As confidentially submitted to the U.S. Securities and Exchange Commission on January 31, 2024.

This draft registration statement has not been publicly filed with the Securities and Exchange Commission and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM F-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

NOVA MINERALS LIMITED

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s Name into English)

| Australia | 1040 | Not Applicable | ||

(State or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Suite 5, 242 Hawthorn Road,

Caulfield, Victoria 3161

Australia

+61 3 9537 1238

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Alaska Range Resources, LLC

Christopher Gerteisen

1150 S Colony Way, Suite 3

Palmer, AK 99645

(907) 707-6564

(Names, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Jeffrey Fessler Sheppard, Mullin, Richter & Hampton LLP 30 Rockefeller Plaza New York, NY 10112-0015 (212) 653-8700 |

Rob Condon Dentons US LLP 1221 Avenue of the Americas New York, NY 10020 (212) 768-6700 | |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED January 31, 2024 |

American Depositary Shares Representing Ordinary Shares

Nova Minerals Limited

We are offering American depositary shares, or ADSs, in the United States, representing ordinary shares of Nova Minerals Limited (“Nova Minerals” or the “Company”) in a firm commitment offering. Each ADS represents ordinary shares, no par value, deposited with the Bank of New York Mellon, as depositary. Prior to this offering, there has been no public market for ADSs representing our ordinary shares. We have applied to list the ADSs on the Nasdaq Capital Market under the symbol “NVAM”. The closing of this offering is contingent upon the successful listing of the ADSs on the Nasdaq Capital Market

Our ordinary shares are listed on the Australian Securities Exchange, or ASX, under the symbol “NVA” and quoted on the OTCQB market under the symbol “NVAAF” and Frankfurt Stock Exchange under the symbol “QM3”. On , 2024, the last reported sale price of our ordinary shares on the ASX was A$ per ordinary share. The ASX price per ordinary share on , 2024, is equivalent to a price of US$ per ADS, after giving effect to the Australian dollar/U.S. dollar exchange rate of A$1.00 to US$ which was the noon buying rate of the Federal Reserve Bank of New York on , 2024, and an ADS-to-ordinary share ratio of 1 to . We have estimated the offering price range between US$ and US$ per ADS and the assumed initial public offering price is the midpoint of this range, or US$ per ADS. The actual initial public offering price per ADS will not be determined by any particular formula but will rather be determined through negotiations between us and the underwriters at the time of pricing. Therefore, the assumed initial public offering price used throughout this prospectus may not be indicative of the final initial offering price.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 13 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per ADS | Total | |||||||

| Initial public offering price | US$ | US$ | ||||||

| Underwriting discounts and commissions(1) | US$ | US$ | ||||||

| Proceeds to us, before expenses | US$ | US$ | ||||||

| (1) | Underwriting discounts and commissions do not include a non-accountable expense allowance equal to 1.0% of the initial public offering price payable to the underwriters. We refer you to “Underwriting” beginning on page 101 for additional information regarding underwriters’ compensation. |

We have granted a 45-day option to the representative of the underwriters to purchase up to additional ADSs solely to cover over-allotments, if any.

The underwriters expect to deliver the ADSs to purchasers on or about , 2024.

ThinkEquity

The date of this prospectus is , 2024

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. Neither we, nor the underwriters have authorized anyone to provide you with different information. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus, or any free writing prospectus, as the case may be, or any sale of ordinary shares.

For investors outside the United States: Neither we, nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ordinary shares and the distribution of this prospectus outside the United States.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, you are cautioned not to give undue weight to this information.

Notes on Prospectus Presentation

Numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them. Certain market data and other statistical information contained in this prospectus are based on information from independent industry organizations, publications, surveys and forecasts. Some market data and statistical information contained in this prospectus are also based on management’s estimates and calculations, which are derived from our review and interpretation of the independent sources listed above and our internal research. While we believe such information is reliable, we have not independently verified any third-party information and our internal data has not been verified by any independent source.

| i |

Our reporting currency and our functional currency is the Australian dollar. This prospectus contains translations of Australian dollars into U.S. dollars at specific rates solely for the convenience of the reader. Unless otherwise noted, all translations from Australian dollars into U.S. dollars in this prospectus were made at a rate of A$1.00 per US$● which was the noon buying rate of the Federal Reserve Bank of New York on , 2024. We make no representation that the Australian dollar or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Australian dollar, as the case may be, at any particular rate or at all.

All references in the prospectus to “U.S. dollars,” “dollars,” “US$” and “$” are to the legal currency of the United States and all references to “A$” are to the legal currency of Australia.

TECHNICAL MINING INFORMATION AND TERMS

Cautionary Note Regarding Presentation of Mineral Reserve and Mineral Resource Estimates

The Securities and Exchange Commission (the “SEC”) adopted new mineral property disclosure requirements in subpart 1300 of Regulation S-K (the “S-K 1300”) effective January 2021 that are applicable to all mining companies filing registration statements with the SEC. These rules better align disclosure with international regulatory practices, including the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia (“JORC”). However, while the definitions in S-K 1300 are more similar to those in JORC compared to the previous SEC disclosure rules, there are differences in the definitions and standards under S-K 1300 and JORC. Investors are therefore cautioned that public disclosure by us of mineral resources in Australia in accordance with JORC (as required by ASX Listing Rules) does not form a part of this Registration Statement on Form F-1.

We have inferred, indicated, and measured mineral resources but not mineral reserves. Investors should understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. An inferred mineral resource has a lower level of confidence than that applying to an indicated or measured mineral resource and may not be converted to a mineral reserve.

We are still in the exploration stage and our planned commercial operations have not yet commenced. There is currently no commercial production at the Estelle Gold Project site. We have completed a technical report summary in compliance with S-K 1300, however we have not yet completed a Preliminary Economic Assessment (PEA), or started a Feasibility Study (FS) on the Estelle Gold Project. As such, our estimated proven or probable mineral reserves, expected mine life and gold pricing, as the case may be, cannot be determined at this time as the feasibility studies, drilling and pit design optimizations have not yet been undertaken.

You are cautioned that, except for that portion of mineral resources classified as mineral reserves, mineral resources do not have demonstrated economic value. Inferred mineral resources have a high degree of uncertainty as to their existence and as to whether they can be economically or legally mined. Under S-K 1300, estimates of inferred mineral resources may not form the basis of an economic analysis. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. A significant amount of exploration must be completed in order to determine whether an inferred mineral resource may be upgraded to a higher category. Therefore, you are cautioned not to assume that all or any part of an inferred mineral resource can be economically or legally mined, or that it will ever be upgraded to a higher category. Likewise, you are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be upgraded to mineral reserves.

Qualified Persons Statement

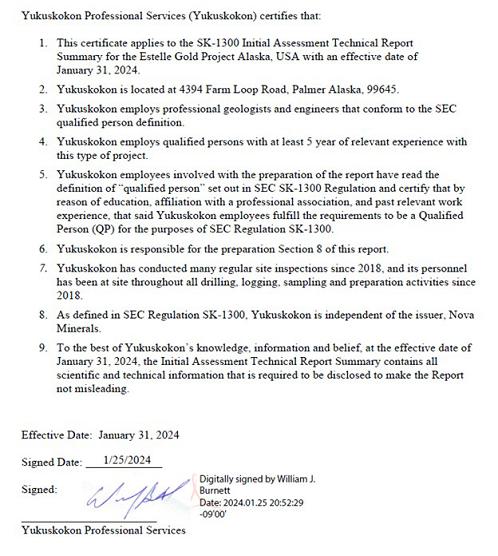

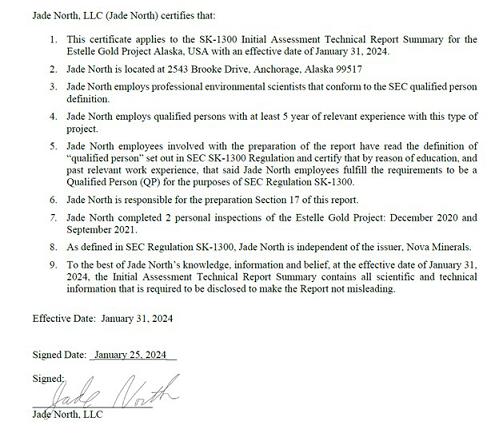

Some technical mining information contained herein with respect to the Estelle Gold Project is derived from the report titled “Initial Assessment Technical Report Summary Estelle Gold Project Alaska, USA” prepared for us with an effective date of January 31, 2024. We refer to this report herein as our S-K 1300 Report. Each of Roughstock Mining Services, LLC, Hans Hoffman of Nova Minerals Ltd., Yukuskokon Professional Services, Vannu Khounphakdee of Nova Minerals Ltd., METS Engineering, Matrix Resource Consultants Pty Ltd., Christopher Gerteisen of Nova Minerals Ltd., and Jade North, LLC have approved and verified the technical mining information related to the Estelle Gold Project contained in the S-K 1300 Report and reproduced in this prospectus.

| ii |

Glossary of Mining Terms

The following is a glossary of certain mining terms that may be used in this prospectus.

| Ag | Silver. | |

| Alluvial | A placer formed by the action of running water, as in a stream channel or alluvial fan; also said of the valuable mineral (e.g. gold or diamond) associated with an alluvial placer. | |

| As | Arsenic | |

| Assay | A metallurgical analysis used to determine the quantity (or grade) of various metals in a sample. | |

| Au | Gold | |

| BFS | Bankable Feasibility Study | |

| Bi | Bismuth | |

| Callie-style | Mineralization characterized by coarse and readily visible gold occurring in quartz veins hosted in carbonaceous siltstone. | |

| Claim | A mining right that grants a holder the exclusive right to search and develop any mineral substance within a given area. | |

| Concentrate | A clean product recovered in flotation, which has been upgraded sufficiently for downstream processing or sale. | |

| Core drilling | A specifically designed hollow drill, known as a core drill, is used to remove a cylinder of material from the drill hole, much like a hole saw. The material left inside the drill bit is referred to as the core. In mineral exploration, cores removed from the core drill may be several hundred to several thousand feet in length. | |

| Cu | Copper. | |

| Cut-off grade | When determining economically viable mineral reserves, the lowest grade of mineralized material that can be mined and processed at a profit. | |

| Deposit | An informal term for an accumulation of mineralization or other valuable earth material of any origin. | |

| Diamond drill | A rotary type of rock drill that cuts a core of rock that is recovered in long cylindrical sections, two centimeters or more in diameter. | |

| Dilational structure | structures composed of mechanisms whose only degree of freedom corresponds to dilation. | |

| Drift | A horizontal or nearly horizontal underground opening driven along a vein to gain access to the deposit. | |

| Dyke | A long and relatively thin body of igneous rock that, while in the molten state, intruded a fissure in older rocks. |

| iii |

| En-echelon | Structures within rock caused by noncoaxial shear. | |

| Exploration | Prospecting, sampling, mapping, diamond drilling and other work involved in searching for ore. | |

| Flotation | A milling process in which valuable mineral particles are induced to become attached to bubbles and float as others sink. | |

| FS | A Feasibility Study is a comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable Modifying Factors together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a Pre-Feasibility Study. | |

| Grade | Term used to indicate the concentration of an economically desirable mineral or element in its host rock as a function of its relative mass. With gold, this term may be expressed as grams per tonne (g/t) or ounces per tonne (opt). | |

| Greywacke | A variety of sandstone generally characterized by its hardness, dark color, and poorly sorted angular grains of quartz, feldspar, and small rock fragments set in a compact, clay-fine matrix. | |

| Ha | Hectare - An area totaling 10,000 square meters or 2.47 acres. | |

| Indicated Mineral Resource | An Indicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit | |

| Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation | ||

| An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve. | ||

| Inferred Mineral Resource | An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply, but not verify, geological and grade or quality continuity. | |

| An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. | ||

| Km | Kilometre(s). Equal to 0.62 miles. | |

| Lithologic | The character of a rock formation, a rock formation having a particular set of characteristics. | |

| M | Meter(s). Equal to 3.28 feet. | |

| Mafic | Igneous rocks composed mostly of dark, iron- and magnesium-rich minerals. | |

| Massive | Said of a mineral deposit, especially of sulfides, characterized by a great concentration of mineralization in one place, as opposed to a disseminated or vein-like deposit. | |

| Measured Mineral Resource | Part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

| iv |

| Metallurgy | The science and art of separating metals and metallic minerals from their ores by mechanical and chemical processes. | |

| Mineral | A naturally occurring homogeneous substance having definite physical properties and chemical composition and, if formed under favorable conditions, a definite crystal form. | |

| Mineral Deposit | A mass of naturally occurring mineral material, e.g. metal ores or nonmetallic minerals, usually of economic value, without regard to mode of origin. | |

| Mineralization | A natural occurrence in rocks or soil of one or more yielding minerals or metals. | |

| Mineral Project | The term “mineral project” means any exploration, development or production activity, including a royalty or similar interest in these activities, in respect of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base, precious and rare metals, coal, and industrial minerals. | |

| Mineral Resource | A concentration or occurrence of diamonds, natural, solid, inorganic or fossilized organic material including base and precious metals, coal and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. | |

| Mo | Molybdenum | |

| Moz | Million ounces. | |

| Mt | Metric tonne. Metric measurement of weight equivalent to 1,000 kilograms or 2,204.6 pounds . | |

| Net Smelter Royalty | The aggregate proceeds received from time to time from any arm’s length smelter or other arm’s length purchaser from the sale of any ores, concentrates, metals or other material of commercial value, net of expenses. | |

Ore |

Mineralized material that can be extracted and processed at a profit. | |

| Ounce | A measure of weight in gold and other precious metals, correctly troy ounces, which weigh 31.2 grams as distinct from an imperial ounce which weigh 28.4 grams. | |

| PEA | Preliminary Economic Assessment. A study, other than a pre-feasibility or feasibility study, that includes an economic analysis of the potential viability of mineral resources. | |

| Pegmatite | An igneous rock, formed by slow crystallization at high temperature and pressure at depth, and exhibiting large interlocking crystals usually greater in size than 2.5 cm (1 in). | |

| PFS | Preliminary Feasibility Study. A Preliminary Feasibility Study is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on the Modifying Factors and the evaluation of any other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be converted to a Mineral Reserve at the time of reporting. A Pre-Feasibility Study is at a lower confidence level than a Feasibility Study. |

| v |

| Probable Mineral Reserve | The mineable part of an indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve. | |

| Proven Mineral Reserve | The term “proven mineral reserve” is the economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors. | |

| Qualified Person | An individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development, production activities and project assessment, or any combination thereof, including experience relevant to the subject matter of the project or report and is a member in good standing of a self-regulating organization. | |

| Reclamation | Restoration of mined land to original contour, use, or condition where possible. | |

| Sb | Antimony | |

| Sedimentary | Said of rock formed at the Earth’s surface from solid particles, whether mineral or organic, which have been moved from their position of origin and re-deposited, or chemically precipitated. | |

| Strike | The direction, or bearing from true north, of a vein or rock formation measure on a horizontal surface. | |

| Te | Tellurium | |

| Tenement | A mineral claim. | |

| Tonne | A metric ton of 1,000 kilograms (2,205 pounds). | |

| μm | Micrometer. | |

| W | Tungsten |

| vi |

The following summary highlights certain information in this prospectus and should be read together with the more detailed information and financial data and statements contained elsewhere in this prospectus. This summary does not contain all of the information that may be important to you. You should read and carefully consider the following summary together with the entire prospectus, especially the “Risk Factors” section of this prospectus and our financial statements and the notes thereto appearing elsewhere in this prospectus before deciding to invest in our Company. For more information on our business, refer to the “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” sections of this prospectus. Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in the “Risk Factors” and other sections of this prospectus. See “Cautionary Note Regarding Forward-Looking Statements”.

As used herein, references to the “S-K 1300 Report” are to the technical report summary titled “Initial Assessment Technical Report Summary Estelle Gold Project, Alaska, USA” prepared by Roughstock Mining Services, LLC, Nova Minerals Limited, Matrix Resource Consultants Pty Ltd, METS Engineering, Yukuskokon Professional Services and Jade North, LLC “ with an effective date of January 31, 2024, which was prepared in accordance with S-K 1300. The S-K 1300 Report is filed as Exhibit 96.1 to the registration statement of which this prospectus forms a part.

In this prospectus, “we,” “us,” “our,” “the Company,” “Nova” and similar references refer to Nova Minerals Limited and its consolidated subsidiaries.

Our Company

Overview

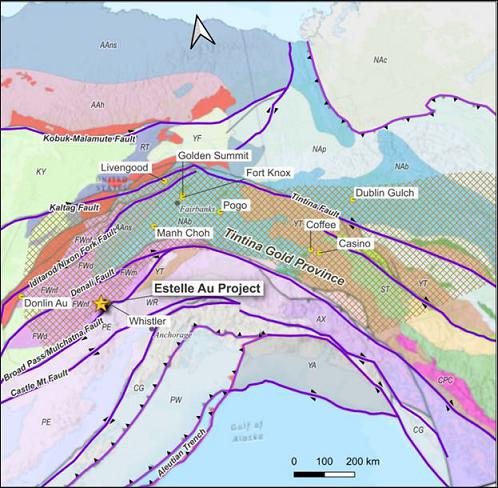

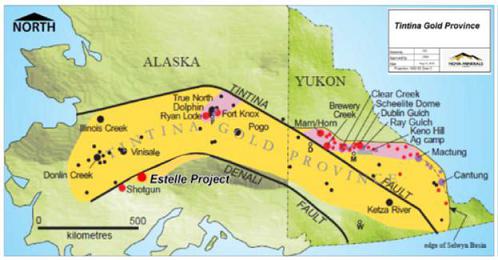

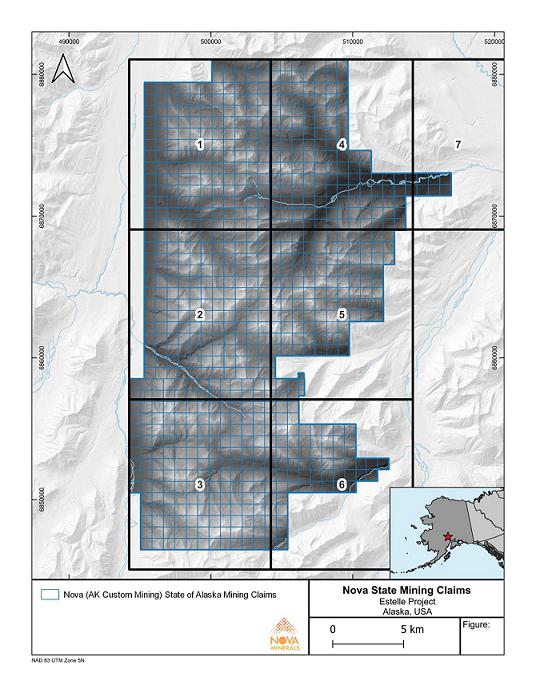

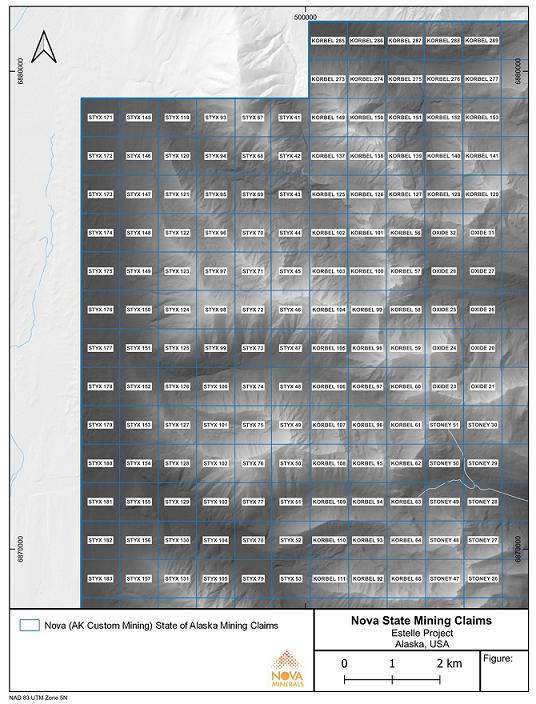

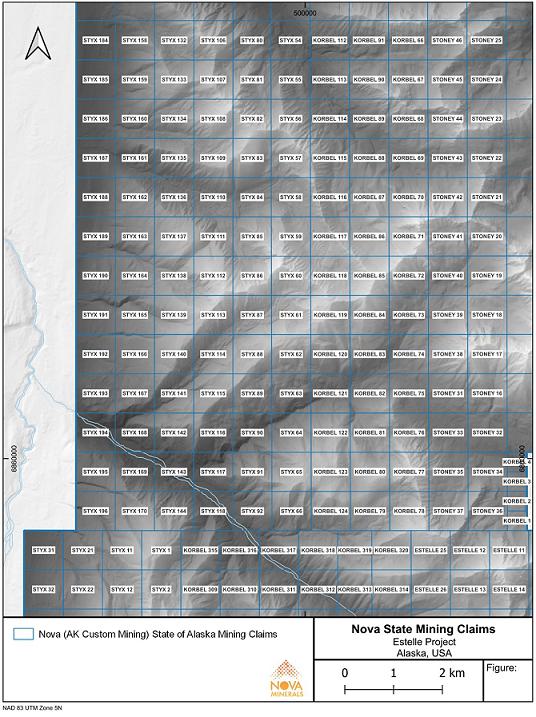

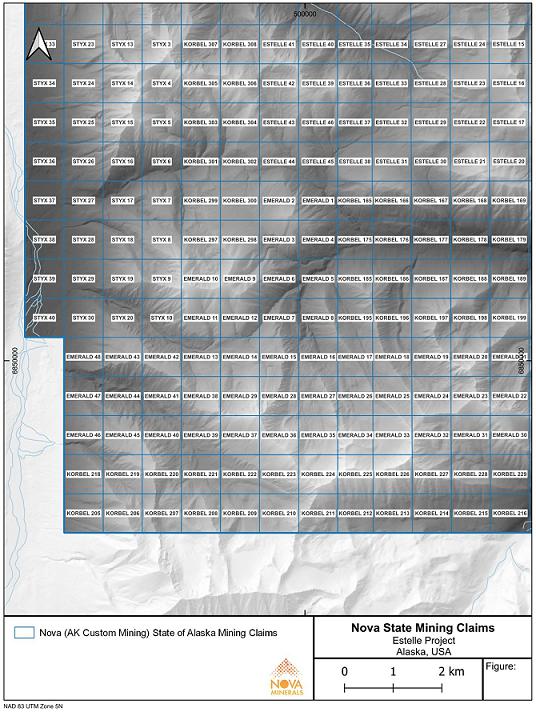

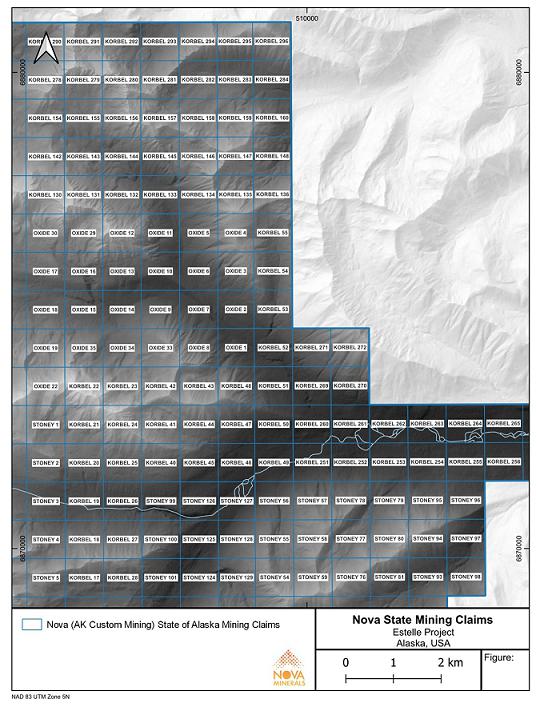

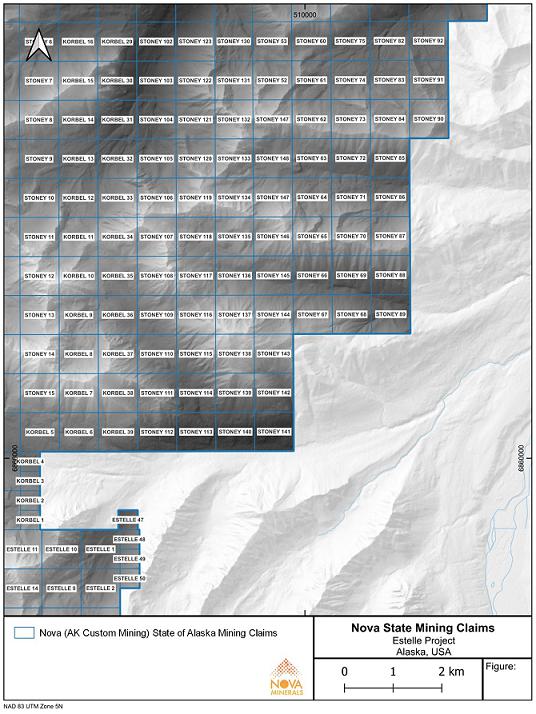

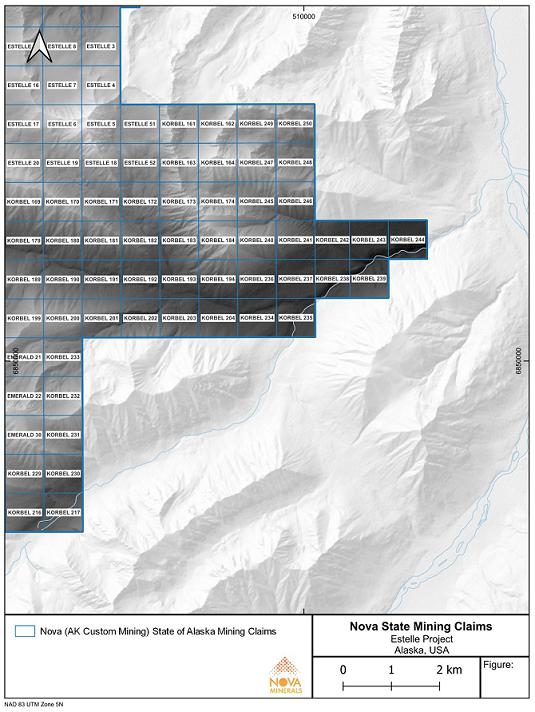

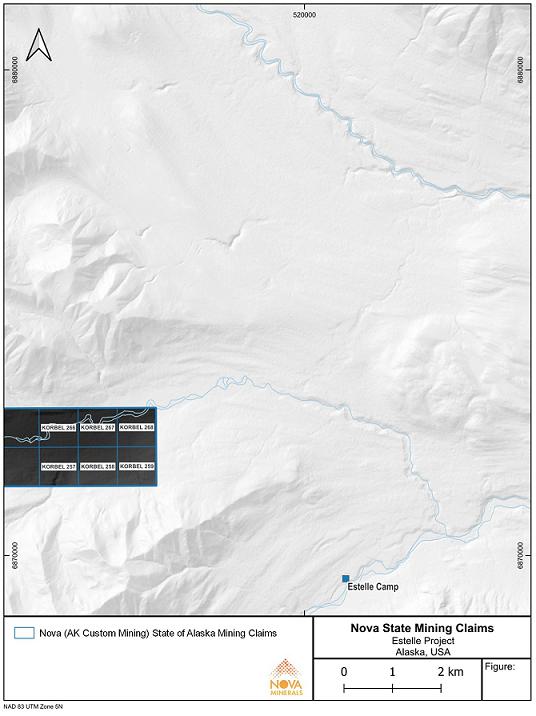

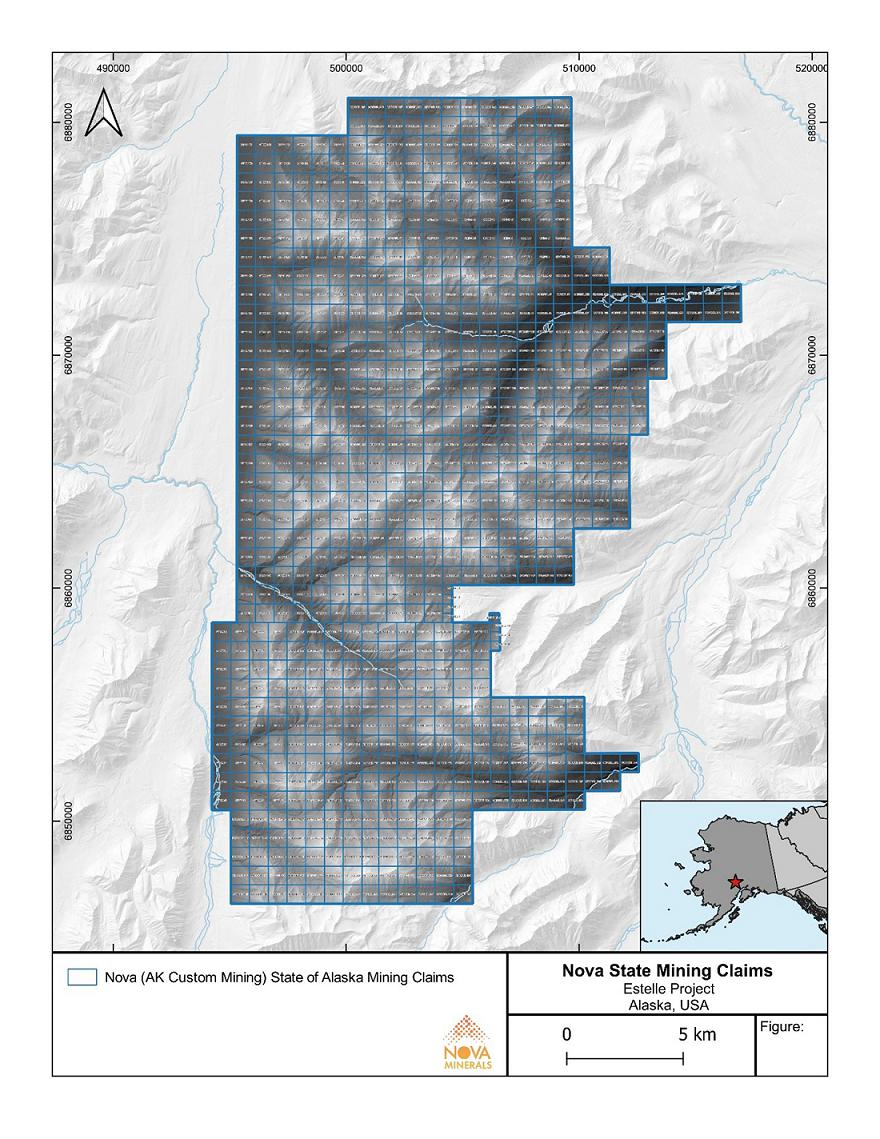

We are an exploration stage company, and our flagship project is the Estelle Gold Project located in Alaska. We have no operating revenues and do not anticipate generating revenues in the foreseeable future. However, we expect to complete our first gold pour in late 2028, although there is no assurance that we will meet that timeframe and consummation of any such commercial production is subject to the risks described herein under “Risk Factors.” The Estelle Gold Project, or the Project, which is 85% owned by us, contains multiple mining complexes across a 35km long mineralized corridor of over 20 identified gold prospects, including two already defined multi-million ounce resources across four deposits containing a combined S-K 1300 compliant 5.17 million ounce (“Moz”) Au, of which Nova’s 85% attributable interest is 4.41 Moz Au. The Project, which is comprised of 513km2 of unpatented mining claims located on State of Alaska public lands, is situated on the Estelle Gold Trend in Alaska’s prolific Tintina Gold Belt, a province which hosts a 220 Moz documented gold endowment and some of the world’s largest gold mines and discoveries including Victoria Gold’s Eagle Mine and Kinross Gold Corporation’s Fort Knox Gold Mine.

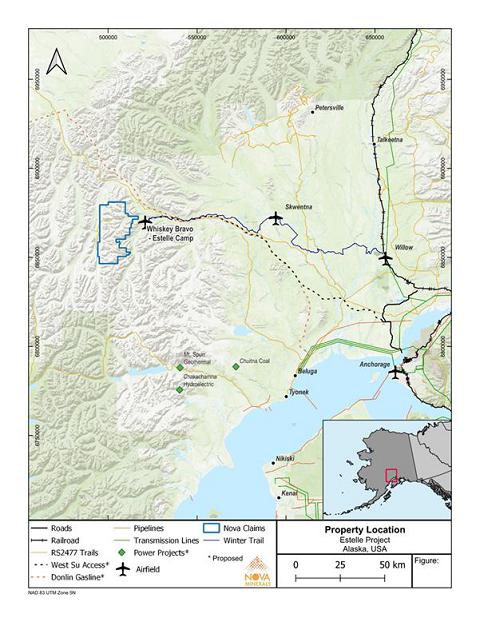

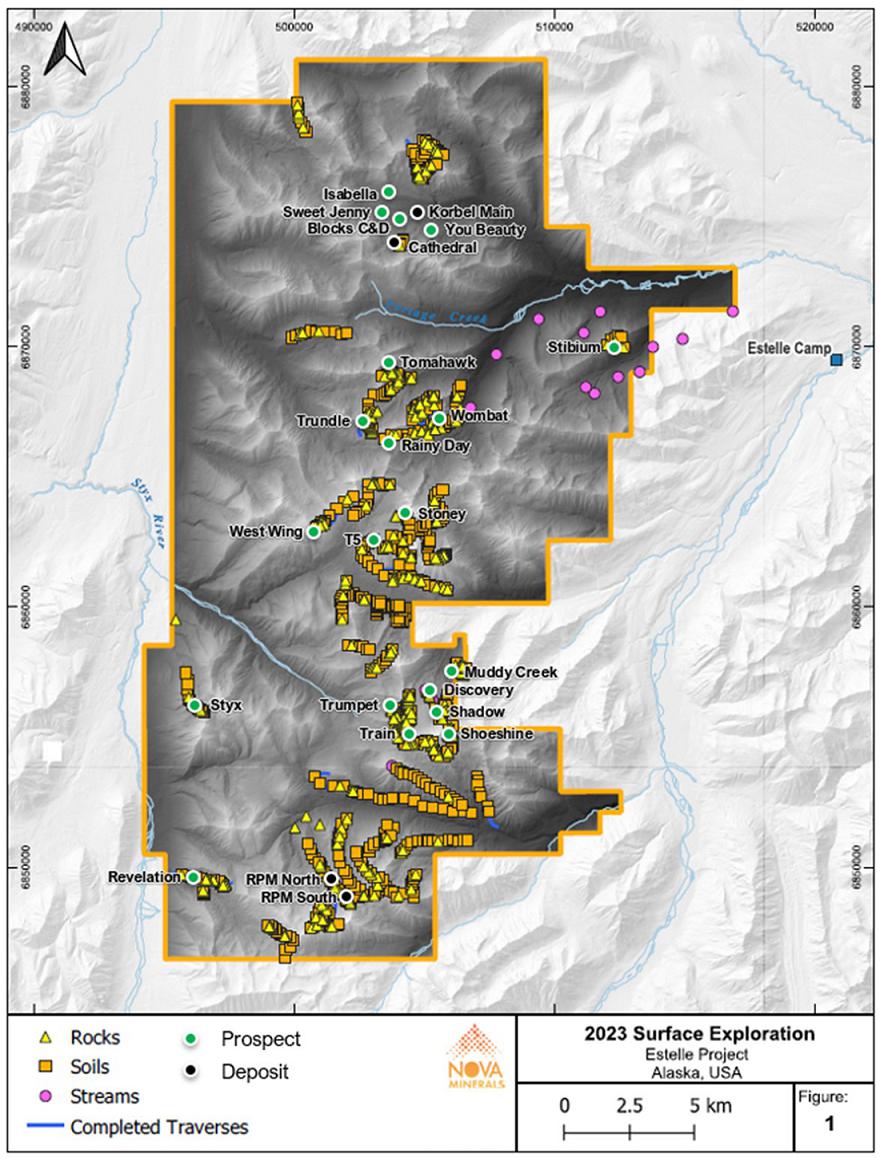

Figure 1: Nova’s flagship Estelle Gold Project is located within Alaska’s prolific Tintina Gold Belt.

The Estelle Gold Project

The following information is condensed and extracted from the S-K 1300 Report. Readers should refer to the full text of the S-K 1300 Report for further information regarding the Estelle Gold Project.

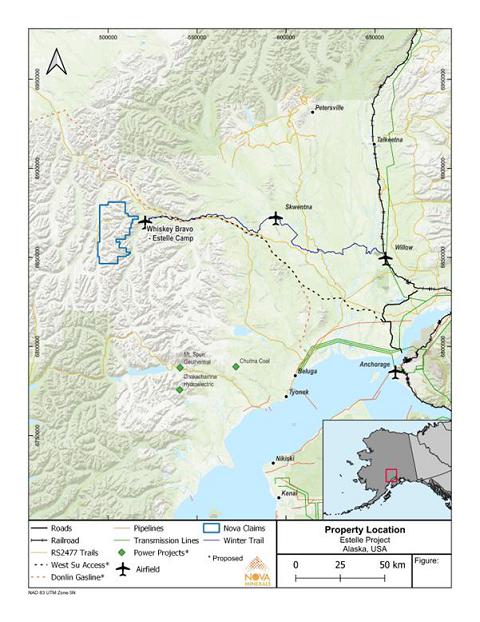

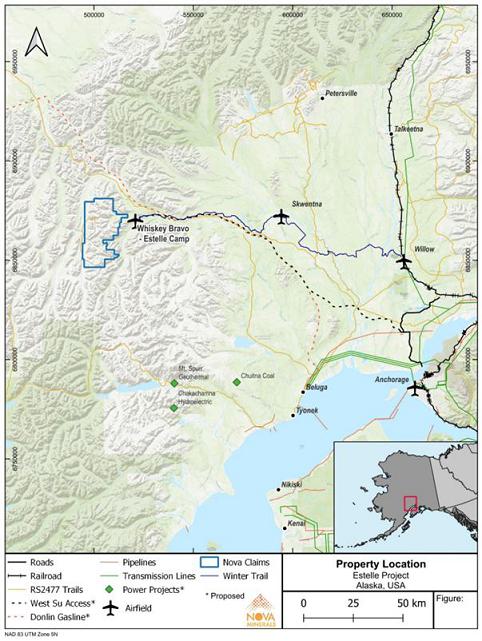

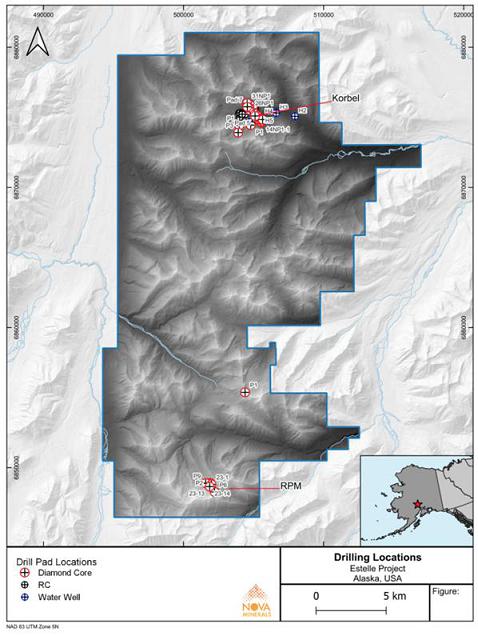

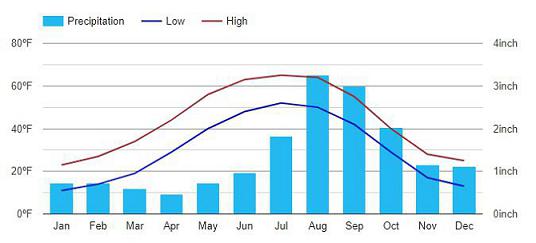

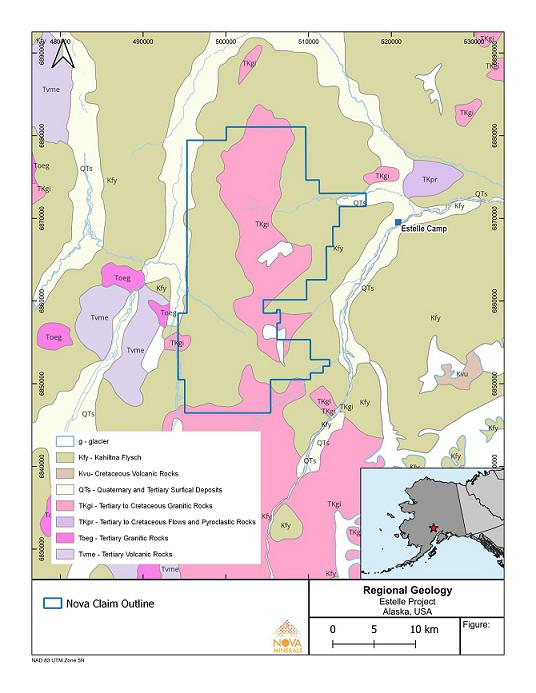

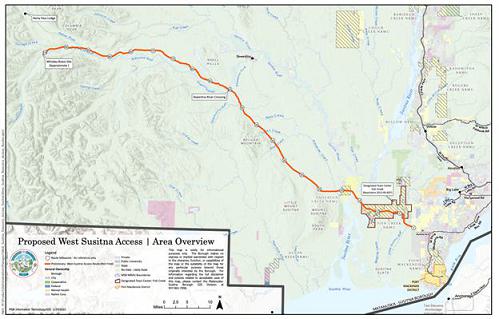

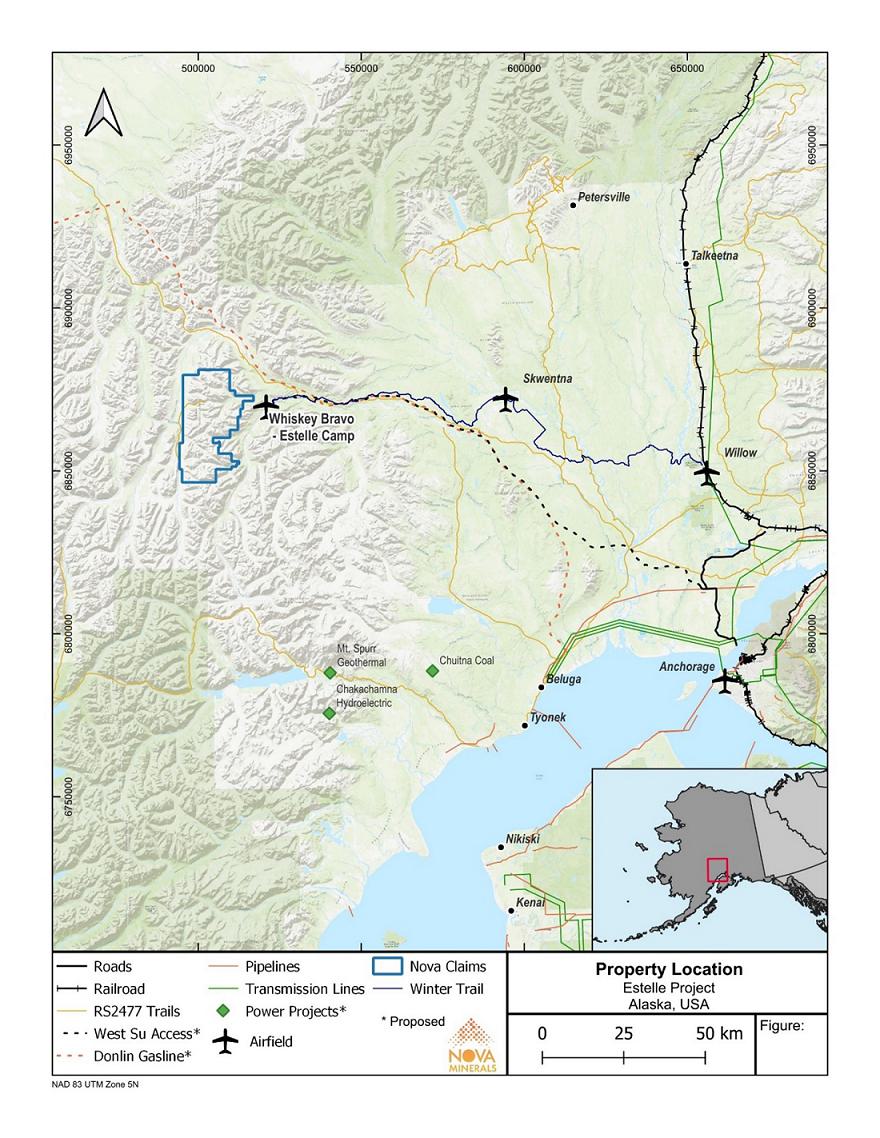

Project Description, Location and Access

The Estelle Gold Project, which is located approximately 150km northwest of Anchorage, Alaska, is a year-round operation, near a large labor force and all essential services with a base site which hosts a fully winterized 80-person camp, including an on-site sample processing facility and the 4,000-foot Whiskey Bravo airstrip, which can facilitate large capacity DC3 type aircraft. Easy access is currently available to the project via a winter road and by air. We anticipate access to be improved further by the recently proposed West Susitna Access Road, which would be situated on State land within the Matanuska-Susitna Borough. The West Susitna Access Road has considerable support from both the community and the State government, and has progressed to the permitting stage, with construction proposed to start in 2025.

| 1 |

Figure 2: Location map of the Estelle Gold Project with infrastructure solutions shown

| 2 |

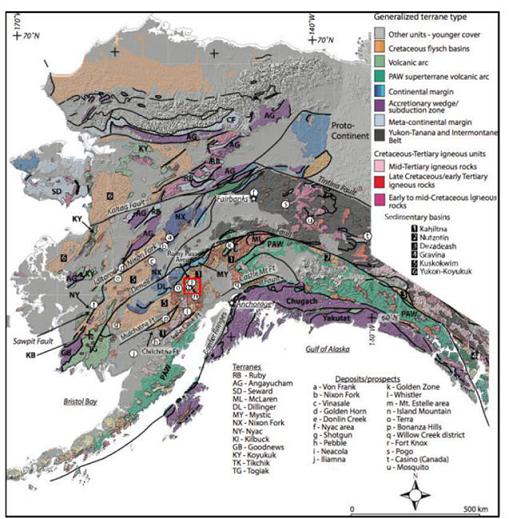

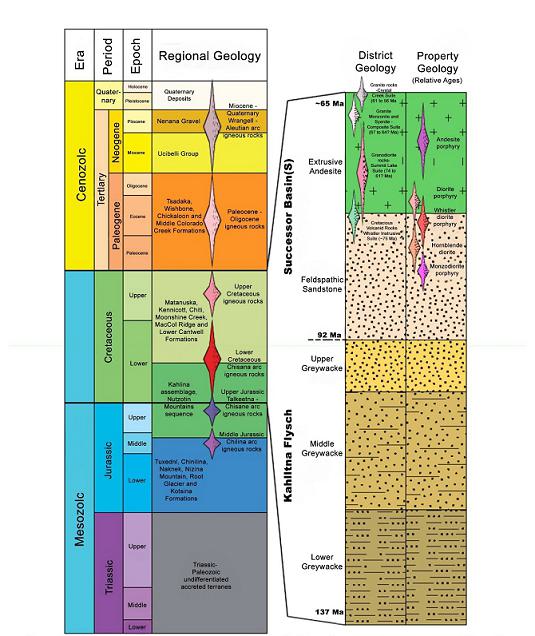

Geological Setting

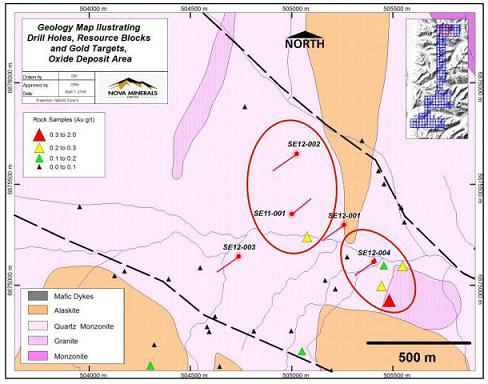

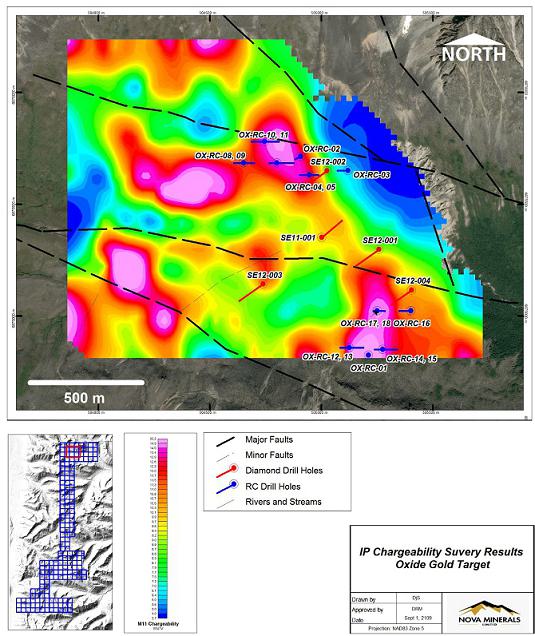

The Estelle Gold Project is located in the Alaskan Mountain Range in the southwestern extremity of the Tintina Gold Province, comprising Cambrian to Devonian deep-water basinal shales and sandstones. Both the terrane and the Tintina Gold Province terminate on the Broad Pass/ Mulchatna Fault Zone, near the Estelle Gold Project’s southern property boundary.

Within the property, lie the Mesozoic marine sedimentary rocks of the Kahiltna terrane. Regionally, these marine rocks were intruded by several plutons. The Mount Estelle pluton has been dated at 65 to 66 Ma. This pluton is compositionally zoned and is made up of a granite core transitioning to quartz monzonite, quartz monzodiorite, augite monzodiorite, diorite, and lamprophyric mafic and ultramafic rocks. The intrusion contains xenoliths of metasedimentary country rocks into which it was intruded. Tourmaline and beryl have been observed in, and adjacent to the pluton. The rock surrounding the Mt. Estelle pluton has undergone contact metamorphism and is locally hornfelsed. There is red staining which likely indicates disseminations of pyrite along fracture faces. Adjacent to the pluton, local sericite and clay alteration is also found.

The Estelle pluton is cut by several dikes which range in composition from aplite, gabbro, dacite, and lamprophyre. These structures are found in the felsic and intermediate phases of the pluton. Gold, associated with pyrrhotite, chalcopyrite, pentlandite and molybdenite also occurs in ultramafic rocks on the south side of the pluton. Mineralization is less common in the sedimentary rocks.

Anomalous gold, platinum-group elements, copper, chrome, nickel and arsenic are reported from many of the composite plutons of the Yentna trend and gold and platinum-group-element placers have been worked at several sites downstream from the plutons.

The high grade RPM deposit within the Estelle Gold Project lies within a plutonic complex intruding a Jurassic to Early Cretaceous flysch sequence. The intrusive complex consists of ultramafic to felsic plutons of Late Cretaceous/Early Tertiary age (69.7 Ma) and are centrally located in a region of arc-magmatic related gold deposits. Though mineralization at Estelle is generally restricted to the intrusive rocks, mineralization at RPM occurs in both the intrusive and hornfels. At RPM, roof pendants of hornfels occur overlying multiple intrusive units. Fingers of fine-grained aplite, monzonite and biotite-rich diorite cut the hornfels. All of the lithologic units are in turn cut by stockwork and/or sheeted veins. Veins range in size and character from meter-wide quartz ± sulfide to millimeter-scale quartz-arsenopyrite veins and centimeter-scale quartz-tourmaline-sulfide veins. A granitic intrusive body, which underlies the hornfels and crops out in the southern part of the prospect area appears to be potentially related to mineralization.

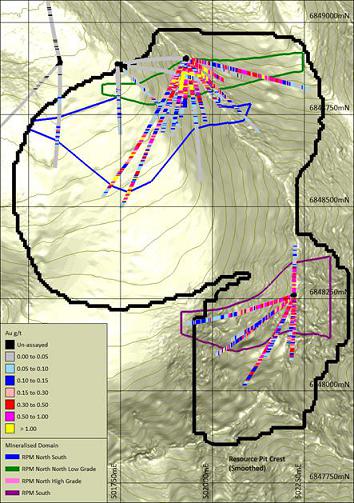

Mineralization and Deposit Types

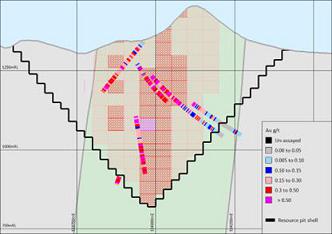

The deposits on the Estelle Gold Project are all large near-surface Intrusion Related Gold Systems (IRGS), and since 2018 we have been aggressively and systematically exploring the multiple prospects within the project area. To date, we have proven a total S-K 1300 compliant mineral resource estimate of 5.17 Moz Au, of which Nova’s 85% attributable interest is 4.41 Moz Au, which is hosted within 4 mineral resource deposits:

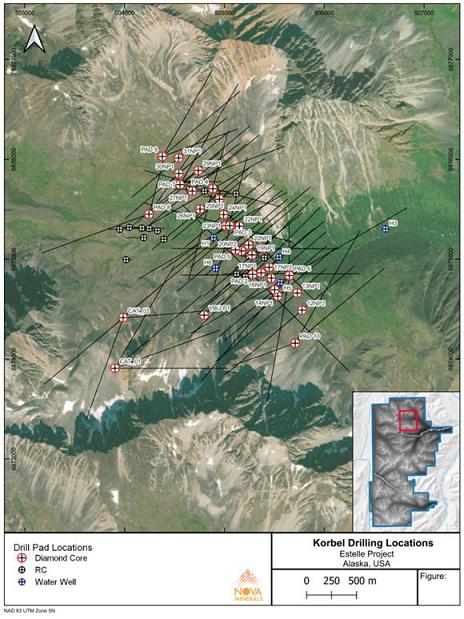

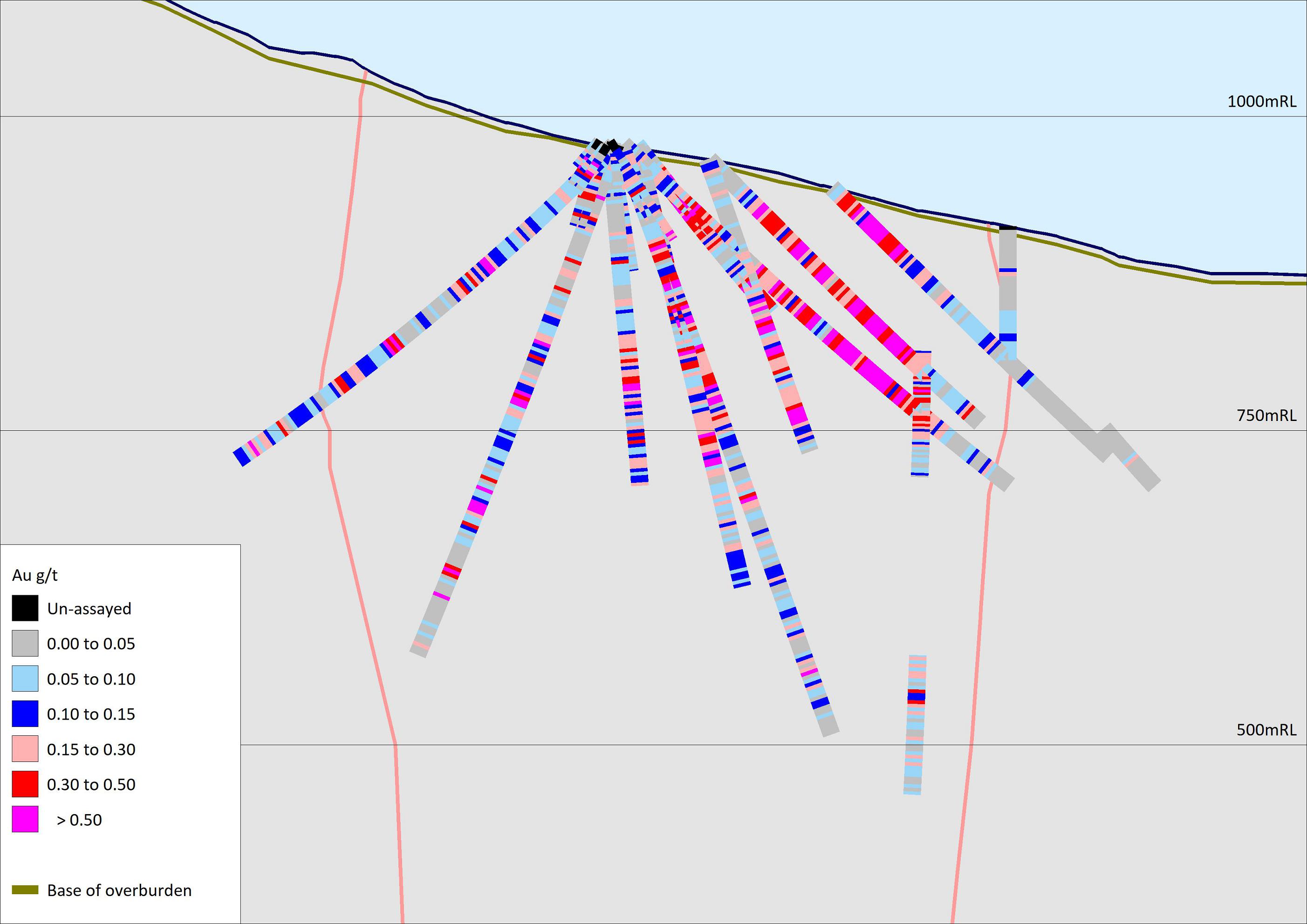

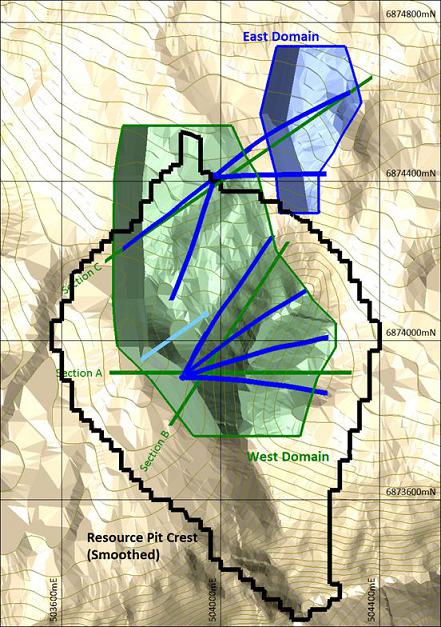

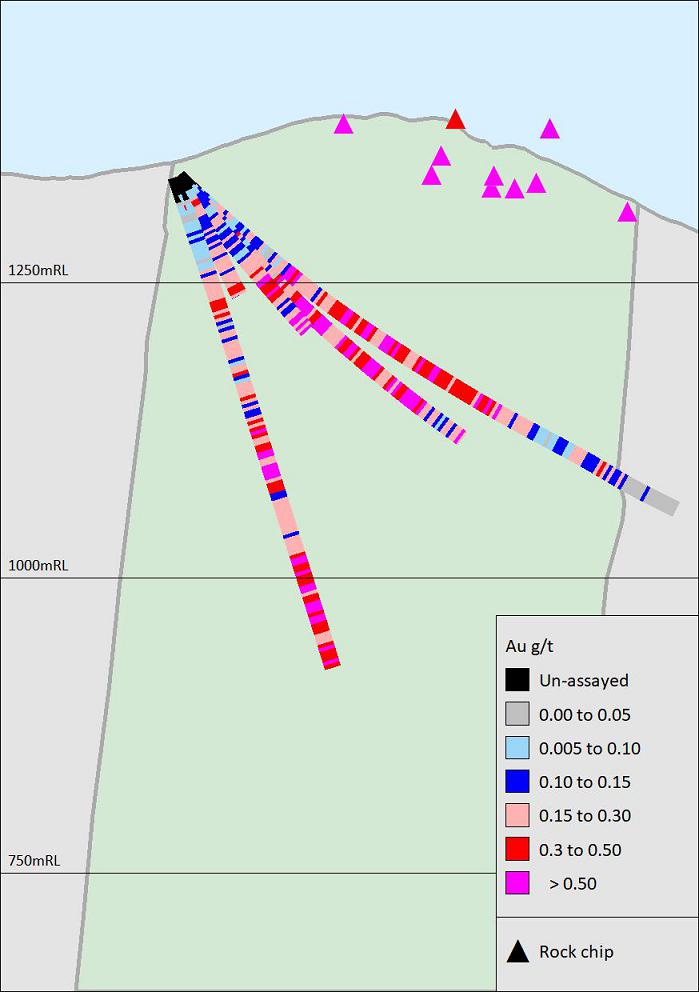

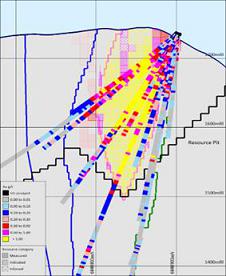

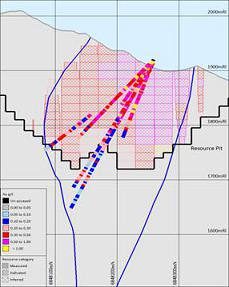

| ● | Korbel Main: A bulk tonnage deposit, located in the Korbel area in the North of the project, which has a confirmed strike length of over 2.5km and up to 500m depth, and remains open with significant potential to further extend the mineralization. | |

| ● | Cathedral: Another bulk tonnage deposit located nearby and similar to Korbel Main. An initial maiden Inferred resource has confirmed a strike length of at least 800m and 350m wide. The deposit remains wide open in all directions and the potential for high-grade zones exist with up to 114 g/t Au in surface rock chip samples. | |

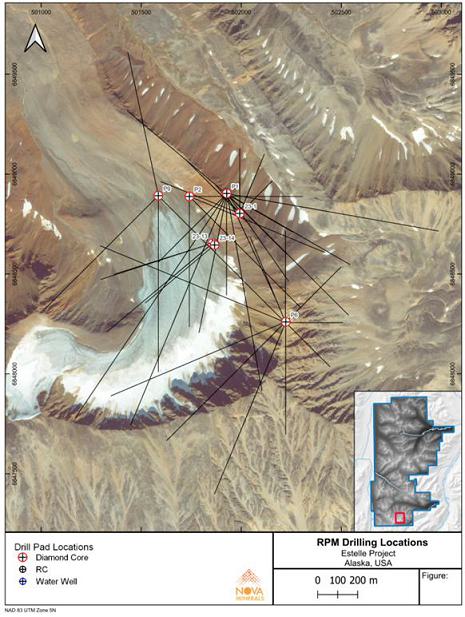

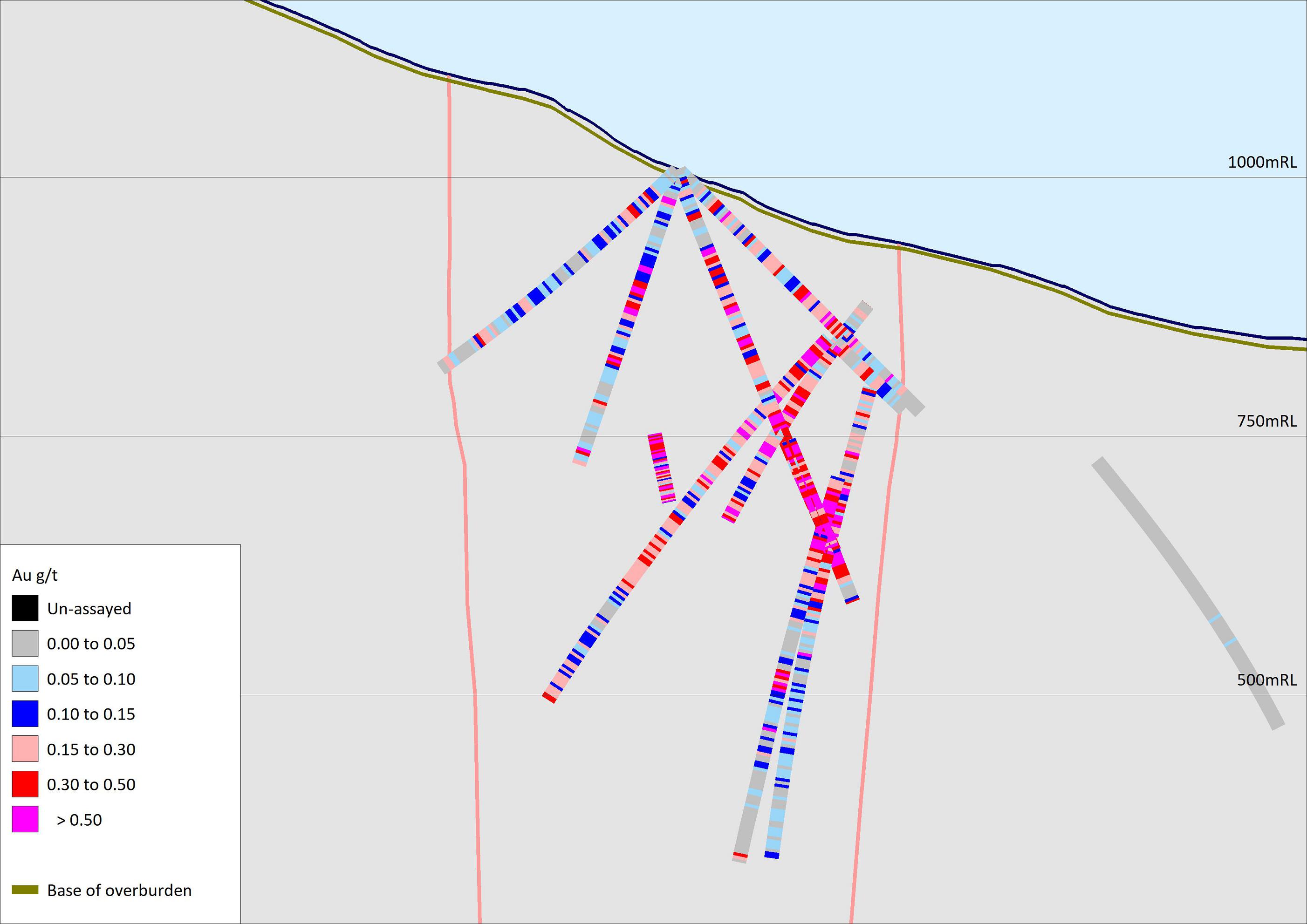

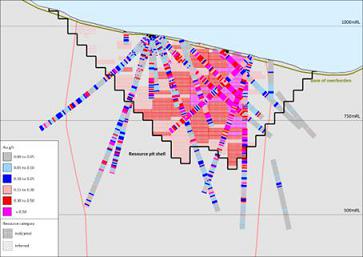

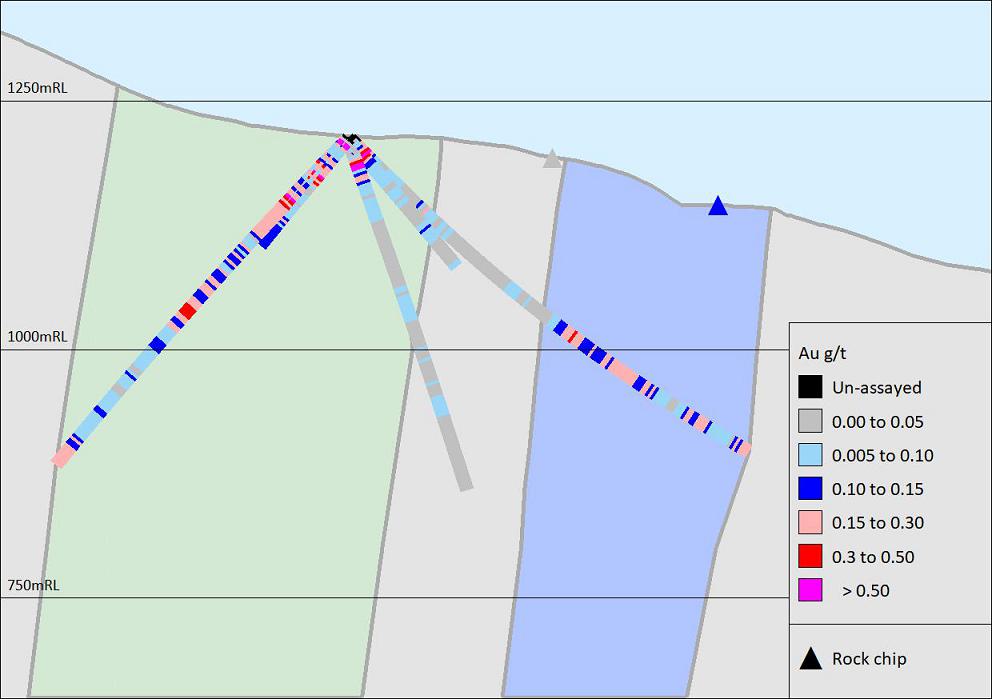

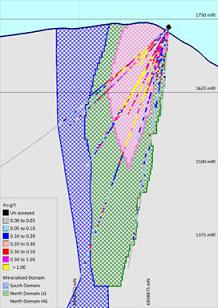

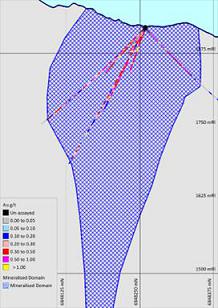

| ● | RPM North: A high-grade deposit, located in the RPM area in the South of the project, which has a 450m strike length and 150m width, defined by close spaced resource drilling, and remains open. It also includes a high-grade M&I core of 100m long x 50m wide x 300m deep and significant potential remains to further extend the mineralization. | |

| ● | RPM South: A newly discovered zone where initial drilling has confirmed a genetically link to RPM North. Currently resources have a strike length of 400m and 250m width. Over 600m of perspective strike length connects RPM South with RPM North which is the highest priority drill target within the Estelle Gold Project with significant positive implications for further resource upside. |

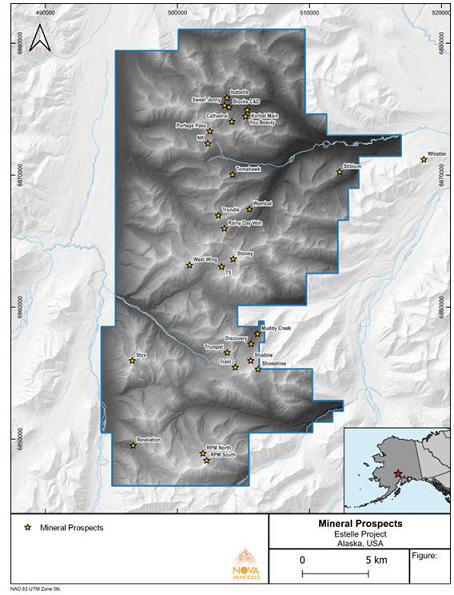

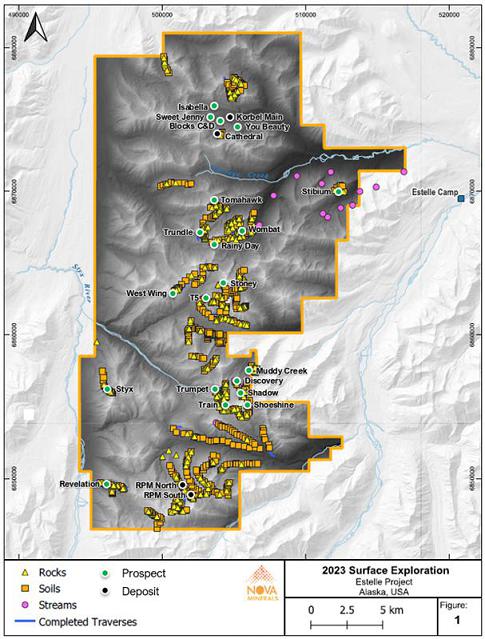

In addition to the 4 defined mineral resource deposits, the project also contains numerous other identified prospects at various stages of exploration including, blocks C, D, Isabella, Sweet Jenny, You Beauty, Shoeshine, Shadow, Train, Muddy Creek, Discovery, Trumpet, Stoney, T5, Tomahawk, Trundle, Rainy Day, West Wing, Stibium, Styx, Portage Pass, NK, Revelation, and Wombat (See figure 4).

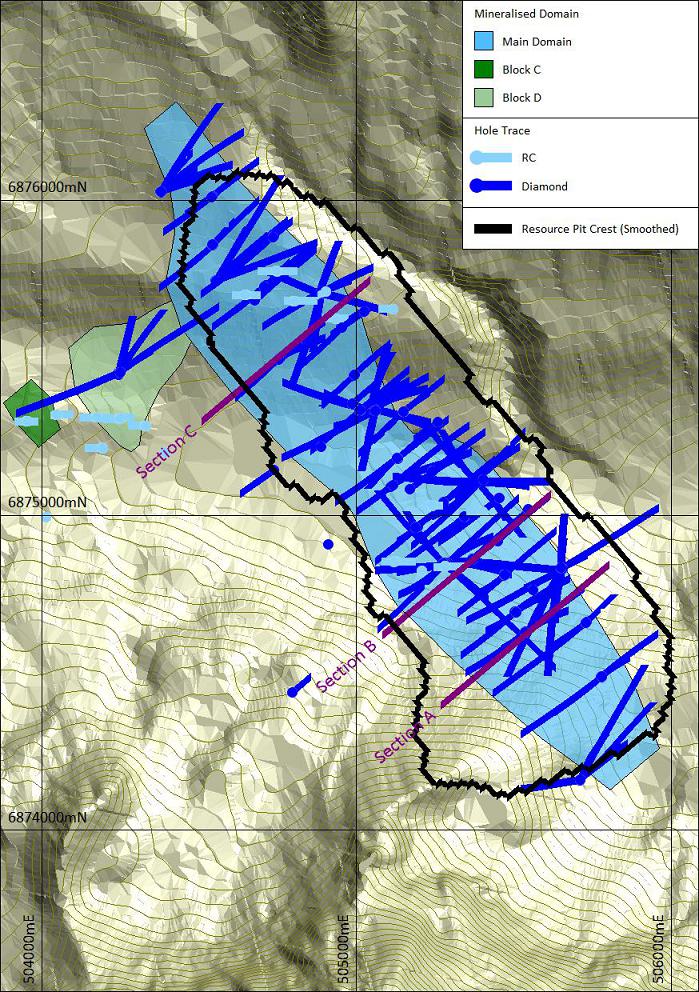

Mineral Resource Estimates

Over 90,000m of diamond and RC drilling has been undertaken for all deposits, in support of a S-K 1300 compliant mineral resource estimate (MRE) of 5.17 Moz Au across the Estelle Gold Project, of which 85% or 4.41 Moz Au is attributable to Nova Minerals. This MRE is based on the drilling information available on March 31, 2023 and contains measured, indicated and inferred categories. Resources were estimated for each deposit by Multiple Indicator Kriging (MIK) with block support adjustment reflecting large scale open pit mining. Drilling undertaken after March 31, 2023, along with future targeted drilling programs, are planned to potentially upgrade both the size and confidence of the MRE.

The following table sets forth the MRE for Nova’s 85% attributable interest in the Estelle Gold Project as detailed in the S-K 1300 Report with an effective date of January 31, 2024.

| Measured | Indicated | Inferred | Total | |||||||||||||||||||||||||||||||||||||||||||||||||

| Deposit | Cut-off Grade | Tonnes Mt | Grade Au g/t | Au

Moz | Tonnes Mt | Grade Au g/t | Au

Moz | Tonnes Mt | Grade Au g/t | Au

Moz | Tonnes Mt | Grade Au g/t | Au

Moz | |||||||||||||||||||||||||||||||||||||||

| RPM North | 0.20 | 1.2 | 4.1 | 0.16 | 2.6 | 1.6 | 0.13 | 20 | 0.60 | 0.39 | 24 | 0.89 | 0.68 | |||||||||||||||||||||||||||||||||||||||

| RPM South | 0.20 | 20 | 0.47 | 0.30 | 20 | 0.47 | 0.30 | |||||||||||||||||||||||||||||||||||||||||||||

| Total RPM | 1.2 | 4.1 | 0.16 | 2.6 | 1.6 | 0.13 | 40 | 0.54 | 0.69 | 44 | 0.70 | 0.98 | ||||||||||||||||||||||||||||||||||||||||

| Korbel Main | 0.15 | 210 | 0.31 | 2.09 | 30 | 0.27 | 0.26 | 240 | 0.31 | 2.35 | ||||||||||||||||||||||||||||||||||||||||||

| Cathedral | 0.15 | 120 | 0.28 | 1.08 | 120 | 0.28 | 1.08 | |||||||||||||||||||||||||||||||||||||||||||||

| Total Korbel | 210 | 0.31 | 2.09 | 150 | 0.28 | 1.34 | 360 | 0.30 | 3.43 | |||||||||||||||||||||||||||||||||||||||||||

| Total Estelle Gold Project | 1.2 | 4.1 | 0.16 | 213 | 0.33 | 2.22 | 190 | 0.33 | 2.03 | 404 | 0.34 | 4.41 | ||||||||||||||||||||||||||||||||||||||||

| 3 |

Notes to the above table:

| 1. | A mineral resource is defined as a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity, that there are reasonable prospects for economic extraction. |

| 2. | The mineral resource applies a reasonable prospect of economic extraction with the following assumptions: |

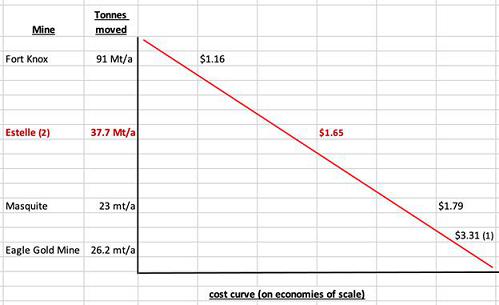

| ● | Resources are constrained within optimized pit shells that reflect a conventional large-scale truck and shovel open pit operation with the cost and revenue parameters as follows | |

| ● | Gold price of US$2,000/oz | |

| ● | 5% royalty on recovered ounces | |

| ● | Pit slope angles of 50o | |

| ● | Mining cost of US$1.65/t | |

| ● | Processing cost for RPM US$9.80/t and for Korbel US$5.23/t (inclusive of ore sorting for Korbel) | |

| ● | Combined processing recoveries of 88.20% for RPM and 75.94% for Korbel | |

| ● | General and Administrative Cost of US$1.30/t | |

| ● | Tonnage and grades are rounded to two significant figures and ounces are rounded to 1,000 ounces. Rounding errors are apparent. |

The US$2,000/oz pit shell constraining the Korbel Main mineral resources extends over around 2.3km of strike with an average width of around 600m, and a maximum vertical depth below surface of approximately 430m.

The US$2,000/oz pit shell constraining the Cathedral mineral resources extends over approximately 1.2km north-south by up to approximately 820m east-west, with a maximum vertical depth below surface of approximately 520m.

The RPM US$2,000/oz resource pit shell encompasses the RPM North and South mineral resources. In the RPM North area, it covers an area around 840m east -west by 700m north-south and reaches a maximum vertical depth below topography of approximately 340m. In the RPM South area, it covers an area around 450 m east-west by 480m north-south and reaches a maximum vertical depth below topography of approximately 250m.

Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves.

Estimation Methodology

Mineral resources were estimated for each deposit by Multiple Indicator Kriging (MIK) with block support adjustment reflecting large scale open pit mining, a method that has been demonstrated to provide reliable estimates of recoverable open pit resources in gold deposits of diverse geological styles.

The estimates for each deposit are based on 3.048 meter (10 foot) down-hole composited gold assay grades from RC and diamond drilling coded by between one and three mineralized domains which delineate zones within which the tenor and spatial trends of mineralization are similar.

For each mineralized domain 14, indicator thresholds were defined using a consistent set of percentiles. Bin grades used for MIK modelling were selected from bin mean grades with the exception of the upper bin grades which were selected on a case-by-case basis, with commonly either the bin median, or bin mean excluding outlier grades was selected. This approach reduces the impact of small numbers of extreme gold grades on estimated resources and is appropriate for MIK modelling of highly variable mineralization such as the Estelle deposits. Mineralization continuity was characterized by indicator variograms modelled at the 14 indicator thresholds.

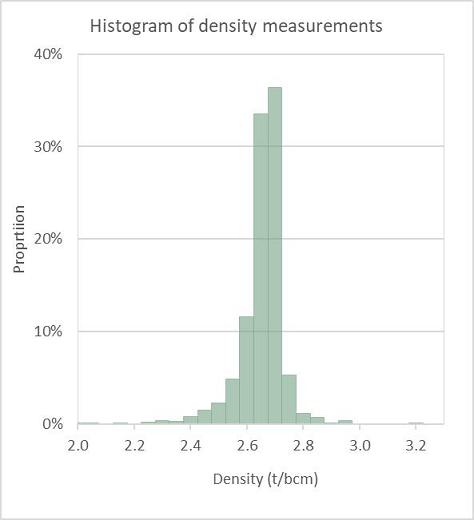

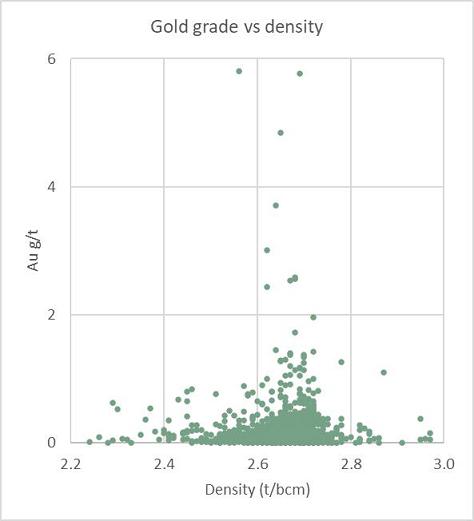

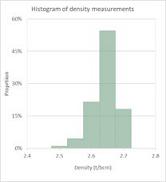

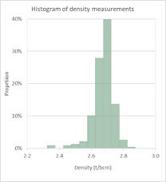

The estimates include a bulk density of 2.65 t/bcm for each deposit, supported by calliper measurements of mineralized drill core samples.

The estimates are classified as Measured, Indicated or Inferred, primarily reflecting the drill hole spacing.

Cut-off Grades

A cut-off grade of 0.20g/t was chosen for reporting the RPM North and South mineral resources, and a cut-off grade of 0.15g/t was chosen for reporting the Korbel Main and Cathedral mineral resources.

The cut-off grade for the RPM South and RPM North deposits is calculated as the grade required to pay for processing, transportation to the mill, and general and administrative (“G&A”) costs. The mill cut-off grade for the Korbel Main and Cathedral deposits is calculated as the grade required to pay for ore sorting, subsequent processing and G&A costs. The reduced processing costs for Korbel Main and Cathedral reflect the average mass rejected by the sorters. An average sorter recovery was included in the cut-off grade calculation.

The cut-off grade calculations and the input parameters used are shown in the table below.

| Cut-off Grade Formula | |||

| Cut off (g/t)= | Combined Processing Cost + Difference between ore and waste mining cost | ||

| (Realised Gold Price ($/g) x Combined Metallurgical Recovery) | |||

| Korbel Main and Cathedral cut-off grade calculation | |||

| Parameters | Gold Price ($/g) | = US$2,000/31.103477 =US$64.301/gram | |

| Realised Gold Price ($/g) = | = Gold Price ($/g) x (1-Royalty(%)) | ||

| = US$64.301 x (1-0.05) | |||

| = US$61.086 /gram | |||

| Combined Processing Cost($/ore tonne) | =Sorter Cost + Processing Cost + G&A Cost | ||

| =US$0.73 +US$4.50+US$1.30 | |||

| = US$6.53/t | |||

| Difference between ore and waste mining cost ($/t) | =US$0.00/t | ||

| Combined Metallurgical Recovery | =0.7594 | ||

| Calculated cut-off (g/t) | =(US$6.53+0.00) / (US$61.086 x 0.7594) | ||

| 0.141 g/t | |||

| Rounded cut-off (g/t) | = 0.15 g/t | ||

| RPM North and South cut-off grade calculation | |||

| Parameters | Gold Price ($/g) | = US$2,000/31.103477 =US$64.301/gram | |

| Realised Gold Price ($/g) = | = Gold Price ($/g) x (1-Royalty(%)) | ||

| = US$64.301 x (1-0.05) | |||

| = US$61.086 /gram | |||

| Combined Processing Cost($/ore tonne) | = Processing Cost + G&A Cost | ||

| =US$9.80+US$1.30 | |||

| = US$11.10/t | |||

| Difference between ore and waste mining cost ($/t) | =$0.00/t | ||

| Combined Metallurgical Recovery | =0.8820 | ||

| Calculated cut-off (g/t) | =(US$11.10+0.00) / (US$61.086 x 0.8820) | ||

| =0.206 g/t | |||

| Rounded cut-off (g/t) | = 0.20 g/t | ||

| 4 |

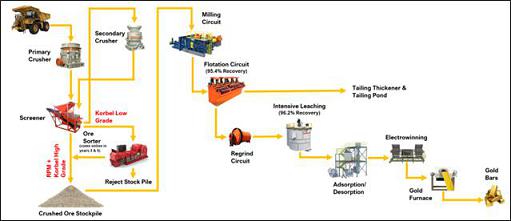

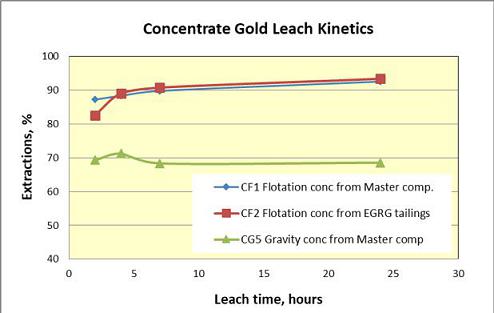

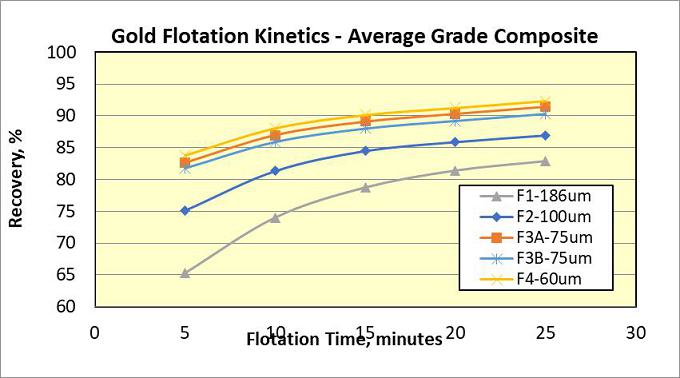

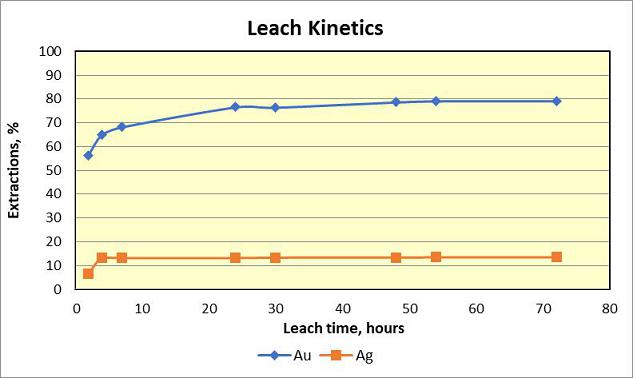

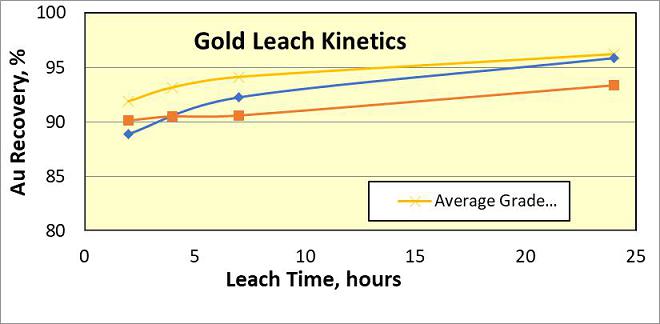

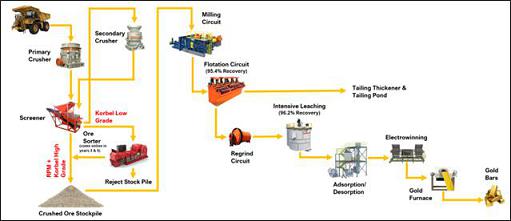

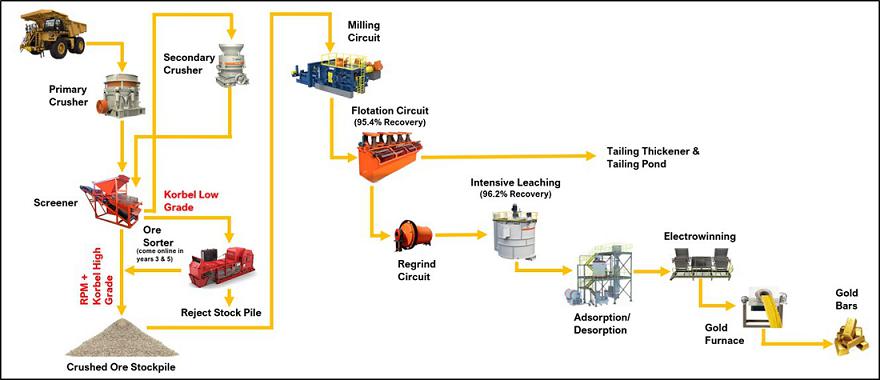

Mineral Processing, Metallurgical Testing and Recovery Methods

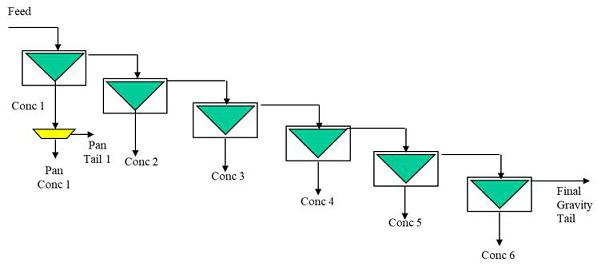

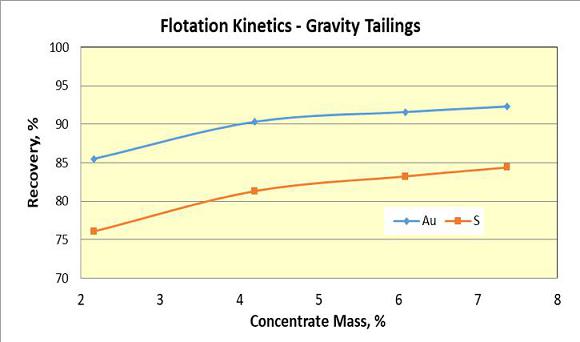

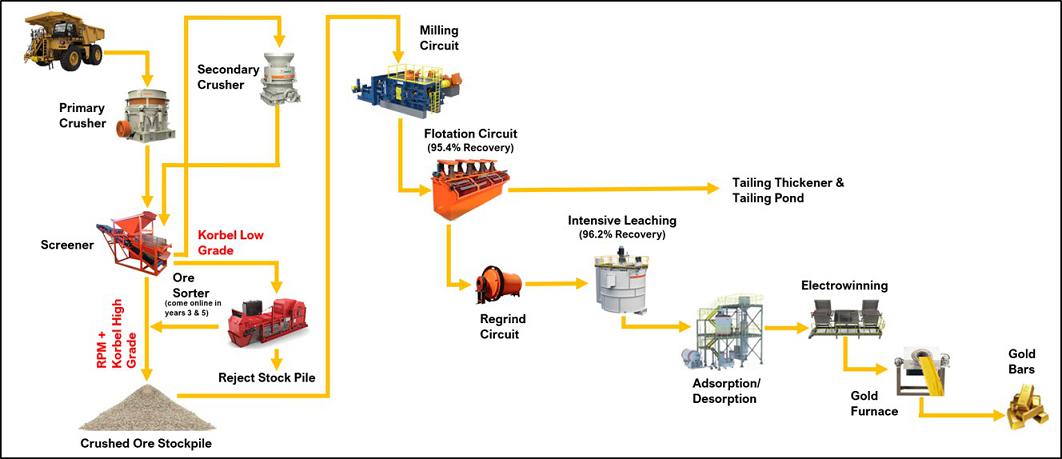

A robust project flowsheet and initial assessment level processing plant design has been established, based on preliminary metallurgy and ore sorting tests in combination with economic considerations. The flow sheet indicates that the gold is easily liberated from the Estelle ore bodies using conventional technology for an average recovery of 88.3%, with further optimization planned.

The process plant was designed using conventional processing unit operations with the addition of XRT ore sorting systems. Only ore originating from Korbel Main and Cathedral will be sorted, with ore originating from the RPM deposits bypassing the sorters. The ore sorting test work performed to date was preliminary in nature in support of the flow sheet to determine the trade off on the gold recoveries. With the preliminary nature of the study, it is still yet to be determined if ore sorting will be included in the final flowsheet and future economic analysis. The product of the process will be doré bars.

Run-of-mine and run–of-stockpile ore will be hauled to the sorting facility where it will be crushed in a primary gyratory crusher before going through a sizing screen. The fines fraction head will be fed directly to the high-pressure grinding rolls (“HPGR”), the mid-sized material will be fed to the XRT ore sorting system, and the oversize material will be crushed in a secondary cone crusher. The ore sorting system will separate the economical ore out from the waste, transporting it to an HPGR. The product of the HPGR will be sent to a closed circuit consisting of a ball mill and hydrocyclone cluster. The P80 overflow of 75µm will flow through the flotation circuit. The tailings from this process will be sent to the tailing’s thickener. The concentrate will move on to the cyclone cluster and IsaMill for fine grinding to P80 of 22µm before finally moving on to the pre-leach thickener where the underflow will report to the leach and CIP circuits.

The gold leached in the CIP circuit will be recovered by activated carbon and elution. From this elution circuit, the gold will be recovered by electrowinning cells in the gold room. The gold sludge will be dried, mixed with fluxes, and then smelted in a furnace to produce doré bars. Carbon will be re-activated in a regeneration kiln before being re-used in the CIP circuit. The CIP tailings will be treated for cyanide in the cyanide destruction circuit before being pumped to the tailings thickener. The waste byproduct of the tailings thickener will be pumped to the tailings storage facility.

Figure 3: The Estelle Gold Project simplified flow sheet

Mining Methods

The open pit optimization assumptions are based on a conventional truck and shovel mining method. The pit shells used for the resource estimation are based on a 50o overall slope angle.

Economic Analysis

No detailed economic analysis is provided in the S-K 1300 Report and the investor is cautioned that only mineral resources are being presented.

Other Assets

In addition to the Estelle Gold Project, we own minority interests in the companies described below that partially provide a hedge against fluctuations in the gold price and expose us to the upside of other high growth sectors none of which are deemed material by us in our operations.

Our investments include:

| ● | Snow Lake Lithium (Nasdaq: LITM) | |

|

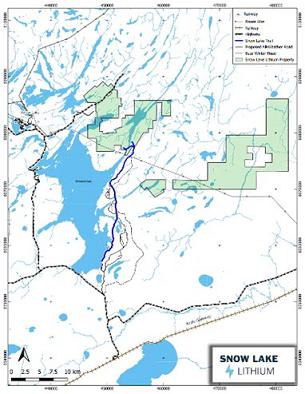

We hold an indirect interest in the Thompson Brothers Lithium Project through a 32.5% ownership stake (as of the date of this prospectus) in Snow Lake Resources Ltd (“Snow Lake”), a lithium exploration stage mining company in the province of Manitoba, Canada, listed on the Nasdaq Capital Market (LITM). Snow Lake has a large land position encompassing 59,587 acres in a pro-mining community with nearly a century of historic and consistent mining in the area.

Year round access to the property is available via boat, barge, helicopter or winter ice roads, with existing infrastructure including a powerline which traverses the property, an airstrip located 8.5km to the North, major road access within 11km and rail access 6.5km to the South. | ||

| In April 2022, we sold 3,000,000 shares in Snow Lake that generated gross proceeds of US$18 million, thus reducing our interest in Snow Lake from 9,600,000 shares to 6,600,000 shares. We continue to hold 6,600,000 Snow Lake shares, representing 32.5% of Snow Lake’s issued and outstanding shares as of the date of this prospectus. |

| 5 |

| ● | Asra Minerals Limited (ASX:ASR) | |

| We hold a free carried investment of 7.73% (as of the date of this prospectus) in Asra Minerals Limited (“Asra”) a gold, lithium and rare earths exploration company based in Western Australia and listed on the ASX (ASR). | ||

| Located in the mining hub of Western Australia’s Eastern Goldfields, Asra Mineral’s Mt Stirling Project consists of 10 major gold prospects, two recent rare earths discoveries, and widespread highly anomalous cobalt and scandium mineralisation. | ||

| Asra’s project is close to existing major mining operations and neighbours Red 5’s King of the Hills gold mine which boasts Australia’s ninth largest gold ore reserve of 2.4 Moz and a 16-year mine life. The region has recently produced approximately 14 Moz of gold from mines such as Tower Hills, Sons of Gwalia, Thunderbox, Harbour Lights and Gwalia. | ||

| Asra also currently holds a large equity holding in Quebec Lithium explorer, Loyal Lithium (ASX: LLI) and a large equity joint ventures with Zuleika Gold (ASX: ZAG) and Monger Gold (now LLI) in the Kalgoorlie-Menzie goldfields region. | ||

In the beginning of September 2022, Asra reported a 23% upgrade to the Mineral Resource Estimate for its flagship Mt Stirling Project in Western Australia. Taking the resource from 118,384 oz Au to 152,000 oz Au. | ||

| ● | Rotor X Aircraft Manufacturing | |

| We also hold a free carried investment of 9.9% in Rotor X Aircraft Manufacturing (“Rotor X”), a pre-IPO revenue generating US-based company that seeks to lead the development of electric VTOL (Vertical Take-Off and Landing) aircraft and innovative low operating cost heavy lift drone technology. Rotor X Aircraft Manufacturing is a helicopter kit manufacturing company that provides the world’s most affordable and reliable 2 seat personal helicopter. Recently Rotor X also announced that it has entered the electric vertical take-off and landing (eVTOL) market with the aim of developing innovative, low operating cost heavy-lift electric helicopters and drones, to support mining and other industries, as well as the growing urban air taxi market. | ||

| The potential benefits for our mining operations through the innovative application of clean aircraft technology, have been the primary motive behind our investment in Rotor X. |

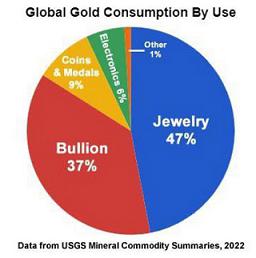

Our Opportunity

We believe that the Estelle Gold Project gives us a potentially lucrative gold mining opportunity similar to the Carlin Gold Trend (the “Carlin”) due to its large size and low grade bulk mines. The Carlin Trend is located in Nevada, and is host to one of America’s largest gold endowments currently estimated at 130 Moz of gold and since it commenced operations in 1963 has produced over 84 Moz gold.

When a subsidiary of Newmont Gold Corporation opened the Carlin mine, it was the world’s first open pit primary gold mine, mining vast bulk tonnages of low grade ore which were crushed, ground and treated by cyanidation with high recovery rates.

The technological know-how in mineral exploration and mine development gained from the Carlin Trend was also quickly applied to other low grade bulk mines around the world.

Similar to the Carlin Trend, the Estelle Gold Project has a vast mineralized land position. In our experience, very few mining companies own a district scale gold asset with an already defined large gold resource, in a Fraser Institute ranked top 4 investment jurisdiction, on State lands, with the possibility for long term opportunity of potentially multiple mines across one single project site, like we have at Estelle. All deposits are open with thick ore zones from surface and a low strip ratio, amendable to large scale bulk mining using conventional truck and shovel methods, with further drill programs planned, which could potentially continue to increase both the size and confidence of the resource base over the coming years.

In 2023 we drilled approximately 7,000m, the majority of which was focused on the RPM area with the aim to further prove up and expand the resource at RPM, including the North, South and Valley zones and test the potential of inter-connection between these zones. To date, this drilling has not been included in any mineral resource estimates and may provide potential future resource upside.

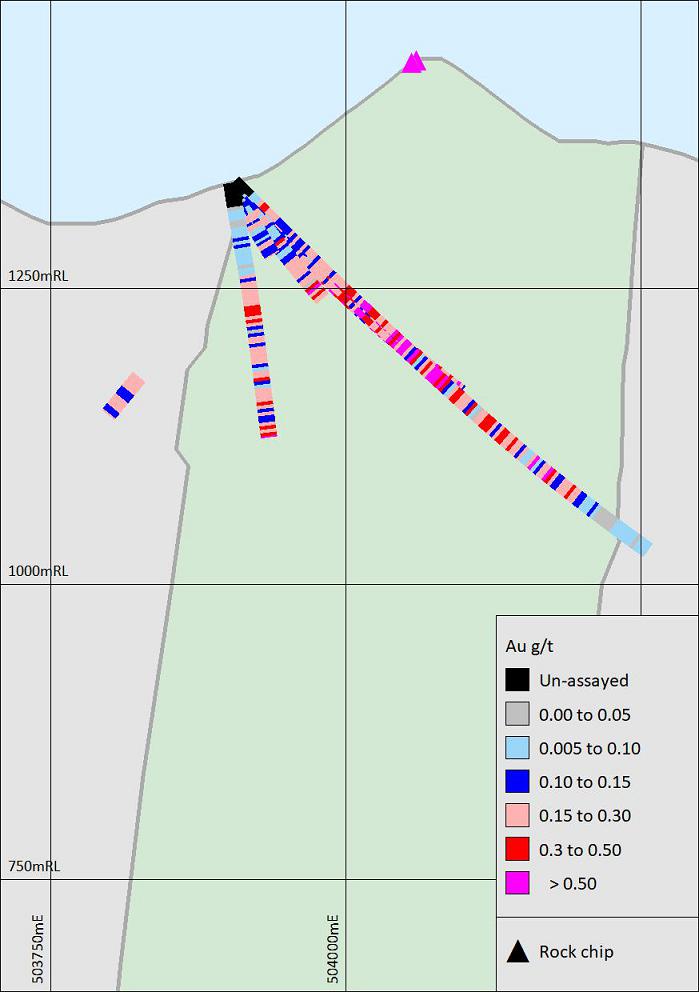

Approximately 600m of exploration drilling was also conducted in the Train prospect area, where RPM-style gold mineralization as well as multi-element Au-Ag-Cu-Sb mineralization has been identified in surface exploration work. The Train prospect is situated approximately 6km north of RPM covering an area 4.5km long and 2.5km wide representing another very large intrusive related mineralized system. The Train prospect area is considered a high priority target for potential discovery and definition of an additional resource deposit.

Extensive surface exploration mapping and sampling programs were also conducted as part of the 2023 field season, with some assay results still currently outstanding at the laboratory. These were primarily focused on the RPM and Train areas, as well as at the highly prospective 3km long polymetallic Au-Ag-Cu system at the Stoney prospect.

| 6 |

In addition to the 4 already defined resource deposits, Nova also has 20 other known prospects at various stages of advancement across the 35km long mineralised corridor, including the recent significant discoveries at the Train/Trumpet, Discovery/Muddy Creek, Stibium and Styx, and Stoney prospects.

At Train, geological observations and high-grade rock chip samples indicate another possibly large IRGS exposed at surface with a 1km strike length and 500m width. Structural controls and more high-grade rock chips also show a possible genetic link to the nearby Trumpet prospect with a strike length of 1.5km between the two prospects.

At the new Discovery and Muddy Creek prospects surface exploration sampling in 2023 has identified one of the most continuous high-grade zones of mineralization on the property, with a 1.5km long surface gold anomaly with multiple high-grade rock and soil samples.

New gold-antimony targets were identified in the Stibium and Styx prospects with the discovery of high grade stibnite, a primary ore source for the rare mineral antimony, associated with the gold systems, which represents a significant development for us as antimony is listed as a critical and strategic mineral to US economic and national security interests with no current US domestic supply.

At Stoney, surface sampling and mapping has identified a high-grade polymetallic gold, copper and silver stacked vein system along a 4km strike length, up to 10m wide and over 300m of vertical extent with the results of further surface exploration mapping and sampling programs conducted in the area in 2023 yet to be received back from the laboratory.

As systematic reconnaissance exploration programs continue, we expect further discoveries of surface outcropping deposits could potentially create a long term opportunity of future mine life through a pipeline of exploitable resources, assuming that we are able to prove additional reserves on our property and that we are also able to develop and market such reserves in a profitable manner.

Figure 4: Unlocking the Estelle Gold Project – District scale with over 20 identified gold prospects – Map Coordinate System: UTM = NAD83 zone 5

Our Competitive Strengths

We believe that we are an industry leader based on the speed and manner in which we have been growing our global resource inventory, working within relatively small budgets. In just over 5 years, our fundamental achievements include:

| ● | The discovery of a district scale gold and other minerals project in a safe jurisdiction on Alaska State lands (no native or federal land across the Estelle Gold property), at a very low cost of discovery per ounce; | |

| ● | Drilled over 90,000m, including very thick high-grade intercepts at RPM, to define a large gold resource from green fields, with deposits spread across 4 large near surface intrusion related gold systems (IRGS) which are continuing to grow with ongoing exploration and drilling programs to potentially improve both the size and confidence of the resource; | |

| ● | Established infrastructure for year-round operation; | |

| ● | Established a proven and robust flow sheet which liberates the gold using conventional technology; and | |

| ● | Built strong relationships with the Alaskan community, suppliers and the State government. |

Coupled with a potentially lucrative asset, we have also established a leadership team of experienced mining executives and operators with a history of growing and de-risking projects, including a local well-connected CEO who has significant experience in bringing mines into production having worked on major projects including Sepon, Carosue Dam, Batu Hijau and the Carlin Trend.

| 7 |

We also pride ourselves on our innovation and efficiency, which we believe is evidenced by our low discovery cost per ounce. We continue to develop our strategies and initiatives to improve our business plans and operations, in particular with respect to the Estelle Gold Project. Some of the innovations we have undertaken to date include:

| ● | Particle density X-Ray ore sorting. Ore sorting test work conducted on drill core samples from Estelle ore demonstrates great potential for less processing and increased mine production to successfully separate the gold-bearing veins. | |

| ● | On-site independent preparation facility. We have established an onsite preparation facility which has the capacity to process up to 7,500 samples per month, providing significant cost savings as the samples are prepared through drying, crushing and splitting on site, significantly reducing the sample weight that is shipped from site to the laboratory for analysis. This also allows us to bypass the commercial prep-lab which in turn improves the assay result turnaround time. |

Our Growth Strategy

Our growth strategy is to get the Estelle Gold Project into production as fast as possible to become a tier one global gold producer in order to maximize shareholder value.

Estelle’s Projected Timeline to Production

| ● | 2024 drill program |

| - | Up to 5 drill rigs running 24 hours, 7 days per week in the almost 24-hour daylight in Alaska during the period | |

| - | RPM infill and extensional resource drilling to improve the size and confidence of the resource (Q2/Q3 2024) | |

| - | Exploration drilling in the Train area (Q2/Q3 2024) |

| ● | FS trade off study work and geotechnical drilling (Ongoing throughout 2024) | |

| ● | Global MRE update (2024 and 2025) | |

| ● | FS, including updated MRE with resources from the 2023 and 2024 drill programs (2025) | |

| ● | BFS and permitting (2026) | |

| ● | Decision to mine and financing (2027) | |

| ● | Commence mine construction (2027/2028) | |

| ● | 1st gold pour (Late 2028) | |

| ● | Ongoing exploration to assess district wide opportunities to increase the resource pipeline | |

| * All timelines are projected only and subject to assay lab turnarounds, market and operating conditions, all necessary approvals, regulatory requirements, weather events and no unforeseen delays. |

Figure 5: Our long-term growth strategy

Our Risks and Challenges

Our prospects should be considered in light of the risks, uncertainties, expenses and difficulties frequently encountered by similar companies. Our ability to realize our business objectives and execute our strategies is subject to risks and uncertainties, including, among others, the following:

| 8 |

Risks Related to Our Business and Industry

Risks and uncertainties related to our business include, but are not limited to, the following:

| ● | We currently report our financial results under IFRS, which differs in certain significant respect from U.S. generally accepted accounting principles, or U.S. GAAP. | |

| ● | Our mineral reserves may be significantly lower than expected. | |

| ● | Our Estelle Gold Project only has estimated inferred, indicated and measured resources identified, there are no known reserves on our property. There is no assurance that we can establish the existence of any mineral reserve on our property in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from this property and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral reserve in a commercially exploitable quantity, the exploration component of our business could fail. | |

| ● | We have no history of producing metals from our current mineral property and there can be no assurance that we will successfully establish mining operations or profitably produce precious metals. | |

| ● | Any material changes in mineral resource/reserve estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital. | |

| ● | The profitability of our operations, and the cash flows generated by our operations, are affected by changes in the market price for gold, which in the past has fluctuated widely. | |

| ● | Our success depends on the exploration development and operation of the Estelle Gold Project, an exploration stage project. | |

| ● | We do not operate any mines and the development of our mineral project into a mine is highly speculative in nature, may be unsuccessful and may never result in the development of an operating mine. | |

| ● | Mineral resource estimates are based on interpretation and assumptions and could be inaccurate or yield less mineral production under actual conditions than is currently estimated. Any material changes in these estimates could affect the economic viability of the Estelle Gold Project, our financial condition and ability to be profitable. | |

| ● | We have negative cash flows from operating activities. | |

| ● | We have no history of earnings, and there are no known commercial quantities of mineral reserves on the Estelle Gold Project. | |

| ● | The development of the Estelle Gold Project or any other projects we may acquire in the future into an operating mine will be subject to all of the risks associated with establishing and operating new mining operations. | |

| ● | Our growth strategy and future exploration and development efforts may be unsuccessful. | |

| ● | We may issue additional ordinary shares or ADSs from time to time for various reasons, resulting in the potential for significant dilution to existing securityholders. | |

| ● | We are subject to various laws and regulations, and the costs associated with compliance with such laws and regulations may cause substantial delays and require significant cash and financial expenditure, which may have a material adverse effect on our business. | |

| ● | The mining industry is intensely competitive in all of its phases, and we compete with many companies possessing greater financial and technical resources. | |

| ● | We are currently operating in a period of economic uncertainty and capital markets disruptions, which have been significantly impacted by geopolitical instability due to the ongoing military conflict between Russia and Ukraine. | |

| ● | If we fail to maintain effective internal controls over financial reporting, the price of the ADSs or ordinary shares may be adversely affected. |

| ● | There will be significant hazards associated with our mining activities, some of which may not be fully covered by insurance. To the extent we must pay the costs associated with such risks, our business may be negatively affected. | |

| ● | Capital and operating cost estimates made in respect of our current and future development projects and mines may not prove to be accurate. |

Risks Related to This Offering and Ownership of The ADSs

Risks and uncertainties related to this offering and ownership of the ADSs include, but are not limited to, the following:

| ● | There has been no prior market for the ADSs and an active and liquid market for our securities may fail to develop, which could harm the market price of the ADSs. | |

| ● | If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, the price of the ADSs and their trading volume could decline. | |

| ● | U.S. investors may have difficulty enforcing civil liabilities against our company, our directors or members of senior management and the experts named in this prospectus. | |

| ● | Our Constitution and Australian laws and regulations applicable to us may adversely affect our ability to take actions that could be beneficial to our shareholders. | |

| ● | You may be subject to limitations on the transfer of your ADSs and the withdrawal of the underlying ordinary shares. |

In addition, we face other risks and uncertainties that may materially affect our business prospects, financial condition, and results of operations. You should consider the risks discussed in “Risk Factors” and elsewhere in this prospectus before investing in our securities.

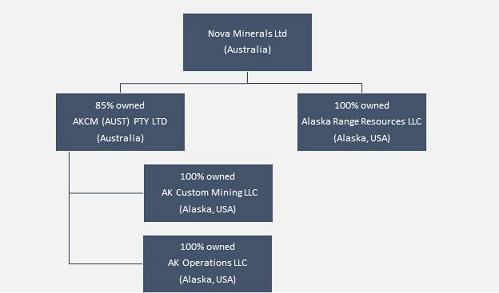

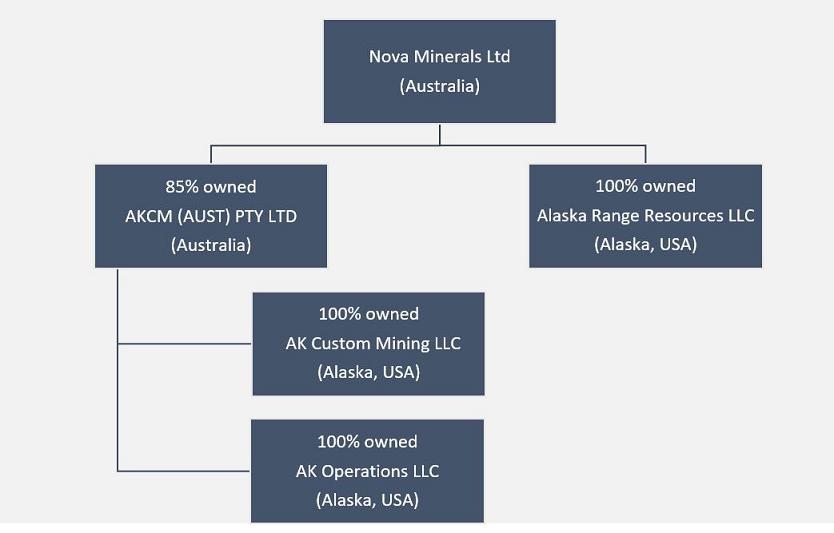

Our Corporate History and Structure

We have the following material, direct and indirect owned subsidiaries: AKCM (AUST) Pty Ltd, Alaska Range Resources LLC, AK Operations LLC and AK Custom Mining LLC.

The following chart depicts the corporate structure of us together with the jurisdiction of incorporation of our subsidiaries and related holding companies.

| 9 |

Corporate Information

Our principal executive office is Suite 5, 242 Hawthorn Road, Caulfield, Victoria 3161 Australia. The telephone number at our executive office is +61 3 9537 1238.

Our registered office is located at Suite 5 on 242 Hawthorn Road in Caulfield, Australia.

Our agent for service of process in the United States is our wholly-owned U.S. subsidiary Alaska Range Resources LLC, 1150 S Colony Way, Suite 3-440, Palmer, AK 99645.

Our website can be found at www.novaminerals.com.au. The information contained on our website is not a part of this prospectus and should not be relied upon in determining whether to make an investment in our company.

| 10 |

The Offering

| Securities offered | ADSs representing ordinary shares (or ADSs representing ordinary shares if the underwriters exercise the over-allotment option in full). | |

| Offering price | We have estimated the initial offering price range between US$ and US$ and the assumed initial offering price is US$ , the midpoint of this range. | |

| ADSs | Each ADS represents of our ordinary shares. The ADSs may be evidenced by American Depositary Receipts. The depositary will be the holder of the ordinary shares underlying the ADSs and you will have the rights of an ADS holder as provided in the deposit agreement among us, the depositary and owners and beneficial owners of ADSs from time to time. | |

| To better understand the terms of the ADSs, you should carefully read the section in this prospectus entitled “Description of American Depositary Shares.” We also encourage you to read the deposit agreement, which is incorporated by reference as an exhibit to the registration statement of which this prospectus forms a part. | ||

| Ordinary shares outstanding immediately prior to this offering | 210,889,961 ordinary shares | |

| Ordinary shares outstanding immediately after the offering | ordinary shares or ordinary shares if the underwriters exercise the over-allotment option in full (including ordinary shares represented by ADSs). | |

| Over-allotment option | We have granted to the underwriters a 45-day option to purchase from us up to an additional 15% of the amount of the ADSs sold in the offering ( additional ADSs) at the initial public offering price, less the underwriting discounts and commissions. | |

| Use of proceeds | We estimate that the net proceeds from the sale of the ADSs that we are selling in this offering will be approximately US$ million (or approximately US$ million if the underwriter’s option to purchase additional ADSs is exercised in full), based upon an assumed initial public offering price of US$ per ADS, after giving effect to the Australian dollar/U.S. dollar exchange rate of as of , 2024, and an ADS-to-ordinary share ratio of 1-to- , after deducting underwriting discounts and commissions and estimated offering expenses payable by us. | |

| We plan to use the net proceeds of this offering for exploration and extensional drilling, metallurgical and process test work, and general working capital as further detailed in the Use of Proceeds section. See “Use of Proceeds” for more information on the use of proceeds. | ||

| Depositary | The Bank of New York Mellon. | |

| Risk factors | Investing in our securities involves a high degree of risk and purchasers of our securities may lose part or all of their investment. See “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in our securities. | |

| Lock-up | We, all of our directors and officers and any other 5% or greater holder of our ordinary shares have agreed with the underwriters, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of the ADSs or ordinary shares or securities convertible into or exercisable or exchangeable for our ordinary shares for a period of six, with respect to the Company and our 5% and greater shareholders, or 12 months, with respect to our directors and officers, after the date of this prospectus. See “Underwriting” for more information. | |

| Proposed trading market and symbol | We have applied to list the ADSs on the Nasdaq Capital Market under the symbol “NVAM.” Our ordinary shares are listed on the ASX under the symbol “NVA”. The closing of this offering is contingent upon the successful listing of the ADSs on the Nasdaq Capital Market. |

The number of ordinary shares outstanding immediately following this offering is based on 210,889,961 ordinary shares outstanding as of January 31, 2024 and excludes:

| ● | 22,322,250 ordinary shares issuable upon the exercise of outstanding options at a weighted average exercise price of A$0.96 per share; | |

| ● | Up to 3,496,804 ordinary shares issuable upon exercise of options with an exercise price of A$1.00 and an expiration date of June 30, 2025 (which options are not currently outstanding but are issuable upon exercise of 6,993,608 outstanding options with an exercise price of A$0.70, and with an expiry date of April 30, 2024); | |

| ● | 8,250,000 ordinary shares issuable upon the exercise of outstanding options under our employee share option plan at a weighted average exercise price of A$1.20; | |

| ● | 11,750,000 further options that are available for issuance under our employee share option plan; | |

| ● | ordinary shares issuable upon conversion of US$5,420,934 in principal (including original issue discount and capitalized interest) under the Nebari Gold Fund 1, LP (“Nebari”) convertible loan facility (based on a A$1.02 fixed conversion price); | |

| ● | up to 1,200,000 ordinary shares that may be issued upon the achievement of certain milestones pursuant to Class A and Class B performance rights granted to certain directors; and | |

| ● | up to 1,200,000 ordinary shares that may be issued upon the achievement of certain milestones pursuant to Class C performance rights granted to certain directors. |

| 11 |

Summary Consolidated Financial Information

The following summary historical financial information should be read in conjunction with our consolidated financial statements and related notes included elsewhere in the prospectus and the information contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below.

The selected consolidated statement of profit or loss and other comprehensive income/(loss) data for the years ended June 30, 2023, and 2022 and consolidated statement of financial position data as of June 30, 2023, have been derived from our audited consolidated financial statements included elsewhere in this prospectus. Our audited consolidated financial statements have been prepared in accordance with IFRS, as issued by the IASB, as of and for the years ended June 30, 2023, and 2022. Financial statements prepared in compliance with IFRS are not comparable in all respects with financial statements that are prepared in accordance with U.S. GAAP. Our historical results for any period are not necessarily indicative of our future performance.

For the fiscal year ended June 30, 2023, the conversion from A$ into US$ was made at the exchange rate as of June 30, 2023, on which US$1.00 equaled A$1.50830. For the fiscal year ended June 30, 2022, the conversion from A$ into US$ was made at the exchange rate as of June 30, 2022, on which $1.00 equaled A$1.45159. The use of US$ is solely for the convenience of the reader.

Consolidated Statement of Profit or Loss and Other Comprehensive Income Data

| For the year ended June 30, | ||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| A$ | A$ | US$ | US$ | |||||||||||||

| Revenue | 12,027 | 20,000 | 7,974 | 13,778 | ||||||||||||

| Other income, gains and losses | (6,055,067 | ) | 39,613,276 | (4,014,498 | ) | 27,289,576 | ||||||||||

| Expenses | (5,528,200 | ) | (5,230,455 | ) | (3,655,186 | ) | (3,603,259 | ) | ||||||||

| (Loss)/Profit After Income Tax Expense for the Year | (11,571,240 | ) | 34,402,821 | (7,671,710 | ) | 23,700,095 | ||||||||||

| Total Comprehensive (Loss)/Income for the Year | (9,629,678 | ) | 38,097,293 | (6,384,458 | ) | 26,245,216 | ||||||||||

| Basic (loss)/earnings per share (1) | (0.06 | ) | 0.20 | (0.04 | ) | 0.14 | ||||||||||

| Diluted (loss)/earnings per share (1) | (0.06 | ) | 0.18 | (0.04 | ) | 0.12 | ||||||||||

| Dividends per share | - | - | - | - | ||||||||||||

| (1) | Adjusted to reflect the 10 for 1 consolidation of our ordinary shares on November 29, 2021. |

Consolidated Statement of Financial Position Data

| As of June 30, 2023 | ||||||||||||||||

| Actual | As Adjusted (1) (2) | |||||||||||||||

| A$ | US$ | A$ | US$ | |||||||||||||

| Cash | 19,240,707 | 12,756,552 | ||||||||||||||

| Total Assets | 122,336,782 | 81,109,051 | ||||||||||||||

| Total Liabilities | 8,946,817 | 5,931,722 | ||||||||||||||

| Net Assets | 113,389,965 | 75,177,329 | ||||||||||||||

| Accumulated profits(losses) | (49,985,023 | ) | (33,139,974 | ) | ||||||||||||

| Issued Capital | 142,986,671 | 94,799,888 | ||||||||||||||

| Reserves | 12,601,533 | 8,354,792 | ||||||||||||||

| Non-controlling Interest | 7,786,784 | 5,162,623 | ||||||||||||||

| (1) | The as adjusted data give effect to our receipt of net proceeds from the issuance and sale of ADSs at the assumed initial offering price of US$ per ADS, after deducting underwriting commissions and estimated offering expenses payable by us. |

| (2) | Each US$1.00 increase (decrease) in the assumed initial public offering price of US$ per ADS would increase (decrease) each of cash, total assets, net assets, and issued capital, by approximately A$ million (or US$ million), assuming the number of ADSs offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, an increase (decrease) of 1,000,000 ADSs offered by us would increase (decrease) each of cash, total assets, net assets, and issued capitalby approximately A$ million (or US$ million), assuming the assumed initial public offering price of US$ per ADS remains the same, and after deducting underwriting discounts and commissions. |

| 12 |

An investment in our securities involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained in this prospectus, before purchasing our securities. We have listed below (not necessarily in order of importance or probability of occurrence) what we believe to be the most significant risk factors applicable to us, but they do not constitute all of the risks that may be applicable to us. Any of the following factors could harm our business, financial condition, results of operations or prospects, and could result in a partial or complete loss of your investment. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section titled “Special Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Industry

Our mineral reserves may be significantly lower than expected.

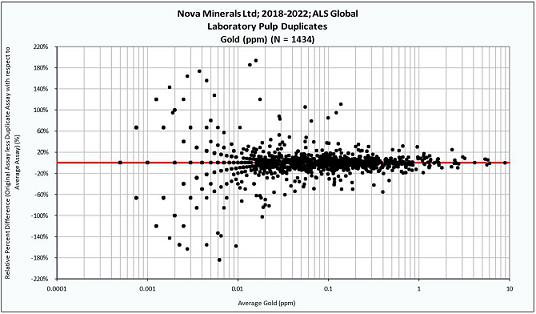

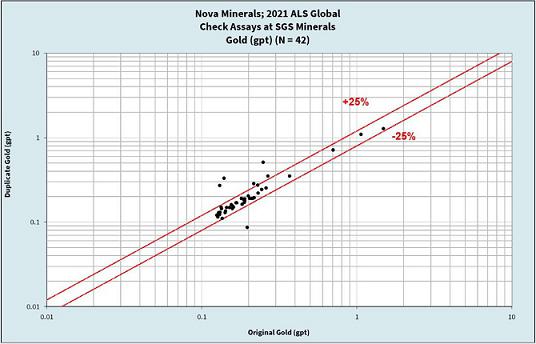

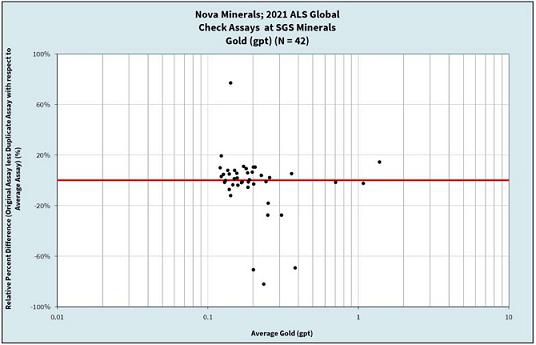

We are in the exploration stage and our planned principal operations have not commenced. There is currently no commercial production at our Estelle Gold Project. However, we expect to complete our first gold pour in late 2028, although there is no assurance that we will meet that timeframe and consummation of any such commercial production is subject to the risks described in this section. We have completed a technical report summary in compliance with the SEC’s S-K 1300 disclosure rules. We have produced an Initial Assessment on a very small area which includes the 4 current resource deposits on the Estelle Gold Project to both JORC and S-K 1300 standards. We have not yet completed a Preliminary Economic Assessment (PEA), or started a Feasibility Study (FS), of the Estelle Gold Project. As such, our estimated proven or probable mineral reserves, expected mine life and mineral pricing cannot be determined as the exploration programs, drilling, economic assessments and feasibility studies and pit (or mine) design optimizations have not yet been undertaken, and the actual mineral reserves may be significantly lower than expected. You should not rely on the technical reports, preliminary economic assessments or feasibility studies, if and when completed and published, as indications that we will have successful commercial operations in the future. Even if we prove reserves on our property, we cannot guarantee that we will be able to develop and market them, or that such production will be profitable.