As filed with the Securities and Exchange Commission on May 17, 2024.

Registration No. 333-278809

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact Name of Registrant as Specified in Its Charter)

Delaware | 6770 | 86-2171699 | ||

(State or Other Jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

2290 North 1st Street, Suite 201

San Jose, California 95131

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

John Schlaefer

Chief Executive Officer

GCT Semiconductor Holding, Inc.

2290 North 1st Street, Suite 201

San Jose, California 95131

(408) 434-6040

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Albert Lung, Esq.

Morgan, Lewis & Bockius LLP

1400 Page Mill Road

Palo Alto, CA 94304

(650) 843-4000

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 under the Securities Exchange Act of 1934:

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the Selling Securityholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION - DATED MAY 17, 2024

PRELIMINARY PROSPECTUS

GCT Semiconductor Holding, Inc.

35,970,732 Shares of Common Stock

6,580,000 Warrants to Purchase Common Stock

Up to 26,724,001 Shares of Common Stock Issuable Upon Exercise of Warrants

This prospectus relates to the issuance by us of an aggregate of up to 26,724,001 shares of our common stock, $0.0001 par value per share (the “Common Stock”) issuable upon the exercise of warrants, which consists of (a) up to 6,580,000 shares of Common Stock that are issuable upon the exercise of 6,580,000 warrants (the “Private Placement Warrants”) held by Concord Sponsor Group III LLC (the “Sponsor”), CA2 Co-Investment LLC (“CA2,” together with the Sponsor, the “Sponsors”), and an affiliate of stockholder of the Company (the “Affiliated Stockholder”) originally issued in a private placement in connection with the initial public offering of Concord Acquisition Corp III (“Concord III”) by the holders thereof and allocated to Affiliated Stockholder upon the consummation of the business combination, (b) up to 17,250,000 shares of Common Stock that are issuable upon the exercise of 17,250,000 warrants (the “Public Warrants”) originally issued in the initial public offering of Concord III by the holders thereof and (c) up to 2,894,001 shares of Common Stock that are issuable upon the exercise of 2,894,001 warrants held by certain warrants holders of GCT Semiconductor, Inc. (the “GCT Warrants” and together with the Public Warrants and Private Placement Warrants, the “Warrants”).

This prospectus also relates to the offer and sale from time to time by the selling securityholders named in this prospectus (the “Selling Securityholders”) of (i) up to 35,970,732 shares of Common Stock consisting of (a) up to 6,580,000 shares of Common Stock issuable upon exercise of the Private Placement Warrants at a price of $11.50 per share, which were initially issued to Sponsors at an effective purchase price of $1.00, (b) 19,685,138 shares of Common Stock acquired by certain Selling Securityholders party to the Registration Rights Agreement (as defined herein), at an effective purchase price ranging from $0.00 to $120.48 per share, (c) up to 4,529,967 shares of Common Stock originally issued to investors in a private placement pursuant to those certain Subscription Agreements (the “PIPE Shares”) at an effective purchase price of $6.67 per share, (d) up to 1,781,626 shares of Common Stock issued to certain third parties as consideration for their entry into certain non-redemption agreements with Concord III and the Sponsor (the “NRA Investors”) pursuant to which such Selling Securityholders agreed not to request redemption or to reverse any previously submitted redemption demand in connection with the Business Combination, (e) up to 500,000 shares of Common Stock underlying a convertible promissory note (the “Note”) issued to a strategic investor (the “Noteholder”) in the principal amount of $5,000,000 and (f) up to 2,894,001 shares of Common Stock that are issuable upon the exercise of the GCT Warrants at an exercise price of $5.00, $10.00, and $18.75 per share, as applicable and (ii) up to 6,580,000 Private Placement Warrants, which were initially issued to Sponsors at an effective purchase price of $1.00. See “Information Related to Offered Securities,” “Selling Securityholders” and “Description of Securities” for more information about the Selling Securityholders, including with respect to their acquisition of the securities offered hereby.

This prospectus provides you with a general description of such securities and the general manner in which we and the Selling Securityholders may offer or sell the securities. More specific terms of any securities that we and the Selling Securityholders may offer or sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus.

We will not receive any proceeds from the sale of the shares of Common Stock by the Selling Securityholders. We could receive up to an aggregate of approximately $107,870,019 if all of the Warrants held by the Selling Securityholders are exercised for cash. However, we will only receive such proceeds if and when the holders of the Warrants exercise the Warrants for cash. The exercise of the Warrants, and any proceeds we may receive from their exercise, are highly dependent on the price of any of our shares of Common Stock and the spread between the exercise price of the Warrants and the price of our Common Stock at the time of exercise. We have outstanding (i) 17,250,000 Public Warrants to purchase 17,250,000 shares of our Common Stock, exercisable at an exercise price of $11.50 per share, (ii) 6,580,000 Private Placement Warrants to purchase 6,580,000 shares of our Common Stock, exercisable at an exercise price of $11.50 per share, and (iii) 2,894,001 GCT Warrants to purchase 2,894,001 shares of our Common Stock, exercisable at an exercise price of $5.00, $10.00, and $18.75 per share, as applicable, as described herein for the GCT Warrants. If the market price of our Common Stock is less than the exercise price of a holder’s Warrants, it is unlikely that holders will exercise their Warrants. As of May 14, 2024, the closing price of our Common Stock was $5.88 per share. There can be no assurance that our Warrants will be in the money prior to their expiration. As such, it is possible that we may never generate any cash proceeds from the exercise of our Warrants. We will pay the expenses, other than underwriting discounts and commissions, associated with the sale of securities pursuant to this prospectus.

Our registration of the securities covered by this prospectus does not mean that either we or the Selling Securityholders will issue, offer or sell, as applicable, any of the securities. The Selling Securityholders may offer and sell the securities covered by this prospectus in a number of different ways and at varying prices. We provide more information in the section titled “Plan of Distribution.”

Sales of a substantial number of shares of Common Stock in the public market, including the resale of the shares of Common Stock held by our stockholders pursuant to this prospectus or pursuant to Rule 144, could occur at any time. These sales, or the perception in the market that the holders of a large number of shares of Common Stock intend to sell shares, could reduce the market price of the Common Stock and make it more difficult for you to sell your holdings at times and prices that you determine are appropriate. Shares of Common Stock held by certain of our stockholders, including the Sponsor, were purchased at an effective price lower than the current market price of our Common Stock. Accordingly, such stockholders could sell their securities at a per-share price that is less than the purchase price other stockholders paid and still realize a significant profit from the sale of those securities that could not be realized by our other stockholders. Furthermore, we expect that, because there is a large number of shares being registered pursuant to the registration statement of which this prospectus forms a part, the Selling Securityholders will continue to offer the securities covered thereby pursuant to this prospectus or pursuant to Rule 144 for a significant period of time, the precise duration of which cannot be predicted. Accordingly, the adverse market and price pressures resulting from an offering pursuant to the registration statement may continue for an extended period of time. See “The Offering” and “Risk Factors – Certain existing stockholders purchased securities in the Company at a price below the current trading price of such securities, and may experience a positive rate of return based on the current trading price. Future investors in our Company may not experience a similar rate of return.” You may not experience a similar rate of return should you invest in our securities, as the price at which you purchase our securities may differ from that of these Selling Securityholders.

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities.

Our Common Stock and Warrants are traded on the New York Stock Exchange under the symbols “GCTS” and “GCTSW,” respectively. On May 14, 2024, the closing price of our Common Stock was $5.88 per share, and the closing price of our Warrants, was $0.22 per Warrant.

We are an “emerging growth company” under federal securities laws and are subject to reduced public company reporting requirements. Investing in our Common Stock or Warrants involves a high degree of risk. See the section titled “Risk Factors” beginning on page 16 of this prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024.

i

Table of Contents

iii | |

v | |

1 | |

4 | |

6 | |

16 | |

41 | |

42 | |

43 | |

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | 44 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 57 |

72 | |

86 | |

93 | |

97 | |

102 | |

104 | |

115 | |

121 | |

125 | |

131 | |

131 | |

131 | |

132 | |

F-1 |

We have not, and the Selling Securityholders have not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of Common Stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of our shares of Common Stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside of the United States: we have not, and the Selling Securityholders has not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our shares of Common Stock and the distribution of this prospectus outside of the United States.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the SEC before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

ii

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we and the Selling Securityholders may, from time to time, issue, offer and sell, as applicable, any combination of the securities described in this prospectus in one or more offerings. We may use the shelf registration statement to issue up to an aggregate of 26,724,001 shares of Common Stock. The Selling Securityholders may use the shelf registration statement to sell up to an aggregate of 35,970,732 shares of Common Stock and 6,580,000 Private Placement Warrants from time to time through any means described in the section titled “Plan of Distribution.” We will not receive any proceeds from the sale by such Selling Securityholders of the securities offered by them described in this prospectus. This prospectus also relates to the issuance by us of the shares of Common Stock issuable upon the exercise of any Warrants. We will not receive any proceeds from the sale of shares of Common Stock underlying the Warrants pursuant to this prospectus, except with respect to amounts received by us upon the exercise of the Warrants for cash. The exercise of the Warrants, and any proceeds we may receive from their exercise, are highly dependent on the price of any of our shares of Common Stock and the spread between the exercise price of the Warrants and the price of our Common Stock at the time of exercise. If the market price of our Common Stock is less than the exercise price of a holder’s Warrants, it is unlikely that holders will exercise their Warrants. There can be no assurance that our Warrants will be in the money prior to their expiration.

A prospectus supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. See section titled “Where You Can Find More Information.”

Neither we nor the Selling Securityholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

This prospectus contains references to trademarks and service marks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

iii

On March 26, 2024 (the “Closing Date”), Concord III, a Delaware corporation, consummated a series of transactions that resulted in the combination of Gibraltar Merger Sub Inc., a Delaware corporation and a wholly-owned subsidiary of Concord III (“Merger Sub”), and GCT, pursuant to a Business Combination Agreement, dated November 2, 2023 (the “Business Combination Agreement”), by and among Concord III, Merger Sub and GCT, as described further below. Pursuant to the terms of the Business Combination Agreement, a business combination between Concord III and GCT was effected through the merger of Merger Sub with and into GCT, with GCT surviving the merger as a wholly-owned subsidiary of Concord III (the “Business Combination”), following the approval by shareholders of Concord III at the special meeting of the stockholders of Concord III held on February 27, 2024 (the “Special Meeting”). Following the closing of the Business Combination (the “Closing”), Concord III was renamed “GCT Semiconductor Holding, Inc.” (the “Company”).

Unless the context indicates otherwise, references to the “Company,” “we,” “us” and “our” refer to the business of GCT Semiconductor Holding, Inc., a Delaware corporation, and its consolidated subsidiaries following the Business Combination. “Concord III” refers to Concord Acquisition Corp III prior to the Business Combination.

iv

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein may contain forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Our forward-looking statements include, but are not limited to, statements regarding our and our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements which speak only as of the date hereof. You should understand that the following important factors, among others, could affect the Company’s future results and could cause those results or other outcomes to differ materially from those expressed or implied in the Company’s forward-looking statements:

| ● | our financial and business performance, including our financial projections and business metrics; |

| ● | changes in our strategy, future operations, financial position, estimated revenues and losses, forecasts, projected costs, prospects and plans; |

| ● | unexpected increases in our expenses resulting from inflationary pressures and rising interest rates, including manufacturing and operating expenses and interest expenses; |

| ● | our inability to anticipate the future market demands and future needs of our customers; |

| ● | our ability to develop new 5th generation (“5G”) products under collaboration agreements with our major partners; |

| ● | the impact of component shortages, suppliers’ lack of production capacity, natural disasters or pandemics on our sourcing operations and supply chain; |

| ● | our future capital requirements and sources and uses of cash; |

| ● | our ability to obtain funding for our operations; |

| ● | our anticipated financial performance, including gross margin, and the expectation that our future results of operations will fluctuate on a quarterly basis for the foreseeable future; |

| ● | our expected capital expenditures, cost of revenue and other future expenses, and the sources of funds to satisfy our liquidity needs; |

| ● | the outcome of any legal proceedings that may be instituted against us following completion of the Business Combination and transactions contemplated thereby; |

| ● | our ability to maintain the listing of our Common Stock on the NYSE; |

| ● | the risk that the Business Combination disrupts current plans and operations; |

| ● | the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, and the ability of us to grow and manage growth profitably; |

| ● | costs related to the Business Combination; and |

| ● | other risks and uncertainties indicated in this prospectus, including those under “Risk Factors” herein, and other filings that have been made or will be made with the SEC. |

v

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this prospectus are more fully described in the “Risk Factors” section. The risks described in “Risk Factors” are not exhaustive. These forward-looking statements are based on information available as of the date of this prospectus, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. New risk factors emerge from time to time and it is not possible for us to predict all such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. We undertake no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

vi

SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus or the documents incorporated by reference herein. Because it is a summary, it may not contain all of the information that may be important to you. To understand this offering fully, you should read this entire prospectus, the registration statement of which this prospectus is a part and the documents incorporated by reference herein carefully, including the information set forth under the heading “Risk Factors” and our financial statements.

Business Summary

Company Overview

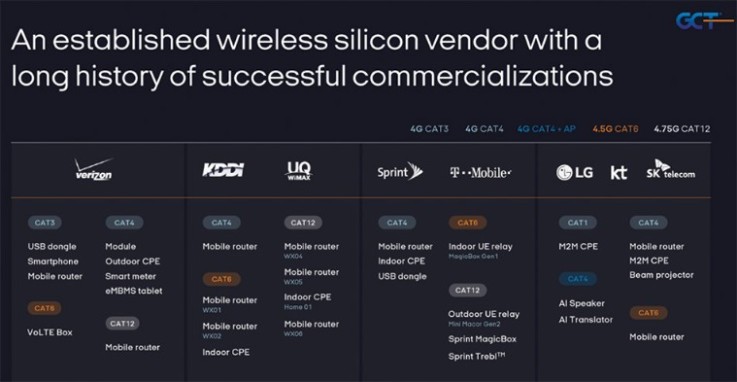

GCT Semiconductor, Inc. (“GCT”) was founded in Silicon Valley, California in 1998 and is a fabless semiconductor company that specializes in the design, manufacturing and sale of communication semiconductors, including high-speed wireless communication technologies such as 5G/4.75G/4.5G/4G transceivers (“RF”) and modems, which are essential for a wide variety of industrial, B2B and consumer applications. We have successfully developed and supplied communication semiconductor chipsets and modules to leading wireless operators worldwide, as well as to original design manufacturers (“ODMs”) and original equipment manufacturers (“OEMs”) for portable wireless routers (e.g., Mobile Router/MiFi), indoor and outdoor fixed wireless routers (e.g., CPE), industrial machine-to-machine (“M2M”) applications and smartphones.

We oversee sales, marketing, and accounting operations from our headquarters in San Jose, California. We conduct product design, development, and customer support through our fully owned subsidiaries, GCT Research, Inc. (“GCT R”) and MTH, Inc., both of which are located in South Korea. GCT R serves as our research and development center. In addition, we utilize separate sales offices for local technical support and sales in Taiwan, China, and Japan.

Our current product portfolio includes RF and modem chipsets based on 4th generation (“4G”), known as Long Term Evolution (“LTE”), technology offering a variety of chipsets differentiated by speed and functionality. These include 4G LTE, 4.5G LTE Advanced (twice the speed of LTE), and 4.75G LTE Advanced-Pro (four times the speed of LTE) chipsets. We also develop and sell cellular IoT chipsets for low-speed mobile networks such as eMTC/NB- IOT/Sigfox, and other network protocols.

Corporate Information

Our principal executive offices are located at 2290 North 1st Street, Suite 201 San Jose, CA 95131, and our telephone number is (408) 434-6040.

Business Combination

On March 26, 2024 (the “Closing Date”), Concord Acquisition Corp III (“Concord III”), a Delaware corporation, consummated a series of transactions that resulted in the combination of Gibraltar Merger Sub Inc., a Delaware corporation and a wholly-owned subsidiary of Concord III (“Merger Sub”), and GCT, pursuant to a Business Combination Agreement, dated November 2, 2023 (the “Business Combination Agreement”), by and among Concord III, Merger Sub and GCT, as described further below. Pursuant to the terms of the Business Combination Agreement, a business combination between Concord III and GCT was effected through the merger of Merger Sub with and into GCT, with GCT surviving the merger as a wholly-owned subsidiary of Concord III (the “Business Combination”), following the approval by shareholders of Concord III at the special meeting of the stockholders of Concord III held on February 27, 2024 (the “Special Meeting”). Following the consummation of the Business Combination, Concord III was renamed “GCT Semiconductor Holding, Inc.” (the “Company”).

As a result of the Business Combination, we became the successor to a publicly traded company, which will require hiring additional personnel and implementing procedures and processes to comply with public company regulatory requirements and customary practices. Consistent with the election initially made by Concord III, we will be classified as an emerging growth company (“EGC”), as defined under the Jumpstart Our Business Startups Act (the “JOBS Act”), which was enacted on April 5, 2012. Following the completion of the Business Combination, we, as an EGC, receive certain disclosure and regulatory relief provided by the SEC by virtue of the JOBS Act.

1

Summary of Risks

You should consider all the information contained in this prospectus before investing in our securities. These risks are discussed more fully in the section titled “Risk Factors”. If any of these risks actually occur, our business, financial condition or results of operations would likely be materially adversely affected. These risks include, but are not limited to, the following:

Risks related to our business, including that:

| ● | If the 5th generation (“5G”) market does not develop or develops more slowly than expected, or if we fail to accurately predict market requirements or market demand for 5G solutions, our financial performance will be adversely affected. |

| ● | Our products target primarily certain segments in the 5G markets, including fixed wireless access, mobile broadband, and M2M applications, and if these markets do not develop or grow as anticipated, our financial performance will be adversely affected. |

| ● | We depend on the commercial deployment of 4G LTE and 5G communications equipment, products and services to grow our business, and our business may be harmed if wireless carriers delay in the adoption of 5G standards, or if they deploy technologies that are not supported by our solutions. |

| ● | We rely on a small number of customers for a significant percentage of our revenue, and the loss of, or a reduction in, orders from these customers could result in a substantial decline in our revenue. |

Risks related to our industry and regulatory environment, including that:

| ● | The semiconductor and communications industries are cyclical and have historically experienced significant fluctuations with prolonged downturns, which could impact our operating results, financial condition and cash flows. |

| ● | The wireless and consumer electronics industry is characterized by short product cycles, significant fluctuations in supply and demand, and rapidly changing technologies, and we may not be able to meet these challenges successfully or consistently. |

| ● | The large amount of capital required to obtain radio frequency licenses, deploy and expand wireless networks and obtain new subscribers could slow the growth of the wireless communications industry and adversely affect our business. |

| ● | Our business depends on international customers, suppliers and operations in Asia, which subjects us to additional risks, including increased complexity and costs of managing international operations and geopolitical instability. |

Risks related to our intellectual property rights, including that:

| ● | Our failure to protect our intellectual property rights adequately could impair our ability to compete effectively or to defend ourselves from litigation. |

| ● | The enforcement and protection of our intellectual property may be expensive, could fail to prevent misappropriation or unauthorized use of our intellectual property, could result in the loss of our ability to enforce one or more patents, and could be adversely affected by changes in patent laws, by laws in certain foreign jurisdictions that may not effectively protect our intellectual property and by ineffective enforcement of laws in such jurisdictions. |

| ● | We may not be able to obtain additional patents and the legal protection afforded by any additional patents may not adequately cover the full scope of our business or permit us to gain or keep competitive advantage. |

Risks related to ownership of our Common Stock and our corporate structure, including that:

| ● | The market price of our Common Stock may be volatile, which could cause the value of your investment to decline. |

| ● | Delaware law, our Second Amended and Restated Certificate of Incorporation of the Company (the “Charter”) and our Amended and Restated Bylaws of the Company (the “Bylaws”) contain provisions that could delay or discourage takeover attempts that stockholders may consider favorable. |

2

| ● | Dr. Kyeongho Lee, Chairman of the Board and founder of the Company, owns a significant portion of our outstanding voting stock and exerts significant influence over our business and affairs. |

| ● | Certain existing stockholders purchased securities in the Company at a price below the current trading price of such securities, and may experience a positive rate of return based on the current trading price. Future investors in our Company may not experience a similar rate of return. |

| ● | There is no guarantee that the exercise price of the Warrants will ever be less than the trading price of Common Stock on the NYSE, and they may expire worthless; and the terms of the Warrants may be amended in a manner adverse to a holder if holders of at least 50% of the then outstanding Warrants approve of such amendment. |

| ● | Sales of a substantial number of our securities could increase volatility or decrease the price of our securities and adversely affect securityholders’ ability to sell or the Company’s ability to issue additional securities. |

General Risks related to the Company, including that:

| ● | The loss of any of our key personnel could seriously harm our business, and our failure to attract or retain specialized technical, management or sales and marketing talent could impair our ability to grow our business. |

| ● | Being a public company will increase our expenses and administrative workload and will expose us to risks relating to evaluation of our internal control over financial reporting required by Section 404 of the Sarbanes-Oxley Act of 2002. |

| ● | Adverse outcomes in tax disputes could subject us to tax assessments and potential penalties. |

| ● | Our business and operations could suffer in the event of security breaches. |

| ● | In preparing our financial statements we make certain assumptions, judgments and estimates that affect amounts reported in our consolidated financial statements, which, if not accurate, may significantly impact our financial results. |

Risks related to ownership of our Common Stock following the Business Combination, including that:

| ● | We may experience significant fluctuations in our results of operations, including as a result of seasonality, making it difficult to project future results. |

| ● | There can be no assurance that the Business Combination will achieve our objectives of providing the Company with sufficient capital, and if we require additional capital to fund our operations or expected growth, there can be no assurance that we will be able to obtain such funds on attractive terms or at all, and you may experience dilution as a result. |

| ● | We may be subject to securities or class action litigation, which is expensive and could divert management attention. |

Risk related to the Offering, including that:

| ● | The issuances of our Common Stock to the Selling Securityholders upon conversion of Warrants will cause dilution to our existing stockholders, and the sale of the shares of Common Stock acquired by the Selling Securityholders, or the perception that such sales may occur, could cause the price of our Common Stock to fall. |

| ● | Investors who buy shares at different times will likely pay different prices and may experience different levels of dilution. |

| ● | Our management team will have broad discretion over the use of the net proceeds from shares of Common Stock issued to the Selling Securityholders following our exercise of Warrants for cash, if any, and you may not agree with how we use the proceeds and the proceeds may not be invested successfully. |

3

THE OFFERING

We are registering the issuance by us of up to 26,724,001 shares of our Common Stock (including shares that may be issued upon exercise of Warrants to purchase Common Stock, such as the Public Warrants). We are also registering the resale by the Selling Securityholders or their permitted transferees of up to 35,970,732 shares of Common Stock and 6,580,000 Private Placement Warrants. Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” on page 6 of this prospectus.

Issuance of Common Stock

The following information is as of May 14, 2024 and does not give effect to issuance of our Common Stock or Warrants after such date, or the exercise of Warrants after such date.

Shares of our Common Stock to be issued | Up to 26,724,001 shares of Common Stock, including shares of Common Stock issuable upon exercise of the Warrants, consisting of (i) up to 6,580,000 shares of Common Stock that are issuable upon the exercise of up to 6,580,000 Private Placement Warrants by the holders thereof; (ii) up to 17,250,000 shares of Common Stock that are issuable upon the exercise of up to 17,250,000 Public Warrants by the holders thereof and (iii) up to 2,894,001 shares of Common Stock that are issuable upon the exercise of 2,894,001 GCT Warrants. | |

Shares of our Common Stock outstanding prior to the exercise of all warrants | 45,890,164 shares (as of May 10, 2024) | |

Shares of Common Stock outstanding assuming exercise of all Warrants | 72,614,165 shares (based on total shares outstanding as of May 10, 2024). | |

Exercise Price | $11.50 per share, subject to adjustment as described herein for the Public Warrants, $11.50 per share, subject to adjustment as described herein for the Private Placement Warrants and $5.00, $10.00, and $18.75 per share, as applicable, as described herein for the GCT Warrants. | |

Resale of Common Stock | ||

Shares of our Common Stock offered by the Selling Securityholders | Up to 35,970,732 shares of our Common Stock (including 6,580,000 shares of Common Stock that may be issued upon exercise of the Private Placement Warrants at a price of $11.50 per share, which were initially issued to Sponsors at an effective purchase price of $1.00, 4,529,967 PIPE Shares issued to the PIPE Investors at an effective purchase price of $6.67 per share, 19,685,138 shares of Common Stock acquired by certain Selling Securityholders party to the registration rights agreement entered into in connection with the Closing (“Registration Rights Agreement”) at effective purchase prices ranging from $0.00 to $120.48 per share, 1,781,626 shares of Common Stock issued to the NRA Investors for their entry into certain non-redemption agreements with Concord III and the Sponsor, pursuant to which such Selling Securityholders agreed not to request redemption or to reverse any previously submitted redemption demand in connection with the Business Combination, 500,000 shares of Common Stock underlying the Note issued to the Noteholder, at an effective purchase price of $10.00 per share and 2,894,001 shares of Common Stock that are issuable upon the exercise of the GCT Warrants at an exercise price of $5.00, $10.00, and $18.75 per share, as applicable). See “Information Related to Offered Securities,” “Selling Securityholders” and “Description of Securities” for more information about the Selling Securityholders, including with respect to their acquisition of the securities offered hereby. | |

Warrants offered by the Selling Securityholders | Up to 6,580,000 Private Placement Warrants, which were initially issued to Sponsors at an effective purchase price of $1.00. | |

Exercise Price | $11.50 per share, subject to adjustment as described herein for the Private Placement Warrants. |

4

Redemption | The Warrants are redeemable in certain circumstances. See “Description of Securities” for further discussion. | |

Use of proceeds | We will not receive any proceeds from the sale of the shares of Common Stock by the Selling Securityholders. We could receive up to an aggregate of approximately $107,870,019 if all of the Warrants held by the Selling Securityholders are exercised for cash. However, we will only receive such proceeds if and when the holders of the Warrants exercise the Warrants for cash. The exercise of the Warrants, and any proceeds we may receive from their exercise, are highly dependent on the price of any of our shares of Common Stock and the spread between the exercise price of the Warrants and the price of our Common Stock at the time of exercise. We have outstanding (i) 17,250,000 Public Warrants to purchase 17,250,000 shares of our Common Stock, exercisable at an exercise price of $11.50 per share, (ii) 6,580,000 Private Placement Warrants to purchase 6,580,000 shares of our Common Stock, exercisable at an exercise price of $11.50 per share, and (iii) 2,894,001 GCT Warrants to purchase 2,894,001 shares of our Common Stock, exercisable at an exercise price of $5.00, $10.00, and $18.75 per share, as applicable, as described herein for the GCT Warrants. If the market price of our Common Stock is less than the exercise price of a holder’s Warrants, it is unlikely that holders will exercise their Warrants. As of May 14, 2024, the closing price of our Common Stock was $5.88 per share. There can be no assurance that our Warrants will be in the money prior to their expiration. As such, it is possible that we may never generate any cash proceeds from the exercise of our Warrants. We will pay the expenses, other than underwriting discounts and commissions, associated with the sale of securities pursuant to this prospectus. | |

Terms of the offering | The Selling Securityholders will determine when and how they will dispose of the securities registered for resale under this prospectus. | |

Lock-up Agreements | The securities that are owned by the parties to the Registration Rights Agreement are subject to Lock-up Agreements, which provide for certain restrictions on transfer until the termination of applicable lock-up periods. See “Certain Relationships and Related Party Transactions - Lock-up Agreements” for further discussions. | |

Risk Factors | Investing in our Common Stock involves a high degree of risk. See the section titled “Risk Factors” of this prospectus and the section titled “Risk Factors” in the documents incorporated by reference herein for a discussion of factors you should carefully consider before investing in our Common Stock. | |

NYSE Ticker-Symbol | Common Stock: “GCTS” Warrants: “GCTSW” |

5

INFORMATION RELATED TO OFFERED SECURITIES

This prospectus relates to:

| ● | the resale of up to 6,580,000 Private Placement Warrants and 6,580,000 shares of Common Stock issuable upon the exercise of the Private Placement Warrants at a price of $11.50 per share, which were originally issued to the Sponsors at an effective purchase price of $1.00 in a private placement in connection with the initial public offering of Concord III by the holders thereof and allocated to the Affiliated Stockholder upon the consummation of the business combination; |

| ● | the resale of 19,685,138 shares of Common Stock issued to various Selling Securityholders party to the Registration Rights Agreement at an effective purchase price ranging from $0.00 to $120.48 per share; |

| ● | the resale of 4,529,967 shares of Common Stock originally issued to investors in a private placement pursuant to certain Subscription Agreements at an effective purchase price of $6.67 per share; |

| ● | the resale of 2,894,001 shares of Common Stock issuable upon the exercise of the GCT Warrants at an exercise price of $5.00, $10.00, and $18.75 per share, as applicable; |

| ● | the resale of 1,781,626 shares of Common Stock issued to various securityholders as consideration for their agreement not to redeem such shares in connection with the Business Combination; and |

| ● | the resale of 500,000 shares of Common Stock underlying a convertible promissory note issued to a strategic investor in the principal amount of $5,000,000. |

The following table includes information relating to the shares of Common Stock offered hereby, including the purchase price each Selling Securityholder paid for its securities, the potential profit relating to such securities, the date the Warrants are exercisable and the exercise price of the Warrants.

Offered Shares |

| Number |

| Exercise |

| Effective |

| Potential |

| Total | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Registration Rights Agreement Investors | ||||||||||||||

Anapass, Inc. (2) | 7,275,863 | $ | 11.46 | * | * | |||||||||

Aon 21 USA LLC (3) | 717,121 | $ | 11.46 | * | * | |||||||||

Asia Pacific Venture Invest II L.P. (4) | 9,950 | $ | 57.83 | * | * | |||||||||

Asia Pacific Venture Invest L.P. (5) | 30,599 | $ | 57.83 | * | * | |||||||||

Barker, Robert Jeffery(6) | 13,074 | $ | 0.11 | $ | 5.76 | $ | 75,437.12 | |||||||

CA2 Co-Investment LLC (7) | 362,141 | $ | 0.003 | $ | 5.88 | $ | 2,128,302.66 | |||||||

Concord Sponsor Group III LLC (8) | 4,992,126 | $ | 0.003 | $ | 5.88 | $ | 29,338,724.50 | |||||||

Global Growth Investment, L.P. (9) | 184,964 | $ | 11.46 | * | ||||||||||

Kim, Jeong-Min(10) | 215,286 | $ | 0.54 | $ | 5.33 | $ | 1,149,627.24 | |||||||

King, Thomas(11) | 30,000 | $ | 0.003 | $ | 5.88 | $ | 176,310.00 | |||||||

Korea Investment & Securities Co., Ltd As Trustee on behalf of “Renaissance Balance No.1 Privately Placed Fund” (12) | 3,114 | — | $ | 5.88 | $ | 18,310.32 | ||||||||

Korea Investment & Securities Co., Ltd As Trustee on behalf of “Renaissance Giovanni Pre-IPO Privately Placed Fund” (13) | 10,244 | — | $ | 5.88 | $ | 60,234.72 | ||||||||

Korea Investment & Securities Co., Ltd as Trustee on behalf of “Renaissance Intelligence Privately Placed Fund” (14) | 3,539 | — | $ | 5.88 | $ | 20,809.32 | ||||||||

Korea Investment & Securities Co., Ltd as Trustee on behalf of “Renaissance Kosdaq Venture Active Privately Placed Fund” (15) | 4,962 | — | $ | 5.88 | $ | 29,176.56 | ||||||||

6

Offered Shares |

| Number |

| Exercise |

| Effective |

| Potential |

| Total | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Korea Investment & Securities Co., Ltd as Trustee on behalf of “Renaissance Pre-IPO Kosdaq Venture Privately Placed Fund” (16) | 5,666 | — | $ | 5.88 | $ | 33,316.08 | ||||||||

Korea Investment & Securities Co., Ltd as Trustee on behalf of “Renaissance Raphaelo Ii Privately Placed Fund” (17) | 8,494 | — | $ | 5.88 | $ | 49,944.72 | ||||||||

Korea Investment & Securities Co., Ltd as Trustee on behalf of “Renaissance Sonnet Pre-Ipo Privately Placed Fund” (18) | 7,078 | — | $ | 5.88 | $ | 41,618.64 | ||||||||

Korea Investment & Securities Co., Ltd as Trustee on behalf of “Renaissance Value No.1 Privately Placed Fund” (19) | 5,511 | — | $ | 5.88 | $ | 32,404.68 | ||||||||

Korea Investment & Securities Co., Ltd as Trustee on behalf of “Renaissance Vasco Privately Placed Fund” (20) | 25,081 | — | $ | 5.88 | $ | 147,476.28 | ||||||||

Lee, Kyeongho(21) | 871,991 | $ | 5.14 | $ | 0.74 | $ | 645,273.34 | |||||||

Leibowitz, Larry(22) | 30,000 | $ | 0.003 | $ | 5.88 | $ | 176,310.00 | |||||||

M-China Fund I(23) | 81,019 | $ | 57.83 | * | * | |||||||||

M-Material·Parts·Equipment Platform Investment 1, L.P.(24) | 725,830 | $ | 6.00 | * | * | |||||||||

Mujin Electronics Co., Ltd. (25) | 324,162 | $ | 18.74 | * | * | |||||||||

M-Venture Investment, Inc. (26) | 1,201,683 | $ | 17.20 | * | * | |||||||||

NH Investment & Securities Co., Ltd as Trustee on behalf of “Renaissance Michelangelo I Privately Placed Fund” (27) | 5,932 | — | $ | 5.88 | $ | 34,880.16 | ||||||||

NH Investment & Securities Co., Ltd as Trustee on behalf of “Renaissance KOSDAQ Venture NH Privately Placed Fund” (28) | 5,011 | — | $ | 5.88 | $ | 29,464.68 | ||||||||

NH Investment & Securities Co., Ltd as Trustee on behalf of “Renaissance Michelangelo Pre-IPO Privately Placed Fund” (29) | 12,033 | — | $ | 5.88 | $ | 70,754.04 | ||||||||

NH Investment & Securities Co., Ltd as Trustee on behalf of “Renaissance Michelangelo Sobujang Pre-IPO Privately Placed Fund” (30) | 3,335 | — | $ | 5.88 | $ | 19,609.80 | ||||||||

N-Venture Investment Partnership I(31) | 22,840 | $ | 30.68 | * | * | |||||||||

Parakletos@Ventures 2000 Fund, L.P.(32) | 16,601 | $ | 120.48 | * | * | |||||||||

Parakletos@Ventures 99 Fund, L.P. (33) | 876,190 | $ | 42.56 | * | * | |||||||||

Parakletos@Ventures Millennium Fund, L.P. (34) | 507,423 | $ | 47.56 | * | * | |||||||||

Parakletos@Ventures, LLC(35) | 211,560 | $ | 36.53 | * | * | |||||||||

Schlaefer, John Brian(36) | 78,700 | $ | 0.11 | $ | 5.77 | $ | 454,099 | |||||||

SG Ace Inc. (37) | 120,000 | $ | 6.00 | * | * | |||||||||

Shin, Hyunsoo(38) | 457 | $ | 1.34 | $ | 4.54 | $ | 2,074.78 | |||||||

Sum, Alexander Kwok(39) | 90,143 | $ | 0.20 | $ | 5.68 | $ | 512,012.24 | |||||||

Yoon, Young Dae(40) | 30,094 | $ | 0.17 | $ | 5.70 | $ | 171,836.74 | |||||||

Yuanta Securities Korea Co., Ltd. (41) | 239,382 | $ | 11.46 | * | * | |||||||||

Yuanta Venture Capital Co., Ltd. (42) | 185,939 | $ | 11.46 | * | * | |||||||||

J.V.B. Financial Group, LLC (43) | 110,000 | — | $ | 5.88 | $ | 646,800.00 | ||||||||

Ort, Peter (44) | 30,000 | $ | 0.003 | $ | 5.88 | $ | 176,310.00 | |||||||

PIPE Shares | ||||||||||||||

Bookook The Tower New Tech Fund(45) | 286,956 | $ | 6.67 | * | * | |||||||||

Chun, Poong(46) | 149,925 | $ | 6.67 | * | * | |||||||||

7

Offered Shares |

| Number |

| Exercise |

| Effective |

| Potential |

| Total | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Shin, Sungyup(47) | 149,925 | $ | 6.67 | * | * | |||||||||

Global Coretech Growth Fund 1(48) | 2,248,875 | $ | 6.67 | * | * | |||||||||

Jeong, Deog Kyoon(49) | 149,925 | $ | 6.67 | * | * | |||||||||

Lee, Tae Won(50) | 149,925 | $ | 6.67 | * | * | |||||||||

NJ Holdings Inc. (51) | 449,775 | $ | 6.67 | * | * | |||||||||

Park, Tae Won(52) | 224,886 | $ | 6.67 | * | * | |||||||||

Today Holdings Corp(53) | 149,925 | $ | 6.67 | * | * | |||||||||

GP K-5G Fund 1(54) | 270,000 | $ | 6.67 | * | * | |||||||||

i Best Development Co., Ltd. (55) | 149,925 | $ | 6.67 | * | * | |||||||||

i Best Investment Co., Ltd. (56) | 149,925 | $ | 6.67 | * | * | |||||||||

GCT Warrants | ||||||||||||||

Choi, Gil Eon(57) | 205,333 | $ | 18.75 | — | * | * | ||||||||

Choi, Ji Hoon(58) | 5,455 | $ | 18.75 | — | * | * | ||||||||

Choi, Sue Jung(59) | 9,273 | $ | 18.75 | — | * | * | ||||||||

DMS Co., Ltd.(60) | 300,000 | $ | 5.00 | — | $ | 0.88 | $ | 264,000 | ||||||

Hong, Hye Ran(61) | 9,273 | $ | 18.75 | — | * | * | ||||||||

Hong, Jun Gi(62) | 105,000 | $ | 10.00 | — | * | * | ||||||||

i Best Development Co., Ltd. (63) | 200,000 | $ | 10.00 | — | * | * | ||||||||

i Best Investment Co., Ltd. (64) | 900,000 | $ | 10.00 | — | * | * | ||||||||

Kim, Da Rae(65) | 35,000 | $ | 10.00 | — | * | * | ||||||||

Kim, Dong Hyun(66) | 18,545 | $ | 18.75 | — | * | * | ||||||||

Kim, Shin Yup(67) | 40,000 | $ | 10.00 | — | * | * | ||||||||

Korea Investment & Securities Co., Ltd as Trustee on behalf of “Renaissance Kosdaq Venture Active Privately Placed Fund” (68) | 10,667 | $ | 18.75 | — | * | * | ||||||||

Lee, Jin(69) | 70,000 | $ | 10.00 | — | * | * | ||||||||

Lee, Junhyuk(70) | 105,000 | $ | 10.00 | — | * | * | ||||||||

Lee, Ki Hyoung(71) | 5,455 | $ | 18.75 | — | * | * | ||||||||

NJ Holdings Inc. (72) | 595,000 | $ | 10.00 | — | * | * | ||||||||

SG Ace Inc. (73) | 280,000 | $ | 18.75 | — | * | * | ||||||||

Non-Redemption Agreements Investors | ||||||||||||||

683 Capital Partners, LP (74) | 126,988 | — | $ | 5.88 | $ | 746,689.44 | ||||||||

Altana Calderwood Specialist Alpha Fund (75) | 3,745 | — | $ | 5.88 | $ | 22,020.60 | ||||||||

A.R.C. Directors Ltd.(76) | 62,500 | — | $ | 5.88 | $ | 367,500.00 | ||||||||

AQR Absolute Return Master Account, L.P.(77) | 20,000 | — | $ | 5.88 | $ | 117,600.00 | ||||||||

AQR Funds – AQR Diversified Arbitrage Fund(78) | 25,000 | — | $ | 5.88 | $ | 147,000.00 | ||||||||

AQR Global Alternative Investment Offshore Fund, L.P.(79) | 30,000 | — | $ | 5.88 | $ | 176,400.00 | ||||||||

AQR Tax Advantaged Absolute Return Fund, L.P.(80) | 25,000 | — | $ | 5.88 | $ | 147,000.00 | ||||||||

Arena Finance Markets, LP(81) | 13,745 | — | $ | 5.88 | $ | 80,820.60 | ||||||||

Arena Special Opportunities (Offshore) Master, LP(82) | 7,111 | — | $ | 5.88 | $ | 41,812.68 | ||||||||

Arena Special Opportunities Fund, LP(83) | 19,896 | — | $ | 5.88 | $ | 116,988.48 | ||||||||

Arena Special Opportunities Partners (Cayman Master) II, LP(84) | 18,312 | — | $ | 5.88 | $ | 107,674.56 | ||||||||

Arena Special Opportunities Partners II, LP(85) | 40,936 | — | $ | 5.88 | $ | 240,703.68 | ||||||||

Boston Patriot Merrimack St. LLC(86) | 27,485 | — | $ | 5.88 | $ | 161,611.80 | ||||||||

Camac Fund LP (87) | 68,538 | — | $ | 5.88 | $ | 403,003.44 | ||||||||

Dryden Capital Fund, LP(88) | 22,050 | — | $ | 5.88 | $ | 129,654.00 | ||||||||

Dryden Special Opportunity Fund, LP(89) | 132,750 | — | $ | 5.88 | $ | 780,570.00 | ||||||||

Fifth Lane Partners Fund LP(90) | 40,000 | — | $ | 5.88 | $ | 235,200.00 | ||||||||

8

Offered Shares |

| Number |

| Exercise |

| Effective |

| Potential |

| Total | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Fir Tree Capital Opportunity Master Fund III, LP(91) | 17,010 | — | $ | 5.88 | $ | 100,018.80 | ||||||||

Fir Tree Capital Opportunity Master Fund, LP(92) | 11,169 | — | $ | 5.88 | $ | 65,673.72 | ||||||||

Fir Tree Value Master Fund, LP(93) | 15,763 | — | $ | 5.88 | $ | 92,686.44 | ||||||||

FT SOF XIII (SPAC) Holdings, LLC(94) | 25,232 | — | $ | 5.88 | $ | 148,364.16 | ||||||||

Gantcher Family Limited Partnership(95) | 3,291 | — | $ | 5.88 | $ | 19,351.08 | ||||||||

Harraden Circle Investors, LP (96) | 62,697 | — | $ | 5.88 | $ | 368,658.36 | ||||||||

Highbridge Tactical Credit Master Fund, L.P. (97) | 79,700 | — | $ | 5.88 | $ | 468,636.00 | ||||||||

Highbridge Tactical Credit Institutional Fund, Ltd. (98) | 20,300 | — | $ | 5.88 | $ | 119,364.00 | ||||||||

Meteora Capital Partners, LP (99) | 14,342 | — | $ | 5.88 | $ | 84,330.96 | ||||||||

Meteora Select Trading Opportunities Master, LP(100) | 24,646 | — | $ | 5.88 | $ | 144,918.48 | ||||||||

Meteora Strategic Capital, LLC (101) | 3,754 | — | $ | 5.88 | $ | 22,073.52 | ||||||||

Meteora Special Opportunity Fund I, LP(102) | 7,258 | — | $ | 5.88 | $ | 42,677.04 | ||||||||

Mmf LT, LLC(103) | 128,250 | — | $ | 5.88 | $ | 754,110.00 | ||||||||

Nautilus Master Fund, L.P. (104) | 140,000 | — | $ | 5.88 | $ | 823,200.00 | ||||||||

One Oak Multi-Strategy Fund Ltd. (105) | 9,000 | — | $ | 5.88 | $ | 52,920.00 | ||||||||

Radcliffe Capital Management, L.P.(106) | 100,000 | — | $ | 5.88 | $ | 588,000.00 | ||||||||

Rivernorth SPAC Arbitrage Fund, LP (107) | 75,000 | — | $ | 5.88 | $ | 441,000.00 | ||||||||

RK Capital Partners LP(108) | 75,000 | — | $ | 5.88 | $ | 441,000.00 | ||||||||

RLH SPAC Fund, LP(109) | 20,000 | — | $ | 5.88 | $ | 117,600.00 | ||||||||

Sandia Investment Management LP(110) | 67,036 | — | $ | 5.88 | $ | 394,171.68 | ||||||||

Sea Hawk Multi-Strategy Master Fund Ltd. (111) | 4,600 | — | $ | 5.88 | $ | 27,048.00 | ||||||||

Sea Otter Trading, LLC(112) | 75,000 | — | $ | 5.88 | $ | 441,000.00 | ||||||||

TQ Master Fund LP (113) | 29,891 | — | $ | 5.88 | $ | 175,759.08 | ||||||||

Valuequest Partners LLC(114) | 9,000 | — | $ | 5.88 | $ | 52,920.00 | ||||||||

Walleye Investments Fund LLC(115) | 25,838 | — | $ | 5.88 | $ | 151,927.44 | ||||||||

Walleye Opportunities Master Fund Ltd(116) | 48,526 | — | $ | 5.88 | $ | 285,332.88 | ||||||||

Warbasse67 Fund LLC (117) | 5,267 | — | $ | 5.88 | $ | 30,969.96 | ||||||||

Promissory Note | ||||||||||||||

Gogo Business Aviation LLC(118) | 500,000 | $ | 10.00 | * | * | |||||||||

Private Placement Warrants | ||||||||||||||

Anapass, Inc.(119) | 937,350 | $ | 11.50 | — | * | * | ||||||||

CA2 Co-Investment LLC (120) | 544,564 | $ | 11.50 | $ | 1.00 | * | * | |||||||

Concord Sponsor Group III LLC (121) | 3,948,086 | $ | 11.50 | $ | 1.00 | * | * | |||||||

Lee, Kyeongho(122) | 800,000 | $ | 11.50 | — | * | * | ||||||||

SG Ace Inc. (123) | 350,000 | $ | 11.50 | — | * | * | ||||||||

*Represents no potential profit per share or total potential profit based on closing price of our Common Stock on May 14, 2024.

| (1) | “Exercise Price” and “Effective Purchase Price per Share” reflect the effective purchase price per security paid or, in the case of the shares issuable upon exercise of Warrants, to be paid upon such exercise by the purchaser of such securities. “Potential Profit per Share” and “Total Potential Profit” are based on the closing price as of May 14, 2024. The closing prices of our Common Stock and Warrants on May 14, 2024 were $5.88 per share and $0.22 per Warrant, respectively. |

| (2) | Consists of 7,275,863 shares of Common Stock that were issued to Anapass, Inc. as a party to the Registration Rights Agreement at an effective price of $11.46 per share. |

| (3) | 717,121 shares of Common Stock that were issued to Aon 21 USA LLC as a party to the Registration Rights Agreement at an effective price of $11.46 per share. |

9

| (4) | 9,950 shares of Common Stock that were issued to Asia Pacific Venture Invest II L.P. as a party to the Registration Rights Agreement at an effective price of $57.83 per share. |

| (5) | 30,599 shares of Common Stock that were issued to Asia Pacific Venture Invest L.P. as a party to the Registration Rights Agreement at an effective price of $57.83 per share. |

| (6) | 13,074 shares of Common Stock that were issued to Robert Jeffery Barker as a party to the Registration Rights Agreement at an effective price of $0.11 per share. |

| (7) | 362,141 shares of Common Stock that were issued to CA2 Co-Investment LLC as a party to the Registration Rights Agreement at an effective price of $0.003 per share. |

| (8) | 4,992,126 shares of Common Stock that were issued to Concord Sponsor Group III LLC as a party to the Registration Rights Agreement at an effective price of $0.003 per share. |

| (9) | 184,964 shares of Common Stock that were issued to Global Growth Investment, L.P. as a party to the Registration Rights Agreement at an effective price of $11.46 per share. |

| (10) | 215,286 shares of Common Stock that were issued to Jeong-Min Kim as a party to the Registration Rights Agreement at an effective price of $0.54 per share. |

| (11) | 30,000 shares of Common Stock that were issued to Thomas King as a party to the Registration Rights Agreement at an effective price of $0.003 per share. |

| (12) | 3,114 shares of Common Stock that were issued to Korea Investment & Securities Co., Ltd, as Trustee on behalf of “Renaissance Balance No.1 Privately Placed Fund,” as a party to the Registration Rights Agreement. |

| (13) | 10,244 shares of Common Stock that were issued to Korea Investment & Securities Co., Ltd, as Trustee on behalf of “Renaissance Giovanni Pre-IPO Privately Placed Fund,” as a party to the Registration Rights Agreement. |

| (14) | 3,539 shares of Common Stock that were issued to Korea Investment & Securities Co., Ltd, as Trustee on behalf of “Renaissance Intelligence Privately Placed Fund,” as a party to the Registration Rights Agreement. |

| (15) | 4,962 shares of Common Stock that were issued to Korea Investment & Securities Co., Ltd as Trustee on behalf of “Renaissance Kosdaq Venture Active Privately Placed Fund,” as a party to the Registration Rights Agreement. |

| (16) | 5,666 shares of Common Stock that were issued to Korea Investment & Securities Co., Ltd, as Trustee on behalf of “Renaissance Pre-IPO Kosdaq Venture Privately Placed Fund,” as a party to the Registration Rights Agreement. |

| (17) | 8,494 shares of Common Stock that were issued to Korea Investment & Securities Co., Ltd, as Trustee on behalf of “Renaissance Raphaelo Ii Privately Placed Fund,” as a party to the Registration Rights Agreement. |

| (18) | 7,078 shares of Common Stock that were issued to Korea Investment & Securities Co., Ltd, as Trustee on behalf of “Renaissance Sonnet Pre-Ipo Privately Placed Fund,” as a party to the Registration Rights Agreement. |

| (19) | 5,511 shares of Common Stock that were issued to Korea Investment & Securities Co., Ltd, as Trustee on behalf of “Renaissance Value No.1 Privately Placed Fund,” as a party to the Registration Rights Agreement. |

| (20) | 25,081 shares of Common Stock that were issued to Korea Investment & Securities Co., Ltd, as Trustee on behalf of “Renaissance Vasco Privately Placed Fund,” as a party to the Registration Rights Agreement. |

| (21) | 871,991 shares of Common Stock that were issued to Kyeongho Lee as a party to the Registration Rights Agreement at an effective price of $5.14 per share. |

| (22) | 30,000 shares of Common Stock that were issued to Larry Leibowitz as a party to the Registration Rights Agreement at an effective price of $0.003 per share. |

10

| (23) | 81,019 shares of Common Stock that were issued to M-China Fund I as a party to the Registration Rights Agreement at an effective price of $57.83 per share. |

| (24) | 725,830 shares of Common Stock that were issued to M-Material·Parts·Equipment Platform Investment 1, L.P. as a party to the Registration Rights Agreement at an effective price of $6.00 per share. |

| (25) | 324,162 shares of Common Stock that were issued to Mujin Electronics Co., Ltd. as a party to the Registration Rights Agreement at an effective price of $18.74 per share. |

| (26) | 1,201,683 shares of Common Stock that were issued to M-Venture Investment, Inc. as a party to the Registration Rights Agreement at an effective price of $17.20 per share. |

| (27) | 5,932 shares of Common Stock that were issued to NH Investment & Securities Co., Ltd, as Trustee on behalf of “Renaissance Michelangelo I Privately Placed Fund,” as a party to the Registration Rights Agreement. |

| (28) | 5,011 shares of Common Stock that were issued to NH Investment & Securities Co., Ltd, as Trustee on behalf of “Renaissance KOSDAQ Venture NH Privately Placed Fund,” as a party to the Registration Rights Agreement. |

| (29) | 12,033 shares of Common Stock that were issued to NH Investment & Securities Co., Ltd, as Trustee on behalf of “Renaissance Michelangelo Pre-IPO Privately Placed Fund,” as a party to the Registration Rights Agreement. |

| (30) | 3,335 shares of Common Stock that were issued to NH Investment & Securities Co., Ltd, as Trustee on behalf of “Renaissance Michelangelo Sobujang Pre-IPO Privately Placed Fund,” as a party to the Registration Rights Agreement. |

| (31) | 22,840 shares of Common Stock that were issued to N-Venture Investment Partnership I as a party to the Registration Rights Agreement at an effective price of $30.68 per share. |

| (32) | 16,601 shares of Common Stock that were issued to Parakletos@Ventures 2000 Fund, L.P. as a party to the Registration Rights Agreement at an effective price of $120.48 per share. |

| (33) | 876,190 shares of Common Stock that were issued to Parakletos@Ventures 99 Fund, L.P. as a party to the Registration Rights Agreement at an effective price of $42.56 per share. |

| (34) | 507,423 shares of Common Stock that were issued to Parakletos@Ventures Millennium Fund, L.P. as a party to the Registration Rights Agreement at an effective price of $47.56 per share. |

| (35) | 211,560 shares of Common Stock that were issued to Parakletos@Ventures, LLC as a party to the Registration Rights Agreement at an effective price of $36.53 per share. |

| (36) | 78,700 shares of Common Stock that were issued to John Brian Schlaefer as a party to the Registration Rights Agreement at an effective price of $0.11 per share. |

| (37) | 120,000 shares of Common Stock that were issued to SG Ace Inc. as a party to the Registration Rights Agreement at an effective price of $6.00 per share. |

| (38) | 457 shares of Common Stock that were issued to certain Hyunsoo Shin as a party to the Registration Rights Agreement at an effective price of $1.34 per share. |

| (39) | 90,143 shares of Common Stock that were issued to Alexander Kwok Sum as a party to the Registration Rights Agreement at an effective price of $0.20 per share. |

| (40) | 30,094 shares of Common Stock that were issued to Young Dae Yoon as a party to the Registration Rights Agreement at an effective price of $0.17 per share. |

| (41) | 239,382 shares of Common Stock that were issued to Yuanta Securities Korea Co., Ltd. as a party to the Registration Rights Agreement at an effective price of $11.46 per share. |

11

| (42) | 185,939 shares of Common Stock that were issued to Yuanta Venture Capital Co., Ltd. as a party to the Registration Rights Agreement at an effective price of $11.46 per share. |

| (43) | 110,000 shares of Common Stock that were issued to J.V.B. Financial Group, LLC as a party to the Registration Rights Agreement. |

| (44) | 30,000 shares of Common Stock that were issued to Peter Ort as a party to the Registration Rights Agreement at an effective price of $0.003 per share. |

| (45) | 286,956 PIPE Shares were issued to Bookook The Tower New Tech Fund pursuant to certain Subscription Agreements at an effective price of $6.67 per share. |

| (46) | 149,925 PIPE Shares were issued to Poong Chun pursuant to certain Subscription Agreements at an effective price of at an effective price of $6.67 per share. |

| (47) | 149,925 PIPE Shares were issued to Sungyup Shin pursuant to certain Subscription Agreements at an effective price of $6.67 per share. |

| (48) | 2,248,875 PIPE Shares were issued to Global Coretech Growth Fund 1 pursuant to certain Subscription Agreements at an effective price of $6.67 per share. |

| (49) | 149,925 PIPE Shares were issued to Deog Kyoon Jeong pursuant to certain Subscription Agreements at an effective price of $6.67 per share. |

| (50) | 149,925 PIPE Shares were issued to Tae Won Lee pursuant to certain Subscription Agreements at an effective price of $6.67 per share. |

| (51) | 449,775 PIPE Shares were issued to NJ Holdings Inc. pursuant to certain Subscription Agreements at an effective price of $6.67 per share. |

| (52) | 224,886 PIPE Shares were issued to Tae Won Park pursuant to certain Subscription Agreements at an effective price of $6.67 per share. |

| (53) | 149,925 PIPE Shares were issued to Today Holdings Corp pursuant to certain Subscription Agreements at an effective price of $6.67 per share. |

| (54) | 270,000 PIPE Shares were issued to GP K-5G Fund 1pursuant to certain Subscription Agreements at an effective price of $6.67 per share. |

| (55) | 149,925 PIPE Shares were issued to i Best Development Co., Ltd. pursuant to certain Subscription Agreements at an effective price of $6.67 per share. |

| (56) | 149,925 PIPE Shares were issued to i Best Investment Co., Ltd. pursuant to certain Subscription Agreements at an effective price of $6.67 per share. |

| (57) | Consists of 205,333 shares of Common Stock issuable to Gil Eon Choi upon the exercise of the GCT Warrants. |

| (58) | Consists of 5,455 shares of Common Stock issuable to Ji Hoon Choi upon the exercise of the GCT Warrants. |

| (59) | Consists of 9,273 shares of Common Stock issuable to Sue Jung Choi upon the exercise of the GCT Warrants. |

| (60) | Consists of 300,000 shares of Common Stock issuable to DMS Co., Ltd. upon the exercise of the GCT Warrants. |

| (61) | Consists of 9,273 shares of Common Stock issuable to Hye Ran Hong upon the exercise of the GCT Warrants. |

| (62) | Consists of 105,000 shares of Common Stock issuable to Jun Gi Hong upon the exercise of the GCT Warrants. |

| (63) | Consists of 200,000 shares of Common Stock issuable to i Best Development Co., Ltd. upon the exercise of the GCT Warrants. |

12

| (64) | Consists of 900,000 shares of Common Stock issuable to i Best Investment Co., Ltd. upon the exercise of the GCT Warrants. |

| (65) | Consists of 35,000 shares of Common Stock issuable to Da Rae Kim upon the exercise of the GCT Warrants. |

| (66) | Consists of 18,545 shares of Common Stock issuable to Dong Hyun Kim upon the exercise of the GCT Warrants. |

| (67) | Consists of 40,000 shares of Common Stock issuable to Shin Yup Kim upon the exercise of the GCT Warrants. |

| (68) | Consists of 10,667 shares of Common Stock issuable to Korea Investment & Securities Co., Ltd, as Trustee on behalf of “Renaissance Kosdaq Venture Active Privately Placed Fund,” upon the exercise of the GCT Warrants. |

| (69) | Consists of 70,000 shares of Common Stock issuable to Jin Lee upon the exercise of the GCT Warrants. |

| (70) | Consists of 105,000 shares of Common Stock issuable to Junhyuk Lee upon the exercise of the GCT Warrants. |

| (71) | Consists of 5,455 shares of Common Stock issuable to Ki Hyoung Lee upon the exercise of the GCT Warrants. |

| (72) | Consists of 595,000 shares of Common Stock issuable to NJ Holdings Inc. upon the exercise of the GCT Warrants. |

| (73) | Consists of 280,000 shares issuable to SG Ace Inc. upon the exercise of the GCT Warrants. |

| (74) | Consists of 126,988 shares of Common Stock issued to 683 Capital Partners, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (75) | Consists of 3,745 shares of Common Stock issued to Altana Calderwood Specialist Alpha Fund as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (76) | Consists of 62,500 shares of Common Stock issued to A.R.C. Directors Ltd. as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (77) | Consists of 20,000 shares of Common Stock issued to AQR Absolute Return Master Account, L.P. as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (78) | Consists of 25,000 shares of Common Stock issued to AQR Funds – AQR Diversified Arbitrage Fund as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (79) | Consists of 30,000 shares of Common Stock issued to AQR Global Alternative Investment Offshore Fund, L.P. as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (80) | Consists of 25,000 shares of Common Stock issued to AQR Tax Advantaged Absolute Return Fund, L.P. as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (81) | Consists of 13,745 shares of Common Stock issued to Arena Finance Markets, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (82) | Consists of 7,111 shares of Common Stock issued to Arena Special Opportunities (Offshore) Master, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (83) | Consists of 19,896 shares of Common Stock issued to Arena Special Opportunities Fund, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (84) | Consists of 18,312 shares of Common Stock issued to Arena Special Opportunities Partners (Cayman Master) II, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (85) | Consists of 40,936 shares of Common Stock issued to Arena Special Opportunities Partners II, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

13

| (86) | Consists of 27,485 shares of Common Stock issued to Boston Patriot Merrimack St. LLC as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (87) | Consists of 68,538 shares of Common Stock issued to Camac Fund LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (88) | Consists of 22,050 shares of Common Stock issued to Dryden Capital Fund, LP as consideration for their agreement not to redeem such shares of Common Stock in connection with the Business Combination. |

| (89) | Consists of 132,750 shares of Common Stock issued to Dryden Special Opportunity Fund, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (90) | Consists of 40,000 shares of Common Stock issued to Fifth Lane Partners Fund LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (91) | Consists of 17,010 shares of Common Stock issued to Fir Tree Capital Opportunity Master Fund III, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (92) | Consists of 11,169 shares of Common Stock issued to Fir Tree Capital Opportunity Master Fund, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (93) | Consists of 15,763 shares of Common Stock issued to Fir Tree Value Master Fund, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (94) | Consists of 25,232 shares of Common Stock issued to FT SOF XIII (SPAC) Holdings, LLC as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (95) | Consists of 3,291 shares of Common Stock issued to Gantcher Family Limited Partnership as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (96) | Consists of 62,697 shares of Common Stock issued to Harraden Circle Investors, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (97) | Consists of 79,700 shares of Common Stock issued to Highbridge Tactical Credit Master Fund, L.P. as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (98) | Consists of 20,300 shares of Common Stock issued to Highbridge Tactical Credit Institutional Fund, Ltd. as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (99) | Consists of 14,342 shares of Common Stock issued to Meteora Capital Partners, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination |

| (100) | Consists of 24,646 shares of Common Stock issued to Meteora Select Trading Opportunities Master, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (101) | Consists of 3,754 shares of Common Stock issued to Meteora Strategic Capital, LLC as consideration for their agreement not to redeem such shares in connection with the Business Combination. |

| (102) | Consists of 7,258 shares of Common Stock issued to Meteora Special Opportunity Fund I, LP as consideration for their agreement not to redeem such shares in connection with the Business Combination. |