☒ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☐ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material Under Rule 240.14a-12 | |

☒ |

No fee required. | |

☐ |

Fee paid previously with preliminary materials. | |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) 0-11. | |

Notice of 2024 Annual Meeting of Shareowners of Sylvamo Corporation

| Meeting Date Thursday, May 16, 2024

|

|

|

Meeting Time 11:30 a.m. U.S. Central Time

|

|

|

Meeting Location Sylvamo World Headquarters 6077 Primacy Parkway Memphis, Tennessee 38119 |

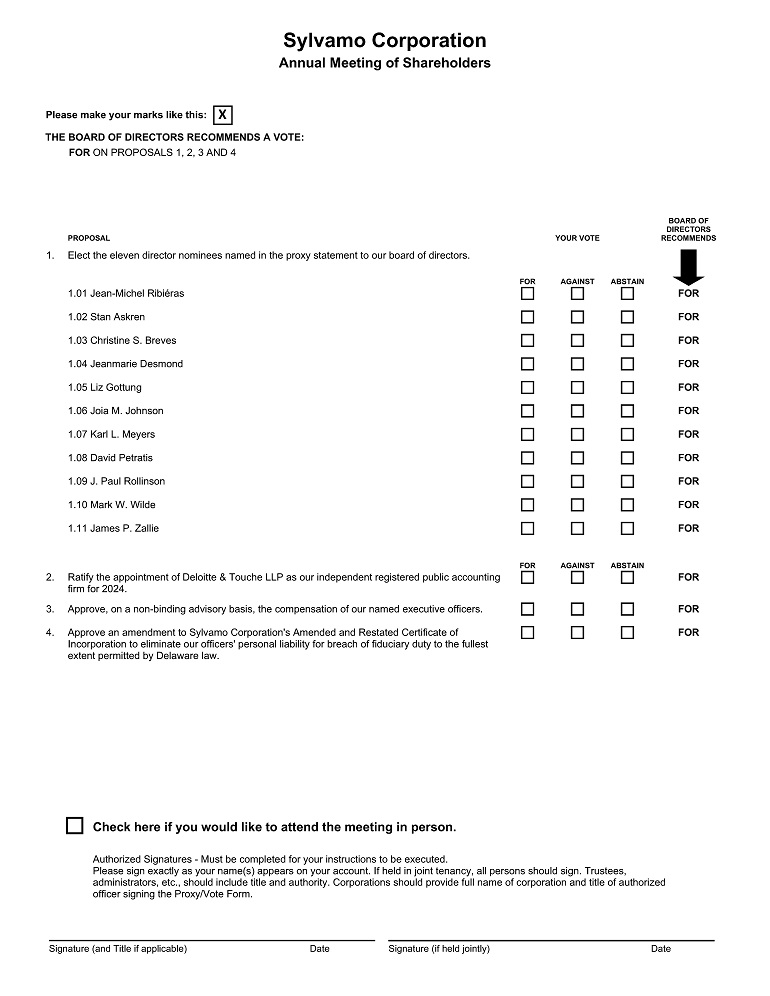

| Proposals on which shareowners will vote | Vote recommended by our board of directors | |

|

Proposal 1 Elect the eleven director nominees named in the proxy statement to our board of directors |

FOR | |

| Proposal 2 Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2024 |

FOR | |

| Proposal 3 Approve, on a non-binding advisory basis, the compensation of our named executive officers |

FOR | |

| Proposal 4 Approve an amendment to our Amended and Restated Certificate of Incorporation to eliminate our officers’ personal liability for breach of fiduciary duty to the fullest extent permitted by Delaware law |

FOR | |

Your Vote is Important

If you are a registered shareowner and you received a notice that the proxy materials are available on the Internet, or you received a full set of proxy materials including a proxy card, please vote promptly using any of the methods listed below.

|

VOTE BY INTERNET

|

Go to www.proxypush.com/SLVM and follow the voting instructions on the notice or proxy card that you received. | ||

|

VOTE BY PHONE

|

Call 866-509-1053 and follow the voting instructions on the notice or proxy card that you received. | ||

|

VOTE BY MAIL

|

Follow the instructions for voting by mail on the notice or proxy card that you received. | ||

|

VOTE AT THE MEETING |

Refer below to “Attendance at the Meeting.” | ||

|

If you hold your shares in street name through a bank or broker, please refer to the voting instructions received from your bank or broker for information on how to vote your shares, and if you plan to vote in person at the meeting, you must present a valid legal proxy from your bank or broker that is the record holder of your shares. | ||||

Attendance at the Meeting

To attend the meeting, you must be a shareowner of Sylvamo on the record date. If you are a registered shareowner, you may vote at the meeting by delivering your completed proxy card in person or by completing and delivering a ballot in person and providing government-issued proof of identification. If you are a beneficial owner of shares held in street name, you may vote at the meeting only if you obtain and bring to the meeting a legal proxy from your broker or bank that is the record holder of your shares, giving you the right to vote those shares in person at the meeting.

Shareowners of record of Sylvamo Corporation common stock (NYSE: SLVM) on the record date of March 18, 2024, are entitled to vote at the meeting and at any postponements or adjournments of the meeting. A list of these shareowners will be available for inspection and review at Sylvamo’s headquarters in Memphis, Tennessee, starting May 2, 2024. We will also make the list available for inspection in person at the meeting.

By order of the Board of Directors,

|

|

Matthew L. Barron Senior Vice President, Chief Administrative and Legal Officer, and Corporate Secretary | |

| April 5, 2024 |

The following materials of Sylvamo Corporation are available for viewing and printing at www.proxydocs.com/SLVM:

| • | Notice of 2024 Annual Meeting of Shareowners |

| • | Sylvamo’s 2024 Proxy Statement (“Proxy Statement”) |

| • | Sylvamo’s 2023 Annual Report (“Annual Report”), which includes our annual report on Form 10-K for the year ended December 31, 2023 (“2023 Form 10-K”) |

These materials or a notice that the proxy materials are available on the Internet (“Notice of Internet Availability”) are first being sent to shareowners on or about April 5, 2024.

We also are including for our shareowners an annual review (“Annual Review”) of certain highlights of 2023 for us as a company. The Annual Review is not part of the proxy materials for the Annual Meeting.

We will furnish without charge to each person whose proxy is being solicited, upon request of any such person, a copy of our Annual Report, including our 2023 Form 10-K as filed with the SEC and the consolidated and combined financial statements and schedules thereto, excluding exhibits. Requests for copies of such report should be sent to our Corporate Secretary, Matthew L. Barron, at 6077 Primacy Parkway, Memphis, TN 38119. Copies of any exhibit to the 2023 Form 10-K will be forwarded upon receipt of a written request to our Corporate Secretary at such address, subject to a reasonable charge for copying and mailing.

Table of Contents

| i |

||

| 1 |

Proposals Submitted for Your Vote at the 2024 Annual Meeting | |

| 1 |

||

| 2 |

||

| 3 |

||

| 4 |

||

| 7 |

||

| 7 |

||

| 7 |

||

| 10 |

||

| 11 |

Matters Pertaining to Sylvamo’s 2025 Annual Meeting of Shareowners | |

| 12 |

||

| 12 |

||

| 12 |

||

| 13 |

||

| 16 |

||

| 16 |

||

| 17 |

||

| 18 |

||

| 18 |

||

| 18 |

||

| 18 |

||

| 18 |

||

| 19 |

||

| 19 |

||

| 19 |

||

| 19 |

||

| 20 |

Procedures for Treatment of Complaints Regarding Accounting, Internal Accounting Controls and Auditing Matters | |

| 21 |

||

| 34 |

||

| 35 |

||

| 35 |

||

| 35 |

||

| 36 |

||

| 40 |

||

| 42 |

||

| 47 |

||

| 48 |

||

| 48 |

||

| 50 |

||

| 51 |

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table | |

| 51 |

||

| 52 |

||

| 52 |

||

| 54 |

||

| 55 |

||

| 55 |

||

Proxy Statement 2024

TABLE OF CONTENTS

| 63 |

||

| 63 |

||

| 64 |

||

| 65 |

||

| 65 |

||

| 67 |

||

| 67 |

||

| 69 |

||

| 69 |

||

| 69 |

||

| 70 |

||

| 73 |

||

In this Proxy Statement, references to “Sylvamo,” “the Company,” “we,” “our,” and “us,” refer to Sylvamo Corporation. References to “shareowners,” “you” and “your” refer to our shareowners. References to years refer to our fiscal year, which is the calendar year ending each December 31st.

This Proxy Statement refers and links to website addresses and materials on those websites. No websites or any materials on those websites are incorporated by reference into this Proxy Statement, and they do not form part of this Proxy Statement.

Cautionary Statement Regarding Forward-Looking Statements

This Proxy Statement includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements regarding our goals, commitments, strategies and expectations. These statements involve risks and uncertainties. Actual results could differ materially from future results expressed or implied by the forward-looking statements for a variety of reasons, including due to the risks and uncertainties discussed in our most recent periodic reports on Form 10-K and Form 10-Q and subsequent filings with the U.S. Securities and Exchange Commission (“SEC”). We assume no obligation to update any forward-looking statements or information, which speak as of their respective dates.

Sylvamo

PROXY SUMMARY

Proxy Summary

Proposals

Our Board of Directors (“Board”) is submitting four proposals for your vote at the 2024 Annual Meeting of Shareowners (“Annual Meeting”).

| Proposal |

Description |

Unanimous Board Recommendation |

Page | |||

| 1 | Elect the 11 director nominees named in this Proxy Statement

|

FOR each nominee

|

1 | |||

| 2 | Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm

|

FOR | 2 | |||

| 3 | Approve, on a non-binding advisory basis, the compensation of our named executive officers

|

FOR | 3 | |||

| 4 |

|

FOR | 4 | |||

Director Nominees

Nominees

The following individuals have been nominated for election by our shareholders at the Annual Meeting. The Board has determined, in its business judgment, that each of the nominees for director are independent under the listing standards of the New York Stock Exchange (“NYSE”) except for our Chief Executive Officer, Jean-Michel Ribiéras. The nominees currently serve on our Board. Additional information about them starts on page 21.

| Name | Director Since |

Board Committees and Leadership |

Professional Background | Other Company Boards (#) | ||||||

|

Jean-Michel Ribiéras | 2021 | Chairman | Chairman and CEO Sylvamo |

||||||

|

Stan Askren | 2021 | Audit Committee Management Development and Compensation Committee |

CEO and Founder Quiet Trail Advisors Advisor and Lean Business Consultant Lean Focus, LLC |

||||||

|

Christine S. Breves | 2021 | Audit Committee | Former CFO, SVP and EVP Business Transformation United States Steel Corporation |

2 |

Proxy Statement 2024 i

PROXY SUMMARY

| Name | Director Since |

Board Committees and Leadership |

Professional Background | Other Company Boards (#) | ||||||

|

Jeanmarie Desmond | 2021 | Chair, Audit Committee Nominating and Corporate Governance Committee |

Former CFO and EVP DuPont de Nemours, Inc. |

2 | |||||

|

Liz Gottung | 2021 | Chair, Management Development and Compensation Committee |

Principal and Consultant Liz Gottung LLC |

1 | |||||

|

Joia M. Johnson | 2021 | Management Development and Compensation Committee Nominating and Corporate Governance Committee |

Former Chief Administrative Officer General Counsel and Corporate Secretary Hanesbrands Inc. |

2 | |||||

|

Karl L. Meyers | 2023 | Nominating and Corporate Governance Committee |

Former Chairman and CEO Soundview Paper Holdings LLC (now Marcal Paper) |

||||||

|

David Petratis | 2021 | Lead Independent Director Chair, Nominating and Corporate Governance Committee |

Former Chairman, President and CEO Allegion plc |

2 | |||||

|

J. Paul Rollinson | 2021 | Management Development and Compensation Committee |

President and CEO Kinross Gold Corporation |

1 | |||||

|

Mark W. Wilde | 2023 | Audit Committee Management Development and Compensation Committee |

Former Managing Director and Sell Side Senior Analyst Bank of Montreal Capital Markets |

||||||

|

James P. Zallie | 2021 | Audit Committee | President and CEO Ingredion Incorporated |

1 |

ii Sylvamo

PROXY SUMMARY

Skills, experience and diversity

Our vision is to be the world’s paper company: the employer, supplier and investment of choice. Our vision encapsulates our long-term strategy for creating value for our shareowners. We believe the director nominees’ skills, experience and diversity noted below enhance their strategic decision-making and guidance relevant to achieving our vision.

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

Strategic planning

Leadership experience in executive level strategic planning is core to our board’s evaluation and guidance of our business strategies.

Benefits our vision to be the employer, supplier and investment of choice |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||

|

Current or former CEO

Directors who have been CEOs bring their experience to bear on running a large public company. It augments their oversight of our CEO and other executive management, long-term strategic planning, human capital management, risk management, governance, shareowner value creation and shareowner engagement.

Benefits our vision to be the employer, supplier and investment of choice |

● | ● |

|

|

|

|

|

|

|

|

|

|

|

|

● | ● | ● |

|

|

|

● | ||||||||||||||||||||||||

|

Current or former CFO (or other financial expert)

In-depth financial expertise strengthens the board’s oversight and direction of our company concerning financial matters, such as capital allocation, financial risk management and internal controls and procedures.

Benefits our vision to be the investment of choice |

|

|

|

● | ● | ● |

|

|

|

|

|

|

|

|

|

|

|

|

● | ● | ● | ||||||||||||||||||||||||

|

Global business

Experience with multinational businesses expands our board’s perspectives on the risks and opportunities of our global business and operations.

Benefits our vision to be the employer, supplier and investment of choice |

● | ● | ● | ● | ● | ● |

|

|

|

● | ● |

|

|

|

● | ||||||||||||||||||||||||||||||

|

Manufacturing

Experience in manufacturing organizations augments the board’s contributions relating to our operational strategies.

Benefits our vision to be the supplier of choice |

● | ● | ● | ● | ● | ● | ● | ● | ● |

|

|

|

● | ||||||||||||||||||||||||||||||||

|

Paper industry

Experience in the paper industry enhances the board’s contributions that inform our strategic decision-making as we build the world’s paper company.

Benefits our vision to be the supplier and investment of choice |

● |

|

|

|

|

|

|

|

|

|

● |

|

|

|

● |

|

|

|

|

|

|

● |

|

|

| ||||||||||||||||||||

Proxy Statement 2024 iii

PROXY SUMMARY

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

Investor relations or investment analysis

Experience in investor relations or investment analysis furthers our board’s investor focus and quality input on our investor of choice strategies.

Benefits our vision to be the investment of choice |

● | ● | ● | ● |

|

|

|

|

|

|

|

|

|

● | ● | ● | ● | ||||||||||||||||||||||||||||

|

Sales and marketing

Experience in sales and marketing enhances the board’s strategic contributions towards our efforts to develop, maintain, strengthen and increase customer relationships and sales.

Benefits our vision to be the supplier of choice |

● | ● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● |

|

|

|

|

|

|

|

|

| ||||||||||||||||||

|

Human capital

Experience in human capital management contributes to the board’s oversight of our human capital strategies, including talent attraction and retention, executive compensation, succession planning and human capital risk mitigation.

Benefits our vision to be the employer of choice |

● | ● | ● |

|

|

|

● | ● |

|

|

|

● | ● |

|

|

|

● | ||||||||||||||||||||||||||||

|

Cybersecurity

Experience overseeing cybersecurity risk, in management leadership positions or on board committees responsible for such oversight, contributes to the board’s oversight and guidance concerning our cybersecurity strategies and initiatives.

Benefits our vision to be the supplier and investment of choice. |

|

|

|

● | ● | ● |

|

|

|

● |

|

|

|

● |

|

|

|

|

|

|

● | ||||||||||||||||||||||||

|

Environmental and social initiatives

Experience overseeing or evaluating environmental and social initiatives/ESG programs, in management leadership positions or on board committees responsible for such oversight, adds to the breadth and depth of expertise that the board brings to oversight of our ESG strategies and programs.

Benefits our vision to be the employer, supplier and investment of choice. |

|

|

|

● | ● | ● | ● | ● |

|

|

|

● | ● | ● | ● | ||||||||||||||||||||||||||||||

|

Public company board practices

Experience in public company board practices facilitates our board’s proper functioning, self-assessment and conduct in accordance with governance best practices.

Benefits our vision to be the investment of choice |

● | ● | ● | ● | ● | ● |

|

|

|

● | ● | ● | ● | ||||||||||||||||||||||||||||||||

|

Diversity

Directors’ gender, race and ethnic diversity enriches the multiple viewpoints from which our directors challenge each other and management in assessing and pursuing the right strategies for our company.

Benefits our vision to be the employer and investment of choice |

● |

|

|

|

● | ● | ● | ● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||

iv Sylvamo

PROXY SUMMARY

Governance Summary

The Nominating and Corporate Governance Committee oversees our Board’s corporate governance practices. Details about our corporate governance practices start on page 12.

| • | 10 of 11 directors are independent |

| • | Annual elections and majority voting for uncontested elections of directors with a director resignation policy |

| • | Lead Independent Director with defined responsibilities and term limit expectation |

| • | Required executive sessions of the Board at each regular meeting, without management present |

| • | Limit on number of public company boards and audit committees on which our Board and Audit Committee members may serve |

| • | Mandatory director retirement age of 75 |

| • | Sylvamo stock ownership and retention requirements for directors and executive management |

| • | Shareowner right to communicate with Board and management embedded in Corporate Governance Guidelines |

| • | Policy prohibiting directors, officers and employees from hedging and pledging Sylvamo stock |

| • | Investor outreach through investor conferences in 2023 |

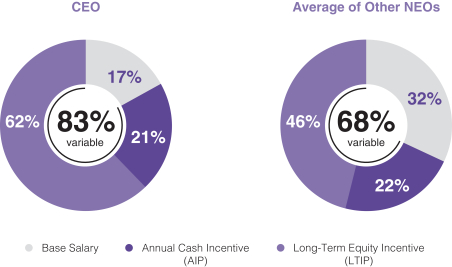

Executive Compensation

At the Annual Meeting, shareowners will cast an advisory vote on executive compensation.

The Management Development and Compensation Committee oversees our executive compensation practices. Details about our executive compensation philosophy, compensation structure and the 2023 compensation of our named executive officers (“NEOs”) start on page 35.

Compensation Philosophy Summary

| • | Attract and inspire talent through attractive pay programs, flexible approach to pay and broad incentives |

| • | Offer incentives to achieve Sylvamo short- and long-term strategic goals through performance-based compensation |

| • | Facilitate succession strategy through pay structures |

| • | Create a shareowner mindset through incentives |

| • | Active governance by the Management Development and Compensation Committee |

Proxy Statement 2024 v

PROXY SUMMARY

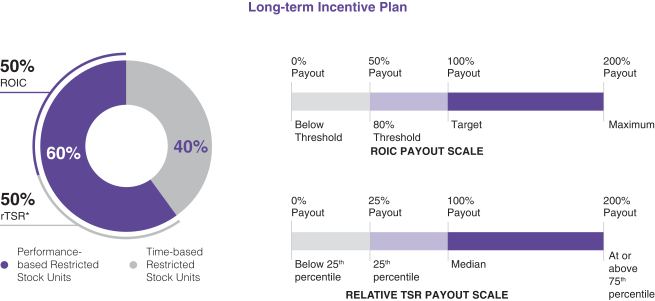

Compensation Structure Summary

| • | Components are salary, annual cash incentive based on performance, and long-term equity incentives, which vest based on a mix of service and performance-based conditions |

| • | Multiple metrics for performance-based compensation |

| • | Stock ownership and retention requirements |

| • | Clawback of incentive compensation for certain financial statement restatements and misconduct |

| • | Change-in-control (CIC) benefits |

| • | Double triggers for severance and equity vesting |

| • | Capped for all NEOs |

| • | Non-competition and non-solicitation agreements |

| • | Benchmarked against peers and industry data |

| • | Annual risk assessment of compensation policies and practices |

| • | Annual shareowner advisory vote on executive compensation |

Proposal to Amend our Certificate of Incorporation

Proposal Summary

At the Annual Meeting, shareowners will vote on a proposal to amend our Amended and Restated Certificate of Incorporation (“Charter”) to eliminate our officers’ personal liability for breach of fiduciary duty to the fullest extent permitted by Delaware law. Details of the proposal start on page 4.

The Charter amendment would –

| • | Eliminate officers’ personal liability for monetary damages for certain breach of fiduciary duty claims, but only to the extent permitted by Delaware law |

| • | Not apply to liability from |

| • | breach of duty of loyalty |

| • | officer acts or omissions not in good faith, intentional misconduct or knowing violations of law |

| • | transactions in which an officer receives an improper personal benefit |

| • | claims brought by or in the right of Sylvamo against an officer, including shareowner derivative claims |

| • | Align our Charter with recent changes to Delaware law that permit the protections which the amendment would provide |

| • | More closely align our officers’ exposure to liability under our Charter with that of our directors |

| • | Address potential officer concerns about exposure to liability for exercising business judgment |

| • | Reduce some risk of frivolous lawsuits |

| • | Enhance Sylvamo’s competitiveness for officer talent |

vi Sylvamo

PROXY SUMMARY

2023 Highlights

Milestones

Milestones reflect ongoing implementation of our vision to be the World’s Paper Company: the employer, supplier and investment of choice

| • | Acquired Nymölla mill in Sweden |

| • | Strategic mill location and products; attractive purchase price |

| • | Expected to deliver $20 million annual run rate synergies by end of 2024 |

| • | Announced Project Horizon to reduce costs by over $110 million |

| • | Published our 2022 Environmental, Social and Governance Report |

| • | Our first report on sustainability matters since becoming a public company in 2021 |

| • | Reports on our strategies, goals and progress on sustainable operations, environmental stewardship, and employee and community endeavors |

| • | Rolled out initiatives facilitating workplace inclusivity and diversity reflecting the communities where we work and live |

| • | Provided training and communications intended to help broaden employee perspectives and reduce biases |

| • | Afforded opportunities for employee mentoring and networking |

Performance

Created value for shareowners in 2023

| • | Continued improving our financial position |

| • | Repaid $76 million in debt |

| • | Achieved net(1) Debt-to-Adjusted EBITDA(2) of 1.2x |

| • | Deposited $60 million in escrow to increase restricted payment capacity under our debt agreements, enabling return of more cash to shareowners |

| • | Delivered on our investment thesis |

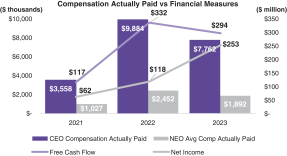

| • | Earned $607 million in Adjusted EBITDA(2) (16% Margin) |

| • | Generated $294 million in Free Cash Flow(2) |

| • | Returned $127 million in cash to shareowners through share repurchases and dividends (43% of Free Cash Flow(2)) |

| • | Reinvested in our business |

| • | Capital spending of $210 million made to strengthen our low-cost assets |

| • | Nymölla mill generated strong cash flow, strengthening our liquidity |

| • | Accelerated investments in high-return capital projects |

| (1) | Total Debt minus Cash on our Balance Sheet for the year ended December 31, 2023 |

Proxy Statement 2024 vii

PROXY SUMMARY

| (2) | Sylvamo reports its financial results in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). This Proxy Statement includes these non-U.S. GAAP financial measures: |

| Non-U.S. GAAP Financial Measure | Most Directly Comparable U.S. GAAP Financial Measure | |

| Adjusted EBITDA

|

Net Income

| |

| Adjusted EBITDA Margin

|

Net Income as a percentage of Net Sales

| |

| Free Cash Flow (FCF)

|

Cash Provided by Operating Activities from Continuing Operations

| |

| Return on Invested Capital (ROIC)

|

Net Income / Equity + Total Debt – Cash and Temporary Investments

| |

These non-U.S. GAAP financial measures are defined on pages 44, 70 and 71 and, for financial information presented using such measures, are reconciled to the most directly comparable U.S. GAAP financial measures on page 71.

Management believes that these non-U.S. GAAP financial measures, when used in conjunction with information presented in accordance with U.S. GAAP, can facilitate a better understanding of the impact of various factors and trends on Sylvamo’s financial condition and results of operations. Management also uses these non-U.S. GAAP financial measures in making financial, operating and planning decisions and in evaluating Sylvamo’s performance, including for purposes of compensation decisions. Non-U.S. GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for, or superior to, U.S. GAAP financial measures. In addition, because not all companies use identical calculations, the non-U.S. GAAP financial measures referenced in this Proxy Statement may not be comparable to similarly titled measures disclosed by other companies, including companies in our industry.

viii Sylvamo

Proposals Submitted for Your Vote at the 2024 Annual Meeting

This section presents each item of business for the Annual Meeting and the voting recommendations of our Board.

Proposal 1

Elect eleven director nominees to our Board

The Board has nominated our current directors, Jean-Michel Ribiéras, Stan Askren, Christine Breves, Jeanmarie Desmond, Liz Gottung, Joia M. Johnson, Karl L. Meyers, David Petratis, J. Paul Rollinson, Mark W. Wilde and James P. Zallie, to be elected to serve on our Board for one year until the 2025 annual meeting of our shareowners and the date a qualified successor has been elected, or until the director’s resignation, removal or death, if earlier.

Each nominee has consented to being named as a nominee in this Proxy Statement and serving on the Board if elected.

We do not know of any reason why any nominee would be unable to or would not serve as a director if elected. If, prior to the Annual Meeting, a nominee is unable or unwilling to serve, the shares represented by all valid proxies will be voted for the election of such other person as the Board may nominate, or the Board may reduce its size.

There are no family relationships among our director nominees and executive officers.

All of our director nominees have served on the Board since the 2023 annual meeting of our shareowners.

More information about the director nominees is in the section of this Proxy Statement entitled “Executive Officers and Directors.”

|

|

The Board recommends that you vote FOR each nominee

|

Vote Required to Elect Nominees

Sylvamo has implemented majority voting in uncontested elections of directors. For a nominee to be re-elected a director at the Annual Meeting, a majority of the votes cast must be “for” the nominee’s election.

If an incumbent director nominee does not receive the requisite vote to be elected, our amended and restated bylaws require the nominee to tender a resignation from the Board, contingent on the Board’s acceptance of the resignation. The Nominating and Corporate Governance Committee will recommend to the Board whether to accept or decline the resignation, considering all factors it determines as relevant and in the best interests of Sylvamo and its shareowners. The Board (except the director who tendered the resignation) will decide whether to accept the resignation by no later than its next regularly scheduled Board meeting after the Annual Meeting’s election results are certified. The Board will announce its decision on the tendered resignation in a current report on Form 8-K or a periodic report filed with the SEC.

Your Voting Options

You may vote “for” or “against” a nominee, or you may “abstain” from voting with respect to a nominee. Abstentions will not count as votes and will have no effect on the results.

Proxy Statement 2024 1

PROPOSALS SUBMITTED FOR YOUR VOTE AT THE 2024 ANNUAL MEETING

If you hold your shares in street name through a bank or broker, your failure to provide voting instructions to your bank or broker will cause your shares to be considered “broker non-votes” because your bank or broker is not entitled to vote your shares in its discretion on this proposal. Broker non-votes will not count as votes cast and will have no effect on the results.

Holders of proxies solicited by this Proxy Statement will vote your proxy received by them as directed on the proxy card or, if no direction is made, “for” the election of all eleven nominees.

Cumulative voting is not permitted. Proxies cannot be voted for a greater number of individuals than the eleven nominees named in this Proxy Statement.

Proposal 2

Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm

Our Audit Committee has selected Deloitte & Touche LLP (“Deloitte”) to serve as our independent registered public accounting firm for 2024.

At the Annual Meeting, our shareowners will vote on a non-binding basis to ratify the appointment of Deloitte as our independent registered public accounting firm for 2024.

Your ratification of the Audit Committee’s appointment of Deloitte is not required for the appointment to be valid. However, we value your opinion and believe that shareowner ratification of the appointment is a good corporate governance practice. If this proposal does not receive enough affirmative votes to ratify the appointment of Deloitte, the Audit Committee will reconsider its selection. Even if the appointment is ratified, the Audit Committee may, in its discretion, appoint a different independent registered public accounting firm at any time, if the Audit Committee determines that such a change would be in our and our shareowners’ best interests.

Deloitte served as our independent registered public accounting firm for our full 2023 fiscal year.

Representatives of Deloitte are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they desire to do so and will be available to respond to questions.

|

The Board recommends that you vote FOR Proposal 2

|

Vote Required for Approval

Approval of this proposal requires the affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting.

Your Voting Options

You may vote “for” or “against” this proposal, or you may “abstain” from voting. Abstentions will have the same effect as votes cast against this proposal because they are considered shares present at the meeting for purposes of determining a quorum.

If you hold your shares in street name through a bank or broker and fail to provide your bank or broker with voting instructions, your bank or broker may vote your shares in its discretion because the ratification of the appointment of our independent registered public accounting firm is a routine matter. As a result, we do not expect there to be any broker non-votes associated with this proposal.

Holders of proxies solicited by this Proxy Statement will vote your proxy received by them as directed on the proxy card or, if no direction is made, “for” ratification of the appointment of Deloitte as our independent registered public accounting firm.

2 Sylvamo

PROPOSALS SUBMITTED FOR YOUR VOTE AT THE 2024 ANNUAL MEETING

Proposal 3

Approve, on a non-binding advisory basis, the compensation of our named executive officers

Our Board seeks your approval of the compensation of our NEOs as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K under the U.S. Securities Exchange Act of 1934, as amended (“Exchange Act”), including in the Compensation Discussion and Analysis, related compensation tables and narrative disclosures that accompany the compensation tables. This is typically called a “say-on-pay” vote.

More specifically, our Board asks you to approve the following non-binding resolution at the Annual Meeting:

“Resolved, that the compensation paid to Sylvamo’s named executive officers, as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K under the Exchange Act, including in the Compensation Discussion and Analysis, the related compensation tables and narrative disclosures, is hereby approved.”

Our Board is presenting you with this “say-on-pay” proposal for your vote, because at our 2022 annual meeting of shareowners, a majority of our shareowners voted, consistent with our Board’s recommendation, to hold an annual non-binding say-on-pay vote. A say-on-pay vote will be held every year unless our shareowners vote, at their annual meeting to be held in 2028, to approve a different frequency of say-on-pay voting. Our Board believes that an annual say-on-pay vote allows our shareowners to provide us with regular, direct input on our executive compensation philosophy, policies and practices as disclosed in our annual proxy statements, and is consistent with our practice of shareowner engagement on our performance, long-term strategy, governance, and other related matters.

Although the say-on-pay vote is a non-binding advisory vote, the Management Development and Compensation Committee and the Board will consider the outcome of this vote when making future compensation decisions regarding our NEOs.

|

|

The Board recommends that you vote FOR Proposal 3

|

Vote Required for Approval

Approval of this proposal requires the affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting.

Your Voting Options

You may vote “for” or “against” this proposal, or you may “abstain” from voting. Abstentions will have the same effect as votes cast against this proposal, because they are considered shares present at the meeting for purposes of determining a quorum.

If you hold your shares in street name through a bank or broker, your failure to provide voting instructions to your bank or broker will cause your shares to be considered “broker non-votes” because your bank or broker is not entitled to vote your shares in its discretion for this proposal. Broker non-votes will have the same effect as votes cast against this proposal because they are considered shares present at the meeting for purposes of determining a quorum.

Holders of proxies solicited by this Proxy Statement will vote the proxies received by them as directed on the proxy card or, if no direction is made, “for” the non-binding advisory resolution approving the compensation of our NEOs.

Proxy Statement 2024 3

PROPOSALS SUBMITTED FOR YOUR VOTE AT THE 2024 ANNUAL MEETING

Proposal 4

Approve an amendment to our Amended and Restated Certificate of Incorporation to eliminate our officers’ personal liability for breach of fiduciary duty to the fullest extent permitted by Delaware law

Sylvamo’s Charter protects our directors from personal monetary liability (referred to as “exculpation”) for breach of fiduciary duty, under limited circumstances in accordance with Section 102(b)(7) of the Delaware General Corporation Law (“DGCL”). The Charter does not include a similar provision for Sylvamo’s officers. When our Charter was adopted and later amended and restated in 2021, the DGCL permitted Delaware corporations to provide exculpation protection for directors, but not officers. The DGCL was amended in August 2022 to permit Delaware corporations to expand exculpation protection to certain officers under limited circumstances.

The Board has determined that it is advisable and in the best interests of Sylvamo and its shareowners to amend our Charter. If approved by our shareowners, the proposed Charter amendment would modify Article SIXTH of the Charter to read in its entirety as follows (content added by the amendment is in bold underlined text, content deleted by the amendment is struck through):

SIXTH. Director Indemnification. Director and Officer Limitation of Liability. No director or officer of the Corporation shall be personally liable to the Corporation or its stockholders for monetary damages for breach of his or her fiduciary duty as a director or officer, provided that nothing contained in this Article SIXTH shall eliminate or limit the liability of a director or officer (a) for any breach of the director’s or officer’s duty of loyalty to the Corporation or its stockholders, (b) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of the law, (c) a director under Section 174 of the DGCL, or (d) for any transaction from which the director or officer derived an improper personal benefit, or (e) an officer for any action by or in the right of the Corporation. If the DGCL is amended to authorize corporate action further eliminating or limiting the personal liability of directors or officers, then the liability of a director or officer of the Corporation shall be eliminated or limited to the fullest extent permitted by the DGCL, as so amended. For purposes of this Article SIXTH, “officer” shall have the meaning provided in Section 102(b)(7) of the DGCL, as it presently exists or may hereafter be amended from time to time.”

Replacing Article SIXTH of our Charter with the proposed Article SIXTH above is the only proposed change to our Charter.

As proposed, the Charter amendment would eliminate the personal liability of certain officers (as defined in DGCL Section 102(b)(7)) for monetary damages for breach of fiduciary duty, to the fullest extent permitted by Section 102(b)(7) of the DGCL. Personal liability would not be eliminated for

| • | breach of the duty of loyalty, effectively restricting the elimination of liability to breaches of the duty of care, |

| • | acts or omissions that were not in good faith, intentional misconduct or knowing violations of law, |

| • | any transactions from which the officer receives an improper personal benefit, or |

| • | breach of fiduciary duty claims brought by or in the right of Sylvamo, including claims brought by our shareowners derivatively in the name of Sylvamo. |

In declaring advisable and recommending that shareowners adopt the proposed Charter amendment, the Board took into account these factors

| • | Officers of a corporation frequently must make decisions in response to time-sensitive opportunities and challenges, which in the absence of protections against personal liability can create a substantial risk of investigations, claims, actions, suits or proceedings seeking to impose liability on the basis of hindsight, sometimes regardless of merit. Limiting officers’ concerns about personal liability in certain circumstances would allow them to best exercise their business judgment in furtherance of Sylvamo’s and our shareowners’ interests, while minimizing the distraction posed by frivolous lawsuits and the risk of an officer’s financial ruin as the result of an unintentional misstep. |

4 Sylvamo

PROPOSALS SUBMITTED FOR YOUR VOTE AT THE 2024 ANNUAL MEETING

| • | The proposed Charter amendment would reduce the risk of frivolous claims involving Sylvamo’s officers, including claims brought only to increase the settlement value of a lawsuit, against which our Charter currently protects our directors but not our officers. |

| • | Many companies chartered in Delaware have adopted, or are adopting, charter amendments to limit their officers’ personal liability under the circumstances permitted by Delaware law, since August 2022 when the DGCL was amended to allow for Delaware corporations to provide their officers with such protection. We expect that more companies will amend their charters to provide their officers with such protection. If the proposed amendment to our Charter is not approved, we might be hindered in our ability to compete against those companies in recruiting and retaining exceptionally qualified officers, due to a candidate’s or officer’s concerns about personal liability exposure at Sylvamo relative to the limitations on personal liability exposure offered at companies providing such protection. |

| • | Although the proposed Charter amendment would eliminate officers’ personal monetary liability for direct claims that they breached their fiduciary duty, except as set forth in the DGCL, it would not eliminate such liability if the claim were brought by or in the right of Sylvamo itself, including by shareowners derivatively in Sylvamo’s name. Thus, the Company and shareowners (including through derivative suits) would retain the right to bring appropriate actions in the name of Sylvamo against officers for alleged breaches of their fiduciary duty. |

| • | Also as noted above, the proposed Charter amendment would not eliminate officers’ personal monetary liability for breach of the duty of loyalty, or for acts or omissions not in good faith, intentional misconduct or knowing violations of law, or with respect to a transaction in which the officer receives an improper personal benefit. |

The Board has unanimously approved and declared advisable an amendment to the Charter to eliminate the personal monetary liability of certain of our officers to the fullest extent permitted by Delaware law, as described above, and recommends that Sylvamo’s shareowners adopt the proposed Charter amendment at the Annual Meeting.

If shareowners approve this proposal to amend the Charter at the Annual Meeting, we intend to file a Certificate of Amendment to the Amended and Restated Certificate of Incorporation (the “Certificate of Amendment”) with the Secretary of State of the State of Delaware, the form of which is attached as Annex A to this Proxy Statement and is considered part of this Proxy Statement. We anticipate filing the Certificate of Amendment promptly after the Annual Meeting if this proposal is approved.

|

|

The Board recommends that you vote FOR Proposal 4

|

Vote Required for Approval

Approval of this proposal requires the affirmative vote of a majority of the shares outstanding on the record date.

Your Voting Options

You may vote “for” or “against” this proposal, or you may “abstain” from voting. Abstentions will have the same effect as votes cast against this proposal because they are considered votes present at the meeting for purposes of determining a quorum.

If you hold your shares in street name through a bank or broker, your failure to provide voting instructions to your bank or broker will cause your shares to be considered “broker non-votes” because your bank or broker is not entitled to vote your shares in its discretion on this proposal. Broker non-votes will have the same effect as votes cast against this proposal because they are considered shares present at the meeting for purposes of determining a quorum.

Holders of proxies solicited by this Proxy Statement will vote the proxies received by them as directed on the proxy card or, if no direction is made, “for” approving the proposed Charter amendment.

Proxy Statement 2024 5

PROPOSALS SUBMITTED FOR YOUR VOTE AT THE 2024 ANNUAL MEETING

If you are a registered shareowner that received a notice that the proxy materials are available on the Internet, or you received a full set of proxy materials including a proxy card, please vote as promptly as possible by using one of the following methods:

|

INTERNET |

Go to www.proxypush.com/SLVM and follow the voting instructions on the notice or proxy card that you received. | ||

|

|

PHONE |

Call 866-509-1053 and follow the voting instructions on the notice or proxy card that you received. | ||

|

|

|

Follow the voting instructions for voting by mail on the notice or proxy card that you received. | ||

|

|

AT THE MEETING |

Attend the meeting, provide a government-issued proof of identification and vote in person when voting is held during the meeting. | ||

|

If you hold your shares in street name through a bank or broker, refer to the voting instructions received from your bank or broker for information on how to vote at the Annual Meeting, and to vote in person at the meeting, you must present a valid legal proxy from your bank or broker that is the record holder of your shares. | ||||

Important Notice Regarding the Availability of Proxy Materials for Shareholder Meeting to Be Held on May 16, 2024

The Proxy Statement and our Annual Report are available for review at www.proxydocs.com/SLVM.

A Notice of Internet Availability of Proxy Materials, or a copy of the Proxy Statement, our Annual Report and other proxy materials, are first being sent to shareowners on or about April 5, 2024.

6 Sylvamo

Information about the Annual Meeting

Meeting Date and Time

The Annual Meeting will be held on Thursday, May 16, 2024, at 11:30 a.m. U.S. Central Time. The Annual Meeting will be held at Sylvamo World Headquarters, 6077 Primacy Parkway, Memphis, Tennessee 38119.

Shareowners of record of Sylvamo common stock at the close of business on the record date, March 18, 2024, or their duly authorized proxy holders, are entitled to vote on each matter submitted to a vote at the Annual Meeting and at any adjournment or postponement of the meeting. There were 41,461,657 shares of Sylvamo common stock outstanding on March 18, 2024. Each share of common stock is entitled to one vote on each matter to be voted on at the Annual Meeting. A list of shareowners as of the record date will be available for inspection and review at our headquarters in Memphis, Tennessee, starting May 2, 2024. To review the list, contact our Corporate Secretary at the address in this Proxy Statement under the heading “How to Contact Us.” We will also make the list available for inspection in person at the Annual Meeting.

Voting and Attendance

Why am I receiving these proxy materials?

We have made these materials available to you or delivered paper copies to you by mail because you are a Sylvamo shareowner of record as of March 18, 2024, and our Board is soliciting your proxy to vote your shares at the Annual Meeting. This Proxy Statement includes information that we are required to provide to you under SEC rules and is intended to assist you in determining how to vote your shares.

What is a proxy?

A proxy is your legal designation of another person to vote the stock you own. The person you designate is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card. By voting electronically on the Internet, voting by telephone, or signing and returning a proxy card, you will have authorized three Sylvamo executive officers — Jean-Michel Ribiéras, Chairman and Chief Executive Officer; John V. Sims, Senior Vice President and Chief Financial Officer; and Matthew L. Barron, Senior Vice President, Chief Administrative and Legal Officer, and Corporate Secretary — to represent you as your proxy and vote your shares at the Annual Meeting in accordance with your instructions. If you do not provide instructions, they may vote with respect to each proposal in their discretion in accordance with the recommendations of the Board, as stated in the section of this Proxy Statement entitled “Proposals Submitted for Your Vote at the 2024 Annual Meeting.” If you submit a valid proxy, they also may vote your shares to adjourn the meeting and will be authorized to vote your shares at any postponements or adjournments of the meeting.

What is included in the proxy materials?

The proxy materials for the Annual Meeting include:

| • | Notice of 2024 Annual Meeting of Shareowners of Sylvamo Corporation (“Annual Meeting Notice”) |

| • | Proxy Statement |

| • | Annual Report |

If you receive a paper copy of the proxy materials, then a proxy card or voting instruction form and pre-paid return envelope are also included. The Annual Meeting Notice and Proxy Statement, our Annual Report and other proxy materials are first being made available for viewing and printing at www.proxydocs.com/SLVM and are first being mailed or otherwise made available to shareowners of record beginning on or about April 5, 2024.

Proxy Statement 2024 7

INFORMATION ABOUT THE ANNUAL MEETING

Why did I receive a Notice of the Internet Availability of Proxy Materials instead of a full set of proxy materials?

We are furnishing proxy materials to our shareowners primarily through notice-and-access delivery pursuant to SEC rules. As a result, beginning April 5, 2024, we are mailing to many of our shareowners a Notice of Internet Availability containing instructions on how to access the proxy materials on the Internet. Shareowners who have affirmatively requested electronic delivery of our proxy materials will receive instructions via email regarding how to access these materials electronically. Shareowners who have previously requested to receive a paper copy of the materials will receive a full paper set of the proxy materials by mail. Using the notice-and-access method of proxy delivery expedites receipt of proxy materials by our shareowners and reduces the cost of producing and mailing the full set of proxy materials. If you receive a Notice of Internet Availability by mail, you will not receive a paper copy of the proxy materials in the mail unless you request a paper copy. Instead, the Notice of Internet Availability instructs you on how to access the proxy materials and vote on the Internet. To request that a paper copy of the proxy materials be sent to you by mail, follow the instructions in the Notice of Internet Availability.

How many votes must be present to hold the Annual Meeting?

Holders of record of Sylvamo common stock present, in person or by proxy, at the Annual Meeting, representing a majority of the number of shares entitled to vote at the meeting (at least 20,730,829 votes) is required to constitute a quorum and transact business at the Annual Meeting. Shares held of record and represented by signed proxy cards, including those marked “abstain” or returned without voting instructions, will be counted as present in determining if a quorum exists. In addition, if you hold shares in street name through a bank or broker, your shares will also be counted as present for the purpose of determining whether the quorum for the Annual Meeting is satisfied, even if you do not provide instructions to your bank or broker, if your bank or broker exercises its discretion to vote on Proposal 2 (a routine proposal). We urge you to vote by proxy even if you plan to attend the Annual Meeting in person. That will help us know as soon as possible that we have enough shares represented to hold the meeting. Returning your proxy will not affect your right to revoke your proxy, attend the Annual Meeting or vote in person at the Annual Meeting.

How do I vote my shares?

If you are a “holder of record” (that is, if your shares are registered in your own name with our transfer agent), you have several options. You may vote in advance of the meeting on the Internet, by telephone or by mail using a written proxy card. You may request a physical proxy card by following the instructions included on the Notice of Internet Availability that you received. If you are a holder of record, you also will have the option to vote your shares in person at the Annual Meeting by delivering a completed proxy card in person or completing and delivering a ballot in person. We will distribute ballots to holders of record who wish to vote in person at the meeting.

If you hold your shares in street name through a bank or broker, you have the right to direct your bank or broker how to vote your shares. If you receive a Notice of Internet Availability or voting instruction form from your bank or broker, please follow the instructions provided on the form. If you do not instruct your bank or broker how to vote your shares, it will nevertheless be entitled to vote your shares with respect to “routine” items (Proposal 2), but it will not be permitted to vote your shares with respect to “non-routine” items (Proposals 1, 3 and 4). In the case of a non-routine item, your shares will be considered “broker non-votes.” Also, you may vote at the meeting if you obtain and bring to the meeting a valid legal proxy from your bank or broker that holds your shares giving you the right to vote the shares at the meeting.

How do I attend the Annual Meeting?

The location of the Annual Meeting is Sylvamo World Headquarters, 6077 Primacy Parkway, Memphis, Tennessee 38119. The meeting will not be held virtually. If you wish to attend the Annual Meeting, please arrive in person no later than 15 minutes before the meeting start time of 11:30 a.m. U.S. Central Time on May 16, 2024, to allow sufficient time to sign in and be seated before the meeting commences.

8 Sylvamo

INFORMATION ABOUT THE ANNUAL MEETING

What happens if the Annual Meeting is postponed or adjourned?

Your proxy will still be valid and may be voted at the postponed or adjourned meeting, but only on business that could have been transacted at the Annual Meeting before it was postponed or adjourned. You will still be able to change or revoke your proxy until it is voted at the postponed or adjourned meeting.

Can I change or revoke my vote or proxy?

Yes, you may change your vote or revoke your proxy at any time before or at the Annual Meeting.

If you are a holder of record, you may change your vote or revoke your proxy by:

| • | casting a new vote by telephone or on the Internet prior to the Annual Meeting; |

| • | properly completing and signing another proxy card with a later date and returning the proxy card prior to the Annual Meeting; |

| • | giving written revocation in person at the Annual Meeting before voting commences or by mail delivered before the Annual Meeting to the attention of our Corporate Secretary at the street address noted in this Proxy Statement under the heading “How to Contact Us;” or |

| • | casting a new vote in person at the Annual Meeting. |

If you hold your shares in street name through a bank or broker, you may change or revoke your voting instructions by contacting your bank or broker prior to the Annual Meeting.

What if I do not indicate my vote for one or more of the proposals on my proxy card?

If you are a holder of record and you return a signed proxy card without indicating your vote, your shares will be voted as follows:

| • | for Proposal 1 to elect as our directors all eleven nominees named in the Proxy Statement; |

| • | for Proposal 2 to ratify the appointment of Deloitte as our independent registered public accounting firm for 2024; |

| • | for Proposal 3 to approve, on a non-binding advisory basis, the compensation of our NEOs; and |

| • | for Proposal 4 to approve an amendment to our Amended and Restated Certificate of Incorporation to eliminate our officers’ personal liability for breach of fiduciary duty to the fullest extent permitted by Delaware law. |

If you are a holder of record and you do not return a proxy card or vote in person at the Annual Meeting, your shares will not be voted and will not count toward the quorum necessary to hold the meeting.

If your shares are held in street name and you do not give your bank or broker instructions on how to vote, your shares will still be counted toward the quorum requirement for the Annual Meeting provided that your bank or broker votes your shares utilizing its discretionary authority for Proposal 2 as noted below. The failure to instruct your bank or broker how to vote will impact the vote on the proposals for consideration at the Annual Meeting as follows:

| • | Proposals 1, 3 and 4 — if you do not provide voting instructions, your bank or broker will not be permitted to vote your shares on any of these proposals, and your shares will be considered broker non-votes. A broker non-vote will have no effect on the outcome of Proposal 1. A broker non-vote will have the same effect as a vote cast against each of Proposals 3 and 4. |

| • | Proposal 2 — your bank or broker may vote your shares at its discretion. |

Proxy Statement 2024 9

INFORMATION ABOUT THE ANNUAL MEETING

Will my vote be confidential?

Yes. Your vote is confidential and will not be disclosed to our directors or employees, unless in accordance with law.

Will our directors attend the Annual Meeting?

Our Corporate Governance Guidelines set an expectation that all directors attend annual meetings of shareowners. All of our directors attended our 2023 annual meeting of shareowners, and we expect that they will attend the Annual Meeting.

Who will solicit proxies on behalf of Sylvamo?

Sylvamo pays the cost of preparing proxy materials and soliciting your vote. Proxies may be solicited on our behalf by our directors, officers or employees by telephone, email or other electronic transmission or in person, without compensation. We have hired Alliance Advisors, LLC to solicit proxies for an estimated fee of approximately $25,000, plus expenses.

What is householding?

We have adopted “householding,” a procedure by which shareowners of record who have the same address and last name and do not participate in electronic delivery will receive only one copy of the Notice of Internet Availability or the proxy materials, unless one or more of those shareowners notifies us that they wish to continue receiving individual copies. This procedure saves us printing and mailing costs. Shareowners will continue to receive separate proxy cards. We will deliver promptly, upon written or oral request, a separate copy of the Notice of Internet Availability or the proxy materials to a shareowner at a shared address to which a single copy of the documents was delivered. To request separate copies of the Notice of Internet Availability or the proxy materials, or to request that only a single copy be sent to the household, either now or in the future, please call us at 1-866-735-0665, or send your written request to our Corporate Secretary at the address in this Proxy Statement under the heading “How to Contact Us.”

How do I change future proxy delivery options?

If you hold your shares in street name and wish to receive separate copies of future Notices of Internet Availability or sets of proxy materials, or if you currently receive multiple copies of the Notice of Internet Availability or multiple sets of proxy materials and would like to receive a single copy or set, please contact call Broadridge Financial Solutions, Inc., at 1-866-540-7095, or send your written request to:

Broadridge Financial Solutions, Inc.

Householding Dept.

51 Mercedes Way

Edgewood, NY 11717

Communicating with the Board

How do I communicate with the Board?

Shareowners or other interested parties may communicate with our entire Board, a Board committee, the Chairman, the independent directors as a group, the Lead Independent Director or any one or more specific directors by writing to our Corporate Secretary at the address in this Proxy Statement under the heading “How to Contact Us.” Our Corporate Secretary will forward all communications relating to Sylvamo’s interests, other than business solicitations, advertisements, job inquiries or improper communications, directly to the appropriate director(s). For more information about communicating with the Board, see page 19.

10 Sylvamo

INFORMATION ABOUT THE ANNUAL MEETING

Matters Pertaining to Sylvamo’s 2025 Annual Meeting of Shareowners

What is the deadline for consideration of Rule 14a-8 shareowner proposals for inclusion in Sylvamo’s proxy statement for the 2025 annual meeting of shareowners?

A shareowner who wishes to submit a proposal under Rule 14a-8 of the Exchange Act, for inclusion in our proxy statement and form of proxy for the 2025 annual meeting of shareowners, must send the proposal to our Corporate Secretary at the address in this Proxy Statement under the heading “How to Contact Us.” We must receive the proposal at our principal executive offices on or before December 7, 2024, and the proposal must otherwise comply with the requirements of Rule 14a-8 under the Exchange Act.

Can I nominate a director in connection with the 2025 annual meeting of shareowners?

Yes. If you would like to make a director nomination for the 2025 annual meeting of shareowners, you must submit such nomination in accordance with the advance notice provisions in our Amended and Restated By-Laws (“Bylaws”). Our Bylaws are available for review as an exhibit linked to our 2023 Form 10-K, accessible at www.sylvamo.com at the “investors” link. Any such nomination must be received by our Corporate Secretary at our principal executive officers at the address in this Proxy Statement under the heading “How to Contact Us,” no earlier than January 16, 2025 and no later February 15, 2025 (assuming we do not hold our 2025 annual meeting more than 30 days before or 70 days after the anniversary date of the Annual Meeting), and written notice of any such nomination must include all information required by our Bylaws in connection with such nomination, including with respect to both the shareowner proponent and the nominee for director, and such notice and nomination must otherwise comply with our Bylaws.

If we hold our 2025 annual meeting more than 30 days before or 70 days after the anniversary date of the Annual Meeting, then the written notice and information required by our Bylaws must be received by our Corporate Secretary no later than the close of business on the later of the 90th day prior to our 2025 annual meeting or the close of business on the 10th day following the day on which public announcement of the date of our 2025 annual meeting is first made by us.

In addition to satisfying the requirements of our Bylaws, to comply with the SEC’s universal proxy rules, if you intend to solicit proxies in support of nominees other than the Company’s nominees, you must also comply with the additional requirements of Rule 14a-19 under the Exchange Act, which written notice must be postmarked or transmitted electronically to our Corporate Secretary at our principal executive offices no later than March 17, 2025. However, if the date of our 2025 annual meeting is changed by more than 30 days before or after the anniversary date of the Annual Meeting, then written notice must be provided by the later of the 60th day prior to the date of our 2025 annual meeting and the 10th day following the day on which public announcement of the date of the annual meeting is first made by us.

In the event any director nomination is made properly in accordance with our Bylaws and the applicable rules as set forth above, the Nominating and Corporate Governance Committee will consider the nominee as a potential nominee for election to our Board at our 2025 annual meeting. The Nominating and Corporate Governance Committee uses the same criteria to evaluate candidates nominated by shareowners as it does for any other candidate for director.

Can I raise other business at the 2025 annual meeting of shareowners?

Yes. If you would like to raise any business (other than director nominations) but not include it in our proxy materials for the 2025 annual meeting, you must raise such business in accordance with the advance notice provisions set forth in our Bylaws. Any such notice must be received by our Corporate Secretary at our principal executive offices at the address in this Proxy Statement under the heading “How to Contact Us,” no earlier than January 16, 2025 and no later February 15, 2025 (assuming we do not hold our 2025 annual meeting more than 30 days before or 70 days after the anniversary date of our Annual Meeting), and must otherwise comply with and include all information required by our Bylaws. If we hold our 2025 annual meeting more than 30 days before or 70 days after the anniversary date of the Annual Meeting, then the written notice and information required by our Bylaws must be received by our Corporate Secretary at our principal executive offices no later than the close of business on the later of the 90th day prior to our 2025 annual meeting or the close of business on the 10th day following the day on which public announcement of the date of our 2025 annual meeting is first made.

Proxy Statement 2024 11

Corporate Governance

Board Composition and Director Independence

Our business and affairs are managed under the direction of our Board. Currently, the size of our Board is eleven directors. Our directors are elected annually to serve until the next annual meeting of shareowners or until their successors are duly elected and qualified.

The number of members on our Board may be fixed by majority vote of the members of our Board. Any vacancy in our Board will be filled by an affirmative vote of at least a majority of the directors then in office, even if less than a quorum, or by a sole remaining director. Each director will hold office until his or her successor has been duly elected and qualified, or until his or her earlier death, resignation or removal.

Our Board has previously determined that Stan Askren, Christine S. Breves, Jeanmarie Desmond, Liz Gottung, Joia M. Johnson, Karl L. Meyers, David Petratis, J. Paul Rollinson, Mark W. Wilde and James P. Zallie are independent in accordance with applicable rules and regulations of the SEC and NYSE.

Board Leadership Structure

Our Board is currently led by our Chairman and Chief Executive Officer, Jean-Michel Ribiéras. Our Board does not mandate the separation of the offices of Chairman and Chief Executive Officer. Our Board believes it is important to retain its flexibility to allocate the responsibilities of the offices of the Chairman and Chief Executive Officer in any way that is in the best interests of Sylvamo at a given point in time. The independent directors on our Board elected David Petratis as our Lead Independent Director, who presides over meetings of the independent directors, has authority over certain governance matters and, in consultation with the chair of the Management Development and Compensation Committee, organizes the processes for the independent directors’ annual performance review of the Chief Executive Officer and, in succession planning, for the selection of the CEO. Our Board believes this governance structure currently promotes a balance between the Board’s independent authority to oversee our business and the Chief Executive Officer and his management team who manage the business on a day-to-day basis. Our Board expects to periodically review its leadership structure to ensure that it continues to meet our needs, including with respect to risk oversight responsibilities. For more information about the Board’s risk oversight, see “Risk Oversight” on page 16.

12 Sylvamo

CORPORATE GOVERNANCE

Board Committees

Our Board has an Audit Committee, a Management Development and Compensation Committee, and a Nominating and Corporate Governance Committee. The composition, duties and responsibilities of these committees are as set forth in the table and narrative below. In the future, our Board may establish other committees as it deems appropriate to assist it with its responsibilities.

| Board Member |

Audit Committee | Management Development and Compensation Committee |

Nominating and Corporate Governance Committee | |||

| Jean-Michel Ribiéras |

|

|

| |||

| Stan Askren |

● |

● |

| |||

| Christine S. Breves |

● |

|

| |||

| Jeanmarie Desmond |

● chair |

|

● | |||

| Liz Gottung |

|

● chair |

● | |||

| Joia M. Johnson |

|

● |

● | |||

| Karl L. Meyers |

|

|

● | |||

| David Petratis |

|

|

● chair | |||

| J. Paul Rollinson |

|

● |

| |||

| Mark W. Wilde |

● |

● |

| |||

| James P. Zallie |

● |

|

| |||

Audit Committee

The Audit Committee, which consists of Jeanmarie Desmond (Chair), Stan Askren, Christine S. Breves, Mark W. Wilde and James P. Zallie, has the responsibility for, among other things, assisting the Board in reviewing and monitoring the quality and integrity of our financial statements, reviewing our accounting, financial and external reporting policies and practices, assessing our independent auditor’s qualifications and independence, overseeing the performance of our internal audit function and independent auditors, overseeing our compliance with legal and regulatory requirements and monitoring the risk of financial fraud involving our management and the controls in place to prevent, deter and detect fraud. The charter of our Audit Committee is available without charge on the investor relations portion of our website at https://investors.sylvamo.com/governance/governance-documents. It is also available without charge in print to any shareowner who requests it by sending their request to our Corporate Secretary at the address in this Proxy Statement under the heading “How to Contact Us.”

Our Board has determined that each director serving on the Audit Committee meets the independence requirements of Rule 10A-3 under the Exchange Act and the applicable listing standards of the NYSE. Our Board has determined that all directors on the Audit Committee are “financially literate” and that each of Ms. Desmond, Ms. Breves and Mr. Askren is an “audit committee financial expert” within the meaning of Item (d)(5) of SEC Regulation S-K and the applicable listing standards of the NYSE.

Audit Committee Engagement and Oversight of Independent Registered Public Accounting Firm

The Audit Committee is responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm retained to audit our financial statements (sometimes referred to below as the “auditor”). To that end, the Audit Committee has adopted pre-approval policies and procedures for services performed by the independent registered public accounting firm. These policies and procedures are intended to assure that the provision of services by the auditor does not impair the auditor’s

Proxy Statement 2024 13

CORPORATE GOVERNANCE

independence. Pursuant to these policies and procedures, each year the Audit Committee receives a listing for services pre-approval that describes nature of work encompassed by the “audit,” “audit-related,” “tax” and “all other” auditor service categories. The term of any pre-approval is for the calendar year following the date of pre-approval, unless the Audit Committee specifically provides for a different period. The fees for all services pre-approved by the Audit Committee must be fixed or based on standard hourly rates for professional time incurred. Contingent fee arrangements are not permitted. If, subsequent to the pre-approval, specific services are considered by our management were not considered in the pre-approval categories, or the proposed cumulative fees are expected to exceed the pre-approval category range, then appropriate members of management and the auditor must request further approval of the Audit Committee, presenting information that is designed to validate that the proposed services or excess fees are consistent with the SEC’s rules on auditor independence.

The Audit Committee engaged Deloitte to perform an annual audit of the Company’s financial statements for the years ended December 31, 2022, and December 31, 2023.

Independent Auditor Fees and Services

The information below reports on the fees paid by us with respect to services provided by Deloitte in 2022 and 2023. All services rendered by Deloitte were approved by the Audit Committee and were determined to be permissible under applicable laws and regulations.

| 2022 ($, in thousands) |

2023 ($, in thousands) |

|||||||

| Audit Fees |

4,786 | 5,241 | ||||||

| Audit-Related Fees |

449 | 129 | ||||||

| Tax Fees |

1,299 | 886 | ||||||

| All Other Fees |

— | — | ||||||

| Total Fees |

6,534 | 6,256 | ||||||

Pursuant to rules adopted by the SEC, the fees paid to Deloitte for the services that it provided in 2022 and 2023 are presented in the table above under the following categories:

| • | Audit Fees: fees for audit services, services associated with SEC filings (including review of our quarterly financial information) and statutory and subsidiary audits |

| • | Audit-Related Fees: fees for acquisition and divestiture services, employee benefit plans audits and research tools |

| • | Tax Fees: fees for tax planning and advice, tax compliance, review and consultation on regulatory matters and advice on tax-related organizational matters |

| • | All Other Fees: fees for other permissible work that does not meet the above category descriptions. |

Audit Committee Report

The following is the report of the Audit Committee with respect to our audited financial statements for the fiscal year ended December 31, 2023.

The Audit Committee assists the board of directors in its oversight of Sylvamo’s financial reporting processes and the independent audit of Sylvamo’s financial statements. The Audit Committee’s responsibilities are more fully described in its charter, which is available at www.sylvamo.com under the “Investors” tab at the “Governance – Governance Documents” link. Paper copies of the Audit Committee charter may be obtained, without cost, by written request to Mr. Matthew L. Barron, Corporate Secretary, Sylvamo Corporation, 6077 Primacy Parkway, Memphis, TN 38119.

14 Sylvamo

CORPORATE GOVERNANCE

Sylvamo’s management is responsible for Sylvamo’s internal controls and financial reporting processes, and for preparing Sylvamo’s financial statements. Deloitte & Touche LLP, an independent registered public accounting firm, performed an independent audit of Sylvamo’s financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”) and expressed an opinion on the conformity of the financial statements to accounting principles generally accepted in the United States of America. Deloitte also audited and expressed an opinion on the effectiveness of Sylvamo’s internal control over financial reporting as of December 31, 2023, based on criteria established in “Internal Control — Integrated Framework (2013)” issued by the Committee of Sponsoring Organizations of the Treadway Commission.

Against this background, in fulfilling its oversight responsibilities, the Audit Committee has reviewed and discussed with management and Deloitte Sylvamo’s audited financial statements for the 2023 fiscal year, management’s assessment of the effectiveness of Sylvamo’s internal control over financial reporting, and Deloitte’s opinion on Sylvamo’s internal control over financial reporting. The Audit Committee has discussed with Deloitte the matters required to be discussed by PCAOB Auditing Standard No. 1301, “Communications with Audit Committees,” and the U.S. Securities and Exchange Commission. The Audit Committee has received the written disclosures and the letter from Deloitte required by the applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning its independence, and has discussed with Deloitte its independence from Sylvamo and its management. The Audit Committee has also considered whether the provision of non-audit services by Deloitte is compatible with maintaining the firm’s independence.

Based on the review and discussions referred to above, the Audit Committee recommended to Sylvamo’s Board that Sylvamo’s audited financial statements be included in Sylvamo’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

By the Audit Committee

| • | Jeanmarie Desmond, Chair |

| • | Stan Askren |

| • | Christine S. Breves |

| • | Mark W. Wilde |

| • | James P. Zallie |

Management Development and Compensation Committee