As filed with the U.S. Securities and Exchange Commission on March 4, 2022 under the Securities Act of 1933, as amended.

Registration No. 333-254498

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Patria Latin American Opportunity Acquisition Corp.

(Exact name of registrant as specified in its charter)

| Cayman Islands | 6770 | N/A |

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

18 Forum Lane, 3rd floor, Camana Bay, PO Box 757, KY1-9006 Grand Cayman, Cayman Islands +1 345 640 4900 |

||

| (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | ||

Patria Investments US LLC 601 Lexington Avenue, 17th floor New York, NY 10022 +1 (646) 313 6271 |

||

| (Name, address, including zip code, and telephone number, including area code, of agent for service) | ||

| Copies to: | ||||

Manuel Garciadiaz Pedro J. Bermeo Davis Polk & Wardwell LLP New York, NY 10017 Tel: (212) 450-4000 |

S. Todd Crider Grenfel S. Calheiros Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, NY 10017 Tel: (212) 455-2000 | |||

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED , 2022 |

Patria Latin

American Opportunity Acquisition Corp.

$200,000,000

20,000,000 Units

Patria Latin American Opportunity Acquisition Corp. is a newly incorporated blank check company incorporated as a Cayman Islands exempted company and incorporated for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses, which we refer to as our initial business combination. We have not selected any specific business combination target and we have not, nor has anyone on our behalf, engaged in any substantive discussions, directly or indirectly, with any business combination target with respect to an initial business combination with us.

This is an initial public offering of our securities. Each unit has an offering price of $10.00 and consists of one Class A ordinary share and one-half of one redeemable warrant. Each whole warrant entitles the holder thereof to purchase one Class A ordinary share at a price of $11.50 per share, subject to adjustment as described herein. Only whole warrants are exercisable. No fractional warrants will be issued upon separation of the units and only whole warrants will trade. The warrants will become exercisable on the later of 30 days after the completion of our initial business combination and 12 months from the closing of this offering, and will expire five years after the completion of our initial business combination or earlier upon redemption or our liquidation, as described herein. The underwriters have a 45-day option from the date of this prospectus to purchase up to an additional 3,000,000 units to cover over-allotments, if any.

We will provide our public shareholders with the opportunity to redeem all or a portion of their Class A ordinary shares upon the completion of our initial business combination at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account described below calculated as of two business days prior to the consummation of our initial business combination, including interest earned on the funds held in the trust account and not previously released to us to pay our taxes, divided by the number of then outstanding Class A ordinary shares that were sold as part of the units in this offering, which we refer to collectively as our public shares, subject to the limitations and on the conditions described herein. The amount in the trust account will initially be $10.30 per unit sold in this offering. If we are unable to complete our initial business combination within 15 months from the closing of this offering and decide not to extend the time to consummate our business combination as described below, we will redeem 100% of the public shares at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest earned on the funds held in the trust account and not previously released to us to pay our taxes (less up to $100,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, subject to applicable law as further described herein. However, in our sole discretion, we may, but are not obligated to, extend the period of time to consummate a business combination by two additional three month periods (for a total of up to 21 months to complete a business combination); provided that our sponsor, as defined below (or its designees) must deposit into the trust account funds equal to $0.10 per unit sold in this offering for each three month extension, for an aggregate additional amount of $2,000,000 (or $2,300,000 if the underwriters’ over-allotment option is exercised in full) for each such extension, in exchange for a non-interest bearing, unsecured promissory note to be repaid by us following our business combination. Such loan may be convertible into warrants, at a price of $1.00 per warrant at the option of the lender. The warrants would be identical to the private placement warrants. If we do not complete a business combination, we will repay such loans solely from assets not held in the trust account, if any. Our public shareholders will not be afforded an opportunity to vote on our extension of time to consummate an initial business combination from 15 months up to 21 months described above or redeem their shares in connection with such extension.

Our sponsor, Patria SPAC LLC, an affiliate of our executive officers, has committed to purchase an aggregate of 13,000,000 warrants (or 14,500,000 warrants if the underwriters’ over-allotment option is exercised in full), each exercisable to purchase one Class A ordinary share at $11.50 per share, subject to adjustment at a price of $1.00 per warrant, or $13,000,000 in the aggregate (or $14,500,000 if the underwriters’ over-allotment option is exercised in full), in a private placement that will close simultaneously with the closing of this offering. Our sponsor is also an affiliate of Patria Investments Limited, or Patria.

Patria or its affiliates have expressed to us an interest to purchase an aggregate of 2,000,000 units (or 2,300,000 units if the underwriters’ over-allotment option is exercised in full) in this offering at the offering price and we have agreed to direct the underwriters to sell to Patria or its affiliates such amount of units. Because these expressions of interest are not binding agreements or commitments to purchase, Patria or its affiliates may determine to purchase more, fewer or no units in this offering or the underwriters may determine to sell more, fewer or no units to Patria or its affiliates. For a discussion of certain additional arrangements with Patria or its affiliates, see “Summary—The Offering—Expression of Interest.”

Our initial shareholders, which include our sponsor, currently own an aggregate of 5,750,000 Class B ordinary shares, up to 750,000 of which may be surrendered to us for no consideration after the closing of this offering depending on the extent to which the underwriters’ over-allotment option is exercised. The Class B ordinary shares may be converted into Class A ordinary shares concurrently with or immediately following the consummation of our initial business combination on a one-for-one basis, subject to the adjustments described herein. Only holders of Class B ordinary shares will have the right to appoint directors in any general meeting held prior to or in connection with the completion of our initial business combination. On any other matters submitted to a vote of our shareholders, holders of the Class B ordinary shares and holders of the Class A ordinary shares will vote together as a single class, except as required by law.

Currently, there is no public market for our units, Class A ordinary shares or warrants. We have applied to list our units on The Nasdaq Global Market, or Nasdaq, under the symbol “PLAOU.” We expect that our units will be listed on Nasdaq on or promptly after the date of this prospectus. We cannot guarantee that our securities will be approved for listing on Nasdaq. We expect the Class A ordinary shares and warrants comprising the units to begin separate trading on the 52nd day following the date of this prospectus (or the immediately following business day if such 52nd day is not a business day) unless and J.P. Morgan Securities LLC and Citigroup Global Markets Inc., the representatives of the underwriters, informs us of its decision to allow earlier separate trading, subject to our satisfaction of certain conditions as described further herein. Once the securities comprising the units begin separate trading, we expect that the Class A ordinary shares and warrants will be listed on Nasdaq under the symbols “PLAO” and “PLAOW,” respectively.

We are an “emerging growth company” and a “smaller reporting company” under applicable federal securities laws and will be subject to reduced public company reporting requirements. Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 48 for a discussion of information that should be considered in connection with an investment in our securities. Investors will not be entitled to protections normally afforded to investors in Rule 419 blank check offerings.

No offer or invitation to subscribe for securities may be made to the public in the Cayman Islands.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit | Total | |||||||

| Public offering price | $ | 10.00 | 200,000,000 | |||||

| Underwriting discounts and commissions(1) | $ | 0.55 | 11,000,000 | |||||

| Proceeds, before expenses, to us | $ | 9.45 | 189,000,000 | |||||

| (1) | $0.20 per unit, or $4,000,000 in the aggregate (or $4,600,000 if the underwriters’ over-allotment option is exercised in full), is payable upon the closing of this offering. $0.35 per unit, or $7,000,000 in the aggregate (or up to $8,050,000 in the aggregate if the underwriters’ over-allotment option is exercised in full) is payable to the underwriters for deferred underwriting commissions to be placed in a trust account located in the United States and released to the underwriters only upon the completion of an initial business combination. See also “Underwriting” for a description of compensation and other items of value payable to the underwriters. |

Of the proceeds we receive from this offering and the sale of the private placement warrants described in this prospectus, $206,000,000, or $236,900,000 if the underwriters’ over-allotment option is exercised in full ($10.30 per unit in either case, which amount may be increased by up to $0.20 per unit sold in this offering in the event we decide to extend the time to consummate our business combination by six months), will be deposited into a trust account located in the United States with Continental Stock Transfer & Trust Company acting as trustee, after deducting $4,000,000 in underwriting discounts and commissions payable upon the closing of this offering (or $4,600,000 if the underwriters’ over-allotment option is exercised in full) and an aggregate of $3,000,000 to pay fees and expenses in connection with the closing of this offering and for working capital following the closing of this offering.

The underwriters are offering the units for sale on a firm commitment basis. The underwriters expect to deliver the units to the purchasers on or about , 2022.

| J.P. Morgan | Citigroup |

, 2022

Page

We have not, and the underwriters have not, authorized anyone to provide you with information that is different from or inconsistent with that contained in this prospectus. We are not, and the underwriters are not, making an offer to sell securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

i

This summary only highlights the more detailed information appearing elsewhere in this prospectus. As this is a summary, it does not contain all of the information that you should consider in making an investment decision. You should read this entire prospectus carefully, including the information under “Risk Factors” and our financial statements and the related notes included elsewhere in this prospectus, before investing.

Unless otherwise stated in this prospectus or the context otherwise requires, references to:

| · | “we,” “us,” “company” or “our company” are to Patria Latin American Opportunity Acquisition Corp., a Cayman Islands exempted company; |

| · | “amended and restated memorandum and articles of association” are to the amended and restated memorandum and articles of association that the company will adopt prior to the consummation of this offering; |

| · | “Companies Act” are to the Companies Act (As Revised) of the Cayman Islands as the same may be amended from time to time; |

| · | “directors” are to our current directors and director nominees (if any); |

| · | “equity-linked securities” are to any debt or equity securities that are convertible, exercisable or exchangeable for our Class A ordinary shares issued in a financing transaction in connection with our initial business combination, including but not limited to a private placement of equity or debt; |

| · | “founder shares” are to Class B ordinary shares initially purchased by our sponsor in a private placement prior to this offering and the Class A ordinary shares that will be issued upon the automatic conversion of the Class B ordinary shares at the time of our initial business combination as described herein; |

| · | “initial shareholders” are to holders of our founder shares prior to this offering; |

| · | “management” or our “management team” are to our officers and directors (including our director nominees that will become directors in connection with the consummation of this offering) and advisory board members; |

| · | “ordinary shares” are to our Class A ordinary shares and our Class B ordinary shares; |

| · | “Patria” are to Patria Investments Limited; |

| · | “private placement warrants” are to the warrants to be issued to our sponsor in a private placement simultaneously with the closing of this offering; |

| · | “public shares” are to our Class A ordinary shares sold as part of the units in this offering (whether they are purchased in this offering or thereafter in the open market); |

| · | “public shareholders” are to the holders of our public shares, including our initial shareholders and management team to the extent our initial shareholders and/or members of our management team purchase public shares, provided that each initial shareholder’s and member of our management team’s status as a “public shareholder” will only exist with respect to such public shares; |

| · | “public warrants” are to the warrants sold as part of the units in this offering (whether they are purchased in this offering or thereafter in the open market) and to the private placement warrants if held by third parties other than out sponsor (or permitted transferees); |

| · | “sponsor” are to Patria SPAC LLC, a Cayman Islands limited liability company; and |

1

| · | “warrants” are to our public warrants and private placement warrants. |

Any conversion of the Class B ordinary shares described in this prospectus will take effect as a redemption of Class B ordinary shares and an issuance of Class A ordinary shares as a matter of Cayman Islands law. Any forfeiture of shares, and all references to forfeiture of shares, described in this prospectus shall take effect as a surrender of shares for no consideration as a matter of Cayman Islands law. Any share dividend described in this prospectus will take effect as a share capitalization as a matter of Cayman Islands law.

Unless we tell you otherwise, the information in this prospectus assumes that the underwriters will not exercise their over-allotment option.

General Overview of Our Company

We are a blank check company newly incorporated as a Cayman Islands exempted company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses, which we refer to as our initial business combination. Our only activities since inception have been organizational activities and those necessary to prepare for this offering. We have not selected any business combination target, and we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any business combination target. Our team has a history of executing transactions in multiple geographies and under varying economic and financial market conditions. Although we may pursue an acquisition in a number of industries or geographies, we intend to capitalize on the broader Patria Investments Limited, or Patria, platform where we believe a combination of our relationships, knowledge and experience across industries and geographies can effect a positive transformation of an existing business.

Our sponsor is an affiliate of Patria, a leading global alternative asset manager. Given Patria’s investment capabilities and the expectation that our company will leverage on Patria’s capabilities, we believe our team has the required investment, operational, due diligence and capital raising resources to affect a business combination with an attractive target and to position it for long-term success in the public markets.

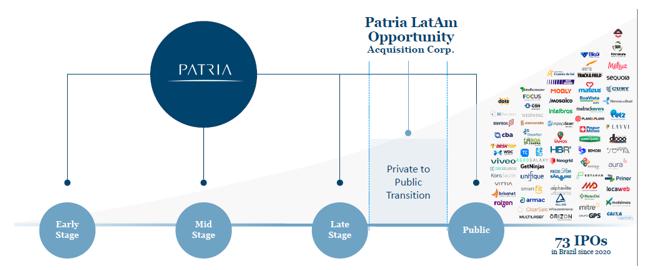

While we may pursue an initial business combination target in any industry or sector, geography, or stage, we intend to focus our search in Latin America and in sectors where Patria has developed investment expertise (including but not limited to healthcare, food and beverage, logistics, agribusiness, education, and financial services). We will pursue an initial business combination with an established business with scale, attractive growth prospects, high-quality shareholders and management, and sustainable competitive advantages. We believe there is a large number of attractive businesses that would benefit from a public listing as well as from the operational and value creation expertise we bring.

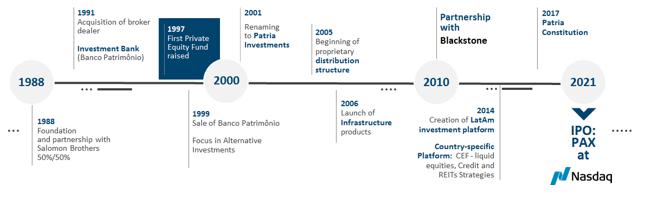

About Our Sponsor

Our sponsor, Patria SPAC LLC, is an affiliate of Patria. We believe Patria offers a compelling value proposition and can help us with value creation for our target business, our shareholders and our Sponsor. Patria is one of the leading private markets investment firms in Latin America in terms of capital raised, with over $8.7 billion raised since 2015 including co-investments. Preqin’s 2020 Global Private Equity & Venture Capital Report ranks Patria as the number one fund manager by total capital raised for private equity funds in the past ten years in Latin America. As of December 31, 2021, Patria’s assets under management, or AUM, was $14.9 billion with 19 active funds, and Patria’s investment portfolio was composed of over 55 companies and assets. Patria’s size and performance over its 32-year history also make it one of the most significant emerging markets-based private markets investments managers. We intend to leverage this unique proprietary investment framework and investment expertise with an established operational track record to generate value in our target business through many operational levers, such as revenue growth via cross-selling with other portfolio companies, margin expansion and premiums from green-field projects, relying on Patria’s expertise to complement the business development competences of our management.

Patria’s track record derived from its strategy and capabilities has attracted a committed and diversified base of investors, with over 300 Limited Partners, or LPs, across four continents, including six of the world’s 10 largest sovereign wealth fund and 10 of the world’s 20 largest pensions, insurance companies, funds of funds, financial

2

institutions, endowments, foundations, and family offices. Approximately 59% of its current LPs have been investing with Patria for over 10 years. Patria’s team has also benefited from the investment of its partner, The Blackstone Group Inc., one of the world’s leading investment firms, which has held a non-controlling interest in Patria since 2010.

On January 26, 2021, Patria announced the closing of its initial public offering of 34,613,647 of its Class A common shares at a public offering price of $17.00 per share. The shares began trading on the Nasdaq Global Select Market on January 22, 2021, under the symbol “PAX.”

On December 1, 2021 Patria announced the closing of its combination with Moneda Asset Management, or “Moneda,” a leading asset manager headquartered in Chile. The transaction creates a combined asset manager with nearly $24 billion in assets under management, which Patria expects will help solidify its private equity, infrastructure and credit platforms in Latin America.

The combination enhanced Patria’s product offering by adding the largest credit investment platform in Latin America, where Moneda manages nearly $5 billion and has generated market-leading performance. Moneda also manages more than $450 million in private credit investments, adding to more than $200 million managed by Patria, which Patria expects to be the foundation to pursue private credit product development in the region.

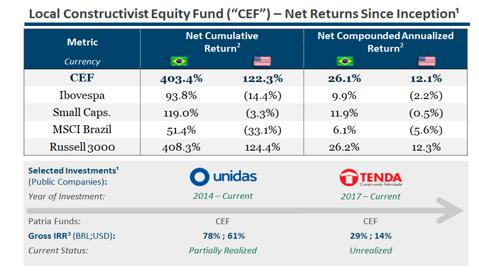

Moneda also added a public equities portfolio, and including Patria’s Constructivist Equity Fund, or CEF, totaled $2.5 billion in public equities AUM. Within this portfolio, the combination created the largest Constructivist Equity/CEF manager in the region with approximately $800 million in assets under management, combining localized expertise in both Brazil and Chile. Complementary investor bases totaling more than 400 institutional clients present a significant cross selling opportunity for Moneda’s products, which will continue to carry the Moneda brand, offering Patria’s global institutional investors access to yield-oriented products in the region.

Patria’s investment approach seeks to take advantage of sizable opportunities in Latin America while mitigating risks such as macroeconomic and foreign exchange volatility. Patria does so by focusing on resilient sectors—largely uncorrelated with macroeconomic factors—driving operational value creation and partnering with entrepreneurs and management teams to develop some of the leading platforms in the region. Patria’s strategy, applied since 1994 in its flagship private equity products, has generated solid returns and sustained growth. The consolidated equal-weighted net internal rate of return, or IRR, in U.S. dollars for all of Patria’s flagship private equity funds since inception was 29.6% as of December 31, 2021 (31.1% in Brazilian reais). The consolidated pooled-weighted net internal rate of return, or IRR, in U.S. dollars for all of Patria’s flagship private equity funds since inception was 15.0% as of December 31, 2021 (21.5% in Brazilian reais). Patria has overseen the deployment of more than $20.0 billion through capital raised by its products, capital raised in IPOs and follow-ons, debt raised by underlying companies and capital expenditures sourced from operational cash flow of underlying companies, with more than 90 investments and approximately 300 underlying acquisitions as of December 31, 2021.

We believe that Patria’s historical returns in U.S. dollars are particularly notable in view of the levels of currency volatility and historically limited use of leverage, which, we also believe, makes Patria better investors focused on value creation, strategy execution and operational excellence, with more limited reliance upon financial engineering. We expect to rely on Patria’s expertise and track record to help our management to source an attractive target business and build on Patria’s extensive public company expertise to take advantage of value creation opportunities by improving the target business’s operations and accelerate its growth.

As of December 31, 2021, Patria had 174 professionals, of which 44 were partners and directors, 19 of these working together for more than ten years, operating in ten offices around the globe, including investment offices in Montevideo (Uruguay), São Paulo (Brazil), Bogotá (Colombia), and Santiago (Chile), as well as client-coverage offices in New York (United States), London (United Kingdom), Dubai (UAE), and Hong Kong (China), in addition to Patria’s corporate business and management office in George Town (Cayman Islands).

3

Latin American Investment Opportunity

Patria has cultivated deep operating & investing acumen and specialized market knowledge in Latin America, a growing and underpenetrated market that we believe provides a sizeable investment opportunity. We believe our affiliation with Patria allows us to be uniquely positioned to capitalize on a number of favorable trends specific to our region, including:

| · | Unique regional fundamentals provides solid drivers for growth and stability: positive economic and currency cycles and a low correlation between the Latin American economy and global economy have driven increased demand for exposure in the region among global investors: |

| · | Scale and growth potential: According to the World Bank, Latin America and the Caribbean’s combined GDP of $4.7 trillion represented 9.0% of the Organization for Economic Co-operation and Development, or OECD’s, combined GDP in 2020. The region’s GDP per capita totaled $7,244.7 in 2020, which represented 19% of OECD’s in the same period. Latin America and the Caribbean is also expected to grow at a strong rate, with the International Monetary Fund forecasting 3.0% GDP growth in 2022, highlighting not only the region’s vast scale but also potential to be a beneficiary of improvements in macroeconomic and sectorial fundamentals in a fast-growing economy; |

| · | Macroeconomic effects drive region-wide growth: Consistently improving macroeconomic fundamentals have been sustainable drivers of the regions’ growth, with: (i) unemployment rates averaging 7.5% on the ten-year period ending December 31,2020, according to the World Bank; (ii) consistent increase in GDP per capita despite the foreign exchange devaluation in recent years, indicating a solid growth trend in relative income levels; (iii) inflation rates remained stable at approximately 3.0% per year on the ten-year period ending December 31, 2020, according to the World Bank; and (iv) continued improvement of educational levels; |

| · | Solid structural developments: On top of the positive macroeconomic tailwinds, Latin America has also benefitted from accelerating development, including: (i) logistics and network infrastructure expansion; (ii) increase in healthcare infrastructure, labor force and health plans coverage ratio; (iii) development of financial services coverage and credit penetration; (iv) development of energy generation infrastructure; (v) development of regional-wide educational platforms and educational coverage; and (vi) development of retail participation in Capital Markets, among other several potential sector developments; and |

| · | Brazil is at the center of the Latin American economy: Particularly, Brazil represented 30.8% of Latin American and the Caribbean combined economy in 2020, with a GDP of $1.4 trillion in 2020, according to the World Bank. Brazil is the largest (8.5 million square kilometers) and most populous (over 210 million inhabitants) country in Latin America. It covers an area greater than the continental United States (demanding continental logistics infrastructure investments) and almost as many people as Germany, France and United Kingdom combined (providing a massive consumer base and labor force for a service-oriented economy, of which 63% of GDP comes from services, according to the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística), or the IBGE. |

| · | Positive tailwinds for equity investment: Several constantly improving fundamentals have driven the capital markets expansion over the past few years in in Latin America, particularly Brazil, promoting long-standing positive changes in market dynamics for the coming years. |

| · | Low interest rates: In Brazil, interest rates had reached 2.00% in August 2020, according to the Brazilian Central Bank. The declining trend between 2017 and mid-2021, from double-digit rates to single digits, which to varying degrees occurred in other markets in the region, greatly accelerated the regional transformation of domestic capital markets; and |

4

| · | Private markets asset base growth in Brazil: According to the Brazilian Association of Financial and Capital Markets Entities (Associação Brasileira das Entidades dos Mercados Financeiro e de Capitais), or ANBIMA, the total private markets asset base in Brazil experienced a compound annual growth rate close to 21% from 2010 to 2020, reaching an all-time-high of R$703 billion (approximately $135 billion) in 2020, making private markets one of the fastest-growing asset classes within the asset management industry in the country. |

| · | Growing opportunity in the rest of the region: Latin America overall has experienced strong growth in private equity funding and venture capital investment (supportive data to come) signaling increasing appetite for capital from growing companies in the region. |

| · | Attractive sectors are underrepresented in the public markets: Patria invests in a number of sectors throughout Latin America that, while contributing a large portion to GDP in the region, are relatively underrepresented in the Latin American public markets. We believe that this makes a U.S. listing via a special purpose acquisition company particularly attractive to potential partners in Latin America, due to the dearth of similar companies listed on local exchanges; and |

| · | Exchange rate devaluation promoting substantial attractiveness for foreign investors: Recent exchange rate devaluation in the region allows for a significant increase in foreign investors’ firepower with dollarized funds, enabling sizeable opportunities with attractive return rates to fit investors’ check sizes and reduce the need to find co-investors. Particularly in Brazil, where market forecasts point to an increase in interest rates over the next four years, the Brazilian real could potentially face a revaluation process that drives a normalization of these impacts, which would further strengthen the potential opportunity for foreign investment. |

Our Business Strategy and Competitive Advantage

We believe that we, as a Patria special purpose acquisition company, offer a highly compelling, attractive proposition when compared with other blank check companies and other sources of equity capital. We bring a singular geographic focus, unique proprietary investment framework, and investment expertise with a deep operational track record. In addition to the partnership-oriented reputation and region-wide network, which we believe, when taken together with our sponsor and Patria, give us a sustained competitive advantage in sourcing and consummating one or more business combinations, we expect to rely on this collective public company expertise to help guide our partners through their journey as they transition to the public markets.

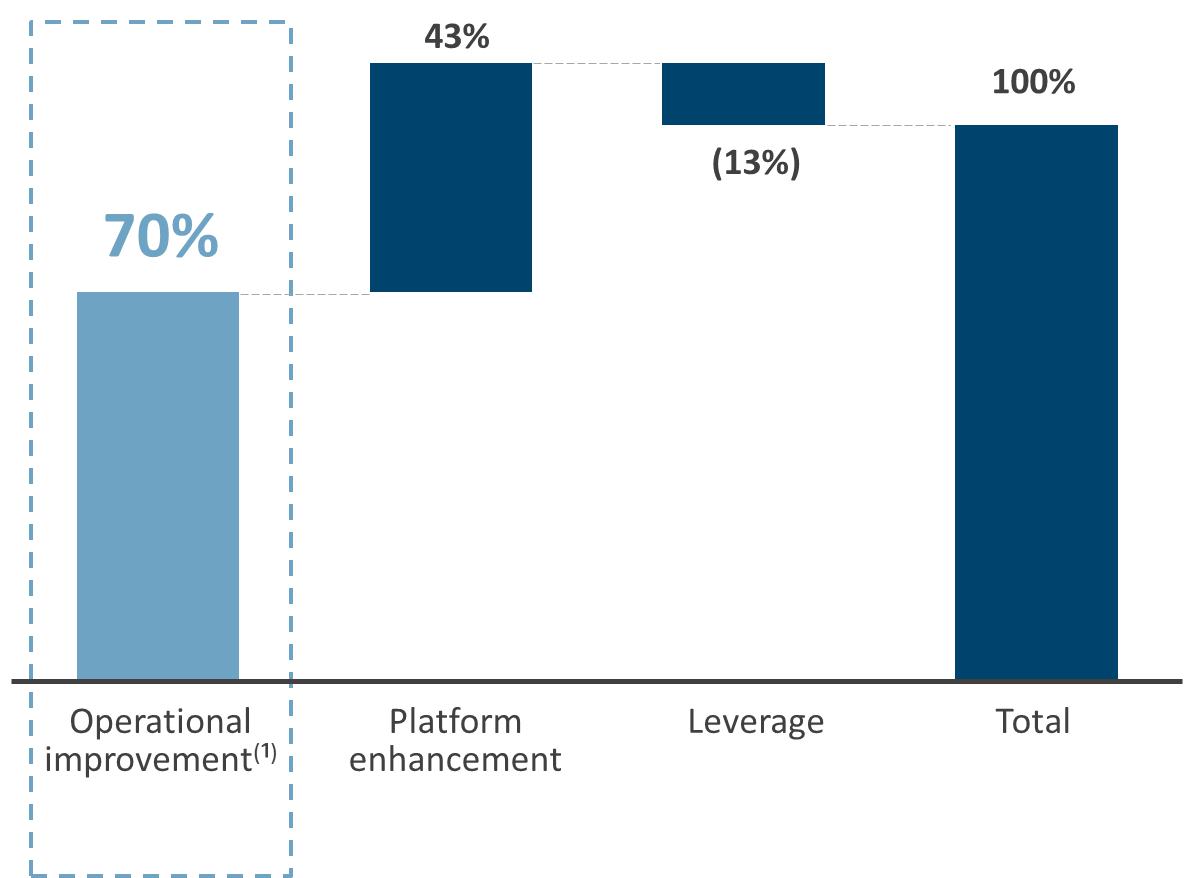

| · | Systematic value-add approach through operational improvement: Patria believes that nearly 60% of value added to their private equity investments generally comes from direct operational improvements, such as revenue growth and margin expansion. Consistent with Patria’s strategy, we will seek to partner with companies at attractive valuations by offering a compelling value proposition and partnership opportunity to owner-operators. Patria has developed a proprietary systematic process that couples an associative approach to partnership and a hands-on operational approach, which at times includes the secondment of Patria executives to portfolio companies. These experienced executives support the existing management team in strategic initiatives, consolidation plays, margin improvement exercises, and active board-level participation, with these initiatives expected to be agreed upon prior to the investment and therefore established as part of the investment thesis itself. These initiatives are formalized in written plans that serve as guidelines for future execution initiatives; |

| · | Proprietary sourcing model: We believe Patria’s sourcing capabilities can be a key competitive advantage in our search for an attractive target business. Approximately 90% of all investments pursued by Patria private equity since 1994 have been originated through its proprietary sourcing initiatives. This is driven by Patria’s methodical approach to investment sourcing. Portfolio managers, each specialist in their respective industries, utilizing their professional networks and knowledge of the local market and sector to identify potential targets. The portfolio managers then work together with designated business developers and Patria’s transactions team to source the transaction. This process is supported by Patria’s strong reputation |

5

as a valuable partner and a prudent hands-on investor that catalyzes consolidation processes and helps owner-operators develop and grow their companies to become market leaders;

| · | Deep public company expertise: Patria has a long track record of expertise in the public markets, including initial public offerings of its portfolio companies as well as its own firm. Patria also has deep expertise in public market investing. In 2015, Patria founded the Constructivist Equity Fund, or CEF, to take advantage of value creation opportunities in publicly listed companies in Brazil. The fund applies Patria’s operationally-focused private equity strategy to minority public investments, as compared to the majority control investments that are the mandate of its flagship private equity funds. In this fund, Patria partners with public companies and their management teams to improve their platforms and accelerate growth. As of December 31, 2021, the CEF had a net compounded annualized return of 22.9% in Brazilian reais. We believe Patria’s track record of successful partnership and value creation in minority public company investments is highly relevant to our value proposition to a potential partner: |

| · | Sustained strong investment performance track record across market cycles: Patria has produced strong long-term investment performance, generating consistent outperformance relative to benchmarks. As of December 31, 2021, considering mid-range returns, Patria’s funds achieved home run ratio (defined as companies with market value at or above 2x multiple on invested capital, or MOIC) of approximately 58.1% and 71.2% of the total equity value of the companies held by such funds, in U.S. dollars and Brazilian reais, respectively, since inception for Patria’s private equity products. Based on the same assumptions, our funds had a loss ratio (defined as companies with market value below 1x MOIC) of only 7.2% and 3.8% in U.S. dollars and Brazilian reais, respectively; and |

| · | Seasoned management team with entrepreneurial spirit and professional culture: As of December 31, 2021, Patria had a senior management team comprised of 44 members, who averaged 20 years of investment experience, and most of Patria’s partners have been working together for more than 15 years. More than half of Patria’s partners and officers have portfolio company executive experience, which support the flywheel of operational improvement and the associative partnership approach towards owner-operators. Patria’s operating partners, usually former C-level executives from the sectors in which we expect to invest, as well as their value creation team staffed by senior functional specialists, and the transactions group of M&A specialists complement the business development competences of the investment team. As a result, we believe Patria offers a compelling value proposition and can help us with value creation for our target business, our shareholders and our Sponsor. |

Our Investment Process

Consistent with Patria’s strategy, our investment process is rooted in a systematic and replicable “investment technology” that Patria uses across all investments. Patria’s performance is a result of this rigorous approach, and gives us confidence to be able to identify and consummate a business combination.

| · | Sector specialization in resilient industries: We plan to focus on Patria’s core sectors, including healthcare, food and beverage, logistics, agribusiness, education and financial services, which are resilient and have significantly and consistently outperformed Brazilian real GDP and other sectors; |

| · | Systematic framework: We intend to rely on Patria’s scalable process to source, diligence, manage investments, supported by nearly 30 modular investment teams and analytical tools; |

| · | Value creation through operational leverage: Nearly 60% of value generated directly by Patria through operational levers, and more than half of Patria’s partners and officers have portfolio company executive experience; |

| · | Compounding through consolidation: Patria’s thesis formulation process is focused on sectors that are historically large, growing, and resilient, where supply-side fragmentation would allow for market consolidations; and |

6

| · | Associative partnership approach: We intend to leverage the long-term relationships in the ecosystems in which Patria invests and with strategic players, founders and key industry executives, which resulted in a great majority of deals being sourced independently and outside of open bidding. |

Acquisition Criteria

Consistent with Patria’s strategy, we have identified the following general criteria, and plan to target businesses with these five core attributes:

| · | Differentiated and sustainable business model, with defensible competitive advantages, and a strong management team; |

| · | Attractive growth prospects, with the potential to capitalize on secular and regional tailwinds; |

| · | Sufficient scale and resources to achieve a successful transition to the public markets; |

| · | High-quality founders, shareholders, executive teams, culturally fit for a constructive and collaborative value creation project; and |

| · | Businesses that would benefit from having a public currency to enhance its ability to grow organically or through M&A. |

We are not prohibited from pursuing an initial business combination with a company that is affiliated with Patria, our sponsor, or our officers or directors. In the event we seek to complete our initial business combination with a company that is affiliated with Patria, our sponsor, or officers or directors, such transaction would be subject to approval by a majority of our independent and disinterested directors. We would not be required to obtain an opinion from a third party firm in such event to address whether the business combination is fair to our public shareholders from a financial point of view.

Our directors and officers may directly or indirectly own our ordinary shares or private placement warrants following this offering, and, accordingly, may have a conflict of interest in determining whether a particular target business is an appropriate business with which to effectuate our initial business combination. Further, our officers and directors may have a conflict of interest with respect to evaluating a particular business combination if the retention or resignation of any such officers and directors is included by a target business as a condition to any agreement with respect to our initial business combination.

Our Management Team

Our management team will consist of Ricardo Leonel Scavazza, our Chairman and Director, Alexandre Teixeira de Assumpção Saigh, our Director, José Augusto Gonçalves de Araújo Teixeira, our CEO, and Marco Nicola D’Ippolito, our Chief Financial Officer. They will be supported by Patria’s sector and functional specialists, particularly those belonging to our advisory committee and our independent directors, as further described below.

Ricardo Leonel Scavazza, Chairman and Director

Ricardo Leonel Scavazza is the Chairman of our board of directors. Mr. Scavazza is a Managing Partner of Patria Investments Limited and is the Chief Executive Officer & Chief Investments Officer of Latin American Private Equity. Mr. Scavazza is responsible for all Latam Private Equity strategy at Patria Investments Limited. Before taking over as CEO & CIO for Private Equity Latam, Mr. Scavazza served as the Head of Private Equity Strategy in Brazil. Mr. Scavazza joined Patrimônio in 1999, became a Partner in 2005, and has worked on several new investments and acquisitions for the portfolio companies of Private Equity Funds I, II, III, IV and V. Mr. Scavazza held operating roles in several investments, including a tenure as Chief Executive Officer at Anhanguera between 2009 and 2013. He was Chief Financial Officer at DASA in 2001 and at Anhanguera Educacional from 2003 to 2006. Mr. Scavazza holds a bachelor’s degree in Business Administration and Management from Fundação Getulio Vargas (FGV) and the University of Texas at Austin. Mr. Scavazza also holds

7

an Master’s in Business Administration and Management from the Kellogg School of Management at Northwestern University.

Alexandre Teixeira de Assumpção Saigh, Director

Alexandre Teixeira de Assumpção Saigh has served as our Director of the Board since our inception. Mr. Saigh is the Chief Executive Officer and is a member of the Board of Directors at Patria Investments Limited since 2010. He is also one of our founding partners and Chairman of our executive-level Private Equity Investment and Divestment Committee. Mr. Saigh is also a Senior Managing Partner of Patria Investments Limited and an Executive Director of Patria Holdings Limited. Before taking the role as Chief Executive Officer, Mr. Saigh was primarily responsible for our Private Equity division being responsible for the start-up and development of this business within Patria. He held and currently holds board member positions in several of our funds’ invested companies. Mr. Saigh was one of the founders of Patria in 2001 (successor of Banco Patrimônio), developing and leading the efforts for Patria to become one of the leading private markets firms in Latin America. Mr. Saigh joined Banco Patrimônio in 1994, as a Managing Partner responsible for the development and execution of Patria Investments Limited’s private equity business. Between 1994 and 1997, while developing Patrimônio’s private equity strategy, Mr. Saigh was Chief Executive Officer and Chief Financial Officer of Drogasil, one of the leading drugstore chains in Brazil and Patria’s first private equity investment. Prior to joining Patrimônio, Mr. Saigh worked at J.P. Morgan Investment Bank from 1989 to 1994, as a Vice President for its private equity, corporate finance and M&A divisions. Mr. Saigh holds a bachelor’s degree in Financial Management and Hotel Administration from Boston University and a Post- Graduate Certificate of Special Studies in Administration and Management from Harvard University.

José Augusto Gonçalves de Araújo Teixeira, Chief Executive Officer

José Augusto Gonçalves de Araújo Teixeira is our Chief Executive Officer. Mr. Teixeira is a Partner of Patria Investments Limited, where he currently serves as a member of its Management Committee and as Head of Marketing and Products. Mr. Teixeira is primarily responsible for Patria’s Global Product & Marketing strategy and development as well as for leading distribution efforts in Brazil. Previously, Mr. Teixeira served as the Head of Marketing and Investor Relations for Private Equity products between 2013 and 2020. From 2005 to 2013, Mr. Teixeira was fully dedicated to Anhanguera Educacional, Patria’s flagship investment in Education, where he held various senior positions: he served as Chief Financial Officer between 2011 and 2013, including oversight over the company’s robust M&A program; Investor Relations Officer between 2007 and 2013; Strategic, Commercial and Financial Planning Director between 2007 and 2011; and Financial Planning Manager between 2005 and 2007. Prior to the investment in Anhanguera, Mr. Teixeira focused on the development of Patria Investments Limited’s post-secondary Education thesis and worked at Anhembi-Morumbi University. Prior to joining Patria in 2004, Mr. Teixeira worked with the Latin American Research Sales team at Goldman Sachs in New York. Mr. Teixeira holds a bachelor’s degree in Political Science and Economics from Amherst College.

Marco Nicola D’Ippolito, Chief Financial Officer

Marco Nicola D’Ippolito has served as our Chief Financial Officer since our inception. Mr. D’Ippolito is also Managing Partner & Chief Financial Officer of Patria Investments Limited. Mr. D’Ippolito is a member of Patria Investments Limited’s Management Committee and is primarily responsible for finance, operations, shareholders relations, fund administration, legal, compliance, technology and governance. Before taking over as CFO, Mr. D’Ippolito served Patria Investments Limited as COO for four years. Before that, Mr. D’Ippolito worked at Patria Investment Limited’s Private Equity division, being responsible for different investments in the technology, logistics, healthcare, agribusiness and food industries. Mr. D’Ippolito was also responsible for fundraising initiatives within the Patria Private Equity business. In addition, Mr. D’Ippolito was the Chairman of the Board and Board Member of different portfolio companies. Before joining Patria in 2005, Mr. D’Ippolito worked for a Latin American family office as private equity portfolio manager between 2002 and 2005. Prior to that, Mr. D’Ippolito participated on the start-up, development and sale of an IT private company in Brazil. Mr. D’Ippolito holds a bachelor’s degree in Economics from Fundação Armando Álvares Penteado (FAAP) and an MBA from Instituto Brasileiro de Mercado de Capitais (IBMEC).

8

Our Independent Director Nominees

Our independent director nominees will join our board of directors upon the effective date of the registration statement of which this prospectus forms a part. We believe our board members will add significant value to our target company and will aid in our ability to source our initial business combination. These nominees are:

Pedro Paulo Elejalde de Campos, Director Nominee

Pedro Paulo Elejalde de Campos will serve as a Director upon the completion of this offering. Mr. Campos is currently a Managing Partner at Arsenal Investimentos, a Brazilian based investment and advisory firm. Mr. Campos joined Arsenal in 2017 and is responsible for leading its investment banking activities. Prior to that, from 2011 to 2017, Mr. Campos was a Partner at Patria Investimentos, a Brazilian investment firm associated with Blackstone Group from New York, where he was responsible for Blackstone’s investments in Brazil and Patria Investment Limited’s investment banking operations. From 2003 to 2011, Mr. Campos was at Angra Partners, an investment and financial advisory firm, where he was a Founding Managing Partner responsible for its general management, investment committees (chair) and investment portfolios. In addition, during his career, Mr. Campos held the position of a Managing Director at Citigroup from 2000 to 2003, the President and CEO of GE Capital Latin America and Banco GE Capital Brasil from 1996 to 2000. Mr. Campos started his professional career in 1982 at J.P. Morgan offices in New York and left the firm in 1995 as a Vice President. Also, along his career, Mr. Campos has served as board director in several corporations and non-profit organizations. Mr. Campos holds bachelors’ degrees in Engineering and Business Administration; both from Universidade Federal do Rio Grande Sul.

Ricardo Barbosa Leonardos, Director Nominee

Ricardo Barbosa Leonardos will serve as a Director upon the completion of this offering. Currently, Mr. Leonardos is a founding partner of Symphony (since 2002), a family business consulting firm focused on governance, succession, financial planning and family office. In this role, Mr. Leonardos structured and was the CEO of the Diniz family office for five years. Additionally, Mr. Leonardos is the vice-chairman of the Tecnisa S.A.’s board of directors (since 2006), an independent board member of Biosev S.A./Louis Dreyfuss Group (since 2013), a member of the board of directors of Associação Umane (since 2016), an independent member of the board of ASG Holdings/Athena Saúde (since 2020) and serves on the advisory board of the family holding companies Componente (since 2010) and Jaguari (since 2019). With over 30 years of experience in the capital markets and investments, Mr. Leonardos has worked in mergers and acquisitions, IPOs, privatization processes, portfolio management and investment funds. Mr. Leonardos is certified as an advisor by the IBGC-Brazilian Institute of Corporate Governance, as a consultant for family businesses by the Family Firm Institute of Boston, as portfolio manager authorized by the Securities and Exchange Commission and as an analyst by APIMEC. Mr. Leonardos holds a bachelor’s degree in Economics from the Faculdade de Economica São Luis and an MBA from the Leonard N. Stern School of Business at New York University. He also holds a certificate in Technology Innovation in Planning Effective Investments in Technology Markets from Tel-Aviv University – Coller School of Management Business Leaders and in the Digital Immersion Program from Digital House of São Paulo.

Maria Cláudia Mello Guimarães, Director Nominee

Maria Cláudia Mello Guimarães will serve as a Director upon the completion of this offering. She is a partner at KPC Consulting Firm, a member of Petrobras’ Board of Directors, a member of Petrobras’ Audit Committee and president of Petrobras’ Environment, Safety and Health Committee. A former board member of Constellation Oil Services in Luxembourg, Ms. Guimarães also worked as Investment Banking Manager Director at Bank of America Merrill Lynch for almost 10 years. Before that, Ms. Guimarães had experiences at ING, Itaú Bank, Bank Boston and ABN AMRO working in several areas, such as investment banking, corporate finance, corporate banking, credit risk, debt restructuring and project finance, mainly focused on Natural Resources, Energy and Capital Goods companies. Additionally, Ms. Guimarães holds a bachelor’s degree in Engineering from Universidade Federal do Rio de Janeiro (UFRJ) with a master’s degree from COPPEAD - UFRJ.

9

Initial Business Combination

The Nasdaq rules require that our initial business combination must occur with one or more target businesses that together have an aggregate fair market value of at least 80% of the net assets held in the trust account (excluding the amount of deferred underwriting commissions held in the trust account and taxes payable on the income earned on the trust account) at the time of signing the agreement to enter into the initial business combination. Our board of directors will make the determination as to the fair market value of our initial business combination upon standards generally accepted by the financial community. If our board of directors is not able to independently determine the fair market value of the target business or businesses, or if we are considering an initial business combination with an affiliated entity, such transaction would be subject to approval by a majority of our independent and disinterested directors. We would not be required to obtain an opinion from a third party firm in such event to address whether the business combination is fair to our public shareholders from a financial point of view. We do not intend to purchase multiple businesses in unrelated industries in conjunction with our initial business combination. We also will not be permitted to effectuate our initial business combination with another blank check company or a similar company with nominal operations. Subject to these limitations, our directors and executive officers will have virtually unlimited flexibility in identifying and selecting one or more prospective businesses.

We may, at our option, pursue an acquisition opportunity jointly with Patria, or one or more parties affiliated with Patria, including without limitation officers and affiliates of Patria, funds associated with Patria or investors in such funds. Any such party may co-invest with us in the target business at the time of our initial business combination, or we could raise additional proceeds to complete the acquisition by borrowing from or issuing to such parties a class of equity or debt securities. The amount and other terms and conditions of any such joint acquisition or specified future issuance would be determined at the time thereof.

We anticipate structuring our initial business combination so that the post-business combination company in which our public shareholders own shares will own or acquire 100% of the equity interests or assets of the target business or businesses. We may, however, structure our initial business combination such that the post-business combination company owns or acquires less than 100% of such interests or assets of the target business in order to meet certain objectives of the prior owners of the target business, the target management team or shareholders or for other reasons. We will only complete such business combination if the post-business combination company owns or acquires 50% or more of the outstanding voting securities of the target or otherwise acquires a controlling interest in the target sufficient for it not to be required to register as an investment company under the Investment Company Act of 1940, as amended, or the Investment Company Act. Even if the post-business combination company owns or acquires 50% or more of the voting securities of the target, our shareholders prior to the business combination may collectively own a minority interest in the post-business combination company, depending on the relative valuations ascribed to the target and us in the business combination transaction. For example, we could pursue a transaction in which we issue a substantial number of new shares in exchange for all of the outstanding capital stock, shares or other equity interests of a target or issue a substantial number of new shares to third parties in connection with financing our initial business combination. In this case, we would acquire a 100% controlling interest in the target. However, as a result of the issuance of a substantial number of new shares, our shareholders immediately prior to our initial business combination could own less than a majority of our issued and outstanding shares subsequent to our initial business combination. If less than 100% of the equity interests or assets of a target business or businesses are owned or acquired by the post-business combination company, the portion of such business or businesses that is owned or acquired is what will be valued for purposes of the 80% of net assets test. If the business combination involves more than one target business, the 80% of net assets test will be based on the aggregate value of all of the target businesses and we will treat the target businesses together as the initial business combination for purposes of a tender offer or for seeking shareholder approval, as applicable.

The time required to select and evaluate a target business and to structure and complete our initial business combination, and the costs associated with this process, are not currently ascertainable with any degree of certainty. Any costs incurred with respect to the identification and evaluation of a prospective target business with which our initial business combination is not ultimately completed will result in our incurring losses and will reduce the funds we can use to complete another business combination.

10

Other Considerations

We currently do not have any specific business combination under consideration. Patria and our directors and officers are regularly made aware of potential business combination opportunities, one or more of which we may desire to pursue. However, we have not selected any business combination target and we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any business combination target.

In addition, certain of our directors and officers currently have, and any of them in the future may have additional, fiduciary and contractual duties to other entities, including without limitation Patria and funds associated with Patria or their current or former portfolio companies. These funds may have overlapping investment objectives and potential conflicts may arise with respect to Patria’s decision regarding how to allocate investment opportunities among these funds. If any of our directors and officers becomes aware of a business combination opportunity that is suitable for a fund or entity to which he or she has then-current fiduciary or contractual obligations (including, without limitation, any funds associated with Patria or their current or former portfolio companies), then, subject to their fiduciary duties under Cayman Islands law, he or she will need to honor such fiduciary or contractual obligations to present such business combination opportunity to such fund or entity, before we can pursue such opportunity. If Patria, funds associated with Patria or other entities decide to pursue any such opportunity, we may be precluded from pursuing the same. In addition, investment ideas generated within or presented to Patria or our directors and executive officers may be suitable for both us and Patria, a current or future Patria fund or one or more of their portfolio companies and, subject to applicable fiduciary duties or contractual obligations, will first be directed to Patria, such fund, investment vehicle or portfolio company before being directed, if at all, to us. However, we do not expect these fiduciary duties or contractual obligations to materially affect our ability to identify and pursue business combination opportunities or to complete our initial business combination. Our amended and restated memorandum and articles of association provide that, to the fullest extent permitted by applicable law: (i) no individual serving as a director or an officer shall have any duty, except and to the extent expressly assumed by contract, to refrain from engaging directly or indirectly in the same or similar business activities or lines of business as us; and (ii) we renounce any interest or expectancy in, or in being offered an opportunity to participate in, any potential transaction or matter which may be a corporate opportunity (including with respect to any business transaction that may involve another Patria entity) for any director or officer, on the one hand, and us, on the other. Accordingly, Patria and our directors or officers may not be obliged to present a business combination opportunity to us.

Our directors and officers or Patria or their affiliates, including funds associated with Patria, may sponsor, form or participate in other blank check companies similar to ours during the period in which we are seeking an initial business combination. Any such companies may present additional conflicts of interest in pursuing an acquisition target, particularly in the event there is overlap among investment mandates and the director and officer teams. However, we do not currently expect that any such other blank check company would materially affect our ability to identify and pursue business combination opportunities or to complete our initial business combination.

In addition, our officers and directors are not required to commit any specified amount of time to our affairs, and, accordingly, will have conflicts of interest in allocating time among various business activities, including identifying potential business combinations and monitoring the related due diligence. Moreover, our officers and directors, including our chief executive officer, are and in the future will be required to commit time and attention to Patria and current and future funds associated with Patria. To the extent any conflict of interest arises between, on the one hand, us and, on the other hand, any of such entities (including, without limitation, arising as a result of certain of officers and directors being required to offer acquisition opportunities to such entities), Patria and its affiliated funds will resolve such conflicts of interest in their sole discretion in accordance with their then existing fiduciary, contractual and other duties and there can be no assurance that such conflict of interest will be resolved in our favor.

Prior to the date of this prospectus, we will file a Registration Statement on Form 8-A with the SEC to voluntarily register our securities under Section 12 of the Securities Exchange Act of 1934, as amended, or the Exchange Act. As a result, we are subject to the rules and regulations promulgated under the Exchange Act. We have no current intention of filing a Form 15 to suspend our reporting or other obligations under the Exchange Act prior or subsequent to the consummation of our initial business combination.

11

Corporate Information

Our executive offices are located at 18 Forum Lane, 3rd floor, Camana Bay, PO Box 757, KY1-9006, Grand Cayman, Cayman Islands and our telephone number is +1 345-640-4900. Our website and the information contained on, or that can be accessed through, the website is not deemed to be incorporated by reference in, and is not considered part of, this prospectus or the registration statement of which this prospectus is a part.

We are a Cayman Islands exempted company. Exempted companies are Cayman Islands companies conducting business mainly outside the Cayman Islands and, as such, are exempted from complying with certain provisions of the Companies Act. As an exempted company, we have received a tax exemption undertaking from the Cayman Islands government that, in accordance with Section 6 of the Tax Concessions Act (As Revised) of the Cayman Islands, for a period of 20 years from the date of the undertaking, no law which is enacted in the Cayman Islands imposing any tax to be levied on profits, income, gains or appreciations will apply to us or our operations and, in addition, that no tax to be levied on profits, income, gains or appreciations or which is in the nature of estate duty or inheritance tax will be payable (i) on or in respect of our shares, debentures or other obligations or (ii) by way of the withholding in whole or in part of a payment of dividend or other distribution of income or capital by us to our shareholders or a payment of principal or interest or other sums due under a debenture or other obligation of us.

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We intend to take advantage of the benefits of this extended transition period.

We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our Class A ordinary shares that are held by non-affiliates equals or exceeds $700 million as of the prior June 30, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period. References herein to “emerging growth company” will have the meaning associated with it in the JOBS Act.

Additionally, we are a “smaller reporting company” as defined in Rule 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of any fiscal year for so long as either (1) the market value of our ordinary shares held by non-affiliates did not equal or exceed $250 million as of the prior June 30, or (2) our annual revenues did not equal or exceed $100 million during such completed fiscal year and the market value of our ordinary shares held by non-affiliates did not equal or exceed $700 million as of the prior June 30.

12

In making your decision on whether to invest in our securities, you should take into account not only the backgrounds of the members of our management team, but also the special risks we face as a blank check company and the fact that this offering is not being conducted in compliance with Rule 419 promulgated under the Securities Act. You will not be entitled to protections normally afforded to investors in Rule 419 blank check offerings. You should carefully consider these and the other risks set forth in the section below entitled “Risk Factors”.

| Securities offered: | 20,000,000 units (or 23,000,000 units if the underwriters’ over-allotment option is exercised in full), at $10.00 per unit, each unit consisting of:

· one Class A ordinary share; and

· one-half of one redeemable warrant.

|

| Nasdaq symbols: | Units: “PLAOU”

Class A Ordinary Shares: “PLAO”

Warrants: “PLAOW”

|

| Trading commencement and separation of Class A ordinary shares and warrants: |

Additionally, the units will automatically separate into their component parts and will not be traded after completion of our initial business combination.

|

| Separate trading of the Class A ordinary shares and warrants is prohibited until we have filed a Current Report on Form 8-K | In no event will the Class A ordinary shares and warrants be traded separately until we have filed with |

13

| the SEC a Current Report on Form 8-K which includes an audited balance sheet reflecting our receipt of the gross proceeds at the closing of this offering. We will file the Current Report on Form 8-K promptly after the closing of this offering, which closing is anticipated to take place three business days from the date of this prospectus. If the underwriters’ over-allotment option is exercised following the initial filing of such Current Report on Form 8-K, a second or amended Current Report on Form 8-K will be filed to provide updated financial information to reflect the exercise of the underwriters’ over-allotment option. | |

| Units: Number outstanding before this offering |

0 |

Number outstanding after this offering

|

20,000,000(1) |

| Ordinary

shares: Number outstanding before this offering |

5,750,000(2) |

| Number outstanding after this offering | 25,000,000(1)(3) |

| Warrants: Number of private placement warrants to be sold in a private placement simultaneously with this offering |

13,000,000(1) |

Number of warrants to be outstanding after this offering and the private placement

|

23,000,000(1)(4) |

|

(1) Assumes no exercise of the underwriters’ over-allotment option and the surrender of 750,000 founder shares to us for no consideration.

(2) Includes up to 750,000 founder shares that may be surrendered to us for no consideration depending on the extent to which the underwriters’ over-allotment option is exercised.

(3) Comprised of 20,000,000 Class A ordinary shares included in the units to be sold in this offering and 5,750,000 Class B ordinary shares (or founder shares). Founder shares are currently classified as Class B ordinary shares, which shares may be converted into Class A ordinary shares concurrently with or immediately following the consummation of our initial business combination on a one-for-one basis, subject to adjustment as described below adjacent to the caption “Founder shares conversion and anti-dilution rights.”

(4) Comprised of 10,000,000 public warrants included in the units to be sold in this offering and 13,000,000 private placement warrants to be sold in the private placement.

| |

| Exercisability | Each whole warrant offered in this offering is exercisable to purchase one Class A ordinary share. Only whole warrants are exercisable. No fractional warrants will be issued upon separation of the units and only whole warrants will trade.

We structured each unit to contain one-half of one warrant, with each whole warrant exercisable for one Class A ordinary share, as compared to units issued by certain other blank check companies which contain

|

14

| whole warrants exercisable for one whole share, in order to reduce the dilutive effect of the warrants upon completion of a business combination, thus making us, we believe, a more attractive business combination partner for target businesses. | |

| Exercise price | $11.50 per share, subject to adjustments as described herein. In addition, if (x) we issue additional Class A ordinary shares or equity-linked securities for capital raising purposes in connection with the closing of our initial business combination at an issue price or effective issue price of less than $9.20 per Class A ordinary share (with such issue price or effective issue price to be determined in good faith by our board of directors and, in the case of any such issuance to our initial shareholders or their affiliates, without taking into account any founder shares held by our initial shareholders or such affiliates, as applicable, prior to such issuance) (the “Newly Issued Price”), (y) the aggregate gross proceeds from such issuances represent more than 60% of the total equity proceeds, and interest thereon, available for the funding of our initial business combination (net of redemptions), and (z) the volume weighted average trading price of our Class A ordinary shares during the 20 trading day period starting on the trading day prior to the day on which we consummate our initial business combination (such price, the “Market Value”) is below $9.20 per share, the exercise price of the warrants will be adjusted (to the nearest cent) to be equal to 115% of the higher of the Market Value and the Newly Issued Price, the $18.00 per share redemption trigger price described adjacent to “Redemption of warrants when the price per share of Class A ordinary shares equals or exceeds $18.00” will be adjusted (to the nearest cent) to be equal to 180% of the higher of the Market Value and the Newly Issued Price, and the $10.00 per share redemption trigger price described adjacent to the caption “Redemption of warrants when the price per share of Class A ordinary shares equals or exceeds $10.00” will be adjusted (to the nearest cent) to be equal to the higher of the Market Value and the Newly Issued Price. |

| Exercise period | The warrants will become exercisable on the later of:

· 30 days after the completion of our initial business combination, and

· 12 months from the closing of this offering;

provided, in each case, that we have an effective registration statement under the Securities Act covering the Class A ordinary shares issuable upon exercise of the warrants and a current prospectus

|

15

relating to them is available and such shares are registered, qualified or exempt from registration under the securities, or blue sky, laws of the state of residence of the holder (or we permit holders to exercise their warrants on a cashless basis under the circumstances specified in the warrant agreement). If and when the warrants become redeemable by us, we may exercise our redemption right even if we are unable to register or qualify the underlying securities for sale under all applicable state securities laws.

We are not registering the Class A ordinary shares issuable upon exercise of the warrants at this time. However, we have agreed that as soon as practicable, but in no event later than 15 business days after the closing of our initial business combination, we will use our commercially reasonable efforts to file with the SEC and have an effective registration statement covering the Class A ordinary shares issuable upon exercise of the warrants and to maintain a current prospectus relating to those Class A ordinary shares until the warrants expire or are redeemed, as specified in the warrant agreement. If a registration statement covering the Class A ordinary shares issuable upon exercise of the warrants is not effective by the 60th business day after the closing of our initial business combination, warrant holders may, until such time as there is an effective registration statement and during any period when we will have failed to maintain an effective registration statement, exercise warrants on a “cashless basis” in accordance with Section 3(a)(9) of the Securities Act or another exemption. Notwithstanding the above, if our Class A ordinary shares are at the time of any exercise of a warrant not listed on a national securities exchange such that they satisfy the definition of a “covered security” under Section 18(b)(1) of the Securities Act, we may, at our option, require holders of public warrants who exercise their warrants to do so on a “cashless basis” in accordance with Section 3(a)(9) of the Securities Act and, in the event we so elect, we will not be required to file or maintain in effect a registration statement, and in the event we do not so elect, we will use our commercially reasonable efforts to register or qualify the shares under applicable blue sky laws to the extent an exemption is not available.