|

Delaware

|

| |

0677

|

| |

86-2433757

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

| |

(Primary Standard Industrial Classification Code Number)

|

| |

(I.R.S. Employer Identification No.)

|

|

Peter Seligson, P.C.

Kirkland & Ellis LLP

601 Lexington Ave

New York, New York 10022

Telephone: (212) 446-4800

|

| |

Justin R. Salon

Morrison & Foerster LLP

2100 L Street, NW

Suite 900

Washington, DC 20037

Tel: (202) 887-1500

|

| |

Simon Romano

Stikeman Elliott LLP

Commerce Court West, Suite 5300

Toronto, Canada M5L 1B9

Telephone: (416) 869-5500

|

|

Large accelerated filer

|

| |

☐

|

| |

|

| |

Accelerated filer

|

| |

☐

|

|

Non-accelerated

|

| |

☒

|

| |

|

| |

Smaller reporting company

|

| |

☒

|

|

|

| |

|

| |

|

| |

Emerging growth company

|

| |

☒

|

|

|

| |

Very truly yours,

|

|

|

| |

|

|

|

| |

|

|

|

| |

Carl Stanton

Chief Executive Officer

Focus Impact Acquisition Corp.

|

|

(1)

|

The Business Combination Proposal (Proposal

1) — To approve and adopt the Business Combination Agreement, dated as of September 12, 2023 (the “Initial Business Combination Agreement”), as amended by the First

Amendment thereto, dated as of May 1, 2024 (the “First Amendment” and as it may be amended or supplemented from time to time, the “Business Combination Agreement,” and the transactions contemplated thereby, the “Business Combination”), by and among FIAC, Focus Impact Amalco Sub Ltd., a

company existing under the laws of the Province of British Columbia and wholly-owned subsidiary of FIAC (“Amalco Sub”), and DevvStream Holdings Inc., a company existing under the

Laws of the Province of British Columbia (“DevvStream”), and approve the transactions contemplated thereby, including:

|

|

(a)

|

prior to the Effective Time, all shares of Class A common stock, par value $0.0001 per share, of FIAC (the “Class A Common Stock”) duly tendered for redemption and not withdrawn will be redeemed and thereafter, FIAC will continue (the “SPAC

Continuance”) from the State of Delaware under the Delaware General Corporation Law (“DGCL”) to the Province of Alberta under the Business Corporations Act (Alberta) (“ABCA”) and change its name to DevvStream Corp. (“New PubCo”);

|

|

(b)

|

following the SPAC Continuance, and in accordance with the applicable provisions of the Plan of Arrangement, to be implemented as

of the Closing Date and attached hereto as Annex G (the “Plan of Arrangement”), and the Business Corporations Act (British

Columbia) (the “BCBCA”), Amalco Sub and DevvStream will amalgamate to form one corporate entity (such entity, “Amalco”,

and such transaction, the “Amalgamation”), and as a result of the Amalgamation, (i) each Company Share issued and outstanding immediately prior to the Effective Time (as such

term is defined in the Plan of Arrangement) will be automatically exchanged for that certain number of common shares of New PubCo (the “New PubCo Common Shares”) equal to the

applicable Per Common Share Amalgamation Consideration, (ii) each Company Option and Company RSU issued and outstanding immediately prior to the Effective Time will be cancelled and converted into Converted Options and Converted RSUs,

respectively, in an amount equal to the Company Shares underlying such Company Option or Company RSU, respectively, multiplied by the Common Conversion Ratio (and, for Company Options, at an adjusted exercise price equal to the exercise

price for such Company Option immediately prior to the Effective Time divided by the Common Conversion Ratio), (iii) each Company Warrant issued and outstanding immediately prior to the Effective Time shall become exercisable for New

PubCo Common Shares in an amount equal to the Company Shares underlying such Company Warrant multiplied by the Common Conversion Ratio (and at an adjusted exercise price equal to the exercise price for such Company Warrant prior to the

Effective Time divided by the Common Conversion Ratio), (iv) each holder of Company Convertible Notes, if any, issued and outstanding immediately prior to the Effective Time will first receive Company Shares and then New PubCo Common

Shares in accordance with the terms of such Company Convertible Notes, (v) Amalco will be the resulting entity in the Amalgamation and (vi) each common share of Amalco Sub issued and outstanding immediately prior to the Effective Time

will be automatically exchanged for one common share of Amalco (the SPAC Continuance and the Amalgamation, together with the other transactions related thereto, the “Proposed

Transactions”); and

|

|

(c)

|

the DevvStream shareholders and securityholders as of the Effective Time (collectively, the “DevvStream Shareholders”), will receive that number of New PubCo Common Shares (or, with respect to Company Options, Company RSUs and Company Warrants, a number of Converted Options, Converted RSUs and

Converted Warrants consistent with the aforementioned conversion

|

|

(2)

|

The SPAC Continuance Proposal (Proposal

2) — To consider and vote upon a proposal (the “SPAC Continuance Proposal”) to approve the SPAC Continuance, and in connection therewith, the adoption of the new

articles of continuance of FIAC effective upon the SPAC Continuance in substantially the form attached to the accompanying proxy statement/prospectus as Annex B (the “post-continuance FIAC Articles”);

|

|

(3)

|

The Nasdaq Proposal (Proposal 3)

— To consider and vote upon a proposal to approve, for purposes of complying with applicable listing rules of The Nasdaq Stock Market LLC (the “Nasdaq Listing Rules”), the

issuance of New PubCo Common Shares pursuant to the Business Combination Agreement (the “Nasdaq Proposal”);

|

|

(4)

|

The Charter Proposal (Proposal 4)

— To consider and vote upon a proposal (the “Charter Proposal”) to approve, by special resolution, and adopt the articles of continuance and bylaws of New PubCo in substantially

the form attached to the accompanying proxy statement/prospectus as Annex B and Annex C, respectively, (the “New PubCo Governing Documents”);

|

|

(5)

|

The Advisory Charter Proposals

(Advisory Proposals 5A through 5H) — To consider and vote upon, on a non-binding, advisory basis, certain differences set forth below between FIAC’s existing organizational documents (the “FIAC Charter”) and the New PubCo Governing Documents, presented separately in accordance with the requirements of the United States Securities and Exchange Commission (the “SEC”) (collectively, the “Advisory Charter Proposals”):

|

|

(A)

|

Name Change — to provide that the name of FIAC shall be changed to “DevvStream Corp.” (Advisory Proposal 5A);

|

|

(B)

|

Amendment of Blank Check Provisions — to remove and change certain provisions in the FIAC

Charter related to FIAC’s status as a special purpose acquisition company (Advisory Proposal 5B);

|

|

(C)

|

Change in Authorized Shares — to authorize an unlimited number of New PubCo Common Shares

and an unlimited number of preferred shares issuable in series with such terms as are determined by the New PubCo Board from time to time (Advisory Proposal 5C);

|

|

(D)

|

Change in Quorum — to provide that the quorum required for shareholder meetings is a

minimum of 331/3% of shares entitled to vote thereon (Advisory Proposal 5D);

|

|

(E)

|

Removal of Directors — to provide that shareholders may remove a director by resolution

of not less than a simple majority of the votes cast in respect thereof (Advisory Proposal 5E);

|

|

(F)

|

Advance Notice — to provide that the time period to provide notice of the time and place

of a meeting of shareholders is not less than twenty-one (21) days and not more than fifty (50) days before the meeting (Advisory Proposal 5F);

|

|

(G)

|

Forum Selection — to provide that, unless New PubCo consents in writing to the selection

of an alternative forum, the Courts of the Province of Alberta, Canada shall be the sole and exclusive forum for certain disputes involving New PubCo, including derivative actions or proceedings brought on behalf of New PubCo (Advisory Proposal 5G); and

|

|

(H)

|

Shareholder Nominations — to provide that stockholder nominations for the board of

directors must be given not less than 30 days prior to the date of the annual meeting of shareholders (Advisory Proposal 5H);

|

|

(6)

|

The Incentive Plan Proposal (Proposal

6) — To consider and vote upon a proposal to adopt the DevvStream Corp. 2024 Equity Incentive Plan (the “Equity Incentive Plan”), a copy of which is attached to the

accompanying proxy statement/prospectus as Annex F and the issuance of shares equal to 10% of the fully diluted, and as converted, amount of New PubCo Common Shares to be outstanding

immediately following consummation of the Business Combination, or approximately shares as equity awards in accordance with the Equity Incentive Plan, if such plan is approved in accordance with the Incentive Plan Proposal (the “Incentive Plan Proposal”); and

|

|

(7)

|

The Adjournment Proposal (Proposal 7)

— To consider and vote upon a proposal to adjourn the FIAC Stockholders Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the FIAC

Stockholders Meeting, there are not sufficient votes to approve the Business Combination Proposal, the SPAC Continuance Proposal, the Charter Proposal or the Incentive Plan Proposal (the “Adjournment Proposal,” and together with the Business Combination Proposal, the SPAC Continuance Proposal, the Nasdaq Proposal, the Charter Proposal, the Advisory Charter Proposals, the Incentive Plan Proposal and the

Adjournment Proposal, collectively, the “Proposals”).

|

|

|

| |

Sincerely,

|

|

|

| |

|

|

|

| |

Carl Stanton

|

|

|

| |

Chief Executive Officer

|

|

•

|

the ability of FIAC and DevvStream prior to the Business Combination to meet the conditions to closing of the Business

Combination, including approval by stockholders of FIAC and DevvStream of the Business Combination and related proposals;

|

|

•

|

the ability of the Combined Company following the Business Combination, to realize the benefits from the Business Combination;

|

|

•

|

changes in the market price of New PubCo Common Shares after the Business Combination, which may be affected by factors different

from those currently affecting the price of shares of Class A Common Stock;

|

|

•

|

the occurrence of any event, change or other circumstances that could give rise to the termination of the Business Combination

Agreement;

|

|

•

|

the ability of FIAC and DevvStream to obtain the Interim Order and the Final Order;

|

|

•

|

the ability of FIAC and DevvStream prior to the Business Combination, and the Combined Company following the Business Combination,

to obtain and/or maintain the listing of the New PubCo Common Shares on Nasdaq following the Business Combination;

|

|

•

|

future financial performance following the Business Combination;

|

|

•

|

public securities’ potential liquidity and trading;

|

|

•

|

the use of proceeds not held in the Trust Account or available to FIAC from interest income on the Trust Account balance;

|

|

•

|

the impact from the outcome of any known and unknown litigation;

|

|

•

|

the ability of the Combined Company to forecast and maintain an adequate rate of revenue growth and appropriately plan its

expenses;

|

|

•

|

expectations regarding future expenditures of the Combined Company following the Business Combination;

|

|

•

|

the future mix of revenue and effect on gross margins of the Combined Company following the Business Combination;

|

|

•

|

changes in interest rates or rates of inflation;

|

|

•

|

the attraction and retention of qualified directors, officers, employees and key personnel of FIAC and DevvStream prior to the

Business Combination, and the Combined Company following the Business Combination;

|

|

•

|

the ability of the Combined Company to compete effectively in a competitive industry;

|

|

•

|

the ability to protect and enhance DevvStream’s and the Combined Company’s corporate reputation and brand;

|

|

•

|

expectations concerning the relationships and actions of DevvStream and its affiliates with third parties;

|

|

•

|

the impact from future regulatory, judicial and legislative changes in DevvStream’s or the Combined Company’s industry;

|

|

•

|

the ability to locate and acquire complementary products or product candidates and integrate those into DevvStream’s or the

Combined Company’s business;

|

|

•

|

future arrangements with, or investments in, other entities or associations;

|

|

•

|

intense competition and competitive pressures from other companies in the industries in which the Combined Company will operate;

|

|

•

|

the financial and other interests of the FIAC Board, which may have influenced the FIAC Board’s decision to approve the Business

Combination;

|

|

•

|

risks related to the uncertainty of the projected financial information with respect to DevvStream;

|

|

•

|

the volatility of the market price and liquidity of the Class A Common Stock and other securities of FIAC; and

|

|

•

|

other factors detailed under the section titled “Risk Factors.”

|

|

Q:

|

Why am I receiving this proxy statement/prospectus?

|

|

A:

|

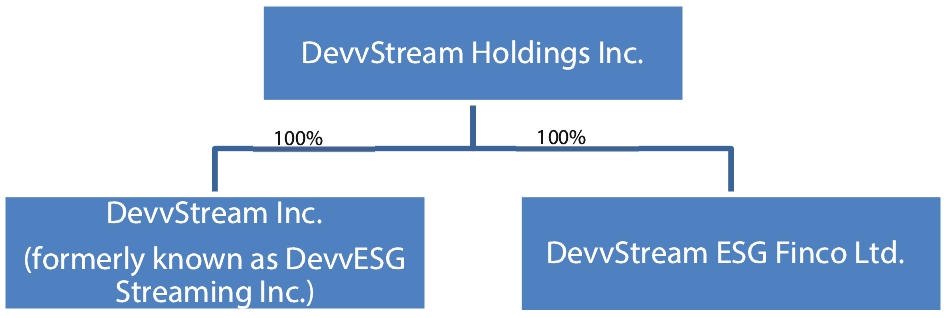

FIAC stockholders are being asked to consider and vote upon a proposal to approve the Business Combination contemplated by the

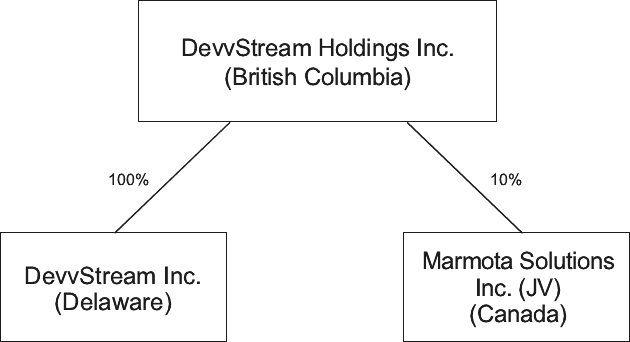

Business Combination Agreement, among other proposals. As a result of the Amalgamation, DevvStream will become a wholly-owned subsidiary of New PubCo. Copies of the Initial Business Combination Agreement and the First Amendment are

attached to this proxy statement/prospectus as Annex A-1 and Annex A-2, respectively.

|

|

(1)

|

The Business Combination Proposal (Proposal 1)

|

|

a.

|

prior to the Effective Time, FIAC will continue from the State of Delaware under the Delaware General Corporation Law to the

Province of Alberta under the Business Corporations Act (Alberta) and change its name to DevvStream Corp.;

|

|

b.

|

following the SPAC Continuance, and in accordance with the applicable provisions of the Plan of Arrangement and the Business

Corporations Act (British Columbia), Amalco Sub and DevvStream will amalgamate to form Amalco, and as a result of the Amalgamation, (i) each Company Share issued and outstanding immediately prior to the Effective Time (as such term is

defined in the Plan of Arrangement) will be automatically exchanged for that certain number of New PubCo Common Shares equal to the applicable Per Common Share Amalgamation Consideration, (ii) each Company Option and Company RSU issued

and outstanding immediately prior to the Effective Time will be cancelled and converted into Converted Options and Converted RSUs, respectively, in an amount equal to the Company Shares underlying such Company Option or Company RSU,

respectively, multiplied by the Common Conversion Ratio (and, for Company Options, at an adjusted exercise price equal to the exercise price for such Company Option immediately prior to the Effective Time divided by the Common Conversion

Ratio), (iii) each Company Warrant issued and outstanding immediately prior to the Effective Time shall become exercisable for New PubCo Common Shares in an amount equal to the Company Shares underlying such Company Warrant multiplied by

the Common Conversion Ratio (and at an adjusted exercise price equal to the exercise price for such Company Warrant prior to the Effective Time divided by the Common Conversion Ratio), (iv) each holder of Convertible Bridge Notes, if any,

issued and outstanding immediately prior to the Effective Time will first receive Company Shares and

|

|

c.

|

the DevvStream Shareholders as of the Effective Time, will receive that number of New PubCo Common Shares (or, with respect to

Company Options, Company RSUs and Company Warrants, a number of Converted Options, Converted RSUs and Converted Warrants consistent with the aforementioned conversion mechanics) equal to (a)(i) the Reverse Split Factor multiplied by

(ii)(x) $145 million plus the aggregate exercise price of all in-the-money Company Options and Company Warrants immediately prior to the Effective Time (or exercised in cash prior to the Effective

Time) divided by (y) $10.20, plus (b) solely to the extent any Company Shares are required to be issued to Approved Financing Sources pursuant to Approved Financings in connection with the

Closing, (i) each such Company Share multiplied by (ii) the Per Common Share Amalgamation Consideration in respect of such Company Share, all as more particularly described elsewhere in this proxy statement/prospectus.

|

|

(2)

|

The SPAC Continuance (Proposal 2)

|

|

(3)

|

The Nasdaq Proposal (Proposal 3)

|

|

(4)

|

The Charter Proposal (Proposal 4)

|

|

(5)

|

The Advisory Charter Proposals (Advisory Proposals 5A through 5H)

|

|

(A)

|

Name Change — to provide that the name of FIAC shall be changed to “DevvStream Corp.” (Advisory Proposal 5A);

|

|

(B)

|

Amendment of Blank Check Provisions — to remove and change certain provisions in the

FIAC Charter related to FIAC’s status as a special purpose acquisition company (Advisory Proposal 5B);

|

|

(C)

|

Change in Authorized Shares — to authorize an unlimited number of New PubCo Common Shares

and an unlimited number of preferred shares issuable in series with such terms as are determined by the New PubCo Board from time to time (Advisory Proposal 5C);

|

|

(D)

|

Change in Quorum — to provide that the quorum required for shareholder meetings is a

minimum of 331/3% of shares entitled to vote thereon (Advisory Proposal 5D);

|

|

(E)

|

Removal of Directors — to provide that stockholders may remove a director by resolution

of not less than a simple majority of the votes cast in respect thereof (Advisory Proposal 5E);

|

|

(F)

|

Advance Notice — to provide that the time period to provide notice of the time and place

of a meeting of shareholders is not less than twenty-one (21) days and not more than fifty (50) days before the meeting (Advisory Proposal 5F);

|

|

(G)

|

Forum Selection — to provide that, unless New PubCo consents in writing to the selection

of an alternative forum, the Courts of the Province of Alberta, Canada shall be the sole and exclusive forum for certain disputes involving New PubCo, including derivative actions or proceedings brought on behalf of New PubCo (Advisory Proposal 5G); and

|

|

(H)

|

Stockholder Nominations — to provide that stockholder nominations for the board of

directors must be given not less than 30 days prior to the date of the annual meeting of shareholders (Advisory Proposal 5H);

|

|

(6)

|

The Incentive Plan Proposal (Proposal 6)

|

|

(7)

|

The Adjournment Proposal (Proposal 7)

|

|

Q:

|

When and where will the FIAC Stockholders Meeting take place?

|

|

A:

|

The FIAC Stockholders Meeting will be held on , at a.m., Eastern Time, via live audio webcast at

https://www.cstproxy.com/focus-impact/2024 or such other date, time and place to which such meeting may be adjourned or postponed, to consider and vote upon the proposals.

|

|

Q:

|

Are the proposals conditioned on one another?

|

|

A:

|

Unless the Business Combination Proposal and the SPAC Continuance Proposal are approved, the Nasdaq Proposal, the Charter

Proposal, the Advisory Charter Proposals and the Incentive Plan Proposal will not be presented to the stockholders of FIAC at the FIAC Stockholders Meeting, insofar as the Incentive Plan Proposal, the Charter Proposal, the Advisory

Charter Proposals and the Nasdaq Proposal are conditioned on the approval of the Business Combination Proposal and the SPAC Continuance Proposal (and the Business Combination Proposal and the SPAC Continuance Proposal are conditioned on

the approval of the Incentive Plan Proposal, the Charter Proposal, the Advisory Charter Proposals and the Nasdaq Proposal). The Adjournment Proposal is not conditioned on the approval of any other proposal set forth in this proxy

statement/prospectus. It is important for you to note that if the Business Combination Proposal and the SPAC Continuance Proposal do not receive the requisite vote for approval, we will not consummate the Business Combination. If FIAC

does not consummate the Business Combination and fails to complete an initial business combination by November 1, 2024, FIAC will be required, in accordance with the FIAC Charter, to dissolve and liquidate its Trust Account by returning

the then remaining funds in such account (less amounts released to pay tax obligations and up to $100,000 for dissolution expenses, and amounts paid pursuant to redemptions) to its public stockholders, unless it seeks and obtains the

approval of FIAC stockholders to amend the FIAC Charter to extend such date.

|

|

Q:

|

What will happen in the Business Combination?

|

|

A:

|

At the Closing, Amalco Sub and DevvStream will amalgamate to form Amalco, as a result of which the DevvStream Shareholders will

receive newly issued New PubCo Common Shares, and upon consummation of the Business Combination, Amalco will become a wholly-owned subsidiary of FIAC and FIAC will change its name to DevvStream Corp. After the Closing, the cash held in

the Trust Account will be released from the Trust Account and used to pay each of FIAC’s and DevvStream’s transaction expenses and other liabilities of FIAC due as of the Closing, and for working capital and general corporate purposes.

Copies of the Initial Business Combination Agreement and the First Amendment are attached to this proxy statement/prospectus as Annex A-1 and Annex

A-2, respectively.

|

|

Q:

|

What equity stake will current stockholders of FIAC and DevvStream securityholders hold in the Combined Company

after the Closing?

|

|

A:

|

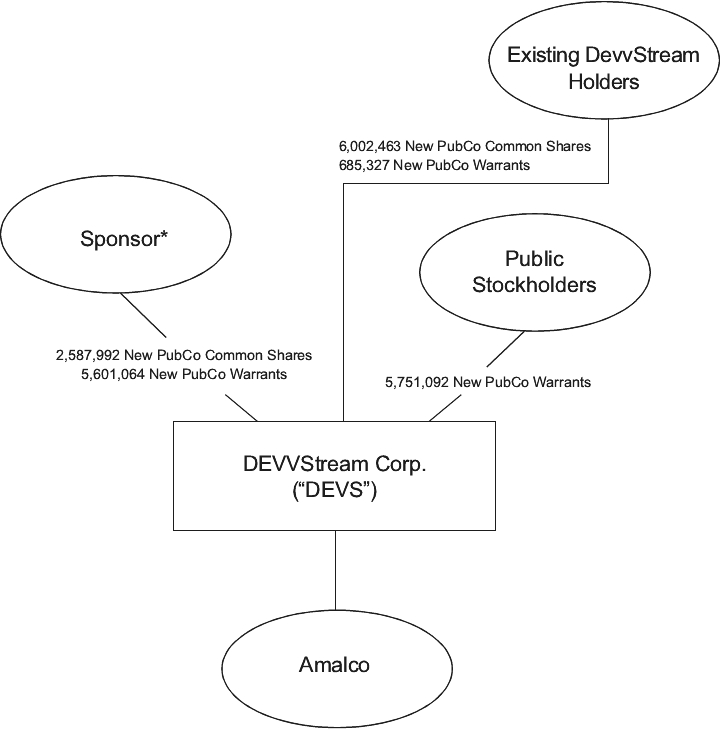

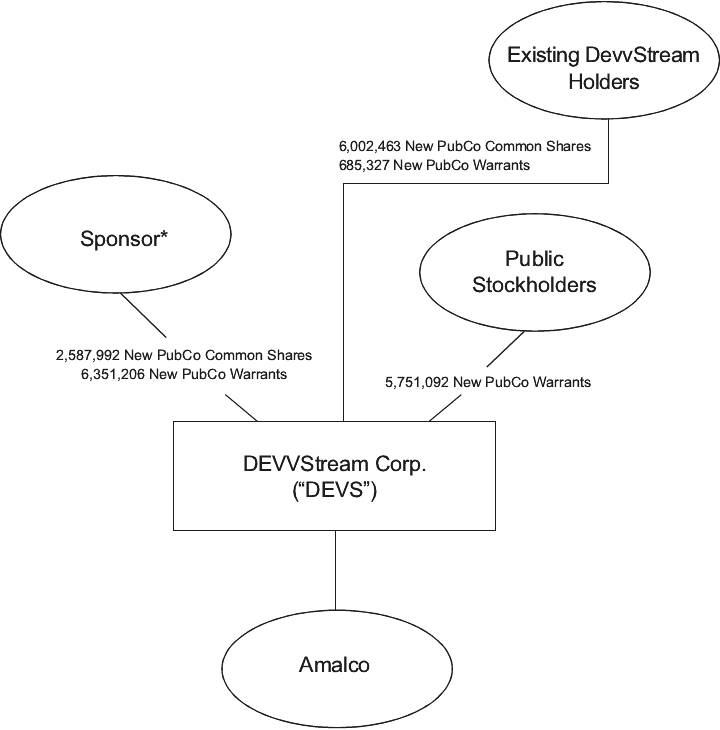

It is anticipated that, upon the completion of the Business Combination, FIAC’s public stockholders will retain an ownership

interest of approximately 9.1% of the outstanding shares of New PubCo, Sponsor will retain an ownership interest of approximately 27.4% of the outstanding shares of New PubCo, the DevvStream Shareholders will own approximately 63.5% of

the outstanding shares of New PubCo and investors signatory to those certain PIPE subscription agreements, dated as of (the “PIPE Investors”), will own approximately % of

the outstanding shares of New PubCo. The foregoing ownership percentages with respect to New PubCo following the Business Combination exclude any outstanding Warrants and assume that (i) there are no redemptions of any shares by FIAC’s

public stockholders in connection with the Business Combination and (ii) no awards are issued under the Equity Incentive Plan. If the actual facts are different than these assumptions (which they are likely to be), the percentage

ownership retained by the FIAC public stockholders in New PubCo will be different. Because the level of stockholder redemptions will not be known until the FIAC Stockholders Meeting, holders of Class A Common Stock will not know at the

time of the vote the percentage of the Combined Company’s outstanding capital stock that they will hold.

|

|

|

| |

Share Ownership in DevvStream Holdings Inc.(1)

|

|||||||||||||||||||||||||||

|

|

| |

Pro Forma

Combined

(Assuming No

Redemptions)(2)

|

| |

Pro Forma

Combined

(Assuming 25%

Redemptions)(3)

|

| |

Pro Forma

Combined

(Assuming 50%

Redemptions)(4)

|

| |

Pro Forma

Combined

(Assuming 75%

Redemptions)(5)

|

| |

Pro Forma

Combined

(Assuming

Maximum

Redemptions)(6)(7)

|

|||||||||||||||

|

|

| |

Number

of Shares

|

| |

%

Ownership

|

| |

Number

of Shares

|

| |

%

Ownership

|

| |

Number

of Shares

|

| |

%

Ownership

|

| |

Number

of Shares

|

| |

%

Ownership

|

| |

Number

of Shares

|

| |

%

Ownership

|

|

Sponsor and initial FIAC stockholders(8)(9)

|

| |

2,587,992

|

| |

27.4%

|

| |

2,587,992

|

| |

28.0%

|

| |

2,587,992

|

| |

28.7%

|

| |

2,587,992

|

| |

29.4%

|

| |

2,587,992

|

| |

30.1%

|

|

FIAC public stockholders(10)

|

| |

858,950

|

| |

9.1%

|

| |

644,213

|

| |

7.0%

|

| |

429,475

|

| |

4.8%

|

| |

214,738

|

| |

2.4%

|

| |

—

|

| |

0.0%

|

|

Former DevvStream shareholders(11)

|

| |

6,002,463

|

| |

63.5%

|

| |

6,002,463

|

| |

65.0%

|

| |

6,002,463

|

| |

66.5%

|

| |

6,002,463

|

| |

68.2%

|

| |

6,002,463

|

| |

69.9%

|

|

Former DevvStream Convertible Bridge Note Holders

|

| |

—

|

| |

0.0%

|

| |

—

|

| |

0.0%

|

| |

—

|

| |

0.0%

|

| |

—

|

| |

0.0%

|

| |

—

|

| |

0.0%

|

|

Total

|

| |

9,449,405

|

| |

100.0%

|

| |

9,234,668

|

| |

100.0%

|

| |

9,019,930

|

| |

100.0%

|

| |

8,805,193

|

| |

100.0%

|

| |

8,590,445

|

| |

100.0%

|

|

(1)

|

Assumes a Reverse Split Factor of 0.5001, based on the closing price of the Subordinated Voting Company Shares on the Cboe

Canada, as of June 3, 2024, converted into United States dollars based on the Bank of Canada daily exchange rate as of June 3, 2024.

|

|

(2)

|

Assumes that no Class A Common Stock is redeemed.

|

|

(3)

|

Assumes 25% of the shares of Class A Common Stock are redeemed for aggregate redemption payments of approximately $4.8 million,

assuming a $11.18 per share redemption price and based on shares subject to redemption (prior to the application of the Reverse Split Factor) and funds in the Trust Account as of March 31, 2024.

|

|

(4)

|

Assumes 50% of the shares of Class A Common Stock are redeemed for aggregate redemption payments of approximately $9.6 million,

assuming a $11.18 per share redemption price and based on shares subject to redemption (prior to the application of the Reverse Split Factor) and funds in the Trust Account as of March 31, 2024.

|

|

(5)

|

Assumes 75% of the shares of Class A Common Stock are redeemed for aggregate redemption payments of approximately $14.4 million,

assuming a $11.18 per share redemption price and based on shares subject to redemption (prior to the application of the Reverse Split Factor) and funds in the Trust Account as of March 31, 2024.

|

|

(6)

|

Assumes the maximum amount of shares of Class A Common Stock are redeemed for aggregate redemption payments of approximately

$19.2 million, assuming a $11.18 per share redemption price and based on shares subject to redemption (prior to the application of the Reverse Split Factor) and funds in the Trust Account as of March 31, 2024.

|

|

(7)

|

Excludes the 1,075,204 Private Placement Warrants exchanged for the payment of the First Sponsor Working Capital Loan and Second

Sponsor Working Capital Loan, given the expectation that these warrants will not be in the money at the time of closing.

|

|

(8)

|

Includes 1,725,328 Founder Shares held by FIAC’s Sponsor, 862,664 Founder Shares held by other investors that will convert into

New PubCo Common Shares.

|

|

(9)

|

Excludes 5,601,064 Private Placement Warrants as the warrants are not expected to be in the money at Closing.

|

|

(10)

|

Excludes 5,751,092 FIAC Warrants as the warrants are not expected to be in the money at Closing.

|

|

(11)

|

Excludes shares underlying (i) Legacy Warrants, which will be exercisable for 685,327 shares at a weighted average exercise

price of $9.29 per share, (ii) Converted Options, which will be exercisable for 323,773 shares at a weighted average exercise price of $7.87 per share and (iii) 534,757 Converted RSUs, as well as shares available for future issuance

pursuant to the proposed Equity Incentive Plan.

|

|

|

| |

Fully Diluted Share Ownership in DevvStream Holdings Inc.(1)

|

|||||||||||||||||||||||||||

|

|

| |

Pro Forma

Combined

(Assuming No

Redemptions)(2)

|

| |

Pro Forma

Combined

(Assuming 25%

Redemptions)(3)

|

| |

Pro Forma

Combined

(Assuming 50%

Redemptions)(4)

|

| |

Pro Forma

Combined

(Assuming 75%

Redemptions)(5)

|

| |

Pro Forma

Combined

(Assuming

Maximum

Redemptions)(6)(7)

|

|||||||||||||||

|

|

| |

Number of

Shares

|

| |

%

Ownership

|

| |

Number of

Shares

|

| |

%

Ownership

|

| |

Number of

Shares

|

| |

%

Ownership

|

| |

Number of

Shares

|

| |

%

Ownership

|

| |

Number of

Shares

|

| |

%

Ownership

|

|

Sponsor and initial FIAC stockholders(8)

|

| |

2,587,992

|

| |

11.6%

|

| |

2,587,992

|

| |

11.7%

|

| |

2,587,992

|

| |

11.8%

|

| |

2,587,992

|

| |

11.9%

|

| |

2,587,992

|

| |

11.6%

|

|

FIAC public stockholders

|

| |

858,950

|

| |

3.8%

|

| |

644,213

|

| |

2.9%

|

| |

429,475

|

| |

2.0%

|

| |

214,738

|

| |

1.0%

|

| |

—

|

| |

0.0%

|

|

Former DevvStream shareholders

|

| |

6,002,463

|

| |

26.8%

|

| |

6,002,463

|

| |

27.1%

|

| |

6,002,463

|

| |

27.4%

|

| |

6,002,463

|

| |

27.6%

|

| |

6,002,463

|

| |

27.0%

|

|

Former DevvStream Convertible Bridge

Note Holders

|

| |

—

|

| |

0.0%

|

| |

—

|

| |

0.0%

|

| |

—

|

| |

0.0%

|

| |

—

|

| |

0.0%

|

| |

—

|

| |

0.0%

|

|

New PubCo Warrants(9)

|

| |

685,327

|

| |

3.1%

|

| |

685,327

|

| |

3.1%

|

| |

685,327

|

| |

3.1%

|

| |

685,327

|

| |

3.2%

|

| |

685,327

|

| |

3.1%

|

|

New PubCo RSUs(9)

|

| |

534,757

|

| |

2.4%

|

| |

534,757

|

| |

2.4%

|

| |

534,757

|

| |

2.4%

|

| |

534,757

|

| |

2.5%

|

| |

534,757

|

| |

2.4%

|

|

New PubCo Stock Options(9)

|

| |

323,773

|

| |

1.5%

|

| |

323,773

|

| |

1.5%

|

| |

323,773

|

| |

1.5%

|

| |

323,773

|

| |

1.6%

|

| |

323,773

|

| |

1.5%

|

|

FIAC Warrants

|

| |

5,751,092

|

| |

25.7%

|

| |

5,751,092

|

| |

26.0%

|

| |

5,751,092

|

| |

26.2%

|

| |

5,751,092

|

| |

26.4%

|

| |

5,751,092

|

| |

25.8%

|

|

Private Placement Warrants

|

| |

5,601,064

|

| |

25.1%

|

| |

5,601,064

|

| |

25.3%

|

| |

5,601,064

|

| |

25.6%

|

| |

5,601,064

|

| |

25.8%

|

| |

6,351,206

|

| |

28.6%

|

|

Total

|

| |

22,325,418

|

| |

100.0%

|

| |

22,130,680

|

| |

100.0%

|

| |

21,915,943

|

| |

100.0%

|

| |

21,701,205

|

| |

100.0%

|

| |

22,236,610

|

| |

100.0%

|

|

(1)

|

Assumes a Reverse Split Factor of 0.5001, based on the closing price of the Subordinated Voting Company Shares on the Cboe

Canada, as of June 3, 2024, converted into United States dollars based on the Bank of Canada daily exchange rate as of June 3, 2024. Additional dilution may occur if certain fees are paid to SRG under the SRG Agreement, pursuant to

which DevvStream may pay to SRG a number of 5-year warrants to purchase New PubCo Common Shares in an amount equal to the value of 5% of the aggregate gross proceeds received by DevvStream from the sale of securities to investors

introduced to DevvStream by SRG. Such potential dilution was excluded from this presentation because the number of warrants to be issued, if any, is not yet known and the conditions for their exercise have not yet been met.

|

|

(2)

|

Assumes that no Class A Common Stock is redeemed.

|

|

(3)

|

Assumes 25% of the shares of Class A Common Stock are redeemed for aggregate redemption payments of approximately $4.8 million,

assuming a $11.18 per share redemption price and based on shares subject to redemption (prior to the application of the Reverse Split Factor) and funds in the Trust Account as of March 31, 2024.

|

|

(4)

|

Assumes 50% of the shares of Class A Common Stock are redeemed for aggregate redemption payments of approximately $9.6 million,

assuming a $11.18 per share redemption price and based on shares subject to redemption (prior to the application of the Reverse Split Factor) and funds in the Trust Account as of March 31, 2024.

|

|

(5)

|

Assumes 75% of the shares of Class A Common Stock are redeemed for aggregate redemption payments of approximately $14.4 million,

assuming a $11.18 per share redemption price and based on shares subject to redemption (prior to the application of the Reverse Split Factor) and funds in the Trust Account as of March 31, 2024.

|

|

(6)

|

Assumes the maximum amount of shares of Class A Common Stock are redeemed for aggregate redemption payments of approximately

$19.2 million, assuming a $11.18 per share redemption price and based on shares subject to redemption (prior to the application of the Reverse Split Factor) and funds in the Trust Account as of March 31, 2024.

|

|

(7)

|

Includes 1,075,204 Private Placement Warrants exchanged for the payment of the First Sponsor Working Capital Loan and Second

Sponsor Working Capital Loan.

|

|

(8)

|

Includes 1,725,328 Founder Shares held by FIAC’s Sponsor, 862,664 Founder Shares held by other investors that will convert into

New PubCo Common Shares.

|

|

(9)

|

Represents shares underlying (i) Legacy Warrants, which will be exercisable for 685,327 shares at a weighted average exercise

price of $9.29 per share, (ii) Converted Options, which will be exercisable for 323,773 shares at a weighted average exercise price of $7.87 per share and (iii) 534,757 Converted RSUs, as well as shares available for future issuance

pursuant to the proposed Equity Incentive Plan.

|

|

Q:

|

What conditions must be satisfied to complete the Business Combination?

|

|

A:

|

There are a number of closing conditions in the Business Combination Agreement, including the approval by the FIAC stockholders of

the Business Combination Approval, the SPAC Continuance Proposal, the Nasdaq Proposal, the Charter Proposal and the Incentive Plan Proposal. The Nasdaq Proposal and the Incentive Plan Proposal are subject to and conditioned on the

approval of the Business Combination Proposal and the SPAC Continuance Proposal. The Business Combination Proposal and the SPAC Continuance Proposal are subject to and conditioned on the approval of the Nasdaq Proposal and the Incentive

Plan Proposal. For a summary of the conditions that must be satisfied or waived prior to the Closing, see the section titled “The Business Combination Proposal (Proposal 1) — The Business Combination

Agreement.”

|

|

Q:

|

Why is FIAC providing stockholders with the opportunity to vote on the Business Combination?

|

|

A:

|

Under the FIAC Charter, FIAC must provide all holders of its Class A Common Stock with the opportunity to have their Class A

Common Stock redeemed upon the consummation of FIAC’s initial business combination either in conjunction with a tender offer or in conjunction with a stockholder vote. For business and other reasons, FIAC has elected to provide its

stockholders with the opportunity to have their Class A Common Stock redeemed in connection with a stockholder vote rather than a tender offer because the terms of the transaction require FIAC to seek stockholder approval under applicable

law and stock exchange listing requirements. Therefore, FIAC is seeking to obtain the approval of its stockholders of the Business Combination Proposal in order to allow its public stockholders to effectuate redemptions of their Class A

Common Stock in connection with the Closing.

|

|

Q:

|

Did the FIAC Board obtain a third-party valuation or fairness opinion in determining whether or not to proceed

with the Business Combination?

|

|

A:

|

Yes. On September 12, 2023, Houlihan Capital delivered an oral opinion to the FIAC Board, which opinion was subsequently confirmed

by delivery of a written opinion dated September 12, 2023 addressed to the FIAC Board (the “HC Opinion”), to the effect that, as of the date of the HC Opinion and based upon and

subject to the assumptions, conditions and limitations set forth in the HC Opinion, the Business Combination is fair to the holders of shares of Class A Common Stock from a financial point of view.

|

|

Q:

|

Are there any arrangements to help ensure that FIAC will have sufficient funds, together with the proceeds in

its Trust Account, to consummate the Business Combination?

|

|

A:

|

Yes. To the extent not utilized to consummate the Business Combination, the proceeds from the Trust Account will be used to pay

any working capital loans owed by FIAC to its Sponsor for any FIAC transaction expenses or other administrative expenses incurred by FIAC, and to pay all unpaid transaction expenses and any remainder will be used for general corporate

purposes, including, but not limited to, working capital for operations, capital expenditures and future acquisitions. FIAC believes the funds available to it outside of the Trust Account will be sufficient to allow it to operate until it

completes its business combination; however, FIAC cannot assure you that its estimate is accurate. If FIAC is required to seek additional capital, it would need to borrow funds from the Sponsor, management team or other third parties to

operate or may be forced to liquidate. Neither the Sponsor, members of FIAC’s management team nor any of their affiliates is under any obligation to advance funds to FIAC in such circumstances. Other than the PIPE Financing, prior to the

completion of FIAC’s initial business combination, it does not expect to seek loans from parties other than the Sponsor or an affiliate of the Sponsor as FIAC does not believe third parties will be willing to loan such funds and provide a

waiver against any and all rights to seek access to funds in the Trust Account. For additional information about the PIPE Financing, see “Unaudited Pro Forma Combined Financial Information—Other Related

Events in Connection with the Business Combination.”

|

|

Q:

|

How many votes do I have at the FIAC Stockholders Meeting?

|

|

A:

|

FIAC stockholders are entitled to one vote at the FIAC Stockholders Meeting for each share of Class A Common Stock held as of the

Record Date. Holders of Class A Common Stock and Class B Common Stock will vote together as one class. As of the close of business on the Record Date, there were outstanding shares of FIAC Common Stock.

|

|

Q:

|

What vote is required to approve the proposals presented at the FIAC Stockholders Meeting?

|

|

A:

|

The approval of the Business Combination Proposal and the SPAC Continuance Proposal require the affirmative vote of the holders of

a majority of the issued and outstanding FIAC Common Stock as of the Record Date. The approval of the Charter Proposal requires the affirmative vote of (i) the holders of a majority of the issued and outstanding FIAC Common Stock as of

the Record Date and (ii) the affirmative vote of the holders of a majority of the shares of Class B Common Stock then outstanding, voting separately as a single class. Approval of the Nasdaq Proposal, the Advisory Charter Amendment

Proposals, the Incentive Plan Proposal and the Adjournment Proposal each requires the affirmative vote of at least a majority of the votes cast by the holders of the issued and outstanding shares of FIAC Common Stock who are present in

person or represented by proxy and entitled to vote thereon at the FIAC Stockholders Meeting. A FIAC stockholder’s failure to vote by proxy or to vote in person at the FIAC Stockholders Meeting will not be counted towards the number of

shares of FIAC Common Stock required to validly

|

|

Q:

|

What constitutes a quorum at the FIAC Stockholders Meeting?

|

|

A:

|

A quorum of our stockholders is necessary to hold a valid meeting. The presence, in person or by proxy, of stockholders holding a

majority of the FIAC Common Stock entitled to vote at the FIAC Stockholders Meeting constitutes a quorum at the FIAC Stockholders Meeting. Abstentions will be considered present for the purposes of establishing a quorum. The Sponsor, who

beneficially owns 77% of the issued and outstanding shares of FIAC Common Stock as of the Record Date, will count towards this quorum. As a result, as of the Record Date, in addition to the shares of the Sponsor, no additional shares of

FIAC Common Stock held by public stockholders would be required to be present at the FIAC Stockholder Meeting to achieve a quorum. Because the Business Combination Proposal, the SPAC Continuance Proposal, the Nasdaq Proposal, the Charter

Proposal, the Advisory Charter Proposals, the Incentive Plan Proposal and the Adjournment Proposal are “non-routine” matters, banks, brokers and other nominees will not have authority to vote on any proposals unless instructed. Therefore,

such broker non-votes will not count towards quorum at the FIAC Stockholders Meeting. In the absence of a quorum, the chairman of the FIAC Stockholders Meeting has the power to adjourn the FIAC Stockholders Meeting.

|

|

Q:

|

How will the Sponsor, directors and officers of FIAC vote?

|

|

A:

|

Pursuant to the Sponsor Letter Agreement, the Sponsor, directors and officers of FIAC have agreed to vote any shares of FIAC

Common Stock owned by them in favor of the Business Combination, including the Business Combination Proposal, the SPAC Continuance Proposal, the Nasdaq Proposal, the Charter Proposal, the Advisory Charter Proposals, the Incentive Plan

Proposal and the Adjournment Proposal.

|

|

Q:

|

Who is FIAC’s Sponsor?

|

|

A:

|

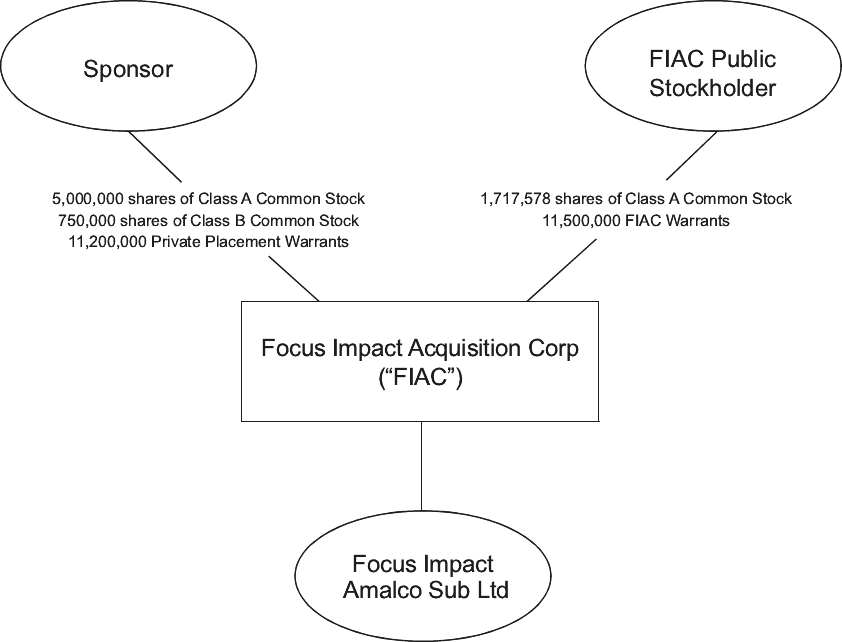

FIAC’s sponsor is Focus Impact Sponsor, LLC, a Delaware limited liability company. The Sponsor currently owns 5,000,000 shares of

Class A Common Stock, 750,000 shares of Class B Common Stock and 11,200,000 Private Placement Warrants. The Sponsor is governed by a four-member board of managers composed of Carl Stanton, Ernest Lyles, Howard Sanders and Wray Thorn. Each

manager has one vote, and the approval of a majority of the managers is required to approve an action of the Sponsor. The Sponsor is not “controlled” (as defined in 31 CFR 800.208) by a foreign person, such that the Sponsor’s involvement

in the Business Combination would result in a “covered transaction” (as defined in 31 CFR 800.213); any non-U.S. investors in the Sponsor are strictly passive with no “control” or “covered investment” rights (as defined in 31 CFR §§

800.208, 211). However, it is possible that non-U.S. persons could be involved in the Business Combination, which may increase the risk that our Business Combination becomes subject to regulatory review, including review by the Committee

on Foreign Investment in the United States (“CFIUS”), and that restrictions, limitations or conditions will be imposed by CFIUS.

|

|

Q:

|

What interests do FIAC’s current officers and directors have in the Business Combination?

|

|

A:

|

None of the Sponsor or current officers or directors of FIAC will receive any interest in the Business Combination other than the

interests they owned prior to the Business Combination or as described above. The interests of the Sponsor or current officers or directors of FIAC may be different from or in addition to (and which may conflict with) your interest. These

interests include:

|

|

•

|

unless FIAC consummates an initial business combination, FIAC’s officers and directors and the Sponsor will not receive

reimbursement for any out-of-pocket expenses incurred by them to the extent that such expenses exceed the amount of available proceeds not deposited in the Trust Account. In the event the Business Combination or an alternative business

combination is completed, there is no cap or ceiling on the reimbursement of out-of-pocket expenses incurred in connection with activities on FIAC’s behalf. As of June 7, 2024, the Sponsor, officers and directors and their respective

affiliates have approximately $40,000 in outstanding reimbursable out-of-pocket expenses. However, the Sponsor, officers and directors, or any of their respective affiliates will not be eligible for any such reimbursement if the

Business Combination or an alternative business combination is not completed;

|

|

•

|

the Sponsor and directors and officers of FIAC paid an aggregate of $25,000 (or approximately $0.003 per share) for their Founder

Shares and $11,200,000 (or $1.00 per warrant) for the Private Placement Warrants and such securities will have a significantly higher value at the time of the Business Combination. Such shares had an aggregate market value of

approximately $ million based upon the closing price of the Class A Common Stock of $ per share on Nasdaq on . As a result of the nominal price of $0.003 per share of Class B Common Stock paid by the Sponsor and the directors and

officers of FIAC compared to the recent market price of the Class A Common Stock, the Sponsor and its affiliates are likely to earn a positive rate of return on their investments in the Class B Common Stock even if the holders of Class A

Common Stock experience a negative rate of return on their investments in the Class A Common Stock;

|

|

•

|

as a condition to the FIAC IPO, the Class B Common Stock became subject to a lock-up whereby, subject to certain limited

exceptions, the Founder Shares cannot be transferred until the earlier of (A) one year after the completion of FIAC’s initial business combination; (B) subsequent to FIAC’s initial business combination, when the reported last sale price

of the Class A Common Stock equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within any 30 trading-day period commencing at least

150 days after FIAC’s initial business combination, or the date on which FIAC completes a liquidation, merger or similar transaction that results in all of FIAC’s stockholders having the right to exchange their shares for cash, securities

or other property;

|

|

•

|

the Sponsor and directors and officers of FIAC have agreed not to redeem any Class A Common Stock they hold in connection with a

stockholder vote to approve a proposed initial business combination;

|

|

•

|

if FIAC does not complete an initial business combination by November 1, 2024, a portion of the proceeds from the sale of the

Private Placement Warrants and Class B Common Stock will be included in the liquidating distribution to FIAC’s public stockholders. In such event, the 750,000 Founder Shares and 11,200,000 shares of Class A Common Stock underlying the

Private Placement Warrants, all of

|

|

•

|

certain of FIAC's directors, officers and affiliates have purchased $500,000 of Convertible Bridge Notes, which are convertible

into Company Shares at a 25% discount to DevvStream's 20-day volume weighted average price, subject to a floor of $2.00 per share, which shares will be converted into New PubCo Common Shares upon the consummation of the Business

Combination;

|

|

•

|

the Sponsor has extended the Sponsor Working Capital Loans to FIAC in order to provide FIAC with additional working capital, which

such amounts may not be repaid if FIAC does not complete an initial business combination; and

|

|

•

|

the Sponsor (including its representatives and affiliates) and FIAC’s directors and officers, are, or may in the future become,

affiliated with entities that are engaged in a similar business to FIAC. The Sponsor and FIAC’s directors and officers are not prohibited from sponsoring, or otherwise becoming involved with, any other blank check companies prior to FIAC

completing its initial business combination. FIAC’s directors and officers also may become aware of business opportunities which may be appropriate for presentation to FIAC, and the other entities to which they owe certain fiduciary or

contractual duties. Accordingly, they may have had conflicts of interest in determining to which entity a particular business opportunity should be presented. These conflicts may not be resolved in FIAC’s favor and such potential business

opportunities may be presented to other entities prior to their presentation to FIAC, subject to applicable fiduciary duties. The FIAC Charter provides that FIAC renounces its interest in any corporate opportunity offered to any director

or officer unless such opportunity is expressly offered to such person solely in his or her capacity as a director or officer of FIAC and such opportunity is one FIAC is permitted to complete on a reasonable basis, and to the extent the

director or officer is permitted to refer that opportunity to FIAC without violating another legal obligation. FIAC, however, does not believe that the waiver of the application of the “corporate opportunity” doctrine in the FIAC Charter

had any impact on its search for a potential business combination.

|

|

Q:

|

How are the funds in the Trust Account currently being held?

|

|

A:

|

Following the closing of the FIAC IPO on November 1, 2021 and the full exercise of the underwriters’ over-allotment, $234,600,000

from the net proceeds of the FIAC IPO and the sale of the FIAC Warrants were placed in a Trust Account, and invested in U.S. government securities, within the meaning set forth in the Investment Company Act, with a maturity of 185 days or

less, or in any open-ended investment company that holds itself out as a money market fund investing solely in U.S. Treasuries and meeting certain conditions under Rule 2a-7 of the Investment Company Act. On April 25, 2023, FIAC held a

special meeting of stockholders, where a proposal to amend FIAC’s Certificate of Incorporation was approved to extend the Termination Date from May 1, 2023 to August 1, 2023, and to allow FIAC, without another stockholder vote, to elect

to extend the Termination Date to consummate a business combination on a monthly basis for up to nine times by an additional one month, by resolution of the Board if requested by the Sponsor, and upon five days’ advance notice prior to

the applicable termination date, until May 1, 2024 (the “First Extension Meeting”). In connection with the approval of the extension at the First Extension Meeting, the holders

of 17,297,209 shares of Class A Common Stock of FIAC properly exercised their right

|

|

Q:

|

What interests do DevvStream’s current officers and directors have in the Business Combination?

|

|

A:

|

Members of the DevvStream Board and its executive officers have interests in the Business Combination that may be different from

or in addition to (and which may conflict with) your interest. These interests include, without limitation, the following:

|

|

•

|

Sunny Trinh, Chris Merkel, David Goertz and Bryan Went are expected to serve as executive officers of the Combined Company after

consummation of the Business Combination;

|

|

•

|

Michael Max Bühler, Stephen Kukucha, Jamila Piracci, Ray Quintana and Tom Anderson, who currently serve on the DevvStream Board,

may serve as directors of the Combined Company after consummation of the Business Combination and DevvStream may nominate one or more of its existing directors to serve on the board of the Combined Company after consummation of the

Business Combination; and

|

|

•

|

upon consummation of the Business Combination, and subject to approval of the Incentive Plan Proposal, DevvStream’s executive

officers are expected to receive grants of stock options and restricted stock units under the Equity Incentive Plan from time to time as determined by the Compensation Committee. In addition, the outstanding Company Options granted to

DevvStream’s executive officers and directors under the Company Equity Incentive Plans prior to Closing will be assumed and converted to options under the Equity Incentive Plan effective as of the Closing.

|

|

Q:

|

What happens if I sell my Class A Common Stock before the FIAC Stockholders Meeting?

|

|

A:

|

The Record Date is earlier than the date of the FIAC Stockholders Meeting. If you transfer your Class A Common Stock after the

Record Date, but before the FIAC Stockholders Meeting, unless the transferee obtains from you a proxy to vote those shares, you will retain your right to vote at the FIAC Stockholders Meeting. However, you will not be able to seek

redemption of your shares because you will no longer be able to deliver them for cancellation upon consummation of the Business Combination in accordance with the provisions described herein. If you transfer your Class A Common Stock

prior to the Record Date, you will have no right to vote those shares at the FIAC Stockholders Meeting.

|

|

Q:

|

What happens if a substantial number of the FIAC public stockholders vote in favor of the Business Combination

and exercise their redemption right?

|

|

A:

|

FIAC stockholders who vote in favor of the Business Combination may also nevertheless exercise their redemption rights.

Accordingly, the Business Combination may be consummated even though the funds available from the Trust Account and the number of public stockholders are reduced as a result of redemptions by FIAC public stockholders. In addition, with

fewer shares of Class A Common Stock outstanding and public stockholders, the trading market for the New PubCo Common Shares may be less liquid than the market for Class A Common Stock was prior to consummation of the Business Combination

and New PubCo may not be able to meet the listing standards for Nasdaq. In addition, with less funds available from the Trust Account, the working capital infusion from the Trust Account into DevvStream’s business will be reduced. As a

result, the proceeds will be greater in the event that no public stockholders exercise redemption rights with respect to their Class A Common Stock for a pro rata portion of the Trust Account as

opposed to the scenario in which the FIAC public stockholders exercise the maximum allowed redemption rights.

|

|

Q:

|

What happens if I vote against any of the Business Combination Proposal, the SPAC Continuance Proposal, the

Nasdaq Proposal, the Charter Proposal, the Advisory Charter Proposals, or the Incentive Plan Proposal?

|

|

A:

|

If any of the Business Combination Proposal, the SPAC Continuance Proposal, the Nasdaq Proposal, the Charter Proposal, or the

Incentive Plan Proposal (together, the “Required Proposals”) are not approved, the Business Combination is not consummated and FIAC does not otherwise consummate an alternative

business combination by November 1, 2024, pursuant to the FIAC Charter, FIAC will be required to dissolve and liquidate its Trust Account by returning the then remaining funds in such account to the public stockholders, unless FIAC seeks

and obtains the consent of its stockholders to amend the FIAC Charter to extend the date by which it must consummate its initial business combination (an “Extension”). The

Advisory Charter Proposals are non-binding and advisory, and a vote against any such proposals will not affect the outcome of the transaction.

|

|

Q:

|

Do I have redemption rights in connection with the Business Combination?

|

|

A:

|

Pursuant to the FIAC Charter, holders of Class A Common Stock may elect to have their shares redeemed for cash at the applicable

redemption price per share calculated in accordance with the FIAC Charter. As of the Record Date, based on funds in the Trust Account of $ as of such date, the pro rata portion of the funds

available in the Trust Account for the redemption of the Class A Common Stock was approximately $ per share. If a holder exercises its redemption rights, then such holder will be exchanging its Class A Common Stock for cash and will

only have equity interests in New PubCo pursuant to the exercise of its FIAC Warrants, to the extent it still holds FIAC Warrants. FIAC public stockholders may continue to hold FIAC Warrants after the Closing regardless of their election

to redeem their Class A Common Stock. The aggregate market value of the FIAC Warrants that may be retained by them, based on the closing trading price per FIAC Warrant as of the Record Date, would be $ regardless of the amount of

redemptions by the public stockholders Such a holder will be entitled to receive cash for its Class A Common Stock only if it properly demands redemption and delivers its shares (either physically or electronically) to FIAC’s transfer

agent prior to the FIAC Stockholders Meeting. See the section titled “The FIAC Stockholders Meeting — Redemption Rights” for the procedures to be followed if you wish to redeem your shares for

cash.

|

|

Q:

|

Will how I vote affect my ability to exercise redemption rights?

|

|

A:

|

No. You may exercise your redemption rights whether or not you attend or vote your Class A Common Stock at the FIAC Stockholders

Meeting, and regardless of how you vote your shares. As a result, the Business Combination Agreement and the Required Proposals can be approved by stockholders who will redeem their shares and no longer remain stockholders, leaving

stockholders who choose not to redeem their shares holding shares in a company with a potentially less liquid trading market, fewer stockholders, potentially less cash and the potential inability to meet the listing standards of Nasdaq.

|

|

Q:

|

How do I exercise my redemption rights?

|

|

A:

|

In order to exercise your redemption rights, you must, prior to 5:00 p.m., Eastern Time, on (two (2) business days before the

FIAC Stockholders Meeting), tender your shares physically or electronically and submit a request in writing that we redeem your Class A Common Stock for cash to Continental Stock Transfer & Trust Company, our transfer agent, at the

following address:

|

|

Q:

|

What are the U.S. federal income tax consequences of exercising my redemption rights?

|

|

A:

|

We expect that a U.S. holder (as defined herein) that exercises its redemption rights to receive cash from the Trust Account in

exchange for its Class A Common Stock will generally be treated as selling such Class A Common Stock resulting in the recognition of capital gain or capital loss. There may be certain circumstances in which the redemption may be treated

as a distribution for U.S. federal income tax purposes depending on the amount of Class A Common Stock that a U.S. holder owns or is deemed to own (including, without limitation, through the ownership of FIAC Warrants). For a more

complete discussion of the U.S. federal income tax considerations of an exercise of redemption rights, see “The Business Combination Proposal — United States Federal Income Tax Considerations.”

|

|

Q:

|

What are the U.S. federal income tax consequences of the SPAC Continuance?

|

|

A:

|

The SPAC Continuance is intended to qualify as a tax-deferred reorganization pursuant to Section 368(a) of the Code. Accordingly,

a U.S. holder that is deemed to exchange Class A Common Stock in FIAC (as a Delaware corporation) for Class A Common Stock in FIAC (as continued to the Province of Alberta, Canada) in pursuance of the plan of reorganization will not

recognize capital gain or loss on the deemed exchange of Class A Common Stock in FIAC (as a Delaware corporation) for Class A Common Stock in FIAC (as continued to the Province of Alberta, Canada).

|

|

Q:

|

If I am a Warrant holder, can I exercise redemption rights with respect to my Warrants?

|

|

A:

|

No. The holders of Warrants have no redemption rights with respect to Warrants.

|

|

Q:

|

If I am a FIAC Unit holder, can I exercise redemption rights with respect to my FIAC Units?

|

|

A:

|

No. Holders of outstanding FIAC Units must separate the constituent Class A Common Stock and FIAC Warrants prior to exercising

redemption rights with respect to the Class A Common Stock.

|

|

Q:

|

Do I have appraisal rights if I object to the proposed Business Combination?

|

|

A:

|

No. Neither FIAC stockholders nor holders of FIAC Warrants have appraisal rights in connection with the Business Combination under

the DGCL.

|

|

Q:

|

What happens to the funds held in the Trust Account upon consummation of the Business Combination?

|

|

A:

|

If the Business Combination is consummated, the funds held in the Trust Account will be released to pay:

|

|

•

|

holders of Class A Common Stock who properly exercise their redemption rights;

|

|

•

|

certain other fees, costs and expenses (including regulatory fees, legal fees, accounting fees, printer fees and other

professional fees) that were incurred by FIAC and DevvStream in connection with the transactions contemplated by the Business Combination and pursuant to the terms of the Business Combination Agreement;

|

|

•

|

any working capital loans owed by FIAC to the Sponsor for transaction and other expenses incurred by or on behalf of FIAC; and

|

|

•

|

any other liabilities of FIAC as of the Closing.

|

|

Q:

|

What happens if the Business Combination is not consummated?

|

|

A:

|

There are certain circumstances under which the Business Combination Agreement may be terminated. See the section titled “The Business Combination Proposal (Proposal 1) — The Business Combination Agreement” for information regarding the parties’ specific termination rights.

|

|

Q:

|

When is the Business Combination expected to be completed?

|

|

A:

|

The Closing is expected to take place (a) the second business day following the satisfaction or waiver of the conditions described

below under the section titled “The Business Combination Proposal (Proposal 1) — Conditions to the Closing” or (b) such other date as agreed to by the parties to the Business Combination Agreement

in writing, in each case, subject to the satisfaction or waiver of the Closing conditions. The Business Combination Agreement may be terminated by either FIAC or DevvStream if the Closing has not occurred by June 12, 2024 (as such date

may be extended, the “Outside Date”).

|

|

Q:

|

What do I need to do now?

|

|

A:

|

You are urged to read carefully and consider the information contained in this proxy statement/prospectus, including the annexes,

and to consider how the Business Combination will affect you as a FIAC stockholder. You should then vote as soon as possible in accordance with the instructions provided in this proxy statement/prospectus and on the enclosed proxy card

or, if you hold your shares through a brokerage firm, bank or other nominee, on the voting instruction form provided by the broker, bank or nominee.

|

|

Q:

|

How do I vote?

|

|

A:

|

If you are a stockholder of record of FIAC as of the Record Date, you may submit your proxy before the FIAC Stockholders Meeting

in any of the following ways, if available:

|

|

•

|

visit the website shown on your proxy card to vote via the Internet; or

|

|

•

|

complete, sign, date and return the enclosed proxy card in the enclosed postage-paid envelope.

|

|

•

|

Within the U.S. and Canada: 1 800-450-7155 (toll-free)

|

|

•

|

Outside of the U.S. and Canada: +1 857-999-9155 (standard rates apply)

|

|

Q:

|

What will happen if I abstain from voting or fail to vote at the FIAC Stockholders Meeting?

|

|

A:

|

At the FIAC Stockholders Meeting, FIAC will count a properly executed proxy marked “ABSTAIN” with respect to a particular proposal

as present for purposes of determining whether a quorum is present. Abstentions will have the same effect as a vote “AGAINST” the Business Combination Proposal, the SPAC Continuance Proposal, the Nasdaq Proposal, the Charter Proposal, the

Advisory Charter Proposals, the Incentive Plan Proposal or the Adjournment Proposal.

|

|

Q:

|

What will happen if I sign and return my proxy card without indicating how I wish to vote?

|

|

A:

|

Signed and dated proxies received by FIAC without an indication of how the stockholder intends to vote on a proposal will be voted

“FOR” each proposal presented to the stockholders. The proxyholders may use their discretion to vote on any other matters which properly come before the FIAC Stockholders Meeting.

|

|

Q:

|

If I am not going to attend the FIAC Stockholders Meeting in person, should I return my proxy card instead?

|

|

A:

|

Yes. Whether you plan to attend the FIAC Stockholders Meeting or not, please read this entire proxy statement/prospectus,

including the annexes, carefully, and vote your shares by completing, signing, dating and returning the enclosed proxy card in the postage-paid envelope provided.

|

|

Q:

|

If my shares are held in “street name,” will my broker, bank or nominee automatically vote my shares for me?

|

|

A:

|

No. Under the rules of various national and regional securities exchanges, your broker, bank or nominee cannot vote your shares

with respect to non-discretionary matters unless you provide instructions on how to vote in accordance with the information and procedures provided to you by your broker, bank or nominee. FIAC believes the Proposals presented to the

stockholders will be considered non-discretionary and therefore your broker, bank or nominee cannot vote your shares without your instruction. Your bank, broker or other nominee can vote your shares only if you provide instructions on how

to vote. You should instruct your broker to vote your shares in accordance with directions you provide.

|

|

Q:

|

May I change my vote after I have mailed my signed proxy card?

|

|

A:

|

Yes. You may change your vote by sending a later-dated, signed proxy card to FIAC’s Chief Executive Officer at the address listed

below so that it is received by FIAC’s Chief Executive Officer prior to the FIAC Stockholders Meeting or attend the FIAC Stockholders Meeting in person and vote. You also may revoke your proxy by sending a notice of revocation to FIAC’s

Chief Executive Officer, which must be received by FIAC’s Chief Executive Officer prior to the FIAC Stockholders Meeting.

|

|

Q:

|

What should I do if I receive more than one set of voting materials?

|

|

A:

|

You may receive more than one set of voting materials, including multiple copies of this proxy statement/prospectus and multiple

proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a holder

of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card and voting instruction card that you receive in order to cast your vote with

respect to all of your shares.

|

|

Q:

|

Who will solicit and pay the cost of soliciting proxies?

|

|

A:

|

FIAC will pay the cost of soliciting proxies for the FIAC Stockholders Meeting. FIAC has engaged Morrow Sodali LLC (“Morrow Sodali”) to assist in the solicitation of proxies for the FIAC Stockholders Meeting. FIAC has agreed to pay Morrow Sodali its customary fee, plus disbursements. FIAC will

reimburse Morrow Sodali for reasonable out-of-pocket expenses and will indemnify Morrow Sodali and its affiliates against certain claims, liabilities, losses, damages and expenses. FIAC will also reimburse banks, brokers and other

custodians, nominees and fiduciaries representing beneficial owners of FIAC Common Stock for their expenses in forwarding soliciting materials to beneficial owners of FIAC Common Stock and in obtaining voting instructions from those

owners. FIAC’s directors, officers and employees may also solicit proxies by telephone, by facsimile, by mail, on the Internet or in person. They will not be paid any additional amounts for soliciting proxies.

|

|

Q:

|

Who can help answer my questions?

|

|

A:

|

If you have questions about the proposals or if you need additional copies of this proxy statement/prospectus or the enclosed

proxy card you should contact:

|

|

(A)

|

prior to the Effective Time, FIAC will be continued from the state of Delaware under the Delaware General Corporation Law to the

Province of Alberta, Canada, and thereby become a company existing under the Business Corporations Act (Alberta) and change its name to DevvStream Corp. (the “SPAC Continuance”);

|

|

(B)

|

following the SPAC Continuance, Amalco Sub and DevvStream will amalgamate to form one corporate entity, Amalco (the “Amalgamation”), and as a result of the Amalgamation, (i) each Multiple Voting Company Share and Subordinated Voting Company Share issued and outstanding immediately prior to the

effective time of the Amalgamation will be automatically exchanged for that certain number of New PubCo Common Shares equal to the applicable Per Common Share Amalgamation Consideration, (ii) each Company Option (whether vested or

unvested) to purchase Multiple Voting Company Shares or Subordinated Voting Company Shares granted under DevvStream’s 2022 Equity Incentive Plan, as amended and restated from time to time, and DevvStream’s 2022 Non-Qualified Stock

Option Plan and each Company RSU representing the right to receive payment in Company Shares, granted under a restricted stock unit award agreement issued and outstanding immediately prior to the Effective Time will be cancelled and