Document

Management’s

Discussion and

Analysis

For the Three Months Ended March 31, 2024 and 2023

This Management’s Discussion and Analysis (“MD&A”) has been prepared as of May 13, 2024 and is intended to provide a review of the financial position and results of operations of Centerra Gold Inc. (“Centerra” or the “Company”) for the three months ended March 31, 2024 in comparison with the corresponding period ended March 31, 2023. This discussion should be read in conjunction with the Company’s audited consolidated financial statements and the notes thereto for the year ended December 31, 2023 prepared in accordance with International Financial Reporting Standards (“IFRS”)available at www.centerragold.com and on SEDAR+ (“SEDAR”) at www.sedarplus.ca and EDGAR at www.sec.gov/edgar. In addition, this discussion contains forward-looking information regarding Centerra’s business and operations. Such forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. See “Caution Regarding Forward-Looking Information” below. All dollar amounts are expressed in United States dollars (“USD”), except as otherwise indicated. All references in this document denoted with NG indicate a “specified financial measure” within the meaning of National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure of the Canadian Securities Administrators. None of these measures are standardized financial measures under IFRS and these measures may not be comparable to similar financial measures disclosed by other issuers. See section “Non-GAAP and Other Financial Measures” below for a discussion of the specified financial measures used in this document and a reconciliation to the most directly comparable IFRS measures.

Caution Regarding Forward-Looking Information

This document contains or incorporates by reference “forward-looking statements” and “forward-looking information” as defined under applicable Canadian and U.S. securities legislation. All statements, other than statements of historical fact, which address events, results, outcomes or developments that the Company expects to occur are, or may be deemed to be, forward-looking statements. Such forward-looking information involves risks, uncertainties and other factors that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as “believe”, “beyond”, “continue”, “expect”, “evaluate”, “finalizing”, “forecast”, “goal”, “ongoing”, “plan”, “potential”, “preliminary”, “project”, “restart”, “target” or “update”, or variations of such words and phrases and similar expressions or statements that certain actions, events or results “may”, “could”, “would” or “will” be taken, occur or be achieved or the negative connotation of such terms.

Such statements include, but may not be limited to: statements regarding 2024 guidance, outlook and expectations, including production, cash flow, costs including care and maintenance and reclamation costs, capital expenditures, depreciation, depletion and amortization, taxes and cash flows; exploration potential, budgets, focuses, programs, targets and projected exploration results; gold and copper prices; the timing and amount of future benefits and obligations in connection with the Additional Royal Gold Agreement; a Preliminary Economic Assessment at Mount Milligan and any related evaluation of resources or a life of mine beyond 2035; a feasibility study regarding a potential restart of the Thompson Creek Mine followed by the Company approving a limited notice to proceed; an initial resource estimate at the Goldfield Project including the success of exploration programs or metallurgical testwork; the Company’s strategic plan; increased gold production at Mount Milligan and the success of any metallurgical reviews including the blending of elevated pyrite bearing high-grade gold, low-grade copper ore and any recoveries thereof; the site-wide optimization program at Mount Milligan including any improvements to occupational health and safety, concentrate management, the mine, mill and the plant and any potential costs savings resulting from the same; the expected gold and copper production at the Mount Milligan Mine and gold production at Öksüt Mine in 2024; the new multi-year contract with the existing mining and hauling services provider at the Öksüt Mine; royalty rates and taxes, including withholding taxes related to repatriation of earnings from Türkiye; project development costs at Thompson Creek Mine and the Goldfield Project; the decommissioning of the Kemess South TSF sedimentation pond and associated works; the commercial optimization plan at Langeloth including any improvements to profitability and its future potential; financial hedges; and other statements that express management’s expectations or estimates of future plans and performance, operational, geological or financial results, estimates or amounts not yet determinable and assumptions of management.

The Company cautions that forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Company at the time of making such statements, are inherently subject to significant business, economic, technical, legal, political and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information.

Risk factors that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements in this document include, but are not limited to: (A) strategic, legal, planning and other risks, including: political risks associated with the Company’s operations in Türkiye, the USA and Canada; resource nationalism including the management of external stakeholder expectations; the impact of changes in, or to the more aggressive enforcement of, laws, regulations and government practices, including unjustified civil or criminal action against the Company, its affiliates, or its current or former employees; risks that community activism may result in increased contributory demands or business interruptions; the risks related to outstanding litigation affecting the Company; the impact of any sanctions imposed by Canada, the United States or other jurisdictions against various Russian and Turkish individuals and entities; potential defects of title in the Company’s properties that are not known as of the date hereof; the inability of the Company and its subsidiaries to enforce their legal rights in certain circumstances; risks related to anti-corruption legislation; Centerra not being able to replace mineral reserves; Indigenous claims and consultative issues relating to the Company’s properties which are in proximity to Indigenous communities; and potential risks related to kidnapping or acts of terrorism; (B) risks relating to financial matters, including: sensitivity of the Company’s business to the volatility of gold, copper, molybdenum and other mineral prices; the use of provisionally-priced sales contracts for production at the Mount Milligan Mine; reliance on a few key customers for the gold-copper concentrate at the Mount Milligan Mine; use of commodity derivatives; the imprecision of the Company’s mineral reserves and resources estimates and the assumptions they rely on; the accuracy of the Company’s production and cost estimates; persistent inflationary pressures on key input prices; the impact of restrictive covenants in the Company’s credit facilities which may, among other things, restrict the Company from pursuing certain business activities or making distributions from its subsidiaries; changes to tax regimes; the Company’s ability to obtain future financing; sensitivity to fuel price volatility; the impact of global financial conditions; the impact of currency fluctuations; the effect of market conditions on the Company’s short-term investments; the Company’s ability to make payments, including any payments of principal and interest on the Company’s debt facilities, which depends on the cash flow of its subsidiaries; the ability to obtain adequate insurance coverage; changes to taxation laws in the jurisdictions where the Company operates and (C) unanticipated ground and water conditions; risks related to operational matters and geotechnical issues and the Company’s continued ability to successfully manage such matters, including: the stability of the pit walls at the Company’s operations leading to structural cave-ins, wall failures or rock-slides; the integrity of tailings storage facilities and the management thereof, including as to stability, compliance with laws, regulations, licenses and permits, controlling seepages and storage of water, where applicable; periodic interruptions due to inclement or hazardous weather conditions or operating conditions and other force majeure events; the risk of having sufficient water to continue operations at the Mount Milligan Mine and achieve expected mill throughput; changes to, or delays in the Company’s supply chain and transportation routes, including cessation or disruption in rail and shipping networks, whether caused by decisions of third-party providers or force majeure events (including, but not limited to: labour action, flooding, landslides, seismic activity, wildfires, earthquakes, pandemics, or other global events such as wars); lower than expected ore grades or recovery rates; the success of the Company’s future exploration and development activities, including the financial and political risks inherent in carrying out exploration activities; inherent risks associated with the use of sodium cyanide in the mining operations; the adequacy of the Company’s insurance to mitigate operational and corporate risks; mechanical breakdowns; the occurrence of any labour unrest or disturbance and the ability of the Company to successfully renegotiate collective agreements when required; the risk that Centerra’s workforce and operations may be exposed to widespread epidemic or pandemic; seismic activity, including earthquakes; wildfires; long lead-times required for equipment and supplies given the remote location of some of the Company’s operating properties and disruptions caused by global events; reliance on a limited number of suppliers for certain consumables, equipment and components; the ability of the Company to address physical and transition risks from climate change and sufficiently manage stakeholder expectations on climate-related issues; regulations regarding greenhouse gas emissions and climate change; significant volatility of molybdenum prices resulting in material working capital changes and unfavourable pressure on viability of the molybdenum business; the Company’s ability to accurately predict decommissioning and reclamation costs and the assumptions they rely upon; the Company’s ability to attract and retain qualified personnel; competition for mineral acquisition opportunities; risks associated with the conduct of joint ventures/partnerships; risk of cyber incidents such as cybercrime, malware or ransomware, data breaches, fines and penalties; and, the Company’s ability to manage its projects effectively and to mitigate the potential lack of availability of contractors, budget and timing overruns, and project resources.

Additional risk factors and details with respect to risk factors that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements contained in this document are set out in the Company’s latest 40-F/Annual Information Form and Management’s Discussion and Analysis, each under the heading “Risk Factors”,

which are available on SEDAR+ (www.sedarplus.ca) or on EDGAR (www.sec.gov/edgar). The foregoing should be reviewed in conjunction with the information, risk factors and assumptions found in this document.

The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether written or oral, or whether as a result of new information, future events or otherwise, except as required by applicable law.

TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Supplementary Information: Exploration Update | 34 |

Overview

Centerra’s Business

Centerra is a Canada-based mining company focused on operating, developing, exploring and acquiring gold and copper properties worldwide. Centerra’s principal operations are the Mount Milligan gold-copper mine located in British Columbia, Canada (the “Mount Milligan Mine”), and the Öksüt gold mine located in Türkiye (the “Öksüt Mine”). The Company also owns the Goldfield District Project (the “Goldfield Project”) in Nevada, United States, the Kemess project (the “Kemess Project”) in British Columbia, Canada as well as exploration properties in Canada, the United States of America (“USA”) and Türkiye and has options to acquire exploration joint venture properties in Canada, Türkiye, and the United States. The Company owns and operates a Molybdenum Business Unit (the “Molybdenum BU”), which includes the Langeloth metallurgical processing facility, operating in Pennsylvania, USA (the “Langeloth Facility”), and two primary molybdenum properties: the Thompson Creek Mine in Idaho, USA, and the Endako Mine (75% ownership) in British Columbia, Canada.

As at March 31, 2024, Centerra’s significant subsidiaries were as follows:

| | | | | | | | | | | | | | | | | |

| Entity | Property - Location | | Current Status | | Ownership |

Thompson Creek Metals Company Inc. | Mount Milligan Mine - Canada | | Operation | | 100% |

| Endako Mine - Canada | | Care and maintenance | | 75% |

Öksüt Madencilik A.S. | Öksüt Mine - Türkiye | | Operation | | 100% |

Thompson Creek Mining Co. | Thompson Creek Mine - USA | | Advanced evaluation | | 100% |

Langeloth Metallurgical Company LLC | Langeloth - USA | | Operation | | 100% |

| Gemfield Resources LLC | Goldfield Project - USA | | Advanced exploration | | 100% |

| AuRico Metals Inc. | Kemess Project - Canada | | Care and maintenance | | 100% |

The Company’s common shares are listed on the Toronto Stock Exchange and the New York Stock Exchange and trade under the symbols “CG” and “CGAU”, respectively.

As at May 13, 2024, there are 214,369,984 common shares issued and outstanding, options to acquire 3,042,455 common shares outstanding under the Company’s stock option plan, and 1,019,767 restricted share units redeemable for common shares outstanding under the Company’s restricted share unit plan (redeemable on a 1:1 basis for common shares).

Overview of Consolidated Financial and Operating Highlights

| | | | | | | | | | | | | | |

| ($millions, except as noted) | Three months ended March 31, | |

| 2024 | 2023 | % Change | | | |

| Financial Highlights | | | | | |

| Revenue | 305.8 | | 226.5 | | 35 | % | | | |

| Production costs | 173.8 | | 204.3 | | (15) | % | | | |

| Depreciation, depletion, and amortization ("DDA") | 33.3 | | 18.5 | | 80 | % | | | |

Earnings from mine operations | 98.7 | | 3.7 | | 2568 | % | | | |

Net earnings (loss) | 66.4 | | (73.5) | | 190 | % | | | |

Adjusted net earnings (loss)(1) | 31.3 | | (52.9) | 159 | % | | | |

| Cash provided by (used in) operating activities | 99.4 | | (99.8) | | 200 | % | | | |

Free cash flow (deficit)(1) | 81.2 | | (105.9) | | 177 | % | | | |

| | | | | | |

| Additions to property, plant and equipment (“PP&E”) | 15.3 | | 8.0 | | 91 | % | | | |

Capital expenditures - total(1) | 16.8 | | 4.9 | | 243 | % | | | |

Sustaining capital expenditures(1) | 16.2 | | 4.9 | | 231 | % | | | |

Non-sustaining capital expenditures(1) | 0.6 | | — | | 0 | % | | | |

| | | | | | |

Net earnings (loss) per common share - $/share basic(2) | 0.31 | | (0.34) | | 191 | % | | | |

| | | | | | |

Adjusted net earnings (loss) per common share - $/share basic(1)(2) | 0.15 | | (0.24) | | 163 | % | | | |

| Operating highlights | | | | | | |

| Gold produced (oz) | 111,341 | | 33,215 | | 235 | % | | | |

| | | | | | |

| Gold sold (oz) | 104,313 | | 38,990 | | 168 | % | | | |

| Average market gold price ($/oz) | 2,074 | | 1,890 | | 10 | % | | | |

Average realized gold price ($/oz )(3) | 1,841 | | 1,446 | | 27 | % | | | |

| Copper produced (000s lbs) | 14,331 | | 13,355 | | 7 | % | | | |

| Copper sold (000s lbs) | 15,622 | | 15,332 | | 2 | % | | | |

| Average market copper price ($/lb) | 3.86 | | 4.05 | | (5) | % | | | |

Average realized copper price ($/lb)(3) | 3.12 | | 3.42 | | (9) | % | | | |

| Molybdenum sold (000s lbs) | 2,948 | | 3,347 | | (12) | % | | | |

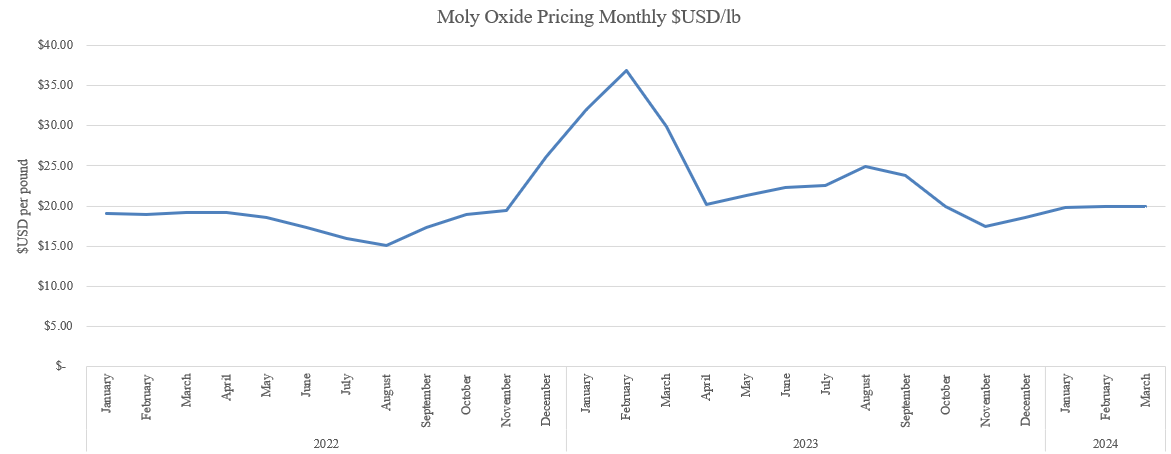

| Average market molybdenum price ($/lb) | 19.93 | | 32.95 | | (40) | % | | | |

Average realized molybdenum price ($/lb) | 20.47 | 29.91 | (32) | % | | | |

| Unit costs | | | | | | |

Gold production costs ($/oz)(4) | 746 | | 1,124 | | (34) | % | | | |

All-in sustaining costs on a by-product basis ($/oz)(1)(4) | 859 | | 1,383 | | (38) | % | | | |

All-in costs on a by-product basis ($/oz)(1)(4) | 991 | | 2,107 | | (53) | % | | | |

Gold - All-in sustaining costs on a co-product basis ($/oz)(1)(4) | 1,013 | | 1,603 | | (37) | % | | | |

Copper production costs ($/lb)(4) | 1.92 | | 2.66 | | (28) | % | | | |

Copper - All-in sustaining costs on a co-product basis – ($/lb)(1)(4) | 2.09 | | 2.67 | | (22) | % | | | |

(1)Non-GAAP financial measure. See discussion under “Non-GAAP and Other Financial Measures”.

(2)As at March 31, 2024, the Company had 214,361,403 common shares issued and outstanding.

(3)This supplementary financial measure within the meaning of National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure (“NI 51-112”). is calculated as a ratio of revenue from the consolidated financial statements and units of metal sold and includes the impact from the Mount Milligan Streaming Agreement, copper hedges and mark-to-market adjustments on metal sold not yet finally settled.

(4)All per unit costs metrics are expressed on a metal sold basis.

Overview of Consolidated Results

First Quarter 2024 compared to First Quarter 2023

Net earnings of $66.4 million was recognized in the first quarter of 2024, compared to a net loss of $73.5 million in the first quarter of 2023. The increase in net earnings was primarily due to:

•higher earnings from mine operations of $98.7 million in the first quarter of 2024 compared to $3.7 million in the first quarter of 2023 primarily due to an increase in gold ounces sold at the Öksüt Mine (63,024 ounces sold in the first quarter of 2024 and no ounces sold in the first quarter of 2023 due to the suspension of gold room operations at the ADR plant). In addition to higher gold ounces sold, higher average gold prices were realized and lower production costs were incurred, partially offset by lower average realized copper prices at the Mount Milligan Mine;

•a reclamation recovery of $25.0 million in the first quarter of 2024 compared to a reclamation expense of $15.6 million in the first quarter of 2023, primarily due to an increase in the risk-free interest rates applied to discount the estimated provision for future reclamation cash outflows at the Thompson Creek Mine, Endako Mine and Kemess Project; and

•other non-operating income of $16.0 million recognized in the first quarter of 2024 compared to other non-operating income of $3.2 million in the first quarter of 2023 primarily attributable to a higher foreign exchange gain related to movement in foreign currency exchange rates, and a higher interest income earned on the Company’s cash balance.

The increase in net earnings was partially offset by a higher income tax expense of $29.9 million in the first quarter of 2024. The increase in income tax expense was primarily due to an increase in current income tax expense resulting from the Öksüt Mine’s resumption of operations in the second quarter of 2023.

Adjusted net earningsNG of $31.3 million were recognized in the first quarter of 2024, compared to an adjusted net lossNG of $52.9 million in the first quarter of 2023. The increase in adjusted net earningsNG was primarily due to higher earnings from mine operations and higher other non-operating income, partially offset by higher income tax expense as outlined above.

The main adjusting items to net earnings in the first quarter of 2024 were:

•$25.0 million of reclamation provision revaluation recovery, as noted above;

•$6.8 million of income tax adjustments mainly resulting from a withholding tax expense on the repatriation of the Öksüt Mine’s earnings;

•$8.9 million of unrealized gain on foreign exchange gains from the effect of movement in foreign currency exchange rates on the reclamation provision at the Endako Mine and Kemess Project and on the income tax payable and royalty payable at the Öksüt Mine;

•$2.5 million of transaction costs related to the Additional Royal Gold Agreement;

•$1.6 million of unrealized loss on marketable securities; and

•$1.5 million of unrealized loss on the financial asset related to the Additional Royal Gold Agreement.$2.5

The adjusting items to net loss in the first quarter of 2023 were:

•$15.6 million of reclamation provision revaluation expense at sites on care and maintenance at the Endako Mine, Kemess Project and the Thompson Creek Mine primarily attributable to a decrease in the risk-free interest rates applied to discount the estimated future reclamation cash flows; and

•$5.0 million of current income tax expense resulting from the introduction by the Turkish government of a one-time income tax levied on taxpayers eligible to claim Investment Incentive Certificate benefits in 2022.

Cash provided by operating activities was $99.4 million in the first quarter of 2024, compared to cash used in operating activities of $99.8 million in the first quarter of 2023. The increase in cash provided by operating activities was primarily due to 63,024 gold ounces sold at the Öksüt Mine in the first quarter of 2024 compared to no ounces sold in the first quarter of 2023, higher average realized gold prices and higher gold ounces sold at the Mount Milligan Mine. Other contributing factors were a favourable working capital change at the Öksüt Mine primarily related to the timing of

vendor payments and a favorable difference in the change in working capital at the Langeloth facility due to the large working capital build-up during the first quarter of 2023 mainly related to the molybdenum price. Partially offsetting the overall increase in cash provided by operating activities were lower average realized copper prices at the Mount Milligan Mine and an unfavorable working capital change at the Mount Milligan Mine primarily related to the timing of vendor payments and timing of cash collection on concentrate shipments.

Free cash flowNG of $81.2 million was recognized in the first quarter of 2024, compared to a free cash flow deficitNG of $105.9 million in the first quarter of 2023. The increase in free cash flowNG was primarily due to higher cash provided by operating activities as outlined above, partially offset by higher property, plant and equipment additions at the Öksüt Mine mainly from higher capitalized stripping costs.

Recent Events and Developments

Transaction with RGLD Gold AG and Royal Gold, Inc.

The Mount Milligan Mine is subject to an arrangement with RGLD Gold AG and Royal Gold, Inc. (together, “Royal Gold”) which entitles Royal Gold to purchase 35% and 18.75% of gold and copper produced, respectively, and requires Royal Gold to pay $435 per ounce of gold and 15% of the spot price per metric tonne of copper delivered (“Mount Milligan Mine Streaming Agreement”).

On February 13, 2024, the Company and its subsidiary, Thompson Creek Metals Company Inc. (“TCM”) entered into an additional agreement with Royal Gold (the “Additional Royal Gold Agreement”), relating to the Mount Milligan Mine. As part of the Additional Royal Gold Agreement, Royal Gold has agreed, among other things, to increase cash payments for the Mount Milligan Mine’s gold and copper delivered to Royal Gold based on the achievement of certain threshold amounts of gold and copper delivered to Royal Gold from shipments occurring after January 1, 2024. The percentage of gold and copper production streamed to Royal Gold remains unchanged at 35% gold and 18.75% copper.

The first threshold date (“First Threshold Date”) will occur when TCM has delivered to Royal Gold either an aggregate of 375,000 ounces of gold or 30,000 tonnes of copper from shipments occurring after January 1, 2024. The second threshold (gold) date (“Second Threshold (Gold) Date”) will occur once TCM has delivered to Royal Gold an aggregate of 665,000 ounces of gold and the second threshold (copper) date (“Second Threshold (Copper) Date”) will occur once TCM has delivered to Royal Gold 60,000 tonnes of copper, in each case from shipments occurring after January 1, 2024.

When considered together with the streaming payments under the Mount Milligan Streaming Agreement, the Additional Royal Gold Agreement will effectively provide aggregate cash payments for gold and copper sold (“Threshold Payments”) under the Mount Milligan Streaming Agreement as follows:

For gold:

•the lower of $850 per ounce and 50% of the gold spot price for the period between the First Threshold Date and the Second Threshold (Gold) Date; and

•the lower of $1,050 per ounce and 66% of the gold spot price from and after the Second Threshold (Gold) Date.

For copper:

•50% of the copper spot price for the period between the First Threshold Date and the Second Threshold (Copper) Date; and

•66% of the copper spot price from and after the Second Threshold Copper Date.

The Additional Royal Gold Agreement also provides the Mount Milligan Mine a right to elect to receive payments (“Pre-Threshold Payments”) from Royal Gold prior to the First Threshold Date but only in a low commodity price environment. If both the gold spot price is at or falls below $1,600 per ounce and the copper spot price is at or falls below $3.50 per pound (“Pre-Threshold Reference Prices”), then the Company may elect to receive:

•For gold, the lesser of: (i) $415 per ounce, for an aggregate cash payment per ounce equal to $850 when including any cash payment under the Mount Milligan Mine Streaming Agreement; and (ii) an amount per

ounce equal to the difference of 66% of the gold spot price, less any cash payment under the Mount Milligan Mine Streaming Agreement; and

•For copper, 35% of the copper spot price, for an aggregate cash payment per metric tonne equal to 50% of the copper spot price when including any cash payment under the Mount Milligan Mine Streaming Agreement.

Any Pre-Threshold Payments previously received would be offset against Threshold Payments if the prices of gold and copper each increase above the Pre-Threshold Reference Prices at the time of any gold or copper delivery under the Mount Milligan Mine Streaming Agreement.

The Company and TCM have agreed to make certain payments and deliveries to Royal Gold as part of the Additional Royal Gold Agreement, including:

•An upfront cash payment of $24.5 million;

•A commitment to deliver an aggregate of 50,000 ounces of gold. The first 33,333 ounces are expected to be delivered in tranches of 11,111 ounces after an equivalent number of gold ounces are received by Centerra in relation to the sale of Centerra’s 50% interest in the Greenstone Gold Mines Partnership. Any remaining ounces are to be delivered to Royal Gold in quarterly installments equally over a 5-year period, with first delivery to occur by June 30, 2030;

•Commencing on January 1 of the fiscal year following the later of delivering to Royal Gold an aggregate of 375,000 ounces of gold and an aggregate of 30,000 tonnes of copper, in each case from shipments occurring after January 1, 2024, but no later than January 1, 2036, payments equal to 5% of the Mount Milligan Mine’s annual free cash flow, which increase by an additional 5% of annual free cash flow (for a total of 10% per year) commencing after the later of the Second Threshold (Gold) Date and Second Threshold (Copper) Date, but no later than January 1, 2036. No payments will be made for a calendar year in which free cash flow is negative, and Centerra is allowed to recoup any negative free cash flow before any such payments to Royal Gold resume. Free cash flow has a meaning specifically defined in the Additional Royal Gold Agreement; and

•An indemnification for Royal Gold and its affiliates for up $25 million of specified incremental taxes that may be assessed as a result of the Additional Royal Gold Agreement for a period of seven years

The value of the Threshold Payments to be received by the Company will depend on the Mount Milligan Mine’s production and the ability to sustain current life of mine (i.e. additional gold and copper payments can be suspended if (and for as long as) the Company discloses proven and probable reserves which, when combined with mining depletion from the transaction date, are lower than those disclosed in the mineral reserves and mineral resources update on February 14, 2024). Potential suspension of Threshold Payments would not impact the Company’s and TCM’s obligation to make the payments and deliveries mentioned above to Royal Gold.

As a result of the Additional Royal Gold Agreement, the mine life has been extended by two years to 2035, subject to normal course permitting, and has declared mineral resources of 510 million tonnes, inclusive of reserves. The Company has initiated a Preliminary Economic Assessment (“PEA”) as part of a strategic process to evaluate the total potential of the Mount Milligan Mine ore deposit with the substantial mineral resources at the Mount Milligan Mine with a goal to unlock additional value beyond its current 2035 mine life. The scope of the PEA is expected to include significant drilling completed to the west of the pit not currently included in the existing resource, plus inclusion of existing resources, most of which are classified in the measured and indicated categories. The PEA also plans to evaluate several capital projects to support a further expansion of the Mount Milligan Mine’s life, including options for a new tailings storage facility (“TSF”) and potential process plant upgrades. The strategic evaluation is expected to continue into next year to be completed in the first half of 2025.

The Company disbursed the cash payment of $24.5 million to Royal Gold in the first quarter of 2024.

Normal Course Issuer Bid

On November 3, 2023, Centerra announced that the Toronto Stock Exchange had accepted the renewal of a normal course issuer bid (“NCIB”) to purchase for cancellation up to an aggregate of 18,293,896 common shares in the capital of the Company during the twelve-month period commencing on November 7, 2023 and ending on November 6, 2024. Any tendered Common Shares taken up and paid for Centerra under the NCIB are cancelled.

During the three months ended March 31, 2024, the Company repurchased 1,783,800 common shares for a total consideration of $10.0 million (C$13.4 million) under its NCIB program.

Exploration and Project Evaluation Update

Exploration activities during the quarter included drilling, surface rock and soil sampling, geological mapping and geophysical surveying at the Company’s various projects and earn-in properties, targeting gold and copper mineralization in Canada, Türkiye, and the United States of America (“USA”). The activities were primarily focused on drilling programs at the Goldfield Project in Nevada, the Mount Milligan Mine in British Columbia, Öksüt Mine in Türkiye and at greenfield projects in the USA and Türkiye. Project evaluation expenditures were primarily focused on the Goldfield Project in Nevada and the Thompson Creek Mine in Idaho.

Mount Milligan Mine

The 2024 planned diamond drilling programs at the Mount Milligan Mine total up to 16,000 meters in 37 drill holes. Resource expansion and brownfield exploration targets include zones on the western margin of the open pit, i.e., Goldmark and North Slope zones, where positive drilling results were returned in previous drilling campaigns.

At the end of the first quarter of 2024, four drill holes totaling 873 meters of diamond drilling were completed. The in-fill drilling in the 66 zone (Phase 7 mining area) focuses on gaps within the current resource model to support mine operations in the area. Brownfield exploration and ongoing in-fill drilling will continue in the second quarter of 2024.

Goldfield Project

Exploration

At the Goldfield project in Nevada, USA, brownfield exploration with diamond and reverse circulation (“RC”) drilling started at the Adams and Jupiter prospects in the first quarter of 2024, completing 26 drillholes for a total of 2,602 meters. Drilling at Jupiter in the first quarter of 2024 comprised 12 reverse circulation drillholes for a total of 1,164 meters. Drilling at Adams in the first quarter of 2024 consisted of 14 diamond drillholes for a total of 1,438 meters. The Jupiter prospect is located 1.5 kilometers northeast of the Gemfield deposit, and the Adams prospect is located 2 kilometers northeast of the Gemfield deposit.

Drilling at the Adams prospect targeted shallow, east-dipping oxide mineralization, hosted in the Kendall Tuff and Diamondfield sediment units. The Adams target zone is a northeast-trending fault system, with dimensions roughly 1.3 by 0.3 kilometers. Historic drilling becomes more and more sparse as the trend continues to the northeast, but mineralization continues throughout the zone.

The drillholes at Adams are designed to follow-up on historic drilling in the area, as well as identify new mineralization along strike of the main ore body. Phase One drilling consists of primarily diamond drilling, as all historic holes were drilled as RC or rotary.

Project Evaluation

As a result of a continuing strategic review of the project, the Company continues to focus exploration activities on oxide and transition material, principally in the Gemfield and nearby deposits with a view to develop a more simplified ore processing method and a flow sheet with lower capital costs and increased returns on the project when compared to the known sulphide ore at the Goldfield project. The Company will take additional time to perform exploration activities in its large, under-explored land position, targeting oxide mineralization that could be incorporated into the initial resource estimate when completed. The primary objective for the Goldfield project in 2024 is to complete initial resource estimate for the property, targeted for the end of year. Ongoing activities include bulk sampling work, large column leach testing, developing preliminary designs for pit and heap leach facilities as well as other technical, permitting, and land work necessary for finalizing the initial resource estimate for the project.

2024 Outlook

The Company’s 2024 outlook, previously disclosed in the MD&A for the year ended December 31, 2023, filed on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar, is unchanged except for the following revisions: the Kemess Project’s reclamation costs have been revised down from the range of $24 to $30 million to the range of $19 to $25 million, and the expected Öksüt Mine taxes have been increased from the range of $46 to $52 million to the range of $54 to $60 million due to higher gold prices. The Company notes that, except for the changes highlighted above, the rest of the outlook remains unchanged. The Company’s full year 2024 outlook, as adjusted, and comparative actual results for the three months ended March 31, 2024 are set out in the following table:

| | | | | | | | | | | | | |

| Units | | Three months ended March 31, 2024 | 2024

Guidance | |

| Production | | | | | |

Total gold production(1) | (Koz) | | 111 | 370 - 410 | |

Mount Milligan Mine(2)(3)(4) | (Koz) | | 48 | 180 - 200 | |

Öksüt Mine | (Koz) | | 63 | 190 - 210 | |

Total copper production(2)(3)(4) | (Mlb) | | 14 | 55 - 65 | |

Unit Costs(5) | | | | | |

Gold production costs(1) | ($/oz) | | 746 | 800 - 900 | |

Mount Milligan Mine(2) | ($/oz) | | 954 | 950 - 1,050 | |

Öksüt Mine | ($/oz) | | 587 | 650 - 750 | |

All-in sustaining costs on a by-product basisNG(1)(3)(4) | ($/oz) | | 860 | 1,075 - 1,175 | |

Mount Milligan Mine(4) | ($/oz) | | 688 | 1,075 - 1,175 | |

Öksüt Mine | ($/oz) | | 823 | 900 - 1,000 | |

All-in costs on a by-product basisNG(1)(3)(4) | ($/oz) | | 990 | 1,225 - 1,325 | |

Mount Milligan Mine(4) | ($/oz) | | 727 | 1,100 - 1,200 | |

Öksüt Mine | ($/oz) | | 826 | 900 - 1,000 | |

All-in sustaining costs on a co-product basisNG(1) | ($/oz) | | 1,013 | 1,125 - 1,225 | |

| Mount Milligan Mine | ($/oz) | | 1,044 | 1,175 - 1,275 | |

Öksüt Mine | ($/oz) | | 826 | 900 - 1,000 | |

Copper production costs | ($/lb) | | 1.92 | 1.75 - 2.25 | |

All-in sustaining costs on a co-product basisNG | ($/lb) | | 2.09 | 2.50 - 3.00 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

1.Consolidated Centerra figures.

2.The Mount Milligan Mine is subject to the Mount Milligan Streaming Agreement. Using an assumed market gold price of $2,000 per ounce and a blended copper price of $3.75 per pound for 2024, Mount Milligan Mine’s average realized gold and copper price for the remaining three quarters of 2024 would be $1,419 per ounce and $2.96 per pound, respectively, compared to average realized prices of $1,552 per ounce and $3.12 per pound in the three-month period ended March 31, 2024, when factoring in the Mount Milligan Streaming Agreement and concentrate refining and treatment costs. The blended copper price of $3.75 per pound factors in copper hedges in place as of March 31, 2024.

3.In 2024, gold and copper production at the Mount Milligan Mine is projected with recoveries estimated at 64% and 78%, respectively.

4.Unit costs include a credit for forecasted copper sales treated as by-product for all-in sustaining costsNG and all-in costsNG. Production for copper and gold reflects estimated metallurgical losses resulting from handling of the concentrate and metal deductions levied by smelters.

5.Units noted as ($/oz) relate to gold ounces and ($/lb) relate to copper pounds.

Production Profile

In the three months ended March 31, 2024, the Company reported consolidated gold and copper production of 111,341 ounces of gold and 14.3 million pounds of copper, respectively. Centerra's full year 2024 consolidated gold production is projected to be between 370,000 and 410,000 ounces with an estimated 180,000 to 200,000 ounces from the Mount Milligan Mine and 190,000 to 210,000 ounces from the Öksüt Mine, which is unchanged from the previous guidance. Copper production is expected to be 55 to 65 million pounds for the full year of 2024 and is unchanged from the previous guidance.

In the three months ended March 31, 2024, the Mount Milligan Mine produced 48,317 ounces of gold and 14.3 million pounds of copper. Mount Milligan’s full year 2024 gold production is expected to be in the range of 180,000 to 200,000 ounces, which is unchanged from the previous guidance. The Company expects gold and copper production for the Mount Milligan Mine to be evenly weighted throughout the year. However, due to the timing of shipments, the second quarter of 2024 is expected to have the lowest quarterly gold and copper sales for the year. Gold and copper sales in the second half of the year are expected to contribute approximately 55% of the annual sales. The Mount Milligan Mine carried out a planned mill shutdown in February 2024 for the SAG mill reline and is planning a second mill maintenance shutdown for approximately 100 hours in the third quarter of the year. The Mount Milligan Mine is continuing to execute on a full asset optimization process, initially launched in the fourth quarter of 2023. This optimization process includes targeted initiatives aimed at enhancing safety, production and cost-efficiency. Notable achievements in the first quarter of 2024 include an improved safety record, increased availability and utilization of the haul fleet and increased mill throughput per operating day. Additionally, as part of the ongoing performance improvement efforts, the site has started to test a number of initiatives that aim to increase the overall copper and gold recoveries. This includes real-time adjustments to the flotation circuit for improved stabilization with regard to optimal grind sizing and throughput, producing a higher volume of gold-copper concentrate with lower copper grades and ore blending initiatives to improve the processing of elevated pyrite bearing high-grade gold, low-grade copper ore.

In the three months ended March 31, 2024, the Öksüt Mine produced 63,024 ounces of gold. For the full year of 2024, the Öksüt Mine is expected to produce between 190,000 to 210,000 ounces of gold, which is unchanged from the previous guidance. The Öksüt Mine plans to process most of the gold inventory accumulated in the previous year in the first half of 2024 which will contribute approximately 60% of the Öksüt Mine annual gold production. Gold sales are expected to closely follow the gold production profile which will be elevated in the first half of 2024.

Cost Profile

In the three months ended March 31, 2024, the Company’s consolidated gold production costs amounted to $746 per ounce. For the full year of 2024, the Company anticipates its consolidated gold production costs to range from $800 to $900 per ounce, which is unchanged from the previous guidance.

In the three months ended March 31, 2024, the Mount Milligan Mine reported gold production costs of $954 per ounce. For the full year of 2024, the Company anticipates the Mount Milligan Mine’s gold production cost guidance to be in the range of $950 to $1,050 per ounce, which is unchanged from the previous guidance. The Company anticipates an increase in gold production costs per ounce in the second and third quarters of 2024. The expected increase in the second quarter is primarily due to the timing of gold and concentrate shipments. In the third quarter, the expected increase in costs is primarily attributed to higher mining costs and increased mill maintenance expenses from the scheduled plant shutdown. Costs are anticipated to normalize in the final quarter of the year, bringing the annual gold production costs per ounce within the guidance range. As part of the ongoing full asset optimization review, the Mount Milligan Mine is actively pursuing opportunities to reduce operational costs. These efforts are focused on several key areas including optimizing costs of major consumables and spare parts by improvement of procurement strategies as well as streamlining logistics to minimize costs related to the transportation of materials and supplies and shipment of gold-copper concentrates.

In the three months ended March 31, 2024, the Öksüt Mine reported gold production costs of $587 per ounce. This low cost per ounce was primarily due to processing the stacked ore inventory that was accumulated at the Öksüt Mine in prior years, resulting in a relatively low weighted average costs per ounce. During the first half of 2024, the Öksüt Mine’s gold production costs per ounce is expected to benefit from processing the heap leach inventory accumulated in the previous year. For the full year of 2024, the Company estimates the Öksüt Mine’s gold production costs in the range

of $650 to $750 per ounce, which is unchanged from the previous guidance. The expected increase in gold production cost per ounce in the second half of 2024 is expected to be primarily attributed to an increase in mining and hauling costs, higher weighted average cost per ounce in the remaining inventory as well as lower gold production and sales, as noted above. The increase in mining and hauling costs reflects adjustments to the mine’s operational agreements and contracts, including the local labour agreements and revisions to the contract with a local mining contractor. In January 2024, the Öksüt Mine renewed its multiyear contract with its local mining contractor, procuring mining and hauling services for the duration of the current life of mine.

Copper production costs at the Mount Milligan Mine were $1.92 per pound in the three months ended March 31, 2024. For the full year of 2024, copper production costs are projected to be in the $1.75 to $2.25 per pound range, which is unchanged from the previous guidance. The Company expects an increase in copper production costs during the second and third quarters of 2024. The expected rise in the second quarter is primarily attributed to the timing of gold and copper sales due to logistical factors associated with gold and copper concentrate shipments, while the cost increase in the third quarter is due to higher mining and mill maintenance costs anticipated in the period. While copper production costs are expected to increase in the second half of 2024, the Company forecasts full year copper production costs to decrease within the guidance range noted above.

Consolidated all-in sustaining costs on a by-product basisNG were $860 per ounce in the three months ended March 31, 2024. For the full year of 2024, the Company expects its consolidated all-in sustaining costs on a by-product basisNG to be in the range of $1,075 to $1,175 per ounce, which is unchanged from the previous guidance. The Company expects an increase in consolidated all-in sustaining costs on a by-product basisNG in the remaining three quarters of 2024, compared to the first quarter of 2024 due to lower gold and copper sales volumes expected in the second quarter at the Mount Milligan Mine followed by a gradual increase in gold production costs per ounce at the Öksüt Mine and higher sustaining capital expendituresNG at the Mount Milligan Mine planned for the remainder of the year.

At the Mount Milligan Mine, all-in sustaining costs on a by-product basisNG were $688 per ounce in the three months ended March 31, 2024. For the full year of 2024, all-in sustaining costs on a by-product basisNG are expected to range from $1,075 to $1,175 per ounce, which is unchanged from the previous guidance. All-in sustaining costs on a by-product basisNG are expected to increase in the second and third quarters of 2024. The expected cost increase in the second quarter is due to lower gold and copper sales volumes, while the expected cost increase in the third quarter is due to lower expected credits from copper sales anticipated for the quarter. In addition, the Company plans higher sustaining capital expendituresNG in the second and third quarters of the year, primarily due to planned TSF construction. Costs are anticipated to normalize in the final quarter of the year, bringing the annual all-in sustaining costs on a by-product basisNG per ounce within the guidance range.

The Öksüt Mine’s all-in sustaining costs on a by-product basisNG were $823 per ounce in the three months ended March 31, 2024. For the full year of 2024, all-in sustaining costs on a by-product basisNG at the Öksüt Mine are expected to be in the range of $900 to $1,000 per ounce, which is unchanged from the previous guidance. The projected increase in all-in sustaining costs on a by-product basisNG per ounce compared to the three months ended March 31, 2024 is mainly attributed to the higher gold production costs, as outlined above. In addition, the Öksüt Mine is anticipated to incur slightly higher sustaining capital expendituresNG in the second and third quarters of 2024 due to timing of planned capital projects.

Consolidated all-in costs on a by-product basisNG were $990 per ounce in the three months ended March 31, 2024. For the full year of 2024, the Company expects all-in costs on a by-product basisNG to be between $1,225 and $1,325 per ounce, which is unchanged from the previous guidance. The Company anticipates an increase in consolidated all-in costs on a by-product basisNG for the remainder of 2024 relative to the first quarter of 2024. This expected increase is due to higher consolidated all-in sustaining costs on a by-product basisNG as outlined above, and higher pre-development and exploration expenditures. All-in costs on a by-product basisNG for the three months ended March 31, 2024 were $727 per ounce at the Mount Milligan Mine and $826 per ounce at the Öksüt Mine and not significantly different from site all-in sustaining costs on a by-product basisNG.

Capital Expenditures

| | | | | | | | | | | |

(Expressed in millions of United States dollars) | | | Three months ended March 31, 2024 | 2024 Guidance | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Capital Expenditures | | | | | |

Additions to PP&E(1) | | | 15.3 | 108 - 140 | |

| Mount Milligan Mine | | | 0.8 | 55 - 65 | |

Öksüt Mine | | | 12.6 | 40 - 50 | |

| | | | | |

Molybdenum BU(2) | | | 0.9 | 12 - 22 | |

| | | | | |

| | | | | |

Other | | | 1.0 | 1 - 3 | |

Sustaining Capital ExpendituresNG(1) | | | 16.2 | 100 - 125 | |

| Mount Milligan Mine | | | 4.1 | 55 - 65 | |

Öksüt Mine | | | 11.3 | 40 - 50 | |

| | | | | |

Langeloth Facility | | | 0.5 | 5 - 10 | |

Other | | | 0.3 | - | |

Non-sustaining Capital ExpendituresNG(1) | | | 0.6 | 8 - 15 | |

Thompson Creek Mine(3) | | | 0.4 | 7 - 12 | |

Other | | | 0.2 | 1 - 3 | |

Total Capital ExpendituresNG(1) | | | 16.8 | 108 - 140 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

1.Consolidated Centerra figures.

2.Includes additions to PP&E at Langeloth Facility of $0.5 million and Thompson Creek Mine of $0.4 million.

3.Outlook range for the Thompson Creek Mine relates to the first half of 2024 only.

Additions to Property, Plant and Equipment (“PP&E”) for IFRS accounting purposes includes certain non-cash additions to PP&E such as positive or negative changes in future reclamation costs and capitalization of leases. Capital expendituresNG, which comprise sustaining capital expendituresNG and non-sustaining capital expendituresNG, exclude such non-cash additions to PP&E. The reconciliation of Additions to PP&E and capital expendituresNG is included in the Non-GAAP and Other Financial Measures section of this MD&A. In the three months ended March 31, 2024, consolidated additions to PP&E were $15.3 million and total capital expendituresNG were $16.8 million. For the full year of 2024, both consolidated additions to PP&E and total capital expendituresNG are planned to be in the range of $108 to $140 million, which is unchanged from the previous guidance. Total capital expendituresNG are expected to be higher in the remaining three quarters of 2024 relative to the first quarter of 2024 primarily due to the timing of the capital expendituresNG at the Mount Milligan Mine.

The Mount Milligan Mine’s additions to PP&E in the three months ended March 31, 2024 were $0.8 million and total capital expendituresNG were $4.1 million. The difference between additions to PP&E and capital expendituresNG was mainly due to a change to future reclamation costs of $3.2 million. For the full year of 2024, the Company is expecting additions to PP&E and total capital expendituresNG in the range of $55 to $65 million, which is unchanged from the previous guidance. Most of the 2024 capital expendituresNG relate to capitalized TSF construction costs amounting to $23 to $25 million, completion of a water pumping system construction project that was started in 2023 as well as overhauls and purchases of mobile equipment.

The Öksüt Mine’s additions to PP&E in the three months ended March 31, 2024 were $12.6 million and total capital expendituresNG were $11.3 million. For the full year of 2024, at the Öksüt Mine the Company plans sustaining capital expendituresNG of $40 to $50 million, which is unchanged from the previous guidance. Most of the sustaining capital expendituresNG relate to capitalized stripping costs (amounting to $24 to $27 million), waste rock dump expansion project, the heap leach pad expansion and contact water treatment plant construction projects.

The Langeloth Facility’s additions to PP&E and total capital expendituresNG were $0.5 million in the three months ended March 31, 2024. For the full year of 2024, the Langeloth Facility is projecting sustaining capital expenditures to be in the range of $5 to $10 million. The majority of these costs are anticipated for maintenance capital expenditures related to a

planned outage of the sulfuric acid plant to be executed in the course of the second quarter of 2024, and is a routine procedure conducted every several years.

The Thompson Creek Mine’s additions to PP&E and total capital expendituresNG were $0.4 million in the three months ended March 31, 2024. In the first half of 2024, the non-sustaining capital expendituresNG are expected to be in the range of $7 to $12 million. These expenditures are primarily intended to cover capital projects associated with early work activities. This includes a limited scope refurbishment of the existing mobile equipment fleet and the purchase of additional mobile equipment, necessary to prepare for a potential limited notice to proceed. The Company expects to authorize a limited notice to proceed upon the completion of a feasibility study anticipated in the late summer of 2024.

Molybdenum Business Unit

| | | | | | | | | | |

(Expressed in millions of United States dollars) | | | Three months ended March 31, 2024 | 2024 Guidance |

| Langeloth Facility | | | | |

Loss from operationsNG(1) | | | (3.8) | (5) - (15) |

| | | | |

| Cash (used in) provided by operations before changes in working capital | | | (2.0) | (5) - 0 |

| Changes in Working Capital | | | 3.8 | (20) - 20 |

Cash Provided by (Used in) Operations | | | 1.8 | (25) - 20 |

Sustaining Capital ExpendituresNG | | | (0.5) | (5) - (10) |

Free Cash Flow (Deficit) from OperationsNG | | | 1.3 | (30) - 10 |

Thompson Creek Mine(2) | | | | |

Project Evaluation Expenses(3) | | | (6.9) | (17) - (20) |

Care and Maintenance Expenses - Cash | | | (0.9) | (1) - (3) |

| Changes in Working Capital | | | 0.6 | — |

| Cash Used in Operations | | | (7.2) | (18) - (23) |

Non-sustaining Capital ExpendituresNG | | | (0.4) | (7) - (12) |

Free Cash Flow Deficit from OperationsNG | | | (7.6) | (25) - (35) |

| Endako Mine | | | | |

Care and Maintenance Expenses - Cash | | | (1.1) | (5) - (7) |

Reclamation Costs | | | — | (15) - (18) |

| Cash Used in Operations | | | (1.1) | (20) - (25) |

| | | | |

| | | | |

1.Includes DDA of $0.9 million in the Q1 2024 actuals and $5 to $10 million in the full year of 2024 guidance.

2.Outlook range for the Thompson Creek Mine relates to the first half of 2024 only.

3.Project evaluation expenses are recognized as expense in the consolidated statements of earnings (loss).

In the three months ended March 31, 2024, the Langeloth Facility’s loss from operations was $3.8 million, which included DDA of $0.8 million and write-down of inventory of $1.0 million. In 2024, the Langeloth Facility expects a loss from operations in the range of $5 to $15 million, which includes DDA of $5 to $10 million, and is unchanged from the previous guidance. The Company expects that the cash used in operations at the Langeloth Facility will primarily be driven by changes in working capital. The working capital requirements at the Langeloth Facility are highly dependent on market molybdenum prices. In 2024, the Company expects an incremental release of working capital of approximately $20 million at a molybdenum price of $15 per pound and an incremental investment in working capital of approximately $20 million at a molybdenum price of $25 per pound. As part of Centerra’s strategy to maximize the value for each asset in its portfolio, the Company has recently completed a commercial optimization plan for the Langeloth Facility, geared at increasing profitability and evaluating its future potential. Details of the commercial optimization plan and the value potential at the Langeloth Facility will be announced in conjunction with the Thompson Creek Mine feasibility study in the late summer of 2024.

In the three months ended March 31, 2024, the Company’s expenditures at the Thompson Creek Mine were $7.6 million, including $0.9 million for care and maintenance, $6.9 million costs related to advancement of project studies and early works, including pre-stripping activities in the main open pit area and $0.4 million costs for capital expendituresNG. In the first half of 2024, Thompson Creek Mine is expected to spend approximately $25 to $35 million, which is unchanged from the previous guidance, and includes $7 to $12 million of capital expendituresNG outlined above, $17 to $20 million of project evaluation expenses, and $1 to $3 million of care and maintenance costs. Project evaluation activities include costs necessary to conduct a mill optimization study, costs to complete the feasibility study, costs to continue pre-stripping in the main pit area and other general site costs. Upon the completion of the feasibility study and a decision on the limited notice to proceed expected in the late summer of 2024, the Company plans to update the outlook for the Thompson Creek Mine for the balance of the year.

In the three months ended March 31, 2024, the Company's cash expenditures at the Endako Mine totaled $1.1 million, with no costs attributed to reclamation. For the full year of 2024, care and maintenance costs are expected to be in the range of $5 to $7 million and reclamation costs are estimated to be between $15 to $18 million, which is unchanged from the previous guidance. Reclamation activities in 2024 will be focused on the closure of the spillway for Tailings Pond 2 with most of the costs expected to be spent in the second half of the year. Reclamation costs planned in 2024 have been included in the reclamation provision as at March 31, 2024.

Project Evaluation, Exploration, and Other Costs

| | | | | | | | | | | |

(Expressed in millions of United States dollars) | | | Three months ended March 31, 2024 | 2024

Guidance | |

Project Exploration and Evaluation Costs | | | | | |

| Goldfield Project | | | 2.6 | 9 - 13 | |

| | | | | |

Thompson Creek Mine(1) | | | 6.9 | 17 - 20 | |

Total Project Evaluation Costs | | | 9.5 | 26 - 33 | |

Brownfield Exploration | | | 2.9 | 17 - 22 | |

| | | | | |

| | | | | |

| | | | | |

Greenfield and Generative Exploration | | | 2.6 | 18 - 23 | |

Total Exploration Costs | | | 5.5 | 35 - 45 | |

Total Exploration and Project Evaluation Costs | | | 15.0 | 61 - 78 | |

| Other Costs | | | | | |

Kemess Project(2) | | | 2.9 | 19 - 25 | |

Corporate Administration Costs | | | 10.0 | 37 - 42 | |

| Stock-based Compensation | | | 1.0 | 8 - 10 | |

| Other Corporate Administration Costs | | | 9.0 | 29 - 32 | |

0.10.21.Outlook range for the Thompson Creek Mine relates to the first half of 2024 only.

2.Includes care and maintenance costs as well as reclamation costs included in the reclamation provision as at March 31, 2024.

Exploration Expenditures (excluding Project Evaluation costs)

In the three months ended March 31, 2024, total exploration expenditures were $5.5 million, including $5.4 million related to expensed exploration and capitalized exploration costs of $0.1 million. Following the relatively low spending in the first quarter of 2024, total exploration expenditures for the full year of 2024 are expected to be in the range of $35 to $45 million, which is unchanged from the previous guidance. The exploration expenditures will be approximately evenly split between brownfield and greenfield projects. The exploration targets for brownfield projects include further drilling at Mount Milligan and Öksüt Mines as well as Goldfield and Oakley Projects.

Goldfield Project

In the three months ended March 31, 2024, exploration and project evaluation costs related to the Goldfield Project in Nevada, USA amounted to $4.3 million, including 1.7$2.6 million for project evaluation costs and $1.7 million for exploration costs. For the full year of 2024, project evaluation costs are expected to be in the range between $9 million to

$13 million, which is unchanged from the previous guidance. The primary objective for the Goldfield Project in 2024 is to complete initial resource estimate for the property, targeted for the end of year. Planned activities include bulk sampling work, large column leach testing, developing preliminary designs for pit and heap leach facilities as well as other technical, permitting, and land work necessary for finalizing the initial resource estimate for the project. While the bulk sampling work and blast fragmentation studies were completed in the first quarter of 2024, the large column leach testwork program is expected to continue in the second quarter of 2024.

Kemess Project

In the three months ended March 31, 2024, care and maintenance costs at the Kemess Project were $2.9 million. In 2024, the Kemess Project will continue to be on care and maintenance. Care and maintenance costs are expected to be in the range of $12 to $14 million, which is unchanged from the previous guidance.

While Kemess Project has not been a priority for the Company’s project pipeline in the recent past, the Company is now re-evaluating the technical concepts for the property. In 2024, the Company has allocated funds to testing these new concepts to determine the future potential of the project. These activities are expected to include confirmation and exploration drilling as well as technical studies. The cost of these activities is included in the guidance range outlined above. The Company is also delaying some works related to decommissioning of the Kemess South TSF sedimentation pond and associated works and has updated its estimate for reclamation and study costs at the Kemess Project to $7 to $11 million from the prior guidance of $12 to $16 million. Reclamation costs planned in 2024 have been included in the reclamation provision as at March 31, 2024.

Corporate Administration

In the three months ended March 31, 2024, corporate and administration expenses were $10.0 million, including stock-based compensation expense of $1.0 million. Corporate and administration expenses for the full year of 2024 are expected to be in the range of $37 to $42 million (including $8 to $10 million of stock-based compensation expenses), which is unchanged from the previous guidance. In the three months ended March 31, 2024, the stock-based compensation expense was partly impacted by the Company’s share price performance. In addition, other corporate administrative costs for the first quarter of 2024 included severance costs of approximately $0.7 million.

Depreciation, Depletion and Amortization

| | | | | | | | | | | |

(Expressed in millions of United States dollars) | | | Three months ended March 31, 2024 | 2024

Guidance | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Depreciation, depletion and amortization(1) | | | 33.3 | 140 - 165 | |

| Mount Milligan Mine | | | 18.3 | 90 - 100 | |

Öksüt Mine | | | 14.2 | 45 - 55 | |

Other | | | 0.8 | 5 - 10 | |

| | | | | |

| | | | | |

| | | | | |

1.Consolidated Centerra figures.

Consolidated DDA included in the costs of sales was $33.3 million in the three months ended March 31, 2024 and is expected to increase to the range of $140 to $165 million in 2024, which is unchanged from the previous guidance. The Mount Milligan Mine’s DDA expense in the three months ended March 31, 2024 was $18.3 million and is expected to trends towards the lower end of the range of $90 to $100 million in 2024 due the extension of the life of mine related to the Additional Royal Gold Agreement. Öksüt Mine’s DDA expense in the months ended March 31, 2024 was $14.2 million and is expected to be in the range of $45 to $55 million, which is unchanged from the previous guidance. The remaining balance of DDA expense for 2024 is estimated to be approximately $5 to $10 million and is primarily related to the Langeloth Facility and is unchanged from the previous guidance.

Current Taxes and Tax Payments

| | | | | | | | | | | |

(Expressed in millions of United States dollars) | | | Three months ended March 31, 2024 | 2024

Guidance | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Income tax and BC mineral tax expense(1) | | | 37.4 | 55 - 65 | |

| Mount Milligan Mine | | | 0.9 | 1 - 5 | |

Öksüt Mine | | | 36.5 | 54 - 60 | |

1.Consolidated Centerra figures.

The Mount Milligan Mine’s British Columbia mineral tax expense in the three months ended March 31, 2024 was $0.9 million and the cash taxes paid were $nil. The difference between tax expense and cash taxes paid is due to timing of tax payments. For the full year of 2024, Mount Milligan Mine’s British Columbia mineral tax expense and tax payments are each expected in the same range of $1 to $5 million, which is unchanged from the previous guidance.

The Öksüt Mine’s current income tax expense in the three months ended March 31, 2024 was $36.5 million, including a withholding tax expense of $11.8 million on the repatriation of the Öksüt Mine’s earnings. Cash taxes of $0.4 million were paid in the quarter. For the full year of 2024, the Öksüt Mine income tax expense is expected to be in the range of $54 to $60 million, which is a slight increase from the previous guidance of $46 to $52 million and reflects an assumption of a higher gold price per ounce. The Öksüt Mine income tax expense reflects a 25% income tax rate and a withholding tax expense of $17 million on the expected repatriation of the Öksüt Mine’s earnings. The Öksüt Mine’s current income tax expense recorded in the first quarter of 2024 was driven by the increasing gold price as well as higher volume of ounces sold in the quarter relative to the remaining three quarters of the year. Lower ounces sold, estimated for the second half of 2024 are expected to result in a lower current income tax expense projected for the second half compared to the first half of 2024.

The Öksüt Mine is expected to pay approximately $95 to $105 million in cash taxes in 2024, which is an increase from the previous guidance of $85 to $95 million which is mainly due to an assumption of a higher gold price per ounce as outlined above. The difference between income tax expense and cash taxes paid is due to the timing of tax payments. Due to timing of Turkish tax filings, the Company expects to pay approximately $75 million of cash taxes in the second quarter of 2024.

On April 30, 2024, a regulation amendment was published in the official gazette of the Republic of Türkiye, announcing that no inflation accounting adjustment should be applied to the calculation of income tax for the three months ended March 31, 2024. As substantive enactment occurred after March 31, 2024, the Company concluded that the regulation amendment constitutes a non-adjusting subsequent event under IAS 10 and hence did not have an impact on the Company’s condensed consolidated interim financial statements for the three months ended March 31, 2024. The Company estimates that the change in tax law would otherwise have increased current income tax expense by $4.2 million and deferred income tax liability by $4.0 million. The Company continues to expect that the inflation accounting adjustment will apply to the full 2024 fiscal year under the current tax law. Therefore, the regulation amendment is expected to only impact the timing of tax payments between the periods in 2024.

Other

As a result of the Additional Royal Gold Agreement, the Company disbursed an upfront cash payment of $24.5 million to Royal Gold in February 2024. See “Recent Events and Developments” section in this MD&A.

2024 Material Assumptions

Other material assumptions or factors not mentioned above but used to estimate production and costs for the remaining three quarters of 2024 after giving effect to the hedges in place as at March 31, 2024, include the following:

•market gold price of $2,000 per ounce ($1,850 per ounce in the previous guidance), and an average realized gold price at the Mount Milligan Mine of $1,419 per ounce after reflecting the Mount Milligan Streaming

Agreement (i.e., 35% of the Mount Milligan Mine’s gold is sold to Royal Gold for $435 per ounce) and gold refining costs.

•market price of $3.75 per pound ($3.50 per pound in the previous guidance) for the unhedged portion of copper production. This equates to a blended copper price of $3.75 per pound ($3.50 per pound in the previous guidance), reflecting a minimum projected impact of a reduced volume of copper hedges in place for 2024. Realized copper price at the Mount Milligan Mine is estimated to average $2.96 per pound after reflecting the Mount Milligan Streaming Agreement (18.75% of the Mount Milligan Mine’s copper is sold to Royal Gold at 15% of the spot price per metric tonne), and copper treatment and refining costs.

•molybdenum price of $20.00 per pound (unchanged from the previous guidance).

•exchange rates are unchanged from the previous guidance and set as follows: $1USD:$1.33 CAD, $1USD:30 Turkish lira.

•diesel fuel price of $1.06/litre or CAD$1.41/litre (unchanged from the previous guidance) at the Mount Milligan Mine.

The Additional Royal Gold Agreement is not expected to have a significant impact on these assumptions in 2024 as the increase in payments received by the Company for gold ounces and copper pounds delivered to Royal Gold are not expected to commence until later. See “Recent Events and Developments” section in this MD&A.

Mount Milligan Streaming Agreement

Production at the Mount Milligan Mine is subject to the Mount Milligan Streaming Agreement. To satisfy its obligations under the Mount Milligan Streaming Agreement, the Company purchases refined gold and copper warrants and arranges for their delivery to Royal Gold. The difference between the cost of the purchases of refined gold and copper warrants, and the corresponding amounts payable to the Company under the Mount Milligan Streaming Agreement is recorded as a reduction of revenue and not a cost of operating the mine.

Other Material Assumptions

Production, cost, and capital expenditure forecasts for the year 2024 are forward-looking information and are based on key assumptions and subject to material risk factors that could cause actual results to differ materially from those estimated. Material assumptions used in forecasting production and costs for 2024 and related risk factors can be found under the heading “Caution Regarding Forward-Looking Information” in this document and under the heading “Risks That Can Affect Centerra’s Business” in the Company’s most recent Annual Information Form (“AIF”).

2024 Sensitivities

Centerra’s costs and cash flows for the remaining three quarters of 2024 are sensitive to changes in certain key inputs. The company has estimated the impact of any such changes on its net income, capital costs and cash flows as follows:

| | | | | | | | | | | | | | | | | | | | | |

| | Impact on

($ millions) | |

| | Production Costs & Taxes | Capital

Costs | Revenues | Cash flows | | All-in sustaining costs on a by-product basis per ounceNG |

Gold price(1)(2) | -$100/oz | 11.0 - 15.5 | — | 22.0 - 25.0 | 11.5 - 14.0 | | 8 - 9 |

| +$100/oz | 8.0 - 5.5 | — | 15.5 - 17.0 | 15.0 - 17.0 | | 22 - 23 |

Copper price(1)(2) | -20% | 0.5 - 1.0 | — | 18.5 - 25.0 | 18.0 - 24.0 | | 70 - 80 |

| 20% | 0.8 - 1.0 | — | 26.0 - 32.5 | 25.0 - 31.0 | | 95 - 100 |

Diesel fuel(1) | 10% | 0.8 - 1.0 | 0.4 - 0.5 | — | 1.2 - 1.5 | | 3 - 4 |

Canadian dollar(1)(3) | 10 cents | 12.4 - 13.0 | 0.1 - 0.2 | — | 12.5 - 13.2 | | 40 - 50 |

Turkish lira(3) | 1 lira | 0.2 - 0.5 | 0.1 - 0.2 | — | 0.3 - 0.7 | | 1 - 3 |

| | | | | | | |

(1)Includes the effect of the Company’s copper, diesel fuel and Canadian dollar hedging programs, with current exposure coverage as of March 31, 2024 of approximately 23%, 75% and 74%, respectively.

(2)Excludes the impact of gold hedges and the effect of 37,631 ounces of gold with an average mark-to-market price of $2,220 per ounce and 12.5 million pounds of copper with an average mark-to-market price of $4.01 per pound outstanding under the Mount Milligan Mine’s contracts awaiting final settlement in future months as of March 31, 2024.

(3)Appreciation of the currency against the US dollar results in higher costs and lower cash flow and earnings, depreciation of the currency against the US dollar results in decreased costs and increased cash flow and earnings.

Liquidity and Capital Resources

The Company’s total liquidity position as March 31, 2024 was $1,046.9 million, representing a cash balance of $647.6 million and $399.3 million available under a corporate credit facility. Credit facility availability is reduced by outstanding letters of credit, amounting to $0.7 million as at March 31, 2024.

First Quarter 2024 compared to First Quarter 2023

See the Overview of Consolidated Results section in this MD&A for the discussion of cash provided by (used in) operating activities.

Cash used in investing activities of $42.7 million was recognized in the first quarter of 2024 compared to $8.1 million in the first quarter of 2023. The increase is primarily related to higher PP&E additions at the Mount Milligan Mine and the Öksüt Mine and the cash payment of $24.5 million related to the Additional Royal Gold Agreement executed in February 2024.

Cash used in financing activities in the first quarter of 2024 was $22.1 million compared to $12.0 million in the first quarter of 2023. The increase was primarily due to repurchase of 1,783,800 Centerra common shares under the Company’s NCIB program in the amount of $10.0 million.

Financial Performance

First Quarter 2024 compared to First Quarter 2023

Revenue of $305.8 million was recognized in the first quarter of 2024 compared to $226.5 million in the first quarter of 2023. The increase in revenue was primarily due to an increase in the ounces of gold sold at the Öksüt Mine and Mount Milligan Mine and higher average realized gold prices. The increase was partially offset by lower average realized copper prices at the Mount Milligan Mine and a decline in molybdenum revenue due to lower prices and sales volumes.

Gold production was 111,341 ounces in the first quarter of 2024 compared to 33,215 ounces in the first quarter of 2023. Gold production in the first quarter of 2024 included 48,317 ounces of gold from the Mount Milligan Mine compared to 33,215 ounces in the first quarter of 2023. The higher gold production at the Mount Milligan Mine was primarily due to higher gold head grade and higher mill throughput. There were 63,024 ounces of gold produced at the Öksüt Mine in the first quarter of 2024 compared to no ounces produced in the first quarter of 2023 due to the suspension of gold room operations at the ADR plant in the comparable period.

Copper production at the Mount Milligan Mine was 14.3 million pounds in the first quarter of 2024 compared to 13.4 million pounds in the first quarter of 2023. The increase in copper production is attributed to higher copper head grade and higher mill throughput, partially offset by lower copper recoveries which were affected by elevated oxidized ore in the mill feed.

The Langeloth Facility roasted 2.9 million pounds and sold 2.9 million pounds of molybdenum in the first quarter of 2024 compared to 3.9 million pounds and 3.3 million pounds in the first quarter of 2023, respectively, in line with the Langeloth Facility’s operating plan for the year.