UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒ | | | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under § 240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

June 26, 2024

Notice of Annual Meeting of Stockholders

Date:

August 19, 2024

Time:

9:00 a.m. (Pacific Time)

Place:

www.virtualshareholder

meeting.com/NXT2024

YOUR VOTE

IS IMPORTANT

All stockholders are cordially invited to virtually attend the annual meeting. Whether or not you expect to attend the annual meeting, please complete, date, sign and return the proxy card, or vote over the telephone or internet as instructed in these materials, as promptly as possible in order to ensure your representation at the annual meeting. Even if you have voted by proxy, you may still vote if you attend the annual meeting.

Dear Stockholder

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Nextracker Inc., a Delaware corporation (“we,” “us,” “Nextracker” or the “Company”). The Annual Meeting will be held virtually on August 19, 2024 at 9:00 a.m. (Pacific Time), to consider and vote on the following proposals:

| | | To elect three nominees to serve as directors until the 2027 annual meeting of stockholders and until their successors are duly elected and qualified, subject to earlier resignation or removal; |

| | | To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2025; |

| | | To approve, on an advisory basis, the compensation for our named executive officers; and |

| | | To approve an amendment and restatement of the Second Amended and Restated 2022 Nextracker Inc. Equity Incentive Plan to increase the number of shares authorized for issuance thereunder by 11,100,000 shares. |

In addition, we will conduct any other business that properly comes before the Annual Meeting or any adjournment thereof. These items of business are more fully described in the proxy statement accompanying this Notice of Annual Meeting of Stockholders (the “Proxy Statement”).

The record date for the Annual Meeting is June 24, 2024 (the “Record Date”). Only stockholders of record of the Company’s Class A common stock and Class B common stock (together, the “common stock”) at the close of business on the Record Date may vote at the Annual Meeting or any adjournment thereof. You will be able to attend the Annual Meeting remotely by registering at www.virtualshareholdermeeting.com/NXT2024. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the Annual Meeting and to vote and submit questions. As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Important Notice Regarding the Availability of Proxy Materials.

IMPORTANT NOTICE Regarding the Availability of Proxy Materials for the Annual Meeting to be held on August 19, 2024 at 9:00 a.m. (Pacific Time) via the internet at www.virtualshareholdermeeting.com/NXT2024. The Proxy Statement and annual report to stockholders are available at: www.proxyvote.com.

We have determined that the 2024 Annual Meeting will be held in a virtual meeting format only, via the internet, with no physical in-person meeting. If you plan to participate in the virtual meeting, please see the Questions and Answers section below. Stockholders who own shares of our common stock as of the Record Date (“stockholders”) will be able to attend, vote and submit questions (both before, and for a portion of, the meeting) via the internet.

In the event of an adjournment, postponement or emergency that may change the Annual Meeting’s time or date, we will make an announcement, issue a press release or post information at www.nextracker.com to notify stockholders, as appropriate. If you have any questions or need assistance in voting your shares, please write to Nextracker Investor Relations at 6200 Paseo Padre Parkway, Fremont, CA 94555 or by email at investor@nextracker.com.

By Order of the Board of Directors

Léah Schlesinger

General Counsel, Chief Ethics and Compliance Officer & Secretary

Fremont, California

These Proxy Materials and Voting

Why Did I Receive a One-page Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

Pursuant to “Notice and Access” rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we are sending an Important Notice Regarding the Availability of Proxy Materials (the “Proxy Availability Notice”) to our stockholders of record. All stockholders will have the ability to access the proxy materials on the website referred to in the Proxy Availability Notice free of charge or request to receive a printed set of the proxy materials for the Annual Meeting. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Proxy Availability Notice. We encourage stockholders to take advantage of the availability of the proxy materials online to help reduce the environmental impact of our annual meetings and reduce our printing and mailing costs.

We expect that this Proxy Statement and the other proxy materials will be available to stockholders on or about June 26, 2024.

Why Are You Having a Virtual Annual Meeting?

The Annual Meeting will be held in a virtual-only meeting format, via webcast that will provide stockholders with the ability to participate in the Annual Meeting, vote their shares and ask questions. We believe that a virtual meeting will enable expanded access and increased stockholder attendance and participation.

How Can I Attend a Virtual Annual Meeting?

The Annual Meeting will be held on August 19, 2024 at 9:00 a.m. (Pacific Time) via webcast.

Only stockholders of record and beneficial owners of shares of our common stock (Class A or Class B) as of the close of business on June 24, 2024, the Record Date, may participate in the Annual Meeting, including voting and asking questions during the virtual Annual Meeting. You will not be able to attend the Annual Meeting physically in person.

Log-in using the control number located on your proxy card, voting instruction form or Proxy Availability Notice. If you are a beneficial owner of shares registered in the name of a broker, bank or other nominee, follow the instructions found on your Proxy Availability Notice or proxy card. If you encounter any difficulties accessing the virtual meeting during the check-in or course of the annual meeting, please call the number listed on the virtual meeting site.

Whether or not you plan to attend the Annual Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described in these proxy materials.

Nextracker Inc. 1 2024 Proxy Statement |

Can I Ask Questions at the Virtual Annual Meeting?

Stockholders as of our Record Date who attend and participate in our virtual Annual Meeting will have an opportunity to submit questions live via the internet during a designated portion of the meeting. These stockholders may also submit a question in advance of the Annual Meeting by registering at www.virtualstockholdermeeting.com/NXT2024. In both cases, stockholders must have available their control number provided on their proxy card, voting instruction form or Proxy Availability Notice.

What Does it Mean if I Receive More than One Proxy Availability Notice?

If you receive more than one Proxy Availability Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each Proxy Availability Notice to ensure that all of your shares are voted.

Will I Receive Any Other Proxy Materials by Mail?

We may send you a proxy card, along with a second Proxy Availability Notice, by mail on or after June 26, 2024.

Who Can Vote at the Annual Meeting?

Only stockholders of record at the close of business on the Record Date of June 24, 2024 will be entitled to vote at the Annual Meeting. On the Record Date, there were 143,244,913 shares of our Class A common stock outstanding and entitled to vote and 1,908,827 shares of our Class B common stock outstanding and entitled to vote. Holders of our Class A common stock and Class B common stock are entitled to one vote per share of our Class A common stock or Class B common stock, as applicable. All holders of Class A common stock and Class B common stock will vote together as a single class except as otherwise required by applicable law. Cumulative voting is not permitted with respect to the election of directors or any other matter to be considered at the Annual Meeting.

Stockholder of record: shares registered in your name

If, on June 24, 2024, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote at the Annual Meeting or vote by proxy.

Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy over the telephone or on the internet as instructed below (see “How do I Vote?”) or, if you received a proxy card by mail, complete, date, sign and return the proxy card mailed to you to ensure your vote is counted.

Beneficial owner: shares registered in the name of a broker, bank or other nominee

If, on June 24, 2024, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Proxy Availability Notice is being forwarded to you by the organization that holds your account. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other nominee regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. You may attend and vote at the Annual Meeting by registering as instructed above (see “How Can I Attend a Virtual Annual Meeting?”).

Nextracker Inc. 2 2024 Proxy Statement |

What am I Voting On?

There are four matters scheduled for a vote at the Annual Meeting:

• | Election of directors; |

• | Ratification of the selection of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending March 31, 2025; |

• | Approval, on an advisory basis, of the compensation of our named executive officers; and |

• | Approval of an amendment and restatement of the Second Amended and Restated 2022 Nextracker Inc. Equity Incentive Plan (the “2022 Plan”) to increase the number of shares authorized for issuance thereunder by 11,100,000 shares (the “2022 Plan Amendment”). |

What if Another Matter is Properly Brought Before the Annual Meeting?

Our Board of Directors (the “Board” or the “Board of Directors”) knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, your proxy holder (one of the individuals named on your proxy card) will vote the shares for which you grant your proxy on those matters in accordance with their best judgment.

What is the Board’s Voting Recommendation?

The Board recommends that you vote your shares:

• | “For” the election of each of the nominees for director; |

• | “For” the ratification of Deloitte as our independent registered public accounting firm for the fiscal year ending March 31, 2025; |

• | “For” the approval, on an advisory basis, of the compensation of our named executive officers; and |

• | “For” the approval of the 2022 Plan Amendment. |

How Do I Vote?

Regarding the election of directors, you may either vote “For” each of the nominees to the Board or you may “Withhold” your vote for any nominee you specify. For Proposal No. 2: Ratification of the Selection of the Independent Registered Public Accounting Firm, Proposal No. 3: The Approval, on an Advisory Basis, of the Compensation of Our Named Executive Officers and Proposal No. 4: The Approval of the 2022 Plan Amendment, or for any other matters to be voted on, you may vote “For” or “Against,” or abstain from voting.

Nextracker Inc. 3 2024 Proxy Statement |

The procedures for voting depend on whether your shares are registered in your name or are held by a bank, broker or other nominee:

Stockholder of record: shares registered in your name

If you are a stockholder of record, you may vote at the Annual Meeting, or vote in advance of the Annual Meeting by proxy over the telephone, by proxy through the internet, or by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the Annual Meeting, we urge you to vote in advance by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote even if you have already voted by proxy. Voting at the Annual Meeting will have the effect of revoking your previously submitted proxy (see “Can I Change my Vote After Submitting my Proxy?” below).

| | | By Internet Go to www.proxyvote.com, which is available 24 hours a day, seven days a week until 11:59 p.m. (Eastern Time) on August 18, 2024, and follow the instructions on the proxy card or in the Proxy Availability Notice. If you vote via the internet, you do not need to return a proxy card by mail. | | |  | | | By Telephone On a touch-tone telephone, dial toll-free 1-800-690-6903, which is available 24 hours a day, seven days a week until 11:59 p.m. (Eastern Time) on August 18, 2024, and follow the instructions on the proxy card or in the Proxy Availability Notice. If you vote by telephone, you do not need to return a proxy card by mail. | | |  | | | By Mail Complete, sign, date and mail your proxy card in the enclosed, postage-prepaid envelope. If mailed, your completed and signed proxy card must be received by August 18, 2024. | | |  | | | At the Virtual Meeting You may also vote by attending the meeting virtually through www.virtualshareholder meeting.com/NXT2024. To attend the Annual Meeting and vote your shares, you must register for the Annual Meeting and provide the control number located on your proxy card, voting instruction form or Proxy Availability Notice. Even if you plan to attend and participate in our virtual Annual Meeting, we encourage you to vote over the internet or by telephone as described above, or by returning a proxy card following your request of paper copies. This will ensure that your vote will be counted if you are unable to, or later decide not to, participate in the virtual Annual Meeting. |

Beneficial owner: shares registered in the name of a broker, bank or other nominee

If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, you should have received a Proxy Availability Notice containing voting instructions from that organization rather than from us. Simply follow the voting instructions in the Proxy Availability Notice to ensure that your vote is counted.

How Many Votes Do I Have?

On each matter to be voted upon, you have one vote for each share of our Class A common stock or Class B common stock you own as of June 24, 2024, the Record Date.

What if I Return a Proxy Card or Otherwise Vote but Do Not Make Specific Choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable: “For” the election of each of the nominees for director; “For” the ratification of Deloitte as our independent registered public accounting firm; “For” the approval, on an advisory basis, of the compensation of our named executive officers; and “For” the approval of the 2022 Plan Amendment. If any other matter is properly presented at the Annual Meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using their best judgment.

Nextracker Inc. 4 2024 Proxy Statement |

Will My Vote be Kept Confidential?

Proxies, ballots and voting tabulations identifying stockholders are handled on a confidential basis to protect your voting privacy. This information will not be disclosed, except as required by law.

Who is Paying for this Proxy Solicitation?

Nextracker is paying the costs of the solicitation of proxies. We have retained D.F. King & Co., Inc. to help us solicit proxies from brokers, bank nominees and other institutions for a fee of approximately $12,500, plus reasonable out-of-pocket expenses. We will also reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. In addition, our directors, officers, and other employees, without additional compensation, may solicit proxies personally or in writing, by telephone, e-mail, or otherwise. If you choose to access the proxy materials and/or vote over the internet, you are responsible for any internet access charges you may incur.

Can I Change my Vote After Submitting my Proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

• | You may grant a subsequent proxy via the internet or telephone. |

• | You may submit another properly completed proxy card with a later date. |

• | You may send a timely written notice that you are revoking your proxy to our Secretary at 6200 Paseo Padre Parkway, Fremont, CA 94555, which must be received by August 18, 2024. |

• | You may attend and vote at the Annual Meeting. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or internet proxy is the one that is counted, so long as it is provided within the applicable deadline. If your shares are held by your broker, bank or other nominee, you should follow the instructions provided by your broker, bank or other nominee to change your vote or revoke your proxy or you may attend and vote at the Annual Meeting.

When are Stockholder Proposals for Inclusion in Our Proxy Statement for Next Year’s Annual Meeting Due?

Stockholders wishing to present proposals for inclusion in our Proxy Statement for the 2025 annual meeting of stockholders (the “2025 Annual Meeting”) pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), must submit their proposals so that they are received by us at our principal executive offices no later than February 26, 2025. Proposals should be sent to our Secretary at 6200 Paseo Padre Parkway, Fremont, CA 94555.

When are Other Proposals and Stockholder Nominations for the 2025 Annual Meeting Due?

With respect to proposals and nominations not to be included in our Proxy Statement pursuant to Rule 14a-8 of the Exchange Act, our amended and restated bylaws (our “Bylaws”) provide that stockholders who wish to nominate a director or propose other business to be brought before the stockholders at an annual meeting of stockholders must notify our Secretary by a written notice, which notice must be received at our principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary date of the immediately preceding year’s annual meeting of stockholders.

Nextracker Inc. 5 2024 Proxy Statement |

Stockholders wishing to present nominations for director or proposals for consideration at the 2025 Annual Meeting under these provisions of our Bylaws must submit their nominations or proposals so that they are received at our principal executive offices not later than May 21, 2025 and not earlier than April 21, 2025 in order to be considered. In the event that the date of the 2025 Annual Meeting is advanced more than 30 days prior to such anniversary date or delayed more than 60 days after such anniversary date then to be timely such notice must be received by the Company no earlier than 120 days prior to the 2025 Annual Meeting and no later than the later of 90 days prior to the date of the 2025 Annual Meeting or, if the first public announcement of the date of the 2025 Annual Meeting is less than 100 days prior to the date of the 2025 Annual Meeting, the 10th day following the day on which public announcement of the date of the 2025 Annual Meeting is first made by the Company.

Nominations or proposals should be sent in writing to our Secretary at 6200 Paseo Padre Parkway, Fremont, CA 94555. A stockholder’s notice to nominate a director or bring any other business before the Annual Meeting or the 2025 Annual Meeting must set forth certain information, which is specified in our Bylaws. A complete copy of our Bylaws is included as Exhibit 3.2 to our Annual Report on Form 10-K for the fiscal year ended March 31, 2024.

In addition to satisfying the foregoing requirements under our Bylaws, to comply with the universal proxy card rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act, which notice must be postmarked or transmitted electronically to us at our principal executive offices no later than 60 calendar days prior to the anniversary date of the Annual Meeting (for the 2025 Annual Meeting, no later than June 20, 2025). However, if the date of the 2025 Annual Meeting is changed by more than 30 calendar days from such anniversary date, then notice must be provided by the later of 60 calendar days prior to the date of the 2025 Annual Meeting or the 10th calendar day following the day on which public announcement of the date of the 2025 Annual Meeting is first made by us.

How are Votes Counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count votes “For,” votes to “Withhold” and broker non-votes for the proposal to elect directors. With respect to other proposals, the inspector of election will separately count votes “For,” votes “Against,” votes to “Abstain” and broker non-votes (if applicable).

What are “Broker Non-Votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker, bank or other nominee holding the shares as to how to vote. Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker, bank or other nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker, bank or other nominee can still vote the shares with respect to matters that are considered to be “routine,” but cannot vote the shares with respect to “non-routine” matters. Under the rules and interpretations of The Nasdaq Stock Market LLC (“Nasdaq”), which generally apply to all brokers, banks or other nominees, on voting matters characterized by Nasdaq as “routine,” Nasdaq member firms have the discretionary authority to vote shares for which their customers do not provide voting instructions. On non-routine proposals, such “uninstructed shares” may not be voted by member firms. Only the proposal to ratify the selection of our independent registered public accounting firm is considered a “routine” matter for this purpose, and brokers, banks or other nominees generally have discretionary voting power with respect to such proposal. Broker non-votes will be counted for the purpose of determining whether a quorum is present at the Annual Meeting.

What is the Effect of Abstentions, Votes to Withhold and Broker Non-Votes?

Abstentions: Under Delaware law (under which we are incorporated), abstentions are counted as shares present and entitled to vote at the Annual Meeting, but they are not counted as shares cast. Our Bylaws provide that a stockholder action (other than the election of directors) shall be decided by the vote of the holders of a majority in voting power of the shares present or represented by proxy at the

Nextracker Inc. 6 2024 Proxy Statement |

meeting and entitled to vote on the matter. Therefore, abstentions will have the same effect as “against” votes on Proposal No. 2: Ratification of the Selection of the Independent Registered Public Accounting Firm; Proposal No. 3: The Approval, on an Advisory Basis, of the Compensation of Our Named Executive Officers; or Proposal No. 4: The Approval of the 2022 Plan Amendment.

Votes to Withhold: For Proposal No. 1: Election of Directors, you may vote “For” all or some of the nominees or you may “Withhold” your vote with respect to one or more of the nominees. The three nominees who receive the most “For” votes cast by the holders of shares either present at the Annual Meeting or represented by proxy will be elected to our Board. Broker non-votes will have no effect on Proposal No. 1: Election of Directors. In an uncontested election, “Withhold” votes will not prevent a candidate from getting elected.

Broker Non-Votes: A “broker non-vote” occurs when a broker, bank or other nominee holding your shares in street name does not vote on a particular matter because you did not provide the broker, bank or other nominee voting instructions and the broker, bank or other nominee lacks discretionary voting authority to vote the shares because the matter is considered “non-routine” under of the corporate governance standards and continued listing rules of Nasdaq (together, the “Nasdaq rules”). The “non-routine” matters on the agenda for the Annual Meeting are Proposal No. 1: Election of Directors, Proposal No. 3: The Approval, on an Advisory Basis, of the Compensation of Our Named Executive Officers, and Proposal No. 4: The Approval of the 2022 Plan Amendment.

Broker non-votes will be counted for the purpose of determining whether a quorum is present at the Annual Meeting. However, because broker non-votes are not considered under Delaware law to be entitled to vote at the Annual Meeting, they will have no effect on the outcome of the vote on Proposal No. 1: Election of Directors, Proposal No. 3: The Approval, on an Advisory Basis, of the Compensation of Our Named Executive or Proposal No. 4: The Approval of the 2022 Plan Amendment. As a result, if you hold your shares in street name and you do not instruct your broker, bank or other nominee how to vote your shares on any of these three proposals, no vote will be cast on your behalf on these proposals. Therefore, it is critical that you indicate your vote on this proposal if you want your vote to be counted. The proposal to ratify the selection of Deloitte as our independent registered public accounting firm for the fiscal year ending March 31, 2025 is considered a “routine” matter. Therefore, your broker, bank or other nominee will be able to vote on Proposal No. 2: Ratification of the Selection of the Independent Registered Public Accounting Firm even if it does not receive instructions from you, so long as it holds your shares in its name.

How Many Votes are Needed to Approve Each Proposal?

Proposal | | | Vote Required | | | Discretionary Voting Allowed? | |||

| | | Election of Directors | | | Plurality | | | No |

| | | Ratification of the Selection of the Independent Registered Public Accounting Firm | | | Majority of the Voting Power Present or Represented by Proxy | | | Yes |

| | | The Approval, on an Advisory Basis, of the Compensation of our Named Executive Officers | | | Majority of the Voting Power Present or Represented by Proxy | | | No |

| | | The Approval of the 2022 Plan Amendment | | | Majority of the Voting Power Present or Represented by Proxy | | | No |

A “Plurality,” with regard to the election of directors, means that the three nominees who receive the most “For” votes cast by the holders of shares either present at the Annual Meeting or represented by proxy will be elected to our Board. A “Majority of the Voting Power Present or Represented by Proxy,” with regard to each of the other proposals means that, to be approved, the holders of a majority in voting power of the shares present or represented by proxy at the meeting and entitled to vote on the matter must vote “For” the proposal.

Nextracker Inc. 7 2024 Proxy Statement |

Accordingly:

• | Proposal No. 1: For the election of directors, the three nominees receiving the most “For” votes from the holders of shares present at the Annual Meeting or represented by proxy and entitled to vote on Proposal No. 1 will be elected as directors to hold office until the 2027 annual meeting of stockholders. Only votes “For” will affect the outcome. Broker non-votes, abstentions, and votes to “Withhold” will have no effect. |

• | Proposal No. 2: To be approved, the holders of a majority in voting power of the shares present or represented by proxy at the meeting and entitled to vote on the matter must vote “For” the ratification of the selection of Deloitte as our independent registered public accounting firm for the fiscal year ending March 31, 2025. Broker non-votes are not applicable with respect to Proposal No. 2 as brokers generally have discretion to vote uninstructed shares on this proposal. Abstentions will have the same effect as an “Against” vote. |

• | Proposal No. 3: To be approved, the holders of a majority in voting power of the shares present or represented by proxy at the meeting and entitled to vote on the matter must vote “For” the approval, on an advisory basis, of the compensation of our named executive officers. Broker non-votes will have no effect. Abstentions will have the same effect as an “Against” vote. |

• | Proposal No. 4: To be approved, the holders of a majority in voting power of the shares present or represented by proxy at the meeting and entitled to vote on the matter must vote “For” the approval, the approval of the 2022 Plan Amendment. Broker non-votes will have no effect. Abstentions will have the same effect as an “Against” vote. |

None of the proposals, if approved, entitles stockholders to appraisal rights under Delaware law or our certificate of incorporation.

What is the Quorum Requirement?

A quorum of stockholders is necessary to hold a valid stockholder meeting. A quorum will be present if stockholders holding at least a majority in voting power of the outstanding shares of common stock entitled to vote are present or represented by proxy at the Annual Meeting. On the Record Date, there were 143,244,913 shares of Class A common stock, and 1,908,827 shares of Class B common stock outstanding and entitled to vote. Virtual attendance at our Annual Meeting constitutes “presence” for purposes of a quorum at the meeting.

Your shares will be counted towards the quorum only if you submit a valid proxy by mail, over the phone or through the internet (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote at the Annual Meeting. Abstentions, votes to “Withhold” and broker non-votes will be counted towards the quorum requirement. If there is no quorum, then the chair of the Annual Meeting may adjourn the meeting to another date. At any adjourned Annual Meeting at which a quorum is present, any business may be transacted that might have been transacted at the Annual Meeting as originally notified. If the adjournment is for more than 30 days, or if after that adjournment a new record date is fixed for the adjourned Annual Meeting, a notice of the adjourned Annual Meeting shall be given to each stockholder of record entitled to vote at the adjourned Annual Meeting.

How Can I Find Out the Results of the Voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K with the SEC within four business days after the Annual Meeting, we intend to file a Form 8-K to publish the preliminary results within four business days after the Annual Meeting and file an additional Form 8-K to publish the final results within four business days after the final results are known to us.

If you have any questions or need assistance in voting your shares, please write to Nextracker Investor Relations at investor@nextracker.com.

Nextracker Inc. 8 2024 Proxy Statement |

Upon the recommendation of our Nominating, Governance and Public Responsibility Committee (the “Nom Gov Committee”), our Board has nominated the three individuals listed below to serve as Class II directors (as defined below in the section titled “Board Composition”). Our nominees include Julie Blunden, Steven Mandel and Willy Shih.

Each of our director nominees currently serves on the Board. The term of each Class II director who is elected at the Annual Meeting will run from the date of their election until the third annual meeting of stockholders after their election and qualification of their successor, or their earlier death, resignation or removal. The term of our Class I directors will expire at the 2026 annual meeting of stockholders, and the term of our Class III directors will expire at the 2025 annual meeting of stockholders.

Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement. If any nominee should become unavailable to serve for any reason, it is intended that votes will be cast for a substitute nominee designated by the Nom Gov Committee and approved by the Board. We have no reason to believe that any nominee named will be unable to serve if elected.

Our Bylaws provide that a director nominee is elected only if they receive a plurality of the votes cast with respect to their election. As a result, any shares not voted “For” a particular candidate, whether as a result of a “Withhold” vote or broker non-vote, will not be counted in such candidate’s favor and will have no effect on the election results. For more information, see the section titled “Questions and answers about these proxy materials and voting” of this Proxy Statement. If a nominee who currently serves as a director is not re-elected, Delaware law provides that the director would continue to serve on the Board as a “holdover director.”

VOTE

The Board of Directors recommends a vote IN FAVOR of each named nominee.

Nextracker Inc. 10 2024 Proxy Statement |

Nominees for Director and Directors with Continuing Terms

The names and ages of the nominees and directors with continuing terms, length of service with the Company and Board committee memberships are set forth in the table below.

Name | | | Age | | | Director Since | | | Current Term Expires | | | Independent | | | Audit Committee | | | Compensation and People Committee | | | Nominating, Governance and Public Responsibility Committee |

Director Nominees | | | | | | | | | | | | | | | |||||||

Julie Blunden | | | 58 | | | 2024 | | | 2024 | | |  | | |  | | |  | | | |

Steven Mandel | | | 36 | | | 2023 | | | 2024 | | |  | | |  | | | | |  | |

Willy Shih | | | 73 | | | 2023 | | | 2024 | | |  | | | | | Chair | | | ||

Directors with Continuing Terms | | | | | | | | | | | | | | | |||||||

William Watkins* | | | 71 | | | 2023 | | | 2026 | | |  | | | | | | | Chair | ||

Jeffrey Guldner | | | 59 | | | 2024 | | | 2025 | | |  | | | | | | |  | ||

Jonathan Coslet | | | 59 | | | 2023 | | | 2025 | | |  | | | | |  | | | ||

Daniel Shugar | | | 61 | | | 2023 | | | 2026 | | | | | | | | | ||||

Brandi Thomas | | | 47 | | | 2023 | | | 2025 | | |  | | | Chair | | | | | ||

Howard Wenger | | | 64 | | | 2024 | | | 2026 | | | | | | | | |

* | Chairperson of the Board |

A brief biography of each nominee and each continuing director is also set forth below, which includes information, as of the date of this Proxy Statement, regarding specific and particular experience, qualifications, attributes or skills of each nominee that led the Nom Gov Committee and the Board to believe that the director should serve on the Board.

Nextracker Inc. 11 2024 Proxy Statement |

Director Nominees

Julie Blunden Board Member Age: 58 Director Since: 2024 | | | Julie Blunden has served on our Board of Directors since January 2024. Ms. Blunden served on the Board of Directors of American Battery Technology Company from February 2022 through March 2024, where she also served as Chair of its Compensation Committee and as a member of its Audit Committee and Governance Committee. Ms. Blunden has also served as an independent director on the Board of Directors of ZincFive, Inc., a privately held company, since February 2022, serving as Chair of its Compensation Committee. In addition, Ms. Blunden has served on the Board of Advisors of Plus Power, LLC, a privately held company, since January 2021 and previously served as its Chief Operating Officer from October 2022 through July 2023. Ms. Blunden served as the Chief Commercial Officer of EVgo, Inc. from March 2018 through the completion of its sale to LS Power, L.P. in January 2020. Ms. Blunden has also served as Vice Chair at the Solar Energy Industries Association. Additionally, Ms. Blunden served on the Board of Directors of the Energy Storage Association from June 2018 through April 2020. Ms. Blunden has also served as a member of four other boards of directors of non-profit organizations and two advisory boards of non-profit organizations, including as a member of the Board of New Energy Nexus since May 2013, where she served as its chair through May 2024. Ms. Blunden served as an Executive in Residence for the Global Energy Management Program at the University of Colorado Denver’s Business School from 2016 through December 2017. Ms. Blunden has an engineering and environmental studies degree from Dartmouth College and a Master of Business Administration degree from Stanford’s Graduate School of Business. Ms. Blunden was selected to serve on our board based on her extensive industry experience and background in the power, renewables and clean energy sectors. |

Steven Mandel Board Member Age: 36 Director Since: 2023 | | | Steven Mandel is a Partner with TPG Rise Climate, the dedicated climate investing strategy of the private equity firm TPG (“TPG”) where he has worked since 2019. He previously worked as a Director at Denham Capital from 2011 to May 2019, focusing on principal investments across the clean energy sector, and in the Power & Renewables investment banking division at Citigroup from 2009 to 2011. Mr. Mandel currently serves on the Board of Directors of Matrix Renewables, Intersect Power, Palmetto Solar, Climavision, and the non-profit Chordoma Foundation. Mr. Mandel holds a Bachelor of Science in Business and Economics with Honors from Lehigh University, a Master of Science in Finance from London Business School and holds Chartered Financial Analyst designation. Mr. Mandel was selected to serve on our board based on his extensive management experience and background in the power, renewables and clean energy sectors. |

Nextracker Inc. 12 2024 Proxy Statement |

Willy Shih Board Member Age: 73 Director Since: 2023 | | | Willy Shih has served as the Robert and Jane Cizik Professor of Management Practice in Business Administration at Harvard Business School since 2007, where he teaches in MBA and Executive Education Programs. Prior to that, Mr. Shih spent 28 years in various senior management and consultancy positions with IBM, Digital Equipment, Silicon Graphics, Eastman Kodak Company and Thomson SA working in product development and manufacturing. Mr. Shih previously served on the Board of Directors of Flex from 2008 to 2022. He presently serves as a member of the Advisory Committee on Supply Chain Competitiveness to the U.S. Secretary of Commerce, and on the Industrial Advisory Committee for the U.S. Secretary of Commerce. Mr. Shih holds Bachelor of Science degrees in Chemistry and Life Sciences from the Massachusetts Institute of Technology, and a Doctor of Philosophy degree from the University of California at Berkeley. He is a Life Member of the Institute of Electrical and Electronics Engineers. Mr. Shih was selected to serve on our board based on his extensive experience in product development and manufacturing. |

Vote Required

For the election of directors, the three nominees receiving the most “For” votes from the holders of shares present at the Annual Meeting or represented by proxy and entitled to vote on Proposal No. 1 will be elected as directors to hold office until the 2027 annual meeting of stockholders. Only votes “For” will affect the outcome. Broker non-votes, abstentions, and votes to “Withhold” will have no effect.

VOTE

The Board of Directors recommends a vote IN FAVOR of each named nominee.

Nextracker Inc. 13 2024 Proxy Statement |

Directors with Continuing Terms

Directors with Terms Continuing Until 2025

Jonathan Coslet Board Member Age: 59 Director Since: 2023 | | | Jonathan Coslet currently serves as the Vice Chairman of TPG Global LLC (“TPG Global”), a global alternative asset firm, and has been with TPG Global since 1993. He previously served as TPG Global’s Chief Investment Officer from 2008 to 2020. During his tenure with TPG Global, Mr. Coslet also served on the boards of directors of several public and private companies, including IQVIA Holdings Inc., a pharmaceutical consulting and contract research organization, from 2003 to 2020, Life Time Group Holdings, Inc., a health, fitness and recreational sports company, since 2015, Cushman & Wakefield plc, a leading global real estate services firm, since 2018, and TPG Inc. since 2021. Mr. Coslet has also previously served on the board of directors of several public and private companies, including Endurance Specialty Holdings, Ltd., IASIS Healthcare LLC, J. Crew Group, Inc., Neiman Marcus Group, Oxford Health Plans, Inc., Petco Health and Wellness Company Inc. and Quintiles. Prior to joining TPG, Mr. Coslet worked at Donaldson, Lufkin & Jenrette, and before that Drexel Burnham Lambert. Mr. Coslet also serves on the Board of Directors of Stanford Lucile Packard Children’s Hospital, where he is Chairman, the Stanford Medicine Board of Fellows and the Stanford Institute for Economic Policy Research Advisory Board. Mr. Coslet received his Bachelor of Science degree in Economics and Finance from the Wharton School of the University of Pennsylvania where he was Valedictorian, and his Master of Business Administration from Harvard Business School, where he was a Baker Scholar. Mr. Coslet was selected to serve on our board based on his background in finance and extensive experience in advising and growing companies. |

Nextracker Inc. 14 2024 Proxy Statement |

Jeffrey Guldner Board Member Age: 59 Director Since: 2024 | | | Jeffrey Guldner has served as President and Chief Executive Officer and Chairman of the Board of Directors of Pinnacle West Capital Corporation, a utility holding company, and Chief Executive Officer and Chairman of the Board of Directors of its primary subsidiary, Arizona Public Service Company (“APS”), an electric utility company, since November 2019. He also served as President of APS from August 2021 to May 2022. Mr. Guldner joined APS in 2004 and held several leadership positions at APS prior to his current roles. Prior to joining APS, Mr. Guldner was a partner in the Phoenix office of Snell & Wilmer LLP, where he practiced public utility, telecommunications and energy law. Before practicing law, Mr. Guldner served as a surface warfare officer in the United States Navy and was an assistant professor of naval history at the University of Washington. Mr. Guldner serves on the Board of Directors of Edison Electric Institute, the McCain Institute, the Nuclear Energy Institute, the Electric Power Research Institute and the Smart Electric Power Alliance. Mr. Guldner also serves on the Board of Directors of Greater Phoenix Leadership and Arizona State University’s Knowledge Exchange for Resilience. Mr. Guldner earned his B.A. from the University of Iowa and his J.D. from Arizona State University College of Law. Mr. Guldner is also a graduate of the Reactor Technology Course at the Massachusetts Institute of Technology and the Advanced Management Program at Columbia Business School. MR. GULDNER WAS SELECTED TO SERVE ON OUR BOARD BASED ON HIS EXTENSIVE INDUSTRY, MANGEMENT AND PUBLIC COMPANY EXPERIENCE. |

Brandi Thomas Board Member Age: 47 Director Since: 2023 | | | Brandi Thomas currently serves as Vice President, Corporate Audit and Enterprise Risk Management of General Motors Company, a multinational vehicle manufacturer of the Buick, GMC, Cadillac and Chevrolet brands, as well as autonomous vehicle technology. Prior to joining General Motors, Ms. Thomas served as Vice President, Chief Audit Executive and Chief Diversity, Equity and Inclusion Officer at General Electric, a multinational company operating in aviation, power and renewable energy from November 2020 to December 2023. Prior to General Electric, Ms. Thomas served as Vice President, Corporate Audit for Delta Air Lines, Inc., one of the leading airlines in the U.S. for domestic and international travel, from April 2017 to December 2020. She holds a Bachelor of Science Degree in Finance from Case Western Reserve University. Ms. Thomas was selected to serve on our board based on her extensive experience in finance, corporate audit, enterprise risk management and strategic growth. |

Nextracker Inc. 15 2024 Proxy Statement |

Directors with Terms Continuing Until 2026

Daniel Shugar Board Member & CEO Age: 61 Director Since: 2023 | | | Daniel Shugar founded Nextracker and has served as its Chief Executive Officer since July 2013. Mr. Shugar began his career in the solar industry in 1988 and has held senior leadership positions in multiple solar companies. Prior to Nextracker, he served as Chief Executive Officer of Solaria Corporation, a solar panel manufacturing company, from January 2010 to June 2013. Mr. Shugar was the President of Systems, a division of SunPower Corporation, a global solar panel manufacturer and construction company, from January 2007 to March 2009. From 1996 to 2007, he served as President of PowerLight Corporation, a commercial and utility-scale solar system integrator. From 1986 to 1995, Mr. Shugar held various positions in the solar businesses of New World Power, Inc., Advance Photovoltaic Systems and the Pacific Gas & Electric Company. Mr. Shugar holds a Bachelor of Science degree in Electrical and Electronics Engineering from Rensselaer Polytechnic Institute and a Master of Business Administration from Golden Gate University. We believe Mr. Sugar is qualified to serve as a director due to his role as Chief Executive Officer and his extensive management experience in the solar energy industry. |

William Watkins Board Member Age: 71 Director Since: 2023 | | | William Watkins served as Chairman of the Board of Imergy Power Systems, Inc. (“Imergy”), a leading innovator in cost-effective energy storage products, from January 2015 to August 2016 and as Chief Executive Officer from September 2013 to August 2016. Prior to his time at Imergy, Mr. Watkins was the Chairman of the Board of Bridgelux, Inc. from February 2013 to December 2013 and Chief Executive Officer from January 2010 to February 2013. Mr. Watkins also served as the Chief Executive Officer of Seagate Technology Holdings PLC from 2004 to January 2009, as President and Chief Operating Officer from 2000 to 2004 and held various other positions from 1996 to 2000. During his time with Seagate, Mr. Watkins was responsible for Seagate’s hard disc drive operations, including recording heads, media and other components, and related R&D and product development organizations. Mr. Watkins has served on the Board of Directors of Flex since 2009. He previously served on the Board of Directors of Avaya Holdings Corp. from 2017 through 2023 and Maxim Integrated Products, Inc., from 2008 to 2021. Mr. Watkins holds a Bachelor of Science degree in Political Science from the University of Texas. We believe that Mr. Watkins is qualified to serve as a director due to his extensive management experience across a number of industries on a global scale, including the energy storage industry, as well as his current and past board experience as a director of various public companies. |

Nextracker Inc. 16 2024 Proxy Statement |

Howard Wenger Board Member & President Age: 64 Director Since: 2024 | | | Howard Wenger has served as President of Nextracker since February 2022. Mr. Wenger began his solar career in 1984 and has held multiple leadership and board positions. Mr. Wenger served as President of Solaria Corporation, a solar panel manufacturing company, from May 2020 to October 2021, and as member of its Board of Directors from September 2019 to November 2022. From 2007 to 2017, he held various executive officer roles at SunPower Corporation, including President, Global Business Units, and for eight years serving as President and Chief Executive Officer of SunPower Corporation Systems, a wholly-owned subsidiary of SunPower Corporation. From 2003 to 2007, Mr. Wenger served as Executive Vice President and Board Director of PowerLight Corporation and prior to that held engineering and research positions at several companies, including AstroPower, Inc., Pacific Energy Group, PG&E and Intersol Power Corporation. Mr. Wenger holds a Bachelor of Arts degree in Environmental Studies from the University of California, Santa Barbara, and a Master of Science degree in Civil Engineering from the University of Colorado, Boulder. We believe Mr. Wenger is qualified to serve as a director due to his role as President and his extensive management experience in the solar energy industry. |

Nextracker Inc. 17 2024 Proxy Statement |

Board Skills Matrix

Name | | | Management Experience | | | Product Development & Manufacturing | | | Solar Industry Experience | | | Finance/ Corporate Audit Experience | | | Risk Management | | | Strategic Growth | | | Public Board Experience |

Julie Blunden | | | • | | | | | | • | | | | | | • | | | • | | | • |

Jeffrey Guldner | | | • | | | | | • | | | | | | | • | | | • | |||

Jonathan Coslet | | | • | | | | | | | | | • | | | | | • | | | • | |

Steven Mandel | | | • | | | | | | • | | | | | | | | | • | | | • |

Brandi Thomas | | | • | | | | | | | | | • | | | • | | | • | | | |

Willy Shih | | | • | | | • | | | | | | | | | | | | | | • | |

Daniel Shugar | | | • | | | • | | | • | | | | | | | | | • | | | • |

William Watkins | | | • | | | | | | • | | | | | | | | | • | | | • |

Howard Wenger | | | • | | | • | | | • | | | | | | • | | | • | | | • |

Nextracker Inc. 18 2024 Proxy Statement |

This section describes key corporate governance guidelines and practices that we have adopted. Complete copies of the charters of the committees of the Board and our Code of Business Conduct and Ethics, described below, can be found in the Governance section of the Investors section of our website at https://investors.nextracker.com/governance/governance/default.aspx. Alternatively, you can request a copy of any of these documents free of charge by writing to: Léah Schlesinger, General Counsel, Chief Ethics and Compliance Officer & Secretary, Nextracker Inc., 6200 Paseo Padre Parkway, Fremont, CA 94555. Information on or accessible through our website is not incorporated by reference in this Proxy Statement.

Board Composition

Our Board of Directors consists of nine members. William Watkins is the Chair. The primary responsibilities of our Board are to provide oversight, strategic guidance, counseling and direction to management. Our Board meets on a regular basis and additionally, as required.

Our amended and restated certificate of incorporation provides for a classified board of directors, with our directors being divided into three classes: Class I, Class II and Class III. Directors belonging to one of the three classes are elected at each annual stockholders’ meeting, with directors designated as Class II to be elected at this Annual Meeting, directors designated as Class III to be elected at the 2025 annual meeting of stockholders, and directors designated as Class I to be elected at the 2026 annual meeting of stockholders. Each director’s term continues until the third annual meeting of stockholders after their election and qualification of their successor, or their earlier death, resignation or removal.

Director Independence

The Board’s guidelines for director independence conform to the independence requirements in the Nasdaq rules for those directors deemed independent. The Board considers all relevant facts and circumstances in determining independence.

Board Leadership Structure

The Board reviews its leadership structure periodically as part of its annual self-assessment process. In addition, the Board continues to monitor developments in corporate governance as well as the approaches our peers undertake.

The Board believes that it is important to retain the flexibility to allocate the responsibilities of the offices of Chair and Chief Executive Officer in any manner that it determines to be in the best interests of the Company at any point in time. Our Chair is currently William Watkins. The Chair and our Chief Executive Officer are currently separate. Our Board of Directors believes that the Company and its stockholders are best served by maintaining the flexibility to determine whether the Chair and Chief Executive Officer positions should be separated or combined at a given point in time in order to provide appropriate leadership for us at that time.

If at any time the Chair is not an independent director, the Board shall appoint a lead director who must be independent. The Chair and the Chief Executive Officer are free, as is the Board of Directors as a whole, to call upon any one or more directors to provide leadership in a given situation should a special need arise.

Nextracker Inc. 19 2024 Proxy Statement |

The Board of Directors, including each of its committees, also has complete and open access to any member of the Company’s management and the authority to retain independent advisors as the Board or such committee deems appropriate. In addition, all members of each of the Audit Committee, the Nom Gov Committee and the Compensation and People Committee (the “C&P Committee”) are independent directors, and the committee chairs have authority to hold executive sessions without management and non-independent directors present.

Board Diversity

The Company seeks to achieve a balance and diversity of knowledge, experience and capability with respect to the directors serving on the Board. The Board considers each candidate’s ability to contribute to the diversity of the Board (including diversity of experience, viewpoints, backgrounds, gender, race and ethnicity).

The below Board Diversity Matrix reports self-identified diversity statistics for the Board in the format required by the Nasdaq rules.

Board Diversity Matrix (as of June 26, 2024) | ||||||||||||

Total Number of Directors | | | 9 | |||||||||

| | | Female | | | Male | | | Non- Binary | | | Did Not Disclose Gender |

Part I: Gender Identity | | | | | | | | | | |||

Directors | | | 2 | | | 7 | | | 0 | | | 0 |

Part II: Demographic Background | | | | | | | | | | | ||

African American or Black | | | 1 | | | 0 | | | 0 | | | 0 |

Alaskan Native or Native American | | | 0 | | | 0 | | | 0 | | | 0 |

Asian | | | 0 | | | 1 | | | 0 | | | 0 |

Hispanic or Latinx | | | 0 | | | 0 | | | 0 | | | 0 |

Native Hawaiian or Pacific Islander | | | 0 | | | 0 | | | 0 | | | 0 |

White | | | 1 | | | 6 | | | 0 | | | 0 |

Two or More Races or Ethnicities | | | 0 | | | 0 | | | 0 | | | 0 |

LGBTQ+ | | | 0 | | | 0 | | | 0 | | | 0 |

Did Not Disclose Demographic Background | | | 0 | | | 0 | | | 0 | | | 0 |

Role of the Board in Risk Oversight

An important function of the Board is oversight of risk management at Nextracker. Risk is inherent in business, and the Board’s oversight, assessment and decisions regarding risks occur in the context of and in conjunction with the other activities of the Board and its committees. The Board believes that its current governance structure facilitates its risk oversight responsibilities.

Nextracker Inc. 20 2024 Proxy Statement |

The Audit Committee manages risk by overseeing the integrity of the Company’s financial statements and internal controls; the qualifications, independence and performance of the Company’s independent registered public accounting firm; the performance of the Company’s internal audit function; risk assessments from management with respect to cybersecurity; and the Company’s compliance with legal and regulatory requirements.

The Nom Gov Committee manages risk by reviewing and evaluating the size, composition, function and duties of the Board consistent with its needs; making recommendations to the Board as to determinations of director independence; reviewing and reassessing the Company’s Corporate Governance Guidelines and the Code of Business Conduct and Ethics for the Company and overseeing compliance with such Code.

The C&P Committee manages risk by reviewing and assessing risks arising from the Company’s employee compensation policies and practices and whether any such risks are reasonably likely to have a material adverse effect on the company; working with the Chief Executive Officer to plan for the succession of the Chief Executive Officer and other senior executive officers, including developing plans for interim or emergency succession; and overseeing the Company’s human capital management strategy.

It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible. Our Chief Executive Officer, Chief Financial Officer and General Counsel, Chief Ethics and Compliance Officer & Secretary coordinate between the Board and management with regard to the determination and implementation of responses to any problematic risk management issues.

Meetings of the Board of Directors

The Board oversees our business. It establishes overall policies and standards and reviews the performance of management. From April 1, 2023 to March 31, 2024, the Board held six meetings. Each Board member attended 75% or more of the aggregate meetings of the Board and of the committees on which they served held during the period for which they were a director or committee member. Our directors are encouraged to attend our annual meetings of stockholders, but we do not currently have a policy relating to director attendance. Nine of our then-directors attended our 2023 annual meeting of stockholders.

The Board and each of our standing committees typically hold an executive session of non-management directors as a part of every regularly scheduled quarterly meeting.

Information Regarding Committees of the Board of Directors

The Board has a number of committees that perform certain functions for the Board. The current committees of the Board are the Audit Committee, the C&P Committee and the Nom Gov Committee. Below is a description of each committee of the Board. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities.

Audit Committee

The Board has a separately designated standing Audit Committee established in accordance with Section 3(a)(58) of the Exchange Act. The Audit Committee was established by the Board to assist the Board in its oversight of the integrity of our financial statements and internal controls, and our compliance with legal and regulatory requirements. In addition, the Audit Committee is responsible for the oversight of the qualification, independence and performance of our independent registered public accounting firm as well as the appointment of our independent registered public accounting firm.

The Audit Committee consists of Julie Blunden, Steven Mandel and Brandi Thomas, with Ms. Thomas serving as chairperson. Our Board has determined (i) that each of Julie Blunden, Steven Mandel and Brandi Thomas satisfies the requirements for independence and financial literacy under the rules and regulations of Nasdaq and the SEC and (ii) that Brandi Thomas qualifies as an “audit committee financial expert” as defined in the SEC rules and regulations and satisfies the financial sophistication requirements of

Nextracker Inc. 21 2024 Proxy Statement |

Nasdaq. In making that determination, the Board relied on the past business experience of each director. This designation does not impose any duties, obligations or liabilities that are greater than are generally imposed on members of our Audit Committee and our Board of Directors.

A majority of the members of the Audit Committee satisfy the independence requirements under the Nasdaq rules and the rules of the SEC. Based on the Board’s assessment, we have determined that the current composition of our Audit Committee will not materially adversely affect its ability to act independently and to carry out its responsibilities, identified immediately below.

Our Audit Committee is directly responsible for, among other things:

• | selecting and hiring our registered public accounting firm; |

• | evaluating the performance and independence of our registered public accounting firm; |

• | approving the audit and pre-approving any non-audit services to be performed by our registered public accounting firm; |

• | reviewing the integrity of our financial statements and related disclosures and reviewing our critical accounting policies and practices; |

• | reviewing the adequacy and effectiveness of our internal control policies and procedures and our disclosure controls and procedures; |

• | overseeing procedures for the treatment of complaints relating to accounting, internal accounting controls or audit matters; |

• | reviewing and discussing with management and the registered public accounting firm the results of the annual audit, our quarterly financial statements and our publicly filed reports; |

• | establishing procedures for employees to anonymously submit concerns about questionable accounting or audit matters; |

• | reviewing the effect of legal, regulatory and accounting initiatives on the Company’s financial statements; |

• | reviewing the effect of off-balance sheet arrangements, if any, on the Company’s financial statements; |

• | reviewing and approving in advance any proposed related-person transactions; |

• | the administration of our related party transaction policy; and |

• | preparing the audit committee report that the SEC requires in our annual proxy statement. |

Our Audit Committee operates under a written charter that satisfies the applicable rules of the SEC and the Nasdaq rules. The Audit Committee met 7 times in fiscal year 2024. The Audit Committee charter can be found in the Governance section of the Investors section of our website at https://investors.nextracker.com/governance/governance/default.aspx. Information on or accessible through our website is not incorporated by reference in this Proxy Statement. The Audit Committee charter grants the Audit Committee authority to obtain, at our expense, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the Audit Committee considers necessary or appropriate in the performance of its duties.

As required by its charter, the Audit Committee conducts a self-evaluation at least annually. The Audit Committee also reviews and assesses the adequacy of its charter at least annually and recommends any proposed changes to the Board for its consideration.

The Board annually reviews the Nasdaq rules’ definition of independence for Audit Committee members and has determined that all members of our Audit Committee are “financially literate” under the Nasdaq rules and that members of the Audit Committee received no compensation from the Company other than for service as a director.

Compensation and People Committee

The C&P Committee consists of Julie Blunden, Jonathan Coslet and Willy Shih, with Mr. Shih serving as chairperson. Our Board has determined that each of Julie Blunden, Willy Shih and Jonathan Coslet satisfies the requirements for independence under the rules and regulations of Nasdaq.

Nextracker Inc. 22 2024 Proxy Statement |

Our C&P Committee is responsible for, among other things:

• | reviewing and recommending to the Board for approval the compensation for Chief Executive Officer, as well as any employment, severance, change in control or termination agreements; |

• | reviewing and approving the compensation for all of our other executive officers (other than the Chief Executive Officer) and any other officers, as well as any employment, severance, change in control or termination agreements; |

• | administering our equity compensation plans; |

• | overseeing our overall compensation policies and practices; |

• | succession planning for the Company’s Chief Executive Officer and all other executive officers; and |

• | reviewing and approving the compensation committee report that the SEC requires in our annual proxy statement. |

Our C&P Committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the Nasdaq. The C&P Committee met 7 times in fiscal year 2024. The C&P Committee charter can be found in the Governance section of the Investors section of our website https://investors.nextracker.com/governance/governance/default.aspx. Information on or accessible through our website is not incorporated by reference in this Proxy Statement. The C&P Committee charter grants the C&P Committee sole authority to retain or obtain the advice of a compensation consultant, legal counsel or other adviser, including the authority to approve the consultant’s reasonable compensation. The C&P Committee may select such advisers, or receive advice from any other adviser, only after taking into consideration all factors relevant to that person’s independence from management, including those independence factors enumerated by Nasdaq rules.

Under the C&P Committee charter, the C&P Committee may, in its discretion, delegate its duties to a subcommittee.

As required by its charter, the C&P Committee conducts a self-evaluation at least annually. The C&P Committee also annually reviews and assesses the adequacy of its charter and recommends any proposed changes to the Board for its consideration.

Compensation and People Committee Processes and Procedures

The implementation of our compensation philosophy is carried out under the supervision of the C&P Committee. The C&P Committee charter requires that the C&P Committee meet as often as its members deem necessary to perform its responsibilities under the charter. The agenda for each meeting is usually developed by the chairperson of the C&P Committee, in consultation with other C&P Committee members, management and the C&P Committee’s independent advisors. The C&P Committee also meets regularly in executive session. Meetings may, at the discretion of the C&P Committee, include other directors or members of management in addition to the C&P Committee’s independent advisors, for the purpose of providing analysis and information to assist management with their recommendations on various compensation matters. Management does not participate in the executive sessions of the C&P Committee. For a description of the role of our management and any compensation consultants for executive compensation decisions for fiscal year 2024, please see the section titled “Compensation Discussion and Analysis” of this Proxy Statement.

Compensation and People Committee Interlocks and Insider Participation

During fiscal year 2024, Julie Blunden, Jonathan Coslet, Michael Hartung, Scott Offer, Willy Shih and Rebecca Sidelinger served on the C&P Committee. None of our executive officers currently serves, or has served during the last year, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board.

Nextracker Inc. 23 2024 Proxy Statement |

Nominating, Governance and Public Responsibility Committee

The Nominating, Governance and Public Responsibility Committee (“Nom Gov Committee”) is generally responsible for identifying qualified Board candidates, recommending director nominees and appointments to Board committees, evaluating Board performance and overseeing our Code of Business Conduct and Ethics. The Nom Gov Committee consists of Jeffrey Guldner, Steven Mandel and William Watkins, with Mr. Watkins serving as chairperson. Our Board has determined that each of Jeffrey Guldner, Steven Mandel and William Watkins satisfies the requirements for independence under the rules and regulations of Nasdaq and the SEC.

Our Nom Gov Committee is responsible for, among other things:

• | identifying, recruiting, evaluating and recommending candidates for service as members of the Board and as members of committees of the Board consistent with criteria approved by the Board, including assessing a candidate’s independence and, in the case of candidates for membership on the Board’s Audit Committee, financial literacy and expertise; |

• | reviewing and considering stockholder-recommended candidates for nomination to the Board; |

• | shaping and overseeing the application of the Company’s environmental, social and corporate governance guidelines, policies and procedures, and compliance with laws and regulations; |

• | overseeing Board communications with stockholders, stockholder proposals and stockholder activism; |

• | reviewing conflicts of interest of our directors and officers and proposed waivers of our corporate governance guidelines and Code of Business Conducts and Ethics; and |

• | assessing the composition and performance of the Board and the committees of the Board and the performance of each individual director. |

The Nom Gov Committee met 4 times in fiscal year 2024. Our Nom Gov Committee operates under a written charter that satisfies the applicable rules of the SEC and the Nasdaq rules. A detailed discussion of the Nom Gov Committee’s procedures for recommending candidates for election as a director appears below under the caption “Procedures of the Nom Gov Committee.”

The Nom Gov Committee charter can be found in the Governance section of the Investors section of our website at https://investors.nextracker.com/governance/governance/default.aspx. The Nom Gov Committee charter complies with the guidelines established by Nasdaq. Information on, or accessible through, our website is not incorporated by reference in this Proxy Statement. The charter of the Nom Gov Committee grants the Nom Gov Committee authority to retain and terminate any advisers, including search firms to identify director candidates, compensation consultants as to director compensation and legal counsel, including sole authority to approve all such advisers’ fees and other retention terms.

Procedures of the Nominating, Governance and Public Responsibility Committee

In connection with nominating directors for election at the Annual Meeting and periodically throughout the year, the Nom Gov Committee considers the composition of the Board and each committee of the Board to evaluate its effectiveness and whether changes should be considered to either the Board or any of the committees. In support of this process, the Board has determined that the Board as a whole must be inclusive and have the right balance and diversity of knowledge, experience and capability for the optimal functioning of the Board in its oversight of our Company. The Board considers the following factors and qualifications, without limitation:

• | the appropriate size and the diversity of the Board; |

• | the needs of the Board with respect to the particular talents and experience of its directors; |

Nextracker Inc. 24 2024 Proxy Statement |

• | the knowledge, skills and experience of nominees, including experience in the industry in which we operate, business, finance, management or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board; |

• | familiarity with domestic and international business matters; |

• | familiarity and experience with legal and regulatory requirements; and |

• | experience with accounting rules and practices. |

Considerations in Evaluating Director Nominees

Pursuant to the Nom Gov Committee charter, the Nom Gov Committee periodically reviews the composition of the Board in light of current challenges and needs of the Board and the Company and determines whether it may be appropriate to add or remove individuals after considering issues of judgment, diversity, skills, background and experience. Although the Nom Gov Committee does not have a formal policy regarding diversity on the Board, the Nom Gov Committee is sensitive to the importance of nominating persons with different perspectives and experience to enhance the deliberation and decision-making processes of the Board. The Nom Gov Committee also considers applicable laws and regulations and Nasdaq listing standards.

Once the Nom Gov Committee and the Board determine that it is appropriate to add a new director, either as a replacement or as a new position, the Nom Gov Committee uses a flexible set of procedures in selecting individual director candidates. Rather than applying specific minimum criteria in identifying candidates, the Nom Gov Committee seeks candidates with high professional and personal ethics and values, a general understanding of various business disciplines (e.g., marketing, finance, etc.), an understanding of the Company’s business and industry, educational and professional background, analytical ability, willingness to devote adequate time to Board duties and ability to act in and represent the balanced best interests of the Company and its stockholders as a whole, rather than special constituencies. This flexibility allows the Nom Gov Committee to adjust the process to best satisfy the objectives it is attempting to accomplish in any director search. The first step in the general process is to identify the type of candidate the Nom Gov Committee may desire for a particular opening, including establishing the specific target skill areas, experiences and backgrounds that are to be the focus of a director search. The Nom Gov Committee may consider candidates recommended by management, by members of the Nom Gov Committee, by the Board, by stockholders or by a third party it may engage to conduct a search for possible candidates. In considering candidates submitted by stockholders, the Nom Gov Committee will take into consideration the needs of the Board, and the qualifications of the candidate. In evaluating recommendations submitted by stockholders, the Board will evaluate such prospective nominees using the same standards that are applicable for all Board candidates.

Once candidates are identified, the Nom Gov Committee conducts an evaluation of qualified candidates. The evaluation generally includes interviews and background and reference checks. As noted above, there is no difference in the evaluation process of a candidate recommended by a stockholder as compared to the evaluation process of a candidate identified by any of the other means described above. In identifying and evaluating potential nominees to serve as directors, the Nom Gov Committee will examine each nominee on a case-by-case basis regardless of who recommended the nominee and take into account all factors it considers appropriate.

If the Nom Gov Committee determines that a candidate should be nominated as a candidate for election to the Board, the candidate’s nomination is then recommended to the Board, and the directors may in turn conduct their own review to the extent they deem appropriate. When the Board has agreed upon a candidate, such candidate is recommended to the stockholders for election at an annual meeting of stockholders or appointed as a director by a vote of the Board as appropriate.

Nextracker Inc. 25 2024 Proxy Statement |

Stockholder Communications with the Board of Directors

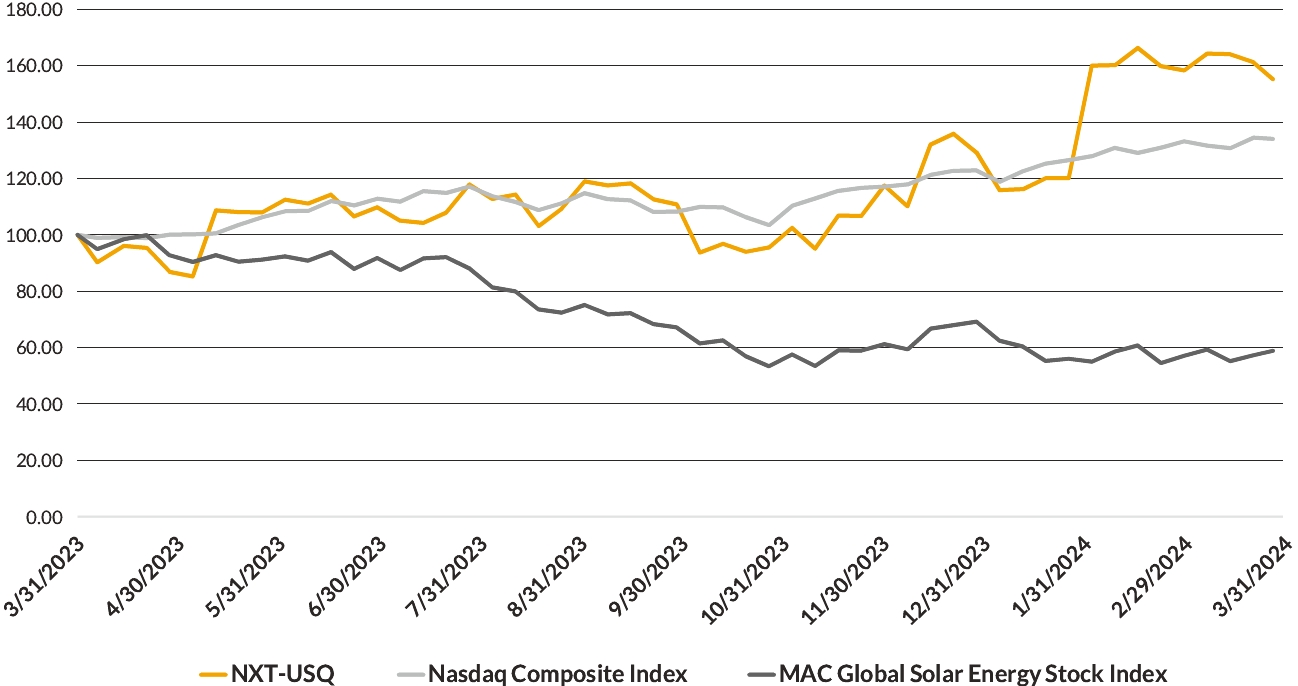

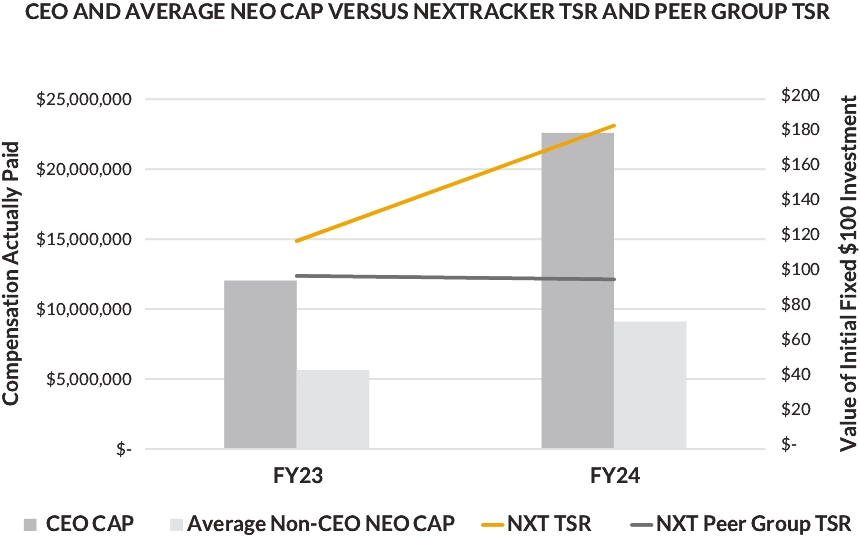

Our relationship with our stockholders is an important part of our corporate governance program. Engaging with our stockholders helps us to understand how they view us, to set goals and expectations for our performance, and to identify emerging issues that may affect our strategies, corporate governance, compensation practices or other aspects of our operations. Our stockholder and investor outreach includes investor road shows, analyst meetings and investor conferences and meetings. We also communicate with stockholders and other stakeholders through various media, including our annual report and SEC filings, proxy statement, news releases and our website. Our conference calls for quarterly earnings releases are open to all. These calls are available in real time and as archived webcasts on our website for a period of time.