UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the quarterly period ended

or

For the transition period from to

Commission File Number:

(Exact name of registrant as specified in its charter)

|

||

(State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer |

☐ |

|

Accelerated Filer |

☐ |

☒ |

|

Smaller reporting company |

||

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

Indicate the number of outstanding Shares as of March 31, 2024:

INVESCO GALAXY BITCOIN ETF

QUARTER ENDED MARCH 31, 2024

TABLE OF CONTENTS

|

|

|

|

|

|

Page |

PART I. |

|

|

1 |

|||

|

|

|

|

|

|

|

|

|

ITEM 1. |

|

|

1 |

|

|

|

|

|

|

6 |

|

|

|

ITEM 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

12 |

|

|

ITEM 3. |

|

|

15 |

|

|

|

ITEM 4. |

|

|

15 |

|

|

|

|

|

|

|

|

PART II. |

|

|

15 |

|||

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

15 |

|

|

|

Item 1A. |

|

|

15 |

|

|

|

Item 2. |

|

|

15 |

|

|

|

Item 3. |

|

|

15 |

|

|

|

Item 4. |

|

|

15 |

|

|

|

Item 5. |

|

|

15 |

|

|

|

Item 6. |

|

|

16 |

|

|

|

|

|

|

|

|

|

17 |

|||||

i

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

Invesco Galaxy Bitcoin ETF

Statements of Financial Condition

March 31, 2024 and December 31, 2023

(Unaudited)

|

|

March 31, |

|

|

December 31, |

|

||

|

|

2024 |

|

|

2023 |

|

||

Assets |

|

|

|

|

|

|

||

Investments in Bitcoin, at value (cost $ |

|

$ |

|

|

$ |

— |

|

|

Cash held by custodian |

|

|

— |

|

|

|

|

|

Receivable for: |

|

|

|

|

|

|

||

Trust shares sold |

|

|

|

|

|

— |

|

|

Total Assets |

|

$ |

|

|

$ |

|

||

Liabilities |

|

|

|

|

|

|

||

Payable for: |

|

|

|

|

|

|

||

Investments purchased |

|

$ |

|

|

$ |

— |

|

|

Total Liabilities |

|

$ |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|||

Net Assets |

|

$ |

|

|

$ |

|

||

Net assets consist of: |

|

|

|

|

|

|

||

Paid-in-capital |

|

$ |

|

|

$ |

|

||

Distributable earnings (loss) |

|

|

|

|

|

— |

|

|

|

|

$ |

|

|

$ |

|

||

Shares outstanding |

|

|

|

|

|

|

||

Net asset value per share |

|

$ |

|

|

$ |

|

||

Market value per share |

|

$ |

|

|

$ |

|

||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

1

Invesco Galaxy Bitcoin ETF

Schedule of Investments

March 31, 2024

(Unaudited)

Description |

|

Quantity |

|

|

Cost |

|

|

Fair Value |

|

|

% of Net Assets |

|

||||

Cyptocurrency |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Bitcoin |

|

|

|

|

$ |

|

|

$ |

|

|

|

% |

||||

Total Investments |

|

|

|

|

$ |

|

|

$ |

|

|

|

% |

||||

Other Assets Less Liabilities |

|

|

|

|

|

|

|

$ |

|

|

|

% |

||||

Net assets |

|

|

|

|

|

|

|

$ |

|

|

|

% |

||||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

2

Invesco Galaxy Bitcoin ETF

Statement of Income and Expenses

For the Three Months Ended March 31, 2024

(Unaudited)

|

|

Three Months Ended |

|

|

|

|

March 31, 2024 |

|

|

Income |

|

|

|

|

Total Income |

|

$ |

|

|

Expenses |

|

|

|

|

Sponsor Fees |

|

|

|

|

Total Expenses |

|

|

|

|

Less: Waivers |

|

|

( |

) |

Net Expenses |

|

|

|

|

Net Investment Income (Loss) |

|

|

|

|

Net Realized and Net Change in Unrealized Gain (Loss) |

|

|

|

|

Net Realized Gain (Loss) on Investments in Bitcoin |

|

|

|

|

Net Change in Unrealized Gain (Loss) on Investments in Bitcoin |

|

|

|

|

Net Realized and Net Change in Unrealized Gain (Loss) on Investments in Bitcoin |

|

|

|

|

Net Income (Loss) |

|

$ |

|

|

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

3

Statement of Changes in Shareholders’ Equity

For the Three Months Ended March 31, 2024

(Unaudited)

|

|

Shares |

|

|

Total Shareholders' |

|

||

Balance at December 31, 2023 |

|

|

|

|

$ |

|

||

Purchases of Shares |

|

|

|

|

|

|

||

Redemption of Shares |

|

|

( |

) |

|

|

( |

) |

Net Increase (Decrease) due to Share Transactions |

|

|

|

|

|

|

||

Net Income (Loss) |

|

|

|

|

|

|

||

Net Investment Income (Loss) |

|

|

|

|

|

— |

|

|

Net Realized Gain (Loss) on Investments in Bitcoin |

|

|

|

|

|

|

||

Net Change in Unrealized Gain (Loss) on Investments in Bitcoin |

|

|

|

|

|

|

||

Net Income (Loss) |

|

|

|

|

|

|

||

Net Change in Shareholder's Equity |

|

|

|

|

|

|

||

Balance at March 31, 2024 |

|

|

|

|

$ |

|

||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

4

Invesco Galaxy Bitcoin ETF

Statement of Cash Flows

For the Three Months Ended March 31, 2024

(Unaudited)

|

|

Three Months Ended |

|

|

|

|

March 31, 2024 |

|

|

Cash flows from operating activities: |

|

|

|

|

Net Income (Loss) |

|

$ |

|

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: |

|

|

|

|

Cost of bitcoin purchased |

|

|

( |

) |

Proceeds from bitcoin sold |

|

|

|

|

Net Realized Gain (Loss) on Investments in Bitcoin |

|

|

( |

) |

Net Change in Unrealized Gain (Loss) on Investments in Bitcoin |

|

|

( |

) |

Net cash provided by (used in) operating activities |

|

|

( |

) |

Cash flows from financing activities: |

|

|

|

|

Proceeds from purchases of Shares |

|

|

|

|

Redemption of Shares |

|

|

( |

) |

Net cash provided by (used in) financing activities |

|

|

|

|

Net change in cash |

|

|

( |

) |

Cash at beginning of period |

|

|

|

|

Cash at end of period |

|

$ |

|

|

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

5

Invesco Galaxy Bitcoin ETF

Notes to Unaudited Financial Statements

March 31, 2024

Note 1 – Organization

Invesco Galaxy Bitcoin ETF (the “Trust”) is a Delaware statutory trust, formed on

The Trust offers Shares only to certain eligible financial institutions (“Authorized Participants”) in

On December 20, 2023, Invesco Ltd. (in such role, the “Seed Capital Investor”), subject to certain conditions, purchased

On January 2, 2024, the Seed Capital Investor purchased an additional

Effective January 10, 2024, the Trust’s registration statement was declared effective by the U.S. Securities and Exchange Commission (the “SEC”). The Trust commenced trading on the Cboe BZX Exchange, Inc. (the “Exchange”) on January 11, 2024.

The Trust’s investment objective is to reflect the performance of the spot price of bitcoin as measured using the Benchmark, less the Trust’s expenses and other liabilities. The Shares are intended to provide institutional and retail investors with a simple, cost-effective means of gaining investment benefits similar to those of holding bitcoin.

In seeking to achieve its investment objective, the Trust will hold bitcoin. Coinbase Custody Trust Company, LLC (the “Bitcoin Custodian”) will hold all of the Trust’s bitcoin on the Trust’s behalf as bitcoin custodian.

The Bank of New York Mellon (“BNYM”), the Trust’s “Administrator,” calculates, and the Sponsor publishes, the Trust’s Net Asset Value (“NAV”) once each business day. To calculate the NAV, the Administrator totals the current market value of bitcoin in the Trust and any other assets, and subtracts any liabilities including accrued but unpaid expenses. The Trust’s NAV is an amount denominated in U.S. dollars.

This Quarterly Report (the “Report”) covers the three months ended March 31, 2024. The accompanying unaudited financial statements were prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial information and with the instructions for Form 10-Q and the rules and regulations of the SEC. In the opinion of management, all material adjustments, consisting only of normal recurring adjustments, considered necessary for a fair statement of the interim period financial statements have been made. Interim period results are not necessarily indicative of results for a full-year period. These financial statements and the notes thereto should be read in conjunction with the Trust’s financial statements included in its Annual Report on Form 10-K for the period ended December 31, 2023, as filed with the SEC on March 8, 2024.

Note 2 – Summary of Significant Accounting Policies

The financial statements of the Trust have been prepared using U.S. GAAP. The Trust is considered an investment company under U.S. GAAP for financial statement purposes and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services— Investment Companies, but is not registered, and is not required to be registered, under the Investment Company Act of 1940, as amended.

6

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements. Actual results could differ from those estimates. In addition, the Trust monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are issued.

The Trust applies FASB ASC Topic 820, Fair Value Measurement, in the valuation of bitcoin held by the Trust and for financial statement purposes. The fair market value price for bitcoin reflects the price that would be received for bitcoin in a current sale, which assumes an orderly transaction between market participants on the measurement date of bitcoin on its “principal market,” generally, the most advantageous market. Market participants are defined as buyers and sellers in the principal or most advantageous market that are independent, knowledgeable, and willing and able to transact. The Trust determines its principal market (or in the absence of a principal market the most advantageous market) on a periodic basis to determine which market is its Principal Market for the purpose of calculating fair value for the creation of quarterly and annual financial statements. Issuer-specific events, market trends, bid/asked quotes of brokers and information providers and other data may be reviewed in the course of making a good faith determination of a security’s fair value.

Bitcoin transactions are accounted for on a trade date basis. Realized gains or losses from the sale or disposition of bitcoin are determined on a specific identification basis and recognized in the Statements of Income and Expenses in the period in which the sale or disposition occurs, respectively.

The Sponsor is responsible for all routine operational, administrative and other ordinary expenses of the Trust, including, but not limited to, the Trustee’s fees, the fees of the BNYM (the Administrator and the “Transfer Agent”) (for its services as the Administrator, Transfer Agent, and Cash Custodian (defined herein)), the fees of the Bitcoin Custodian, the fees of Galaxy Digital Funds LLC (the “Execution Agent”), Exchange listing fees, SEC registration fees, printing and mailing costs, legal costs and audit fees. The Trust does not reimburse the Sponsor for the routine operational, administrative and other ordinary expenses of the Trust. Accordingly, such expenses are not reflected in the Statements of Income and Expense of the Trust.

In certain cases, the Trust will pay for some expenses in addition to the Sponsor Fee. These exceptions include expenses not assumed by the Sponsor (i.e., expenses other than those identified in Section E of this Note 2), litigation and indemnification expenses, judgments, transactional expenses, taxes and other expenses not expected to be incurred in the ordinary course of the Trust’s business. The only expenses of the Trust during the three months ended March 31, 2024 were the Sponsor Fee.

The Sponsor intends to take the position that the Trust is properly treated as a grantor trust for U.S. federal income tax purposes. Assuming that the Trust is a grantor trust, the Trust will not be subject to U.S. federal income tax and, therefore, no provision for federal income taxes is required. Rather, if the Trust is a grantor trust, each beneficial owner of Shares will be treated as directly owning its pro rata share of the Trust’s assets and a pro rata portion of the Trust’s income, gain, losses and deductions will “flow through” to each beneficial owner of Shares.

Note 3 – Concentration Risk

Unlike other funds that may invest in diversified assets, the Trust’s investment strategy is concentrated in a single asset: bitcoin. This concentration maximizes the degree of the Trust’s exposure to a variety of market risks associated with bitcoin, including the rise or fall in its price, sometimes rapidly or unexpectedly. By concentrating its investment strategy solely in bitcoin, any losses suffered as a result of a decrease in the value of bitcoin can be expected to reduce the value of an interest in the Trust proportionately and will not be offset by other gains if the Trust were to invest in underlying assets that were diversified. There is no assurance that bitcoin will maintain its long-term value in terms of purchasing power in the future. In the event that the price of bitcoin declines, the Sponsor expects the value of an investment in the Shares to decline proportionately. Each of these events could have a material effect on the Trust’s financial position and the results of its operations.

Note 4 – Service Providers and Related Party Agreements

The Trustee

Delaware Trust Company, a Delaware trust company, acts as the Trustee of the Trust as required to create a Delaware statutory trust in accordance with the Trust Agreement and the DSTA. Under the Trust Agreement, the duties of the Trustee are limited to (i)

7

accepting legal process served on the Trust in the State of Delaware and (ii) at the direction of the Sponsor, the execution of any certificates required to be filed with the Secretary of State of the State of Delaware which the Trustee is required to execute under the DSTA.

The Sponsor

Invesco Capital Management LLC is the Sponsor of the Trust. The Sponsor arranged for the creation of the Trust and is responsible for the ongoing registration of the Shares for their public offering, the listing of Shares on the Exchange and valuing the bitcoin held by the Trust. The Sponsor is a limited liability company formed in the state of Delaware on February 7, 2003, and is a wholly-owned subsidiary of Invesco Ltd. Invesco Ltd. and its subsidiaries, including the Sponsor, are an independent global investment management group.

The Trust will pay the Sponsor a unified fee (the “Sponsor Fee”) as compensation for services performed under the Trust Agreement. The Sponsor Fee will be accrued daily and paid monthly in arrears on the first day the Exchange is open for regular trading (a “Business Day”) of the month in U.S. dollars, and will be calculated by the Administrator. The Sponsor also paid the costs of the Trust’s organization.

Effective as of January 29, 2024, the Sponsor Fee was

To cover the Sponsor Fee, and extraordinary expenses not assumed by the Sponsor, the Sponsor or its delegate will cause the Trust (or its delegate) to instruct the Execution Agent to convert bitcoin held by the Trust into U.S. dollars. The NAV of the Trust and the number of bitcoins represented by a Share will decline each time the Trust accrues the Sponsor Fee or any Trust expenses not assumed by the Sponsor. The Trust is not responsible for paying any costs associated with the transfer of bitcoin to or from the Trust in connection with paying the Sponsor Fee or in connection with creation and redemption transactions.

The Sponsor waived fees of $

The Administrator

The BNYM serves as the Trust’s Administrator. Under the trust administration and accounting agreement, the Administrator provides necessary administrative, tax and accounting services and financial reporting for the maintenance and operations of the Trust, including calculating the NAV of the Trust and the net assets of the Trust.

The Transfer Agent

BNYM also serves as the Transfer Agent for the Trust. The Transfer Agent is responsible for (1) issuing and redeeming Shares, (2) responding to correspondence by Shareholders and others relating to its duties, (3) maintaining Shareholder accounts and (4) making periodic reports to the Trust.

The Bitcoin Custodian

Coinbase Custody Trust Company, LLC serves as the Trust’s Bitcoin Custodian. Under the custodial agreement, the Bitcoin Custodian is responsible for (1) safekeeping all of the bitcoin owned by the Trust, (2) opening an account that holds the Trust’s bitcoin and (3) facilitating the transfer of bitcoin required for the operation of the Trust, as directed by the Sponsor. The Bitcoin Custodian is chartered as a limited purpose trust company by the New York State Department of Financial Services (“NYSDFS”) and is authorized by the NYSDFS to provide digital asset custody services. The Bitcoin Custodian is a wholly-owned subsidiary of Coinbase Global, Inc.

The Cash Custodian

Under the Cash Custody Agreement, BNYM is responsible for holding the Trust’s cash in connection with creation and redemption transactions effected in cash (the “Cash Custodian”). The Cash Custodian is a New York state-chartered bank and a member of the Federal Reserve System.

The Marketing Agent

Invesco Distributors, Inc. (the “Marketing Agent”) is responsible for: (1) working with the Transfer Agent to review and approve, or reject, purchase and redemption orders of Creation Baskets placed by Authorized Participants with the Transfer Agent; and (2) reviewing and approving the marketing materials prepared by the Trust for compliance with applicable SEC and Financial Industry Regulatory Authority advertising laws, rules, and regulations.

8

The Execution Agent

The Sponsor has entered into an agreement with Galaxy Digital Funds LLC, a subsidiary of Galaxy Digital LP (“Galaxy”), to serve as Execution Agent. The Trust from time to time will be required to sell bitcoin in such quantities as necessary to permit payment of the Sponsor Fee and any Trust expenses and liabilities not assumed by the Sponsor. The Sponsor has engaged the Execution Agent to sell bitcoin on the Trust’s behalf in such circumstances. At the direction of the Trust, the Execution Agent will seek to sell bitcoin at approximately the price at which it is valued by the Trust and in the smallest amounts required to permit such payments as they become due, with the intention of minimizing the Trust’s holdings of assets other than bitcoin. Accordingly, the amount of bitcoin to be sold may vary from time to time depending on the level of the Trust’s expenses and liabilities and the market price of bitcoin. The Trust also may utilize the services of the Execution Agent to purchase or sell bitcoin in connection with cash creations and redemptions. In addition, as part of this agreement, the Execution Agent has agreed to co-brand and co-market the Trust, and the Sponsor has licensed the use of certain Galaxy trademarks, service marks and trade names in connection with the Trust.

Galaxy is a subsidiary of Galaxy Digital Holdings LP (“Galaxy Holdings”). Galaxy Digital Holdings Ltd., which holds a limited partner interest in Galaxy Holdings, is listed on the Toronto Stock Exchange under the symbol “GLXY.”

Note 5 – Organization and Offering Costs

The Sponsor has agreed to pay the organizational and initial offering costs of the Trust and the Trust will not be obligated to reimburse the Sponsor. The organizational and initial offering costs include preparation and filing of incorporation documents, bylaws, declarations of trust, registration statements, board materials, state and federal registration of shares and audit fees. As a result, the Trust’s financial statements will not reflect these organizational and offering costs.

Note 6 – Additional Valuation Information

U.S. GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions. U.S. GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant unobservable inputs (Level 3), generally when market prices are not readily available or are unreliable. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods or market conditions may result in transfers in or out of an investment’s assigned level:

Level 1: Prices are determined using quoted prices in an active market for identical assets.

Level 2: Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities and others.

Level 3: Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period), unobservable inputs may be used. Unobservable inputs reflect the Trust’s own assumptions about the factors market participants would use in determining fair value of the securities or instruments and would be based on the best available information.

As of March 31, 2024, the investments in this Trust were valued based on Level 1 inputs. The levels assigned to the investment valuations may not be an indication of the risk or liquidity associated with investing in those investments. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

Note 7 – Investments in Bitcoin

The Trust expects to purchase or sell bitcoin in connection with cash creation or redemption transactions, and may sell bitcoin to pay certain expenses, including the Sponsor Fee.

Opening Balance as of 12/31/2023 |

|

|

Purchases at Cost |

|

|

Proceeds from Sales |

|

|

Change in Unrealized Appreciation (Depreciation) |

|

|

Realized Gain (Loss) |

|

|

Ending Balance as of 03/31/2024 |

|

||||||

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

|

|||||

Note 8 – Share Purchases and Redemptions

The Trust will process all creations and redemptions of Shares in transactions with Authorized Participants. When the Trust issues or redeems its Shares, it will do so only in Creation Baskets based on the quantity of bitcoin attributable to each Share of the Trust (net of accrued but unpaid Sponsor fees and any accrued but unpaid expenses or liabilities). Creation and redemption

9

transactions take place in cash, but in the future, pending regulatory approval, the Trust may permit or require creation and redemption transactions to take place in-kind. Authorized Participants are the only persons that may place orders to create and redeem Creation Baskets. Authorized Participants must be (1) registered broker-dealers or other securities market participants, such as banks or other financial institutions, that are not required to register as broker-dealers to engage in securities transactions as described below, and (2) participants in DTC such as banks, dealers and trust companies (“DTC Participants”). To become an Authorized Participant, a person must enter into an Authorized Participant Agreement.

When purchasing Creation Baskets, Authorized Participants will deliver cash to the Cash Custodian. The Execution Agent will be responsible for acquiring the requisite amount of bitcoin on behalf of the Trust on an agency basis. After receipt of the bitcoin by the Bitcoin Custodian, the Transfer Agent will issue Creation Baskets of Shares to the creating Authorized Participant in satisfaction of the creation order.

When redeeming Creation Baskets, the Execution Agent will be responsible for selling the requisite amount of bitcoin on behalf of the Trust on an agency basis. After receipt of the cash payment, the Transfer Agent will redeem the Shares and the Cash Custodian will distribute the resulting cash to the redeeming Authorized Participant in satisfaction of the redemption order.

Note 9 – Commitments and Contingencies

The Sponsor, either in its own capacity or in its capacity as the Sponsor and on behalf of the Trust, has entered into various service agreements that contain a variety of representations, or provide indemnification provisions related to certain risks service providers undertake in performing services for the Trust. The Trust’s organizational documents provide for the Trust to indemnify the Sponsor and any affiliate of the Sponsor that provides services to the Trust to the maximum extent permitted by applicable law, subject to certain exceptions for disqualifying conduct by the Sponsor or such an affiliate. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Further, the Trust has not had prior claims or losses pursuant to these contracts. Accordingly, the Sponsor expects the risk of loss to be remote.

10

Note 10 – Financial Highlights

The Trust is presenting the following NAV and financial highlights related to investment performance for a Share outstanding for the period ended March 31, 2024. An individual investor’s return and ratios may vary based on the timing of capital transactions.

NAV per Share is the NAV of the Trust divided by the number of outstanding Shares at the date of each respective period presented.

|

|

For the Period January 10, 2024 (the effective date of the Trust's registration statement) to March 31, 2024 |

|

|

Net Asset Value |

|

|

|

|

Net asset value per Share, beginning of period |

|

$ |

|

|

Net realized and change in unrealized gain (loss) on investments in Bitcoin (a) |

|

|

|

|

Net investment income (loss) (b) |

|

|

|

|

Net income (loss) |

|

|

|

|

Net asset value per Share, end of period |

|

$ |

|

|

Market value per Share, beginning of period (c) |

|

$ |

|

|

Market value per Share, end of period (c) |

|

$ |

|

|

|

|

|

|

|

Ratio to average Net Assets (d) |

|

|

|

|

Net investment income (loss) |

|

|

% |

|

Expenses, after waivers |

|

|

% |

|

Expenses, prior to waivers |

|

|

% |

|

Total Return, at net asset value (e)(f) |

|

|

% |

|

Total Return, at market value (e)(f) |

|

|

% |

|

11

ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This information should be read in conjunction with the financial statements and notes included in Part I, Item 1 of this Quarterly Report on Form 10-Q (the “Report”). This Report includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties. The matters discussed throughout this Report that are not historical facts are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this Report that address activities, events or developments that will or may occur in the future, including such matters as movements in the digital asset markets, operations of Invesco Galaxy Bitcoin ETF (the “Trust”), plans and references by Invesco Capital Management LLC (the “Sponsor”) to the Trust’s future success and other similar matters, are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses the Sponsor has made based on its perception of historical trends, technology developments regarding the use of bitcoin and other digital assets, including the systems used by the Sponsor and Coinbase Custody Trust Company, LLC, the Trust’s bitcoin custodian (the “Bitcoin Custodian”) in their provision of services to the Trust, current conditions and expected future developments, as well as other factors appropriate in the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this Report, and the risks described in the in Part I, Item 1A. “Risk Factors” of the Trust’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in other U.S. Securities and Exchange Commission (“SEC”) filings by the Trust, as well as general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies, and other economic and political developments. Consequently, all the forward-looking statements made in this Report are qualified by these cautionary statements, and there can be no assurance that actual results or developments the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the Trust’s operations or the value of its Shares. None of the Trust, the Sponsor, or the Trustee or their respective affiliates is under a duty to update any of the forward-looking statements to conform such statements to actual results or to a change in the Sponsor’s expectations or predictions.

Overview/Introduction

The Invesco Galaxy Bitcoin ETF (the “Trust”) is a Delaware statutory trust that was formed on April 5, 2021. The Trust continuously issues common shares representing fractional undivided beneficial interest in and ownership of the Trust (“Shares”). The Trust operates pursuant to its Second Amended and Restated Declaration of Trust and Trust Agreement, dated as of January 5, 2024 (the “Trust Agreement”). The Shares began trading on the Cboe BZX Exchange, Inc. (the “Exchange”) under the ticker symbol “BTCO” on January 11, 2024. The Trust offers Shares only to certain eligible financial institutions (“Authorized Participants”) in one or more blocks of 5,000 Shares (“Creation Baskets”) based on the quantity of bitcoin attributable to each Share of the Trust.

The following discussion and analysis was prepared to supplement information contained in the accompanying financial statements and is intended to explain certain items regarding the Trust's financial condition as of March 31, 2024, and its results of operations for the period ended March 31, 2024. It should be read in conjunction with the audited financial statements and related notes thereto contained in this Report.

Investment Objective

The investment objective of the Trust is for the Shares to reflect the performance of the spot price of bitcoin as measured using the Lukka Prime Bitcoin Reference Rate (the “Benchmark”) less the Trust’s expenses and other liabilities. The Shares are intended to provide institutional and retail investors with a simple, cost-effective means of gaining investment benefits similar to those of holding bitcoin.

Determination of Net Asset Value

The Administrator calculates, and the Sponsor publishes, the Trust’s Net Asset Value (“NAV”) once each business day. To calculate the NAV, the Administrator totals the current market value of bitcoin in the Trust and any other assets, and subtracts any liabilities including accrued but unpaid expenses. The Trust’s NAV is an amount denominated in U.S. dollars.

The Administrator also determines the NAV per Share, which equals the NAV of the Trust divided by the number of outstanding Shares. The NAV of the Trust and the NAV per Share are published by the Sponsor on each day that the Exchange is open for regular trading and are posted on the Trust’s website, www.invesco.com/BTCO.

Valuation of Bitcoin

The Trust applies FASB ASC Topic 820, Fair Value Measurement, in the valuation of bitcoin held by the Trust and for financial statement purposes. The fair market value price for bitcoin reflects the price that would be received for bitcoin in a current sale, which assumes an orderly transaction between market participants on the measurement date of bitcoin on its “principal market,”

12

generally, the most advantageous market. Market participants are defined as buyers and sellers in the principal or most advantageous market that are independent, knowledgeable, and willing and able to transact. The Trust determines its principal market (or in the absence of a principal market the most advantageous market) on a periodic basis to determine which market is its Principal Market for the purpose of calculating fair value for the creation of quarterly and annual financial statements. Issuer-specific events, market trends, bid/asked quotes of brokers and information providers and other data may be reviewed in the course of making a good faith determination of a security’s fair value.

Liquidity and Capital Resources

The Sponsor is not aware of any known trends, demands, commitments, events or uncertainties that will result in, or are reasonably likely to result in, material changes to the Trust’s liquidity and capital resources needs.

The Trust will pay the Sponsor a unified fee of 0.25% per annum (the “Sponsor Fee”) as compensation for services performed under the Trust Agreement. From January 9, 2024 until January 28, 2024, the Sponsor Fee was 0.39% per annum. Prior to January 9, 2024, the Sponsor Fee was 0.59% per annum. The Trust’s only ordinary recurring expense is the Sponsor Fee. For a 6-month period beginning January 11, 2024 the Sponsor has agreed to waive the entire Sponsor Fee on the first $5 billion of Trust assets.

Except for periods during which all or a portion of the Sponsor Fee is being waived, the Sponsor Fee will be accrued daily and paid monthly in arrears in U.S. dollars, and will be calculated by Bank of New York Mellon (the “Administrator”). The Administrator will calculate the Sponsor Fee on a daily basis by applying the 0.25% annualized rate to the Trust’s total net assets.

Except as noted below, the Sponsor has agreed to pay all of the Trust’s ordinary expenses out of the Sponsor’s unified fee, including, but not limited to, the Trustee’s fees, the fees of The Bank of New York Mellon (for its services as the Administrator, Transfer Agent, and Cash Custodian), the fees of the Bitcoin Custodian, the fees of the Execution Agent, Exchange listing fees, SEC registration fees, printing and mailing costs, legal costs and audit fees. The Sponsor also paid the costs of the Trust’s organization.

The Trust may incur certain extraordinary expenses that are not assumed by the Sponsor. These include, but are not limited to, taxes and governmental charges, any applicable brokerage commissions, financing fees, Bitcoin network fees and similar transaction fees, expenses and costs of any extraordinary services performed by the Sponsor (or any other service provider) on behalf of the Trust to protect the Trust or the interests of Shareholders (including, for example, in connection with any fork of the Bitcoin blockchain), any indemnification of the Sponsor, Cash Custodian, Bitcoin Custodian, Administrator or other agents, service providers or counterparties of the Trust and extraordinary legal fees and expenses, including any legal fees and expenses incurred in connection with litigation, regulatory enforcement or investigation matters.

To cover the Sponsor Fee, and extraordinary expenses not assumed by the Sponsor, the Sponsor or its delegate will cause the Trust (or its delegate) to instruct Galaxy Digital Funds LLC (the “Execution Agent”) to convert bitcoin held by the Trust into U.S. dollars. The NAV of the Trust and the number of bitcoins represented by a Share will decline each time the Trust accrues the Sponsor Fee or any Trust expenses not assumed by the Sponsor. The Trust is not responsible for paying any costs associated with the transfer of bitcoin to or from the Trust in connection with paying the Sponsor Fee or in connection with creation and redemption transactions.

The Trust from time to time will be required to sell bitcoin in such quantities as necessary to permit payment of the Sponsor Fee and any Trust expenses and liabilities not assumed by the Sponsor. The Sponsor has engaged the Execution Agent to sell bitcoin on the Trust’s behalf in such circumstances. At the direction of the Trust, the Execution Agent will seek to sell bitcoin at approximately the price at which it is valued by the Trust and in the smallest amounts required to permit such payments as they become due, with the intention of minimizing the Trust’s holdings of assets other than bitcoin. Accordingly, the amount of bitcoin to be sold may vary from time to time depending on the level of the Trust’s expenses and liabilities and the market price of bitcoin.

The Trust has not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Trust’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources and would be considered material to Shareholders.

Cash Flows

A primary cash flow activity of the Trust is to raise capital from Authorized Participants through the issuance of Shares. This cash is used to invest in bitcoin.

As of the date of this Report, each of ABN AMRO Clearing Chicago LLC, Citadel Securities LLC, Goldman Sachs & Co., Jane Street Capital LLC, JP Morgan Securities Inc., Macquarie Capital (USA) Inc., Marex Capital Markets Inc. and Virtu Americas LLC has executed a Participant Agreement and are the only Authorized Participants.

Results of Operations

FOR THE PERIOD JANUARY 11, 2024 TO MARCH 31, 2024

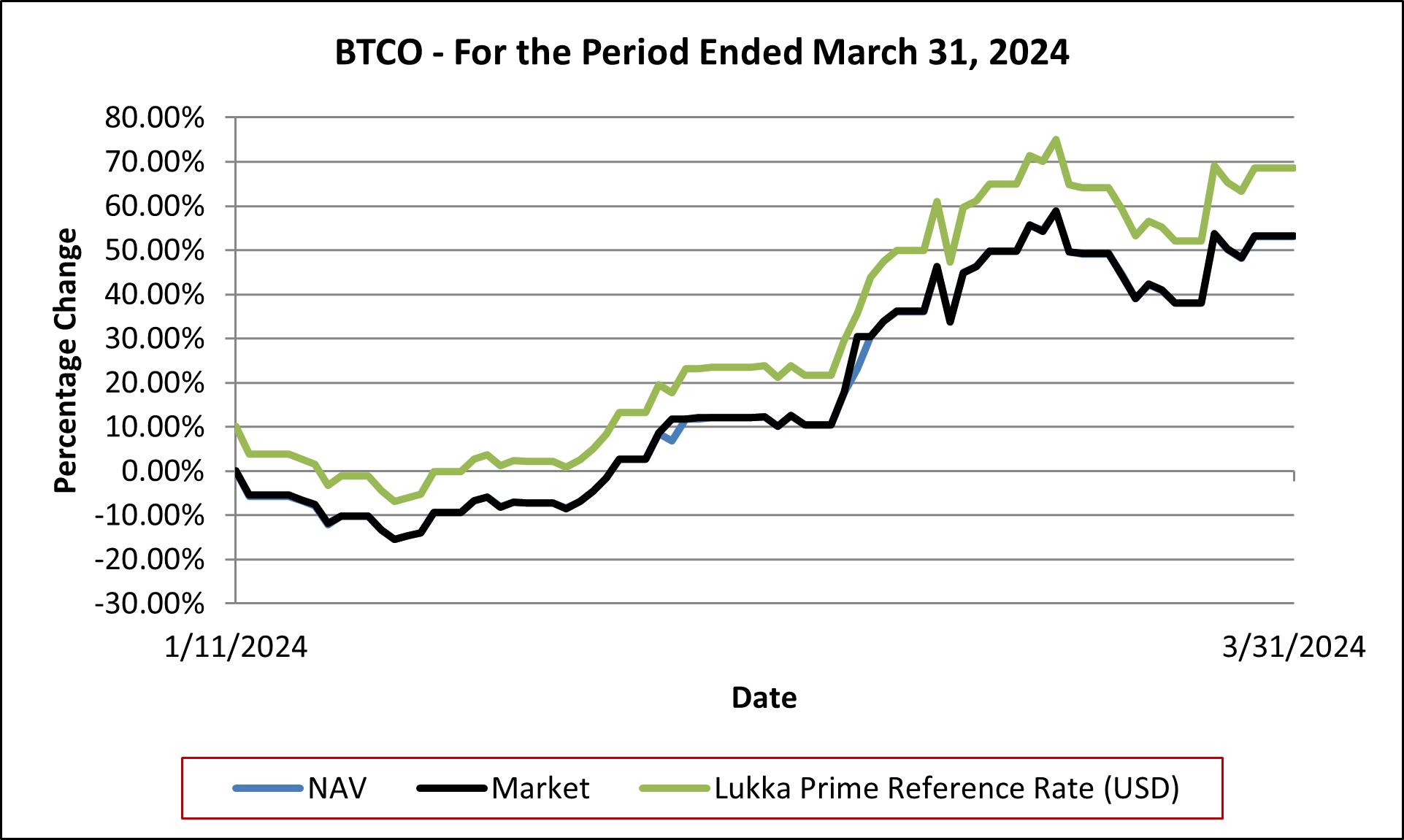

The following graph illustrates the percentage changes in (i) the market price of the Shares (as reflected by the line “Market”), (ii) the Trust’s NAV (as reflected by the line “NAV”), and (iii) the closing levels of the Benchmark (as reflected by the line “Lukka

13

Prime Reference Rate (USD)”). There can be no assurances that the price of the Shares or the Trust’s NAV will exceed the Benchmark levels.

No representation is being made that the Benchmark will or is likely to achieve closing levels consistent with or similar to those set forth herein.

COMPARISON OF MARKET, NAV AND LUKKA PRIME REFERENCE RATE (USD)

FOR THE PERIOD ENDED MARCH 31, 2024

Trust Share Price Performance

For the period January 11, 2024 to March 31, 2024, the Exchange market value of each Share increased from $46.30 per Share to $70.98 per Share. The Share price low and high for the period ended March 31, 2024 and related change from the Share price on January 11, 2024 was as follows: Shares traded at a low of $39.11 per Share (-15.54%) on January 23, 2024, and a high of $73.57 per Share (+58.90%) on March 13, 2024. The total return for the Trust on a market value basis was +53.30%.

Bitcoin saw extremely strong performance during the period January 11, 2024 through March 31, 2024, with its spot price increasing over 50%, leading to equivalent gains for the Trust. The rally for bitcoin was driven by spot bitcoin ETF demand following their historic launch on January 11, 2024, improving macro sentiment supporting investor risk appetite, and the anticipation leading up to the April 2024 halving event (halvings reduce the amount of coins rewarded to miners in half). Prices did retreat in early March on heightened geopolitical risks and a broader equity market selloff, but managed to recover most of those losses to end the period. During the period, the Trust saw net inflows of over $220 million. More broadly, spot bitcoin ETPs saw inflows of over $10 billion.

Trust Share Net Asset Performance

For the period January 11, 2024 to March 31, 2024, the NAV of each Share increased from $46.29 per Share to $70.84 per Share. Rising prices for bitcoin during the period ended March 31, 2024 contributed to an overall 53.04% increase in the level of the Benchmark. The total return for the Trust on a NAV basis was +53.04%.

Net income (loss) for the three months ended March 31, 2024 was $185.8 million, primarily resulting from net realized gain (loss) of $37.0 million and net change in unrealized gain (loss) of $148.8 million.

Critical Accounting Estimates

The preparation of financial statements in conformity with U.S. GAAP requires the Sponsor to make estimates and assumptions that affect the reported amounts of the assets and liabilities and disclosures of contingent liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period covered by this report. In addition, please refer to Note 2 to the financial statements of the Trust for further discussion of the Trust’s accounting policies and Part II, Item 7 – “Management’s Discussions and Analysis of Financial Condition and Results of Operations – Critical Accounting Estimates” in the Annual Report on Form 10-K for the period ended December 31, 2023.

There were no material estimates, which involve a significant level of estimation uncertainty and had or are reasonably likely to have had a material impact on the Trust's financial condition, used in the preparation of these financial statements.

14

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

None.

ITEM 4. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures

Under the supervision and with the participation of the management of the Sponsor, including Brian Hartigan, its Principal Executive Officer, and Kelli Gallegos, its Principal Financial and Accounting Officer, Investment Pools, the Trust carried out an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures (as defined in Rules 13a-15(e) or 15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of the end of the period covered by this Quarterly Report, and, based upon that evaluation, Brian Hartigan, the Principal Executive Officer of the Sponsor, and Kelli Gallegos, the Principal Financial and Accounting Officer, Investment Pools, of the Sponsor, concluded that the Trust's disclosure controls and procedures were effective to provide reasonable assurance that information the Trust is required to disclose in the reports that it files or submits with the Securities and Exchange Commission (the “SEC”) under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms, and to provide reasonable assurance that information required to be disclosed by the Trust in the reports that it files or submits under the Exchange Act is accumulated and communicated to management of the Sponsor, including its Principal Executive Officer and Principal Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Control Over Financial Reporting

There has been no change in internal control over financial reporting (as defined in the Rules 13a-15(f) and 15d-15(f) of the Exchange Act) that occurred during the Trust’s quarter ended March 31, 2024 that has materially affected, or is reasonably likely to materially affect, the Trust's internal control over financial reporting.

PART II. OTHER INFORMATION

Item 1. Legal Proceedings.

Not applicable.

Item 1A. Risk Factors.

There are no material changes from risk factors as previously disclosed in the Trust's Annual Report on Form 10-K for the period ended December 31, 2023, filed March 8, 2024.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

(a) There have been no unregistered sales of Shares. No Shares are authorized for issuance by the Trust under equity compensation plans.

(b) Not applicable.

(c) Although the Trust did not redeem Shares directly from its Shareholders, the Trust redeemed Creation Baskets from Authorized Participants during the three months ended March 31, 2024 as follows:

Period of Redemption |

|

Total Number |

|

|

Average Price |

|

||

January 1, 2024 to January 31, 2024 |

|

|

564,000 |

|

|

$ |

36.84 |

|

February 1, 2024 to February 29, 2024 |

|

|

2,015,000 |

|

|

|

49.60 |

|

March 1, 2024 to March 31, 2024 |

|

|

1,595,000 |

|

|

|

66.67 |

|

Total |

|

|

4,174,000 |

|

|

$ |

54.40 |

|

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Other Information.

During the period covered by this Report, none of the members of the Sponsor responsible for overseeing the business and operations of the Trust

15

Item 6. Exhibits.

Exhibit No. |

|

Description |

|

|

|

31.1 |

|

Certification required under Exchange Act Rules 13a-14 and 15d-14 (filed herewith) |

|

|

|

31.2 |

|

Certification required under Exchange Act Rules 13a-14 and 15d-14 (filed herewith) |

|

|

|

32.1 |

|

|

|

|

|

32.2 |

|

|

|

|

|

101 |

|

Interactive data file pursuant to Rule 405 of Regulation S-T: (i) the Statements of Financial Condition of Invesco Galaxy Bitcoin ETF — March 31, 2024 and December 31, 2023 (Unaudited), (ii) the Schedule of Investments of Invesco Galaxy Bitcoin ETF — March 31, 2024 (Unaudited), (iii) the Statement of Income and Expenses of Invesco Galaxy Bitcoin ETF — For the Three Months Ended March 31, 2024 (Unaudited), (iv) the Statement of Changes in Shareholders’ Equity of Invesco Galaxy Bitcoin ETF — For the Three Months Ended March 31, 2024 (Unaudited), (v) the Statement of Cash Flows of Invesco Galaxy Bitcoin ETF — For the Three Months Ended March 31, 2024 (Unaudited) and (vi) Notes to Unaudited Financial Statements of Invesco Galaxy Bitcoin ETF — March 31, 2024. |

|

|

|

101.INS |

|

Inline XBRL Instance Document – The instance document does not appear in the interactive data file because its XBRL tags are embedded within the Inline XBRL document |

|

|

|

101.SCH |

|

Inline XBRL Taxonomy Extension Schema With Embedded Linkbase Documents |

|

|

|

104 |

|

The cover page of the Trust's Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, formatted in Inline XBRL |

16

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Invesco Galaxy Bitcoin ETF |

||

|

|

||

|

By: |

Invesco Capital Management LLC |

|

|

|

its Sponsor |

|

|

|

|

|

|

|

|

|

Dated: May 10, 2024 |

|

By: |

/S/BRIAN HARTIGAN |

|

|

Name: |

Brian Hartigan |

|

|

Title: |

Principal Executive Officer |

|

|

|

|

|

|

|

|

Dated: May 10, 2024 |

|

By: |

/S/KELLI GALLEGOS |

|

|

Name: |

Kelli Gallegos |

|

|

Title: |

Principal Financial and Accounting Officer, Investment Pools |

17