As filed with the Securities and Exchange Commission on January 23, 2024

Registration No. 333-[__]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 3721 | ||||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

AERWINS Technologies Inc.

Telephone:

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Telephone:

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Laura Anthony, Esq. Craig D. Linder, Esq. Anthony, Linder & Cacomanolis, PLLC 1700 Palm Beach Lakes Blvd, Suite 820 West Palm Beach, Florida 33401 (561) 514-0936 |

Ross D. Carmel, Esq. Barry P. Biggar, Esq. Sichenzia Ross Ference Carmel LLP 1185 Avenue of the Americas, 31st Floor New York, NY 10036 (212) 930-9700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller

reporting company | |

| Emerging

growth company |

If

an emerging growth company, indicate by check market if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933, as amended (the “Securities Act”) or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JANUARY 23, 2024 |

AERWINS TECHNOLOGIES INC.

137,614,679 shares of Common Stock

We are offering 137,614,679 shares of common stock, par value $0.000001 per share of AERWINS Technologies Inc., a Delaware corporation (referred to herein as the “Company,” “we,” “our,” “us,” or other similar pronouns) at an assumed public offering price of $0.109 (equal to the last sale price of our Common Stock as reported by The Nasdaq Capital Market on January 22, 2024).

We intend to use the proceeds from this offering for general corporate purposes, including working capital. See “Use of Proceeds.”

Our common stock and our redeemable warrants to purchase common stock (the “Public Warrants”) are listed on the Nasdaq Capital Market under the symbols “AWIN” and “AWINW,” respectively. On January 22, 2024, the closing price of our common stock was $0.109 per share and the closing price of our Public Warrants was $0.0111 per warrant.

The public offering price per share of common stock will be determined by us at the time of pricing, may be at a discount to the current market price, and the recent market price used throughout this prospectus may not be indicative of the final offering price.

We are an “emerging growth company” and a “smaller reporting company” under the federal securities laws and will be subject to reduced disclosure and public reporting requirements. See “Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 12 of this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share(2) | Total | |||||||

| Price to the public | $ | [●] | $ | [●] | ||||

| Underwriting discounts and commissions(1) | $ | [●] | $ | [●] | ||||

| Proceeds to us, before expenses | $ | [●] | $ | [●] | ||||

| (1) | Represents an underwriting discount equal to 5.0% per share of common stock, which is the underwriting discount we have agreed to pay for sales to investors in this offering identified by the underwriter. |

| (2) | The public offering corresponds to a public offering price per share of common stock of $[●]. |

This offering is being conducted on a firm commitment basis. The underwriters are obligated to take and purchase all of the shares of common stock offered under this prospectus if any such shares are taken.

We have granted the underwriters an option for a period of 45 days after the closing of this offering to purchase up to 15% of the total number of our shares to be offered by us pursuant to this offering (excluding shares subject to this option), solely for the purpose of covering over-allotments, at the public offering price less the underwriting discount. If the underwriters exercise the option in full, the total underwriting discount and commissions, not including other offering expenses, will be $862,500 based on the assumed public offering price of $0.109 per share, and the total gross proceeds to us, before underwriting discounts, commissions and expenses, will be $17,250,000. Net proceeds will be delivered to us on the closing date.

We anticipate that delivery of the securities against payment will be made on or about ______, 2024.

Prospectus dated ______, 2024.

TABLE OF CONTENTS

No dealer, salesperson or other individual has been authorized to give any information or to make any representation other than those contained in this prospectus in connection with the offer made by this prospectus and, if given or made, such information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make such offer or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in our affairs or that information contained herein is correct as of any time subsequent to the date hereof.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside the United States.

| i |

ABOUT THIS PROSPECTUS

Throughout this prospectus, unless otherwise designated or the context suggests otherwise,

| ● | all references to the “Company,” “AWIN,” the “registrant,” “we,” “our” or “us” in this prospectus mean AERWINS Technologies, Inc. and its subsidiaries; |

| ● | “year” or “fiscal year” means the year ending December 31st; |

| ● | all dollar or $ references, when used in this prospectus, refer to United States dollars; and |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Specifically, forward-looking statements may include statements relating to:

| ● | our future financial performance; |

| ● | changes in the market for our products and services; |

| ● | our expansion plans and opportunities; and |

| ● | other statements preceded by, followed by or that include the words “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “target” or similar expressions. |

These forward-looking statements are based on information available as of the date of this prospectus and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements including those described in the “Risk Factors” section beginning on page 12 and elsewhere in this prospectus.

INDUSTRY AND MARKET DATA

We are responsible for the disclosure in this prospectus. However, this prospectus includes industry data that we obtained from internal surveys, market research, publicly available information and industry publications. The market research, publicly available information and industry publications that we use generally state that the information contained therein has been obtained from sources believed to be reliable. The information therein represents the most recently available data from the relevant sources and publications, and we believe remains reliable. We did not fund and are not otherwise affiliated with any of the sources cited in this prospectus. Forward-looking information obtained from these sources is subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus.

TRADEMARKS AND COPYRIGHTS

We own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect the content of our products and the formulations for such products. This prospectus may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this prospectus are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

| ii |

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY AND A SMALLER REPORTING COMPANY

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). For so long as we remain an emerging growth company, we are permitted, and currently intend, to rely on the following provisions of the JOBS Act that contain exceptions from disclosure and other requirements that otherwise are applicable to public companies and file periodic reports with the SEC. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements and selected financial data and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our periodic reports and registration statements, including this prospectus, subject to certain exceptions; |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (“SOX”); |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements, and registration statements, including in this prospectus; |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; and |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We will remain an emerging growth company until the earliest to occur of:

| ● | December 31, 2026 (the last day of the fiscal year that follows the fifth anniversary of the completion of our initial public offering); |

| ● | the last day of the fiscal year in which we have total annual gross revenue of at least $1.235 billion; |

| ● | the date on which we are deemed to be a “large accelerated filer,” as defined in the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”); and |

| ● | the date on which we have issued more than $1 billion in non-convertible debt over a three-year period. |

We have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in our future filings with the SEC. As a result, the information that we provide to holders of our common stock may be different than what you might receive from other public reporting companies in which you hold equity interests.

We have elected to avail ourselves of the provision of the JOBS Act that permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. As a result, we will not be subject to new or revised accounting standards at the same time as other public companies that are not emerging growth companies.

We are also a “smaller reporting company” as defined in the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies until the fiscal year following the determination that our voting and non-voting common stock held by non-affiliates is $250 million or more measured on the last business day of our second fiscal quarter, or our annual revenues are less than $100 million during the most recently completed fiscal year and our voting and non-voting common stock held by non-affiliates is $700 million or more measured on the last business day of our second fiscal quarter.

| iii |

PROSPECTUS SUMMARY

This summary of the prospectus highlights material information concerning our business and this offering. This summary does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, including the information presented under the section entitled “Risk Factors” and the financial data and related notes, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of factors such as those set forth in “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

This summary contains basic information about us and the offering. Because it is a summary, it does not contain all the information that you should consider before investing. You should read the entire prospectus carefully, including the risk factors and our financial statements and the related notes to those statements included in this prospectus.

We have not authorized anyone to provide you with different information and you must not rely on any unauthorized information or representation. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. This document may only be used where it is legal to sell these securities. You should assume that the information appearing in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus, or any sale of our common stock. Our business, financial condition and results of operations may have changed since the date on the front of this prospectus. We urge you to carefully read this prospectus before deciding whether to invest in any of the common stock being offered.

Business

Through our U.S.-based subsidiary, we are redesigning our single-seat optionally Manned Air Vehicle (“MAV” or “Manned Air Vehicle”). We aim to align this vehicle with the stringent requirements of the Federal Aviation Administration’s (“FAA”) Powered Ultra-Light Air Vehicle Category, setting a new standard for safe low-altitude manned flight. Following an evaluation of the viability of other areas of the Company’s business which AWIN considered non-core and our desire to focus solely on our core business of developing an FAA-compliant MAV in the United States, we discontinued our non-core operations formerly carried out by our wholly owned indirect subsidiary, A.L.I. Technologies Inc., a Japanese corporation (“ALI”). Following the discontinuation, on December 27, 2023, ALI filed a voluntary bankruptcy petition with the Tokyo District Court, Civil Division 20, “Tokutei Kanzai Kakari” [Special Trusteeship Section], Case ID: No. 8234 of 2023 (Fu). A bankruptcy trustee was appointed on January 10, 2024, and proceedings have commenced.

Corporate History

We were initially incorporated in Delaware on February 12, 2021, under the name “Pono Capital Corp” as a special purpose acquisition company formed to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses.

On August 13, 2021, we consummated an initial public offering (“Initial Public Offering”). The Company’s Initial Public Offering registration statement was declared effective on August 10, 2021. On August 13, 2021, the Company consummated its Initial Public Offering of 10,000,000 units (the “Units” and, with respect to the Class A common stock included in the Units being offered, the “Public Shares”) at $10.00 per Unit, generating gross proceeds of $100,000,000 (see Note 6) (the “Initial Public Offering”). The Company granted the underwriter for the Initial Public Offering a 45-day option to purchase up to an additional 1,500,000 Units at the Initial Public Offering price to cover over-allotments, if any. Simultaneously with the consummation of the closing of the Offering, the Company consummated the private placement of an aggregate of 469,175 units (the “Placement Units”) to the Sponsor for $10.00 per Placement Unit, generating total gross proceeds of $4,691,750 (the “Private Placement”).

On August 18, 2021, the underwriters for the Initial Public Offering exercised the over-allotment option in full, and the closing of the issuance and sale of the additional Units occurred (the “Over-allotment Option Units”). The total aggregate issuance by the Company of 1,500,000 units for $10.00 per unit resulted in total gross proceeds of $15,000,000. On August 18, 2021, simultaneously with the sale of the Over-allotment Option Units, the Company consummated the private sale of an additional 52,500 Placement Units, generating gross proceeds of $525,000. As amended, the Placement Units were issued under Section 4(a)(2) of the Securities Act of 1933, as the transactions did not involve a public offering. A total of $116,725,000, comprised of the proceeds from the Offering and the proceeds of private placements that closed on August 13, 2021, and August 18, 2021, net of the underwriting commissions, discounts, and offering expenses, was deposited in a trust account established for the benefit of the Company’s public stockholders. On October 8, 2021, the Class A ordinary shares and Public Warrant included in the Units began trading separately.

| 1 |

On March 17, 2022, the Company entered into an Agreement and Plan of Merger (the “Old Merger Agreement”) by and among Pono, Merger Sub, Benuvia, Inc., a Delaware corporation (“Benuvia”), Mehana Equity, LLC, in its capacity as Purchaser Representative, and Shannon Soqui, in his capacity as Seller Representative. Pursuant to the Old Merger Agreement, at the closing of the transactions contemplated by the Old Merger Agreement, Merger Sub would merge with and into Benuvia, with Benuvia continuing as the surviving corporation. The Business Combination Agreement and related agreements are further described in the Company’s Current Report on Form 8-K filed with the SEC on March 18, 2022. On August 8, 2022, the Company and Benuvia mutually terminated the Merger Agreement under Section 8.1(a) of the Merger Agreement, effective immediately. Neither party was required to pay the other a termination fee due to the mutual decision to terminate the Merger Agreement.

On November 9, 2022, the Company entered into purchase agreements (“Purchase Agreements”) and completed the private sale of an aggregate of 115,000 Placement Units at a purchase price of $10.00 per Placement Unit in a private placement and deposited $1,150,000 into the Company’s Trust account for its public stockholders, representing $0.10 per public share, allowing the Company to extend the period it had to consummate its initial business combination by three months from November 11, 2022 to February 13, 2023. The Purchase Agreements and related agreements are further described in the Company’s Current Report on Form 8-K filed with the SEC on November 10, 2022.

On December 31, 2022, all the assets in the Trust Account were held in mutual funds.

No payments for our expenses were made in the offerings described above directly or indirectly to (i) any of our directors, officers, or their associates, (ii) any person(s) owning 10% or more of any class of our equity securities or (iii) any of our affiliates, except in connection with the repayment of outstanding loans and pursuant to the administrative support agreement disclosed herein which we entered into with our sponsor.

On February 3, 2023, we consummated a merger (the “Merger”) with Pono Merger Sub, Inc., a Delaware corporation (“Merger Sub”) and a wholly-owned subsidiary of the Company, then called Pono Capital Corp., a Delaware corporation (“Pono”) with and into AERWINS, Inc. (formerly named AERWINS Technologies Inc.), a Delaware corporation pursuant to an agreement and plan of merger, dated as of September 7, 2022 (as amended on January 19, 2023, the “Merger Agreement”), by and among Pono, Merger Sub, AERWINS, Mehana Equity LLC, a Delaware limited liability company (“Sponsor” or “Purchaser Representative”) in its capacity as the representative of the stockholders of Pono, and Shuhei Komatsu in his capacity as the representative of the stockholders of AERWINS, Inc. (“Seller Representative”). The Merger and other transactions contemplated thereby (collectively, the “Business Combination”) closed on February 3, 2023, when pursuant to the Merger Agreement, Merger Sub merged with and into AERWINS, Inc. with AERWINS, Inc. surviving the Merger as a wholly-owned subsidiary of Pono, and Pono changed its name to “AERWINS Technologies Inc.” and the business of the Company became the business of AERWINS, Inc. (the “Company,” “we,” “us, “our” “AERWINS,” or “AERWINS Technologies”).

Pursuant to the terms of the Merger Agreement, the total consideration for the Business Combination and related transactions (the “Merger Consideration”) was approximately $600 million. In connection with the Special Meeting, holders of 11,328,988 shares of Pono Common Stock sold in its initial public offering exercised their right to redeem those shares for cash before the redemption deadline of January 25, 2023, for $10.50 per share, for an aggregate payment from Pono’s trust account of approximately $118.9 million. Effective February 3, 2023, Pono’s units ceased trading, and effective February 6, 2023, AERWINS Technologies’ common stock began trading on the Nasdaq Global Market under the symbol “AWIN,” and the warrants began trading on the Nasdaq Capital Market under the symbol “AWINW.”

After taking into account the aggregate payment regarding the redemption, Pono’s trust account had a balance immediately before the closing of $1,795,997. Such balance in the trust account was used to pay Pono’s transaction expenses and other liabilities and pay certain AERWINS, Inc. transaction expenses, with the remaining being deposited in AERWINS, Inc.’s cash account. In connection with the Business Combination, a warrant holder of AERWINS, Inc. received a warrant to purchase 469,291 shares of AERWINS Technologies’ common stock as Merger Consideration as set forth in the Merger Agreement. The Merger Consideration was subject to a post-closing true-up 90 days after the Closing, which expired on May 5, 2023, without any claims having been made.

As a result of the Merger and the Business Combination, holders of Pono common stock automatically received common stock of AERWINS Technologies, and holders of Pono warrants automatically received warrants of AERWINS Technologies with substantively identical terms. At the Closing of the Business Combination, all shares of Pono owned by the Sponsor (consisting of shares of Class A Common Stock and shares of Class B Common Stock), which we refer to as the founder shares, automatically converted into an equal number of shares of AERWINS Technologies’ Common Stock, and Private Placement Warrants held by the Sponsor, automatically converted into warrants to purchase one share of AERWINS Technologies Common Stock with substantively identical terms. As of the Closing: public stockholders owned approximately 0.3% of the outstanding shares of AERWINS Technologies Common Stock; the Sponsor and its affiliates owned approximately 6.7% of the outstanding shares of AERWINS Technologies Common Stock and AERWINS, Inc.’s former security holders collectively owned approximately 93.0% of the outstanding shares of AERWINS Technologies Common Stock.

| 2 |

At the closing of the Merger, we issued to the former shareholders of AERWINS an aggregate of 51,929,065 shares of common stock, of which 1,407,878 shares are being held in escrow (the “Escrow Shares”). The Escrow Shares were subject to a post-closing true-up 90 days after the Closing based on confirmed amounts of the Closing Net Indebtedness of AERWINS, the Net Working Capital of AERWINS, and certain Transaction Expenses, each of which are defined in the Merger Agreement. If the adjustment was negative in favor of us, the escrow agent was required to distribute some shares of our common stock with a value equal to the adjustment amount. If the adjustment was positive in favor of AERWINS, we were required to issue the former AERWINS stockholders an additional number of shares of our common stock with a value equal to the adjustment amount and the post-Closing true up period expired on May 5, 2023 without any claims having been made. In addition, at the closing of the Merger, the Company issued an aggregate of 150,000 shares of common stock (the “Compensation Shares”) to Boustead Securities, LLC (“Boustead”), in partial satisfaction of fees due to them in connection with the Merger. In addition, Boustead is entitled to an increase in the number of Compensation Shares on the 180th day following the closing of the Merger (the “Measurement Date”) if the VWAP for the common stock during over the five trading days prior to the Measurement Date is less than $10.00 per share (the “Adjustment”). The number of shares of common stock subject to the Adjustment equals (1) $1,500,000 divided by the average VWAP of the common stock over the five trading days prior to the Measurement Date minus (2) the number of Compensation Shares.

AERWINS, Inc. was formerly named AERWINS Technologies Inc. until its name changed to AERWINS, Inc. on January 24, 2023, and was incorporated in the State of Delaware on June 9, 2022. A. L. I. Technologies Inc., a Japanese corporation and a wholly owned subsidiary of AERWINS, Inc., was established in Japan in September 2016. On August 5, 2022, pursuant to the terms of a share exchange agreement among the Company, A. L. I. Technologies, the shareholders of A. L. I. Technologies and Shuhei Komatsu, as the representative of the shareholders of A. L. I. Technologies, we issued 30,000,000 shares of AERWINS, Inc. Common Stock to the shareholders of A. L. I. Technologies in exchange for 2,006,689 shares A. L. I. Technologies’ Common Stock, representing 100% of the issued and outstanding capital stock of A. L. I. Technologies. As a result of this transaction, A. L. I. Technologies became AERWINS Inc.’s 100%-owned subsidiary, and the former shareholders of A. L. I. Technologies owned 100% of AERWINS, Inc.’s outstanding Common Stock as of August 5, 2022.

Potential Nasdaq Delisting

As previously disclosed in the Current Report on Form 8-K filed on April 21, 2023 by the Company, on April 20, 2023, Nasdaq Listing Qualifications staff (“Staff”) notified the Company that it no longer complied with the minimum bid price requirement under Listing Rule 5450(a)(1). In accordance with Listing Rule 5810(c)(3)(A), the Company was provided 180 calendar days, or until October 17, 2023, to regain compliance with Rule 5450(a)(1) (the “Bid Price Rule”). As previously disclosed on a Form 8-K filed with the SEC on October 23, 2023, on October 18, 2023, Staff notified the Company that it had determined to delist the Company as it did not comply with the requirements for continued listing on the Exchange. As previously disclosed in the Current Report on Form 8-K filed with the SEC on November 28, 2023, the Company appealed Nasdaq’s determination in accordance with the procedures set forth in the Nasdaq Listing Rules and requested a hearing (the “Hearing Request”) before the Nasdaq Hearings Panel (the “Panel”). As previously disclosed on a Form 8-K filed with the SEC on November 28, 2023, on November 21, 2023, Staff issued an additional delist determination letter after the Company failed to file its Form 10-Q for the period ended September 30, 2023 (the “Delinquent Report”), as required by Listing Rule 5250(c)(1) (the “Periodic Filing Rule”). On November 28, 2023, the Company filed its Delinquent Report and, thus, regained compliance with the Periodic Filing Rule. As previously disclosed on a Form 8-K filed with the SEC on December 12, 2023, on December 6, 2023, Staff issued an additional delist determination letter as the Company’s no longer complied with the $50,000,000 minimum market value of listed securities requirement set forth in Listing Rule 5450(b)(2)(A) (the “MVLS Rule”), which served as an additional and separate basis for delisting.

A hearing before the Panel was conducted on January 4, 2024. The Panel conditionally granted the Company’s request to transfer its shares from The Nasdaq Global Market to The Nasdaq Capital Market, effective at the open of trading on January 18, 2024 and the Company’s request for an exception to the Exchange’s listing rules until April 15, 2024, to demonstrate compliance, subject to the satisfaction of the following conditions (the “Panel Decision”):

| 1. | On or before January 23, 2024, the Company shall file a Form S-1 for a public offering of up to $13.5 million contemplated in its presentation to the Panel; | |

| 2. | On or before January 19, 2024, the Company shall file all necessary documentation required to transfer its listing from The Nasdaq Global Market to The Nasdaq Capital Market; |

| 3 |

| 3. | On or before January 31, 2024, the Company will complete the deconsolidation of its Japanese subsidiary A.L.I. Technologies Inc. (“A.L.I. Technologies”); | |

| 4. | On or before March 28, 2024, the Company will implement a reverse stock split in a range of 1-for-10 to 1-for-100 with a target per share price of $7.00 per share; | |

| 5. | On or before April 15, 2024, the Company shall demonstrate compliance with all applicable continued listing requirements for The Nasdaq Capital Market under Rule 5550. |

The Panel Decision indicates that the Company may request that the Nasdaq Listing and Hearing Review Council (the “Council”) review the Panel Decision, in which case a written request for review would need to be received within 15 days from the date of the Panel Decision. The Council may also on its own motion determine to review the Panel Decision.

The Panel Decision has no immediate effect on the listing of the Company’s common stock on the Nasdaq Global Market. The Company plans to fulfil each of the conditions as stated in the Panel Decision. To this end, the Company filed a Registration Statement on Form S-1 which this prospectus is a part on January 23, 2024 and completed the filing of all necessary documentation required to transfer its listing from The Nasdaq Global Market to The Nasdaq Capital Market. In addition, in satisfaction of the A.L.I. Technologies deconsolidation condition of the Panel Decision and as previously disclosed in a Form 8-K filed by the Company with the SEC on January 16, 2024, the Tokyo District Court entered an order on January 10, 2024, (the “January 10 Order”) confirming that bankruptcy proceedings are commenced against the A.L.I. Technologies, that A.L.I. Technologies is found to be insolvent and other administrative matters relating to the A.L.I. Technologies bankruptcy filing. Finally, on November 20, 2023, our stockholders voted to approve an amendment of our Fourth Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”), to effectuate a reverse stock split of our common stock at a ratio of no less than 1-for-10 and no more than 1-for-100, with such ratio to be determined at the sole discretion of our board of directors. No assurance can be given, however, as to the definitive date on which the remaining condition set forth in the Panel Decision will be achieved.

Submission of Matters to a Vote of Security Holders

On November 20, 2023, the Company held its 2023 virtual special meeting of stockholders to vote on the following matters:

Stockholders voted to approve the amendment of the Company’s Fourth Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”), to effectuate a reverse stock split of the Company’s outstanding shares of our common stock, at a ratio of no less than 1-for-10 and no more than 1-for-100, with such ratio to be determined at the sole discretion of the Board (the “Reverse Stock Split”).

Stockholders voted to approve, for purposes of complying with NASDAQ Listing Rule 5635(b), the issuance of the shares of the Company’s common stock pursuant to its purchase agreement with Lind Global representing more than 20% of our common stock outstanding, which would result in a “change of control” of the Company under applicable Nasdaq listing rules.

Stockholders voted to approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of more than 20% of the Company’s issued and outstanding common stock pursuant to its purchase agreement with Lind Global.

Manned Air Vehicle Development Letter of Intent

Effective as of December 19, 2023 (the “Effective Date”), the Company entered into a letter of intent (the “Letter of Intent”) with Helicopter Technology Company (“Helicopter Technology”) regarding the design, development, manufacturing, sales, and marketing (collectively, the “Project”) of the MAV (the “MAV”). Under the Letter of Intent, the Company and Helicopter Technology will form an entity (the “Operating Company”) that will be owned 70% by the Company and 30% by Helicopter Technology. The Operating Company agreed to enter into an agreement with Helicopter Technology to design, build, assemble, and test the MAV planned to meet the FAA Powered Ultra-Light Category (the “Development Services Agreement”). In addition, according to the Development Services Agreement, Helicopter Technology will determine and obtain all required regulatory approvals for the MAV, providing all the necessary labor, materials, and customized equipment. The Letter of Intent contemplates that the Company and Helicopter Technology will enter into a manufacturing supply agreement on terms to be mutually agreed on. In addition, the parties will work together to secure the funding required to start production of the MAV. Helicopter Technology already has a working capital arrangement with its bank. The Operating Company will pay Helicopter Technology its costs plus 15% of such amount to provide the services it provides pursuant to the Development Services Agreement in addition to equity compensation in the Company no less favorable than comparable compensation to the Company’s executive management.

| 4 |

The Operating Company will enter into a marketing and support agreement with the Company to provide certain engineering oversight, accounting, marketing, sales, advertising, development of a dealer distribution network, online marketplace, and other distribution channels, and financial management, budgeting, accounting, legal, and other administrative services as may be required by the Operating Company. The Operating Company will pay the Company its costs plus 15% of such amount to provide these services. Payments will be subject to the available cash flow of the Operating Company. In addition, the Company has agreed to provide working capital to the Operating Company of up to a maximum of $1,700,000 for its operations over the first 12 months.

Pursuant to the Letter of Intent, the parties intend to use their best efforts to negotiate and enter into an operating agreement for the Operating Company (the “Operating Agreement”) within 45 days of executing the Letter of Intent. The Letter of Intent also contains additional customary conditions for entering the Operating Agreement.

Summary of our business

Mission

With the mission of “Transforming society from the sky down,” we aim to realize an “Air Mobility Society” in which cars, specialized crafts and drones can fly freely. To this end, we are redesigning our single-seat optionally Manned Air Vehicle (“MAV”). We aim to align this vehicle with the stringent requirements of the Federal Aviation Administration’s (“FAA”) Powered Ultra-Light Air Vehicle Category, setting a new standard for safe low-altitude manned flight.

To achieve this goal, we have established AERWIN Development Company LLC, a California subsidiary with offices in Los Angeles, California, and entered into the Letter of Intent with Helicopter Technology discussed above. Helicopter Technology is a designer, developer, and manufacturer of over 20 FAA-approved helicopters and turbine systems with over 20,000 square feet of facilities located five miles from the Company’s Los Angeles office. Its primary focus is helicopter rotor blades with capabilities that include tool design and fabrication, structural design and assembly, and fatigue testing. They are an FAA-approved repair station, certified ISO 9001:2015 + AS9100D, ISO 9001:2015 + AS9110C, hold various EU approvals, and have U.S. Department of Defense (“DOD”) clearance.

The specifications for our MAV has a target price of $200,000 and is designed to be used for sightseeing, sports, agriculture, surveillance, field delivery and numerous military applications. Training time for flying the MAV is expected to last three to five days, with a payload of up to 250 pounds to carry a single-seat occupant, cargo, or weaponry. The MAV is expected to be designed to be manually or entirely remotely controlled with an innovative and proprietary three-rotor configuration to reduce sound and increase stability at a cruise speed of up to 40 miles per hour at a height ranging from 20 to 50 feet.

The timeline for the planned development and launch of our redesigned MAV is as follows:

| ● | End of 2024 – Schematic design and detailed specifications; | |

| ● | End of 2025 – Prototype parts design, fabrication, and systems finalization; | |

| ● | End of 2026 – Commencement of assembly, test planning, then testing, and DOD review; and | |

| ● | End of 2027 – Begin sales of the MAV. |

Our Chief Executive Officer, Kiran Sidhu, will lead the MAV development initiative. He plans to lead a dedicated U.S.-based team working with and within Helicopter Technology to design, build, and commercialize the MAV within the Federal Aviation Regulation Part 103 requirements for ultralight aircraft current.

Data from the U.S. Bureau of Labor Statistics and Indeed.com reveal that the Los Angeles metropolitan area is home to the highest number of aerospace engineers in the U.S., with over 4,000 aerospace engineers. The region potentially employs over 50,000 professionals in the aerospace and defense sector. Prominent aerospace entities like Jet Propulsion Laboratory in Pasadena, SpaceX in Hawthorne, and NASA Armstrong Flight Research Center in Palmdale are nearby, and major aerospace corporations, including Boeing, Lockheed Martin, and Raytheon, have a local presence.

Discontinued Operations

On December 27, 2023, we discontinued the operations of A.L.I. Technologies Inc., a Japanese corporation (“A.L.I.”) which is our wholly-owned indirect subsidiary, as part of our operations, moved to Los Angeles, California, and continued the development of a line of FAA-compliant manned and unmanned crafts for low-altitude flight. Among the reasons for discontinuing the business of A.L.I., was the desire to develop an MAV that would comply with the Federal Aviation Regulation Part 103 requirements for ultralight aircraft and the difficulties that we believed the XTURISMO limited edition hoverbike being developed by A.L.I. would encounter. Following the discontinuation, on December 27, 2023, A.L.I. filed a voluntary bankruptcy petition with the Tokyo District Court, Civil Division 20, “Tokutei Kanzai Kakari” [Special Trusteeship Section], Case ID: No. 8234 of 2023 (Fu). A bankruptcy trustee was appointed on January 10, 2024, and proceedings have commenced.

ALI’s discontinued operations include the manned air mobility business, including the further development of the XTURISMO limited edition hoverbike, the air mobility platform COSMOS (Centralized Operating System for Managing Open Sky), the computing power-sharing business, drone photography business and drone and artificial intelligence research and development business.

Significant Market Opportunities

In today’s increasingly populated and interconnected world, traditional modes of urban transportation continue to contribute to congestion and pollution, and they are primarily confined to land-based infrastructure. Mobility for the future requires a revolutionary solution.

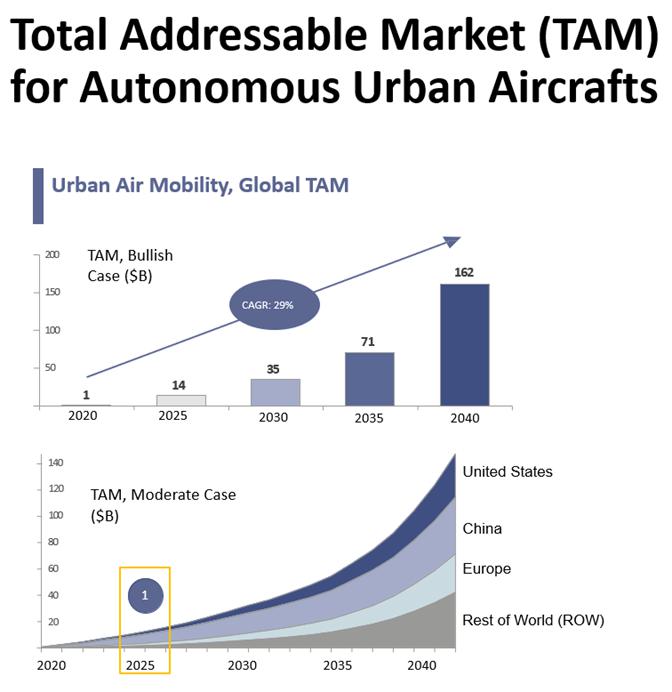

The Total Addressable Market (TAM) for Autonomous Urban aircraft is expected to increase at a cumulative annual growth rate of 29% from 2020 to 2040, reaching $162 billion.1

1 See UBS report/Japan Ministry of Economy, Trade and Industry.

| 5 |

| 6 |

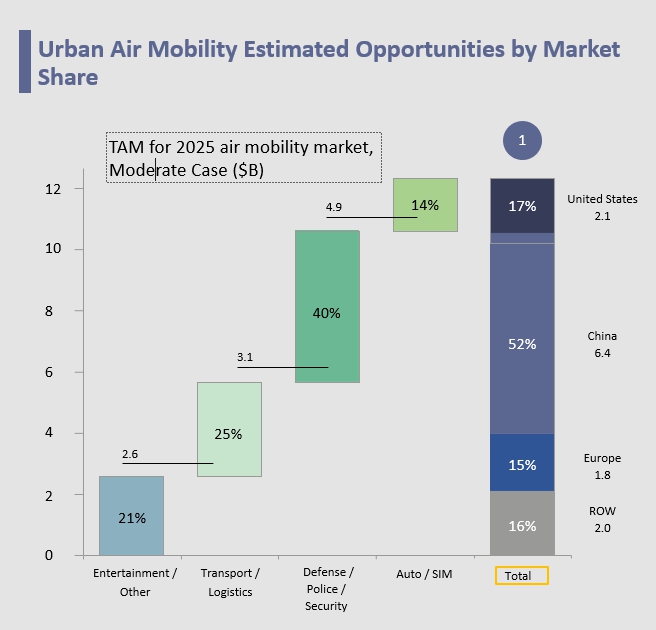

Estimated urban air mobility opportunities by market share are as follows:

See: Urban Air Mobility eVTOL/Urban Air Mobility TAM Update: A Slow Take-Off, But Sky’s the Limit, Morgan Stanley May 6, 2021 .

Our Proprietary Technologies

To provide a highly differentiated solution in the development of the MAV, we are developing new technologies, plan to license existing technologies and use commercially available technologies through a Development Services Agreement that we plan to enter into with Helicopter Technology pursuant to the Letter of Intent.

Intellectual Property

In connection with our redesign of the MAV, we are evaluating the utility of the proprietary systems, technologies and other intellectual property developed or owned by A.L.I. given that we elected to discontinue all of its operations, shift development, production and potentially initial sales efforts to the United States. Our success depends in part on our ability to protect our technology and intellectual property we may develop or license as part of our efforts to develop the MAV. We expect to rely on a combination of patents, patent applications, trade secrets, know-how, copyrights, trademarks, intellectual property licenses and other contractual rights to establish and protect proprietary rights in technology we utilize in connection with the development and ultimate sale of the MAV. In addition, we plan to enter into confidentiality and non-disclosure agreements with our employees and business partners. The agreements we plan to enter into with our employees will provide that all software, inventions, developments, works of authorship and trade secrets created by them during the course of their employment are our property or that of the Operating Company.

| 7 |

Government Regulation

Our business is subject to regulation by various federal, state, local and foreign governmental agencies, including agencies responsible for monitoring and enforcing employment and labor laws, workplace safety, environmental laws, consumer protection laws, anti-bribery laws, import/export controls, federal securities laws and tax laws and regulations. In certain jurisdictions, these regulatory requirements may be more stringent than those in the United States. Noncompliance with applicable regulations or requirements could subject us to investigations, sanctions, mandatory recalls, enforcement actions, disgorgement of profits, fines, damages, civil and criminal penalties or injunctions. For additional information on the governmental regulations affecting our business, please see “Description of Business – Government Regulation” on page 45 of this prospectus.

Summary of Lind Global Financing

On April 12, 2023, we entered into the Purchase Agreement with Lind Global pursuant to which we agreed to issue to Lind Global up to three secured convertible promissory notes (the “Convertible Notes” and each a “Convertible Note”) in the aggregate principal amount of $6,000,000 for a purchase price of an aggregate of $5,000,000 and up to 5,601,613 warrants (the “Warrants” and each a “Warrant”) to purchase 5,601,613 shares of the Company’s common stock (the “Transaction”). On August 25, 2023 (the “Amendment Date”), we entered into an Amendment to Senior Convertible Promissory Note First Closing Note and an Amendment to the Senior Convertible Promissory Note Second Closing Note with Lind Global (collectively, the “Note Amendments”) which amended the Conversion Price (as defined below) to include a floor price of $0.18176 (the “Floor Price”).

The closings of the Transaction (the “Closings and each a “Closing”) will occur in tranches (each a “Tranche”): the Closing of the first Tranche (the “First Closing”) occurred on April 12, 2023 and consisted of the issuance and sale to Lind Global of a Convertible Note at a purchase price of $2,100,000 with a principal amount of $2,520,000 (the “First Closing Note”) and the issuance to Lind Global of 2,352,678 Warrants to acquire 2,352,678 shares of common stock and the Closing of the second Tranche (the “Second Closing”) occurred on May 23, 2023 and consisted of the issuance and sale to Lind Global of a Convertible Note at a purchase price of $1,400,000 with a principal amount of $1,680,000 (the “Second Closing Note”) and the issuance to Lind Global of 1,568,542 Warrants to acquire 1,568,542 shares of common stock.(The Convertible Notes issued in the First Closing and the Second Closing are hereinafter referred to as the “Closing Notes”.) So long as no Event of Default has occurred under the Convertible Note sold at the First Closing, and the Convertible Note issued at the Second Closing, the Closing of the third Tranche (the “Third Closing), will consist of the issuance and sale to Lind Global of a Convertible Note with a purchase price of $1,500,000 with a principal amount of $1,800,000, and the issuance to Lind Global of 1,680,484 Warrants to acquire 1,680,484 shares of common stock. and will occur upon the effectiveness of the Registration Statement, as such term is defined below. The Third Closing is subject to certain conditions precedent as set forth in the Purchase Agreement. Pursuant to the Purchase Agreement, at each Closing, the Company agreed to pay Lind Global a commitment fee in an amount equal to 2.5% of the funding amount being funded by Lind Global at the applicable Closing.

The Convertible Note issued in the First Closing has a maturity date of April 12, 2025, the Convertible Note issued in the Second Closing has a maturity date of May 23, 2025 and the Convertible Note to be issued in Third Closing will have a maturity date of 2 years from the date of issuance (the “Maturity Date”).

Each Convertible Note has a conversion price equal to the lesser of: (i) US$0.90 (“Fixed Price”); or (ii) 90% of the lowest single volume weighted average price during the 20 Trading Days prior to conversion of each Convertible Note (the “Conversion Price”), provided that in no event shall the Conversion Price be less than $0.18176 (the “Floor Price”), and in the event that the calculation as set forth above would result in a Conversion Price less than the Floor Price, the “Conversion Price” shall be the Floor Price.

In addition to inclusion of a Floor Price, the Floor Note Amendments also provide that at the option of Selling Securityholder, if in connection with a conversion under the Closing Notes, as amended, the Conversion Price is deemed to be the Floor Price, then in addition to issuing the Conversion Shares (as defined in the Closing Notes) at the Floor Price, we agreed to pay to Selling Securityholder a cash amount equal to (i) the number of shares of common stock that would be issued to Selling Securityholder upon a conversion determined by dividing the dollar amount to be converted being paid in shares of common stock by ninety percent (90%) of the lowest single VWAP during the twenty (20) Trading Days prior to the applicable date of conversion (notwithstanding the Floor Price) less (ii) the number of Conversion Shares issued to Selling Securityholder in connection with the conversion; and (iii) multiplying the result thereof by the VWAP on the Conversion Date.

| 8 |

The Convertible Note will not bear interest other than in the event that if certain payments under the Convertible Note as set forth therein are not timely made, the Convertible Note will bear interest at the rate of 2% per month (prorated for partial months) until paid in full. The Company will have the right to prepay the Convertible Note under the terms set forth therein.

The Warrants were issued or will be issued to Lind Global without payment of any cash consideration. Each Warrant will have an exercise period of 60 months from the date of issuance. The Exercise price of each First Closing Warrant is $0.8926 per share and the exercise price of each Second Closing Warrant is $0.7316 per share, subject to adjustments as set forth in the Warrant. The exercise price for each Warrant issued in the Third Closing will be an amount equal to 100% of the 10-day VWAP prior to such closing.

In the event that there is no effective registration statement registering the shares underlying the Warrants or upon the occurrence of a Fundamental Transaction as defined in the Purchase Agreement, then the Warrants may be exercised by means of a “cashless exercise” at the holder’s option, such that the holder may use the appreciated value of the Warrants (the difference between the market price of the underlying shares of common stock and the exercise price of the underlying warrants) to exercise the warrants without the payment of any cash.

In accordance with our obligations under the Purchase Agreement, we filed a registration statement on Form S-1 on May 12, 2023 (the “May 2023 Registration Statement”) with the SEC to register under the Securities Act the resale by Lind Global of up to 11,222,357 shares of common stock issuable by us upon partial conversion of the Convertible Notes and exercise of the Warrants issued by us in connection with the Purchase Agreement. We plan to withdraw the May 2023 Registration Statement as permitted pursuant to the SPA Amendment No. 2 discussed below.

The Purchase Agreement contains customary registration rights, representations, warranties, conditions and indemnification obligations by each party, including our agreement to refrain from engaging in certain “Prohibited Transactions” as defined in the Purchase Agreement, to hold a special meeting of shareholders for the purpose of obtaining shareholder approval of the Transactions, certain events giving rise to a default under the Convertible Notes, obligations to use the proceeds from certain future financings to repay a portion of the principal amount of the Convertible Notes, our pledge to Lind Global of the ownership interests in our subsidiaries, a grant by us and our subsidiaries of a security interest in all of their respective assets and rights as collateral for the obligations due under the Convertible Notes, and a guaranty by our subsidiaries of our obligations under the Convertible Notes.

The A.L.I. Bankruptcy constitutes an event of default pursuant to the Closing Notes in the aggregate principal amount of $4,200,000. Consequently, Lind Global may at any time, at its option, (1) demand payment of an amount equal to 120% of the outstanding principal amount of the Closing Notes and (2) exercise all other rights and remedies available to it under the Closing Notes and other agreements entered into among the Company and Lind in connection with the issuance of the Closing Notes (collectively, the “Transaction Documents”); provided, however, that (x) upon the occurrence of the event of default described above, Lind Global, in its sole and absolute discretion (without the obligation to provide notice of such event of default), may: (a) from time-to-time demand that all or a portion of the outstanding principal amount of the Closing Notes be converted into shares of the Company’s common stock at the lower of (i) the then-current Conversion Price (that price being $0.18176 per share (the “Floor Price”)) and (ii) eighty-percent (80%) of the average of the three (3) lowest daily volume weighted average prices (“VWAPs”) during the 20 trading days prior to the delivery by Lind Global of the applicable notice of conversion or (b) exercise or otherwise enforce any one or more of Lind Global’s rights, powers, privileges, remedies and interests under the Closing Notes, the Transaction Documents or applicable law.

The Closing Notes also provide that at the option of Lind Global, if in connection with a conversion under the Closing Notes, the Conversion Price is deemed to be the Floor Price, then in addition to issuing the Conversion Shares (as defined in the Closing Notes) at the Floor Price, the Company will also pay to Lind Global a cash amount equal to (i) the number of shares of common stock that would be issued to Lind Global upon a conversion determined by dividing the dollar amount to be converted being paid in shares of common stock by ninety percent (90%) of the lowest single VWAP during the twenty (20) trading days prior to the applicable date of conversion (notwithstanding the Floor Price) less (ii) the number of shares of the Company’s common stock issued to Lind Global in connection with the conversion; and (iii) multiplying the result thereof by the VWAP on the date of conversion.

| 9 |

On January 23, 2024, the Company and Lind Global entered into an Amendment No. 2 to Senior Convertible Promissory Note First Closing Note and an Amendment No. 2 to the Senior Convertible Promissory Note Second Closing Note (collectively, the “January Note Amendments”) which amended the Closing Notes to, subject to the conditions discussed below, (i) reduce the aggregate principal amount of the Closing Notes from $2,520,000 to $2,100,000, (ii) require the Company to repay an aggregate of $1,750,000 of the principal amount of the Closing Notes no later than the closing date of a public offering of the Company’s common stock where it receives gross proceeds of at least $13,500,000 (the “Public Offering”) and (iii) requires Lind Global to convert no less than an aggregate of $1,750,000 of the Closing Notes no later than 11 months after the closing of the Public Offering, provided that at the time of such conversion Lind Global receives shares of common stock that may be disposed of without restrictive legend at their issuance pursuant to an effective registration statement under the Securities Act of 1933, as amended (the “Securities Act”) or pursuant to an available exemption from or in a transaction not subject to the registration requirements of the Securities Act (the “Mandatory Conversion Amount”).

In addition, on January 23, 2024, the Company and Lind Global entered into Amendment No. 2 to Securities Purchase Agreement (the “SPA Amendment No. 2”) to, subject to the conditions discussed below, (i) eliminate the obligation of the Company and Lind Global to complete the Third Closing, (ii) delete the clause obligating the Company to register the shares of common stock issuable upon conversion of the Closing Notes and exercise of the Warrants (collectively, the “Closing Securities”) or pay Lind Global any delay payments as a result of the Company’s failure to register the Closing Securities, (iii) eliminate certain restrictions on the Company’s right to issue equity and debt in future transactions and (iv) eliminate Lind Global’s right to participate in future offerings of the Company’s securities, other than its rights to participate in this offering.

The January Note Amendments and the SPA Amendment are subject to the Company completing this offering and making the Mandatory Prepayment as discussed above.

Summary Risk Factors

Our business is subject to numerous risks and uncertainties, including those described in the “Risk Factors” section beginning on page 12 and elsewhere in this prospectus. These risks represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business. Below is a summary of material risks, uncertainties and other factors that could have a material effect on the Company and its operations:

Risks Related to the Lind Global Financing

| ● | It is not possible to predict the actual number of shares of common stock, if any, we will issue upon conversion of the Convertible Notes or sell upon exercise of the Warrants by Lind Global, or the actual gross proceeds resulting from exercise of those warrants; |

| ● | Investors who buy shares of common stock from Lind Global at different times will likely pay different prices; and |

| ● | We may use proceeds from issuance of the Convertible Notes sales of shares of our common stock upon exercise of the Warrants in ways with which you may not agree or in ways which may not yield a significant return. |

| 10 |

Risks Related to our Business

| ● | We have incurred, and in the future may continue to incur, net losses; |

| ● | We are a holding company and will depend upon our subsidiary Aerwin Development CA LLC for our cash flows; |

| ● | We will need additional capital, and we cannot be sure that additional financing will be available; |

| ● | Our business performance may be adversely affected if the growth of the Air Mobility Vehicle industry slows down; |

| ● | Our future growth depends on the demand for, and customers’ willingness to adopt, our planned Manned Air Vehicle; |

| ● | We may be unable to make product deliveries as we have not completed the design of our planned MAV and due to limited production capacity; |

| ● | We may not be able to engage customers successfully and to obtain meaningful orders in the future. |

| ● | We may become subject to product liability claims or warranty claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims; |

| ● | If we fail to successfully develop and commercialize new products, services and technologies that are well received by customers, our operating results may be materially and adversely affected; |

| ● | The execution of our business plans requires a significant amount of capital. In addition, our future capital needs will require us to sell additional equity or debt securities that may dilute the equity interests of our shareholders or introduce covenants that may restrict our operations or our ability to pay dividends; |

| ● | The failure to attract and retain additional qualified personnel could prevent us from executing our business strategy; |

| ● | We and our subsidiaries may need to defend ourselves against claims of intellectual property infringement, which may be time-consuming and costly; |

| ● | Our or our subsidiaries’ intellectual property rights may not protect us effectively; |

| ● | Failure to comply with laws and regulations could harm our business; |

| ● | We are exposed to fluctuations in currency exchange rates; |

| ● | Nasdaq may delist the Company’s securities from trading on its exchange, which could limit investors’ ability to make transactions in our securities and subject the Company to additional trading restrictions; |

| ● | The market price of our common stock may be volatile, and you could lose all or part of your investment; and |

| ● | As an “emerging growth company” under the JOBS Act, we are permitted to rely on exemptions from certain disclosure requirements. |

In addition, our management has concluded that its historical recurring losses from operations and negative cash flows from operations as well as its dependence on securing private equity and other financings raise substantial doubt about its ability to continue as a going concern and the auditor of AERWINS, Inc. has included an explanatory paragraph relating to its ability to continue as a going concern in its audit report for the fiscal years ended December 31, 2022 and December 31, 2021 and our management has concluded that our operating losses and accumulated deficit as well as our dependence on raising additional funds raise substantial doubt about our ability to continue as a going concern as disclosed in Note 2 to our financial statements for the period ended June 30, 2023.

Corporate Information

We are a Delaware corporation based in Los Angeles, California and were originally incorporated in Delaware on February 12, 2021 under the name “Pono Capital Corp” as a special purpose acquisition company, formed to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. Our principal executive offices are located at The Walnut Building, 691 Mill St., Suite 240, Los Angeles, CA 90021. Our telephone number is (702) 527-1270. Our website address is www.aerwins.us. The information contained on, or that can be accessed through, our website is not part of this prospectus or the registration statement of which it forms a part. We have included our website address in this prospectus solely as an inactive textual reference.

| 11 |

THE OFFERING

| Securities being offered: | 137,614,679 shares based on the sale of our common stock at an assumed public offering price of $ 0.109 per share of common stock, which is the last reported sale price of our common stock on The Nasdaq Capital Market on January 22, 2024. | |

| Common Stock Outstanding Before the Offering: | 62,688,215 shares. | |

| Common Stock Outstanding After the Offering: | 200,302,894 shares, assuming no exercise of the over-allotment option. | |

| Use of Proceeds: | We currently intend to use the net proceeds to us from this offering for general corporate purposes, including working capital. See “Use of Proceeds” beginning on page 43. | |

| Assumed Offering Price: | $0.109 per share, based upon the last reported sale price of our common stock on The Nasdaq Capital Market on January 22, 2024. | |

| Over-allotment Option: | The underwriter has a 45-day option to purchase up to an additional 20,642,202 shares of common stock (15% of the shares of common stock sold in this offering). | |

| Transfer Agent: | Continental Stock Transfer & Trust Company. | |

| Risk Factors: | You should read the “Risk Factors” section of this prospectus and the other information in this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

RISK FACTORS

An investment in our securities carries a significant degree of risk. You should carefully consider the following risks, as well as the other information contained in this prospectus, including our historical financial statements and related notes included elsewhere in this prospectus, before you decide to purchase our securities. Any one of these risks and uncertainties has the potential to cause material adverse effects on our business, prospects, financial condition and operating results which could cause actual results to differ materially from any forward-looking statements expressed by us and a significant decrease in the value of our common stock shares and warrants. Refer to “Cautionary Statement Regarding Forward-Looking Statements.”

We may not be successful in preventing the material adverse effects that any of the following risks and uncertainties may cause. These potential risks and uncertainties may not be a complete list of the risks and uncertainties facing us. There may be additional risks and uncertainties that we are presently unaware of, or presently consider immaterial, that may become material in the future and have a material adverse effect on us. You could lose all or a significant portion of your investment due to any of these risks and uncertainties.

Risks Relating to Our Business and Industry

AERWINS, Inc. has incurred net losses in the past and may do so in the future, and in the future, the Company may also incur, net losses.

For the nine months ended September 30, 2023 and 2022, we had net losses from continuing operations of $23,087,172 and $11,299,066, respectively, and had net operating cash outflows of $7,790,283 and $12,093,061, respectively. For the years ended December 31, 2022 and 2021, Pono had net income of $2,732,973 and $4,585,547, respectively, and we had net operating cash outflows of $1,233,766 and $459,012, respectively. AERWINS, Inc. has incurred net losses in the past. For the years ended December 31, 2022 and 2021, AERWINS, Inc. had net losses of $14,479,819 and $14,555,670, respectively, and had net operating cash outflows of $16,865,274 and $9,876,472, respectively. We expect our costs to increase in future periods as we continue to expand our business and operations. We also expect to incur substantial costs and expenses as a result of being a public company. We cannot assure you that we will be able to generate net profits or positive operating cash flows in the future. Our ability to achieve profitability depends in large part on, among other factors, our ability to increase orders and sales of our planned Manned Air Vehicle. If we are unable to generate adequate revenues or effectively manage our expenses, we may continue to incur significant losses in the future and may not be able to achieve or subsequently maintain profitability.

| 12 |

We are a holding company and depend upon our subsidiary AERWINS Development CA LLC for our cash flows.

We are a holding company. Following the discontinuance of ALI’s business, all of our operations are conducted, by our operating subsidiary, Aerwin Development CA LLC, a California limited liability company. Furthermore, we don’t expect to launch sales until the end of 2027. Consequently, our cash flows and our ability to meet our obligations depend upon the cash flows of our operating subsidiary and the payment of funds by this operating subsidiary to us in the form of dividends, distributions or otherwise. The ability of our subsidiary to make any payments to us depends on their earnings, the terms of their indebtedness, including the terms of any credit facilities and legal restrictions. Any failure to receive dividends or distributions from our subsidiary when needed could have a material adverse effect on our business, results of operations or financial condition.

We will need additional capital, and we cannot be sure that additional financing will be available.

As of and for the nine month period ended September 30, 2023, we incurred net loss from continuing operations of $22,233,949 and retained earnings deficit of $69,560,075 and as of and for the year ended December 31, 2022, AERWINS has incurred operating losses of $13,435,045 and retained earnings deficit of $46,451,520. Our ability to continue as a going concern is dependent on us obtaining adequate capital to fund operating losses until we become profitable. Our ability to obtain financing will depend, among other things, on our development efforts, business plans, operating performance and condition of the capital markets at the time we seek financing. We cannot assure you that additional financing will be available to us on favorable terms when required, or at all. If we raise additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences, or privileges senior to the rights of our common stock, and the existing stockholders may experience dilution.

A new health epidemic could significantly disrupt our operations and adversely affect our results of operations.

Our business could be significantly affected by public health epidemics that may hit the United States and/or other countries where we may sell our products, such as the outbreak of coronavirus, avian influenza, severe acute respiratory syndrome, or SARS, Zika virus, Ebola virus or other disease. For example, the severity of the recent COVID-19 pandemic resulted in lock-downs, travel restrictions and quarantines imposed by governments across the world and materially affected general commercial activities on a global scale.

A COVID-19 outbreak may result in potential customers failing to place orders for our planned MAV or make payments on amounts owed to us in a timely manner or at all, which may materially and adversely impact our business and result of operations. Lingering effects of the COVID-19 pandemic has caused, and is expected to cause in the near future, an economic downturn in many countries. Such general economic slowdown may reduce the demand for our products.

Our business performance may be adversely affected if the growth of the Air Mobility Vehicle industry slows down.

In the manned air mobility business, we have acquired various technological expertise and relationships with various technology partners. We recognize that this trend will continue in the future. However, if the growth of the market slows down due to laws and regulations, economic trends, or changes in social awareness that restrict business in the industries in which we are involved, and if our business does not expand accordingly, our business performance may be affected.

Our future growth depends on the demand for, and customers’ willingness to adopt, our planned Manned Air Vehicle.

We operate in the new and evolving Manned Air Vehicle (“MAVs”) industry. Our business and operating results depend in large part on the acceptance of and demand for our MAVs. The success of these products are and will be subject to risks, including with respect to:

| ● | the extent of market reception and adoption of MAVs as transportation and logistics solutions; |

| ● | our navigating a new and evolving regulatory environment; |

| ● | our timely fulfillment of product orders; |

| ● | our ability to produce safe, high-quality and cost-effective MAVs on an ongoing basis; |

| ● | the performance of our MAVs relative to customer expectations and customers’ interest in and demand for our MAVs; and |

| ● | our building a well-recognized and respected brand. |

| 13 |

Our failure to manage the risks described above may discourage current or potential customers from purchasing our MAVs, and there may be downward price pressure on our MAVs. If the market for MAVs does not develop as we expect or develops more slowly than we expect, our business, prospects, financial condition and operating results will be materially and adversely affected.

We may be unable to make product deliveries as we have not completed the design of our planned MAV and due to limited production capacity.

Commercial production of our manned MAVs requires that we complete the design of our planned MAV and timely and adequate supply of various types of raw materials and components, as well as mass production capacity and efficient manufacturing and assembly. We have no experience in high-volume manufacturing of our MAVs. We cannot assure you that we will be able to complete the design of the MAV as we expect and to commence production on an efficient and cost-effective basis , or to procure sufficient raw materials and components to meet our future production requirements. We expect to rely on Helicopter Technology to produce our MAV’s. While we expect to obtain components from multiple sources whenever possible, disruption in the supply of components could temporarily disrupt commercial production of our MAVs. We may experience operational difficulties with Helicopter Technology or other contract manufacturers we may utilize in the future, including reductions in the availability of production capacity, failure to comply with product specifications, insufficient quality control, failure to meet production deadlines, increases in manufacturing costs and longer lead time. Any of the foregoing could result in our failure to make timely deliveries to our customers. Such failure would materially and adversely affect our business, results of operations, financial condition and prospects.

We may not be able to engage customers successfully and to obtain meaningful orders in the future.

Our success depends on our ability to generate revenue and operate profitably, which depends in part on our ability to identify customers and convert them into orders for our MAV’s. We do not currently have any revenue or orders from customers. If we are unable to negotiate, finalize and satisfy the conditions of customer orders, or only able to do so on terms that are unfavorable to us, we will not be able to generate any revenue, which would have a material adverse effect on our business, prospects, operating results and financial condition. Further, if our targeted customers do not commit to make meaningful orders, or at all, it could adversely affect our business, prospects and results of operations. Delays in delivery of the MAV, unexpected performance problems or other events could cause us to fail to meet contractual commitments to deliver the MAV, resulting in defects in material or workmanship or unexpected problems in our manufacturing process, which could lead to unanticipated revenue and earnings losses and financial penalties. The occurrence of any of these events could harm our business, prospects, results of operations and financial results.

Our reputation and the trading price of our common stock may be negatively affected by adverse publicity or detrimental conduct against us.

Adverse publicity concerning our failure or perceived failure to comply with legal and regulatory requirements, alleged accounting or financial reporting irregularities, regulatory scrutiny and further regulatory action or litigation could harm our reputation and cause the trading price of our common stock to decline and fluctuate significantly. The negative publicity and the resulting decline of the trading price of our common stock may lead to the filing of shareholder class action lawsuits against us and some of our senior executive officers, and may potentially have further severe impact on the market price of our common stock and divert management’s attention from the day-to-day operations of our company.