|

|

|

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange

on which registered

|

||

|

|

|

|

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Smaller reporting company

|

Emerging growth company

|

|

Part I

|

||

|

Item 1.

|

5

|

|

|

Item 1A.

|

22

|

|

|

Item 1B.

|

50

|

|

|

Item 2.

|

50

|

|

|

Item 3.

|

50

|

|

|

Item 4.

|

50

|

|

|

Part II

|

||

|

Item 5.

|

51

|

|

|

Item 6.

|

53

|

|

|

Item 7.

|

54

|

|

|

Item 7A.

|

77

|

|

|

Item 8.

|

78

|

|

|

Item 9.

|

117

|

|

|

Item 9A.

|

117

|

|

|

Item 9B.

|

118

|

|

|

Part III

|

||

|

Item 10.

|

118

|

|

|

Item 11.

|

118

|

|

|

Item 12.

|

119

|

|

|

Item 13.

|

119

|

|

|

Item 14.

|

119

|

|

|

Part IV

|

||

|

Item 15.

|

120

|

|

|

123

|

||

| • |

the success of the financial technology industry, the development and acceptance of which is subject to a high degree of uncertainty, as well as the continued evolution of the regulation of this industry;

|

| • |

the ability of our Strategic Program service providers to comply with regulatory regimes, including laws and regulations applicable to consumer credit transactions, and our ability to adequately oversee and

monitor our Strategic Program service providers;

|

| • |

our ability to maintain and grow our relationships with our Strategic Program service providers;

|

| • |

changes in the laws, rules, regulations, interpretations or policies relating to financial institutions, accounting, tax, trade, monetary and fiscal matters, including the application of interest rate caps or

maximums;

|

| • |

our ability to keep pace with rapid technological changes in the industry or implement new technology effectively;

|

| • |

conditions relating to Covid-19, including the severity and duration of associated economic impacts either nationally or in our market areas;

|

| • |

system failure or cybersecurity breaches of our network security;

|

| • |

our reliance on third-party service providers for core systems support, informational website hosting, internet services, online account opening and other processing services;

|

| • |

general economic conditions, either nationally or in our market areas (including interest rate environment, government economic and monetary policies, the strength of global financial markets and inflation and

deflation), that impact the financial services industry and/or our business;

|

| • |

increased competition in the financial services industry, particularly from regional and national institutions and other companies that offer banking services;

|

| • |

our ability to measure and manage our credit risk effectively and the potential deterioration of the business and economic conditions in our primary market areas;

|

|

•

|

the adequacy of our risk management framework;

|

| • |

the adequacy of our allowance for loan losses (“ALL”);

|

| • |

the financial soundness of other financial institutions;

|

| • |

new lines of business or new products and services;

|

| • |

changes in Small Business Administration (“SBA”) rules, regulations and loan products, including specifically the Section 7(a) program, changes in SBA standard operating procedures or changes to the status of

the Bank as an SBA Preferred Lender;

|

| • |

changes in the value of collateral securing our loans;

|

| • |

possible increases in our levels of nonperforming assets;

|

| • |

potential losses from loan defaults and nonperformance on loans;

|

| • |

our ability to protect our intellectual property and the risks we face with respect to claims and litigation initiated against us;

|

| • |

the inability of small- and medium-sized businesses to whom we lend to weather adverse business conditions and repay loans;

|

| • |

our ability to implement aspects of our growth strategy and to sustain our historic rate of growth;

|

| • |

our ability to continue to originate, sell and retain loans, including through our Strategic Programs;

|

| • |

the concentration of our lending and depositor relationships through Strategic Programs in the financial technology industry generally;

|

| • |

our ability to attract additional merchants and retain and grow our existing merchant relationships;

|

| • |

interest rate risk associated with our business, including sensitivity of our interest earning assets and interest-bearing liabilities to interest rates, and the impact to our earnings from changes in interest

rates;

|

| • |

the effectiveness of our internal control over financial reporting and our ability to remediate any future material weakness in our internal control over financial reporting;

|

| • |

potential exposure to fraud, negligence, computer theft and cyber-crime and other disruptions in our computer systems relating to our development and use of new technology platforms;

|

| • |

our dependence on our management team and changes in management composition;

|

| • |

the sufficiency of our capital, including sources of capital and the extent to which we may be required to raise additional capital to meet our goals;

|

| • |

compliance with laws and regulations, supervisory actions, the Dodd-Frank Act, capital requirements, the Bank Secrecy Act, anti-money laundering laws, predatory lending laws, and other statutes and regulations;

|

| • |

our ability to maintain a strong core deposit base or other low-cost funding sources;

|

| • |

results of examinations of us by our regulators, including the possibility that our regulators may, among other things, require us to increase our ALL or to write-down assets;

|

| • |

our involvement from time to time in legal proceedings, examinations and remedial actions by regulators;

|

| • |

further government intervention in the U.S. financial system;

|

| • |

natural disasters and adverse weather, acts of terrorism, pandemics, an outbreak of hostilities or other international or domestic calamities, and other matters beyond our control;

|

| • |

compliance with requirements associated with being a public company;

|

| • |

level of coverage of our business by securities analysts;

|

| • |

future equity and debt issuances; and

|

| • |

other factors that are discussed in the section entitled “Risk Factors,” beginning on page 22.

|

|

($ in thousands)

|

Total Loans

|

% of Loans in

Category of

Total Loans

|

||||||

|

SBA

|

$

|

145,172

|

55.8

|

%

|

||||

|

Commercial, non-real estate

|

11,484

|

4.4

|

%

|

|||||

|

Residential real estate

|

37,815

|

14.5

|

%

|

|||||

|

Strategic Program loans

|

47,848

|

18.4

|

%

|

|||||

|

Commercial real estate

|

12,063

|

4.7

|

%

|

|||||

|

Consumer

|

5,808

|

2.2

|

%

|

|||||

|

Total

|

$

|

260,190

|

100.0

|

%

|

||||

| • |

understanding the customer’s financial condition and ability to repay the loan;

|

| • |

evaluating management performance and expertise and industry experience;

|

| • |

verifying that the primary and secondary sources of repayment are adequate in relation to the amount and structure of the loan;

|

| • |

observing appropriate loan-to-value guidelines for collateral secured loans;

|

| • |

maintaining our targeted levels of diversification for the loan portfolio, both as to type of borrower and type of collateral; and

|

| • |

ensuring that each loan is properly documented with perfected liens on collateral.

|

| • |

whether the applicant has any other loans(s) (including through the PPP, SBA EIDL, other stimulus financing) that have repayment or contingent repayment requirements which could impact cash flow;

|

| • |

for commercial applicants, whether the business revenue and staffing levels were impacted by the Covid-19 pandemic and whether the business has a contingency plan for revenues and operations for a minimum of the

next 18 months;

|

| • |

for individual applicants, whether his or her source of income has been or may be impacted;

|

| • |

whether historical financial information can be reasonably relied upon based on current market conditions; and

|

| • |

the impact current market conditions have on collateral adequacy.

|

| • |

Ensure the Safety of Principal—Bank investments are generally limited to investment-grade instruments that fully comply with all applicable regulatory guidelines and limitations. Allowable non-investment-grade

instruments must be approved by the board of directors.

|

| • |

Income Generation—The Bank’s investment portfolio is managed to maximize income on invested funds in a manner that is consistent with the Bank’s overall financial goals and risk considerations.

|

| • |

Provide Liquidity—The Bank’s investment portfolio is managed to remain sufficiently liquid to meet anticipated funding demands either through declines in deposits and/or increases in loan demand.

|

| • |

Mitigate Interest Rate Risk—Portfolio strategies are used to assist the Bank in managing its overall interest rate sensitivity position in accordance with goals and objectives approved by our board of directors.

|

| Item 1A. |

RISK FACTORS

|

| • |

third-party service provider risk, including risks that we may be unable to maintain or increase loan originations facilitated through our Strategic Programs;

|

| • |

legal, accounting and compliance risks, including risks related to the extensive state and federal regulation under which we operate and changes in such regulations;

|

| • |

changes in the regulatory oversight environment impacting our Strategic Programs or non-compliance of federal and state consumer protection laws by our Strategic Program service providers;

|

| • |

legal and regulatory risks associated with “true lender” statutes associated with our Strategic Programs;

|

| • |

reputational risks, including the risk that we may be subject to negative publicity about us or our industry, including the transparency, fairness, user experience, quality, and reliability of our lending

products or distribution channels;

|

| • |

legislative, regulatory, legal, and reputational risks related to our Strategic Programs, including those relating to our small dollar lending program;

|

| • |

securities market, inflation and interest rate risks, including risks related to interest rate fluctuations and the monetary policies and regulations of the Board of Governors of the Federal Reserve System, or

the Federal Reserve;

|

| • |

risks related to cybersecurity breaches and system failures;

|

| • |

operational and strategic risks, including the risk that we may not be able to implement our growth strategy, our continued ability to establish relationships with Strategic Program service providers, and the

possible loss of key members of our senior leadership team;

|

| • |

the impact and extent of Covid-19 (including the emergence of any new variants thereof) and the response of governmental authorities to Covid-19;

|

| • |

credit risks, including risks related to the significance of SBA 7(a), Strategic Programs and construction loans in our portfolio, our relationship with BFG, our ability to effectively manage our credit risk and

the potential deterioration of the business and economic conditions in our markets;

|

| • |

liquidity and funding risks, including the risk that we will not be able to meet our obligations due to risks relating to our funding sources; and

|

| • |

investment risks, including volatility in the trading of our common stock and limitations on our ability to pay dividends.

|

| • |

difficulty in estimating the value of any target company;

|

| • |

investing time and incurring expense associated with identifying and evaluating potential investments or acquisitions and negotiating potential transactions, resulting in our attention being diverted from the

operation of our existing business;

|

| • |

the lack of history among our management team in working together on acquisitions and related integration activities;

|

| • |

obtaining necessary regulatory approvals, which we may have difficulty obtaining or be unable to obtain;

|

| • |

the time, expense and difficulty of integrating the operations and personnel of any combined businesses;

|

| • |

unexpected asset quality problems with acquired companies;

|

| • |

inaccurate estimates and judgments used to evaluate credit, operations, management and market risks with respect to any target institution or assets;

|

| • |

risks of impairment to goodwill or other-than-temporary impairment of investment securities;

|

| • |

potential exposure to unknown or contingent liabilities of banks and businesses we acquire;

|

| • |

an inability to realize expected synergies or returns on investment;

|

| • |

potential disruption of our ongoing banking business;

|

| • |

maintaining adequate regulatory capital; and

|

| • |

loss of key employees, key customers or key business counterparties following our investment or acquisition.

|

| Item 1B. |

UNRESOLVED STAFF COMMENTS

|

| Item 2. |

PROPERTIES

|

|

Location

|

Owned/

Leased

|

Lease

Expiration

|

Type of Office

|

|||

|

Murray, Utah

|

Leased

|

October 31, 2029

|

Corporate Headquarters

|

|||

|

Sandy, Utah

|

Leased

|

July 31, 2024

|

Retail Bank Branch

|

| Item 3. |

LEGAL PROCEEDINGS

|

| Item 4. |

MINE SAFETY DISCLOSURES

|

| Item 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

Period

|

Total Number of

Shares Purchased

|

Average Price

Paid

Per Share

|

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or Programs (1)

|

Maximum Number of

Shares that May

Yet Be Purchased

Under the Plans or

Programs (1)

|

|||||

|

October 1, 2022 -

October 31, 2022

|

—

|

—

|

—

|

624,241

|

|||||

|

November 1, 2022 -

November 30, 2022

|

57,882

|

$9.34

|

57,882

|

566,359

|

|||||

|

December 1, 2022 -

December 31, 2022

|

42,118

|

$8.99

|

42,118

|

524,241

|

|||||

|

Total

|

100,000

|

$9.19

|

100,000

|

524,241

|

| (1) |

On August 18, 2022, the Company announced that the Board has authorized, effective August 16, 2022, a common stock repurchase program to purchase up to 644,241 shares of the Company’s common stock in the aggregate. The repurchase

program expires on August 31, 2024 but may be limited or terminated at any time without prior notice. The repurchase program authorizes the repurchase by the Company of its common stock in open market transactions, including pursuant to a

trading plan in accordance with Rule 10b-18 promulgated under the Exchange Act or privately negotiated transactions. The authorization permits management to repurchase shares of the Company’s common stock from time to time at management’s

discretion. Repurchases may also be made pursuant to a trading plan under Rule 10b5-1 under the Exchange Act, which would permit shares to be repurchased when the Company might otherwise be precluded from doing so because of self-imposed

trading blackout periods or other regulatory restrictions. The actual means and timing of any shares purchased under the program will depend on a variety of factors, including the market price of the Company’s common stock, general market

and economic conditions, and applicable legal and regulatory requirements. The repurchase program does not obligate the Company to purchase any particular number of shares.

|

|

Plan Category

|

Number of Securities to be

Issued Upon Exercise of

Outstanding Options

or Restricted Stock Awards

|

Weighted-Average Exercise

Price of Outstanding Options

or Restricted Stock Awards

|

Number of Securities

Remaining Available for

Future Issuance under Equity

Compensation Plans (excluding

securities reflected in the first

column)

|

|||||||||

|

Equity compensation plans approved by security holders:

|

||||||||||||

|

FinWise Bancorp 2016 Stock Option Plan

|

132,018

|

$

|

5.23

|

894

|

||||||||

|

FinWise Bancorp 2019 Stock Option Plan

|

498,693

|

5.20

|

621,472

|

|||||||||

|

Equity compensation plans not approved by security holders (1)

|

250,914

|

5.43

|

NA

|

|||||||||

|

Total

|

881,625

|

622,366

|

||||||||||

| (1) |

Reflects (a) a grant to Kent Landvatter of 40,914 non-qualified stock options, (b) a grant to Javvis Jacobson of 60,000 non-qualified stock options, (c) a grant to James Noone of 60,000 non-qualified stock

options, (d) grants to Howard Reynolds of an aggregate of 18,000 non-qualified stock options, (e) grants to Gerald E. Cunningham of an aggregate of 18,000 non-qualified stock options, (f) grants to Thomas E. Gibson of an aggregate of

18,000 non-qualified stock options, (g) grants to James N. Giordano of an aggregate of 18,000 non-qualified stock options, (h) grants to Jeana Hutchings of an aggregate of 9,000 non-qualified stock options and (i) grants to Lisa Ann

Nievaard of an aggregate of 9,000 non-qualified stock options.

|

| Item 6. |

[RESERVED]

|

| Item 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

|

For the Years Ended

December 31,

|

|||||||

|

($ in thousands)

|

2022

|

2021

|

||||||

|

Interest income

|

$

|

52,329

|

$

|

49,243

|

||||

|

Interest expense

|

(1,434

|

)

|

(1,265

|

)

|

||||

|

Provision for loan losses

|

(13,519

|

)

|

(8,039

|

)

|

||||

|

Non-interest income

|

37,411

|

31,844

|

||||||

|

Non-interest expense

|

(38,756

|

)

|

(29,511

|

)

|

||||

|

Provision for income taxes

|

(10,916

|

)

|

(10,689

|

)

|

||||

|

Net income

|

25,115

|

31,583

|

||||||

|

|

Years Ended December 31,

|

|||||||||||||||||||||||

|

|

2022

|

2021

|

||||||||||||||||||||||

|

($ in thousands)

|

Average

Balance

|

Interest

|

Average

Yield/Rate

|

Average

Balance

|

Interest

|

Average

Yield/Rate

|

||||||||||||||||||

|

Interest earning assets:

|

||||||||||||||||||||||||

|

Interest-bearing deposits with the Federal Reserve, non

|

||||||||||||||||||||||||

|

U.S. central banks and other banks

|

$

|

74,920

|

$

|

1,180

|

1.58

|

%

|

$

|

55,960

|

$

|

61

|

0.11

|

%

|

||||||||||||

|

Investment securities

|

12,491

|

208

|

1.67

|

%

|

3,298

|

47

|

1.43

|

%

|

||||||||||||||||

|

Loans held for sale

|

65,737

|

21,237

|

32.31

|

%

|

59,524

|

22,461

|

37.73

|

%

|

||||||||||||||||

|

Loans held for investment

|

209,352

|

29,704

|

14.19

|

%

|

198,992

|

26,674

|

13.40

|

%

|

||||||||||||||||

|

Total interest earning assets

|

362,500

|

52,329

|

14.44

|

%

|

317,774

|

49,243

|

15.50

|

%

|

||||||||||||||||

|

Less: ALL

|

(10,816

|

)

|

(7,548

|

)

|

||||||||||||||||||||

|

Non-interest earning assets

|

30,141

|

17,002

|

||||||||||||||||||||||

|

Total assets

|

$

|

381,825

|

$

|

327,228

|

||||||||||||||||||||

|

Interest bearing liabilities:

|

||||||||||||||||||||||||

|

Demand

|

$

|

17,564

|

$

|

531

|

3.02

|

%

|

$

|

6,060

|

$

|

53

|

0.87

|

%

|

||||||||||||

|

Savings

|

7,310

|

7

|

0.10

|

%

|

7,897

|

10

|

0.13

|

%

|

||||||||||||||||

|

Money market accounts

|

26,054

|

116

|

0.45

|

%

|

21,964

|

75

|

0.34

|

%

|

||||||||||||||||

|

Certificates of deposit

|

71,661

|

778

|

1.09

|

%

|

72,311

|

1,000

|

1.38

|

%

|

||||||||||||||||

|

Total deposits

|

122,589

|

1,432

|

1.17

|

%

|

108,232

|

1,138

|

1.05

|

%

|

||||||||||||||||

|

Other borrowings

|

566

|

2

|

0.35

|

%

|

36,363

|

127

|

0.35

|

%

|

||||||||||||||||

|

Total interest bearing liabilities

|

123,155

|

1,434

|

1.16

|

%

|

144,595

|

1,265

|

0.87

|

%

|

||||||||||||||||

|

Non-interest bearing deposits

|

114,174

|

107,481

|

||||||||||||||||||||||

|

Non-interest bearing liabilities

|

15,781

|

11,392

|

||||||||||||||||||||||

|

Shareholders’ equity

|

128,715

|

63,760

|

||||||||||||||||||||||

|

Total liabilities and shareholders’ equity

|

$

|

381,825

|

$

|

327,228

|

||||||||||||||||||||

|

Net interest income and interest rate spread

|

$

|

50,895

|

13.28

|

%

|

$

|

47,978

|

14.63

|

%

|

||||||||||||||||

|

Net interest margin

|

14.04

|

%

|

15.10

|

%

|

||||||||||||||||||||

|

Ratio of average interest-earning assets to average interest- bearing liabilities

|

294.34

|

%

|

219.77

|

%

|

||||||||||||||||||||

|

Years Ended December 31,

|

||||||||||||||||||||||||

|

|

2022

|

2021

|

||||||||||||||||||||||

|

|

Increase (Decrease) Due to

|

Increase (Decrease) Due to

|

||||||||||||||||||||||

|

($ in thousands)

|

Rate

|

Volume

|

Total

|

Rate

|

Volume

|

Total

|

||||||||||||||||||

|

Interest income:

|

|

|||||||||||||||||||||||

|

Interest-bearing deposits with the Federal Reserve, non-U.S. central banks and other banks

|

$

|

1,092

|

$

|

27

|

$

|

1,119

|

$

|

(219

|

)

|

$

|

79

|

$

|

(140

|

)

|

||||||||||

|

Investment securities

|

9

|

152

|

161

|

(6

|

)

|

19

|

13

|

|||||||||||||||||

|

Loans held-for-sale

|

(4,460

|

)

|

3,236

|

(1,224

|

)

|

(1,990

|

)

|

13,891

|

11,901

|

|||||||||||||||

|

Loans held for investment

|

1,603

|

1,427

|

3,030

|

6,735

|

1,228

|

7,963

|

||||||||||||||||||

|

Total interest income

|

(1,756

|

)

|

4,842

|

3,086

|

4,520

|

15,217

|

19,737

|

|||||||||||||||||

|

Interest expense:

|

||||||||||||||||||||||||

|

Demand

|

270

|

208

|

478

|

15

|

(24

|

)

|

(9

|

)

|

||||||||||||||||

|

Savings

|

(2

|

)

|

(1

|

)

|

(3

|

)

|

(13

|

)

|

7

|

(6

|

)

|

|||||||||||||

|

Money market accounts

|

25

|

16

|

41

|

(113

|

)

|

84

|

(29

|

)

|

||||||||||||||||

|

Certificates of deposit

|

(213

|

)

|

(9

|

)

|

(222

|

)

|

(992

|

)

|

591

|

(401

|

)

|

|||||||||||||

|

Other borrowings

|

—

|

(125

|

)

|

(125

|

)

|

(2

|

)

|

(44

|

)

|

(46

|

)

|

|||||||||||||

|

Total interest bearing liabilities

|

80

|

89

|

169

|

(1,105

|

)

|

614

|

(491

|

)

|

||||||||||||||||

|

Net interest income

|

$

|

(1,836

|

)

|

$

|

4,753

|

$

|

2,917

|

$

|

5,625

|

$

|

14,603

|

$

|

20,228

|

|||||||||||

|

|

For the Years Ended

December 31,

|

Change

|

||||||||||||||

|

($ in thousands)

|

2022

|

2021

|

$ |

|

%

|

|||||||||||

|

Noninterest income:

|

||||||||||||||||

|

Strategic Program fees

|

$

|

22,467

|

$

|

17,959

|

$

|

4,508

|

25.1

|

%

|

||||||||

|

Gain on sale of loans, net

|

13,550

|

9,689

|

3,861

|

39.8

|

%

|

|||||||||||

|

SBA loan servicing fees

|

1,603

|

1,156

|

447

|

38.7

|

%

|

|||||||||||

|

Change in fair value on investment in BFG

|

(478

|

)

|

2,991

|

(3,469

|

)

|

(116.0

|

%)

|

|||||||||

|

Other miscellaneous income

|

269

|

49

|

220

|

449.0

|

%

|

|||||||||||

|

Total noninterest income

|

$

|

37,411

|

$

|

31,844

|

$

|

5,567

|

17.5

|

%

|

||||||||

|

($ in thousands)

|

For the Years Ended

December 31,

|

Change

|

||||||||||||||

|

|

2022

|

2021

|

$ |

|

%

|

|||||||||||

|

Noninterest expense:

|

||||||||||||||||

|

Salaries and employee benefits

|

$

|

24,489

|

$

|

21,744

|

$

|

2,745

|

12.6

|

%

|

||||||||

|

Professional services

|

5,454

|

1,670

|

3,784

|

226.6

|

%

|

|||||||||||

|

Occupancy and equipment expenses

|

2,204

|

882

|

1,322

|

149.9

|

%

|

|||||||||||

|

Impairment of SBA servicing asset

|

1,728

|

800

|

928

|

116.0

|

%

|

|||||||||||

|

Other operating expenses

|

4,881

|

4,415

|

466

|

10.6

|

%

|

|||||||||||

|

Total noninterest expense

|

$

|

38,756

|

$

|

29,511

|

$

|

9,245

|

31.3

|

%

|

||||||||

|

As of

December 31,

|

Change

|

|||||||||||||||

|

($ in thousands)

|

2022

|

2021

|

$ |

|

%

|

|||||||||||

|

Total assets

|

$

|

400,780

|

$

|

380,214

|

$

|

20,566

|

5.4

|

%

|

||||||||

|

Investment securities held to maturity, at cost

|

14,292

|

11,423

|

2,869

|

25.1

|

%

|

|||||||||||

|

Loans receivable, net

|

224,217

|

198,102

|

26,115

|

13.2

|

%

|

|||||||||||

|

Deposits

|

242,998

|

251,892

|

(8,894

|

)

|

(3.5

|

%)

|

||||||||||

|

PPP Liquidity Facility

|

314

|

1,050

|

(736

|

)

|

(70.1

|

%)

|

||||||||||

|

Total shareholders' equity

|

140,459

|

115,442

|

25,017

|

21.7

|

%

|

|||||||||||

|

Total equity to total assets

|

34.9

|

%

|

30.4

|

%

|

15.0

|

%

|

||||||||||

|

Weighted average shares outstanding, basic

|

12,740,933

|

10,169,005

|

25.3

|

%

|

||||||||||||

|

Weighted average shares outstanding, diluted

|

13,218,403

|

10,818,984

|

22.2

|

%

|

||||||||||||

|

|

As of December 31,

|

|||||||||||||||

|

|

2022

|

2021

|

||||||||||||||

|

|

Amount

|

% of

total

loans

|

Amount

|

% of

total

loans

|

||||||||||||

|

SBA

|

$

|

145,172

|

55.8

|

%

|

$

|

142,392

|

53.6

|

%

|

||||||||

|

Commercial, non real estate

|

11,484

|

4.4

|

%

|

3,428

|

1.3

|

%

|

||||||||||

|

Residential real estate

|

37,815

|

14.5

|

%

|

27,108

|

10.2

|

%

|

||||||||||

|

Strategic Program loans

|

47,848

|

18.4

|

%

|

85,850

|

32.3

|

%

|

||||||||||

|

Commercial real estate

|

12,063

|

4.7

|

%

|

2,436

|

0.9

|

%

|

||||||||||

|

Consumer

|

5,808

|

2.2

|

%

|

4,574

|

1.7

|

%

|

||||||||||

|

Total

|

$

|

260,190

|

100.0

|

%

|

$

|

265,788

|

100.0

|

%

|

||||||||

|

At December 31, 2022

|

Remaining Contractual Maturity Held for Investment

|

|||||||||||||||||||||||

|

($ in thousands)

|

One Year

or Less

|

Average

Yield/Rate

|

After

One

Year and

Through

Five

Years

|

Average

Yield/Rate

|

After Five

Years and

Through

Fifteen

Years

|

Average

Yield/Rate

|

||||||||||||||||||

|

Fixed rate loans:

|

||||||||||||||||||||||||

|

SBA

|

$ |

272

|

1.00

|

%

|

$

|

354

|

1.00

|

%

|

$

|

—

|

—

|

%

|

||||||||||||

|

Commercial, non-real estate

|

2,683

|

4.97

|

%

|

8,395

|

4.96

|

%

|

394

|

4.79

|

%

|

|||||||||||||||

|

Residential real estate

|

3,924

|

5.40

|

%

|

3,590

|

5.50

|

%

|

61

|

4.27

|

%

|

|||||||||||||||

|

Strategic Program loans

|

16,589

|

113.89

|

%

|

7,669

|

51.27

|

%

|

1

|

24.56

|

%

|

|||||||||||||||

|

Commercial real estate

|

1,689

|

5.39

|

%

|

1,102

|

5.80

|

%

|

29

|

3.87

|

%

|

|||||||||||||||

|

Consumer

|

1,838

|

7.57

|

%

|

3,597

|

7.80

|

%

|

62

|

10.31

|

%

|

|||||||||||||||

|

|

||||||||||||||||||||||||

|

Variable rate loans:

|

||||||||||||||||||||||||

|

SBA

|

9,335

|

8.53

|

%

|

36,741

|

8.53

|

%

|

61,545

|

8.38

|

%

|

|||||||||||||||

|

Commercial, non-real estate

|

—

|

—

|

%

|

—

|

—

|

%

|

—

|

—

|

%

|

|||||||||||||||

|

Residential real estate

|

29,242

|

8.08

|

%

|

550

|

9.28

|

%

|

445

|

9.23

|

%

|

|||||||||||||||

|

Strategic Program loans

|

—

|

—

|

%

|

—

|

—

|

%

|

—

|

—

|

%

|

|||||||||||||||

|

Commercial real estate

|

957

|

8.72

|

%

|

2,525

|

8.32

|

%

|

3,909

|

8.27

|

%

|

|||||||||||||||

|

Consumer

|

82

|

4.56

|

%

|

229

|

1.38

|

%

|

—

|

—

|

%

|

|||||||||||||||

|

Total

|

$

|

66,611

|

34.10

|

%

|

$

|

64,752

|

12.81

|

%

|

$

|

66,446

|

8.36

|

%

|

||||||||||||

|

At December 31, 2022

|

Remaining Contractual Maturity Held for Investment

|

|||||||||||||||

|

($ in thousands)

|

After

Fifteen

Years

|

Average

Yield/Rate

|

Total

|

Average

Yield/Rate

|

||||||||||||

|

Fixed rate loans:

|

||||||||||||||||

|

SBA

|

$ |

—

|

—

|

%

|

$

|

626

|

1.00

|

%

|

||||||||

|

Commercial, non-real estate

|

12

|

3.78

|

%

|

11,484

|

4.96

|

%

|

||||||||||

|

Residential real estate

|

3

|

4.43

|

%

|

7,578

|

5.44

|

%

|

||||||||||

|

Strategic Program loans

|

—

|

—

|

%

|

24,259

|

94.10

|

%

|

||||||||||

|

Commercial real estate

|

8

|

3.50

|

%

|

2,828

|

5.53

|

%

|

||||||||||

|

Consumer

|

—

|

—

|

%

|

5,497

|

7.75

|

%

|

||||||||||

|

|

||||||||||||||||

|

Variable rate loans:

|

||||||||||||||||

|

SBA

|

36,925

|

8.20

|

%

|

144,546

|

8.38

|

%

|

||||||||||

|

Commercial, non-real estate

|

—

|

—

|

%

|

—

|

—

|

%

|

||||||||||

|

Residential real estate

|

—

|

—

|

%

|

30,237

|

8.12

|

%

|

||||||||||

|

Strategic Program loans

|

—

|

—

|

%

|

—

|

—

|

%

|

||||||||||

|

Commercial real estate

|

1,844

|

8.15

|

%

|

9,235

|

8.31

|

%

|

||||||||||

|

Consumer

|

—

|

—

|

%

|

311

|

2.22

|

%

|

||||||||||

|

Total

|

$

|

38,792

|

8.20

|

%

|

$

|

236,601

|

16.80

|

%

|

||||||||

|

|

As of December 31,

|

|||||||||||||||||||||||

|

|

2022

|

2021

|

||||||||||||||||||||||

|

($ in thousands)

|

ALL to

Total

Loans

|

Nonaccrual

to Total

Loans

|

ALL to

Nonaccrual

Loans

|

ALL to

Total

Loans

|

Nonaccrual

to Total

Loans

|

ALL to

Nonaccrual

loans

|

||||||||||||||||||

|

SBA

|

3.0

|

%

|

—

|

%

|

—

|

%

|

1.9

|

%

|

0.5

|

%

|

401.6

|

%

|

||||||||||||

|

Commercial, non-real estate

|

3.5

|

%

|

—

|

%

|

—

|

%

|

3.9

|

%

|

—

|

%

|

—

|

%

|

||||||||||||

|

Residential real estate

|

1.3

|

%

|

—

|

%

|

—

|

%

|

1.3

|

%

|

—

|

%

|

—

|

%

|

||||||||||||

|

Strategic program loans(1)

|

14.0

|

%

|

—

|

%

|

—

|

%

|

7.6

|

%

|

—

|

%

|

—

|

%

|

||||||||||||

|

Commercial real estate

|

0.2

|

%

|

—

|

%

|

—

|

%

|

0.9

|

%

|

—

|

%

|

—

|

%

|

||||||||||||

|

Consumer

|

1.1

|

%

|

—

|

%

|

—

|

%

|

1.4

|

%

|

—

|

%

|

—

|

%

|

||||||||||||

|

Total

|

4.6

|

%

|

—

|

%

|

—

|

%

|

3.7

|

%

|

0.3

|

%

|

1,445.1

|

%

|

||||||||||||

|

|

Years Ended December 31,

|

|||||||||||||||||||||||

|

|

2022

|

2021

|

||||||||||||||||||||||

|

($ in thousands)

|

Net

Charge-

Offs

|

Average

Loans

|

NCO to

Average

Loans

|

Net

Charge-

Offs

|

Average

Loans

|

NCO to

Average

Loans

|

||||||||||||||||||

|

SBA

|

$

|

326

|

$

|

132,199

|

0.2

|

%

|

$

|

109

|

$

|

149,285

|

0.1

|

%

|

||||||||||||

|

Commercial, non-real estate

|

(2

|

)

|

7,562

|

0.0

|

%

|

(40

|

)

|

3,945

|

(1.0

|

%)

|

||||||||||||||

|

Residential real estate

|

—

|

27,937

|

—

|

%

|

—

|

23,171

|

—

|

%

|

||||||||||||||||

|

Strategic program loans(1)

|

11,063

|

93,115

|

11.9

|

%

|

4,311

|

75,171

|

5.7

|

%

|

||||||||||||||||

|

Commercial real estate

|

—

|

8,912

|

—

|

%

|

—

|

2,082

|

—

|

%

|

||||||||||||||||

|

Consumer

|

2

|

5,364

|

0.0

|

%

|

3

|

4,862

|

0.1

|

%

|

||||||||||||||||

|

Total

|

$

|

11,389

|

$

|

275,089

|

4.1

|

%

|

$

|

4,383

|

$

|

258,516

|

1.7

|

%

|

||||||||||||

|

|

December 31, 2022

|

|||||||

|

($ in thousands)

|

Amount

|

% of

Total

Allowance

|

||||||

|

SBA

|

$

|

4,294

|

35.8

|

%

|

||||

|

Commercial, non real estate

|

401

|

3.4

|

%

|

|||||

|

Residential real estate

|

497

|

4.2

|

%

|

|||||

|

Strategic Program loans

|

6,701

|

55.9

|

%

|

|||||

|

Commercial real estate

|

27

|

0.2

|

%

|

|||||

|

Consumer

|

65

|

0.5

|

%

|

|||||

|

Total

|

$

|

11,985

|

100.0

|

%

|

||||

|

|

December 31, 2021

|

|||||||

|

($ in thousands)

|

Amount

|

% of

Total

Allowance

|

||||||

|

SBA

|

$

|

2,739

|

27.8

|

%

|

||||

|

Commercial, non real estate

|

132

|

1.3

|

%

|

|||||

|

Residential real estate

|

352

|

3.6

|

%

|

|||||

|

Strategic Program loans

|

6,549

|

66.5

|

%

|

|||||

|

Commercial real estate

|

21

|

0.2

|

%

|

|||||

|

Consumer

|

62

|

0.6

|

%

|

|||||

|

Total

|

$

|

9,855

|

100.0

|

%

|

||||

|

|

At December 31, 2022

|

|||||||||||||||||||

|

|

After Five to Ten Years Weighted

|

After Ten Years Weighted

|

||||||||||||||||||

|

($ in thousands)

|

Amortized

Cost

|

Weighted

Average Yield

|

Amortized

Cost

|

Weighted

Average Yield

|

Total

Amortized

Cost

|

|||||||||||||||

|

Mortgage-backed securities

|

$

|

3,388

|

3.0

|

%

|

$

|

10,904

|

3.4

|

%

|

$

|

14,292

|

||||||||||

|

For the Years Ended December 31,

|

||||||||||||||||

|

|

2022

|

2021

|

||||||||||||||

|

($ in thousands)

|

Total

|

Percent

|

Total

|

Percent

|

||||||||||||

|

Period end:

|

||||||||||||||||

|

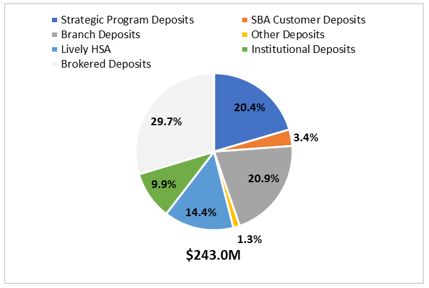

Noninterest-bearing demand deposits

|

$

|

78,817

|

32.5

|

%

|

$

|

110,548

|

43.9

|

%

|

||||||||

|

Interest-bearing deposits:

|

||||||||||||||||

|

Demand

|

50,746

|

20.8

|

%

|

5,399

|

2.1

|

%

|

||||||||||

|

Savings

|

8,289

|

3.4

|

%

|

6,685

|

2.7

|

%

|

||||||||||

|

Money markets

|

10,882

|

4.5

|

%

|

31,076

|

12.3

|

%

|

||||||||||

|

Time certificates of deposit

|

94,264

|

38.8

|

%

|

98,184

|

39.0

|

%

|

||||||||||

|

Total period end deposits

|

$

|

242,998

|

100.0

|

%

|

$

|

251,892

|

100.0

|

%

|

||||||||

|

Years Ended

|

||||||||||||||||||||||||

|

|

December 31, 2022

|

December 31, 2021

|

||||||||||||||||||||||

|

($ in thousands)

|

Total

|

Weighted

average

rate paid

|

Percent

of total

|

Total

|

Weighted

average

rate paid

|

Percent

of total

|

||||||||||||||||||

|

Average:

|

||||||||||||||||||||||||

|

Noninterest-bearing demand deposits

|

$

|

114,174

|

0.00

|

%

|

48.2

|

%

|

$

|

107,481

|

0.00

|

%

|

49.8

|

%

|

||||||||||||

|

Interest-bearing deposits:

|

||||||||||||||||||||||||

|

Demand

|

17,564

|

3.02

|

%

|

7.4

|

%

|

6,060

|

0.87

|

%

|

2.8

|

%

|

||||||||||||||

|

Savings

|

7,310

|

0.10

|

%

|

3.1

|

%

|

7,897

|

0.13

|

%

|

3.7

|

%

|

||||||||||||||

|

Money market

|

26,054

|

0.45

|

%

|

11.0

|

%

|

21,965

|

0.34

|

%

|

10.2

|

%

|

||||||||||||||

|

Time certificates of deposit

|

71,661

|

1.09

|

%

|

30.3

|

%

|

72,311

|

1.38

|

%

|

33.5

|

%

|

||||||||||||||

|

Total average deposits

|

$

|

236,763

|

0.60

|

%

|

100.0

|

%

|

$

|

215,713

|

0.53

|

%

|

100.0

|

%

|

||||||||||||

|

($ in thousands)

|

Three

months

or less

|

More than

three

months

to six

months

|

More than

six months

to twelve

months

|

More than

twelve

months

|

Total

|

|||||||||||||||

|

Time deposits, uninsured

|

$

|

—

|

$

|

65

|

$

|

37

|

$

|

1,627

|

$

|

1,729

|

||||||||||

|

|

December 31,

|

|||||||||||

|

Capital Ratios

|

2022

|

2021

|

Well-

Capitalized

Requirement

|

|||||||||

|

Leverage Ratio (under CBLR)

|

25.1

|

%

|

17.7

|

%

|

9.0

|

%(1)

|

||||||

|

($ in thousands)

|

Total

|

Less

than

One

Year

|

One to

Three

Years

|

Three to

Five

Years

|

More

Than

Five

Years

|

|||||||||||||||

|

Contractual Obligations

|

||||||||||||||||||||

|

Deposits without stated maturity

|

$

|

129,563

|

$ |

129,563

|

$

|

—

|

$

|

—

|

$

|

—

|

||||||||||

|

Time deposits

|

94,264

|

57,721

|

26,828

|

9,715

|

—

|

|||||||||||||||

|

Long term borrowings(1)

|

314

|

—

|

314

|

—

|

—

|

|||||||||||||||

|

Operating lease obligations

|

7,513

|

850

|

2,190

|

2,270

|

2,203

|

|||||||||||||||

|

Total

|

$

|

231,654

|

$

|

188,134

|

$

|

29,332

|

$

|

11,985

|

$

|

2,203

|

||||||||||

|

|

As of December 31,

|

|||||||

|

($ in thousands)

|

2022

|

2021

|

||||||

|

Revolving, open-end lines of credit

|

$

|

1,683

|

$

|

1,259

|

||||

|

Commercial real estate

|

17,886

|

15,402

|

||||||

|

Other unused commitments

|

253

|

377

|

||||||

|

Total commitments

|

$

|

19,822

|

$

|

17,038

|

||||

| • |

Expected Term. The expected term represents the period that our awards are expected to be outstanding. We calculated the expected term using a permitted simplified

method, which is based on the vesting period and contractual term for each tranche of awards.

|

| • |

Expected Volatility. Prior to our initial public offering, the expected volatility was based on the historical share volatility of several comparable publicly traded

companies over a period of time equal to the expected term of the awards, as we did not have any trading history to use the volatility of our own common shares. After the completion of our initial public offering, it is no longer

necessary to utilize the volatility of comparable publicly traded companies as we now have historical trading volatility data on our own common shares.

|

| • |

Risk-Free Interest Rate. The risk-free rate is based on the U.S. Treasury yield curve in effect at the time of grant for periods corresponding with the expected life.

|

| • |

Expected Dividend Yield. We have not paid dividends on our common shares nor do we expect to pay dividends in the foreseeable future. Therefore, we used an expected

dividend yield of zero.

|

| • |

Our financial performance, capital structure and stage of development;

|

| • |

Our management team and business strategy;

|

| • |

External market conditions affecting our industry, including competition and regulatory landscape;

|

| • |

Our financial position and forecasted operating results;

|

| • |

The lack of an active public or private market for our equity shares;

|

| • |

Historical discussions we have had with potential private investors;

|

| • |

The likelihood of achieving a liquidity event, such as a sale of the Company or an initial public offering of our equity shares; and

|

| • |

Market performance analyses, including with respect to share price valuation, of similar companies in our industry.

|

| • |

“Tangible book value per share” is defined as book value per share less goodwill and other intangible assets, divided by the outstanding number of common shares at the end of each period. The most directly

comparable GAAP financial measure is book value per share. We had no goodwill or other intangible assets as of any of the dates indicated. We have not considered loan servicing rights or loan trailing fee asset as intangible assets for

purposes of this calculation. As a result, tangible book value per share is the same as book value per share as of each of the dates indicated.

|

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk

|

|

Page

|

|

|

78

|

|

|

79

|

|

|

80

|

|

| 81 |

|

| 82 |

|

|

83

|

|

|

December 31,

|

|||||||

|

|

2022

|

2021

|

||||||

|

ASSETS

|

||||||||

|

Cash and cash equivalents

|

||||||||

|

Cash and due from banks

|

$

|

|

$

|

|

||||

|

Interest-bearing deposits

|

|

|

||||||

|

Total cash and cash equivalents

|

|

|

||||||

|

Investment securities held-to-maturity, at cost

|

|

|

||||||

|

Investment in Federal Home Loan Bank (FHLB) stock, at cost

|

|

|

||||||

|

Strategic Program loans held-for-sale, at lower of cost or fair value

|

||||||||

|

Loans receivable, net

|

|

|

||||||

|

Premises and equipment, net

|

|

|

||||||

|

Accrued interest receivable

|

|

|

||||||

|

Deferred taxes, net

|

|

|

||||||

|

SBA servicing asset, net

|

|

|

||||||

|

Investment in Business Funding Group (BFG), at fair value

|

|

|

||||||

|

Operating lease right-of-use (“ROU”) assets

|

|

|

||||||

|

Other assets

|

|

|

||||||

|

Total assets

|

$

|

|

$

|

|

||||

|

|

||||||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

||||||||

|

Liabilities

|

||||||||

|

Deposits

|

||||||||

|

Noninterest bearing

|

$

|

|

$

|

|

||||

|

Interest-bearing

|

|

|

||||||

|

Total deposits

|

|

|

||||||

|

Accrued interest payable

|

|

|

||||||

|

Income taxes payable

|

|

|

||||||

|

PPP Liquidity Facility

|

|

|

||||||

|

Operating lease liabilities

|

||||||||

|

Other liabilities

|

|

|

||||||

|

Total liabilities

|

|

|

||||||

|

|

||||||||

|

Commitments and contingencies (Note 8)

|

||||||||

|

|

||||||||

|

Shareholders’ equity

|

||||||||

|

Preferred stock, $

|

|

|

||||||

|

Common stock, $

|

|

|

||||||

|

Additional paid-in-capital

|

|

|

||||||

|

Retained earnings

|

|

|

||||||

|

Total shareholders’ equity

|

|

|

||||||

|

Total liabilities and shareholders’ equity

|

$

|

|

$

|

|

||||

|

|

For the Years Ended December 31,

|

|||||||

|

|

2022

|

2021

|

||||||

|

Interest income

|

||||||||

|

Interest and fees on loans

|

$

|

|

$

|

|

||||

|

Interest on securities

|

|

|

||||||

|

Other interest income

|

|

|

||||||

|

Total interest income

|

|

|

||||||

|

|

||||||||

|

Interest expense

|

||||||||

|

Interest on deposits

|

|

|

||||||

|

Interest on PPP Liquidity Facility

|

|

|

||||||

|

Total interest expense

|

|

|

||||||

|

Net interest income

|

|

|

||||||

|

|

||||||||

|

Provision for loan losses

|

|

|

||||||

|

Net interest income after provision for loan losses

|

|

|

||||||

|

|

||||||||

|

Non-interest income

|

||||||||

|

Strategic Program fees

|

|

|

||||||

|

Gain on sale of loans, net

|

|

|

||||||

|

SBA loan servicing fees

|

|

|

||||||

|

Change in fair value on investment in BFG

|

(

|

)

|

|

|||||

|

Other miscellaneous income

|

|

|

||||||

|

Total non-interest income

|

|

|

||||||

|

|

||||||||

|

Non-interest expense

|

||||||||

|

Salaries and employee benefits

|

|

|

||||||

|

Professional services

|

||||||||

|

Occupancy and equipment expenses

|

|

|

||||||

|

Impairment of SBA servicing asset

|

|

|

||||||

|

Other operating expenses

|

|

|

||||||

|

Total non-interest expense

|

|

|

||||||

|

Income before income tax expense

|

|

|

||||||

|

|

||||||||

|

Provision for income taxes

|

|

|

||||||

|

Net income

|

$

|

|

$

|

|

||||

|

|

||||||||

|

Earnings per share, basic

|

$ |

$ |

||||||

|

Earnings per share, diluted

|

$ |

$ |

||||||

|

|

||||||||

|

Weighted average shares outstanding, basic

|

|

|

||||||

|

Weighted average shares outstanding, diluted

|

|

|

||||||

|

|

Common Stock

|

|||||||||||||||||||

|

|

Shares

|

Amount |

Additional

Paid-In

Capital

|

Retained

Earnings

|

Total

Shareholders’

Equity

|

|||||||||||||||

|

Balance at December 31, 2020

|

|

$ |

$

|

|

$

|

|

$

|

|

||||||||||||

|

Stock-based compensation expense

|

—

|

|

|

|

|

|||||||||||||||

|

Issuance of common stock

|

|

|

|

|

|

|||||||||||||||

|

Stock options exercised

|

|

|

|

|

|

|||||||||||||||

|

Net income

|

—

|

|

|

|

|

|||||||||||||||

|

Balance at December 31, 2021

|

|

$ |

$

|

|

$

|

|

$

|

|

||||||||||||

|

Stock-based compensation expense

|

|

|

|

|

|

|||||||||||||||

|

Stock options exercised

|

|

|

|

|

|

|||||||||||||||

|

Repurchase of common stock

|

( |

) | ( |

) | ( |

) | ||||||||||||||

|

Net income

|

—

|

|

|

|

||||||||||||||||

|

Balance at December 31, 2022

|

|

$ |

$

|

|

$

|

|

$

|

|

||||||||||||

|

|

For the Years Ended

December 31,

|

|||||||

|

|

2022

|

2021

|

||||||

|

Cash flows from operating activities:

|

||||||||

|

Net income

|

$

|

|

$

|

|

||||

|

Adjustments to reconcile net income to net cash from operating activities

|

||||||||

|

Depreciation and amortization

|

|

|

||||||

|

Provision for loan losses

|

|

|

||||||

|

Noncash operating lease cost

|

||||||||

|

Net amortization in securities discounts and premiums

|

|

|

||||||

|

Capitalized servicing assets

|

(

|

)

|

(

|

)

|

||||

|

Capitalized loan trailing fee asset

|

( |

) | ||||||

|

Gain on sale of SBA loans, net

|

(

|

)

|

(

|

)

|

||||

|

Originations of Strategic Program loans held-for-sale

|

(

|

)

|

(

|

)

|

||||

|

Proceeds on Strategic Program loans held-for-sale

|

|

|

||||||

|

Change in fair value of BFG

|

|

(

|

)

|

|||||

|

Impairment of SBA servicing asset

|

|

|

||||||

|

Stock-based compensation expense

|

|

|

||||||

|

Deferred income tax benefit (expense)

|

|

(

|

)

|

|||||

|

Net changes in:

|

||||||||

|

Accrued interest receivable

|

(

|

)

|

|

|||||

|

Accrued interest payable

|

|

(

|

)

|

|||||

|

Other assets

|

(

|

)

|

(

|

)

|

||||

|

Operating lease liabilities

|

( |

) | ||||||

|

Other liabilities

|

(

|

)

|

|

|||||

|

Net cash provided by (used in) operating activities

|

|

(

|

)

|

|||||

|

|

||||||||

|

Cash flows from investing activities:

|

||||||||

|

Net increase (decrease) in loans receivable

|

(

|

)

|

|

|||||

|

Purchase of loan pools

|

(

|

)

|

(

|

)

|

||||

|

Investments in FinWise Investments, LLC

|

(

|

)

|

(

|

)

|

||||

|

Distributions from BFG

|

|

|

||||||

|

Purchase of bank premises and equipment

|

(

|

)

|

(

|

)

|

||||

|

Proceeds from maturities and paydowns of securities held-to-maturity

|

|

|

||||||

|

Purchases of securities held-to-maturity

|

(

|

)

|

(

|

)

|

||||

|

Purchase of FHLB stock

|

(

|

)

|

(

|

)

|

||||

|

Net cash provided by (used in) investing activities

|

(

|

)

|

|

|||||

|

|

||||||||

|

Cash flows from financing activities:

|

||||||||

|

Net increase (decrease) in deposits

|

(

|

)

|

|

|||||

|

Proceeds from initial public offering, net

|

|

|

||||||

|

Common stock repurchased

|

( |

) | ||||||

|

Proceeds from exercise of stock options

|

|

|

||||||

|

Proceeds from PPP Liquidity Facility

|

|

|

||||||

|

Repayment of PPP Liquidity Facility

|

(

|

)

|

(

|

)

|

||||

|

Net cash provided by (used in) financing activities

|

(

|

)

|

|

|||||

|

|

||||||||

|

Net change in cash and cash equivalents

|

|

|

||||||

|

Cash and cash equivalents, beginning of the period

|

|

|

||||||

|

Cash and cash equivalents, end of the period

|

$

|

|

$

|

|

||||

|

|

||||||||

|

Supplemental disclosures of cash flow information:

|

||||||||

|

Cash paid during the period

|

||||||||

|

Income taxes

|

$ |

$

|

|

|||||

|

Interest

|

$

|

|

$

|

|

||||

| Supplemental disclosures of noncash activities: |

||||||||

| Operating cash flows from operating leases |

$ |

$ |

||||||

| Right-of-use assets obtained in exchange for operating lease liabilities |

$ |

$ |

||||||

Federal Reserve Board Regulations require maintenance of certain minimum reserve balances based on certain average deposits; however, on March 15, 2020, the Federal Reserve announced that reserve requirement ratios would be reduced to zero percent effective March 26, 2020, due to economic conditions, which eliminated the reserve requirement for all depository institutions. The reserve requirement is still at zero percent as of December 31, 2022.

|

|

2022

|

2021

|

||||||

|

Risk-free interest rate

|

|

%

|

|

%

|

||||

|

Expected term in years

|

|

|

||||||

|

Expected volatility

|

|

%

|

|

%

|

||||

|

Expected dividend yield

|

|

|

||||||

|

|

December 31, 2022

|

|||||||||||||||

|

($ in thousands)

|

Amortized

Cost

|

Unrealized

Gain

|

Unrealized

Loss

|

Estimated

Fair Value

|

||||||||||||

|

Mortgage-backed securities

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

|

|||||||

|

|

December 31, 2021

|

|||||||||||||||

|

($ in thousands)

|

Amortized

Cost

|

Unrealized

Gain

|

Unrealized

Loss

|

Estimated

Fair Value

|

||||||||||||

|

Mortgage-backed securities

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

|

|||||||

|

|

December 31, 2022

|

|||||||||||||||||||||||

|

Less than 12 months

|

12 Months or More

|

Total

|

||||||||||||||||||||||

|

($ in thousands)

|

Fair Value

|

Unrealized

Losses

|

Fair Value

|

Unrealized

Losses

|

Fair Value

|

Unrealized

Losses

|

||||||||||||||||||

|

Mortgage-backed securities

|

$

|

|

$

|

(

|

)

|

$

|

|

$

|

(

|

)

|

$

|

|

$

|

(

|

)

|

|||||||||

|

December 31, 2021

|

||||||||||||||||||||||||

|

Less than 12 months

|

12 Months or More

|

Total

|

||||||||||||||||||||||

|

($ in thousands)

|

Fair Value

|

Unrealized

Losses

|

Fair Value

|

Unrealized

Losses

|

Fair Value

|

Unrealized

Losses

|

||||||||||||||||||

|

Mortgage-backed securities

|

$

|

|

$

|

(

|

)

|

$

|

|

$ |

$

|

|

$

|

(

|

)

|

|||||||||||

| December 31, 2022 | December 31, 2021 | |||||||||||||||

|