKremeIncKKIMember2019-12-302021-01-030001857154dnut:KrispyKremeIncKKIMember2021-01-030001857154dnut:KrispyKremeIncKKIMember2021-01-042022-01-020001857154dnut:KrispyKremeIncKKIMember2022-01-020001857154us-gaap:EmployeeStockOptionMember2019-12-302021-01-030001857154us-gaap:EmployeeStockOptionMember2018-12-312019-12-290001857154us-gaap:EmployeeStockOptionMemberdnut:KrispyKremeIncKKIMember2022-01-020001857154us-gaap:OtherNoncurrentAssetsMember2022-01-020001857154us-gaap:OtherNoncurrentAssetsMember2021-01-030001857154dnut:DeferredIncomeTaxLiabilitiesNetMember2022-01-020001857154dnut:DeferredIncomeTaxLiabilitiesNetMember2021-01-030001857154us-gaap:StateAndLocalJurisdictionMember2022-01-020001857154us-gaap:DomesticCountryMember2022-01-020001857154us-gaap:StateAndLocalJurisdictionMember2021-01-030001857154us-gaap:DomesticCountryMember2021-01-030001857154us-gaap:ForeignCountryMember2022-01-020001857154us-gaap:ForeignCountryMember2021-01-030001857154srt:MinimumMember2022-01-020001857154srt:MaximumMember2022-01-020001857154dnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMember2022-01-020001857154dnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMember2021-01-030001857154dnut:K2AsiaLitigationMember2009-04-072009-04-070001857154dnut:InsomniaCookiesLitigationEmployeeWagesMember2021-03-112021-03-11dnut:equityMethodInvestment0001857154dnut:KremeWorksUSALLCMember2022-01-020001857154dnut:KremeWorksUSALLCMember2021-01-030001857154dnut:KremeWorksCanadaLPMember2021-01-030001857154dnut:KremeWorksCanadaLPMember2022-01-020001857154us-gaap:EquityMethodInvesteeMember2022-01-020001857154us-gaap:EquityMethodInvesteeMember2021-01-030001857154dnut:SalesOfIngredientsAndEquipmentToFranchiseesMemberus-gaap:EquityMethodInvesteeMember2021-01-042022-01-020001857154dnut:SalesOfIngredientsAndEquipmentToFranchiseesMemberus-gaap:EquityMethodInvesteeMember2019-12-302021-01-030001857154dnut:SalesOfIngredientsAndEquipmentToFranchiseesMemberus-gaap:EquityMethodInvesteeMember2018-12-312019-12-290001857154dnut:RoyaltyRevenuesFromFranchiseesMemberus-gaap:EquityMethodInvesteeMember2021-01-042022-01-020001857154dnut:RoyaltyRevenuesFromFranchiseesMemberus-gaap:EquityMethodInvesteeMember2019-12-302021-01-030001857154dnut:RoyaltyRevenuesFromFranchiseesMemberus-gaap:EquityMethodInvesteeMember2018-12-312019-12-290001857154dnut:KeurigDrPepperIncKDPMembersrt:AffiliatedEntityMemberdnut:LicensingRevenuesMember2021-01-042022-01-020001857154dnut:KeurigDrPepperIncKDPMembersrt:AffiliatedEntityMemberdnut:LicensingRevenuesMember2019-12-302021-01-030001857154dnut:KeurigDrPepperIncKDPMembersrt:AffiliatedEntityMemberdnut:LicensingRevenuesMember2018-12-312019-12-290001857154dnut:AdvisoryServicesAgreementMembersrt:AffiliatedEntityMemberdnut:BDTCapitalPartnersLLCBDTMember2021-01-042022-01-020001857154dnut:AdvisoryServicesAgreementMembersrt:AffiliatedEntityMemberdnut:BDTCapitalPartnersLLCBDTMember2019-12-302021-01-030001857154dnut:AdvisoryServicesAgreementMembersrt:AffiliatedEntityMemberdnut:BDTCapitalPartnersLLCBDTMember2018-12-312019-12-290001857154dnut:ValuationAssistanceInPreparationForIPOMembersrt:AffiliatedEntityMemberdnut:BDTCapitalPartnersLLCBDTMember2021-01-042022-01-020001857154dnut:ValuationAssistanceInPreparationForIPOMembersrt:AffiliatedEntityMemberdnut:BDTCapitalPartnersLLCBDTMember2018-12-312019-12-290001857154dnut:ValuationAssistanceInPreparationForIPOMembersrt:AffiliatedEntityMemberdnut:BDTCapitalPartnersLLCBDTMember2019-12-302021-01-030001857154srt:AffiliatedEntityMemberdnut:KrispyKremeByJABHoldingCompanyJABMember2021-01-030001857154dnut:OtherJABPortfolioCompaniesMembersrt:AffiliatedEntityMember2021-01-030001857154srt:AffiliatedEntityMemberdnut:KrispyKremeByJABHoldingCompanyJABMember2022-01-020001857154dnut:KrispyKremeGPKKGPMemberdnut:SeniorUnsecuredNoteTheOriginalAgreementMembersrt:AffiliatedEntityMemberus-gaap:UnsecuredDebtMember2017-12-310001857154dnut:KrispyKremeGPKKGPMembersrt:AffiliatedEntityMemberus-gaap:UnsecuredDebtMemberdnut:SeniorUnsecuredNoteTheAdditionalAgreementMember2019-04-300001857154dnut:KrispyKremeGPKKGPMembersrt:AffiliatedEntityMemberus-gaap:UnsecuredDebtMember2021-01-030001857154dnut:KrispyKremeGPKKGPMembersrt:AffiliatedEntityMemberus-gaap:UnsecuredDebtMember2021-01-042022-01-020001857154dnut:KrispyKremeGPKKGPMembersrt:AffiliatedEntityMemberus-gaap:UnsecuredDebtMember2019-12-302021-01-030001857154dnut:KrispyKremeGPKKGPMembersrt:AffiliatedEntityMemberus-gaap:UnsecuredDebtMember2018-12-312019-12-290001857154srt:AffiliatedEntityMember2022-01-020001857154srt:AffiliatedEntityMember2021-01-030001857154dnut:FinishedProductInShopsMember2021-01-042022-01-020001857154dnut:FinishedProductInShopsMember2019-12-302021-01-030001857154dnut:FinishedProductInShopsMember2018-12-312019-12-290001857154dnut:MixAndEquipmentRevenueFromFranchiseesMember2021-01-042022-01-020001857154dnut:MixAndEquipmentRevenueFromFranchiseesMember2019-12-302021-01-030001857154dnut:MixAndEquipmentRevenueFromFranchiseesMember2018-12-312019-12-2900018571542022-01-032022-01-0200018571542023-01-022022-01-0200018571542024-01-012022-01-0200018571542025-12-302022-01-0200018571542026-01-052022-01-0200018571542027-01-042022-01-020001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeIncKKIMember2021-01-042022-01-020001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeIncKKIMember2019-12-302021-01-030001857154us-gaap:RestrictedStockUnitsRSUMemberdnut:KrispyKremeIncKKIMember2018-12-312019-12-290001857154dnut:KrispyKremeHoldingUKLtdKKUKMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-042022-01-020001857154dnut:KrispyKremeHoldingUKLtdKKUKMemberus-gaap:RestrictedStockUnitsRSUMember2019-12-302021-01-030001857154dnut:KrispyKremeHoldingUKLtdKKUKMemberus-gaap:RestrictedStockUnitsRSUMember2018-12-312019-12-290001857154dnut:InsomniaCookiesHoldingsLLCInsomniaCookiesMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-042022-01-020001857154dnut:InsomniaCookiesHoldingsLLCInsomniaCookiesMemberus-gaap:RestrictedStockUnitsRSUMember2019-12-302021-01-030001857154dnut:InsomniaCookiesHoldingsLLCInsomniaCookiesMemberus-gaap:RestrictedStockUnitsRSUMember2018-12-312019-12-290001857154dnut:KrispyKremeHoldingsPtyLtdKKAustraliaMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-042022-01-020001857154dnut:KrispyKremeHoldingsPtyLtdKKAustraliaMemberus-gaap:RestrictedStockUnitsRSUMember2019-12-302021-01-030001857154dnut:KrispyKremeHoldingsPtyLtdKKAustraliaMemberus-gaap:RestrictedStockUnitsRSUMember2018-12-312019-12-290001857154dnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-042022-01-020001857154dnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMemberus-gaap:RestrictedStockUnitsRSUMember2019-12-302021-01-030001857154dnut:KrispyKremeMexicoSDeRLDeCVKKMexicoMemberus-gaap:RestrictedStockUnitsRSUMember2018-12-312019-12-290001857154us-gaap:EmployeeStockOptionMemberdnut:KrispyKremeIncKKIMember2021-01-042022-01-020001857154us-gaap:OperatingSegmentsMemberdnut:USAndCanadaSegmentMember2021-01-042022-01-020001857154us-gaap:OperatingSegmentsMemberdnut:USAndCanadaSegmentMember2019-12-302021-01-030001857154us-gaap:OperatingSegmentsMemberdnut:USAndCanadaSegmentMember2018-12-312019-12-290001857154us-gaap:OperatingSegmentsMemberdnut:InternationalSegmentMember2021-01-042022-01-020001857154us-gaap:OperatingSegmentsMemberdnut:InternationalSegmentMember2019-12-302021-01-030001857154us-gaap:OperatingSegmentsMemberdnut:InternationalSegmentMember2018-12-312019-12-290001857154us-gaap:OperatingSegmentsMemberdnut:MarketDevelopmentSegmentMember2021-01-042022-01-020001857154us-gaap:OperatingSegmentsMemberdnut:MarketDevelopmentSegmentMember2019-12-302021-01-030001857154us-gaap:OperatingSegmentsMemberdnut:MarketDevelopmentSegmentMember2018-12-312019-12-290001857154us-gaap:CorporateNonSegmentMember2021-01-042022-01-020001857154us-gaap:CorporateNonSegmentMember2019-12-302021-01-030001857154us-gaap:CorporateNonSegmentMember2018-12-312019-12-290001857154dnut:KrispyKremeByJABHoldingCompanyJABMember2019-12-302021-01-030001857154country:US2021-01-042022-01-020001857154country:US2019-12-302021-01-030001857154country:US2018-12-312019-12-290001857154country:GB2021-01-042022-01-020001857154country:GB2019-12-302021-01-030001857154country:GB2018-12-312019-12-290001857154dnut:AustraliaNewZealandMember2021-01-042022-01-020001857154dnut:AustraliaNewZealandMember2019-12-302021-01-030001857154dnut:AustraliaNewZealandMember2018-12-312019-12-290001857154country:MX2021-01-042022-01-020001857154country:MX2019-12-302021-01-030001857154country:MX2018-12-312019-12-290001857154dnut:AllOtherMember2021-01-042022-01-020001857154dnut:AllOtherMember2019-12-302021-01-030001857154dnut:AllOtherMember2018-12-312019-12-290001857154country:US2022-01-020001857154country:US2021-01-030001857154country:US2019-12-290001857154country:GB2022-01-020001857154country:GB2021-01-030001857154country:GB2019-12-290001857154dnut:AustraliaNewZealandMember2022-01-020001857154dnut:AustraliaNewZealandMember2021-01-030001857154dnut:AustraliaNewZealandMember2019-12-290001857154country:MX2022-01-020001857154country:MX2021-01-030001857154country:MX2019-12-290001857154dnut:AllOtherMember2022-01-020001857154dnut:AllOtherMember2021-01-030001857154dnut:AllOtherMember2019-12-290001857154us-gaap:SubsequentEventMember2022-02-092022-02-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 10-K

_________________________

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 2, 2022

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission file number: 001-04321

Krispy Kreme, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 37-1701311 | |

(State or other jurisdiction of incorporation) | (IRS Employer Identification No.) | |

2116 Hawkins Street, Charlotte, North Carolina 28203

(Address of principal executive offices)

(800) 457-4779

(Registrant's telephone number, including area code)

_________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common stock, $0.01 par value per share | | DNUT | | Nasdaq Global Select Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the registrant on July 4, 2021, based on the closing price of $19.12 for shares of the registrant’s common stock as reported by the Nasdaq Global Select Market, was approximately $1.8 billion. Shares of common stock beneficially owned by each executive officer, director, and holder of more than 10% of our common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

APPLICABLE ONLY TO CORPORATE ISSUERS:

The registrant had outstanding 167,250,855 shares of common stock as of March 4, 2022.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the registrant’s Annual Meeting of Shareholders to be held on May 17, 2022 have been incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

| | | | | | | | |

| | Pages |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| (PCAOB ID Number 248) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

PART I

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words “plan,” “believe,” “may,” “could,” “will,” “should,” “would,” “anticipate,” “estimate,” “expect,” “intend,” “objective,” “seek,” “strive” or similar words, or the negative of these words, identify forward-looking statements. Such forward-looking statements are based on certain assumptions and estimates that we consider reasonable but are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial conditions, business, prospects, growth strategy and liquidity. Accordingly, there are, or will be, important factors that could cause our actual results to differ materially from those indicated in these statements including, without limitation, those described under the heading “Risk Factors” in this Annual Report on Form 10-K. The inclusion of this forward-looking information should not be regarded as a representation by us that the future plans, estimates or expectations contemplated by us will be achieved. Our actual results could differ materially from the forward-looking statements included herein. These forward-looking statements are made only as of the date of this document, and we do not undertake any obligation, other than as may be required by applicable law, to update or revise any forward-looking or cautionary statement to reflect changes in assumptions, the occurrence of events, unanticipated or otherwise, or changes in future operating results over time or otherwise. We are including this Cautionary Note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements after the date of this report as a result of new information, future events, or other developments, except as required by applicable laws and regulations.

Item 1. Business

The Joy of Krispy Kreme

Krispy Kreme, Inc. (“KKI”) and its subsidiaries (collectively, the “Company” or “Krispy Kreme”) is one of the most beloved and well-known sweet treat brands in the world. Our iconic Original Glazed® doughnut is universally recognized for its hot-off-the-line, melt-in-your-mouth experience. Over its 84-year history, Krispy Kreme has developed a broad consumer base globally and currently operates in over 30 countries through its unique network of fresh Doughnut Shops, partnerships with leading retailers, and a rapidly growing Ecommerce and delivery business. Our purpose of touching and enhancing lives through the joy that is Krispy Kreme guides how we operate every day and is reflected in the love we have for our people, our communities, and the planet.

We are a global omni-channel business with more than 10,000 global points of access, creating awesome fresh doughnut experiences via (1) our Hot Light Theater and Fresh Shops, (2) Delivered Fresh Daily (“DFD”) branded cabinets and merchandising units within high traffic grocery and convenience stores, (3) Ecommerce and (4) our Branded Sweet Treat Line. We have a capital-efficient Hub and Spoke model, which leverages our Hot Light Theater Shops’ production capabilities and Doughnut Factories to deliver fresh doughnuts daily to local Fresh Shops, DFD Doors, and through Ecommerce channels. We seek to increase our Sales per Hub through innovation, marketing campaigns and increasing physical availability to our fresh doughnuts from our Hubs to new points of access, primarily DFD Doors. Additionally, our convenient Ecommerce platform and delivery capability are significant enablers of our omni-channel growth.

We also launched in mid-2020 our Branded Sweet Treat Line, a new line of Krispy Kreme-branded packaged sweet treats intended to extend our consumer reach with shelf-stable, high quality products available through grocery, mass merchandise,

and convenience locations. In addition to creating awesome doughnut experiences, we create “cookie magic” through Insomnia Cookies, which specializes in warm, delicious cookies delivered right to the doors of its consumers or “Insomniacs”, along with an innovative portfolio of cookie cakes, ice cream, cookie-wiches and brownies. Insomnia Cookies is a digital-first concept with over 40% of its sales driven through Ecommerce in fiscal 2021. Targeting affordable, high-quality emotional indulgence experiences is at the heart of both the Krispy Kreme and Insomnia Cookies brands.

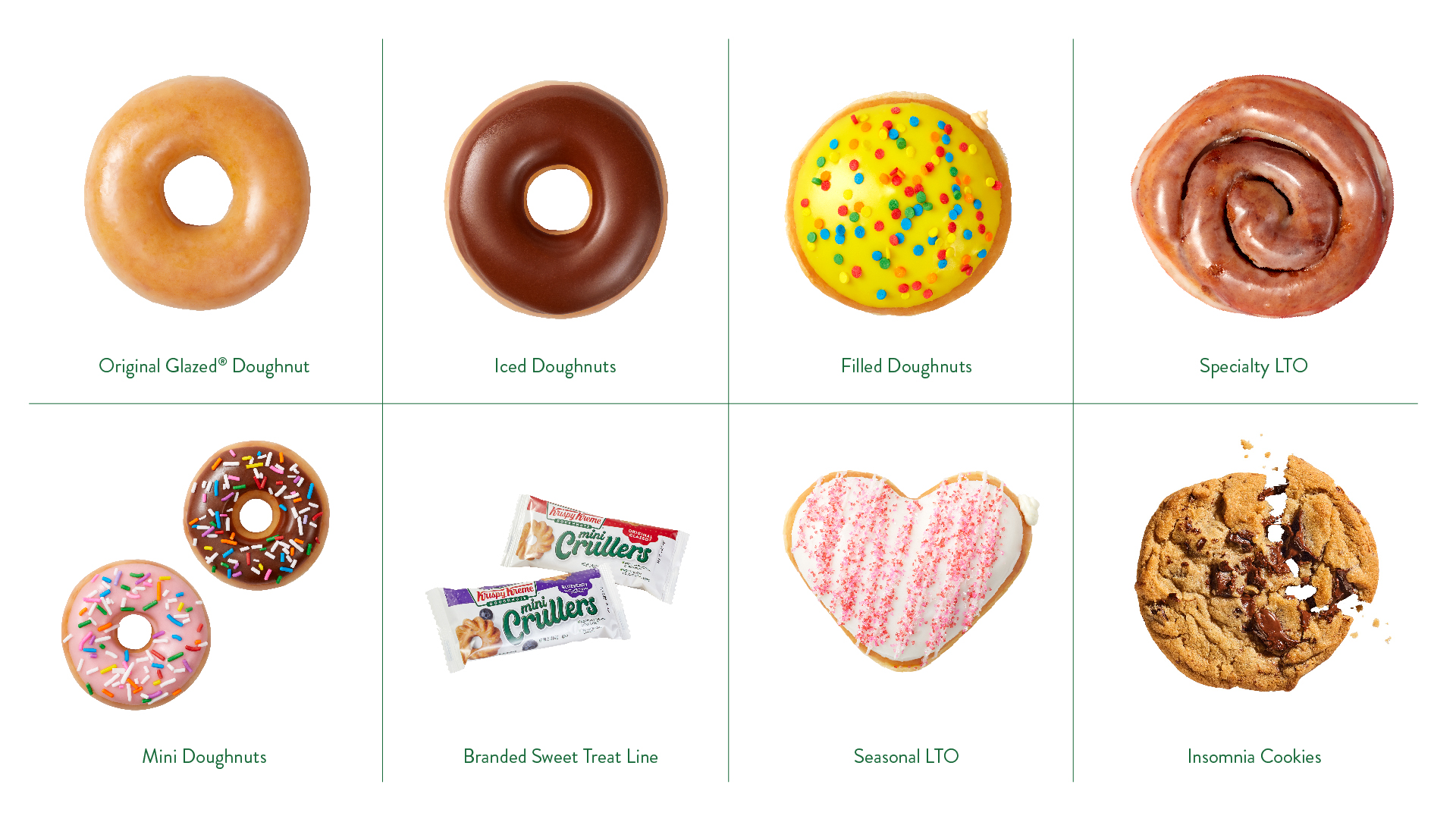

Our current business model, which focuses on fresh daily premium quality doughnuts produced by the capital-efficient Hub and Spoke model, primarily via Company controlled shops is in contrast to the Krispy Kreme operating model prior to 2016, which was focused on retail and legacy wholesale channels (including discounted long shelf-life doughnuts and coffeehouse execution), a capital-heavy Hot Light Theater Shop production model, and primarily via franchisee controlled shops. We now focus on limited time offerings (“LTOs”) and seasonal occasions to generate buzz for our premium products. 96% of net revenues in fiscal 2021 were fresh sweet treats, the majority being fresh doughnuts, approximately 85% of which were shared with others, and approximately 30% of which were to celebrate a special occasion or event. A taste of our offerings includes:

The Ingredients of Our Success

We operate in the attractive and growing $650 billion global indulgence market. We see consumer preferences in this market for fresh sweet treats and offering freshness is approximately double the importance of any other single ingredient or nutritional claim in the category. Our strategy is built on our belief that almost all consumers desire an occasional indulgence, and that when they indulge, they want a high quality, emotionally differentiated experience. To increase consumer access to our fresh premium products we have a long-term goal of expanding to over 50,000 global points of access, up from our current footprint of over 10,000. This includes adding more doughnut shops and expanding to more grocery and convenience stores in both existing and new countries. We are excited for the opportunity to open in at least three new countries in 2022 and expand our global footprint for years to come.

We believe the following competitive differentiators position us to generate significant growth as we continue towards our goal of becoming the most loved sweet treat brand in the world.

Beloved Global Brand with Ubiquitous Appeal

We believe that our brand love and ubiquitous appeal differentiate us from the competition. We believe that Krispy Kreme is an iconic, globally recognized brand with rich history that is epitomized by our fresh Original Glazed doughnut. We are one of the most loved sweet treat retailers in the U.S. and many markets around the world. We are the most loved sweet treat brand in several key countries already in fiscal 2021, such as the U.S., the U.K., Australia, Thailand and Turkey, based on the results of Krispy Kreme’s Annual Global Brand Tracking Survey conducted by Service Management Group based on over 17,000 consumer responses with Krispy Kreme achieving the highest percentage of consumers indicating they “ten: absolutely love the brand for sweet treats” on a ten point scale. We have an extremely loyal, energetic, and emotionally connected consumer base.

We continuously seek to understand what consumers are celebrating or experiencing in their lives and actively engage our passionate followers to activate this emotional connection through memorable, sharable moments – our “Acts of Joy” – which we believe further fuel our brand love. In fiscal 2021, Krispy Kreme generated over 40 billion total media impressions, up from less than two billion media impressions in 2016.

Creating Awesome Experiences

We provide authentic indulgent experiences, delivering joy through high quality doughnuts made from our own proprietary formulations. Our strict quality standards and uniform production systems ensure the consumer’s interaction with Krispy Kreme is consistent with our brand promise, no matter where in the world they experience it. We aim to create product experiences that align with seasonal and trending consumer interests and make positive connections through simple, frequent, brand-focused offerings that encourage shared experiences.

We utilize seasonal innovations, alongside the expansion of our core product offering, to inspire consumer wonder and keep our consumers engaged with the brand and our products. Our sweet treat assortment begins with our iconic Original Glazed doughnut inspired by our founder’s classic yeast-based recipe that serves as the canvas for our product innovation and ideation. Using the Original Glazed doughnut as our foundation, we have expanded our offerings to feature everyday classic items such as our flavor glazes and “minis,” which lend themselves well to gifting occasions such as birthdays and school activities. Our “Original Filled” rings offer the benefits of a filled shell doughnut without the mess. Our seasonal items create unique assortments centered on holidays and events, with Valentine’s Day, St. Patrick’s Day, Easter, the Fourth of July, Halloween, and Christmas, all examples of holidays for which we routinely innovate. We also maintain brand relevance by participating in significant cultural moments. We strategically launch offerings tied to these historic moments to gain mind share, grow brand love, and help drive sales.

Leveraging our Omni-Channel Model to Expand Our Reach

We believe our omni-channel model, enabled by our Hub and Spoke approach and Ecommerce, allows us to maximize our market opportunity while ensuring control and quality across our suite of products. Our goal is to provide our fresh doughnuts to consumers as conveniently and efficiently as possible. We apply a tailored approach across a variety of distinct shop formats to grow in discrete, highly attractive and diverse markets, and maintain brand integrity and scarcity value while capitalizing on significant untapped consumer demand. Many of our shops offer drive-thrus, which also expand their off-premises reach. Our Hot Light Theater Shops’ production capacity allow us to leverage our investment by efficiently expanding to our consumers wherever they may be — whether in a local Fresh Shop, in a grocery or convenience store, on their commute home or directly to their doorstep via home delivery.

Hub and Spoke

• Hot Light Theater Shops and other Hubs: Immersive and interactive experiential shops which provide unique and differentiated consumer experiences while serving as local production facilities for our network. These locations serve as Hubs to enable our Hub and Spoke model and expand our brand’s reach, by supplying fresh doughnuts to other points of access. Each features our famous glaze waterfalls and “Hot Now” light that communicate the joy and emotion at the core of our brand. Hot Light Theater Shops are typically destination locations, with over 85% of U.S. locations featuring drive-thru capability. Our flexible drive-thru model offers a convenient off-premises experience. We also have smaller Mini Hot Light Theater Shops that serve hot doughnut experiences to high foot fall, urban locations. In higher density urban environments, we also utilize Doughnut Factories to provide fresh doughnuts to Spoke locations, which include Fresh Shops and DFD Doors. The average capital investment for a Hot Light Theater Shop is $2 million to $4 million.

•Fresh Shops: Smaller doughnut shops and kiosks, without manufacturing capabilities, selling fresh doughnuts delivered daily from Hub locations. Fresh Shops expand our consumer-serving capacity, while maintaining quality and scarcity value. The average capital investment for a Fresh Shop is $0.1 million to $1 million.

• Delivered Fresh Daily: Krispy Kreme branded doughnut cabinets within high traffic grocery and convenience locations, selling fresh doughnuts delivered daily to more than 8,500 doors from Hub locations. Through our DFD partnerships, we can significantly expand our points of access so that more consumers can experience Krispy Kreme doughnuts. These additional Spoke locations further leverage our manufacturing Hub locations, creating greater system efficiency. Consistent with our commitment to product quality, our current DFD business has been transformed materially from our legacy wholesale model. In 2018, we began strategically exiting unprofitable, low-volume doors and pivoting towards DFD products offered in branded, in-store cabinets. This evolution was largely completed in

2020 and we believe positions us for strong and sustainable growth in DFD. The average capital investment for a DFD Door is $2,000 to $10,000.

• Ecommerce and Delivery: Fresh doughnuts for pickup or delivery, ordered via our branded Ecommerce platforms or through third-party digital channels. In the U.S. and Canada, our branded Ecommerce platform enables attractive opportunities like gifting and office catering, further fueling our momentum across key geographies. For fiscal 2021, 17% of our Company-owned sales, inclusive of Insomnia Cookies and exclusive of our Branded Sweet Treat Line and DFD, were digital and we aim to grow this significantly in the next few years, both domestically and internationally. We plan to do so by exploring new points for delivery coverage. After a successful pilot in the U.K. where we have achieved national delivery coverage with more than 50 third-party owned facilities where we ship fresh doughnuts for hosting prior to sell-through to the consumer, we are now building up capabilities in the U.S. and Mexico markets in 2022. This will allow us to expand our Ecommerce capabilities in a capital-efficient manner.

The Hub and Spoke approach is applied globally and is currently most developed in our international Company-owned markets such as the U.K., Australia and Mexico. We are in process of applying lessons learned in those international markets to the U.S., and particularly to expansion in top growth markets such as New York City, Chicago, and Los Angeles, among others, which we expect to be a significant driver of margin expansion in the U.S., as well as in Canada, Japan, and in new countries we plan to enter in the future.

We believe that lack of access is the primary reason consumers do not choose Krispy Kreme-branded products for their indulgent treat, based on the results of Krispy Kreme’s 2021 Annual Global Brand Tracking Survey conducted by Service Management Group based on over 17,000 consumer responses. Today, we have more than 10,000 global points of access in more than 30 countries. We plan to open in at least three new countries per year from a combination of strategic franchise partnerships and equity investments in select, key markets. Additionally, we seek to add at least 10% more global points of access each year, primarily through low cost DFD Doors, and ultimately grow to more than 50,000 points of access globally to increase our reach through our omni-channel model. Our current and target points of access are less than 5% of the current number of grocery and convenience stores in the countries we operate or have plans to enter in the future, allowing our brand to remain special and unique.

Branded Sweet Treat Line

Our Krispy Kreme branded packaged sweet treat line offers a delicious, quality experience free of artificial flavors. This new line of products is distributed in the U.S. through major grocery, mass merchandise, and convenience locations, allowing us to capture the sweet snacking occasion for our customers seeking more convenience.

Insomnia Cookies

Our addition of Insomnia Cookies has expanded our sweet treat platform to include a complementary brand rooted in the belief that indulgent experiences are better enjoyed together. Insomnia Cookies delivers warm, delicious cookies right to

the doors of individuals and companies alike. We own the night through incredibly craveable offerings of cookies, brownies, cookie cakes, ice cream, cookie-wiches and cold milk. In addition to satisfying late night cravings, Insomnia Cookies delivers the cookie magic across a broad set of daytime occasions, including in-shop, gifting, and catering. Through its 210 locations as of January 2, 2022, Insomnia Cookies is able to deliver locally within 30 minutes while also expanding its nationwide shipping capabilities that allows it to deliver next day to more than 95% of addresses in the U.S. We continue to leverage these digital and internal delivery capabilities while expanding Insomnia Cookies’ omni-channel presence, combining both of our strengths to improve our overall platform.

Our Segments

We conduct our business through the following three reported segments:

•U.S. and Canada: Includes all our Krispy Kreme Company-owned operations in the U.S. and Canada, Insomnia Cookies shops, and the Branded Sweet Treat Line;

•International: Includes all our Krispy Kreme Company-owned operations in the U.K., Ireland, Australia, New Zealand, and Mexico; and

•Market Development: Includes our franchise operations across the globe, as well as our Company-owned operations in Japan.

The following table presents our global points of access as of January 2, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Global Points of Access (1) |

| Hot Light Theater Shops | | Fresh Shops | | Cookie Shops | | Carts, Food Trucks, and Other | | DFD Doors | | Total | | Company-Owned (%) |

| U.S. and Canada | 241 | | | 66 | | | 210 | | | 2 | | | 5,204 | | | 5,723 | | | 100 | % |

| International | 32 | | | 370 | | | — | | | 1 | | | 2,488 | | | 2,891 | | | 100 | % |

Market Development (2) | 109 | | | 782 | | | — | | | 31 | | | 891 | | | 1,813 | | | 9 | % |

| Total global points of access | 382 | | | 1,218 | | | 210 | | | 34 | | | 8,583 | | | 10,427 | | | 84 | % |

1.Excludes Branded Sweet Treat Line distribution points and legacy wholesale business doors.

2.Includes Japanese locations, which are Company-owned.

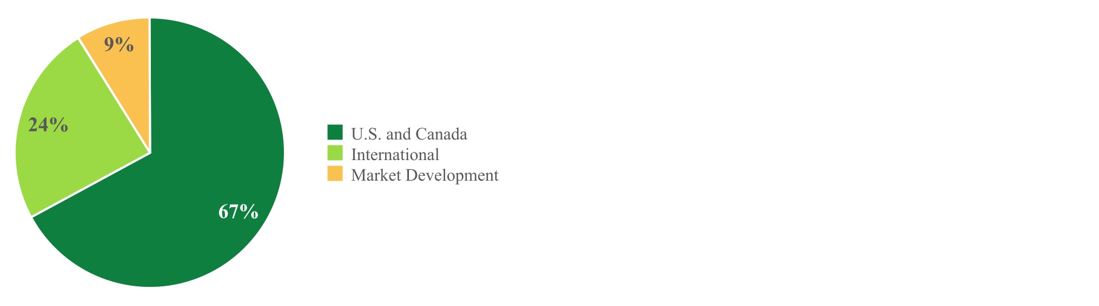

Total fiscal 2021 revenue of $1,384.4 million consisted of the following revenue by reporting segment:

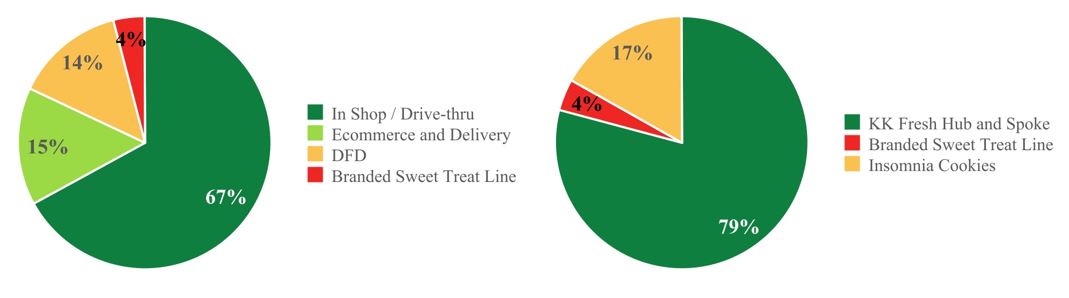

The U.S and Canada’s fiscal 2021 revenue of $928.4 million consisted of:

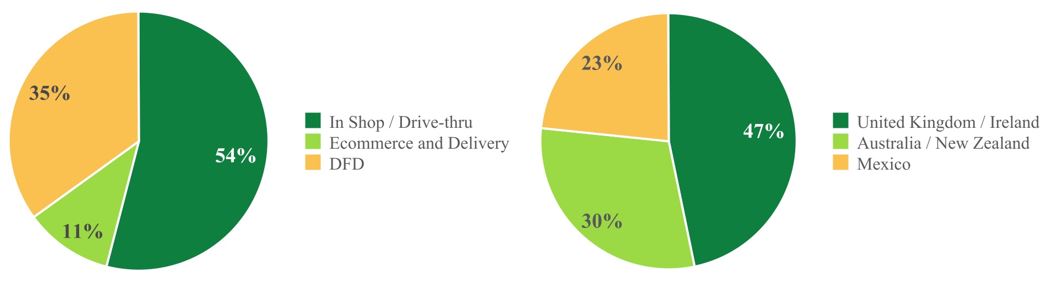

The International segment’s fiscal 2021 revenue of $333.0 million consisted of:

Market Development’s fiscal 2021 revenue of $123.0 million consisted of:

Our Growth Strategies

We have made investments in our brand, our people and our infrastructure and believe we are well positioned to drive sustained growth as we execute on our strategy. Across our global organization, we have built a team of talented and highly engaged Krispy Kremers and Insomniacs. Over the past several years we have taken increased control of the U.S. operations to enable execution of our omni-channel strategy, including accelerating growth across our doughnut shops, DFD, Ecommerce and Branded Sweet Treat Line. Globally, we have developed an operating model that sets the foundation for continued expansion in both existing and new geographies. As a result, we believe we are able to combine a globally recognized and loyalty-inspiring brand with a leading management team and we aim to unlock increased growth in sales and profitability through the following strategies:

• Increase trial and frequency;

• Increase availability by increasing fresh points of access in new and existing markets; and

• Increase profitability by driving additional efficiency benefits from our omni-channel execution.

Increase trial and frequency

Almost all consumers desire an occasional indulgence, and when they indulge, they want a high quality, emotionally differentiated experience. We believe we have significant runway to be part of a greater number of shared indulgence occasions. On average, consumers visit Krispy Kreme less than three times per year, creating a significant frequency opportunity. The success of recently launched products, including filled rings and minis, seasonal favorites, limited time buzz-worthy offerings, and flavored glazes, affirms our belief that our innovations create greater opportunities for consumers to engage with our brand. We intend to strengthen our product portfolio by centering further innovation around seasonal and societal events, and through the development of new innovation platforms to drive sustained baseline growth. Our strategy of linking product launches with relevant events has allowed us to effectively increase consumption occasions while meaningfully engaging with our communities and consumers.

Our marketing and innovation efforts have expanded the number of incremental consumer use cases for Krispy Kreme doughnuts. For example, our gifting value proposition makes doughnuts an ideal way to celebrate everyday occasions like birthdays and holidays, through gifting sleeves and personalized gift messaging. Our gifting value proposition fulfills distinct consumption occasions and will continue to make our brand and products more accessible and allow us to participate with greater frequency in small and large indulgent occasions, from impromptu daily gatherings with family and friends to holidays and weddings, and everything in between.

Increase availability by increasing fresh points of access in new and existing markets

We believe there are opportunities to continue to grow in new and existing markets in which we currently operate by further capitalizing on our strong brand awareness as we deploy our Hub and Spoke model. We apply a deliberate approach to growing these discrete, highly attractive markets and maintain our brand integrity and scarcity value while unlocking significant consumer demand. We focus on increasing points of access through low cost DFD Doors as well as investments in Fresh Shops with a limited number of investments in our experiential Hot Light Theater shops to implement the Hub and Spoke model in new and existing markets. This will lead to growth in our key Sales per Hub metric as we further leverage the production capacity of existing Hubs.

We believe our omni-channel strategy, empowered by our Hub and Spoke model, will allow us to effectively seize expansion opportunities both domestically and internationally. Despite our high brand awareness, we have a limited presence in certain key U.S. markets, such as New York and Chicago, and have yet to build a presence in key U.S. cities, including Boston and Minneapolis. We also believe we have a significant opportunity to increase our presence in our existing international markets such as Mexico, Japan and Ireland where we have a less developed Hub and Spoke system. We believe this provides us ample opportunity to grow within markets in which we are already present. We also view Hub and Spoke expansion to other international markets where we do not currently have a presence as a major growth driver for the future. We have identified key international whitespace market opportunities such as China, Brazil, and parts of Western Europe. Our goal is to open in at least three new countries per year. Our proven track record of entering new diverse markets across multiple continents and deploying the capital-efficient Hub and Spoke approach demonstrates our ability to effectively penetrate a broad range of market types. New markets will either consist of Company-owned shops or entered via franchise operations, to be determined on a case-by-case basis.

Increase profitability by driving additional efficiency benefits from our omni-channel execution

We are making focused investments in our omni-channel strategy to expand our presence efficiently while driving top-line growth and margin expansion. The Hub and Spoke model enables an integrated approach to operations, which is designed to bring efficiencies in production, distribution and supervisory management while ensuring product freshness and quality are consistent with our brand promise no matter where consumers experience our doughnuts. By expanding points of access such as new local DFD Doors to existing Hubs, we increase not just total Sales per Hub, but also profitability because the production Hubs have largely fixed costs including rent, utilities, and even labor.

To support the Hub and Spoke model in the U.S., we have implemented new labor management systems and processes in our shops and new delivery route optimization technology to support our DFD logistics chain. In addition, we are launching a new demand planning system that is intended to improve service and to deliver both waste and labor efficiencies across all our business channels, including production of our Branded Sweet Treat Line. We are also investing in our manufacturing capabilities to support growth of our Branded Sweet Treat Line by implementing new packing automation technology, which is intended to significantly increase productivity through labor savings and increased capacity. By streamlining these operations across our platform, we believe we can continue to deliver on our brand promise and provide joy to our consumers while continuing to drive efficiencies across our platform.

Corporate Social Responsibility

We are committed to making a positive impact on the world — to touch and enhance lives through the joy that is Krispy Kreme — and our ambition is to Be Sweet in All That We Do, which represents our corporate social responsibility (“CSR”) platform. With this platform, we focus on our greatest opportunities for positive social and environmental impact with our people, our communities, and our planet. We are committed to transparency and disclosure of our CSR strategies, programs, and governance. Progress along our CSR strategy is regularly reported to our senior management leadership team (“the Global Leadership Team”) and our Board of Directors, which also has oversight of our environmental, social, and governance strategy.

•Loving our People: We create opportunities for our Krispy Kremers to achieve their dreams — building the most engaged, inclusive workforce.

We are committed to diversity and inclusion throughout our organization, from our board room to our shops. We have established a Diversity, Equity and Inclusion Council (sponsored by members of the Global Leadership Team) and four Employee Resource Groups in the U.S. We are focused on gender parity globally and increasing representation of people of color in the U.S. We are also developing a comprehensive, global total rewards framework to drive pay equity and access for our Krispy Kremers.

•Loving our Communities: We bring joy to others — engaging locally to support and uplift communities globally.

Our brand purpose truly shines through our Acts of Joy and community fundraising initiatives. Whether through our COVID-19 vaccination free doughnut offer, our “Healthcare Mondays” supporting the tireless work of healthcare workers throughout the pandemic or free dozen Original Glazed doughnuts to graduating seniors, we bring joy to others while doing good. In fiscal 2021, we raised more than $30 million to support local community causes. We also engage with numerous local philanthropic organizations in the communities that we serve around the world.

•Loving our Planet: We respect our planet — using sustainable practices and reducing our environmental impacts.

We are working to address climate change and build the resilience of our business and supply chain. We are conducting a global emissions assessment in 2022 to establish our emissions baseline. From this foundation, we will then set goals for reducing our greenhouse gas emissions, including Science Based Targets. We are also committed to responsible sourcing across our supply chain. Krispy Kreme has set a goal of using 100% cage-free eggs by 2026. We are committed to use of sustainable palm oil, with a goal to achieve 100% deforestation-free palm oil use by 2026. We are also focused on reducing food waste through landfill diversion programs and food-to-feed initiatives across our business.

Team Members and Human Capital Resources

Investing in, developing, and maintaining human capital is critical to our success. Globally, we employ approximately 21,500 employees as of January 2, 2022, including approximately 17,500 at Krispy Kreme locations that we refer to as our “Krispy Kremers.” We are not a party to any collective bargaining agreement, although we have experienced occasional unionization initiatives.

We depend on our Krispy Kremers to provide great customer service, to make our products in adherence to our high-quality standards and to maintain the consistency of our operations and logistics chain. While we continue to operate in a competitive market for talent, we believe that our culture, policies, and practices contribute to our strong relationship with our Krispy Kremers, which we feel is instrumental to our business model. Our culture is best captured by our Leadership Mix, which are the dozen behaviors that guide us every day. The Leadership Mix was developed based on the beliefs of our founder, incorporating years of learning on what makes Krispy Kreme such a special organization. These cultural behaviors are shared with Krispy Kremers globally, through an internally developed Leadership Mix training program.

The Leadership Mix is what keeps our consumers at the center of everything we do and ensures that our Krispy Kremers are empowered to do the right thing for our consumers and for the business. We pride ourselves on being an entrepreneurial and innovative team that is not afraid to take smart risks in service of creating awesome doughnut experiences.

Consistent with our Leadership Mix ingredients, we pride ourselves on attracting a diverse team of Krispy Kremers and Insomniac team members from a wide range of backgrounds. As of January 2, 2022, our U.S. Krispy Kreme Company-owned operations include approximately 10,000 employees, of which 96% are field-based employees and the remaining 4% are corporate employees. 65% of such employees are people of color and 55% of such employees are female. We believe our diverse team drives the entrepreneurial culture that is at the center of our success.

The success of our business is fundamentally connected to the well-being of our Krispy Kremers. Accordingly, we are committed to their health, safety, and wellness. During the ongoing COVID-19 pandemic, we have taken and continue to take extraordinary measures that we determined were in the best interest of our Krispy Kremers and complied with government regulations.

Our Total Rewards platform provides Krispy Kremers and their families with access to a variety of competitive, innovative, flexible, and convenient pay, health, and wellness programs. Our total package of pay and benefits is designed to support the physical, mental, and financial health of our people and includes medical, dental, vision, EAP, life insurance and retirement benefits as well as disability benefits and assistance with major life activities, such as educational reimbursement and adoption. Many of these benefits are available to our part-time Krispy Kremers; we believe that offering select benefits to our part-time Krispy Kremers offers us a competitive advantage in recruiting and retaining talent.

Marketing and Innovation

Our marketing strategy is as unique and innovative as our brand. Krispy Kreme’s marketing strategy is to participate in culture through “Acts of Joy,” deliver new product experiences that align with seasonal and trending consumer and societal interests and to create positive connections through simple, frequent, brand-focused offerings that encourage shared experiences. The tactics which support this strategy are also distinct. In the U.S., Krispy Kreme’s paid media strategy is 100% digital with a heavy focus on social media where our passionate consumer base engages and shares our marketing programs far and wide through their own networks. Earned media is also an important part of our media mix. We create promotions and products that attract media outlets to our brand. Through the widespread dissemination of our programs through pop culture, entertainment, and news outlets, we believe we can achieve disproportionately large attention relative to our spend in a media environment populated by brands with far larger media budgets. We believe our marketing strategy, supported with non-traditional media tactics, has proven to be a potent combination that simultaneously drives sales while growing brand love. In 2021, we received over 40 billion media impressions.

By drawing inspiration from important societal events, we create a unique way for our consumers to celebrate and engage. For example, in 2021 we offered any consumer who had received a COVID-19 vaccination free doughnuts every day through the end of the year. This event created social “buzz” (including more than 7.5 billion media impressions) and significant consumer traffic for our Doughnut Shops. Our ability to create this connection between our consumers and our brand is what has helped make the Krispy Kreme brand iconic, and helps to solidify our position in popular culture.

Limited time seasonal innovation and permanent innovations are used to create consumer wonder and are an essential ingredient in keeping our consumers engaged with the brand and the products. Our limited time offerings are anticipated by consumers and the media alike and generate significant social sharing amongst our fans and media coverage. The impact of limited time seasonal offerings goes well beyond the sales of the innovations themselves; they drive traffic and create additional sales of our core product offering.

Krispy Kreme has a strong brand presence across both emerging and well-established social media platforms, including Facebook, Instagram, Twitter, YouTube, Tik-Tok, and Pinterest. These channels enable us to engage with our consumers on a personal level, while spreading the global brand of Krispy Kreme, including communicating promotional activity, featured products, new shop openings, and highlighting core equities of the brand. Social media allows precise geo-targeting around our shops and effective targeting of consumers likely to be interested in our messages.

Supply Chain

Sourcing and Supplies

We are committed to sourcing the best ingredients available for our products. The principal ingredients to manufacture our products include flour, shortening, and sugar which are used to formulate our proprietary doughnut mix and concentrate at our Winston-Salem manufacturing facility. We procure the raw materials for these products from different vendors. Although most raw materials we require are typically readily available from multiple vendors, we currently have 20 main vendors in addition to our own mix plant.