Delaware |

7990 |

86-3355184 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer |

☒ | Smaller reporting company | ||||

| Emerging growth company | ||||||

| | ||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per security |

Proposed maximum aggregate offering price |

Amount of registration fee | ||||

| Class A common stock (1)(2) |

187,267,173 |

$12.82 (3) |

$2,400,765,158.86 |

$222,550.93 | ||||

| Class A common stock underlying warrants (1)(4) |

41,652,569 |

$12.82 (3) |

$533,985,934.58 |

$49,500.50 | ||||

| Class A common stock underlying warrants (1)(5) |

17,000,000 |

$15.00 (6) |

$255,000,000.00 |

$23,638.50 | ||||

| Warrants (7) |

45,686,457 |

$— |

$— |

$— (8) | ||||

| Total |

$3,189,751,092.44 |

$295,689.93 (9) | ||||||

| | ||||||||

| | ||||||||

(1) |

Pursuant to Rule 416 under the Securities Act, the registrant is also registering an indeterminate number of additional shares of Class A common stock of Vivid Seats Inc., par value $0.0001 per share (the “Class A common stock”), issuable by reason of any stock dividend, stock split, recapitalization or other similar transaction. |

(2) |

The number of shares of Class A common stock being registered includes (i) 47,517,173 shares of Class A common stock issued to certain qualified institutional buyers and accredit investors in private placements consummated in connection with the Business Combination described herein, (ii) 15,550,000 shares of Class A common stock issued to Horizon Sponsor, LLC, a Delaware limited liability company (“Sponsor”) in connection with the Business Combination and (iii) 124,200,000 shares of Class A common stock that may be issued upon exchange of Intermediate Common Units (as defined below) held by Hoya Topco, LLC, a Delaware limited liability company (“Hoya Topco”), including 6,000,000 Intermediate Common Units issuable in the future pursuant to the exercise of warrants held by Hoya Topco. |

(3) |

Estimated solely for the purpose of calculating the registration fee, based on the average of the high and low prices of the shares of Class A common stock on The Nasdaq Global Select Market on November 2, 2021. November 2, 2021 was the date for which the most recent reported high and low prices of the Class A common stock were available prior to the initial filing of this registration statement (such date being within five business days of the date that this registration statement was first filed with the Securities and Exchange Commission (the “SEC”)). This calculation is in accordance with Rule 457(c) and Rule 457(g) under the Securities Act. |

(4) |

Reflects (i) 18,132,778 shares of Class A common stock that may be issued upon exercise of the Vivid Seats Public IPO Warrants (as defined below), with each warrant exercisable for one share of Class A common stock, subject to adjustment, for an exercise price of $11.50 per share, (ii) 6,519,791 shares of Class A common stock that may be issued upon exercise of the Vivid Seats Private Placement IPO Warrants (as defined below), with each warrant exercisable for one share of Class A common stock, subject to adjustment, for an exercise price of $11.50 per share and (iii) 17,000,000 shares of Class A common stock that may be issued upon exercise of the Vivid Seats PubCo $10.00 Exercise Warrants (as defined below), with each warrant exercisable for one share of Class A common stock, subject to adjustment, for an exercise price of $10.00 per share. |

(5) |

Reflects the shares of Class A common stock that may be issued upon exercise of the Vivid Seats PubCo $15.00 Exercise Warrants (as defined below), with each warrant exercisable for one share of Class A common stock, subject to adjustment, for an exercise price of $15.00 per share. |

(6) |

Calculated pursuant to Rule 457(g) under the Securities Act, based on the exercise price of the Vivid Seats PubCo $15.00 Exercise Warrants. |

(7) |

The number of warrants being registered includes (i) 6,519,791 Vivid Seats Private Placement IPO Warrants to acquire shares of Class A common stock, (ii) 5,166,666 Vivid Seats Public IPO Warrants to acquire shares of Class A common stock, (iii) 17,000,000 Vivid Seats PubCo $10.00 Exercise Warrants to acquire shares of Class A common stock and (iv) 17,000,000 Vivid Seats PubCo $15.00 Exercise Warrants to acquire shares of Class A common stock, all held by the Sponsor. |

(8) |

In accordance with Rule 457(g) under the Securities Act, the entire registration fee for the warrants is allocated to the shares of Class A common stock underlying the warrants, and no separate fee is payable for the warrants. |

(9) |

A filing fee of $295,689.93 has already been paid. |

| Page | ||||

| vi | ||||

| 1 | ||||

| 5 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 47 | ||||

| 74 | ||||

| 87 | ||||

| 94 | ||||

| 112 | ||||

| 122 | ||||

| 124 | ||||

| 127 | ||||

| 129 | ||||

| 135 | ||||

| 138 | ||||

| 138 | ||||

| 138 | ||||

F-1 |

||||

| • | “2021 Plan” are to the Vivid Seats Inc. 2021 Incentive Award Plan; |

| • | “Amended and Restated Bylaws” are to the amended and restated bylaws of Vivid Seats PubCo; |

| • | “Amended and Restated Charter” are to the amended and restated certificate of incorporation of Vivid Seats PubCo; |

| • | “Amended and Restated Warrant Agreement” are to that certain Warrant Agreement, dated as of October 14, 2021, between Continental Stock Transfer & Trust Company and Horizon, which amended and restated the Prior Warrant Agreement; |

| • | “Blocker Corporations” are to the Blocker Corporations as defined in the Tax Receivable Agreement; |

| • | “Blocker Sellers” are to Crescent Mezzanine Partners VIB, L.P., Crescent Mezzanine Partners VIC, L.P., NPS/Crescent Strategic Partnership II, LP and Crescent Mezzanine Partners VIIB, L.P.; |

| • | “Business Combination” are to the transactions contemplated by the Transaction Agreement; |

| • | “Class A common stock” are to Vivid Seats PubCo’s Class A common stock, par value $0.0001 per share; |

| • | “Class B common stock” are to Vivid Seats PubCo’s Class B common stock, par value $0.0001; |

| • | “Closing” are to the consummation of the Business Combination; |

| • | “Closing Date” are to October 18, 2021; |

| • | “Code” are to the U.S. Internal Revenue Code of 1986, as amended; |

| • | “DGCL” are to the General Corporation Law of the State of Delaware; |

| • | “Effective Time” are to the time at which the Merger becomes effective pursuant to the Transaction Agreement; |

| • | “ESPP” are to the Vivid Seats Inc. 2021 Employee Stock Purchase Plan; |

| • | “Exchange” are to the irrevocable tender by Sponsor to Horizon all of its Horizon Class B ordinary shares for cancellation in exchange for (i) the Horizon $10.00 Exercise Warrants, (ii) the Horizon $15.00 Exercise Warrants and (iii) 50,000 shares of Horizon Class A ordinary shares pursuant to the Exchange Agreement; |

| • | “Exchange Agreement” are to that certain exchange Agreement, dated as of April 21, 2021, by and between Sponsor and Horizon; |

| • | “Form of New Warrant Agreement” are to that certain form of warrant agreement entered into by and between Horizon and Continental Stock Transfer & Trust Company pursuant to which the Vivid Seats PubCo $10.00 Exercise Warrants and Vivid Seats PubCo $15.00 Exercise Warrants were issued; |

| • | “founder shares” are to Horizon Class B ordinary shares initially purchased by Sponsor in a private placement prior to the IPO, and the Horizon Class A ordinary shares issued upon the conversion thereof; |

| • | “Horizon $10.00 Exercise Warrants” are to warrants for Horizon Class A ordinary shares with an exercise price of $10.00, issued in connection with the Exchange; |

| • | “Horizon $15.00 Exercise Warrants” are to warrants for Horizon Class A ordinary shares with an exercise price of $15.00, issued in connection with the Exchange; |

| • | “Horizon Class A ordinary shares” are to Horizon’s Class A ordinary shares, par value $0.0001 per share; |

| • | “Horizon Class B ordinary shares” are to Horizon’s Class B ordinary shares, par value $0.0001 per share; |

| • | “Horizon Equityholders” are to Sponsor and any investment vehicles or funds managed or controlled, directly or indirectly, by any of Sponsor’s affiliates; |

| • | “Horizon IPO Private Placement Warrants” are to the warrants sold by Horizon as part of the private placement in connection with the IPO; |

| • | “Horizon IPO Public Warrants” are to the warrants sold by Horizon as part of the units in the IPO; |

| • | “Horizon Warrants” are to the Horizon IPO Public Warrants, Horizon IPO Private Placement Warrants, the Horizon $10.00 Exercise Warrants and the Horizon $15.00 Exercise Warrants; |

| • | “Hoya Intermediate Warrants” are warrants issued by Hoya Intermediate to Vivid Seats PubCo and Hoya Topco; |

| • | “Intermediate Common Units” means Common Units of Hoya Intermediate; |

| • | “IPO” are to Horizon’s initial public offering of units, the base offering of which closed on August 25, 2020; |

| • | “IRS” are to the U.S. Internal Revenue Service; |

| • | “Lock-up Period” are to the period beginning on the Closing Date and ending on the date that is twelve (12) months following the Closing Date; |

| • | “lock-up shares” are to (a) with respect to Sponsor, the shares of Vivid Seats PubCo common stock and warrants exercisable for shares of Vivid Seats PubCo common stock held by Sponsor and its affiliates (other than any such shares acquired in connection with the PIPE Subscription) and (b) with respect to Hoya Topco, any Vivid Seats PubCo common stock and any warrants exercisable for shares of Vivid Seats PubCo common stock held by Hoya Topco and its affiliates; |

| • | “Marketplace GOV” are to the total transactional amount of Marketplace segment orders placed on the Vivid Seats platform in a period, inclusive of fees, exclusive of taxes, and net of event cancellations that occurred during that period; |

| • | “Merger” are to the merging of Horizon with and into Vivid Seats PubCo, upon which the separate corporate existence of Horizon ceased and Vivid Seats PubCo became the surviving entity; |

| • | “Nasdaq” are to The Nasdaq Global Select Market; |

| • | “PIPE Investors” are to the qualified institutional buyers and accredited investors, including Sponsor or its affiliates, that purchased shares of our Class A common stock in the PIPE Subscription; |

| • | “PIPE Subscription” are to the issuance and sale of shares of our Class A common stock to the PIPE Investors in a private placement that closed concurrently with the Closing; |

| • | “Prior Warrant Agreement” are to that certain Warrant Agreement, dated as of August 20, 2020, between Continental Stock Transfer & Trust Company and Horizon; |

| • | “Private Equity Owner” are to, collectively, GTCR Fund XI/B LP, GTCR Fund XI/C LP, GTCR Co-Invest XI LP, GTCR Golder Rauner, L.L.C., GTCR Golder Rauner II, L.L.C., GTCR Management XI LLC and GTCR LLC; |

| • | “public shareholders” are to the holders of Horizon’s public shares prior to the Closing; |

| • | “public shares” are to Horizon Class A ordinary shares sold as part of the units in the IPO (whether they were purchased in the IPO or thereafter in the open market); |

| • | “Registration Rights Agreement” are to that certain Amended and Restated Registration Rights Agreement, dated as of October 18, 2021, by and among Vivid Seats PubCo, Sponsor, Hoya Topco and the other holders party thereto; |

| • | “Reorganization Transaction” are to a Reorganization Transaction as defined in the Tax Receivable Agreement; |

| • | “special dividend” are to the special dividend, in an amount of $0.23 per share as described herein, paid by Vivid Seats on November 2, 2021 to holders of shares of our Class A common stock as of the record date for such special dividend, which holders included, among others, |

| • | “Sponsor” are to Horizon Sponsor, LLC, a Delaware limited liability company; |

| • | “Sponsor Agreement” are to that certain Sponsor Agreement, dated as of April 21, 2021, by and among Eldridge Industries, LLC, Sponsor, Horizon and Hoya Topco; |

| • | “Stockholders’ Agreement” are to that certain Stockholders’ Agreement, dated as of October 18, 2021, by and among Vivid Seats PubCo, Sponsor and Hoya Topco; |

| • | “Tax Receivable Agreement” are to that certain Tax Receivable Agreement, dated as of October 18, 2021, by and among Vivid Seats PubCo, Hoya Intermediate, the TRA Holder Representative, Hoya Topco and the other TRA Holders; |

| • | “Topco Equityholders” are to (a) Hoya Topco or (b) after the distribution (in the aggregate pursuant to one or more distributions) by Hoya Topco of more than 50% of the voting shares of Vivid Seats PubCo held by Hoya Topco on the Closing Date, (i) GTCR Fund XI/B LP, GTCR Fund XI/C LP, GTCR Co-Invest XI LP, GTCR Golder Rauner, L.L.C., GTCR Golder Rauner II, L.L.C., GTCR Management XI LLC and/or GTCR LLC and (ii) any investment vehicles or funds managed or controlled, directly or indirectly, by or otherwise affiliated with the foregoing entities; |

| • | “Total Marketplace orders” are to the volume of Marketplace segment orders placed on the Vivid Seats platform during a period, net of event cancellations occurring during the period; |

| • | “Total Resale orders” are to the volume of Resale segment orders sold by the Vivid Seats’ resale team in a period, net of event cancellations that occurred during that period; |

| • | “TRA Holder Representative” are to GTCR Management XI, LLC; |

| • | “TRA Holders” are to the TRA Holders as defined in the Tax Receivable Agreement; |

| • | “Transactions” means the PIPE Subscription and the Business Combination; |

| • | “Transaction Agreement” are to the Transaction Agreement, dated as of April 21, 2021, by and among Horizon, Sponsor, Hoya Topco, Hoya Intermediate and Vivid Seats PubCo; |

| • | “Trust Account” are to the trust account for the benefit of Horizon, certain of its public shareholders and the underwriter of the IPO; |

| • | “Vivid Seats” are to, prior to the consummation of the Business Combination, Hoya Intermediate and its consolidated subsidiaries and, following the consummation of the Business Combination, to Vivid Seats PubCo and its consolidated subsidiaries; |

| • | “Vivid Seats PubCo” are to Vivid Seats Inc., a Delaware corporation; |

| • | “Vivid Seats PubCo $10.00 Exercise Warrants” are to warrants for our Class A common stock with an exercise price of $10.00, issued in exchange for the Horizon $10.00 Exercise Warrants, with terms consistent with the Form of New Warrant Agreement; |

| • | “Vivid Seats PubCo $15.00 Exercise Warrants” are to warrants for our Class A common stock with an exercise price of $10.00, issued in exchange for the Horizon $15.00 Exercise Warrants, with terms consistent with the Form of New Warrant Agreement; |

| • | “Vivid Seats PubCo Class B Warrants” are to warrants for our Class B common stock exercisable upon the exercise of Hoya Intermediate Warrants held by Hoya Topco; |

| • | “Vivid Seats PubCo common stock” are to our Class A common stock and our Class B common stock, collectively; |

| • | “Vivid Seats PubCo Warrants” are to the warrants for our Class A common stock and our Class B common stock; |

| • | “Vivid Seats Private Placement IPO Warrants” are to warrants for our Class A common stock, with terms identical to the Horizon IPO Private Placement Warrants; and |

| • | “Vivid Seats Public IPO Warrants” are to warrants for our Class A common stock, with terms identical to Horizon IPO Public Warrants. |

| • | the COVID-19 pandemic, its duration, its impact on our business, results of operations, financial condition, liquidity, use of our borrowings, business practices, operations, suppliers, third-party service providers, customers, employees, industry, ability to meet future performance obligations, ability to efficiently implement advisable safety precautions; |

| • | our ability to raise financing in the future; |

| • | our future financial performance; |

| • | our success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| • | our ability to pay dividends on our Class A common stock on the terms currently contemplated or at all; and |

| • | factors relating to our business, operations and financial performance, including, but not limited to: |

| • | the impact of the COVID-19 pandemic on our business and the industries in which we operate; |

| • | our ability to compete in the ticketing industry; |

| • | our ability to maintain relationships with buyers, sellers and distribution partners; |

| • | our ability to continue to improve our platform and maintain and enhance our brand; |

| • | the impact of extraordinary events or adverse economic conditions on discretionary consumer and corporate spending or on the supply and demand of live events; |

| • | our ability to comply with domestic regulatory regimes; |

| • | our ability to successfully defend against litigation; |

| • | our ability to maintain the integrity of our information systems and infrastructure, and to mitigate possible cyber security risks; |

| • | our ability to generate sufficient cash flows or raise additional capital necessary to fund our operations; and |

| • | The COVID-19 pandemic has had, and is likely to continue to have, a material negative impact on our business and operating results. |

| • | Our business is dependent on the continued occurrence of large-scale sporting events, concerts and theater shows and on relationships with buyers, sellers and distribution partners and any change in such occurrence or relationships could adversely affect our business. |

| • | Changes in Internet search engine algorithms or changes in marketplace rules could have a negative impact on traffic for our sites and ultimately, our business and results of operations. |

| • | We face intense competition in the ticketing industry. |

| • | Our business is dependent on the willingness of artists, teams and promoters to continue to support the secondary ticket market and any decrease in such support may result in decreased demand for our services. |

| • | If we do not continue to maintain and improve our platform and brand or develop successful new solutions and enhancements or improve existing ones, our business will suffer. |

| • | We may be adversely affected by the occurrence of extraordinary events or factors affecting concert, sporting and theater events. |

| • | We may be unsuccessful in potential future acquisition endeavors. |

| • | Due to our business’ seasonality, our financial performance in particular financial periods may not be indicative of, or comparable to, our financial performance in subsequent financial periods. |

| • | The failure to retain, motivate or integrate any of our senior management team or other skilled personnel could have an adverse effect on our business, financial condition or results of operations. |

| • | The processing, storage, use and disclosure of personal data could give rise to liabilities as a result of governmental regulation, conflicting legal requirements or applications of privacy regulations. |

| • | Unfavorable legislative outcomes, or outcomes in legal proceedings in which we may be involved, may adversely affect our business and operating results. |

| • | System interruption and the lack of integration and redundancy in our systems and infrastructure may have an adverse impact on our business, financial condition and results of operations. |

| • | Cyber security risks, data loss or other breaches of our network security could materially harm our business and results of operations. |

| • | We may fail to adequately protect or enforce our intellectual property rights or face potential liability and expense for legal claims alleging that the operation of our business infringes intellectual property rights of third parties. |

| • | Our payments system depends on third-party providers. |

| • | The agreements governing our indebtedness impose restrictions on us that limit the discretion of management in operating our business. |

| • | We depend on the cash flows of our subsidiaries in order to satisfy our obligations, and we may not be able to generate sufficient cash flows or raise the additional capital necessary to fund our liquidity needs. |

| • | Our Private Equity Owner controls us, and its interest may conflict with ours or yours in the future. |

| • | We are a “controlled company” within the meaning of Nasdaq listing standards. |

| • | Our only material asset is our direct and indirect interests in Hoya Intermediate. |

| • | The Tax Receivable Agreement requires us to make cash payments to Hoya Topco. |

| • | Our ability to pay dividends may be limited by our holding company structure and Delaware law. |

| • | the impact of any lingering economic downturn or recession resulting from the pandemic, including without limitation any reduction in discretionary spending or confidence for both buyers and sellers, that would result in a decline in ticket sales and attendance; |

| • | a reduction in the profitability of our operations |

| • | sub-national borders are closed to travel, which could reduce the demand for our services; |

| • | |

| • | loss of ticketing sales due to the economic impacts of the pandemic whereby certain venue operators are no longer in operation, reducing the number of events our marketplace can serve; |

| • | the inability to pursue expansion opportunities or acquisitions due to capital constraints; |

| • | the future availability or increased cost of insurance coverage; and |

| • | the incurrence of additional expenses related to compliance, precautions and management |

| • | competitors’ offerings that may include more favorable terms or pricing; |

| • | technological changes and innovations that we are unable to adopt or are late in adopting that offer more attractive alternatives than we currently offer, which may lead to a loss of ticket sales or lower ticket fees; |

| • | other entertainment options or ticket inventory selection and variety that we do not offer; and |

| • | increased pricing in the primary ticket marketplace, which could result in reduced profits for secondary ticket sellers and reduced demand for our services. |

| • | using a significant portion of our available cash; |

| • | issuing equity securities, which would dilute current stockholders’ percentage ownership; |

| • | incurring substantial debt; |

| • | incurring or assuming contingent liabilities, known or unknown; |

| • | incurring amortization expenses related to intangibles; and |

| • | incurring large accounting write-offs or impairments. |

| • | integrating the operations, financial reporting, technologies and personnel of acquired companies; |

| • | scaling of operations, system and infrastructure and achieving synergies to meet the needs of the combines or acquired company; |

| • | managing geographically dispersed operations; |

| • | the diversion of management’s attention from other business concerns; |

| • | the inherent risks in entering markets or lines of business in which we have either limited or no direct experience; |

| • | the potential loss of key employees, customers and strategic partners of acquired companies; and |

| • | the impact of laws and regulations at the state, federal and international levels when entering new markets or business, which could significantly affect our ability to complete acquisitions and expand our business. |

| • | incur additional debt; |

| • | pay dividends and make distributions; |

| • | make certain investments; |

| • | |

| • | create liens; |

| • | enter into transactions with affiliates; |

| • | modify the nature of our business; |

| • | transfer and sell assets, including material intellectual property; |

| • | enter into agreements prohibiting our ability to grant liens in favor of our senior secured creditors; |

| • | amend or modify the terms of any junior financing arrangements; |

| • | amend our organizational documents; and |

| • | merge or consolidate. |

| • | making it more difficult for us to satisfy our obligations; |

| • | increasing our vulnerability to adverse economic, regulatory and industry conditions; |

| • | limiting our ability to obtain additional financing for future working capital, capital expenditures, acquisitions and other purposes; |

| • | requiring us to dedicate a substantial portion of our cash flow from operations to fund payments on our debt, thereby reducing funds available for operations and other purposes; |

| • | limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| • | making us more vulnerable to increases in interest rates; and |

| • | placing us at a competitive disadvantage compared to our competitors that have less debt. |

| • | general economic and capital market conditions, including as a result of the COVID-19 pandemic; |

| • | the availability of credit from banks or other lenders; |

| • | investor confidence in us; and |

| • | our results of operations. |

| • | develop and enhance our platform and solutions; |

| • | continue to invest in our technology development and marketing organizations; |

| • | hire, train and retain employees; |

| • | respond to competitive pressures or unanticipated working capital requirements; or |

| • | pursue acquisition opportunities. |

| • | existing tax basis in certain assets of Hoya Intermediate and certain of its direct or indirect subsidiaries, including assets that will eventually be subject to depreciation or amortization, once placed in service; |

| • | tax basis adjustments resulting from taxable exchanges of Intermediate Common Units (including any such adjustments resulting from certain payments made by us under the Tax Receivable Agreement) acquired by us from a TRA Holder pursuant to the terms of the Second Amended and Restated Limited Liability Company Agreement of Hoya Intermediate (the “Second A&R LLCA”); |

| • | certain tax attributes of Blocker Corporations holding Intermediate Common Units that are acquired directly or indirectly by us pursuant to a Reorganization Transaction; |

| • | certain tax benefits realized by us as a result of certain U.S. federal income tax allocations of taxable income or gain away from us to other members of Hoya Intermediate and deductions or losses to us and away from other members of Hoya Intermediate, in each case, as a result of the Business Combination; and |

| • | tax deductions in respect of portions of certain payments made under the Tax Receivable Agreement. |

| • | it is an “orthodox” investment company because it is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities; or |

| • | it is an inadvertent investment company because, absent an applicable exemption, it owns or proposes to acquire investment securities having a value exceeding 40% of the value of its total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis. |

| • | the realization of any of the risk factors presented in this prospectus; |

| • | difficult global market and economic conditions; |

| • | loss of investor confidence in the global financial markets and investing in general; |

| • | adverse market reaction to indebtedness we may incur, securities we may grant under our 2021 Plan or otherwise, or any other securities we may issue in the future, including shares of our Class A common stock; |

| • | unanticipated variations in our quarterly operating results or dividends; |

| • | failure to meet securities analysts’ earnings estimates; |

| • | publication of negative or inaccurate research reports about us or the live events or ticketing industry or the failure of securities analysts to provide adequate coverage of our Class A common stock in the future; |

| • | changes in market valuations of similar companies; |

| • | speculation in the press or investment community about our business; |

| • | additional or unexpected changes or proposed changes in laws or regulations or differing interpretations thereof affecting our business or enforcement of these laws and regulations, or announcements relating to these matters; and |

| • | increases in compliance or enforcement inquiries and investigations by regulatory authorities. |

| • | not being required to have our independent registered public accounting firm audit our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act; |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation or golden parachute payments not previously approved. |

| • | Our status as an emerging growth company will end as soon as any of the following takes occurs: |

| • | the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; |

| • | the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; |

| • | the date on which we have issued, in any three-year period, more than $1.0 billion in non-convertible debt securities; or |

| • | December 31, 2026 |

| • | the sole ability of directors to fill a vacancy on the board of directors; |

| • | advance notice requirements for stockholder proposals and director nominations; |

| • | after we no longer qualify as a “controlled company” under applicable Nasdaq listing rules, provisions limiting stockholders’ ability (i) to call special meetings of stockholders, (ii) to require extraordinary general meetings of stockholders to be called and (iii) to take action by written consent; |

| • | the ability of the board of directors to designate the terms of and issue new series of preferred stock without stockholder approval, which could be used, among other things, to institute a rights plan that would have the effect of significantly diluting the stock ownership of a potential hostile acquirer, likely preventing acquisitions that have not been approved by our governing body; |

| • | the division of the board of directors into three classes, with each class serving staggered three year terms; and |

| • | the lack of cumulative voting for the election of directors. |

| • | general economic and business conditions; |

| • | our strategic plans and prospects; |

| • | our business and investment opportunities; |

| • | our financial condition and operating results, including our cash position, net income and realizations on investments made by its investment funds; |

| • | working capital requirements and anticipated cash needs; |

| • | contractual restrictions and obligations, including payment obligations pursuant to the Tax Receivable Agreement and restrictions pursuant to any credit facility; and |

| • | legal, tax and regulatory restrictions. |

| • | Payment of $13.6 million in deferred underwriting commissions associated with Horizon’s initial public offering; |

| • | The Crescent Redemption; |

| • | Reduction of long-term debt of Hoya Intermediate and its subsidiaries; and |

| • | Payment of all advisory fees, transaction fees and expenses of Horizon and Hoya Topco. |

Pro Forma Combined |

||||||||

Number of |

% |

|||||||

Shares |

Ownership |

|||||||

| Hoya Topco |

118,200,000 | 60.6 | % | |||||

| Horizon Public shareholders |

13,881,260 | 7.1 | % | |||||

| Shares held by Horizon Sponsor and other holders of founder shares (1) |

59,557,173 | 30.5 | % | |||||

| PIPE Investors (2) |

3,510,000 | 1.8 | % | |||||

| |

|

|

|

|||||

| Total |

195,148,433 | 100 | % | |||||

| |

|

|

|

|||||

(1) |

Includes shares acquired by Horizon Sponsor, or its affiliates, as part of the PIPE Subscription. Horizon Sponsor, or its affiliates, acquired 44,017,173 shares under the PIPE Subscription. |

(2) |

Excludes shares acquired by Horizon Sponsor, or its affiliates, as part of the PIPE Subscription. |

| • | Horizon IPO Public Warrants and Horizon IPO Private Placement Warrants exchanged for Vivid Seats Public IPO Warrants and Vivid Seats Private Placement IPO Warrants, respectively – |

| • | Horizon $10.00 Exercise Warrants and Horizon $15.00 Exercise Warrants (collectively, the “Exercise Warrants”) exchanged for Vivid Seats PubCo $10.00 Exercise Warrants and Vivid Seats PubCo $15.00 Exercise Warrants, respectively – |

| • | Hoya Intermediate Warrants issued to Vivid Seats PubCo – |

| • | Hoya Intermediate Warrants issued to Hoya Topco - |

| • | Vivid Seats PubCo Class B Warrants issued to Hoya Topco - |

| • | existing tax basis in certain assets of Hoya Intermediate and certain of its direct or indirect subsidiaries, including assets that will eventually be subject to depreciation or amortization, once placed in service; |

| • | tax basis adjustments resulting from taxable exchanges of Intermediate Common Units (including any such adjustments resulting from certain payments made by Vivid Seats PubCo under the Tax Receivable Agreement) acquired by Vivid Seats PubCo from a TRA Holder pursuant to the terms of the Second Amended and Restated Limited Liability Company Agreement of Hoya Intermediate (“Second A&R LLCA”); |

| • | certain tax attributes of blocker corporations holding Intermediate Common Units that are acquired directly or indirectly by Vivid Seats PubCo pursuant to a reorganization transaction; |

| • | certain tax benefits realized by Vivid Seats PubCo as a result of certain U.S. federal income tax allocations of taxable income or gain away from Vivid Seats PubCo and to other members of Hoya Intermediate and deductions or losses to Vivid Seats PubCo and away from other members of Hoya Intermediate, in each case as a result of the Business Combination; and |

| • | tax deductions in respect of portions of certain payments made under the Tax Receivable Agreement. |

Hoya Intermediate, LLC (Historical) |

Horizon Acquisition Corp. (Historical) |

Transaction Accounting Adjustments |

PIPE Subscription Adjustments |

Pro Forma Balance Sheet |

||||||||||||||||

| Current assets: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 488,467 | $ | 18,015 | $ | (234,489 | )(c) | $ | 475,172 | (e) | $ | 486,975 | ||||||||

| 293,836 | (f) | |||||||||||||||||||

| (13,614 | )(g) | |||||||||||||||||||

| (40,307 | )(h) | |||||||||||||||||||

| (482,407 | )(i) | |||||||||||||||||||

| (17,698 | )(l) | |||||||||||||||||||

| Accounts receivable - net |

54,034 | 54,034 | ||||||||||||||||||

| Inventory - net |

17,122 | 17,122 | ||||||||||||||||||

| Prepaid expenses and other current assets |

96,760 | 218 | (5,148 | )(h) | 91,830 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current assets |

656,383 |

18,233 |

(499,827 |

) |

475,172 |

649,961 |

||||||||||||||

| Property and equipment - net |

664 | 664 | ||||||||||||||||||

| Intangible assets - net |

72,102 | 72,102 | ||||||||||||||||||

| Goodwill |

683,327 | 683,327 | ||||||||||||||||||

| Investments held in Trust Account |

544,027 | (250,191 | )(a) | — | ||||||||||||||||

| (293,836 | )(f) | |||||||||||||||||||

| Deferred tax assets |

— | (j) | — | |||||||||||||||||

| Other non-current assets |

579 | 579 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

1,413,055 |

562,260 |

(1,043,854 |

) |

475,172 |

1,406,633 |

||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Current liabilities: |

||||||||||||||||||||

| Accounts payable |

206,250 | 132 | (9,803 | )(h) | 196,579 | |||||||||||||||

| Accrued expenses and other current liabilities |

340,127 | 2,976 | (174 | )(i) | 342,929 | |||||||||||||||

| Deferred revenue |

20,523 | 20,523 | ||||||||||||||||||

| Current maturities of long-term debt - net |

6,412 | (1,567 | )(i) | 4,845 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current liabilities |

573,312 |

3,108 |

(11,544 |

) |

— |

564,876 |

||||||||||||||

| Long-term debt - net |

897,855 | (444,661 | )(i) | 453,194 | ||||||||||||||||

| Other liabilities |

602 | 602 | ||||||||||||||||||

| Deferred underwriting commissions |

13,614 | (13,614 | )(g) | — | ||||||||||||||||

| Derivative warrant liabilities |

41,909 | (41,909 | )(a) | 35,220 | ||||||||||||||||

| 35,220 | (d) | |||||||||||||||||||

| Tax receivable agreement liability |

— | (k) | — | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total long-term liabilities |

898,457 |

55,523 |

(464,964 |

) |

— |

489,016 |

||||||||||||||

| Commitments and contingencies |

||||||||||||||||||||

| Redeemable Preferred Units |

||||||||||||||||||||

| Redeemable Senior Preferred Units - $0 par value; 100 units authorized, issued, and outstanding at September 30, 2021 (aggregate involuntary liquidation preference of $234,489 at September 30, 2021) |

234,489 | (234,489 | )(c) | — | ||||||||||||||||

| Redeemable Preferred Units - $0 par value; 100 units authorized, issued, and outstanding at September 30, 2021 |

9,939 | (9,939 | )(b) | — | ||||||||||||||||

| Class A ordinary shares; 54,398,433 shares subject to possible redemption at $10.00 per share |

543,984 | (543,984 | )(a) | — | ||||||||||||||||

| Non-controlling interest |

213,653 | (m) | 213,653 | |||||||||||||||||

| Members’ equity (deficit): |

||||||||||||||||||||

| Common Units - $0 par value; unlimited authorized, 100 units issued and outstanding at June 30, 2021 |

— | |||||||||||||||||||

| Preference shares, $0.0001 par value; 1,000,000 shares authorized; none issued and outstanding |

— | |||||||||||||||||||

| Class A ordinary shares, $0.0001 par value; 400,000,000 shares authorized; none issued and outstanding (excluding shares subject to possible redemption) |

— | — | (a) | — | ||||||||||||||||

| Class B ordinary shares, $0.0001 par value; 40,000,000 shares authorized; 13,599,608 shares issued and outstanding |

1 | (1 | )(a) | — | ||||||||||||||||

| Class A common stock |

3 | (a) | 5 | (e) | 8 | |||||||||||||||

| Class B common stock |

12 | (b) | 12 | |||||||||||||||||

| Preferred stock - None outstanding |

— | — | ||||||||||||||||||

| Additional paid-in capital |

742,986 | — | 295,344 | (a) | 475,167 | (e) | 1,223,922 | |||||||||||||

| 9,927 | (b) | |||||||||||||||||||

| (35,220 | )(d) | |||||||||||||||||||

| (32,931 | )(h) | |||||||||||||||||||

| (17,698 | )(l) | |||||||||||||||||||

| (213,653 | )(m) | |||||||||||||||||||

| Accumulated deficit |

(1,046,128 | ) | (40,356 | ) | 40,356 | (a) | (1,084,854 | ) | ||||||||||||

| (2,721 | )(h) | |||||||||||||||||||

| (36,005 | )(i) | |||||||||||||||||||

| Total members’/stockholders’ equity (deficit) |

(303,142 |

) |

(40,355 |

) |

7,413 |

475,172 |

139,088 |

|||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities, redeemable preferred units, non-controlling interests and members’/stockholders’ equity (deficit) |

$ |

1,413,055 |

$ |

562,260 |

$ |

(1,043,854 |

) |

$ |

475,172 |

$ |

1,406,633 |

|||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

Hoya Intermediate, LLC (Historical) |

Horizon Acquisition Corp. (Historical) |

Transaction Accounting Adjustments |

Pro Forma Statement of Operations |

|||||||||||||

| Revenues |

$ | 279,150 | $ | $ | — | $ | 279,150 | |||||||||

| Cost of revenues (exclusive of depreciation and amortization shown separately below) |

54,386 | — | 54,386 | |||||||||||||

| Marketing and selling |

104,748 | — | 104,748 | |||||||||||||

| General and administrative |

87,486 | 3,211 | (11,430 | )(bb) | 79,267 | |||||||||||

| Depreciation and amortization |

1,506 | — | 1,506 | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Income (loss) from operations |

31,024 |

(3,211 |

) |

11,430 |

39,243 |

|||||||||||

| Other income |

25,000 | (gg) | — | 25,000 | ||||||||||||

| Interest expense - net |

(50,477 | ) | 7 | 34,985 | (dd) | (15,485 | ) | |||||||||

| Net gain from investments held in Trust Account |

— | 24 | (24 | )(aa) | — | |||||||||||

| Change in fair value of warrant liabilities |

(6,163 | ) | 7,393 | (cc) | 1,230 | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net (loss) income before income taxes |

(19,453 |

) |

15,657 |

53,784 |

49,988 |

|||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Income taxes |

— | (7,500 | )(gg) | — | (ee) | (7,500 | ) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net (loss) income |

(19,453 |

) |

8,157 |

53,784 |

42,488 |

|||||||||||

| Less: Net (loss) income attributable to non-controlling interests in subsidiaries |

25,735 | (ff) | 25,735 | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net (loss) income attributable to Vivid Seats PubCo |

$ |

(19,453 |

) |

$ |

8,157 |

$ |

28,049 |

$ |

16,753 |

|||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss per unit attributable to Common Unit holders, basic and diluted |

$ | (356,540 | ) | |||||||||||||

| Weighted average Common Units outstanding, basic and diluted |

100 | |||||||||||||||

| Basic and diluted weighted average shares outstanding of Class A ordinary shares |

54,398,433 | 76,948,433 | (hh) | |||||||||||||

| Basic and diluted net income per share, Class A ordinary shares |

$ | 0.32 | $ | 0.22 | (hh) | |||||||||||

| Basic and diluted weighted average shares outstanding of Class B ordinary shares |

13,599,608 | |||||||||||||||

| Basic and diluted net loss per share, Class B ordinary shares |

$ | (0.69 | ) | |||||||||||||

Hoya Intermediate, LLC (Historical) |

Horizon Acquisition Corp. (Historical) |

Transaction Accounting Adjustments |

Pro Forma Statement of Operations |

|||||||||||||

| Revenues |

$ | 35,077 | $ | $ | — | $ | 35,077 | |||||||||

| Cost of revenues (exclusive of depreciation and amortization shown separately below) |

24,690 | — | 24,690 | |||||||||||||

| Marketing and selling |

38,121 | — | 38,121 | |||||||||||||

| General and administrative |

66,199 | 538 | 14,150 | (bb) | 80,887 | |||||||||||

| Depreciation and amortization |

48,247 | — | 48,247 | |||||||||||||

| Impairment charges |

573,838 | — | 573,838 | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(716,018 |

) |

(538 |

) |

(14,150 |

) |

(730,706 |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Other income (expense) |

||||||||||||||||

| Interest expense - |

(57,482 | ) | 36,608 | (dd) | (20,874 | ) | ||||||||||

| Loss on extinguishment of debt |

(685 | ) | (57,630 | )(dd) | (58,315 | ) | ||||||||||

| Net gain from investments held in Trust Account |

— | 18 | (18 | )(aa) | — | |||||||||||

| Financing cost - derivative warrant liabilities |

(579 | ) | (579 | ) | ||||||||||||

| Change in fair value of warrant liabilities |

(16,517 | ) | 15,497 | (cc) | (1,020 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Loss before income taxes |

(774,185 |

) |

(17,616 |

) |

(19,693 |

) |

(811,494 |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Income taxes |

— | (ee) | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss |

(774,185 |

) |

(17,616 |

) |

(19,693 |

) |

(811,494 |

) | ||||||||

| Less: Net loss attributable to non-controlling interests in subsidiaries |

(491,516 | )(ff) | (491,516 | ) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to Vivid Seats PubCo |

$ |

(774,185 |

) |

$ |

(17,616 |

) |

$ |

471,823 |

$ |

(319,978 |

) | |||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss per unit attributable to Common Unit holders, basic and diluted |

(7,953,192 | ) | ||||||||||||||

| Weighted average Common Units outstanding, basic and diluted |

$ | 100 | ||||||||||||||

| Basic and diluted weighted average shares outstanding of Class A ordinary shares |

54,364,337 | 76,948,433 | (hh) | |||||||||||||

| Basic and diluted net income per share, Class A ordinary shares |

$ | — | $ | (4.16 | )(hh) | |||||||||||

| Basic and diluted weighted average shares outstanding of Class B ordinary shares |

13,269,125 | |||||||||||||||

| Basic and diluted net loss per share, Class B ordinary shares |

$ | (1.33 | ) | |||||||||||||

| • | Following the Transactions, the business affairs of Hoya Intermediate are controlled by a board of managers. The Hoya Intermediate board of managers consist of two individuals, one of which is designated by Vivid Seats PubCo and one of which is designated by Hoya Topco. For each matter presented to the board of managers of Hoya Intermediate, the Vivid Seats PubCo designee will be entitled to two (2) votes and the Hoya Topco designee will be entitled to one (1) vote. Accordingly, Hoya Topco’s ability to influence the operations of Hoya Intermediate following the Closing will be by virtue of its ownership of Vivid Seats PubCo common stock; |

| • | The pre-combination controlling equityholder of Hoya Intermediate holds the majority of voting rights in Vivid Seats PubCo; |

| • | The pre-combination controlling equityholder of Hoya Intermediate holds the right to appoint the majority of the directors on the board of directors of Vivid Seats PubCo; |

| • | Operations of Hoya Intermediate comprise the ongoing operations of Vivid Seats PubCo going forward; and |

| • | Hoya Intermediate is significantly larger than Horizon in terms of revenue, total assets (excluding cash) and employees. |

| Nine months ended September 30, 2021 |

||||

| Pro forma net income |

$ | 42,488 | ||

| |

|

|||

| Noncontrolling interest percentage |

60.6 | % | ||

| Noncontrolling interest pro forma adjustment |

25,735 | |||

| |

|

|||

| Net income attributable to Vivid Seats PubCo |

$ | 16,753 | ||

| |

|

|||

| Year ended December 31, 2020 |

||||

| Pro forma net loss |

$ | (811,494 | ) | |

| Noncontrolling interest percentage |

60.6 | % | ||

| Noncontrolling interest pro forma adjustment |

(491,516 | ) | ||

| |

|

|||

| Net loss attributable to Vivid Seats PubCo |

$ | (319,978 | ) | |

| |

|

| Shares held by Horizon Public shareholders |

13,881,260 | |||

| Shares held by Sponsor and other holders of founder shares |

15,550,000 | |||

| PIPE Investors |

47,517,173 | |||

| |

|

|||

| Pro forma Class A Ordinary Shares outstanding (1) |

76,948,433 | |||

| |

|

|||

| Nine months ended September 30, 2021 |

||||

| Pro forma net income attributable to Vivid Seats PubCo |

16,753 | |||

| Weighted average Common Stock outstanding, basic and diluted |

76,948,433 | |||

| |

|

|||

| Net income per share of Common Stock, basic and diluted |

$ | 0.22 | ||

| |

|

|||

| Year ended December 31, 2020 |

||||

| Pro forma net loss attributable to Vivid Seats PubCo |

(319,978 | ) | ||

| Weighted average Common Stock outstanding, basic and diluted |

76,948,433 | |||

| |

|

|||

| Net loss per share of Common Stock, basic and diluted |

$ | (4.16 | ) | |

| |

|

(1) |

Excludes Class B common stock as these shares do not participate in earnings |

Years Ended December 31, |

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

2019 |

2020 |

2020 |

2021 |

2020 |

2021 |

|||||||||||||||||||

| Marketplace GOV (1) |

$ | 2,279,773 | $ | 347,259 | $ | (30,778 | ) | $ | 713,062 | $ | 309,308 | $ | 1,522,625 | |||||||||||

| Total Marketplace orders (2) |

7,185 | 1,066 | (72 | ) | 2,354 | 988 | 4,360 | |||||||||||||||||

| Total Resale orders (3) |

303 | 49 | (3 | ) | 73 | 42 | 121 | |||||||||||||||||

| Adjusted EBITDA (4) |

$ | 119,172 | $ | (80,204 | ) | $ | (19,549 | ) | $ | 41,965 | $ | (66,685 | ) | $ | 82,347 | |||||||||

| (1) | Marketplace GOV represents the total transactional amount of Marketplace segment orders placed on our platform in a period, inclusive of fees, exclusive of taxes, and net of event cancellations that occurred during that period. Marketplace GOV was negatively impacted by event cancellations in the amount of $22.2 million during the year ended December 31, 2019 and $216.0 million during the year ended December 31, 2020. Marketplace GOV was negatively impacted by event cancellations in the amount of $52.7 million during the three months ended September 30, 2020 and $37.8 million during the three months ended September 30, 2021. Marketplace GOV was negatively impacted by event cancellations in the amount of $197.1 million during the nine months ended September 30, 2020 and $74.8 million during the nine months ended September 30, 2021. |

| (2) | Total Marketplace orders represents the volume of Marketplace segment orders placed on our platform during a period, net of event cancellations that occurred during that period. During the year ended December 31, 2019, our Marketplace segment experienced 54,961 event cancellations, compared to 549,085 event cancellations during the year ended December 31, 2020. During the three months ended September 30, 2020, our Marketplace segment experienced 117,290 event cancellations, compared to 85,593 event cancellations during the three months ended September 30, 2021. During the nine months ended September 30, 2020, our Marketplace segment experienced 508,994 event cancellations, compared to 185,687 event cancellations during the three months ended September 30, 2021. |

| (3) | Total Resale orders represents the volume of Resale segment orders sold by our Resale team in a period, net of event cancellations that occurred during that period. During the year ended December 31, 2019, our Resale segment experienced 1,517 event cancellations, compared to 20,644 event cancellations during the year ended December 31, 2020. During the three months ended September 30, 2020, our Resale segment experienced 5,965 event cancellations, compared to 2,592 event cancellations during the three months ended September 30, 2021. During the nine months ended September 30, 2020, our Resale segment experienced 19,929 event cancellations, compared to 4,505 event cancellations during the nine months ended September 30, 2021. |

| (4) | Adjusted EBITDA is not a measure defined under GAAP. We believe Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our results of operations, as well as provides a useful measure for period-to-period |

Years Ended December 31, |

Three Months Ended |

Ended September 30 |

||||||||||||||||||||||

2019 |

2020 |

2020 |

2021 |

2020 |

2021 |

|||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||

| Net loss |

$ | (53,848 | ) | $ | (774,185 | ) | $ | (40,216 | ) | $ | (1,847 | ) | $ | (740,828 | ) | $ | (19,453 | ) | ||||||

| Interest expense — net |

41,497 | 57,482 | 18,310 | 17,319 | 41,076 | 50,477 | ||||||||||||||||||

| Depreciation and amortization |

93,078 | 48,247 | 80 | 711 | 48,057 | 1,506 | ||||||||||||||||||

| Sales tax liability (1) |

10,045 | 6,772 | 488 | 21,574 | 4,959 | 34,561 | ||||||||||||||||||

| Transaction costs (2) |

8,857 | 359 | — | 1,428 | 359 | 8,837 | ||||||||||||||||||

| Equity-based compensation(3) |

5,174 | 4,287 | 1,099 | 1,197 | 3,475 | 3,471 | ||||||||||||||||||

| Senior management transition costs (4) |

2,706 | — | — | — | — | — | ||||||||||||||||||

| Loss on extinguishment of debt (5) |

2,414 | 685 | — | — | 685 | — | ||||||||||||||||||

| Litigation, settlements and related costs (6) |

2,256 | 1,347 | 492 | 1,583 | 837 | 2,662 | ||||||||||||||||||

| Change to annual bonus program (7) |

2,810 | — | — | — | — | — | ||||||||||||||||||

| Customer loyalty program stand-up costs(8) |

3,223 | — | — | — | — | — | ||||||||||||||||||

| Impairment charges (9) |

— | 573,838 | — | — | 573,838 | — | ||||||||||||||||||

| Loss on asset disposals (10) |

960 | 169 | — | — | 169 | — | ||||||||||||||||||

| Severance related to COVID-19 (11) |

— | 795 | 198 | — | 688 | 286 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 119,172 | $ | (80,204 | ) | $ | (19,549 | ) | $ | 41,965 | $ | (66,685 | ) | $ | 82,347 | |||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | These expenses relate to sales tax liabilities incurred during the periods presented. We incur sales tax expenses in jurisdictions where we expect to remit sales tax payments. We are in the process of upgrading our IT infrastructure to enable us to collect sales tax from ticket buyers going forward. |

| (2) | Transaction costs incurred during the years ended December 31, 2019 and 2020 and during the three and nine months ended September 30, 2020 and 2021 consist primarily of transaction and transition related fees and expenses incurred in relation to completed and attempted acquisitions. During 2019, Vivid Seats completed the acquisition of Fanxchange, in addition to pursuing an attempted acquisition that was ultimately abandoned. Acquisition-related transaction costs consist of legal, accounting, tax and other professional fees, as well as personnel-related costs, which consist of severance and retention bonuses. Transition costsacquisition-related costs to be representative of normal, recurring, cash operating expenses. |

| (3) | We incur equity-based compensation expenses, which we do |

| (4) | During 2019, we incurred costs associated with the transition to our |

| (5) | Losses incurred in 2019 related to the repayment of our |

| (6) | These expenses relate to external legal costs and settlement costs incurred, which were unrelated to our |

| (7) | We |

| (8) | During August 2019, we stand-up costs related to the commencement of the program. These stand-up costs consist primarily of customer incentives and marketing costs, which are not expected to reoccur. |

| (9) | During 2020, COVID-19 pandemic. The impairment charges resulted in a reduction in the carrying values of indefinite-lived trademark, definite-lived intangible assets, and other long-lived assets. See our audited financial statements included elsewhere in this prospectus for additional information. |

| (10) | During 2019 and 2020, |

| (11) | These charges relate to severance costs resulting from significant reductions in employee headcount during 2020 due to the effects of the COVID-19 pandemic. |

| Three Months Ended |

September 30, |

|||||||||||||||||||||||||||||||

2020 |

2021 |

Change |

% Change |

2020 |

2021 |

Change |

% Change |

|||||||||||||||||||||||||

| Revenues |

$ | (7,082 | ) | $ | 139,538 | $ | 146,620 | 2,070 | % | $ | 33,682 | $ | 279,150 | $ | 245,468 | 729 | % | |||||||||||||||

| Costs and expenses: |

||||||||||||||||||||||||||||||||

| Cost of revenues (exclusive of depreciation and amortization shown separately below) |

379 | 30,475 | 30,096 | 7941 | % | 22,310 | 54,386 | 32,076 | 144 | % | ||||||||||||||||||||||

| Marketing and selling |

1,511 | 50,371 | 48,860 | 3234 | % | 35,092 | 104,748 | 69,656 | 198 | % | ||||||||||||||||||||||

| General and administrative |

12,854 | 42,509 | 29,655 | 231 | % | 53,452 | 87,486 | 34,034 | 64 | % | ||||||||||||||||||||||

| Depreciation and amortization |

80 | 711 | 631 | 789 | % | 48,057 | 1,506 | (46,551 | ) | (97 | )% | |||||||||||||||||||||

| Impairment charges |

— | — | — | — | % | 573,838 | — | (573,838 | ) | (100 | )% | |||||||||||||||||||||

| Income (loss) from operations |

$ |

(21,906 |

) |

$ |

15,472 |

$ |

37,378 |

171 |

% |

$ |

(699,067 |

) |

$ |

31,024 |

$ |

730,091 |

104 |

% | ||||||||||||||

| Other expenses |

||||||||||||||||||||||||||||||||

| Interest expense – net |

18,310 | 17,319 | (991 | ) | (5 | )% | 41,076 | 50,477 | 9,401 | 23 | % | |||||||||||||||||||||

| Loss on extinguishment of debt |

— | — | — | — | % | 685 | — | (685 | ) | (100 | )% | |||||||||||||||||||||

| Net loss |

$ |

(40,216 |

) |

$ |

(1,847 |

) |

$ |

38,369 |

95 |

% |

$ |

(740,828 |

) |

$ |

(19,453 |

) |

$ |

721,375 |

97 |

% | ||||||||||||

| Three Months Ended September 30, |

September 30, |

|||||||||||||||||||||||||||||||

2020 |

2021 |

Change |

% Change |

2020 |

2021 |

Change |

% Change |

|||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||||||||||

| Marketplace |

$ | (5,832 | ) | $ | 120,465 | $ | 126,297 | 2,166 | % | $ | 23,111 | $ | 247,106 | $ | 223,995 | 969 | % | |||||||||||||||

| Resale |

(1,250 | ) | 19,073 | 20,323 | 1,626 | % | 10,571 | 32,044 | 21,473 | 203 | % | |||||||||||||||||||||

| Total revenues |

$ |

(7,082 |

) |

$ |

139,538 |

$ |

146,620 |

2,070 |

% |

$ |

33,682 |

$ |

279,150 |

$ |

245,468 |

729 |

% | |||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||||||||||||

2020 |

2021 |

Change |

% Change |

2020 |

2021 |

Change |

% Change |

|||||||||||||||||||||||||

| Revenues: |

| |||||||||||||||||||||||||||||||

| Concerts |

$ | (3,455 | ) | $ | 55,343 | $ | 58,798 | 1,702 | % | $ | 20,769 | $ | 112,200 | $ | 91,431 | 440 | % | |||||||||||||||

| Sports |

(1,565 | ) | 53,485 | 55,050 | 3,518 | % | (1,636 | ) | 115,628 | 117,264 | 7,168 | % | ||||||||||||||||||||

| Theater |

(828 | ) | 11,131 | 11,959 | 1,444 | % | 3,742 | 18,429 | 14,687 | 392 | % | |||||||||||||||||||||

| Other |

16 | 506 | 490 | 3,063 | % | 236 | 849 | 613 | 260 | % | ||||||||||||||||||||||

| Total Marketplace revenues |

$ |

(5,832 |

) |

$ |

120,465 |

$ |

126,297 |

2,166 |

% |

$ |

23,111 |

$ |

247,106 |

$ |

223,995 |

969 |

% | |||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||||||||||||

2020 |

2021 |

Change |

% Change |

2020 |

2021 |

Change |

% Change |

|||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||||||||||

| Owned Properties |

$ | (2,519 | ) | $ | 96,169 | $ | 98,688 | 3,918 | % | $ | 21,601 | $ | 198,900 | $ | 177,299 | 821 | % | |||||||||||||||

| Private Label |

(3,313 | ) | 24,296 | 27,609 | 833 | % | 1,510 | 48,206 | 46,696 | 3,092 | % | |||||||||||||||||||||

| Total Marketplace revenues |

$ |

(5,832 |

) |

$ |

120,465 |

$ |

126,297 |

2,166 |

% |

$ |

23,111 |

$ |

247,106 |

$ |

223,995 |

969 |

% | |||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||||||||||||

2020 |

2021 |

Change |

% Change |

2020 |

2021 |

Change |

% Change |

|||||||||||||||||||||||||

| Cost of revenues: |

||||||||||||||||||||||||||||||||

| Marketplace |

$ | 949 | $ | 15,694 | $ | 14,745 | 1,554 | % | $ | 12,497 | $ | 32,101 | $ | 19,604 | 157 | % | ||||||||||||||||

| Resale |

(570 | ) | 14,781 | 15,351 | 2,693 | % | 9,813 | 22,285 | 12,472 | 127 | % | |||||||||||||||||||||

| Total cost of revenues |

$ |

379 |

$ |

30,475 |

$ |

30,096 |

7,941 |

% |

$ |

22,310 |

$ |

54,386 |

$ |

32,076 |

144 |

% | ||||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||||||||||||

2020 |

2021 |

Change |

% Change |

2020 |

2021 |

Change |

% Change |

|||||||||||||||||||||||||

| Marketing and selling: |

||||||||||||||||||||||||||||||||

| Online |

$ | 1,144 | $ | 48,711 | $ | 47,567 | 4,158 | % | $ | 31,064 | $ | 101,595 | $ | 70,531 | 227 | % | ||||||||||||||||

| Offline |

367 | 1,660 | 1,293 | 352 | % | 4,028 | 3,153 | (875 | ) | (22 | )% | |||||||||||||||||||||

| Total marketing and selling |

$ |

1,511 |

$ |

50,371 |

$ |

48,860 |

3,234 |

% |

$ |

35,092 |

$ |

104,748 |

$ |

69,656 |

198 |

% | ||||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||||||||||||

2020 |

2021 |

Change |

% Change |

2020 |

2021 |

Change |

% Change |

|||||||||||||||||||||||||

| General and administrative: |

||||||||||||||||||||||||||||||||

| Personnel expenses |

$ | 7,642 | $ | 12,549 | $ | 4,907 | 64 | % | $ | 30,812 | $ | 28,822 | $ | (1,990 | ) | (6 | )% | |||||||||||||||

| Sales tax expense |

523 | 22,075 | 21,552 | 4,121 | % | 5,243 | 35,520 | 30,277 | 577 | % | ||||||||||||||||||||||

| Other |

4,689 | 7,885 | 3,196 | 68 | % | 17,397 | 23,144 | 5,747 | 33 | % | ||||||||||||||||||||||

| Total general and administrative |

$ |

12,854 |

$ |

42,509 |

$ |

29,655 |

231 |

% |

$ |

53,452 |

$ |

87,486 |

$ |

34,034 |

64 |

% | ||||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||||||||||||

2020 |

2021 |

Change |

% Change |

2020 |

2021 |

Change |

% Change |

|||||||||||||||||||||||||

| Other expenses |

||||||||||||||||||||||||||||||||

| Interest expense - net |

$ | 18,310 | $ | 17,319 | $ | (991 | ) | (5 | )% | $ | 41,076 | $ | 50,477 | $ | 9,401 | 23 | % | |||||||||||||||

| Loss on extinguishment of debt |

— | — | — | — | % | 685 | — | (685 | ) | (100 | )% | |||||||||||||||||||||

| Total other expenses |

$ |

18,310 |

$ |

17,319 |

$ |

(991 |

) |

(5 |

)% |

$ |

41,761 |

$ |

50,477 |

$ |

8,716 |

21 |

% | |||||||||||||||

Years Ended December 31, |

||||||||

2019 |

2020 |

|||||||

| Revenues |

$ | 468,925 | $ | 35,077 | ||||

| Costs and expenses: |

||||||||

| Cost of revenues (exclusive of depreciation and amortization shown separately below) |

106,003 | 24,690 | ||||||

| Marketing and selling |

178,446 | 38,121 | ||||||

| General and administrative |

101,335 | 66,199 | ||||||

| Depreciation and amortization |

93,078 | 48,247 | ||||||

| Impairment charges |

— | 573,838 | ||||||

| |

|

|

|

|||||

| Loss from operations |

$ |

(9,937 |

) |

$ |

(716,018 |

) | ||

| |

|

|

|

|||||

| Other expenses |

||||||||

| Interest expense — net |

41,497 | 57,482 | ||||||

| Loss on extinguishment of debt |

2,414 | 685 | ||||||

| |

|

|

|

|||||

| Net loss |

$ |

(53,848 |

) |

$ |

(774,185 |

) | ||

| |

|

|

|

|||||

Years Ended December 31, |

||||||||

2019 |

2020 |

|||||||

| Revenues |

100 | % | 100 | % | ||||

| Costs and expenses: |

||||||||

| Cost of revenues (exclusive of depreciation and amortization shown separately below) |

23 | 70 | ||||||

| Marketing and selling |

38 | 109 | ||||||

| General and administrative |

21 | 189 | ||||||

| Depreciation and amortization |

20 | 138 | ||||||

| Impairment charges |

— | 1,635 | ||||||

| |

|

|

|

|||||

| Loss from operations |

(2 |

) |

(2,041 |

) | ||||

| |

|

|

|

|||||

| Other expenses |

||||||||

| Interest expense — net |

9 | 164 | ||||||

| Loss on extinguishment of debt |

— | 2 | ||||||

| |

|

|

|

|||||

| Net loss |

(11 |

)% |

(2,207 |

)% | ||||

| |

|

|

|

|||||

Years Ended December 31, |

||||||||||||||||

2019 |

2020 |

Change |

% Change |

|||||||||||||

| Revenues: |

||||||||||||||||

| Marketplace |

$ | 403,645 | $ | 23,281 | $ | (380,364 | ) | (94 | )% | |||||||

| Resale |

65,280 | 11,796 | (53,484 | ) | (82 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total revenues |

$ |

468,925 |

$ |

35,077 |

$ |

(433,848 |

) |

(93 |

)% | |||||||

| |

|

|

|

|

|

|

|

|||||||||

Years Ended December 31, |

||||||||||||||||

2019 |

2020 |

Change |

% Change |

|||||||||||||

| Revenues: |

||||||||||||||||

| Concerts |

$ | 187,753 | $ | 15,775 | $ | (171,978 | ) | (92 | )% | |||||||

| Sports |

169,577 | 3,484 | (166,093 | ) | (98 | ) | ||||||||||

| Theater |

44,754 | 3,759 | (40,995 | ) | (92 | ) | ||||||||||

| Other |

1,561 | 263 | (1,298 | ) | (83 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total marketplace revenues |

$ |

403,645 |

$ |

23,281 |

$ |

(380,364 |

) |

(94 |

)% | |||||||

| |

|

|

|

|

|

|

|

|||||||||

Years Ended December 31, |

||||||||||||||||

2019 |

2020 |

Change |

% Change |

|||||||||||||

| Revenues: |

||||||||||||||||

| Owned Properties |

$ | 329,262 | $ | 24,188 | $ | (305,074 | ) | (93 | )% | |||||||

| Private Label |

74,383 | (907 | ) | (75,290 | ) | (101 | ) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total marketplace revenues |

$ |

403,645 |

$ |

23,281 |

$ |

(380,364 |

) |

(94 |

)% | |||||||

| |

|

|

|

|

|

|

|

|||||||||

Years Ended December 31, |

||||||||||||||||

2019 |

2020 |

Change |

% Change |

|||||||||||||

| Cost of revenues: |

||||||||||||||||

| Marketplace |

$ | 52,857 | $ | 13,741 | $ | (39,116 | ) | (74 | )% | |||||||

| Resale |

53,146 | 10,949 | (42,197 | ) | (79 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total cost of revenues |

$ |

106,003 |

$ |

24,690 |

$ |

(81,313 |

) |

(77 |

)% | |||||||

| |

|

|

|

|

|

|

|

|||||||||

Years Ended December 31, |

||||||||||||||||

2019 |

2020 |

Change |

% Change |

|||||||||||||

| Marketing and selling: |

||||||||||||||||

| Online costs |

$ | 166,315 | $ | 34,213 | $ | (132,102 | ) | (79 | )% | |||||||

| Offline costs |

12,131 | 3,908 | (8,223 | ) | (68 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total marketing and selling |

$ |

178,446 |

$ |

38,121 |

$ |

(140,325 |

) |

(79 |

)% | |||||||

| |

|

|

|

|

|

|

|

|||||||||

Years Ended December 31, |

||||||||||||||||

2019 |

2020 |

Change |

% Change |

|||||||||||||

| General and administrative: |

||||||||||||||||

| Personnel expenses |

$ | 60,659 | $ | 37,696 | $ | (22,963 | ) | (38 | )% | |||||||

| Sales tax expense |

10,819 | 7,060 | (3,759 | ) | (35 | ) | ||||||||||

| Other |

29,857 | 21,443 | (8,414 | ) | (28 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total general and administrative |

$ |

101,335 |

$ |

66,199 |

$ |

(35,136 |

) |

(35 |

)% | |||||||

| |

|

|

|

|

|

|

|

|||||||||

Years Ended December 31, |

||||||||||||||||

2019 |

2020 |

Change |

% Change |

|||||||||||||

| Depreciation and amortization |

$ | 93,078 | $ | 48,247 | $ | (44,831 | ) | (48 | )% | |||||||

Years Ended December 31, |

||||||||||||||||

2019 |

2020 |

Change |

% Change |

|||||||||||||

| Other expenses |

||||||||||||||||

| Interest expense — net |

$ | 41,497 | $ | 57,482 | $ | 15,985 | 39 | % | ||||||||

| Loss on extinguishment of debt |

2,414 | 685 | (1,729 | ) | (72 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total other expenses |

$ |

43,911 |

$ |

58,167 |

$ |

14,256 |

32 |

% | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

Years Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

2019 |

2020 |

2020 |

2021 |

|||||||||||||

| Net cash provided by (used in) operating activities |

$ | 76,478 | $ | (33,892 | ) | $ | (30,984 | ) | $ | 215,262 | ||||||

| Net cash used in investing activities |

(40,155 | ) | (7,605 | ) | (6,380 | ) | (7,323 | ) | ||||||||

| Net cash provided by (used in) financing activities |

(55,462 | ) | 245,545 | 247,148 | (4,809 | ) | ||||||||||

| Net increase (decrease) in cash and cash equivalents |

$ |

(19,139 |

) |

$ |

204,048 |

$ |

209,784 |

$ |

203,130 |

|||||||

| |

|

|

|

|

|

|

|

|||||||||

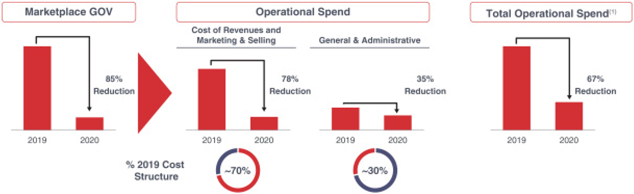

| (1) | Total Operational Spend includes Cost of Revenues, Marketing and Selling and General & Administrative |

| • | Sports: |

| • | Concerts. |

| • | Theater. off-Broadway plays and musicals, family entertainment events, comedy acts and speaker series. |

| • | Content Rights Holders (“CRH”) |

| • | Media Partners well-known media companies to integrate our branding, promotions and links to allow users to access and purchase tickets. Working with media partners allows us to broaden our reach to their users while enhancing the consumer experience. |

| • | Product and Service Partners |

| • | Distribution Partners third-party distribution partners that allows them to own the customer relationships while leveraging our platform, inventory and customer service. |

| • | We are Decisively United. |

| • | We are Proudly Accountable. |

| • | We are Ambitiously Unconventional. |

| • | We are Objective and Experimental. |

| • | We are Fiercely Dedicated. |

| • | We are Community Enhancers. |

| • | Vivid Seats is proud to partner with Chicago’s Lurie Children’s Hospital, one of the country’s top-ranked pediatric institutions, to bring joy to patients and their families. Over the past two years, Vivid Seats employees have recorded bedtime stories, donated wish list gifts and hosted patients and their families at live events. |

| • | In 2020, the live entertainment industry was devastated by the global pandemic, leaving thousands with an uncertain future. Vivid Seats and its customers donated millions of dollars to the Recording Academy’s charity, MusiCares, to support those in the music community and their families. |

| Name |

Age |

Position | ||

| Stanley Chia |

40 | Chief Executive Officer and Director | ||

| Lawrence Fey |

41 | Chief Financial Officer | ||

| Jon Wagner |

49 | Chief Technology Officer | ||

| Riva Bakal |

37 | Senior Vice President, Strategy and Product | ||

| David Morris |

47 | General Counsel | ||

| Todd Boehly |

48 | Director | ||

| Jane DeFlorio |

51 | Director | ||

| Craig Dixon |

46 | Director | ||

| Julie Masino |

51 | Director | ||

| Martin Taylor |

52 | Director | ||

| Mark Anderson |

46 | Director | ||

| David Donnini |

56 | Director | ||

| Tom Ehrhart |

34 | Director |

| • | that a majority of our board of directors consist of directors who qualify as “independent” as defined under Nasdaq rules; |

| • | that we have a nominating and corporate governance committee and, if we have such a committee, that it is composed entirely of independent directors; and |