Table of Contents

As filed with the Securities and Exchange Commission on May 10, 2022

Registration No. 333-261949

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1 TO

FORM F-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Grab Holdings Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Cayman Islands | 7372 | Not Applicable | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3 Media Close, #01-03/06

Singapore 138498

855-739-7864

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

+1 (302) 738-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jonathan B. Stone, Esq. and

Rajeev P. Duggal, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

c/o 6 Battery Road

Suite 23-02

Singapore 049909

+65-6434-2900

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (as amended, the “Securities Act”), check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, as amended, or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, or “SEC”, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

On December 30, 2021, Grab Holdings Limited (the “Registrant”) filed a registration statement on Form F-1 (File No. 333-261949), with the U.S. Securities and Exchange Commission (the “SEC”), which was amended by Amendment No. 1 filed on January 13, 2022 (as amended, “Registration Statement”). The Registration Statement was declared effective by the SEC on January 14, 2022. The Registrant is filing this post-effective amendment no. 1 to the Registration Statement to include information contained in the Registrant’s Annual Report on Form 20-F and to update certain other information contained in the Registration Statement.

No additional securities are being registered by this post-effective amendment. All applicable registration fees were paid at the time of the original filing of the Registration Statement on Form F-1.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission, or “SEC”, is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 10, 2022

PRELIMINARY PROSPECTUS

Grab Holdings Limited

2,387,815,268 CLASS A ORDINARY SHARES,

16,000,000 WARRANTS TO PURCHASE CLASS A ORDINARY SHARES AND

16,000,000 CLASS A ORDINARY SHARES UNDERLYING WARRANTS

This prospectus relates to the offer and resale from time to time by the selling securityholders or their pledgees, donees, transferees, assignees or other successors-in-interest that receive any of the securities being registered hereunder as a gift, distribution, or other non-sale related transfer (collectively, the “Selling Securityholders”) of up to 2,387,815,268 Class A Ordinary Shares, (b) up to 16,000,000 Warrants, and (c) up to 16,000,000 Class A Ordinary Shares issuable upon exercises of the Warrants.

We are registering the offer and resale of these securities to satisfy certain registration rights we have granted. The Selling Securityholders may offer all or part of the securities for resale from time to time through public or private transactions, in amounts, at prices and on terms determined at the time of offering. The Selling Securityholders may offer and sell these securities directly to purchasers, through agents in ordinary brokerage transactions, directly to market makers of our shares or through any other means described in the section entitled “Plan of Distribution” herein. In connection with any sales of securities offered hereunder, the Selling Securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, or the “Securities Act”.

We will not receive any proceeds from the sale of the securities by the Selling Securityholders, except with respect to amounts received by the Company upon exercise of the Warrants to the extent such Warrants are exercised for cash.

Our Class A Ordinary Shares and Warrants are listed on the Nasdaq Stock Market LLC, or “NASDAQ,” under the trading symbols “GRAB” and “GRABW,” respectively. On May 9, 2022, the closing price for our Class A Ordinary Shares on NASDAQ was $2.80 per share. On May 9, 2022, the closing price for our Warrants on NASDAQ was $0.4698 per unit.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are an “emerging growth company” under applicable U.S. federal securities laws and, as such, are eligible for certain reduced public company reporting requirements. See “Prospectus Summary—Emerging Growth Company.”

We are a “foreign private issuer” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company disclosure and reporting requirements. See “Prospectus Summary—Foreign Private Issuer.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 9 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PROSPECTUS DATED , 2022

Table of Contents

| ii | ||||

| iii | ||||

| iii | ||||

| iv | ||||

| 1 | ||||

| 8 | ||||

| 9 | ||||

| 70 | ||||

| 71 | ||||

| 74 | ||||

| 75 | ||||

| 76 | ||||

| 108 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |

144 | |||

| 176 | ||||

| 189 | ||||

| 191 | ||||

| 207 | ||||

| 213 | ||||

| 222 | ||||

| 225 | ||||

| 233 | ||||

| 238 | ||||

| 239 | ||||

| 240 | ||||

| ENFORCEABILITY OF CIVIL LIABILITIES AND AGENT FOR SERVICE OF PROCESS IN THE UNITED STATES |

241 | |||

| 242 | ||||

| F-1 | ||||

| II-1 |

You should rely only on the information contained or incorporated by reference in this prospectus or any supplement. Neither we nor the Selling Securityholders have authorized anyone else to provide you with different information. The securities offered by this prospectus are being offered only in jurisdictions where the offer is permitted. You should not assume that the information in this prospectus or any supplement is accurate as of any date other than the date on the front of each document. Our business, financial condition, results of operations and prospects may have changed since that date.

Except as otherwise set forth in this prospectus, neither we nor the Selling Securityholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

i

Table of Contents

This prospectus is part of a registration statement on Form F-1 filed with the SEC by Grab Holdings Limited. The Selling Securityholders named in this prospectus may, from time to time, sell the securities described in this prospectus in one or more offerings. This prospectus includes important information about us, the securities being offered by the Selling Securityholders and other information you should know before investing. Any prospectus supplement may also add, update, or change information in this prospectus. If there is any inconsistency between the information contained in this prospectus and any prospectus supplement, you should rely on the information contained in that particular prospectus supplement. This prospectus does not contain all of the information provided in the registration statement that we filed with the SEC. You should read this prospectus together with the additional information about us described in the section below entitled “Where You Can Find Additional Information.” You should rely only on information contained in this prospectus, any prospectus supplement and any related free writing prospectus. We have not, and the Selling Securityholders have not, authorized anyone to provide you with information different from that contained in this prospectus, any prospectus supplement and any related free writing prospectus. The information contained in this prospectus is accurate only as of the date on the front cover of the prospectus. You should not assume that the information contained in this prospectus is accurate as of any other date.

The Selling Securityholders may offer and sell the securities directly to purchasers, through agents selected by the Selling Securityholders, to or through underwriters or dealers or through any other means described in “Plan of Distribution.” A prospectus supplement, if required, may describe the terms of the plan of distribution and set forth the names of any agents, underwriters or dealers involved in the sale of securities.

References to “U.S. Dollars” and “$” in this prospectus are to United States dollars, the legal currency of the United States. Discrepancies in any table between totals and sums of the amounts listed are due to rounding. Certain amounts and percentages have been rounded; consequently, certain figures may add up to be more or less than the total amount and certain percentages may add up to be more or less than 100% due to rounding. In particular and without limitation, amounts expressed in millions contained in this prospectus have been rounded to a single decimal place for the convenience of readers. In addition, period on period percentage changes with respect to our IFRS and non-IFRS measures and operating metrics have been calculated using actual figures derived from our internal accounting records and not the rounded numbers contained in this prospectus, and as a result, such percentages may differ from those calculated based on the numbers contained in this prospectus.

Throughout this prospectus, unless otherwise designated, the terms “we”, “us”, “our”, “Grab”, “GHL”, “the Company” and “our company” refer to Grab Holdings Limited and its subsidiaries and consolidated affiliated entities. References to “GHI” refers to Grab Holdings Inc. and its subsidiaries and consolidated affiliated entities.

ii

Table of Contents

FINANCIAL STATEMENT PRESENTATION

Our audited consolidated financial statements as of December 31, 2021 and 2020 and for each of the years in the three-year period ended December 31, 2021 included in this prospectus have been prepared in accordance with IFRS as issued by the International Accounting Standards Board and are reported in U.S. Dollars.

We refer in various places in this prospectus to non-IFRS financial measures, Adjusted EBITDA, Total Segment Adjusted EBITDA and Segment Adjusted EBITDA, which are more fully explained in “Selected Historical Financial Data—Key Non-IFRS Financial Measures and Operating Metrics.” The presentation of non-IFRS information is not meant to be considered in isolation or as a substitute for our audited consolidated financial results prepared in accordance with IFRS.

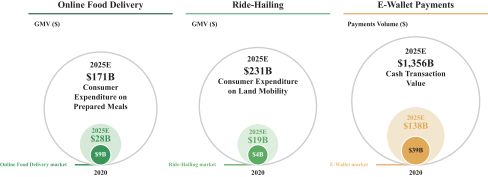

Our industry and market position information that appears in this prospectus is from independent market research carried out by Euromonitor International Limited (“Euromonitor”), which was commissioned by us. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates. Such information is supplemented where necessary with our own internal estimates and information obtained from discussions with our platform users, taking into account publicly available information about other industry participants and our management’s judgment where information is not publicly available. This information appears in “Summary of the Prospectus,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other sections of this prospectus.

Industry reports, publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. In some cases, we do not expressly refer to the sources from which this data is derived. While we have compiled, extracted, and reproduced industry data from these sources, we have not independently verified the data. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

iii

Table of Contents

This prospectus and any prospectus supplement include statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results of operations or financial condition and therefore are, or may be deemed to be, “forward-looking statements.” These forward-looking statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believe,” “estimate,” “anticipate,” “expect,” “seek,” “project,” “intend,” “plan,” “may,” “will” or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies, future market conditions or economic performance and developments in the capital and credit markets, expected future financial performance, the markets in which we operate, the benefits and synergies of the Business Combination, including anticipated cost savings, as well as the possible or assumed future results of operations of the combined company after the recent consummation of the Business Combination. Such forward-looking statements are based on available current market material and management’s expectations, beliefs and forecasts concerning future events impacting us. Factors that may impact such forward-looking statements include:

| • | Developments related to the COVID-19 pandemic, including, among others, with respect to stay-at-home orders, social distancing measures, the success of vaccine rollouts, numbers of COVID-19 cases and the occurrence of new COVID-19 strains; |

| • | The regulatory environment and changes in laws, regulations or policies in the jurisdictions in which we operate; |

| • | Our ability to successfully compete in highly competitive industries and markets; |

| • | Our ability to reduce incentives paid to driver-partners, merchant-partners and consumers; |

| • | Our ability to continue to adjust our offerings to meet market demand, attract users to our platform and grow our ecosystem; |

| • | Political instability in the jurisdictions in which we operate; |

| • | Breaches of laws or regulations in the operation and management of our current and future businesses and assets; |

| • | The overall economic environment and general market and economic conditions in the jurisdictions in which we operate; |

| • | Our ability to execute our strategies, manage growth and maintain our corporate culture as we grow; |

| • | Our anticipated investments in new products and offerings, and the effect of these investments on our results of operations; |

| • | Changes in the need for capital and the availability of financing and capital to fund these needs; |

| • | Anticipated technology trends and developments and our ability to address those trends and developments with our products and offerings; |

| • | The safety, affordability, convenience and breadth of our platform and offerings; |

| • | Man-made or natural disasters, including war, acts of international or domestic terrorism, civil disturbances, occurrences of catastrophic events and acts of God such as floods, earthquakes, wildfires, typhoons and other adverse weather and natural conditions that may directly or indirectly affect our business or assets; |

iv

Table of Contents

| • | The loss of key personnel and the inability to replace such personnel on a timely basis or on acceptable terms; |

| • | Exchange rate fluctuations; |

| • | Changes in interest rates or rates of inflation; |

| • | Legal, regulatory and other proceedings; |

| • | Changes in applicable laws or regulations, or the application thereof on us; |

| • | Our ability to maintain the listing of our securities on NASDAQ; and |

| • | The results of any future financing efforts. |

The forward-looking statements contained in this prospectus are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We will not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. In light of these risks and uncertainties, you should keep in mind that any event described in a forward-looking statement made in this prospectus or elsewhere might not occur.

v

Table of Contents

CONVENTIONS AND FREQUENTLY USED TERMS

In this prospectus, unless the context otherwise requires, the “Company,” “Grab” and references to “we,” “us,” or similar such references should be understood to be references to Grab Holdings Limited and its subsidiaries and consolidated affiliated entities. When this prospectus refers to “Grab” “we,” “us,” or similar such references in the context of discussing Grab’s business or others affairs prior to the consummation of the Business Combination on December 1, 2021, it refers to the business of Grab Holdings Inc. and its subsidiaries and consolidated affiliated entities. Following the date of consummation of the Business Combination, references to “Grab” “we,” “us,” or similar such references should be understood to refer to Grab Holdings Limited and its subsidiaries and consolidated affiliated entities. Given that the Business Combination is accounted for as a reverse acquisition, as described in more detail elsewhere in this prospectus, and the accounting acquirer is Grab Holdings Inc., the post-Business Combination financial statements included in this prospectus show the consolidated balances and transactions of the Company and Grab Holdings Inc.

Certain amounts and percentages that appear in this prospectus may not sum due to rounding.

Unless otherwise stated or unless the context otherwise requires, in this prospectus:

“AI” means artificial intelligence;

“base incentive(s)” means the amount of incentives to driver- and merchant-partners up to the amount of commissions and fees earned by us from those driver- and merchant-partners;

“Business Combination” means the Initial Merger, the Acquisition Merger and the other transactions contemplated by the Business Combination Agreement;

“Business Combination Transactions” means, collectively, the Initial Merger, the Acquisition Merger and each of the other transactions contemplated by the Business Combination Agreement, the Confidential Disclosure Agreement, dated as of February 8, 2021, between AGC and GHI, the PIPE Subscription Agreements, the Amended and Restated Forward Purchase Agreements, the Sponsor Support Agreement, the GHI Shareholder Support Agreements, the Registration Rights Agreement, the Shareholders’ Deed, the Backstop Subscription Agreement, the Sponsor Subscription Agreement, the Assignment, Assumption and Amendment Agreement, the Initial Merger Filing Documents, the Acquisition Merger Filing Documents and any other related agreements, documents or certificates entered into or delivered pursuant thereto. For details about the Business Combination Transactions and the related agreements, see “Certain Relationships and Related Person Transactions”;

“CAGR” means compound annual growth rate;

“Class A Ordinary Shares” refers to Class A ordinary shares of the share capital of our company with a par value of $0.000001 each;

“Class B Ordinary Shares” refers to Class B ordinary shares of the share capital of our company with a par value of $0.000001 each;

“consumer” refers to an end-user who uses services offered through our platform;

“Digital Banking JV” means GXS Bank Pte. Ltd., a private limited company incorporated under the laws of Singapore, which is the joint venture entity with one of our subsidiaries and a subsidiary of Singapore Telecommunications Limited (“Singtel”) as its shareholders and is the entity through which their joint application to the MAS for a digital full bank license in Singapore was made and the entity which successfully made the application to Bank Negara Malaysia for a Malaysia digital bank license;

vi

Table of Contents

“digital lending” means lending through digital channels with no in-person interactions, which includes both corporate SME lending and consumer lending conducted through such channels;

“driver-partner” refers to an independent third-party contractor who provides mobility and/or deliveries services on our platform;

“e-wallet” means a software-based system that allows individuals to perform digital and/or electronic payments to a business or individual for either goods or services. This includes proximity transactions in which the device must interact with the point of sale (“POS”) terminal in some way in order to initiate the payment transaction and remote transactions in which the location of the device to the POS terminal is irrelevant. Both pass-through and staged e-wallets transactions are included. Peer to peer transfer transactions are excluded;

“excess incentive(s)” occurs when the amount of payments made to driver- and merchant-partners exceed the amount of commissions and fees earned by us from those driver- and merchant-partners;

“Exchange Ratio” means the quotient obtained by dividing $13.032888 by $10.00, which is 1.3032888;

“Existing Warrant Agreement” means the warrant agreement, dated September 30, 2020, by and between AGC and Continental;

“GDP” means gross domestic product, which is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources. Current prices of goods and services were used in its calculation;

“GFG” means AA Holdings Inc., an exempted company limited by shares incorporated under the laws of the Cayman Islands and holding company for Grab’s financial services businesses, including its equity interest in the Digital Banking JV;

“GHI” means Grab Holdings Inc., an exempted company limited by shares incorporated under the laws of the Cayman Islands, or as the context requires, Grab Holdings Inc. and its subsidiaries and consolidated affiliated entities;

“GHL” means Grab Holdings Limited (formerly known as J1 Holdings Inc.), an exempted company limited by shares incorporated under the laws of the Cayman Islands, or as the context requires, Grab Holdings Limited and its subsidiaries and consolidated affiliated entities;

“GrabBike” refers to our ride-hailing booking service, which enables driver-partners to accept bookings for private hire motorcycle rides through our driver-partner application;

“GrabCar” refers to our ride-hailing booking service, which enables private hire driver-partners to accept bookings through our driver-partner application, and includes various localized offerings including premium cars (GrabCar Premium), cars equipped to transport persons with mobility needs (GrabAssist), cars equipped with child seats (GrabFamily), large format vehicles or premium economy vehicles (GrabCar Plus) and luxury vans for airport or business travelers (GrabLux);

“GrabExpress” means our package delivery booking service, which enables driver-partners to accept bookings for package delivery services through our driver-partner application; “GrabFood” means our food ordering and delivery booking service, which enables merchant-partners to accept bookings for prepared meals from consumers (with options for on-demand deliveries, scheduled deliveries and pick-up orders) through our merchant-partner application and it also enables driver-partners to accept bookings for prepared meal delivery services through our driver-partner application;

vii

Table of Contents

“GrabForGood Fund” means our proposed endowment fund that aims to introduce and support programs that empower Southeast Asian communities to improve socioeconomic mobility and quality of life;

“GrabHitch” refers to our carpooling booking service, which enables drivers other than our driver-partners, who sign up through our platform, to accept bookings for carpool rides through our platform;

“GrabInvest” refers to investment products offered through our platform, including those based on money market and short-term fixed-income mutual funds, in which users can invest and grow their savings;

“GrabKios” refers to the services offered through our platform in Indonesia, which allow GrabKios agents to act as distributors or resellers of digital goods including mobile airtime credits, bill payment services and e-commerce purchasing services;

“GrabKitchen” means our centralized food preparation facilities, which are used by certain merchant-partners;

“GrabMart” means our goods ordering and delivery booking service, which enables merchant-partners to accept bookings for goods from consumers (with options for on-demand deliveries, scheduled deliveries and pick-up orders) through our merchant-partner application, and it also enables driver-partners to accept bookings for goods delivery services through our driver-partner application;

“GrabMerchant” refers to the platform that we provide which equips merchant-partners with tools to grow their business;

“GrabPay” means our digital payments solution, which allows consumers to make online and offline electronic payments using their mobile wallet and also allows our driver- and merchant-partners to receive digital payments for their services;

“GrabRentals” refers to our offering which facilitates vehicle rental for our driver-partners at competitive rates through our rental fleet or third-party rental services, to allow driver-partners with limited vehicle access to offer services on our platform;

“GrabRewards” means our loyalty platform providing consumers that use services offered through our platform with a large catalog of points redemption options, including offers from both popular merchant-partners and us;

“JustGrab” refers to our ride-hailing booking service, which enables driver-partners to accept bookings for private hire car rides or taxi rides, in both cases with upfront non-metered pricing;

“Key Executives” refers to our CEO and co-founder Anthony Tan, co-founder Tan Hooi Ling and President Maa Ming-Hokng;

“MAS” means the Monetary Authority of Singapore;

“merchant-partner” refers to online and offline merchants, restaurants and food stalls, convenience stores or retail shops or shops that sell products or services on our platform;

“MSMEs” means micro, small and medium sized businesses;

“NASDAQ” means the Nasdaq Stock Market;

“on-demand driver” refers to drivers (regardless of vehicle type) registered with an on-demand service provider, who can be deployed on demand to fulfill a variety of services such as services associated with ride-hailing, food delivery, and logistics;

viii

Table of Contents

“online food delivery” means prepared meals (food and drink) which are ordered online and delivered to the consumer. Only orders made by means of platforms are included and does not include takeaway sales, transported off premise by the consumer;

“online investment” means investments through digital channels with no in-person interactions;

“OVO” refers to PT Visionet Internasional, a subsidiary of PT Bumi Cakrawala Perkasa, one of our subsidiaries, and a digital platform service located in Indonesia that offers payments, customer incentives in the form of loyalty points and financial services;

“PayLater” refers to the buy-now-pay-later products offered through our platform that enables receivables factoring or digital lending service (in certain markets) and allow our driver- and merchant-partners to offer their consumers the option to pay for goods and services either in one bill at the end of the month or such other predetermined period or on an installment basis;

“PDPC” means Personal Data Protection Commission, Singapore’s main authority in matters relating to personal data protection;

“Permitted Entities” of a Key Executive means: (i) any person in respect of which the Key Executive has, directly or indirectly (A) control over the voting of Class B Ordinary Shares held or to be transferred to that person, (B) the ability to direct or cause the direction of the management and policies of that person or any other person having authority referred to in the immediately foregoing, or (C) the operational or practical control of that person, including through the right to appoint, designate, remove or replace the person having the authority referred to in the foregoing; (ii) any trust the beneficiaries of which consist primarily of a Key Executive, his or her family members, and/or any person controlled by a trust, including, with respect to Mr. Tan, Hibiscus Worldwide Ltd.; or (iii) any person controlled by a trust described in the immediately foregoing;

“Permitted Transferee” of a holder of Class B Ordinary Shares means: (i) any Key Executive; (ii) any Key Executive’s Permitted Entities; (iii) the transferee or other recipient in any transfer of any Class B Ordinary Shares by any holder of Class B Ordinary Shares to (A) his or her family members, (B) any other relative or individual approved by the GHL board of directors, (C) any trust or estate planning entity primarily for the benefit of, or the ownership interest of which are controlled by, such holder of Class B Ordinary Shares, his or her family members and/or other trusts or estate planning entities, or any entity controlled by such a trust or estate planning entity, or (D) occurring by operation of law, including in connection with divorce proceedings; (iv) any charitable organization, foundation or similar entity; (v) GrabForGood Fund; (vi) GHL or any of its subsidiaries; and (vii) in connection with a transfer as a result of, or in connection with, the death or incapacity of a Key Executive other than Mr. Tan, any Key Executive’s family members, another holder of Class B Ordinary Shares, or a designee approved by a majority of all members of GHL’s board of directors (and Class B Directors shall form a majority of such majority of all directors); provided that (x) as a condition to the applicable transfer, any Permitted Transferee shall have adhered to the proxy to Mr. Tan; and (y) in case of any transfer of Class B Ordinary Shares pursuant to clauses (ii)-(v) above to a person who later ceases to be a Permitted Transferee, GHL may refuse registration of any subsequent transfer except back to the transferor of such Class B Ordinary Shares;

“PIPE Investors” means the third-party investors who entered into PIPE Subscription Agreements;

“PIPE Investment” means the commitment by the PIPE Investors to subscribe for and purchase, in the aggregate, 326,500,000 Class A Ordinary Shares for $10 per share, or an aggregate purchase price equal to $3.265 billion pursuant to the PIPE Subscription Agreements;

“PIPE Subscription Agreements” means the share subscription agreements, dated April 12, 2021, by and among GHL, AGC and the PIPE Investors pursuant to which the PIPE Investors subscribed for and purchased, in

ix

Table of Contents

the aggregate, 326,500,000 Class A Ordinary Shares for $10 per share, or an aggregate purchase price equal to $3.265 billion;

“prepared meal” means food and drink served through channels such as cafés/bars, full-service restaurants, limited-service restaurants, self-service cafeterias and street stalls/kiosks;

“receivables factoring” means the purchasing from merchants or service providers of account payables to them by consumers to whom they have provided goods or services;

“regional corporate costs” means costs that are not attributed to any of the business segments, including certain regional research and development expenses, general and administrative expenses and marketing expenses. These regional research and development expenses also include mapping and payment technologies and support and development of the internal technology infrastructure. These general and administrative expenses also include certain shared costs such as finance, accounting, tax, human resources, technology and legal costs. Regional corporate costs exclude share-based compensation expenses;

“Registration Rights Agreement” means the registration rights agreement, dated April 12, 2021, by and among AGC, GHL, Sponsor, the Sponsor Related Parties and certain of the former shareholders of GHI that became effective upon completion of the Business Combination pursuant to which, among other things, GHL agreed to undertake certain resale shelf registration obligations in accordance with the Securities Act and Sponsor, the Sponsor Related Parties and the shareholders of GHI party thereto have been granted customary demand and piggyback registration rights;

“ride-hailing” means prearranged and on-demand transportation service for compensation in which drivers and passengers connect via digital applications or platforms;

“SEC” means the U.S. Securities and Exchange Commission;

“Southeast Asia” refers to Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam, unless otherwise noted;

“superapp” means an integrated mobile application of many applications that aims to provide a one-stop marketplace platform with multiple offerings delivered via a single technology platform and third-party integrations;

“Term Loan B Facility” means the $2 billion senior secured term loan B facility under the Credit and Guaranty Agreement, dated as of January 29, 2021 (as amended), by and among GHI, Grab Technology LLC, certain guarantors, certain lenders, JPMorgan Chase Bank, N.A., as administrative agent, and Wilmington Trust (London) Limited, as collateral agent;

“total insurance premium volume” means direct premium volumes of insurance companies. Premiums paid to state social insurers are not included, and life and non-life premium volume are included;

“U.S. Dollars” and “$” means United States dollars, the legal currency of the United States; and

“Warrant” means a warrant to purchase one Class A Ordinary Share at an exercise price of $11.50 per share.

Non-IFRS Financial Measures

Unless otherwise stated or unless the context otherwise requires in this prospectus:

“Adjusted EBITDA” is a non-IFRS financial measure calculated as net loss adjusted to exclude: (i) net interest income (expenses), (ii) other income (expenses), (iii) income tax expenses (credit), (iv) depreciation and

x

Table of Contents

amortization, (v) share-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii) unrealized foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and (xii) share listing and associated expenses; and

“Segment Adjusted EBITDA” is a non-IFRS financial measure, representing the Adjusted EBITDA of each of our four business segments, excluding, in each case, regional corporate costs.

Key Operating Metrics

Unless otherwise stated or unless the context otherwise requires in this prospectus:

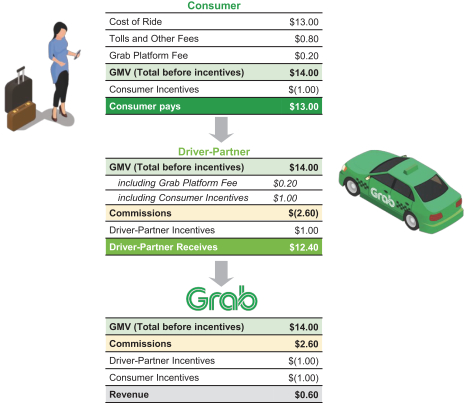

“commission rate” represents the total dollar value paid to Grab in the form of commissions and fees from each transaction, without any adjustments for incentives paid to driver- and merchant-partners or promotions to end-users, as a percentage of GMV, over the period of measurement;

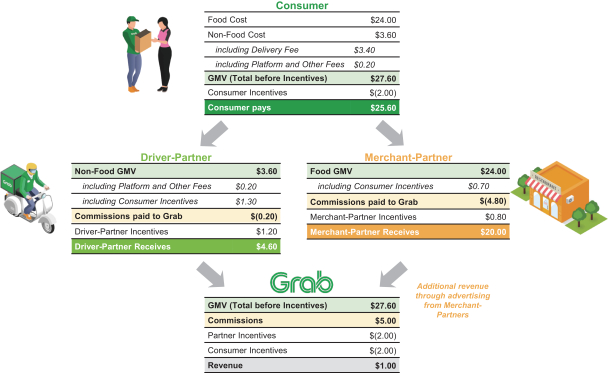

“consumer incentives” represents the dollar value of discounts and promotions offered to consumers, the effect of which is to reduce revenue;

“GMV” means gross merchandise value, an operating metric representing the sum of the total dollar value of transactions from our services, including any applicable taxes, tips, tolls and fees, over the period of measurement;

“MTUs” means monthly transacting users, which is an operating metric defined as the monthly number of unique users who transact via our products, where transact means to have successfully paid for any of our products. MTUs over a quarterly or annual period are calculated based on the average of the MTUs for each month in the relevant period;

“partner incentives” represents the dollar value of incentives granted to driver- and merchant-partners, the effect of which is to reduce revenue. The incentives granted to driver- and merchant-partners include base incentives and excess incentives, with base incentives being the amount of incentives paid to driver- and merchant-partners up to the amount of commissions and fees earned by us from those driver- and merchant-partners, and excess incentives being the amount of payments made to driver- and merchant-partners that exceed the amount of commissions and fees earned by us from those driver- and merchant-partners; and

“TPV” means total payments volume received from consumers, which is an operating metric defined as the value of payments, net of payment reversals, successfully completed through our platform.

xi

Table of Contents

This summary highlights certain information about us, this offering and selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in the securities covered by this prospectus. You should read the following summary together with the more detailed information in this prospectus, any related prospectus supplement and any related free writing prospectus, including the information set forth in the section titled “Risk Factors” in this prospectus, any related prospectus supplement and any related free writing prospectus in their entirety before making an investment decision.

Overview

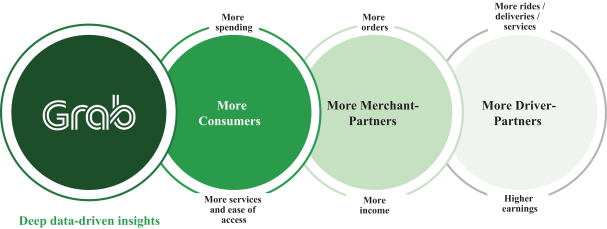

We are Southeast Asia’s leading superapp, operating primarily across the deliveries, mobility and digital financial services sectors in 480 cities across eight countries in the region—Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. We enable millions of people each day to access driver- and merchant-partners to order food or groceries, send packages, hail a ride or taxi, pay for online purchases or access services such as lending, insurance, wealth management and telemedicine. Our platform enables important high frequency hyperlocal consumer services—all through a single “everyday everything” app. Based on Euromonitor’s independent analysis, Grab continued to be the category leader in 2021 by GMV in online food delivery and ride-hailing, and by TPV in the e-wallet segment of financial services in Southeast Asia, despite increased competition. Notably, Euromonitor found that Grab continues to be the leading ride-hailing and food delivery platform in Indonesia in 2021.

Recent Development

COVID-19 Update

The ongoing COVID-19 pandemic has globally resulted in loss of life, business closures, restrictions on travel, and widespread cancellation of social gatherings. Governments in the markets in which we operate continue to implement measures or encourage actions to curb the spread of COVID-19 as cases spike, including stay-at-home and movement control orders, work-from-home arrangements and social distancing measures. The COVID-19 pandemic has had a material adverse impact on certain parts of our business in 2020 and 2021 and may continue to impact our results.

During 2021, the COVID-19 pandemic had different impacts on our business segments. For our deliveries segment, the COVID-19 pandemic drove its GMV and revenue growth as consumer adoption of deliveries offerings increased in light of the stay-at-home and movement control orders, work-from-home arrangements and social distancing measures imposed as a result of the pandemic. On the other hand, the COVID-19 pandemic negatively affected our mobility segment as a result of a decrease in rides booked through our platform. Our financial services segment experienced significant year-on-year pre-Interco TPV growth and revenue growth driven by strong performance in deliveries transactions, although this growth was partially offset by the drop in demand for mobility offerings. Our lending business was also impacted by COVID-19, driven by closures of businesses, a decline in general consumer spending, and compulsory repayment holidays implemented by governments in certain of our markets.

We will continue to strive to mitigate the impact of COVID-19 on our overall business by adapting to changes in consumer demand and preferences. For example, as demand in our mobility segment decreased, we were able to utilize driver-partners providing mobility services to provide deliveries for our deliveries segment. In addition, stay-at-home or movement control orders and other COVID-19 measures may lead to a decrease in the number of active driver-partners, as it did in March and April 2020, with some recovery starting in May

1

Table of Contents

2020. We also saw a decrease in the number of driver-partners in the third quarter of 2021 due to similar COVID-19 measures in response to a new wave of COVID-19, and we preemptively invested in driver incentives to grow the supply of active drivers on our platform in the fourth quarter of 2021.

Significant uncertainty remains over the severity and duration of the COVID-19 pandemic, and as the pandemic continues, we may need to continue to adapt to changing circumstances. There can be no assurance that we will be successful in doing so, including by maintaining and optimizing utilization of the driver-partner base. See “Risk Factors” for more information.

Completion of Business Combination

On December 1, 2021, we completed the Business Combination and the PIPE Financing. On December 2, 2021, our Class A Ordinary Shares and Warrants commenced trading on the NASDAQ, under the symbols “GRAB” and “GRABW,” respectively.

Emerging Growth Company

We qualify as an “emerging growth company” as defined in the JOBS Act, and we will remain an “emerging growth company” until the earliest to occur of (i) the last day of the fiscal year (a) following the fifth anniversary of the closing of the Business Combination, (b) in which we have total annual gross revenue of at least $1.07 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our shares held by non-affiliates exceeds $700 million as of the last business day of our prior second fiscal quarter, we have been subject to Exchange Act reporting requirements for at least 12 calendar months; and filed at least one annual report, and (ii) the date on which we issued more than $1.0 billion in non-convertible debt during the prior three-year period. We intend to take advantage of exemptions from various reporting requirements that are applicable to most other public companies, whether or not they are classified as “emerging growth companies,” including, but not limited to, an exemption from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that our independent registered public accounting firm provide an attestation report on the effectiveness of our internal control over financial reporting and reduced disclosure obligations regarding executive compensation.

In addition, Section 102(b)(1) of the JOBS Act exempts “emerging growth companies” from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements with certain other public companies difficult or impossible because of the potential differences in accounting standards used.

Furthermore, even after we no longer qualify as an “emerging growth company,” as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including, but not limited to, the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on

2

Table of Contents

Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. In addition, we will not be required to file annual reports and financial statements with the SEC as promptly as U.S. domestic companies whose securities are registered under the Exchange Act, and are not required to comply with Regulation FD (Fair Disclosure), which restricts the selective disclosure of material information.

Foreign Private Issuer

We are subject to the information reporting requirements of the Securities Exchange Act of 1934, or “the Exchange Act,” that are applicable to “foreign private issuers,” and under those requirements we file reports with the SEC. As a foreign private issuer, we are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, we are not required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We also have four months after the end of each fiscal year to file our annual reports with the SEC and are not required to file current reports as frequently or promptly as U.S. domestic reporting companies. Furthermore, our officers, directors and principal shareholders are exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we are also not subject to the requirements of Regulation FD promulgated under the Exchange Act. These exemptions and leniencies reduce the frequency and scope of information and protections available to you in comparison to those applicable to shareholders of U.S. domestic reporting companies.

Our Corporate Information

We are a holding limited company incorporated under the laws of the Cayman Islands. Our principal place of business is at 3 Media Close, #01-03/06, Singapore 138498 and our telephone number is 855-739-7864. Our website is https://grab.com/sg/. The information contained in, or accessible through, our website does not constitute a part of this prospectus.

The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers, such as we, that file electronically, with the SEC at www.sec.gov.

Our agent for service of process in the United States is Puglisi & Associates, 850 Library Avenue, Suite 204, Newark, Delaware 19711.

3

Table of Contents

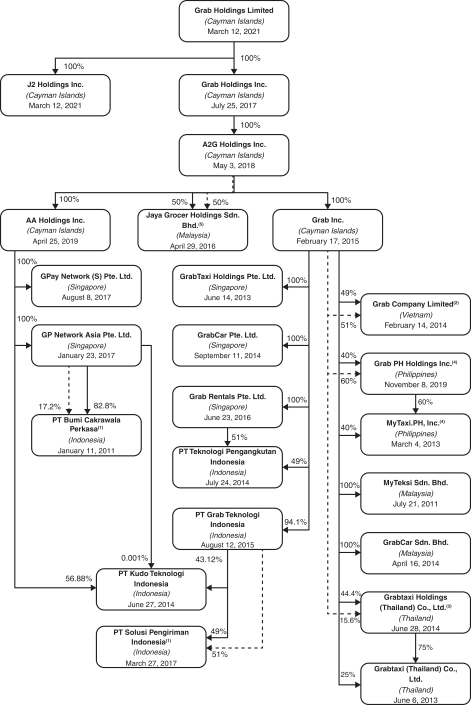

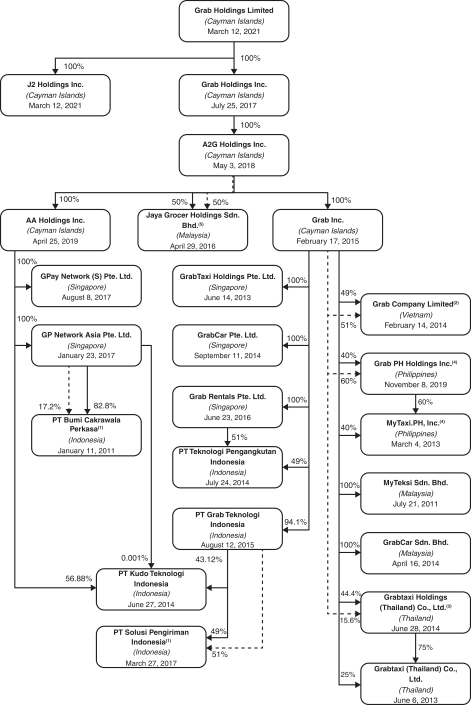

Our Organizational Structure

The following diagram depicts a simplified organizational structure of the Company as of the date hereof.

| Our equity ownership. |

| … | Our direct and/or indirect contractual rights. See footnotes below for information on our contractual rights. |

4

Table of Contents

| (1) | Indonesia: In addition to our ownership of 82.8% of the shares, which, due to a dual-class structure, represent a 38.9% voting interest, of PT Bumi Cakrawala Perkasa (“BCP”) through which we own OVO and conduct our financial services businesses in Indonesia, we have contractual rights to (a) control the appointment of the Chief Executive Officer, and the Chief Financial Officer (including the right to nominate any such officers as directors or as president director), (b) approve the budget and business plan of BCP and its subsidiaries; (c) approve future funding of BCP and its subsidiaries, whether through debt, equity or otherwise, and (d) certain economic rights with respect to the remaining shareholding of BCP. We conduct our point-to-point courier delivery business through PT Solusi Pengiriman Indonesia (“SPI”), in which a 94.12%-owned subsidiary owns 49%. We have entered into contractual arrangements with a third-party Indonesian shareholder, which holds 51% of the shares of SPI, as a result of which we are able to control SPI and consolidate its financial results in our consolidated financial statements in accordance with IFRS. The non-controlling interests of minority shareholders in BCP are accounted for in our consolidated financial statements. |

| (2) | Vietnam: We conduct our deliveries and mobility businesses in Vietnam through Grab Company Limited. In addition to our ownership of 49% of the shares of Grab Company Limited and control exercised through voting thresholds in the company’s charter, we have entered into contractual arrangements with the holder of the balance of the shares of Grab Company Limited, who is a Vietnamese national and senior executive, as a result of which we are able to control Grab Company Limited and consolidate its financial results in our consolidated financial statements in accordance with IFRS. |

| (3) | Thailand: Our deliveries, mobility and financial services businesses are each conducted through a Thai operating entity (including, in the case of mobility and deliveries, Grabtaxi (Thailand) Co., Ltd) established using a tiered shareholding structure, so that each Thai entity (including Grabtaxi Holdings (Thailand) Co., Ltd) is more than 50% owned by a Thai person or entity. This tiered shareholding structure, together with certain rights attendant to the classes of shares we hold and as otherwise set forth in the organizational documents of the relevant entities within our shareholding structure in Thailand, enables us to control these Thai operating entities and consolidate their financial results in our consolidated financial statements in accordance with IFRS. The non-controlling interests of relevant Thai shareholders are accounted for in our consolidated financial statements. |

| (4) | Philippines: Our four wheel-mobility and delivery businesses are each conducted through a Philippine operating entity (including, in the case of our four wheel-mobility business, MyTaxi.PH, Inc.), the shares of which are 40% owned by us, with the balance owned by a Philippine holding company. The shares of the Philippine holding company are owned 40% by us, with the balance 60% of the shares held by a Philippine national who is a director of certain of our Philippine operating entities, including MyTaxi.PH, Inc. Through contractual rights with the Philippine shareholder together with certain other rights, we are able to consolidate the financial results of our Philippine operating entities in our consolidated financial statements in accordance with IFRS. The non-controlling interest of the Philippine shareholder is accounted for in our consolidated financial statements. |

| (5) | Malaysia: In Malaysia, we operate Jaya Grocer, a mass-premium supermarket chain in Malaysia, through Jaya Grocer Holdings Sdn. Bhd. We own 50% of the voting shares in Jaya Grocer outright. The balance of the voting shares are owned by our Malaysian local partner, Green Aurora Sdn Bhd (“Malaysian local partner”), an entity owned by our co-founder, Hooi Ling Tan. Pursuant to a management agreement entered into by us through our wholly owned subsidiary, Jaya Grocer and the Malaysian local partner, to the extent permitted by local law, we generally have the right to decide, among others, on business and financial strategies, including funding, and other strategy matters in relation to the business of Jaya Grocer, in the best interest of Jaya Grocer and in consultation with the Malaysian local partner. Through contractual rights with the Malaysian local partner together with certain other rights, we are able to consolidate the financial results of Jaya Grocer in our consolidated financial statements in accordance with IFRS. |

5

Table of Contents

Summary Risk Factors

An investment in our Class A Ordinary Shares and Warrants involves significant risks. Below is a summary of certain material risks we face, organized under relevant headings. These risks are discussed more fully under “Risk Factors.” You should carefully consider such risks before making an investment decision. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition, results of operations or prospects could be materially and adversely affected by any of these risks.

Risks Relating to Our Business and Industry

| • | Our business is still in a relatively early stage of growth, and if our business or superapp platform do not continue to grow, grow more slowly than we expect, fail to grow as large as we expect or fail to achieve profitability, our business, financial condition, results of operations and prospects could be materially and adversely affected. |

| • | We face intense competition across the segments and markets we serve. |

| • | We have incurred net losses in each year since inception and may not be able to continue to raise sufficient capital or achieve or sustain profitability. |

| • | Our ability to decrease net losses and achieve profitability is dependent on our ability to reduce the amount of partner and consumer incentives we pay relative to the commissions and fees we receive for our services. |

| • | Our business is subject to numerous legal and regulatory risks that could have an adverse impact on our business and prospects. |

| • | Our brand and reputation are among our most important assets and are critical to the success of our business. |

| • | The COVID-19 pandemic has materially impacted our business, is still ongoing, and it or other pandemics or public health threats could adversely affect our business, financial condition, results of operations and prospects. |

| • | If we fail to manage our growth effectively, our business, financial condition, results of operations and prospects could be materially and adversely affected. |

| • | We are subject to various laws with regard to anti-corruption, anti-bribery, anti-money laundering and countering the financing of terrorism and have operations in certain countries known to experience high levels of corruption. Our audit and risk committee led an investigation into potential violations of certain anti-corruption laws related to our operations in one of the countries in which we operate and have voluntarily self-reported the potential violations to the U.S. Department of Justice. There can be no assurance that failure to comply with any such laws would not have a material adverse effect on us. |

| • | If we are required to reclassify drivers as employees or otherwise, or if driver-partners and/or employees unionize, there may be adverse business, financial, tax, legal and other consequences. |

| • | If we are unable to continue to grow our base of platform users, including driver- or merchant-partners and consumers accessing our offerings, our value proposition for each such constituent group could diminish, impacting our results of operations and prospects. |

Risks Relating to Our Corporate Structure and Doing Business in Southeast Asia

| • | In certain jurisdictions, we are subject to restrictions on foreign ownership. |

| • | We are subject to risks associated with operating in the rapidly evolving Southeast Asia, and we are therefore exposed to various risks inherent in operating and investing in the region. |

6

Table of Contents

| • | Our revenue and net income may be materially and adversely affected by any economic slowdown or developments in the social, political, regulatory and economic environments in any regions of Southeast Asia as well as globally. |

| • | Uncertainties with respect to the legal system in certain markets in Southeast Asia could adversely affect us. |

| • | We could face uncertain tax liabilities in various jurisdictions where we operate, and suffer adverse financial consequences as a result. |

Risks Relating to the Company’s Securities

| • | The prices of our Class A Ordinary Shares and Warrants may be volatile. |

| • | Sales of a substantial number of our securities in the public market by our existing securityholders could cause the price of our Class A Ordinary Shares and Warrants to fall. |

| • | Unanticipated losses, write-downs or write-offs, restructuring and impairment or other charges, taxes (direct or indirect), levies or other liabilities may be incurred or required subsequent to, or in connection with, the Business Combination consummated in December 2021, which could have a significant negative effect on our financial condition and results of operations and the price of Class A Ordinary Shares and Warrants, which in turn could cause you to lose some or all of your investment. |

| • | Becoming a public company through a merger rather than an underwritten offering presents risks to unaffiliated investors. We may be required to subsequently take write-downs or write-offs, restructuring and impairment or other charges that could have a significant negative effect on our financial condition, results of operations and the price of our Securities, which could cause our shareholders to lose some or all of their investment. |

| • | We may issue additional securities without shareholder approval in certain circumstances, which would dilute existing ownership interests and may depress the market price of our shares. |

7

Table of Contents

The summary below describes the principal terms of the offering. The “Description of Share Capital” section of this prospectus contains a more detailed description of the Company’s Class A Ordinary Shares and Warrants.

| Securities being registered for resale by the Selling Securityholders named in the prospectus |

(i) 2,387,815,268 Class A Ordinary Shares; (ii) 16,000,000 Class A Ordinary Shares issuable upon the exercise of the Warrants; and (iii) 16,000,000 Warrants. |

| Terms of Warrants |

Each Warrant entitles the holder to purchase one Class A Ordinary Share at a price of $11.50 per share. Our Warrants expire on December 1, 2026 at 5:00 p.m., New York City time. |

| Offering prices |

The securities offered by this prospectus may be offered and sold at prevailing market prices, privately negotiated prices or such other prices as the Selling Securityholders may determine. See “Plan of Distribution.” |

| Ordinary shares issued and outstanding prior to any exercise of Warrants |

3,709,406,012 Class A Ordinary Shares and 130,198,761 Class B Shares as of March 31, 2022. |

| Warrants issued and outstanding |

25,999,981 Warrants as of March 31, 2022. |

| Use of proceeds |

All of the securities offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective accounts. We will not receive any of the proceeds from such sales. |

| Dividend Policy |

We have never declared or paid any cash dividend on our Class A Ordinary Shares. We currently intend to retain any future earnings and do not expect to pay any dividends in the foreseeable future. Any further determination to pay dividends on our ordinary shares would be at the discretion of our board of directors, subject to applicable laws, and would depend on our financial condition, results of operations, capital requirements, general business conditions, and other factors that our board of directors may deem relevant. |

| Market for our Class A Ordinary Shares and Warrants |

Our Class A Ordinary Shares and Warrants are listed on NASDAQ under the trading symbols “GRAB” and “GRABW,” respectively. |

| Risk factors |

Prospective investors should carefully consider the “Risk Factors” for a discussion of certain factors that should be considered before buying the securities offered hereby. |

8

Table of Contents

You should carefully consider the risks described below before making an investment decision. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition or results of operations could be materially and adversely affected by any of these risks. The trading price and value of our Class A Ordinary Shares and Warrants could decline due to any of these risks, and you may lose all or part of your investment. This prospectus and prospectus supplement or related free writing prospectus also contain forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus and any prospectus supplement or related free writing prospectus.

Risks Relating to Our Business and Industry

Our business is still in a relatively early stage of growth, and if our business or superapp platform do not continue to grow, grow more slowly than we expect, fail to grow as large as we expect or fail to achieve profitability, our business, financial condition, results of operations and prospects could be materially and adversely affected.

Although our business has grown rapidly, our businesses in Southeast Asia and in particular our superapp platform are relatively new, and there is no assurance that we will be able to achieve and maintain growth and profitability across all of our business segments. There is also no assurance that market acceptance of our offerings will continue to grow or that new offerings will be accepted. In addition, our business could be impacted by macroeconomic conditions and their effect on discretionary consumer spending, which in turn could impact consumer demand for offerings made available through our platform.

Our management believes that our growth depends on a number of factors, including our ability to:

| • | expand and diversify our deliveries, mobility, financial services and other offerings, which include innovating in new areas such as financial services and often requires us to make long-term investments and absorb losses while we build scale; |

| • | maintain and/or increase the scale of the driver- and merchant-partner base and increase consumer usage of our platform and the synergies within our ecosystem; |

| • | optimize our cost efficiency; |

| • | reduce incentives paid to driver-partners, merchant-partners and consumers; |

| • | enhance and develop our superapp, the tools we provide the driver- and merchant-partners and payments network along with our other technology and infrastructure; |

| • | recruit and retain high quality industry talent; |

| • | expand our business in the countries in which we operate, which requires managing varying infrastructure, regulations, systems and user expectations and implementing our hyperlocal approach to operations; |

| • | expand into business activities where we have limited experience, such as offline businesses, or no experience at all; |

| • | manage price sensitivity and driver- and merchant-partner and consumer preferences by segment and geographic location, particularly as we aim to increase market penetration within our markets; |

| • | maintain and enhance our reputation and brand; |

| • | ensure adequate safety and hygiene standards are established and maintained across our offerings; |

9

Table of Contents

| • | continue to form strategic partnerships, including with leading multinationals and global brands; |

| • | manage our relationships with stakeholders and regulators in each of our markets, as well as the impact of existing and evolving regulations; |

| • | obtain and maintain licenses and regulatory approvals that may be required for our financial services or other offerings; |

| • | compete effectively with our competitors; and |

| • | manage the challenges associated with the COVID-19 pandemic. |

We may not successfully accomplish any of these objectives.

In addition, achieving profitability will require us, for example, to continue to grow and scale our business, manage promotion and incentive spending, improve monetization, improve efficiency in marketing and other spending and increase consumer spending on our platform. Our growth so far has been driven in part by incentives we offer driver-partners, merchant-partners and consumers. As we have achieved greater scale, we have sought and may continue to seek to reduce incentives, which can impact both profitability and growth. For example, in the fourth quarter of 2021 our revenue declined by 44% from the fourth quarter of 2020 as we preemptively invested to grow the supply of active drivers on our platform to support recovery in mobility demand. Consumer incentives for mobility and deliveries also increased in the same quarter as we invested in maintaining and growing our category share and MTU growth. We have made and may continue to make additional investments in driver and consumer incentives in the first half of 2022, and to the extent we continue to make such investments in the future, our revenue could again be adversely impacted.

We cannot assure you that we will be able to continue to grow and manage each of our segments or our superapp platform or achieve or maintain profitability. Our success will depend to a substantial extent on our ability to develop appropriate strategies and plans, including our sales and marketing efforts, and implement such plans effectively. If driver- and merchant-partners and consumers accessing offerings through our platform do not perceive us as beneficial, or choose not to utilize us, then the market for our business may not further develop, may develop slower than we expect, or may not achieve the growth potential or profitability we expect, any of which could materially and adversely affect our business, financial condition, results of operations and prospects.

We face intense competition across the segments and markets we serve.

We face competition in each of our segments and markets. The segments and markets in which we operate are intensely competitive and characterized by shifting user preferences, fragmentation, and introductions of new services and offerings. We compete both for driver- and merchant-partners and for consumers accessing offerings through our platform. Our competitors may operate in single or multiple segments and in a single market or regionally across multiple markets. These competitors may be well-established or new entrants and focused on providing low-cost alternatives or higher quality offerings, or any combination thereof. New competitors may include established players with existing businesses in other segments or markets that expand to compete in our segments or markets. Competitors focused on a limited number of segments or markets may be better able to develop specialized expertise or employ resources in a more targeted manner than we do. Such competitors may also enjoy lower overhead costs by not operating across multiple segments and markets. Our competitors in certain geographic markets may enjoy competitive advantages such as reputational advantages, better brand recognition, longer operating histories, larger marketing budgets, better localized knowledge, and more supportive regulatory regimes and may also offer discounted services, driver- or merchant-partner incentives, consumer incentives, discounts or promotions, innovative products and offerings, or alternative pricing models. From time to time competitive factors have caused, and may continue to cause, us to reduce prices or fees and commissions and increase driver-partner, merchant-partner or consumer incentives and marketing expenses, which has impacted and could continue to impact our revenues and costs. Furthermore, the

10

Table of Contents

rise of nationalism coupled with government policies favoring the creation or growth of local technology companies could favor our competitors and impact our position in our markets. In addition, some of our competitors may consolidate to expand their market position and capabilities. For example, in May 2021 there was a merger between Indonesia-based Gojek, which operates in the ride-hailing and deliveries business, and Tokopedia, an e-commerce platform.

In our segments and markets, the barriers to entry are low and driver- and merchant-partners and consumers may choose alternative platforms or services. Our competitors may adopt certain of our product features, or may adopt innovations that consumers or driver- or merchant-partners value more highly than ours, which could render the offerings on our platform less attractive or reduce our ability to differentiate our offerings. The driver-partners may shift to the platform with the highest earning potential or highest volume of work, and the merchant-partners may shift to the platform that provides the lowest fees and commissions or the highest volume of business or other opportunities to increase profitability. Driver- and merchant-partners and consumers may shift to the platform that otherwise provides them with the best opportunities. Consumers may access driver or merchant goods or services through the lowest-cost or highest-quality provider or platform or a provider or platform that provides better choices or a more convenient technology platform. With respect to our platform, driver- and merchant-partners and consumers may shift to other platforms based on overall user experience and convenience, tools to enhance profitability, integration with mobile and networking applications, quality of mobile applications, and convenience of payment settlement services. In our deliveries segment, we face competition from regional players such as Foodpanda, ShopeeFood and Gojek (primarily in Indonesia) and single market players in Southeast Asia, including Deliveroo in Singapore, Baemin in Vietnam, Line Man Wongnai and Robinhood in Thailand. In addition, many chain merchants have their own online ordering platforms and pizza companies, such as Domino’s and other merchants often own and operate their own delivery fleets. Consumers also have other options through offline channels such as in-restaurant and take-out dining, and buying directly from supermarkets, grocery and convenience stores, which may have their own delivery services. Our platform also competes with last-mile package delivery services including on-demand services such as Gojek and Lalamove, and single market players such as AhaMove in Vietnam. In our mobility segment, we face competition from Gojek in Indonesia, and certain other Southeast Asian countries, licensed taxi operators such as ComfortDelGro in Singapore, bonku, Hello Phuket Service, Bolt in Thailand and traditional ground transportation services, including taxi-hailing. In addition, consumers have other options including public transportation and personal vehicle ownership.

In the Philippines, the Land Transportation Franchising & Regulatory Board (“LTFRB”) recently lifted the moratorium on the acceptance of accreditation applications for transport network corporations (“TNCs”) to promote healthy competition among TNCs. Since such lifting, two other companies have been accredited by the LTFRB as TNCs in the Philippines. There may also be additional competition in this market due to the enactment of Republic Act No. 11659, which removed the foreign ownership restriction on public utilities (including TNCs). The removal of the requirement that TNCs have at least 60% Filipino ownership may result in new foreign competitors entering the Philippines market.