EX-99.1

Exhibit 99.1

GENESCO INC. REPORTS FISCAL 2022 FOURTH QUARTER

AND FULL YEAR RESULTS

--Record EPS for Full Year, Exceeding Expectations--

--Revenue and Earnings Exceed Pre-Pandemic Levels for Quarter and Year--

--Repurchased over $80 Million in Stock in Fiscal 2022--

Fourth Quarter Fiscal 2022 Financial Summary

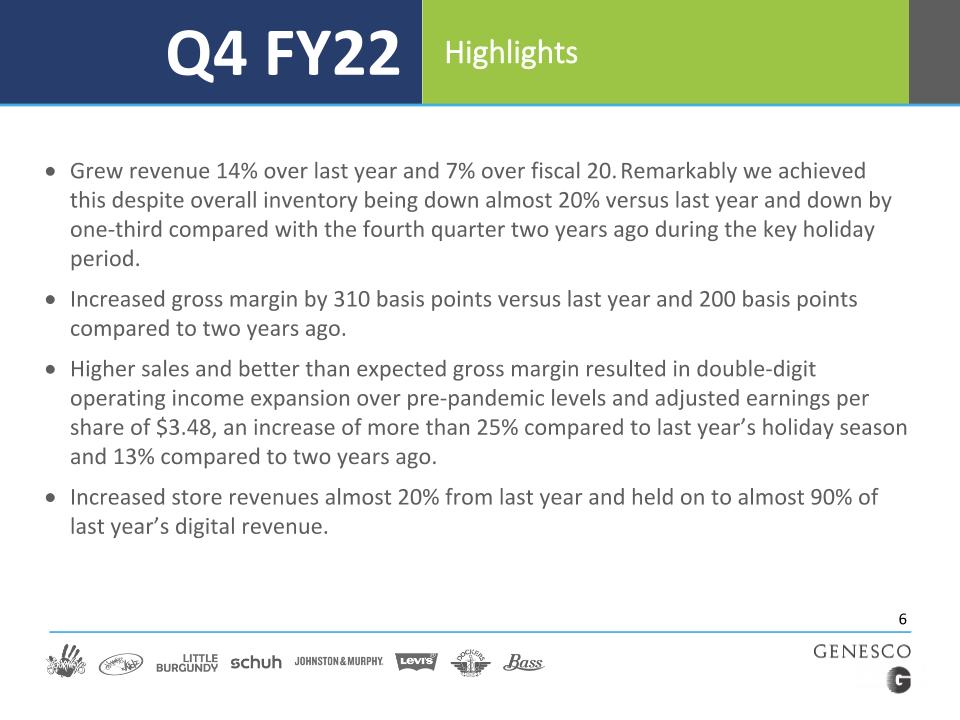

•Net sales increased 14% from last year to $728 million

•Net sales increased 7% over the fourth quarter two years ago

•Gross margin up 310 and 200 basis points, respectively, over fourth quarter last year and two years ago

•GAAP and Non-GAAP operating income increased 84% and 12%, respectively, over fourth quarter two years ago

•Same store sales increased 10% over last year

•E-commerce sales increased 36% from fourth quarter two years ago

•Returned capital to shareholders with the repurchase of $52 million in stock

•GAAP EPS from continuing operations was $4.41 vs. $6.20 last year and $2.49 two years ago

•Non-GAAP EPS from continuing operations increased to $3.481 vs. $2.76 last year and $3.09 two years ago

Fiscal 2022 Financial Summary

•Net sales increased 36% from last year to $2.4 billion

•Net sales increased 10% over Fiscal 2020

•GAAP and Non-GAAP operating income increased 87% and 53%, respectively, over Fiscal 2020

•E-commerce sales increased 77% from Fiscal 2020

•Generated operating cash flow of $240 million

•Returned capital to shareholders with the repurchase of $83 million in stock

•GAAP EPS from continuing operations increased to $7.92 vs. $(3.94) last year and $3.94 in Fiscal 2020

•Non-GAAP EPS from continuing operations increased to $7.621 vs. $(1.18) last year and $4.58 in Fiscal 2020

NASHVILLE, Tenn., March 10, 2022 --- Genesco Inc. (NYSE: GCO) today reported GAAP earnings from continuing operations per diluted share of $4.41 for the three months ended January 29, 2022, compared to earnings from continuing operations per diluted share of $6.20 in the fourth quarter last year and $2.49 per diluted share two years ago. Adjusted for the Excluded Items in both periods, the Company reported fourth quarter earnings from continuing operations per diluted share of $3.48, compared to $2.76 per diluted share last year and $3.09 per diluted share two years ago.

__________________________

1Excludes a gain on the sale of a distribution warehouse and expenses related to the Company’s new headquarters building, net of tax effect in the fourth quarter and year of Fiscal 2022, and, additionally, charges for professional fees related to the actions of a shareholder activist and retail store asset impairments, partially offset by an insurance gain, net of tax effect for the year of Fiscal 2022 (“Excluded Items”). A reconciliation of earnings/loss and earnings/loss per share from continuing operations in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”) with the adjusted earnings/loss and earnings/loss per share numbers is set forth on Schedule B to this press release. The Company believes that disclosure of earnings/loss and earnings/loss per share from continuing operations adjusted for the items not reflected in the previously announced expectations will be meaningful to investors, especially in light of the impact of such items on the results.

GAAP earnings from continuing operations per diluted share were $7.92 for the year ended January 29, 2022, compared to a loss from continuing operations per diluted share of $(3.94) for the year ended January 30, 2021 and earnings from continuing operations per diluted share of $3.94 for the year ended February 1, 2020. Adjusted for the Excluded Items in all periods, the Company reported Fiscal 2022 earnings from continuing operations per diluted share of $7.62, compared to a loss from continuing operations per diluted share of $(1.18) for Fiscal 2021 and earnings from continuing operations per diluted share of $4.58 for Fiscal 2020.

Mimi E. Vaughn, Genesco board chair, president and chief executive officer, said, “We concluded an outstanding year with a very strong fourth quarter that far exceeded our expectations. Our holiday performance was fueled by unprecedented levels of full-price selling and strong in-store sales while our digital channel held on to most of last year’s record gains. Throughout Fiscal 2022 we accelerated our recovery from the pandemic even as we navigated a number of challenges, driving double digit sales growth and record profitability for our footwear companies led by Journeys. We believe our exceptional results this year underscore the earnings power of our business model and the work we’ve done enhancing the strong competitive positions of our retail and branded concepts through our footwear focused strategy.

“Fiscal 2023 has gotten off to a strong start compared with last year, however, we expect this trend to moderate in the near-term as we anniversary last year’s March stimulus payments and first half sales revert to more normalized, pre-pandemic patterns. That said, we believe we can deliver another year of solid top-line growth on top of a very strong Fiscal 2022 driven by a strong second half as inventory levels improve and recent price actions provide an additional tailwind.”

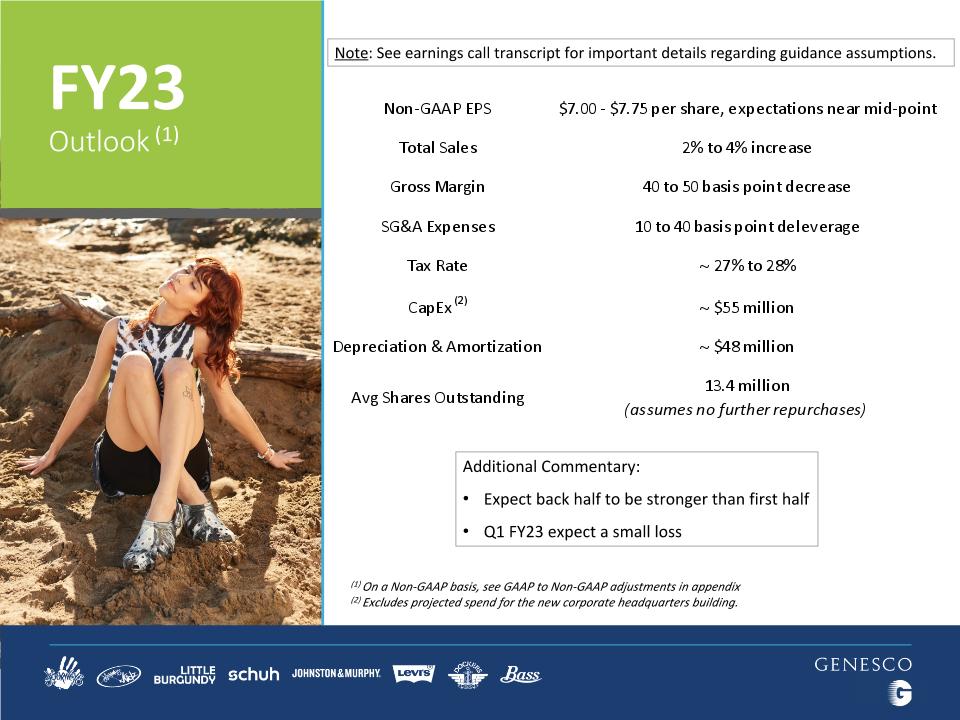

Thomas A. George, Genesco chief financial officer, commented, “Throughout the year we witnessed continued strength in all of our businesses, culminating in exceptional fourth quarter results. Our strong finish helped drive record annual operating income for our footwear businesses, a 66% increase in full year adjusted EPS compared to Fiscal 2020 two years ago, and $240 million in operating cash flow, putting us in a great position to further invest in our business and continue returning value to shareholders. We are excited about the year ahead and momentum of our business. We expect adjusted earnings per share for Fiscal 2023 to range between $7.00 and $7.75 per share with our best current expectation near the midpoint of that range. In addition, we expect the back half will be much stronger than the first half with the greatest pressure in the first quarter.”

Fourth Quarter Review

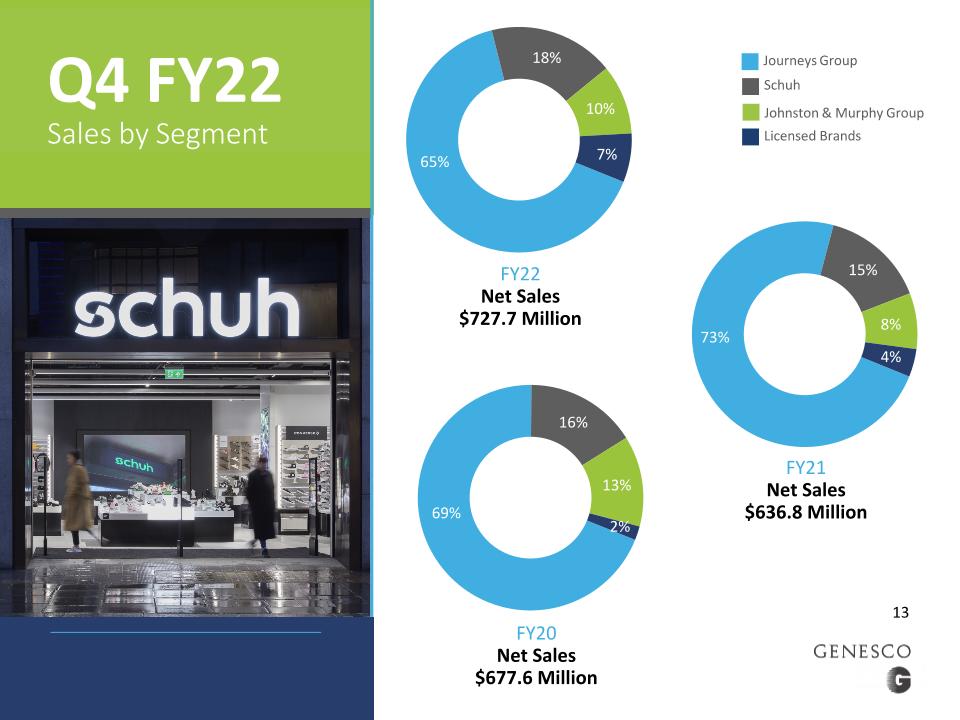

Net sales for the fourth quarter of Fiscal 2022 increased 14% to $728 million from $637 million in the fourth quarter of Fiscal 2021 and increased 7% from $678 million in the fourth quarter of Fiscal 2020. The sales increase from Fiscal 2020, reflecting strong holiday sales, was driven by increased wholesale sales, a 36% increase in e-commerce sales, and the positive impact of changes in foreign exchange rates, partially offset by a 4% decrease in store sales as supply chain challenges created inventory shortfalls. Although the Company has disclosed comparable sales for the fourth quarter of Fiscal 2022, it believes that overall sales is a more meaningful metric during these periods due to the impact of COVID-19.

|

|

|

Comparable Sales |

|

|

|

Comparable Same Store and Direct Sales: |

4QFY22 |

4QFY21 |

Journeys Group |

1% |

2% |

Schuh Group |

(2)% |

35% |

Johnston & Murphy Group |

38% |

(35)% |

Total Genesco Comparable Sales |

3% |

1% |

Same Store Sales |

10% |

(10)% |

Comparable Direct Sales |

(12)% |

55% |

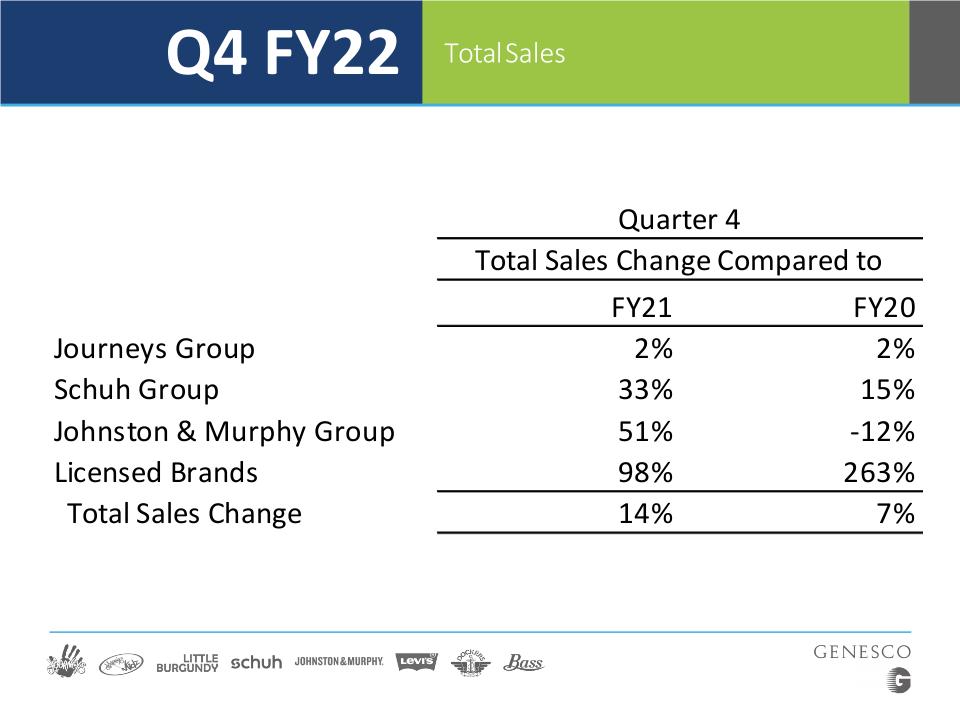

Overall sales for the fourth quarter this year compared to the fourth quarter of Fiscal 2021 were up 2% at Journeys, up 33% at Schuh, up 51% at Johnston & Murphy and up 98% at Licensed Brands. Overall sales compared to the fourth quarter of Fiscal 2020 were up 2% at Journeys, up 15% at Schuh and up 263% at Licensed Brands, partially offset by a 12% decrease in Johnston & Murphy sales.

Fourth quarter gross margin this year was 48.9%, up 310 basis points, compared with 45.8% last year and up 200 basis points compared with the fourth quarter of Fiscal 2020 at 46.9%. The increase as a percentage of sales compared to Fiscal 2020 is due primarily to increased full-price selling and price increases at Journeys, Schuh and Johnston & Murphy retail, partially offset by the mix impact of our e-commerce and wholesale businesses and increased logistics costs.

GAAP selling and administrative expense for the fourth quarter this year increased 430 basis points as a percentage of sales compared with last year and increased 140 basis points compared with the fourth quarter of Fiscal 2020. Adjusted selling and administrative expense for the fourth quarter this year increased 410 basis points as a percentage of sales compared with last year and increased 170 basis points compared with the fourth quarter of Fiscal 2020. The increase from Fiscal 2020 is due primarily to increased marketing expenses and performance-based compensation expense, partially offset by reduced occupancy expense. Fiscal 2021’s selling and administrative expenses benefitted from significant one-time COVID-19 rent relief.

Genesco’s GAAP operating income for the fourth quarter was $83.4 million, or 11.5% of sales this year, compared with $62.6 million, or 9.8% of sales last year, and $45.3 million, or 6.7% of sales in the fourth quarter of Fiscal 2020. Adjusted for the Excluded Items in all periods, operating income for the fourth quarter was $66.4 million this year compared to $64.7 million last year and $59.3 million in the fourth quarter of Fiscal 2020. Adjusted operating margin was 9.1% of sales in the fourth quarter of Fiscal 2022, 10.2% last year and 8.8% in the fourth quarter of Fiscal 2020.

The effective tax rate for the quarter was 24.9% in Fiscal 2022 compared to -45.6% last year and 21.0% in the fourth quarter of Fiscal 2020. The adjusted tax rate, reflecting Excluded Items, was 25.3% in Fiscal 2022 compared to 37.5% last year and 25.3% in the fourth quarter of Fiscal 2020. The lower adjusted tax rate for this year as compared to last year reflects the impact of the CARES Act provisions in the fourth quarter of Fiscal 2021 which does not apply in the fourth quarter of Fiscal 2022.

GAAP earnings from continuing operations were $62.2 million in the fourth quarter of Fiscal 2022, compared to $90.0 million in the fourth quarter last year and $35.5 million in the fourth quarter of Fiscal 2020. Adjusted for the Excluded Items in all periods, fourth quarter earnings from continuing operations were $49.1 million, or $3.48 per share, in Fiscal 2022, compared to $40.0 million, or $2.76 per share, last year and $44.1 million, or $3.09 per share, in the fourth quarter of Fiscal 2020.

Full Year Review

Net sales for Fiscal 2022 increased 36% to $2.4 billion from $1.8 billion in Fiscal 2021 and increased 10% from $2.2 billion in Fiscal 2020. The sales increase from Fiscal 2020 was driven by a 77% increase in e-commerce sales, increased wholesale sales and the positive impact of changes in foreign exchange rates, partially offset by a 4% decrease in store sales. The decrease in store sales for Fiscal 2022 was impacted by Schuh stores open 79% of days in Fiscal 2022 as the COVID-19 pandemic continued to impact store openings in the U.K. in the first part of this year and supply chain challenges impacting all of our retail stores in the later part of this year. Comparable direct sales decreased 2% in Fiscal 2022 compared to a 74% increase in Fiscal 2021 and an 18% increase in Fiscal 2020. The Company has not disclosed comparable sales, except for comparable direct sales, for Fiscal 2022 and Fiscal 2021, as it believes that overall sales is a more meaningful metric during these periods due to the impact of COVID-19.

Overall sales for Fiscal 2022 compared to Fiscal 2021 were up 28% at Journeys, up 38% at Schuh, up 65% at Johnston & Murphy and up 70% at Licensed Brands. Overall sales compared to Fiscal 2020 were up 8% at Journeys, up 13% at Schuh and up 174% at Licensed Brands, partially offset by a 16% decrease in Johnston & Murphy sales.

Gross margin for Fiscal 2022 was 48.8%, up 380 basis points, compared with 45.0% last year and up 40 basis points compared with Fiscal 2020 at 48.4%. The increase as a percentage of sales from Fiscal 2020 is due primarily to increased full-price selling at Journeys, Schuh and Johnston & Murphy retail, partially offset by the mix of our businesses and increased shipping and warehouse expense in all our retail businesses driven by the growth in e-commerce.

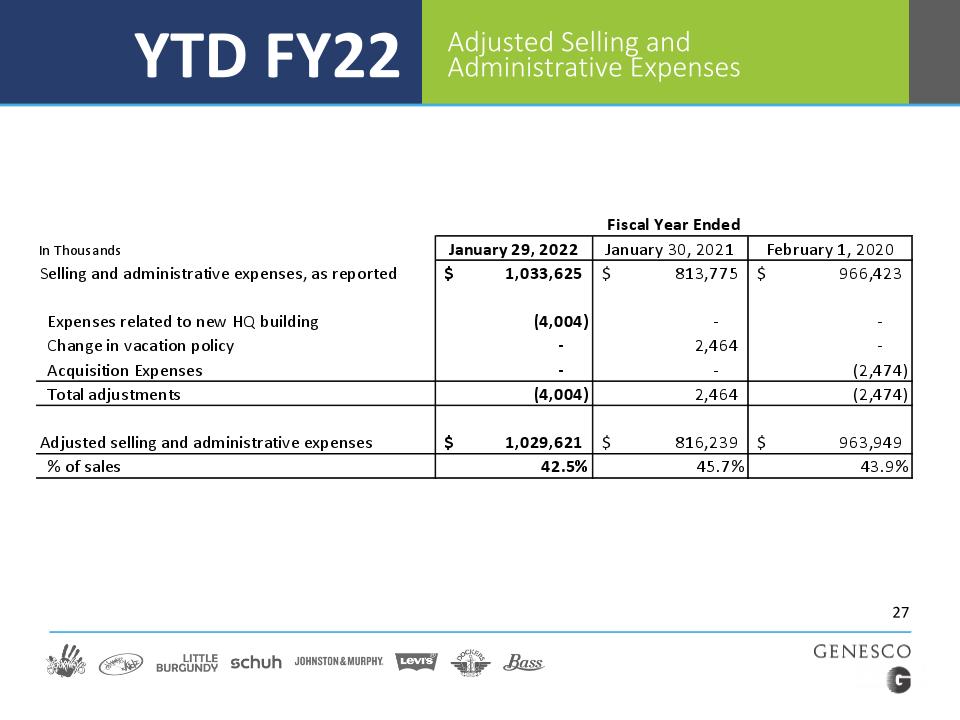

GAAP selling and administrative expense for Fiscal 2022 decreased 290 basis points as a percentage of sales compared with last year and decreased 130 basis points compared with Fiscal 2020. Adjusted selling and administrative expense as a percentage of sales for Fiscal 2022 was 42.5%, down 320 basis points, compared to 45.7% last year and decreased 140 basis points compared to 43.9% in Fiscal 2020. The decrease from Fiscal 2020 is due primarily to reduced occupancy expense, along with selling salaries, partially offset by increased performance-based compensation and marketing expenses. The reduction in occupancy expense is driven in part by rent abatement agreements with landlords and savings from government programs in Canada and the U.K.

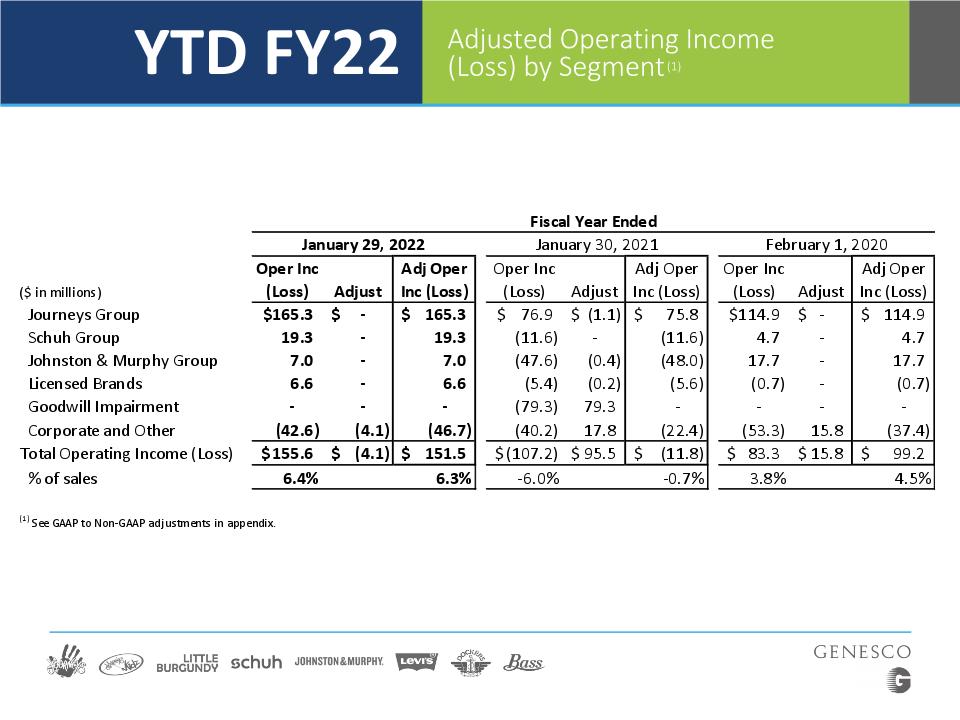

Genesco’s GAAP operating income for Fiscal 2022 was $155.6 million, or 6.4% of sales, compared with an operating loss of $(107.2) million, or (6.0)% of sales last year and $83.3 million, or 3.8% of sales for Fiscal 2020. Adjusted for the Excluded Items in all periods, operating income was $151.5 million this year compared to an operating loss of $(11.8) million last year and operating income of $99.2 million in Fiscal 2020. Adjusted operating margin was 6.3% of sales in Fiscal 2022 and (0.7)% of sales last year and 4.5% in Fiscal 2020.

The effective tax rate was 24.9% in Fiscal 2022 compared to 49.8% last year and 25.1% in Fiscal 2020. The adjusted tax rate, reflecting Excluded Items, was 25.8% in Fiscal 2022 compared to -3.3% last year and 26.9% in Fiscal 2020. The higher adjusted tax rate for this year as compared to last year reflects the inability to recognize a tax benefit for certain foreign losses and a higher mix of earnings in jurisdictions where the Company generates taxable income.

GAAP earnings from continuing operations were $114.9 million in Fiscal 2022, compared to a loss from continuing operations of $(56.0) million last year and earnings from continuing operations of $61.8 million in Fiscal 2020. Adjusted for the Excluded Items in all periods, earnings from continuing operations were $110.6 million, or $7.62 per share, in Fiscal 2022, compared to a loss from continuing

operations of $(16.7) million, or $(1.18) per share, last year and earnings from continuing operations of $71.8 million, or $4.58 per share, in Fiscal 2020.

Cash, Borrowings and Inventory

Cash and cash equivalents as of January 29, 2022, were $320.5 million, compared with $215.1 million as of January 30, 2021. Total debt at the end of the fourth quarter of Fiscal 2022 was $15.7 million compared with $33.0 million at the end of last year’s fourth quarter. Inventories decreased 4% in the fourth quarter of Fiscal 2022 on a year-over-year basis and decreased 24% versus the fourth quarter of Fiscal 2020.

Capital Expenditures and Store Activity

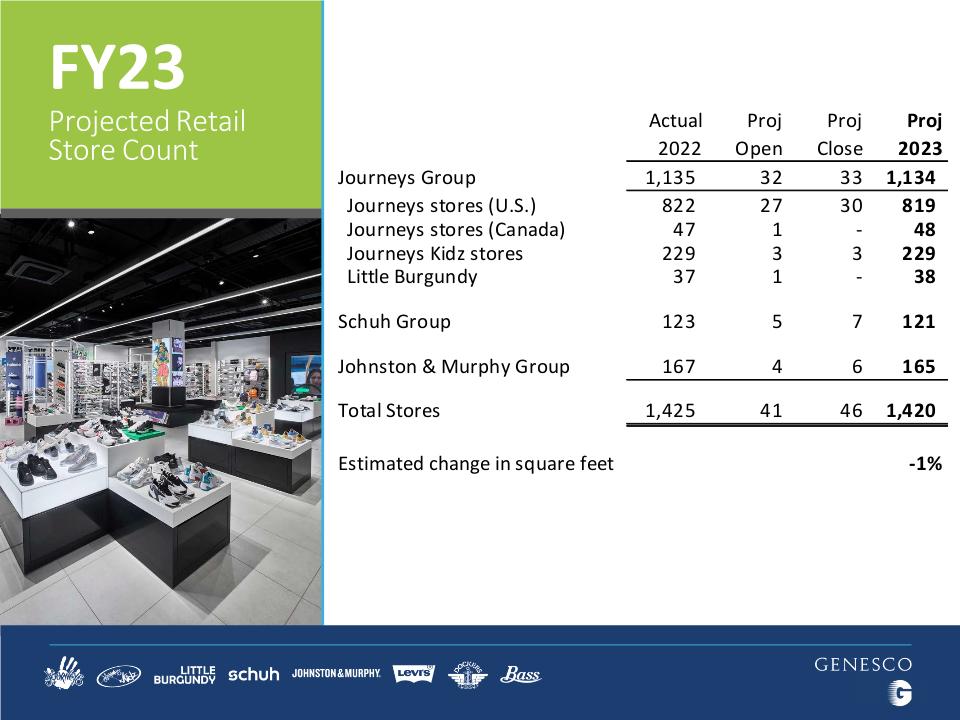

For the fourth quarter, capital expenditures were $19 million, related primarily to the Company’s new headquarters building and digital and omnichannel initiatives. Depreciation and amortization was $11 million. For Fiscal 2022, capital expenditures were $54 million and depreciation and amortization was $43 million. During the quarter, the Company opened two stores and closed eleven stores. The Company ended the quarter with 1,425 stores compared with 1,460 stores at the end of the fourth quarter last year, or a decrease of 2%. Square footage was down 2% on a year-over-year basis.

Share Repurchases

The Company repurchased 839,216 shares during the fourth quarter of Fiscal 2022 at a cost of $52.2 million or an average of $62.22 per share. The Company repurchased 1,360,909 shares, or 9% of common shares outstanding, during Fiscal 2022 at a cost of $82.8 million or an average of $60.88 per share. In February 2022, the Company announced a $100 million increase to the existing $100 million share repurchase authorization. The Company currently has $100.3 million remaining under the expanded share repurchase authorization.

Fiscal 2023 Outlook

For Fiscal 2023, the Company expects:

•Sales to be up 2% to 4%, compared to FY22

•Adjusted diluted earnings per share from continuing operations in the range of $7.00 to $7.75, with an expectation that earnings per share for the year will be near the mid-point of the range.2

•Assumes no further share repurchases and a tax rate of 27% to 28%

Please refer to the Q4FY22 conference call and Q4FY22 Summary Results presentation for details regarding guidance assumptions.

Conference Call, Management Commentary and Investor Presentation

The Company has posted detailed financial commentary and a supplemental financial presentation of fourth quarter results on its website, www.genesco.com, in the investor relations section. The Company's live conference call on March 10, 2022, at 7:30 a.m. (Central time), may be accessed through the Company's website, www.genesco.com. To listen live, please go to the website at least 15 minutes early to register, download and install any necessary software.

__________________________

2A reconciliation of the adjusted financial measures cited in the guidance to their corresponding measures as reported pursuant to GAAP is included in Schedule B to this press release.

Safe Harbor Statement

This release contains forward-looking statements, including those regarding future sales, earnings, gross margins, expenses, capital expenditures, depreciation and amortization, tax rates, store openings and closures and all other statements not addressing solely historical facts or present conditions. Forward- looking statements are usually identified by or are associated with such words as “intend,” “expect,” “believe,” “anticipate,” “optimistic” and similar terminology. Actual results could vary materially from the expectations reflected in these statements. A number of factors could cause differences. These include adjustments to projections reflected in forward-looking statements, including those resulting from the effects of COVID-19 on the Company’s business, including COVID-19 case spikes in locations in which the Company operates, additional stores closures due to COVID-19, weakness in store and shopping mall traffic, restrictions on operations imposed by government entities and/or landlords, changes in public safety and health requirements, and limitations on the Company’s ability to adequately staff and operate stores. Differences from expectations could also result from stores closures and effects on the business as a result of civil disturbances; the level and timing of promotional activity necessary to maintain inventories at appropriate levels; the imposition of tariffs on product imported by the Company or its vendors as well as the ability and costs to move production of products in response to tariffs; the Company’s ability to obtain from suppliers products that are in-demand on a timely basis and effectively manage disruptions in product supply or distribution, including disruptions as a result of COVID-19 or geopolitical events; our ability to pass on price increases to our customers; unfavorable trends in fuel costs, foreign exchange rates, foreign labor and material costs, and other factors affecting the cost of products; the effects of the British decision to exit the European Union and other sources of market weakness in the U.K. and Republic of Ireland; the effectiveness of the Company's omnichannel initiatives; costs associated with changes in minimum wage and overtime requirements; wage pressure in the U.S. and the U.K.; weakness in the consumer economy and retail industry; competition and fashion trends in the Company's markets; risks related to the potential for terrorist events; risks related to public health and safety events; changes in buying patterns by significant wholesale customers; retained liabilities associated with divestitures of businesses including potential liabilities under leases as the prior tenant or as a guarantor; and changes in the timing of holidays or in the onset of seasonal weather affecting period-to-period sales comparisons. Additional factors that could cause differences from expectations include the ability to renew leases in existing stores and control or lower occupancy costs, and to conduct required remodeling or refurbishment on schedule and at expected expense levels; the Company’s ability to realize anticipated cost savings, including rent savings; the amount and timing of share repurchases; the Company’s ability to achieve expected digital gains and gain market share; deterioration in the performance of individual businesses or of the Company's market value relative to its book value, resulting in impairments of fixed assets, operating lease right of use assets or intangible assets or other adverse financial consequences and the timing and amount of such impairments or other consequences; unexpected changes to the market for the Company's shares or for the retail sector in general; costs and reputational harm as a result of disruptions in the Company’s business or information technology systems either by security breaches and incidents or by potential problems associated with the implementation of new or upgraded systems; the Company’s ability to realize any anticipated tax benefits; and the cost and outcome of litigation, investigations and environmental matters involving the Company. Additional factors are cited in the "Risk Factors," "Legal Proceedings" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of, and elsewhere in, the Company’s SEC filings, copies of which may be obtained from the SEC website, www.sec.gov, or by contacting the investor relations department of Genesco via the Company’s website, www.genesco.com. Many of the factors that will determine the outcome of the subject matter of this release are beyond Genesco's ability to control or predict. Genesco undertakes no obligation to release publicly the results of any revisions to

these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Forward-looking statements reflect the expectations of the Company at the time they are made. The Company disclaims any obligation to update such statements.

About Genesco Inc.

Genesco Inc., a Nashville-based specialty retailer and branded company, sells footwear and accessories in more than 1,420 retail stores throughout the U.S., Canada, the United Kingdom and the Republic of Ireland, principally under the names Journeys, Journeys Kidz, Little Burgundy, Schuh, Schuh Kids, Johnston & Murphy, and on internet websites www.journeys.com, www.journeyskidz.com, www.journeys.ca, www.littleburgundyshoes.com, www.schuh.co.uk, www.schuh.ie, www.schuh.eu, www.johnstonmurphy.com, www.johnstonmurphy.ca, www.nashvilleshoewarehouse.com and www.dockersshoes.com. In addition, Genesco sells footwear at wholesale under its Johnston & Murphy brand, the licensed Levi’s brand, the licensed Dockers brand, the licensed Bass brand, and other brands. Genesco is committed to progress in its diversity, equity and inclusion efforts, and the Company’s environmental, social and governance stewardship. For more information on Genesco and its operating divisions, please visit www.genesco.com.

Genesco Inc. Financial Contact

Thomas A. George

(615) 367-7465

tgeorge@genesco.com

Genesco Inc. Media Contact

Claire S. McCall

(615) 367-8283

cmccall@genesco.com

GENESCO INC.

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter 4 |

|

|

Quarter 4 |

|

|

|

Jan. 29,

2022 |

|

|

% of

Net Sales |

|

|

Jan. 30,

2021 |

|

|

% of

Net Sales |

|

Net sales |

|

$ |

727,660 |

|

|

|

100.0 |

% |

|

$ |

636,801 |

|

|

|

100.0 |

% |

Cost of sales |

|

|

371,909 |

|

|

|

51.1 |

% |

|

|

344,982 |

|

|

|

54.2 |

% |

Gross margin |

|

|

355,751 |

|

|

|

48.9 |

% |

|

|

291,819 |

|

|

|

45.8 |

% |

Selling and administrative expenses |

|

|

290,478 |

|

|

|

39.9 |

% |

|

|

226,511 |

|

|

|

35.6 |

% |

Asset impairments and other, net |

|

|

(18,110 |

) |

|

|

-2.5 |

% |

|

|

2,729 |

|

|

|

0.4 |

% |

Operating income |

|

|

83,383 |

|

|

|

11.5 |

% |

|

|

62,579 |

|

|

|

9.8 |

% |

Other components of net periodic benefit cost (income) |

|

|

56 |

|

|

|

0.0 |

% |

|

|

(182 |

) |

|

|

0.0 |

% |

Interest expense, net |

|

|

517 |

|

|

|

0.1 |

% |

|

|

912 |

|

|

|

0.1 |

% |

Earnings from continuing operations before income taxes |

|

|

82,810 |

|

|

|

11.4 |

% |

|

|

61,849 |

|

|

|

9.7 |

% |

Income tax expense (benefit) |

|

|

20,612 |

|

|

|

2.8 |

% |

|

|

(28,195 |

) |

|

|

-4.4 |

% |

Earnings from continuing operations |

|

|

62,198 |

|

|

|

8.5 |

% |

|

|

90,044 |

|

|

|

14.1 |

% |

Loss from discontinued operations, net of tax |

|

|

(58 |

) |

|

|

0.0 |

% |

|

|

(126 |

) |

|

|

0.0 |

% |

Net Earnings |

|

$ |

62,140 |

|

|

|

8.5 |

% |

|

$ |

89,918 |

|

|

|

14.1 |

% |

Basic earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Before discontinued operations |

|

$ |

4.53 |

|

|

|

|

|

$ |

6.30 |

|

|

|

|

Net earnings |

|

$ |

4.52 |

|

|

|

|

|

$ |

6.29 |

|

|

|

|

Diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Before discontinued operations |

|

$ |

4.41 |

|

|

|

|

|

$ |

6.20 |

|

|

|

|

Net earnings |

|

$ |

4.41 |

|

|

|

|

|

$ |

6.20 |

|

|

|

|

Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

13,738 |

|

|

|

|

|

|

14,293 |

|

|

|

|

Diluted |

|

|

14,106 |

|

|

|

|

|

|

14,513 |

|

|

|

|

GENESCO INC.

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended |

|

|

Fiscal Year Ended |

|

|

|

Jan. 29,

2022 |

|

|

% of

Net Sales |

|

|

Jan. 30,

2021 |

|

|

% of

Net Sales |

|

Net sales |

|

$ |

2,422,084 |

|

|

|

100.0 |

% |

|

$ |

1,786,530 |

|

|

|

100.0 |

% |

Cost of sales |

|

|

1,240,948 |

|

|

|

51.2 |

% |

|

|

982,063 |

|

|

|

55.0 |

% |

Gross margin |

|

|

1,181,136 |

|

|

|

48.8 |

% |

|

|

804,467 |

|

|

|

45.0 |

% |

Selling and administrative expenses |

|

|

1,033,625 |

|

|

|

42.7 |

% |

|

|

813,775 |

|

|

|

45.6 |

% |

Goodwill impairment |

|

|

— |

|

|

|

0.0 |

% |

|

|

79,259 |

|

|

|

4.4 |

% |

Asset impairments and other, net |

|

|

(8,056 |

) |

|

|

-0.3 |

% |

|

|

18,682 |

|

|

|

1.0 |

% |

Operating income (loss) |

|

|

155,567 |

|

|

|

6.4 |

% |

|

|

(107,249 |

) |

|

|

-6.0 |

% |

Other components of net periodic benefit cost (income) |

|

|

128 |

|

|

|

0.0 |

% |

|

|

(670 |

) |

|

|

0.0 |

% |

Interest expense, net |

|

|

2,448 |

|

|

|

0.1 |

% |

|

|

5,090 |

|

|

|

0.3 |

% |

Earnings (loss) from continuing operations before income taxes |

|

|

152,991 |

|

|

|

6.3 |

% |

|

|

(111,669 |

) |

|

|

-6.3 |

% |

Income tax expense (benefit) |

|

|

38,044 |

|

|

|

1.6 |

% |

|

|

(55,641 |

) |

|

|

-3.1 |

% |

Earnings (loss) from continuing operations |

|

|

114,947 |

|

|

|

4.7 |

% |

|

|

(56,028 |

) |

|

|

-3.1 |

% |

Loss from discontinued operations, net of tax |

|

|

(97 |

) |

|

|

0.0 |

% |

|

|

(401 |

) |

|

|

0.0 |

% |

Net Earnings (Loss) |

|

$ |

114,850 |

|

|

|

4.7 |

% |

|

$ |

(56,429 |

) |

|

|

-3.2 |

% |

Basic earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Before discontinued operations |

|

$ |

8.11 |

|

|

|

|

|

$ |

(3.94 |

) |

|

|

|

Net earnings (loss) |

|

$ |

8.11 |

|

|

|

|

|

$ |

(3.97 |

) |

|

|

|

Diluted earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Before discontinued operations |

|

$ |

7.92 |

|

|

|

|

|

$ |

(3.94 |

) |

|

|

|

Net earnings (loss) |

|

$ |

7.92 |

|

|

|

|

|

$ |

(3.97 |

) |

|

|

|

Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

14,170 |

|

|

|

|

|

|

14,216 |

|

|

|

|

Diluted |

|

|

14,509 |

|

|

|

|

|

|

14,216 |

|

|

|

|

GENESCO INC.

Sales/Earnings Summary by Segment

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter 4 |

|

|

Quarter 4 |

|

|

|

Jan. 29,

2022 |

|

|

% of

Net Sales |

|

|

Jan. 30,

2021 |

|

|

% of

Net Sales |

|

Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

Journeys Group |

|

$ |

473,725 |

|

|

|

65.1 |

% |

|

$ |

464,716 |

|

|

|

73.0 |

% |

Schuh Group |

|

|

128,979 |

|

|

|

17.7 |

% |

|

|

97,023 |

|

|

|

15.2 |

% |

Johnston & Murphy Group |

|

|

76,099 |

|

|

|

10.5 |

% |

|

|

50,340 |

|

|

|

7.9 |

% |

Licensed Brands |

|

|

48,857 |

|

|

|

6.7 |

% |

|

|

24,722 |

|

|

|

3.9 |

% |

Net Sales |

|

$ |

727,660 |

|

|

|

100.0 |

% |

|

$ |

636,801 |

|

|

|

100.0 |

% |

Operating income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Journeys Group |

|

$ |

58,441 |

|

|

|

12.3 |

% |

|

$ |

79,784 |

|

|

|

17.2 |

% |

Schuh Group |

|

|

9,780 |

|

|

|

7.6 |

% |

|

|

3,556 |

|

|

|

3.7 |

% |

Johnston & Murphy Group |

|

|

4,617 |

|

|

|

6.1 |

% |

|

|

(8,660 |

) |

|

|

-17.2 |

% |

Licensed Brands |

|

|

3,163 |

|

|

|

6.5 |

% |

|

|

(2,499 |

) |

|

|

-10.1 |

% |

Corporate and Other(1) |

|

|

7,382 |

|

|

|

1.0 |

% |

|

|

(9,602 |

) |

|

|

-1.5 |

% |

Operating income |

|

|

83,383 |

|

|

|

11.5 |

% |

|

|

62,579 |

|

|

|

9.8 |

% |

Other components of net periodic benefit cost (income) |

|

|

56 |

|

|

|

0.0 |

% |

|

|

(182 |

) |

|

|

0.0 |

% |

Interest, net |

|

|

517 |

|

|

|

0.1 |

% |

|

|

912 |

|

|

|

0.1 |

% |

Earnings from continuing operations before income taxes |

|

|

82,810 |

|

|

|

11.4 |

% |

|

|

61,849 |

|

|

|

9.7 |

% |

Income tax expense (benefit) |

|

|

20,612 |

|

|

|

2.8 |

% |

|

|

(28,195 |

) |

|

|

-4.4 |

% |

Earnings from continuing operations |

|

|

62,198 |

|

|

|

8.5 |

% |

|

|

90,044 |

|

|

|

14.1 |

% |

Loss from discontinued operations, net of tax |

|

|

(58 |

) |

|

|

0.0 |

% |

|

|

(126 |

) |

|

|

0.0 |

% |

Net Earnings |

|

$ |

62,140 |

|

|

|

8.5 |

% |

|

$ |

89,918 |

|

|

|

14.1 |

% |

(1)Includes an $18.1 million gain in the fourth quarter of Fiscal 2022 for the sale of a distribution warehouse. Includes a $2.7 million charge in the fourth quarter of Fiscal 2021 for retail store asset impairments.

GENESCO INC.

Sales/Earnings Summary by Segment

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended |

|

|

Fiscal Year Ended |

|

|

|

Jan. 29,

2022 |

|

|

% of

Net Sales |

|

|

Jan. 30,

2021 |

|

|

% of

Net Sales |

|

Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

Journeys Group |

|

$ |

1,576,475 |

|

|

|

65.1 |

% |

|

$ |

1,227,954 |

|

|

|

68.7 |

% |

Schuh Group |

|

|

423,560 |

|

|

|

17.5 |

% |

|

|

305,941 |

|

|

|

17.1 |

% |

Johnston & Murphy Group |

|

|

252,855 |

|

|

|

10.4 |

% |

|

|

152,941 |

|

|

|

8.6 |

% |

Licensed Brands |

|

|

169,194 |

|

|

|

7.0 |

% |

|

|

99,694 |

|

|

|

5.6 |

% |

Net Sales |

|

$ |

2,422,084 |

|

|

|

100.0 |

% |

|

$ |

1,786,530 |

|

|

|

100.0 |

% |

Operating income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Journeys Group |

|

$ |

165,336 |

|

|

|

10.5 |

% |

|

$ |

76,896 |

|

|

|

6.3 |

% |

Schuh Group |

|

|

19,257 |

|

|

|

4.5 |

% |

|

|

(11,602 |

) |

|

|

-3.8 |

% |

Johnston & Murphy Group |

|

|

7,029 |

|

|

|

2.8 |

% |

|

|

(47,624 |

) |

|

|

-31.1 |

% |

Licensed Brands |

|

|

6,583 |

|

|

|

3.9 |

% |

|

|

(5,430 |

) |

|

|

-5.4 |

% |

Corporate and Other(1) |

|

|

(42,638 |

) |

|

|

-1.8 |

% |

|

|

(40,230 |

) |

|

|

-2.3 |

% |

Goodwill Impairment |

|

|

— |

|

|

|

0.0 |

% |

|

|

(79,259 |

) |

|

|

-4.4 |

% |

Operating income (loss) |

|

|

155,567 |

|

|

|

6.4 |

% |

|

|

(107,249 |

) |

|

|

-6.0 |

% |

Other components of net periodic benefit cost (income) |

|

|

128 |

|

|

|

0.0 |

% |

|

|

(670 |

) |

|

|

0.0 |

% |

Interest, net |

|

|

2,448 |

|

|

|

0.1 |

% |

|

|

5,090 |

|

|

|

0.3 |

% |

Earnings (loss) from continuing operations before income taxes |

|

|

152,991 |

|

|

|

6.3 |

% |

|

|

(111,669 |

) |

|

|

-6.3 |

% |

Income tax expense (benefit) |

|

|

38,044 |

|

|

|

1.6 |

% |

|

|

(55,641 |

) |

|

|

-3.1 |

% |

Earnings (loss) from continuing operations |

|

|

114,947 |

|

|

|

4.7 |

% |

|

|

(56,028 |

) |

|

|

-3.1 |

% |

Loss from discontinued operations, net of tax |

|

|

(97 |

) |

|

|

0.0 |

% |

|

|

(401 |

) |

|

|

0.0 |

% |

Net Earnings (Loss) |

|

$ |

114,850 |

|

|

|

4.7 |

% |

|

$ |

(56,429 |

) |

|

|

-3.2 |

% |

(1)Includes an $8.1 million gain in Fiscal 2022 which includes an $18.1 million gain on the sale of a distribution warehouse and a $0.6 million insurance gain, partially offset by $8.6 million for professional fees related to the actions of a shareholder activist and $2.0 million for retail store asset impairments. Includes an $18.7 million charge in Fiscal 2021 which includes a $13.8 million charge for retail store asset impairments and a $5.3 million charge for trademark impairment, partially offset by a $0.4 million gain for the release of an earnout related to the Togast acquisition.

GENESCO INC.

Condensed Consolidated Balance Sheets

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Jan. 29, 2022 |

|

|

Jan. 30, 2021 |

|

Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

320,525 |

|

|

$ |

215,091 |

|

Accounts receivable |

|

|

39,509 |

|

|

|

31,410 |

|

Inventories |

|

|

278,200 |

|

|

|

290,966 |

|

Other current assets(1) |

|

|

71,564 |

|

|

|

130,128 |

|

Total current assets |

|

|

709,798 |

|

|

|

667,595 |

|

Property and equipment |

|

|

216,308 |

|

|

|

207,842 |

|

Operating lease right of use assets |

|

|

543,789 |

|

|

|

621,727 |

|

Goodwill and other intangibles |

|

|

68,411 |

|

|

|

69,479 |

|

Other non-current assets |

|

|

23,793 |

|

|

|

20,725 |

|

Total Assets |

|

$ |

1,562,099 |

|

|

$ |

1,587,368 |

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

Accounts payable |

|

$ |

152,484 |

|

|

$ |

150,437 |

|

Current portion operating lease liabilities |

|

|

145,088 |

|

|

|

173,505 |

|

Other current liabilities |

|

|

134,156 |

|

|

|

78,991 |

|

Total current liabilities |

|

|

431,728 |

|

|

|

402,933 |

|

Long-term debt |

|

|

15,679 |

|

|

|

32,986 |

|

Long-term operating lease liabilities |

|

|

471,878 |

|

|

|

527,549 |

|

Other long-term liabilities |

|

|

40,346 |

|

|

|

57,141 |

|

Equity |

|

|

602,468 |

|

|

|

566,759 |

|

Total Liabilities and Equity |

|

$ |

1,562,099 |

|

|

$ |

1,587,368 |

|

(1) Includes prepaid income taxes of $53.4 million and $108.6 million at January 29, 2022 and January 30, 2021, respectively.

GENESCO INC.

Store Count Activity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance

02/01/20 |

|

|

Open |

|

|

Close |

|

|

Balance

01/30/21 |

|

|

Open |

|

|

Close |

|

|

Balance

01/29/22 |

|

Journeys Group |

|

|

1,171 |

|

|

|

8 |

|

|

|

20 |

|

|

|

1,159 |

|

|

|

5 |

|

|

|

29 |

|

|

|

1,135 |

|

Schuh Group |

|

|

129 |

|

|

|

1 |

|

|

|

7 |

|

|

|

123 |

|

|

|

0 |

|

|

|

0 |

|

|

|

123 |

|

Johnston & Murphy Group |

|

|

180 |

|

|

|

4 |

|

|

|

6 |

|

|

|

178 |

|

|

|

1 |

|

|

|

12 |

|

|

|

167 |

|

Total Retail Units |

|

|

1,480 |

|

|

|

13 |

|

|

|

33 |

|

|

|

1,460 |

|

|

|

6 |

|

|

|

41 |

|

|

|

1,425 |

|

GENESCO INC.

Store Count Activity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance

10/30/21 |

|

|

Open |

|

|

Close |

|

|

Balance

01/29/22 |

|

Journeys Group |

|

|

1,137 |

|

|

|

2 |

|

|

|

4 |

|

|

|

1,135 |

|

Schuh Group |

|

|

123 |

|

|

0 |

|

|

0 |

|

|

|

123 |

|

Johnston & Murphy Group |

|

|

174 |

|

|

|

0 |

|

|

|

7 |

|

|

|

167 |

|

Total Retail Units |

|

|

1,434 |

|

|

|

2 |

|

|

|

11 |

|

|

|

1,425 |

|

GENESCO INC.

Comparable Sales(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter 4 |

|

|

Fiscal Year Ended |

|

|

|

Jan. 29,

2022 |

|

|

Jan. 30,

2021 |

|

|

Jan. 29,

2022 |

|

|

Jan. 30,

2021 |

|

Journeys Group |

|

|

1 |

% |

|

|

2 |

% |

|

NA |

|

|

NA |

|

Schuh Group |

|

|

-2 |

% |

|

|

35 |

% |

|

NA |

|

|

NA |

|

Johnston & Murphy Group |

|

|

38 |

% |

|

|

-35 |

% |

|

NA |

|

|

NA |

|

Total Comparable Sales |

|

|

3 |

% |

|

|

1 |

% |

|

NA |

|

|

NA |

|

Same Store Sales |

|

|

10 |

% |

|

|

-10 |

% |

|

NA |

|

|

NA |

|

Comparable Direct Sales |

|

|

-12 |

% |

|

|

55 |

% |

|

|

-2 |

% |

|

|

74 |

% |

(1)As a result of store closures in response to the COVID-19 pandemic and the Company's policy of removing any store closed for seven consecutive days from comparable sales, the Company has not included comparable sales for Fiscal 2022 or Fiscal 2021, except for comparable direct sales, as it felt that overall sales was a more meaningful metric during these periods.

GENESCO INC.

COVID-19 Related Items

Decrease (Increase) to Pretax Earnings

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter 4 |

|

|

Fiscal Year Ended |

|

|

|

Jan. 29, 2022 |

|

Jan. 30, 2021 |

|

|

Jan. 29, 2022 |

|

Jan. 30, 2021 |

|

Goodwill impairment |

|

$ |

— |

|

$ |

— |

|

|

$ |

— |

|

$ |

79,259 |

|

Incremental retail store asset impairment(1) |

|

|

— |

|

|

1,471 |

|

|

|

— |

|

|

11,036 |

|

Trademark impairment(1) |

|

|

— |

|

|

— |

|

|

|

— |

|

|

5,260 |

|

Release of Togast earnout(1) |

|

|

— |

|

|

— |

|

|

|

— |

|

|

(441 |

) |

Excess inventory(2) and (3) |

|

|

(2,009 |

) |

|

3,240 |

|

|

|

(5,445 |

) |

|

8,568 |

|

Excess freight & logistics costs(3) |

|

|

8,670 |

|

|

— |

|

|

|

12,720 |

|

|

— |

|

Non-productive compensation(4) and (5) |

|

|

— |

|

|

3,637 |

|

|

|

(334 |

) |

|

10,899 |

|

UK property tax relief(4) |

|

|

(1,254 |

) |

|

(3,879 |

) |

|

|

(9,730 |

) |

|

(13,291 |

) |

Other governmental relief(4) and (6) |

|

|

(40 |

) |

|

— |

|

|

|

(5,231 |

) |

|

— |

|

Rent abatements and temporary rent concessions(4) and (7) |

|

|

(3,857 |

) |

|

(23,146 |

) |

|

|

(17,278 |

) |

|

(34,299 |

) |

Incremental bad debt reserve(4) |

|

|

— |

|

|

(364 |

) |

|

|

— |

|

|

2,633 |

|

Other(4) and (8) |

|

|

— |

|

|

415 |

|

|

|

— |

|

|

1,584 |

|

Total COVID-19 Related Items |

|

$ |

1,510 |

|

$ |

(18,626 |

) |

|

$ |

(25,298 |

) |

$ |

71,208 |

|

(1)Included in asset impairments and other, net on the Condensed Consolidated Statements of Operations.

(2)Estimated impact of COVID-19 upon permanent markdowns and inventory markdown reserves as well as sell through of inventory previously reserved.

(3)Included in cost of sales on the Condensed Consolidated Statements of Operations.

(4)Included in selling and administrative expenses on the Condensed Consolidated Statements of Operations.

(5)Certain compensation paid to furloughed workers and commission based associates, net of the CARES Act, and U.K., ROI and Canadian government relief.

(6)Includes U.K. and ROI Relief Grants and Canadian rent subsidy.

(7)Estimated impact of abatements and temporary rent savings agreements that are being recognized when executed if they pertain to a prior period.

(8)Includes primarily severance and increased cleaning and personal protective equipment expenses in the fourth quarter and year of Fiscal 2021 and is partially offset by the reversal of percentage rent for Fiscal 2021.

Schedule B

Genesco Inc.

Adjustments to Reported Earnings (Loss) from Continuing Operations

Three Months Ended January 29, 2022, January 30, 2021 and February 1, 2020

The Company believes that disclosure of earnings (loss) and earnings (loss) per share from continuing operations and operating income (loss) adjusted for the items not reflected in the previously announced expectations will be meaningful to investors, especially in light of the impact of such items on the results.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter 4 |

|

|

Quarter 4 |

|

|

Quarter 4 |

|

|

January 29, 2022 |

|

|

January 30, 2021 |

|

|

February 1, 2020 |

|

In Thousands (except per share amounts) |

Pretax |

|

Net of

Tax |

|

Per Share

Amounts |

|

|

Pretax |

|

Net of

Tax |

|

Per Share

Amounts |

|

|

Pretax |

|

Net of

Tax |

|

Per Share

Amounts |

|

Earnings from continuing operations, as reported |

|

|

$ |

62,198 |

|

$ |

4.41 |

|

|

|

|

$ |

90,044 |

|

$ |

6.20 |

|

|

|

|

$ |

35,515 |

|

$ |

2.49 |

|

Asset impairments and other adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail store and intangible asset impairment charges |

$ |

— |

|

|

6 |

|

|

0.00 |

|

|

$ |

2,729 |

|

|

4,014 |

|

|

0.28 |

|

|

$ |

1,258 |

|

|

965 |

|

|

0.07 |

|

Fees related to shareholder activist |

|

(25 |

) |

|

23 |

|

|

0.00 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

Expenses related to new HQ building |

|

1,093 |

|

|

794 |

|

|

0.05 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

Gain on sale of warehouse |

|

(18,085 |

) |

|

(12,893 |

) |

|

(0.91 |

) |

|

|

— |

|

|

— |

|

|

0.00 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

Insurance gain |

|

— |

|

|

(3 |

) |

|

0.00 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

Trademark impairment |

|

— |

|

|

— |

|

|

0.00 |

|

|

|

— |

|

|

24 |

|

|

0.00 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

Pension settlement |

|

— |

|

|

— |

|

|

0.00 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

|

|

11,510 |

|

|

8,409 |

|

|

0.59 |

|

Gain on lease terminations |

|

— |

|

|

— |

|

|

0.00 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

|

|

(502 |

) |

|

(366 |

) |

|

(0.03 |

) |

Acquisition expenses |

|

— |

|

|

— |

|

|

0.00 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

|

|

2,474 |

|

|

1,808 |

|

|

0.13 |

|

Gain on sale of Lids building |

|

— |

|

|

— |

|

|

0.00 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

|

|

(586 |

) |

|

(428 |

) |

|

(0.03 |

) |

Release Togast earnout |

|

— |

|

|

— |

|

|

0.00 |

|

|

|

— |

|

|

(25 |

) |

|

0.00 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

Change in vacation policy |

|

— |

|

|

— |

|

|

0.00 |

|

|

|

(616 |

) |

|

(639 |

) |

|

(0.04 |

) |

|

|

— |

|

|

— |

|

|

0.00 |

|

Gain on Hurricane Maria |

|

— |

|

|

— |

|

|

0.00 |

|

|

|

— |

|

|

— |

|

|

0.00 |

|

|

|

(149 |

) |

|

(110 |

) |

|

(0.01 |

) |

Total asset impairments and other adjustments |

$ |

(17,017 |

) |

|

(12,073 |

) |

|

(0.86 |

) |

|

$ |

2,113 |

|

|

3,374 |

|

|

0.24 |

|

|

$ |

14,005 |

|

|

10,278 |

|

|

0.72 |

|

Income tax expense adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discrete tax items provided by the CARES Act |

|

|

|

— |

|

|

0.00 |

|

|

|

|

|

(41,678 |

) |

|

(2.87 |

) |

|

|

|

|

— |

|

|

0.00 |

|

IRC Section 165 (g) 3 deduction for an outside basis difference for GCO Canada |

|

|

|

— |

|

|

0.00 |

|

|

|

|

|

(12,811 |

) |

|

(0.88 |

) |

|

|

|

|

— |

|

|

0.00 |

|

Other tax items |

|

|

|

(998 |

) |

|

(0.07 |

) |

|

|

|

|

1,058 |

|

|

0.07 |

|

|

|

|

|

(1,719 |

) |

|

(0.12 |

) |

Total income tax expense adjustments |

|

|

|

(998 |

) |

|

(0.07 |

) |

|

|

|

|

(53,431 |

) |

|

(3.68 |

) |

|

|

|

|

(1,719 |

) |

|

(0.12 |

) |

Adjusted earnings from continuing operations (1) and (2) |

|

|

$ |

49,127 |

|

$ |

3.48 |

|

|

|

|

$ |

39,987 |

|

$ |

2.76 |

|

|

|

|

$ |

44,074 |

|

$ |

3.09 |

|

(1)The adjusted tax rate for the fourth quarter of Fiscal 2022, 2021 and 2020 is 25.3%, 37.5% and 25.3%, respectively.

(2)EPS reflects 14.1 million, 14.5 million and 14.3 million share count for the fourth quarter of Fiscal 2022, 2021 and 2020, respectively, which includes common stock equivalents in each period.

Schedule B

Genesco Inc.

Adjustments to Reported Operating Income (Loss) and Selling and Administrative Expenses

Three Months Ended January 29, 2022, January 30, 2021 and February 1, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter 4 - January 29, 2022 |

|

In Thousands |

|

Operating

Income (Loss) |

|

|

Asset Impair

& Other Adj |

|

|

Adj Operating

Income (Loss) |

|

Journeys Group |

|

$ |

58,441 |

|

|

$ |

— |

|

|

$ |

58,441 |

|

Schuh Group |

|

|

9,780 |

|

|

|

— |

|

|

|

9,780 |

|

Johnston & Murphy Group |

|

|

4,617 |

|

|

|

— |

|

|

|

4,617 |

|

Licensed Brands |

|

|

3,163 |

|

|

|

— |

|

|

|

3,163 |

|

Corporate and Other |

|

|

7,382 |

|

|

|

(17,017 |

) |

|

|

(9,635 |

) |

Total Operating Income |

|

$ |

83,383 |

|

|

$ |

(17,017 |

) |

|

$ |

66,366 |

|

% of sales |

|

|

11.5 |

% |

|

|

|

|

|

9.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter 4 - January 30, 2021 |

|

In Thousands |

|

Operating

Income (Loss) |

|

|

Asset Impair

& Other Adj |

|

|

Adj Operating

Income (Loss) |

|

Journeys Group |

|

$ |

79,784 |

|

|

$ |

(263 |

) |

|

$ |

79,521 |

|

Schuh Group |

|

|

3,556 |

|

|

|

— |

|

|

|

3,556 |

|

Johnston & Murphy Group |

|

|

(8,660 |

) |

|

|

(96 |

) |

|

|

(8,756 |

) |

Licensed Brands |

|

|

(2,499 |

) |

|

|

(39 |

) |

|

|

(2,538 |

) |

Corporate and Other |

|

|

(9,602 |

) |

|

|

2,511 |

|

|

|

(7,091 |

) |

Total Operating Income |

|

$ |

62,579 |

|

|

$ |

2,113 |

|

|

$ |

64,692 |

|

% of sales |

|

|

9.8 |

% |

|

|

|

|

|

10.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter 4 - February 1, 2020 |

|

In Thousands |

|

Operating

Income (Loss) |

|

|

Asset Impair

& Other Adj |

|

|

Adj Operating

Income (Loss) |

|

Journeys Group |

|

$ |

55,685 |

|

|

$ |

— |

|

|

$ |

55,685 |

|

Schuh Group |

|

|

5,679 |

|

|

|

— |

|

|

|

5,679 |

|

Johnston & Murphy Group |

|

|

7,363 |

|

|

|

— |

|

|

|

7,363 |

|

Licensed Brands |

|

|

(849 |

) |

|

|

— |

|

|

|

(849 |

) |

Corporate and Other |

|

|

(22,549 |

) |

|

|

14,005 |

|

|

|

(8,544 |

) |

Total Operating Income |

|

$ |

45,329 |

|

|

$ |

14,005 |

|

|

$ |

59,334 |

|

% of sales |

|

|

6.7 |

% |

|

|

|

|

|

8.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter 4 |

|

In Thousands |

|

Jan. 29, 2022 |

|

|

Jan. 30, 2021 |

|

|

Feb. 1, 2020 |

|

Selling and administrative expenses, as reported |

|

$ |

290,478 |

|

|

$ |

226,511 |

|

|

$ |

260,612 |

|

|

|

|

|

|

|

|

|

|

|

Expenses related to new HQ building |

|

|

(1,093 |

) |

|

|

— |

|

|

|

— |

|

Change in vacation policy |

|

|

— |

|

|

|

616 |

|

|

|

— |

|

Acquisition expenses |

|

|

— |

|

|

|

— |

|

|

|

(2,474 |

) |

Total adjustments |

|

|

(1,093 |

) |

|

|

616 |

|

|

|

(2,474 |

) |

Adjusted selling and administrative expenses |

|

|

289,385 |

|

|

|

227,127 |

|

|

|

258,138 |

|

% of sales |

|

|

39.8 |

% |

|

|

35.7 |

% |

|

|

38.1 |

% |

Schedule B

Genesco Inc.

Adjustments to Reported Earnings (Loss) from Continuing Operations

Fiscal Year Ended January 29, 2022, January 30, 2021 and February 1, 2020

The Company believes that disclosure of earnings (loss) and earnings (loss) per share from continuing operations and operating income (loss) adjusted for the items not reflected in the previously announced expectations will be meaningful to investors, especially in light of the impact of such items on the results.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended |

|

Fiscal Year Ended |

|

Fiscal Year Ended |

|

|

January 29, 2022 |

|

January 30, 2021 |

|

February 1, 2020 |

|

In Thousands (except per share amounts) |

Pretax |

|

Net of Tax |

|

Per Share

Amounts |

|

Pretax |

|

Net of Tax |

|

Per Share

Amounts |

|

Pretax |

|

Net of

Tax |

|

Per Share

Amounts |

|

Earnings (loss) from continuing operations, as reported |

|

|

$ |

114,947 |

|

$ |

7.92 |

|

|

|

$ |

(56,028 |

) |

$ |

(3.94 |

) |

|

|

$ |

61,757 |

|

$ |

3.94 |

|

Asset impairments and other adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail store and intangible asset impairment charges |

$ |

2,049 |

|

|

1,694 |

|

|

0.12 |

|

$ |

13,863 |

|

|

11,892 |

|

|

0.84 |

|

$ |

3,095 |

|

|

2,261 |

|

|

0.14 |

|

Fees related to shareholder activist |

|

8,558 |

|

|

6,101 |

|

|

0.42 |

|

|

— |

|

|

— |

|

|

0.00 |

|

|

— |

|

|

— |

|

|

0.00 |

|

Expenses related to new HQ building |

|

4,004 |

|

|

2,855 |

|

|

0.20 |

|

|

— |

|

|

— |

|

|

0.00 |

|

|

— |

|

|

— |

|

|

0.00 |

|

Gain on sale of warehouse |

|

(18,085 |

) |

|

(12,893 |

) |

|

(0.89 |

) |

|

— |

|

|

— |

|

|

0.00 |

|

|

— |

|

|

— |

|

|

0.00 |

|

Insurance gain |

|

(578 |

) |

|

(412 |

) |

|

(0.03 |

) |

|

— |

|

|

— |

|

|

0.00 |

|

|

— |

|

|

— |

|

|

0.00 |

|

Trademark impairment |

|

— |

|

|

— |

|

|

0.00 |

|

|

5,260 |

|

|

5,177 |

|

|

0.36 |

|

|

— |

|

|

— |

|

|

0.00 |

|

Goodwill impairment |

|

— |

|

|

— |

|

|

0.00 |

|

|

79,259 |

|

|

79,259 |

|

|

5.58 |

|

|

— |

|

|

— |

|

|

0.00 |

|

Release Togast earnout |

|

— |

|

|

— |

|

|

0.00 |

|

|

(441 |

) |

|

(348 |

) |

|

(0.03 |

) |

|

— |

|

|

— |

|

|

0.00 |

|

Change in vacation policy |

|

— |

|

|

— |

|

|

0.00 |

|

|

(2,464 |

) |

|

(1,947 |

) |

|

(0.14 |

) |

|

— |

|

|

— |

|

|

0.00 |

|

Pension settlement |

|

— |

|

|

— |

|

|

0.00 |

|

|

— |

|

|

— |

|

|

0.00 |

|

|

11,510 |

|

|

8,409 |

|

|

0.54 |

|

Acquisition expenses |

|

— |

|

|

— |

|

|

0.00 |

|

|

— |

|

|

— |

|

|

0.00 |

|

|

2,474 |

|

|

1,808 |

|

|

0.12 |

|

Gain on sale of Lids building |

|

— |

|

|

— |

|

|

0.00 |

|

|

— |

|

|

— |

|

|

0.00 |

|

|

(586 |

) |

|

(428 |

) |

|

(0.03 |

) |

Gain on lease terminations |

|

— |

|

|

— |

|

|

0.00 |

|

|

— |

|

|

— |

|

|

0.00 |

|

|

(458 |

) |

|

(335 |

) |

|

(0.02 |

) |

Gain on Hurricane Maria |

|

— |

|

|

— |

|

|

0.00 |

|

|

— |

|

|

— |

|

|

0.00 |

|

|

(187 |

) |

|

(137 |

) |

|

(0.01 |

) |

Total asset impairments and other adjustments |

$ |

(4,052 |

) |

|

(2,655 |

) |

|

(0.18 |

) |

$ |

95,477 |

|

|

94,033 |

|

|

6.61 |

|

$ |

15,848 |

|

|

11,578 |

|

|

0.74 |

|

Income tax expense adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax impact share based awards |

|

|

|

(1,747 |

) |

|

(0.12 |

) |

|

|

|

1,129 |

|

|

0.08 |

|

|

|

|

(54 |

) |

|

0.00 |

|

Discrete tax items provided by the CARES Act |

|

|

|

— |

|

|

0.00 |

|

|

|

|

(46,379 |

) |

|

(3.26 |

) |

|

|

|

— |

|

|

0.00 |

|

IRC Section 165 (g) 3 deduction for an outside basis difference for GCO Canada |

|

|

|

— |

|

|

0.00 |

|

|

|

|

(12,811 |

) |

|

(0.90 |

) |

|

|

|

— |

|

|

0.00 |

|

Other tax items |

|

|

|

17 |

|

|

0.00 |

|

|

|

|

3,326 |

|

|

0.23 |

|

|

|

|

(1,475 |

) |

|

(0.10 |

) |

Total income tax expense adjustments |

|

|

|

(1,730 |

) |

|

(0.12 |

) |

|

|

|

(54,735 |

) |

|

(3.85 |

) |

|

|

|

(1,529 |

) |

|

(0.10 |

) |

Adjusted earnings (loss) from continuing operations (1) and (2) |

|

|

$ |

110,562 |

|

$ |

7.62 |

|

|

|

$ |

(16,730 |

) |

$ |

(1.18 |

) |

|

|

$ |

71,806 |

|

$ |

4.58 |

|

(1)The adjusted tax rate for Fiscal 2022, 2021 and 2020 is 25.8%, -3.3% and 26.9%, respectively.

(2)EPS reflects 14.5 million, 14.2 million and 15.7 million share count for Fiscal 2022, 2021 and 2020, respectively, which includes common stock equivalents in Fiscal 2022 and Fiscal 2020 and excludes common stock equivalents in Fiscal 2021 due to the loss from continuing operations.

Schedule B

Genesco Inc.

Adjustments to Reported Operating Income (Loss) and Selling and Administrative Expenses

Fiscal Year Ended January 29, 2022, January 30, 2021 and February 1, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended January 29, 2022 |

|

In Thousands |

|

Operating

Income (Loss) |

|

|

Asset Impair

& Other Adj |

|

|

Adj Operating

Income (Loss) |

|

Journeys Group |

|

$ |

165,336 |

|

|

$ |

— |

|

|

$ |

165,336 |

|

Schuh Group |

|

|