Table of Contents

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Title of each class: |

Trading Symbol(s) |

Name of each exchange on which registered: | ||

— |

(1) |

| Large accelerated filer ☐ | Accelerated filer ☐ | Emerging growth company |

| U.S. GAAP ☐ | |

Other ☐ | ||||||

| by the International Accounting Standards Board ☒ |

| (1) | |

Table of Contents

TABLE OF CONTENTS

| i | ||||

| i | ||||

| i | ||||

| i | ||||

| ii | ||||

| iii | ||||

| v | ||||

| 1 | ||||

| ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

1 | |||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| 62 | ||||

| 69 | ||||

| 73 | ||||

| 73 | ||||

| 73 | ||||

| 74 | ||||

| 74 | ||||

| 82 | ||||

| 89 | ||||

| 91 | ||||

| 92 | ||||

| 92 | ||||

| 92 | ||||

| 93 | ||||

| 95 | ||||

i

Table of Contents

| 95 | ||||

| 95 | ||||

| 95 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

| 97 | ||||

| 107 | ||||

| 107 | ||||

| 107 | ||||

| 107 | ||||

| ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

107 | |||

| ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

107 | |||

| 107 | ||||

| 108 | ||||

| 108 | ||||

| 108 | ||||

| 110 | ||||

| 110 | ||||

| ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

110 | |||

| 110 | ||||

| 112 | ||||

| 112 | ||||

| 113 | ||||

| ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

113 | |||

| ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

113 | |||

| 113 | ||||

| 113 | ||||

| 114 | ||||

ii

Table of Contents

Table of Contents

INTRODUCTION

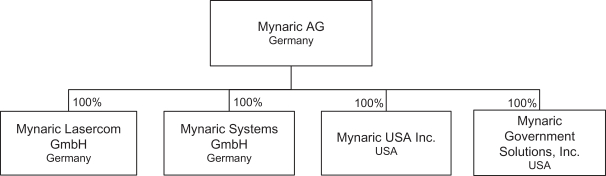

We conduct our business through Mynaric AG, a German stock corporation (Aktiengesellschaft). Unless otherwise indicated or the context otherwise requires or where otherwise indicated, the terms “Mynaric,” the “Company,” “we,” “our,” “ours,” “ourselves,” “us” or similar terms refer to Mynaric AG together with its subsidiaries.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

We report under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), which differ in certain significant aspects from U.S. generally accepted accounting principles (“U.S. GAAP”). Accordingly, our results of operations and financial condition as reflected by our IFRS financial statements that are included in this Annual Report on Form 20-F (“Annual Report”) may differ substantially from the results of operations and financial condition that would be reflected by financial statements prepared in accordance with U.S. GAAP. We have not prepared a reconciliation of our financial information to U.S. GAAP or a summary of significant accounting differences between IFRS and U.S. GAAP, nor have we otherwise reviewed the impact the application of U.S. GAAP would have on our financial reporting.

Our consolidated financial statements are reported in euros, which are denoted “euros,” “EUR” or “€” throughout this Annual Report and refer to the currency introduced at the start of the third stage of European economic and monetary union pursuant to the treaty establishing the European Community, as amended. Also, throughout this Annual Report, the terms “dollar,” “USD” or “$” refer to U.S. dollars. For the convenience of the reader, we have translated some financial information into U.S. dollars. Unless otherwise indicated, these translations were made based on the Euro/U.S. dollar exchange rate published by the European Central Bank on December 30, 2022, which was €1.00 to $1.0666.

Financial information in thousands or millions, and percentage figures have been rounded. Rounded total and sub-total figures in tables in this Annual Report may differ marginally from unrounded figures indicated elsewhere in this Annual Report or in the financial statements. Moreover, rounded individual figures and percentages may not produce the exact arithmetic totals and sub-totals indicated elsewhere in this Annual Report.

MARKET AND INDUSTRY DATA

We obtained the industry, market and competitive position data in this Annual Report from our own internal estimates, surveys, and research as well as from publicly available information, industry and general publications and research, surveys and studies conducted by third parties, including, but not limited to, Air Force Magazine, ArkInvest, Aviation Week Network, Breaking Defense, C4ISRNet, Congressional Research Service, German Aerospace Center, Grand View Research, MarketsandMarkets, Morgan Stanley (Space Economy), National Defense Magazine, ResearchandMarkets, Space Capital, Space News, UCS Satellite Database, The National Interest, the U.S. Air Force, Via Satellite, and the Stockholm International Peace Research Institute.

Industry publications, research, surveys, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this Annual Report. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Item. 3 Key Information—D. Risk Factors.” These and other factors could cause results to differ materially from those expressed in our forecasts or estimates or those of independent third parties. While we believe our internal estimates, surveys, and research are reliable, they have not been verified by any independent source.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We have proprietary rights to trademarks used in this Annual Report that are important to our business, many of which are registered under applicable intellectual property laws. Solely for convenience, the trademarks, service marks, logos and trade names referred to in this Annual Report are without the ® and ™ symbols, but such

i

Table of Contents

references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

This Annual Report contains additional trademarks, service marks and trade names of others, which are the property of their respective owners. All trademarks, service marks and trade names appearing in this Annual Report are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

FREQUENTLY USED TERMS

In this Annual Report:

“CJADC2” refers to Combined Joint All Domain Command and Control architecture.

“Coarse pointing assembly” refers to a two axis gimballed mirror for independent steering of optical communication terminals. It is a device that is mounted on a terminal telescope and allows the terminal to operate without constraining the satellite attitude. It is used in inter-satellite links in high- and low-earth orbits.

“DARPA” refers to the U.S. Defense Advanced Research Projects Agency.

“DLR” refers to the German Aerospace Center (Deutsches Zentrum für Luft- und Raumfahrt e.V.).

“Free space optic communication” is the wireless transmission of data via a modulated optical beam directed through free space, without fiber optics or other optical systems guiding the light.

“Inter-plane” refers to the communication between satellites in different orbital planes occurring through inter-plane inter-satellite lines.

“Intra-plane” refers to the communication between satellites in the same orbital plane occurring through intra-plane inter-satellite lines.

“LEO” refers to low Earth orbit, which is an orbit around Earth with an altitude above Earth’s surface from 160 kilometers to 2,000 kilometers.

“MEO” refers to medium Earth orbit, which is an orbit around Earth with a distance of 2,000 kilometers to 35,786 kilometers.

“Mesh Network” means a type of wireless network topology, where each network node participates in the distribution of data across the network by relaying data to other nodes that are in range. A mesh network has no centralized access points but uses wireless nodes to create a virtual wireless backbone. Mesh network nodes typically establish network links with neighboring nodes, enabling user traffic to be sent through the network by hopping between nodes on many different paths. At least some nodes must be connected to a core network for backhaul.

“OISLs” refers to optical-intersatellite links, which are wireless communication links using optical signals to interconnect satellites.

“PWSA” refers to the SDA’s Proliferated Warfighter Space Architecture.

“Quantum key distribution” refers to a technique that enables secure communications between devices using a cryptographic protocol that is partly based on quantum mechanics.

“RF” refers to radio frequency, which is a measurement representing the oscillation rate of electromagnetic radiation spectrum, or electromagnetic radio waves, from frequencies ranging from 300 gigahertz (GHz) to as low as 9 kilohertz (kHz).

“SDA” refers to the U.S. Space Development Agency.

“UAVs” refers to unmanned aerial vehicles.

ii

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements that relate to our current expectations and views of future events. These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Item 3 Key Information—D. Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “believe,” “may,” “will,” “expect,” “estimate,” “could,” “should,” “anticipate,” “aim,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar or comparable expressions. These forward-looking statements include all matters that are not historical facts. Forward-looking statements contained in this Annual Report include, but are not limited to, statements about:

| • | our future business and financial performance, including our revenue, operating expenses and our ability to achieve profitability and maintain our future business and operating results; |

| • | our strategies, plans, objectives and goals, including, for example, the planned completion of the development of our products and the intended expansion of our product portfolio or geographic reach; |

| • | the expected start of serial production of our products and terminal production output; |

| • | our planned monetization of our technology and products; |

| • | our expectations regarding the development of our industry, market size and the competitive environment in which we operate. |

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions, many of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industries in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this Annual Report. In addition, even if our results of operations, financial condition and liquidity, and the development of the industries in which we operate, are consistent with the forward-looking statements contained in this Annual Report, those results or developments may not be indicative of results or developments in subsequent periods. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Item 3. Key Information—D. Risk Factors,” the following:

| • | we are a development-stage company with a history of significant losses and expected continuing losses for the foreseeable future, which lead to continued reliance on external financing and raise substantial doubt about our ability to continue as a going concern; we may never be able to execute our business strategy, generate revenue or reach profitability; |

| • | our success and future growth are dependent upon our potential customers’ investments in the development of a market for wireless laser communication networks; |

| • | our prospects and operations may be adversely affected by changes in government spending and general economic conditions, which may negatively affect demand for laser communication solutions; |

| • | the potential customer base for the use of our products is limited; |

| • | our business is affected by the implementation of industry standards guaranteeing interoperability between laser communication products of different vendors, which could be unsuccessful; |

| • | we may be unable to manage our future growth effectively, which could make it difficult to execute our business strategy; |

| • | positive market developments in the area of wireless laser communication could lead to increasingly intense competition and endanger our market position; |

| • | industry consolidation may give our competitors advantages over us, which could result in a loss of customers and/or a reduction of our revenue; |

| • | we use innovative technologies and solutions in our products, which may not be fully functional, and the initial deployment of our products by customers could prove unsuccessful; |

iii

Table of Contents

| • | we depend on third-party suppliers to provide us with components for our products, and any interruptions in supplies provided by these third-party suppliers or any general disruptions to global supply chains may subject us to external procurement risks that negatively affect our business; |

| • | defects or performance problems in our products could result in a loss of customers, reputational damage, lawsuits and decreased revenue, and we may face warranty, indemnity and product liability claims arising from defective products; |

| • | our sales cycle can be long and sophisticated as well as requiring considerable time and expense; |

| • | orders included in our optical communications terminal backlog may not result in actual revenue and are an uncertain indicator of our future earnings; |

| • | we have limited experience with order processing and are subject to internal order processing risks that could materially impact our ability to process orders; |

| • | we may not be able to obtain sufficient financing for our operations and ongoing growth of our business; |

| • | the covenants under our credit agreement 2023 impose operating and financial restrictions on us that could significantly impact our ability to operate our business and a breach of which could result in a default under the terms of this agreement, which could accelerate our repayment of funds; |

| • | a change of control could result in substantial repayment obligations under our credit agreement 2023; |

| • | we may not be able to obtain or agree on acceptable terms and conditions for all or a significant portion of the government grants, loans and other incentives for which we may apply, which may negatively affect our ability to reach funding goals; |

| • | we are exposed to foreign currency exchange risk and our financial position and results of operations may be negatively affected by the fluctuation of different currencies; |

| • | we are highly dependent on our senior management team and other highly qualified personnel, and if we are not successful in attracting or retaining highly qualified personnel, we may not be able to successfully implement our business strategy; |

| • | our business and operations would suffer in the event of computer system failures, cyber-attacks or deficiencies in our cyber-security; |

| • | we are a supplier for government programs, which subjects us to risks including early termination, audits, investigations, sanctions and penalties; |

| • | our operations, or those of our suppliers and other business partners, could be adversely affected as a result of disasters or unpredictable events; |

| • | adverse developments affecting the financial services industry, such as actual events or concerns involving liquidity, defaults, or non-performance by financial institutions or transactional counterparties, could adversely affect our business operations and our financial condition; |

| • | we are subject to regulatory risks, in particular related to sanctions laws and governmental export controls, that could limit our customer base and result in higher compliance costs; |

| • | if we do not maintain required security clearances from, and comply with our security agreements with, the U.S. government, we may not be able to enter into future contracts with the U.S. government; |

| • | our business is and could become subject to a wide variety of extensive and evolving government laws and regulations; any failure to comply could have a material adverse effect on our business; |

| • | positive market developments in the area of wireless laser communication could lead to increasingly intense political interest and influence impacting our business; |

| • | regulations related to conflict minerals and other supply chain regulations such as the German Supply Chain Act may cause us to incur additional expenses and could limit the supply and increase the costs of certain metals and other materials used in the manufacturing of our products; |

| • | we may be unable to adequately protect our intellectual property and proprietary rights and prevent others from making unauthorized use of our products and technology; |

| • | we may be involved in legal proceedings based on the alleged violation of intellectual property rights, which may be time-consuming and incur substantial costs; |

iv

Table of Contents

| • | we have been and may become involved in litigation, administrative and regulatory proceedings, which require significant attention and could result in significant expense to us and disruptions to our business; |

| • | we may be subject to claims that our employees, consultants or advisers have wrongfully used or disclosed alleged trade secrets of their former employers; |

| • | we may become exposed to unforeseen tax consequences as a result of our international operations; |

| • | we have identified material weaknesses in our internal control over financial reporting; if we are unable to successfully remediate these material weaknesses and to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our results or prevent fraud; and |

| • | our risk management and internal control procedures may not prevent or detect violations of law. |

The forward-looking statements made in this Annual Report relate only to events or information as of the date on which the statements are made in this Annual Report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this Annual Report, including the uncertainties and factors discussed under “Item 3. Key Information—D. Risk Factors” and the documents that we have filed as exhibits to the registration statement, of which this Annual Report is a part, completely and with the understanding that our actual future results or performance may be materially different from what we expect. All forward-looking statements made in this Annual Report are qualified by these cautionary statements.

Comparison of results between current and prior periods are not intended to express any future trends, or indications of future performance, unless expressed as such, and should only be viewed as historical data.

RISK FACTOR SUMMARY

The following is a summary of the principal risks that could significantly and negatively affect our business, prospects, financial conditions, or operating results. For a more complete discussion of the material risks facing our business, see “Item 3. Key Information—D. Risk Factors”:

| • | we are a development-stage company with a history of significant losses and expected continuing losses for the foreseeable future, which lead to continued reliance on external financing and raise substantial doubt about our ability to continue as a going concern; we may never be able to execute our business strategy, generate revenue or reach profitability; |

| • | our success and future growth are dependent upon our potential customers’ investments in the development of a market for wireless laser communication networks; |

| • | our prospects and operations may be adversely affected by changes in government spending and general economic conditions, which may negatively affect demand for laser communication solutions; |

| • | the potential customer base for the use of our products is limited; |

| • | our business is affected by the implementation of industry standards guaranteeing interoperability between laser communication products of different vendors, which could be unsuccessful; |

| • | we may be unable to manage our future growth effectively, which could make it difficult to execute our business strategy; |

| • | positive market developments in the area of wireless laser communication could lead to increasingly intense competition and endanger our market position; |

| • | industry consolidation may give our competitors advantages over us, which could result in a loss of customers and/or a reduction of our revenue; |

| • | we use innovative technologies and solutions in our products, which may not be fully functional, and the initial deployment of our products by customers could prove unsuccessful; |

| • | we depend on third-party suppliers to provide us with components for our products, and any interruptions in supplies provided by these third-party suppliers or any general disruptions to global supply chains may subject us to external procurement risks that negatively affect our business; |

v

Table of Contents

| • | defects or performance problems in our products could result in a loss of customers, reputational damage, lawsuits and decreased revenue, and we may face warranty, indemnity and product liability claims arising from defective products; |

| • | our sales cycle can be long and sophisticated as well as requiring considerable time and expense; |

| • | orders included in our optical communications terminal backlog may not result in actual revenue and are an uncertain indicator of our future earnings; |

| • | we have limited experience with order processing and are subject to internal order processing risks that could materially impact our ability to process orders; |

| • | we may not be able to obtain sufficient financing for the operations and ongoing growth of our business; |

| • | the covenants under our credit agreement 2023 impose operating and financial restrictions on us that could significantly impact our ability to operate our business and a breach of which could result in a default under the terms of this agreement, which could accelerate our repayment of funds; |

| • | a change of control could result in substantial repayment obligations under our credit agreement 2023; |

| • | we may not be able to obtain or agree on acceptable terms and conditions for all or a significant portion of the government grants, loans and other incentives for which we may apply, which may negatively affect our ability to reach funding goals; |

| • | we are exposed to foreign currency exchange risk and our financial position and results of operations may be negatively affected by the fluctuation of different currencies; |

| • | we are highly dependent on our senior management team and other highly qualified personnel, and if we are not successful in attracting or retaining highly qualified personnel, we may not be able to successfully implement our business strategy; |

| • | our business and operations would suffer in the event of computer system failures, cyber-attacks or deficiencies in our cyber-security; |

| • | we are a supplier for government programs, which subjects us to risks including early termination, audits, investigations, sanctions and penalties; |

| • | our operations, or those of our suppliers and other business partners, could be adversely affected as a result of disasters or unpredictable events; |

| • | adverse developments affecting the financial services industry, such as actual events or concerns involving liquidity, defaults, or non-performance by financial institutions or transactional counterparties, could adversely affect our business operations and our financial condition; |

| • | we are subject to regulatory risks, in particular related to sanctions laws and governmental export controls, that could limit our customer base and result in higher compliance costs; |

| • | if we do not maintain required security clearances from, and comply with our security agreements with, the U.S. government, we may not be able to enter into future contracts with the U.S. government; |

| • | our business is and could become subject to a wide variety of extensive and evolving government laws and regulations; any failure to comply could have a material adverse effect on our business; |

| • | positive market developments in the area of wireless laser communication could lead to increasingly intense political interest and influence impacting our business; |

| • | regulations related to conflict minerals and other supply chain regulations such as the German Supply Chain Act may cause us to incur additional expenses and could limit the supply and increase the costs of certain metals and other materials used in the manufacturing of our products; |

| • | we may be unable to adequately protect our intellectual property and proprietary rights and prevent others from making unauthorized use of our products and technology; |

| • | we may be involved in legal proceedings based on the alleged violation of intellectual property rights, which may be time-consuming and incur substantial costs; |

| • | we have been and may become involved in litigation, administrative and regulatory proceedings, which require significant attention and could result in significant expense to us and disruptions to our business; |

vi

Table of Contents

| • | we may be subject to claims that our employees, consultants or advisers have wrongfully used or disclosed alleged trade secrets of their former employers; |

| • | we may become exposed to unforeseen tax consequences as a result of our international operations; |

| • | we have identified material weaknesses in our internal control over financial reporting; if we are unable to successfully remediate these material weaknesses and to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud; and |

| • | our risk management and internal control procedures may not prevent or detect violations of law. |

vii

Table of Contents

PART I.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

The following risks may have material adverse effects on our business, financial condition and results of operations. Additional risks and uncertainties of which we are not presently aware or that we currently deem immaterial could also materially affect our business operations and financial condition.

General Risks Related to Our Business Activities and Our Markets

We are a development-stage company with a history of significant losses and expected continuing losses for the foreseeable future, which lead to continued reliance on external financing and raise substantial doubt about our ability to continue as a going concern. We may never be able to execute our business strategy, generate revenue or reach profitability.

We are a development-stage company and are subject to all of the risks inherent in the establishment of a new business enterprise. We have a limited operating history and only a preliminary and unproven business plan upon which investors may evaluate our prospects. Although we have developed, produced and tested prototypes of our products and are currently finalizing our products for serial production, we cannot assure you that our products will perform as expected under daily operating conditions or that we will be able to detect and fix any potential weaknesses in our technology or products prior to commencing serial production. Even if our products become commercially viable, we may not generate sufficient revenue necessary to support our business.

We have a history of net losses and negative net cash used in operating activities since our inception and we expect losses and negative net cash used in operating activities to continue for the foreseeable future. For the years 2022, 2021 and 2020, we incurred consolidated net losses of €73.8 million, €45.5 million and €19.8 million, respectively. As of December 31, 2022, 2021 and 2020, we had an accumulated deficit of €166.5 million, €92.8 million and €47.3 million, respectively. For the years ended December 31, 2022, 2021 and 2020, we had negative net cash used in operating activities of €50.2 million, €39.4 million and €16.9 million, respectively. We expect that we will incur additional significant expenses as we continue to conduct research, expand and refine our technology, and further develop our products. We will also incur significant expenses related to preparations for the commercialization of our products, increasing our sales and marketing activities with the goal of building our brand, and adding infrastructure and personnel to support our growth. We will not be able to cover our expenses with revenues at least until such time at which we begin material deliveries of our products and significantly increase the scale of our operations and, therefore, intend to use the proceeds from recent debt and equity financings to cover our ongoing and future expenses.

Based on our liquidity position as of the date of this Annual Report and our management’s forecast of sources and uses of cash and cash equivalents, we believe that we have sufficient liquidity to finance our operations over at least the next twelve months from the date of this Annual Report. However, there can be no

1

Table of Contents

assurance that revenue and cash-in from customer contracts will be generated in the amount as expected or at the time needed. A shortfall of revenues and of the corresponding cash-in from customer contracts compared to the budget could require additional external financing to meet our current operational planning. In such a situation, if we should be unable to obtain such additional financing or take other timely actions in response to such circumstances, for example significantly curtailing our current operational budget in 2024, we may be unable to continue as a going concern. As a result, these events and conditions indicate that a material uncertainty exists that may cast significant doubt on our ability to continue as a going concern and, therefore, we may be unable to realize our assets and discharge our liabilities in the normal course of business.

Our business strategy is focused on growth and our decisions regarding capital expenditures and investments are made on this basis. Our projects and strategic decisions may fail to meet expectations and the anticipated return on investment from these projects may not be achieved. Our ability to generate revenue from our operations and, ultimately, achieve profitability will depend on, among other things, whether we can complete the development and commercialization of our technology, whether we can manufacture our products on a commercial scale in amounts and at costs consistent with our expectations, and whether we can achieve market acceptance of our products, services and business model. We may never operate on a profitable basis. Even if we reach profitability, we may not be able to sustain it. If we are unable to reach or sustain profitability, we may need to reduce the scale of our operations, which may impact the growth of our business, or we may not be able to continue as a going concern and investors may lose some or even all of their investment.

Our success and future growth are dependent upon our potential customers’ investments in the development of a market for wireless laser communication, in particular for aerospace-based communication networks.

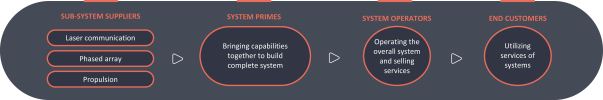

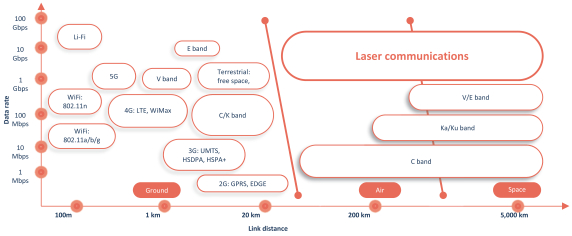

We develop and manufacture laser communication products for aerospace-based communication networks. Laser communication is designed to serve as a backbone technology, a key connectivity component of telecommunication networks featuring very high data transmission rates, creating data highways by connecting individual platforms such as airplanes and satellites. Our success and future growth, therefore, depend significantly on the development of a market for laser communication, in particular for aerospace-based communication networks.

Aerospace-based communication networks may comprise various platforms, including drones, airplanes and satellites, and may be located in the troposphere (i.e., at the height of commercial aviation), the stratosphere (i.e., at a height of 20 to 30 kilometers above ground), or in outer space. Aerospace-based communication networks consisting of a large volume of satellite or aircraft platforms are referred to as constellations. Each individual node within the network, i.e., each aircraft or satellite, typically contains multiple laser communication units ranging from two to four units. Our ability to successfully develop and commercialize our laser communication products (e.g., flight terminals) depends on potential customers’ willingness to invest, on a global scale, in the development of such constellations. If such constellations are not developed on a global scale, there would be limited applications available for our ground and flight terminals, such as the connection of individual airplanes, drones or satellites with the ground.

Constellations in general, and the market for laser communication systems specifically, are still in early stages of deployment and development. To our knowledge, there are only two commercial constellations currently operational, one of which partly utilizes an internally built laser communication solution for linking its satellites. Other commercial constellations utilizing laser communication are planned but not yet deployed operationally. The future implementation of constellations by potential customers remains subject to significant technological, operational and financing risks. For example, many of the constellations currently being planned by potential customers that envisage worldwide internet and network coverage have not yet issued orders for laser communication equipment. To our knowledge, establishing such extensive coverage through multiple laser communication units has had only limited testing and usage in practice and could entail substantial technical difficulties. At the same time, the development of commercial constellations with such coverage requires investment of potentially billions of dollars, including the costs associated with satellite development and launch capacity, and accordingly depends on the ability to obtain related financing.

If laser communication remains a niche market, demand for our products would be significantly lower than we currently anticipate as a result of which we may not be able to sell our technology or products. Our approach of developing standardized and modularized products for large-scale deployment could prove unsuccessful if certain customers demand widely varying product specifications and units in significantly lower quantities. This would require project-specific production (as typically being carried out by traditional key suppliers to the air and space (defense) industries) instead of serial production, meaning that our anticipated economies of scale could

2

Table of Contents

fail to materialize. If the wireless laser communication market does not develop as we anticipate, we may not be able to implement our business strategy and/or generate any revenues as a result of which we may need to curtail our operations or seek additional financing earlier than anticipated.

Our prospects and operations may be adversely affected by changes in government spending and general economic conditions, which may negatively affect demand for laser communication solutions.

Current demand for laser communication is predominantly driven by government needs, with the United States government spearheading the adoption of laser communication technology. U.S. allies and other governments are also evaluating new technologies as part of their national objectives to modernize their space capabilities. Accordingly, governments around the world have invested significantly in research and development as well as deployment of laser communication and other technologies. In fact, defense-related spending in the U.S. and Europe increased following geopolitical tensions. For example, the U.S. Department of Defense’s (the “DoD”) budget for the fiscal year 2023 includes $26.3 billion for the U.S. Space Force and the U.S. Space Development Agency (“SDA”), which is $1.7 billion more than the DoD requested. However, spending authorizations for defense-related and other programs by the U.S. and other governments have fluctuated in the past, and future levels of expenditures and authorizations for these programs may not remain at current levels and could possibly decrease, including due to shifts to programs in areas where we do not provide services. To the extent the U.S. government and its agencies or other governments reduce spending on such services, as a result of the need to reduce overall spending during periods of fiscal restraint, to reduce budget deficits or otherwise, demand for our services could decrease which could adversely affect our anticipated revenue and business prospects.

While government funding is currently driving laser communication demand, we expect additional demand for commercial applications to drive growth in the overall market in the near to medium-term. Although commercial market demand may be negatively affected in the short to medium term by prevailing economic conditions, with high inflation, rising interest rates and fears of recession relative to demand from government-funded programs. The global economy has in the past, and will in the future, experience recessionary periods and periods of economic instability. During such periods, our commercial and, to a lesser extent, our governmental customers may choose not to pursue high-risk, capital-intensive infrastructure projects such as satellite constellations or other systems including laser communication capabilities. To the extent any of the risks to the commercial market for laser communication materializes, demand for our products may be lower than we currently anticipate, which could have a negative impact on our revenue and overall financial condition.

The potential customer base for the use of our products is limited.

Given the technological challenges and the high capital expenditures required for the development and deployment of our products, our potential customer base is limited. There are a small number of potential customers deploying our laser communication equipment. Successful customer acquisition and retention of capable significant initial customers is therefore critical to generate follow-on business such as the implementation and maintenance of complementary products. As a result, our ability to sell laser communication products at scale is dependent on our ability to successfully acquire and retain significant initial customers by winning their business at an early stage like our strategic agreement with Northrop Grumman International Trading, Inc. (“NG”) and our strategic cooperation framework with an affiliate of L3Harris. Due to our limited potential customer base, we anticipate that sales to initial customers will be, individually, material to our future revenues, results of operations and cash flows. Accordingly, any change in the relationship with any existing customer, the strength of any customer’s business or their demand for our products could materially adversely affect our results of operations and net cash used in operating activities. Similarly, any failure to acquire and maintain relationships with other key customers, as well as the loss of any potential customer, would have a highly adverse impact on the sale of our products and, as a result, on our results of operations.

Our business is affected by the implementation of industry standards guaranteeing interoperability between laser communication products of different vendors, which could be unsuccessful.

We believe that the establishment of a large-scale market for laser communication depends on the successful development and implementation of industry standards guaranteeing interoperability between laser communication products of different vendors. As of today, the optical communications terminal standard issued by the SDA is the leading industrial standard adapted by multiple companies involved in U.S. government programs. So far, we and others have successfully conducted demonstrations of the implementation of the SDA standard in various test scenarios. We cannot assure you that efforts to ensure cross-vendor interoperability will ultimately be successful.

3

Table of Contents

Furthermore, commercial constellations of sufficient size and scale may decide to create and implement their own standard to optimize their network. As a consequence, multiple competing industry standards may emerge in parallel, which could cause a fragmentation of the market, potentially hindering sustained growth of the laser communication market. The U.S. Defense Advanced Research Projects Agency’s (“DARPA”) Space Based Adaptive Communications Node (“Space-BACN”) program aims to establish a flexible optical communications terminal that can adapt to multiple future industry standards. In December 2021 and August 2022 we were selected to contribute to phase 0 and phase 1, respectively, of the program. We cannot, however, assure you that efforts to ensure a terminal agnostic to a large variety of industry standards will ultimately be successful.

If a potential customer decides to purchase laser communication products from one of our competitors, our products can currently only be sold to that customer and integrated into its existing laser communication system with significant operational and technical outlays or only if the competitor’s product is compliant with interoperability standards. Hence, any failure to implement cross-vendor interoperability or respective industry standards for laser communication vendors could have an adverse effect on the usability of and the demand for our products and ultimately on our revenue potential and business strategy.

We may be unable to manage our future growth effectively, which could make it difficult to execute our business strategy.

If our operations continue to grow as planned, we will need to expand our sales and marketing, research and development, customer and commercial strategy, products and services, supply, manufacturing and accounting and administrative functions. We will also need to continue to leverage our manufacturing and operational systems and processes, and we cannot assure you that we will be able to scale the business and the manufacture of products as currently planned or within the envisaged timeframe. The continued expansion of our business may also require additional manufacturing and operational facilities, as well as space for administrative support, and we cannot assure you that we will be able to find suitable locations for the manufacture of our products.

Our continued growth could increase the strain on our resources, and we could experience operating difficulties, including difficulties in hiring and training employees, finding manufacturing capacity to produce our products, and delays in production. We may have to invest significant additional resources and focus our attention on adapting our internal organization, function and processes which may cause distraction from our operations and negatively affect our business.

Risks Related to Competition

Positive market developments in the area of wireless laser communication could lead to increasingly intense competition and endanger our market position.

While we believe that there are currently only a few enterprises offering viable products to utilize laser communication technology for aerospace-based communication networks, we are subject to significant and intensifying competition within the satellite industry and from other providers of communication capacity, including large multinational enterprises. For example, in September 2020, SpaceX announced its first successful test of its Starlink satellite “space lasers” in orbit. On September 13, 2021, SpaceX launched its first whole batch of 51 laser-equipped Starlink satellites with the goal to enable future Starlink satellites to transmit information to one another while in orbit using the optical “space lasers.” In August 2022, Capella Space announced the next-generation of its satellites called Acadia, which will offer higher resolution and be equipped with our optical communications terminals. Public announcements of successful test missions and future functionality availability such as these have drawn significant public attention to the laser communication market. To compete successfully and to be able to establish and maintain a competitive position in current and future technologies, we will need to demonstrate the advantages of our technology over both new and well-established alternative solutions for communication networks. If our technology is not, or our future products or services are not, competitive, our business and sales potential would be harmed.

Many of our current and potential competitors are larger than us and have substantially greater resources than we have and expect to have in the future. They may also be able to devote greater resources to the development of their current and future technologies and the promotion of their offerings, and they may be able to offer lower prices in order to establish or gain market share. In addition, certain companies that are potential customers (such as SpaceX or Amazon) may develop or advance their in-house laser communication capabilities and as a result compete with us or not require laser communication equipment from third parties, such as us.

4

Table of Contents

Competitors may also establish cooperative or strategic relationships among themselves or with third parties that may further enhance their resources and offerings or may lobby potential governmental customers against us. Furthermore, it is possible that German or foreign companies or governments, some with greater experience in the aerospace industry or greater financial resources, may seek to provide products or services that compete directly or indirectly with ours. Any such foreign competitor, for example, could benefit from subsidies from, or other protective measures implemented by, its home country.

In the aerospace sector, our competitors include TESAT Spacecom (an Airbus subsidiary), Thales Alenia Space, SA Photonics (a subsidiary of CACI International Inc), Ball Aerospace, General Atomics Electromagnetic Systems, Honeywell International, Skyloom Global Corp., and Space Micro, as well as a handful of other entities that possess the necessary technical know-how and resources to compete with us. Furthermore, large information technology enterprises such as Cisco, Huawei, CommScope, Infinera and Corning already have experience in wired laser communication for ground-based fiber networks and may potentially enter the market. In addition, aviation enterprises such as Boeing and large military equipment suppliers may enter the market. For example, QinetiQ and Hensoldt are both actively promoting laser communication capabilities even though little public information is available regarding the maturity of their systems. These companies may employ aggressive strategies like subsidy-enabled dumping and lobbying of customers, partners, investors and the media in an attempt to force us out of the market (e.g., by delaying the deployment of our products in certain geographical areas). As the market expands, we expect the entry of additional competitors who may have longer operating histories, more extensive international operations, greater name recognition and/or substantially greater technical, marketing and financial resources.

Our business is also subject to competition from ground-based forms of communication technology. A number of companies are increasing their ability to transmit signals on existing terrestrial infrastructures, such as fiber optic cable and terrestrial wireless transmitters, often with funding and other incentives provided by governments. The ability of terrestrial companies to significantly increase the capacity, capability and/or the reach of their conventional or other competing networks or significantly lower prices for such networks could result in a decrease in the demand for laser-enabled aerospace-based communication networks and consequently for laser communication products, thereby having a material adverse impact on our earnings and business prospects. In addition, new technologies could render laser communication-based services less competitive by satisfying connectivity demand in other ways.

If competition in the market for wireless laser communication intensifies, the resulting increase in supply could lead to lower sales or could cause prices to fall, thus narrowing our margins, which in turn would materially adversely impact our future revenues or results of operations.

Industry consolidation may give our competitors advantages over us, which could result in a loss of customers and/or a reduction of our revenue.

Some of our customers, suppliers or competitors have made or may make acquisitions or enter into partnerships or other strategic relationships in order to offer more comprehensive services or achieve greater economies of scale. For example, in November 2021, Viasat and Inmarsat entered into an agreement for Viasat to acquire Inmarsat and, in December 2021, our competitor SA Photonics was acquired by CACI International Inc. Most recently, in November 2022, Eutelsat and OneWeb entered into a combination agreement and, in December 2022, Maxar Technologies entered into a definitive agreement to be acquired by Advent International. As of today, the OneWeb and Eutelsat merger, the Maxar Technologies acquisition and the Inmarsat acquisition are still pending. The effects of these recent consolidations on us and our industry in general are still to be determined, but they may create unforeseeable dynamics giving advantages to our competitors. In addition, new entrants not currently considered competitors may enter our market through acquisitions, partnerships or strategic relationships. Potential entrants may have competitive advantages over us, such as greater name recognition, longer operating histories, more varied services and larger marketing budgets as well as greater financial, technical and other resources. Industry consolidation may result in practices that make it more difficult for us to compete effectively, including on the basis of price, sales and marketing programs, technology or services functionality. Continuing industry consolidation may give our competitors advantages over us which may result in decreased demand for our products or increased pressure to lower the prices for our products, each of which would negatively impact our revenue and consequently harm our results of operations and business prospects.

5

Table of Contents

Risks Related to Our Products

We use innovative technologies and solutions in our products, which may not be fully functional, and the initial deployment of our products by customers could prove unsuccessful.

The functionality, usability and availability of our technology and products in daily use and at scale is, as of today, unproven. We cannot assure you that our technology or products will perform as expected under daily operating conditions or that we will be able to detect and fix weaknesses or flaws in our technology or products prior to commencing serial production. For example, we have designed and built the metal telescope that we use in our CONDOR terminal ourselves and this design has never been built at scale. Any of the technologies we intend to use or solutions we expect to offer may not be available or fully functional at the time of the first delivery of our products or at all, and this could have an adverse effect on our ability to grow our business. In addition, we may be required to develop new or to adapt our existing technologies and products in light of changing customer requirements. The development of new or adaptation of existing technologies and products may significantly impact our costs or our ability to retain or improve our competitive position.

If our customers are unsuccessful in the initial deployment of our products, this could be considered as indicative of future performance of our products and could significantly harm our reputation in the market. Potential difficulties in connection with meeting obligations under contracts with initial customers, such as delivery delays, technical performance or quality, could lead to a loss of the affected customer and other existing or potential customers. In such cases, it is unlikely that we would succeed in compensating for the related losses in revenues through new customers in the short to medium term. As a result, any failure in the initial deployment of our products by initial customers would have a materially adverse impact on our anticipated revenue and future prospects.

We depend on third-party suppliers to provide us with components for our products, and any interruptions in supplies provided by these third-party suppliers or any general disruptions to global supply chains may subject us to external procurement risks that negatively affect our business.

We depend on third-party suppliers to provide individual components such as optical components, special electronics and structural components for our products and we expect to continue to do so for future products. While some key components are manufactured to our specifications, many components are “off-the-shelf” and available commercially.

We typically do not maintain long-term supply contracts, but instead rely on informal arrangements and off-the-shelf purchases based on purchase orders. We do not carry a significant inventory of necessary components and our suppliers could discontinue the manufacture or supply of these components at any time. Establishing additional or replacement suppliers for any of these components, if required, or any supply interruption from our suppliers, could limit our ability to manufacture our products, result in production delays and increased costs and adversely affect our ability to deliver products to our customers on a timely basis, which could result in our failure to perform under customer contracts. If we are not able to identify alternate sources of supply for the components, we may need to modify our product to use substitute components, which could cause delays in shipments, increase design and manufacturing costs and increase prices for our products. Any such modified product might not be as effective as the predecessor product or might not gain market acceptance. This could lead to customer dissatisfaction, reputational harm and loss of customer orders.

In addition, some of our current suppliers are specialty suppliers providing components that are only available from a handful of suppliers worldwide (or in some cases a sole supplier), which means that off-the-shelf components may not be viable substitutes. It is therefore not always possible to adhere to our “second source strategy” (pursuant to which we always seek to have at least two qualified suppliers for every component). If these specialty suppliers become unable to deliver the required components, procuring these components from another supplier may only be possible at significant additional cost, if at all. As a result, there is a risk that we cannot obtain the components needed for manufacturing our products on a timely basis or at an economically viable cost, and, thus, become unable to deliver our products, resulting in reputational harm and loss of existing and future business. In addition, it is possible that certain components are ultimately not qualified for use, or may not function as intended. The particularly long development cycles in our business and lengthy qualification of individual components render quick replacement of individual suppliers difficult. Insourcing of certain components may require lengthy preparations, license negotiations or significant capital expenditures, or may not be possible at all.

Furthermore, any disruptions to our supply chain, significant increase in component costs, or shortages of critical components could adversely affect our business and result in increased costs or missed deliveries to our

6

Table of Contents

customers. Such a disruption could occur as a result of any number of events, including, but not limited to, an extended closure of or any slowdown at any of our suppliers’ plants or shipping delays due to efforts to limit the spread of COVID-19 or implementation of post-COVID-19 policies or practices, war and economic sanctions against third parties, including those arising from the ongoing war between Russia and Ukraine, the implementation of tariffs, export controls or other actions by or against foreign nations (including China) and general market shortages due to surge in demand for any particular part or component. Any such disruption or shortage may be further driven by increases in prices or impact of inflation, labor stoppages, transportation delays or failures affecting the supply chain and shipment of materials and finished goods, the unavailability of raw materials, geopolitical developments, terrorism and disruptions in utilities, trade embargos and other services. For example, COVID-19 related lockdowns implemented in Asia in 2022 further exacerbated the global (semiconductor) chip shortage, and significant recent increases in energy prices, especially for natural gas, may further negatively impact worldwide supply chains and general economic conditions. In addition, certain countries have imposed or may impose in the future export restrictions with respect to certain electronic components, which may include components that we use in our manufacturing process.

In 2022 we were faced with supply chain problems that resulted in lower production volumes for a product version of our HAWK terminal than initially planned. Since then we have redesigned our HAWK product to avoid further supply chain constraints. Nevertheless, supply chain constraints may reemerge delaying production or the development of upcoming HAWK and CONDOR product versions. The high inflation environment could put pressure on our unit costs in the future and increased upfront payments to our suppliers and earlier phasing of those payments may put pressure on our non-recurring costs in future periods. In addition, any future updates or modifications to the anticipated design of our products may increase the number of parts and components we would be required to source and increase the complexity of our supply chain management. Failure to effectively manage the supply of parts and components could materially and adversely affect our production capacities and thus delay the shipment of our products as well as adversely affect market acceptance for our products.

Defects or performance problems in our products could result in a loss of customers, reputational damage, lawsuits and decreased revenue, and we may face warranty, indemnity and product liability claims arising from defective products.

To date, we have only delivered pre-serial and individual prototype versions of our products. Although we have implemented stringent quality controls, our products may contain undetected errors or defects, especially when first introduced, or may otherwise fail to meet our customers’ quality requirements. These errors, defects, product failures or poor performance can arise due to design flaws, defects in raw materials or components or manufacturing difficulties, which can affect both the quality and the performance of the product.

Any actual or perceived errors, defects or poor performance in our products could result in the replacement or rejection of our products, damage to our reputation, lost revenue, diversion of our engineering personnel from our product development efforts or increases in customer service and support costs. Furthermore, our customers may suffer consequential damages significantly exceeding the value of the products we sell to them if our products are defective or fail to meet their quality requirements. Defective components may give rise to warranty, indemnity or product liability claims against us that could significantly exceed any revenue or profit we receive from such products. Moreover, our insurance coverage may be inadequate to cover our liabilities related to such claims and we may not be able to maintain adequate insurance in the future at rates we consider reasonable and commercially justifiable, and insurance may not continue to be available on the same terms as our current arrangements. The occurrence of a significant uninsured claim, or a claim in excess of the insurance coverage limits maintained by us, could have a severe negative impact on our financial condition.

If one of our products causes bodily injury or property damage, including as a result of product malfunctions, defects or improper installation, then we could be exposed to product liability claims. We could incur significant costs and liabilities if we are sued and if damages are awarded against us. Further, any product liability claim we face could be expensive to defend and could divert management’s attention.

Risks Related to the Sale of Our Products

Our sales cycle can be long and sophisticated as well as requiring considerable time and expense.

The timing of our sales is difficult to predict because of the length of our sales cycle, particularly with respect to sales of our products in the government market.

The typical sales cycle for our products in the government market includes a pre-sale process to define a potential customer’s needs and budget. Certain customers may choose, or be required, to conduct a request for

7

Table of Contents

information (“RfI”) or request for proposal (“RfP”) process, requiring us to openly bid for the project. In our response to these RfIs and RfPs, we offer potential customers specific commercial solutions covering detailed technical and commercial explanations as well as details on production capacities and ramp-up strategies. Proposals are evaluated based on various criteria, including technical requirements, reliability, associated risk and successful track-record of the manufacturer, and price. If we are selected, we enter into negotiations and, if successful, ultimately receive a purchase order from the customer. Many purchase orders allow for or require phased delivery of products over several months or years, with payments being made following order placement, achievement of other milestones and product delivery. The sales cycle for our products from initial contact with a potential customer in the government market varies widely, ranging from a few months to well over a year. The sales process for our products for commercial applications depends on the individual customer and the size and structure of a project. Our sales team often engages in detailed discussions with potential customers to define the customer’s needs and budget. Following these discussions, we sometimes either sign a memorandum of understanding (“MoU”) or a term sheet or directly negotiate long-form agreements but even then there is no guarantee that we will enter into final agreements. Accordingly, relationships and anticipated opportunities, in some of which we may invest considerable time and resources, might not come to fruition. From time to time, in particular with respect to large, established customers, we may also be required to participate in commercial RfI or RfP processes. As with sales in the government market, the entire commercial sales process may take from a few months to over a year.

There are many other factors specific to clients that contribute to the timing of their purchases, including budgetary constraints, funding authorization, changes in technical requirements and changes in their personnel. In addition, the significance and timing of our product enhancements, and the introduction of new products by our competitors, may also affect our customer’s purchases. As a result, even final purchase orders or definitive agreements relating to the development and delivery of laser communication products may be subject to change or cancelation. For all of these reasons, it is difficult to predict whether a sale will be completed or changed, the particular period in which a sale will be completed or the period in which revenue from a sale will be recognized. It is possible that in the future we may experience even longer sales cycles, more complex customer needs, higher upfront sales costs, and less predictability in completing some of our sales. Moreover, we may in the future enter into agreements under which we will not receive any payments or recognize any revenue until we complete a lengthy implementation cycle.

We have entered into and may in the future enter into strategic partnership agreements with key customers, which may include exclusivity arrangements and provisions that allow either party to terminate the relationship under certain specified circumstances. For example, on October 31, 2021, we entered into a strategic agreement (the “Strategic Agreement”) with NG pursuant to which we agreed to serve as a strategic supplier to NG and to exclusively develop and sell to NG customized laser communication solutions for use in or relating to space where the ultimate customer is a U.S. government customer. Under the Strategic Agreement, we may also collaborate on the development of laser communications for aerospace-based and defense applications outside the space sector. In return, NG has agreed to provide us with an annual minimum awards opportunity to sell and provide to NG customized products or off-the-shelf products and/or related services. Although NG was selected by the U.S. government to provide 42 satellites for the Tranche 1 Transport Layer program, making us the sole supplier of optical communication terminals, there is no guarantee that NG will present us with further opportunities in the anticipated annual amount. Even if they do, there is no guarantee that NG will be awarded the contracts. Furthermore, during the term of the Strategic Agreement, we will not be able to develop and sell customized products to any third party in the space sector where the ultimate customer is a U.S. government customer. Our failure to comply with this exclusivity obligation under the Strategic Agreement could result in NG terminating the Strategic Agreement. In July 2022, we agreed with L3Harris on a strategic cooperation framework pursuant to which we will serve as preferred provider of laser communication solutions to L3Harris and L3Harris, in return, was granted certain collaboration privileges. In connection therewith, L3Harris invested approximately €11.2 million by means of a capital increase from authorized capital in exchange for 409,294 new ordinary shares. While we intend to build on our existing collaboration with L3Harris in the airborne domain and widen the scope to cover all domains including space, air, maritime and ground, there is no guarantee that we will receive any purchase orders from L3Harris.

If our sales cycle lengthens or our substantial upfront sales and implementation investments do not result in sufficient sales to justify our investments, our revenue could be lower than expected and it could have a material adverse effect on our financial condition.

8

Table of Contents

Orders included in our optical communications terminal backlog may not result in actual revenue and are an uncertain indicator of our future earnings.

Our optical communications terminal backlog grew significantly year-over-year from three terminal deliverables in backlog as of December 31, 2020 to 10 terminal deliverables in backlog as of December 31, 2021 and to 256 units as of December 31, 2022 (in each case, not taking into account the terminal deliverables under our contract with SpaceLink; see further information below). Optical communications terminal backlog represents the quantity of all open optical communications terminal deliverables in the context of signed customer programs at the end of a reporting period. Optical communications terminals are defined as the individual devices responsible for pointing the laser beam and capable of establishing a singular optical link. The optical communications terminal backlog includes (i) optical communications terminal deliverables related to customer purchase orders; and (ii) optical communications terminal deliverables in the context of other signed agreements. Backlog is calculated as the order backlog at the beginning of a reporting period plus the order intake within the reporting period minus terminal deliveries recognized as revenue within the reporting period and as adjusted for canceled orders, changes in scope and adjustments. If there are multiple options for deliveries under a particular purchase order or binding agreement, backlog only takes into account the most likely contract option based on management assessment and customer discussions.

Our optical communications terminal backlog is comprised of executed purchase orders from leading customers in the defense industries, customers with which we have had long-standing relationships and governmental agencies. We believe that the disclosure of backlog aids in the analysis of the demand for our products, as well as our ability to meet that demand. However, because revenue will not be recognized until we have fulfilled our obligations to a customer, there may be a significant amount of time between executing a contract with a customer and delivery of the product to the customer and revenue recognition. Any changes in government spending, the 2022 slowdown in economic activity, the ongoing supply chain disruptions (in particular, the global chip shortage) and/or any decreases and/or instability in commodity prices, generally increase the risk of backlog orders being delayed, suspended or canceled. Any such delays, suspensions or cancelations, or any scope changes could materially reduce or eliminate profits that we would otherwise realize from orders in optical communications terminal backlog. For example, in September / October 2022, Electro Optic Systems Holdings Ltd., the parent company of SpaceLink, announced that it will end its investment in U.S.-based satellite optical data-relay constellation startup SpaceLink due to the lack of an investment partner, thereby preparing SpaceLink for liquidation. SpaceLink, a former customer, is a commercial constellation builder seeking to develop a medium Earth orbit-based constellation that deploys optical-intersatellite links (“OISLs”) to relay data for space systems in low Earth orbit. While SpaceLink made several milestone payments throughout 2021 and 2022, it defaulted on its obligations in October 2022 as a result of which we decided to terminate our contract with SpaceLink with immediate effect in November 2022. Given the termination of the contract, we decided to no longer show any terminal deliverables under our SpaceLink contract in our backlog for the relevant periods.

Finally, poor contract performance could also result in cancelations and reduce or eliminate profits realized from orders in backlog. Such developments could have a material adverse effect on our business and our profits. In addition, our customers may order products from multiple sources to ensure timely delivery and may cancel or defer orders subject to penalties. Should any cancelations or deferrals occur, our optical communications terminal backlog and anticipated revenue would be reduced unless we were able to replace the canceled order. As a result, optical communications terminal backlog is not necessarily indicative of our revenues to be recognized in a specified future period and we cannot assure you that we will recognize revenue with respect to each order included in our backlog.

We have limited experience with order processing and are subject to internal order processing risks that could materially impact our ability to process orders.

We develop, manufacture and assemble our laser communication products in-house. As part of our order processing management, we must implement adequate internal logistical and technical production processes to minimize project-based risks. Once a customer orders our products, we are required to deliver such products to the customer on a mutually agreed date. Since we have only limited experience with order processing, serial production and delivery logistics, there is a risk that unexpected or spontaneous demand for our products could lead to delays in our internal logistical and technical production processes as well as delays in delivery. This is especially true in the space domain, in which potential customers may demand a steep production increase of laser communication equipment for the rapid deployment of constellations in order to minimize the time during which the constellation is only partially deployed and therefore of limited use. Unanticipated developments with

9

Table of Contents

respect to component assembly, or inability to handle customer orders due to a lack of appropriate processes, structures or other factors, could materially impact our ability to process orders. This could lead to customer dissatisfaction, reputational harm and loss of customer orders. Issues related to order processing could also render the sourcing of future orders more difficult, thereby having an adverse effect on our business and our reputation as a reliable partner.

Risks Related to Our Financial Position

We may not be able to obtain sufficient financing for our operations and ongoing growth of our business.

The implementation of our business strategy requires significant capital outlays. The nature of our business also requires us to make capital expenditure decisions in anticipation of customer demand. To date, we have primarily raised capital and funded our operations with proceeds from the sale of our ordinary shares as well as debt financing. For example, in July 2022, L3Harris invested approximately €11.2 million by means of a capital increase from authorized capital in exchange for 409,294 new ordinary shares, which corresponded to 7.2% of our share capital at the time. On April 25, 2023, the Company, as guarantor, Mynaric USA Inc. (“Mynaric USA”), as the borrower, two funds affiliated with a U.S.-based global investment management firm, as lenders (the “Lenders”), and Alter Domus (US) LLC, as administrative agent, entered into a five-year, secured term loan credit agreement in an aggregate principal amount of $75 million (the “Credit Agreement 2023”). In addition to the loan, two affiliates of the Lenders agreed to subscribe for and acquire an aggregate of 565,224 new ordinary shares of the Company. The placement price for the new shares is €22.019 per ordinary share, resulting in aggregate proceeds raised of €12.4 million.