UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-23654

MAINSTAY CBRE GLOBAL

INFRASTRUCTURE MEGATRENDS

TERM FUND

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: May 31

Date of reporting period: November 30, 2023

562826.V3

FORM N-CSR

| Item 1. | Reports to Stockholders. |

please log in to www.computershare.com/investor.

| Not FDIC/NCUA Insured | Not a Deposit | May Lose Value | No Bank Guarantee | Not Insured by Any Government Agency |

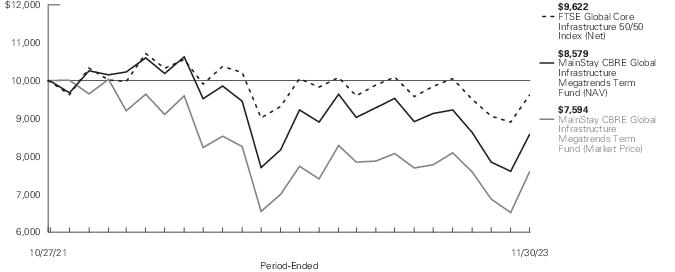

| Average Annual Total Returns for the Period-Ended November 30, 2023* | |||

| Six

Months1 |

One

Year |

Since

Inception 10/27/21 | |

| Net Asset Value (“NAV”) | (3.80)% | (7.03)% | (7.06)% |

| Market Price | (1.31) | (1.88) | (12.32) |

| FTSE Global Core Infrastructure 50/50 Index (Net)2 | 0.45 | (4.27) | (1.83) |

| * | Returns for indices reflect no deductions for fees, expenses or taxes, except for foreign withholding taxes where applicable. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 1. | Not annualized. |

| 2. | The FTSE Global Core Infrastructure 50/50 Index (Net) is the Fund’s primary broad-based securities market index for comparison purposes. The FTSE Global Core Infrastructure 50/50 Index (Net) gives participants an industry-defined interpretation of infrastructure and adjusts the exposure to certain infrastructure sub-sectors. |

| NYSE Symbol | MEGI | Premium/Discount 1 | (13.63)% |

| CUSIP | 56064Q107 | Total Net Assets (millions) | $767.6 |

| Inception Date | 10/27/2021 | Total Managed Assets (millions)2 | $1,047.3 |

| Market Price | $12.74 | Leverage 3 | 26.43% |

| NAV | $14.75 |

| 1. | Premium/Discount is the percentage (%) difference between the market price and the NAV. When the market price exceeds the NAV, the Fund is trading at a premium. When the market price is less than the NAV, the Fund is trading at a discount. |

| 2. | "Managed Assets" is defined as the Fund's total assets, including assets attributable to any form of leverage minus liabilities (other than debt representing leverage and the aggregate liquidation preference of any preferred shares that may be outstanding). |

| 3. | Leverage is based on the use of funds borrowed from banks or other financial institutions, expressed as a percentage of Managed Assets. |

| † | As a percentage of Managed Assets. |

| 6 | MainStay CBRE Global Infrastructure Megatrends Term Fund |

| 1. | See “Fund Performance and Statistics” for more information on Fund returns. |

| 8 | MainStay CBRE Global Infrastructure Megatrends Term Fund |

| 10 | MainStay CBRE Global Infrastructure Megatrends Term Fund |

| Number

of Rights |

Value | ||

| Rights 0.1% | |||

| China 0.1% ( 0.0%‡ of Managed Assets) | |||

| Zhejiang Expressway Co. Ltd. (Asset Modernization) Expires12/5/23 (a) | 4,436,880 | $ 499,847 | |

| Total

Rights (Cost $0) |

499,847 | ||

| Total

Investments (Cost $1,307,811,320) |

135.7% | 1,041,417,630 | |

| Line of Credit Borrowing | (36.1) | (276,800,000) | |

| Other Assets, Less Liabilities | 0.4 | 2,988,804 | |

| Net Assets | 100.0% | $ 767,606,434 | |

| † | Percentages indicated are based on Fund net assets applicable to Common Shares. |

| ^ | Industry and country classifications may be different than those used for compliance monitoring purposes. |

| ‡ | Less than one-tenth of a percent. |

| (a) | Non-income producing security. |

| (b) | Floating rate—Rate shown was the rate in effect as of November 30, 2023. |

| (c) | Security is perpetual and, thus, does not have a predetermined maturity date. The date shown, if applicable, reflects the next call date. |

| Affiliated Investment Companies | Value,

Beginning of Period |

Purchases

at Cost |

Proceeds

from Sales |

Net

Realized Gain/(Loss) on Sales |

Change

in Unrealized Appreciation/ (Depreciation) |

Value,

End of Period |

Dividend

Income |

Other

Distributions |

Shares

End of Period |

| MainStay U.S. Government Liquidity Fund | $ 274 | $ 30,649 | $ (30,923) | $ — | $ — | $ — | $ 16 | $ — | — |

| Description | Quoted

Prices in Active Markets for Identical Assets (Level 1) |

Significant

Other Observable Inputs (Level 2) |

Significant

Unobservable Inputs (Level 3) |

Total | |||

| Asset Valuation Inputs | |||||||

| Investments in Securities (a) | |||||||

| Closed-End Funds | $ 45,551,620 | $ — | $ — | $ 45,551,620 | |||

| Common Stocks | 845,252,126 | — | — | 845,252,126 | |||

| Convertible Preferred Stocks | 48,387,958 | 8,191,750 | — | 56,579,708 | |||

| Corporate Bonds | — | 38,309,540 | — | 38,309,540 | |||

| Preferred Stocks | 55,224,789 | — | — | 55,224,789 | |||

| Rights | 499,847 | — | — | 499,847 | |||

| Total Investments in Securities | $ 994,916,340 | $ 46,501,290 | $ — | $ 1,041,417,630 |

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

| Value | Percent | ||

| Decarbonization | $ 572,836,400 | 74.7% | |

| Asset Modernization | 327,151,630 | 42.6 | |

| Digital Transformation | 141,429,600 | 18.4 | |

| 1,041,417,630 | 135.7 | ||

| Line of Credit Borrowing | (276,800,000) | (36.1) | |

| Other Assets, Less Liabilities | 2,988,804 | 0.4 | |

| Net Assets | $ 767,606,434 | 100.0% |

| † Percentages indicated are based on Fund net assets applicable to Common Shares. |

| ^ Industry and country classifications may be different than those used for compliance monitoring purposes. |

| 12 | MainStay CBRE Global Infrastructure Megatrends Term Fund |

| Assets | |

| Investment

in securities, at value (identified cost $1,307,811,320) |

$1,041,417,630 |

| Cash | 1,355 |

| Receivables: | |

| Dividends and interest | 8,272,560 |

| Investment securities sold | 240,634 |

| Other assets | 58,828 |

| Total assets | 1,049,991,007 |

| Liabilities | |

| Payable for Line of Credit | 276,800,000 |

| Payables: | |

| Investment securities purchased | 1,709,304 |

| Manager (See Note 3) | 830,910 |

| Custodian | 44,688 |

| Professional fees | 32,896 |

| Trustees | 4,613 |

| Accrued expenses | 28,269 |

| Interest expense and fees payable | 2,933,893 |

| Total liabilities | 282,384,573 |

| Net assets applicable to Common shares | $ 767,606,434 |

| Common shares outstanding | 52,047,534 |

| Net asset value per Common share (Net assets applicable to Common shares divided by Common shares outstanding) | $ 14.75 |

| Net Assets Applicable to Common Shares Consist of | |

| Common shares, $0.001 par value per share, unlimited number of shares authorized | $ 52,048 |

| Additional paid-in-capital | 1,040,350,077 |

| 1,040,402,125 | |

| Total distributable earnings (loss) | (272,795,691) |

| Net assets applicable to Common shares | $ 767,606,434 |

| Investment Income (Loss) | |

| Income | |

| Dividends-unaffiliated (net of foreign tax withholding of $2,028,501) | $ 38,573,807 |

| Interest | 1,377,842 |

| Dividends-affiliated | 16,208 |

| Total income | 39,967,857 |

| Expenses | |

| Manager (See Note 3) | 5,337,534 |

| Interest expense and fees | 9,073,794 |

| Shareholder communication | 83,748 |

| Professional fees | 78,940 |

| Custodian | 52,933 |

| Transfer agent | 11,916 |

| Trustees | 7,835 |

| Miscellaneous | 91,297 |

| Total expenses | 14,737,997 |

| Net investment income (loss) | 25,229,860 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

| Unaffiliated investment transactions | (2,846,511) |

| Foreign currency transactions | (109,727) |

| Net realized gain (loss) | (2,956,238) |

| Net change in unrealized appreciation (depreciation) on: | |

| Unaffiliated investments | (54,806,771) |

| Translation of other assets and liabilities in foreign currencies | 51,273 |

| Net change in unrealized appreciation (depreciation) | (54,755,498) |

| Net realized and unrealized gain (loss) | (57,711,736) |

| Net

increase (decrease) in net assets to Common shares resulting from operations |

$(32,481,876) |

| 14 | MainStay CBRE Global Infrastructure Megatrends Term Fund |

for the six months ended November 30, 2023 (Unaudited) and the year ended May 31, 2023

| Six months

ended November 30, 2023 |

Year

ended May 31, 2023 | |

| Increase (Decrease) in Net Assets Applicable to Common Shares | ||

| Operations: | ||

| Net investment income (loss) | $ 25,229,860 | $ 40,546,967 |

| Net realized gain (loss) | (2,956,238) | 27,499,790 |

| Net change in unrealized appreciation (depreciation) | (54,755,498) | (240,271,618) |

| Net increase (decrease) in net assets applicable to Common shares resulting from operations | (32,481,876) | (172,224,861) |

| Distributions to Common shareholders | (37,297,263) | (67,640,975) |

| Net increase (decrease) in net assets applicable to Common shares | (69,779,139) | (239,865,836) |

| Net Assets Applicable to Common Shares | ||

| Beginning of period | 837,385,573 | 1,077,251,409 |

| End of period | $767,606,434 | $ 837,385,573 |

for the six months ended November 30, 2023 (Unaudited)

| Cash Flows From (Used in) Operating Activities: | |

| Net decrease in net assets resulting from operations | $ (32,481,876) |

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash used in operating activities: | |

| Long term investments purchased | (69,580,199) |

| Long term investments sold | 103,167,837 |

| Sale of affiliated investments, net | 273,935 |

| Amortization (accretion) of discount and premium, net | 82,599 |

| Increase in investment securities sold receivable | (240,634) |

| Decrease in dividends and interest receivable | 1,894,631 |

| Increase in other assets | (22,597) |

| Increase in investment securities purchased payable | 1,709,304 |

| Increase in professional fees payable | 9,679 |

| Increase in custodian payable | 18,186 |

| Decrease in shareholder communication payable | (14,040) |

| Decrease in due to Trustees | (1,669) |

| Decrease in due to manager | (170,728) |

| Decrease in due to transfer agent | (4,252) |

| Increase in accrued expenses | 22,189 |

| Decrease in interest expense and fees payable | (17,062) |

| Net realized loss from investments | 2,846,511 |

| Net change in unrealized (appreciation) depreciation on unaffiliated investments | 54,806,771 |

| Net cash from operating activities | 62,298,585 |

| Cash Flows From (Used in) Financing Activities: | |

| Proceeds from line of credit | 73,500,000 |

| Payments on line of credit | (98,500,000) |

| Cash distributions paid, net of change in Common share dividend payable | (37,297,263) |

| Net cash used in financing activities | (62,297,263) |

| Net increase in cash | 1,322 |

| Cash at beginning of period | 33 |

| Cash at end of period | $ 1,355 |

| Supplemental disclosure of cash flow information: | |

| The following tables provide a reconciliation of cash reported within the Statement of Assets and Liabilities that sums to the total of the such amounts shown on the Statement of Cash Flows: | |

| Cash at beginning of period | |

| Cash denominated in foreign currencies | $ 33 |

| Total cash shown in the Statement of Cash Flows | $ 33 |

| Cash at end of period | |

| Cash | $1,355 |

| Total cash shown in the Statement of Cash Flows | $1,355 |

| 16 | MainStay CBRE Global Infrastructure Megatrends Term Fund |

| Six

months ended November 30, 2023* |

Year Ended May 31, | October

27, 2021^ through May 31, | |||

| 2023 | 2022 | ||||

| Net asset value at beginning of period applicable to Common shares | $ 16.09 | $ 20.70 | $ 20.00 | ||

| Net investment income (loss) (a) | 0.48 | 0.78 | 0.58 | ||

| Net realized and unrealized gain (loss) | (1.10) | (4.09) | 0.66 | ||

| Total from investment operations | (0.62) | (3.31) | 1.24 | ||

| Dividends and distributions to Common shareholders | (0.72) | (1.30) | (0.54) | ||

| Dilution effect on net asset value from overallotment issuance | — | — | 0.00‡ | ||

| Net asset value at end of period applicable to Common shares | $ 14.75 | $ 16.09 | $ 20.70 | ||

| Market price at end of period applicable to Common shares | $ 12.74 | $ 13.66 | $ 18.65 | ||

| Total investment return on market price (b) | (1.31)% | (19.84)% | (4.02)% | ||

| Total investment return on net asset value (b) | (3.80)% | (16.09)% | 6.28% | ||

| Ratios

(to average net assets of Common shareholders)/ Supplemental Data: |

|||||

| Net investment income (loss) | 6.43%†† | 4.51% | 4.78%†† | ||

| Net expenses (including interest expense and fees) (c) | 3.76%†† | 3.07%(d) | 1.92%†† (d)(e) | ||

| Interest expense and fees (f) | 2.31%†† | 1.62% | 0.36%†† | ||

| Portfolio Turnover Rate | 7% | 26% | 12% | ||

| Net assets applicable to Common shareholders at end of period (in 000’s) | $ 767,606 | $ 837,386 | $ 1,077,251 |

| * | Unaudited. |

| ^ | Commencement of Operations |

| ‡ | Less than one cent per share. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return on market price is calculated assuming a purchase of a Common share at the market price on the first day and a sale on the last day business day of each month. Dividends and distributions are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return on net asset value reflects the changes in net asset value during each period and assumes the reinvestment of dividends and distributions at net asset value on the last business day of each month. This percentage may be different from the total investment return on market price, due to differences between the market price and the net asset value. For periods less than one year, total investment return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| (d) | Net of Excise tax expense of 0.02% and 0.06% for the year ended May 31, 2023 and the period from October 27, 2021 (commencement of operations) through May 31, 2022. |

| (e) | The expense ratio is higher than the Fund anticipates for a typical fiscal year due to the short fiscal period and the annualization of all expenses, some of which are fixed or non-recurring. |

| (f) | Interest expense and fees relate to the Line of Credit borrowing (See Note 6). |

| 18 | MainStay CBRE Global Infrastructure Megatrends Term Fund |

| 20 | MainStay CBRE Global Infrastructure Megatrends Term Fund |

| 22 | MainStay CBRE Global Infrastructure Megatrends Term Fund |

| Item 2. | Code of Ethics. |

Not applicable.

| Item 3. | Audit Committee Financial Expert. |

Not applicable.

| Item 4. | Principal Accountant Fees and Services. |

Not applicable.

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable.

| Item 6. | Investments. |

The Schedule of Investments is included as part of Item 1 of this report.

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. |

Not applicable.

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies. |

Not applicable.

| Item 9. | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. |

Not applicable.

| Item 10. | Submission of Matters to a Vote of Security Holders. |

Since the Registrant’s last response to this item, there have been no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Trustees.

| Item 11. | Controls and Procedures. |

(a) Based on an evaluation of the Registrant’s Disclosure Controls and Procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) (the “Disclosure

Controls”), as of a date within 90 days prior to the filing date (the “Filing Date”) of this Form N-CSR (the “Report”), the Registrant’s principal executive officer and principal financial officer have concluded that the Disclosure Controls are reasonably designed to ensure that information required to be disclosed by the Registrant in the Report is recorded, processed, summarized and reported by the Filing Date, including ensuring that information required to be disclosed in the Report is accumulated and communicated to the Registrant’s management, including the Registrant’s principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure.

(b) There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d)) under the Investment Company Act of 1940 that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

| Item 12. | Disclosure of Securities Lending Activities for Closed-End Management Investment Companies. |

Not applicable.

| Item 13. | Exhibits. |

| (a) |

| (b) |

| (c) |

| (d) |

| (e) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

MAINSTAY CBRE GLOBAL INFRASTRUCTURE MEGATRENDS TERM FUND

| By: /s/ Kirk C. Lehneis | ||

| Kirk C. Lehneis | ||

| President and Principal Executive Officer | ||

Date: February 2, 2024

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| By: /s/ Kirk C. Lehneis | ||

| Kirk C. Lehneis | ||

| President and Principal Executive Officer | ||

Date: February 2, 2024

| By: /s/ Jack R. Benintende | ||

| Jack R. Benintende | ||

| Treasurer and Principal Financial | ||

| and Accounting Officer | ||

Date: February 2, 2024