BUSINESS OF CAR TECH, LLC

Unless the context otherwise requires, all references in this “Business of Car Tech, LLC” section to “we,” “us,” or “our” refer to Car Tech, LLC prior to the consummation of the Business Combination.

Company Overview

We are a U.S. manufacturer of auto body parts and accessories. Our goal is to be a leading global company in the automotive parts industry. We provide products and services to major Original Equipment Manufacturers (“OEMS”). We are a Tier 1 direct supplier to automotive companies such as BMW, Volvo, and Volkswagen. We have strong relationships with other Tier 1 suppliers such as Voestalpine and Unipres to provide services to Mercedes Benz and Nissan. We have maintained stable sales bases with major OEMs and secured a sales pipeline with Shinyoung Co., Ltd (“Shinyoung”) for the next five years.

Shinyoung is a leading Korean Tier 1 automotive “Body in White” (“BIW”) supplier (an industry term referring to a supplier of the skeletal parts of a car), offering body parts, stamping tools, and automation solutions to numerous major OEMs worldwide. Shinyoung established its R&D Center in 1997 and following Shinyoung’s success spanning over 50 years in various countries, including Korea, China, Russia, and Germany, the management team established Car Tech, LLC on April 14, 2016. Shinyoung will be a major stockholder of Car Tech following the Business Combination and has entered into a license agreement with Car Tech (the “Know-How License Agreement”) to license the accumulated skills, processes, information, experience and documents disclosed, provided or made available by Shinyoung to Car Tech (the “Licensed Know-How”). Pursuant to the Know-How License Agreement, Shinyoung granted Car Tech a perpetual, world-wide, royalty-free, fully paid-up, non-exclusive, sublicensable and transferable license to use the Licensed Know-How. Consideration for the rights granted under the Know-How License Agreement is provided by the value exchanged under the Merger Agreement. The Know-How License Agreement will automatically terminate in the event the Merger Agreement is terminated.

The representations, warranties and covenants contained in the Know-How License Agreement were made solely for the benefit of the parties to the Know-How License Agreement. In addition, such representations, warranties and covenants: (i) are intended as a way of allocating the risk between the parties to the Know-How License Agreement and not as statements of fact, and (ii) may apply standards of materiality in a way that is different from what may be viewed as material by investors in Car Tech.

We initiated factory construction in December 2016 and commenced business operations in May 2018. Car Tech, LLC achieved Tier 1 supplier status for various renowned companies: Volkswagen in May 2018, BMW in May 2019, Daimler in August 2019, and Volvo in December 2020.

Products Overview

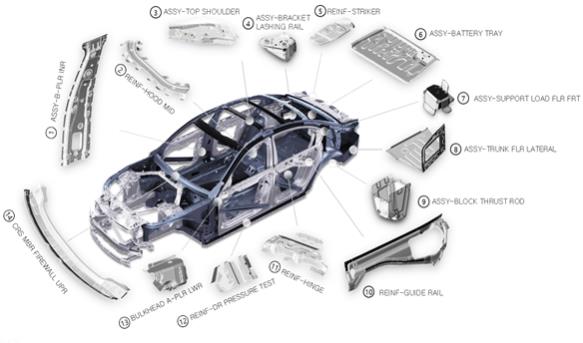

We provide BIW auto parts for motor vehicles to OEMS and other Tier 1 suppliers. The auto body parts produced primarily include reinforcement hoods, guide rails, cross members, strikers, support loads, and hinges. (See the graphic below).

183