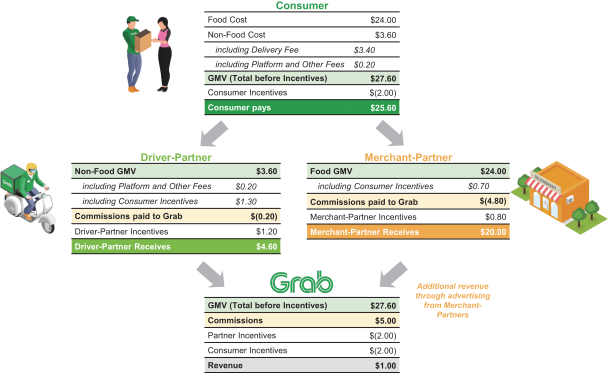

—Our deliveries platform connects our driver- and merchant-partners with consumers to create a local logistics platform, facilitating on-demand and scheduled delivery of a wide variety of daily necessities including in selected markets, ready-to-eat meals and groceries, as well as point-to-point package delivery.

—Our mobility offerings connect our driver-partners with consumers seeking rides across a wide variety of multi-modal mobility options including private cars, taxis, motorcycles in certain countries, and shared mobility options such as carpooling in selected markets. It also includes GrabRentals, which facilitates vehicle rental for our driver-partners to allow driver-partners (with otherwise limited vehicle access) to be able to offer services through our platform.

—Our financial services offerings include digital solutions offered by and with our partners to address the financial needs of driver- and merchant-partners and consumers, including digital payments, lending, receivables factoring, insurance distribution and wealth management in selected markets. The Grab-Singtel consortium, the Digital Banking JV, has been issued a digital full bank license in Singapore. In May 2022, the Digital Banking JV received approval from the MAS to commence restricted business activities, but has yet to receive approval to commence full business activities. The Digital Banking JV together with a consortium of partners was also selected to receive a full digital banking license in Malaysia, subject to meeting all of Bank Negara Malaysia’s regulatory conditions. In Indonesia, Grab has also acquired a 33.6% equity interest in PT Bank Fama International.

Enterprise and New Initiatives

—We have a growing suite of enterprise offerings including GrabAds, our advertising and marketing offerings, and GrabMaps, a B2B mapping and location-based service and software solution. In addition, our partners offer other lifestyle services to consumers through our superapp, including domestic and home services, flights, hotel bookings, subscriptions and more in certain countries.

The key to our platform is the relevance of our offerings to consumers’ everyday lives from the time the consumer wakes up and orders breakfast, commutes to and from the workplace, all the way to the evening when the consumer orders dinner, pays for bills or shops online. We focus on everyday transactions such as transportation, eating, shopping, digital payments and other financial services. At a touch of a button, consumers have access to all offerings on our platform through a single mobile application.

In a region as geographically diverse as Southeast Asia, the offerings on our platform have a wide geographic coverage, operating in capital cities, major commercial and tourist cities, as well as non-tier 1 cities and towns across Southeast Asia. Our application offers localized offerings and personalized experiences based on the consumer’s location.

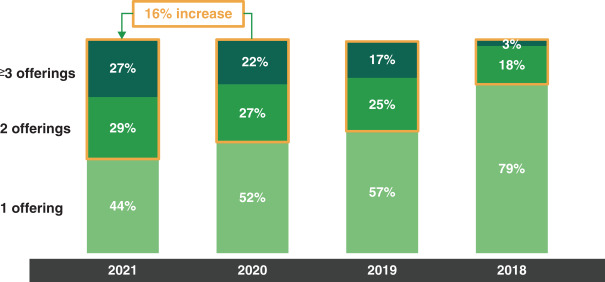

Tight-knit integration across the offerings available through our platform provides, we believe, a consistently high-quality experience for consumers and encourages consumers to use more of the offerings on our platform. We saw the percentage of our MTUs using two or more offerings increase to 56% for the year ended December 31, 2021, from 48% and 43% for the years ended December 31, 2020 and 2019, respectively, and to 59% for the six months ended June 30, 2022.

Our deliveries, mobility, financial services and enterprise and new initiatives represented (i) 40.8%, 49.8%, 4.4% and 5.0%, respectively, of our revenue in the six months ended June 30, 2022, (ii) 24.8%, 66.4%, 3.5% and 5.3%, respectively, of our revenue in the six months ended June 30, 2021, (iii) 21.9%, 67.6%, 4.0% and 6.5%, respectively, of our revenue in the year ended December 31, 2021, (iv) 1.2%, 93.3%, (2.2)% and 7.7%, respectively, of our revenue in the year ended December 31, 2020 and (v) 75.5%, (1.0)%, 27.1% and (1.5)%, respectively, of our revenue in the year ended December 31, 2019.

In addition, deliveries, mobility, financial services and enterprise and new initiatives represented (i) 51.1%, 18.9%, 28.9% and 1.1%, respectively, of our GMV in the six months ended June 30, 2022, (ii) 50.2%, 19.8%, 29.2% and 0.8%, respectively, of our GMV in the six months ended June 30, 2021, (iii) 53.1%, 17.4%, 28.6% and 1.0%, respectively, of our GMV in the year ended December 31 2021, (iv) 43.8%, 25.9%, 30.0% and 0.4%, respectively, of our GMV in the year ended December 31, 2020 and (v) 24.1%, 46.7%, 29.2% and 0.1%, respectively, of our GMV in the year ended December 31, 2019.

Our deliveries platform connects our driver- and merchant-partners with consumers to create a local logistics platform, facilitating on-demand delivery of a wide variety of daily necessities including ready-to-eat meals and groceries, as well as point-to-point package delivery. We enable consumers to conveniently discover and place food and grocery delivery orders, empower our merchant-partners to build an online presence, reach consumers and scale their business and provide our driver-partners with income opportunities outside of our mobility offerings.

Key deliveries offerings on our platform include the following:

| |

• |

|

is a food ordering and delivery booking service, which enables merchant-partners to accept bookings for prepared meals from consumers (with options for on-demand deliveries, scheduled deliveries and pick-up orders) through Grab’s merchant-partner application, and it also enables driver- partners to accept bookings for prepared meal delivery services through Grab’s driver-partner application. |