As filed with the Securities and Exchange Commission on June 8, 2023.

Registration Statement No. 333-272005

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 2 to

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

OKYO Pharma Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

OKYO Pharma Limited

Martello Court

Admiral Park

St. Peter Port

Guernsey GY1 3HB

+44 (0)20 7495 2379

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

| Guernsey | 2836 | Not Applicable | ||

(State or other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

OKYO Pharma US, Inc.

420 Lexington Avenue, Suite 1405

New York, NY 10170

(917) 225-9646

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jeffrey Fessler Sean F. Reid Sheppard, Mullin, Richter & Hampton LLP 30 Rockefeller Plaza New York, NY 10112-0015 (212) 653 8700 |

Ed Lukins Ed Dyson Orrick, Herrington & Sutcliffe (UK) LLP 107 Cheapside London EC2V 6DN United Kingdom +44 (0) 207 862 4620 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

| Large Accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☒ | |||

| Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period* for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act of 1933. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JUNE 8, 2023 |

18,406,026 Ordinary Shares

OKYO Pharma Limited

This prospectus relates to the resale from time to time in one or more offerings by the selling shareholders named herein with respect to an aggregate of 18,406,026 ordinary shares held by the selling shareholders identified herein. Holders of all such ordinary shares are identified in this prospectus as the Registered Holders and the aggregate of 18,406,026 ordinary shares registered hereby as the Registered Shares. The Registered Holders are also permitted to sell ordinary shares in private transactions. The Registered Holders may, or may not, elect to dispose of Registered Shares as and to the extent that they may individually determine. Such dispositions, if any, will be made through brokerage transactions on Nasdaq or other securities exchanges in the United States at prevailing market prices. See the section entitled “Plan of Distribution.” We will not receive proceeds from any disposition of Registered Shares by Registered Holders.

We are not selling any ordinary shares under this prospectus, and we will not receive any of the proceeds from the offer and sale of ordinary shares by the selling shareholders.

Our American Depositary Shares, or ADSs, were listed on The Nasdaq Capital Market under the symbol “OKYO” On May 22, 2023, our ADSs were exchanged for ordinary shares, on a one for one basis, which are now listed on The Nasdaq Capital Market under the same symbol. On June 7, 2023, the last reported sale price of our ordinary shares on The Nasdaq Capital Market was $1.45 per ordinary share. Our ordinary shares were previously admitted to listing on the standard segment of Official List of the United Kingdom Financial Conduct Authority, or FCA, and to trading on the main market for listed securities, or Main Market, of London Stock Exchange plc, or LSE, under the symbol “OKYO.” On May 22, 2023, we delisted our ordinary shares from the standard segment of Official List of the FCA, and trading ceased on the Main Market.

Investing in our ordinary shares involves a high degree of risk. See “Risk Factors” beginning on page 9 of this prospectus for a discussion of information that you should consider before investing in our ordinary shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We are an “emerging growth company,” or EGC, as defined under applicable Securities and Exchange Commission, or SEC, rules and, as such, have elected to comply with certain reduced public company reporting requirements for this and future filings.

We are also a “foreign private issuer,” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act, and are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions under Section 16 of the Exchange Act. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

The date of this prospectus is , 2023

TABLE OF CONTENTS

We are responsible for the information contained in this prospectus and any free-writing prospectus we prepare or authorize. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. We are not making an offer to sell our Ordinary Shares in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or the sale of any Ordinary Shares.

For investors outside the United States, we have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, this offering and the distribution of this prospectus outside the United States.

We are a non-cellular company limited by shares incorporated under the Companies (Guernsey) Law 2008, or the Guernsey Companies Law, and a majority of our outstanding securities are owned by non-U.S. residents. Under the rules of the SEC, we are currently eligible for treatment as a “foreign private issuer,” or FPI. As an FPI, we will not be required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic registrants whose securities are registered under the Exchange Act.

| i |

Unless otherwise indicated or the context otherwise requires, all references in this registration statement to the terms “OKYO,” “OKYO Pharma Limited,” the “Company,” “we,” “us” and “our” refer to OKYO Pharma Limited and our wholly owned subsidiary OKYO Pharma US Inc.

Solely for convenience, the trademarks, service marks and trade names in this registration statement may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. This registration statement contains additional trademarks, service marks and trade names of others, which are the property of their respective owners. We do not intend to use or display other companies’ trademarks, service marks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

In this registration statement, unless otherwise stated, all references to “U.S. dollars” or “US$” or “$” or “cents” are to the currency of the United States of America, and all references to “Pounds Sterling” or “£” or “pence” are to the currency of the United Kingdom.

In this registration statement, any reference to any provision of any legislation shall include any amendment, modification, re-enactment or extension thereof. Words importing the singular shall include the plural and vice versa, and words importing the masculine gender shall include the feminine or neutral gender.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

OKYO discusses in this prospectus its business strategy, market opportunity, capital requirements, product introductions and development plans and the adequacy of our funding. Other statements contained in this prospectus, which are not historical facts, are also forward-looking statements. OKYO has tried, wherever possible, to identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and other comparable terminology.

OKYO cautions investors that any forward-looking statements presented in this prospectus, or that OKYO may make orally or in writing from time to time, are based on the beliefs of, assumptions made by, and information currently available to, OKYO. These statements are based on assumptions, and the actual outcome will be affected by known and unknown risks, trends, uncertainties and factors that are beyond its control or ability to predict. Although OKYO believes that its assumptions are reasonable, they are not a guarantee of future performance, and some will inevitably prove to be incorrect. As a result, its actual future results can be expected to differ from its expectations, and those differences may be material. Accordingly, investors should use caution in relying on forward-looking statements, which are based only on known results and trends at the time they are made, to anticipate future results or trends. Certain risks are discussed in this prospectus and also from time to time in OKYO’s other filings with the SEC.

This prospectus and all subsequent written and oral forward-looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to its forward-looking statements to reflect events or circumstances after the date of this prospectus.

In particular, you should consider the risks provided under “Risk factor summary” in this prospectus and in the Form 20-F for the fiscal year ended March 31, 2022 as filed with the SEC (the “2022 Form 20-F”) incorporated by reference in this prospectus.

Presentation of Financial Information

This prospectus includes our audited consolidated financial statements as of March 31, 2022 and 2021 and for the two years ended March 31, 2022, which are prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. None of our financial statements were prepared in accordance with generally accepted accounting principles in the United States.

Our financial information is presented in U.S. dollars. For the convenience of the reader, in this prospectus, unless otherwise indicated, translations from Pounds Sterling into U.S. dollars were made at the rate of £1.00 to $1.265 which was the noon buying rate of the Federal Reserve Bank of New York on May 5, 2023. Such U.S. dollar amounts are not necessarily indicative of the amounts of U.S. dollars that could actually have been purchased upon exchange of Pounds Sterling at the dates indicated.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

| ii |

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our ordinary shares, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes and the information set forth under the sections titled “Risk Factors,” “Special Note Regarding Forward-Looking Statements,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case included elsewhere in this prospectus.

Overview

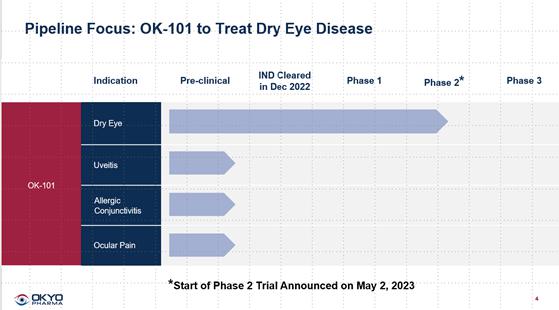

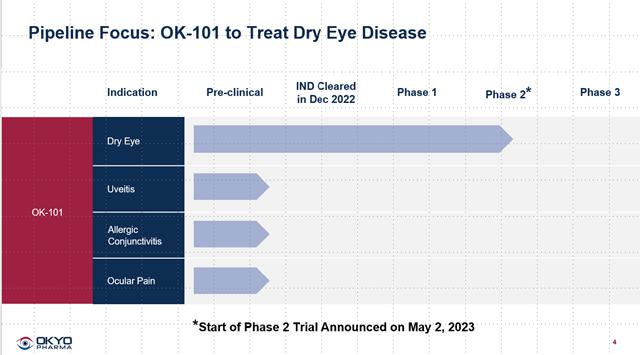

We are a clinical-stage biopharmaceutical company developing next-generation therapeutics to improve the lives of patients suffering from inflammatory eye diseases and ocular pain. Our research program is focused on a novel G Protein-Coupled Receptor, or GPCR, which we believe plays a key role in the pathology of these inflammatory eye diseases of high unmet medical need. Our therapeutic approach is focused on targeting inflammatory and pain modulation pathways that drive these conditions. We are presently developing OK-101, our lead preclinical product candidate, for the treatment of dry eye disease (“DED”). We also plan to evaluate its potential in benefiting patients with ocular neuropathic pain, uveitis and allergic conjunctivitis. We have also been evaluating OK-201, a bovine adrenal medulla, or BAM, lipidated-peptide preclinical analogue candidate that is currently in developmental stage.

On February 21, 2018, we announced that we successfully obtained (via assignment from Panetta Partners Ltd., a related party) a license from On Target Therapeutics LLC, or OTT, to patents owned or controlled by OTT and a sub-license from OTT to certain patents licensed by OTT from Tufts Medical Center Inc., or TMC, to support our ophthalmic disease drug programs. These licenses gave us the right to exploit the intellectual property, or IP estate which is directed to compositions-of-matter and methodologies for treating ocular inflammation, DED, with chemerin or lipid-linked chemerin analogues. We also have a license from TMC to a separate IP estate for treating symptoms of ocular neuropathic pain and uveitis associated pain. On August 6, 2019, we signed a collaborative agreement with TMC on a research program focused on ocular neuropathic pain.

On January 7, 2021, we announced the appointment of Mr. Gabriele Cerrone as Non-Executive Chairman and Director, and Gary S. Jacob, Ph.D. as Chief Executive Officer and Director. The addition of these two individuals was a significant step for us, highlighting a careful realignment of the strategic focus of our research and development program, with the aim of facilitating advancement of both of our preclinical programs. We believed this realignment would allow us to file investigational new drug, or IND, applications on our drug candidates with the U.S. Food and Drug Administration, or FDA, in the shortest time possible.

OK-101

OK-101, our lead clinical-stage product candidate, is focused on keratoconjunctivitis sicca, commonly referred to as DED, which is a multifactorial disease caused by an underlying inflammation resulting in the lack of lubrication and moisture in the surface of the eye. DED is one of the most common ophthalmic conditions encountered in clinical practice. Symptoms of DED include constant discomfort and irritation accompanied by inflammation of the ocular surface, visual impairment and potential damage to the ocular surface. There are presently approximately 20 million people suffering from DED in the U.S. alone (Farrand et al. AJO 2017; 182:90), with the disease affecting approximately up to 34% of the population aged 50+ (Dana et al. AJO 2019; 202:47), and with women representing approximately two-thirds of those affected (Matossian et al. J Womens Health (Larchmt) 2019; 28:502–514). Prevalence of DED is anticipated to increase substantially in the next 10-20 years due to aging populations in the U.S., Europe, Japan and China and use of contact lenses in the younger population. We believe this increase in prevalence of DED represents a major expanding economic burden to public healthcare. According to Market Research Report, Dry Eye Disease, December 2020, the global DED market in 2019 was approximately $5.22 billion, with the market size expected to reach $6.54 billion by 2027. In addition, DED causes approximately $3.8 billion annually in healthcare costs and represents a major economic burden to public healthcare, accounting for more than $50 billion to the U.S. economy annually.

| -1- |

At present, there are 5 prescription drugs available to treat DED: 1) Restasis (0.05% cyclosporine), 2) Cequa (0.09% cyclosporine), 3) Xiidra (5% lifitegrast), 4) Tyrvaya (0.03 mg varenicline), and 5) Eysuvis (0.25% loteprednol – a corticosteroid for short term use only). However, DED continues to be a major unmet medical need due to the large number of patients not well served by the treatments available to them through the medical community.

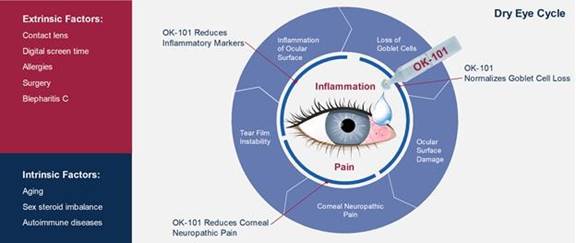

The development of new drugs to treat DED has been particularly challenging due to the heterogeneous nature of the patient population suffering from DED, and due to the difficulties in demonstrating an improvement in both signs and symptoms of the disease in well-controlled clinical trials. The evidence from over 40 years of scientific literature, however, suggests inflammation as the most common underlying element of DED. Consequently, development of new therapeutic agents that target inflammatory pathways is looking to be an attractive approach in improving symptoms in DED patients. Moreover, large number of dry eye patients suffer from ocular neuropathic pain, making their condition more resistant to topical anti-inflammatory therapy, and a drug capable of targeting both of these aspects of DED would be a significant addition to the ocular-care practitioner’s arsenal for the treatment of DED.

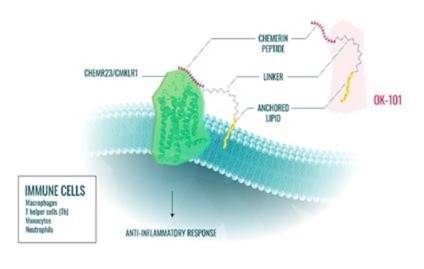

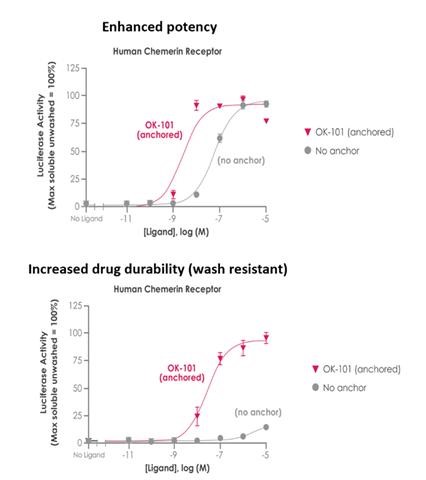

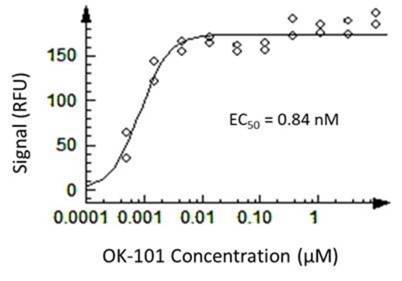

The chemerin receptor (CMKLR1 or ChemR23) is a chemokine like GCPR expressed on select populations of cells including inflammatory mediators, epithelial and endothelial cells as well as neurons and glial cells in the dorsal root ganglion, spinal cord, and retina. Activation of CMKLR1 by chemerin has been shown to resolve the inflammation and pain in animal models of asthma and pain, respectively. We have been pioneering the development of OK-101, a lipidated-chemerin analogue, which is an agonist of CMKLR1, in treating DED and other ocular inflammatory conditions. OK-101 was first identified in a program developed by OTT using membrane-tethered ligand technology.

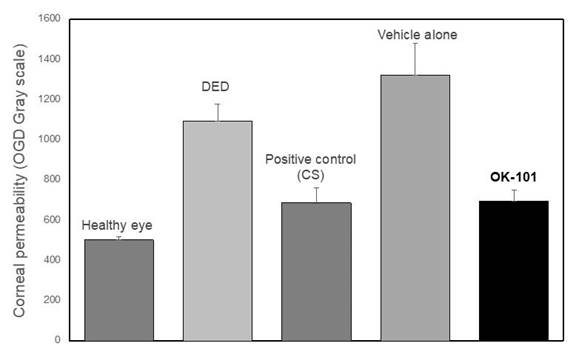

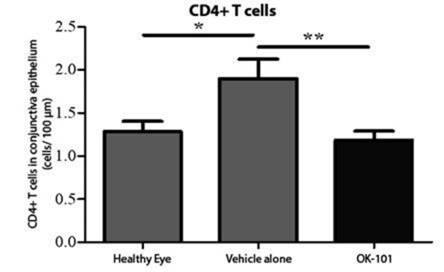

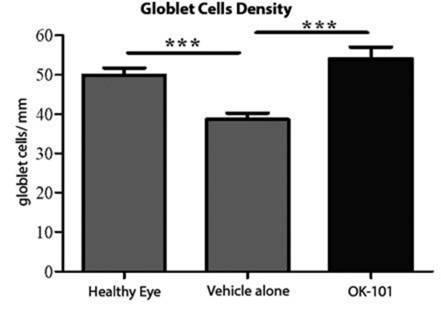

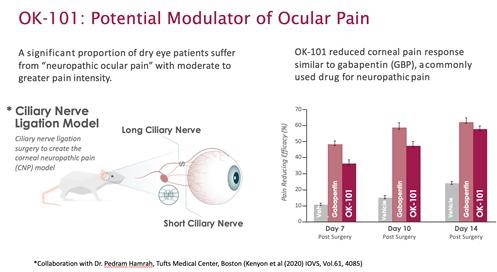

To expand our understanding of the structure-activity relationships of the lipidated-chemerin analogues, such as OK-101, as agonists of the chemerin receptor, we synthesized a small library of analogues of OK-101. We screened these analogues in a cell-line based receptor binding assay to characterize the agonist potency of these lipidated-chemerin analogues. This work has also been coupled to an evaluation of a subset of these analogues’ potential in treating DED by using a variety of preclinical studies and dry eye animal model studies. After evaluating a number of our analogues in a mouse model of acute DED by looking at their ability to reduce corneal permeability, a measure of dry-eye effectiveness, as well as the analogues’ impact on immune response, we determined that OK-101 was in fact the most potent analogue in reducing corneal permeability and down-regulating immune response. In addition, in a separate set of animal model experiments, OK-101 was shown to exhibit potent ocular pain-reducing activity in a ciliary nerve ligation mouse model of corneal neuropathic pain. Following these studies, we evaluated the ocular tolerance of OK-101 via repeated ocular instillation in rabbits followed by clinical ophthalmic observations. Rabbit ocular tolerance tests on OK-101 showed no adverse signs such as inflammation, chemosis or hyperemia and no signs of local irritation. With potential anti-inflammatory and neuropathic pain reducing characteristics, we are developing OK-101 for the treatment of DED.

Based on the results from the DED animal model, the neuropathic corneal pain model as well as the rabbit ocular tolerance studies, we moved forward over the past 18 months with plans to file an IND on OK-101 to treat DED to enable us to begin clinical trials soon thereafter. During the fourth quarter of 2021 we successfully manufactured a 200-gram batch of OK-101 drug substance needed for initiating the IND-enabling studies that were begun during the first quarter of 2022. In support of this work, we also had previously signed an agreement on April 13, 2021, with Ora, Inc., or Ora, a major clinical research organization, or CRO, specializing in ophthalmic drug development who have been providing us with the following services over the past 18 months:

| 1) | Preparation of the OK-101 pre-IND briefing document used in the successful pre-IND meeting with FDA in February, 2022 | |

| 2) | Support with the OK-101 pre-IND meeting OKYO accomplished with FDA in February of 2022 | |

| 3) | Support for the planned regulatory publishing and submission of the OK-101 IND in electronic common technical document, or eCTD, format | |

| 4) | Quality oversight for the recent successful development of the topical OK-101 formulation for future human studies | |

| 5) | Quality oversight of the successful development and qualification of the drug stability analysis method for OK-101 along with successfully conducting stability studies to establish formulated drug product is stable for at least 90 days | |

| 6) | Support for the recently completed 90 days animal toxicology studies in rabbit and dog |

| -2- |

Over the past twelve months we accomplished the following:

| ● | Completed topical formulation of the OK-101 drug product as well as initial stability studies |

| ● | Finalized the bioanalytical method development to support the OK-101 clinical program |

| ● | Completed batch manufacture of cGMP OK-101 for clinical trials |

| ● | Completed toxicokinetic method development |

| ● | Completed toxicology studies in rabbits and dogs |

| ● | Completed stability studies of formulated OK-101 |

We recently completed the final stages of a concerted effort to complete all IND enabling activities and filed with FDA the IND on OK-101 to treat DED on November 18, 2022. On December 22, 2022 we announced that we received clearance of the IND application from the FDA to enable us to initiate a Phase 2, first-in-human, clinical study of OK-101 for the treatment of DED.

On May 2, 2023, we announced that the first patient has been screened for our Phase 2, multi-center, randomized, double-blinded, placebo-controlled trial of OK-101. Because the drug is designed to be administered topically, we were able to skip the standard Phase 1 studies typically expected with orally delivered or injectable drug candidates in non-life-threatening conditions and we opened the first trial with OK-101 as a Phase 2 clinical trial in DED patients (See OKYO Pipeline below). This trial is planned to be conducted in approximately 200 to 240 DED patients. The study is being designed in conjunction with and is being managed and monitored by Ora, well known for its leadership of ophthalmic clinical trial activities. The Phase 2 trial is expected to be completed in 6-8 months from enrollment of the first patient.

OKYO Pipeline

On February 15, 2022, we announced the successful completion of the pre-IND meeting facilitated by Ora with the FDA regarding development plans for OK-101 to treat DED. Both nonclinical and clinical development milestones were covered in the pre-IND meeting, with the FDA agreeing that our first human trial would be a Phase 2 safety and efficacy trial in DED patients. The FDA also provided guidance on the planned protocol for this trial in DED patients, concurring with one particular option OKYO has considered for the protocol which is to designate co-primary efficacy endpoints covering both a sign and a symptom of DED in the clinical trial. Notably, the final decision, we recently took to, in fact, designate these two primary efficacy endpoints in the clinical protocol of the ongoing phase 2 trial is significant as should this phase 2 trial then meet these prespecified endpoints, the trial should considerably affect the timeline to an NDA filing with the FDA for OK-101 to treat DED.

| -3- |

Additional Applicable Disease Indications for OK-101

A second related ophthalmic disease indication that is the target of our chemerin-based technology is uveitis. Uveitis is the third leading cause of blindness worldwide. The most common type of uveitis is an inflammation of the iris called iritis (anterior uveitis). Uveitis can damage vital eye tissue, leading to permanent vision loss. Uveitis is currently treated with corticosteroid eyedrops and injections that reduce inflammation, however, the long-term use of corticosteroids causes risk of cataract and glaucoma, requiring close monitoring for their potential side effects.

We believe that OK-101, in addition to its potential to treat DED, should also be evaluated to treat allergic conjunctivitis and uveitis. Correspondingly, once we have an IND on OK-101 in place and are clinically evaluating OK-101 to treat DED, we also plan to explore the drug candidate’s potential to suppress the inflammation associated with allergic conjunctivitis and uveitis.

OK-201

MAS-Related G Protein-Coupled Receptors, or MRGPRs, mainly expressed in the sensory neurons, are involved in the perception of pain, thus making them a promising analgesic target. Activation of MRGPR by Bovine Adrenal Medulla, or BAM, peptide inhibits pain perception by modulating Ca2+ influx. OK-201, a BAM peptide analogue, licensed from TMC on May 1, 2018, is a potent agonist of human MRGPR and a promising candidate for the treatment of neuropathic and inflammatory pain.

On August 6, 2019, we signed a collaborative agreement with TMC and Pedram Hamrah, MD, Professor of Ophthalmology at Tufts University School of Medicine, Boston, MA as Principal Investigator to evaluate OK-201 and other proprietary lead compounds to suppress corneal neuropathic pain using a mouse ocular pain model recently developed in Dr. Hamrah’s laboratory. Our goal was to further develop this lipidated peptide, as well as explore additional analogues, for their potential use in treating ocular pain, and for potentially treating long-term chronic pain.

On April 28, 2021, we announced positive results of OK-201, a non-opioid analgesic drug candidate delivered topically in Dr. Hamrah’s mouse neuropathic corneal pain model, as a potential drug to treat acute and chronic ocular pain. Importantly, OK-201 demonstrated a reduced corneal pain response equivalent to that of gabapentin, a commonly used oral drug for neuropathic pain. These observations demonstrated preclinical ‘proof-of-concept’ for the topical administration of OK-201 as a potential non-opioid analgesic for ocular pain. Current treatments for corneal pain are limited to short term non-steroidal anti-inflammatory drugs, or NSAIDs, steroids, and oral gabapentin and opioids in severe cases.

Although the results with OK-201 were encouraging, due to subsequent success obtained with OK-101 (see section above on OK-101) in follow-on animal model studies utilizing the same mouse corneal neuropathic pain model as for OK-201, we have decided to maintain this drug candidate at the exploratory level while we focus our primary energy on the OK-101 program to treat DED, based on OK-101’s combination of anti-inflammatory and corneal pain-reducing activities in animal models of these conditions.

SUMMARY OF RISKS AFFECTING OUR BUSINESS

Our business is subject to a number of risks of which you should be aware before making an investment decision. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth in the section titled “Risk Factors” before deciding whether to invest in our ordinary shares. These important risks include, but are not limited to, the following:

● We have only recently committed to our new business and our product candidates are in the early stages of development and it may be some years until we generate revenue, if at all.

● Our product candidates have not been evaluated in clinical trials and results in the clinic may not be reproduced in human trials.

● There is a high degree of failure for product candidates as they progress through clinical trials and clinical trial data may be interpreted in varying ways which may delay, limit or prevent future regulatory approvals.

| -4- |

● The development of pharmaceutical products carries significant risk of failure in early and late stage development programs.

● We anticipate that we will continue to incur significant losses for the foreseeable future.

● We will need to spend extensively on further research activities and there can be no guarantee that we will have access to sufficient funds to fully realize our research and development plan or to commercialize any products derived from research activities.

● Even if we successfully develop a product which shows efficacy in human subjects there remain high barriers to commercial success.

● We face significant competition from pharmaceutical companies. We have competitors internationally, including major multinational pharmaceutical companies, universities and research institutions. In respect of OK-101 as an indication for the treatment of DED, there are a number of established companies engaged in the development and marketing of preparations addressing the DED market. In addition, there are a wide range of products addressing the DED market currently approved and marketed by a number of large and small pharmaceutical companies.

●The expiration of certain intellectual property rights or an inability to obtain, maintain or enforce adequate intellectual property rights for products that are marketed or in development may result in additional competition from other third-party products. Third parties may have blocking intellectual property rights which could prevent the sale of products by us or require that compensation be paid to such third parties.

● Our product candidates could infringe patents and other intellectual property rights of third parties.

● COVID-19 has adversely affected our business, and any new pandemic, epidemic or outbreak of an infectious disease may further adversely affect our business.

● The relationship of the UK with the EU could impact our ability to operate efficiently in certain jurisdictions or in certain markets.

● Even if we complete the necessary clinical trials, we cannot predict when, or if, we will obtain regulatory approval to commercialize our product candidates and the approval may be for a more narrow indication than we seek.

● If our competitors are able to obtain orphan drug exclusivity for products that constitute the same drug and treat the same indications as our product candidates, we may not be able to have competing products approved by applicable regulatory authorities for a significant period of time. In addition, even if we obtain orphan drug exclusivity for any of our products, such exclusivity may not protect us from competition.

● Even if we obtain regulatory approval for a product candidate, our product candidates will remain subject to regulatory oversight.

● Even if we obtain and maintain approval for our product candidates in a major pharmaceutical market such as the United States, we may never obtain approval for our product candidates in other major markets.

● We may seek a conditional marketing authorization in the United Kingdom and EU for some or all of our current product candidates, but we may not be able to obtain or maintain such designation.

● Healthcare legislative reform measures may have a negative impact on our business and results of operations.

● We are subject to governmental regulation and other legal obligations related to privacy, data protection and data security. Our actual or perceived failure to comply with such obligations could harm our business.

| -5- |

● We do not know whether an active, liquid and orderly trading market will develop for our ordinary shares or what the market price of our ordinary shares will be. As a result, it may be difficult for shareholders to sell their ordinary shares.

● Holders of our ordinary shares may experience substantial dilution upon the exercise of outstanding options and warrants.

● The rights of our shareholders may differ from the rights typically offered to shareholders of a U.S. corporation.

● If we are a passive foreign investment company, there could be adverse U.S. federal income tax consequences to U.S. holders.

Corporate Information

We were originally incorporated in the British Virgin Islands as a British Virgin Islands Business Company on July 4, 2007 under the BVI Business Companies Act 2004 with company number 1415559 under the name Jellon Enterprises, Inc. Our legal and commercial name was changed to Minor Metals & Mining, Inc. on October 24, 2007, to Emerging Metals Limited on November 28, 2007, to West African Minerals Corporation on December 9, 2011, and to OKYO Pharma Corporation on January 10, 2018. On March 9, 2018, shareholders approved the cancellation of our AIM listing and migration to Guernsey. On July 3, 2018, following the approval of the Guernsey Companies Registry, we were registered under the Guernsey Companies Law under the name OKYO Pharma Limited, as a Guernsey company with limited liability, an indefinite life and company number 65220. We are domiciled in Guernsey. On July 17, 2018, our Ordinary Shares were admitted to listing on the standard segment of the Official List of the FCA and admitted to trading on the Main Market of the London Stock Exchange. On May 22, 2023, we delisted our ordinary shares from the standard segment of Official List of the FCA, and trading ceased on the Main Market of the London Stock Exchange. We are no longer subject to the Takeover Code.

Our registered office is located at Martello Court, Admiral Park, St. Peter Port, Guernsey GY1 3HB and our telephone number is +44 (0) 20 7495 2379. Our website address is www.okyopharma.com. The reference to our website is an inactive textual reference only and the information contained in, or that can be accessed through, our website is not a part of this registration statement. Our agent for service of process in the United States is OKYO Pharma US, Inc.

“OKYO,” the OKYO logo and other trademarks or service marks of OKYO Pharma Limited appearing in this prospectus are the property of OKYO or our subsidiary. This prospectus contains additional trade names, trademarks and service marks of others, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols.

Implications of Being an Emerging Growth Company

We are an EGC as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we may take advantage of certain exemptions from various reporting requirements that are applicable to other publicly traded entities that are not EGCs. These exemptions include:

| ● | the option to present only two years of audited financial statements and related discussion in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus; | |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley Act; | |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); | |

| ● | not being required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency,” and “say-on-golden parachutes;” and | |

| ● | not being required to disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

| -6- |

Section 107 of the JOBS Act also provides that an EGC can take advantage of the extended transition period provided in Section 13(a) of the Exchange Act, for complying with new or revised accounting standards. As a result, an EGC can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We will remain an EGC until the earliest of: (1) the last day of the first fiscal year in which our annual gross revenues exceed $1.235 billion; (2) the last day of our fiscal year following the fifth anniversary of the completion of our public offering; (3) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur on the last day of any fiscal year that the aggregate worldwide market value of our common equity held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter; or (4) the date on which we have issued more than $1.0 billion in non-convertible debt securities during any three-year period.

Implications of Being a Foreign Private Issuer

We currently report under the Exchange Act as a non-U.S. company with FPI status. Even after we no longer qualify as an EGC, as long as we qualify as an FPI under the Exchange Act we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; | |

| ● | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and | |

| ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specific information, and current reports on Form 8-K upon the occurrence of specified significant events. |

FPIs are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an EGC, but remain an FPI, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither an EGC nor an FPI.

The REGISTERED SHARES

| Nasdaq Capital Market Symbol for ordinary shares | “OKYO” | |

| Registered Shares being registered on behalf of the Registered Holders | 18,406,026 ordinary shares | |

| Ordinary shares issued and outstanding immediately before and after the effectiveness of this registration statement, of which this prospectus forms a part | 25,519,774 ordinary shares | |

| Use of proceeds | The selling shareholders will receive proceeds from the sale of the ordinary shares in this offering. We will not receive any proceeds from the sale of the ordinary shares but will pay the expenses (other than any underwriting discounts and broker’s commissions and similar expenses) of this offering. | |

| Transfer Agent and Registrar | Computershare Investor Services (Guernsey) Limited | |

| Risk factors | See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our securities |

(1) The number of ordinary shares to be outstanding after this offering is based on 25,519,774 ordinary shares outstanding as of May 26, 2023, and excludes:

| -7- |

| ● | 1,722,615 ordinary shares issuable upon the exercise of share options at exercise prices of between $2.01 and $143 per ordinary share of which 550,856 ordinary shares are currently exercisable and 1,171,759 are exercisable between January 6, 2023 and March 31, 2033; and |

| ● | 38,461 ordinary shares that currently may be issued upon the exercise of warrants to purchase ordinary shares at an exercise price of $3.61 per ordinary share. | |

| Unless otherwise indicated, this prospectus reflects and assumes the following: | ||

| ● | no exercise of outstanding share options or warrants after May 26, 2023. | |

Summary Consolidated Financial Data

The following tables set forth our summary consolidated financial data for the periods indicated. We have derived the consolidated statement of operations data for the two years ended March 31, 2022 and the consolidated balance sheet data as of March 31, 2022 from our audited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated statement of operations data for the six months ended September 30, 2022 and 2021 and the unaudited consolidated balance sheet data as of September 30, 2022 have been derived from our unaudited consolidated financial statements for the periods included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that should be expected for any future period. You should read the following summary consolidated financial data together with the audited consolidated financial statements included elsewhere in this prospectus and the sections titled “Exchange Rate Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

We maintain our books and records in Pounds Sterling, and we prepare our financial statements in accordance with IFRS as issued by the IASB. We report our financial results in U.S. dollars.

Consolidated Statement of Operations and Comprehensive Loss Data:

| Six Months Ended September 30, | Years Ended March 31, | |||||||||||||||

| 2022 (unaudited) | 2021 (unaudited) | 2022 | 2021 | |||||||||||||

| Revenue | - | - | - | - | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | $ | (2,607,675 | ) | $ | (479,700 | ) | $ | (1,301,178 | ) | $ | (173,821 | ) | ||||

| General and administrative | (2,936,714 | ) | (2,254,393 | ) | (4,916,388 | ) | (3,192,385 | ) | ||||||||

| Total operating expenses | (5,544,389 | ) | (2,734,092 | ) | (6,217,566 | ) | (3,366,206 | ) | ||||||||

| Other income (expense), net | - | (1,021 | ) | - | (12,295 | ) | ||||||||||

| Loss from operations | (5,544,389 | ) | (2,735,114 | ) | (6,217,566 | ) | (3,378,501 | ) | ||||||||

| Tax provision | - | 188,761 | 786,521 | 24,994 | ||||||||||||

| Net loss attributable to ordinary shareholders | (5,544,389 | ) | (2,546,353 | ) | (5,431,045 | ) | (3,353,507 | ) | ||||||||

| Other comprehensive loss: | ||||||||||||||||

| Foreign currency translation adjustment | (62,581 | ) | 37,845 | (837,152 | ) | 346,365 | ||||||||||

| Total comprehensive loss | $ | (5,606,970 | ) | (2,508,508 | ) | $ | (6,268,197 | ) | $ | (3,007,142 | ) | |||||

| Basic and diluted net loss per ordinary share | $ | (0.00 | ) | (0.00 | ) | $ | (0.01 | ) | $ | (0.01 | ) | |||||

| -8- |

Consolidated Balance Sheet Data:

As of September 30, 2022 | ||||

| Cash and cash equivalents | $ | 705,076 | ||

| Working capital | (350,187 | ) | ||

| Total assets | 1,768,056 | |||

| Total shareholders’ equity (deficit) | (344,585 | ) | ||

You should carefully consider the risks described below, together with all of the other information in this registration statement. The risks and uncertainties below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we believe to be immaterial may also adversely affect our business. If any of the following risks occur, our business, financial condition and results of operations could be seriously harmed and potential future investors in our ordinary shares could lose all or part of their investment. Further, if we fail to meet the expectations of the public market in any given period, the potential market price of our ordinary shares could decline. We operate in a highly competitive environment that involves significant risks and uncertainties, some of which are outside of our control. If any of these risks actually occurs, our business and financial condition could suffer and the potential market price of our ordinary shares could decline.

Risks Relating to Our Business

We have only recently committed to our new business and our product candidates are in the early stages of development and it may be some years until we generate revenue, if at all.

Our product candidates, OK-101 and OK-201, are both very early in the development stage and even the lead product candidate, OK-101, is still in the pre-clinical stage. Through our scientific collaborators, we have only recently completed initial pre-clinical studies with respect to OK-101 and OK-201 and our ability to generate product revenue, which is not expected to occur for several years, if ever, will depend heavily on the successful development of the product candidates, many stages of clinical trials, regulatory approval and eventual commercialization. We have only recently committed to our new business operating as a life sciences and biotechnology business. We currently generate no revenue from sales of any product and may never be able to develop or commercialize a marketable product.

Our product candidates have not been evaluated in clinical trials and results in the clinic may not be reproduced in human trials.

The early stages of our business strategy carry significant risks associated with product candidates which have not been evaluated in human clinical trials. Not only may encouraging results seen in pre-clinical trials not be indicative of results in later clinical trials but given that the product candidates have only been evaluated in mouse models to date, unexpected or adverse effects may be seen once the product candidates enter the human clinical trials stage which in turn may create significant hurdles to further development or lead to the abandonment of further development.

There is a high degree of failure for product candidates as they progress through clinical trials and clinical trial data may be interpreted in varying ways which may delay, limit or prevent future regulatory approvals.

Many companies in the life sciences and biotechnology sector have made significant initial progress only to suffer significant setbacks in later stage clinical trials and there is a high failure rate for product candidates as they proceed through clinical trials. Data obtained from pre-clinical and clinical activities is subject to varying interpretations which may delay, limit or prevent applications for regulatory approvals.

| -9- |

The development of pharmaceutical products carries significant risk of failure in early and late stage development programs.

The development of pharmaceutical products is inherently uncertain, even in late-stage product development programs. There is a high failure rate in the development of pharmaceutical products and there is a substantial risk of adverse, undesirable, unintended or inconclusive results from testing or pre-clinical or clinical trials, which may substantially delay, or halt entirely, or make uneconomic, any further development of our products and may prevent or limit the commercial use of such products.

While the pre-clinical development of OK-101 and initial studies in animal models have been encouraging, the scope of these studies is limited, and significant risks exist that OK-101 may never progress to a commercially viable product. Laboratory studies in animal models carry the risk that similar results may not be seen or reproduced in future tests and trials, and there can be no guarantee that a successful test in a mouse or other animal model will be capable of being reproduced in a human clinical trial. Small scale trials and the results thereof, can be misleading as to efficacy, safety and other findings, as the outcome may be influenced by laboratory or demographic factors and not due to the chemistry or biological effect of the drug candidate being evaluated. Larger scale trials often fail to produce the same positive results seen in small scale trials for a variety of reasons and clinical trials in humans frequently fail to reproduce efficacy seen in animal trials in the laboratory. Failure can often result after significant sums have been expended on research and often where initial trial results (both in animals and in humans) have shown very encouraging results.

Management initially intends to conduct laboratory and pre-clinical trials to establish safety and efficacy of our products. Due to the inherent risks involved in developing pharmaceutical products, there is a risk that some or all of our products will not ultimately be successfully developed or launched. In addition, the planned clinical trials may fail to show the desired safety and efficacy. This may be the case even if the FDA approves an IND application as positive data in animal studies may not be reflected or reproduced in human trials. Successful completion of one stage of development of a pharmaceutical product does not ensure that subsequent stages of development will be successful. Our inability to market any of our products currently under development would adversely affect our business and financial condition.

We are currently primarily dependent for our short to medium-term success on a single early-stage product, OK-101, which is a research product that has shown pre-clinical potential but has not yet been tested on humans and has not obtained the necessary approvals required to conduct Phase I clinical trials in humans.

Any commercial development of OK-101 is highly dependent on a number of factors, including:

| ● | the successful conduct of human trials in the initial indications of DED; | |

| ● | receipt of marketing approvals for OK-101 in the United States and other jurisdictions where separate approval is required and where we subsequently choose to market OK-101; | |

| ● | launching commercial sales of OK-101, if and when approved; | |

| ● | acceptance of OK-101 by patients, the medical community and third-party payers; | |

| ● | OK-101 competing effectively with existing therapies and in particular with established products addressing the same clinical needs; | |

| ● | OK-101 influencing the treatment guidelines in relevant territories; and | |

| ● | further clinical trials to provide additional data to support commercialization of OK-101 and to permit wider label claims. |

If any of these milestones are not met, our business, financial condition, prospects and results of operations could be materially adversely affected.

| -10- |

Risks Related to Our Financial Position and Need for Capital.

We will need to raise substantial additional capital to develop and commercialize our product candidates and our failure to obtain funding when needed may force us to delay, reduce or eliminate our product development programs or collaboration efforts.

As of September 30, 2022, our cash and cash equivalents balance was approximately $0.7 million and our working capital was approximately ($0.4 million). Due to our recurring losses from operations and the expectation that we will continue to incur losses in the future, we will be required to raise additional capital to complete the development and commercialization of our current product candidates. We have historically relied upon private and public sales of our equity, as well as debt financings to fund our operations. In order to raise additional capital, we may seek to sell additional equity and/or debt securities or obtain a credit facility or other loan, which we may not be able to do on favorable terms, or at all. Our ability to obtain additional financing will be subject to a number of factors, including market conditions, our operating performance and investor sentiment. If we are unable to raise additional capital when required or on acceptable terms, we may have to significantly delay, scale back or discontinue the development and/or commercialization of our product candidate, restrict our operations or obtain funds by entering into agreements on unfavorable terms. Failure to obtain additional capital at acceptable terms would result in a material and adverse impact on our operations.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

Mazars LLP, our independent registered public accounting firm for the fiscal year ended March 31, 2022, has included an explanatory paragraph in their opinion that accompanies our audited consolidated financial statements as of and for the year ended March 31, 2022, indicating that liquidity position post December 2022 raises substantial doubt about our ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments that might result if we are unable to continue as a going concern and, therefore, be required to realize our assets and discharge our liabilities other than in the normal course of business which could cause investors to suffer the loss of all or a substantial portion of their investment.

We anticipate that we will continue to incur significant losses for the foreseeable future.

The amount of our future net losses will depend, in part, on the rate of our future expenditures, including further research and development activity. The amount of net losses will also depend on our success in developing and commercializing OK-101 and other products that generate significant revenue. Any failure by us to become and remain profitable could depress the value of the ordinary shares and could impair our ability to expand our business, maintain our research and development efforts, diversify our product offerings or continue our operations.

We will need to spend extensively on further research activities and there can be no guarantee that we will have access to sufficient funds to fully realize our research and development plan or to commercialize any products derived from research activities.

We expect to incur further significant expenses in connection with our ongoing research and development activities in relation to our products in development, including the future funding of clinical studies, registration, manufacturing, marketing, sales and distribution. To finance fully our strategy, we may require more capital than is available from our existing cash balances.

Access to adequate additional financing, whether through debt financing, an equity capital raise or a suitable partnering transaction may not be available to us on acceptable terms, or at all. Further, while the potential economic impact brought by, and the duration of the COVID-19 pandemic is difficult to assess or predict, the impact of the COVID-19 pandemic on the global financial markets may reduce our ability to access capital, which could negatively impact our short-term and long-term liquidity. If we are unable to raise capital, we could be forced to delay, reduce or eliminate our research and development programs or commercialization efforts. Any additional equity fundraising may be dilutive for our shareholders.

| -11- |

Any of these events could have a material adverse effect on our business financial condition, prospects and results of operation and may lead us to delay, reduce or abandon research and development programs or commercialization of some of our products.

Risks Related to Commercialization of Our Product Candidates

Even if we successfully develop a product which shows efficacy in human subjects there remain high barriers to commercial success

Even if we were to receive regulatory approval for OK-101 or any other products, we may be unable to commercialize them.

There are a number of factors that may inhibit our efforts to commercialize OK-101 or any other products on our own, including:

| ● | our inability to recruit, train and retain adequate numbers of effective sales and marketing personnel; | |

| ● | the inability of sales personnel to obtain access to or persuade adequate numbers of potential practitioners to prescribe any future products; | |

| ● | unforeseen costs and expenses associated with creating an independent sales and marketing organization; | |

| ● | costs of marketing and promotion above those anticipated by us; and | |

| ● | the inability to secure a suitable level of pricing and/or reimbursement approval from the relevant regulatory authorities in the countries we are targeting. |

While we may only seek to enter into arrangements with third parties to perform sales and marketing services in non-core territories, any such arrangements could result in our product revenues (or the profitability of such product revenues) being lower than if we were to market and sell the products itself. In addition, we may not be successful in entering into arrangements with third parties to sell and market our products or may be unable to do so on terms that are favorable to us. Acceptable third parties may fail to devote the necessary resources and attention to sell and market our products effectively. If we do not establish sales and marketing capabilities successfully, either on our own or in collaboration with third parties, we will not be successful in commercializing our products, which in turn would have a material adverse effect on our business, prospects, financial condition and results of operations.

We have also invested and will continue to invest resources into the development of other products, such as OK-201. Even where these products are successfully developed and marketing approval is secured from relevant regulatory authorities, these products might not achieve commercial success. Factors which could limit commercial success of a product include but are not limited to:

| ● | limited market acceptance or a lack of recognition of the unmet medical need for the product amongst prescribers; | |

| ● | new competitor products entering the market; | |

| ● | the number and relative efficacy, safety or cost of competitive products; | |

| ● | an inability to supply a sufficient amount of the product to meet market demand; | |

| ● | insufficient funding being available to market the product adequately; | |

| ● | an inability to enforce intellectual property rights, or the existence of third-party intellectual property rights; |

| ● | safety concerns arising pre- or post-launch resulting in negative publicity or product withdrawal or narrowing of the product label and the group of persons who may receive the product; | |

| ● | labelling being restricted/narrowed in the future and in the future by regulatory agencies; and | |

| ● | refusals by government or other healthcare payors to fund the purchase of the products by healthcare providers at a commercially viable level (or at all) or otherwise to restrict the availability of approved products on other grounds. |

| -12- |

If any of the foregoing were to occur, it could materially and adversely affect our business, financial condition, prospects and results of operations.

We face significant competition from pharmaceutical companies. We have competitors internationally, including major multinational pharmaceutical companies, universities and research institutions. In respect of OK-101 as an indication for the treatment of DED, there are a number of established companies engaged in the development and marketing of preparations addressing the DED market. In addition, there are a wide range of products addressing the DED market currently approved and marketed by a number of large and small pharmaceutical companies

Many of our competitors have substantially greater financial, technical and other resources, such as larger research and development teams, proven marketing and manufacturing organizations and well-established sales forces. Our competitors may succeed in developing, acquiring or licensing drug products that are more effective or less costly than products which we are currently developing or which it may develop.

Established pharmaceutical companies may invest heavily to accelerate the discovery and development of products that could make our products less competitive. In addition, any new product that competes with an approved product must demonstrate compelling advantages in efficacy, convenience, tolerability or safety in order to overcome price competition and to be commercially successful. Accordingly, our competitors may succeed in obtaining patent protection, receiving approval from the FDA, the European Medicines Agency, or EMA, or that of another relevant regulatory authority or discovering, developing and commercializing pharmaceutical products before we do, which would have a material adverse effect on our business.

The availability and price of our competitors’ products could limit the demand, and the price we are able to charge, for any of our products, if approved for sale. We will not achieve our business plan if acceptance is inhibited by price competition or the reluctance of physicians to switch from existing drug products to our products, or if physicians switch to other new drug products or choose to reserve our products for use in limited circumstances. Competition from lower-cost generic pharmaceuticals may also result in significant reductions in sales volumes or prices for our products, which could materially adversely affect our business, prospects, financial condition and results of operations.

We are dependent on third party supply, development and manufacturing and clinical service relationships and on single manufacturing sites for certain products. Our business strategy utilizes the expertise and resources of third parties in a number of areas, including the conduct of clinical trials, other product development, manufacture and the protection of our intellectual property rights in various geographical locations. This strategy creates risks for us by placing critical aspects of our business in the hands of third parties whom we may not be able to manage or control adequately and who may not always act in our best interests.

Where we are dependent upon third parties for the development or manufacture of certain products, our ability to procure our development or manufacture in a manner which complies with regulatory requirements may be constrained, and our ability to develop and deliver such material on a timely and competitive basis may be materially adversely affected, which may impact revenues.

Regulatory requirements for pharmaceutical products tend to make the substitution of suppliers and contractors costly and time-consuming. Alternative suppliers may not be able to manufacture products effectively or obtain the necessary manufacturing licenses from relevant regulatory authorities. The unavailability of adequate commercial quantities, the inability to develop alternative sources, a reduction or interruption in supply of contracted services, or a significant increase in the price of materials and services, could have a material adverse effect on our ability to manufacture and market our products or to fulfill orders from our distributors or licensees, which in turn would have a material adverse impact on our cash flows.

| -13- |

Insurance coverage and reimbursement may be limited, unavailable or may be reduced over time in certain market segments for our products.

Government authorities and third-party payers, such as private health insurers, decide which pharmaceutical products they will cover and the amount of reimbursement. Reimbursement may depend upon a number of factors, including the payer’s determination that use of a product is:

| ● | a covered benefit under the payor’s health plan; | |

| ● | safe, effective and medically necessary; | |

| ● | appropriate for the specific patient; | |

| ● | cost-effective; and | |

| ● | neither experimental nor investigational. |

Obtaining coverage and reimbursement approval for a product from a government or other third- party payer is a time-consuming and costly process that could require us to provide supporting scientific, clinical and cost-effectiveness data for the use of our products.

We may not be able to provide data sufficient to gain acceptance with respect to coverage and reimbursement, or to demonstrate commercial value compared to existing established treatments. Even if we are able to furnish the requested data, there is no guarantee that a third-party payor will cover a product. If reimbursement of our products is unavailable or limited in scope or amount, or if pricing is set at unsatisfactory levels, we may be unable to achieve or sustain profitability.

We may, in the future, seek approval to market our products in the EU, the US and in selected other jurisdictions. In the EU, the pricing of prescription pharmaceuticals is subject to national governmental control and pricing negotiations with governmental authorities can, in some circumstances, take several years after obtaining marketing approval for a product. In addition, market acceptance and sales of our products will depend significantly on the availability of adequate coverage and reimbursement from third-party payers and may be affected by existing and future healthcare reform measures.

The continuing efforts of governments, insurance companies, managed care organizations and other payers of healthcare services to contain or reduce costs of healthcare and/or impose price controls may materially adversely affect our ability to set prices for our products, generate revenues and achieve or maintain profitability. Any reduction in government reimbursement programs may result in a similar reduction in payments from private payers, which may materially adversely affect our business, prospects, financial condition and results of operations.

Risks Related to Our Intellectual Property

The expiration of certain intellectual property rights or an inability to obtain, maintain or enforce adequate intellectual property rights for products that are marketed or in development may result in additional competition from other third-party products. Third parties may have blocking intellectual property rights which could prevent the sale of products by us or require that compensation be paid to such third parties

The extent of our success will, to a significant degree, depend on our ability to establish, maintain, defend and enforce adequate intellectual property rights and to operate without infringing the proprietary or intellectual property rights of third parties. We have been granted, or have in-licensed rights under, a number of key patent families for OK-101 (or other proprietary rights), and patent applications are pending in the U.S., the EU, and certain other jurisdictions. We may develop or acquire further technology or products that are not patentable or otherwise protectable. The strength of patents in the pharmaceutical field involves complex legal and scientific questions and can be uncertain. Patents or other rights might not be granted under any pending or future applications filed or in-licensed by us and any claims allowed might not be sufficiently broad to protect our technologies and products from competition. Competitors may also successfully design around key patents held by us, thereby avoiding a claim of infringement. There is a risk that not all relevant prior art has been identified with respect to any particular patent or patent application and the existence of such prior art may invalidate any patents granted (or result in a patent application not proceeding to grant). Patents or other registerable rights might also be revoked for other reasons after grant. Third parties may challenge the validity, enforceability or scope of any granted patents. Our defense of our proprietary rights could involve substantial costs (even if successful) and could result in declarations of invalidity or significantly narrow the scope of those rights, limiting their value.

| -14- |

Competitors may have filed applications or been granted patents, or obtained additional patents and proprietary rights, which relate to and could be infringed by our products. An adverse outcome with respect to third party rights such as claims of infringement of patents or third-party proprietary rights by us could subject us to significant liabilities or require us to obtain a license for the continued use of the affected rights, which may not be available on acceptable terms or at all, or require us to cease commercialization and development efforts, or the sale of the relevant products, in whole or in part in the relevant jurisdictions.

We could be subject to claims for compensation by third parties claiming an ownership interest in the intellectual property rights relating to a commercially successful product. This may include claims from employee inventors in territories which permit such claims even where we own the intellectual property rights in question. Any such failure to defend our proprietary intellectual property could have a material adverse effect on our business, prospects, financial condition and results of operations.

We may not be able to obtain, maintain, defend or enforce the intellectual property rights covering our products

To date, we have had certain patents licensed to us in jurisdictions we consider to be important to our business. However, we cannot predict:

| ● | the degree and range of protection any patents will afford against competitors and competing technologies, including whether third parties will find ways to invalidate or otherwise circumvent the patents by developing a competitive product that falls outside its scope; | |

| ● | if, or when any patents will be granted; | |

| ● | that granted patents will not be contested, invalidated or found unenforceable; | |

| ● | whether or not others will obtain patents claiming aspects similar to those covered by the Company’s patents and patent applications; | |

| ● | whether we will need to initiate litigation or administrative proceedings, or whether such litigation or proceedings will be initiated by third parties against us, which may be costly and time consuming; and | |

| ● | whether third parties will claim that our technology infringes upon their rights. |

While we believe that we have novel composition of matter on the OK-101 peptide and novel methods of its use in treating DED, we cannot be sure that these patent applications will issue as patents. Each patent office has different patentability requirements, but we believe that the license patent applications contain patentable subject matter. The process for issuance of a patent involves correspondence with each local patent office in the jurisdictions in which the patent application is filed. That process, patent prosecution, involves a discussion of any relevant prior art and typically a discussion of the scope of the claims. The patent prosecution process can take several years depending on the jurisdiction and is not in the control of the patent owner, but in the control of the local patent office. We cannot be sure the outcome of the patent prosecution will be successful and result in issued patents.

Patent protection is of importance to us in maintaining our competitive position in our planned product lines and a failure to obtain or retain adequate protection could have a material adverse effect on our business, prospects, financial condition and results of operations.

We may not be able to prevent disclosure of our trade secrets, know-how or other proprietary information.

We rely on trade secret protection to protect our interests in proprietary know-how and in processes for which patents are difficult to obtain or enforce. If we are unable to protect our trade secrets adequately the value of our technology and products could be significantly diminished. Furthermore, our employees, consultants, contract personnel or third-party partners, either accidentally or through willful misconduct, may cause serious damage to our programs and/or our strategy by disclosing confidential information to third parties. It is also possible that confidential information could be obtained by third parties as a result of breaches of our physical or electronic security systems. Any disclosure of confidential data into the public domain or to third parties could allow third parties to access confidential information and use it in competition with us. In addition, others may independently discover the confidential information. Any action to enforce our rights against any misappropriation or unauthorized use and/or disclosure of confidential information is likely to be time-consuming and expensive, and may ultimately be unsuccessful, or may result in a remedy that is not commercially valuable. Any such loss of confidential information or failure to enforce our rights in relation to such confidential information, or unsatisfactory outcome of any related litigation could have a material adverse effect on our business, prospects, financial condition or results of operation.

| -15- |

Our product candidates could infringe patents and other intellectual property rights of third parties.

Our commercial success depends upon our ability, and the ability of any third party with which we may partner to develop, manufacture, market and sell our products and use our patent- protected technologies without infringing the patents of third parties.

Our products may infringe or may be alleged to infringe existing patents or patents that may be granted in the future which may result in costly litigation and could result in our having to pay substantial damages or limit our ability to commercialize our products.

Because some patent applications in Europe, the U.S. and many foreign jurisdictions may be maintained in secrecy until the patents are issued, patent applications in such jurisdictions are typically not published until 18 months after filing, and publications in the scientific literature often lag behind actual discoveries. Accordingly, we cannot be certain that others have not filed patents that may cover our technologies, our products or the use of our products. Additionally, pending patent applications which have been published can, subject to certain limitations, be later amended in a manner that could cover our technologies, our products or the use of our products. As a result, we may become party to, or threatened with, future adversarial proceedings or litigation regarding patents with respect to our products and technology.