As filed with the Securities and Exchange Commission on May 6, 2024

Registration No. 333-276130

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION

STATEMENT

UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 3721 | ||||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

OneMedNet Corporation

Telephone:

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, DE 19801

Telephone: 302-658-7581

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Rimon P.C.

Telephone:

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large-accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large-accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large-accelerated filer ☐ | Accelerated filer ☐ |

| Smaller

reporting company | |

| Emerging

growth company |

If

an emerging growth company, indicate by check market if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED MAY __, 2024 |

Primary Offering of

Up to 12,085,275 Shares of Common Stock

Upon the Exercise of Warrants

Secondary Offering of

Up to 19,683,367 Shares of Common Stock

Up to 681,019 Warrants

This prospectus relates to the primary issuance by us of up to an aggregate of 12,085,275 shares of common stock, par value $0.0001 per share (the “Common Stock”), of OneMedNet Corporation, a Delaware corporation (“we,” “us,” the “Company” and “OneMedNet”), which consists of (i) up to 11,500,000 shares of Common Stock issuable upon the exercise of 11,500,000 warrants (the “Public Warrants”) originally issued and registered in the initial public offering of Data Knights Acquisition Corp” as a special purpose acquisition company (“DKAC”) at a price of $10.00 per unit with each unit consisting of one share of Class A common stock and one warrant (each Public Warrant entitles the holder thereof to purchase one share of Class A common stock at a price of $11.50 per share), and (ii) up to an aggregate of 585,275 shares of Common Stock issuable upon the exercise of 585,275 warrants (the “Placement Warrants,” together with the Public Warrants, the “Warrants”) that made up a part of the private units originally issued in a private placement in connection with DKAC’s initial public offering at a price of $10.00 per unit, for an aggregate purchase price of $5,852,750. We will receive the proceeds from any exercise of the Warrants for cash.

This prospectus also relates to the offer and resale from time to time, upon the expiration of lock-up agreements, if applicable, by: (a) the selling shareholders named in this prospectus (including their permitted transferees, donees, pledgees and other successors-in-interest) (collectively, the “Selling Securityholders”) of up to an aggregate of 19,683,367 shares of Common Stock consisting of (i) 797,872 shares of Common Stock upon conversion of up to $1,595,744.70 of OneMedNet Senior Secured Convertible Notes (the “Pre-Closing PIPE Notes”) issued at the closing of the Business Combination (as defined below) that are convertible into shares of Common Stock at the PIPE investors election at a conversion price equal to the lower of (i) $10.00 per share, and (ii) 92.5% of the lowest volume weighted average trading price for the ten (10) trading days immediately preceding the Conversion Date, subject to a floor price of $2.00 per share of common stock pursuant to the terms of the Securities Purchase Agreement dated June 28, 2023, by and among Data Knights Acquisition Corp, a Delaware corporation (“Data Knights”) and the named investors (the “Pre-Closing PIPE”), (ii) 95,744 shares underlying 95,744 warrants issued to the PIPE investors as additional consideration for the PIPE investors investment in the Pre-Closing PIPE Notes, which Warrant Agreements were executed at the closing of the Business Combination, (iii) 7,312,817 shares of Common Stock upon conversion (the “Conversion Shares) of up to $4,547,500 of funding to the Company pursuant to the Securities Purchase Agreement and convertible promissory notes dated March 28, 2024 (the “PIPE Notes Financing”), at the price of $0.62 per share of Common Stock, with Helena Global Investment Opportunities 1 Ltd. (the “Notes Investor”), (iv) 3,656,408 shares underlying 3,656,408 warrants issued to the Notes Investor as additional consideration for the PIPE Notes Financing with the Notes Investor, (v) 277,778 shares of Common Stock issued pursuant to the terms of the Satisfaction and Discharge Agreement at $10.88 per share of Common Stock dated as of June 28, 2023, by and among the Company, Data Knights, and EF Hutton LLC (“EF Hutton”), (vi) 1,315,840 shares of Common Stock issuable pursuant to the outstanding loans converted to equity at $1.00 per share of Common Stock to Data Knights to fund its extension payments prior to the Business Combination by certain of the Selling Securityholders named in this prospectus, (vii) 1,439,563 shares of Common Stock issued upon the closing of the Business Combination to ARC Group Limited, as consideration for its financial advisory services at a cash price of $0.00 per share of Common Stock, (viii) 1,327,070 shares of Common Stock at $0.7535 per share of Common Stock (95% of VWAP 10-day average $0.7932) for $1,000,000 investment by Dr. Thomas Kosasa, and (ix) 3,609,859 shares of Common Stock issued to Data Knights LLC (the “Sponsor”) and its affiliates, including 2,875,000 shares of Common Stock originally issued as share of Class B Stock in connection with the initial public offering of DKAC for aggregate consideration of $25,000, or approximately $0.009 per share, and 585,275 shares of Common Stock originally issued to Sponsor as part of the Placement Units issued to the Sponsor in connection with DKAC’s initial public offering at $10.00 per unit, and which are subject to six month lock-up restrictions set forth herein; and (b) the selling warrant holders named in this prospectus (including their permitted transferees, donees, pledgees and other successors-in-interest) (collectively, the “Selling Warrantholders” and, together with the Selling Shareholders and including their permitted transferees, the “Selling Securityholders”) of up to an aggregate of 585,275 Placement Warrants. Even though the current trading price is at or significantly below DKAC’s initial public offering price, the private investors have an incentive to sell because they will still profit on sales because of the lower price that they purchased their shares than the public investors.

On April 25, 2022, the Company, Data Knights Merger Sub, Inc., a Delaware corporation (“Merger Sub”), and Data Knights, LLC, the Company’s sponsor (the “Sponsor”), entered into a definitive Agreement and Plan of Merger (the “Merger Agreement”) with OneMedNet Corporation, Inc., a Delaware corporation (the “Target,” which has since been renamed “OneMedNet Solutions Corporation”), and together with the Company and Merger Sub, the “Parties”) and Paul Casey, as seller representative (“Casey”). Pursuant to the Merger Agreement, upon the closing (the “Closing”) of the transactions contemplated in the Merger Agreement (collectively, the “Business Combination”), the Parties would consummate the merger of Merger Sub with and into the Target, with the Target continuing as the surviving entity (the “Merger”), which would result in all of the issued and outstanding capital stock of the Target being exchanged for shares of the Company’s Common Stock upon the terms set forth in the Merger Agreement. The Merger and Merger Agreement and the related transactions were approved unanimously by the boards of directors of each of the Company and the Target.

As described herein, the Selling Securityholders named in this prospectus or their permitted transferees, may resell from time to time up to 19,683,367 shares of our Common Stock and 681,019 Warrants. We are registering the offer and sale of these securities to satisfy certain registration rights we have granted. The Selling Securityholders may offer, sell or distribute all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of our shares of our Common Stock or Warrants, except with respect to amounts received by us upon the exercise of the Warrants. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sale of shares of our Common Stock or Warrants. See section entitled “Plan of Distribution” beginning on page 61 of this prospectus.

Our Common Stock and warrants are listed on The Nasdaq Stock Market LLC (“Nasdaq”) under the symbols, “ONMD” and “ONMDW.” As of April 15, 2024, we had approximately 23,850,010 shares of Common Stock and 12,181,019 warrants outstanding. On April 15, 2024, the last reported closing price of our of Common Stock and warrants as reported on Nasdaq was $0.68 per share and $0.180 per warrant. While the Sponsor, private placement investors, PIPE investors and other Selling Securityholders may experience a positive rate of return based on the current trading price of the Company’s Common Stock, the public securityholders may not experience a similar rate of return on the securities they purchased due to differences in the purchase prices and the current trading price. Even though the current trading price is at or significantly below DKAC’s initial public offering price, the private investors have an incentive to sell because they will still profit on sales because of the lower price that they purchased their shares than the public investors.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements. We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 32 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated ______, 2024.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or any supplement. Neither we nor the Selling Securityholders have authorized anyone else to provide you with different information. The securities offered by this prospectus are being offered only in jurisdictions where the offer is permitted. You should not assume that the information in this prospectus or any supplement is accurate as of any date other than the date on the front of each document. Our business, financial condition, results of operations and prospects may have changed since that date.

Except as otherwise set forth in this prospectus, neither we nor the Selling Securityholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

| i |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC using a “shelf” registration process. By using a shelf registration statement, the Selling Securityholders may sell up to 19,683,367 shares of Common Stock and up to 681,019 Warrants from time to time in one or more offerings as described in this prospectus. We will not receive any proceeds from the sale of Common Stock or Warrants by the Selling Securityholders. This prospectus also relates to the issuance by up to 12,085,275 Common Stock upon the exercise of Warrants. We will receive the proceeds from any exercise of the Warrants for cash.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment, as the case may be, may add, update or change information contained in this prospectus with respect to such offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any of the Common Stock or Warrants, you should carefully read this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, together with the additional information described under “Where You Can Find More Information.”

Neither we nor the Selling Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, prepared by or on behalf of us or to which we have referred you. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the Selling Securityholders will not make an offer to sell the Common Stock or Warrants in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, is accurate only as of the date on the respective cover. Our business, prospects, financial condition or results of operations may have changed since those dates. This prospectus contains, and any prospectus supplement or post-effective amendment may contain, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable. Accordingly, investors should not place undue reliance on this information.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information contained in this prospectus concerning our industry and the regions in which we operate, including our general expectations and market position, market opportunity, market share and other management estimates, is based on information obtained from various independent publicly available sources and other industry publications, surveys and forecasts. While we believe that the market data, industry forecasts and similar information included in this prospectus are generally reliable, such information is inherently imprecise. In addition, assumptions and estimates of our future performance and growth objectives and the future performance of our industry and the markets in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those discussed under the headings “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus.

Information contained in this prospectus concerning our industry, market and competitive position data in this prospectus from our own internal estimates and research as well as from publicly available information, industry and general publications and research, surveys and studies conducted by third parties.

| 1 |

Industry publications and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but such information is inherently imprecise. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve risks and uncertainties. You should not place undue reliance on these forward-looking statements. All statements other than statements of historical facts contained in this prospectus are forward-looking statements. The forward-looking statements in this prospectus are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition, and results of operations. In some cases, you can identify these forward-looking statements by terms such as “anticipate,” “believe,” “continue,” “could,” “depends,” “estimate,” “expects,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms or other similar expressions, although not all forward-looking statements contain those words. We have based these forward-looking statements on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, strategy, short- and long-term business operations and objectives, and financial needs. These forward-looking statements include, but are not limited to, statements concerning the following:

| ● | our projected financial position and estimated cash burn rate; | |

| ● | our estimates regarding expenses, future revenues and capital requirements; | |

| ● | our ability to continue as a going concern; | |

| ● | our need to raise substantial additional capital to fund our operations; | |

| ● | our ability to compete in the global space industry; | |

| ● | our ability to obtain and maintain intellectual property protection for our current products and services; | |

| ● | our ability to protect our intellectual property rights and the potential for us to incur substantial costs from lawsuits to enforce or protect our intellectual property rights; | |

| ● | the possibility that a third party may claim we have infringed, misappropriated or otherwise violated their intellectual property rights and that we may incur substantial costs and be required to devote substantial time defending against these claims; | |

| ● | our reliance on third-party suppliers and manufacturers; | |

| ● | the success of competing products or services that are or become available; | |

| ● | our ability to expand our organization to accommodate potential growth and our ability to retain and attract key personnel; and | |

| ● | the potential for us to incur substantial costs resulting from lawsuits against us and the potential for these lawsuits to cause us to limit our commercialization of our products and services. |

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

| 2 |

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus to conform these statements to actual results or to changes in our expectations.

You should read this prospectus and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements including those described in the “Risk Factors” section beginning on page 32 and elsewhere in this prospectus.

TRADEMARKS AND COPYRIGHTS

We own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect the content of our products and the formulations for such products. This prospectus may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this prospectus are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY AND

A SMALLER REPORTING COMPANY

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). For so long as we remain an emerging growth company, we are permitted, and currently intend, to rely on the following provisions of the JOBS Act that contain exceptions from disclosure and other requirements that otherwise are applicable to public companies and file periodic reports with the SEC. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements and selected financial data and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our periodic reports and registration statements, including this prospectus, subject to certain exceptions; | |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (“SOX”); | |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements, and registration statements, including in this prospectus; | |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; and | |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We will remain an emerging growth company until the earliest to occur of:

| ● | December 31, 2028 (the last day of the fiscal year that follows the fifth anniversary of the completion of our initial public offering); |

| ● | the last day of the fiscal year in which we have total annual gross revenue of at least $1.235 billion; | |

| ● | the date on which we are deemed to be a “large-accelerated filer,” as defined in the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”); and | |

| ● | the date on which we have issued more than $1 billion in non-convertible debt over a three-year period. |

We have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in our future filings with the SEC. As a result, the information that we provide to holders of our Common Stock may be different than what you might receive from other public reporting companies in which you hold equity interests. We have elected to avail ourselves of the provision of the JOBS Act that permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. As a result, we will not be subject to new or revised accounting standards at the same time as other public companies that are not emerging growth companies.

We are also a “smaller reporting company” as defined in the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies until the fiscal year following the determination that our voting and non-voting common stock held by non-affiliates is $250 million or more measured on the last business day of our second fiscal quarter, or our annual revenues are less than $100 million during the most recently completed fiscal year and our voting and non-voting common stock held by non-affiliates is $700 million or more measured on the last business day of our second fiscal quarter.

| 3 |

PROSPECTUS SUMMARY

This summary of the prospectus highlights material information concerning our business and this offering. This summary does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, including the information presented under the section entitled “Risk Factors” and the financial data and related notes, before making an investment decision. It does not contain all the information that may be important to you and your investment decision. You should carefully read this entire prospectus, including the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes included elsewhere in this prospectus. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of factors such as those set forth in “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

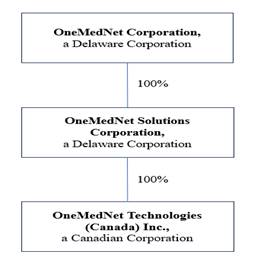

In this prospectus, unless the context indicates otherwise, “OneMedNet,” the “Company,” “we,” “our,” “ours” or “us” refer to OneMedNet Corporation a Delaware corporation, and its direct and indirect subsidiaries, including, but not limited to, OneMedNet Solutions Corporation, a Delaware corporation and its wholly-owned subsidiary, OneMedNet Technologies (Canada) Inc., incorporated on October 16, 2015 under the provisions of the Business Corporations Act of British Columbia whose functional currency is the Canadian dollar.

We have not authorized anyone to provide you with different information and you must not rely on any unauthorized information or representation. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. This document may only be used where it is legal to sell these securities. You should assume that the information appearing in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus, or any sale of our Common Stock. Our business, financial condition and results of operations may have changed since the date on the front of this prospectus. We urge you to carefully read this prospectus before deciding whether to invest in any of the Common Stock being offered.

The Company

OneMedNet Corporation a Delaware corporation (the “Company,” “we,” “us,” or “OneMedNet”) together with its wholly-owned subsidiary OneMedNet Solutions Corporation, a Delaware corporation, founded in 2009 and incorporated in November 20, 2015, and its wholly-owned subsidiary, OneMedNet Technologies (Canada) Inc., incorporated on October 16, 2015 under the provisions of the Business Corporations Act of British Columbia whose functional currency is the Canadian dollar. All refences in this prospectus to the “Company,” “we,” “us,” or “OneMedNet” include OneMedNet Solutions Corporation.

Corporate History

We were originally incorporated in Delaware on February 8, 2021 under the name “Data Knights Acquisition Corp” as a special purpose acquisition company, formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

On May 11, 2021, we consummated an initial public offering (the “Initial Public Offering”). The registration statement for the Company’s Initial Public Offering was declared effective on May 6, 2021. The Company’s Initial Public Offering of 10,000,000 units (the “Units” and, with respect to the Common Stock included in the Units being offered, the “Public Shares”), at $10.00 per Unit, generated gross proceeds of $100,000,000. The Company granted the underwriter a 45-day option to purchase up to an additional 1,500,000 Units at the Initial Public Offering price to cover over-allotments, which the underwriters exercised the over-allotment option in full, and the closing of the issuance and sale of the additional Units occurred (the “Over-allotment Option Units”). The total aggregate issuance by the Company of 1,500,000 units at a price of $10.00 per unit resulted in total gross proceeds of $15,000,000. Simultaneously with the consummation of the closing of the Offering, the Company consummated the private placement of an aggregate of 585,275 units (the “Placement Units”) to the Sponsor at a price of $10.00 per Placement Unit, generating total gross proceeds of $5,852,750 (the “Private Placement”).

| 4 |

The Placement Units were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended, as the transactions did not involve a public offering. A total of $117,300,000, comprised of the proceeds from the Offering and the proceeds of private placements that closed on May 11, 2021, net of the underwriting commissions, discounts, and offering expenses, was deposited in a trust account established for the benefit of the Company’s public stockholders. On June 22, 2021, the Common Stock and Public Warrant included in the Units began separate trading.

No payments for our expenses were made in the offering described above directly or indirectly to (i) any of our directors, officers or their associates, (ii) any person(s) owning 10% or more of any class of our equity securities or (iii) any of our affiliates, except in connection with the repayment of outstanding loans and pursuant to the administrative support agreement disclosed herein which we entered into with our sponsor.

On April 25, 2022, the Company, Data Knights Merger Sub, Inc., a Delaware corporation (“Merger Sub”), and Data Knights, LLC, the Company’s sponsor (the “Sponsor”), entered into a definitive Agreement and Plan of Merger (the “Merger Agreement”) with OneMedNet Corporation, Inc., a Delaware corporation (the “Target,” which has since been renamed “OneMedNet Solutions Corporation”), and together with the Company and Merger Sub, the “Parties”) and Paul Casey, as seller representative (“Casey”). Pursuant to the Merger Agreement, upon the closing (the “Closing”) of the transactions contemplated in the Merger Agreement (collectively, the “Business Combination”), the Parties would consummate the merger of Merger Sub with and into the Target, with the Target continuing as the surviving entity (the “Merger”), which would result in all of the issued and outstanding capital stock of the Target being exchanged for shares of the Company’s Common Stock upon the terms set forth in the Merger Agreement. The Merger and Merger Agreement and the related transactions were approved unanimously by the boards of directors of each of the Company and the Target.

On December 31, 2022, substantially all of the assets held in the Trust Account were held in mutual funds.

On June 28, 2023, the Company executed a Securities Purchase Agreement for PIPE financing in the aggregate original principal amount of $1,595,744.70 and a purchase price of $1.5 million (the “Pre-Closing PIPE”). Pursuant to the Securities Purchase Agreement, the Company agreed to issue and sell to each of Thomas Kosasa, Dr. Jeffrey Yu, Aaron Green and Steve Kester (the “PIPE Investors”), a new series of senior secured convertible notes (the “Pre-Closing PIPE Notes”), which Notes shall be convertible into shares of Common Stock at the PIPE Investors election at the conversion price (rounded to the nearest 1/100th of one cent) which shall be computed as the lesser of:

(a) with respect to a conversion pursuant to Section 4.1 of the Securities Purchase Agreement (discussed below), the lesser of: (i) a price per share equal to the product of (x) 100% less the Discount and (y) the lowest per share purchase price of the Equity Securities issued in the Next Equity Financing; and (ii) $2.50 per share; and

(b) with respect to a conversion pursuant to Section 4.2 (discussed below), (relating to payment at maturity) or Section 4.3, $2.50 per share. The Securities Purchase agreement provided that the PIPE Investors’ $1.5 million investment in the Pre-Closing PIPE Notes would close and fund contemporaneous to the Closing of the Business Combination.

Section 4.1 of the Securities Purchase Agreement provides that the principal balance and unpaid accrued interest on each Note will automatically convert into the PIPE Conversion Shares upon the closing of the Next Equity Financing (“Next Equity Financing” means the next sale or series of related sales by the Company of its Common Stock in one or more offerings relying on Section 4(a)(2) of the Securities Act or Regulation D thereunder for exemption from the registration requirements of Section 5 of the Securities Act, from which the Company receives gross proceeds of not less than US$5,000,000 (excluding, for the avoidance of doubt, the aggregate principal amount of the Notes).

Section 4.2 of the Securities Purchase Agreement provides that in the event of a Corporate Transaction or the repayment of such Note, at the closing of a corporate transaction, the holder of each Note may elect that either: (a) the Company will pay the holder of such Note an amount equal to the sum of (x) the outstanding principal balance of such Note, and (y) a premium equal to 20% of the outstanding principal balance of such Note (which premium, is in lieu of all accrued and unpaid interest due on such Note); or (b) such Note will convert into that number of Conversion Shares equal to the quotient (rounded down to the nearest whole share) obtained by dividing (x) the outstanding principal balance and unpaid accrued interest of such Note on a date that is no more than five days prior to the closing of such corporate transaction by (y) the applicable Conversion Price.

| 5 |

Notwithstanding the foregoing, any sale (or series of related sales) of the Company’s Equity Securities to a special purpose acquisition company will not be deemed a “Next Equity Financing. Notwithstanding the foregoing, the Company may, at its option, pay any unpaid accrued interest on each Note in cash at the time of conversion. The number of PIPE Conversion Shares the Company issues upon such conversion will equal the quotient (rounded down to the nearest whole share) obtained by dividing (x) the outstanding principal balance and unpaid accrued interest under each converting Note on a date that is no more than five days prior to the closing of the Next Equity Financing by (y) the applicable Conversion Price. At least five days prior to the closing of the Next Equity Financing, the Company will notify the holder of each Note in writing of the terms of the Equity Securities that are expected to be issued in such financing. The issuance of PIPE Conversion Shares pursuant to the conversion of each Note will be on, and subject to, the same terms and conditions applicable to the Equity Securities issued in the Next Equity Financing.

Also on June 28, 2023, EF Hutton LLC (“EF Hutton”) waived $3,025,000 of the $4,025,000 cash deferred underwriting commission do to it at the Closing of the Business Combination, pursuant to a Satisfaction and Discharge Agreement. In accordance with the Satisfaction and Discharge Agreement, EF Hutton accepted, in lieu of the cash deferred underwriting commission due at closing (i) a one-time cash payment of $500,000 at the time of the Closing; (ii) a $500,000 promissory note executed by the Company on June 30, 2023 in which it is obligated to make six monthly payments to EF Hutton in the cash amount of $83,333.33 commencing after the Closing; and (iii) 277,778 shares of common stock of the Company (the “Common Stock”) at $10.89 per share, for an aggregate value of $3,025,000.

On September 21, 2023, the Securities and Exchange Commission (the “SEC”) declared effective the Company’s registration statement and proxy statement/prospectus on Form S-4 (the “Definitive Proxy”).

As of the close of business on September 20, 2023 (the “Record Date”), 5,172,973 shares of common stock of the Company (the “Common Stock”) were issued and outstanding and entitled to vote at the Special Meeting. On October 17, 2023, the Company held a special meeting of its stockholders (the “Stockholders”) in lieu of its 2023 annual meeting of Stockholders (the “Special Meeting”) in connection with the transactions contemplated by the Merger Agreement. At the Special Meeting, the Stockholders were asked to consider and vote on the proposals identified in the Definitive Proxy; 4,690,565 shares of Common Stock were represented in person or by proxy at the Special Meeting, and, therefore, a quorum was present and all proposal were approved.

On November 7, 2023, we held the Closing of the previously announced Merger whereby Merger Sub merged with and into OneMedNet Solutions Corporation (formerly named OneMedNet Corporation), with OneMedNet Solutions Corporation continuing as the surviving entity, which resulted in all of the issued and outstanding capital stock of OneMedNet Solutions Corporation being exchanged for shares of the Company’s Common Stock upon the terms set forth in the Merger Agreement. The Merger and other transactions that closed on November 7, 2023, pursuant to the Merger Agreement, led to Data Knights changing its name to “OneMedNet Corporation” and the business of the Company became the business of OneMedNet Solutions Corporation.

Pursuant to the terms of the Merger Agreement, the total consideration for the Business Combination and related transactions (the “Merger Consideration”) was approximately $200 million. In connection with the Special Meeting, certain public holders (the “Redeeming Stockholders”) holding 1,600,741 shares of Common Stock exercised their right to redeem such shares for a pro rata portion of the funds held by Continental Stock Transfer & Trust Company, as trustee (“Continental”) in the trust account established in connection with Data Knights’ initial public offering (the “Trust Account”).

Effective November 7, 2023, Data Knights’ units ceased trading, and effective November 8, 2023, OneMedNet’s common stock began trading on the Nasdaq Capital Market under the symbol “ONMD” and the warrants began trading on the Nasdaq Capital Market under the symbol “ONMDW.”

As a result of the Merger and the Business Combination, holders of Data Knights common stock automatically received common stock of OneMedNet, and holders of Data Knights warrants automatically received warrants of OneMedNet with substantively identical terms. At the Closing of the Business Combination, all shares of Data Knights owned by the Sponsor (consisting of shares of Common Stock and shares of Class B common stock, which we refer to as the founder shares), automatically converted into an equal number of shares of OneMedNet’s Common Stock, and the Private Placement Warrants held by the Sponsor, automatically converted into warrants to purchase one share of OneMedNet Common Stock with substantively identical terms.

| 6 |

Effective as of the Closing on November 7, 2023, among other holders, public stockholders own 98,178 shares of OneMedNet Common Stock approximately representing 0.35% of the outstanding shares of OneMedNet Common Stock; the Sponsor and its affiliates own approximately 15.1% of the outstanding shares of OneMedNet common stock (inclusive of shares received upon conversion of the Sponsor’s loan); OneMedNet’s former security holders own approximately 61.992% of the outstanding shares of OneMedNet common stock from the conversion of their shares; PIPE investors own 0.46% of the outstanding shares of OneMedNet Common Stock and former convertible note holders own approximately 16.24% of the outstanding shares of OneMedNet Common Stock resulting from the issuance of 5,238,800 shares of Common Stock upon conversion of their notes.

On March 28, 2024, the Company entered into a definitive securities purchase agreement (the “Notes Securities Purchase Agreement”) with Helena Global Investment Opportunities 1 Ltd. (the “Notes Investor”), an affiliate of Helena Partners Inc., a Cayman-Islands based advisor and investor providing for up to USD$4.54 million in funding through a private placement (the “PIPE Notes Financing”) for the issuance of senior secured convertible notes (the “PIPE Notes”). In connection with the issuance of the Notes, the Company will issue to the Investor common stock purchase warrants (the “Warrants”) across multiple tranches (the “Tranches”) consisting of an initial tranche (the “Initial Tranche”) of (i) an aggregate principal amount $2,000,000.00 and including an original issue discount (“OID”) of up to an aggregate of $300,000.00 plus Warrants to purchase a number of shares of Common Stock equal to the applicable Warrant Share Amounts (defined below). The second tranche (the “Second Tranche”) consists of an aggregate principal amount of Notes of up to $350,000.00 and including an OID of up to $52,500.00 and Warrants to purchase a number of shares of Common Stock equal to the applicable Warrant Share Amounts with respect to such Tranche. The Notes Securities Purchase Agreement contemplates three subsequent Tranches each of which shall be in an aggregate principal amount of Notes of up to $1,000,000 each and each including an OID of 15.0% of the applicable principal amount, and Warrants to purchase a number of shares of Common Stock equal to the applicable Warrant Share Amounts with respect to such Tranches.

The purchase price of a PIPE Note and its accompanying Warrant shall be computed by subtracting the portion of the OID represented by that such PIPE Note from the portion of the principal amount represented by such Note (a “Purchase Price”).

The Notes Securities Purchase Agreement defines Warrant Share Amounts means in respect of any Warrant issued in a Closing the initial amount of shares of Common Stock (the “Warrant Shares”) for which such Warrant may be exercised and which shall be equal to the applicable principal amount of the Note issued to the Investor in such closing multiplied by 50% and divided by the 95% of lowest VWAP over the ten Trading Day period immediately preceding the applicable Closing Date.

In connection with the closings of each Tranche, a portion of the proceeds will be held in escrow (the “Escrow”) pursuant to an executed Escrow Agreement dated as of March 28, 2024 in accordance with the following: (i) $1,350,000.00 of the net proceeds of the Initial Tranche will be paid into the Escrow Account for distribution in accordance with the release of proceeds conditions (the “Release Conditions” discussed below), with the balance of the net proceeds paid to the Company less initial closing expenses relating to such Initial Tranche; (ii) 100% of the net proceeds of the Third Tranche shall be paid into the Escrow Account for distribution in accordance with the Release Conditions; and (iii) 75% of the net proceeds of the Third Tranche shall be paid into the Escrow Account for distribution in accordance with the Release Conditions with the balance of the net proceeds of the Third Tranche being paid to the Company less initial closing expenses relating to such Third Tranche.

| 7 |

The Securities Purchase Agreement provides that the amounts in Escrow (the “Escrowed Proceeds”) related to the Initial Tranche, Second Tranche and Third Tranche are governed by the following terms:

| a) | The Escrowed Proceeds will be released to the Investor for payment amounts owing in respect of the Notes, if the closing price of the Common Stock shall have been less than the then Floor Price (as defined in the Notes) for a period of 10-consecutive trading days, or an event of default shall have occurred; | |

| b) | The Escrowed Proceeds will be released to the Company if the aggregate outstanding amount is equal to zero; | |

| c) | If on the date that is 20 trading days following the closing of the Initial Tranche, the aggregate outstanding amount is more than zero but less than $1,700,000.00, then the Escrowed Proceeds will be released to the Company in an amount equal to the difference between $1,700,000.00 and the aggregate outstanding amount; and | |

| d) | If on the date that is 40 trading days following the Closing Date of the Initial Tranche and every 20 trading days thereafter, the aggregate outstanding amount is more than zero but less than $1,700,000.00 minus the amount of any prior disbursement from the Escrow Account pursuant to this provision (d) or provision (c) above (the “Adjusted Escrow Reference Amount”), then the Escrowed Proceeds will be released to the Company an amount equal to the difference between the Adjusted Escrow Reference Amount and such aggregate outstanding amount. |

In connection with the Notes Securities Purchase Agreement, the Company and the Investor also entered into a Registration Rights Agreement, dated as of March 28, 2024 (the “RRA”), providing for the registration of the Note shares (the “Note Conversion Shares”) and the Warrant Shares (the “Registerable Securities”). The Company has agreed to prepare and file a registration statement (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) promptly, and in any event within 30 days of the closing of the private placement. The Company has granted the Investor customary indemnification rights in connection with the Registration Rights Agreement. The Investors have also granted the Company customary indemnification rights in connection with the Registration Statement.

The securities to be issued pursuant to the Notes Securities Purchase Agreement was made in reliance on the exemption from registration provided by Section 3(a)(9) of the Securities Act of 1933, as amended (the “Securities Act”), as promulgated by the Securities and Exchange Commission under the Securities Act.

Who We Are

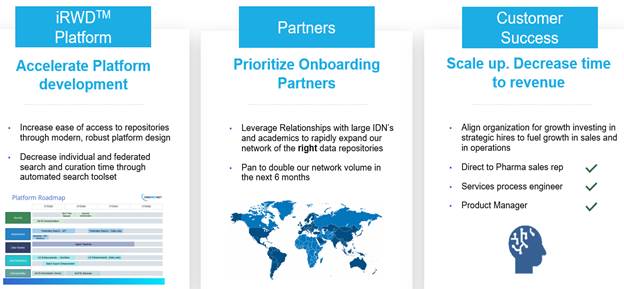

We are OneMedNet, and our goal is to be a leader in the future of regulatory-grade Imaging Real Word Data (“RWD”) through our intelligent, thoughtful and inclusive iRWDTM solution. We strive to revolutionize access fast and secure access to curated medical images with our strategic thinking, successful market entry and execution to continue to open new possibilities for providing clinical imaging evidence.

We are bold, decisive and eager to advance a global platform for our OneMedNet iRWD™ solution.

We aim to constantly push boundaries in our approach to technology, service innovation, customer engagement and curation excellence, all for the sake of delivering an exceptional customer experience.

Our mission is affect a material positive impact on the lives of tens of millions of people while improving our customers’ business productivity. First and foremost, OneMedNet’s iRWDTM offering plays a significant role in enabling Life Science companies to bring safer and more effective patient care to market sooner. Using our highly curated de-identified clinical data in our iRWDTM offering in Life Science product development, validation, and regulatory approval processes, they contribute to patient care advancements in more meaningful ways, which Life Sciences industry can improve their product development and validation processes, which benefits all parties.

At OneMedNet, our motto is to “Unlock the Value in Imaging ArchivesTM”. By utilizing OneMedNet’s iRWDTM offering, providers can greatly improve their research efforts with streamlined data access. Health care providers such as hospitals, clinics, and imaging centers can also accelerate life science patient care innovations by sharing de-identified data in a well-defined and de-identified and secure manner. In return for doing so, income is generated and applied to critical and possibly unfunded provider projects. In that spirit, we are breaking boundaries by focusing on the future, constantly innovating from a technology and user experience perspective and are ready to push forward. With that said, we recognize that we cannot do this alone, and we urge those who share this desire to unite with us on our journey to a brighter and greener future.

Come join the charge with us.

Our Business

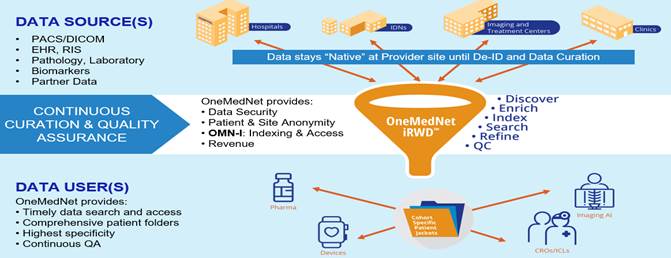

OneMedNet is a global provider of clinical imaging innovation and curator of regulatory-grade Imaging Real-World Data3 or iRWDTM. OneMedNet’s innovative solutions connect healthcare providers and patients satisfying a crucial need within the Life Sciences field offering direct access to clinical images and the associated contextual patient record. OneMedNet’s innovative technology proved the commercial and regulatory viability of imaging Real-World Data, an emerging market, and provides regulatory-grade image-centric iRWDTM that exactly matches OMN’s Life Science partners Case Selection Protocols and paves the way for Real World Evidence.

OneMedNet was founded to solve a deficiency in how clinical images were shared between healthcare providers. This resulted in OMN’s initial product BEAMTM image exchange that enabled the successful sharing of images for more than a decade with OMN’s largest customer being the Country of Ireland.

| 8 |

OneMedNet continued to innovate by responding to the demand for and utilization of Real-World Data and Real-World Evidence, specifically data that focused on clinical images with its associated contextual clinical record. We were able to leverage internal technological competencies along with OneMedNet’s formidable healthcare provider installed base from its first product with BEAMTM to become the first RWD solution for Life Science companies with its launch of iRWDTM in 2019.

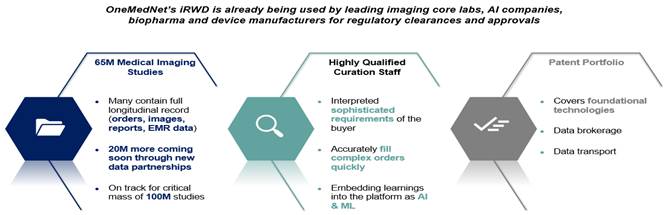

OneMedNet provides innovative solutions that unlock the significant value contained within clinical image archives. With a growing federated network of 95+ healthcare facilities, OneMedNet has the immediate ability to quickly search and extensively curate multi-layer data from a Federated group of healthcare facilities. The term “healthcare facilities” refers specifically to the hospitals, integrated delivery networks (“IDNs”) and imaging centers that provide imaging to OneMedNet, which represent the core source of our data. At present, OneMedNet works with more than 95 facilities who provide regulatory grade imaging to us. OneMedNet has access to these more than 95 facilities because these 95+ contracted facilities have more than 200 locations among them including offices and clinics, which in total generates regulatory grade imaging from more than 200 customers. Among these customers, all are data providers and some are data purchasers.

OneMedNet is ahead of the curve when it comes to providing fast and secure access to curated medical images. Initially, it was all about solving the diverse access needs of patient care providers. This focus systematically evolved to addressing the rapidly growing needs of image analysis and researchers, clinicians, regulators, scientists and more.

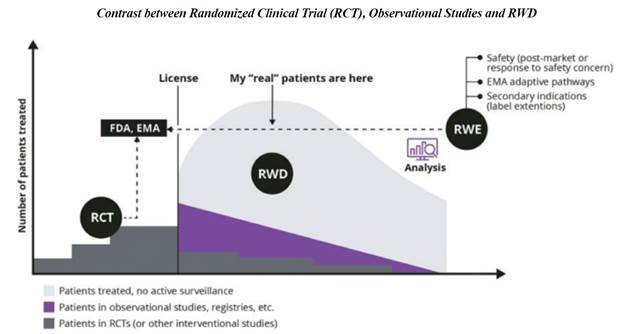

Real-world data is any data that is collected in the context of the routine delivery of care, in contrast to data collected within a clinical trial where study design controls variability in ways that are not representative of real-world care and outcomes.

A key component driving its mission is that OneMedNet believes we have a unique opportunity to affect a material positive impact on the lives of tens of millions of people while improving our customers’ business productivity. First and foremost, OneMedNet’s iRWDTM offering plays a significant role in enabling Life Science companies to bring safer and more effective patient care to market sooner. Using our highly curated de-identified clinical data in our iRWDTM offering in Life Science product development, validation, and regulatory approval processes, they contribute to patient care advancements in more meaningful ways. Moreover, Life Sciences improve their product development and validation processes, which benefits all parties.

Significant documentation exists that shows that Real-World Data can provide expanded insights across broader and more representative patient populations.1 For this reason, the Food and Drug Administration (“FDA”) has instituted Real-World Data guidelines for regulatory approvals. Utilization of highly reliable and quality Real-World Data that strictly adheres to all of the very specific data stratification requirements can supplement or supplant clinical trials.

OneMedNet covers the complete value chain in imaging Real-World Data; it begins with our 10+ year federated network of providers and is supported by a multi-faceted data curation process managed by an expert in-house clinical team. Additionally, we work hand-in-hand with our Life Science partners regarding the Case Selection Protocol and when required producing Case Report Forms for regulatory clearance. We are focused on delivering value by supporting Life Science Advancements with OneMedNet’s iRWDTM which holds the key to unlocking boundless patient care advances. We unleash the power of research-grade image-centric iRWDTM that is highly curated to painstakingly meet every cohort requirement and stand up to all of the rigors of prospective clinical trials.

Today, life science companies, including pharmaceutical companies, artificial intelligence (AI) developers, medical device businesses, and clinical research organizations share the same widespread challenge in obtaining insight-rich, high-quality patient data that explicitly matches their precise cohort specifications. A substantial portion of patient diagnosis involves clinical imaging and approximately 90% of healthcare data, by size, is associated with imaging. Historically, much of imaging value has been derived from its initial review and further gains from the image archives have been very limited.

1 See https://www.fda.gov/media/120060/download

| 9 |

We help providers to “Unlock the Value in Imaging Archives”.TM By utilizing OneMedNet’s iRWDTM offering, providers can greatly improve their research efforts with streamlined data access. Health care providers such as hospitals, clinics, and imaging centers can also accelerate life science patient care innovations by sharing de-identified data in a well-defined and de-identified and secure manner. In return for doing so, income is generated and applied to critical and possibly unfunded provider projects.

The OneMedNet Difference

OneMedNet has been a leader in the business of extracting, securing, and transferring medical data for 12+ years. Doing so requires specialized expertise in:

| ● | Compliancy (HIPAA, GDPR, 21 Part11) | |

| ● | Advanced privacy & security measures | |

| ● | Clinical patient condition(s) and hospital processes | |

| ● | Radiology interpretation | |

| ● | AI/ML technology |

Attaining in-house expertise in all essential elements is quite a challenge and deters many organizations from even attempting such a venture. We take pride in this ambitious achievement – while continually working to maintain state-of-the-art expertise. OneMedNet strictly adheres to the highest level of professional and ethical standards and applicable regulations throughout all interactions and activities.

We believe there is a reason OneMedNet is the leader in an uncrowded field of regulatory-grade imaging RWD curators. Doing so requires specialized expertise in AI/ML technology, data privacy/security, as well as expertise in clinical patient condition(s) and healthcare record keeping. Having, or achieving, expertise in all essential disciplines is a challenging achievement. OneMedNet had a significant head start with our clinical image exchange solution which served to launch the company nearly a decade ago. All data remains “native” within the federated OneMedNet iRWDTM provider network – meaning all the data remains locally onsite until specific de-identified data is licensed for a particular Life Science research opportunity.

OneMedNet’s Competitive Advantages

We believe that OneMedNet iRWDTM offers the best of advanced technology, clinical expert curation, and service. Medical imaging and associated clinical data is indexed at each network site using state-of-the-art AI/ML technology. This typically includes electronic health records (“EHR”), radiology, cardiology, lab, path and more. Our in-house clinical team performs intensive curation of the data ensuring that results meet the exact specification and requirements of Life Science Data Collection Protocol (“DCP”) – regardless of the complexity.

| 10 |

We believe that OneMedNet unlocks the value in imaging and electronic health records data in the following three principal ways:

| ● | Regulatory Grade — Our imaging results serve as proof of effectiveness for regulatory agencies, meeting requirements for quality & diversity; | |

| ● | On Demand — Our powerful indexing platform access and harmonizes complete patient profiles across fragmented data silos, delivering images and records on-demand; | |

| ● | Expertly Curated — We curate to the most stringent multi-level stratified requirements, providing unmatched data accuracy and completeness. |

OneMedNet’s data is fully de-identified using a multi-step quality control process and goes beyond PHI to include PII (personally identifiable information), SII (Site Identifiable Information), and more. Importantly, Life Science users receive the data in the exact format that they require. No data sifting or manipulation is needed. The data is simply ready for use. Moreover, OneMedNet has the unique combination of knowledge, tools, and experience to:

| ● | Access and harmonize complete patient profiles across fragmented data silos; | |

| ● | Provide unmatched data accuracy and completeness; | |

| ● | Ensure the security and privacy of patients’ Protected Health Information (PHI)Imaging RWD is our singular passion and focus and no one does it better. |

Finally, OneMedNet has the most experienced and clinically trained data curators in the industry. This team appreciates the complexity and criticality of clinical data and can effectively communicate with both Provider and Life Science specialists.

| 11 |

OneMedNet has been a leader in the business of extracting, securing, and transferring medical data for 12+ years. Doing so requires specialized expertise in:

| ● | Compliancy (HIPAA, GDPR, 21 Part11) | |

| ● | Advanced privacy & security measures | |

| ● | Clinical patient condition(s) and hospital processes | |

| ● | Radiology interpretation | |

| ● | AI/ML technology |

Attaining in-house expertise in all essential elements is quite a challenge and deters many organizations from even attempting such a venture. We take pride in this ambitious achievement – while continually working to maintain state-of-the-art expertise. OneMedNet strictly adheres to the highest level of professional and ethical standards and applicable regulations throughout all interactions and activities.

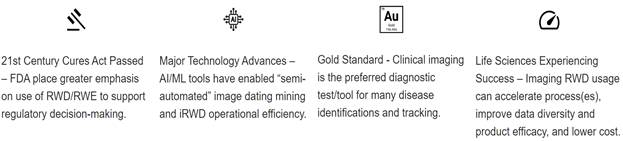

Industry Background

A 2016 analysis published in the Journal of Health Economics and authored by the Tufts Center for the Study of Drug Development placed the cost of bringing a drug to market, including post-approval research and development, at a staggering $2.87 billion.2 Meanwhile, a 2018 study from the Tufts Center noted that the timeline for new drug development ranged from 12.8 years for the average drug to 17.2 years for ultra-orphan drugs that only affect several hundred patients.3 This places the onus on life science organizations to find ways to deliver treatments to patients faster — especially those who cannot wait 17 years for a potentially life-saving treatment. Knowing how a medicinal product is actually used by patients can help stakeholders across the healthcare ecosystem make important and potentially life-saving real-time decisions.

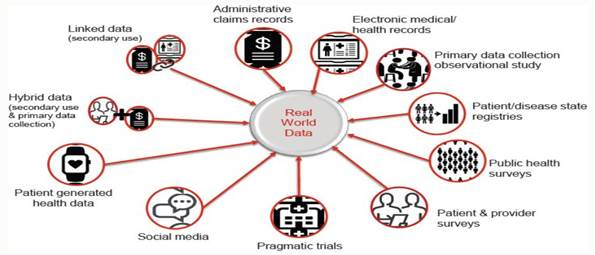

Real-World Data is observational data typically gathered when an approved medical product is on the market and used by “real” patients in real life, as opposed to clinical trials or real world images for real patients. The FDA cites several potential sources of Real-World Data, including electronic health records (“EHRs”), claims, disease and product registries, there are multiple types of data including structured and unstructured data, clinical and billing data, transactional and claims data, patient-generated data, and data gathered from additional sources that can shed light on a patient’s health status and more. As reliance on healthcare data grows exponentially, OneMedNet has observed that the reliance on information has increased coming from multiple additional sources including EHRs, claims, registries, clinical trials, patient and provider surveys, wearable devices and more. These additional sources include the internet of things (“IoT”), social media forums and blogs. Real-World Data has the potential to break down inefficiencies and fill gaps in information silos among stakeholders throughout the healthcare ecosystem of providers, payers, manufacturers, government entities and patients. This information sharing, in turn, enables all parties to derive new insights, support value-based care and deliver better health outcomes.

Commercializing a drug requires its developer to harness various sources of Real-World Data to identify patient populations and refine sales and marketing strategies for those populations among many other undertakings. Historically, this practice involved purchasing large amounts of data from data aggregators or data platforms, if not directly from the source itself, sometimes without much knowledge about the quality of the data. Preparing this data for analysis is both expensive and time-consuming thus many organizations would outsource the process to consultants or third-party vendors; moreover, the process of preparing this data for analysis by untrained consultants can yield a static analysis that is difficult to modify or rerun in response to follow-up questions or potential discrepancies.

2 https://www.outsourcing-pharma.com/Article/2016/03/14/Tufts-examines-2.87bn-drug-development-cost

3 https://www.hcplive.com/view/new-data-reinforces-difficulty-orphan-drug-development

| 12 |

Definitions of Real-World Data and Real-World Evidence

Real-World Data has become a powerful tool in the life sciences industry. After decades of relying on clinical data as the gold standard for decision making, industry leaders now recognize how data collected in the real world adds valuable context and insight to their efforts. From identifying unmet medical needs and defining the patient journey, to supporting regulatory submissions, proving value to payers, and shaping market strategies, Real-World Data adds value at every stage of the drug development lifecycle. Real-World Data also sets the foundation for Real World Evidence, and while the terms are often used interchangeably, they are distinct and they are changing health care. Here’s how it happens:

| 1. | First, Real-World Data are data relating to patient health status and/or the delivery of health care routinely collected from a variety of sources. Real-World Data is aggregated and transformed such as through OneMedNet’s robust analytics. Real-World Data are the data relating to patient health status and/or the delivery of health care routinely collected from a variety of sources. There are many different types, sources and uses of Real-World Data, for example: |

| ● | Clinical Data — For example, clinical data from EHRs and case report forms (“eCRF”) including biopsies and other pathology tests, diagnostic imaging, social determinants of health, cancer organoids, that provide patient demographics, family history, comorbidities, procedure and treatment history, and outcomes. | |

| ● | Patient Generated Data — For example, patient-generated data from patient-reported outcome surveys, which data provide insights directly from the patient, and they help researchers understand what happens outside of clinic visits, procedures, and hospital stays. | |

| ● | Cost and Utilization Data (Qualitative Studies) — For example, cost and utilization data from claims and public datasets, which data provides information regarding healthcare services utilization, population coverage, and prescribing patterns. | |

| ● | Public Health Data — For example, public health data from various government data sources. These add critical information to enable stakeholders to best serve the needs of the populations they serve. |

The availability of medical imaging in Real-World Data such as that provided by OneMedNet is facilitated by the development of digital image analysis to increase the accuracy of diagnostics and conduct passive screening on large databases of medical images using artificial-intelligence (“AI”) algorithms such as those applied by OneMedNet. Algorithms can also help identify additional diagnostic tests of value from medical images with pathology.

Real-World Evidence is the clinical evidence regarding the usage and potential benefits or risks of a medical product derived from analysis of Real-World Data, as defined by the Food and Drug Administration. Real-World Evidence can be generated by different study designs or analyses, including but not limited to, randomized trials, including large simple trials, pragmatic trials, and observational studies (prospective and/or retrospective). The difference in Real World Evidence and Real World Data focuses on the end use case. Real World Data can take the form of claims, electronic health records, labs, data etc. Often this insight is used to better understand a patient’s journey or a natural history of a disorder (how does a disease progress if left untreated.)

| 13 |

Real World Evidence in contrast builds upon many of these data sets and prepares them for submission, as part of regulatory review such as to the Food and Drug Administration or the European Medicines Agency, for example, in support of a customer’s clinical trial application. When data and in particular imaging data is submitted to the FDA the agency requires the following:

| ● | Guard against biased — evidence must align with the patient population being study — expectations focus on the similar patient demographics, comorbidities, disease severity, etc.; | |

| ● | Traceability — confirm the chain of custody, the source of the data is known and can be validated if required; and | |

| ● | Go forward basis — regulatory agencies seek evidence that aligns with the trials timeframe and when possible collect evidence that mirrors the clinical trials timeline. |

One area where Real World Evidence has been relief on heavily relates to oncology approvals. Food and Drug Administration’s Oncology Center of Excellence actually presented an analysis of this at American Society of Clinical Oncology in 2021, looking at oncology applications containing Real-World Data and Real-World Evidence. That analysis looked at 94 applications that were submitted from 2011-2020, and showed that inclusion of Real-World Data to support regulatory decision-making has increased dramatically over that period. In 2020 alone, there were 28 submissions for oncology products that contained Real-World Data. Outside of the oncology context, probably the most notable recent example of an approval relying on Real World Evidence is the July 2021 approval of a new indication for Astellas’ drug Prograf (or tacrolimus) for the prevention of organ rejection in lung transplant patients. The approval there was based on a non-interventional study providing Real-World Evidence of effectiveness.4 FDA’s press release announcing the approval noted that the approval was “significant because it reflects how a well-designed, non-interventional study relying on fit-for-purpose real-world data, when compared to a suitable control, can be considered adequate and well-controlled under FDA regulations.”

4See https://www.fda.gov/drugs/news-events-human-drugs/fda-approves-new-use-transplant-drug-based-real-world-evidence

| 14 |

An additional recent approval of note was the December 2021 approval of the supplemental BLA for Orencia to prevent graft versus host disease.5 The application included data from a randomized clinical trial, with additional evidence of effectiveness provided by a registry-based clinical study that was conducted using real-world data from the Center for International Blood and Marrow Transplant Research.6 And that registry study analyzed outcomes of 54 patients treated with Orencia for the prevention of graft versus host disease, in combination with standard immunosuppressive drugs, versus 162 patients treated with the standard immunosuppressive drugs alone, and showed efficacy in that indication.

AI is employed in Real-World Data to enhance data anomaly detection, standardization, and quality checking at the pre-processing stage. AI is expected to offer pharma and biotech companies the ability to increase meaningful Real World Evidence output, decrease time to insights, and make the most of the available vast data sources. A Real World Evidence technology platform that delivers smart data processing, analysis, and outcomes offers an unparalleled opportunity to capitalize on these computing advancements.

When used as part of an overall comprehensive Real World Evidence strategy, AI innovations can enhance drug development, improve patient treatment and access, and drive valuable new business opportunities.

In post-marketing studies, adverse events reporting is an area where AI is used, creating greater automation and efficiency in historical data sets. Techniques like natural language processing (“NLP”) enable AI to scan tens of thousands of records and quickly find adverse event details. AI integrated analytics and automation provide access to crucial insights from historical clinical trial Real-World Data and Real World Evidence, expanding end-to-end clinical trial capabilities:

| ● | Data ingestion — publicly/historical available Real-World Data | |

| ● | Text extraction — NLP used to extract key entities from clinical trial documents | |

| ● | Data transformation & standardization — data standardization using pre-built models | |

| ● | AI model deployment — predicting trial design impacts on costs, feasibility, cycle times, and quality risk |

AI is driving ground-breaking leaps in protein structure identification, and advances in regulations are providing healthcare research organizations with access to real-world data to accelerate clinical trial processes. We believe that AI-enabled technologies have unparalleled potential to offer innovative trial design and collection, organizing, and analyzing the increasing amount of data generated by clinical trials. AI has many applications in clinical trials, both short and long-term. AI technologies make possible innovations crucial for transforming clinical trials, such as seamlessly combining Phases I and II, developing novel patient-centered endpoints, and collecting and analyzing Real-World Data.

OneMedNet believes that AI tools also have wider benefits for hospitals and health systems. Professor Alexander Wong, University of Waterloo Canada Research Chair in AI and Medical Imaging, points out that AI benefits include the potential to ease the burden on radiology departments in terms of assessing scans and predicting upcoming demand for general hospital and intensive care beds, and demand for equipment such as respirators and ventilators, medicines, masks, and ventilator mouthpieces, as well as aiding workforce planning.7

Across a diverse set of imaging modalities, digital images typically include metadata and/or annotations that may include protected health information (e.g., patient name, date of birth). Although diagnostic images generally do not warrant the same level of privacy concerns as genomic data, researchers must also remove facial characteristics or other features that could identify a patient.