Exhibit 99.1

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED December 31, 2022

Digihost Technology inc.

March 31, 2023

TABLE OF CONTENTS

| GLOSSARY | 1 | |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION AND RISKS | 3 | |

| CORPORATE STRUCTURE | 5 | |

| Name, Address, Incorporation, and Corporate Organizational Chart | 5 | |

| GENERAL DEVELOPMENT OF THE BUSINESS | 5 | |

| Three Year History | 5 | |

| Anticipated Changes in the Corporation’s Business | 10 | |

| Significant Acquisitions | 11 | |

| BUSINESS OF THE CORPORATION | 11 | |

| Risk Factors | 13 | |

| DIVIDENDS OR DISTRIBUTIONS | 25 | |

| CAPITAL STRUCTURE | 25 | |

| MARKET FOR SECURITIES | 26 | |

| Trading Price and Volume | 26 | |

| Prior Sales | 27 | |

| DIRECTORS AND OFFICERS | 28 | |

| Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 29 | |

| Conflicts of Interest | 30 | |

| AUDIT COMMITTEE INFORMATION | 30 | |

| Audit Committee Charter | 30 | |

| Composition of the Audit Committee | 30 | |

| PROMOTERS | 31 | |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 31 | |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 32 | |

| TRANSFER AGENT AND REGISTRAR | 32 | |

| MATERIAL CONTRACTS | 32 | |

| INTERESTS OF EXPERTS | 32 | |

| ADDITIONAL INFORMATION | 32 | |

| Audit Committee Charter | A-1 |

-i-

GLOSSARY

“AIF” means this annual information form for the financial year ended December 31, 2022;

“BCBCA” means the Business Corporations Act (British Columbia), or its successor legislation and the regulations made thereunder;

“Bit Digital” means Bit Digital USA, Inc.;

“Bitcoin Transfer Memo” has the meaning given to it under the heading “General Development of the Business – Three Year History – 2019”;

“Blockchain” means a distributed ledger comprised of blocks that serves as a historical transaction record of all past transactions and can be accessed by anyone with appropriate permissions. Blocks are chained together using cryptographic signatures;

“Board” means the board of directors of the Corporation;

“Buffalo Facility Lease Agreement” means the lease agreement dated June 4, 2018 entered into by East Delavan and Bit Management, LLC and assigned to by Bit Management, LLC to Digihost;

“Buffalo Mining Facility” means the 1001 East Delavan facility in Buffalo, NY subject to the Buffalo Facility Lease Agreement;

“Buyer” means the buyer under the Energy Contract;

“CEO” means Chief Executive Officer;

“CFO” means Chief Financial Officer;

“Colocation Agreements” means the Colocation Facilities Agreements no. 51 and 62, each dated May 20, 2018 between HashChain and Bit.Management, LLC, as amended from time to time including by the Bitcoin Transfer Memo dated July 1, 2019 between HashChain and Bit.Management, LLC;

“Co-Mining Agreement” means the Co-Mining Agreement entered into with Bit Digital as announced on June 10, 2021;

“Consolidation” means the Consolidation of the SV Shares and PV Shares on the basis of three (3) pre-consolidation SV Shares or PV Shares for every one (1) post-consolidation SV Share or PV Share, respectively, effective as of October 28, 2021;

“Corporation” means Digihost Technology Inc. (TSXV: DGHI; Nasdaq: DGHI);

“Digifactory1” means the 60 MW power plant located in the State of New York;

“Digihost” means Digihost International Inc., a corporation incorporated under the laws of the State of Delaware on October 9, 2018;

“Digihost Shareholder” means a holder of Digihost common shares, from time to time, including holders of Digihost common shares acquired through asset purchases or private placements;

“East Delavan” means East Delavan Property, LLC;

“EH” means Exahash per second;

“Energy Contract” means the energy contract dated February 6, 2018 entered into by EnergyMark and Bit Management, LLC, and assigned to by Bit Management, LLC to Digihost;

“EnergyMark” means EnergyMark LLC;

-1-

“Exchange” or “TSXV” means the TSX Venture Exchange;

“Exchange Policies” means the policies of the TSXV;

“Exclusionary Offer” has the meaning given to it under the heading “Capital Structure – PV Shares”;

“HashChain” means HashChain Technology Inc., a corporation incorporated pursuant to the laws of British Columbia on February 18, 2017;

“Insider” if used in relation to an issuer, means: a director or senior office of the issuer; a director or senior officer of a company that is an Insider or subsidiary of the issuer; a Person that beneficially owns or controls, directly or indirectly, voting shares carrying more than 10% of the voting rights attached to all outstanding voting shares of the issuer; or, the issuer itself if it holds any of its own securities;

“KVA” means kilovolt-ampere;

“Landlord” means the landlord under the Buffalo Facility Lease Agreement;

“MW” means Megawatts;

“Northern Data” means Northern Data AG;

“Northern Data Purchase Agreement” means the agreement between Northern Data and the Corporation for the purchase of Bitcoin miners.

“Option” means an option to purchase SV Shares;

“OSC” means the Ontario Securities Commission;

“Permitted Transfer” has the meaning given to it under the heading “Capital Structure – PV Shares”;

“Person” means a company or individual;

“PH” means Petahash per second;

“PSC” means the New York Public Service Commission;

“PV Share” means a proportionate voting share of the Corporation;

“RSU” means a restricted share unit of the Corporation;

“RTO” means the reverse take-over whereby the business and assets of HashChain and Digihost were combined by way of a share exchange between HashChain and shareholders of Digihost;

“SEC” means the U.S. Securities and Exchange Commission;

“Second Extension Agreement” has the meaning given to it under the heading “General Development of the Business – Three Year History – 2019”;

“SEDAR” means System for Electronic Document Analysis and Retrieval and located on the Internet at www.sedar.com;

“Share Exchange Agreement” means the share exchange agreement between HashChain and Digihost Shareholders;

“Shareholder” means a holder of SV Shares;

“SV Share” means a subordinate voting share of the Corporation;

“Tenant” means the tenant under the Buffalo Facility Lease Agreement;

“Transactions” has the meaning given to it under the heading “General Development of the Business – Three Year History – 2019”.

-2-

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION AND RISKS

This annual information form (the “AIF”) of Digihost Technology Inc. (the “Corporation”) contains or refers to certain forward-looking information or statements (collectively, “forward-looking information”) that are covered by safe harbors under applicable securities laws. Forward-looking information can often be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “plan”, “intend”, “estimate”, “may”, “potential” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. All information, other than information regarding historical fact that addresses activities, events or developments that the Corporation believes, expects or anticipates will or may occur in the future is forward-looking information. Forward-looking information does not constitute historical fact but reflects the current expectations the Corporation regarding future results or events based on information that is currently available. By their nature, forward-looking information involve numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and other forward-looking information will not occur.

Forward-looking information in this AIF include, but are not limited to, information with respect to:

| ● | the expectations concerning performance of the Corporation’s business and operations; |

| ● | the intention to grow Corporation’s business and operations; |

| ● | growth strategy and opportunities; |

| ● | the treatment of the Corporation under government regulatory and taxation regimes; and |

| ● | the Corporation’s ability to monitor, assess and manage the impact of any future large-scale outbreaks of infectious diseases, such as the recent COVID-19 pandemic. |

Forward-looking information involve known and unknown risks, estimates, assumptions, uncertainties and other factors that may cause the actual results, performance or achievements of the Corporation to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information, including the following:

| ● | The Corporation’s cryptocurrency inventory may be exposed to cybersecurity threats and hacks; |

| ● | Regulatory changes or actions may alter the nature of an investment in the Corporation or restrict the use of cryptocurrencies in a manner that adversely affects the Corporation’s operations; |

| ● | The value of cryptocurrencies may be subject to momentum pricing risk; |

| ● | Cryptocurrency exchanges and other trading venues are relatively new and, in most cases, largely unregulated and may therefore be more exposed to fraud and failure; |

| ● | Banks may not provide banking services, or may cut off banking services, to businesses that provide cryptocurrency-related services or that accept cryptocurrencies as payment; |

| ● | The impact of geopolitical events on the supply and demand for cryptocurrencies is uncertain; |

| ● | The further development and acceptance of the cryptographic and algorithmic protocols governing the issuance of and transactions in cryptocurrencies is subject to a variety of factors that are difficult to evaluate; |

| ● | Acceptance and/or widespread use of cryptocurrency is uncertain; |

| ● | The Corporation is subject to risks associated with the Corporation’s need for significant electrical power. The Corporation’s mining operations require electrical power to be available at commercially feasible rates. Government regulators may potentially restrict the ability of electricity suppliers to provide electricity to mining operations; |

| ● | The Corporation may be required to sell its cryptocurrency portfolio to pay for expenses; |

| ● | The Bitcoin block reward halves approximately every four years, which reduces the number of Bitcoin the Corporation would receive from solving blocks; |

| ● | The Corporation is exposed to hashrate and network difficulty, which could reduce the ability of the Corporation to remain competitive with its peers; |

-3-

| ● | The risks posed by the large-scale infectious disease outbreaks, such as the recent COVID-19 pandemic, cannot be predicted with certainty and the Corporation remains exposed to government -imposed restrictions on operations; |

| ● | The Corporation’s operations, investment strategies, and profitability may be adversely affected by competition from other methods of investing in cryptocurrencies; |

| ● | The Corporation’s coins may be subject to loss, theft or restriction on access; |

| ● | Incorrect or fraudulent coin transactions may be irreversible; |

| ● | If the award of coins for solving blocks and transaction fees are not sufficiently high, miners (other than of the Corporation) may not have an adequate incentive to continue mining and may cease their mining operations, which could adversely impact the Corporation’s mining operations; |

| ● | The price of coins may be affected by the sale of coins by other vehicles investing in coins or tracking cryptocurrency markets; |

| ● | Technological obsolescence and difficulty obtaining hardware may adversely impact the Corporation’s operating results and financial condition; |

| ● | Delays in the development of existing and planned cryptocurrency mining facilities may result in different outcomes than those intended; |

| ● | Exposure to environmental liabilities and hazards may result in the imposition of fines, penalties and restrictions; |

| ● | The Corporation’s success is largely dependent on the performance of the Corporation’s management and executive officers; |

| ● | The Corporation may be unable to attract, develop and retain its key personal and establish adequate succession planning; |

| ● | The Corporation may be unable to obtain additional financing on acceptable terms or at all; |

| ● | The Corporation faces competition from other cryptocurrency companies; |

| ● | Uninsured or uninsurable risks could result in significant financial liabilities; |

| ● | The Corporation does not currently pay cash dividends, and, therefore, the Corporation’s shareholders will not be able to receive a return on their SV Shares unless they sell them; |

| ● | The SV Shares are subject to volatility risk and there is no guarantee that an active or liquid market will be sustained for the SV Shares; |

| ● | There are significant legal, accounting, and financial costs of being a publicly traded company which may reduce the resources available for the Corporation to deploy on its cryptocurrency mining operations; |

| ● | Directors and officers may have a conflict of interest between their duties owed to the Corporation and their interest in other personal or business ventures; |

| ● | The Corporation may be subject to litigation; |

| ● | The Corporation could lose its foreign private issuer status in the future, which could result in significant additional costs and expenses to the Corporation; |

| ● | The Corporation has a limited history of operations and is in the early stage of development; |

| ● | Ineffective management of growth could result in a failure to sustain the Corporation’s progress; |

| ● | The Corporation may be subject to tax consequences which could reduce the Corporation’s profitability; |

| ● | The Corporation may be exposed to risks from exchanging currencies, including currency exchange fees; and |

| ● | The other factors discussed under the heading, “Risk Factors” in this AIF. |

New factors emerge from time to time, and it is not possible for management to predict all such factors and to assess in advance the impact of each such factor on the business of the Corporation or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking information. Further, the forward-looking information in this AIF speaks only as of the date of this AIF, and, except as required by applicable law, the Corporation undertakes no obligation to update any forward-looking information to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

-4-

CORPORATE STRUCTURE

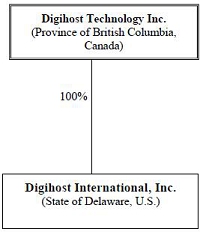

Name, Address, Incorporation, and Corporate Organizational Chart

Digihost Technology Inc. (formerly HashChain Technology Inc.) is a corporation incorporated under the Business Corporations Act (British Columbia). Its head office is located at 2830 Produce Row, Houston, TX 77023 and its registered office is located at 595 Howe Street – 10th Floor, Vancouver, BC V6C 2T5.

The following organization chart outlines the corporate structure of the Corporation and its material subsidiaries:

Material Amendments to the Corporation’s Articles

The Corporation was originally incorporated under the BCBCA on February 18, 2017 under the name Chortle Capital Corp. and later changed its name to HashChain Technology Inc. (“HashChain”) on September 18, 2017. HashChain was subject to a reverse takeover by Digihost International Inc., which closed on February 14, 2020 (the “RTO”). Prior to the closing date of the reverse takeover, the Corporation passed a special resolution authorizing an unlimited number of proportionate voting shares of the Corporation (the “PV Shares”) and an unlimited number of subordinate voting shares of the Corporation (the “SV Shares”) without par value. Upon closing of the RTO, HashChain filed articles of amendment to rename itself to Digihost Technology Inc.

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

The following is a summary of the general development of the Corporation’s business over the three most recently completed financial years:

Fiscal 2020

On February 14, 2020, in connection with the RTO, Digihost entered into an agreement with Bit.Management, LLC, NYAM, LLC and BIT Mining International, LLC for the sale, transfer and assignment of a 100% right, title and interest in the leasehold improvements and equipment, the transfer of the lease of the 1001 East Delavan facility in Buffalo, NY (the “Buffalo Mining Facility”) and transfer of a power contract for the supply of electricity at the facility. As consideration and immediately prior to the closing of the reverse takeover transaction, Digihost issued 104,000 Digihost common shares for an aggregate value of C$2,704,000. On February 14, 2020, Digihost also entered into an agreement with BIT Mining International, LLC for the sale, transfer and assignment of a 100% right, title and interest in the leasehold improvements and equipment located at the Buffalo Mining Facility. As consideration and immediately prior to the closing of the reverse takeover, Digihost issued 60,000 Digihost common shares for an aggregate value of C$1,560,000.

-5-

On February 14, 2020, immediately prior to the completion of the RTO, Digihost closed its non-brokered private placement for aggregate gross proceeds of C$5,395,325 from the sale of 5,418,912 Digihost common share subscription receipts at a price of C$0.96 per Digihost common share subscription receipt and 110,575 Digihost unit subscription receipts at a price of C$1.20 per Digihost unit subscription receipt.

On February 14, 2020, the RTO was completed and HashChain changed its name to Digihost Technology Inc. In connection with the RTO, all the issued and outstanding 6,530,560 HashChain common shares were exchanged for 6,530,560 SV Shares. In addition, all 5,693,487 Digihost common shares were exchanged for 33,412,490 SV Shares and 10,000 PV Shares of the Corporation. In addition, 130,911 common shares of the Corporation were issued to creditors of HashChain in settlement of outstanding debt. As a result of the RTO completion, the Colocation Agreements were terminated, and the Corporation was released from accrued liabilities owing under the Colocation Agreements.

On March 20, 2020, the Corporation temporarily ceased operations at its Buffalo Mining Facility until the end of the month due to the COVID-19 pandemic. On April 7, 2020 the Corporation resumed operations at a 75% operating level pursuant to safe practices as they pertained to social distancing.

On October 20, 2020, the Corporation acquired 180 Whatsminer M30S cryptocurrency miners adding 16.2 petahash per second (“PH”) of hashing power to the Corporation’s aggregate cryptocurrency mining output.

On December 7, 2020, the Corporation received TSXV approval to undertake, at the Corporation’s discretion, a Normal Course Issuer Bid program to purchase up to 2,003,683 SV Shares for cancellation. The issuer bid program is scheduled to run until December 10, 2021.

On December 31, 2020, the Corporation announced the acquisition of Antminer S19 Pro 110TH miners, adding an additional 15.4 PH to the Corporation’s aggregate cryptocurrency mining output.

Fiscal 2021

On January 8, 2021, the Corporation closed a fully subscribed non-brokered private placement of SV Shares for C$0.81 per SV Share, capitalizing the company in the amount of C$283,400.00.

On February 8, 2021, the Corporation announced that its listing on the OTC Markets was upgraded from a listing on the Pink Sheets to the OTCQB.

On February 19, 2021, the Corporation announced the closing of a non-brokered private placement of 4,938,271 SV Shares at a price of C$0.81 per PV Share for aggregate gross proceeds of C$4,000,000. In connection with the private placement, the Corporation paid a commission of 148,148 PV Shares to third party advisors.

On March 4, 2021, the Corporation announced that it had increased its hashrate from 184 PH to 189 PH.

On March 17, 2021, the Corporation announced the closing of a private placement for gross proceeds C$25,000,000. The private placement consisted of the sale of 9,363,296 SV Shares and warrants to purchase up to 9,363,296 SV Shares at a price of C$2.67 per PV Share and associated warrant. Each warrant entitles the holder thereof to purchase PV Shares at an exercise price of C$3.14 per PV Share for a period of three (3) years from the date of issuance. 749,064 broker warrants were issued in connection with the private placement, exercisable at a price of C$3.3375 for a period of three (3) years from the date of issuance.

On March 24, 2021, the Corporation announced it has entered an agreement for the purchase of a 60MW power plant (“Digifactory 1”) located in Upstate New York, which, as of the date thereof, is expected to bring the Corporation’s total power capacity to approximately 102 MW. The Corporation expects that internal power generation capabilities will significantly reduce electricity costs, which is the Corporation’s largest operating expense for its cryptocurrency mining operations. Digifactory1 will have the capacity to operate an additional 18,000 top tier Bitcoin miners. The increased power capacity would also allow a potential increase to the hashrate existing as of the date thereof from 190 PH to 3 exahash per second (“EH”). Under the terms of the agreement, the Corporation will pay to the vendor cash consideration of $3,500,000 and issue to the vendor 437,318 SV Shares with a deemed value of $750,000 ($1.71 per share. The transaction is subject to New York regulatory approval as well as the approval of the TSXV. The securities issuable in connection therewith will be subject to a statutory four month and a day hold period.

-6-

On March 29, 2021, the Corporation announced the acquisition of 700 Bitmain S17+ 76TH miners for a total price of US$4.025 million, comprised of cash consideration of US$2,975 million and the issuance to the vendor of $533,781 SV Shares, The acquisition has the potential to increase the Corporation’s hashrate by approximately 50 PH.

On April 6, 2021, the Corporation announced that it had repaid all of its debt in the aggregate amount of US$3,975,000.

On April 13, 2021, the Corporation announced the closing of a private placement for gross proceeds of C$25,000,000. The private placement consisted of the sale of 11,682,243 SV Shares and warrants to purchase up to 11,682,243 SV Shares at a purchase price of C$2.14 per SV Share and associated warrant. Each warrant entitles the holder thereof to purchase SV Shares at an exercise price of C$2.37 per SV Share for a period of four (4) years from the date of issuance.

On April 14, 2021, the Corporation announced the appointment of Raymond Chabot Grant Thornton LLP as auditors of the Corporation, replacing the Corporation’s former auditors, Clearhouse LLP.

On April 29, 2021, the Corporation announced the resignation of Cindy Davis as Chief Financial Officer of the Corporation and the subsequent appointment of Paul Ciullo as Chief Financial Officer of the Corporation.

On May 10, 2021, the Corporation announced that it had commenced the application process for listing of its securities on the Nasdaq Capital Market (“Nasdaq”).

On May 13 and May 14, 2021, the Corporation announced it had entered into a purchase agreement (the “Northern Data Purchase Agreement”) with Northern Data AG (“Northern Data”) for the purchase of 9,900 Bitcoin miners. This acquisition is expected to increase the Corporation’s hashrate by between 925 PH to 1.145 EH once the miners are installed at the Corporation’s facilities, which is expected to be completed by January 2022. Northern Data and the Corporation concurrently entered into an associated hosting arrangement in connection with purchase of the miners, whereby Northern Data will provide hosting services to the Corporation including the installation and hosting of the miners in proprietary pre-manufactured performance optimized mobile data centres. The Corporation and Northern Data will split the net revenue generated from Bitcoin mining operations according to a fixed distribution formula. As of the date hereof, the Corporation has received approximately 4050 miners and expects to receive the remaining miners and have them installed and operational by the end of Q1 2022.

On June 10, 2021, the Corporation announced it had entered into a co-mining agreement (the “Co-Mining Agreement”) with Bit Digital USA, Inc. (“Bit Digital”). Pursuant to the Co-Mining Agreement, the Corporation agreed to provide its premises and power to Bit Digital for the operation of a 20 MW Bitcoin mining system. This collaboration is expected to increase the combined hashrate between the two companies by an aggregate of approximately 400 PH. It is expected that the miners will begin to be delivered and installed during Q1 2022.

On June 21, 2021, the Corporation closed a private placement for gross proceeds of C$15 million. The private placement was comprised of 8,333,336 SV Shares, as well as warrants to purchase up to 6,250,002 SV Shares, at a price of C$1.80 per SV Share and associated warrant. Each warrant entitles the holder thereof to purchase SV Shares at an exercise price of C$1.99 per SV Share for a period of three (3) years from the date of issuance.

On June 22, 2021, the Corporation announced it filed a registration statement on Form 40-F with the U.S. Securities and Exchange Commission (the “SEC”).

On July 6, 2021, the Corporation announced that it was including Ether, the native token of the Ethereum network, as part of its cryptocurrency holdings so as to diversity its portfolio holdings. To further the same goal, the Corporation exchanged a portion of its Bitcoin held in its inventory to purchase Ether.

-7-

On July 26, 2021, the Corporation announced the expansion of its strategic collaboration with Bit Digital, pursuant to which the Corporation and Bit Digital entered into a second strategic co-mining agreement to provide its premises and power to Bit Digital for the operation of a 100 MW Bitcoin mining system. The collaboration is expected to increase the combined hashrate between the two companies by an aggregate of approximately 2 EH, for a total increase in hashrate of approximately 2.4 EH when combined with the Co-Mining Agreement announced on June 10, 2021.

On October 5, 2021, the Corporation announced that, to facilitate a proposed listing of the SV Shares on Nasdaq and to satisfy the minimum share price requirements thereof, the Corporation underwent a consolidation (the “Consolidation”) of the SV Shares and PV Shares on the basis of three (3) pre-consolidation SV Shares or PV Shares for every one (1) post-consolidation SV Share or PV Share, respectively. The exercise price and number of SV Shares issuable upon the exercise of the Corporation’s outstanding options and warrants was also proportionately adjusted upon completion of the Consolidation. The Corporation did not issue any fractional post-Consolidation SV Shares or PV Shares as a result of the Consolidation. Instead, each fractional share remaining after conversion was rounded down to the nearest whole post-Consolidation SV Share or PV Share, as applicable. The Consolidation became effective on October 28, 2021.

On October 13, 2021 the Corporation announced that it had received 1,952 M30 Bitcoin miners pursuant to the Northern Data Purchase Agreement.

On November 12, 2021, the Corporation announced that it was approved to list its SV Shares on Nasdaq and that trading was expected to begin on November 15, 2021 under the symbol “DGHI”.

On November 15, 2021, the Corporation’s SV Shares began trading on Nasdaq.

Fiscal 2022

On January 13, 2022, the Corporation filed a preliminary base shelf short form prospectus.

On February 23, 2022, the Corporation filed a final base shelf short form prospectus.

On March 2, 2022, the Corporation closed a $10,000,000 committed, collateralized revolving credit facility (the “Loan Facility”) with Securitize, Inc. The Loan Facility was collateralized against the Corporation’s Bitcoin inventory, had a one-year committed term and an interest rate of 7.5% per annum and was fully drawn by the Corporation.

On March 4, 2022, the Corporation entered into an at the market offering agreement (the “Equity Distribution Agreement”) with H.C. Wainwright & Co., pursuant to which the Corporation may, from time to time, sell up to $250 million of SV Shares (the “ATM Equity Program”). The ATM Equity Program can be terminated by either party at any time upon delivery of written notice.

On March 6, 2022, the Corporation announced it had entered into a private placement with a single institutional investor, for gross proceeds of approximately C$13.3 million, comprised of 3,029,748 subordinate voting shares of the Corporation (or subordinate voting share equivalents) and warrants to purchase up to 3,029,748 subordinate voting shares, at a purchase price of C$4.40 per subordinate voting share and associated warrant. The Warrants have an exercise price of C$6.25 per subordinate voting share and exercise period of three and one-half years from the issuance date. H.C. Wainwright & Co. acted as the exclusive placement agent and received cash commission and expenses totaling $1,066,471 and 242,380 non-transferable broker warrants. Each broker warrant entitles the holder to purchase one subordinate voting share at an exercise price of C$6.25 at any time for a period of three years from the issuance date. In connection with the private placement, to the Corporation cancelled existing warrants to purchase up to 1,248,440 subordinate voting shares of the Corporation at an exercise price of C$9.42 per share issued in March 2021 and existing warrants to purchase up to 1,781,308 subordinate voting shares of the Corporation at an exercise price of C$7.11 issued in April 2021.

On April 4, 2022, the Corporation announced it achieved a milestone of operating at 1 EH, more than doubling its hashrate from 415 PH at year-end 2021. The Corporation also announced that it completed substantial infrastructure installation work at Digifactory1.

-8-

On May 4, 2022, the Corporation announced that it successfully completed electrical testing phases at its infrastructure buildout at Digifactory1 and was awaiting approval from the PSC to complete the acquisition of Digifactory1. The Corporation also announced that it acquired, in escrow, 25 acres of land in North Carolina in conjunction with ongoing negotiations to access a 200MW power infrastructure program that would be expected to be completed and ready for operation by the end of the third fiscal quarter of 2023.

On May 19, 2022, the Corporation announced that it received TSXV approval to undertake, at the Corporation’s discretion, a normal course issuer bid program in Canada to purchase up to 1,219,762 of its SV Shares for cancellation (the “Bid”). In connection with the launch of the Bid, the Corporation announced that it would not issue any securities pursuant to the ATM Equity Program while the Corporation purchases shares pursuant to the Bid.

On June 1, 2022, the Corporation announced that it paid back approximately $4,000,000 of the fully drawn down Loan Facility.

On June 6, 2022, the Corporation announced that entered into a long-term deal to purchase community solar credits from a nearby community solar farm to its Buffalo Mining Facility. The community solar project is 5MW in size and will produce roughly 9,500,000 kWh’s of clean electricity annually. The Buffalo Mining Facility will be the anchor subscriber to the project.

On June 14, 2022, the Corporation announced that it entered into an agreement to acquire property in the state of Alabama in order to expand the Corporation’s operational capacity. The site consists of approximately 160,000 square feet of office and industrial warehouse space with initial access to 28 MW of power with a total capacity of 55 MW (the “Alabama Property”). The terms of the agreement include a total purchase price of $2,750,000, $1,500,000 of which was due on or before June 17, 2022 and the remaining $1,250,000 to be paid in 25 equal monthly installments of $50,000 per month.

On June 14, 2022, the Corporation also announced the repayment in full of the fully drawn down Loan Facility.

On June 22, 2022, the Corporation announced the completion of the previously announced acquisition of the Alabama Property. The Corporation immediately commenced construction and the development of the facilities in Alabama.

On July 5, 2022, the Corporation announced that planning was underway at the Alabama Property with mining operations projected to commence in fourth quarter of 2022. The Corporation also announced that it does not intend to open any new mining facilities in New York State.

On August 2, 2022, the Corporation announced that it commenced construction and the development of the facilities build-out of the Alabama Property. In support of its infrastructure expansion, the Corporation transferred a portion of its existing mining fleet from New York State to the site in Alabama to allow the Corporation to benefit from the lower direct energy costs it has negotiated with Alabama Power.

On August 16, 2022, the Corporation announced that it acquired 25 acres of land in North Carolina with a request for allocation of up to 200 MW of power (the “North Carolina Property”). The Corporation is seeking potential joint venture partners.

On August 16, 2022, the Corporation also announced that it suspended the use of the Bid until further notice. Following suspension of the Bid, the Corporation will resume the use of the ATM Equity Program and may issue securities pursuant to the ATM Equity Program from time to time, if the Corporation determines that such issuances would be beneficial.

On September 7, 2022, the Corporation announced that it received PSC approval for an economic rider rate discount for its facilities in New York State. The Corporation continued the development of the facilities build-out and construction work on the Alabama Property on schedule and on budget.

-9-

On October 4, 2022, the Corporation announced the continued development of the facilities Phase 1 build-out and construction work on the Alabama Property on schedule and on budget. Completion of the Phase 1 build will provide the Corporation with approximately 550 PH of additional operating capacity. The Corporation also announced that it intends to develop the North Carolina Property for use in 2024, with a request for allocation of up to 200 MW of power.

On October 14, 2022, the Corporation announced that it received a written notification (the “Notification Letter”) from Nasdaq indicating that, for the prior thirty consecutive business days, the bid price for the Corporation’s SV Shares had been below the minimum $1.00 per share requirement for continued listing on Nasdaq under Nasdaq Listing Rule 5550(a)(2). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Corporation was provided an initial period of 180 calendar days, or until April 10, 2023, to regain compliance. The letter stated that Nasdaq staff will provide written notification that the Corporation has achieved compliance with Rule 5550(a)(2) if, at any time before April 10, 2023, the bid price of the SV Shares closes at $1.00 per share or more for a minimum of ten consecutive business days.

On November 1, 2022, the Corporation announced that it continues to move forward with closing documentation and approval requirements related to the acquisition of Digifactory1. The Alabama Property Phase 1 build-out also continued on schedule and on budget. The Corporation also announced that it secured a $1.3 million surety bond with Alabama Power Company for electric service.

On December 2, 2022, the Corporation announced that, as a result of the potential contagion from the recent collapse of FTX, the Corporation made the decision to move a majority of its digital currencies to an offline cold storage wallet in order to better safeguard its assets. This change in custodial practices is consistent with the Corporation’s risk management strategy in the current market environment.

On December 2, 2022, the Corporation also announced that the Alabama Property Phase 1 build-out also continued on schedule and on budget, with testing of mining equipment beginning in December 2022 and completion of Phase 1 scheduled for first quarter of 2023.

Subsequent to Fiscal 2022

On January 3, 2023, the Corporation announced that initial mining capacity of 100 PH came online at the Alabama Property during the month of December 2022. The Corporation is currently working on the design of Phase 2 for the Alabama Property.

On January 20, 2023, the Corporation announced that it was made aware that a legal proceeding was filed by the Sierra Club and the Clean Air Coalition of Western New York against the PSC, challenging the PSC’s decision to approve the sale of Digifactory1 to the Corporation. The Corporation is of the view that the proceeding is not material to the closing of the acquisition and the Corporation believes that the PSC acted within its legislative authority and took all appropriate steps and measures in granting the approval.

On February 2, 2023, the Corporation announced that it received formal notice from Nasdaq stating that the Corporation has regained compliance with the minimum bid price requirement in Nasdaq Listing Rule 5550(a)(2) for continued listing on Nasdaq.

On February 8, 2023, the Corporation announced the completion of the acquisition of Digifactory1. Further to the Corporation’s initial news release on March 24, 2021, the terms of the acquisition were amended to reflect an all-cash purchase price, and no securities of the Corporation were issued in connection with the acquisition.

Anticipated Changes in the Corporation’s Business

Over the next 12 months, the Corporation intends to:

| (a) | expand its operations through the development of additional operating sites and through the acquisition of additional Bitcoin mining rigs; and |

-10-

| (b) | upon completion of the deployment of additional Bitcoin mining rigs, continue generating positive operating margins with a view to increasing these operating margins from both an increase in the price of Bitcoin and by pursuing opportunities to reduce power costs. |

Significant Acquisitions

The Corporation has not engaged in any significant acquisitions of property, equipment or shares in the most recently completed financial year, ended December 31, 2022, for which disclosure is required under Part 8 of National Instrument 51-102 – Continuous Disclosure Obligations.

BUSINESS OF THE CORPORATION

The Corporation (formerly HashChain) was subject to the RTO, which closed on February 14, 2020, whereby the business and assets of HashChain and Digihost were combined by way of a share exchange between HashChain and shareholders of Digihost. In connection with the RTO, all the issued and outstanding 6,530,560 HashChain common shares were exchanged for 6,530,560 SV Shares, and all of Digihost’s common shares were exchanged for 33,412,490 SV Shares and 10,000 PV Shares of the Corporation.

In connection with and immediately prior to the closing of the RTO, Digihost entered into an agreement with Bit.Management, LLC, NYAM, LLC and BIT Mining International, LLC for the sale, transfer and assignment of a 100% right, title and interest in the leasehold improvements and equipment, the transfer of the lease of the Buffalo Mining Facility and transfer of a power contract for the supply of electricity at the facility. As consideration and immediately prior to the closing of the reverse takeover transaction, Digihost issued 104,000 Digihost common shares for an aggregate value of C$2,704,000. Digihost also entered into an agreement with BIT Mining International, LLC for the sale, transfer and assignment of a 100% right, title and interest in the leasehold improvements and equipment located at the Buffalo Mining Facility. As consideration and immediately prior to the closing of the reverse takeover, Digihost issued 60,000 Digihost common shares for an aggregate value of C$1,560,000

The Corporation is an innovative U.S. based blockchain technology and computer infrastructure company, primarily focused on digital currency mining, which is the Corporation’s only operating segment that is a reportable segment. The Corporation acquired a 60 MW natural gas fired power plant in February 2023. The power plant currently operates as a peaker plant providing the grid with electrical power in times of peak demand. The Corporation’s operations provide its shareholders with exposure to the operating margins of digital currency mining which the Corporation believes is the most profitable application of the Corporation’s computing power, as well exposure to the power industry. As of the date of this AIF, the Corporation has 20 employees.

The Corporation produces digital currencies by “mining”. “Mining” is a process whereby “miners”, which are specialized computers with high amounts of computational processing power, compete to solve “blocks”, which are digital files where digital currency transactions are recorded on the blockchain. A miner that verifies and solves a new block is awarded newly-generated quantity of coins, an amount which is usually proportional to the miner’s contributed hashrate or work, (plus a small transaction fee) as an incentive to invest their computer power, as mining is critical to the continuing functioning and security of the networks on which digital currencies operate on.

The Corporation has three mining facilities located in Buffalo and North Tonawanda in upper New York State as well as a facility in Columbiana, Alabama, which the Corporation acquired in June 2022. The Corporation’s power plant is also located in North Tonawanda.

Miners require significant amounts of electrical power, and these energy requirements represent the Corporation’s largest operating expense. The Corporation’s operating and maintenance expenses are therefor principally composed of electricity to power its computing equipment as well as cooling and lighting, etc. Other site expenses include leasing costs for the facilities, internet access, equipment maintenance and software optimization, and facility security, maintenance and management. Ultimately, the central production line of the Corporation is converting electrical power into digital currencies through ‘mining’. Natural gas represents the largest operating cost associated with the generation of electricity at the Corporation’s power plant.

-11-

The Corporation has experienced volatility in electricity prices over the last 12 to 18 months as a result of the rapid rise in natural gas prices that are passed through from the grid operators to their customers. There has been a significant decline in natural gas prices over the last 6 months, which is expected to result in lower operating costs for the Corporation’s mining and power businesses.

The Corporation’s operation in the digital currency mining industry requires extensive knowledge of cryptocurrency mining, cryptocurrency economics, and blockchain technology. Further, the Corporation’s focus on vertical integration with energy production and its focus on environmentally conscious development requires specialized knowledge of the energy procurement industry, with a particular focus on green energy.

All key components of the Corporation’s facilities are monitored including the intake air temperature, hash board temperature, voltage, hashrate, air temperature, exhaust air temperature and humidity. All parameters are monitored and changed remotely, as required. Parallel monitoring is performed by local on-site staff who are responsible for implementing any necessary repairs to mining infrastructure. In the event that the Corporation’s remote monitoring or any parallel monitoring identifies any malfunction or technical issue, personnel are dispatched to physically inspect and, if necessary, repair defective components. The Company intends to maintain an inventory of all necessary components for repair, which are kept at the same facility as such operations.

During April 2021, the Corporation was approved for an account with Gemini Trust Company, LLC (“Gemini”). Gemini is a digital currency exchange and custodian that allows customers to buy, sell, and store digital assets. Gemini was the first crypto exchange and custodian in the world to complete a SOC 2 Type 1 and a SOC 2 Type 2 examination. While a SOC 2 Type 1 evaluates the design and implementation of system controls at a point in time, a SOC 2 Type 2 evaluates whether these system controls have been operating effectively over a period of time. A SOC 2 Type 2 examination is the highest level of security compliance an organization can demonstrate, and Gemini completes this examination on an annual basis. As of the date of this AIF, the Corporation has holdings of 15.56 BTC coins in its Gemini account.

The Corporation performs credit due diligence in the normal course of business when beginning a relationship with counterparties, as well as during on-going business activities. Gemini maintains insurance coverage for the cryptocurrency held on behalf of the Corporation in its online hot wallet. The Corporation has not been able to independently insure its mined digital currency. Given the novelty of digital currency mining and associated businesses, insurance of this nature is generally not available, or uneconomical for the Corporation to obtain which leads to the risk of inadequate insurance coverage.

To mitigate third-party risk, the Corporation will hold a portion of its digital currencies in cold storage solutions which are not connected to the internet. The Corporation’s digital assets that are held in cold storage are stored in safety deposit boxes at a bank branch. The wallets on which the Corporation stores its cryptocurrency assets are not multi-signature wallets, however, the Corporation secures the 24-word seed phrase, which facilitates recovery of the wallets should the wallets become lost, stolen or damaged, by partitioning the seed phrase in multiple parts, and securing each part in a separate location. Each part of the seed phrase is stored in either a safe or safety deposit box. The Corporation replicates this security protocol by taking the same 24-word seed phrase, partitioning this into several parts and storing each part in a secure location in a separate safe or safety deposit box than was used for the first copy of the seed-phrase. This duplication ensures that the digital currencies held via cold storage solutions will be recoverable by the Corporation, should the Corporation’s cold-wallets become lost, stolen or damaged.

The digital currency mining industry is highly competitive. In addition, there exist many online companies that offer digital currency cloud mining services, as well as companies, individuals and groups that run their own mining farms. Miners can range from individual enthusiasts to professional mining operations with dedicated data centres, including those of the kind operated by the Corporation’s principal publicly-listed competitors. The largest competitor operating in the same space as the Corporation in North America is Hut 8 Mining Corp. (TSX: HUT; NASDAQ: HUT), a public company trading on the TSX. There are several other companies competing in the Corporation’s industry, including Riot Blockchain, Inc.(NASDAQ: RIOT), MGT Capital Investments Inc. (OTCQB: MGTI), Marathon Digital Holdings Inc. (NASDAQ: MARA), Bitfarms Ltd. (TSX: BITF; NASDAQ: BITF), Argo Blockchain Plc (LSE: ARB; NASDAQ: ARBK), CryptoStar Corp. (TSXV: CSTR), HIVE Blockchain Technologies Ltd. (TSXV: HIVE; NASDAQ: HIVE), Skychain Technologies Inc. (TSXV: SCT), DMG Blockchain Solutions Inc. (TSXV: DMGI) and Link Global Technologies Inc. (CSE: LNK).

The vast majority of mining is now undertaken by mining pools, whereby miners organize themselves and pool their processing power over a network and mine transactions together. Rewards are then distributed proportionately to each miner based on the work/hashpower contributed. Mining pools became popular when mining difficulty and block time increased. While the rewards for successfully solving a block become considerably lower in the case of pooling, rewards are earned on a far more consistent basis, reducing the risk to miners with smaller computational power. Consequently, the Corporation may decide to participate in a mining pool in order to smooth the receipt of rewards.

Mining pools generally exist for each well-known cryptocurrency.

-12-

Risk Factors

An investment in SV Shares should be considered highly speculative due to the nature of the Corporation’s business and its present stage of development. Where applicable, references in this section to the Corporation include Digihost and vice versa. An investment in SV Shares should only be made by knowledgeable and sophisticated investors who are willing to risk and can afford the potential loss of their entire investment. Investors and potential investors should consult with their professional advisors to assess an investment in the Corporation. In evaluating the Corporation and its business, investors should carefully consider, in addition to other information contained in this AIF, the risk factors below. The following is a summary only of certain risk factors and is qualified in its entirety by reference to, and must be read in conjunction with, the detailed information appearing elsewhere in this AIF. These risks and uncertainties are not the only ones the Corporation is facing. Additional risks and uncertainties not presently known to the Corporation, or that the Corporation currently deems immaterial, may also impair its operations. If any such risks actually occur, the Corporation’s business, financial condition, liquidity and results of operations could be materially adversely affected.

Risks Related to the Corporation’s Business

The Corporation’s cryptocurrency inventory may be exposed to cybersecurity threats and hacks.

Malicious actors may seek to exploit vulnerabilities within cryptocurrency programming codes. Several errors and defects have been found and corrected, including those that disabled some functionality for users and exposed users’ information. Discovery of flaws in or exploitations of the source code that allow malicious actors to take or create virtual Bitcoin assets have been relatively rare, however attempts to discover flaws in or exploitations of the source code are not entirely uncommon. Hackers have been able to gain unauthorized access to digital wallets and cryptocurrency exchanges, thereby exposing the crypto-assets stored and traded on these platforms at risk.

If a malicious actor exposes a vulnerability on a platform or Blockchain on which the Corporation stores, trades or mines cryptocurrency, as may be applicable, that could interfere with and introduce defects to the mining operation and could put the Corporation’s cryptocurrency holdings at risk of being hacked or stolen. Private keys which enable holders to transfer funds may also be lost or stolen, resulting in irreversible losses of cryptocurrencies. Hackers may discover novel tactics not currently contemplated herein which jeopardize the Corporation’s assets and operations. The actions of one or more malicious actors could have a material adverse effect on the Corporation’s business, financial condition, liquidity and results of operation.

Regulatory changes or actions may alter the nature of an investment in the Corporation or restrict the use of cryptocurrencies in a manner that adversely affects the Corporation’s operations.

As cryptocurrencies have grown in both popularity and market size, governments around the world have reacted differently to cryptocurrencies with certain governments deeming cryptocurrency mining illegal while others have allowed their use and trade. Ongoing and future regulatory actions may alter, perhaps to a materially adverse extent, the ability of the Corporation to continue to operate. The effect of any future regulatory change on the Corporation or any cryptocurrency that the Corporation may mine is impossible to predict, but any such change could be substantial and have a material adverse effect on the Corporation. Governments may in the future curtail or outlaw the acquisition, use or redemption of cryptocurrencies. Ownership of, holding or trading in cryptocurrencies may then be considered illegal and subject to sanction. Governments may also take regulatory action that may increase the cost of mining cryptocurrency and/or subject cryptocurrency mining companies to additional regulation. Governments may in the future take regulatory actions that prohibit or severely restrict the right to acquire, own, hold, sell, use or trade cryptocurrencies or to exchange cryptocurrencies for fiat currency.

On March 9, 2022, the President of the United States issued an executive order that identified the following objectives for future regulation of digital assets in the United States: (1) protect consumers, investors, and businesses, (2) protect financial stability, (3) mitigate the illicit finance and national security risks posed by misuse of digital assets, (4) reinforce United States leadership in the global financial system and in technological and economic competitiveness, (5) promote access to safe and affordable financial services, and (6) support technological advances that promote responsible development and use of digital assets. Although the executive order was generally received positively by the digital asset industry, especially in the United States, the nature, scope and effect of any future regulations inspired by that executive order and their effect on the cryptocurrency mining industry, the use and adoption of cryptocurrency and, ultimately, the Corporation cannot be reasonably estimated at this time.

More recently, in March 2023, the U.S. Treasury Department proposed a 30% excise tax on the cost of powering mining facilities that, if enacted, would be based on the costs of electricity used in mining and would be phased in over the next three years, increasing 10% each year. The proposal, if enacted, would also require miners, like the Corporation to report how much electricity they use and what type of power was tapped. If the proposed excise tax is approved, it could adversely impact the Corporation’s results of operations and financial condition.

-13-

By extension, similar actions by other governments may result in the restriction of the acquisition, ownership, holding, selling, use or trading in the SV Shares. Such a restriction could result in the Corporation liquidating its cryptocurrency inventory at unfavorable prices and may otherwise adversely affect the Corporation’s shareholders.

Increased scrutiny and changing expectations from stakeholders with respect to the Corporation’s ESG practices and the impacts of Climate Change may result in additional costs or risks.

Companies across many industries, including cryptocurrency mining, are facing increasing scrutiny related to their environmental, social, and governance (“ESG”) practices. Investor advocacy groups, certain institutional investors, investment funds and other influential investors are also increasingly focused on ESG practices and in recent years have placed increasing importance on the non-financial impacts of their investments. Furthermore, increased public awareness and concern regarding environmental risks, including global climate change, may result in increased public scrutiny of the Corporation’s business and its industry, and the management team may divert significant time and energy away from the Corporation’s operations and towards responding to such scrutiny and enhancing the Corporation’s ESG practices.

In addition, the impacts of climate change may affect the availability and cost of materials and natural resources, sources and supply of energy, demand for Bitcoin and other cryptocurrencies, and could increase the Corporation’s insurance and other operating costs, including, potentially, to repair damage incurred as a result of extreme weather events or to renovate or retrofit facilities to better withstand extreme weather events. If environmental laws or regulations or industry standards are either changed or adopted and impose significant operational restrictions and compliance requirements on the Corporation’s operations, or if its operations are disrupted due to physical impacts of climate change, the Corporation’s business, capital expenditures, results of operations, financial condition and competitive position could be negatively impacted.

The value of cryptocurrencies may be subject to momentum pricing.

Momentum pricing typically is associated with growth stocks and other assets whose valuation, as determined by the investing public, accounts for anticipated future appreciation in value. Cryptocurrency market prices are determined primarily using data from various exchanges, over-the-counter markets, and derivative platforms. Momentum pricing may have resulted, and may continue to result, in speculation regarding future appreciation in the value of cryptocurrencies, inflating and making their market prices more volatile. As a result, they may be more likely to fluctuate in value due to changing investor confidence in future appreciation (or depreciation) in their market prices, which could adversely affect the value of the cryptocurrency the Corporation mines and holds and thereby negatively affect the Corporation’s shareholders.

Cryptocurrency exchanges and other trading venues are relatively new and, in most cases, largely unregulated and may therefore be more exposed to fraud and failure.

To the extent that cryptocurrency exchanges or other trading venues are involved in fraud or experience security failures or other operational issues, this could result in a reduction in cryptocurrency prices. Cryptocurrency market prices depend, directly or indirectly, on the prices set on exchanges and other trading venues, which are new and, in most cases, largely unregulated as compared to established, regulated exchanges for securities, derivatives and other currencies. For example, during the past three years, a number of Bitcoin exchanges have been closed due to fraud, business failure or security breaches. In many of these instances, the customers of the closed Bitcoin exchanges were not compensated or made whole for the partial or complete losses of their account balances in such Bitcoin exchanges. These risks also apply to other cryptocurrency exchanges, including exchanges on which Ether is traded. While smaller exchanges are less likely to have the infrastructure and capitalization that provide larger exchanges with additional stability, larger exchanges may be more likely to be appealing targets for hackers and “malware” (i.e., software used or programmed by attackers to disrupt computer operation, gather sensitive information or gain access to private computer systems) and may be more likely to be targets of regulatory enforcement action. The Corporation’s current strategy is to hold its mined cryptocurrencies; however, if the Corporation decides to sell its cryptocurrency in the future, it may rely on a cryptocurrency exchange to facilitate such a sale. Fraud or failure of cryptocurrency exchanges could decrease the number of platforms available to the Corporation to liquidate its holdings and could also decrease public confidence in trading on such exchanges, which may adversely affect the price of cryptocurrencies. Sustained lack of regulation and potential fraud or failure of cryptocurrency exchanges could have a material adverse effect of the Corporation’s business, financial condition, liquidity and results of operation.

-14-

Banks may not provide banking services, or may cut off banking services, to businesses that provide cryptocurrency-related services or that accept cryptocurrencies as payment.

A number of companies that provide Bitcoin and/or other cryptocurrency-related services have been unable to find banks that are willing to provide them with bank accounts and banking services. Similarly, a number of such companies have had their existing bank accounts closed by their banks. Banks may refuse to provide bank accounts and other banking services to Bitcoin and/or other cryptocurrency-related companies or companies that accept cryptocurrencies for a number of reasons, such as perceived compliance risks or costs. The difficulty that many businesses that provide Bitcoin and/or other cryptocurrency-related services have and may continue to have in finding banks willing to provide them with bank accounts and other banking services may be currently decreasing the usefulness of cryptocurrencies as a payment system and harming public perception of cryptocurrencies or could decrease its usefulness and harm its public perception in the future. Similarly, the usefulness of cryptocurrencies as a payment system and the public perception of cryptocurrencies could be damaged if banks were to close the accounts of many or of a few key businesses providing Bitcoin and/or other cryptocurrency-related services. This could decrease the market prices of cryptocurrencies and adversely affect the value of the Corporation’s cryptocurrency inventory.

The impact of geopolitical events on the supply and demand for cryptocurrencies is uncertain.

Crises may motivate large-scale purchases of cryptocurrencies, which could increase the price of cryptocurrencies rapidly. This may increase the likelihood of a subsequent price decrease as crisis-driven purchasing behavior wanes, adversely affecting the value of the Corporation’s cryptocurrency inventory.

As an alternative to fiat currencies that are backed by central governments, cryptocurrencies, which are relatively new, are subject to supply and demand forces based upon the desirability of an alternative, decentralised means of buying and selling goods and services, and it is unclear how such supply and demand will be impacted by geopolitical events. Nevertheless, political or economic crises may motivate large-scale acquisitions or sales of Bitcoin either globally or locally. Large-scale sales of cryptocurrencies would result in a reduction in their market prices and adversely affect the Corporation’s operations and profitability.

The further development and acceptance of the cryptographic and algorithmic protocols governing the issuance of and transactions in cryptocurrencies is subject to a variety of factors that are difficult to evaluate.

The use of cryptocurrencies to, among other things, buy and sell goods and services and complete other transactions, is part of a new and rapidly evolving industry that employs digital assets based upon a computer-generated mathematical and/or cryptographic protocol. The growth of this industry in general, and the use of cryptocurrencies in particular, is subject to a high degree of uncertainty, and the slowing, or stopping of the development or acceptance of developing protocols may adversely affect the Corporation’s operations. The factors affecting the further development of the industry, include, but are not limited to:

| ● | Continued worldwide growth in the adoption and use of cryptocurrencies; |

| ● | Governmental and quasi-governmental regulation of cryptocurrencies and their use, or restrictions on or regulation of access to and operation of the network or similar cryptocurrency systems; |

| ● | Changes in consumer demographics and public tastes and preferences; |

| ● | The maintenance and development of the open-source software protocol of the network; |

| ● | The availability and popularity of other forms or methods of buying and selling goods and services, including new means of using fiat currencies; |

| ● | General economic conditions and the regulatory environment relating to digital assets; and |

| ● | Negative consumer sentiment and perception of Bitcoins specifically and cryptocurrencies generally |

-15-

Acceptance and/or widespread use of cryptocurrency is uncertain.

Currently, there is relatively small use of Bitcoins and/or other cryptocurrencies in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect the Corporation’s operations, investment strategies, and profitability.

As relatively new products and technologies, Bitcoin and other cryptocurrencies have not been widely adopted as a means of payment for goods and services by major retail and commercial outlets. Conversely, a significant portion of cryptocurrency demand is generated by blockchain technology enthusiasts, price speculators and investors seeking to profit from the short-term or long-term holding of cryptocurrencies.

The relative lack of acceptance of cryptocurrencies in the retail and commercial marketplace limits the ability of end-users to use them to pay for goods and services. A lack of expansion by cryptocurrencies into retail and commercial markets, or a contraction of such use, may result in increased volatility or a reduction in their market prices, either of which could adversely impact the Corporation’s operations, investment strategies, and profitability.

The Corporation is subject to risks associated with the Corporation’s need for significant electrical power and for such electrical power to be available at commercially feasible rates. Government regulators may potentially restrict the ability of electricity suppliers to provide electricity to mining operations.

Cryptocurrency mining operations require substantial amounts of electrical power, and the Corporation’s operations can only be successful if the Corporation can obtain electrical power on a reliable and cost-effective basis. Shortages of natural gas, infrastructural damage to power plants or power carriage infrastructure, increases in demand for power, or any other factor that contributes to a rise in the price of electrical power may render the Corporation’s mining operations unprofitable. Additionally, in times of electricity shortages, government regulators may restrict or prohibit the provision of electricity to cryptocurrency mining operations.

At the same time, the consumption by cryptocurrency mining companies, including the Corporation of significant amounts of electrical power may potentially have a deleterious effect on the environment, which may cause government regulators to restrict the ability of electricity suppliers to provide electricity to mining operations in order to curtail their energy consumption.

The Corporation currently conducts its cryptocurrency mining in the states of New York and Alabama. As a result of maintaining operations in limited geographic locations, the Corporation’s current and future operations and anticipated growth, as well as the sustainability of electricity at economical prices for the purposes of cryptocurrency mining in the states of New York and Alabama poses certain risks. Any significant increase in the price the Corporation pays for the electrical power it consumes could adversely impact the Corporation’s operations and profitability.

The Corporation may be required to sell its cryptocurrency portfolio to pay for expenses.

The Corporation has in the past, and may in the future, sell part of its cryptocurrency portfolio to pay for expenses incurred, irrespective of the price at that point in time. Consequently, the Corporation’s cryptocurrencies may be sold at a time when the price is low, resulting in a negative effect on the Corporation’s profitability.

The Bitcoin block reward halves approximately every four years, which reduces the number of Bitcoin the Corporation would receive from solving blocks.

The difficulty of Bitcoin mining, or the amount of computational resources required for a set amount of reward for recording a new block, directly affects the Corporation’s results of operations. Bitcoin mining difficulty is a measure of how much computing power is required to record a new block, and it is affected by the total amount of computing power in the Bitcoin network. The Bitcoin algorithm is designed so that one block is generated, on average, every ten minutes, no matter how much computing power is in the network. Thus, as more computing power joins the Bitcoin network, and assuming the rate of block creation does not change (remaining at one block generated every ten minutes), the amount of computing power required to generate each block, and, hence, the mining difficulty, increases. In other words, based on the current design of the Bitcoin network, Bitcoin mining difficulty would increase together with the total computing power available in the Bitcoin network, which is in turn affected by the number of Bitcoin mining machines in operation.

-16-

In May 2020, the Bitcoin daily reward halved from 12.5 Bitcoin per block, or approximately 1,800 Bitcoin per day, to 6.25 Bitcoin per block, or approximately 900 Bitcoin per day. Bitcoin halving events are expected to occur approximately every four years, and each halving event may have a potential deleterious impact on the Corporation’s profitability as the Corporation will be rewarded less Bitcoin for each new block it records. Based on the fundamentals of Bitcoin mining and historical data on Bitcoin prices and the network difficulty rate after a halving event, it is unlikely that the network difficulty rate and price would remain at the current level when the Bitcoin rewards per block are halved, which could offset some of the impact of a halving event. Nevertheless, there is a risk that a future halving event may render the Corporation unprofitable and unable to continue as a going concern.

The Corporation’s profitability depends upon the hashrate of its miners and of the network as well as network difficulty, any adverse changes in which could reduce the ability of the Corporation to remain competitive.

The hashrate in cryptocurrency networks is expected to increase as a result of upgrades across the industry as Bitcoin and Ether miners use more efficient chips. As the hashrate increases, the mining difficulty will increase in response to the increase in computing power in the network. This may make it difficult for the Corporation to remain competitive as the Corporation may be required to deploy significant capital to acquire additional miners in order to increase their total mining power and offset the rise in hashrate. The effect of increased computing power in the network combined with fluctuations in the price of Bitcoin and Ether could have a material adverse effect on the Corporation’s results of operations and financial condition.

There is a possibility of cryptocurrency mining algorithms transitioning to proof of stake validation and other mining related risks, which could make the Corporation less competitive and ultimately adversely affect the Corporation’s business and the value of its shares.

Proof of stake is an alternative method in validating cryptocurrency transactions that is less dependent on the consumption of electricity. Should the algorithm for validating Bitcoin or Ether transactions, or transactions involving any cryptocurrency the Corporation mines in the future, shift from the current proof of work validation method to a proof of stake method, mining would likely require less energy, which may render any company that maintains advantages in the current climate (for example, from lower priced electricity, processing, real estate, or hosting) less competitive. The Corporation, as a result of its efforts to optimize and improve the efficiency of its mining operations by seeking to acquire low cost, long-term electricity may be exposed to the risk in the future of losing the relative competitive advantage it may have over some of its competitors as a result and may be negatively impacted if a switch to proof of stake validation were to occur. Such events could have a material adverse effect on our ability to continue as a going concern, which could have a material adverse effect on our business, prospects or results of operations, the value of Bitcoin, Ether and any other cryptocurrencies the Corporation mines in the future and your investment in the SV Shares.

The risks to the Corporation posed by the COVID-19 pandemic and any future infectious diseases cannot be predicted with certainty.

Pandemic risk is the risk of large-scale outbreaks of infectious diseases that can greatly increase morbidity and mortality over a wide geographic area and cause significant social and economic disruption. Pandemics, epidemics or outbreaks of an infectious disease in Canada or worldwide could have an adverse impact on the Corporation’s business, including changes to the way the Corporation and its counterparties operate, and on the Corporation’s financial results and condition. In March 2020, the World Health Organization declared COVID-19 a pandemic. The global response to the pandemic is constantly evolving, including various measures implemented at the global, national, state, provincial and local levels.

Although many health and safety restrictions have been lifted, certain adverse consequences of the pandemic continue to impact the macroeconomic environment and may continue to persist. The growth in economic activity and demand for goods and services, alongside labor shortages and supply chain complications and/or disruptions, has also contributed to rising inflationary pressures. The final outcome and/or potential duration of the economic disruption that resulted from the onset and subsequent recovery from COVID-19 remains uncertain at this time, and the financial markets continue to be impacted. Despite the decreased severity of the pandemic in recent months and the decreased global travel restrictions, the Corporation cannot accurately predict the impact that COVID-19 will have on its future revenue and business undertakings, due to uncertainties relating to future outbreaks and potential new variants of COVID-19, and their duration. Although the Corporation temporarily ceased operations at its Buffalo Mining Facility during March 2020 due to the COVID-19 pandemic, the Corporation resumed operations at a 75% operating level in April 2020 and, since then, has been at a 100% operating level; however, exposure to potential future government-imposed restrictions that may restrict the number of employees permitted to work in the mining facilities or that might otherwise limit the Corporation’s operations in the wake of an infectious disease outbreak remains uncertain. As a result, it is not possible to reliably estimate the length or severity of any such developments or their impact on the financial results and condition of the Corporation and its operating subsidiaries in future periods.

Although the impact of COVID-19 appears to be less severe and government interventions appears to be minimal compared to the beginning of the pandemic, it is not possible to reliably estimate the length and severity of these developments as well as the impact on the financial results and condition of the Corporation and its operating subsidiaries in future periods. The extent to which the Corporation’s business and financial condition will continue to be affected by the COVID-19 pandemic or any future infectious disease outbreaks will depend on future developments including the spread of variants, efficacy of vaccines against new variants, the vaccination progress and the impact of related controls and restrictions imposed by government authorities.

-17-

The Corporation’s operations, investment strategies, and profitability may be adversely affected by competition from other methods of investing in cryptocurrencies.

The Corporation competes with other users and/or companies that are mining cryptocurrencies and other potential financial vehicles, possibly including securities backed by or linked to cryptocurrencies through entities similar to the Corporation. Market and financial conditions, and other conditions beyond the Corporation’s control, may make it more attractive to invest in other financial vehicles, or to invest in cryptocurrencies directly which could limit the market for the Corporation’s shares and reduce their liquidity.

The Corporation’s coins may be subject to loss, theft or restriction on access.

There is a risk that some or all of the Corporation’s coins could be lost or stolen. Access to the Corporation’s coins could also be restricted by cybercrime (such as a denial of service attack) against a service at which the Corporation maintains a hosted online wallet. Any of these events may adversely affect the operations of the Corporation and, consequently, its investments and profitability.

The loss or destruction of a digital private key required to access the Corporation’s digital wallets may be irreversible. The Corporation’s loss of access to its private keys or its experience of a data loss relating to the Corporation’s digital wallets could adversely affect its investments.

Cryptocurrencies are controllable only by the possessor of both the unique public and private keys relating to the local or online digital wallet in which they are held, which wallet’s public key or address is reflected in the network’s public Blockchain. The Corporation will publish the public key relating to digital wallets in use when it verifies the receipt of cryptocurrency transfers and disseminates such information into the network, but it will need to safeguard the private keys relating to such digital wallets. To the extent such private keys are lost, destroyed or otherwise compromised, the Corporation will be unable to access its coins, and such private keys will not be capable of being restored by network. Any loss of private keys relating to digital wallets used to store the Corporation’s cryptocurrency could adversely affect its investments and profitability.