UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________

FORM 20-F

_____________________

(Mark One)

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

Date of event requiring this shell company report

Commission file number 001-40692

_____________________

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

State of Israel

(Jurisdiction of incorporation or organization)

Riskified Ltd.

Europe House

(Address of principal executive offices)

Chief Executive Officer

Riskified Ltd.

Email: ir@riskified.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

_____________________

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Securities registered or to be registered pursuant to Section 12(g) of the Act.: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: As of December 31, 2022, the registrant had 102,084,746 Class A ordinary shares, no par value and 68,945,014 Class B ordinary shares, no par value, outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer, "accelerated filer,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | |||||||||

| Non-accelerated filer | ☐ | Emerging growth company | |||||||||

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board | ☐ | Other | ☐ | |||||||||||||

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

TABLE OF CONTENTS

| Page | |||||

ABOUT THIS ANNUAL REPORT

Except where the context requires or where otherwise indicated in this Annual Report on Form 20-F for the fiscal year ended December 31, 2022 (this “Annual Report”), the terms “Riskified,” the “Company,” “we,” “us,” “our,” “our company,” and “our business” refers to Riskified Ltd. and its subsidiaries.

All references in this Annual Report to “Israeli currency” and “NIS” refer to New Israeli Shekels, the terms “dollar,” “USD” or “$” refer to U.S. dollars and the terms “€” or “euro” refer to the currency introduced at the start of the third stage of the European economic and monetary union pursuant to the treaty establishing the European Community, as amended.

BASIS OF PRESENTATION

Presentation of Financial Information

Our consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP (“GAAP”). We present our consolidated financial statements in U.S. dollars.

Our fiscal year ends on December 31 of each year. Our most recent fiscal year ended on December 31, 2022.

Certain monetary amounts, percentages and other figures included elsewhere in this Annual Report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables or charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them. Certain amounts in prior periods have been reclassified to conform to the current period presentation.

Certain Definitions

As used in this Annual Report, except where the context otherwise requires or where otherwise indicated:

•“Riskified,” the “Company,” “we,” “us,” “our,” “our company” and similar references refer to Riskified Ltd. together with its consolidated subsidiaries as a consolidated entity.

•“Chargebacks” refers to forced transaction reversals typically associated with credit and debit card transactions. Chargebacks occur when a cardholder disputes a transaction with its bank and the cardholder’s bank rules in favor of the cardholder. In such instances, funds associated with the payment are withdrawn from the merchant’s bank account resulting in a loss equal to the amount of the item that was received by the consumer. Chargebacks are meant as a consumer protection mechanism from fraudulent transactions, however, they may also incite abuse and friendly fraud. For example, friendly fraud may occur when a consumer, rather than returning an order they are dissatisfied with, instead initiates the chargeback process to avoid the complicated returns process. Friendly fraud may violate the merchant’s cancellation policies and, depending on the jurisdiction, may also be unlawful.

•“Consumers” refers to end-consumers who purchase goods or services from our merchants.

•“Merchants” refers to the businesses that purchase our products.

Key Performance Indicators and Non-GAAP Financial Measures Used in this Annual Report

Throughout this Annual Report, we provide a number of key performance indicators and non-GAAP financial measures used by our management and often by competitors in our industry. These are discussed in more detail in the section entitled “Operating and Financial Review and Prospects—Key

1

Performance Indicators and Non-GAAP Financial Measures” which also includes a reconciliation of our non-GAAP financial measures to the most directly comparable GAAP measure. We define these key performance indicators and non-GAAP financial measures as follows:

•“Adjusted EBITDA” is a non-GAAP measure of financial performance and is defined as net profit (loss) adjusted to remove the effects of the provision for income taxes, interest income, net, other income (expense), net, depreciation and amortization (including amortization of capitalized internal-use software as presented in our statement of cash flows), share-based compensation expense, payroll taxes related to share-based compensation, and litigation-related expenses that are outside of the normal course of business.

•“Non-GAAP Gross Profit” is a non-GAAP measure of financial performance and represents gross profit excluding the impact of depreciation and amortization (including amortization of capitalized internal-use software as presented in our statement of cash flows), share-based compensation expense, and payroll taxes related to share-based compensation.

•“Non-GAAP Gross Profit Margin” is a non-GAAP measure of financial performance and is defined as Non-GAAP Gross Profit expressed as a percentage of revenue.

•“Approval rate” is defined as GMV that has been approved divided by GMV that has been reviewed.

•“Billings” or “amounts billed” is defined as (1) gross amounts invoiced to our merchants and estimates for cancellations and service level agreements for transactions approved during the period plus (2) changes in estimates for cancellations and service level agreements for orders approved in prior periods. Billings excludes credits issued for chargebacks.

•“Chargebacks-to-billings ratio” or “CTB Ratio” is defined as the total amount of chargeback expenses incurred during the period indicated divided by the total amount of Billings to all of our merchants over the same period.

•“Free Cash Flow” is a non-GAAP measure of liquidity and is defined as net cash provided by (used in) operating activities, less cash payments for property and equipment and capitalized software development costs.

•“Gross Merchandise Volume” or “GMV” is defined as the gross total dollar value of orders reviewed through our eCommerce risk intelligence platform during the period indicated, including orders that we did not approve.

The aforementioned key performance indicators and non-GAAP financial measures are used by management and our board of directors to assess our performance, for financial and operational decision-making, and as a means to evaluate period-to-period comparisons. These measures are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. We believe that these non-GAAP financial measures are appropriate measures of operating performance because they remove the impact of certain items that we believe do not directly reflect our core operations, and permit investors to view performance using the same tools that we use to budget, forecast, make operating and strategic decisions, and evaluate historical performance. By providing these non-GAAP financial measures together with a reconciliation to the most comparable GAAP measure, we believe we are enhancing investors’ understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing our strategic initiatives. Additionally, we provide Free Cash Flow because it is a non-GAAP liquidity measure that we believe provides useful information to management and investors about the amount of cash generated by the business that can be used for strategic opportunities, including investing in our business and strengthening our balance sheet. Free Cash Flow is limited, however, because it does not represent the residual cash flow available for discretionary expenditures. Free Cash Flow is not necessarily a measure of our ability to fund our cash needs.

2

The non-GAAP financial measures used herein have limitations as analytical tools in that they do not reflect certain cash costs that may recur in the future, including, among other things, cash requirements for costs to replace assets being depreciated and amortized or cash payments for taxes. These non-GAAP financial measures are not necessarily comparable to similarly titled captions of other companies due to different methods of calculation. Non-GAAP financial measures should not be considered in isolation, as an alternative to, or superior to information prepared and presented in accordance with GAAP.

Reverse Share Split

On July 28, 2021, we effectuated a two-for-one reverse share split of our Class A ordinary shares (the “Reverse Share Split”). No fractional shares were issued in connection with the Reverse Share Split. The historical financial statements included elsewhere in this Annual Report have been adjusted retroactively for the Reverse Share Split. Unless otherwise indicated, all other share and per share data in this Annual Report has been retroactively adjusted, where applicable, to reflect the Reverse Share Split as if it had occurred at the beginning of the earliest period presented.

Additional Class B Issuance

Immediately after the effectiveness of the Reverse Share Split, we issued and distributed Class B ordinary shares to holders of the Class A ordinary shares on a two-for-one ratio, such that each holder of Class A ordinary shares received two Class B ordinary shares for each Class A ordinary share held (the “Additional Class B Issuance”). The historical financial statements presented prior to the Reverse Share Split included elsewhere in this Annual Report have not been retroactively adjusted for the Additional Class B Issuance.

Market and Industry Data

Unless otherwise indicated, information in this Annual Report concerning economic conditions, our industry, our markets and our competitive position is based on a variety of sources, including information from independent industry analysts and publications, as well as our own estimates and research.

Our estimates are derived from publicly available information released by independent third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of our industry, which we believe to be reasonable. Certain statistical data, estimates and forecasts contained elsewhere in this Annual Report have been derived from:

•an independent industry report published by eMarketer, titled “Global Retail eCommerce Forecast 2023” (February 2023);

•an independent industry report published by DigitalCommerce360, titled “Top 500 Report (2022 Edition)”; and

•an independent industry data set published by eCommerceDB.com as of December 31, 2021.

None of the independent industry publications or data sets relied upon by us or otherwise referred to in this Annual Report were prepared on our behalf. Although we believe the data from these third-party sources is reliable, we have not independently verified any such information, and these sources generally state that the information they contain has been obtained from sources believed to be reliable but that the accuracy and completeness of such information is not guaranteed.

Projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Cautionary Note Regarding Forward-Looking Statements” and Item 3.D. “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the estimates made by independent third parties and by us.

3

Certain estimates of market opportunity and forecasts of market growth included in this Annual Report may prove to be inaccurate. The market for our products is relatively new and will experience changes over time. The estimates and forecasts in this Annual Report relating to the size of our target market, market demand and adoption, capacity to address this demand and pricing may prove to be inaccurate. The addressable market we estimate may not materialize for many years, if ever, and even if the markets in which we compete meet the size estimates in this Annual Report, our business could fail to grow at similar rates, if at all.

Trademarks

We have proprietary rights to trademarks, service marks and trade names used in this Annual Report that are important to our business, including, among others, Riskified and the Riskified design logo. Solely for convenience, trademarks, service marks and trade names referred to in this Annual Report may appear without the “®” or “™” symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trademarks, trade names or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Each trademark, trade name or service mark of any other company appearing in this Annual Report is the property of its respective holder.

4

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements contained in this Annual Report other than statements of historical fact, including, without limitation, statements regarding our future results of operations and financial position, growth strategy, plans and objectives of management for future operations, including, among others, expansion in new and existing markets, development and introductions of new products, capital expenditures and debt service obligations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “predict,” “forecasts,” “aims,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions. These forward-looking statements are principally contained in the sections entitled Item 3.D. “Risk Factors,” Item 4. “Information on the Company,” and Item 5. “Operating and Financial Review and Prospects.” These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following:

•our ability to manage our growth effectively;

•our history of net losses and ability to achieve profitability;

•our ability to attract new merchants and retain existing merchants;

•Continued use of credit cards and other payment methods that expose merchants to the risk of payment fraud, and changes in laws and regulations related to use of these payment methods, such as PSD2, and the emergence of new alternative payment products;

•the impact of macroeconomic conditions on us and on the performance of our merchants;

•our ability to continue to improve our machine learning models;

•fluctuations in our CTB Ratio and gross profit margin;

•our ability to protect the information of our merchants and consumers;

•our ability to predict future revenue due to lengthy sales cycles;

•seasonal fluctuations in revenue;

•competition;

•our merchant concentration;

•the financial condition of our merchants, particularly in challenging macroeconomic environments;

•our ability to increase the adoption of our products and to develop and introduce new products;

•our ability to mitigate the risks involved with selling our products to large enterprises;

•our ability to retain the services of our executive officers, and other key personnel, including our co-founders;

5

•our ability to attract and retain highly qualified personnel, including software engineers and data scientists, particularly in Israel;

•changes to our prices and pricing structure;

•our exposure to existing and potential future litigation claims;

•our exposure to fluctuations in currency exchange rates;

•our ability to obtain additional capital;

•our third-party providers of cloud-based infrastructure;

•our ability to protect our intellectual property rights;

•technology and infrastructure interruptions or performance problems;

•the efficiency and accuracy of our machine learning models and access to third-party and merchant data;

•our ability to comply with evolving data protection, privacy and security laws;

•our ability to comply with lending regulation and oversight;

•the development of regulatory frameworks for machine learning technology and artificial intelligence;

•our use of open-source software;

•our ability to enhance and maintain our brand;

•our ability to execute potential acquisitions, strategic investments, partnerships, or alliances;

•potential claims related to the violation of the intellectual property rights of third parties;

•our limited experience managing a public company;

•our failure to comply with anti-corruption, trade compliance, and economic sanctions laws and regulations;

•disruption, instability and volatility in global markets and industries as a result of the ongoing Russian activities in Ukraine;

•our ability to enforce non-compete agreements entered into with our employees;

•our ability to maintain effective systems of disclosure controls and financial reporting;

•our ability to accurately estimate or judgements relating to our critical accounting policies;

•our business in China;

•changes in tax laws or regulations;

•increasing scrutiny of, and expectations for, environmental, social and governance initiatives;

•potential future requirements to collect sales or other taxes;

•potential future changes in the taxation of international business and corporate tax reform;

•changes in and application of insurance laws or regulations;

6

•conditions in Israel that may affect our operations;

•the impact of the dual class structure of our ordinary shares;

•our status as a foreign private issuer; and

•the other matters described in the section entitled Item 3.D. “Risk Factors.”

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in Item 3.D. “Risk Factors” and elsewhere in this Annual Report. Moreover, we operate in an evolving environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any estimates or forward-looking statements. We qualify all of our estimates and forward-looking statements by these cautionary statements.

Additionally, we may provide information herein or on our website, or documents accessible thereby, that is not necessarily “material” under the federal securities laws for Securities and Exchange Commission (“SEC”) reporting purposes, but that is informed by various environmental, social, and governance (“ESG”) standards and frameworks (including standards for the measurement of underlying data), and the interests of various stakeholders, among other things. Much of this information is subject to assumptions, estimates or third-party information that is still evolving and subject to change. For example, our disclosures based on any standards may change due to revisions in framework requirements, availability of information, changes in our business or applicable government policies, or other factors, some of which may be beyond our control.

The estimates and forward-looking statements contained in this Annual Report speak only as of the date of this Annual Report. Except as required by applicable law, we undertake no obligation to publicly update or revise any estimates or forward-looking statements contained in this Annual Report, whether as a result of any new information, future events, or otherwise, or to reflect the occurrence of unanticipated events or otherwise.

7

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

You should carefully consider the risks and uncertainties described below and the other information in this Annual Report before making an investment decision. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also impair our business operations. Our business, financial condition, results of operations or strategic objectives could be materially and adversely affected by any of these risks and uncertainties. The trading price and value of our Class A ordinary shares could decline due to any of these risks and uncertainties, and you may lose all or part of your investment. This Annual Report also contains forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements.” Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks and uncertainties faced by us described below and elsewhere in this Annual Report.

Risks Relating to Our Business and Industry

We have experienced rapid growth since our inception. If we fail to manage our growth effectively, then our revenues, results of operations, and financial condition may be adversely affected.

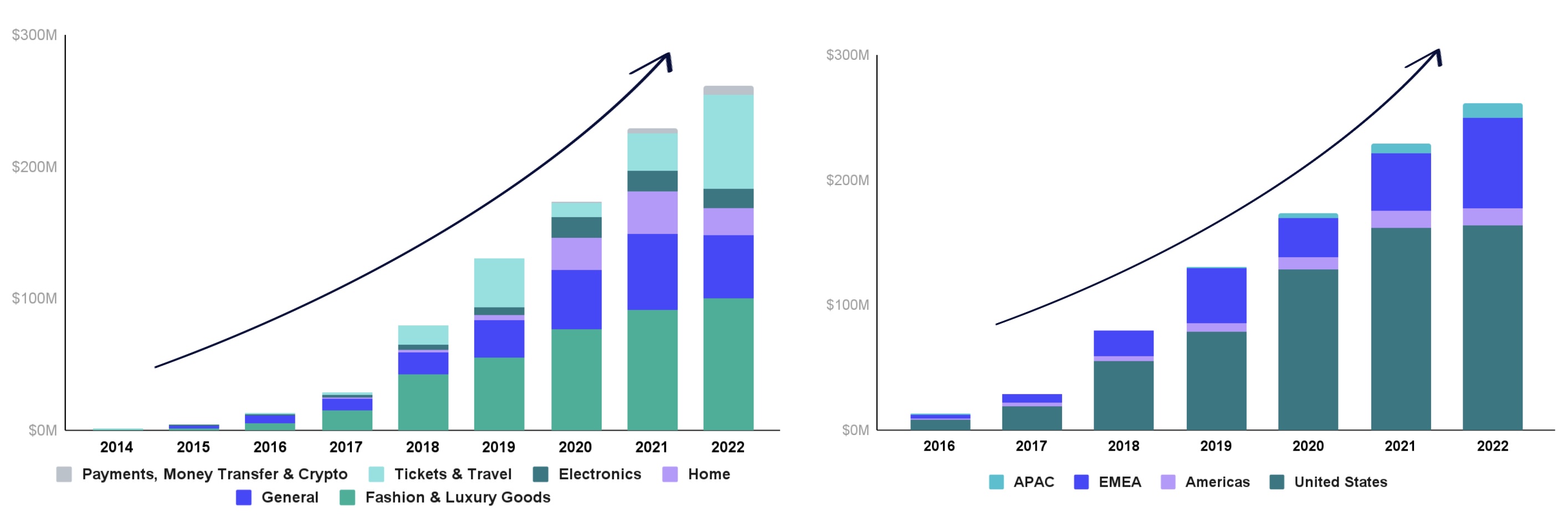

We have experienced substantial growth in our business since inception in 2012. Our revenue was $261.2 million and $229.1 million for the years ended December 31, 2022 and 2021, respectively, representing an increase of 14%. Our historical revenue growth may not be sustainable and should not be considered indicative of our future performance. Since launching our business, we have frequently expanded and enhanced our products, extended our geographic presence, and changed our pricing methodologies. Our rapid growth makes it difficult to evaluate our future prospects and the risks and challenges we may encounter. These risks include our ability to:

•accurately forecast our revenue and plan our operating expenses;

•increase the number of new merchants and retain existing merchants using our products;

•successfully compete with current and future competitors;

•successfully expand our business in existing markets, and enter new markets and geographies;

•anticipate and respond to macroeconomic changes and changes in the markets in which we operate;

8

•successfully execute on our growth initiatives while also focusing on enhanced expense discipline and path to profitability;

•accurately adjust our pricing structures for our products;

•maintain and enhance the value of our reputation and brand;

•adapt to rapidly evolving trends in the ways merchants and consumers interact with, and shop using, technology;

•accurately predict projected chargeback expenses, especially in new industry verticals and new geographies, or if new fraud patterns develop more quickly than our ability to detect and block new fraud patterns;

•avoid interruptions or disruptions to our service;

•develop a scalable, high-performance technology infrastructure that can efficiently and reliably handle increased usage, as well as the deployment of new features and products;

•hire, integrate, and retain talented technology, sales, and other personnel; and

•effectively manage growth in our personnel and operations.

In addition, the onset of the COVID-19 pandemic in March 2020 greatly accelerated existing trends of consumers moving online and our merchants prioritizing digital channels, due, in part, to the shutdown of brick-and-mortar stores, social distancing measures, and travel restrictions which diverted spending previously conducted in physical stores to the online space. This accelerated migration toward eCommerce has had a generally positive impact on our growth and business. While we believe that the increased eCommerce adoption that resulted from the COVID-19 pandemic is likely to persist, as COVID-19 related restrictions have eased, we have seen, and predict that we will continue to see, some return to spending in physical stores and an associated slow-down, or decline, in year-over-year eCommerce growth. In addition, following the easing of certain COVID-19 related restrictions, we have seen, and predict that we will continue to see, a recalibration in the industry and portfolio mix of our Billings and revenues. For example, during 2022 we saw a recovery in certain negatively impacted sectors, such as “tickets and travel”, to levels at or exceeding their pre-pandemic levels. On the other hand, we saw a corresponding deterioration in certain positively impacted sectors, including our U.S. “home” sector. To the extent that consumer spending patterns change in the future, in ways that reduce eCommerce transaction volumes, our future revenues and financial condition may be adversely impacted.

If we fail to address the risks and difficulties we face, including those associated with the challenges listed above as well as those described elsewhere in this “Risk Factors” section, our business, financial condition, and results of operations could be adversely affected.

We have a history of net losses and there are no assurances that we will achieve profitability in the future.

We have not been profitable since our inception in 2012 and have incurred significant net losses in prior years, including net losses of $104.0 million and $178.9 million for the years ended December 31, 2022 and 2021, respectively. We have taken, and are continuing to take decisive action to achieve profitability. For example, we have taken steps to reduce overhead and manage our variable and fixed-cost structures, and have begun to shift resources from certain legacy or non-core products to high-priority areas. While we have implemented certain cost reduction measures, we anticipate that our non-GAAP operating expenses may increase modestly over the next several years as we continue to hire additional personnel, expand our partnerships, operations, and infrastructure, continue to expand and enhance our products, and increase our spending on sales and marketing. In addition, our ability to achieve profitability will depend, in part, on our ability to effectively manage and decrease our chargeback expenses, which is dependent on our ability to improve the accuracy of our products. The accuracy of our

9

products is, in part, driven by the amount of information we are able to obtain from processing transactions. In addition, higher rates of inflation in the U.S. and globally, and demand for high-tech personnel in Israel, have impacted, and may continue to impact our costs of labor and the prices at which we are able to acquire goods and services from third-party vendors on which we rely. In many instances, we are not able to increase the prices at which we sell our products and services to offset these higher costs, either partially or at all. We intend to continue enhancing our existing products and may develop and introduce new products through internal research and development, and we may also selectively pursue acquisitions. These efforts may prove more expensive than we currently anticipate. If our revenue declines, or fails to grow at a rate sufficient to offset increases in our operating expenses, we may continue to generate losses and not be able to achieve and maintain profitability in future periods. In addition, our increased focus on expense discipline and path to profitability may require us to reduce the resources we can allocate to growth initiatives, which may in turn result in slower than anticipated revenue growth. We cannot assure you that we will become profitable, or that if we do become profitable, we will be able to sustain profitability.

If we are unable to attract new merchants, retain existing merchants or increase sales of our products to existing merchants, our business, financial condition and results of operations may be adversely affected.

Our growth is dependent on our ability to continue attracting new merchants while retaining existing merchants and expanding and enhancing the products we sell to them. In particular, if we are not able to attract new merchants and increase the amount of transactions we process within our existing merchant network, we may not be able to continue to improve our products. Growth in the demand for our products may also be inhibited, and we may be unable to grow our merchant base for a number of reasons, including, but not limited to:

•our failure to develop or offer new or enhanced products in a timely manner that are comparable with, or superior to, new technologies or competitor offerings, and that meet the evolving needs of our merchants and changes in the regulatory environment in which we operate;

•difficulties providing high quality support or maintaining a high level of merchant satisfaction, which could reduce demand for our products if existing merchants terminate their relationship with us or stop referring prospective merchants to us;

•increases in our merchant churn rates, including churn of significant merchants from whom we derive a significant percent of our revenue;

•perceived or actual security, availability, integrity, privacy, reliability, quality, or compatibility problems with our products, including related to unscheduled downtime, outages, or network security breaches; and

•continued or increased competition in our industry, including greater marketing efforts or investments by our competitors in advertising and promoting their brands or in product development.

Our future success depends, in part, on our ability to sell additional products to our existing merchants. If our merchants do not purchase additional products from us, or do not renew their agreements upon expiration, our business, financial condition, and results of operations may be adversely affected.

Our merchant expansions and renewals may decline or fluctuate as a result of a number of factors, including merchant usage, merchant satisfaction with our products and eCommerce risk intelligence platform capabilities and merchant support, our prices, the prices of competing products, mergers and acquisitions affecting our merchant base, consolidation of affiliates’ multiple paid business accounts into a single paid business account, the effects of global economic conditions, including recession and inflation, or reductions in our merchants’ spending levels generally. These factors may be exacerbated if,

10

consistent with our growth strategy, our merchant base continues to grow to encompass large online enterprises.

We are dependent upon the continued use of credit cards and other payment methods that expose our merchant to the risk of payment fraud as a primary means of payment for eCommerce transactions. Changes in laws and regulations related to use of these types of payment methods, including card scheme rules and PSD2, the emergence of new alternative payment products, or the general public’s use of such payment methods has, and may in the future continue to reduce or change the use-cases for our products, and has and could continue to adversely affect our revenues, our results of operations and financial condition.

The future success of our business depends upon the continued use of credit cards and other payment methods that expose our merchants to the risk of payment fraud, as a primary means to pay for online purchases and conduct commercial transactions. Federal, state or foreign government bodies or agencies have in the past adopted, and may in the future adopt, laws or regulations affecting the use of such payment methods, and in particular with respect to card-not-present transactions. In addition, card schemes such as Visa, MasterCard and American Express, impose rules and other requirements on participants in the payment chain. Changes in these laws, regulations or card scheme rules could require us to modify our products in order to comply with these changes. In addition, the adoption of regulations intended to reduce fraudulent transactions, that shift the liability for fraudulent transactions away from merchants and on to other participants in the payment chain, and other rules and regulations related to the use of credit cards may adversely affect the use-cases and demand for our products, our business, financial condition, and results of operations or require us to make changes to our business and strategies. For example, the revised European Payment Services Directive (Directive (EU) 2015/2366; PSD2) (“PSD2”) imposed new standards for payment security and strong customer authentication and shifted the liability for online payment fraud for certain types of transactions involving European issuing banks further towards issuing banks and away from online merchants. This impacted the demand for our Chargeback Guarantee product since this offering protects merchants from fraud related chargebacks that they may no longer be liable for. We believe that the impact of declines in our European GMV and revenue associated with the implementation of PSD2 is substantially reflected in our second half 2021 and full year 2022 financial results. Based on our internal modeling, and taking into consideration merchant feedback related to PSD2 adoption, we anticipate that the impact of PSD2 on our future financial performance will continue to decrease and is unlikely to be significant in 2023. PSD2 and other rules and regulations related to the use of credit cards has and may continue to adversely affect our business, financial condition, and results of operations or require us to make changes to our business and strategies. In addition, to the extent the performance of strong factor authentication protocols, such as 3D Secure, improves over time, or merchant risk profiles or consumer preferences shift over time, we may begin to see merchants electing to voluntarily adopt similar protocols with respect to online transaction volume originating outside of the EU. The adoption of 3D Secure or other strong factor authentication protocols that reduce online payment fraud, or shift the liability for online payment fraud away from the merchant, may change the demand or use-cases for our products and could adversely affect our revenues, our results of operations and financial condition.

Further, we depend upon the general public’s continued willingness to use credit cards and other payment methods that expose our merchants to the risk of payment fraud as a primary means to pay for online purchases and conduct commercial transactions. While we are able to review and guarantee transactions completed using alternative eCommerce payment methods, such as Apple Pay and Paypal, the increased availability of, and adoption by our merchants and by the general public of these and other alternative payment methods (such as “buy now pay later” services, cryptocurrencies or “digital wallet” style products, including those offered by large “traditional” financial institutions with large customer bases), which may be less susceptible to fraud, or include native fraud management features, may reduce the attractiveness of our products and may adversely affect our business, financial condition, and results of operations.

11

Our revenue is impacted, to a significant extent, by macroeconomic conditions and the financial performance of our merchants.

Our business, the eCommerce retail sector, and our merchants’ businesses are sensitive to macroeconomic conditions. Economic factors, such as interest rates, inflation, currency exchange rates, changes in monetary and related policies, market volatility, consumer confidence, recession or recessionary indicators, supply chain issues, unemployment rates, shifts in consumer spending patterns (for example, between goods and services), and real wages, are among the most significant factors that impact consumer spending behavior. Weak economic conditions or a significant deterioration in economic conditions, including sustained and prolonged recession, has reduced, and may continue to reduce the amount of disposable income consumers have, which, in turn, reduces consumer spending. This has had, and may continue to have an adverse effect on our business, financial condition, and results of operations.

Any prolonged economic downturn, including a recession, with sustained high interest rates and unemployment rates may lead to decreased retail consumption, and may materially decrease our merchants’ transaction volume, which, in turn, would impact the volume of transactions available for us to review for fraud. In particular, there are certain industries, including the luxury goods industry, that are particularly susceptible to recession and other macroeconomic conditions, such as inflation, that reduce consumer discretionary spending. Similarly, external macroeconomic factors and business conditions including global supply chain disruptions, such as those experienced in many industries in the second half of 2021 and throughout 2022, have and may in the future result in shortages of raw products and prolonged shipping and delivery times for consumer goods. This may in turn lead to decreased eCommerce transaction volumes as consumers instead opt to purchase stock-on-hand from bricks-and-mortar retailers, rather than transact through digital channels. Further, increased competition from large online players, such as Amazon, may also reduce our merchants’ transaction volumes. Any reduction in our merchants’ transaction volume directly impacts the revenue we derive from them and, if such reduction continues for a prolonged period, would have a material adverse effect on our business, financial condition and results of operations.

Our ability to review transactions for fraud, and the fees due to us associated with providing such products, depends upon sales of products and services by our merchants. Certain of our merchants’ sales have and may in the future decrease or fail to increase at rates consistent with prior performance, current expectations, or at all, as a result of factors outside of their control, such as the macroeconomic conditions referenced above, or business conditions affecting a particular industry vertical or region. For example, in 2022 we saw a year-over-year slowdown in our U.S. “home” sector, which we believe is primarily attributable to changing consumer preferences and demand for products in this category, following a period of abnormally high volume in this sector throughout the COVID-19 pandemic, and the subsequent easing of COVID-19 related restrictions. In our experience, weak economic conditions can also extend the length of our merchants’ sales cycles, and cause consumers to delay making (or not make) purchases of our merchants’ products and services. Even in the absence of macroeconomic factors, the performance of our merchants directly impacts our business, and, as a result, if the sales volume and financial performance of a merchant is negatively impacted for reasons specific to such merchant, our revenues will be negatively impacted. Alternatively, a reduction in online engagement at the macroeconomic level or for any of our individual merchants, including due to a general decrease in online spending, a result of consumers re-prioritizing traditional non eCommerce channels due to the easing of COVID-19 related restrictions, or a decreased demand for any of our merchants’ products or services for any reason could lead to a decrease in our merchants’ eCommerce revenues, which, in turn, would harm our revenues or reduce the attractiveness of our products.

If we are unable to continue to improve our machine learning models or if our machine learning models contain errors or are otherwise ineffective, our growth prospects, business, financial condition, and results of operations may be adversely affected.

12

Our products are based on our machine learning models and our ability to attract new merchants, retain existing merchants, or increase sales of our products to existing merchants will depend in large part on our ability to maintain a high degree of accuracy and automation in our automated decisioning process. Maintaining or improving the level of accuracy in our automated decisioning process in turn allows us to maintain or improve approval rates for our merchants over time. If our machine learning models fail to accurately detect fraud, or any of the other components of our automated decisioning process fail, we may experience higher than forecasted chargebacks, which in turn may put downward pressure on our gross margins, and our ability to attract new merchants, retain existing merchants or increase sales of our products to existing merchants and our business, financial condition, and results of operations may be adversely affected.

Our machine learning models are designed to analyze data attributes to identify complex transaction and behavior patterns, which enables us to detect fraud and illegitimate consumers quickly and accurately. Our ability to accurately detect fraud even as methods of committing fraud evolve and become more sophisticated is dependent on our ability to continuously improve and train these models. However, it is possible that our machine learning models may prove to be less accurate than we expect, or than they have been in the past, for a variety of reasons, including inaccurate assumptions or other errors made in building or training such models, incorrect interpretations of the results of such models, increased fraud sophistication beyond the capabilities of our machine learning models, and failure to timely update model assumptions and parameters. In addition, our machine learning models may initially be less accurate following expansion into new industry verticals, geographic regions and use-cases, such as review of ACH payments. Further, the successful performance of our machine learning models relies on the ability to constantly review and process large amounts of transactions and other data. If we are unable to attract new merchants, retain existing merchants or increase sales of our products to existing merchants, or if our merchants do not provide us with access to a significant volume of their transaction data or if the number of transactions processed by our existing merchants declines, the amount of data reviewed and processed by our machine learning models will be reduced or fail to grow at a pace that will allow us to continue to improve the efficiency of our machine learning models, which may reduce the accuracy of such models. Additionally, such models may not be able to effectively account for matters that are inherently difficult to predict or are otherwise beyond our control, such as social engineering and other methods of perpetrating fraud that do not lend themselves well to risk-based analysis. Material errors or inaccuracies in such machine learning models could lead us to make inaccurate or sub-optimal operational or strategic decisions, which could adversely affect our business, financial condition and results of operations. Our inability to train our models or develop new technology that can detect new fraud schemes may also result in significant chargeback expenses, which would materially and adversely impact our business, financial condition, and results of operations.

The data gathering for, and development of, our machine learning models have largely occurred during a period of sustained economic growth, and our machine learning models have not been extensively tested during a down-cycle economy or recession. For example, consumer spending patterns, transaction volumes and fraud patterns experienced during a down-cycle economy or recession may differ from those experienced during periods of sustained economic growth. There is no assurance that our machine learning models can continue to accurately detect fraud under adverse economic conditions. If our machine learning models are unable to accurately detect fraud under such economic conditions, the performance of our product may be worse than anticipated and we may be required to issue a significant amount of credits as a result of valid chargebacks, which would adversely affect our business, financial condition and results of operations.

Our CTB Ratio and gross profit margin have historically fluctuated from quarter-to-quarter and we expect that to continue. These metrics are managed, and should be analyzed, on an annual basis.

Our CTB Ratio and gross profit margin are managed, and are best analyzed, on an annual basis. Historically, our CTB Ratio and gross profit margin have fluctuated between periods, and we expect that these financial metrics will continue to fluctuate between periods in the future, based on a number of factors, including changes in the mix of our merchant industry base, our entry into new geographies and

13

industries, the risk profile of orders approved in the period, technological improvements in the performance of our models, seasonality and other factors. For example, our CTB Ratio and gross profit margins are sometimes negatively impacted in the first several quarters following the onboarding of merchants in new industry verticals or geographic regions, as our machine learning models adapt to the unique fraud patterns and other characteristics associated with transaction volume in those industries or regions. Model performance will generally normalize over time as our machine learning models gather more data and their accuracy improves. We believe that similar trends will continue to affect our future quarterly performance. In addition, order populations in certain industry verticals or geographic regions may be more or less risky. For example, historically “tickets and travel” has been a higher-risk, lower-margin industry, while other industry verticals, such as “electronics” and “fashion, cosmetics and luxury goods” have been lower-risk, higher-margin industries. Any change in our merchant industry mix between periods is likely to impact our CTB Ratio and gross profit margin between periods.

Our products enable the collection and storage of personal, confidential or proprietary information of our merchants and their consumers, and security concerns could result in liability to us or inhibit sales of our products.

In conducting our business, we rely heavily on computer systems, hardware, software, technology infrastructure and online websites and networks (collectively, “IT Systems”) for both internal and external operations. Our operations involve the storage, transmission and processing of our merchants’ and their consumers’ confidential proprietary data, which can include personal information. While we have developed systems and processes to protect our IT Systems and the integrity, confidentiality and security of such data, our security measures or those of our third-party service providers, including, but not limited to, the third-party providers of cloud-based infrastructure, or Public Cloud Providers, have in the past and could in the future result in unauthorized access to or disclosure, modification, misuse, loss or destruction of such data. Any security breaches, computer malware, ransomware or extortion based attack, exploited hardware or software bugs, misconfigurations or similar vulnerabilities experienced by us or by our third-party service providers, could expose us to a risk of loss of personal, confidential or proprietary information, operational disruptions, loss of business, severe reputational damage adversely affecting merchant or investor confidence, regulatory investigations and orders, litigation, indemnity obligations, damages for contract breach, fines and penalties for violation of applicable laws or regulations, and significant costs for remediation and incentives offered to merchants or other business partners in an effort to maintain business relationships after a breach, and other liabilities.

We have experienced and expect to continue to experience actual and attempted cyber-attacks of our IT networks, such as through phishing scams and ransomware. Although none of these actual or attempted cyber-attacks to date, individually or in the aggregate, has had a material adverse impact on our operations or financial condition, we cannot guarantee that such incidents will not have such an impact in the future. Cyberattacks and other malicious Internet-based activity continue to increase generally. If our products or security measures are perceived as weak or are actually compromised as a result of third-party action, employee or merchant error, malfeasance, stolen or fraudulently-obtained log-in credentials, or otherwise, our merchants may curtail or stop using our products, our reputation could be damaged, our business may be adversely affected, and we could incur significant liability. We may be unable to anticipate or prevent techniques used to obtain unauthorized access to or to sabotage systems because they change frequently and generally are not detected until after an incident has occurred. As adoption of our products by merchants continues to increase and our brand becomes more widely known and recognized, we may become more of a target for third parties seeking to compromise our security systems or gain unauthorized access to our merchants’ data. Moreover, if a high-profile security breach occurs with respect to another cloud platform provider, our merchants and potential merchant customers may lose trust in the security of cloud platforms generally, which could adversely impact our ability to retain existing merchants or attract new ones. While we continue to implement controls and plans for preventative actions to further strengthen our IT Systems against future attacks, we cannot assure you that such measures will provide adequate security, that we will be able to react in a timely manner, or that our remediation efforts following past or future attacks will be successful.

14

If we are not able to detect activity on our eCommerce risk intelligence platform that might be nefarious in nature or if we are not able to design processes or systems to reduce the impact of similar activity on a platform of a third-party service provider, our merchants could suffer harm. In such cases, we could face exposure to legal claims, particularly if a merchant suffers actual harm. We cannot assure you that any limitation of liability provisions in our contracts for a security lapse or breach would be enforceable, adequate or would otherwise protect us from any liabilities or damages with respect to any particular claim related to such lapse or breach. We also cannot be sure that our existing insurance coverage will continue to be available on acceptable terms or will be available in sufficient amounts to cover one or more large claims related to a security breach, or that the insurer will not deny coverage as to any future claim. Our existing general liability and cyber liability insurance policies may not cover, or may cover only a portion of, any potential claims related to security lapses or breaches to which we are exposed or may not be adequate to indemnify us for all or any portion of liabilities that may be imposed. We also cannot be certain that our existing insurance coverage will continue to be available on acceptable terms or in amounts sufficient to cover the potentially significant losses that may result from a security incident or breach, which could therefore have a material adverse effect on our business, financial condition and results of operations.

Lengthy sales cycles with large enterprises make it difficult to predict our future revenue and may cause variability in our operating results.

Our sales cycle can vary substantially from merchant to merchant, but with large enterprises it typically requires 25 to 55 weeks on average from the time we designate a merchant as a sales qualified lead, or SQL, to execution of an agreement with that merchant. Our ability to forecast revenue accurately is affected by our ability to forecast new merchant acquisitions. Lengthy sales cycles make it difficult to predict the quarter in which revenue from a new merchant may first be recognized. If we overestimate new merchant growth in a particular period or generally, our revenue will not grow as quickly as our forecasts, our costs and expenses may continue to exceed our revenue, and our results of operations will be adversely affected. In addition, we may not meet or may be required to revise guidance that we have provided to the public, if any.

In addition, we plan our operating budget, including sales and marketing expenses, and our hiring needs, in part, based on our forecasts of new merchant growth and future sales. If new merchant growth or sales for a particular period is lower than expected, we may not be able to proportionately reduce our operating expenses for that period, which could harm our operating results for that period. Delays in our sales cycles could cause significant variability in our revenue and operating results for any particular period.

We have experienced in the past, and expect to continue to experience, seasonal fluctuations in our revenues. If we fail to accommodate increased volumes during peak seasons and events, our business, financial condition, and results of operations may be adversely affected.

Our business is seasonal in nature and our GMV and revenues are typically highest in the calendar fourth quarter. Our revenue is directly correlated with the level of revenue that our merchants generate, and our merchants typically generate the most revenue in the calendar fourth quarter, which includes Black Friday, Cyber Monday, the holiday season, and other peak events included in the eCommerce calendar, such as Chinese Singles’ Day and Thanksgiving. Our gross profit margin typically follows a similar trend. For each of the years ended December 31, 2022 and 2021, calendar fourth quarter revenue represented approximately 30% of our total revenues. As a result, our revenue will typically decline in the calendar first quarter of each year relative to the calendar fourth quarter of the previous year.

Any service disruption affecting our products, especially during the calendar fourth quarter, could have a negative effect on our operating results. Surges in volumes during peak periods may strain our technological infrastructure and merchant support activities which may reduce our revenue and the attractiveness of our products.

15

Any disruption to our operations or the operations of our merchants during calendar fourth quarter could lead to a material decrease in revenues relative to our expectations for the calendar fourth quarter which could in turn result in a significant shortfall in revenue, results of operations and operating cash flows for the full year.

We operate in a highly competitive industry. Competition presents an ongoing challenge to the success of our business.

We operate in a highly competitive industry, and we expect competition to continue to increase. With the introduction of new technologies and the entry of new competitors into the market, including risk scoring companies that provide non-guaranteed decisions, typically at a lower price point, we expect competition to persist and intensify in the future. This could harm our ability to attract new merchants, increase sales, maintain or increase renewals, and maintain or increase our prices. We believe that our ability to compete depends upon many factors both within and beyond our control, including the following:

•the size of our merchant base;

•the timing and market acceptance of products, including the developments and enhancements to those products, offered by us or our competitors;

•the quality of our products and our merchant service and support efforts;

•our selling and marketing efforts;

•our continued ability to develop technology to support our business model;

•our continued ability to develop and implement new products to meet evolving merchant needs, use-cases and regulatory requirements;

•our continued ability to expand into and localize our products in new geographies and new industry verticals in a timely manner;

•the pricing structures and pricing practices employed by our competitors; and

•our brand strength relative to our competitors.

Many of our existing and potential competitors could have substantial competitive advantages, such as greater name recognition, longer operating histories, larger sales and marketing budgets, greater merchant support resources, lower labor and development costs, larger and more mature intellectual property portfolios and significantly greater financial, technical, marketing and other resources. Further, in addition to fraud detection and prevention, certain of our competitors may offer a more comprehensive portfolio of products and services, which may make them more attractive to potential merchants.

Our competitors may engage in more extensive research and development efforts, undertake more far-reaching marketing campaigns and adopt more aggressive pricing policies which may allow them to attract merchants. Our competitors may develop products that are similar to our products or that achieve greater market acceptance than our products, which could attract merchants away from our products and reduce our market share.

In addition, if one or more of our competitors were to merge or partner with another of our competitors, our ability to compete effectively could be adversely affected. Our competitors may also establish or strengthen cooperative relationships with our current or future strategic distribution and technology partners or other parties with whom we have relationships (i.e. channel partners), thereby limiting our ability to promote and implement our eCommerce risk intelligence platform.

These competitive pressures in our market, or our failure to compete effectively, may result in price reductions, lower transaction volumes, reduced revenue and gross profit margins, increased net losses,

16

merchant-churn and loss of market share. Any failure to meet and address these factors may adversely affect our business, financial condition and results of operations.

We have a substantial merchant concentration, with a limited number of merchants accounting for a substantial portion of our revenues. The loss of a significant merchant would materially and negatively affect our business, financial condition and results of operations.

We derive a significant portion of our revenues from a few significant merchants, each of which operates in the eCommerce retail sector. For the three years ended December 31, 2022, 2021 and 2020, our three largest merchants in the aggregate accounted for 25%, 30% and 36% of our revenues, respectively. In addition, our five largest merchants in aggregate accounted for approximately 34%, 39% and 49% of our revenues for the years ended December 31, 2022, 2021 and 2020, respectively. While the proportion of our total revenues that we derive from these merchants continues to decrease year-over-year as our merchant base expands, inherent risks remain whenever a large percentage of total revenues are concentrated with a limited number of merchants. It is not possible for us to predict the future business activities or volumes of sales that will be generated by these merchants. If any of these merchants experience declining or delayed sales or other business interruptions due to market, economic, or competitive conditions, the fees we receive from such merchant will decline proportionally. Further, because the retail sector, where most of our major merchants operate, is generally susceptible to macroeconomic factors, we too are susceptible to macroeconomic factors. See “Item 3.D. “Risk Factors —Risks Relating to our Business and Industry— Our revenue is impacted, to a significant extent, by macroeconomic conditions and the financial performance of our merchants.” In addition, we could be pressured to reduce our prices, make other contractual concessions or we could experience a decline in the demand for our products, any of which could negatively affect our business, financial condition, and results of operations. If any of our five largest merchants terminate their relationships with us, such termination would materially negatively affect our business, financial condition, and results of operations. Furthermore, if any of our largest merchants terminate their relationships with us, or if these merchants experience declining or delayed eCommerce sales or other business interruptions, our estimates and forecasts relating to the size and expected growth of our market and our revenues may prove to be inaccurate.

The risk of losing merchants as a result of bankruptcies may be higher due to challenging macroeconomic conditions (including a recession), and could materially and negatively affect our business, financial condition and results of operations.

We have in the past had, and may in the future have, merchants, including significant merchants, whose financial condition deteriorates significantly, or who become subject to bankruptcy proceedings. In particular, merchants who are highly leveraged, operate on narrow margins, or are otherwise susceptible to changes in economic, competitive and market conditions, may be at an increased risk of bankruptcy in a recessionary environment. In addition to a reduction in these merchants’ eCommerce sales volumes, possibly to zero, we are not always able to recover amounts due to us from these merchants, which can have a material adverse impact on our business, financial condition, and results of operations.

A number of cryptocurrency exchanges including FTX Trading Ltd., et al. (“FTX”) (including its affiliated fund Alameda Research LLC), cryptocurrency hedge fund Three Arrows Capital (“Three Arrows Capital”) and cryptocurrency lenders Celsius Network LLC, et al. (“Celsius”), Voyager Digital Ltd., et al. (“Voyager”), Genesis Global Capital et al. (“Genesis”) and BlockFi Inc., et al. (BlockFi”) recently filed for Chapter 11 bankruptcy. While we do not work with, or otherwise have exposure to any of the above cryptocurrency market participants, these events have resulted in a loss of confidence in participants in the digital asset ecosystem and negative publicity surrounding the industry more broadly. Other participants, including our cryptocurrency exchange merchants may be negatively affected, which may in turn reduce activity on their platforms and the revenues that we derive from these merchants. In addition, should any of our cryptocurrency exchange merchants become subject to a bankruptcy proceeding in the future, we may not be able to recover amounts due to us from such merchant. For the year ended

17

December 31, 2022, revenue derived from our cryptocurrency exchange merchants accounted for less than 1% of our total revenue.

If we are unable to develop enhancements to our products, increase adoption and usage of our products, and introduce new products and capabilities that achieve market acceptance, our business, financial condition and results of operations may be adversely affected.

Our ability to attract new merchants and increase revenue from existing merchants depends on numerous factors, including our ability to enhance and improve our existing products, increase adoption and usage of our products, and introduce new products and capabilities. In particular, if we are not able to develop technology that is able to keep pace with new and increasingly complex fraud schemes, we may not be able to achieve a return on investment that satisfies our merchants. The success of any enhancements or new products depends on several factors, including timely completion, adequate quality testing, introduction to the market, and market acceptance. Any products we develop may not be introduced in a timely or cost-effective manner (or at all), may contain errors or defects, or may not achieve the broad market acceptance necessary to generate sufficient revenue. If we are unable to successfully enhance our existing products to meet merchant requirements, increase adoption and usage of our products, or develop new products, our business, financial condition, and results of operations may be adversely affected.

If we are unable to continue to increase the sales of our products to large enterprises while mitigating the risks associated with serving such merchants, our business, financial condition and results of operations may be adversely affected.

Our growth strategy is dependent, in large part, upon the continued increase of sales to large enterprises. For the year ended December 31, 2022, we estimate that more than 90% of our Billings were derived from merchants generating over $75 million in online sales per year. Sales to large enterprises involve risks that may not be present or that are present to a lesser extent with sales to smaller entities, such as longer sales cycles, more complex merchant requirements, substantial upfront sales costs, and less predictability in completing some of our sales. For example, large enterprises may require considerable time to evaluate and test our applications and those of our competitors prior to making a purchase decision and placing an order. A number of factors influence the length and variability of our sales cycle, including the need to educate potential merchants about the uses and benefits of our products, the discretionary nature of purchasing and budget cycles, and the competitive nature of evaluation and purchasing approval processes. As a result, the length of our sales cycle may vary significantly from merchant to merchant, and sales to large enterprises typically take longer to complete. Moreover, large enterprises often begin to deploy our products on a limited basis, but nevertheless demand configuration, integration services, and pricing negotiations, which increase our upfront investment in the sales effort with no guarantee that these merchants will deploy our products widely enough across their organization to justify the substantial upfront investment. Our ability to improve our sales to such large enterprises is also partially dependent on our ability to continue to attract, train and retain sales personnel with experience selling to large enterprises, and competition for such personnel can be intense.

In addition, as security breaches with respect to larger, high-profile enterprises are likely to be heavily publicized, there is an increased reputational risk associated with serving such merchants. If we are unable to continue to increase sales of our products to large enterprises while mitigating the risks associated with serving such merchants, our business, financial condition, and results of operations may be adversely affected.

The loss of the services of any of our executive leadership team, including our co-founders, who are also our Chief Executive Officer and Chief Technology Officer, could materially and adversely affect our revenues, our results of operations and financial condition.

18

Our success and future growth depend largely upon the continued services of our executive officers and other key employees in the areas of research and development, marketing, business development, sales, products, and general administrative functions. In particular, the experiences of Eido Gal, our co-founder and Chief Executive Officer, and Assaf Feldman, our co-founder and Chief Technology Officer, are valuable assets to us. Mr. Gal and Mr. Feldman both have significant experience in developing automated risk and identity products and developing robust systems with machine learning algorithms and intelligent UIs for risk management applications and would be difficult to replace. Competition for senior executives in our industry is intense, and we may not be able to attract and retain qualified personnel to replace or succeed Mr. Gal, Mr. Feldman or other key executives. Failure to retain Mr. Gal, Mr. Feldman or other key executives would have a material adverse effect on our business, financial condition and results of operations.

In addition, executive leadership transition periods are often difficult as the new executives gain more detailed knowledge of our operations, and friction can result from changes in strategy and management style. Management turnover inherently causes some loss of institutional knowledge, which can negatively affect strategy and execution.

If we are unable to attract and retain executives and employees that we need to support our operations and growth, our revenues, our results of operations and financial condition may be adversely affected.

To execute our growth plan, we must attract and retain highly qualified personnel. Competition for these personnel is intense, especially for software engineers experienced in designing and developing software as a service (“SaaS”) applications and experienced sales professionals. Competition for talent in Israel has in the past been and remains intense. See Item 3.D. “Risk Factors—Risks Relating to our Incorporation and Location in Israel — Due to competition for highly skilled personnel in Israel, we may fail to attract, recruit, retain and develop qualified employees, which could materially and adversely impact our business, financial condition and results of operations.” If we are unable to attract such personnel remotely or in cities or countries where we are located, we may need to hire in other locations which may add to the complexity and costs of our business operations. In particular, we expect to establish a research & development hub in a new, lower cost region, in order to enhance and expand our talent pool and to help rationalize our labor costs. There can be no guarantee that we will be successful in hiring in this region, that we will be successful in integrating our research & development teams across locations, or that such initiative will lead to meaningful cost savings. From time to time, we have experienced, and we expect to continue to experience, difficulty in hiring and retaining employees with appropriate qualifications. Many of the companies with which we compete for experienced personnel have greater resources than we have. If we hire employees from competitors or other companies, their former employers may attempt to assert that these employees or we have breached their legal obligations, resulting in a diversion of our time and resources.

We believe that our corporate culture has been a critical component of our success. We have invested substantial time and resources in building our team and nurturing our culture. As we continue to grow, we may find it difficult to maintain our corporate culture while managing this growth. Any failure to manage our anticipated growth and organizational changes in a manner that preserves the key aspects of our culture could hurt our ability to recruit and retain personnel. This, in turn, could adversely affect our revenues, our results of operations and financial condition.