UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission

File Number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s

telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| The |

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and ‘‘emerging growth company’’ in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company filer | ||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

☐

As of February 7, 2024, the registrant had shares of common stock, par value $0.001 per share, outstanding.

THE GLIMPSE GROUP, INC.

TABLE OF CONTENTS

| Page No. | ||

| PART I | FINANCIAL INFORMATION | |

| ITEM 1. | FINANCIAL STATEMENTS (Unaudited) | 4 |

| Condensed Consolidated Balance Sheets | 5 | |

| Condensed Consolidated Statements of Operations | 6 | |

| Condensed Consolidated Statements of Stockholders’ Equity | 7 | |

| Condensed Consolidated Statements of Cash Flows | 9 | |

| Notes to Condensed Consolidated Financial Statements | 10 | |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 29 |

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 36 |

| ITEM 4. | CONTROLS AND PROCEDURES | 37 |

| PART II | OTHER INFORMATION | 37 |

| ITEM 1. | LEGAL PROCEEDINGS | 37 |

| ITEM 1A. | RISK FACTORS | 37 |

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | 38 |

| ITEM 6. | EXHIBITS | 38 |

| SIGNATURES | 39 | |

| 2 |

THE GLIMPSE GROUP, INC.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2023 AND 2022

| 3 |

THE GLIMPSE GROUP, INC.

INDEX TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| 4 |

THE GLIMPSE GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| As

of December 31, 2023 | As

of June 30, 2023 | |||||||

| (Unaudited) | (Audited) | |||||||

| ASSETS | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Accounts receivable | ||||||||

| Deferred costs/contract assets | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Total current assets | ||||||||

| Equipment, net | ||||||||

| Right-of-use assets, net | ||||||||

| Intangible assets, net | ||||||||

| Goodwill | ||||||||

| Other assets | ||||||||

| Total assets | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued liabilities | ||||||||

| Accrued non cash performance bonus | ||||||||

| Deferred revenue/contract liabilities | ||||||||

| Lease liabilities, current portion | ||||||||

| Contingent consideration for acquisitions, current portion | ||||||||

| Total current liabilities | ||||||||

| Long term liabilities | ||||||||

| Contingent consideration for acquisitions, net of current portion | ||||||||

| Lease liabilities, net of current portion | ||||||||

| Total liabilities | ||||||||

| Commitments and contingencies | ||||||||

| Stockholders’ Equity | ||||||||

| Preferred

Stock, par value $ per share, million shares authorized; shares issued and outstanding | ||||||||

| Common

Stock, par value $ per share, million shares authorized; and issued and outstanding | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total stockholders’ equity | ||||||||

| Total liabilities and stockholders’ equity | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements (unaudited).

| 5 |

THE GLIMPSE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Revenue | ||||||||||||||||

| Software services | $ | $ | $ | $ | ||||||||||||

| Software license/software as a service | ||||||||||||||||

| Total Revenue | ||||||||||||||||

| Cost of goods sold | ||||||||||||||||

| Gross Profit | ||||||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development expenses | ||||||||||||||||

| General and administrative expenses | ||||||||||||||||

| Sales and marketing expenses | ||||||||||||||||

| Amortization of acquisition intangible assets | ||||||||||||||||

| Intangible

asset impairment (inclusive of $ | ||||||||||||||||

| Change in fair value of acquisition contingent consideration | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Total operating expenses | ||||||||||||||||

| Income (Loss) from operations before other income | ( | ) | ( | ) | ( | ) | ||||||||||

| Other income | ||||||||||||||||

| Interest income | ||||||||||||||||

| Net Income (Loss) | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | ||||||

| Basic net income (loss) per share | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | ||||||

| Diluted net income (loss) per share | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | ||||||

| Weighted-average shares used to compute basic net income (loss) per share | ||||||||||||||||

| Weighted-average shares used to compute diluted net income (loss) per share | ||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements (unaudited).

| 6 |

THE GLIMPSE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE THREE MONTHS ENDED DECEMBER 31, 2023

(Unaudited)

| Common Stock | Additional | Accumulated | ||||||||||||||||||

| Shares | Amount | Paid-In Capital | Deficit | Total | ||||||||||||||||

| Balance as of October 1, 2023 | $ | $ | $ | ( | ) | $ | ||||||||||||||

| Common stock issued in Securities Purchase Agreement, net | ||||||||||||||||||||

| Common stock issued to vendors for compensation | ||||||||||||||||||||

| Stock based compensation expense | ||||||||||||||||||||

| Stock option-based board of directors expense | - | |||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | |||||||||||||||

| Balance as of December 31, 2023 | $ | $ | $ | ( | ) | $ | ||||||||||||||

THE GLIMPSE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE SIX MONTHS ENDED DECEMBER 31, 2023

(Unaudited)

| Common Stock | Additional | Accumulated | ||||||||||||||||||

| Shares | Amount | Paid-In Capital | Deficit | Total | ||||||||||||||||

| Balance as of July 1, 2023 | $ | $ | $ | ( | ) | $ | ||||||||||||||

| Common stock issued in Securities Purchase Agreement, net | ||||||||||||||||||||

| Common stock issued to vendors for compensation | ||||||||||||||||||||

| Common stock issued for exercise of options | ( | ) | ||||||||||||||||||

| Common stock issued to satisfy contingent acquisition obligations | ||||||||||||||||||||

| Stock based compensation expense | ||||||||||||||||||||

| Stock option-based board of directors expense | - | |||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | |||||||||||||||

| Balance as of December 31, 2023 | $ | $ | $ | ( | ) | $ | ||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements (unaudited).

| 7 |

THE GLIMPSE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE THREE MONTHS ENDED DECEMBER 31, 2022

(Unaudited)

| Common Stock | Additional | Accumulated | ||||||||||||||||||

| Shares | Amount | Paid-In Capital | Deficit | Total | ||||||||||||||||

| Balance as of October 1, 2022 | $ | $ | $ | ( | ) | $ | ||||||||||||||

| Common stock issued for purchase of intangible asset - technology | ||||||||||||||||||||

| Common stock issued for satisfaction of prior year acquisition liability | ||||||||||||||||||||

| Common stock issued for exercise of options | ||||||||||||||||||||

| Common stock issued for contingent acquisition obligation | ||||||||||||||||||||

| Stock based compensation expense | ||||||||||||||||||||

| Stock option-based board of directors expense | - | |||||||||||||||||||

| Net income | - | |||||||||||||||||||

| Balance as of December 31, 2022 | $ | $ | $ | ( | ) | $ | ||||||||||||||

THE GLIMPSE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE SIX MONTHS ENDED DECEMBER 31, 2022

(Unaudited)

| Common Stock | Additional | Accumulated | ||||||||||||||||||

| Shares | Amount | Paid-In Capital | Deficit | Total | ||||||||||||||||

| Balance as of July 1, 2022 | $ | $ | $ | ( | ) | $ | ||||||||||||||

| Common stock issued for acquisition | ||||||||||||||||||||

| Common stock issued for satisfaction of prior year acquisition liability | ||||||||||||||||||||

| Common stock issued for purchase of intangible asset - technology | ||||||||||||||||||||

| Common stock issued for exercise of options | ||||||||||||||||||||

| Common stock issued for contingent acquisition obligation | ||||||||||||||||||||

| Stock based compensation expense | ||||||||||||||||||||

| Stock option-based board of directors expense | - | |||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | |||||||||||||||

| Balance as of December 31, 2022 | $ | $ | $ | ( | ) | $ | ||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements (unaudited).

| 8 |

THE GLIMPSE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| For the Six Months Ended December 31, | ||||||||

| 2023 | 2022 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Amortization and depreciation | ||||||||

| Common stock and stock option based compensation for employees and board of directors | ||||||||

| Accrued non cash performance bonus fair value adjustment | ( | ) | ||||||

| Acquisition contingent consideration fair value adjustment | ( | ) | ( | ) | ||||

| Impairment of intangible assets | ||||||||

| Issuance of common stock to vendors as compensation | ||||||||

| Adjustment to operating lease right-of-use assets and liabilities | ( | ) | ( | ) | ||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | ( | ) | ||||||

| Deferred costs/contract assets | ||||||||

| Prepaid expenses and other current assets | ( | ) | ( | ) | ||||

| Other assets | ( | ) | ||||||

| Accounts payable | ( | ) | ( | ) | ||||

| Accrued liabilities | ( | ) | ( | ) | ||||

| Deferred revenue/contract liabilities | ( | ) | ( | ) | ||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| Cash flow from investing activities: | ||||||||

| Purchases of equipment | ( | ) | ( | ) | ||||

| Acquisitions, net of cash acquired | ( | ) | ||||||

| Proceeds from maturity of investments | ||||||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| Cash flows provided by financing activities: | ||||||||

| Proceeds from securities purchase agreement, net | ||||||||

| Proceeds from exercise of stock options | ||||||||

| Cash provided by financing activities | ||||||||

| Net change in cash, cash equivalents and restricted cash | ( | ) | ( | ) | ||||

| Cash, cash equivalents and restricted cash, beginning of year | ||||||||

| Cash, cash equivalents and restricted cash, end of period | $ | $ | ||||||

| Non-cash Investing and Financing activities: | ||||||||

| Issuance of common stock for satisfaction of contingent liability | $ | $ | ||||||

| Issuance of common stock for non cash performance bonus | $ | $ | ||||||

| Lease liabilities arising from right-of-use assets | $ | $ | ||||||

| Note receivable for sale of subsidiary assets | $ | $ | ||||||

| Allowance against note receivable | $ | ( | ) | $ | ||||

| Common stock issued for acquisition | $ | $ | ||||||

| Contingent acquisition consideration liability recorded at closing | $ | $ | ||||||

| Common stock issued for purchase of intangible asset - technology | $ | $ | ||||||

| Issuance of common stock for satisfaction of contingent liability, net of note extinguishment | $ | $ | ||||||

| Extinguishment of note receivable for satisfaction of contingent liability | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements (unaudited).

| 9 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

NOTE 1. DESCRIPTION OF BUSINESS

The Glimpse Group, Inc. (“Glimpse” and together with its wholly owned subsidiaries, collectively, the “Company”) is an Immersive technology company, comprised of a diversified portfolio of wholly owned Virtual (VR), Augmented (AR) Reality and Spatial Computing software and services companies. Glimpse’s subsidiary companies are located in the United States and Turkey. The Company was incorporated in the State of Nevada in June 2016.

Glimpse’s unique business model builds scale and a robust ecosystem, while simultaneously providing investors an opportunity to invest directly into this emerging industry via a diversified platform.

The Company completed an initial public offering (“IPO”) of its common stock on the Nasdaq Capital Market Exchange (“Nasdaq”) on July 1, 2021, under the ticker VRAR.

NOTE 2. GOING CONCERN

At each reporting period, the Company evaluates whether there are conditions or events that raise doubt about the Company’s ability to continue as a going concern within one year after the date that the financial statements are issued. The Company’s evaluation entails analyzing expectations for the Company’s cash needs and comparing those needs to the current cash and cash equivalent balances. The Company is required to make certain additional disclosures if it concludes substantial doubt exists and it is not alleviated by the Company’s plans or when its plans alleviate substantial doubt about the Company’s ability to continue as a going concern.

The

Company has incurred recurring losses since its inception, including a net loss of approximately $

Outside of potential revenue growth generated by the Company, in order to alleviate the going concern the Company may take actions which could include, but are not limited to: further cost reductions, equity or debt financings and restructuring of potential future cash contingent acquisition liabilities. There is no assurance that these actions will be taken or be successful if pursued.

The financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the ordinary course of business. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of the uncertainties described.

| 10 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

Potential liquidity resources

Potential

liquidity resources may include the further sale of common stock pursuant to the unused portion of the $

NOTE 3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation

The unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information and the rules and regulations of the SEC. In the opinion of management, the unaudited condensed consolidated financial statements have been prepared on the same basis as the annual consolidated financial statements and reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly the financial position as of December 31, 2023, the results of operations for the three and six months ended December 31, 2023 and 2022, and cash flows for the six months ended December 31, 2023 and 2022. The financial data and other information disclosed in these notes to the interim financial statements related to these periods are unaudited. The results for the three and six months ended December 31, 2023 are not necessarily indicative of the results to be expected for the entire year ending June 30, 2024 or for any subsequent periods. The consolidated balance sheet at June 30, 2023 has been derived from the audited consolidated financial statements at that date.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) have been condensed or omitted pursuant to the Securities and Exchange Commission’s rules and regulations.

These unaudited condensed consolidated financial statements should be read in conjunction with our audited consolidated financial statements and notes thereto for the year ended June 30, 2023.

Principles of Consolidation

The accompanying condensed consolidated financial statements include the balances of Glimpse and its wholly owned subsidiaries. All significant intercompany accounts and transactions have been eliminated in consolidation.

Use of Accounting Estimates

The preparation of the accompanying condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the accompanying condensed consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

The principal estimates relate to the valuation of allowance for doubtful accounts, stock options, warrants, revenue recognition, cost of goods sold, allocation of the purchase price of assets relating to business combinations, calculation of contingent consideration for acquisitions and fair value of intangible assets.

Cash and Cash Equivalents, Restricted Cash

Cash and cash equivalents consist of cash and deposits in bank checking accounts with immediate access and cash equivalents that represent highly liquid investments.

| 11 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

Restricted cash represented escrowed cash related to the Sector 5 Digital, LLC (“S5D”) acquisition and was fully disbursed during the year ended June 30, 2023 (see Note 6).

The components of cash, cash equivalents and restricted cash on the condensed consolidated statements of cash flows as of December 31, 2023 and 2022 are as follows:

| As of December 31, | As of December 31, | |||||||

| 2023 | 2022 | |||||||

| Cash and cash equivalents | $ | $ | ||||||

| Restricted cash | ||||||||

| Total | $ | $ | ||||||

Accounts Receivable

Accounts receivable consist primarily of amounts due from customers under normal trade terms. Allowances for uncollectible accounts are provided for based upon a variety of factors, including historical amounts written-off, an evaluation of current economic conditions, and assessment of customer collectability. As of December 31, 2023 and 2022 no allowance for doubtful accounts was recorded as all amounts were considered collectible.

Customer Concentration and Credit Risk

One

customer accounted for approximately

Three

customers accounted for approximately

The Company maintains cash in accounts that, at times, may be in excess of the Federal Deposit Insurance Corporation limit. The Company has not experienced any losses on such accounts.

Business Combinations

The results of a business acquired in a business combination are included in the Company’s condensed consolidated financial statements from the date of the acquisition. Purchase accounting results in assets and liabilities of an acquired business generally being recorded at their estimated fair values as of the acquisition date. Any excess consideration over the fair value of assets acquired and liabilities assumed is recognized as goodwill. Acquisition-related expenses are recognized separately from the business combination and are expensed as incurred.

| 12 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

The Company performs valuations of assets acquired and liabilities assumed and allocates the purchase price to its respective assets and liabilities. Determining the fair value of assets acquired and liabilities assumed may require management to use significant judgment and estimates, including the selection of valuation methodologies, estimates of future revenues, costs and cash flows. Estimates of fair value are based upon assumptions believed to be reasonable, but which are inherently uncertain and unpredictable and, as a result, actual results may differ from estimates. During the measurement period, which is typically one year from the acquisition date, if new information is obtained about facts and circumstances that existed as of the acquisition date, changes in the estimated values of the net assets recorded may change the amount of the purchase price allocated to goodwill. Upon the conclusion of the measurement period, any subsequent adjustments are recorded in the condensed consolidated statement of operations. At times, the Company engages the assistance of valuation specialists in concluding on fair value measurements in connection with determining fair values of assets acquired and liabilities assumed in a business combination.

Intangible assets (other than Goodwill)

Intangible assets represent the allocation of a portion of an acquisition’s purchase price. They include acquired customer relationships and developed technology purchased. Intangible assets are stated at allocated cost less accumulated amortization and less impairments. Amortization is computed using the straight-line method over the estimated useful lives of the related assets. The Company reviews intangibles, being amortized, for impairment when current events indicate that the fair value may be less than the carrying value.

Goodwill

Goodwill represents the excess of the purchase price over the fair value of identifiable net assets acquired in business combinations accounted for under the acquisition method. Goodwill is not amortized but instead is tested at least annually for impairment, or more frequently when events or changes in circumstances indicate that goodwill might be impaired.

Impairment of Long-Lived Assets

The Company reviews long-lived assets to be held and used, other than goodwill, whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. If an evaluation of recoverability is required, the estimated undiscounted future cashflows directly associated with the asset are compared with the asset’s carrying amount. If the estimated future cash flows from the use of the asset are less than the carrying value, an impairment charge would be recorded to write down the asset to its estimated fair value.

Fair Value of Financial Instruments

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Valuation techniques used to measure fair value must maximize the use of observable inputs and minimize the use of unobservable inputs. The fair value hierarchy, which is based on three levels of inputs, the first two of which are considered observable and the last unobservable, that may be used to measure fair value, is as follows:

● Level 1 — quoted prices (unadjusted) in active markets for identical assets or liabilities;

● Level 2 — inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities; or

● Level 3 — unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

| 13 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

The Company classifies its cash equivalents and investments within Level 1 of the fair value hierarchy on the basis of valuations based on quoted prices for the specific securities in an active market.

The Company’s contingent consideration is categorized as Level 3 within the fair value hierarchy. Contingent consideration is recorded within contingent consideration, current, and contingent consideration, non-current, in the Company’s condensed consolidated balance sheets as of December 31 and June 30, 2023. Contingent consideration has been recorded at its fair values using unobservable inputs and have included using the Monte Carlo simulation option pricing framework, incorporating contractual terms and assumptions regarding financial forecasts, discount rates, and volatility of forecasted revenue. The development and determination of the unobservable inputs for Level 3 fair value measurements and fair value calculations are the responsibility of the Company’s management with the assistance of a third-party valuation specialist.

The Company’s other financial instruments consist primarily of accounts receivable, accounts payable, accrued liabilities and other liabilities, and approximate fair value due to the short-term nature of these instruments.

Revenue Recognition

Nature of Revenues

The Company reports its revenues in two categories:

| ● | Software Services: Virtual and Augmented Reality projects, solutions and consulting services. |

| ● | Software License and Software-as-a-Service (“SaaS”): Virtual and Augmented Reality software that is sold either as a license or as a SaaS subscription. |

The Company applies the following steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its agreements:

| ● | identify the contract with a customer; | |

| ● | identify the performance obligations in the contract; | |

| ● | determine the transaction price; | |

| ● | allocate the transaction price to performance obligations in the contract; | |

| ● | recognize revenue as the performance obligation is satisfied; | |

| ● | determine that collection is reasonably assured. |

Revenue is recognized when the Company satisfies its performance obligation under the contract by transferring the promised product to its customer or service is performed and collection is reasonably assured. A performance obligation is a promise in a contract to transfer a distinct product or service to a customer. A portion of the Company’s contracts have a single performance obligation, as the promise to transfer products or services is not separately identifiable from other promises in the contract and, therefore, not distinct. Other contracts can include various services and products which are at times capable of being distinct, and therefore may be accounted for as separate performance obligations.

Revenue is measured as the amount of consideration the Company expects to receive in exchange for transferring products or providing services. As such, revenue is recorded net of returns, allowances, customer discounts, and incentives. Sales taxes and other taxes are excluded from revenues.

For distinct performance obligations recognized at a point in time, any unrecognized portion of revenue and any corresponding unrecognized expenses are presented as deferred revenue/contract liability and deferred costs/contract asset, respectively, in the accompanying condensed consolidated balance sheets. Contract assets include cash payroll costs and may include payments to consultants and vendors.

| 14 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

For distinct performance obligations recognized over time, the Company records a contract asset (costs in excess of billings) when revenue is recognized prior to invoicing, or a contract liability (billings in excess of costs) when revenue is recognized subsequent to invoicing.

Significant Judgments

The Company’s contracts with customers may include promises to transfer multiple products/services. Determining whether products/services are considered distinct performance obligations that should be accounted for separately versus together may require significant judgment. Further, judgment may be required to determine the standalone selling price for each distinct performance obligation.

Disaggregation of Revenue

The Company generated revenue for the three and six months ended December 31, 2023 and 2022 by delivering: (i) Software Services, consisting primarily of VR/AR software projects, solutions and consulting services, and (ii) Software Licenses & SaaS, consisting primarily of VR/AR software licenses or SaaS. The Company currently generates its revenues primarily from customers in the United States.

Revenue for a significant portion of Software Services projects and solutions (projects whereby, the development of the project leads to an identifiable asset with an alternative use to the Company) is recognized at the point of time in which the customer obtains control of the project, customer accepts delivery and confirms completion of the project. Certain other Software Services revenues are custom project solutions (projects whereby, the development of the custom project leads to an identifiable asset with no alternative use to the Company, and, in which, the Company also has an enforceable right to payment under the contract) and are therefore recognized based on the percentage of completion using an input model with a master budget. The budget is reviewed periodically and percentage of completion adjusted accordingly.

Revenue for Software Services consulting services is recognized when the Company performs the services, typically on a monthly retainer basis.

Revenue for Software Licenses is recognized at the point of time in which the Company delivers the software and customer accepts delivery. Software Licenses often include third party components that are a fully integrated part of the Software License stack and are therefore considered as one deliverable and performance obligation. If there are significant contractually stated ongoing service obligations to be performed during the term of the Software License or SaaS contract, then revenues are recognized ratably over the term of the contract.

Timing of Revenue

The timing of revenue recognition for the three and six months ended December 31, 2023 and 2022 was as follows:

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Products and services transferred at a point in time | $ | $ | $ | $ | ||||||||||||

| Products and services transferred/recognized over time | ||||||||||||||||

| Total Revenue | $ | $ | $ | $ | ||||||||||||

| 15 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

Remaining Performance Obligations

Timing of revenue recognition may differ from the timing of invoicing to customers. The Company generally records a receivable/contract asset when revenue is recognized prior to invoicing, or deferred revenue/contract liability when revenue is recognized subsequent to invoicing.

For certain Software Services project contracts, the Company invoices customers after the project has been delivered and accepted by the customer. Software Service project contracts typically consist of designing and programming software for the customer. In most cases, there is only one distinct performance obligation, and revenue is recognized upon completion, delivery and customer acceptance. Contracts may include multiple distinct projects that can each be implemented and operated independently of subsequent projects in the contract. In such cases, the Company accounts for these projects as separate distinct performance obligations and recognizes revenue upon the completion of each project or obligation, its delivery and customer acceptance.

For contracts recognized over time, contract liabilities include billings invoiced for software projects for which the contract’s performance obligations are not complete.

For certain other Software Services project contracts, the Company invoices customers for a substantial portion of the project upon entering into the contract due to their custom nature and revenue is recognized based upon percentage of completion. Revenue recognized subsequent to invoicing is recorded as a deferred revenue/contract liability (billings in excess of cost) and revenue recognized prior to invoicing is recorded as a deferred cost/contract asset (cost in excess of billings).

For Software Services consulting or retainer contracts, the Company generally invoices customers monthly at the beginning of each month in advance for services to be performed in the following month. The sole performance obligation is satisfied when the services are performed. Software Services consulting or retainer contracts typically consist of ongoing support for a customer’s software or specified business practices.

For Software License contracts, the Company generally invoices customers when the software has been delivered to and accepted by the customer, which is also when the performance obligation is satisfied. For SaaS contracts, the Company generally invoices customers in advance at the beginning of the service term.

For multi-period Software License contracts, the Company generally invoices customers annually at the beginning of each annual coverage period. Software License contracts consist of providing clients with software designed by the Company. For Software License contracts, there are generally no ongoing support obligations unless specified in the contract (becoming a Software Service).

Unfulfilled

performance obligations represent amounts expected to be earned by the Company on executed contracts. As of December 31, 2023, the Company

had approximately $

The Company recognizes stock-based compensation expense related to grants to employees, directors and service providers based on grant date fair values of common stock or the stock options, which are amortized over the requisite period, as well as forfeitures as they occur.

The Company values the options using the Black-Scholes Merton (“Black Scholes”) method utilizing various inputs such as expected term, expected volatility and the risk-free rate. The expected term reflects the application of the simplified method, which is the weighted average of the contractual term of the grant and the vesting period for each tranche. Expected volatility is based upon historical volatility for a rolling previous year’s trading days of the Company’s common stock. The risk-free rate is based on the implied yield of U.S. Treasury notes as of the grant date with a remaining term approximately equal to the expected life of the award.

| 16 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

Research and Development Costs

Research and development expenses are expensed as incurred, and include payroll, employee benefits and stock-based compensation expense. Research and development expenses also include third-party development and programming costs. Given the emerging industry and uncertain market environment the Company operates in, research and development costs are not capitalized.

Leases

We determine if an arrangement is a lease at inception. Operating leases are included in right-of-use (“ROU”) assets and lease liabilities in our condensed consolidated balance sheets.

ROU assets represent our right to use an underlying asset for the lease term and lease liabilities represent our obligation to make lease payments arising from the lease. Operating lease ROU assets and liabilities are recognized at commencement date based on the present value of lease payments over the lease term. As our leases do not provide an implicit rate, we generally use an incremental borrowing rate based on below investment grade corporate debt over a similar term of the lease payments at commencement date. The operating lease ROU asset also includes any lease payments made and excludes lease incentives. Our lease terms may include options to extend or terminate the lease when it is reasonably certain that we will exercise that option. Lease expense for lease payments is recognized on a straight-line basis over the lease term.

Basic earnings per share (“EPS”) is computed based on the weighted average number of shares of common stock outstanding during the period. Diluted EPS is computed based on the weighted average number of shares of common stock plus the effect of dilutive potential shares of common stock outstanding during the period using the treasury stock method. Dilutive potential common shares include the issuance of potential shares of common stock for outstanding stock options and warrants.

Reclassifications

Certain accounts in the prior period financial statements have been reclassified for comparative purposes to conform with the presentation in the current period financial statements.

Significant Accounting Policies

There have been no material changes in the Company’s significant accounting policies from those disclosed in its Annual Report on Form 10-K for the year ended June 30, 2023, other than those associated with the recently adopted guidance on accounting for expected credit losses and income taxes as further described below.

Recently Adopted Accounting Pronouncements

In September 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update (“ASU”) No. 2016-13, Financial Instruments – Credit Losses (Topic 326) which requires measurement and recognition of expected credit losses for financial assets held. The Company adopted this guidance on July 1, 2023 and the impact of the adoption was not material to our condensed consolidated financial statements as credit losses are not expected to be significant based on historical collection trends, the financial condition of payment partners, and external market factors.

In December 2019, the FASB issued ASU No. 2019-12 to simplify the accounting in Accounting Standards Codification (“ASC”) 740, Income Taxes. This standard removes certain exceptions related to the approach for intra-period tax allocation, the methodology for calculating income taxes in an interim period, and the recognition of deferred tax liabilities for outside basis differences. This guidance also clarifies and simplifies other areas of ASC 740. The Company adopted this guidance on July 1, 2023 using the prospective transition method. The adoption of this guidance did not have a material impact on the Company’s condensed consolidated financial statements.

Recent Accounting Pronouncements

Management does not believe that any recently issued, but not yet effective, accounting standards if currently adopted would have a material effect on the Company’s financial statements.

| 17 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

NOTE 4. IMPAIRMENT OF GOODWILL AND LONG-LIVED ASSETS

PulpoAR, LLC (“Pulpo”)

The assets of Pulpo were acquired by the Company in May 2022. Pulpo has not and is not expected to meet any future revenue performance milestones as defined in the asset acquisition agreement. In addition, Pulpo has generated negative cash flows and is expected to continue doing so for the foreseeable future, and its business has become less strategically aligned with the Company’s current focus. As a result, a decision was made by the Company to divest the operations of its wholly owned subsidiary Pulpo.

Accordingly,

the fair value of intangible assets, including goodwill, originally recorded at the time of the purchase, were determined to be

zero. The net assets of $

On

December 1, 2023 the Company executed an asset purchase agreement whereby the Pulpo assets, as defined, were transferred to a new independent

entity, PulpoAR, Inc., majority owned by the original sellers of Pulpo, in return for a

The

Note is due

The

Company has fully reserved against the Note as collectability is considered remote and accounts for this investment at cost ($

For

the three and six months ended December 31, 2023, Pulpo had revenue of

For

the three and six months ended December 31, 2022, Pulpo had revenue of

The divestiture did not have a material impact on the Company’s operations or financial results.

| 18 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

NOTE 5. GOODWILL AND INTANGIBLE ASSETS

The composition of goodwill at December 31, 2023 is as follows:

| As of December 31, 2023 | ||||||||||||||||

| XRT | PulpoAR | BLI | Total | |||||||||||||

| Goodwill - beginning of year | $ | $ | $ | $ | ||||||||||||

| Impairment | ( | ) | ( | ) | ||||||||||||

| Goodwill - end of period | $ | $ | $ | $ | ||||||||||||

Intangible assets, their respective amortization period, and accumulated amortization at December 31, 2023 are as follows:

| As of December 31, 2023 | ||||||||||||||||||||||||

| Value ($) | Amortization Period (Years) | |||||||||||||||||||||||

| XR Terra | Pulpo | BLI | inciteVR | Total | ||||||||||||||||||||

| Intangible Assets | ||||||||||||||||||||||||

| Customer Relationships - beginning of year | $ | $ | - | $ | $ | $ | ||||||||||||||||||

| Technology - beginning of year | 925,000 | |||||||||||||||||||||||

| Technology impairment | (925,000 | ) | ( | ) | ||||||||||||||||||||

| Customer Relationships - end of period | - | 5 | ||||||||||||||||||||||

| Technology - end of period | - | 3 | ||||||||||||||||||||||

| Less: Accumulated Amortization | ( | ) | - | ( | ) | ( | ) | ( | ) | |||||||||||||||

| Intangible Assets, net | $ | $ | - | $ | $ | $ | ||||||||||||||||||

Intangible

asset amortization expense for the three and six months ended December 31, 2023 was approximately $

Intangible

asset amortization expense for the three and six months ended December 31, 2022 was approximately $

Estimated intangible asset amortization expense for the remaining lives are as follows:

| Years Ended June 30, | |||||

| 2024 (remaining 6 months) | $ | ||||

| 2025 | $ | ||||

| 2026 | $ | ||||

| 2027 | $ | ||||

| 2028 | $ | ||||

| 19 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

NOTE 6. FINANCIAL INSTRUMENTS

Cash and Cash Equivalents

The Company’s money market funds are categorized as Level 1 within the fair value hierarchy. As of December 31 and June 30, 2023, the Company’s cash and cash equivalents were as follows:

| As of December 31, 2023 | ||||||||||||||||

| Cost | Unrealized

Gain (Loss) | Fair Value | Cash

and Cash Equivalents | |||||||||||||

| Cash | $ | $ | $ | |||||||||||||

| Level 1: | ||||||||||||||||

| Money market funds | $ | |||||||||||||||

| Total cash and cash equivalents | $ | $ | $ | $ | ||||||||||||

| As of June 30, 2023 | ||||||||||||||||

| Cost | Unrealized

Gain (Loss) | Fair Value | Cash

and Cash Equivalents | |||||||||||||

| Cash | $ | $ | $ | |||||||||||||

| Level 1: | ||||||||||||||||

| Money market funds | $ | |||||||||||||||

| Total cash and cash equivalents | $ | $ | $ | $ | ||||||||||||

Contingent Consideration

As of December 31 and June 30, 2023, the Company’s contingent consideration liabilities related to acquisitions are categorized as Level 3 within the fair value hierarchy. Contingent consideration was valued at the time of acquisitions and at December 31 and June 30, 2023 using unobservable inputs and have included using the Monte Carlo simulation model. This model incorporates revenue volatility, internal rate of return, and a risk-free rate. The development and determination of the unobservable inputs for Level 3 fair value measurements and fair value calculations are the responsibility of the Company’s management with the assistance of a third-party valuation specialist.

As of December 31, 2023, the Company’s contingent consideration liabilities current and non-current balances were as follows:

| As of December 31, 2023 | ||||||||||||||||||||

| Contingent Consideration at Purchase Date | Consideration Paid | Changes in Fair Value | Fair Value | Contingent Consideration | ||||||||||||||||

| Level 3: | ||||||||||||||||||||

| Contingent consideration, current - S5D | $ | $ | ( | ) | $ | $ | $ | |||||||||||||

| Contingent consideration, current - BLI | ||||||||||||||||||||

| Contingent consideration, current - XRT | ( | ) | ||||||||||||||||||

| Total contingent consideration, current portion | $ | $ | ( | ) | $ | $ | $ | |||||||||||||

| Level 3: | ||||||||||||||||||||

| Contingent consideration, non-current - S5D | $ | $ | ( | ) | $ | ( | ) | $ | $ | |||||||||||

| Contingent consideration, non-current - BLI | ( | ) | ||||||||||||||||||

| Total contingent consideration, net of current portion | $ | $ | ( | ) | $ | ( | ) | $ | $ | |||||||||||

| 20 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

S5D

has significantly underperformed revenue expectations that were employed to determine fair value at acquisition. The possibility of

achieving any remaining revenue targets to trigger additional consideration is remote. Accordingly, the quantitative inputs used to

value S5D’s contingent consideration as of December 31, 2023 were solely revenue projections, the remaining achieved (as

defined) and unpaid consideration and the $

A

summary of the quantitative significant inputs used to value BLI’s contingent consideration as of December 31, 2023 was: $

The

change in fair value of contingent consideration for S5D and BLI for the three and six months ended December 31, 2023 was a non-cash

gain of approximately $

The

change in fair value of contingent consideration for XR Terra, LLC (“XRT”) for the three and six months ended December

31, 2023 includes the payout to the sellers of XRT for consideration earned in prior periods. This payout was made in September 2023

in the form of Company common stock, fair valued at $

The

range of potential additional contingent consideration related to the previous divestiture of AUGGD, LLC (“AUGGD”) assets

at December 31, 2023 is

As of June 30, 2023, the Company’s contingent consideration liabilities current and non-current balances were as follows:

| As of June 30, 2023 | ||||||||||||||||||||

| Contingent Consideration at Purchase Date | Consideration Paid | Changes in Fair Value | Fair Value | Contingent Consideration | ||||||||||||||||

| Level 3: | ||||||||||||||||||||

| Contingent consideration, current - S5D | $ | $ | ( | ) | $ | $ | $ | |||||||||||||

| Contingent consideration, current - BLI | ||||||||||||||||||||

| Contingent consideration, current - AUGGD | ( | ) | ||||||||||||||||||

| Contingent consideration, current - XRT | ( | ) | ||||||||||||||||||

| Total contingent consideration, current portion | $ | $ | ( | ) | $ | $ | $ | |||||||||||||

| Level 3: | ||||||||||||||||||||

| Contingent consideration, non-current - S5D | $ | $ | ( | ) | $ | ( | ) | $ | $ | |||||||||||

| Contingent consideration, non-current - BLI | ( | ) | ||||||||||||||||||

| Total contingent consideration, net of current portion | $ | $ | ( | ) | $ | ( | ) | $ | $ | |||||||||||

| 21 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

A

summary of the quantitative significant inputs used to value S5D’s contingent consideration as of June 30, 2023 was: $

A

summary of the quantitative significant inputs used to value BLI’s contingent consideration as of June 30, 2023 was: $

The

change in fair value of contingent consideration for S5D and BLI for the three and six months ended December 31, 2022 was a non-cash

gain of approximately $

NOTE 7. DEFERRED COSTS/CONTRACT ASSETS and DEFERRED REVENUE/CONTRACT LIABILITIES

At

December 31 and June 30, 2023, deferred costs/contract assets totaling $

The following table shows the reconciliation of the costs in excess of billings and billings in excess of costs for contracts recognized over time:

| As of December 31, 2023 | As of June 30, 2023 | |||||||

| Cost incurred on uncompleted contracts | $ | $ | ||||||

| Estimated earnings | ||||||||

| Earned revenue | ||||||||

| Less: billings to date | ||||||||

| Billings in excess of costs, net | $ | ( | ) | $ | ( | ) | ||

| Balance Sheet Classification | ||||||||

| Contract assets includes costs and estimated earnings in excess of billings on uncompleted contracts | $ | $ | ||||||

| Contract liabilities includes billings in excess of costs and estimated earnings on uncompleted contracts | ( | ) | ( | ) | ||||

| Billings in excess of costs, net | $ | ( | ) | $ | ( | ) | ||

| 22 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

NOTE 8. EQUITY

Securities Purchase Agreement (“SPA”)

On

September 28, 2023, the Company entered into a SPA with certain institutional investors to sell shares of common stock for

approximately $

The SPA shares were issued on October 3, 2023. Simultaneously, the exercise price on warrants to purchase shares of common stock originally issued pursuant to a SPA entered into in November 2021 were repriced from $ per share to $ per share.

Common Stock Issued

Common stock issued for Business Acquisition and Asset Acquisition - Technology

During

the six months ended December 31, 2022, the Company issued approximately: shares of common stock, valued at $

Common stock issued to satisfy contingent acquisition obligations

During

the six months ended December 31, 2023, the Company issued approximately shares of common stock, with a fair value of approximately

$

During

the six months ended December 31, 2022, the Company issued approximately shares of common stock, with a fair value of approximately

$

| 23 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

Common stock issued for Exercise of Stock Options

During

the six months ended December 31, 2023 and 2022, the Company issued approximately and shares of common stock in cash and

cashless transactions, respectively, upon exercise of the respective option grants and realized cash proceeds of approximately

Common stock issued to Vendors

During the six months ended December 31, 2023, the Company issued approximately shares of common stock to various vendors for services performed and recorded share-based compensation of approximately $ million.

Common stock issued to Employees as Compensation

During the six months ended December 31, 2023, the Company issued approximately shares of common stock to various employees as compensation and recorded share-based compensation of approximately $ million.

During the six months ended December 31, 2022, the Company issued approximately shares of common stock to various employees as compensation and recorded share-based compensation of approximately $ million.

Employee Stock-Based Compensation

Stock Option issuance to Executives

In February 2023, pursuant to the Equity Incentive Plan (see below), the Company granted certain executive officers million stock options as a long-term incentive. The options have an exercise price of $ per share. million of these options vest ratably over four years (“Initial Options”). The remainder (“Target Options”) vest in fixed amounts based on achieving various revenue or common stock prices within seven years of grant date. Given the Company’s current stock price and revenue, the Company views the achievement of the milestones that would trigger vesting of the Target Options as remote.

Equity Incentive Plan

The Company’s 2016 Equity Incentive Plan (the “Plan”), as amended, as of December 31, 2023 has approximately million common shares reserved for issuance. As of December 31, 2023, there were approximately million shares available for issuance under the Plan. The shares available are after the granting of million shares of executive Target Options.

| 24 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

The Company recognizes compensation expense relating to awards ratably over the requisite period, which is generally the vesting period.

| For

the Three Months Ended December 31, | For

the Six Months Ended December 31, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Weighted average expected terms (in years) | ||||||||||||||||

| Weighted average expected volatility | % | % | % | % | ||||||||||||

| Weighted average risk-free interest rate | % | % | % | % | ||||||||||||

| Expected dividend yield | % | % | % | % | ||||||||||||

The grant date fair value for options granted during the six months ended December 31, 2023 and 2022 was approximately $ million and $ million, respectively.

| Weighted Average | ||||||||||||||||

| Remaining | ||||||||||||||||

| Exercise | Contractual | Intrinsic | ||||||||||||||

| Options | Price | Term (Yrs) | Value | |||||||||||||

| Outstanding at July 1, 2023 | $ | $ | ||||||||||||||

| Options Granted | ||||||||||||||||

| Options Exercised | ( | ) | ||||||||||||||

| Options Forfeited / Cancelled | ( | ) | ||||||||||||||

| Outstanding at December 31, 2023 | $ | $ | ||||||||||||||

| Exercisable at December 31, 2023 | $ | $ | ||||||||||||||

The above table excludes executive Target Options: granted, $ exercise price, remaining term in years, no intrinsic value. Vesting of these is considered remote.

| Weighted Average | ||||||||||||||||

| Remaining | ||||||||||||||||

| Exercise | Contractual | Intrinsic | ||||||||||||||

| Options | Price | Term (Yrs) | Value | |||||||||||||

| Outstanding at July 1, 2022 | $ | $ | ||||||||||||||

| Options Granted | ||||||||||||||||

| Options Exercised | ( | ) | ||||||||||||||

| Options Forfeited / Cancelled | ( | ) | ||||||||||||||

| Outstanding at December 31, 2022 | $ | $ | ||||||||||||||

| Exercisable at December 31, 2022 | $ | $ | ||||||||||||||

| 25 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

The intrinsic value of stock options at December 31, 2023 and 2022 was computed using a fair market value of the common stock of $ per share and $ per share, respectively.

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Stock option-based expense: | ||||||||||||||||

| Research and development expenses | $ | $ | $ | $ | ||||||||||||

| General and administrative expenses | ||||||||||||||||

| Sales and marketing expenses | ||||||||||||||||

| Cost of goods sold | ||||||||||||||||

| Board option expense | ||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

There is no expense included for the executive officers’ Target Options.

At December 31, 2023 total unrecognized compensation expense to employees, board members and vendors related to stock options was approximately $ million (excluding executive Target Options of $ million), and is expected to be recognized over a weighted average period of years (which excludes the executive Target Options).

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| Numerator: | 2023 | 2022 | 2023 | 2022 | ||||||||||||

| Net income (loss) | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | ||||||

| Denominator: | ||||||||||||||||

| Weighted-average

common shares outstanding for basic net income (loss) per share | ||||||||||||||||

| Weighted-average

common shares outstanding for diluted net income (loss) per share | ||||||||||||||||

| Basic net income (loss) per share | $ | ) | $ | $ | ) | $ | ) | |||||||||

| Diluted net income (loss) per share | $ | ) | $ | $ | ) | $ | ) | |||||||||

| 26 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

| At December 31, 2023 | At December 31, 2022 | |||||||

| Stock Options | ||||||||

| Warrants | ||||||||

| Total | ||||||||

December 31, 2023 Stock Options include executive Target Options.

NOTE 10. COMMITMENTS AND CONTINGENCIES

Lease Costs

The

Company made cash payments for all operating leases for the six months ended December 31, 2023 and 2022, of approximately $

The

total rent expense for all operating leases for the three months ended December 31, 2023 and 2022, was approximately $

The

total rent expense for all operating leases for the six months ended December 31, 2023 and 2022, was approximately $

Lease Commitments

The Company has various operating leases for its offices. These existing leases have remaining lease terms ranging from approximately 1 to 3 years. Certain lease agreements contain options to renew, with renewal terms that generally extend the lease terms by 1 to 3 years for each option. The Company determined that none of its current leases are reasonably certain to renew.

Future approximate undiscounted lease payments for the Company’s operating lease liabilities and a reconciliation of these payments to its operating lease liabilities at December 31, 2023 are as follows:

| Years Ended June 30, | ||||

| 2024 (remaining 6 months) | $ | |||

| 2025 | ||||

| 2026 | ||||

| Total future minimum lease commitments, including short-term leases | ||||

| Less: future minimum lease payments of short -term leases | ( | ) | ||

| Less: imputed interest | ( | ) | ||

| Present value of future minimum lease payments, excluding short term leases | $ | |||

| Current portion of operating lease liabilities | $ | |||

| Non-current portion of operating lease liabilities | ||||

| Total operating lease liability | $ | |||

| 27 |

THE GLIMPSE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2023 AND 2022

Contingent Consideration for Acquisitions

Contingent consideration for acquisitions consists of the following as of December 31, 2023 and June 30, 2023 respectively (see Note 6):

| As of December 31, | As of June 30, | |||||||

| 2023 | 2023 | |||||||

| S5D, current portion | $ | $ | ||||||

| BLI, current portion | ||||||||

| XRT | ||||||||

| Subtotal current portion | ||||||||

| S5D, net of current portion | ||||||||

| BLI, net of current portion | ||||||||

| Total contingent consideration for acquisitions | $ | $ | ||||||

Employee Bonus

During

this fiscal year, a certain employee met the revenue threshold to earn a bonus payout of approximately $

Potential Future Distributions Upon Divestiture or Sale

In some instances, upon a divestiture or sale of a subsidiary company or capital raise into a subsidiary company, the Company is contractually obligated to distribute a portion of the net proceeds or capital raise to the senior management team of the divested subsidiary company.

NOTE 11. SUBSEQUENT EVENTS

None

| 28 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis summarizes the significant factors affecting the consolidated operating results, financial condition, liquidity and cash flows of our Company as of and for the periods presented below. The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and related notes included in this Quarterly Report on Form 10-Q and the audited financial statements and notes thereto, and related disclosures, as of and for the year ended June 30, 2023, which are included in the Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on September 28, 2023. Unless the context requires otherwise, references in this Quarterly Report on Form 10-Q to “we,” “us,” “our” or “the Company,” refer to The Glimpse Group, Inc., a Nevada corporation and its subsidiaries.

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning our strategy, future operations, future financial position, future revenues, projected costs, prospects and plans and objectives of management. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including, without limitation, the risks set forth in Part II, Item 1A, “Risk Factors” in this Quarterly Report on Form 10-Q and in our other filings with the SEC. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements.

Overview

We are an Immersive technology (Virtual Reality (“VR”), Augmented Reality (“AR”) and Spatial Computing) company, comprised of a diversified group of wholly-owned and operated Immersive technology companies, providing enterprise-focused software, services and solutions. We believe that we offer significant exposure to the rapidly growing and potentially transformative Immersive technology markets via our diversified model and ecosystem.

Our platform of Immersive technology subsidiary companies, collaborative environment and diversified business model aims to simplify the challenges faced by companies in the emerging Immersive technology industry, create scale, operational efficiencies and go-to-market synergies, potentially improving each subsidiary company’s ability to succeed, while simultaneously providing investors an opportunity to invest directly via a diversified infrastructure.

The Immersive technology industry is an early-stage technology industry with nascent markets. We believe that this industry has significant growth potential across verticals, may be transformative and that our diversified platform and ecosystem create important competitive advantages. We focus primarily on the business-to-business (“B2B”) and business-to-business-to-consumer (“B2B2C”) segments industry and we are hardware agnostic.

At the time of this filing, we have approximately 120 full time employees, primarily software developers, engineers and 3D artists. Of these, approximately 60 are based in the US and 60 internationally in Turkey.

| 29 |

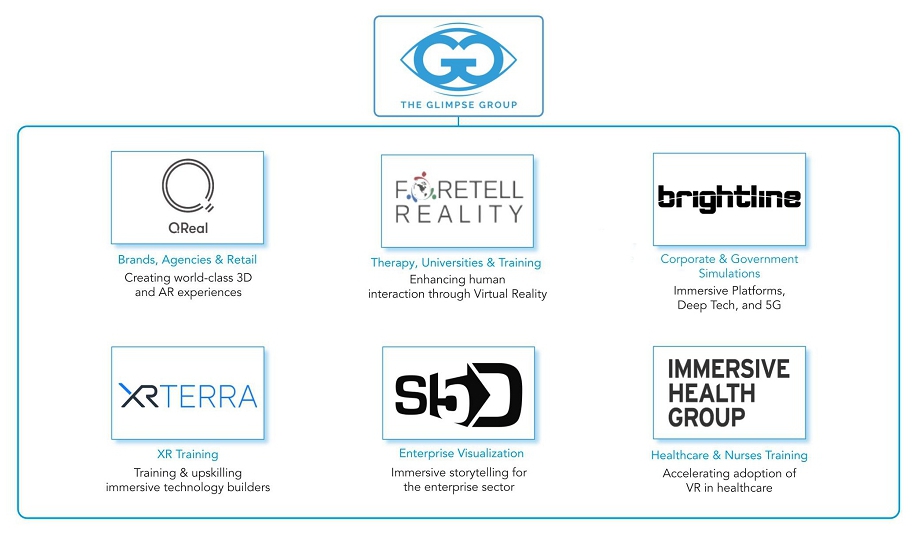

We were incorporated as The Glimpse Group, Inc. in the State of Nevada, on June 15, 2016 and are headquartered in New York, New York. We currently own and operate numerous subsidiary companies (“Subsidiary Companies”, “Subsidiaries”) operating under the following business names as represented in the organizational chart below:

Significant Transactions

Securities Purchase Agreement (“SPA”)

On September 28, 2023, the Company entered into a SPA with certain institutional investors to sell 1,885,715 shares of common stock for approximately $3.30 million (at $1.75 per share). The Company realized net proceeds (after underwriting, professional fees and listing expenses) of $2.97 million on October 3, 2023.

The SPA shares were issued on October 3, 2023. Simultaneously, the exercise price on warrants to purchase 750,000 shares of common stock originally issued pursuant to a SPA entered into in November 2021 were repriced from $14.63 per share to $1.75 per share.

| 30 |

Financial Highlights for the three and six months ended December 31, 2023 compared to the three and six months ended December 31, 2022

Results of Operations

The following table sets forth our results of operations for the three and six months ended December 31, 2023 and 2022:

Summary P&L

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||||||||||||||||||

| December 31, | Change | December 31, | Change | |||||||||||||||||||||||||||||

| 2023 | 2022 | $ | % | 2023 | 2022 | $ | % | |||||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||

| Revenue | $ | 2.08 | $ | 2.95 | $ | (0.87 | ) | (29 | )% | $ | 5.18 | $ | 6.90 | $ | (1.72 | ) | (25 | )% | ||||||||||||||

| Cost of Goods Sold | 0.66 | 0.88 | (0.22 | ) | (25 | )% | 1.84 | 2.09 | (0.25 | ) | (12 | )% | ||||||||||||||||||||

| Gross Profit | 1.42 | 2.07 | (0.65 | ) | (31 | )% | 3.34 | 4.81 | (1.47 | ) | (31 | )% | ||||||||||||||||||||

| Total Operating Expenses (*) | 2.23 | 0.84 | 1.39 | 165 | % | 4.33 | 9.01 | (4.68 | ) | (52 | )% | |||||||||||||||||||||

| Income (Loss) from Operations before Other Income | (0.81 | ) | 1.23 | (2.04 | ) | 166 | % | (0.99 | ) | (4.20 | ) | 3.21 | (76 | )% | ||||||||||||||||||

| Other Income | 0.07 | 0.08 | (0.01 | ) | 13 | % | 0.13 | 0.13 | - | 0 | % | |||||||||||||||||||||

| Net Income (Loss) | $ | (0.74 | ) | $ | 1.31 | $ | (2.05 | ) | 156 | % | $ | (0.86 | ) | $ | (4.07 | ) | $ | 3.21 | (79 | )% | ||||||||||||

(*) – Includes non cash gains related to fair value change in acquisition contingent consideration liabilities.

Revenues

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||||||||||||||||||

| December 31, | Change | December 31, | Change | |||||||||||||||||||||||||||||

| 2023 | 2022 | $ | % | 2023 | 2022 | $ | % | |||||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||

| Software Services | $ | 2.03 | $ | 2.89 | $ | (0.86 | ) | (30 | )% | $ | 5.04 | $ | 6.75 | $ | (1.71 | ) | (25 | )% | ||||||||||||||

| Software License/Software as a Service | 0.05 | 0.06 | (0.01 | ) | (17 | )% | 0.14 | 0.15 | (0.01 | ) | (7 | )% | ||||||||||||||||||||

| Total Revenue | $ | 2.08 | $ | 2.95 | $ | (0.87 | ) | (29 | )% | $ | 5.18 | $ | 6.90 | $ | (1.72 | ) | (25 | )% | ||||||||||||||

Total revenue for the three months ended December 31, 2023 was approximately $2.08 million compared to approximately $2.95 million for the three months ended December 31, 2022, a decrease of 29%. Total revenue for the six months ended December 31, 2023 was approximately $5.18 million compared to approximately $6.9 million for the six months ended December 31, 2022, a decrease of 25%. The decrease for both periods reflects our strategic shift to Spatial Computing, Cloud and AI driven immersive software solutions, which reflects a significant turnover in our targeted customer base.

We break out our revenues into two main categories – Software Services and Software License.

| ● | Software Services revenues are primarily comprised of VR/AR projects, services related to our software licenses and consulting retainers. |

| ● | Software License revenues are comprised of the sale of our internally developed VR/AR software as licenses or as software-as-a-service (“SaaS”). |

For the three months ended December 31, 2023, Software Services revenue was approximately $2.03 million compared to approximately $2.89 million for the three months ended December 31, 2022, a decrease of approximately 30%. For the six months ended December 31, 2023, Software Services revenue was approximately $5.04 million compared to approximately $6.75 million for the six months ended December 31, 2022, a decrease of approximately 25%. The decrease for both periods reflects our strategic shift to Spatial Computing, Cloud and AI driven immersive software solutions.

For the three months ended December 31, 2023, Software License revenue was approximately $0.5 million compared to approximately $0.6 million for the three months ended December 31, 2022, a decrease of approximately 17%. For the six months ended December 31, 2023, Software License revenue was approximately $0.14 million compared to approximately $0.15 million for the six months ended December 31, 2022, a decrease of approximately 7%. As the Immersive technology industry continues to mature, we expect our Software License revenue to continue to grow on an absolute basis and as an overall percentage of total revenue.

| 31 |

Customer Concentration

One customer accounted for approximately 28% of the Company’s total gross revenues during the three months ended December 31, 2023. No other customer accounted for greater than 10% of gross revenue. The same customer and a different customer accounted for approximately 55% (29% and 26%, respectively) of the Company’s total gross revenues during the three months ended December 31, 2022. Two customers accounted for approximately 44% (22% and 22%, respectively) of the Company’s total gross revenues during the six months ended December 31, 2023. The same two customers accounted for approximately 58% (32% and 26%, respectively) of the Company’s total gross revenues during the six months ended December 31, 2022.

Gross Profit

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||||||||||||||||||

| December 31, | Change | December 31, | Change | |||||||||||||||||||||||||||||

| 2023 | 2022 | $ | % | 2023 | 2022 | $ | % | |||||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||

| Revenue | $ | 2.08 | $ | 2.95 | $ | (0.87 | ) | (29 | )% | $ | 5.18 | $ | 6.90 | $ | (1.72 | ) | (25 | )% | ||||||||||||||

| Cost of Goods Sold | 0.66 | 0.88 | (0.22 | ) | (25 | )% | $ | 1.84 | 2.09 | (0.25 | ) | (12 | )% | |||||||||||||||||||

| Gross Profit | 1.42 | 2.07 | (0.65 | ) | (31 | )% | 3.34 | 4.81 | (1.47 | ) | (31 | )% | ||||||||||||||||||||

| Gross Profit Margin | 68 | % | 70 | % | 64 | % | 70 | % | ||||||||||||||||||||||||

Gross profit was approximately 68% for the three months ended December 31, 2023, compared to approximately 70% for the three months ended December 31, 2022. Gross profit was approximately 64% for the six months ended December 31, 2023 compared to approximately 70% for the six months ended December 31, 2022. The decrease for both periods was driven by the lower margin on project revenue in the current fiscal year due to use of outside contractors.

For the three months ended December 31, 2023 and 2022, internal staffing was approximately $0.44 million (67% of total cost of revenue) and approximately $0.50 million (58% of total cost of revenue), respectively. The percentage increase reflects an increase in non-project revenue as a percentage of total revenue between the periods. For the six months ended December 31, 2023 and 2022, internal staffing was approximately $1.10 million (60% of total cost of revenue) and approximately $1.25 million (60% of total cost of revenue), respectively. The percentage of revenue is consistent between the periods, as non-project revenue as a percentage of total revenue was also consistent between the periods.

Operating Expenses

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||||||||||||||||||

| December 31, | Change | December 31, | Change | |||||||||||||||||||||||||||||

| 2023 | 2022 | $ | % | 2023 | 2022 | $ | % | |||||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||

| Research and development expenses | $ | 1.39 | $ | 2.53 | $ | (1.14 | ) | (45 | )% | $ | 3.07 | $ | 4.54 | $ | (1.47 | ) | (32 | )% | ||||||||||||||

| General and administrative expenses | 1.05 | 1.26 | (0.21 | ) | (17 | )% | 2.14 | 2.64 | (0.50 | ) | (19 | )% | ||||||||||||||||||||

| Sales and marketing expenses | 0.77 | 1.74 | (0.97 | ) | (56 | )% | 1.58 | 3.48 | (1.90 | ) | (55 | )% | ||||||||||||||||||||

| Amortization of acquisition intangible assets | 0.29 | 0.54 | (0.25 | ) | (46 | )% | 0.66 | 0.98 | (0.32 | ) | (33 | )% | ||||||||||||||||||||

| Intangible asset impairment | - | - | - | N/A | 0.90 | - | 0.90 | N/A | ||||||||||||||||||||||||

| Change in fair value of acquisition contingent consideration | (1.27 | ) | (5.23 | ) | 3.96 | (76 | )% | (4.02 | ) | (2.63 | ) | (1.39 | ) | 53 | % | |||||||||||||||||

| Total Operating Expenses | $ | 2.23 | $ | 0.84 | $ | 1.39 | 165 | % | $ | 4.33 | $ | 9.01 | $ | (4.68 | ) | (52 | )% | |||||||||||||||