Filed by Focus Impact Acquisition Corp. pursuant to Rule 425

under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Focus Impact Acquisition Corp. (File No. 001-40977)

under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Focus Impact Acquisition Corp. (File No. 001-40977)

I n v e s t o r P r e s e n t a t i o n A u g u s t 2 0 2 4 Highly confidential

and proprietary. Unauthorized distribution without prior consent f rom Cohen & Company Capital Markets i s strictly prohibited.

This presentation (this “Presentation”) is provided for informational purposes

only and has been prepared to assist interested parties in making their own evaluation with respect to a potential financing transaction (the “Transaction”) to be consummated in connection with the potential business combination between Focus

Impact Acquisition Corp. (“FIAC") and DevvStream Holdings Inc. (“DevvStream” or “the Company”) and the related transactions (the “Contemplated Business Combination"), and for no other purpose. By reviewing or reading this Presentation, you will

be deemed to have agreed to the obligations and restrictions set out below. Without the express prior written consent of FIAC and DevvStream, this Presentation and any information contained within it may not be (i) reported (in whole or in

part), (ii) copied at any time, (iii) used for any purpose other than your evaluation of the Transaction or (iv) provided to any other person except your employees and advisors with a need to know and who are advised of the confidentiality of

the information. This Presentation supersedes and replaces all previous oral or written communications relating to the subject matter hereof. Information disclosed in this Presentation is current as of August 2024, except as otherwise provided

herein, and neither DevvStream nor FIAC undertakes or agrees to update this presentation after the date hereof. By your acceptance of this Presentation, you acknowledge that applicable securities laws restrict a person who has received

material, non-public information concerning a company from purchasing or selling securities of such company and from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person

is likely to purchase or sell such securities. Certain information included herein describes or assumes the expected terms that will be included in the agreements to be entered into by the parties to the Contemplated Business Combination. The

consummation of the Contemplated Business Combination is also subject to other various risks and contingencies, including customary closing conditions. These risks and contingencies are described more fully in the section entitled “Risk

Factors” in the Appendix to this Presentation. There can be no assurance that the Contemplated Business Combination will be consummated, with the terms described herein or otherwise. As such, the subject matter of this Presentation is evolving

and is subject to further change by FIAC, DevvStream and Focus Impact Sponsor, LLC (“FIAC Sponsor") in their joint and absolute discretion. Neither the Securities and Exchange Commission (“SEC”) nor any securities commission of any other U.S.

or non-U.S. jurisdiction has approved or disapproved of the Transaction or the Contemplated Business Combination described herein or determined that this Presentation is truthful or complete. No representations or warranties, express or

implied, are given in, or in respect of, this Presentation, and no person may rely on any of the information or projections contained herein. To the fullest extent permitted by law, in no circumstances will FIAC, DevvStream, FIAC Sponsor, any

placement agent or any of their respective subsidiaries, stockholders, affiliates, representatives, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit

arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or any opinions communicated in relation thereto or otherwise arising in connection therewith. C O P Y R I G H T © D E V V

S T R E A M , I N C W W W . D E V V S T R E A M . C O M 2 D I S C L A I M E R S

Forward-Looking Statements This Presentation includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”,

“intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. These forward-looking statements, including, without limitation, FIAC’s

and DevvStream’s expectations with respect to future performance and anticipated financial impacts of the Contemplated Business Combination, estimates and forecasts of other financial and performance metrics, projections of market opportunity

and market share, the satisfaction of the closing conditions to the Contemplated Business Combination and the timing of the completion of the Contemplated Business Combination, are subject to risks and uncertainties, which could cause actual

results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by FIAC and its management, and

DevvStream and its management, as the case may be, are inherently uncertain and subject to material change. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on

by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that

may cause actual results to differ materially from current expectations include, but are not limited to: (1) changes in domestic and foreign business, market, financial, political, and legal conditions; (2) the amount of redemptions by FIAC’s

public stockholders in connection with the Contemplated Business Combination; (3) the occurrence of any event, change or other circumstances that could give rise to the termination of negotiations and any subsequent definitive agreements with

respect to the proposed transactions; (4) the outcome of any legal proceedings that may be instituted against FIAC, DevvStream, the combined company or others; (5) the inability of the parties to successfully or timely consummate the

Contemplated Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of

the Contemplated Business Combination or that the approval of stockholders is not obtained; (6) changes to the proposed structure of the proposed transactions that may be required or appropriate as a result of applicable laws or regulations;

(7) the ability to meet stock exchange listing standards following the consummation of the proposed transactions; (8) the risk that the proposed transactions disrupts current plans and operations of FIAC or DevvStream as a result of the

announcement and consummation of the proposed transactions; (9) the ability to recognize the anticipated benefits of the proposed transactions, which may be affected by, among other things, competition, the ability of the combined company to

grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (10) costs related to the proposed transactions; (11) changes in applicable laws or regulations; (12) risks

related to extensive regulation, compliance obligations and rigorous enforcement by federal, state, and non- U.S. governmental authorities; (13) the possibility that FIAC, DevvStream or the combined company may be adversely affected by other

economic, business, and/or competitive factors; (14) risks relating to DevvStream’s key intellectual property rights; (15) the Company’s estimates of expenses and profitability and underlying assumptions with respect to stockholder redemptions

and purchase price and other adjustments; (16) various factors beyond management’s control, including general economic conditions and other risks, uncertainties and factors set forth in the section entitled “Risk Factors” and “Cautionary Note

Regarding Forward-Looking Statements” in FIAC’s final prospectus relating to its initial public offering, filed with the SEC on October 27, 2021, and other filings with the SEC, including the registration statement on Form S-4 to be filed by

FIAC in connection with the transaction (as amended, the “Registration Statement”); and (17) certain other risks identified and discussed in DevvStream’s Annual Information Form for the fiscal year ended July 31, 2023, and DevvStream’s other

public filings with Canadian securities regulatory authorities, available on DevvStream’s profile on SEDAR at www.sedarplus.ca. If any of these risks materialize or FIAC’s, DevvStream’s or FIAC Sponsor’s assumptions prove incorrect, actual

results could differ materially from the results implied by these forward-looking statements. There may be additional risks that FIAC, DevvStream or FIAC Sponsor does not presently know or that it currently believes are immaterial that could

also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect FIAC’s, DevvStream’s or FIAC Sponsor’s expectations, plans or forecasts of future events and views as of

the date of this Presentation. While FIAC, DevvStream or FIAC Sponsor may elect to update these forward-looking statements at some point in the future, FIAC, DevvStream and FIAC Sponsor specifically disclaim any obligation to do so. These

forward-looking statements should not be relied upon as representing FIAC’s, DevvStream’s or FIAC Sponsor’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the

forward-looking statements. No representations or warranties expressed or implied are given in, or in respect of, this Presentation. Industry and market data used in this Presentation have been obtained from third-party industry publications

and sources as well as from research reports prepared for other purposes. Neither DevvStream, FIAC nor FIAC Sponsor has independently verified the data contained from these sources and cannot assure you of the data’s accuracy or completeness.

Such data is subject to change. Recipients of this Presentation should not consider its contents, or any prior or subsequent communications from or with DevvStream, FIAC or FIAC Sponsor or their respective representatives as investment, legal

or tax advice. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of DevvStream, FIAC or FIAC Sponsor. Recipients of this Presentation should

each consult their own legal adviser, independent financial adviser or tax adviser for legal, financial or tax advice, make their own evaluation of DevvStream, FIAC and FIAC Sponsor and of the relevance and adequacy of the information and make

such other investigations as they deem necessary. The data contained herein is derived from various internal and external sources. No representation is made as to the reasonableness of the assumptions made or within or the accuracy or

completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. DevvStream, FIAC and FIAC Sponsor assume no

obligation to update the information in this Presentation. In this Presentation, all amounts are in United States dollars, unless otherwise indicated. Investments in any securities described herein have not been approved or disapproved by the

SEC or any other regulatory authority, nor has any authority passed upon or endorsed the merits of the Transaction or the Contemplated Business Combination or the accuracy or adequacy of the information contained herein. Any representation to

the contrary is a criminal offense. C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 2 D I S C L A I M E R S

Financial Outlook This Presentation contains statements that are considered

financial outlook within the meaning of applicable Canadian securities laws (“Financial Outlook”), including statements regarding EBITDA margins on DevvStream’s Carbon Management and Carbon Investment segments, revenue and EBITDA margin

estimates for DevvStream’s portfolio of projects. These statements are subject to the same assumptions, risk factors, limitations and qualifications as set forth above. In addition, certain key assumptions that underpin the Financial Outlook

are as follows: the timing and duration of projects and the number of credits issued and the pricing of such credits. The methodology used by DevvStream to forecast revenue differs for different contracts, but generally relies on inputs from

DevvStream’s operations staff and its contractual partners, which may prove to be inaccurate. With respect to any references to the Company’s EBITDA herein, the related revenue calculations include the Company’s interest in its joint venture

with 1824400 Alberta Limited. Financial Outlook contained in this Presentation was prepared using the same accounting principles that the parties expect the combined company to use in preparing its financial statements for the applicable

periods covered by such Financial Outlook. Financial Outlook was made as of the date of this Presentation and is provided for the purpose of describing anticipated sources, amounts and timing of revenue generation and the combined company’s

business model. Although Financial Outlook presented in this Presentation is based on reasonable expectations developed by DevvStream’s management, the assumptions and estimates underlying such Financial Outlook are subject to significant

business, economic, and competitive uncertainties and contingencies, many of which will be beyond the control of the combined company. Accordingly, the Financial Outlook are only estimates and are necessarily speculative in nature and actual

results may vary materially from such Financial Outlook. Financial Outlook contained in this Presentation should not be used for purposes other than for which it is disclosed herein. Non-IFRS Measures In this Presentation, reference is made

to EBITDA margins (“Non-IFRS measures”). DevvStream believes that these Non-IFRS measures are useful indicators with regard to understanding the business model of the combined company. These Non-IFRS measures are not generally accepted

financial measures under International Financial Reporting Standards (“IFRS”) and do not have standardized meanings prescribed by IFRS. Investors are cautioned that none of these Non-IFRS measures should be considered as an alternative to

earnings, earnings per share, or cash flow, as determined in accordance with IFRS. As there is no standardized method of calculating any of these Non-IFRS measures, DevvStream’s method of calculating each of them may differ from the methods

used by other entities and, accordingly, DevvStream’s use of any of these Non-IFRS measures may not be directly comparable to similarly titled measures used by other entities. Accordingly, these Non-IFRS measures are intended to provide

additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. EBITDA margins is defined as earnings determined in accordance with IFRS, adding back the

following line items form the consolidated income statement: interest, taxes, depreciation and amortization. Non-GAAP Measures This Presentation includes certain financial measures not presented in accordance with U.S. generally accepted

accounting principals (“GAAP”). These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items are significant in understanding and assessing DevvStream’s financial results. Therefore,

these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that DevvStream’s presentation of

these measures may not be comparable to similarly-titled measures used by other companies. DevvStream believes these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and

business trends relating to DevvStream’s financial condition and results of operations. This Presentation also includes certain projections of non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts

and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, DevvStream is unable to quantify certain amounts that would be required to

be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward-looking non-GAAP financial

measures is included. C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 2 D I S C L A I M E R S

Additional Information and Where to Find It In connection with the Contemplated

Business Combination, FIAC and DevvStream have prepared, and FIAC has filed a Registration Statement on Form S-4 (the “Registration Statement”) containing a prospectus with respect to the securities to be issued in connection with the

Contemplated Business Combination, a proxy statement with respect to the stockholders’ meeting of FIAC to vote on the Contemplated Business Combination and certain other related matters. Investors, securityholders and other interested persons

are urged to read the proxy statement/prospectus in connection with FIAC’s solicitation of proxies for its special meeting of stockholders to be held to approve the Contemplated Business Combination (and related matters) and amendments and

supplements thereto and the definitive proxy statement/prospectus because the proxy statement/prospectus contains important information about FIAC, DevvStream and the Contemplated Business Combination. When available, FIAC will mail the

definitive proxy statement/prospectus and other relevant documents to its stockholders as of a record date to be established for voting on the Contemplated Business Combination. This communication is not a substitute for the Registration

Statement, the definitive proxy statement/prospectus or any other document that FIAC will send to its stockholders in connection with the Contemplated Business Combination. Copies of the Registration Statement, including the definitive proxy

statement/prospectus and other documents filed by FIAC or DevvStream with the SEC, may be obtained, free of charge, by directing a request to Focus Impact Acquisition Corp., 250 Park Avenue, Suite 911, New York, New York 10177. The proxy

statement/prospectus included in the Registration Statement can also be obtained, without charge, at the SEC’s website (www.sec.gov). Participants in the Solicitation FIAC and its directors, executive officers, other members of management,

and employees, may be deemed to be participants in the solicitation of proxies of FIAC’s stockholders in connection with the Contemplated Business Combination under SEC rules. Information regarding the persons who may, under SEC rules, be

deemed participants in the solicitation of FIAC’s stockholders in connection with the Contemplated Business Combination is available in the Registration Statement and the proxy statement/prospectus included therein. To the extent that holdings

of FIAC’s securities have changed since the amounts printed in FIAC’s Registration Statement on Form S-1 relating to its initial public offering, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed

with the SEC. Investors and security holders may obtain more detailed information regarding the names and interests in the Contemplated Business Combination of FIAC’s directors and officers in FIAC’s filings with the SEC and in the Registration

Statement, which includes the proxy statement/prospectus of FIAC relating to the Contemplated Business Combination. DevvStream and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from

the stockholders of FIAC in connection with the Contemplated Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the Contemplated Business Combination are included in

the proxy statement/prospectus of FIAC for the Contemplated Business Combination. You may obtain free copies of these documents as described in the preceding paragraph. No Offer or Solicitation This Presentation relates to the Transaction and

the Contemplated Business Combination and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction pursuant to the Contemplated Business

Combination or otherwise, nor shall there be any sale, issuance or transfer or securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom, and otherwise in accordance with applicable law. RISK FACTORS For a description of the risks relating to DevvStream, FIAC and the Contemplated Business

Combination, please see “Risk Factors” in the Appendix to this Presentation and the Registration Statement. C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 2 D I S C L A I M E R S

Executive summary Introduction to DevvStream Financial overview Appendix -

Supplementary information & risk factors C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 2 C O N T E N T S

7 E X E C U T I V E S U M M A R Y

F O C U S I M P A C T I S T H E S O C I A L L Y F O R W A R D S P A C DevvStream

is the perfect fit for Focus Impact’s mission. Focus Impact Partners has created a social-forward vehicle as a response to stakeholders' demands for companies to deliver both financial and societal value. The Focus Impact team brings decades

of investing and operating experience, along with strategic relationships to help fuel growth for DevvStream. Exchange: Ticker NASDAQ: FIAC IPO Pricing Date Oct 2021 Carl Stanton CHIEF EXECUTIVE OFFICER C O P Y R I G H T © D E V V S T

R E A M , I N C W W W . D E V V S T R E A M . C O M 10 Wray Thorn CHIEF INVESTMENT OFFICER Ernest Lyles CHIEF FINANCIAL OFFICER

~25 years experience in business development and operations. Held various

senior-level business development roles at Avnet (NASDAQ: AVT) and Arrow Electronics (NYSE: ARW). Chris Merkel CHIEF OPERATING OFFICER D E V V S T R E A M ’ S L E A D E R S H I P DevvStream CEO and Founder Sunny Trinh speaks at the UN

Science Policy Business Forum in 2024. Sunny Trinh CHIEF EXECUTIVE OFFICER ~25 years experience in tech, CSR, ESG and carbon markets. Led innovation, engineering and sales at Avnet (NASDAQ: AVT) and Arrow Electronics (NYSE: ARW) working

with dozens of companies in renewable and energy-efficiency technologies. David Goertz CHIEF FINANCIAL OFFICER ~22 years experience in public accounting, taxation, and business advisory. Deep understanding of public company

operations, restructurings, acquisitions & IPOs. Dr. Destenie Nock CHIEF SUSTAINABILITY OFFICER C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 10 ~10 years experience in sustainability

investments, environmental policies, and energy equality Assistant Professor at Carnegie Mellon University Helped develop Ireland’s Renewable Obligation Credits

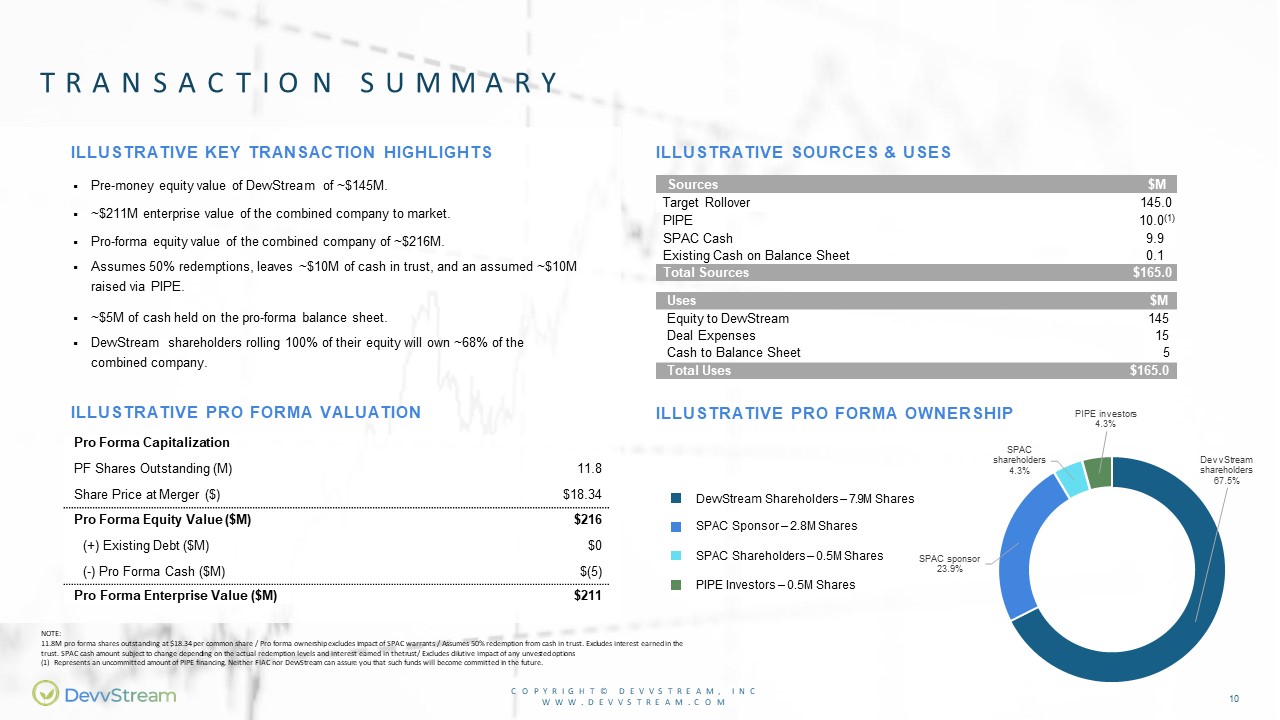

T R A N S A C T I O N S U M M A R Y ILLUSTRATIVE KEY TRANSACTION

HIGHLIGHTS Pre-money equity value of DevvStream of ~$145M. ~$211M enterprise value of the combined company to market. Pro-forma equity value of the combined company of ~$216M. Assumes 50% redemptions, leaves ~$10M of cash in trust, and an

assumed ~$10M raised via PIPE. ~$5M of cash held on the pro-forma balance sheet. DevvStream shareholders rolling 100% of their equity will own ~68% of the combined company. Pro Forma Capitalization PF Shares Outstanding (M) 11.8 Share

Price at Merger ($) $18.34 Pro Forma Equity Value ($M) $216 (+) Existing Debt ($M) $0 (-) Pro Forma Cash ($M) $(5) Pro Forma Enterprise Value ($M) $211 ILLUSTRATIVE PRO FORMA VALUATION ILLUSTRATIVE SOURCES &

USES Uses $M Equity to DevvStream 145 Deal Expenses 15 Cash to Balance Sheet 5 Total Uses $165.0 NOTE: 11.8M pro forma shares outstanding at $18.34 per common share / Pro forma ownership excludes impact of SPAC warrants / Assumes

50% redemption from cash in trust. Excludes interest earned in the trust. SPAC cash amount subject to change depending on the actual redemption levels and interest earned in the trust / Excludes dilutive impact of any unvested options (1)

Represents an uncommitted amount of PIPE financing. Neither FIAC nor DevvStream can assure you that such funds will become committed in the future. ILLUSTRATIVE PRO FORMA OWNERSHIP DevvStream Shareholders – 7.9M Shares SPAC Sponsor – 2.8M

Shares SPAC Shareholders – 0.5M Shares PIPE Investors – 0.5M Shares DevvStream shareholders 67.5% SPAC sponsor 23.9% SPAC shareholders 4.3% PIPE investors 4.3% Sources $M Target Rollover 145.0 PIPE 10.0(1) SPAC Cash 9.9 Existing

Cash on Balance Sheet 0.1 Total Sources $165.0 C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 10

11 I N T R O D U C T I O N T O D E V V S T R E A M

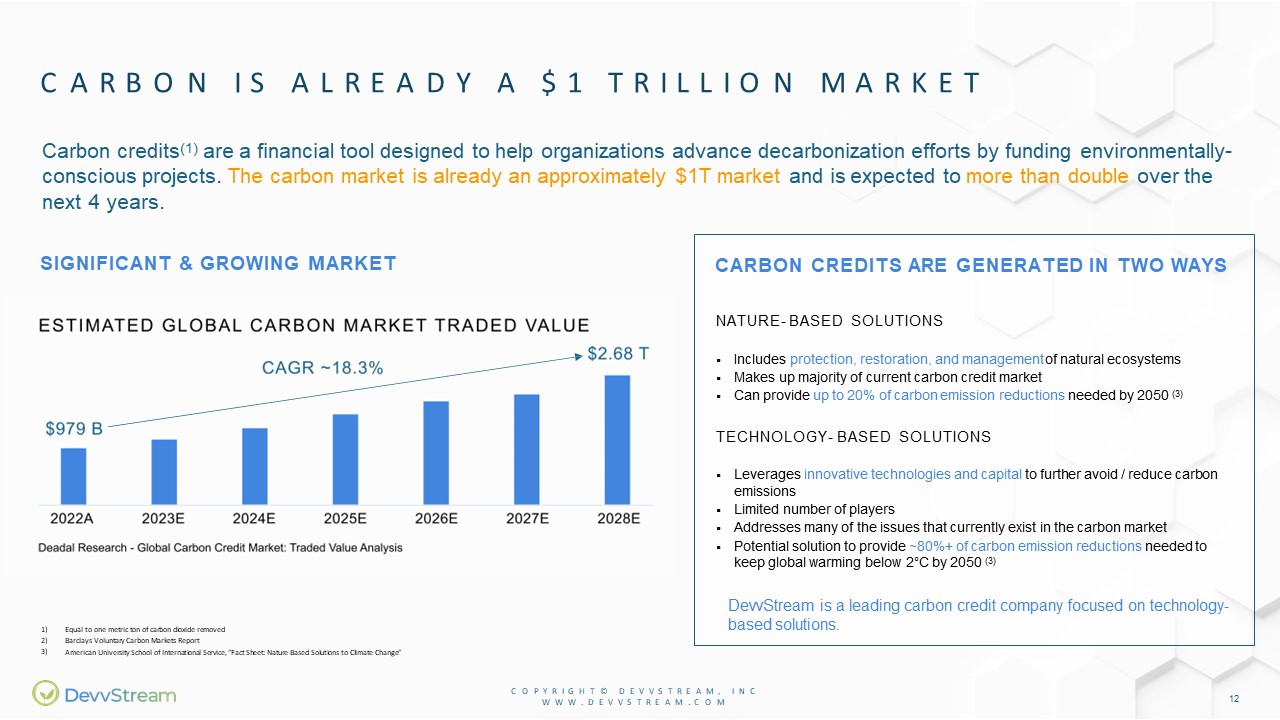

C A R B O N I S A L R E A D Y A $ 1 T R I L L I O N M A R K E T SIGNIFICANT &

GROWING MARKET 1) 2) 3) Equal to one metric ton of carbon dioxide removed Barclays Voluntary Carbon Markets Report American University School of International Service, “Fact Sheet: Nature-Based Solutions to Climate Change” Carbon

credits(1) are a financial tool designed to help organizations advance decarbonization efforts by funding environmentally- conscious projects. The carbon market is already an approximately $1T market and is expected to more than double over the

next 4 years. CARBON CREDITS ARE GENERATED IN TWO WAYS NATURE- BASED SOLUTIONS Includes protection, restoration, and management of natural ecosystems Makes up majority of current carbon credit market Can provide up to 20% of carbon

emission reductions needed by 2050 (3) TECHNOLOGY- BASED SOLUTIONS Leverages innovative technologies and capital to further avoid / reduce carbon emissions Limited number of players Addresses many of the issues that currently exist in the

carbon market Potential solution to provide ~80%+ of carbon emission reductions needed to keep global warming below 2°C by 2050 (3) DevvStream is a leading carbon credit company focused on technology- based solutions. C O P Y R I G H T © D E

V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 12

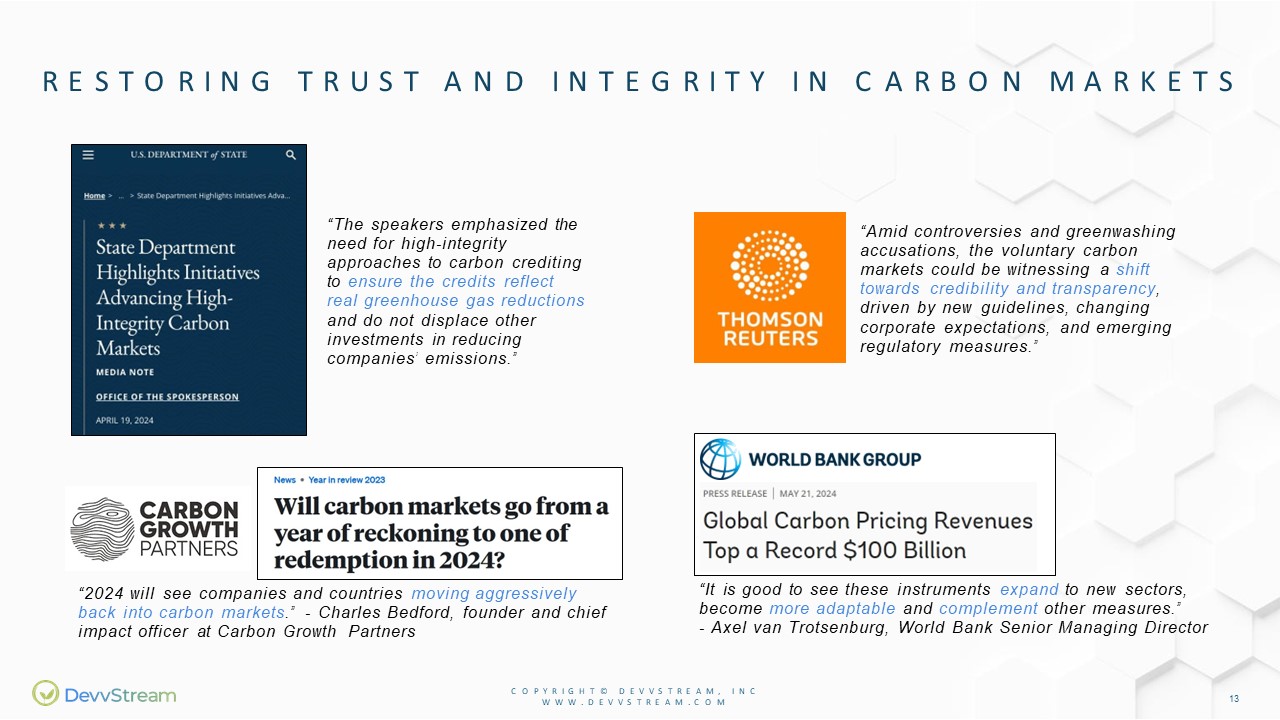

“The speakers emphasized the need for high-integrity approaches to carbon

crediting to ensure the credits reflect real greenhouse gas reductions and do not displace other investments in reducing companies’ emissions.” R E S T O R I N G T R U S T A N D I N T E G R I T Y I N C A R B O N M A R K E T S “Amid

controversies and greenwashing accusations, the voluntary carbon markets could be witnessing a shift towards credibility and transparency, driven by new guidelines, changing corporate expectations, and emerging regulatory measures.” “2024

will see companies and countries moving aggressively back into carbon markets.” - Charles Bedford, founder and chief impact officer at Carbon Growth Partners “It is good to see these instruments expand to new sectors, become more adaptable

and complement other measures.” - Axel van Trotsenburg, World Bank Senior Managing Director C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 12

T H E 3 P I L L A R S O F D E V V S T R E A M ’ S B U S I N E S S ENVIRONMENTAL

ASSET GENERATION Carbon credits, water credits and international renewable energy certificates (I- RECs) Project manager for eligible technologies and activities DevvStream generally retains 25% of the asset stream with little to no

investment Long-term contracts from 5-30 years ENVIRONMENTAL ASSET GENERATION ENVIRONMENTAL ASSET MANAGEMENT INDUSTRY CONSOLIDATION PLATFORM ENVIROMENTAL ASSET MANAGEMENT Project developers looking for assistance to sell their issued

assets DevvStream vets the assets and only selects high-quality candidates to bring to buyers (less than 10% qualify) Immediate revenue for selling assets DevvStream has received requests for over 100M assets to date C O P Y R I G H T © D E

V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 12 INDUSTRY CONSOLIDATION PLATFORM Carbon credit industry is primarily populated with smaller operators or nonprofits The anticipated Nasdaq listing may make the company a

desirable merger partner Focus Impact Partners, DevvStream’s sponsor, is comprised of highly regarded private equity investors with deep transaction expertise Consolidation may allow the company to become a full end-to-end solutions provider

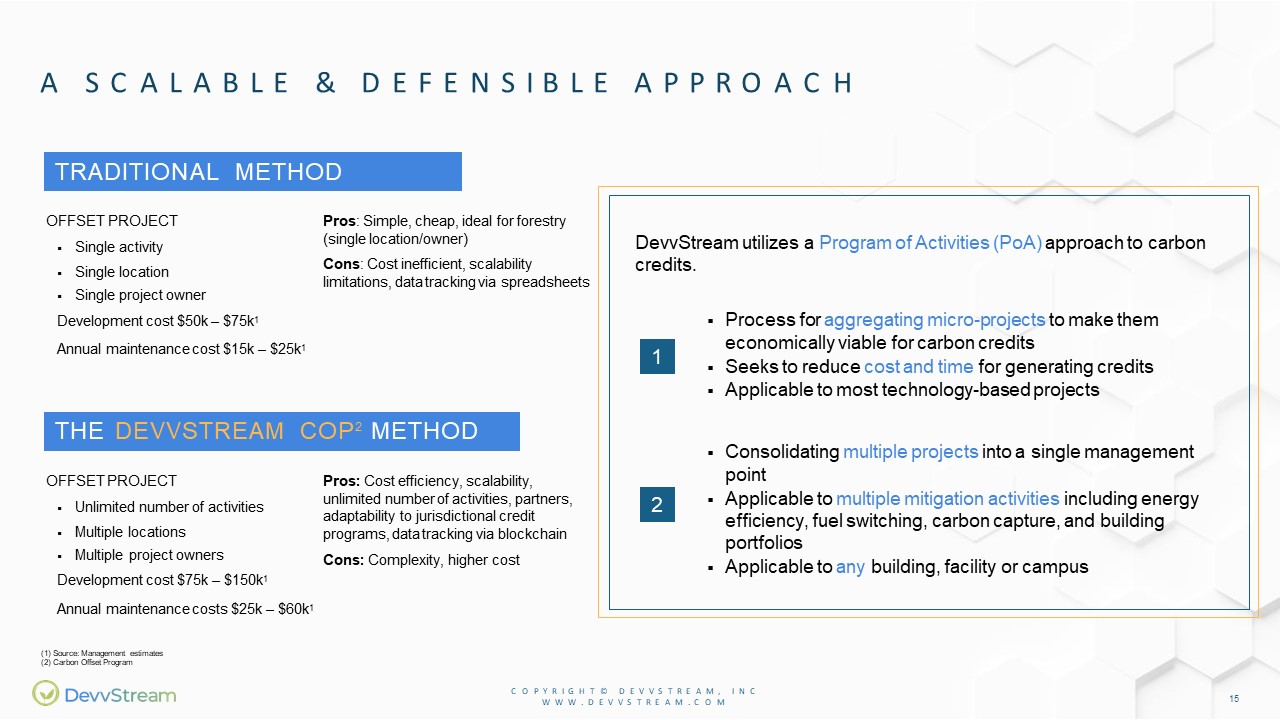

OFFSET PROJECT Unlimited number of activities Multiple locations Multiple

project owners Development cost $75k – $150k1 Annual maintenance costs $25k – $60k1 Pros: Cost efficiency, scalability, unlimited number of activities, partners, adaptability to jurisdictional credit programs, data tracking via

blockchain Cons: Complexity, higher cost A S C A L A B L E & D E F E N S I B L E A P P R O A C H DevvStream utilizes a Program of Activities (PoA) approach to carbon credits. Process for aggregating micro-projects to make

them economically viable for carbon credits Seeks to reduce cost and time for generating credits Applicable to most technology-based projects Consolidating multiple projects into a single management point Applicable to multiple mitigation

activities including energy efficiency, fuel switching, carbon capture, and building portfolios Applicable to any building, facility or campus 1 2 OFFSET PROJECT Single activity Single location Single project owner Development cost $50k

– $75k1 Annual maintenance cost $15k – $25k1 Pros: Simple, cheap, ideal for forestry (single location/owner) Cons: Cost inefficient, scalability limitations, data tracking via spreadsheets TRADITIONAL METHOD THE DEVVSTREAM COP2

METHOD Source: Management estimates Carbon Offset Program C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 12

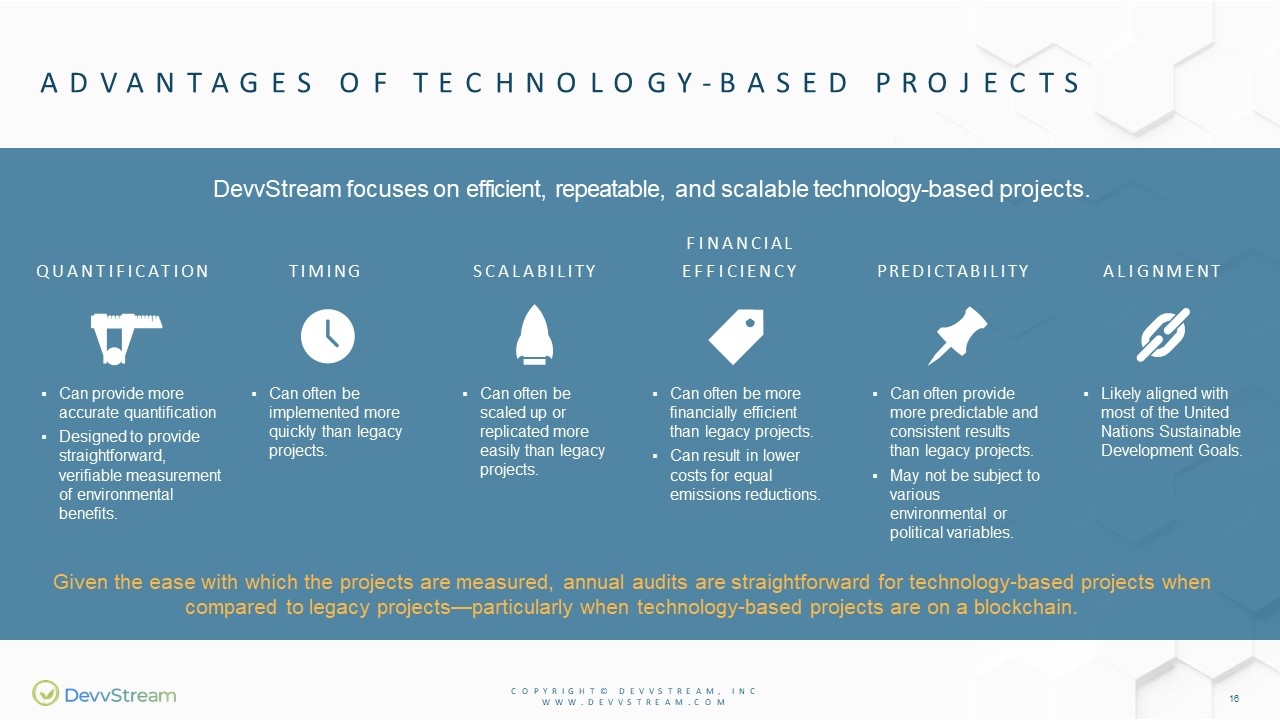

Given the ease with which the projects are measured, annual audits are

straightforward for technology-based projects when compared to legacy projects—particularly when technology-based projects are on a blockchain. Can provide more accurate quantification Designed to provide straightforward, verifiable

measurement of environmental benefits. QUANTIFICATION C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 12 Can often be scaled up or replicated more easily than legacy projects. SCALABILITY Can often be

more financially efficient than legacy projects. Can result in lower costs for equal emissions reductions. FINANCIAL EFFICIENCY Can often provide more predictable and consistent results than legacy projects. May not be subject to various

environmental or political variables. PREDICTABILITY Likely aligned with most of the United Nations Sustainable Development Goals. ALIGNMENT Can often be implemented more quickly than legacy projects. TIMING DevvStream focuses on

efficient, repeatable, and scalable technology-based projects. A D V A N T A G E S O F T E C H N O L O G Y - B A S E D P R O J E C T S

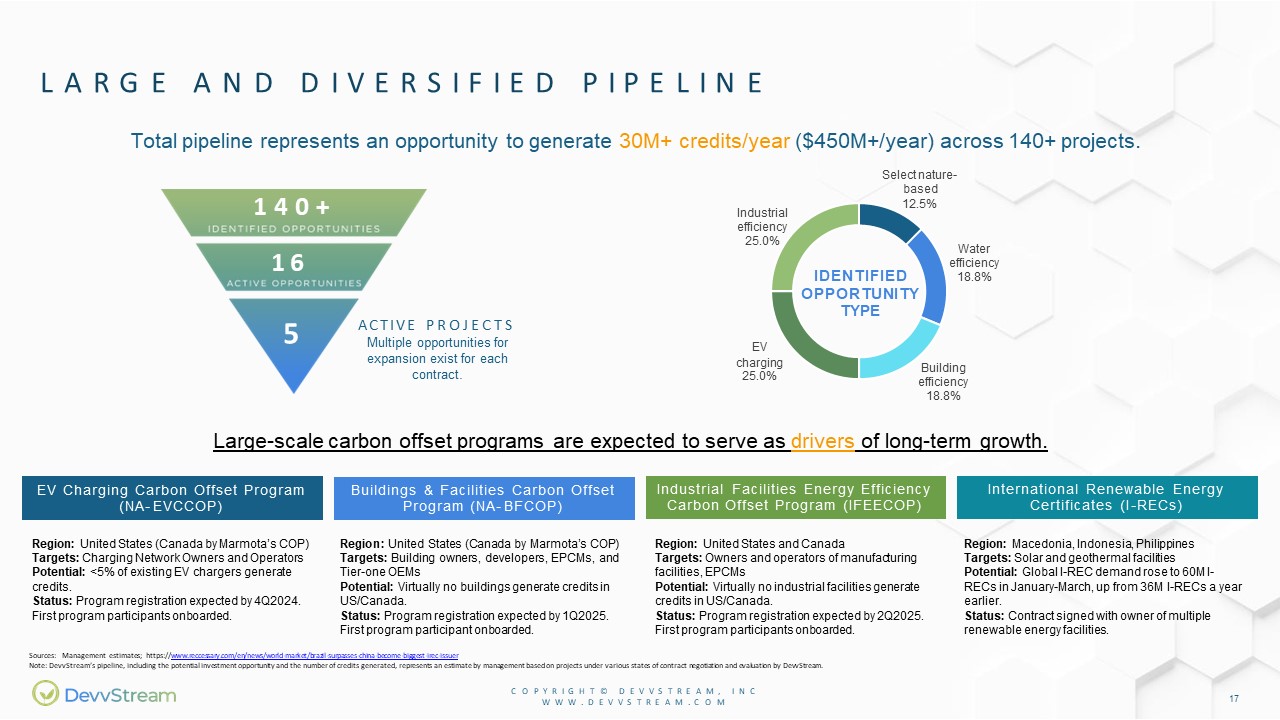

L A R G E A N D D I V E R S I F I E D P I P E L I N E 140+ 16 ACTIVE

PROJECTS Multiple opportunities for expansion exist for each contract. Total pipeline represents an opportunity to generate 30M+ credits/year ($450M+/year) across 140+ projects. Select nature- based C O P Y R I G H T © D E V V S T R E A M ,

I N C W W W . D E V V S T R E A M . C O M 12 12.5% Water efficiency 18.8% Building efficiency 18.8% EV charging 25.0% Industrial efficiency 25.0% IDENTIFIED OPPORTUNITY TYPE Large-scale carbon offset programs are expected to serve as

drivers of long-term growth. EV Charging Carbon Offset Program ( NA- EVCCOP) Region: United States (Canada by Marmota’s COP) Targets: Charging Network Owners and Operators Potential: <5% of existing EV chargers generate credits. Status:

Program registration expected by 4Q2024. First program participants onboarded. Buildings & Facilities Carbon Offset Program ( NA- BFCOP) Region: United States (Canada by Marmota’s COP) Targets: Building owners, developers, EPCMs, and

Tier-one OEMs Potential: Virtually no buildings generate credits in US/Canada. Status: Program registration expected by 1Q2025. First program participant onboarded. Industrial Facilities Energy Efficiency Carbon Offset Program (

IFEECOP) International Renewable Energy Certificates ( I - RECs) Region: United States and Canada Targets: Owners and operators of manufacturing facilities, EPCMs Potential: Virtually no industrial facilities generate credits in

US/Canada. Status: Program registration expected by 2Q2025. First program participants onboarded. Region: Macedonia, Indonesia, Philippines Targets: Solar and geothermal facilities Potential: Global I-REC demand rose to 60M I- RECs in

January-March, up from 36M I-RECs a year earlier. Status: Contract signed with owner of multiple renewable energy facilities. Sources: Management estimates;

https://www.reccessary.com/en/news/world-market/brazil-surpasses-china-become-biggest-irec-issuer Note: DevvStream’s pipeline, including the potential investment opportunity and the number of credits generated, represents an estimate by

management based on projects under various states of contract negotiation and evaluation by DevvStream. 5

P R O G R A M E X A M P L E : E V C H A R G I N G C O P Y R I G H T © D E V V S T

R E A M , I N C W W W . D E V V S T R E A M . C O M 12 As of May 2023, there are over 3.9 million public EV charging points worldwide. Fast Chargers with typical use can generate up to $10K per year from credits. L2 (prior generation)

chargers can generate up to $1K per year. Contracts signed with Go Station, Green Energy Technology, and E-Fill in India. In discussions with other EV charger companies. Large US installer with over 25,000 installations One with over

250,000 chargers One with over 65,000 chargers Program to offer free EV chargers in British Columbia. Eligible for compliance credits worth up to $790 CAD per credit. Combination of Low Carbon Fuel Standard (LCFS) and Clean Fuel Regulation

(CFR) credits IRR of > 40% after DevvStream’s 25% fee Investment of $510K for 2 chargers yields a 10-year EBITDA of ~$3M. Insurance available for the EV chargers and carbon credit stream. LOI for initial $10M investment into

program. Sources: Management estimates EVO Report 2024 | BloombergNEF | Bloomberg Finance LP. BloombergNEF. Retrieved 15 June 2024.

Industrial and manufacturing facilities upgrading their equipment to reduce energy

consumption are eligible for carbon credits. Contract signed with nonprofit in semiconductor industry and manufacturing with over 1,500 corporate members. C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 19

P R O G R A M E X A M P L E : I N D U S T R I A L E N E R G Y E F F I C I E N C Y Source: Management estimates

H I G H - Q U A L I T Y & S C A L A B L E O F F T A K E A G R E E M E N T

S Clean Water in Rural Africa Project Location: Sub-Saharan Africa Registry: Gold Standard Credit types: VER: avoided deforestation WBC (water credits): clean water delivery W+ credits: women’s empowerment Status: PDD undergoing

validation VERs/WBCs expected by 3Q2024 C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 19

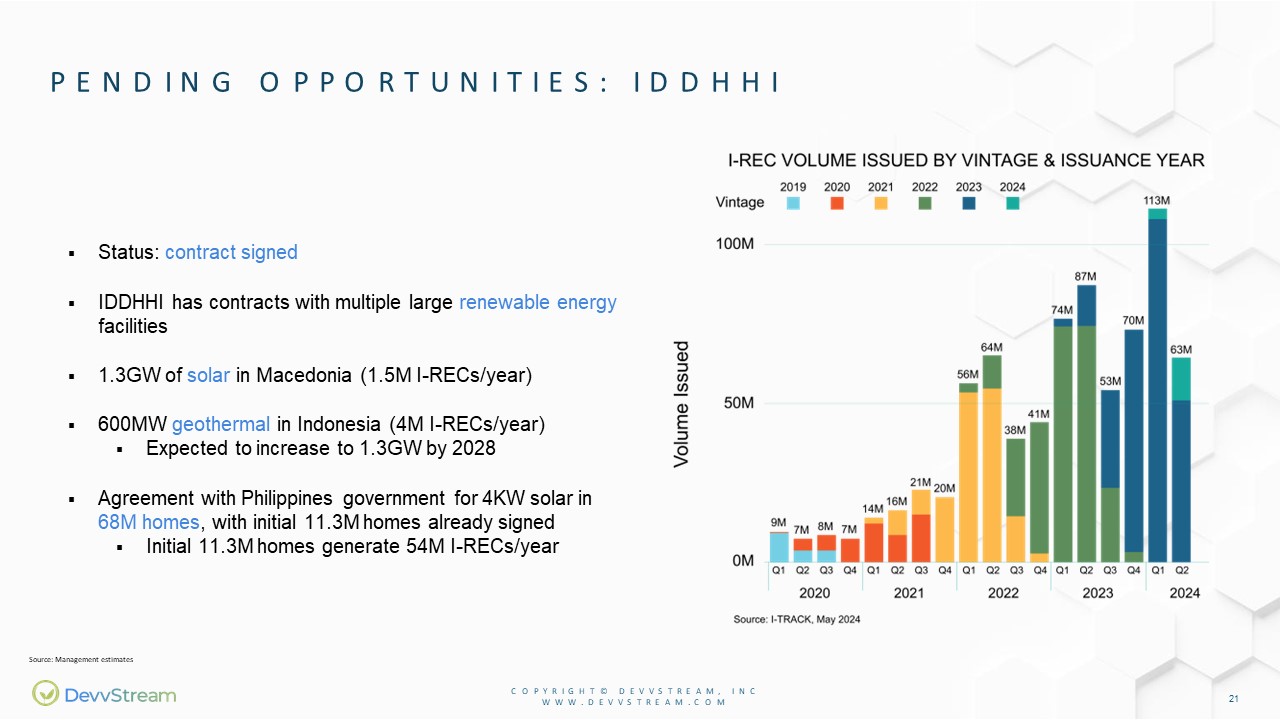

P E N D I N G O P P O R T U N I T I E S : I D D H H I Status: contract

signed IDDHHI has contracts with multiple large renewable energy facilities 1.3GW of solar in Macedonia (1.5M I-RECs/year) 600MW geothermal in Indonesia (4M I-RECs/year) Expected to increase to 1.3GW by 2028 Agreement with Philippines

government for 4KW solar in 68M homes, with initial 11.3M homes already signed Initial 11.3M homes generate 54M I-RECs/year Source: Management estimates C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 21

P E N D I N G O P P O R T U N I T I E S : G R E E N C R O S S U K Source:

Management estimates C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 21 Status: contract signed Grain storage project to eliminate 30M tons of grain lost annually Total grain lost is over 45M tons per

year Enough to feed 450M people for one year Equates to 69M tons of CO2e reduced, which equals 69M carbon credits annually Working with the government of India to make these ITMOs-compliant Expected to generate credits > $15

23 F I N A N C I A L O V E R V I E W

H I G H - L E V E L F I N A N C I A L P R O F I L E The underlying assumptions

for the company’s financial projections can be found in its Proxy Statement, filed on August 9, 2024 and linked as follows: https://www.sec.gov/Archives/edgar/data/1854480/000114036124036478/ny20010621x15_424b3.htm Updated Financial

Projections are summarized below:(1) Notes: The Updated Financial Projections were prepared and shared with management of FIAC and financial advisors to FIAC and to reflect DevvStream’s updated views on DevvStream’s new venue development

and opening schedule, and to reflect the update to the business given the passage of time since the Initial Financial Projections were prepared. The Updated Financial Projections were not available to the FIAC Board or Houlihan as of

September 12, 2023. The Initial Financial Projections no longer reflect DevvStream’s outlook for the calendar year ending December 31, 2024. See the disclaimers regarding "Financial Outlook", "Non-IFRS Measures" and "Non-GAAP Measures" for

additional information. Currently guiding for 2026 net income and corporate EBITDA of $25-35M and $35-45M, respectively. Neither FIAC, DevvStream nor any of their respective representatives, affiliates, advisors, officers or directors make

any representation to any person with regard to the ultimate performance of the combined company. EBITDA is defined as Net income (loss) before interest expense (net of interest income), Income tax expense (benefit) and Depreciation and

amortization expense. Adjusted EBITDA is defined as EBITDA, excluding equity-based compensation expense, venue pre-opening expenses, as well as certain items that DevvStream does not believe directly reflect its core operations and may not be

indicative of DevvStream’s recurring business operations. Adjusted EBITDA in the Updated Financial Projections includes management’s estimates for incremental costs associated with being a public company of $5.7 million in the calendar year

ending December 31, 2024. (in millions) Calendar Year Ending December 31, 2024P Calendar Year Ending December 31, 2025P Total Revenue $31.2 $131.7 Adjusted EBITDA(2) $6.6 $12.7 C O P Y R I G H T © D E V V S T R E A M , I N C W W W .

D E V V S T R E A M . C O M 24

C O M P A R A B L E C O M P A N Y S E L E C T I O N No perfect public

comparable is available, but an array of relevant companies exist and offer a strong basis for comparison. Relevant industries include: Proprietary cleantech manufacturers Carbon market intermediaries Renewable energy

developers Yield-based investment companies Metals royalty and streaming KEY TAKEAWAYS Yield-based investment & streaming Cleantech & renewables Hardware manufacturing Often CAPEX-intensive Sector focus Green premium No green

premium No tech upside Business model Near-term cash flow C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 24

15.3 7.4 2.1 NM 8.4 4.2 10.1 9.3 8.3 10.1 8.0 3.9 13.7 16.3 17.9 31.6 10.2 PROJECTED

EV / EBITDA 2026 C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 24 Cleantech & renewables Yields C O M P A R A B L E B E N C H M A R K I N G ILLUSTRATIVE ENTERPRISE VALUE * 7.0X 11.0X MIDPOINT

2026 EBITDA GUIDANCE $40.0 $308.0 EBITDA MULTIPLE 8.0X 9.0X 10.0X $352.0 $396.0 $440.0 $484.0 *Enterprise Value assumes no debt or cash Updated as of August, 2024. Note: See the disclaimers regarding "Financial Outlook", "Non-IFRS

Measures" and "Non-GAAP Measures" for additional information.

27 R I S K A P P E N D I X : S U P P L E M E N T A R Y I N F O R M A T I O N

& F A C T O R S

Sunny Trinh Chief Executive Officer ~25 years experience in technology, ESG and

carbon markets Led innovation, engineering and sales at Avnet (NASDAQ: AVT) and Arrow Electronics (NYSE: ARW) working with dozens of companies in renewable and energy efficiency technologies David Goertz Chief Financial Officer ~22 years

experience in public accounting, taxation, and business advisory Deep understanding of public company operations, restructurings, acquisitions & IPOs L E A D E R S H I P W I T H E X P E R I E N C E I N T E C H N O L O G Y & E S

G Bryan Went Chief Revenue Officer ~15 years experience as a founder, executive, and investor in sustainability and blockchain technologies Co-founded companies in alternative fuel motors, LEDs and other green technologies Erick

Went Chief Technology Officer Multiple VC-backed startups Multiple exits 30 years impact tech Chris Merkel Chief Operating Officer ~25 years experience in business development and operations Held various senior-level business

development roles at Avnet (NASDAQ: AVT) and Arrow Electronics (NYSE: ARW) Destenie Nock, PhD Chief Sustainability Officer C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 28 ~10 years experience in

sustainability investments, environmental policies, and energy equality Assistant Professor at Carnegie Mellon University Helped develop Ireland’s Renewable Obligation Credits

Tom Anderson Chairman Founder and CEO of Devvio, a leading provider of

enterprise blockchain solutions for ESG markets Successful entrepreneur with multiple exits including large IP sale to Facebook B O A R D C O M P R I S E D O F T H O U G H T L E A D E R S Michael Max Buehler Director C O P Y R I G H T © D

E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 28 Member of G20/Think20 Task Force 7 Infrastructure Investment and Financing World Economic Forum, Former Director & Head of Infrastructure & Urban Development

Industries Ray Quintana Director Chairman & President, Forevver Association; CEO, Envviron ~20 years experience in technology investing, corporate strategy, valuation and strategic finance Will Stewart Advisory Board Member Executive

Chairman of Xpansiv; Xpansiv recently raised US$400M from Blackstone Technology venture investor, having invested US$4bn+ in ~75 early-stage technology companies over the course of ~28 years Jamila Piracci Director Attorney at Federal

Reserve Bank of New York Created regulatory program at the National Futures Assoc. Lawyer for the International Swaps and Derivatives Assoc. Stephen Kukucha Lead Independent Director Partner at PacBridge Partners and Senior Advisor at Fort

Capital Previously board member at SDTC and External Affairs team lead at Ballard Power

S E L E C T M E D I A M E N T I O N S DevvStream is a recognized leader in

technology-based carbon credit generation. DevvStream CEO and Founder Sunny Trinh (seated on left) speaks at the UN Science Policy-Business Forum. C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O M 28

R I S K F A C T O R S C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E

V V S T R E A M . C O M 28 Certain factors may have a material adverse effect on our business, financial condition and results of operations. The risks and uncertainties described below are not the only ones we face. Additional risks and

uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that could have a material adverse effect on our business, financial condition and results of operations. If any of the

following risks actually materialize, they could have a material adverse effect on our business, financial condition and results of operations. In that event, you could lose part or all of your investment. All references in this section to

“we,” “our” or “us” refer to both the business of DevvStream Holdings Inc. and its subsidiaries (collectively, “DevvStream”) prior to the consummation of the contemplated business combination (the “Contemplated Business Combination”) with Focus

Impact Acquisition Corp. (“FIAC”) and to the business of the post-business combination public company and its subsidiaries. The list below is not exhaustive. It has been prepared solely for purposes of the private placement transaction and

solely for potential private placement investors. It has not been prepared for any other purpose. You should carefully consider these risks and uncertainties, together with any other information provided to you, and you should carry out your

own diligence and consult with your own financial and legal advisors concerning the risks and suitability of an investment in this offering before making an investment decision. Risks relating to the business and securities of DevvStream and

FIAC as well as the Contemplated Business Combination will be disclosed in future documents filed or furnished by DevvStream or FIAC with the U.S. Securities and Exchange Commission (“SEC”), including the documents filed or furnished in

connection with the Contemplated Business Combination. The risks and uncertainties presented in such filings will be consistent with those that would be required for a public company in its SEC filings, including with respect to the business

and securities of DevvStream and FIAC as well as the Contemplated Business Combination. Accordingly, such risks and uncertainties may differ significantly from, and be more exhaustive than, those presented below. Risks Related to DevvStream’s

Business and Industry We have a limited operating history and financial results make our future results, prospects and the risks we may encounter difficult to predict. We may lack sufficient funds to achieve or planned business

objectives and may seek to raise further funds through equity or debt financing or other means. An inability to access the capital or financial markets may limit our ability to fund our ongoing operations and execute our business plan to pursue

investments that we may rely on for future growth. Our business is substantially reliant on our technology partnership with Devvio, Inc., the termination of which could have a material adverse effect on our financial condition. If the

assumptions used to determine our market opportunity are inaccurate, our future growth rate may be affected and the potential growth of our business may be limited. If demand for carbon credits does not grow as expected or develops more slowly

than expected, our revenues may stagnate or decline and our business may be adversely affected. The carbon credit market is competitive and we expect to face increasing competition in many aspects of our business, which could cause operating

results to suffer. The carbon market is an emerging market and its growth is dependent on the development of a commercialized market for carbon credits. Because our business is significantly concentrated in carbon credits and the carbon

market, we are susceptible to adverse economic or regulatory occurrences materially and adversely affecting our performance. If we fail to retain our key personnel or if we fail to attract additional qualified personnel, we may not be able to

achieve our anticipated level of growth and our business could suffer. Certain of our directors, director nominees and/or officers may have interests that compete with ours. Continued on the following page. The risks described herein are not

the only ones DevvStream or FIAC face. Additional risks that are not currently known or that are currently believed to be immaterial may also impact our business, financial condition or results of operations. You should review the investor

presentation and perform your own due diligence prior to making in investment in FIAC. PLEASE SEE DEFINITIVE PROXY STATEMENT FOR ADDITIONAL RELEVANT DETAILS

R I S K F A C T O R S C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E

V V S T R E A M . C O M 28 The risks described herein are not the only ones DevvStream or FIAC face. Additional risks that are not currently known or that are currently believed to be immaterial may also impact our business, financial

condition or results of operations. You should review the investor presentation and perform your own due diligence prior to making in investment in FIAC. PLEASE SEE DEFINITIVE PROXY STATEMENT FOR ADDITIONAL RELEVANT

DETAILS Increased scrutiny of ESG matters, including our completion of certain ESG initiatives, could have an adverse effect on our business, financial condition and results of operations, result in

reputational harm and negatively impact the assessments made by ESG-focused investors when evaluating us. The market price of shares of our common stock is subject to the price of carbon credits and may decline regardless of our operating

performance. Our due diligence process in connection with acquisitions, investments or streaming arrangements that we undertake may not reveal all relevant facts in connection with an acquisition, investment or streaming arrangement. We may

not realize the anticipated benefits of past or future acquisitions, and integration of these acquisitions may disrupt our business. Our long-term success depends, in part, on properties and assets developed and managed by third party project

developers, owners and operators. We may have limited access to data and disclosure regarding the operations or projects for which we are not developer, owner or operator. This limited access may restrict our ability to assess the value and

performance of our operations. Our streams are largely contract-based and the terms of such contracts may not be honored by developers or operators of a project. We may acquire future streams in which we have limited control and our

interests in such streams may be subject to transfer or other related restrictions. Physical and transition risks arising from climate change, including risks posed by the increased frequency or severity of natural and catastrophic events and

regulations or policies related to climate change, may negatively impact our business and operations. The threat of global economic, capital markets and credit disruptions pose risks to our business. Inflation could adversely affect our

business and results of operations. Carbon markets, particularly the voluntary markets, are still evolving and there are no assurances that the carbon credits we purchase or generate through our investments will find a market. We are subject

to economic, political and other risks of doing business globally and in emerging markets. Our insurance policies may be inadequate, may not cover all of our potential liabilities and may potentially expose us to uncoverable

risks. Fluctuations in foreign exchange rates may negatively affect our business. Risks Related to DevvStream’s Information Technology and Intellectual Property Failure of a key information technology system, process or site could

have an adverse effect on our business. We have experienced security incidents or breaches in the past. If we suffer a security incident or breach, our reputation may be harmed and we may suffer significant liabilities, any of which would harm

our business and results of operations. The actual or perceived failure to comply with data privacy and data security laws, regulations and industry standards could have a material adverse effect on our reputation, results of operations or

financial condition or have other adverse consequences. Our inability to retain licenses to intellectual property owned by third parties may negatively impact our financial results and operations. If we are unable to obtain, protect or

enforce our rights in proprietary technology, brands or other intellectual property, our competitive advantage, business, financial condition, results of operations, cash flow and prospects could be adversely affected.

R I S K F A C T O R S C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E

V V S T R E A M . C O M 28 Risks Related to Legal, Compliance and Regulations Our business and current and future operations are subject to liabilities and operating restrictions arising from regulatory requirements. We

will be subject to regulatory requirements in multiple jurisdictions, which impose substantial compliance requirements on our operations. Our operating costs could be significantly increased in order to comply with new or more stringent

regulatory standards in the jurisdictions in which we operate. From time to time, we may be involved in litigation, regulatory actions or government investigations and inquiries, which could have an adverse impact on our profitability and

financial position. It may be difficult for our stockholders to acquire jurisdiction and enforce liabilities against our assets based in international jurisdictions. We may not be able to have all our projects validated through a compliance

market or by an internationally recognized carbon credits standard body. Carbon pricing initiatives are based on scientific principles that are subject to debate. Failure to maintain international consensus may negatively affect the value of

carbon credits. Our business may require numerous permits, licenses and other approvals from various governmental agencies, and the failure to obtain or maintain any of them, or delays in obtaining them, could materially adversely affect

us. Our cross-border operations require us to comply with anti-bribery and anti-corruption laws. We are subject to legal risks associated with our global operations. Carbon trading is heavily regulated and new legislation in the jurisdictions

in which we operate may materially impact our operations. Risks Related to the Contemplated Business Combination Events, changes or other circumstances, many of which are beyond the control of DevvStream and FIAC, could give rise

to the termination of negotiations and any subsequent definitive agreements with respect to the Contemplated Business Combination. The Contemplated Business Combination may disrupt current plans and operations of DevvStream. If the

Contemplated Business Combination's benefits do not meet expectations of investor or securities analysts, the market price of FIAC's securities, or following the consummation of the Contemplated Business Combination, the combined company's

securities, may decline. The valuation ascribed to the combined company may not be indicative of the price that will prevail in the trading market following the Contemplated Business Combination. If an active market for the combined company's

securities develops and continues, the trading price of the combined company's securities following the Contemplated Business Combination could be volatile and subject to wide fluctuations in response to various factors, which could contribute

to the loss of all or part of your investment. Both FIAC and DevvStream have incurred and will incur significant transactions costs in connection with the Contemplated Business Combination. Continued on the following page. The risks

described herein are not the only ones DevvStream or FIAC face. Additional risks that are not currently known or that are currently believed to be immaterial may also impact our business, financial condition or results of operations. You should

review the investor presentation and perform your own due diligence prior to making in investment in FIAC. PLEASE SEE DEFINITIVE PROXY STATEMENT FOR ADDITIONAL RELEVANT DETAILS

R I S K C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A

M . C O M 28 F A C T O R S The risks described herein are not the only ones DevvStream or FIAC face. Additional risks that are not currently known or that are currently believed to be immaterial may also impact our business, financial

condition or results of operations. You should review the investor presentation and perform your own due diligence prior to making in investment in FIAC. PLEASE SEE DEFINITIVE PROXY STATEMENT FOR ADDITIONAL RELEVANT

DETAILS FIAC and DevvStream may not successfully or timely consummate the Contemplated Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated

conditions that could adversely affect the combined company or the expected benefits of the Contemplated Business Combination or that the approval of the stockholders of FIAC or DevvStream is not obtained. The consummation of the Contemplated

Business Combination is subject to a number of conditions and if those conditions are not satisfied or waived, the Contemplated Business Combination agreement may be terminated in accordance with its terms and the Contemplated Business

Combination may not be completed. Since Focus Impact Sponsor, LLC (“FIAC Sponsor”) has interests that are different, or in addition to (and which may conflict with), the interests of the FIAC public stockholders, a conflict of interest may

exist in determining whether the Contemplated Business Combination is appropriate as a business combination. Such interests include that the FIAC Sponsor will lose its entire investment in FIAC if a business combination is not completed. There

is no guarantee that a stockholder's decision whether to redeem its shares for a pro rata portion for the trust account will put the stockholder in a better future economic position. Legal proceedings in connection with the Contemplated

Business Combination, the outcomes of which are uncertain, could delay or prevent the completion of the Contemplated Business Combination. Following the consummation of the Contemplated Business Combination, the combined company will incur

significant increased expenses and administrative burdens as a public company, which could have an adverse effect on its business, financial condition and results of operation. Changes in laws or regulations, or a failure to comply with any

laws and regulations, may adversely affect DevvStream's or the combined company's business, including the ability of the parties to consummate the Contemplated Business Combination, and results of operation of DevvStream or the combined

company.

C O P Y R I G H T © D E V V S T R E A M , I N C W W W . D E V V S T R E A M . C O

M S U N N Y T R I N H | C E O S U N N Y @ D E V V S T R E A M . C O M