As filed with the Securities and Exchange Commission on January 13, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NEXTRACKER INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3990 | 00-0000000 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

6200 Paseo Padre Parkway

Fremont, California 94555

(510) 270-2500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Léah Schlesinger, Esq.

General Counsel

Nextracker Inc.

6200 Paseo Padre Parkway

Fremont, California 94555

(510) 270-2500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Heather Childress, Esq. Senior Vice President, Deputy General Counsel Flex Ltd. 2 Changi South Lane Singapore 486123 (65) 6876 9899 |

Sharon R. Flanagan, Esq. Samir A. Gandhi, Esq. Lindsey A. Smith, Esq. Helen Theung, Esq. Sidley Austin LLP 1001 Page Mill Road, Building 1 Palo Alto, California 94304 (650) 565-7000 |

Robert G. Day, Esq. Melissa S. Rick, Esq. Wilson Sonsini Goodrich & Rosati, Professional Corporation 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

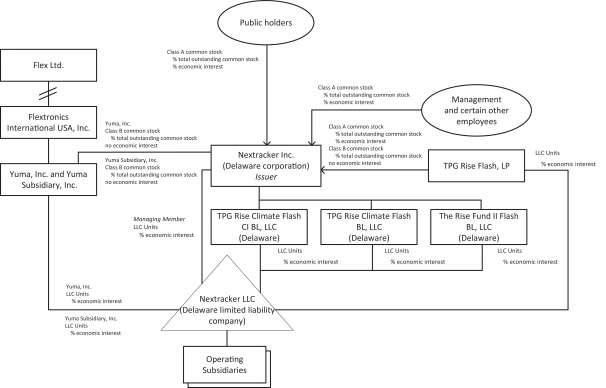

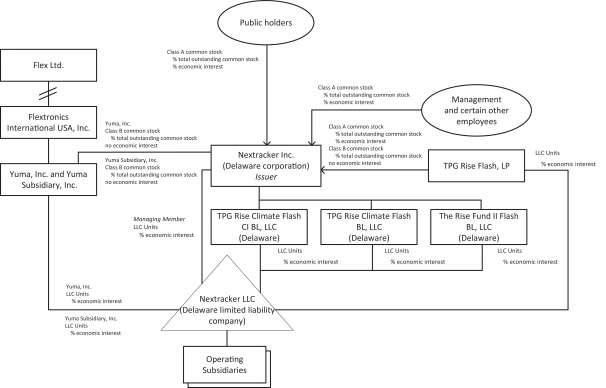

Explanatory note

Nextracker Inc., the registrant whose name appears on the cover of this registration statement, is a private company incorporated under the laws of the State of Delaware (“Nextracker Inc.”). Prior to this offering and the completion of the Transactions (as described in “Our organizational structure” in the prospectus included as part of this registration statement), Nextracker Inc. had no operations and all of the business operations of Nextracker Inc. were conducted through the legacy solar tracker business of Flex Ltd. (“Flex”), including Nextracker LLC (the “LLC”), which was initially formed in 2013 as a Delaware corporation under the name NEXTracker Inc. and in 2022 was converted into a Delaware limited liability company. On February 1, 2022, Flex sold Series A Preferred Units of the LLC (the “LLC Preferred Units”) representing a 16.7% limited liability company interest of the LLC to TPG Rise Flash, L.P. (“TPG”), resulting in TPG holding all of the outstanding LLC Preferred Units and subsidiaries of Flex holding all of the outstanding common units of the LLC (the “LLC Common Units” and together with the LLC Preferred Units, the “LLC Units”). Immediately prior to the consummation of the Transactions, all of the LLC Preferred Units will be automatically converted into a certain number of LLC Common Units (the “Automatic Conversion”) and TPG will purchase from Nextracker Inc. for cash consideration a number of shares of Nextracker Inc. Class B common stock equal to the number of LLC Common Units received by TPG in the Automatic Conversion. The LLC Common Units are exchangeable into shares of Nextracker Inc. Class A common stock (or cash) and upon such exchange, a corresponding number of such holder’s Class B common stock will be cancelled. Notwithstanding the foregoing, as permitted under and in accordance with the second amended and restated limited liability company agreement of Nextracker LLC in effect prior to this offering, TPG has exercised its right to have certain blocker corporations affiliated with TPG merge with a separate direct, wholly-owned subsidiary of Nextracker Inc., with the blocker corporations surviving each such merger, in a transaction intended to qualify as a tax-free transaction, with the investors in each such blocker corporation being entitled to a number of shares of Nextracker Inc. Class A common stock with a value based on the LLC Preferred Units held by such blocker corporation. As a result of the Transactions, which will be effected upon the completion of this offering, Nextracker Inc. will be (a) a holding company, with its principal asset consisting of limited liability company interests of the LLC and (b) the managing member of the LLC and will operate and control all of the business and affairs of the LLC and its subsidiaries. Except as otherwise disclosed in the prospectus included in this registration statement, the historical combined financial statements and summary and selected historical combined financial data and other financial information included in this registration statement are those of the legacy solar tracker business of Flex, including the LLC (formerly known as NEXTracker Inc.) and its subsidiaries, and do not give effect to the Transactions.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to completion, dated , 2023

Prospectus

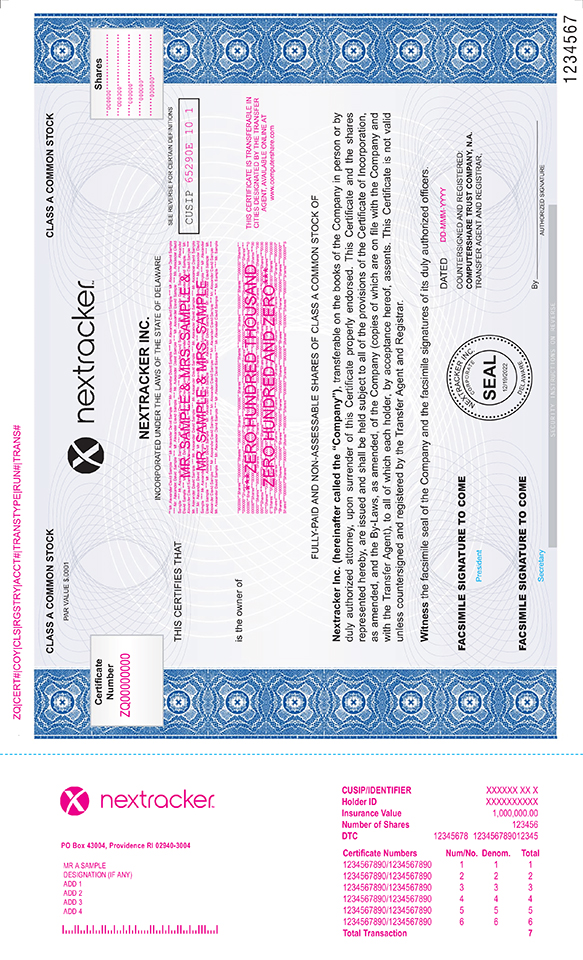

Shares

Class A common stock

This is an initial public offering of shares of Class A common stock of Nextracker Inc. We are offering shares of our Class A common stock. Prior to this offering, there has been no public market for our Class A common stock. We currently expect the initial public offering price of the Class A common stock being offered to be between $ and $ per share. We have applied to list the Class A common stock on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “NXT.”

We will use all of the net proceeds from this offering to purchase LLC Common Units (as defined herein) from a subsidiary of Flex Ltd. (or LLC Common Units if the underwriters exercise in full their option to purchase additional shares of Class A common stock) at a price per unit equal to the initial public offering price per share of Class A common stock in this offering less the underwriting discount. We will not retain any of the net proceeds of this offering.

Following the completion of this offering, we will have two classes of authorized and outstanding common stock. Each share of our Class A common stock and Class B common stock entitles its holder to one vote on all matters presented to our stockholders generally. We are offering shares of our Class A common stock, which immediately after this offering will represent in the aggregate % of our total outstanding shares of common stock (or % of our total outstanding shares of common stock if the underwriters exercise in full their option to purchase additional shares of Class A common stock).

Immediately after this offering, Flex Ltd., our parent company, will own, indirectly through one or more subsidiaries, % of the outstanding shares of our Class B common stock, representing % of our total outstanding shares of common stock (or % of our total outstanding shares of common stock if the underwriters exercise in full their option to purchase additional shares of Class A common stock) and, so long as it owns a controlling interest in our common stock, it will be able to control any action requiring the general approval of our stockholders, including the election and removal of directors, any amendments to our certificate of incorporation and the approval of any merger or sale of all or substantially all of our assets. Accordingly, we will be a “controlled company” within the meaning of the corporate governance rules of Nasdaq. See “Risk factors—Risks related to the Transactions and our relationship with Flex,” “Management—controlled company exemption” and “Principal stockholders.”

We will be a holding company and, upon the completion of this offering, our principal asset will consist of LLC Common Units that we acquire from a subsidiary of Flex Ltd. with the proceeds from this offering, representing % of the total economic interest in the LLC (as defined herein) (or % if the underwriters exercise in full their option to purchase additional shares of Class A common stock). The remaining economic interest in the LLC will be owned by subsidiaries of Flex Ltd. and TPG Rise Flash, L.P. through their ownership of LLC Common Units.

Upon the completion of this offering, we will be the managing member of the LLC. We will operate and control all of the business and affairs of the LLC and its direct and indirect subsidiaries and will conduct our business through the LLC and its direct and indirect subsidiaries.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds to Nextracker Inc., before expenses |

$ | $ | ||||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

We have granted the underwriters an option for a period of 30 days to purchase up to an additional shares of Class A common stock.

Investing in our Class A common stock involves a high degree of risk. See “Risk factors” beginning on page 26.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2023.

| J.P. Morgan | BofA Securities | |

| Citigroup | Barclays | |

| Truist Securities | HSBC | BNP PARIBAS | ||

| Mizuho | Scotiabank | KeyBanc Capital Markets |

| SMBC Nikko | BTIG | UniCredit | Roth Capital Partners |

, 2023

Our mission is to be the world’s leading energy solutions company by enabling the most intelligent, reliable, and productive solar power for future generations. Photo credit: Swinerton Renewable Energy Photo credit: Flex

$1.5 Billion ANNUAL REVENUE (FY 2022)

Global

Leader

FOR 7

CONSECUTIVE YEARS

IN THE SOLAR INDUSTRY (2015-2021)

Based on GW Shipped Globally

~70 GW OF TRACKER SYSTEMS SHIPPED

(AS OF 9/30/2022)

15 GW DELIVERED IN FY 2022

200+ ACTIVE CUSTOMERS

30+ COUNTRIES WITH ACTIVE CUSTOMERS

| Page | ||||

| ii | ||||

| ii | ||||

| iii | ||||

| 1 | ||||

| 26 | ||||

| 71 | ||||

| 73 | ||||

| 74 | ||||

| 75 | ||||

| 81 | ||||

| 82 | ||||

| 83 | ||||

| 85 | ||||

| 89 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

95 | |||

| 121 | ||||

| 143 | ||||

| 148 | ||||

| 179 | ||||

| 181 | ||||

| 204 | ||||

| 206 | ||||

| 213 | ||||

| Material U.S. federal income tax considerations for non-U.S. holders of our Class A common stock |

215 | |||

| 219 | ||||

| 232 | ||||

| 232 | ||||

| 232 | ||||

| F-1 | ||||

i

As used in this prospectus, unless the context otherwise indicates, any reference to “Nextracker,” “our Company,” “the Company,” “us,” “we” and “our” refers, prior to the completion of the Transactions (as defined herein), including this offering, to Nextracker LLC, a Delaware limited liability company (the “LLC”) (formerly known as NEXTracker Inc.), together with its consolidated subsidiaries and with the operations that comprise the legacy solar tracker business of Flex, and after the completion of the Transactions, including this offering, refers to Nextracker Inc., a Delaware corporation and the issuer of the shares of Class A common stock offered hereby (“Nextracker Inc.”), together with its consolidated subsidiaries including the LLC and the operations that comprise the legacy solar tracker business of Flex. References in this prospectus to “Flex” or “Parent” refer to Flex Ltd., a Singapore incorporated public company limited by shares and having a registration no. 199002645H, and its consolidated subsidiaries, unless the context otherwise indicates.

Neither we nor the underwriters have authorized anyone to provide you with any information or to make any representations other than that contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the underwriters take any responsibility for, and provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of Class A common stock and the distribution of this prospectus outside the United States.

Unless otherwise indicated, the information presented in this prospectus:

| • | gives effect to the completion of the Transactions as described under the section entitled “Our organizational structure;” |

| • | assumes an initial public offering price of $ per share of our Class A common stock, which is the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus; |

| • | excludes shares of our Class A common stock that will be reserved for issuance under the Second Amended and Restated 2022 Nextracker Inc. Equity Incentive Plan (our “Equity Incentive Plan” or “LTIP”), which will be available for issuance upon the effectiveness of the registration statement of which this prospectus forms a part; and |

| • | assumes the underwriters’ option to purchase additional shares of Class A common stock will not be exercised. |

Except as otherwise disclosed in this prospectus, the historical combined financial statements and summary and selected historical combined financial data and other financial information included elsewhere in this prospectus are those of the LLC (formerly known as NEXTracker Inc.), together with its consolidated subsidiaries, and includes the operations that comprise the legacy solar tracker business of Flex, and have been prepared in U.S. dollars in accordance with accounting principles generally accepted in the United States (“GAAP”), except for the presentation

ii

of Non-GAAP gross profit, Non-GAAP operating income, Non-GAAP net income, Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted Free Cash Flow, each of which is a non-GAAP financial measure. This historical financial information does not give effect to the Transactions or this offering, other than pro forma earnings per share.

The unaudited pro forma financial information of Nextracker Inc. presented in this prospectus has been derived from the application of pro forma adjustments to the historical combined financial statements of the legacy solar tracker business of Flex, including the LLC (formerly known as NEXTracker Inc.) and its subsidiaries included elsewhere in this prospectus. These pro forma adjustments give effect to the Transactions as described in “Our organizational structure,” including the completion of this offering, as if all such transactions had occurred on April 1, 2021, which was the first day of fiscal year 2022, in the case of the unaudited pro forma combined statement of operations and comprehensive income (loss) data, and as if all such transactions had occurred on September 30, 2022 in the case of the unaudited pro forma combined balance sheet data. See the section entitled “Unaudited pro forma combined financial statements” for a complete description of the adjustments and assumptions underlying the pro forma financial information included in this prospectus.

Our fiscal year ends on March 31 of each year and references in this prospectus to a fiscal year means the year in which that fiscal year ends. Accordingly, references in this prospectus to “fiscal year 2020,” “fiscal year 2021” and “fiscal year 2022” refer to the fiscal year ended March 31, 2020, March 31, 2021 and March 31, 2022, respectively, and references to a “year” made in connection with our financial information or operating results are to the fiscal year ended March 31, unless otherwise stated. The second quarter for fiscal years 2023 and 2022 ended on September 30, 2022 and October 1, 2021, respectively, which respective periods are each comprised of 91 days.

The name and mark, Nextracker, and other trademarks, trade names and service marks of Nextracker appearing in this prospectus are the property of Nextracker. The name and mark, Flex, and other trademarks, trade names and service marks of Flex appearing in this prospectus are the property of Flex. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, trade names and service marks. Other trademarks, trade names and service marks appearing in this prospectus are the property of their respective holders. We do not intend our use or display of other companies’ trademarks, trade names or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

iii

This summary highlights selected information contained elsewhere in this prospectus. It does not contain all of the information that may be important to you and your investment decision. Before investing in our Class A common stock, you should carefully read this entire prospectus, including the matters set forth under the sections of this prospectus entitled “Risk factors” and “Management’s discussion and analysis of financial condition and results of operations” and our combined financial statements and related notes included elsewhere in this prospectus. In this prospectus, we make certain forward-looking statements, including expectations relating to our future performance. These expectations reflect our management’s view of our prospects and are subject to the risks described under “Risk factors” and “Special note regarding forward-looking statements.” Our expectations of our future performance may change after the date of this prospectus and there is no guarantee that such expectations will prove to be accurate. In this prospectus, unless the context otherwise indicates, any reference to “Nextracker,” “our Company,” “the Company,” “us,” “we” and “our” refers, prior to the completion of the Transactions, including this offering, to the legacy solar tracker business of Flex, including the LLC (formerly known as NEXTracker Inc.) and its consolidated subsidiaries, and after completion of the Transactions, including this offering, to Nextracker Inc., the issuer of the shares of Class A common stock offered hereby, together with its consolidated subsidiaries, including the LLC.

Our mission

Our mission is to be the world’s leading energy solutions company enabling the most intelligent, reliable and productive solar power for future generations.

Overview

We are a leading provider of intelligent, integrated solar tracker and software solutions used in utility-scale and ground-mounted distributed generation solar projects around the world. Our products enable solar panels in utility-scale power plants to follow the sun’s movement across the sky and optimize plant performance. We have led the solar industry based on gigawatts (“GW”) shipped globally in 2015 and both globally and in the United States from 2016 to 2021.1

Over the past several years, the cost of solar energy has declined significantly, and today utility-scale solar is one of the lowest cost sources of wholesale energy production, driving demand for solar energy globally. In addition, demand for renewable energy continues to increase as countries, industries and firms move to reduce their carbon footprint and pursue more aggressive decarbonization targets. Electrification, including the proliferation of electric vehicles and the replacement of natural gas with electricity in buildings and residences, is expected to drive increased demand for energy production, including solar energy. We believe that both the attractive cost of solar generation and increasing demand for renewable energy will drive continued growth in the utility-scale solar market. Approximately 59.1% of installations in the United States are larger than 5 MW and most correspond to the utility-scale segment.2

The solar tracker market plays a key part in driving the global energy transition by increasing energy production and improving the levelized cost of energy (“LCOE”). The majority of utility-scale projects installed today in mature markets such as the United States, Latin America and Australia use solar trackers and adoption of solar tracker technology is growing in developing solar markets such as the Middle East and Africa. According

| 1 | Wood Mackenzie, June 2022. |

| 2 | Wood Mackenzie, December 2022 (Global solar PV market outlook update: Q4 2022). |

1

to Wood Mackenzie, the global solar tracking market is estimated to be a $71 billion cumulative opportunity from 2020 to 2030, representing approximately 682 GW of solar capacity installed over that time period.3

By optimizing and increasing energy production and reducing costs, our tracker products and software solutions offer significant return on investment (“ROI”) for utility-scale solar projects. Single axis solar trackers generate up to 25% more energy than projects that use fixed-tilt systems that do not track the sun. To achieve these benefits, the industry initially focused on linked-row tracker architecture that moves rows of solar panels together as one unit to follow the sun. We have developed the next generation of solar trackers that enable rows to move independently, providing further benefits to customers. Our intelligent independent row tracking system incorporates proprietary technology that we believe produces more energy, lowers operating costs, is easier to deploy and has greater reliability compared to linked row, other independent tracker products and fixed-tilt systems. Our tightly-integrated software solutions use advanced algorithms and artificial intelligence technologies to further optimize the performance and capabilities of our tracker products.

We have shipped approximately 70 GW of our solar tracker systems as of September 30, 2022 to projects on six continents for use in utility-scale and ground-mounted distributed generation solar applications worth more than $67 billion (based on recent global utility-scale system pricing).4 Our customers include engineering, procurement and construction firms (“EPCs”), as well as solar project developers and owners. We are a qualified, preferred provider to some of the largest solar EPC firms and solar project developers and owners in the world.

We have firm orders representing executed contracts, purchase orders and volume commitment agreements for projects that total approximately $2.0 billion in the aggregate as of September 30, 2022. These firm orders do not include our pipeline for projects that are currently in various stages of negotiations and contract execution.

We were founded in 2013 by our Chief Executive Officer, Dan Shugar, and were acquired by Flex Ltd. in 2015. Flex provides design, manufacturing and supply chain services through a network of over 100 locations in approximately 30 countries across five continents. Flex’s expertise in global supply chains and procurement and its strong financial backing has helped us accelerate our penetration of our end markets and run an optimized supply chain.

Our growth and success are evidenced by our operating and financial results in the six-month periods ended September 30, 2022 and October 1, 2021, and in the fiscal years 2022, 2021 and 2020:

| • | We generated revenue of $870.4 million in the six-month period ended September 30, 2022 compared to $680.2 million in the six-month period ended October 1, 2021. We generated revenue of $1,457.6 million, $1,195.6 million and $1,171.3 million in fiscal year 2022, 2021 and 2020, respectively. |

| • | We generated gross profit of $114.4 million in the six-month period ended September 30, 2022 compared to $74.3 million in the six-month period ended October 1, 2021. Non-GAAP gross profit was $115.3 million for the six-month period ended September 30, 2022 compared to $78.9 million for the six-month period ended October 1, 2021. We generated gross profit of $147.0 million, $232.0 million and $212.9 million in fiscal year 2022, 2021 and 2020, respectively. Non-GAAP gross profit was $152.6 million, $242.0 million and $222.5 million for fiscal year 2022, 2021 and 2020, respectively. |

| 3 | Wood Mackenzie, December 2022 (The global solar PV tracker landscape 2022). Global total addressable market excludes China. |

| 4 | Wood Mackenzie, April 2022 (Global solar PV system price: country breakdowns and forecasts). The $67 billion value represents the estimated aggregate capital expenditures made on solar applications in order to build the projects; solar trackers generally represent approximately 12% of those capital expenditures. Such value is not necessarily indicative of the current market value of the projects as financial assets, which would depend on each project’s future projected cash flows. |

2

| • | We generated operating income of $69.2 million in the six-month period ended September 30, 2022 compared to $41.2 million in the six-month period ended October 1, 2021. Non-GAAP operating income was $73.6 million for the six-month period ended September 30, 2022 compared to $50.0 million for the six-month period ended October 1, 2021. We generated operating income of $65.9 million, $158.5 million and $148.9 million in fiscal year 2022, 2021 and 2020, respectively. Non-GAAP operating income was $90.4 million, $177.9 million and $168.0 million for fiscal year 2022, 2021 and 2020, respectively. |

| • | We generated net income of $51.2 million in the six-month period ended September 30, 2022 compared to $32.6 million in the six-month period ended October 1, 2021. We generated net income of $50.9 million, $124.3 million and $118.3 million in fiscal year 2022, 2021 and 2020, respectively. |

| • | Non-GAAP net income was $53.8 million for the six-month period ended September 30, 2022 compared to $39.0 million for the six-month period ended October 1, 2021. Non-GAAP net income was $69.9 million, $140.3 million and $134.3 million for fiscal year 2022, 2021 and 2020, respectively. |

| • | Adjusted EBITDA was $73.8 million for the six-month period ended September 30, 2022 compared to $51.1 million for the six-month period ended October 1, 2021. Adjusted EBITDA was $92.3 million, $179.2 million and $170.7 million for fiscal year 2022, 2021 and 2020, respectively. |

| • | Net income as a percentage of revenue was 5.9% for the six-month period ended September 30, 2022 compared to 4.8% for the six-month period ended October 1, 2021. Net income as a percentage of revenue was 3.5%, 10.4% and 10.1% for fiscal year 2022, 2021 and 2020, respectively. |

| • | Adjusted EBITDA as a percentage of revenue was 8.5% for the six-month period ended September 30, 2022 compared to 7.5% for the six-month period ended October 1, 2021. Adjusted EBITDA as a percentage of revenue was 6.3%, 15.0% and 14.6% for fiscal year 2022, 2021 and 2020, respectively. |

Non-GAAP gross profit, Non-GAAP operating income, Non-GAAP net income, Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. See the section entitled “—Summary historical and pro forma combined financial and other data” for definitions of Non-GAAP gross profit, Non-GAAP operating income, Non-GAAP net income, Adjusted EBITDA and Adjusted EBITDA Margin and reconciliations to the most directly comparable GAAP measures.

Industry trends

Growing demand for solar energy production is driven by the increasing cost competitiveness of solar energy and global trends including decarbonization and electrification.

Globally, many countries, industries and firms have been aggressively pursuing decarbonization standards that pledge to increase the percentage of electricity production from renewable energy sources while decreasing use of fossil fuel and nuclear generation. This pursuit, coupled with increasing demands for electrification to help achieve greenhouse gas emissions reductions, has created a significant demand for clean energy production. Electrification refers to electricity replacing other sources for energy consumption, such as the transition to electric vehicles and electric heating.

Solar is the fastest growing segment of the renewable energy sector and has become one of the most cost-effective forms of wholesale energy generation. According to Lazard, over the past decade the cost of solar generation has fallen by 90%.5 Today, solar electricity is competitive with both natural gas and wind and costs significantly less than some conventional generation technologies such as coal and nuclear.

| 5 | Lazard, 2021. |

3

Utilities are expanding solar generation both to replace pre-existing capacity from conventional plants as they are retired and to build new capacity as overall electricity demand grows. As more coal generation plants were retired than constructed, global coal capacity began to fall for the first time ever in 2020 and has fallen in 2021 and the first half of 2022.6 The U.S. Energy Information Administration (“EIA”) expects retirement of coal-fired generators to increase again in 2022—12.6 GW of coal capacity is scheduled to retire in 2022, or 6% of the coal-fired generating capacity that was operating at the end of 2021.7 The International Energy Agency expects solar power to account for more than 70% of renewable electricity net capacity additions worldwide over the next four years.8

In the United States, capacity is projected to grow with nearly 161.5 GW of new solar installations across all market segments from 2022 to 2026, more than double the increase over the prior five year period from 2017 to 2021.9 International markets are expected to grow in both more developed solar markets such as Latin America, Australia and Europe, as well as in emerging markets such as the Middle East, Africa and Southeast Asia. All such markets are experiencing growth as cost declines have made solar more attractive. Approximately 59.1% of installations in the United States are larger than 5 MW and most correspond to the utility-scale segment.10

In the 1980s, many utility scale plants in the early growth of the industry used `fixed-tilt’ mounting systems to secure PV panels. Fixed-tilt systems hold PV panels in a non-moving, fixed orientation, typically arranged in south-facing rows tilted at an appropriate elevation angle based on summer or winter energy optimization.

Fixed-tilt structures remained the predominant mounting system for ground-based projects until the commercialization of tracking systems in the early 1990s.

Today’s utility-scale solar plants have evolved from ‘fixed-tilt’ systems to generally rely on solar tracking technologies that increase electricity generation and improve economics for plant owners by enabling solar panels to rotate and follow the sun’s movement across the sky. Single axis solar trackers can increase energy yield of solar projects and generate up to 25% more energy than projects that use fixed-tilt, or stationary, panel mounting systems that do not track the sun.11 The additional cumulative revenue from energy production that trackers provide typically exceeds the incremental cost of using a tracking system, improving the LCOE and providing significant ROI for solar projects.

There are several types of tracking solutions with differing geometry and operational characteristics. The majority of the market uses single axis horizontal trackers such as our solar tracker products. We believe single axis horizontal trackers offer the best optimization of performance, cost and reliability for utility-scale solar plants. Other tracking designs, such as dual axis trackers, are typically more expensive and primarily used for niche applications.

While solar trackers have existed for over 30 years, there are many limitations to competing tracker solutions that reduce ROI for utility-scale solar plants.

| • | Legacy architectures. Certain tracker technologies in the market today rely on a legacy, linked-row architecture. These systems use mechanical linkages and a single large motor to simultaneously move multiple interconnected, or “linked,” rows of trackers, introducing significant single points of failure. Linked-row architectures were designed over 30 years ago primarily due to the high cost of electric motors and control systems at the time. These designs do not leverage the substantial cost reductions in motors and control systems today, and have limitations in optimizing performance, reliability and operations. |

| 6 | Electric Power Monthly, May 2022. |

| 7 | U.S. Energy Information Administration, January 2022. |

| 8 | International Energy Agency, 2022. |

| 9 | Wood Mackenzie, December 2022. |

| 10 | Wood Mackenzie, December 2022. |

| 11 | Joule, 2020. |

4

| • | Lack of software and sensor capabilities. Legacy architectures were not designed to tightly couple the solar tracker with advanced software and sensors to further increase energy production levels, optimize performance for variable site and severe weather conditions, and efficiently manage a power plant’s operating costs. |

| • | Vulnerable to damage from severe weather conditions. Solar power plants can be damaged by severe weather conditions, including flooding, hail and extreme wind events. Other tracker architectures have exhibited significant vulnerabilities to such conditions. |

| • | Difficult to deploy. Other solar tracker architectures may incur substantial installation costs and significant time to deploy and operationalize due to factors such as greater structural complexity. Since many project sites have varying topographies, legacy architectures can create additional deployment complexities, such as significant site grading costs and longer installation and commissioning processes. |

| • | Difficult to operate. Legacy linked-row architectures create challenges with management of the solar array. Physically-linking tracker rows together significantly inhibits or eliminates the ability to control each row independently to increase overall power production. In addition to introducing significant single points of failure, linkages also create a physical barrier that limits vehicle access for maintenance activities, such as panel cleaning and vegetation management, thus increasing operating costs and reducing power production. |

| • | Lack of future upgradability. Most trackers are designed with a fixed set of features and capabilities at the time of their installation. As a result, future software and mechanical upgrades are unavailable or cost prohibitive, in large part due to limited control systems and connectivity capabilities in existing solutions. |

We believe that our solution addresses these limitations and provides tremendous benefits to our customers and end users.

Our solution

We provide intelligent, integrated solar tracker and software solutions that use an innovative design approach to enable new capabilities and to expand the viability of trackers across a broader range of topographical and climate conditions.

Tracking solutions portfolio

NX Horizon is our flagship solar tracking solution. NX Horizon’s smart solar tracker system delivers what we believe to be an attractive LCOE and has been deployed more than any other tracker as of December 31, 2021. Based on our internal analysis, experience and customer feedback, we believe we generally have an LCOE advantage compared to legacy linked row trackers and, depending upon terrain, climate, location and other factors, we believe this LCOE advantage can be as high as 9%. NX Horizon’s system mounts a single line of panels along a tracker row. NX Horizon’s reliable self-powered motor and control system, balanced mechanical design and independent-row architecture provide project design flexibility while lowering operations and maintenance costs. With its self-aligning module rails and vibration-proof fasteners, NX Horizon can be easily and rapidly installed. The self-powered, decentralized architecture allows each row to be commissioned in advance of site power and is designed to withstand high winds and other adverse weather conditions. NX Horizon combines several key features that improve performance, reliability and operability compared to competing designs.

NX Gemini is our two-in-portrait (“2P”) format tracker which holds two rows of solar panels along the central support beam. Ideally suited for sites with challenging soils, high winds and irregular boundaries, NX Gemini features a distributed drive system for robust stability in extreme weather, eliminating the need for dampers and minimizing energy required to stow panels in a safe position during inclement weather.

5

In March 2022, we launched NX Horizon-XTR, our terrain-following tracker designed to expand the addressable market for trackers on sites with sloped, uneven and challenging terrain. NX Horizon-XTR conforms to the natural terrain of the site, reducing or eliminating cut-and-fill earthworks and reducing foundation lengths. These benefits help accelerate construction schedules and make trackers more economically and environmentally viable on difficult sites.

| • | Independent rows. Over the last decade, the substantial decrease in the cost of electric motors and control systems helped accelerate the adoption of independent row tracking systems over linked-row architectures. In addition to the ability to rotate each row individually, independent rows provide many benefits such as increased redundancy and therefore lower risk of single points of component failure, site layout flexibility including reduced grading requirements, ease of installation, and ease of maintenance and operations, including unrestricted vehicle access. |

| • | Mechanically-balanced rows. Our patented, mechanically-balancing rows have several benefits, including greater range of motion, less energy required to rotate the panels than competing products, and reduced component wear and tear. Mechanical balancing also enables greater elevation of solar panels above a central support beam (torque tube), significantly improving energy production in bifacial applications by allowing more reflected light to reach the back side of the panel. Bifacial panels capture sunlight on both their front and back sides and are increasingly adopted in utility-scale projects. |

| • | Self-powered. Our tracker design includes the placement of a small solar panel on each row that powers the trackers, eliminating the need for more expensive AC power. In addition, our self-powered controller also enables advanced software capabilities by collecting and distributing real-time sensor data. |

| • | Terrain following capability. Unlike typical designs that constrain tracker rows to a plane, Nextracker’s NX Horizon-XTR tracker variant conforms to a site’s natural terrain undulations. This design eliminates or reduces the cost and impact of cut-and-fill earthworks, reduces foundation material, eases permitting and accelerates project construction schedules. NX Horizon-XTR’s ability to significantly reduce earthwork allows many otherwise infeasible sites to become economically viable for solar trackers. Less earthwork lowers upfront costs and improves scheduling while mitigating environmental impacts to topsoil, native vegetation, and natural drainage features. |

| • | Embedded sensors and connectivity. Our embedded sensors and wireless mesh network with real-time connectivity enable visibility and system monitoring of critical components and remote maintenance, upgrades, and future software enhancements if separately purchased by the customer. |

| • | Operations and maintenance efficiency. Our highly engineered fasteners replace standard nuts and bolts. Our fasteners increase long-term reliability and eliminate the need for periodic inspection and maintenance required by systems held together with nuts and bolts. |

| • | Sealed, elevated drive system. All our trackers have sealed gears, motors and controllers, which are typically elevated three or more feet above the ground, protecting the system against dust, flooding and ground accumulations of snow and ice. |

Software solutions portfolio

We offer a number of software solutions to optimize the performance and capabilities of our tracking solutions. Our software is licensed on a separate basis and integrated with our tracker products, leveraging the embedded sensors, communication and control capabilities in these solutions. When we develop new software features, we can provide these capabilities to both our customers’ existing installed fleet as well as new projects. Through

6

software innovation, we have been able to improve energy yields and operability over time, providing differentiated benefits to our customers.

TrueCapture is our flagship software offering, which as of September 30, 2022 has been installed on approximately 186 projects and is under contract for approximately 38 additional projects. As of December 31, 2022, TrueCapture has been installed on approximately 192 projects, an increase of 181 installed projects from 11 installed projects as of March 31, 2019, and is under contract for approximately 52 additional projects as of December 31, 2022. TrueCapture is an intelligent, self-adjusting tracker control system that uses machine learning to increase typical solar power plant energy yield between 1-2.2% for the majority of projects. While linked row tracking systems angle all rows in an identical direction facing the sun, TrueCapture boosts solar power plant production by continuously optimizing the position of each individual tracker row in response to site features such as varying topography and changing weather conditions.

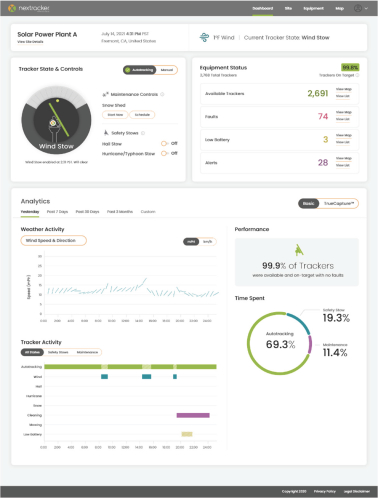

NX NavigatorTM, which is typically bundled with TrueCapture, enables solar power plant owners and operators to monitor, control and protect their solar projects. An intuitive dashboard helps plant managers to precisely visualize real-time operational data at the site, subfield and individual tracker level. In addition, NX Navigator’s risk mitigation features include Hurricane/Typhoon Stow and Hail Stow modes, both of which quickly command solar panels to rotate to safe positions in response to inclement weather that might otherwise cause significant damage to solar panels.

Benefits of our solution

We approach tracking with a holistic and forward-thinking view toward increasing solar power plant energy production levels and decreasing operating and maintenance costs. Our trackers provide high levels of performance and operability and improve over time through our separately licensed software solutions. We see trackers as not only a physical mounting and rotating platform for solar panels, but also as a nexus of intelligent control and optimization for the entire solar plant. Our innovative approach provides the following significant competitive advantages:

| • | Next-generation architecture. Our self-balancing, independent-row architecture provides many performance and cost advantages, including improved reliability, easier access for maintenance vehicles, a wide rotational range and the ability to optimize the tracker angle on a row-by-row basis for increased energy production. Unlike some linked-row designs, our key drive components are located well above ground to reduce risk from flooding and ground accumulations of snow and ice. |

| • | Advanced software and sensor capabilities. We optimize performance and operability through hardware and software integration, validated by rigorous testing and field-based measurement and verification. Our software solutions interface with our network of data-mining sensors dispersed throughout the solar plant and enable operators to optimize performance. |

| • | Ease of deployment. Our solutions are designed to enhance system configuration and planning for customers, reduce costs associated with grading, earthworks, anchoring, deployment and other installation, and reduce time to deploy and operationalize. |

| • | Ease of operation. Our architecture, sensors and software are designed to reduce operating costs, optimize uptime and mitigate risks such as potential damage from severe weather. Independent-row architecture reduces the cost of cleaning, vegetation management and inspection operations by providing significantly easier vehicle movement along rows. Embedded sensors provide terabytes of data that deliver individual row level insights to drive operational benefits for our customers. |

| • | Future upgradability. We take an innovative approach to ‘future proofing’ the optimization of our trackers over time, enabling the release of improved features and capabilities to both legacy and new solar projects via future software enhancements to our separately sold software solutions. |

7

| • | Severe weather protection. Our systems combine multiple approaches to reduce risk of damage while maintaining as much energy production as feasible in severe weather conditions, including a feature that automatically puts the panels into stow position shortly after a loss of utility power. Our trackers use wind stowing methods and dampening based on research on dynamic wind force mitigation, increasing protection against high winds while seeking to minimize energy production impacts. Our software also provides rapid stowing modes to reduce risk of damage from hail. |

| • | Superior production for bifacial solar panels. Our tracker platforms are designed to optimize production from bifacial solar panels. Bifacial panels capture sunlight on both their front and back sides and are increasingly adopted in utility-scale projects. Our architecture is designed to mitigate obstructions that can block reflected light from reaching the back side of the panels. |

Our key strengths

| • | Global Leader in the Solar Tracking Industry. We are the global leader in the solar tracking industry based on GW shipped and have been for the last seven consecutive years from 2015 to 2021.12 |

| • | Culture and Track Record of Innovation. We pioneered what we believe to be today’s leading generation of tracker solutions, including many “industry first” innovations, such as self-powering and self-grounding capabilities, and associated software offerings. |

| • | Proven Solutions with a Long Track Record of Performance and Reliability. We have an established track record of delivering what we believe to be the highest performing trackers for solar energy projects in markets around the world. |

| • | Strategic, Value-driven Relationships Throughout the Customer Value Chain. We have developed long-term, entrenched strategic relationships throughout the value chain with leading developers, EPCs, owners and operators of solar projects. |

| • | Differentiated, Robust Intellectual Property Portfolio. We have a large portfolio of intellectual property protecting both our hardware and software products, including 70 issued U.S. patents, 100 granted non-U.S. patents and 197 U.S. and non-U.S. patent applications pending, including provisional patent applications pending in the U.S. and pending Patent Cooperation Treaty applications as of September 30, 2022. |

| • | Visionary, Founder-Led Management Team. Our founders and management team pioneered tracking technology and key members of our management team have an average of 20 years of experience in the solar industry. |

Our growth strategies

We intend to drive the growth of our business primarily through the following strategies:

| • | Maintain clear leadership position in sophisticated and growing U.S. market. |

| • | Expand in rapidly growing and maturing international markets. |

| • | Leverage our cutting-edge technological expertise to expand the existing addressable market. |

| • | Expand our product offerings and capitalize on our large installed base. |

| • | Pursue selective and accretive acquisitions to complement our existing platform. |

Our market opportunity

Trackers are the fastest-growing utility-scale mounting system across the world, with the percentage of ground-mounted solar installations (in GW) utilizing trackers growing from 23% in 2015 to a projected 49% in 2022 globally

| 12 | Wood Mackenzie, June 2022. |

8

(and was over 80% in 2022 in mature markets such as the United States and Australia), according to Wood Mackenzie.13 In addition, the most recent tracker-specific forecasts from Wood Mackenzie estimate a $4.6 billion market for trackers in 2022, the third consecutive year in which the annual market value of trackers would exceed that of fixed-tilt systems for the ground-mounted market.14 We believe that the global demand for trackers is growing faster than the overall demand for mounting systems because solar energy projects that use trackers generate significantly more ROI than projects that do not. According to Wood Mackenzie, the global tracker market is expected to be a $71 billion cumulative opportunity from 2020 to 2030, representing approximately 682 GW of solar installed over that time period.15

Impact of COVID-19

The COVID-19 pandemic resulted in a widespread public health crisis and numerous disease control measures being taken to limit its spread, including travel bans and restrictions, quarantines, shutdowns, vaccine mandates and social distancing measures. These events and control measures impacted our operations and the operations of our customers and our suppliers. We experienced disruptions due to illness and the effect of governmental mandates and recommendations, as well as the measures we took to mitigate the impact of COVID-19 at our offices around the world in an effort to protect the health and well-being of our employees, customers, suppliers and the communities in which we operate. Our operations were also affected by the disruptions experienced by our customers, suppliers, freight operators and trucking companies due to the COVID-19 pandemic and related events, including site closures, factory closures, labor shortages and wide-scale disruptions in the world-wide shipping infrastructure. During the height of the COVID-19 pandemic, our management team committed significant time, attention and resources to update our processes and business systems, and expand localized capacity. Although the COVID-19 pandemic appears to have abated, its long-term effects on the global economy, including ongoing transportation and logistics issues and rapid inflation, continue to affect our business. Furthermore, should the COVID-19 pandemic become more virulent, or should another pandemic arise, this could further negatively affect our operations and financial results. See the section entitled “Risk factors—Risks related to our business and our industry—We face risks related to the COVID-19 pandemic, which could have a material and adverse effect on our business, results of operations and financial condition” for additional information regarding the potential impact of COVID-19 on our business and operations.

Tax Receivable Agreement

We will enter into a tax receivable agreement (the “Tax Receivable Agreement”) with the LLC, Yuma, Inc., a Delaware corporation and indirect wholly-owned subsidiary of Flex (“Yuma”), Yuma Subsidiary, Inc., a Delaware corporation and wholly-owned subsidiary of Yuma (“Yuma Sub”), TPG Rise Flash, L.P., an affiliate of the private equity firm TPG (“TPG”), and the following affiliates of TPG: TPG Rise Climate Flash Cl BDH, LP, TPG Rise Climate BDH, LP and The Rise Fund II BDH, LP (collectively, the “TPG Affiliates”). The Tax Receivable Agreement will provide for the payment by us to Yuma, Yuma Sub, TPG and the TPG Affiliates (or certain permitted transferees thereof) of 85% of the tax benefits, if any, that we are deemed to realize under certain circumstances as a result of (i) our allocable share of existing tax basis in tangible and intangible assets resulting from exchanges or acquisitions of outstanding Series A Preferred Units of the LLC (the “LLC Preferred Units”) or common units of the LLC (the “LLC Common Units” and together with the LLC Preferred Units, the “LLC Units”), including as part of the Transactions or under the Exchange Agreement, (ii) increases in tax basis resulting from exchanges or acquisitions of LLC Units and shares of Class B common stock (including as part of the Transactions or under the Exchange Agreement), (iii) certain pre-existing tax attributes of certain blocker corporations affiliated with TPG that will each merge with a separate direct, wholly-owned subsidiary of us, as part of the Transactions, and

| 13 | Wood Mackenzie, December 2022. Global total addressable market excludes China. |

| 14 | Ibid. |

| 15 | Ibid. Global total addressable market excludes China. |

9

(iv) certain other tax benefits related to our entering into the Tax Receivable Agreement, including tax benefits attributable to payments under the Tax Receivable Agreement. See the section entitled “Certain relationships and related party transactions—Tax receivable agreement.” Assuming no material changes in the relevant tax law and that we earn sufficient taxable income to realize all tax benefits that are subject to the Tax Receivable Agreement, we expect that the tax savings we will be deemed to realize associated with the tax benefits described above would aggregate approximately $ million over 20 years from the date of this offering based on the initial public offering price of $ per share of our Class A common stock (which is the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus), and assuming all future exchanges of LLC Units occur at the time of this offering. Under such scenario we would be required to pay the owners of LLC Units approximately 85% of such amount, or $ million, over the 20 year period from the date of this offering, and the yearly payments over that time would range between approximately $ million to $ million per year. Such payments will reduce the cash provided to us by the tax savings described above. As a result, investors purchasing shares in this offering or in the public market following this offering will not be entitled to the economic benefit of the tax benefits subject to the Tax Receivable Agreement that would have been available if the Tax Receivable Agreement were not in effect (except to the extent of our continuing 15% interest in the tax benefits subject to the Tax Receivable Agreement). See the section entitled “Certain relationships and related party transactions—Tax receivable agreement.”

Summary risk factors

Our business and our ability to execute our strategy are subject to many risks. Before making a decision to invest in our Class A common stock, you should carefully consider all of the risks and uncertainties described in the section entitled “Risk factors” and elsewhere in this prospectus. These risks and uncertainties include, but are not limited to, the following:

| • | The demand for solar energy and, in turn, our products are impacted by many factors outside of our control, and if such demand does not continue to grow or grows at a slower rate than we anticipate, our business and prospects will suffer. |

| • | Competitive pressures within our industry may harm our business, revenues, growth rates and market share. |

| • | We face competition from conventional and renewable energy sources that may offer products and solutions that are less expensive or otherwise perceived to be more advantageous than solar energy solutions, which could materially and adversely affect the demand for and the average selling price of our products and services. |

| • | Our results of operations may fluctuate from quarter to quarter, which could make our future performance difficult to predict and could cause our results of operations for a particular period to fall below expectations. |

| • | The reduction, elimination or expiration of government incentives for, or regulations mandating the use of, renewable energy and solar energy specifically could reduce demand for solar energy systems and harm our business. |

| • | We rely heavily on our suppliers and our operations could be disrupted if we encounter problems with our suppliers or if there are disruptions in our supply chain. |

| • | Economic, political and market conditions can adversely affect our business, results of operations and financial condition, including our revenue growth and profitability, which in turn could adversely affect our stock price. |

10

| • | Changes in the global trade environment, including the imposition of import tariffs, could adversely affect the amount or timing of our revenues, results of operations or cash flows. |

| • | We face risks related to the COVID-19 pandemic, which could have a material and adverse effect on our business, results of operations and financial condition. |

| • | A further increase in interest rates, or a reduction in the availability of tax equity or project debt financing, could make it difficult for project developers and owners to finance the cost of a solar energy system and could reduce the demand for our products. |

| • | A loss of one or more of our significant customers, their inability to perform under their contracts, or their default in payment, could harm our business and negatively impact our revenue, results of operations and cash flows. |

| • | Defects or performance problems in our products could result in loss of customers, reputational damage and decreased revenue, and we may face warranty, indemnity and product liability claims arising from defective products. |

| • | We may experience delays, disruptions or quality control problems in our product development operations. |

| • | Our business is subject to the risks of severe weather events, natural disasters and other catastrophic events. |

| • | Our continued expansion into new markets could subject us to additional business, financial, regulatory and competitive risks. |

| • | Our indebtedness could adversely affect our financial flexibility and our competitive position. |

| • | Electric utility industry policies and regulations may present technical, regulatory and economic barriers to the purchase and use of solar energy systems that could significantly reduce demand for our products or harm our ability to compete. |

| • | We will be required to pay Yuma, Yuma Sub, TPG and the TPG Affiliates (or certain permitted transferees thereof) for certain tax benefits that we are deemed to realize arising in connection with this offering and related transactions, and the amounts we may pay could be significant. |

Incorporation of Nextracker Inc.

Nextracker Inc., a Delaware corporation, was formed on December 19, 2022 and is the issuer of the Class A common stock offered by this prospectus. Prior to the completion of the Transactions, including this offering, all of our business operations have been conducted through the LLC (formerly known as NEXTracker Inc.) and its direct and indirect subsidiaries. Nextracker Inc. has not engaged in any material business or other activities except in connection with its formation and the Transactions.

The TPG investment

On February 1, 2022, Flex sold LLC Preferred Units representing a 16.7% limited liability company interest in the LLC to TPG, resulting in TPG holding all of the outstanding LLC Preferred Units and subsidiaries of Flex holding all of the outstanding LLC Common Units. Immediately prior to this offering, as a result of accrued distributions paid in kind in respect of TPG’s outstanding LLC Preferred Units, TPG owned, through one or more subsidiaries, a % limited liability company interest in the LLC. The LLC Preferred Units will be automatically converted into a certain number of LLC Common Units in connection with this offering as described below under “—The Transactions” and “Our organizational structure—The Transactions,” and TPG and the TPG Affiliates will be parties to the Tax Receivable Agreement.

11

The Transactions

We will complete the following organizational and other transactions in connection with this offering:

| • | We will amend and restate Nextracker Inc.’s certificate of incorporation to, among other things, provide for Class A common stock and Class B common stock, with each share entitling its holder to one vote on all matters presented to our stockholders generally, and provide that shares of Class B common stock may only be held by Yuma, Yuma Sub, TPG and each of their permitted transferees; |

| • | We will issue shares of our Class A common stock to the purchasers in this offering (or shares if the underwriters exercise in full their option to purchase additional shares of Class A common stock) in exchange for net proceeds therefrom of approximately $ million (or approximately $ million if the underwriters exercise in full their option to purchase additional shares of Class A common stock), based upon an assumed initial public offering price of $ per share (which is the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus), less the underwriting discount and estimated offering expenses payable by us; |

| • | We will issue shares of our Class B common stock to Yuma, Yuma Sub and TPG in exchange for cash consideration, which number of shares shall be equal to the number of LLC Common Units held directly or indirectly by Yuma, Yuma Sub and TPG immediately following the Transactions, and we will repurchase all of the shares of our common stock previously issued to Yuma for cash consideration; |

| • | Immediately prior to the consummation of this Offering, the LLC will make a distribution in respect of the LLC Units in an aggregate amount of $175.0 million (the “Distribution”). With respect to such Distribution, $125.0 million shall be distributed to TPG, Yuma and Yuma Sub in accordance with their pro rata LLC Units and $50.0 million to Flex. The Distribution will be financed, in part, with net proceeds from a $150.0 million term loan under a credit agreement entered into by the LLC which will be guaranteed by Nextracker Inc., and various lenders party thereto (the “2023 Credit Agreement”). |

| • | In connection with this offering, the LLC Preferred Units held by TPG will be automatically converted into a certain number of LLC Common Units (the “Automatic Conversion”) which are exchangeable, together with a corresponding number of shares of Class B common stock, for shares of our Class A common stock (or cash). Notwithstanding the foregoing, as permitted under and in accordance with the second amended and restated limited liability company agreement of Nextracker LLC in effect prior to this offering (the “Prior LLC Agreement”), TPG has exercised its right to have certain blocker corporations affiliated with TPG merge with a separate direct, wholly-owned subsidiary of Nextracker Inc., with the blocker corporations surviving each such merger, in a transaction intended to qualify as a tax-free transaction, with the investors in each such blocker corporation being entitled to a number of shares of Nextracker Inc. Class A common stock with a value based on the LLC Preferred Units held by such blocker corporation; |

| • | We will use all of the net proceeds from this offering as consideration for Yuma’s transfer to us of LLC Common Units (or LLC Common Units if the underwriters exercise in full their option to purchase additional shares of Class A common stock) at a price per unit equal to the initial public offering price per share of Class A common stock in this offering less the underwriting discount; |

| • | We will be appointed as the managing member of the LLC; |

| • | We, the LLC, Yuma, Yuma Sub and TPG will enter into an exchange agreement (the “Exchange Agreement”) under which Yuma, Yuma Sub and TPG (or certain permitted transferees thereof) will have the right, subject |

12

| to the terms of the Exchange Agreement, to require the LLC to exchange LLC Common Units (together with a corresponding number of shares of Class B common stock) for newly-issued shares of Class A common stock on a one-for-one basis, or, in the alternative, we may elect to exchange such LLC Common Units (together with a corresponding number of shares of Class B common stock) for cash equal to the product of (i) the number of LLC Common Units (together with a corresponding number of shares of Class B common stock) being exchanged, (ii) the then-applicable exchange rate under the Exchange Agreement (which will initially be one and is subject to adjustment) and (iii) the Class A common stock value (based on the market price of our Class A common stock), subject to customary conversion rate adjustments for stock splits, stock dividends, reclassifications and other similar transactions; provided further, that in the event of an exchange request by an exchanging holder, Nextracker Inc. may at its option effect a direct exchange of shares of Class A common stock for LLC Common Units and shares of Class B common stock in lieu of such exchange or make a cash payment to such exchanging holder, in each case pursuant to the same economic terms applicable to an exchange between the exchanging holder and the LLC; |

| • | We, the LLC, Yuma, Yuma Sub, TPG and the TPG Affiliates will enter into the Tax Receivable Agreement described above under the section entitled “—Tax Receivable Agreement”; and |

| • | We, Yuma, Yuma Sub and TPG will enter into a registration rights agreement pursuant to which we will grant such parties (and their transferees, if any) certain registration rights with respect to any of our Class A common stock owned by them (including upon exchange of LLC Common Units and shares of Class B common stock held by them). See the section entitled “Certain relationships and related party transactions—Agreements with Flex—Registration rights agreement.” |

We collectively refer to the foregoing organizational and other transactions and this offering as the “Transactions.”

Immediately following the completion of the Transactions (including this offering):

| • | Nextracker Inc. will be a holding company and its principal asset will be the LLC Units it purchases from Yuma; |

| • | Nextracker Inc. will be the managing member of the LLC and will control the business and affairs of the LLC and its subsidiaries; |

| • | Nextracker Inc. will beneficially own LLC Common Units, representing approximately % of the economic interest in the business of the LLC (or LLC Common Units, representing approximately % of the economic interest in the business of the LLC, if the underwriters exercise in full their option to purchase additional shares of Class A common stock); |

| • | The purchasers in this offering will own (i) shares of Class A common stock of Nextracker Inc., representing approximately % of the total outstanding shares of Nextracker Inc.’s common stock (or shares of Class A common stock, representing approximately % of the total outstanding shares of Nextracker Inc.’s common stock, if the underwriters exercise in full their option to purchase additional shares of Class A common stock) and (ii) indirectly through Nextracker Inc.’s ownership of LLC Units, approximately % of the economic interest in the business of the LLC (or approximately % of the economic interest in the business of the LLC if the underwriters exercise in full their option to purchase additional shares of Class A common stock); |

| • | Flex (i) through Yuma and Yuma Sub, will own shares of Class B common stock of Nextracker Inc., representing approximately % of the total outstanding shares of Nextracker Inc.’s common stock (or shares of Class B common stock, representing approximately % of the total outstanding |

13

| shares of Nextracker Inc.’s outstanding common stock, if the underwriters exercise in full their option to purchase additional shares of Class A common stock) and (ii) through Yuma and Yuma Sub, will own LLC Common Units, representing approximately % of the economic interest in the business of the LLC (or LLC Common Units, representing approximately % of the economic interest in the business of the LLC, if the underwriters exercise in full their option to purchase additional shares of Class A common stock); and |

| • | TPG will own (i) shares of Class A common stock of Nextracker Inc., representing approximately % of the total outstanding shares of Nextracker Inc.’s common stock (or shares of Class A common stock, representing approximately % of the total outstanding shares of Nextracker Inc.’s outstanding common stock, if the underwriters exercise in full their option to purchase additional shares of Class A common stock), (ii) shares of Class B common stock of Nextracker Inc., representing approximately % of the total outstanding shares of Nextracker Inc.’s common stock (or shares of Class B common stock, representing approximately % of the total outstanding shares of Nextracker Inc.’s common stock, if the underwriters exercise in full their option to purchase additional shares of Class A common stock), and (iii) LLC Common Units representing approximately % of the economic interest in the business of the LLC (or LLC Common Units, representing approximately % of the economic interest in the business of the LLC, if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

As the managing member of the LLC, we will operate and control all of the business and affairs of the LLC and, through the LLC and its direct and indirect subsidiaries, conduct our business. Immediately following the Transactions, including this offering, we will have the majority economic interest in the LLC and will control the management of the LLC as its managing member. As a result, we will consolidate the LLC and record a significant non-controlling interest in a consolidated entity in our consolidated financial statements for the economic interest in the LLC held directly or indirectly by Flex and TPG.

The separation agreement

We have entered into various agreements to provide a framework for our relationship with Flex after the Transactions, including a separation agreement, a transition services agreement and an employee matters agreement. These agreements provide for the allocation between us and Flex of Flex’s employees, liabilities and obligations attributable to periods prior to, at and after the separation. For additional information regarding the separation agreement and such other agreements, refer to the sections entitled “Risk factors—Risks related to the Transactions and our relationship with Flex” and “Certain relationships and related party transactions—Agreements with Flex.”

14

Subsequent distribution or dispositions

Distribution or Other Dispositions

The separation agreement provides that Flex may, in its sole discretion, determine: (i) whether to proceed with all or part of a tax-free or other distribution or disposition of its retained beneficial interest in the LLC (as applicable, a “Distribution or Other Disposition”), whether directly or through a distribution or disposition of the stock of Yuma, which directly or indirectly holds Flex’s beneficial interest in the LLC; and (ii) all terms of the Distribution or Other Disposition, as applicable, including the form, structure and terms of any transaction(s) and/or offering(s) to effect the Distribution or Other Disposition and the timing of and conditions to the consummation of the Distribution or Other Disposition. In addition, the separation agreement provides that in the event that Flex determines to proceed with any Distribution or Other Disposition, Flex may at any time and from time to time until the completion of such Distribution or Other Disposition abandon, modify or change any or all of the terms of such Distribution or Other Disposition, including by accelerating or delaying the timing of the consummation of all or part of such Distribution or Other Disposition. The separation agreement also provides that upon Flex’s request, we and the LLC will cooperate with Flex in all respects to accomplish the Distribution or Other Disposition and will, at Flex’s direction, promptly take any and all actions necessary or desirable to effect the Distribution or Other Disposition, including the registration under the Securities Act of the offering of our Class A common stock on an appropriate registration form or forms to be designated by Flex and the filing of any necessary documents pursuant to the Exchange Act.

Merger Agreement

In addition to our obligations with respect to any Distribution or Other Disposition, the separation agreement provides Flex with the right, exercisable at any time following this offering, to require us, following any dividend or distribution of the equity of Yuma to the holders of ordinary Flex shares, to, at Flex’s option, effect a merger of Yuma with a wholly-owned subsidiary of ours, with Yuma surviving as a wholly owned subsidiary of ours in a tax-free transaction under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). We have further agreed under the separation agreement to, at Flex’s request, at any time whether before or after this offering, fully cooperate with Flex to submit an agreement and plan of merger to effect such merger for approval by our board of directors and stockholders and the board of directors and stockholders of such subsidiary, to the extent required under Delaware law, and cause such agreement and plan of merger to be executed and delivered by our authorized officers and the authorized officers of such subsidiary, and take all other actions reasonably necessary to adopt and approve such agreement and plan of merger, to be operative when and if Flex so elects to effect such merger following this offering.