i-80 GOLD CORP.

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2022

March 29, 2023

TABLE OF CONTENTS

1

GENERAL MATTERS

References to the Corporation

Unless otherwise indicated or the context otherwise requires, use of the terms "Corporation" and "i-80" in this annual information form (this "AIF") refer to i-80 Gold Corp. and its direct and indirect subsidiaries as of the date of this AIF, or other entities controlled by them, on a consolidated basis, notwithstanding that such direct and indirect subsidiaries may not have been controlled by them at all relevant times, including December 31, 2022.

Financial Information

Unless otherwise indicated, all financial information referred to in this AIF was prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Currency References and Exchange Rate Information

This AIF contains references to the Canadian dollar and the United States dollar. Unless otherwise indicated, all references to "$" or "C$" or "dollars" in this AIF are references to Canadian dollars. United States dollars are referred to as "US$". As at December 31, 2022, the rate of exchange between the U.S. dollar and the Canadian dollar as reported by the Bank of Canada was C$1.00 = US$0.7383 or US$1.00 = C$1.3544.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This AIF contains certain forward-looking information and forward-looking statements, as defined in applicable securities laws (collectively referred to herein as "forward-looking statements"). These statements relate to future events or the Corporation's future performance. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as "guidance", "plans", "expects", "is expected", "budget", "scheduled", "estimates", "continues", "forecasts", "projects", "predicts", "intends", "anticipates" or "believes", or variations of, or the negatives of, such words and phrases, or state that certain actions, events or results "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved. All forward-looking statements contained in this AIF speak only as of the date of this AIF or as of the date or dates specified in such statements. Forward-looking statements in this AIF include, but are not limited to, statements with respect to:

•future objectives of the Corporation and strategies to achieve those objectives;

•future financial or operating performance of the Corporation;

•targeted milestones for the Corporation's mineral properties and projects;

•expectations, strategies and plans for the Corporation's mineral properties and projects, including with respect to mineral reserve and mineral resource estimates and the quantity and quality thereof, expected mine life, development schedule, production, capital and operating cost estimates, availability of capital for development and overall financial analyses;

•supply and demand for gold and silver;

•estimation and realization of mineral resources;

•timing of exploration and development projects;

•costs, timing and location of future drilling;

•results of future exploration and drilling and estimated completion dates for certain milestones;

2

•the ability of the Corporation to obtain and maintain all government approvals, permits and third party consents in connection with the Corporation's activities;

•government regulation of mining operations;

•evolution and economic performance of development projects;

•timing of geological and/or technical reports;

•timing and completion of the Paycore Arrangement (as defined below);

•timing and ability to execute the security documents relating to the Convertible Debenture Offering (as defined below);

•future strategic plans;

•operating and exploration budgets and targets;

•continuity of a favourable gold market;

•contractual commitments;

•environmental and reclamation expenses;

•continuous availability of required manpower;

•continuous access to capital markets; and

•any other statement that may predict, forecast, indicate or imply future plans, intentions, levels of activity, results, performance or achievements.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Corporation to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others:

•risks normally incidental to the nature of mineral exploration, development and mining;

•exploration programs not resulting in profitable commercial mining operations;

•general business, social, economic, political, regulatory and competitive uncertainties;

•the actual results of current mining operations and development activities;

•operating and/or project delays or interruptions;

•capital requirements, including increases in operating and capital costs;

•debt and liquidity risks;

•the uncertainty of mineral resource estimates;

•mineral resources not having demonstrated economic viability;

•risks associated with the construction and start-up of new mines;

3

•fluctuating commodity prices;

•failure to develop the Corporation's mineral projects;

•failure to operate independently;

•risks associated with inaccurate capital and operational costs estimates;

•risks related to future production estimates and guidance, if any;

•dependence on key personnel, including key employees, directors and senior management;

•reliance on third parties;

•financial statements may not reflect the Corporation's financial position, results of operations or cash flows in the future;

•risks related to the failure or breach of network systems or other digital technologies;

•there being no assurance of title to mineral projects;

•the Corporation's activities being subject to extensive governmental regulation;

•risks related to health epidemics and outbreak of communicable diseases, such as the current outbreak of the novel coronavirus, COVID-19;

•maintenance or provision of infrastructure;

•tax matters;

•information technology;

•risks associated with obtaining or complying with all required permits and licenses;

•environmental regulations and potential liabilities;

•ability to arrange for, or continue to obtain, satisfactory surety bonds in favor of government agencies, as financial support for environmental reclamation and exploration permitting at its properties;

•reclamation requirements;

•insurance and uninsured risks;

•competition from other mining businesses;

•the Corporation's failure to select appropriate acquisition targets;

•undisclosed risks and liabilities relating to the Acquisitions (as defined below);

•not realizing the anticipated benefits of the Acquisitions;

•undisclosed risks and liabilities relating to the Paycore Arrangement;

•not realizing the anticipated benefits of the Paycore Arrangement

4

•early redemption of the Convertible Debentures (as defined below);

•conflicts of interest;

•non-compliance with ESTMA;

•disputes with third parties;

•reputational risks;

•reliance on transition services;

•weather and climate change risks;

•ability to access resources and materials, including water rights;

•land payments relating to mineral properties and projects;

•risks associated with having significant shareholders and contractual obligations with respect thereto;

•international conflict, such as the current Russia-Ukraine conflict;

•the Corporation's ability to produce accurate and timely financial statements;

•volatility of the trading price of the common shares of the Corporation (the "Common Shares");

•dilution and future sales of the Common Shares;

•decline in price of the Common Shares;

•the Corporation's lack of history of earnings;

•failure of plant, equipment or processes to operate as anticipated;

•the Corporation's failure to comply with laws and regulations or other regulatory requirements; and

•the accuracy of forward-looking statements and forecast financial information, as well as those additional risk factors listed in the "Risk Factors" section of this AIF.

Although the Corporation has attempted to identify important factors that could cause actual actions, events, conditions, results, performance or achievements to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events, conditions, results, performance or achievements to differ from what is anticipated, estimated or intended. Those factors are described or referred to below in this AIF under the heading "Risk Factors" and elsewhere herein. Additional risks and uncertainties not presently known to the Corporation or that the Corporation currently deems immaterial may also impair the Corporation's business operations.

Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect forward-looking statements. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this AIF. Such statements are based on a number of assumptions, which may prove to be incorrect, including, but not limited to, assumptions about the following:

•favourable equity and debt capital markets;

•the supply and demand for, and the level and volatility of, future gold and silver prices;

5

•operating and capital costs;

•the Corporation's ability to raise any necessary additional capital on reasonable terms to advance the development of its projects and pursue planned exploration;

•the economy and the mining industry in general;

•the accuracy of the Corporation's mineral reserve and mineral resource estimates and the geological and metallurgical assumptions (including with respect to size, grade and recoverability of mineral reserves and mineral resources) and operational and price assumptions on which the mineral reserve and resource estimates are based;

•permitting, development and operations are consistent with the Corporation's expectations;

•no unforeseen changes in the legislative and operating framework for the Corporation occur;

•the accuracy of budgeted exploration and development costs and expenditures;

•foreign exchange rates;

•plant and equipment work as anticipated;

•no unusual geological or technical problems occur;

•the receipt of any necessary regulatory approvals;

•the Corporation's ability to attract and retain skilled staff;

•prices and availability of equipment;

•the ability of contracted parties to provide goods and/or services on a timely basis or at all; and

•no significant events occur outside of the Corporation's normal course business.

All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Corporation undertakes no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information or future events or otherwise, except as may be required by law. If the Corporation does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

TECHNICAL INFORMATION

Except where otherwise indicated, the disclosure contained in this AIF that is of a scientific or technical nature with respect to the Corporation's mineral properties is supported by and in certain cases summarized from, as applicable:

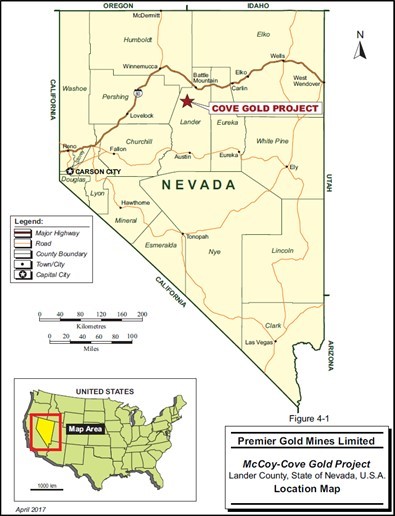

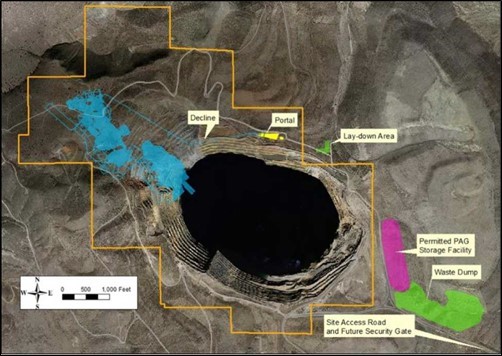

•McCoy-Cove Project: the technical report titled "Preliminary Economic Assessment for the Cove Project, Lander County, Nevada" dated January 25, 2021, with an effective date of January 1, 2021, prepared by Dagny Odell, P.E. and Laura Symmes, RM-SME of Practical Mining LLC and Tommaso Roberto Raponi, P.Eng. of TR Raponi Consulting Ltd. (the "McCoy-Cove Report"). Each of Mmes. and Messrs. Odell, Symmes and Raponi has reviewed the scientific and technical information that is supported by or summarized from the McCoy-Cove Report in the form and context in which it appears, confirms that such information is based on and fairly represents the McCoy-Cove Report, and consents to its inclusion in this AIF.

6

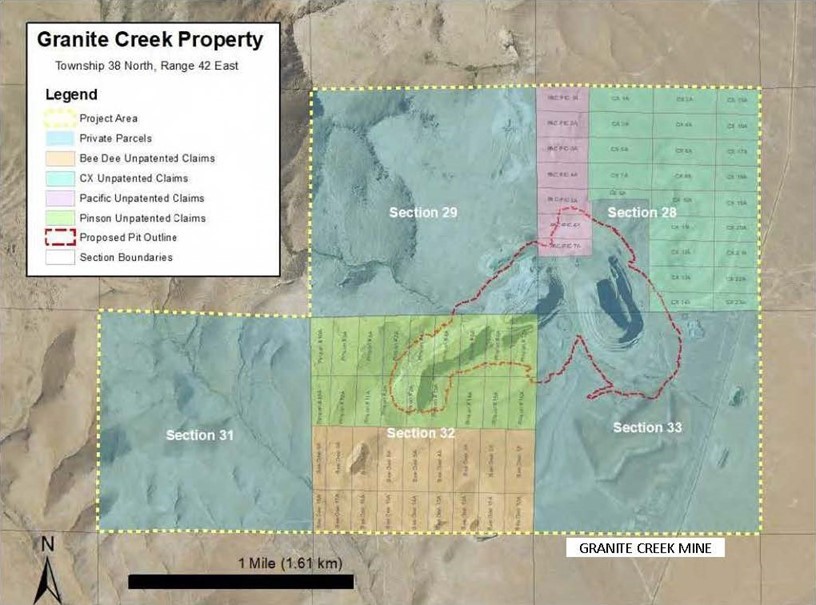

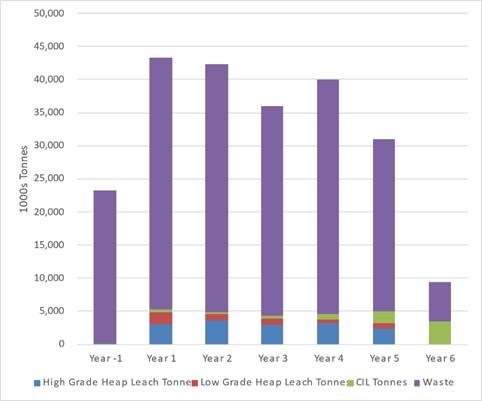

•Granite Creek Project: the technical report titled "Preliminary Economic Assessment NI 43-101 Technical Report, Granite Creek Mine Project, Humboldt County, Nevada, USA" dated November 8, 2021, with an effective date of May 4, 2021, prepared by Terre A. Lane, MMSA-QP, RM-SME, Dr. J. Todd Harvey, Ph.D., P.E., RM-SME, Richard D. Moritz, MMSA-QP, Dr. Hamid Samari, Ph.D., MMSA-QP and J. Larry Breckenridge, P.E. of Global Resource Engineering, Ltd. (the "Granite Creek Report"). Each of Dr. Harvey, Dr. Samari and Mmes. and Messrs. Lane, Moritz and Breckenridge has reviewed the scientific and technical information that is supported by or summarized from the Granite Creek Report in the form and context in which it appears, confirms that such information is based on and fairly represents the Granite Creek Report, and consents to its inclusion in this AIF.

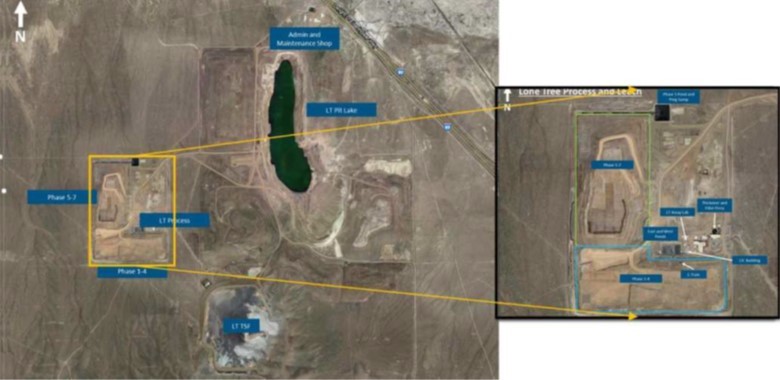

•Lone Tree Project: the technical report titled "Technical Report on the Mineral Resource Estimates for the Lone Tree Deposit, Nevada" dated October 21, 2021, with an effective date of July 30, 2021, prepared by Dr. Abani R. Samal, Ph.D., RM-SME of GeoGlobal, LLC (the "Lone Tree Report"). Dr. Samal has reviewed the scientific and technical information that is supported by or summarized from the Lone Tree Report in the form and context in which it appears, confirms that such information is based on and fairly represents the Lone Tree Report, and consents to its inclusion in this AIF.

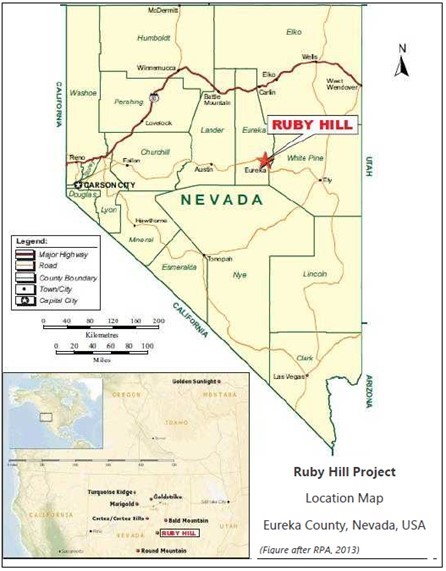

•Ruby Hill Project: the technical report titled "NI 43-101 Technical Report on the 2021 Ruby Hill Mineral Resource Estimate, Eureka County, Nevada, USA" dated October 22, 2021, with an effective date of July 31, 2021, prepared by Wood Canada Limited and Raymond H. Walton, B.Tech., P.Eng. of Ray Walton Consulting Inc. (the "Ruby Hill Report"). Mr. Walton has reviewed the scientific and technical information that is supported by or summarized from the Ruby Hill Report in the form and context in which it appears, confirms that such information is based on and fairly represents the Ruby Hill Report, and consents to its inclusion in this AIF.

The technical reports referred to above are subject to certain assumptions, qualifications and procedures described therein. Reference should be made to the full text of the technical reports, which have been filed with securities regulatory authorities pursuant to National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators ("NI 43-101") and are available for review under the Corporation's profile on SEDAR at www.sedar.com. The McCoy-Cove Report, the Granite Creek Report, the Lone Tree Report and the Ruby Hill Report are not and shall not be deemed to be incorporated by reference in this AIF.

Where appropriate, certain information contained in this AIF provides non-material updates or expansions upon the information contained in such technical reports. Any updates or expansions upon the scientific or technical information contained in such technical reports and any other scientific or technical information contained in this AIF was prepared by or under the supervision of Tim George, P.E. Mr. George is the Mine Operations Manager of the Corporation and a "qualified person" for the purposes of NI 43-101.

The mineral resources for the Corporation's properties (including as used in the technical reports) have been estimated in accordance with NI 43-101, which incorporates by reference the definitions and categories of mineral resources and mineral reserves set out by the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") in the CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by the CIM Council on May 10, 2014.

CORPORATE STRUCTURE

Name, Address and Incorporation

The Corporation was incorporated on November 10, 2020, pursuant to the Business Corporations Act (British Columbia) ("BCBCA") under the name "i-80 Gold Corp.", as a wholly-owned subsidiary of Premier Gold Mines Limited ("Premier") for the purposes of completing a plan of arrangement (the "Plan of Arrangement") under Section 182 of the Business Corporations Act (Ontario) (the "Arrangement"). The Arrangement was completed on April 7, 2021. Under the Arrangement, among other things, Premier transferred all of its ownership interest in Premier Gold Mines USA, Inc. ("Premier USA") to the Corporation and spun out 70% of the issued and outstanding Common Shares of the Corporation to shareholders of Premier. As a result of the Arrangement, the Corporation became a public company and a "reporting issuer" under applicable Canadian

7

securities laws and is no longer a subsidiary of Premier. See "General Development of the Business – Three Year History – The Arrangement and Related Matters" for additional information.

The Corporation's registered and records office is located at Suite 2500 Park Place, 666 Burrard Street, Vancouver, British Columbia, V6B 2X8, and its head office is located at 5190 Neil Road, Suite 460, Reno, Nevada, 89502.

Intercorporate Relationships

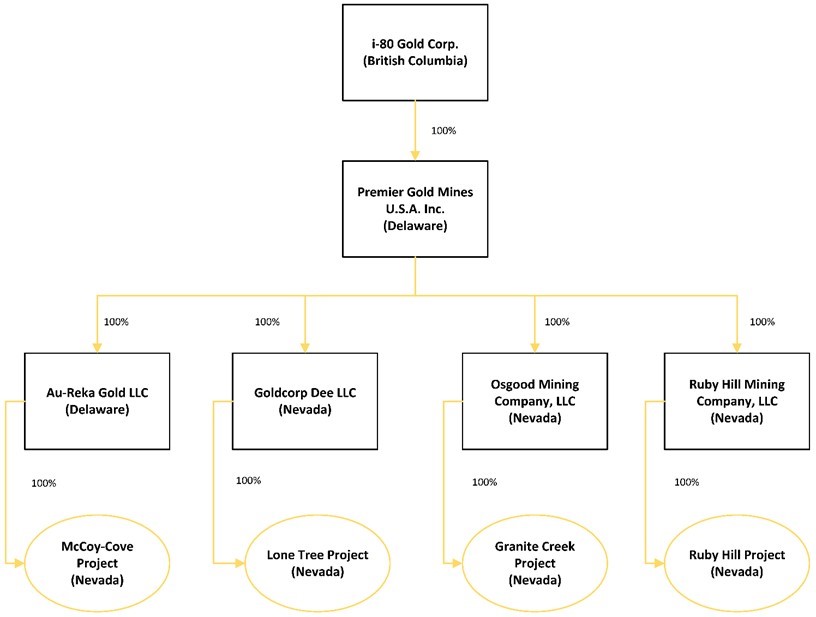

The Corporation's material wholly-owned subsidiary is Premier USA, a Delaware corporation. Premier USA has four material wholly-owned subsidiaries: (i) Au-Reka Gold LLC, a Delaware limited liability company ("Au-Reka LLC"); (ii) Goldcorp Dee LLC, a Nevada limited liability company ("Dee LLC"); (iii) Osgood Mining Company LLC, a Nevada limited liability company ("Osgood LLC"); and (iv) Ruby Hill Mining Company, LLC, a Nevada limited liability company ("Ruby Hill LLC").

The following diagram illustrates the corporate structure of the material subsidiaries of the Corporation and the location of the Corporation's principal assets within its corporate structure as at the date hereof.

8

GENERAL DEVELOPMENT OF THE BUSINESS

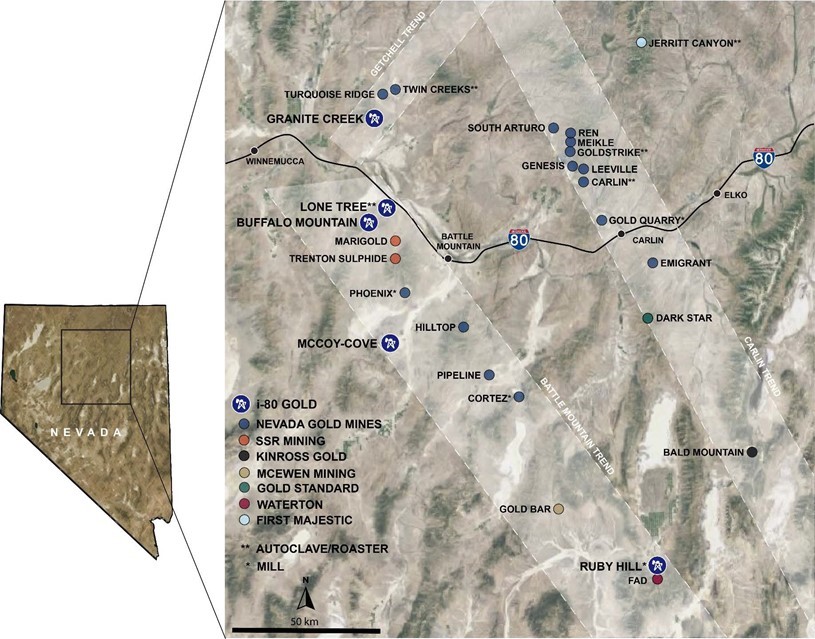

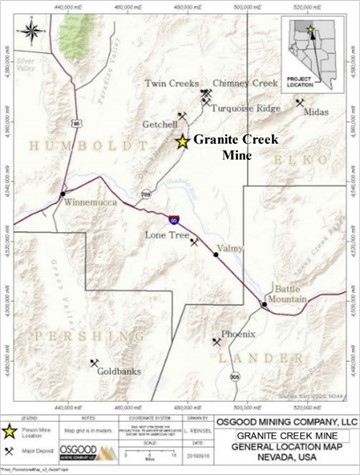

The Corporation is a mining company engaged in the exploration, development and production of gold and silver mineral deposits in the United States, with a particular focus on the State of Nevada. The Corporation's principal mining projects include: (i) a 100% interest in the McCoy-Cove gold properties located on the Battle Mountain-Eureka Trend in Lander County, Nevada (collectively, the "McCoy-Cove Project"); (ii) a 100% interest in the Granite Creek gold project (formerly referred to as the Getchell project) located at the intersection of the Getchell gold belt and the Battle Mountain-Eureka Trend in Humboldt County, Nevada (the "Granite Creek Project"); (iii) a 100% interest in the Lone Tree and Buffalo Mountain gold deposits and Lone Tree processing complex, located midway between the Corporation's McCoy-Cove and Granite Creek Projects in Humboldt County, Nevada (collectively, the "Lone Tree Project"); and (iv) a 100% interest in the Ruby Hill mine located along the Battle Mountain-Eureka Trend in Eureka County, Nevada (the "Ruby Hill Project").

The below figure shows the location of the McCoy-Cove Project, the Granite Creek Project, the Lone Tree Project and the Ruby Hill Project within the State of Nevada.

The Corporation also holds the right to earn a 100% interest in the exploration-stage Tabor gold property (formerly referred to as the Baby Doe property) located in Esmeralda County, Nevada (the "Tabor Project"). This interest is not material to the Corporation.

9

Three Year History

The Corporation was incorporated on November 10, 2020. The following is a summary of the key developments since incorporation.

The Arrangement and Related Matters

On December 16, 2020, Premier, Equinox Gold Corp. ("Equinox Gold") and the Corporation entered into an arrangement agreement (the "Arrangement Agreement") to complete the Arrangement, whereby Equinox Gold agreed to acquire all of the issued and outstanding common shares of Premier (the "Premier Shares") following the spin-out of the Corporation to the Premier shareholders. The Arrangement closed on April 7, 2021 (the "Effective Date").

Under the Arrangement, pursuant to the Plan of Arrangement, among other things:

•Premier assigned all of its legal and beneficial right, title and interest in and to Premier USA, including its interest in the South Arturo, McCoy-Cove, Tabor and Rodeo Creek assets, to the Corporation pursuant to the Premier Contribution Agreement (as defined below), in consideration for the issuance of Common Shares;

•the capital of Premier was reorganized to create a new class of shares designated as "Class B Common Shares" ("New Premier Shares");

•in conjunction with the reorganization of Premier's capital, each issued and outstanding Premier Share was exchanged for (i) one New Premier Share, and (ii) 0.4 of a Common Share of the Corporation; and

•following the exchange of Premier Shares described above, Equinox Gold acquired all of the outstanding New Premier Shares, and the Premier shareholders received, for each New Premier Share, 0.1967 of a common share of Equinox Gold (each whole share, an "Equinox Gold Share").

In addition, pursuant to the Arrangement, each option to purchase Premier Shares ("Premier Option") outstanding immediately prior to the effective time of the Arrangement (the "Effective Time") was exchanged for (i) a replacement option to purchase 0.1967 of an Equinox Gold Share, and (ii) a replacement option to purchase 0.4 of a Common Share ("Replacement i-80 Option"). Each warrant to purchase a Premier Share ("Premier Warrant") outstanding immediately prior to the Effective Time was adjusted in accordance with its terms such that the holder was entitled to receive, upon the exercise of such Premier Warrant and payment of the original exercise price set forth in such Premier Warrant, 0.1967 of an Equinox Gold Share and 0.4 of a Common Share.

A total of 96,337,099 Common Shares were distributed to the shareholders of Premier pursuant to the Plan of Arrangement, representing 70% of the then outstanding Common Shares before giving effect to any subsequent share issuances by the Corporation, including, but not limited to, the Subscription Receipt Financing (as defined below) and the Granite Creek Acquisition (as defined below). The balance of the outstanding Common Shares were held by Premier (now a wholly-owned subsidiary of Equinox Gold). In addition, as at the Effective Date, a further 5,722,000 Common Shares were reserved for issuance pursuant to Replacement i-80 Options issued to former holders of Premier Options and 800,000 Common Shares were reserved for issuance pursuant to the adjusted Premier Warrants. The adjusted Premier Warrants have since been exercised in full.

Following the Arrangement, the Corporation became a stand-alone reporting issuer under applicable Canadian securities laws, though it operates, amongst others, certain U.S. gold projects formerly held by Premier and its management team includes certain former executives of Premier. See "Directors and Officers" for more details.

Premier USA Contribution

In connection with the Arrangement, Premier and the Corporation entered into a contribution agreement dated April 7, 2021 (the "Premier Contribution Agreement"), providing for the assignment (the

10

"Contribution") of all of Premier's ownership interest in Premier USA, including all of the issued and outstanding common shares of Premier USA, and any indebtedness owing by Premier USA to Premier, to the Corporation in consideration for the issuance of Common Shares to Premier. Following the completion of the Arrangement, the Corporation, through its ownership of Premier USA (including the direct and indirect subsidiaries of Premier USA), holds all of Premier's former mining projects located in the State of Nevada.

Under the Arrangement Agreement, the Corporation covenanted and agreed in favour of Premier and Equinox Gold, from and after the Effective Time, to indemnify Equinox Gold, Premier and their respective directors, officers, employees and agents, substantially on the terms provided in Schedule G to the Arrangement Agreement, in connection with any claims made against, or losses suffered by, Equinox Gold or Premier arising in connection with, or relating in any way to, the SpinCo Liabilities (as defined in the Arrangement Agreement). The SpinCo Liabilities include, among other things, all of the liabilities and obligations of the Corporation, Premier USA and any subsidiary of the Corporation or Premier USA (collectively the "SpinCo Group"), whether accrued, contingent or otherwise, which pertain or relate to the Corporation, the SpinCo Transactions (as defined in the Arrangement Agreement) or the assets or property of Premier USA, including any direct or indirect taxes in connection with the SpinCo Transactions or any other taxes of the SpinCo Group for which Premier may be liable. The SpinCo Transactions include the Contribution, the Granite Creek Acquisition, the Subscription Receipt Financing and distribution of the Common Shares under the Arrangement, and any pre-Arrangement transactions carried out by Premier in connection with Premier USA as contemplated in the Arrangement Agreement. For greater certainty, the parties to the Arrangement Agreement have acknowledged that the Corporation shall not be required to reimburse Premier or Equinox Gold for the reduction of any tax pools or attributes of Premier that are reduced as a result of the SpinCo Transactions. The Corporation also acknowledged and agreed that the foregoing indemnity would survive the Effective Date for a period of one year following the Effective Date except with respect to a claim or loss related to taxes, in which case the foregoing indemnity will survive until 60 days after expiration of the time within which an assessment, reassessment or similar document may be issued by a governmental entity under any applicable law in respect of taxation years ending on or before the Effective Date. The contents of this section are qualified in their entirety by the Arrangement Agreement. A copy of the Arrangement Agreement is available for review under the Corporation's issuer profile on SEDAR at www.sedar.com.

TSX Listing and Securities Law Matters

Prior to the completion of the Arrangement, the Corporation was not a reporting issuer and the Common Shares were not listed on any stock exchange. Upon completion of the Arrangement, the Corporation became a reporting issuer in each of the Provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador.

In connection with the Arrangement, the Common Shares of the Corporation were listed and posted for trading on the Toronto Stock Exchange ("TSX") under the stock symbol "IAU". Trading in the Common Shares commenced on April 13, 2021.

Equinox Gold Loan

In connection with the Arrangement, Equinox Gold advanced a US$20.75 million bridge loan (the "Equinox Gold Loan") to the Corporation concurrently with the closing of the Subscription Receipt Financing. The purpose of the Equinox Gold Loan was to enable the Corporation to make a US$20.75 million cash deposit with affiliates of Waterton Global Resource Management, Inc. (collectively, "Waterton") in partial satisfaction of the purchase price payable to Waterton for the acquisition of the Granite Creek Project (the "Granite Creek Acquisition"). Equinox Gold's subscription price payable to the Corporation under the Subscription Receipt Financing of approximately $24.1 million was set-off against a corresponding amount of the principal amount outstanding under the Equinox Gold Loan. See "General Development of the Business – Three Year History – Subscription Receipt Financing". On April 16, 2021, the Corporation repaid the remaining balance of US$1,639,350.81 under the Equinox Gold Loan (inclusive of interest and expenses).

11

Support Agreement

In connection with the Arrangement, Equinox Gold and the Corporation entered into a support agreement dated April 7, 2021 (the "Support Agreement"), pursuant to which the Corporation granted various rights to Equinox Gold. The rights granted to Equinox Gold under the Support Agreement include, among other things:

•the right to nominate an individual to the board of directors of the Corporation (the "Board"), so long as Equinox Gold continues to hold at least 20% of the issued and outstanding Common Shares;

•the right to appoint its nominee to committees of the Board, including the audit committee and the compensation committee; and

•certain equity-related rights, including a participation right to maintain its pro rata equity position in the Corporation, certain other anti-dilution protections and mandatory registration rights.

With respect to Equinox Gold's right to nominate an individual to the Board, the Corporation has agreed to cause management of the Corporation to vote the Common Shares in respect of which management is granted a discretionary proxy, in favour of the election of such nominee to the Board at every such meeting.

Equinox Gold has also agreed to certain "standstill" provisions customary for an agreement of this nature, including, without limitation, to not, without the written authorization of the Corporation, vote or cause to be voted any Common Shares beneficially held by Equinox Gold against the recommendation of management and the recommendation of the Board in respect of any vote on any item of business at any meeting of the shareholders of the Corporation unless such management or Board recommendation is contrary to the election of Equinox Gold's nominee to the Board.

i-80 Offtake Agreement

Prior to the Arrangement, Premier and certain of its subsidiaries were party to a second amended and restated offtake agreement dated March 4, 2020, with OMF Fund II SO Ltd. ("OMF SO"), an affiliate of Orion Mine Finance Management II Limited ("Orion Mine Finance II"), as purchaser and purchasers' agent (the "Premier Offtake Agreement"), pursuant to which OMF SO had the right to purchase up to a specified number of ounces of refined gold annually (the "Annual Gold Quantity") from production derived from mineral projects in which any Premier group entity, directly or indirectly, held an interest as of March 4, 2020. OMF SO transferred all of its rights and obligations under the Premier Offtake Agreement to its affiliate, OMF Fund II (O) Ltd. ("OMF O"), on May 1, 2020. Under the Premier Offtake Agreement, the Annual Gold Quantity was (i) 80,000 ounces for 2020, (ii) 85,000 ounces for 2021, and (iii) 90,000 ounces each year thereafter, subject to an annual maximum of 50,000 ounces of refined gold from each of Premier's producing projects. The term of the Premier Offtake Agreement was from the date of the agreement until March 1, 2027.

Concurrently with the completion of the Arrangement, OMF O agreed to waive the project transfer fee under the Premier Offtake Agreement that would have been payable to OMF O upon the occurrence of the spin-out of the Corporation, and entered into (i) a new offtake agreement with i-80 and its subsidiaries dated April 7, 2021, in respect of i-80's mineral properties (the "i-80 Offtake Agreement"), and (ii) a third amended and restated offtake agreement with Premier and its subsidiaries dated April 7, 2021, which replaced the Premier Offtake Agreement.

The i-80 Offtake Agreement applied to (i) any mineral project in which an i-80 group entity, directly or indirectly, held an interest as of April 7, 2021, including, but not limited to, the South Arturo Mine and the McCoy-Cove Project, and (ii) the Granite Creek Project. The term of the i-80 Offtake Agreement was from the date of the agreement until March 1, 2027.

Under the i-80 Offtake Agreement, the Annual Gold Quantity was (i) up to an aggregate of 29,750 ounces of refined gold in respect of the 2021 calendar year (net of the ounces of refined gold delivered by Premier in 2021 under the Premier Offtake Agreement prior to April 7, 2021), and (ii) up to an aggregate of 31,500 ounces of refined gold in respect of any calendar year after 2021 until March 1, 2027. If the Corporation produced less than the applicable Annual Gold Quantity in any given year, its delivery obligations under the i-80 Offtake Agreement were limited to those ounces of refined gold actually produced.

12

In October 2021, the i-80 Offtake Agreement was amended and restated in connection with the Asset Exchange. See "General Development of the Business – Three Year History – Orion and Sprott Financing Arrangements – Amended and Restated Offtake Agreement" for more information.

Prior i-80 Silver Purchase Agreement

Prior to the Arrangement, Premier and certain of its subsidiaries were party to an amended and restated silver purchase and sale agreement dated January 31, 2019, with OMF SO and certain of its affiliates, as purchasers (the "Premier Stream Agreement"), pursuant to which OMF SO paid an additional deposit of US$10 million to a wholly-owned subsidiary of Premier, which subsidiary was required to deliver to OMF SO 100% of the silver production from the Mercedes mine located in the State of Sonora, Mexico (the "Mercedes Mine") and 100% of the silver production from the South Arturo Mine attributable to Premier until the delivery of 3.75 million refined ounces of silver (including deliveries previously made to OMF SO), after which the delivery would be reduced to 30% of the silver production from the Mercedes Mine and the South Arturo Mine. The Premier subsidiary was required to deliver at least 300,000 ounces of refined silver in the aggregate from the Mercedes Mine and the South Arturo Mine in each calendar year to OMF SO until 2.1 million ounces of refined silver in the aggregate had been delivered to OMF SO. OMF SO would purchase the refined silver at an ongoing cash purchase price equal to 20% of the prevailing silver price. As security for the payment of its obligations under the Premier Stream Agreement, Premier granted a continuing security interest over the assets relating to the Mercedes Mine and the South Arturo Mine.

Concurrently with the completion of the Arrangement, OMF SO and the Corporation entered into a silver purchase and sale agreement dated April 7, 2021 (the "Prior i-80 Silver Purchase Agreement"), pursuant to which the Corporation was required to deliver to OMF SO 100% of the silver production from the South Arturo Mine attributable to the Main Stream Area (as defined in the Prior i-80 Silver Purchase Agreement) and 50% of the silver production attributable to the Exploration Stream Area (as defined in the Prior i-80 Silver Purchase Agreement). Following the delivery to OMF SO of an aggregate amount of refined silver equal to US$1.0 million under the Prior i-80 Silver Purchase Agreement, OMF SO would continue to purchase the refined silver at an ongoing cash purchase price equal to 20% of the prevailing silver price. The Prior i-80 Silver Purchase Agreement was unsecured, as the security granted by Premier over the South Arturo Mine in connection with the Premier Stream Agreement was discharged concurrently with the entering into the Prior i-80 Silver Purchase Agreement.

As part of the Asset Exchange, Nevada Gold assumed all of the Corporation's obligations under the Prior i-80 Silver Purchase Agreement and entered into an amended and restated silver purchase and sale agreement with OMF SO dated October 14, 2021, which replaced the Prior i-80 Silver Purchase Agreement. On December 13, 2021, the Corporation entered into a new silver purchase and sale agreement in respect of its mineral properties with an affiliate of Orion Mine Finance Management III LLC ("Orion Mine Finance III"). See "General Development of the Business – Three Year History – Orion and Sprott Financing Arrangements – New Silver Purchase Agreement" for more information.

Subscription Receipt Financing

On March 18, 2021, the Corporation closed a brokered private placement offering of 30,914,614 subscription receipts of the Corporation (the "Subscription Receipts") at a subscription price of $2.60 per Subscription Receipt for aggregate gross proceeds of approximately $80.4 million (the "Subscription Receipt Financing"). The Subscription Receipt Financing was conducted on a marketed basis through a syndicate of agents led by CIBC World Markets Inc. (the "Lead Agent"), and including Sprott Capital Partners LP, Stifel Nicolaus Canada Inc., Canaccord Genuity Corp., Scotia Capital Inc., BMO Nesbitt Burns Inc., Cormark Securities Inc. and RBC Dominion Securities Inc. (collectively, the "Agents").

The Subscription Receipts were created and issued pursuant to the terms of a subscription receipt agreement dated March 18, 2021 (the "Subscription Receipt Agreement"), among the Corporation, the Lead Agent, on its own behalf and on behalf of the Agents, and TSX Trust Company, as subscription receipt agent (the "Subscription Receipt Agent"). The Subscription Receipt Agreement provided that each Subscription Receipt would be automatically exchanged, without any further consideration or action by the holder thereof, for one Common Share and one quarter of one common share purchase warrant (each whole warrant, a "Sub Receipt Warrant") upon the satisfaction of the Escrow Release Conditions (as defined below). Each whole

13

Sub Receipt Warrant entitled the holder thereof to acquire one Common Share at an exercise price of $3.64 per Common Share until September 18, 2022.

The gross proceeds of the Subscription Receipt Financing, less (i) 50% of the commission payable to the Agents and the Agents' expenses incurred in connection with the Subscription Receipt Financing, and (ii) the $24.1 million subscription by Equinox Gold, which was set off against the principal amount outstanding under the Equinox Gold Loan (as discussed above), were deposited in escrow with the Subscription Receipt Agent on the closing date of the Subscription Receipt Financing, pending the satisfaction of certain conditions, including: the filing of the articles of arrangement in connection with the Arrangement; the Common Shares issuable upon conversion of the Subscription Receipts (including the Common Shares issuable upon exercise of the Sub Receipt Warrants) having been conditionally approved for listing on the TSX; and certain other customary conditions (collectively, the "Escrow Release Conditions").

Upon completion of the Arrangement, the Escrow Release Conditions were satisfied. Each of the 30,914,614 Subscription Receipts issued pursuant to the Subscription Receipt Financing were automatically converted into one Common Share and one quarter of one Sub Receipt Warrant. The Corporation issued an aggregate of 30,914,614 Common Shares and 7,728,652 Sub Receipt Warrants (as of December 31, 2022, all outstanding Sub Receipt Warrants had expired) in connection with the conversion of the Subscription Receipts. Concurrently, the Subscription Receipt Agent released the net proceeds of the financing to the Corporation.

The Corporation used a portion of the proceeds from the Subscription Receipt Financing to fund the cash portion of the purchase price for the Granite Creek Acquisition. The balance of the proceeds have been used for working capital and general corporate purposes, and to pay for exploration and development expenses related to the Corporation's mining projects.

Escrow Agreement

In accordance with the requirements of the TSX, an aggregate of 11,061,614 Common Shares and 2,765,403 Sub Receipt Warrants issued upon the conversion of the Subscription Receipts were deposited into escrow pursuant to an escrow agreement dated April 7, 2021, between the Corporation, TSX Trust Company, as escrow agent, and certain securityholders of the Corporation (the "Escrow Agreement"). One quarter of the escrowed securities were released on the date the Common Share were listed on the TSX, being April 13, 2021 (the "Listing Date"). One third of the escrowed securities were released 6 months after the Listing Date, one half of the escrowed securities were released 12 months after the Listing Date and the remaining escrowed securities were released 18 months after the Listing Date. As of December 31, 2022, no securities remain in escrow under the Escrow Agreement.

Granite Creek Acquisition

On August 10, 2020, Premier and Premier USA entered into a membership interest purchase agreement with affiliates of Waterton (the "Granite Creek Acquisition Agreement"), pursuant to which Premier USA agreed to acquire from Waterton all of the outstanding membership interests of Osgood LLC, the 100% owner of the Granite Creek Project. The Granite Creek Acquisition Agreement was amended on December 15, 2020, to, among other things, include the Corporation as a party. The Granite Creek Acquisition closed on April 14, 2021, and upon closing thereof, Osgood LLC became an indirect, wholly-owned subsidiary of the Corporation.

The consideration paid to Waterton pursuant to the Granite Creek Acquisition consisted of: (i) US$23 million in cash; (ii) 13,036,846 Common Shares at a deemed issue price of $2.60 per Common Share; (iii) 12,071,152 common share purchase warrants (the "Granite Creek Warrants"), with each warrant exercisable to acquire one Common Share at an exercise price of $3.64 per Common Share for a period of 36 months from the closing date of the Granite Creek Acquisition; and (iv) contingent value rights, including a payment to Waterton in the amount of US$5 million upon the public announcement of a positive production decision related to the Granite Creek Project (underground or open pit) and an additional payment of US$5 million upon production of the first ounce of gold (excluding ordinary testing and bulk sampling programs) following a 60 consecutive day period where gold prices have exceeded US$2,000 per ounce.

14

In September 2022, the Corporation paid to Waterton US$5 million as part of the contingent value rights payment due upon the public announcement of a positive production decision related to the Granite Creek Project.

First Equinox Top-Up

Equinox Gold exercised its participation right under the Support Agreement to acquire additional Common Shares in connection with the Granite Creek Acquisition. Pursuant to such exercise, on May 26, 2021, Equinox Gold subscribed for and purchased 5,479,536 Common Shares at a price of $2.60 per Common Share, for aggregate gross proceeds to the Corporation of approximately $14.2 million.

Equinox Gold also exercised its participation right under the Support Agreement in connection with the Ruby Hill Acquisition. See "General Development of the Business – Three Year History – Concurrent Financing – Second Equinox Top-Up" for more information.

Christison Acquisition

On December 15, 2020, Premier, Premier USA and the Corporation entered into a definitive purchase agreement with members of the Christison family and Seven Dot Cattle Co. LLC to acquire certain properties adjacent to the Granite Creek Project in Humboldt County, Nevada (the "Christison Acquisition"). The total purchase price under the Christison Acquisition was US$15 million, of which US$10 million was to be paid in cash and the remaining amount was to be satisfied with Common Shares at a price equal to the 10-day volume weighted average closing price immediately prior to the closing date of the Christison Acquisition.

In December 2020, Premier USA acquired a portion of the lands and claims comprising the Christison Acquisition through the payment of US$7.5 million in cash. On May 10, 2021, the Corporation completed the acquisition of the remaining lands and claims comprising the Christison Acquisition with the payment by the Corporation of US$2.5 million in cash and the issuance of 2,430,488 Common Shares at a deemed issue price of $2.5008 per Common Share.

The properties acquired in the Granite Creek Acquisition and the Christison Acquisition have been combined under the Granite Creek Project.

OTCQX Listing

On August 26, 2021, the Corporation announced that its application to OTC Markets Group, Inc. for the Common Shares to begin trading on the OTCQX® Best Market (the "OTCQX") had been accepted. The Common Shares commenced trading on the OTCQX at market open on August 26, 2021, under the ticker symbol "IAUCF".

Lone Tree Asset Exchange

On September 3, 2021, the Corporation, together with its wholly-owned subsidiaries, Dee LLC and Au-Reka LLC, entered into a definitive asset exchange agreement (the "Exchange Agreement") with Nevada Gold Mines LLC ("Nevada Gold"), pursuant to which the Corporation agreed to acquire, by way of asset exchange (the "Asset Exchange"), Nevada Gold's 100% ownership interest in the Lone Tree Project in exchange for the Corporation's (i) indirect 40% interest in the South Arturo mine located in Elko County, Nevada (the "South Arturo Mine") and (ii) option to acquire 100% interest in the exploration stage Rodeo Creek property located in Elko County, Nevada (the "Rodeo Creek Property"). Nevada Gold is a joint venture between Newmont Mining Corporation ("Newmont") and Barrick Gold Corporation ("Barrick") that is operated by Barrick, and, prior to the Asset Exchange, was the Corporation's joint venture partner at the South Arturo Mine. The Asset Exchange was completed on October 14, 2021.

Pursuant to the Exchange Agreement, the Corporation acquired a 100% interest in the Lone Tree Project from Nevada Gold in exchange for: (i) Dee LLC's 40% ownership interest in the South Arturo Mine, (ii) assignment of Au-Reka LLC's option to acquire the adjacent Rodeo Creek Property; (iii) contingent consideration of up to US$50 million based on production from the Lone Tree mine (as described below); and

15

(iv) arrangement of substitute bonding (and release of Nevada Gold bonds) in respect of the Lone Tree and Buffalo Mountain reclamation obligations at closing. The Corporation's interest in the Lone Tree Project is held through its subsidiary, Dee LLC.

The property acquired by the Corporation as part of the Lone Tree Project includes the past-producing Lone Tree mine, which is host to substantial processing infrastructure (including a whole ore autoclave), and the Buffalo Mountain gold deposits. In the event the Corporation restarts the processing of ore at Lone Tree, Nevada Gold will be entitled to receive the following contingent payments of up to US$50 million, subject to the terms and conditions of a contingent consideration agreement dated October 14, 2021, between the Corporation, Dee LLC and Nevada Gold:

•an amount equal to US$25.00 per recovered gold equivalent mineral reserve ounce identified in the feasibility study for the restart of mining at the Lone Tree mine ("Initial Contingent Consideration"), payable in two equal installments six months and 18 months following the later of: (i) commencement of commercial production at the Lone Tree mine, (ii) and the completion of such feasibility study; and

•an amount equal to US$25.00 per ounce of produced gold in excess of the number of recovered gold equivalent mineral reserve ounces (the "Continuing Contingent Consideration", together with the Initial Contingent Consideration, the "Contingent Consideration"), payable within five days after the end of each calendar quarter during which a payment of Continuing Contingent Consideration accrues, provided that the aggregate Contingent Consideration does not exceed US$50 million.

The Contingent Consideration is a registered real property interest which runs with the mineral properties comprising the Lone Tree Project.

At the closing of the Asset Exchange, Nevada Gold reimbursed the Corporation approximately US$7.3 million for amounts previously advanced by the Corporation for the autonomous truck haulage test work completed at South Arturo and for funds advanced by the Corporation that were not used for reclamation activities.

Nevada Gold Subscription Agreement

As a condition precedent to the closing of the Asset Exchange, Nevada Gold was required to participate in the Concurrent Financing (as defined below). Pursuant to a subscription agreement between the Corporation and Nevada Gold dated October 14, 2021, Nevada Gold subscribed for and purchased 22,757,393 Common Shares under the Concurrent Financing at the price of $2.62 per Common Share, for gross proceeds to the Corporation of approximately $59.6 million. Immediately following the completion of the Concurrent Financing, Nevada Gold owned approximately 9.90% of the issued and outstanding Common Shares, calculated on a non-diluted basis. See "General Development of the Business – Three Year History – Concurrent Financing".

Toll Milling Agreements

Concurrently with the closing of the Asset Exchange, the Corporation and Nevada Gold entered into two toll milling agreements, as described below.

•Autoclave Toll Milling Agreement: Pursuant to the autoclave toll milling agreement dated October 14, 2021, between Osgood LLC, Au-Reka LLC and Nevada Gold (the "Autoclave Toll Milling Agreement"), Nevada Gold agreed to process up to an aggregate of 1,000 tons/day of ore produced from the Granite Creek Project and the McCoy-Cove Project at its autoclave facilities, until the earlier of (i) the date the Lone Tree autoclave becomes fully operational, and (ii) October 14, 2024, subject to extension by mutual agreement between the parties. Ruby Hill LLC may in the future become party to the Autoclave Toll Milling Agreement, in which event ore produced from the Ruby Hill Project may also be processed at Nevada Gold's autoclave facilities.

•Roaster Toll Milling Agreement: Pursuant to the roaster toll milling agreement dated October 14, 2021, between Au-Reka LLC and Nevada Gold (the "Roaster Toll Milling Agreement"), Nevada Gold

16

agreed to process up to 750 tons/day of ore produced at the McCoy-Cove Project at its roaster facilities until October 14, 2031, subject to extension by mutual agreement between the parties.

Concurrent Financing

Concurrently with the closing of the Asset Exchange, on October 14, 2021, the Corporation closed a non-brokered private placement offering of 39,041,515 Common Shares at price of $2.62 per Common Share for aggregate gross proceeds of approximately $102.3 million (the "Concurrent Financing"). The issue price represents the five-day volume weighted average trading price of the Common Shares on the TSX ending on September 2, 2021, being the last trading date prior to the date of execution of the Exchange Agreement.

The Concurrent Financing included the participation of Nevada Gold as described under the heading "General Development of the Business – Three Year History – Lone Tree Asset Exchange – Nevada Gold Subscription Agreement". The Concurrent Financing also included the participation of Orion Mine Finance III as described under the heading "General Development of the Business – Three Year History – Orion and Sprott Financing Arrangements – Orion Subscription Agreement".

The Corporation used a portion of the proceeds from the Concurrent Financing to fund the cash portion of the purchase price for the Ruby Hill Acquisition (as defined below). The Corporation used the balance of the proceeds, together with other available funds, to pay for exploration and development expenses related to the Corporation's mining projects, refurbishment of the processing facility at Lone Tree and for working capital and general corporate purposes.

Second Equinox Top-Up

Equinox Gold exercised its participation right under the Support Agreement to maintain its pro rata ownership of Common Shares in connection with the Ruby Hill Acquisition. Pursuant to such exercise, on December 10, 2021, Equinox Gold subscribed for and purchased 4,800,000 Common Shares at a price of $2.62 per Common Share, for aggregate gross proceeds to the Corporation of approximately $12.6 million.

Shareholder approval was required in respect of Equinox Gold's subscription as well as the Orion Subscription Agreement, the Orion Convertible Loan, the Sprott Convertible Loan, the Transfer Fee Shares and the Orion Warrants (each as defined below) pursuant to Section 607(g)(i) of the TSX Company Manual. In reliance on the exemption from the requirement to hold a shareholder meeting in Section 604(d) of the TSX Company Manual, the Corporation obtained the required shareholder approval by written consent of shareholders of the Corporation holding in the aggregate more than 50% of the outstanding Common Shares.

Ruby Hill Acquisition

On September 3, 2021, the Corporation, together with Premier USA, entered into a membership interest purchase agreement with affiliates of Waterton (the "Ruby Hill Acquisition Agreement"), pursuant to which Premier USA agreed to acquire from Waterton all of the outstanding membership interests of Ruby Hill LLC, the 100% owner of the Ruby Hill Project (the "Ruby Hill Acquisition"). The Ruby Hill Acquisition closed on October 15, 2021, and upon closing thereof, Ruby Hill LLC became an indirect, wholly-owned subsidiary of the Corporation.

Under the terms of the Ruby Hill Acquisition Agreement, the consideration paid to Waterton consisted of: (i) US$75 million in cash; (ii) 3,191,358 Common Shares at a deemed issue price of $3.1237 per Common Share; and (iii) milestone payment rights, pursuant to which Waterton is entitled to receive up to an additional US$67 million upon the occurrence of certain milestones.

The milestone payment rights were granted pursuant to a milestone payment rights agreement entered into at the closing of the Ruby Hill Acquisition, which provides for the following milestone payments:

•US$17 million in cash and/or Common Shares, payable on the earlier of 60 days following the issuance of a press release by the Corporation regarding the completion of a new or updated mineral resource estimate for the Ruby Hill Project or 15 months after the closing date of the Ruby Hill

17

Acquisition, based on the market price of the Common Shares at the time of such payment (the "First Milestone Payment");

•US$15 million in cash and/or Common Shares payable on the earlier of 60 days following the issuance of a press release by the Corporation regarding the completion of a feasibility study for the Ruby Hill Project or 24 months after the closing date of the Ruby Hill Acquisition, based on the market price of the Common Shares at the time of such payment (the "Second Milestone Payment");

•US$15 million in cash and/or Common Shares payable on the earlier of 30 months after the closing date of the Ruby Hill Acquisition and 90 days following the announcement by the Corporation of a construction decision related to a deposit on any portion of the Ruby Hill Project that is not currently being mined, based on the market price of the Common Shares at the time of such payment (the "Third Milestone Payment"); and

•US$20 million in cash and/or Common Shares payable on the earlier of 36 months after the closing date of the Ruby Hill Acquisition and 90 days following the announcement by the Corporation of achieving commercial production related to a deposit on any portion of the Ruby Hill Project that is not currently being mined, priced based on the market price of the Common Shares at the time of such payment (the "Fourth Milestone Payment").

Up to 50% of each milestone payment may consist of Common Shares, provided that the number of Common Shares then held by Waterton after giving effect to the share issuance shall not exceed 9.99% of the then issued and outstanding Common Shares, calculated on a partially diluted basis.

In January 2023, the Corporation exercised the early prepayment option and paid to Waterton total consideration of US$27.0 million in satisfaction of the First Milestone Payment and Second Milestone Payment. Consideration paid to Waterton consisted of US$11.0 million in cash and 5,515,313 Common Shares. The Corporation may prepay the aggregate of the Third and Fourth Milestone Payments by paying to Waterton, on or before 24 months following the closing date of the Ruby Hill Acquisition, US$20 million (provided that up to US$10 million of such amount may be satisfied, at the Corporation's option, in Common Shares, based on the market price of the Common Shares at the time of such prepayment), provided that the number of Common Shares then held by Waterton after giving effect to the share issuance shall not exceed 9.99% of the then issued and outstanding Common Shares, calculated on a partially diluted basis.

Orion and Sprott Financing Arrangements

In connection with the Asset Exchange and the Ruby Hill Acquisition, the Corporation entered into a series of financing arrangements with affiliates of Orion Mine Finance II and Orion Mine Finance III (collectively, "Orion") and certain investment funds managed by Sprott Inc. (collectively, "Sprott"), for aggregate proceeds of US$135 million in addition to Orion's subscription under the Concurrent Financing, and an accordion option to potentially access up to an additional US$100 million (the "Financing Package").

The Financing Package in its aggregate consisted of:

•an equity subscription agreement dated October 14, 2021, between the Corporation and Orion Mine Finance Fund III LP ("Orion Fund III"), an affiliate of Orion Mine Finance III (the "Orion Subscription Agreement"), providing for Orion's participation in the Concurrent Financing;

•a convertible credit agreement dated December 13, 2021, between the Corporation, as borrower, Premier USA, Osgood LLC and Ruby Hill LLC, as guarantors, OMF Fund III (F) Ltd. ("OMF F"), an affiliate of Orion Mine Finance III, as administrative agent and lender, and the other lenders from time to time party thereto (the "Orion Convertible Credit Agreement");

•a convertible credit agreement dated December 10, 2021, between the Corporation, as borrower, Premier USA, Osgood LLC and Ruby Hill LLC, as guarantors, Sprott Hathaway Special Situations Fund Master Fund LP ("Sprott Hathaway"), as administrative agent, SAF Sub Holdings, LLC ("SAF Holdings")

18

and SAF Bullion Sub, LLC ("SAF Bullion"), as lenders, and the other lenders from time to time party thereto (the "Sprott Convertible Credit Agreement");

•an amended and restated offtake agreement dated December 13, 2021, between Dee LLC, as seller, the Corporation, Premier USA, Au-Reka LLC, Osgood LLC, Ruby Hill LLC and Premier Gold Mines Nevada Inc., as guarantors, OMF O, as purchaser and purchasers' agent, OMF Fund III (Cr) Ltd. ("OMF CR"), an affiliate of Orion Mine Finance III, as purchaser, and the other purchasers from time to time party thereto (the "Amended and Restated Offtake Agreement");

•a silver purchase and sale agreement dated December 13, 2021, between the Corporation, as seller, Premier USA, Osgood LLC and Ruby Hill LLC, as guarantors, OMF Fund III (HG) Ltd. ("OMF HG"), an affiliate of Orion Mine Finance III, as purchaser and purchasers' agent, and the other purchasers from time to time party thereto (the "Silver Purchase Agreement"); and

•a gold prepay purchase and sale agreement dated December 13, 2021, between the Corporation, as seller, Premier USA, Osgood LLC and Ruby Hill LLC, as guarantors, OMF HG, as administrative agent and buyer, and the other buyers from time to time party thereto (the "Gold Prepay Agreement").

The following is a description of each component of the Financing Package.

Orion Subscription Agreement

On October 14, 2021, the Corporation entered into the Orion Subscription Agreement with Orion Fund III, an affiliate of Orion, pursuant to which Orion subscribed for and purchased 7,500,000 Common Shares under the Concurrent Financing for aggregate gross proceeds of approximately $19.6 million. See "General Development of the Business – Three Year History – Concurrent Financing".

Under the Orion Subscription Agreement, the Corporation also granted Orion a participation right to maintain its pro rata equity position in the Corporation. The Orion Subscription Agreement provides that, for so long as Orion holds at least 5% of the Common Shares (calculated on a non-diluted basis), Orion will have the right to participate in any offerings of Common Shares, or securities convertible into, or exchangeable for, Common Shares, on the same terms and conditions and at the same price at which such securities are offered for issue or sale to other purchasers, so as to maintain its proportionate interest in the Corporation.

Orion Convertible Loan

On December 13, 2021, the Corporation and certain of its subsidiaries entered into the Orion Convertible Credit Agreement with OMF F, an affiliate of Orion, pursuant to which Orion made available and advanced to the Corporation an unsecured convertible loan in the principal amount of US$50 million (the "Orion Convertible Loan"). The Orion Convertible Loan bears interest at a rate of 8.0% per annum and matures on December 13, 2025 (the "Orion Maturity Date").

The outstanding initial principal amount under the Orion Convertible Loan, and any accrued interest thereon, may, at Orion's option, be converted into Common Shares at any time, and from time to time, prior to the earlier of (a) the business day preceding the Orion Maturity Date, and (b) the date of repayment in full of the principal amount of the Orion Convertible Loan and all accrued and unpaid interest thereon, at a price per Common Share, (i) in the case of the outstanding initial principal, equal to 125% of the issue price, being $3.275 per Common Share (the "Conversion Price"), and (ii) in the case of accrued and unpaid interest, equal to the volume-weighted average trading price of the Common Shares on the TSX for the five trading days immediately preceding the conversion of such interest, subject to the approval of the TSX. Commencing on April 12, 2022, if at any time the volume-weighted average trading price of the Common Shares on the TSX is equal to or exceeds 150% of the Conversion Price for a period 20 consecutive trading days, then for the three trading days following such period, the Orion Convertible Loan will be convertible at the Corporation's option. The number of Common Shares to be issued upon conversion of the Orion Convertible Loan will be calculated based on the outstanding principal and accrued interest amount at the time of conversion. Any portion of the Orion Convertible Loan that is not converted into Common Shares will be due and payable in cash on the Orion Maturity Date.

19

The Canadian dollar equivalent of the US$50 million principal of the Orion Convertible Loan was deemed to be $63.5 million (as determined in accordance with the Orion Convertible Credit Agreement). If the initial principal amount of the Orion Convertible Loan is converted in full, at the Conversion Price, an aggregate of 19,389,313 Common Shares (the "Orion Conversion Shares") will be issued to Orion.

Sprott Convertible Loan

As part of the Financing Package, on December 10, 2021, the Corporation and certain of its subsidiaries also entered into the Sprott Convertible Credit Agreement with Sprott Hathaway, SAF Holdings and SAF Bullion, each of whom is an affiliate of Sprott, pursuant to which Sprott made available and advanced to the Corporation an unsecured convertible loan in the principal amount of US$10 million (the "Sprott Convertible Loan") on the same terms as the Orion Convertible Loan. The Sprott Convertible Loan bears interest at a rate of 8.0% per annum and matures on December 9, 2025 (the "Sprott Maturity Date").

The outstanding initial principal amount under the Sprott Convertible Loan, and any accrued interest thereon, may, at Sprott's option, be converted into Common Shares at any time, and from time to time, prior to the earlier of (a) the business day preceding the Sprott Maturity Date, and (b) the date of repayment in full of the principal amount of the Sprott Convertible Loan and all accrued and unpaid interest thereon, at a price per Common Share, (i) in the case of the outstanding initial principal, equal to the Conversion Price, and (ii) in the case of accrued and unpaid interest, equal to the volume-weighted average trading price of the Common Shares on the TSX for the five trading days immediately preceding the conversion of such interest, subject to the approval of the TSX. Commencing on April 9, 2022, if at any time the volume-weighted average trading price of the Common Shares on the TSX is equal to or exceeds 150% of the Conversion Price for a period 20 consecutive trading days, then for the three trading days following such period, the Sprott Convertible Loan will be convertible at the option of the Corporation. The number of Common Shares to be issued upon conversion of the Sprott Convertible Loan will be calculated based on the outstanding principal and accrued interest amount at the time of conversion. Any portion of the Sprott Convertible Loan that is not converted into Common Shares will be due and payable in cash on the Sprott Maturity Date.

The Canadian dollar equivalent of the US$10 million principal of the Sprott Convertible Loan was deemed to be approximately $12.64 million (as determined in accordance with the Sprott Convertible Credit Agreement). If the initial principal amount of the Sprott Convertible Loan is converted in full, at the Conversion Price, an aggregate of 3,860,152 Common Shares (the "Sprott Conversion Shares") will be issued to Sprott.

Amended and Restated Offtake Agreement

On December 13, 2021, the Corporation and its subsidiaries entered into the Amended and Restated Offtake Agreement with OMF O and OMF CR, each an affiliate of Orion, in connection with the Asset Exchange. The Amended and Restated Offtake Agreement replaces the i-80 Offtake Agreement, and applies to any mineral project in which an i-80 group entity, directly or indirectly, held an interest as of December 13, 2021, including, but not limited to, the Granite Creek Project, the McCoy-Cove Project and the Ruby Hill Project, but excluding the Lone Tree Project. The term of the Amended and Restated Offtake Agreement is from the date of the agreement until December 31, 2028.

Under the Amended and Restated Offtake Agreement, the Annual Gold Quantity is (i) up to an aggregate of 29,750 ounces of refined gold in respect of the 2021 calendar year (net of the ounces of refined gold delivered by Premier under the Premier Offtake Agreement from January 1, 2021 to April 7, 2021, and by the Corporation under the i-80 Offtake Agreement from April 7, 2021 to December 31, 2021), (ii) up to an aggregate of 37,500 ounces of refined gold in respect of the 2022 and 2023 calendar years, and (iii) up to an aggregate of 40,000 ounces of refined gold in respect of any calendar year after 2023. If the Corporation produces less than the applicable Annual Gold Quantity in any given year, its delivery obligations under the Amended and Restated Offtake Agreement are limited to those ounces of refined gold actually produced.

In addition, pursuant to the i-80 Offtake Agreement, the Corporation was required to pay a transfer fee (the "Transfer Fee") of US$1.75 million to OMF O as a result of the sale and transfer of the Corporation's interest in the South Arturo Mine to Nevada Gold pursuant to the Asset Exchange. On October 21, 2021, the

20

Corporation satisfied its obligation to pay the Transfer Fee by issuing 839,799 Common Shares (the "Transfer Fee Shares") to OMF O at the price of $2.62 per Common Share.

In December 2021, OMF O and OMF CR assigned all of their respective right, title and interest under the Amended and Restated Offtake Agreement to affiliates of Trident Royalties PLC.

New Silver Purchase Agreement

On December 13, 2021, the Corporation and certain of its subsidiaries entered into the Silver Purchase Agreement with OMF HG, an affiliate of Orion, pursuant to which Orion agreed to provide a senior secured deposit of US$30 million to the Corporation in consideration for the Corporation agreeing to deliver to Orion silver from the Granite Creek and Ruby Hill Projects, subject to the terms and conditions contained therein.

Under the Silver Purchase Agreement, commencing on April 30, 2022, in exchange for a US$30 million prepayment, the Corporation will be required to deliver to Orion 100% of the silver production from the Granite Creek Project and 100% of the silver production from the Ruby Hill Project until the delivery of 1.2 million ounces of silver, after which the delivery will be reduced to 50% of the silver production from the Granite Creek Project and the Ruby Hill Project until the delivery of 2.5 million ounces of silver (including deliveries previously made to Orion), after which the delivery will be reduced to 10% of the silver production solely from Ruby Hill Project. The Corporation will be required to deliver the following minimum amounts of refined silver from the Granite Creek Project and the Ruby Hill Project to Orion in each calendar year until at least 1.2 million ounces of refined silver in the aggregate has been delivered to Orion:

| Year | Refined Silver Delivery Obligation | ||||

| 2022 | 300,000 ounces | ||||

| 2023 | 400,000 ounces | ||||

| 2024 | 400,000 ounces | ||||

| 2025 | 100,000 ounces | ||||

At the Corporation's sole option, the obligation to make up any shortfall of the amounts noted above may be satisfied by the delivery of refined gold instead of refined silver, at a ratio of 1/75th ounce of refined gold for each ounce of refined silver, on the terms and conditions outlined in the Silver Purchase Agreement.

Orion will purchase the refined silver from the Corporation at an ongoing cash purchase price equal to 20% of the prevailing silver price. Pursuant to the Silver Purchase Agreement, the Corporation is required to comply with certain covenants, including maintaining a specified annual metal delivery coverage ratio.

Upon a construction decision for the Ruby Hill Project, comprised of one or both of the Ruby Deeps or Blackjack deposits, which construction decision shall be based on a feasibility study in form and substance satisfactory to Orion, acting reasonably, the Corporation will have the right to request an additional deposit from Orion in the amount of US$50 million in accordance with the terms of the Silver Purchase Agreement.

As security for the payment of its obligations under the Silver Purchase Agreement, the Corporation granted a continuing security interest over the assets relating to the Granite Creek Project and the Ruby Hill Project.

Gold Prepay Agreement

On December 13, 2021, the Corporation and certain of its subsidiaries entered into the Gold Prepay Agreement with OMF HG, an affiliate of Orion, pursuant to which Orion will make available to the Corporation a senior secured gold prepayment in the amount of US$45 million on account of the future delivery by the Corporation to Orion of an aggregate of 32,000 ounces of refined gold. Under the Gold Prepay Agreement (as amended on April 12, 2022), the Corporation delivered to Orion 1,600 troy ounces of gold in respect of the first delivery, 3,100 troy ounces of gold for the calendar quarter ending June 30, 2022 and

21

thereafter is required to deliver, 2,100 troy ounces of gold per calendar quarter until September 30, 2025, in satisfaction of the US$45 million prepayment. As the funding from Orion did not occur until April 13, 2022, payment for the delivery of 1,600 ounces for the quarter ending March 31, 2022 was offset against the US$45 million of proceeds received from Orion.

Upon a positive construction decision by the Corporation for both (i) the processing facilities at the Lone Tree Project, and (ii) any two of the following: the Ruby Hill underground development (including one or both of the Ruby Deeps or Blackjack deposits), the Granite Creek open pit development or the McCoy-Cove Project, in all cases based on a feasibility study in form and substance satisfactory to Orion, acting reasonably, the Corporation will have the right to request an increase in the US$45 million prepayment by an additional amount not exceeding US$50 million in aggregate in accordance with the terms of the Gold Prepay Agreement.

As security for the payment of its obligations under the Gold Prepay Agreement, the Corporation granted a continuing security interest over the assets relating to the Granite Creek Project and the Ruby Hill Project.

Additionally, in connection with the Gold Prepay Agreement, the Corporation issued to OMF HG warrants to purchase up to 5,500,000 Common Shares (the "Orion Warrants"). Each Orion Warrant is exercisable for one Common Share at an exercise price of $3.275 per Common Share until December 13, 2024. The number and exercise price of Orion Warrants are subject to customary anti-dilution provisions.

Granite Creek Expansion

In May 2022, the Corporation entered into an agreement with Nevada Gold to acquire strategic land sections ("Granite Creek Expansion Property") adjoining the Granite Creek Project. The Granite Creek Expansion Property increased the size the of the Granite Gold Creek Project package by approximately 1,280 acres.

Total consideration for the purchase of the Granite Creek Expansion Property consisted of a cash payment of US$4 million and the inclusion of the acquired Granite Creek Expansion Property into the existing 10% net profits royalty that Nevada Gold currently holds on the existing Granite Creek Project.

Listing on NYSE American

The Common Shares commenced trading on the NYSE American at market open on May 19, 2022, under the ticker symbol "IAUX". Subsequently, the Common Shares were delisted from the OTCQX.

Change of Auditor

In conjunction with its NYSE American listing, the Corporation changed its auditor from Grant Thornton LLP (Canada) to Grant Thornton LLP (USA) effective December 5, 2022.

Recent Developments

Private Placement of Convertible Debentures

On February 22, 2023, the Corporation completed a "best efforts" private placement (the "Convertible Debenture Offering") of US$65 million principal amount of secured convertible debentures of the Corporation (the "Convertible Debentures"). The Convertible Debentures bear a fixed interest of 8.00% per annum and will mature on February 22, 2027, being the date that is four years from the closing date of the private placement (the "Maturity Date"). The principal amount of the Convertible Debentures are convertible at the holder's option into Common Shares at a conversion price equal to US$3.38 per Common Share (the "Debenture Conversion Price"). The Corporation will have the option but not the obligation to pay interest in Common Shares which shall be priced at the greater of (i) 90% of the average of the closing price of the Common Shares as measured in U.S. dollars on the NYSE American exchange during the ten business days leading up to the interest payment, or (ii) the volume weighted average trading price of the Common Shares listed on TSX during the five trading days immediately preceding the relevant date, less the TSX permitted discount.

22

In addition, if at any time the daily volume weighted average price of the Common Shares as measured in U.S. dollars on the NYSE American exchange equals or exceeds 150% of the Debenture Conversion Price per share for 20 consecutive trading days ("Trading Period") commencing 120 days after the closing date of the Convertible Debenture Offering, the Corporation shall have the right within three trading days after such Trading Period to have all of the principal amount outstanding under the Convertible Debentures converted into Common Shares at the Debenture Conversion Price.

The Convertible Debentures are senior unsecured obligation of the Corporation, and are secured on a limited recourse basis by Premier USA, the Corporation's wholly-owned subsidiary, with recourse limited to a pledge of all present and future limited liability company units issued by its wholly-owned subsidiary, Au-Reka LLC. The Convertible Debentures are guaranteed on a full recourse basis by Au-Reka LLC which is secured by a first ranking security over all of Au-Reka LLC's present and future real and personal property (including the McCoy-Cove Project). The Convertible Debentures are not redeemable prior to the Maturity Date; provided, however, that, if the Corporation has not executed the security documents relating to the security being provided in connection with the Convertible Debenture Offering within 90 days from the closing date of the Convertible Debenture Offering, the Corporation shall be obligated to repurchase the Convertible Debentures, by the date that is 120 days from the closing date of the Convertible Debenture Offering, at a price equal to 100% of the principal amount of the Convertible Debentures then outstanding plus any accrued and unpaid interest thereon up to and including the date of redemption.

Paycore Arrangement

On February 27, 2023, the Corporation announced the proposed acquisition of all of the issued and outstanding common shares (the "Paycore Shares") of Paycore Minerals Inc. ("Paycore") pursuant to a statutory plan of arrangement under the Business Corporations Act (Ontario) (the "Paycore Arrangement"). Paycore owns the FAD property, located in Eureka County, Nevada, located south of, and adjoining the Ruby Hill Project.