UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the year ended

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission

file number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s

telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Ticker symbol(s) | Name of each exchange on which registered | ||

| The

|

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. ☐ Yes ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| ☒ | Smaller reporting company | |||||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒

As

of December 30, 2022, the aggregate market value of the registrants voting and non-voting common stock held by non-affiliates of the

registrant was $

As of September 22, 2023, shares of the registrant’s common stock were issued and outstanding.

TABLE OF CONTENTS

THE GLIMPSE GROUP, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED JUNE 30, 2023

| 2 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report includes statements of our expectations, intentions, plans, and beliefs that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Nonetheless, it is important for an investor to understand that these statements involve risks and uncertainties. These statements relate to the discussion of our business strategies and our expectations concerning future operations, margins, profitability, liquidity, and capital resources and to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. We have used words such as “may,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “think,” “estimate,” “seek,” “expect,” “predict,” “could,” “project,” “potential,” and other similar terms and phrases, including references to assumptions, in this report to identify forward-looking statements. These forward-looking statements are made based on expectations and beliefs concerning future events affecting us and are subject to uncertainties, risks and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed or implied by these forward-looking statements.

Such risks and other factors also include those listed in Item 1A. “Risk Factors” and elsewhere in this report and our other filings with the Securities and Exchange Commission (“SEC”). When considering these forward-looking statements, you should keep in mind the cautionary statements in this report and the documents incorporated by reference. New risks and uncertainties arise from time to time, and we cannot predict those events or how they may affect us. We assume no obligation to update any forward-looking statements after the date of this report as a result of new information, future events or developments, except as required by applicable laws and regulations.

When used in this annual report, the terms the “Company,” “Glimpse Group,”, “Glimpse,” “we,” “us,” “ours,” and similar terms refer to The Glimpse Group, Inc., a Nevada corporation, and its subsidiaries.

As of the date of this annual report, we currently own and operate numerous wholly-owned subsidiary companies (“Subsidiary Companies”, “Subsidiaries”): QReal, LLC (dba QReal), Immersive Health Group, LLC (dba IHG), Foretell Studios, LLC (dba Foretell Reality), Glimpse Group Yazilim ve ARGE Ticaret Anonim Sirketi (Glimpse Turkey), XR Terra, LLC, Sector 5 Digital, LLC (“S5D”), PuploAR, LLC (a subsidiary company of QReal) and Brightline Interactive, LLC (“BLI”) and a legal entity in Israel.

| 3 |

PART I

ITEM 1. BUSINESS

History

The Glimpse Group, Inc. was incorporated on June 15, 2016, under the laws of the State of Nevada and is headquartered in New York, New York.

COMPANY OVERVIEW

We are an Immersive technology (Virtual Reality (“VR”), Augmented Reality (“AR”), Spatial Computing, Artificial Intelligence (“AI”)) platform company, comprised of a diversified group of wholly-owned and operated Immersive technology companies, providing enterprise-focused software, services and solutions. We believe that we offer significant exposure to the rapidly growing and potentially transformative Immersive technology markets, while mitigating downside risk via our diversified model and ecosystem.

Our platform of Immersive technology subsidiary companies, collaborative environment and diversified business model aims to simplify the challenges faced by companies in the emerging Immersive technology industry, potentially improving each subsidiary company’s ability to succeed, while simultaneously providing investors an opportunity to invest directly via a diversified infrastructure.

By leveraging our platform, we strive to cultivate and manage the business operations of our Immersive technology subsidiary companies, with the goal of allowing each underlying company to better focus on mission-critical endeavors, collaborate with the other subsidiary companies, reduce time to market, optimize costs, improve product quality and leverage joint go-to-market strategies. Subject to operational, market and financial developments and conditions, we intend to carefully add to our current portfolio of subsidiary companies via a combination of organic expansion and/or outside acquisition.

The Immersive technology industry is an early-stage technology industry with nascent markets. We believe that this industry has significant growth potential across verticals, may be transformative and that our diversified platform and ecosystem create important competitive advantages. Our subsidiary companies currently target a wide array of industry verticals, including but not limited to: Corporate Training, Education, Healthcare, Government & Defense, Branding/Marketing/Advertising, Retail, Financial Services, Food & Hospitality, Media & Entertainment, Architecture/Engineering/Construction (“AEC”), Corporate Events and Presentations, Beauty and Cosmetics, and Social VR support groups and therapy. We do not currently target direct-to-consumer (“B2C’) customers, we focus primarily on the business-to-business (“B2B”) and business-to-business-to-consumer (“B2B2C”) segments. In addition, we are hardware agnostic.

| 4 |

The Glimpse Platform

We develop, commercialize and market innovative and proprietary Immersive technology software products, solutions and intellectual property (“IP”). Our platform is currently comprised of numerous active wholly-owned subsidiary companies, each targeting different industry segments in a non-competitive, collaborative manner. Our experienced management and dynamic Immersive technology entrepreneurs have deep domain expertise, providing the foundation for value-add-collaborations throughout our ecosystem.

Each of our subsidiary companies share operational, financial and IP infrastructure, facilitating shorter time-to-market, higher quality products, reduced development costs, fewer redundancies, significant go-to-market synergies and, ultimately, a higher potential for success for each subsidiary company. We believe that our collaborative platform is unique and necessary, especially given the early nature of the Immersive technology industry. By offering technologies and solutions in various industry segments, we aim to reduce dependency on any one single subsidiary company, technology or industry segment.

We believe that three core tenets enhance our probability of success: (1) our ecosystem of Immersive technology companies, (2) diversification and (3) profitable growth.

(1) Our ecosystem of Immersive technology software and service companies provides significant benefits to each subsidiary company and our group as a whole. We believe that the most notable benefits are: (a) economies of scale, cost efficiencies and reduced redundancies; (b) cross company collaboration, deep domain expertise, IP and knowledge transfer; (c) superior product offerings; (d) faster time to market; (e) enhanced business development and sales synergies; and (f) multiple monetization paths. In an emerging industry that is lacking in infrastructure, we believe that our ecosystem provides a distinct competitive advantage relative to a single, standalone company in the industry.

(2) By design, we incorporate multiple aspects of diversity to reduce the risks associated with an early stage industry, create multiple monetization venues and improve the probabilities of success. There is no single point of failure or dependency. This is created through: (a) ownership of numerous wholly-owned subsidiary companies operating in different industry segments; (b) targeting large industries with clear Immersive technology use-cases; (c) developing and utilizing various technologies and IP; (d) expanding to different geographic technology centers in a hub model under our umbrella; and (e) across industries, having a wide array of customers and potential acquirers/investors.

(3) From our inception, we have balanced minimizing operational cash burn with capturing the growth opportunities in front of us. This remains an important factor driving our strategy to: (a) focus on enterprise software and services, only onboarding companies that are generating revenues or clearly could in the short term; (b) target solutions that are based on use cases that have a clear return on investment (“ROI”) and can be effectively developed from existing technologies and hardware; and (c) centralize costs to reduce inefficiencies. By striving to balance cash burn and growth, our goal is to lower dilution and support greater independence from capital markets, thereby increasing resiliency and maximizing upside potential.

As part of our platform, we provide a centralized corporate structure, which significantly reduces general and administrative costs (financial, operational, legal & IP), streamlines capital allocation and helps in coordinating business strategies. This allows our subsidiary company general managers to focus their time and effort almost exclusively on the core software, product and business development activities relating to their subsidiary.

Additionally, aligned economic incentives encourage cross-Company collaboration. Substantially all of our employees own equity in our Company. The leadership team of each subsidiary company, in addition to their initial equity ownership in Glimpse, may also have an economic interest that typically takes form in either: i) a 5-10% economic interest in the total net sale proceeds of the subsidiary upon a divestiture event or ii) additional Glimpse equity issuances based on revenue milestones achieved by the subsidiary company over a period of several years (typically three years). Thus, there is benefit to them not only when their subsidiary company succeeds but also when any of the other subsidiaries succeeds, and when Glimpse as a whole succeeds. We believe that this ownership mechanism is a strong driver of cross-pollination of ideas and fosters collaboration. While each subsidiary company owns its own IP, our parent company currently owns 100% of each subsidiary company. In addition, there will be perpetual licensing agreements between our subsidiary companies, so that if a subsidiary company is divested, then the remaining subsidiaries, if utilizing the IP of a divested subsidiary company, will continue to retain usage rights post-divestiture.

| 5 |

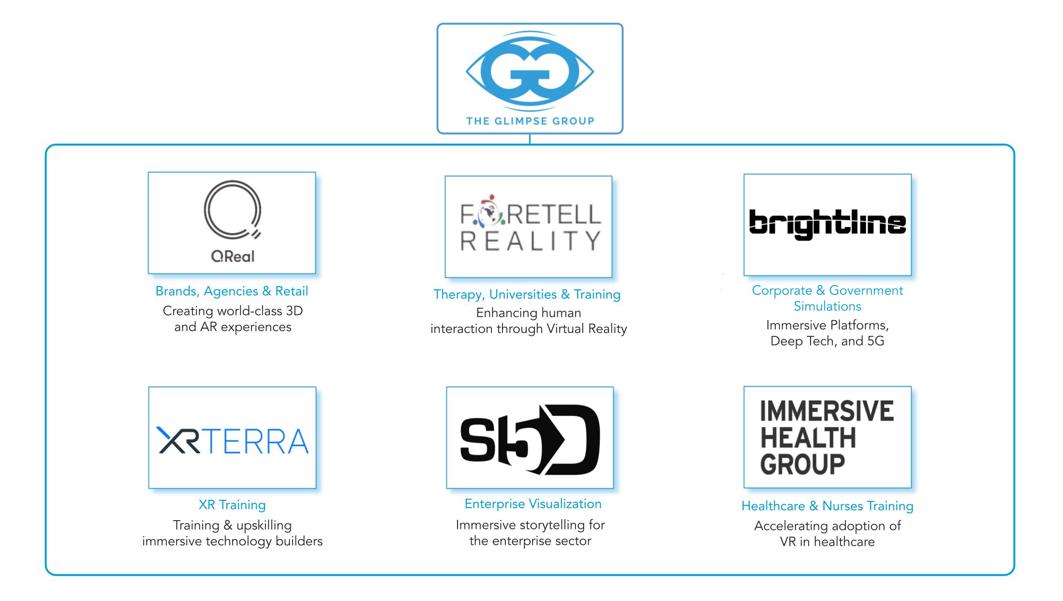

We currently own and operate numerous subsidiary companies (“Subsidiary Companies”, “Subsidiaries”) operating under the following business names as represented in the organizational chart below:

Active Glimpse Subsidiary Companies

| 1. | QReal, LLC (dba QReal): Creation of lifelike photorealistic 3D interactive digital models and experiences in AR | |

| 2. | Immersive Health Group, LLC (IHG): VR/AR platform for evidence-based and outcome driven healthcare solutions | |

| 3. | Foretell Studios, LLC (dba Foretell Reality): Customizable social VR platform for behavioral health, support groups, collaboration, corporate training, soft skills training, higher education | |

| 4. | Glimpse Group Yazilim ve ARGE Ticaret Anonim Sirketi (Glimpse Turkey): a development center in Turkey, primarily developing and creating 3D models for QReal | |

| 5. | XR Terra, LLC (dba XR Terra): Immersive technologies teaching courses and training | |

| 6. | Sector 5 Digital, LLC (S5D): Corporate immersive experiences and events | |

| 7. | PulpoAR, LLC (PulpoAR): AR try-on technologies, targeting the Beauty and Cosmetics industry; a subsidiary company of QReal | |

| 8. | Brightline Interactive, LLC (BLI): Immersive and interactive experiences, training scenarios, and simulations for both government and commercial customers. |

| 6 |

Key Business Developments During Fiscal Year 2023

Brightline Interactive, LLC Acquisition

In May 2022, the Company entered into an Agreement and Plan of Merger (the “BLI Agreement”) to purchase all of the membership interests of Brightline Interactive, LLC (“BLI”), an immersive technology company that provides VR and AR based training scenarios and simulations for commercial and government customers. The transaction’s total potential purchase price is $32.5 million, with an initial payment of $8.0 million upon closing, consisting of $3.0 million in cash and approximately 0.71 million shares of the Company’s common stock valued at $5.0 million at the time the Agreement was entered (and issued at closing based on a common stock floor price of $7.00/share). Future potential purchase price considerations, up to $24.5 million, are based on BLI’s achievement of revenue growth milestones in the three years post-closing, the payment of which shall be made up to $12 million in cash and the remainder in common shares of the Company, priced at the date of the future potential share issuance subject to a common stock price floor of $7.00/share.

The aggregate consideration to the members of BLI per the Agreement consisted of: (a) $568,046 cash paid (net of working capital adjustments, as defined, of $505,787) at the August 1, 2022 closing (the “Closing”); (b) $1,926,167 of cash paid at the Closing to extinguish BLI’s outstanding debt and pay down other obligations; (c) 714,286 shares of the Company’s common stock fair valued at the Closing; and (d) future purchase price considerations payable to the members of BLI, up to a residual of $24,500,000. The $24,500,000 is based and payable on BLI’s achievement of certain revenue growth milestones at points in time and cumulatively during the three years post-Closing Date, the payment of which shall be made up to $12,000,000 in cash and the remainder in common shares of the Company, priced at the dates of the future potential share issuance subject to a common stock price floor of $7.00 per share.

The fair value allocation for the purchase price consideration paid at Closing was recorded as follows:

| Purchase price consideration: | ||||

| Cash paid to members at Closing | $ | 2,494,213 | ||

| Company common stock fair value at Closing | 2,846,144 | |||

| Fair value of contingent consideration to be achieved | 7,325,000 | |||

| Total purchase price | $ | 12,665,357 | ||

| Fair value allocation of purchase price: | ||||

| Cash and cash equivalents | $ | 15,560 | ||

| Accounts receivable | 253,041 | |||

| Deferred costs/contract assets | 552,625 | |||

| Other assets | 10,000 | |||

| Equipment, net | 55,580 | |||

| Accounts payable and accrued expenses | (848,079 | ) | ||

| Deferred revenue/contract liabilities | (2,037,070 | ) | ||

| Intangible assets - customer relationships | 3,310,000 | |||

| Intangible assets - technology | 880,000 | |||

| Goodwill | 10,473,700 | |||

| Total fair value allocation of purchase price | $ | 12,665,357 | ||

For more details please refer to Note 4 of the Company’s enclosed Financial Statements.

| 7 |

The Immersive Technology Markets

Virtual Reality (VR) fully immerses the user in a digital environment via a head mounted display (“HMD”), where the user is blocked out of their immediate physical environment. Augmented Reality (AR) is a less immersive experience, where the user views their immediate physical environment with digital images overlaid, via a phone, tablet or a dedicated HMD such as smart glasses. While distinct, VR and AR are related, utilize some similar underlying technologies and are expected to become increasingly interconnected - combined they are often referred to as Immersive Technology (XR).

VR and AR are emerging technologies, and the markets for them are still nascent. We believe that Immersive technologies and solutions have the potential to fundamentally transform how people and businesses interact, further enabling remote work, education and commerce. Immersive technologies are also expected to increasingly interconnect with other emerging technologies such as artificial intelligence, spatial computing, computer vision, big data, NFT and crypto currencies. Additionally, HMD and telecommunication (5G) advancements have been driving vast improvements in capabilities and ease of use, while significantly reducing headset cost. As a result, market adoption has accelerated and is expected to continue. Leading technology companies such as Meta/Facebook, Apple, Microsoft, Google, ByteDance (Pico), Samsung, Sony and HP have been at the forefront of VR/AR hardware development and software infrastructure, while also increasing integration of their products with AR and VR capabilities.

Since Facebook released its first VR headset as a consumer product in 2016 (after its $2B+ acquisition of Oculus), successive iterations of it, as well as others, such as the recently announced Apple Vision Pro, have become significantly lighter, more comfortable, lower priced, with higher resolution and increasingly wireless/mobile. With a standalone mobile headset, users no longer need an expensive gaming computer to power the headset and they also do not have a wire tethered to that computer restricting movement. These advances have facilitated easier corporate procurement and integration. The accelerating rollout of 5G should enable further improvement in user experience since with 5G, remote processing and heavier, real time applications become possible without noticeable visual lag, allowing for lighter, smaller, more comfortable HMDs with longer battery life.

Bain & Company, Citibank and Goldman Sachs research have recently estimated the potential market size of commercial Immersive technology in excess of $1 trillion by 2023.

Business Development and Sales

We utilize a hybrid approach to the sales and distribution of our software products and services.

At our subsidiary company level, each company has its own business development and sales team, the size of which depends on its stage of development. Each subsidiary company’s general manager is responsible for business development, and as the subsidiary gains market traction, its business development and sales team are expanded as needed.

Our subsidiary companies’ business development and sales teams are enhanced by the shared resources and influence of our ecosystem. Our management takes an active role in the business development activities of each subsidiary company and in the overall development and integration of sale strategies, goals and budgets. As an integral part of the business development and sales processes, each subsidiary company’s general manager is very familiar with the product offerings of other subsidiary companies and leverages those into his or her own efforts when appropriate. This leads to substantial cross marketing collaboration.

We believe that a subsidiary company’s ability to demonstrate to potential customers scale as part of our ecosystem of companies, combined with our subsidiary’s ability to offer its products and solutions as well as those of our other subsidiary companies in an integrated manner, represents a key competitive advantage. We believe our customers often view us as a “one-stop-shop” for all their Immersive technology needs and an expert in this emerging space.

We and our subsidiary companies continue to develop a shared partner ecosystem to further scale business and expand our solutions into new and existing target markets.

| 8 |

Competitive Environment

We believe that our competitors in the Immersive technology industry are focused on two primary segments: VR/AR Hardware (headsets) and Software.

Immersive Technology Hardware (Headsets) (“Hardware”):

We do not develop any Hardware, and our software and service solutions are mostly compatible with any Hardware. We believe that Hardware development, commercialization and distribution are highly capital intensive and there is not yet large enough scale or mass adoption in the Immersive technology industry to justify such expenditures for a smaller company. As such, there are relatively few participants on the Hardware side, some very large (for example: Meta/Facebook, Microsoft, Samsung, Google, Apple, ByteDance (Pico), HTC, HP, Lenovo, Sony and Epson) and some much smaller (for example: Magic Leap, XREAL, Varjo and Vuzix). In general, Hardware cycles have been accelerating and performance improving, with simplified usability and reduced end-user costs. The more advanced, easier to use and cheaper the Hardware becomes, the higher the potential for the development of robust software applications and increased market adoption of Immersive technology solutions.

Immersive Technology Software (“Software”):

In contrast to Immersive Technology Hardware, Software is highly fragmented with hundreds of Immersive Technology Software companies targeting different segments and solutions. Many are consumer oriented, whereas we are entirely enterprise focused (B2B, B2B2C). We believe that the Immersive Technology Software segment is currently far less competitive than traditional software markets, as most companies in the space tend to be early stage and often underfunded.

While competition is evolving, there is currently no dominant player in any particular VR/AR Software segment. We believe that we have the potential to become a leader in the VR/AR Software space in general and that each of our subsidiary companies has the potential to become a significant player in their particular industry sector.

As previously described, we believe that our structure, ecosystem and integrated capabilities create significant competitive advantages for each of our subsidiary companies, not available to other Software companies in the Immersive technology space. By owning and operating a diverse set of Immersive technology companies, we believe that we significantly improve each of our subsidiary company’s ability to succeed by addressing many of the challenges early stage companies face and expanding each’s opportunity set and capabilities.

We believe that there are a select number of earlier stage companies of approximately our size that provide Immersive Technology and could be viewed as potential competitors. In addition, several of the larger technology players provide general infrastructure Immersive Technology Software. In particular: ARCore from Google and ARKit from Apple, which enable AR functionality on smartphones and tablets; and Unity and Unreal from Epic, which enable software languages used in VR and AR programing. We do not view these larger companies as competition, but rather as complementary to our business (indeed, some of these are customers of ours). We believe infrastructure software benefits us, and the industry at large, as they are not industry specific and enable companies like us to more effectively build industry specific solutions, thereby saving significant costs and development efforts.

Platform Expansion and Diversification Strategy

As described above in “Competitive Environment,” the Immersive Technology Software and services industries are highly fragmented. There are numerous potential acquisition targets that, while having established a niche market position, product or technology, have limited resources and ability to pursue growth initiatives. We may continue to add to our platform both companies, technologies and other appropriate targets, subject to the availability of capital, at attractive deal terms. Beyond the expected financial impact of each such potential addition, these could also enhance our ecosystem, technology, scale and competitive position. These potential acquisitions may be domestic or international. We currently have multiple locations in the US, offices in several locations in Turkey and an international presence in the UK and Israel.

| 9 |

Strategic Divestitures

Each one of our subsidiary companies has the potential to be divested or spun off. Although the purpose of our platform is to grow and develop the ecosystem on which each of our subsidiaries can mature by benefitting from collaboration, each subsidiary company targets a specific industry vertical (e.g., Healthcare, Education, Corporate Training, etc.) and as such has a distinct set of potential acquirers or investors. If a subsidiary company is divested and the proceeds are substantive, then our intent is to distribute the majority of the net proceeds to our shareholder base, if such distribution would not jeopardize our growth and operations.

Intellectual Property

Our intellectual property is an integral part of our business strategy and practice. In accordance with industry practice, we protect our proprietary products, technology and competitive advantage through a combination of contractual provisions and trade secrets, patents, copyright and trademark laws in the United States and other jurisdictions where business is conducted.

As of the date of this disclosure and summarized in the table below, we have been issued 10 patents by the United States Patent and Trademark Office (the “USPTO”) and have an additional 5 filed patent applications in process.

| Title of Invention | Subsidiary | Initial Filing Date | Issuance Date | Patent Number | ||||

| Issued Patents: | Pagoni VR | 06-21-2018 | Oct ‘19 | 10445941 | ||||

| Interactive Mixed Reality System for a Real World Event | ||||||||

| Immersive Display System with Adjustable Perspective | Pagoni VR | 11-27-2018 | Sept ‘20 | 10764553 | ||||

| Augmented Reality Geolocation Using Image Matching | KreatAR | 08-22-2018 | March ‘21 | 10949669 | ||||

| System for Sharing User-Generated Content | Pagoni VR | 06-12-2019 | Aug ‘21 | 11095947 | ||||

| Presenting a Simulated Reality Experience in a Preset Location | Post Reality | 06-14-2019 | Nov ‘21 | 11189097 | ||||

| Virtual Reality System Cross Platform | Foretell Reality | 04-23-2019 | April ‘22 | 11294453 | ||||

| Simulated Reality Adaptive User Space | Foretell Reality | 07-26-2019 | April ‘22 | 11288868 | ||||

| Marker-Based Positioning of Simulated Reality | KreatAR | 04-23-2019 | July ‘22 | 11380011 | ||||

| System and Method for Generating an Augmented Reality Experience | Brightline | 11-19-2020 | April ‘22 | 11302038 | ||||

| Immersive Ecosystem | Brightline | 08-05-2020 | June ‘22 | 11373383 | ||||

| Filed Patents: | ||||||||

| Real-Time Visualization of Head Mounted Display User Reactions | Foretell Reality | 04-06-2022 | ||||||

| Audio Processing In a Virtual Environment | Adept Reality | 06-22-2022 | ||||||

| AI Controlled Non-Human Conversation Flow in VR | Foretell Reality | 06-12-2023 | ||||||

| Dispositional Affect for Virtual Character Interactions in VR Applications | Foretell Reality | 12-13-2022 | ||||||

| Large Language Model Artificial Intelligence Spatial Core: A Collaborative Spatial Computing Platform | Brightline | 06-01-2023 |

| 10 |

We may continue to file for patents regarding various aspects of our products, services and technologies at a later date depending on the costs and timing associated with such filings. We may make investments to further strengthen our copyright protection going forward, although no assurances can be given that we will be successful in such patent and trademark protection endeavors. We seek to limit disclosure of our intellectual property by requiring employees, consultants, and partners with access to our proprietary information to execute confidentiality agreements and non-competition agreements (when applicable) and by restricting access to our proprietary information. Due to rapid technological change, we believe that establishing and maintaining an industry and technology advantage in factors such as the expertise and technological and creative skills of our personnel, as well as new services and enhancements to our existing services, are more important to our business and profitability than other available legal protections. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our services or to obtain and use information that we regard as proprietary. The laws of many countries do not protect proprietary rights to the same extent as the laws of the U.S. Litigation may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets, to determine the validity and scope of the proprietary rights of others or to defend against claims of infringement. Any such litigation could result in substantial costs and diversion of resources and could have a material adverse effect on our business, operating results and financial condition. There can be no assurance that our means of protecting our proprietary rights will be adequate or that our competitors will not independently develop similar services or products. Any failure by us to adequately protect our intellectual property could have a material adverse effect on our business, operating results and financial condition. See “Risk Factors—Risks Related to our Business.”

Business Cycles

Based on our history and information available to date, we have not been able to identify any seasonality of cycles within our business. Since Immersive technology is an emerging industry, market and customer education are material and therefore the length of the typical sales cycle can be between 3 and 18 months, depending on the size and complexity of the proposed solution and the customer’s level of understanding of the Immersive technology space and prior experience.

Economic Dependence

For the year ended June 30, 2023, one customer accounted for approximately 26% of our revenues and another for approximately 21% of our revenues. No other customer accounted for more than 10% of our revenues for the year ended June 30, 2023. One of these same customers and a different customer accounted for approximately 40% and 14% of revenues, respectively, for the year ended June 30, 2022. For the fiscal year ended June 30, 2022, no other customer accounted for 10% or more of our revenues.

We operate in an early stage industry, and customers are exploring various options for Immersive technology solutions and acting as early adopters of these solutions. As such, there has been a high degree of variance on our source of revenues while customers are on-boarded and our software product and solutions are integrated, measured and digested. A customer that may account for a higher concentration of revenue in one period may not account for any revenue in subsequent periods.

| 11 |

With the additions of S5D and Brightline Interactive, we have significantly increased our scale and are approaching a point with less variability in customer concentration and less dependency on any one customer in the aggregate. That being said, we continue to have a handful of customers that comprise the majority of our revenues. A significant reduction in revenue from our larger customers could have a material negative impact on our operations.

Typically, customer contracts can be canceled at any time by the customer upon 30-90 day written notice (depending on the size and complexity of the contract). In such an event, the customer would owe the Company unpaid amounts up until the point of cancelation. For most customers we charge 25-50% of the contract value upfront and the amounts are usually not refundable, mitigating some of the contract cancellation risk. While it does happen on occasion, it is rare that a signed contract is canceled.

Facilities

We are based in New York, New York, with a lease through 2024.

We have a lease in Fort Worth, Texas for the operations of S5D, and a lease in Ashburn, Virginia for the operations of Brightline Digital.

We also lease four offices in Turkey, for the operations of Glimpse Turkey and PulpoAR.

Our current facilities are leased and adequate to meet our ongoing needs. If we require additional space or expand geographically, we may seek additional facilities on commercially reasonable terms at such time.

Human Capital

At June 30, 2023, we had 186 full time employees, primarily software developers, engineers and 3D artists. Of these, 86 are based in the US and 100 internationally in Turkey.

Corporate Information

Information contained on our websites, including www.theglimpsegroup.com, shall not be deemed to be part of this filing or incorporated herein by reference and should not be relied upon by prospective investors for the purposes of determining whether to invest in the Company.

ITEM 1A. RISK FACTORS

RISKS RELATED TO OUR BUSINESS

The Company is an early stage technology company

We were incorporated on June 15, 2016 and are an early stage technology development company, comprised of a wholly-owned group of early stage companies in the VR and AR space. As such, we are subject to the risks associated with being an early stage company operating in an emerging industry, including, but not limited to, the risks set forth herein.

Health epidemics, including the COVID-19 pandemic, have had, and could in the future have, an adverse impact on our business, operations, and the markets and communities in which we, our partners and customers operate. For example, sales cycles had generally lengthened and some customers delayed purchase decisions.

Our business and operations could be adversely affected by health epidemics, including reemergence of the COVID-19 pandemic, impacting the markets and communities in which we, our partners and customers operate. The COVID-19 pandemic caused significant business and financial markets disruption worldwide and, if there is a reemergence of it or other epidemics they could cause disruptions on both a nationwide and global level, as well as the ongoing effects on our business.

For example, as a result of the COVID-19 pandemic, we saw the length of our sale cycles generally increase and some of our customers delayed purchase decisions. A decline in revenue or the collectability of our receivables could harm our business.

We have incurred significant net losses since inception and anticipate that we will continue to incur net losses for the foreseeable future and may never achieve or maintain profitability. There is doubt about our ability to continue as a going concern.

Since inception, we have incurred significant net losses. As of June 30, 2023 and June 30, 2022, we had an accumulated deficit of approximately $56.6 million and $28.1 million respectively. The net loss for the fiscal year ended June 30, 2023 was approximately $28.6 million and fiscal year ended June 30, 2022 was approximately $6.0 million. To date, we have devoted our efforts towards securing financing, building and evolving our technology platform and creating an infrastructure that allows for the growth of such technology platform. We expect to continue to incur significant expenses and potential operating losses for the foreseeable future. We believe that the cash and cash equivalents balance of $5.6 million at June 30, 2023 may not be sufficient to fund our operating expenses and capital requirements for one year after the date this filing is made. The combination of operating losses, cash expected to be used to continue operating activities and uncertain conditions relating to additional capital raises and continued revenue growth creates an uncertainty about the Company’s ability to continue as a going concern. If we cannot continue as a going concern, our stockholders would likely lose most or all of their investment in us.

| 12 |

We may not be successful in raising additional capital necessary to meet expected funding needs. If we need additional funding for operations and we are unable to raise it, we may not be able to continue our business operations.

We expect our capital needs to increase in the future as we continue to expand and enhance our operations. Our ability to raise additional funds through equity or debt financings or other sources will depend on the financial success of our current business and successful implementation of our key strategic initiatives, financial, economic and market conditions and other factors, some of which are beyond our control. No assurance can be given that we will be successful in raising the required capital at reasonable cost and at the required times, or at all. Further equity financings may have a dilutive effect on shareholders and any debt financing, if available, may require restrictions to be placed on our future financing and operating activities. If we require additional capital and are unsuccessful in raising that capital, we may not be able to continue our business operations and advance our growth initiatives, which could adversely impact our business, financial condition and results of operations.

Our market is competitive and dynamic. New competing products and services could be introduced at any time that could result in reduced profit margins and loss of market share.

The Immersive technology industries are very dynamic, with new technology and services being introduced by a range of players, from larger established companies to start-ups, on a frequent basis. Our competitors may announce new products, services, or enhancements that better meet the needs of end-users or changing industry standards. Further, new competitors or alliances among competitors could emerge. Increased competition may cause price reductions, reduced gross margins and loss of market share, any of which could have a material adverse effect on our business, financial condition and results of operations.

Furthermore, the worldwide Immersive technology markets are increasingly competitive. A number of companies developing Immersive technology products and services compete for a limited number of customers. Some of our competitors in this market have substantially greater financial and other resources, larger research and development staffs, and more experience and capabilities in developing, marketing and distributing products. Potential pricing pressure could result in significant price erosion, reduced profit margins and loss of market share, any of which could have a material adverse effect on our business, results of operations, financial position and liquidity.

Our plans for growth will place significant demands upon our resources. If we are unsuccessful in achieving our plan for growth, our business could be harmed.

We are actively marketing our products domestically and internationally. The plan places significant demands upon managerial, financial, and human resources. Our ability to manage future growth will depend in large part upon several factors, including our ability to rapidly:

| ● | build or leverage, as applicable, a network of business partners to create an expanding presence in the evolving marketplace for our products and services; | |

| ● | build or leverage, as applicable, sales teams to keep end-users and business partners informed regarding the technical features, issues and key selling points of our products and services; |

| ● | attract and retain qualified technical personnel in order to continue to develop reliable and flexible products and provide services that respond to evolving customer needs; | |

| ● | develop support capacity for end-users as sales increase, so that we can provide post-sales support without diverting resources from product development efforts; and | |

| ● | expand our internal management and financial controls significantly, so that we can maintain control over our operations and provide support to other functional areas as the number of personnel and size increases. |

Our inability to achieve any of these objectives could harm our business, financial condition and results of operations.

| 13 |

We have material customer concentration, with a limited number of customers accounting for a material portion of our 2023 revenues.

For the years ended June 30, 2023 and 2022, our five largest customers, accounted for approximately 59% and 66% of our revenues, respectively. There are inherent risks whenever a large percentage of total revenues are concentrated with a limited number of customers. It is not possible for us to predict the future level of demand for our services that will be generated by these customers or the future demand for the products and services of these customers in the end-user marketplace. In addition, revenues from these customers may fluctuate from time to time based on the commencement and completion of projects, the timing of which may be affected by market conditions or other facts, some of which may be outside of our control. Further, some of our contracts with these customers permit them to terminate our services at any time (subject to notice and certain other provisions). If any of these customers experience declining or delayed sales due to market, economic or competitive conditions, we could be pressured to reduce the prices we charge for our services or we could lose a major customer. Any such development could have an adverse effect on our margins and financial position, and would negatively affect our revenues and results of operations and/or trading price of our common stock.

We anticipate our products and technologies will require ongoing research and development (“R&D”) and we may experience technical problems or delays and may not have the funds necessary to continue their development, which could lead our business to fail.

Our R&D efforts are subject to the risks typically associated with the development of new products and technologies based on emerging and innovative technologies, including, for example, unexpected technical problems or the possible insufficiency of funds for completing development of these products or technologies. If we experience technical problems or delays, further improvements in our products or technologies and the introduction of future products or technologies could be delayed, and we could incur significant additional expenses and our business may fail.

We anticipate that we may require additional funds to increase or sustain our current levels of expenditure for the R&D of new products and technologies, and to obtain and maintain patents and other intellectual property rights in these technologies, the timing and amount of which are difficult to forecast. Any funds we need may not be available on commercially reasonable terms or at all. If we cannot obtain the necessary additional capital when needed, we might be forced to reduce our R&D efforts which would materially and adversely affect our business. If we attempt to raise capital in an offering of shares of our common stock, preferred stock, convertible securities or warrants, our then-existing stockholders’ interests will be diluted.

Our success depends on our ability to anticipate technological changes and develop new and enhanced products and services.

The markets for our products and services are characterized by rapidly changing technology, evolving industry standards and increasingly sophisticated customer requirements. The introduction of products embodying new technology and the emergence of new industry standards can negatively impact the marketability of our existing products and can exert price pressures on existing products. It is critical to our success that we are able to anticipate and react quickly to changes in technology or in industry standards and to successfully develop, introduce, and achieve market acceptance of new, enhanced and competitive products and services on a timely basis and cost-effective basis. We invest substantial resources towards continued innovation; however, there can be no assurance that we will successfully develop new products and services or enhance and improve our existing products and services, that new products and services and enhanced and improved existing products and services will achieve market acceptance or that the introduction of new products and services or enhanced existing products and services by others will not negatively impact us. Our inability to develop products and services that are competitive in technology and price and that meet end-user needs could have a material adverse effect on our business, financial condition or results of operations.

| 14 |

Development schedules for technology products and services are inherently uncertain. We may not meet our products and/or services development schedules, and development costs could exceed budgeted amounts. Our business, results of operations, financial position and liquidity may be materially and adversely affected if the products or product enhancements that we develop are delayed or not delivered due to developmental problems, quality issues or component shortage problems, or if our products or product enhancements do not achieve market acceptance or are unreliable. We or our competitors will continue to introduce products embodying new technologies. In addition, new industry standards may emerge. Such events could render our existing products obsolete or not marketable, which would have a material adverse effect on our business, results of operations, financial position and liquidity.

We place significant decision making powers with our subsidiaries’ management, which presents certain risks that may cause the operating results of individual subsidiaries to vary.

We believe that our practice of placing significant decision making powers with each of our subsidiaries’ management is important to our successful growth and allows us to be responsive to opportunities and to our customers’ needs. However, this practice could make it difficult to coordinate procedures across our operations and presents certain risks, including the risk that we may be slower or less effective in our attempts to identify or react to problems affecting an important business issue, or that we would be slower to identify a misalignment between a subsidiary’s and our overall business strategy. Inconsistent implementation of corporate strategy and policies at the subsidiary level could materially and adversely affect our financial position, results of operations and cash flows and prospects.

The operating results of an individual subsidiary may differ from those of another subsidiary for a variety of reasons, including market size, customer base, competitive landscape, regulatory requirements and economic conditions affecting a particular industry vertical. As a result, certain of our subsidiaries may experience higher or lower levels of profitability and growth than other subsidiaries.

The failure to attract, hire, retain and motivate key personnel could have a significant adverse impact on our operations.

Our success depends on the retention and maintenance of key personnel, including members of senior management and our technical, sales and marketing teams. Achieving this objective may be difficult due to many factors, including competition for such highly skilled personnel; fluctuations in global economic and industry conditions; changes in our management or leadership; competitors’ hiring practices; and the effectiveness of our compensation programs. The loss of any of these key persons could have a material adverse effect on our business, financial condition or results of operations. Competition for qualified employees is particularly intense in the technology industry. Our failure to attract and to retain the necessary qualified personnel could seriously harm our operating results and financial condition. Competition for such personnel can be intense, and no assurance can be provided that we will be able to attract or retain highly qualified technical and managerial personnel in the future, which may have a material adverse effect on our future growth and profitability.

Our financial results may fluctuate substantially for many reasons, and past results should not be relied on as indications of future performance.

Our revenues and operating results may fluctuate from quarter to quarter and from year to year due to a combination of factors, including, but not limited to:

| ● | varying size, timing and contractual terms of orders for our products and services, which may delay the recognition of revenue; | |

| ● | competitive conditions in the industry, including strategic initiatives by us or our competitors, new products or services, product or service announcements and changes in pricing policy by us or our competitors; | |

| ● | market acceptance of our products and services; |

| 15 |

| ● | our ability to maintain existing relationships and to create new relationships with customers and business partners; | |

| ● | the discretionary nature of purchase and budget cycles of our customers and end-users; | |

| ● | the length and variability of the sales cycles for our products; | |

| ● | general weakening of the economy resulting in a decrease in the overall demand for our products and services or otherwise affecting the capital investment levels of businesses with respect to our products or services; | |

| ● | timing of product development and new product initiatives; | |

| ● | changes in customer mix; | |

| ● | increases in the cost of, or limitations on, the availability of materials; | |

| ● | changes in product mix; and | |

| ● | increases in costs and expenses associated with the introduction of new products. |

Further, the markets that we serve are volatile and subject to market shifts that we may be unable to anticipate. A slowdown in the demand for AR or VR products and services can have a significant adverse effect on the demand for our products and services in any given period. Our customers may cancel or delay purchase orders for a variety of reasons, including, but not limited to, the rescheduling of new product introductions, changes in our customers’ inventory practices or forecasted demand, general economic conditions affecting our customers’ markets, changes in our pricing or the pricing of our competitors, new product announcements by us or others, quality or reliability problems related to our products, or selection of competitive products as alternate sources of supply.

Thus, there can be no assurance that we will be able to reach profitability on a quarterly or annual basis. We believe that our revenue and operating results will continue to fluctuate, and that period-to-period comparisons are not necessarily indications of future performance. Our revenue and operating results may fail to meet the expectations of public market analysts or investors, which could have a material adverse effect on the price of our common stock. In addition, portions of our expenses are fixed and difficult to reduce if our revenues do not meet our expectations. These fixed expenses magnify the adverse effect of any revenue shortfall.

Our plans for implementing our business strategy and achieving profitability are based upon the experience, judgment and assumptions of our key management personnel, and available information concerning the communications and technology industries. If management’s assumptions prove to be incorrect, it could have a material adverse effect on our business, financial condition or results of operations.

Our centralized management will have significant discretion over directing our resources and if management does not allocate resources effectively, our business, financial condition or result of operations could be harmed.

Our centralized management has significant discretion over directing our resources to any and all of our subsidiary companies. As a consequence, it is possible that one or more of our subsidiary companies will not receive adequate capital or management resources. If a subsidiary company does not receive adequate capital or resources, it may not be able to commercialize its products and services, or if its products and services are already commercialized, it may not be able to keep such products and services competitive. Therefore, if we don’t allocate resources effectively, our business, financial condition or result of operations could be harmed.

| 16 |

Competitive pricing pressure may reduce our gross profits and adversely affect our financial results.

If we are unable to maintain our pricing due to competitive pressures or other factors, our margins will be reduced and our gross profits, business, results of operations, and financial condition would be adversely affected. The subscription prices for our software platforms, cloud modules, and professional services may decline for a variety of reasons, including competitive pricing pressures, discounts, anticipation of the introduction of new solutions by our competitors, or promotional programs offered by us or our competitors. Competition continues to increase in the market segments in which we operate, and we expect competition to further increase in the future.

Our future growth depends on our ability to attract, retain customers, and the loss of existing customers, or failure to attract new ones, could adversely impact our business and future prospects.

Once the platform is further developed, the size of our community of customers on our platforms is critical to our success. Our ability to achieve profitability in the future will depend, in large part, on our ability to add new customers, while retaining and even expanding offerings to existing customers. Our customers can generally decide to cease using our solutions at any time. While we have experienced customer growth, this growth may not continue at the same pace in the future or at all. In addition, it is possible that a recurrence of COVID-19 or a like kind pandemic occurrence may have a deleterious effect on our customer growth in the future. Achieving growth in our customer base may require us to engage in increasingly sophisticated and costly sales and marketing efforts that may not result in additional customers. We may also need to modify our pricing model to attract and retain such customers. If we fail to attract new customers or fail to maintain or expand existing relationships in a cost-effective manner, our business and future prospects may be materially and adversely impacted.

The continued operation of our business depends on the performance and reliability of the Internet, mobile networks, and other infrastructure that is not under our control.

Our business depends on the performance and reliability of the Internet, mobile networks, and other infrastructure that is not under our control. Disruptions in such infrastructure, including as the result of power outages, telecommunications delay or failure, security breach, or computer virus, as well as failure by telecommunications network operators to provide us with the bandwidth we need to provide our products and offerings, could cause delays or interruptions to our products, offerings, and platforms. Any of these events could damage our reputation, resulting in fewer users actively using our platforms, disrupt our operations, and subject us to liability, which could adversely affect our business, financial condition, and operating results.

If we do not make our platforms, including new versions or technology advancements, easier to use or properly train customers on how to use our platforms, our ability to broaden the appeal of our products and services and to increase our revenue could suffer.

In order to get full use of our platforms, users generally need training. We provide a variety of training and support services to our customers, and we believe we will need to continue to maintain and enhance the breadth and effectiveness of our training and support services as the scope and complexity of our platforms increase. If we do not provide effective training and support resources for our customers on how to efficiently and effectively use our platforms, our ability to grow our business will suffer, and our business and results of operations may be adversely affected. Additionally, when we announce or release new versions of our platforms or advancements in our technology, we could fail to sufficiently explain or train our customers on how to use such new versions or advancements or we may announce or release such versions prematurely. These failures on our part may lead to our customers being confused about use of our products or expected technology releases, and our ability to grow our business, results of operations, brand and reputation may be adversely affected.

Interruptions, performance problems or defects associated with our platforms may adversely affect our business, financial condition and results of operations.

Our reputation and ability to attract and retain customers and grow our business depends in part on our ability to operate our platforms at high levels of reliability, scalability and performance, including the ability of our existing and potential customers to access our platforms at any time and within an acceptable amount of time. Interruptions in the performance of our platforms, whether due to system failures, computer viruses or physical or electronic break-ins, could affect the availability of our platforms. We have experienced, and may in the future experience, disruptions, outages and other performance problems due to a variety of factors, including infrastructure changes, introductions of new functionality, human or software errors, capacity constraints due to an overwhelming number of customers accessing our platforms simultaneously, denial of service attacks or other security-related incidents.

| 17 |

It may become increasingly difficult to maintain and improve our performance, especially during peak usage times and as our customer base grows and our platforms becomes more complex. If our platforms are unavailable or if our customers are unable to access our platforms within a reasonable amount of time or at all, we may experience a loss of customers, lost or delayed market acceptance of our platforms, delays in payment to us by customers, injury to our reputation and brand, legal claims against us, significant cost of remedying these problems and the diversion of our resources. In addition, to the extent that we do not effectively address capacity constraints, upgrade our systems as needed and continually develop our technology and network architecture to accommodate actual and anticipated changes in technology, our business, financial condition and results of operations, as well as our reputation, may be adversely affected.

Further, the software technologies underlying our platforms are inherently complex and may contain material defects or errors, particularly when new products are first introduced or when new features or capabilities are released. We have from time to time found defects or errors in our platforms, and new defects or errors in our existing platforms or new products may be detected in the future by us or our users. We cannot assure you that our existing platforms and new products will not contain defects. Any real or perceived errors, failures, vulnerabilities, or bugs in our platforms could result in negative publicity or lead to data security, access, retention or other performance issues, all of which could harm our business. The costs incurred in correcting such defects or errors may be substantial and could harm our business. Moreover, the harm to our reputation and legal liability related to such defects or errors may be substantial and could similarly harm our business.

If we fail to timely release updates and new features to our platforms and adapt and respond effectively to rapidly changing technology, evolving industry standards, changing regulations, or changing customer needs, requirements or preferences, our platforms may become less competitive.

The markets in which we compete are subject to rapid technological change, evolving industry standards, and changing regulations, as well as changing customer needs, requirements and preferences. The success of our business will depend, in part, on our ability to adapt and respond effectively to these changes on a timely basis. Accordingly, our ability to increase our revenue depends in large part on our ability to maintain, improve and differentiate our existing platforms and introduce new functionality.

We must continue to improve existing features and add new features and functionality to our platforms in order to retain our existing customers and attract new ones. If the technology underlying our platforms become obsolete or do not address the needs of our customers, our business would suffer.

Revenue growth from our products depends on our ability to continue to develop and offer effective features and functionality for our customers and to respond to frequently changing data protection regulations, policies and end-user demands and expectations, which will require us to incur additional costs to implement. If we do not continue to improve our platforms with additional features and functionality in a timely fashion, or if improvements to our platforms are not well received by customers, our revenue could be adversely affected.

If we fail to deliver timely releases of our products that are ready for commercial use, release a new version, service, tool or update with material errors, or are unable to enhance our platforms to keep pace with rapid technological and regulatory changes or respond to new offerings by our competitors, or if new technologies emerge that are able to deliver competitive solutions at lower prices, more efficiently, more conveniently or more securely than our solutions, or if new operating systems, gaming platforms or devices are developed and we are unable to support our customers’ deployment of games and other applications onto those systems, platforms or devices, our business, financial condition and results of operations could be adversely affected.

| 18 |

We are an “emerging growth company,” and we cannot be certain if the reduced reporting and disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, or Section 404, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. Pursuant to Section 107 of the JOBS Act, as an emerging growth company, we may choose to elect to use the extended transition period for complying with new or revised accounting standards until those standards would otherwise apply to private companies. As a result, our consolidated financial statements may not be comparable to the financial statements of issuers who are required to comply with the effective dates for new or revised accounting standards that are applicable to public companies, which may make our common stock less attractive to investors. In addition, if we cease to be an emerging growth company, we will no longer be able to use the extended transition period for complying with new or revised accounting standards.

We will remain an emerging growth company until the earliest of: (1) the last day of the fiscal year following the fifth anniversary of our initial public offering; (2) the last day of the first fiscal year in which our annual gross revenue is $1.235 billion or more; (3) the date on which we have, during the previous rolling three-year period, issued more than $1 billion in non-convertible debt securities; and (4) the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates.

We cannot predict if investors will find our common stock less attractive if we choose to rely on these exemptions. For example, if we do not adopt a new or revised accounting standard, our future results of operations may not be as comparable to the results of operations of certain other companies in our industry that adopted such standards. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock, and our stock price may be more volatile.

A failure in our information technology, or IT, systems could cause interruptions in our services, undermine the responsiveness of our services, disrupt our business, damage our reputation and cause losses.

Our IT systems support all phases of our operations, including finance, marketing, customer development and the business of customer support services. If our systems fail to perform, we could experience disruptions in operations, slower response time or decreased customer satisfaction. System interruptions, errors or downtime can result from a variety of causes, including changes in customer usage patterns, technological failures, changes to our systems, linkages with third-party systems and power failures. Our systems may be vulnerable to disruptions from human error, execution errors, errors in models, employee misconduct, unauthorized trading, external fraud, computer viruses, distributed denial of service attacks, computer viruses or cyberattacks, terrorist attacks, natural disaster, power outage, capacity constraints, software flaws, events impacting key business partners and vendors, and similar events.

It could take an extended period of time to restore full functionality to our technology or other operating systems in the event of an unforeseen occurrence. Instances of fraud or other misconduct might also negatively impact our reputation and customer confidence in us, in addition to any direct losses that might result from such instances. Despite our efforts to identify areas of risk, oversee operational areas involving risks, and implement policies and procedures designed to manage these risks, there can be no assurance that we will not suffer unexpected losses, reputational damage or regulatory actions due to technology or other operational failures or errors, including those of our vendors or other third parties.

If we fail to prevent security breaches, improper access to or disclosure of our data or user data, or other hacking and attacks, we may lose users, and our business, reputation, financial condition and results of operations may be materially and adversely affected.

Our business can include the hosting and/or transmission of proprietary information and sensitive or confidential data. In connection with our services business, some of our employees also have access to its customers’ confidential data and other information, which could be compromised, whether intentionally or unintentionally, by our employees, consultants or vendors.

We have privacy and data security policies in place that are designed to prevent security breaches and we have employed significant resources to develop our security measures against breaches. However, as technologies evolve, and the portfolio of the service providers with which the Company shares confidential information with grows, we could be exposed to increased risk of breaches in security and other illegal or fraudulent acts, including cyberattacks. The evolving nature of such threats, in light of new and sophisticated methods used by criminals and cyberterrorists, including computer viruses, malware, phishing, misrepresentation, social engineering and forgery, is making it increasingly challenging to anticipate and adequately mitigate these risks.

We may be subject to these types of attacks. If we are unable to avert these attacks and security breaches, we could be subject to significant legal and financial liabilities, our reputation would be harmed and we could sustain substantial revenue loss from lost sales and customer dissatisfaction. We may not have the resources or technical sophistication to anticipate or prevent rapidly evolving types of cyber-attacks. Cyber-attacks may target us, our suppliers, customers or other participants, or the internet infrastructure on which we depend. Actual or anticipated attacks and risks may cause us to incur significantly higher costs, including costs to deploy additional personnel and network protection technologies, train employees, and engage third-party experts and consultants. While we do carry cybersecurity insurance, we may not be able to mitigate such risks to any third party. Cybersecurity breaches would not only harm our reputation and business, but also could materially decrease our revenue and net income.

A compromise of the security of our information technology systems leading to theft or misuse of our own or our clients’ proprietary or confidential information, or the public disclosure or use of such information by others, could result in losses, third-party claims against us and reputational harm, including the loss of clients. The theft or compromise of our or our clients’ information could negatively impact our reputation, financial results and prospects. In addition, if our reputation is damaged due to a data security breach, our ability to attract new engagements and clients may be impaired or we may be subjected to damages or penalties, which could negatively impact our businesses, financial results or financial condition.

| 19 |

RISKS RELATED TO OUR ACQUISITION STRATEGY

We may be unable to obtain additional financing, if required, to fund the existing operations of the business, complete future acquisitions or to fund the development and commercialization of the companies, technologies, or intellectual property.

Our primary business strategy is to: 1) generate and increase revenues of existing subsidiary companies and 2) to further enhance our presence in the Immersive technology market through the acquisition of additional companies, technologies, or intellectual property. If our existing subsidiary companies do not achieve sufficient levels of revenue and profits, we may be required to seek additional financing through the issuance of equity or debt securities or other arrangements to finance the operations of the business.

Additionally, there can be no assurance that we will be able to successfully identify, acquire or profitably manage such additional companies, technologies, or intellectual property or successfully integrate these, if any, into the Glimpse ecosystem without substantial costs, delays or other operational or financial problems. If potential acquisition targets are unwilling to accept our equity as the consideration for their businesses, then we may be required to seek additional financing through the issuance of equity or debt securities or other arrangements to finance the acquisition transaction. If we complete a business combination, we may require additional financing to fund the operations or growth of an acquisition target. Further, acquisitions involve a number of other special risks, including possible adverse effects on our operating results, diversion of management’s attention, dependence on retention, hiring and training of key personnel, risks associated with unanticipated problems or legal liabilities, and realization of acquired intangible assets, some or all of which could have a material adverse effect on our business, financial condition and results of operations. In addition, there can be no assurance that the companies, technologies, or intellectual property acquired in the future, if any, will generate anticipated revenues and earnings. As a result, we may be required to seek additional financing through the issuance of equity or debt securities or other arrangements. To the extent that we are unable to acquire additional companies, technologies, or intellectual property or integrate those successfully, our ability to generate and increase our revenues may be reduced significantly. As a result, we may be required to seek additional financing through the issuance of equity or debt securities or other arrangements. As an early-stage company, we cannot assure that such financing will be available on acceptable terms, if at all.

With respect to our future acquisition strategy, no assurance can be made that we will have the funds necessary to make future acquisitions. To the extent that additional financing proves to be unavailable, that fact will likely have a negative impact on our business and we may be compelled to restructure the operations of the business or abandon a particular contemplated business combination.

If we fail to integrate any existing or acquired subsidiaries into the Glimpse ecosystem, we may not realize the anticipated benefits of the collaborative Glimpse ecosystem and the integration of any acquisitions, which could harm our business, financial condition or results of operations.

Even though Glimpse’s ecosystem provides a centralized corporate structure and the potential for cross company collaboration synergies, each subsidiary company has its own business development, technology development, sales team and general manager. Although we believe that the integration of our existing subsidiary companies has been a success, there is still continued risk that we may encounter difficulties related to continued integration of the existing subsidiary companies in the future. There is also the risk that the business development, sales team and general manager of a future acquired subsidiary are unsuccessful. Some of these risks are out of our control. Successfully integrating any acquired subsidiary may be more difficult, costly or time-consuming than we anticipate, or we may not otherwise realize any of the anticipated benefits of such acquisition. Any of the foregoing could adversely affect our business, financial condition or results of operations.

We have made a number of acquisitions in the past and we intend to make more acquisitions in the future. Our ability to identify complementary assets, products or businesses for acquisition and successfully integrate them could affect our business, financial condition and operating results.