As filed with the Securities and Exchange Commission on January 11, 2023

Registration No. 333-_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

China Jo-Jo Drugstores, Inc.

(Exact name of registrant as specified in its charter)

| Cayman Islands | Not Applicable | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

Hai Wai Hai Tongxin Mansion Floor 6

Gong Shu District, Hangzhou City, Zhejiang Province

People’s Republic of China, 310008

+86-571-88219579

(Address and telephone number of registrant’s principal executive offices)

Pryor Cashman LLP

7 Times Square

New York, NY 10036

(212) 326 0199

(Name, address and telephone number of agent for service)

with a copy to:

Elizabeth Fei Chen, Esq.

Pryor Cashman LLP

7 Times Square

New York, NY 10036

(212) 326 0199

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the post-effective amendment to registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated January 11, 2023

PROSPECTUS

China Jo-Jo Drugstores, Inc.

12,128,704 Ordinary Shares

This prospectus relates to the resale, from time to time, of up to 12,128,704 ordinary shares, par value $.012 per share (the “Ordinary Shares”), which may be offered and sold from time to time by shareholders set forth in the “Selling Shareholders” section of this prospectus. The Ordinary Shares that are being registered for resale pursuant to the registration statement of which this prospectus forms a part are the Ordinary Shares issued by our company to the Selling Shareholders in two private placements (the “Private Placements”), and the Ordinary Shares issued as a result of the exercise of the warrants issued by our company to the Selling Shareholders in the Private Placements. The first of the Private Placements (the “First Private Placement”) had an aggregate gross proceeds of $1,500,000 for 1,000,000 Ordinary Shares plus 1,000,000 warrants and closed on August 3, 2022. The second of the Private Placements (the “Second Private Placement”) had an aggregate gross proceeds of $3,200,000 for 3,200,000 Ordinary Shares plus 9,600,000 warrants and closed on October 11, 2022.

The Selling Shareholders will receive all of the net proceeds from the sale of the Ordinary Shares offered hereby. The Selling Shareholders may resell the Ordinary Shares offered for resale through this prospectus to or through underwriters, broker-dealers, or agents, who may receive compensation in the form of discounts, concessions or commissions. We will not receive any proceeds from the sale of these shares by the Selling Shareholders, but we will bear all costs, fees and expenses in connection with the registration of the Ordinary Shares offered by the Selling Shareholders. The Selling Shareholders will bear all commissions and discounts, if any, attributable to the sale of the Ordinary Shares offered for resale through this prospectus.

The Selling Shareholders will determine where they may sell the shares in all cases, including, in the over-the-counter market or otherwise, at market prices prevailing at the time of sale, at prices related to the prevailing market prices, or at negotiated prices. For information regarding the Selling Shareholders and the times and manner in which they may offer or sell Ordinary Shares, see “Selling Shareholders” and “Plan of Distribution.”

All references to “we,” “us,” “our,” “the Company,” “CJJD,” or similar terms used in this prospectus refer to China Jo-Jo Drugstores, Inc., a Cayman Islands exempted company with limited liability, including its consolidated wholly-owned subsidiaries, excluding the variable interest entities (“VIEs”) and the VIEs’ subsidiaries, unless the context otherwise indicates.

“WFOEs” or “PRC Subsidiaries,” which are wholly foreign owned entities and are corporations organized under the laws of the PRC which are wholly owned by us, through our subsidiaries. Our WFOEs are Zhejiang Jiuxin Investment Management Co., Ltd. (“Jiuxin Management”), Zhejiang Shouantang Medical Technology Co., Ltd. (“Shouantang Technology”) and Hangzhou Jiutong Medical Technology Co., Ltd (“Jiutong Medical”), and Hangzhou Jiuyi Medical Technology Co. Ltd. (“Jiuyi Technology”).

“VIE” or “consolidated VIE” is a variable interest entity which give us, through our WFOE, the ability to conduct the operations in China and consolidate the financial statements of such entities for accounting purposes through a series of agreements (the “VIE Agreements”) to the extent we have satisfied the conditions for consolidation of the VIE under the U.S. Generally Accepted Accounting Principles (the “U.S. GAAP”). The VIEs are Hangzhou Jiuzhou Grand Pharmacy Chain Co., Ltd. (“Jiuzhou Pharmacy”) (including its subsidiaries and controlled entities), Hangzhou Jiuzhou Clinic of Integrated Traditional and Western Medicine (“Jiuzhou Clinic”) and Hangzhou Jiuzhou Medical and Public Health Service Co., Ltd. (“Jiuzhou Service”) (collectively, “VIE Entities”, or “VIEs”).

Our ordinary shares are traded on the Nasdaq Capital Market under the symbol “CJJD”. On January 10, 2023, the last reported sale price for our ordinary shares was $3.31 per share.

We raised capital of $17.5 million in our IPO in April 2010. In addition, we raised capital for a total amount of $33.648 million from 2015 to 2020 through various financings. Renovation Investment (HK) Co., Ltd. (“Renovation”), our Hong Kong subsidiary, received funds from our investors in these financings. After receiving the proceeds, Renovation typically invested these funds into Jiuxin Management, a WFOE, which then exchanged the currency of the proceeds from U.S. dollar into Chinese Yuan (“RMB”) upon the approval from local banks. Jiuxin Management then distributed the RMB as loans to the operating entities including Jiuzhou Pharmacy, Jiuzhou Service and Jiuzhou Clinic, which are the consolidated VIEs, and to Jiuxin Medicine, which is a subsidiary of Jiuzhou Pharmacy, one of the VIEs.

Additionally, Jiuxin Medicine is the major supplier to Jiuzhou Pharmacy and Jiuzhou Pharmacy transfers funds to pay off the debts owed to Jiuxin Medicine as a result of merchandise purchases. In the last three fiscal years, the annual amount of purchases by Jiuxin Medicine from Jiuzhou Pharmacy was $58,575,861 in the fiscal year of 2020, $73,239,387 in the fiscal year of 2021 and $80,712,044 in the fiscal year of 2022. Additional transfers between other VIEs and subsidiaries are as below:

| Amount | ||||||||||||||

| Transfer from | Transfer to | 2020 | 2021 | 2022 | ||||||||||

| Renovation | Jiuxin Management | $ | 8,705,000 | $ | 9,000,000 | $ | - | |||||||

| Jiuxin Management | Jiuzhou Pharmacy | 574,248 | 1,860,573 | 582,736 | ||||||||||

| Jiuxin Management | Jiuxin Medicine | - | 2,622,495 | 779,059 | ||||||||||

| Jiuxin Management | Qianhong Agriculture | 37,083 | 31,433 | 30,496 | ||||||||||

| Jiuzhou Pharmacy | Jiuzhou Service | 420,810 | 425,345 | 342,822 | ||||||||||

All the sales and purchases between Jiuxin Medicine and Jiuzhou Pharmacy are eliminated as internal transactions. Furthermore, the ending balances owed to/from the VIEs are eliminated in the balance sheets.

As of the date of this prospectus, the Company did not have any distributions to our investors through either our holding company, subsidiaries or the consolidated VIEs, and does not intend to distribute any dividends in any forms in the near future. Please refer to “condensed consolidating schedule” and “consolidated financial statements” in Company’s annual report on Form 20-F filed with SEC on July 28, 2022, which is incorporated by reference to this registration statement.

Investing in these securities involves certain risks. China Jo-Jo Drugstores, Inc., offering securities under this prospectus, is not a Chinese operating company but a holding company incorporated in the Cayman Islands. The Cayman Islands holding company has no material operations of its own. We conduct a substantial majority of our operations through the operating entities established in the People’s Republic of China, or the PRC, primarily the variable interest entities and their subsidiaries, collectively, the VIEs. We do not have any equity ownership of the VIEs, instead, we receive the economic benefits of the VIEs, are the primary beneficiary for accounting purposes, and consolidate VIEs’ financial statements through the VIE Agreements to the extent we have satisfied the conditions for consolidation of the VIEs under U.S. GAAP. We, through contractual agreements, establish the VIE structure to provide exposure to foreign investment in such Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies, and that investors may never directly hold equity interests in the Chinese operating entities. Our securities offered in this prospectus are securities of our Cayman Islands holding company that maintains service agreements with the associated operating companies.

Additionally, we are subject to certain legal and operational risks associated with the VIEs’ operations in China, the risk being discussed could result in the value of our securities to significantly decline or be worthless. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in the VIEs’ operations, significant depreciation of the value of our ordinary shares, or a complete hindrance of our ability to offer or continue to offer our securities to investors. Rules and regulations in China can change quickly with little advance notice. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact of such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. or other foreign exchange. These contractual agreements have not been tested in a court of law. The Chinese regulatory authorities could disallow our structure, which could result in a material change in our operations and the value of our securities could decline or become worthless. In addition, conducting the operations through contractual agreements may not be as effective as direct equity ownership, the VIEs and their shareholders may be unwilling or unable to perform its contractual obligations under our commercial agreements. Consequently, we would not be able to conduct our operations in the manner currently planned. We consolidate the VIEs financial statements and are their primary beneficiaries for accounting purposes to the extent we satisfy the conditions for consolidation of the VIEs under U.S. GAAP, therefore, we may not succeed in enforcing our rights under them insofar as our contractual rights and legal remedies under PRC law are inadequate. In addition, the VIEs may seek to renew their agreements on terms that are disadvantageous to us. If we are unable to renew these agreements on favorable terms when these agreements expire or enter into similar agreements with other parties, our business may not be able to operate or expand, and our operating expenses may significantly increase. Please carefully consider the “Risk Factors” contained in, or incorporated by reference into, this prospectus, including the “Risks Related to Our Corporate Structure and Doing Business in the PRC” starting on page 18 as well as the “Risk Factors” in any applicable prospectus supplement, for a discussion of the factors you should consider carefully before deciding to purchase these securities.

The PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of currency out of China. The majority of the VIEs’ and their subsidiaries’ income is received in RMB and shortages in foreign currencies may restrict our ability to pay dividends or other payments, or otherwise satisfy our foreign currency denominated obligations, if any. Relevant PRC laws and regulations permit the PRC companies to pay dividends only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Additionally, the Company’s PRC subsidiary and the VIE can only distribute dividends upon approval of the shareholders after they have met the PRC requirements for appropriation to the statutory reserves. As a result of these and other restrictions under the PRC laws and regulations, our PRC subsidiaries and the VIEs are restricted to transfer a portion of their net assets to the Company either in the form of dividends, loans or advances. To the extent cash or assets in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds or assets may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of such entities, our subsidiaries, or the consolidated VIEs by the PRC government to transfer cash or assets. We have maintained cash management policies which dictates the purpose, amount and procedure of cash transfers among CJJD, the VIEs and non-VIE subsidiaries. Cash transfers of less than RMB50,000 (approximately $7,182) must be reported to and approved by both the financial departments of the entities and the heads of subsidiaries or VIEs. Cash transfers in excess of RMB50,000 (approximately $7,182) other than regular payments to suppliers need the approval from the CEO of the Company in addition to the procedure mentioned above. Other than those disclosed above, the Company and its subsidiaries, the VIEs and its subsidiaries do not have any applicable regulatory or contractual cash management policies. Please see “Cash Transfer and Dividend Payment” and “Risk Factor - We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the Renminbi, especially with respect to foreign exchange transactions” for detailed discussion.

On May 20, 2020, the U.S. Senate passed the Holding Foreign Companies Accountable Act (the “HFCAA”) requiring a foreign company to certify it is not owned or controlled by a foreign government if the Public Company Accounting Oversight Board (the “PCAOB”) is unable to audit specified reports because the Company uses a foreign auditor not subject to PCAOB inspection. If the PCAOB is unable to inspect the Company’s auditors for three consecutive years, the issuer’s securities are prohibited to trade on a national securities exchange or in the over the counter trading market in the U.S. On December 18, 2020, the HFCAA was signed into law. The HFCAA has since then been subject to amendments by the U.S. Congress and interpretations and rulemaking by the SEC. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), which proposes to reduce the period of time for foreign companies to comply with PCAOB audits from three to two consecutive years, thus reducing the time period before the securities of such foreign companies may be prohibited from trading or delisted. On December 29, 2022, the AHFCAA was signed into law. On December 16, 2021, PCAOB announced the PCAOB HFCAA determinations relating to the PCAOB’s inability to inspect or investigate completely registered public accounting firms headquartered in mainland China of the PRC or Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in the PRC or Hong Kong. The inability of the PCAOB to conduct inspections of auditors in China made it more difficult to evaluate the effectiveness of these accounting firms’ audit procedures or quality control procedures as compared to auditors outside of China that are subject to the PCAOB inspections, which could cause existing and potential investors in issuers operating in China to lose confidence in such issuers’ procedures and reported financial information and the quality of financial statements. Our auditor is headquartered in Irvine, California, and is subject to inspection by the PCAOB on a regular basis with the last inspection in 2020. As of the date of this prospectus, our auditor is not among the firms listed on the PCAOB Determination List issued in December 2021. On August 26, 2022, the PCAOB announced and signed a Statement of Protocol (the “Protocol”) with the China Securities Regulatory Commission and the Ministry of Finance of the People’s Republic of China (together, the “PRC Authorities”). The Protocol provides the PCAOB with: (1) sole discretion to select the firms, audit engagements and potential violations it inspects and investigates, without any involvement of Chinese authorities; (2) procedures for PCAOB inspectors and investigators to view complete audit work papers with all information included and for the PCAOB to retain information as needed; (3) direct access to interview and take testimony from all personnel associated with the audits the PCAOB inspects or investigates. On December 15, 2022, the PCAOB announced in its 2022 HFCAA Determination Report (the “2022 Report”) its determination that the PCAOB was able to secure complete access to inspect and investigate audit firms in the People’s Republic of China (PRC), and the PCAOB Board voted to vacate previous determinations to the contrary. According to the 2022 Report, this determination was reached after the PCAOB had thoroughly tested compliance with every aspect of the Protocol necessary to determine complete access, including on-site inspections and investigations in a manner fully consistent with the PCAOB’s methodology and approach in the U.S. and globally. According to the 2022 Report, the PRC Authorities had fully assisted and cooperated with the PCAOB in carrying out the inspections and investigations according to the Protocol, and have agreed to continue to assist the PCAOB’s investigations and inspections in the future. The PCAOB may reassess its determinations and issue new determinations consistent with the HFCAA at any time. Further developments related to the HFCAA could add uncertainties to our offering. We cannot assure you what further actions the SEC, the PCAOB or the stock exchanges will take to address these issues and what impact such actions will have on U.S. companies that have significant operations in the PRC and have securities listed on a U.S. stock exchange (including a national securities exchange or over-the-counter stock market). In addition, any additional actions, proceedings, or new rules resulting from these efforts to increase U.S. regulatory access to audit information could create uncertainty for investors, the market price of our ordinary shares could be adversely affected, and we could be delisted if we and our auditor are unable to meet the PCAOB inspection requirement. Such a delisting would substantially impair your ability to sell or purchase our ordinary shares when you wish to do so, and would have a negative impact on the price of our ordinary shares.

Neither the Securities and Exchange Commission nor any state or other securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is [ ], 2023

TABLE OF CONTENTS

The distribution of this prospectus may be restricted by law in certain jurisdictions. You should inform yourself about and observe any of these restrictions. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this prospectus does not extend to you.

We have not authorized anyone to give any information or make any representation about us that is different from, or in addition to, that contained in this prospectus, including in any of the materials that we have incorporated by reference into this prospectus, any accompanying prospectus supplement, and any free writing prospectus prepared or authorized by us. Therefore, if anyone does give you information of this sort, you should not rely on it as authorized by us. You should rely only on the information contained or incorporated by reference in this prospectus and any accompanying prospectus supplement.

You should not assume that the information contained in this prospectus and any accompanying supplement to this prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying supplement to this prospectus is delivered or securities are sold on a later date. Neither the delivery of this prospectus, nor any sale made hereunder, shall under any circumstances create any implication that there has been no change in our affairs since the date hereof or that the information incorporated by reference herein is correct as of any time subsequent to the date of such information.

i

You should carefully read this prospectus and the information described under the heading “Where You Can Find More Information.” Neither we nor the Selling Shareholders have authorized anyone to give any information or make any representation about our company that is different from, or in addition to, that contained in this prospectus, including in any of the materials that have been incorporated by reference into this prospectus or any accompanying prospectus supplement. Therefore, if anyone does give you information of this sort, you should not rely on it as authorized by us. You should rely only on the information contained or incorporated by reference in this prospectus and any accompanying prospectus supplement.

You should not assume that the information contained in this prospectus and any accompanying supplement to this prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information that has been incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying supplement to this prospectus is delivered or securities are sold on a later date. Neither the delivery of this prospectus, nor any sale made hereunder, shall under any circumstances create any implication that there has been no change in our affairs since the date hereof or that the information incorporated by reference herein is correct as of any time subsequent to the date of such information.

The distribution of this prospectus may be restricted by law in certain jurisdictions. You should inform yourself about and observe any of these restrictions. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this prospectus does not extend to you.

This prospectus and any applicable prospectus supplement, including the documents incorporated by reference herein and therein, may contain forward-looking statements that are based on our current expectations, assumptions, estimates and projections about us and our industry. All statements other than statements of historical fact in this prospectus are forward-looking statements. These forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “estimate,” “plan,” “believe,” “is/are likely to” or other similar expressions.

The forward-looking statements included in or incorporated by reference into this prospectus and any applicable prospectus supplement are subject to known and unknown risks, uncertainties and assumptions about our businesses and business environments. These statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual results of our operations may differ materially from information contained in the forward-looking statements as a result of risk factors, some of which are described under “Risk Factors” in the documents incorporated by reference herein.

The forward-looking statements contained in or incorporated into this prospectus and any applicable prospectus supplement speak only as of the date of hereof or thereof or of such documents incorporated by reference or, if obtained from third-party studies or reports, the date of the corresponding study or report, and are expressly qualified in their entirety by the cautionary statements in this prospectus, any applicable prospectus supplement and the documents incorporated by reference herein and therein. You should not rely upon forward-looking statements as predictions of future events. Except as otherwise required by the securities laws of the United States, we undertake no obligation to update or revise any forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

ii

All references to “we,” “us,” “our,” “the Company,” “CJJD,” or similar terms used in this prospectus refer to China Jo-Jo Drugstores, Inc., a Cayman Islands exempted company with limited liability, including its consolidated wholly-owned subsidiaries, excluding the variable interest entities (“VIEs”) and the VIEs’ subsidiaries, unless the context otherwise indicates.

“PRC” or “China” refers to the mainland of People’s Republic of China, and include, for the purpose of this prospectus, Hong Kong.

“PRC Counsel” refers to Zhejiang Minhe Law Firm.

“RMB” or “Renminbi” refers to the legal currency of China.

“VIE” or “consolidated VIE” is a variable interest entity whose financial statements are included in our consolidated financial statements as a result of a series of agreements which, under U.S. GAAP, give us, through our WFOE, the ability to conduct operations in China to the extent we and the VIE or consolidated VIE have satisfied the conditions for consolidation of the VIE under U.S. GAAP. The VIEs are Hangzhou Jiuzhou Grand Pharmacy Chain Co., Ltd. (“Jiuzhou Pharmacy”) (including its subsidiaries and controlled entities), Hangzhou Jiuzhou Clinic of Integrated Traditional and Western Medicine (“Jiuzhou Clinic”) and Hangzhou Jiuzhou Medical and Public Health Service Co., Ltd. (“Jiuzhou Service”) (collectively, “VIE Entities”, or “VIEs”).

“WFOE” or “PRC Subsidiary,” which is a wholly foreign owned entity and is a corporation organized under the laws of the PRC which is wholly owned by us, through our subsidiaries. Our WFOEs are Zhejiang Jiuxin Investment Management Co., Ltd. (“Jiuxin Management”), Zhejiang Shouantang Medical Technology Co., Ltd. (“Shouantang Technology”) and Hangzhou Jiutong Medical Technology Co., Ltd (“Jiutong Medical”), Hangzhou Jiuyi Medical Technology Co. Ltd. (“Jiuyi Technology”).

“$,” “US$” or “U.S. Dollars” refers to the legal currency of the United States.

Our reporting currency is the US$. The functional currency of our entities located in China is the RMB. For the entities whose functional currency is the RMB, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. As a result, amounts relating to assets and liabilities reported on the statements of cash flows may not necessarily agree with the changes in the corresponding balances on the balance sheets. Translation adjustments resulting from the process of translating the local currency financial statements into US$ are included in determining comprehensive income/loss. Transactions denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing on the transaction dates. Assets and liabilities denominated in foreign currencies are translated into the functional currencies at the exchange rates prevailing at the balance sheet date with any transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

The following summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our securities. You should read this entire prospectus carefully, including the section entitled “Risk Factors”, and our consolidated financial statements and the related notes thereto (as well as the related “Management’s Discussion and Analysis of Financial Condition and Results of Operations”), in each case, included in or incorporated by reference into this prospectus, before making an investment decision.

1

Overview

China Jo-Jo Drugstores, Inc., offering securities under this prospectus, is not a Chinese operating company but a holding company incorporated in the Cayman Islands. The Cayman Islands holding company has no material operations of its own. We conduct a substantial majority of our operations through our operating entities established in the PRC, including the VIEs. We do not have any equity ownership in the business of the VIEs. Instead, we receive the economic benefits of the VIEs, are the primary beneficiary for accounting purposes, and consolidate VIEs’ financial statements through the VIE Agreements to the extent we have satisfied the conditions for consolidation of the VIEs under U.S. GAAP.. The VIE structure is used to provide contractual exposure to foreign investment in Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies, and that investors may never directly hold equity interests in the Chinese operating entities.

Additionally, we are subject to certain legal and operational risks associated with the VIEs’ operations in China. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in the VIEs’ operations, significant depreciation of the value of our ordinary shares, or a complete hindrance of our ability to offer or continue to offer our securities to investors. Rules and regulations in China can change quickly with little advance notice. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact of such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. or other foreign exchange. The Chinese regulatory authorities could disallow our structure, which could result in a material change in our operations and the value of our securities could decline or become worthless. Our current corporate structure and business operations and the market price of our ordinary shares may be affected by the newly enacted PRC Foreign Investment Law which does not explicitly classify whether VIEs that we have contractual arrangements with would be deemed as foreign-invested enterprises if they are ultimately “controlled” by foreign investors. Our securities offered in this prospectus are shares of our Cayman Islands holding company, and, as a shareholder of the Company, you will have an equity interest in an entity which does not have ownership of the VIEs, which generates a significant portion of the consolidated revenue, but you will never own any equity interest in any of the VIEs. Because we do not have ownership of the VIEs, we must rely on the shareholders of these VIEs to comply with their contractual obligations. The approval of PRC regulatory agencies may be required in connection with this offering under a PRC regulation or any new laws, rules or regulations to be enacted, and if required, we may not be able to obtain such approval.

We, through the operating VIEs in China, including Hangzhou Jiuzhou Grand Pharmacy Chain Co., Ltd. (“Jiuzhou Pharmacy”) (including its subsidiaries and controlled entities), Hangzhou Jiuzhou Clinic of Integrated Traditional and Western Medicine (“Jiuzhou Clinic”) and Hangzhou Jiuzhou Medical and Public Health Service Co., Ltd. (“Jiuzhou Service”, together with Jiuzhou Pharmacy and Jiuzhou Clinic, the “VIEs”), operate as a retailer and distributor of pharmaceutical and other healthcare products typically found in retail pharmacies in the PRC. Prior to acquiring Zhejiang Jiuxin Medicine Co., Ltd. (“Jiuxin Medicine”) in August 2011, we, through the VIEs, were primarily a retail pharmacy operator. Through the WOFEs and VIE entities, as of March 31, 2022, we had one hundred and eleven (111) pharmacies under the store brand “Jiuzhou Grand Pharmacy” in Hangzhou city. Jiuzhou Pharmacy acquired four single drugstores in fiscal 2021. After the acquisition, we liquidated them and then opened four new stores with the four licenses of local government medical insurance reimbursement program. During the year ended March 31, 2021, we sold Lin’An Jiuzhou Pharmacy Co., Ltd (“Lin’An Jiuzhou”), which runs ten stores in Lin’an City, to local investors for total proceeds of $129,586. On the other side, Jiuzhou Pharmacy have been concentrating on new stores within the Hangzhou metropolitan area and opened eleven stores in the fiscal year 2021. Amidst the COVID-19 outbreak, the VIEs experienced a decline in the number of customer visits during the first three months of calendar year 2020 due to the implementation of the lockdown policy in China. However, as China has been able to control the spread of COVID-19, the negative impacts have become limited.

The VIEs currently operate in four business segments in China: (1) retail drugstores, (2) online pharmacy, (3) wholesale business selling products similar to those the VIEs carry in our pharmacies, and (4) farming and selling herbs used for traditional Chinese medicine (“TCM”). All of the above business are performed in China with no other international sales.

2

The VIEs’ stores provide customers with a wide variety of pharmaceutical products, including prescription and over-the-counter (“OTC”) drugs, nutritional supplements, TCM, personal and family care products, and medical devices, as well as convenience products, including consumable, seasonal, and promotional items. Additionally, the VIEs have doctors licensed in both western medicine and TCM on site for consultation, examination and treatment of common ailments at scheduled hours. Four (4) stores of the VIEs have adjacent medical clinics offering urgent care (to provide treatment for minor ailments such as sprains, minor lacerations, and dizziness that can be treated on an outpatient basis), TCM (including acupuncture, therapeutic massage, and cupping) and minor outpatient surgical treatments (such as suturing). Our stores vary in size, but presently average close to 200 square meters per store. The VIEs attempt to tailor each store’s product offerings, physician access, and operating hours to suit the community where the store is located.

We operate our pharmacies (including the medical clinics) through the following companies in China that we have contractual arrangements with:

| ● | Jiuzhou Pharmacy operates “Jiuzhou Grand Pharmacy” stores; |

| ● | Jiuzhou Clinic operates one (1) of our three (3) medical clinics; and |

| ● | Jiuzhou Service operates our other medical clinics. |

Jiuzhou Pharmacy also offers OTC drugs and nutritional supplements for sale through a website (www.dada360.com). For the fiscal year ended March 31, 2022, retail revenue, including pharmacies, medical clinics accounted for approximately 51.2% of the VIEs’ total revenue, while online pharmacy revenue accounted for 18.4% of the VIEs’ total revenue.

Since August 2011, we have operated a wholesale business through Zhejiang Jiuxin Medicine Co., Ltd. (“Jiuxin Medicine”), distributing third-party pharmaceutical products (similar to those carried by our pharmacies) primarily to trading companies throughout China. Jiuxin Medicine is wholly owned by Jiuzhou Pharmacy. For the fiscal year ended March 31, 2022, wholesale revenue accounted for approximately 30.4% of our total revenue.

We also have an herb farming business cultivating and wholesaling herbs used for TCM. This business is conducted through Hangzhou Qianhong Agriculture Development Co., Ltd. (“Qianhong Agriculture”), a wholly-owned subsidiary. During the fiscal year ended March 31, 2022, Qianhong Agriculture generated no revenue from our herb farming business.

Redomicile Merger

At 9:00 a.m., Eastern Time, on July 30, 2021, China Jo-Jo Drugstores, Inc., a Nevada corporation (“Predecessor CJJD”), completed a corporate reorganization (the “Reorganization” or “Redomicile Merger”), resulting in the Company becoming the publicly held parent company of Predecessor CJJD, with Predecessor CJJD merged with and into the Company, pursuant to the Agreement and Plan of Merger, dated as of May 14, 2021, by and between Predecessor CJJD and the Company (the “Merger Agreement”). The Merger Agreement was approved by the stockholders of Predecessor CJJD at a special meeting of stockholders held on July 19, 2021. The Merger Agreement was filed with the Registration Statement on Form F-4 that we filed with the United States Securities and Exchange Commission (the “SEC” or the “Commission”) on May 15, 2021 which was declared effective by the SEC on May 28, 2021. On July 30, 2021, Predecessor CJJD issued a press release announcing the completion of the Reorganization.

Prior to the Reorganization, shares of Predecessor CJJD’s common stock were registered pursuant to Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and listed on the NASDAQ Capital Market under the symbol “CJJD.” As a result of the Reorganization, each issued and outstanding share of Predecessor CJJD’s common stock was converted into the right to receive one ordinary share of our company, which shares were issued by us as part of the Reorganization. On July 30, 2021, Predecessor CJJD filed a Form 15 with the SEC to terminate the registration of the shares of its common stock and suspend its reporting obligations under Sections 13 and 15(d) of the Exchange Act.

Our ordinary shares were approved for listing on the NASDAQ Capital Market and began trading under the symbol “CJJD,” the same symbol under which the shares of Predecessor CJJD’s common stock previously traded, on July 30, 2021. On August 9, 2021, we filed a Form 8-A to register our ordinary shares under Section 12(b) of the Exchange Act.

3

As of July 30, 2021, each of the directors and officers of Predecessor CJJD immediately prior to the Reorganization had been appointed to the same position(s) with the Company, with the directors to serve until the earlier of the next annual meeting of our shareholders or until their successors are elected or appointed (or their earlier death, disability or retirement).

Following the completion of the Reorganization and as of the date of this prospectus, the rights of shareholders of the Company are governed by our Second Amended and Restated Memorandum and Articles of Association.

As mentioned above, our securities offered in this prospectus are securities of our Cayman Islands holding company that maintains service agreements with the associated operating companies. Investors may never directly hold equity interests in our Chinese operating entities.

On December 24, 2021, the CSRC released the Administrative Provisions of the State Council Regarding the Overseas Issuance and Listing of Securities by Domestic Enterprises (Draft for Comments) (the “Draft Administrative Provisions”) and the Measures for the Overseas Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing Measures”, collectively with the Draft Administrative Provisions, the “Draft Rules Regarding Overseas Listing”), both of which have a comment period that expires on January 23, 2022. The Draft Rules Regarding Overseas Listing lay out the filing regulation arrangement for both direct and indirect overseas listing, and clarify the determination criteria for indirect overseas listing in overseas markets.

The Draft Rules Regarding Overseas Listing stipulate that the Chinese-based companies, or the issuer, shall fulfill the filing procedures within three working days after the issuer makes an application for initial public offering and listing in an overseas market. The required filing materials for an initial public offering and listing shall include but not limited to: record-filing report and related undertakings; regulatory opinions, record-filing, approval and other documents issued by competent regulatory authorities of relevant industries (if applicable); and security assessment opinion issued by relevant regulatory authorities (if applicable); PRC legal opinion; and prospectus. In addition, an issuer who issues overseas listed securities after overseas listing shall, within three working days after the completion of the issuance, submit required filing materials to the CSRC, including but not limited to: filing report and relevant commitment; and domestic legal opinion. Furthermore, an overseas offering and listing is prohibited under any of the following circumstances: (1) if the intended securities offering and listing is specifically prohibited by national laws and regulations and relevant provisions; (2) if the intended securities offering and listing may constitute a threat to or endangers national security as reviewed and determined by competent authorities under the State Council in accordance with law; (3) if there are material ownership disputes over the equity, major assets, and core technology, etc. of the issuer; (4) if, in the past three years, the domestic enterprise or its controlling shareholders or actual controllers have committed corruption, bribery, embezzlement, misappropriation of property, or other criminal offenses disruptive to the order of the socialist market economy, or are currently under judicial investigation for suspicion of criminal offenses, or are under investigation for suspicion of major violations; (5) if, in past three years, directors, supervisors, or senior executives have been subject to administrative punishments for severe violations, or are currently under judicial investigation for suspicion of criminal offenses, or are under investigation for suspicion of major violations; (6) other circumstances as prescribed by the State Council. The Administration Provisions defines the legal liabilities of breaches such as failure in fulfilling filing obligations or fraudulent filing conducts, imposing a fine between RMB 1 million and RMB 10 million, and in cases of severe violations, a parallel order to suspend relevant business or halt operation for rectification, revoke relevant business permits or operational license.

As of the date of this prospectus, the Draft Rules Regarding Overseas Listing have not been promulgated, and as advised by our PRC Counsel, we are not required to obtain any permissions or approvals from the government of China for any offering pursuant to this prospectus. The final version of the Draft Rules Regarding Overseas Listing to be adopted is still highly uncertain, but as advised by the PRC counsel, upon the enactment, our subsidiaries and/or VIEs will then be required to comply with the filing requirements or procedures set forth in the Draft Rules Regarding Overseas Listing assuming the final rules contain no changes comparing to the draft rules previously circulated for comments.

4

On December 28, 2021, the Cyberspace Administration of China, or the “CAC”, and other PRC authorities promulgated the Cybersecurity Review Measures, which took effect on February 15, 2022. The Cybersecurity Review Measures further restates and expands the applicable scope of the cybersecurity review in effect. We do not believe we are among the “operator of critical information infrastructure” or “data processor” as mentioned above. Based on the above and our understanding of the Chinese laws and regulations currently in effect as of the date of this prospectus, we are not required to submit an application to the CSRC or the CAC for the approval of this offering and the listing and trading of our securities on the Nasdaq. However, the revised draft of the Measures for Cybersecurity Review is in the process of being formulated and the Opinions remain unclear on how it will be interpreted, amended and implemented by the relevant PRC governmental authorities. Thus, it is still uncertain how PRC governmental authorities will regulate overseas listing in general and whether we are required to obtain any permissions or specific regulatory approvals. Furthermore, if the CSRC or other regulatory agencies later promulgate new rules or explanations requiring that we obtain their permissions or approvals for this offering and any follow-on offering, we may be unable to obtain such permissions or approvals which could significantly limit or completely hinder our ability to offer or continue to offer securities to our investors. In the event that the CSRC approval or any regulatory approval is required for this offering, or if the CSRC or any other PRC government authorities promulgates any new laws, rules or regulations or any interpretation or implements rules before our listing that would require us to obtain the CSRC or any other governmental approval for this offering, we may face sanctions by the CSRC or other PRC regulatory agencies for failure to seek CSRC approval for this offering. These sanctions may include fines and penalties on our operations in the PRC, limitations on our operating privileges in the PRC, delays in or restrictions on the repatriation of the proceeds from this offering into the PRC, restrictions on or prohibition of the payments or remittance of dividends by our PRC subsidiary, or other actions that could have a material and adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ordinary shares. The CSRC or other PRC regulatory agencies may also take actions requiring us, or making it advisable for us, to halt this offering before the settlement and delivery of the securities that we are offering. Consequently, if you engage in market trading or other activities in anticipation of and prior to the settlement and delivery of the securities we are offering, you would be doing so at the risk that the settlement and delivery may not occur. Any uncertainties or negative publicity regarding such approval requirements could have a material adverse effect on our ability to complete this offering or any follow-on offering of our securities or the market for and market price of our ordinary shares.

According to PRC Counsel, neither the Company, nor any of its subsidiaries, including the VIEs are currently required to obtain any permissions or approvals from Chinese authorities, including the China Securities Regulatory Commission, or CSRC, or Cybersecurity Administration Committee, or CAC, to list on U.S exchanges or offer securities to foreign investors. We have not been denied any permissions or approvals either as of the date of this prospectus. However, if we were required to obtain any permissions or approvals in the future and were denied permissions or approvals from Chinese authorities to list on U.S. exchanges or offer securities to foreign investors, or if we inadvertently conclude that permissions or approvals to offer securities are not required, we will not be able to continue to list on U.S. exchanges or offer securities to foreign investors, which would materially affect the interest of the investors. It is uncertain when and whether the Company will be required to obtain any permissions or approvals from the PRC government to list on U.S. exchanges or offer securities to foreign investors in the future, and even when such permissions or approvals are obtained, whether they will be denied or rescinded. Although the Company is currently not required to obtain permissions or approvals from any of the PRC central or local government and has not received any denial to list on the U.S. exchange or offer securities to foreign investors, the VIEs’ operations could be adversely affected, directly or indirectly, by changes on any existing or promulgation of any future laws and regulations relating to its business or industry.

As of the date of this prospectus, based on the management’s belief, we, the VIEs and their subsidiaries, have obtained all the requisite licenses and approvals to operate business in China, and have not been denied any permissions or approvals to operate the business. The Company management, including its in-house local counsel is responsible to maintain and update the licenses and permissions. However, if our subsidiaries, the VIEs or the VIE’s subsidiaries (i) do not receive or maintain permissions or approvals to operate our businesses, (ii) inadvertently conclude that permissions or approvals to operate our businesses are not required, or (iii) applicable laws, regulations, or interpretations change and we, the VIEs and/or the VIEs’ subsidiaries are required to obtain permissions or approvals in the future to operate our businesses, we will have to obtain such permissions or approvals as required, which may be expensive and time-consuming, and we cannot ensure that our subsidiaries, the VIEs or the VIE’s subsidiaries will successfully obtain every permissions and approvals. If that happens, we may have to switch business focus or temporarily halt the operation, which could result in a material change in our operations and the value of our securities could decline or become worthless.

5

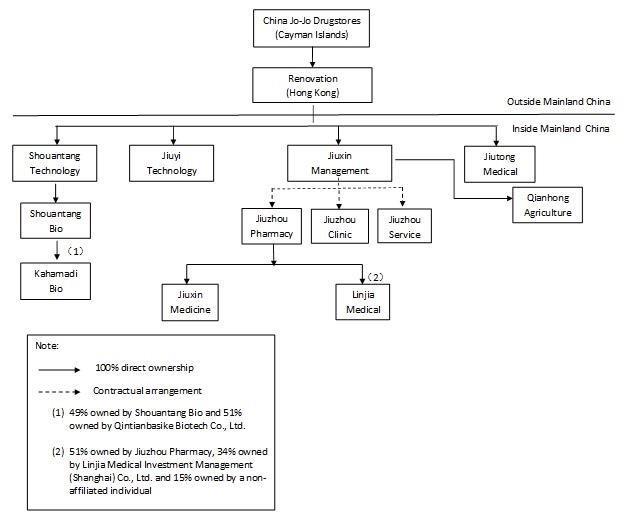

Our Current Corporate Structure

The following diagram illustrates our current corporate structure as of the date of this prospectus:

The table below summarizes the status of the registered capital of our PRC subsidiaries, controlled companies and joint ventures as of the date of this prospectus:

| Entity Name | Entity Type | Registered

Capital |

Registered Capital Paid |

Due

Date for Unpaid Registered Capital | ||||

| Jiutong Medical | Subsidiary | USD 2,600,000 | USD 2,600,000 | N/A | ||||

| Jiuzhou Clinic | VIE | N/A | N/A | N/A | ||||

| Jiuzhou Pharmacy | VIE | USD 733,500 | USD 733,500 | N/A | ||||

| Jiuzhou Service | VIE | USD 73,350 | USD 73,350 | N/A | ||||

| Jiuxin Management | Subsidiary | USD 24,500,000 | USD 23,500,000 | N/A | ||||

| Jiuxin Medicine | Subsidiary of the VIE | USD 1,564,000 | USD 1,564,000 | N/A | ||||

| Qianhong Agriculture | Subsidiary | USD 1,497,000 | USD 1,497,000 | N/A | ||||

| Shouantang Technology | Subsidiary | USD 11,000,000 | USD 11,000,000 | N/A | ||||

| Shouantang Bio | Subsidiary | USD 162,900 | USD 162,900 | N/A | ||||

| Jiuyi Technology | Subsidiary | USD 5,000,000 | USD 2,500,000 | September 25, 2026 | ||||

| Linjia Medical* | Subsidiary of the VIE | USD 2,979,460 | USD 1,489,730 | N/A | ||||

| Kahamadi Bio** | Joint Venture | USD 1,524,540 | USD 259,172 | N/A |

| * | Linjia Medical is 51% held by Jiuzhou Pharmacy, 34% held by Linjia Medical Investment Management (Shanghai) Co., Ltd., whose shareholders are not affiliated to the Company, and 15% held by a non-affiliated individual. |

| ** | Kahamadi Bio is 49% held by Shouantang Bio and 51% held by Qintianbasike Biotech Co., Ltd, whose shareholders are not affiliated to the Company. |

6

Set forth below is selected consolidating statements of income and cash flows for the years ended March 31, 2022, 2021 and 2020 and selected balance sheet information as of March 31, 2022, 2021 and 2020 showing financial information for CJJD (excluding the VIEs), the VIEs, eliminating entries and consolidated information.

Consolidating Statements of Income Information

| Year Ended March 31, 2022 | ||||||||||||||||||||

| PARENT | SUBSIDIARIES | VIE | Eliminations | Consolidated | ||||||||||||||||

| Revenue | $ | - | $ | 181,179 | $ | 244,933,524 | $ | (80,722,148 | ) | $ | 164,392,555 | |||||||||

| Cost of revenue | - | 182,732 | 208,169,174 | (80,478,391 | ) | 127,873,515 | ||||||||||||||

| Gross profit | - | (1,553 | ) | 36,764,350 | (243,757 | ) | 36,519,040 | |||||||||||||

| Operating Expenses | 43,042 | 1,479,243 | 37,583,788 | 106,857 | 39,212,930 | |||||||||||||||

| Loss from operations | (43,042 | ) | (1,480,796 | ) | (819,438 | ) | (350,614 | ) | (2,693,890 | ) | ||||||||||

| Other income, net | (258 | ) | (21,931 | ) | 617,439 | - | 595,250 | |||||||||||||

| Provision for income tax | - | 247 | 1,099,479 | - | 1,099,726 | |||||||||||||||

| Net loss | $ | (43,300 | ) | (1,502,974 | ) | (1,301,478 | ) | (350,614 | ) | (3,198,366 | ) | |||||||||

| Year Ended March 31, 2021 | ||||||||||||||||||||

| PARENT | SUBSIDIARIES | VIE | Eliminations | Consolidated | ||||||||||||||||

| Revenue | $ | - | $ | 1,693,950 | $ | 206,173,492 | $ | (74,732,809 | ) | $ | 133,134,633 | |||||||||

| Cost of revenue | - | 1,250,742 | 177,441,192 | (74,801,110 | ) | 103,890,824 | ||||||||||||||

| Gross profit | - | 443,208 | 28,732,300 | 68,301 | 29,243,809 | |||||||||||||||

| Operating Expenses | 3,941,600 | 2,724,339 | 31,569,482 | (154,372 | ) | 38,081,049 | ||||||||||||||

| Loss from operations | (3,941,600 | ) | (2,281,131 | ) | (2,837,182 | ) | 222,673 | (8,837,240 | ) | |||||||||||

| Other income, net | 64,090 | (646,415 | ) | 467,923 | 607,702 | 493,300 | ||||||||||||||

| Provision for income tax | - | - | 31,638 | - | 31,638 | |||||||||||||||

| Net loss | $ | (3,877,510 | ) | $ | (2,927,546 | ) | (2,400,897 | ) | $ | 830,375 | $ | (8,375,578 | ) | |||||||

| Year Ended March 31, 2020 | ||||||||||||||||||||

| PARENT | SUBSIDIARIES | VIE | Elimination | Consolidated | ||||||||||||||||

| Revenue | $ | $ | 2,059,685 | $ | 175,378,838 | $ | (60,110,834 | ) | $ | 117,327,689 | ||||||||||

| Cost of revenue | - | 1,504,696 | 150,319,467 | (60,022,904 | ) | 91,801,259 | ||||||||||||||

| Gross profit | - | 554,989 | 25,059,371 | (87,930 | ) | 25,526,430 | ||||||||||||||

| Operating Expenses | 34,560 | 1,351,229 | 31,734,804 | (590,421 | ) | 32,530,172 | ||||||||||||||

| Loss from operations | (34,560 | ) | (796,240 | ) | (6,675,433 | ) | 502,491 | (7,003,742 | ) | |||||||||||

| Other income, net | 401,158 | (164,693 | ) | 916,278 | (590,420 | ) | 562,323 | |||||||||||||

| Provision for income tax | - | 1 | 16,257 | - | 16,258 | |||||||||||||||

| Net loss | $ | 366,598 | $ | (960,934 | ) | $ | (5,775,412 | ) | $ | (87,929 | ) | $ | (6,457,677 | ) | ||||||

Consolidating Balance Sheets Information

| Year Ended March 31, 2022 | ||||||||||||||||||||

| PARENT | SUBSIDIARIES | VIE | Elimination | Consolidated | ||||||||||||||||

| Total assets | $ | 46,700 | $ | 55,796,336 | $ | 90,528,406 | $ | (39,987,233 | ) | $ | 106,384,209 | |||||||||

| Total liabilities | (48,578,210 | ) | 17,576,098 | 107,864,555 | 6,782,980 | 83,645,423 | ||||||||||||||

| Current assets | 46,700 | 12,676,793 | 71,423,189 | (8,694,788 | ) | 75,451,894 | ||||||||||||||

| Current liabilities | (48,578,210 | ) | 17,576,098 | 107,864,555 | (2,414,047 | ) | 74,448,396 | |||||||||||||

| Working capital | 48,624,910 | (4,899,305 | ) | (36,441,366 | ) | (6,280,741 | ) | 1,003,498 | ||||||||||||

| Accumulated deficit | (17,136,455 | ) | (5,669,391 | ) | (24,496,890 | ) | (831,757 | ) | (48,134,493 | ) | ||||||||||

| Total equity | 48,624,910 | 38,220,238 | (17,336,149 | ) | (46,770,213 | ) | 22,738,786 | |||||||||||||

| Year Ended March 31, 2021 | ||||||||||||||||||||

| PARENT | SUBSIDIARIES | VIE | Elimination | Consolidated | ||||||||||||||||

| Total assets | $ | - | $ | 57,976,479 | $ | 82,863,681 | $ | (34,529,529 | ) | $ | 106,310,631 | |||||||||

| Total liabilities | (48,668,211 | ) | 19,712,130 | 98,304,131 | 12,560,236 | 81,908,286 | ||||||||||||||

| Current assets | - | 14,880,358 | 61,824,239 | (4,470,354 | ) | 72,234,243 | ||||||||||||||

| Current liabilities | (48,668,211 | ) | 19,712,130 | 96,411,862 | (2,557,847 | ) | 64,897,934 | |||||||||||||

| Working capital | 48,668,211 | (4,831,772 | ) | (34,587,623 | ) | (1,912,507 | ) | 7,336,309 | ||||||||||||

| Accumulated deficit | (17,093,153 | ) | (4,525,944 | ) | (21,987,871 | ) | (1,335,406 | ) | (44,942,374 | ) | ||||||||||

| Total equity | 48,668,211 | 38,264,349 | (15,440,450 | ) | (47,089,765 | ) | 24,402,345 | |||||||||||||

7

| Year Ended March 31, 2020 | ||||||||||||||||||||

| PARENT | SUBSIDIARIES | VIE | Elimination | Consolidated | ||||||||||||||||

| Total assets | $ | - | $ | 46,018,763 | $ | 72,390,246 | $ | (18,892,776 | ) | $ | 99,516,233 | |||||||||

| Total liabilities | (39,239,520 | ) | 17,605,106 | 84,235,162 | 18,137,356 | 80,738,104 | ||||||||||||||

| Current assets | - | 11,704,443 | 52,758,690 | (3,475,921 | ) | 60,987,212 | ||||||||||||||

| Current liabilities | (39,303,610 | ) | 19,892,848 | 77,831,462 | (982,726 | ) | 57,437,974 | |||||||||||||

| Working capital | 39,303,610 | (8,188,405 | ) | (25,072,772 | ) | (2,493,195 | ) | 3,549,238 | ||||||||||||

| Accumulated deficit | (13,215,642 | ) | (2,600,637 | ) | (17,900,981 | ) | (2,683,577 | ) | (36,400,837 | ) | ||||||||||

| Total equity | 39,239,520 | 28,413,657 | (11,844,916 | ) | (37,030,132 | ) | 18,778,129 | |||||||||||||

Consolidating Cash Flows Information

| Year Ended March 31, 2022 | ||||||||||||||||||||

| PARENT | SUBSIDIARIES | VIE | Elimination | Consolidated | ||||||||||||||||

| Net cash (used in)/provided by operating activities | $ | (43,300 | ) | $ | 3,283,202 | $ | (10,638,849 | ) | $ | 2,012,974 | $ | (5,385,973 | ) | |||||||

| Net cash used in investing activities | - | (63,291 | ) | (242,847 | ) | - | (306,138 | ) | ||||||||||||

| Net cash (used in)/provided by financing activities | 90,000 | (6,256,428 | ) | 12,810,723 | (1,807,397 | ) | 4,836,898 | |||||||||||||

| Effect of exchange rate on cash and cash equivalents | - | 1,499,349 | 228,373 | (205,577 | ) | 1,522,146 | ||||||||||||||

| Net increase in cash and cash equivalents | 46,700 | (1,537,168 | ) | 2,157,401 | - | 666,933 | ||||||||||||||

| Year Ended March 31, 2021 | ||||||||||||||||||||

| PARENT | SUBSIDIARIES | VIE | Elimination | Consolidated | ||||||||||||||||

| Net cash (used in)/provided by operating activities | $ | (9,364,000 | ) | $ | 2,197,717 | $ | 6,164,131 | $ | 939,860 | $ | (62,292 | ) | ||||||||

| Net cash used in investing activities | $ | - | $ | (297,265 | ) | $ | (2,355,805 | ) | $ | 654,745 | $ | (1,998,325 | ) | |||||||

| Net cash (used in)/provided by financing activities | $ | 9,364,600 | $ | (346,960 | ) | $ | (3,241,948 | ) | $ | (2,695,839 | ) | $ | 3,079,853 | |||||||

| Net increase in cash and cash equivalents | $ | - | $ | 3,151,646 | $ | 538,392 | $ | - | $ | 3,690,038 | ||||||||||

| Year Ended March 31, 2020 | ||||||||||||||||||||

| PARENT | SUBSIDIARIES | VIE | Elimination | Consolidated | ||||||||||||||||

| Net cash (used in)/provided by operating activities | $ | (9,273,077 | ) | $ | 6,492,750 | $ | (3,689,278 | ) | $ | (438,340 | ) | $ | (6,907,945 | ) | ||||||

| Net cash used in investing activities | $ | - | $ | (304,645 | ) | $ | (3,058,771 | ) | $ | (1,473,197 | ) | $ | (4,836,613 | ) | ||||||

| Net cash (used in)/provided by financing activities | $ | 9,273,077 | $ | (285,123 | ) | $ | 8,448,290 | $ | 1,577,462 | $ | 19,013,706 | |||||||||

| Net increase in cash and cash equivalents | $ | - | $ | 5,822,263 | $ | 415,141 | $ | - | $ | 6,237,404 | ||||||||||

Cash Transfer and Dividend Payment

Our holding company, subsidiaries and the consolidated VIEs usually operate independently and transfer funds upon capital raising. We raised capital of $17.5 million in our IPO in April 2010. In addition, we raised capital for a total amount of $33.648 million from 2015 to 2020 through various financings. Renovation Investment (HK) Co., Ltd. (“Renovation”), our Hong Kong intermediate holding subsidiary, received funds from our investors in these financings. After receiving the proceeds, Renovation typically invested these funds into Jiuxin Management, a WFOE, which then exchanged the currency of the proceeds from U.S. dollar into Chinese Yuan (“RMB”) upon the approval from local banks. Additionally, Renovation lent funds to Jiuxin Management. As of the date of this prospectus, the total amount invested in and lent to Jiuxin Management is approximately $23.5 million and $8.7 million, respectively. Jiuxin Management then distributed the RMB as loans to the operating entities including Jiuzhou Pharmacy, Jiuxin Medicine, Jiuzhou Service and Jiuzhou Clinic, which are the consolidated VIEs. As of the date of this prospectus, Jiuxin Management has distributed a loan of approximately $21.9 million to Jiuzhou Pharmacy, a loan of approximately $1.4 million to Jiuzhou Service, a loan of approximately $0.04 million to Jiuzhou Clinic, a loan of approximately $0.31 million to Linjia Medical, a loan of approximately $0.16 to Shouantang Bio.

Additionally, Jiuxin Medicine is the major supplier to Jiuzhou Pharmacy and Jiuzhou Pharmacy transfers funds to pay off the debts owed to Jiuxin Medicine as a result of merchandise purchases. In the last three fiscal years, the annual amount of purchases by Jiuxin Medicine from Jiuzhou Pharmacy ranges from approximately $60 million to $80 million.

8

All the sales and purchases between Jiuxin Medicine and Jiuzhou Pharmacy are eliminated as internal transactions. Furthermore, the ending balances owed to/from the VIEs are eliminated in the balance sheets. Below are the sales and purchases between Jiuxin Medicine and Jiuzhou Pharmacy in last three fiscal years:

| Years | Amount | |||

| Fiscal 2020 | $ | 58,575,861 | ||

| Fiscal 2021 | $ | 73,239,387 | ||

| Fiscal 2022 | $ | 80,712,044 | ||

Additional transfers between other VIEs and subsidiaries are as below:

| Amount | ||||||||||||||

| Transfer from | Transfer to | 2020 | 2021 | 2022 | ||||||||||

| Renovation | Jiuxin Management | $ | 8,705,000 | $ | 9,000,000 | $ | - | |||||||

| Jiuxin Management | Jiuzhou Pharmacy | 574,248 | 1,860,573 | 582,736 | ||||||||||

| Jiuxin Management | Jiuxin Medicine | - | 2,622,495 | 779,059 | ||||||||||

| Jiuxin Management | Qianhong Agriculture | 37,083 | 31,433 | 30,496 | ||||||||||

| Jiuzhou Pharmacy | Jiuzhou Service | 420,810 | 425,345 | 342,822 | ||||||||||

The PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of currency out of China. The majority of the VIEs’ and their subsidiaries’ income is received in RMB and shortages in foreign currencies may restrict our ability to pay dividends or other payments, or otherwise satisfy our foreign currency denominated obligations, if any. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from The State Administration of the Foreign Exchange (“SAFE”) in the PRC as long as certain procedural requirements are met. Approval from appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be able to pay dividends in foreign currencies to our shareholders. To the extent cash or assets in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds or assets may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of such entities, their subsidiaries, or the consolidated VIEs by the PRC government to transfer cash or assets.

Cash dividends, if any, on our ordinary shares will be paid in U.S. dollars. Our ability to pay dividends depend on the distribution from the operating entities to the Company. As of the date of this prospectus, none of the subsidiaries or consolidated VIEs has made any distribution to the Company. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax. As of the date of this prospectus, the Company did not have any distributions to our investors through either our holding company, subsidiaries or the consolidated VIEs, and does not intend to distribute any dividends in any forms in the near future. Please refer to “condensed consolidating schedule” and “consolidated financial statements” in Company’s annual report on Form 20-F filed with SEC on July 28, 2022, which is incorporated by reference to this registration statement.

Relevant PRC laws and regulations permit the PRC companies to pay dividends only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Additionally, the Company’s PRC subsidiary and the VIE can only distribute dividends upon approval of the shareholders after they have met the PRC requirements for appropriation to the statutory reserves. As a result of these and other restrictions under the PRC laws and regulations, our PRC subsidiaries and the VIEs are restricted to transfer a portion of their net assets to the Company either in the form of dividends, loans or advances. Even though the Company currently does not require any such dividends, loans or advances from the PRC subsidiaries and the VIEs for working capital and other funding purposes, the Company may in the future require additional cash resources from its PRC subsidiaries and the VIEs due to changes in business conditions, to fund future acquisitions and developments, or merely declare and pay dividends to or distributions to the Company’s shareholders.

We have maintained cash management policies which dictates the purpose, amount and procedure of cash transfers among CJJD, the VIEs and non-VIE subsidiaries. Cash transfers of less than RMB50,000 (approximately $7,182) must be reported to and approved by both the financial departments of the entities and the heads of subsidiaries or VIEs. Cash transfers in excess of RMB50,000 (approximately $7,182) other than regular payments to suppliers need the approval from the CEO of the Company in addition to the procedure mentioned above.

Other than those disclosed above, the Company and its subsidiaries, the VIEs and its subsidiaries do not have any applicable regulatory or contractual cash management policies.

9

Licenses and Permits

As a wholesale distributor and retailer of pharmaceutical products, we are subject to regulation and oversight by different levels of the food and drug administration in China, in particular, National Medical Products Administration (the “NMPA”) . The Drug Administration Law of the PRC, as amended, provides the basic legal framework for the administration of the production and sale of pharmaceutical products in China and governs the manufacturing, distributing, packaging, pricing, and advertising of pharmaceutical products in China. The corresponding implementation regulations set out detailed rules with respect to the administration of pharmaceuticals in China. The VIEs are also subject to other PRC laws and regulations that are applicable to business operators, retailers, and foreign-invested companies.

A distributor of pharmaceutical products must obtain a distribution permit from the relevant provincial or designated municipal-level NMPA. The grant of such permit is subject to an inspection of the distributor’s facilities, warehouses, hygienic environment, quality control systems, personnel, and equipment. The distribution permit is valid for five (5) years, and the holder must apply for renewal of the permit within six (6) months prior to its expiration. After inspection, NMPA must decide whether to grant a new distribution permit prior to the expiration of the old permit. If a distributor does not meet the NMPA requirements, a three months grace period will be granted for further remediation. If the distributor still misses the NMPA requirements, the permit will be canceled and the distributor will no longer be allowed to distribute pharmaceutical products. In addition, a pharmaceutical product distributor needs to obtain a business license from the relevant administration for industry and commerce prior to commencing its business. Based on the management belief, all of the VIEs that engage in the retail pharmaceutical business have obtained necessary pharmaceutical distribution permits, and we do not expect to face any difficulties in renewing these permits and/or certifications.

Our wholly owned subsidiaries and the VIEs and their subsidiaries are required to have, and each has, a business license issued by the PRC State Administration for Market Regulation and its local counterparts. In addition, major PRC regulations applicable to our products and services and the Internet security industry include Internet Security Protection Technology Measures Provision (Ministry of Public Security Order No. 82) (“Order 82”).

Order 82 specifies certain security measures Internet service providers shall take to ensure Internet security among operations. Providers of ISP connecting service and Internet-based data processing service are within the scope of Order 82. During the operations, any violations to take certain security measures, such as failure to establish a security protection management system, failure to take security technology protection measures, among others, shall be punished by the public security bureaus. The penalty includes but is not limited to rectification, confiscation of illegal income or fine. If the circumstances are serious, Internet service providers may even be given a cessation of networking for no more than six months. The Company has implemented appropriate measures such as utilizing a separate server, and allowing only authorized access to data to keep customer information safe and secure to comply with Order 82.

On December 24, 2021, the CSRC released the Administrative Provisions of the State Council Regarding the Overseas Issuance and Listing of Securities by Domestic Enterprises (Draft for Comments) (the “Draft Administrative Provisions”) and the Measures for the Overseas Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing Measures”, collectively with the Draft Administrative Provisions, the “Draft Rules Regarding Overseas Listing”), both of which have a comment period that expires on January 23, 2022. The Draft Rules Regarding Overseas Listing lay out the filing regulation arrangement for both direct and indirect overseas listing, and clarify the determination criteria for indirect overseas listing in overseas markets.

As of the date of this prospectus, the comment period has ended, but the Draft Rules Regarding overseas listing have not been promulgated, and we are not required to obtain any permissions or approvals from the government of China for any offering pursuant to this prospectus. The final version of the Draft Rules Regarding overseas listing is expected to be adopted in later 2022, and as advised by our PRC counsel, our subsidiaries and/or the VIEs will then be required to comply with the filing requirements or procedures set forth in the Draft Rules Regarding overseas listing assuming the final rules contain no changes comparing to the Draft Rules Regarding Overseas Listing.

As of the date of this prospectus, based on the management’s belief, we, including the VIEs and their subsidiaries, have obtained all the requisite licenses and approvals to operate business in China. The Company management, including its in-house local counsel is responsible to maintain and update the licenses and permissions. However, it is uncertain whether the current laws will be modified or the new laws will be enacted to require any additional licenses or approvals that we currently are not required to.

10

If the Company, its subsidiaries or the VIEs or their subsidiaries do not receive or maintain such permissions or approvals to offer the securities to foreign investors (not by or related to the CSRC or CAC), or mistakenly conclude that such permissions or approvals are not required, our business may be adversely affected. In such case, the Company would either exit from such field of business, or collaborate with parties that can obtain such permissions or the Company may have to switch the participating industry, which may trigger material negative impact on the Company’s business such as posing significant costs in receiving such permissions or approvals, halting our operation of business and consequently reduce the value of our securities. If applicable laws, regulations, or interpretations change and the Company, or its subsidiaries or the VIEs or their subsidiaries are required to obtain such permissions or approvals in the future, we may need to obtain such permissions or approvals, which could result in a material change in our operations and the value of our securities could decline or become worthless.

Contractual Arrangement with VIE Entities and the Key Personnel