UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number:

(Exact name of registrant as specified in its charter)

Not applicable | ||

(Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Nexters Inc.

Telephone: +35725580040

(Address of principal executive offices)

Chief Executive Officer

Nexters Inc.

Telephone: +

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered, pursuant to Section 12(b) of the Act

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Note—Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☐ Large accelerated filer | ☐ Accelerated filer | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

☐ U.S. GAAP | ☒ | ☐ Other |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

Auditor Name: | Auditor Location: | Auditor Firm ID: |

TABLE OF CONTENTS

i

ABOUT THIS ANNUAL REPORT

Except where the context otherwise requires or where otherwise indicated in this Annual Report, all references in this subsection to the “Company,” “we,” “us” or “our” refer to the business of Nexters Inc. and its subsidiaries, which prior to the Transactions was the business of Nexters Global Ltd. and its subsidiaries, and references to “Nexters” refer solely to Nexters Inc.

All references in this Annual Report to “dollar,” “USD,” “US$” or “$” refer to U.S. dollars and the terms “€” or “euro” refer to the currency introduced at the start of the third stage of European economic and monetary union pursuant to the treaty establishing the European Community, as amended.

SELECTED DEFINITIONS

The following terms used in this Annual Report are defined below, unless the context otherwise requires:

“2021 ESOP” means the Company’s 2021 Employee Stock Option Plan adopted by the Company’s board of directors on November 16, 2021.

“A&R Forward Purchase Agreement” means the amended and restated Forward Purchase Agreement, dated as of January 31, 2021, by and among Kismet, Nexters and the Sponsor.

“BVI” means British Virgin Islands.

“Business Combination Agreement” means the Business Combination Agreement, dated as of January 31, 2021, as amended on July 17, 2021 and August 11, 2021, by and among Kismet, Nexters, the Sponsor, solely in its capacity as Kismet’s representative, Nexters Global, Fantina Holdings Limited, a private limited liability company domiciled in Cyprus, solely in its capacity as the Company Shareholders representative, and the shareholders of Nexters Global party thereto.

“Closing” means the Merger Closing and the Share Acquisition Closing, collectively.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“Companies Act” means the BVI Business Companies Act, 2004 (as amended).

“Company” means Nexters Inc., a British Virgin Islands business company, and its consolidated subsidiaries.

“Company Shareholders” means the shareholders of Nexters Global prior to the Closing.

“Company Shareholders Lock-Up Agreement” means the Lock-Up Agreement entered into by the Key Company Shareholders at the Share Acquisition Closing in connection with the Transactions.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“Forward Purchase Agreement” means the forward purchase agreement dated August 5, 2020, by and among Kismet and Sponsor.

“IFRS” means International Financial Reporting Standards as adopted by the International Accounting Standards Board.

“Insolvency Act” means the Insolvency Act, 2003 of the British Virgin Islands.

“Investment Company Act” means the U.S. Investment Company Act of 1940, as amended.

“IPO” means Kismet’s initial public offering of Kismet units, consummated on August 10, 2020.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended.

ii

“Key Company Shareholders” means, collectively, Andrey Fadeev, Boris Gertsovskiy and Everix Investments Limited, a private limited liability company domiciled in Cyprus.

“Kismet” means, prior to the Merger, Kismet Acquisition One Corp, a company incorporated under the laws of the British Virgin Islands.

“Kismet founder shares” means the Kismet ordinary shares issued prior to the IPO.

“Lock-Up Agreements” means, collectively, the Company Shareholders Lock-Up Agreement and the Sponsor Lock-Up Agreement.

“Merger” means the merger of Kismet with and into Nexters, as a result of which the separate corporate existence of Kismet ceased, with Nexters will continuing as the surviving company, and the security holders of Kismet (other than security holders of Kismet who elected to redeem their Kismet ordinary shares) became security holders of Nexters.

“Merger Closing” means the closing of the Merger.

“Nasdaq” means the Nasdaq Global Market.

“Nexters” means Nexters Inc., a British Virgin Islands business company.

“Nexters Global” means Nexters Global Ltd., a private limited liability company domiciled in Cyprus, and its consolidated subsidiaries.

“PCAOB” means the Public Company Accounting Oversight Board.

“PIPE” means the issuance and sale of newly issued Nexters ordinary shares to the PIPE Investors in private placements outside the United States in reliance on Regulation S under the Securities Act consummated substantially concurrently with the closing of the Transactions.

“PIPE Investors” means the investors in the PIPE.

“PIPE Subscription Agreements” means the subscription agreements, dated July 16, 2021, as amended, among Kismet, Nexters, the Sponsor and the investors named therein, relating to the PIPE.

“Registration Rights Agreement” means the Registration Rights Agreement entered into by and among Nexters, the Key Company Shareholders and the Sponsor in connection with the Merger Closing.

“SEC” means the U.S. Securities Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Share Acquisition” means the acquisition by Nexters all of the issued and outstanding share capital of Nexters Global in exchange for the payment, issue and delivery to the Company Shareholders of a combination of cash and Nexters ordinary shares, pursuant to which Nexters Global became a direct wholly owned subsidiary of Nexters.

“Share Acquisition Closing” means the closing of the Share Acquisition.

“Share Acquisition Closing Date” means the date of the Share Acquisition Closing, which occurred on August 26, 2021.

“Sponsor” means Kismet Sponsor Limited, a British Virgin Islands business company.

“Sponsor Lock-Up Agreement” means the Lock-Up Agreement entered into by the Sponsor at the Share Acquisition Closing in connection with the Transactions.

iii

“Transactions” means the transactions contemplated by the Business Combination Agreement which, among other things, provided for the Merger, the Share Acquisition and, unless the context otherwise requires, the PIPE subscription financing.

“Warrant Agreement” means the warrant agreement governing Nexters’ outstanding warrants, comprising the warrant agreement, dated as of August 5, 2020, between Kismet and Continental Stock Transfer & Trust Company and the assignment, assumption and amendment agreement, dated as of August 25, 2021, by and among Kismet, Nexters and Continental Stock Transfer & Trust Company.

iv

PRESENTATION OF FINANCIAL INFORMATION

Our consolidated financial statements are presented in U.S. dollars and have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). We have made rounding adjustments to some of the figures included in this Annual Report. Accordingly, any numerical discrepancies in any table between totals and sums of the amounts listed are due to rounding.

KEY PERFORMANCE METRICS

Throughout this Annual Report, we provide a number of key performance metrics used by our management to manage our business. Our key performance metrics include the following:

| ● | “Daily Active Users,” or “DAUs,” defined as the number of individuals who played one of the Company’s games during a particular day. |

| ● | “Monthly Active Users,” or “MAUs,” defined as the number of individuals who played a particular game in the 30-day period ending with the measurement date. |

| ● | “Monthly Paying Users,” or “MPUs,” defined as the number of individuals who made a purchase of a virtual item at least once on a particular platform in the 30-day period ending with the measurement date. |

| ● | “Monthly Payer Conversion,” defined as the total number of MPUs, divided by the number of MAUs. |

| ● | “Average Bookings Per Paying User,” or “ABPPU,” defined as the Company’s total Bookings attributable to in-game purchases in a given period, divided by the number of months in that period, divided by the average number of MPUs during the period. |

| ● | “Bookings,” defined as sales contracts generated from in-game purchases and advertising in a given period. |

For more information on each of these metrics, see “Item 5. Operating and Financial Review and Prospects—Key Performance Metrics.”

INDUSTRY AND MARKET DATA

In this Annual Report, we present industry data, information and statistics regarding the markets in which we compete as well as publicly available information, industry and general publications and research and studies conducted by third parties. This information is supplemented where necessary with our own internal estimates and information obtained from discussions with its customers, taking into account publicly available information about other industry participants and the Company’s management’s judgment where information is not publicly available. This information appears in “Item 4. Information on the Company,” “Item 5. Operating and Financial Review and Prospects,” and other sections of this Annual Report.

Industry publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this Annual Report. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Item 1. Key Information—D. Risk Factors.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

v

TRADEMARKS

We have proprietary rights to trademarks used in this Annual Report that are important to our business, many of which are registered under applicable intellectual property laws. Solely for convenience, trademarks and trade names referred to in this Annual Report may appear without the “®” or “™” symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trademarks, trade names or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Each trademark, trade name or service mark of any other company appearing in this Annual Report is the property of its respective holder.

vi

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report and the information incorporated by reference herein include certain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements include, but are not limited to, statements with respect to (i) our revenues, Bookings, performance, strategies, plans, prospects, forecasts and other aspects of our business, (ii) trends in the gaming industry, (iii) our target cohorts and user and the expected arrangement with them, (iv) our projected growth opportunities, including relative to its competitors and (v) other statements regarding our expectations, hopes, beliefs, intentions or strategies regarding the future.

Such statements are based on current expectations that are subject to risks and uncertainties. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements contained in this Annual Report are based our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. Forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions. Many factors could cause actual results or performance to be materially different from those expressed or implied by the forward-looking statements in this Annual Report, including among other things:

| ● | our ability to implement business plans, forecasts, and other expectations, and identify and realize additional opportunities; |

| ● | our failure to realize anticipated benefits of the Transactions or to realize estimated pro forma results and underlying assumptions; |

| ● | our potential inability to achieve our projected Bookings growth and scale its platform; |

| ● | our potential inability to maintain our current revenue stream and its relationships with players and advertisers; |

| ● | our potential inability to become a consolidator in the gaming industry; |

| ● | the enforceability of our intellectual property and protection of our proprietary information; |

| ● | the risk to our business, operations and plans if internal processes and information technology systems are not properly maintained and risks associated with our operational reliance on third parties, including third-party platforms and infrastructure; |

| ● | the risk to our business, operations and plans from cyber-attacks or other privacy or data security incidents; |

| ● | the ability to maintain the listing of our securities on a national securities exchange; |

| ● | changes in the competitive and regulated industries in which we operate, variations in operating performance across competitors, changes in laws and regulations (including data privacy, cybersecurity and tax laws and regulations) affecting our business and changes in our capital structure; |

| ● | the risk of downturns and a changing regulatory landscape in the highly competitive industry in which the we operate; |

| ● | the effect of global epidemics and contagious disease outbreaks, including COVID-19, and public perception thereof; |

| ● | risks relating to our Bookings derived from players located in Russia; |

| ● | the ongoing suspension of trading in our securities on Nasdaq and their potential delisting; |

vii

| ● | volatility in the price of our securities; and |

| ● | the other matters described in the section titled “Item 3. Key Information—D. Risk Factors.” |

The foregoing list of factors is not exhaustive. The forward-looking statements contained in this Annual Report are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Item 3. Key Information—D. Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Some of these risks and uncertainties may in the future be amplified by the COVID-19 pandemic and there may be additional risks that we consider immaterial or which are unknown. It is not possible to predict or identify all such risks. We will not and do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

You should read this Annual Report and information incorporated by reference herein with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

viii

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. | [Reserved] |

B. | Capitalization and Indebtedness |

Not applicable.

C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

D. | Risk Factors |

Our business faces significant risks and uncertainties. You should carefully consider all of the information set forth in this Annual Report and in the other documents we file with or furnish to the SEC, including the following risk factors, before deciding to invest in or to maintain an investment in our securities. Our business, financial condition or results of operations could be materially and adversely affected by any of these risks, any of which could have an adverse effect on the trading price of our securities. Additional risks not presently known to us or that we currently deem immaterial may also impair our business, financial condition and results of operations in future periods.

Summary of Risk Factors

The risks more fully described below that relate to our business include, but are not limited to, the following important risks:

| ● | We rely on third-party platforms, such as the iOS App Store, Facebook, and Google Play Store, to distribute our games and collect revenues, and such platforms may adversely change their policies. |

| ● | Our core game offering, Hero Wars, generates a substantial portion of our revenue. |

| ● | A small percentage of total users have generated a majority of our revenues. |

| ● | Our free-to-play business model, and the value of virtual items sold in our games, is highly dependent on how we manage the game revenues and pricing models. |

| ● | We may be unable to successfully develop new games. |

| ● | We operate in a highly competitive industry with low barriers to entry. |

| ● | Legal or regulatory restrictions or proceedings could adversely impact our business and limit the growth of our operations. |

| ● | Security breaches or other disruptions could compromise our information or the information of our players and expose us to liability. |

1

| ● | Our inability to protect our intellectual property and proprietary information could adversely impact our business. |

| ● | Our use of open source software in connection with certain of our games, may pose particular risks to our proprietary software, games and services in a manner that could have a negative impact on our business. |

| ● | We face added business, political, regulatory, operational, financial and economic risks as a result of our operations and distribution in a variety of countries. |

| ● | We have no controlling shareholders, however, the loss of one or more of our largest shareholders could significantly harm our business. |

| ● | In connection with the preparation of Nexters Inc.’s consolidated financial statements as of and for the years ended December 31, 2021 and 2020, and of Nexters Global’s consolidated financial statements as of and for the years ended December 31, 2020 and 2019, we identified material weaknesses in our internal controls over financial reporting. |

| ● | A delisting of our ordinary shares from Nasdaq could have materially adverse effects on our business, financial condition and results of operations. |

Risks Related to the Company’s Business and Operations

We rely on third-party platforms, such as the iOS App Store, Facebook, and Google Play Store, to distribute our games and collect revenues generated on such platforms and rely on third-party payment service providers to collect revenues generated on our own platforms.

Our games are primarily accessed and operated through Apple, Facebook, Google, Xsolla and Huawei, which also serve as significant online distribution platforms for our games. Substantially all of the virtual items that we or our distributors sell to paying players are purchased using the payment processing systems of these platforms. Consequently, our prospects and expansion depend on our continued relationships with these providers, and any other emerging platform providers that are widely adopted by our target players. We and our distributors are subject to the standard terms and conditions of these platform providers for application developers, which govern the content, promotion, distribution, operation of games and other applications on their platforms, as well as the terms of the payment processing services provided by the platforms, and which the platform providers can change unilaterally with little or no notice. Our business would be harmed if:

| ● | the platform providers discontinue or limit our or our distributors’ access to their platforms; |

| ● | governments or private parties, such as internet providers, impose bandwidth restrictions or increase charges or restrict or prohibit access to those platforms; |

| ● | the platforms increase the fees they charge us or our distributors; |

| ● | the platforms modify their algorithms, communication channels available to developers, respective terms of service or other policies; |

| ● | the platforms decline in popularity; |

| ● | the platforms adopt changes or updates to their technology that impede integration with other software systems or otherwise require us to modify our technology or update our games in order to ensure players can continue to access our games and content with ease; |

| ● | the platforms elect or are required to change how they label free-to-play games or take payment for in-game purchases; |

| ● | the platforms block or limit access to the genres of games that we or our distributors provide in any jurisdiction; |

2

| ● | the platforms impose restrictions or spending caps or make it more difficult for players to make in-game purchases of virtual items; |

| ● | the platforms change how the personal information of players is made available to developers or develop or expand their own competitive offerings; or |

| ● | we or our distributors are unable to comply with the platform providers’ terms of service. |

If our platform providers do not perform their obligations in accordance with our platform agreements, we could be adversely impacted. For example, in the past, some of these platform providers have been unavailable for short periods of time, unexpectedly changed their terms and conditions, or experienced issues with their features that permit our players to purchase virtual items. Additionally, we rely on Xsolla, a third-party online payment service provider, to process any payments generated on games accessed and operated on our own proprietary platform. If this third-party service provider is unable to process payments, even for a short period of time, our business would be harmed. These platforms and our third-party online payment service provider may also experience security breaches or other issues with their functionalities, which could expose us to data breaches and could result in negative publicity, loss of customer confidence, fines from regulators and exposure to litigation. In addition, if we do not adhere to the terms and conditions of our platform providers, the platform providers may take actions to limit the operations of, suspend or remove our games from the platform, and/or we may be exposed to liability or litigation. For example, in August 2020, Epic Games, Inc., or Epic Games, attempted to bypass Apple and Google’s payment systems for in-game purchases with an update that allowed users to make purchases directly through Epic Games in its game, Fortnite. Apple and Google promptly removed Fortnite from their respective app stores, and Apple filed a lawsuit seeking injunctive relief to block the use of Epic Games’ payment system and seeking monetary damages to recover funds made while the updated version of Fortnite was active.

If any events described above or similar to those described above were to occur on a short-term or long-term basis, or if these third-party platforms and our online payment service provider otherwise experience issues that impact the ability of players to download or access our games, access social features, or make in-game purchases, they could have a material adverse effect on our brands and reputation, as well as our business, financial condition and results of operations.

Our core game offering, Hero Wars, generates a substantial portion of our revenue. There can be no assurance as to the continued success of Hero Wars, and we may be unable to offset any declines in revenues from Hero Wars.

Our business is primarily dependent on the success of a single core game offering, Hero Wars, and on our ability to consistently enhance and improve it, as well as our other games that achieve popularity. Historically, we have depended on Hero Wars for a majority of our revenues and we expect that this dependency will continue for the foreseeable future. For the years ended December 31, 2021, 2020 and 2019, Hero Wars generated approximately 99%, 98% and 87%, respectively, of our revenues for each period. For a game to remain popular and to retain players, we must constantly enhance, expand and upgrade the game with new features, offers, and content that players find attractive. As a result, each of our games require significant product development, marketing and other resources to develop, launch and sustain popularity through regular upgrades, expansions and new content, and such costs on average have increased over time. Even with these investments, we may experience sudden declines in the popularity of Hero Wars or any of our other games and fluctuations in the number of daily average users and monthly average users.

A small percentage of total users have generated a majority of our revenues, and we may be unable to attract new paying or retain existing paying users and maintain their spending levels.

Revenues of free-to-play games typically rely on a small percentage of players who spend moderate or large amounts of money in games to receive special advantages, levels, access and other features, offers, or content. The vast majority of users play free of charge or only occasionally spend money in games. As a result, compared to all users who play our games in any period, only a small percentage of such users were paying users. For example, for the year ended December 31, 2021, our Monthly Payer Conversion was 6.1%. In addition, a large percentage of our revenues comes from a small subset of these paying users. For example, for the year ended December 31, 2021, 122 thousand, or 10% of our total number of the annual paying users, generated 84% of our Bookings, while for the year ended December 31, 2020, 98 thousand, or 10% of our total number of annual paying users, generated 83% of our Bookings. The growth in the number of high paying users was 24% over the same period. Because many users do not generate revenues, and each paying user does not generate an equal amount of revenues, it is particularly important for us to retain the small percentage of paying users and to maintain or increase their spending levels. There can be no assurance that we will be able to

3

continue to retain paying users or that paying users will maintain or increase their spending. If we fail to attract and retain a significant number of new and existing players to our games or if we experience a reduction in the number of players of our most popular games or any other adverse developments relating to our most popular games occur, our market share and reputation could be harmed and there could be a material adverse effect on our business, financial condition and results of operations. It is possible that we could lose more paying users than we gain in the future, which would cause a decrease in the monetization of our games and could have a material adverse effect on our business, financial condition and results of operations.

We invest in new user acquisition and rely on monetization strategies to convert users to paying users, retain our existing paying users and maintain or increase the spending levels of our paying users. If our investments on new user acquisition and monetization strategies do not produce the desired results, we may fail to attract, retain or monetize users and may experience a decrease in spending levels of existing paying users, any of which would result in lower revenues for our games and could have a material adverse effect on our business, financial condition and results of operations.

We believe that the key factors in attracting and retaining paying users include our ability to enhance existing games and game experiences in ways that are specifically appealing to paying users. These abilities are subject to various uncertainties, including but not limited to:

| ● | our ability to provide an enhanced experience for paying users without adversely affecting the gameplay experience for non-paying users; |

| ● | our ability to continually anticipate and respond to changing user interests and preferences generally and to changes in the gaming industry; |

| ● | our ability to timely and adequately react in case of general rise of user discontent with our games or any of their existing or new features, including any coordinated actions by paying users; |

| ● | our ability to compete successfully against a large and growing number of industry participants with essentially no barriers to entry; |

| ● | our ability to hire, integrate and retain skilled personnel; |

| ● | our ability to increase penetration in, and enter into new, demographic markets; |

| ● | our ability to achieve a positive return on our user acquisition and other marketing investments and to drive organic growth; and |

| ● | our ability to minimize and quickly resolve bugs or outages. |

Some of our users also depend on our customer support organization to answer questions relating to our games. Our ability to provide high-quality effective customer support is largely dependent on our ability to attract, resource, and retain employees who are not only qualified to support our users, but are also well versed in our games. Any failure to maintain high-quality customer support, or a market perception that we do not maintain high-quality customer support, could harm our reputation and adversely affect our ability to sell virtual items within our games to existing and prospective users.

If we are unable to maintain or increase our customer base or engagement, or effectively monetize our customer base’s use of our products and offerings, our revenue and financial results may be adversely affected. Any decrease in customer retention, growth or engagement, including player liquidity, could render our products less attractive to customers, which is likely to have a material and adverse impact on our revenue, business, financial condition and results of operations. If our active player growth rate slows, we will become increasingly dependent on our ability to maintain or increase levels of player engagement and monetization in order to drive revenue growth.

If we are unable to attract and retain users, especially paying users, it would have a material adverse effect on our business, financial condition and results of operations.

4

We utilize a free-to-play business model, which depends on players making optional in-game purchases, and the value of the virtual items sold in our games is highly dependent on how we manage the game revenues and pricing models.

Our games are available to players free of charge, and we generate the majority of our revenues from the sale of virtual items when players make voluntary in-game purchases. For example, in each of the years ended December 31, 2021, 2020 and 2019, we derived 93.7%, 94.2% and 95.1%, respectively, of our revenues from in-game purchases.

Paying users usually spend money in our games because of the perceived value of the virtual items that we offer for purchase. The perceived value of these virtual items can be impacted by various actions that we take in the games, such as offering discounts, giving away virtual items in promotions or providing easier non-paid means to secure such virtual items. If we fail to manage our game economies properly, players may be less likely to spend money in the games, which could have a material adverse effect on our business, financial condition and results of operations.

Unrelated third parties have developed, and may continue to develop, “cheats” or guides that enable players to advance in our games or result in other types of malfunction, which could reduce the demand for in-game virtual items. In particular, for our games where players play against each other, such as our Hero Wars game, there is a higher risk that these “cheats” will enable players to obtain unfair advantages over those players who play fairly, and harm the experience of those players. Additionally, these unrelated third parties may attempt to scam our players with fake offers for virtual items or other game benefits. These scams may harm the experience of our players, disrupt the economies of our games and reduce the demand for our virtual items, which may result in increased costs to combat such programs and scams, a loss of revenues from the sale of virtual items and a loss of players. As a result, players may have a negative gaming experience and be less likely to spend money in the games, which could have a material adverse effect on our business, financial condition and results of operations.

Our inability to complete acquisitions and integrate any acquired businesses successfully could limit our growth or disrupt our plans and operations.

We believe that acquisitions may be one of the sources of growth in the near future. As part of our broader mergers and acquisition strategy, in September 2021 we launched our first program, Nexters Boost, to identify and support new or small game makers in their early stages of development and growth. Our ability to succeed in implementing our strategy will depend to some degree upon our ability to identify quality games and businesses and complete commercially viable acquisitions. We can provide no assurance that acquisition opportunities will be available on acceptable terms or at all, or that we will be able to obtain necessary financing or regulatory approvals to complete potential acquisitions. In some cases, the costs of such acquisitions may be substantial and there is no assurance that the time and resources expended in pursuing a particular acquisition will result in a completed transaction, or that any completed transaction will ultimately be successful. Furthermore, our ability to successfully grow through these types of transactions also depends upon our ability to identify, negotiate, complete and integrate suitable target businesses, technologies and products and to obtain any necessary financing, and is subject to numerous risks, including:

| ● | failure to identify acquisition, investment or other strategic alliance opportunities that we deem suitable or available on favorable terms; |

| ● | problems integrating acquired businesses, technologies or products, including issues maintaining uniform standards, procedures, controls and policies; |

| ● | the availability of funding sufficient to meet increased capital needs; |

| ● | unanticipated costs associated with acquisitions, investments or strategic alliances; |

| ● | adverse impacts on our overall margins; |

| ● | diversion of management’s attention from the day-to-day operations of our existing business; |

| ● | the ability to retain or hire qualified personnel for expanded operations and the potential loss of key employees of acquired businesses; and |

5

| ● | increased legal and accounting compliance costs. |

In addition, the expected cost synergies associated with such acquisitions may not be fully realized in the anticipated amounts or within the contemplated timeframes, which could result in increased costs and have an adverse effect on our prospects, results of operations, cash flows and financial condition. We would expect to incur incremental costs and capital expenditures related to integration activities. Acquisition transactions may also disrupt our ongoing business, as the integration of acquisitions would require significant time and focus from management and might delay the achievement of our strategic objectives. For example, on February 4, 2021, we acquired Nexters Online (formerly known as NX Online LLC) and Nexters Studio (formerly known as NX Studio LLC), two Russian game development studios. On December 9, 2021, we also acquired 70% of the voting shares in Game Positive LLC, another Russian development studio. Furthermore, on January 25, 2022, we entered into share purchase agreements to acquire 100% of the issued share capital of Gracevale Limited, the parent company of Cubic Games, the developer and publisher of the mobile first-person shooter 8game Pixel Gun 3D. In order to successfully integrate these companies’ operations into ours, we will need to align their accounting, corporate governance and other policies with our own internal structures, consistent with those of a public company. To the extent that we are unable to efficiently integrate these companies into ours, there may be a material adverse effect on our business, financial condition and result of operations. Furthermore, we are still in the early stages of developing our production center with Nexters Boost, where we will leverage our expertise to search for and potentially make monetary investments in new projects of other game developers. If we are unable to identify or adequately assess the quality of potential new projects or properly manage the cost of our investments, or if our investments do not prove to be successful due to various reasons outside of our control (including without limitation, due to market conditions, actions of our counterparties or regulatory requirements), we may not realize the expected benefit, incur increased costs or suffer reputational damage, which may lead to a material adverse effect on our business, financial condition and result of operations.

If we are unable to identify suitable target businesses, technologies or products, or if we are unable to successfully integrate any acquired businesses, technologies and products effectively, we may not realize the expected benefits, and our business, financial condition and results of operations could be materially and adversely affected, and we can provide no assurances that we will be able to adequately supplement any such inability to successfully acquire and integrate with organic growth. Also, while we employ several different methodologies to assess potential business opportunities, the businesses we may acquire may not meet or exceed our expectations.

Furthermore, we may target or maintain a noncontrolling interest in companies as part of our acquisition strategy. Acquisitions of interests in companies in which we share or have no control, and the dilution of our interests in or a further reduction of our control of companies, will involve additional risks that could cause the performance of our interests and our operating results to suffer, including:

| ● | the management teams or other equity or debt holders of these companies having economic or business interests or objectives that are different from ours, and |

| ● | these companies not taking our advice with respect to the financial or operating issues they may encounter. |

Our inability to control companies in which we have a noncontrolling interest also could prevent us from assisting them, financially or otherwise, or could prevent us from liquidating our interests in them at a time or at a price that is favorable to us. Additionally, these companies may not act in ways that are consistent with our business strategy. These factors could hamper our ability to maximize returns on our interests and cause us to incur losses on our interests in these companies.

If we fail to develop or acquire new games that achieve broad popularity, we may be unable to attract new players or retain existing players, which could negatively impact our business.

Developing or acquiring new games that achieve broad popularity is vital to our continued growth and success. Our ability to successfully develop or acquire new games and their ability to achieve broad popularity and commercial success depends on a number of factors, including our ability to:

| ● | attract, retain and motivate talented game designers, product managers and engineers; |

6

| ● | identify, acquire or develop, sustain and expand games that are fun, interesting and compelling to play over long periods of time; |

| ● | effectively market new games and enhancements to our new and existing players; |

| ● | achieve viral organic growth and gain customer interest in our games; |

| ● | minimize launch delays and cost overruns on new games and game expansions; |

| ● | minimize downtime and other technical difficulties; |

| ● | adapt to player preferences; |

| ● | expand and enhance games after their initial release; |

| ● | partner with mobile platforms; |

| ● | maintain a quality social game experience; and |

| ● | accurately forecast the timing and expense of our operations. |

These and other uncertainties make it difficult to know whether we will succeed in continuing to develop or acquire successful games and launch new games that achieve broad popularity. If we are unable to successfully acquire new games or develop new games in-house, it could have a material effect on our pipeline and negatively affect our growth and results of operations.

We operate in a highly competitive industry with low barriers to entry, and our success depends on our ability to effectively compete.

The mobile gaming industry is a rapidly evolving industry with low barriers to entry, and we expect more companies to enter the industry and a wider range of competing games to be introduced. As a result, we are dependent on our ability to successfully compete against a large and growing number of industry participants. In addition, the market for our games is characterized by rapid technological developments, frequent launches of new games and enhancements to current games, changes in player needs and behavior, disruption by innovative entrants and evolving business models and industry standards. As a result, our industry is constantly changing games and business models in order to adopt and optimize new technologies, increase cost efficiency and adapt to player preferences. Our competitors may adapt to an emerging technology or business model more quickly or effectively, developing products and games or business models that are technologically superior to ours, more appealing to consumers, or both. Potential new competitors could have significant resources for developing, enhancing or acquiring games and gaming companies, and may also be able to incorporate their own strong brands and assets into their games or distribution of their games. We also face competition from a vast number of small companies and individuals who may be successful in creating and launching games and other content for these devices and platforms using relatively limited resources and with relatively limited start-up time or expertise. New game developers enter the gaming market continuously, some of which experience significant success in a short period of time. A significant number of new titles are introduced each day.

In addition, the high ratings of our games on the platforms on which we operate are important as they help drive users to find our games. If the ratings of any of our games decline or if we receive significant negative reviews that result in a decrease in our ratings, our games could be more difficult for players to find or recommend. In addition, we may be subject to negative review campaigns or defamation campaigns intended to harm our ratings. This could lead to loss of users and revenues, additional advertising and marketing costs, and reputation harm.

Additionally, if our platform providers were to develop competitive offerings, either on their own or in cooperation with one or more competitors, our growth prospects could be negatively impacted. For example, in September 2019, Apple launched its own video game subscription service, Apple Arcade, which includes a catalogue of game offerings that may compete with our games. Increased competition and success of other brands, genres, business models and games could result in, among other things, a loss of

7

players, or negatively impact our ability to acquire new players cost-effectively, which could have a material adverse effect on our business, financial condition and results of operations.

Moreover, current and future competitors may also make strategic acquisitions or establish cooperative relationships among themselves or with others, including our current or future business partners or third-party software providers. By doing so, these competitors may increase their scale, their ability to meet the needs of existing or prospective players and compete for similar human resources. If we are unable to compete effectively, successfully and at a reasonable cost against our existing and future competitors, our results of operations, cash flows and financial condition would be adversely impacted.

Our ability to successfully attract in-game advertisers depends on our ability to design an attractive advertising model that retains players.

While the vast majority of our revenues are generated by in-game purchases, a portion of our revenues are generated from the sale of in-game advertisements. For example, in each of the years ended December 31, 2021, 2020 and 2019, we derived 6.3% 5.8% and 4.9%, respectively, of our revenues from in-game advertising. If we are unable to attract and maintain a sufficient player base or otherwise fail to offer attractive in-game advertising models, advertisers may not be interested in purchasing such advertisements in our games, which could adversely affect our revenues from in-game advertising. Alternatively, if our advertising inventory is unavailable and the demand exceeds the supply, this limits our ability to generate further revenues from in-game advertising, particularly during peak hours and in key geographies. Further, a full inventory may divert advertisers from seeking to obtain advertising inventory from us in the future, and thus deprive us of potential future in-game advertising revenues. This could have a material adverse effect on our reputation and our business, financial condition and results of operations.

In addition, if we include in-game advertising in our games that players view as excessive, such advertising may materially detract from players’ gaming experiences, thereby creating player dissatisfaction, which may cause us to lose players and revenues, and negatively affect the in-game experience for players making purchases of virtual items in our games.

If we develop new games that achieve success, it is possible that these games could divert players of our other games without growing the overall size of our network, which could harm our results of operations.

As we develop new games, it is possible that these games could cause players to reduce their playing time and purchases in our other existing games without increasing their overall playing time or purchases. In addition, we also may cross-promote our new games in our other games, which could further encourage players of existing games to divert some of their playing time and spending on existing games. If new games do not grow or generate sufficient additional revenues to offset any declines in purchases from our other games, our revenues could be materially and adversely affected.

Changes to digital platforms’ rules, including those relating to “loot boxes,” or the potential adoption of regulations or legislation impacting loot boxes, could require us to make changes to some of our games’ economies or design, which could negatively impact the monetization of these games, thereby reducing our revenues.

In December 2017, Apple updated its terms of service to require publishers of applications that include “loot boxes” to disclose the odds of receiving each type of item within each loot box to customers prior to purchase. Google similarly updated its terms of service in May 2019. Loot boxes are a commonly used monetization technique in free-to-play mobile games in which a player can acquire a virtual loot box, but the player does not know which virtual item(s) he or she will receive (which may be a common, rare or extremely rare item, and may be a duplicate of an item the player already has in his or her inventory) until the loot box is opened. The player will always receive one or more virtual items when he or she opens the loot box. In the event that Apple, Google, or any of our other platform providers changes its developer terms of service to include more onerous requirements or if any of our platform providers were to prohibit the use of loot boxes in games distributed on its digital platform, we would be required to redesign the economies of the affected games in order to continue distribution on the impacted platforms, which would likely cause a decline in the revenues generated from these games and require us to incur additional costs.

In addition, there are ongoing academic, political and regulatory discussions in the United States, Europe, Australia and other jurisdictions regarding whether certain game mechanics, such as loot boxes, should be subject to a higher level or different type of regulation than other game genres or mechanics to protect consumers, in particular minors and persons susceptible to addiction, and, if so, what such regulation should include. Additionally, loot box game mechanics have been the subject of increased public discussion

8

— for example, the Federal Trade Commission, or FTC, held a public workshop on loot boxes in August 2019, and at least one bill has been introduced in the U.S. Senate that would regulate loot boxes in games marketed toward players under the age of 18. In addition, the United Kingdom’s Department for Digital, Culture, Media and Sport in September 2020 launched a call for evidence into the impact of loot boxes on in-game spending and gambling-like behavior, and politicians have cited loot boxes as an example of recent technology innovation where government regulation is needed. In October 2020, a Netherlands district administrative court upheld an administrative order by the Dutch gambling authority demanding that Electronic Arts remove certain loots boxes from one of its games because they violated Dutch gambling laws and recommended a maximum fine of 10 million euros for non-compliance with the administrative order. For the first time, the Dutch district administrative court ruled that virtual items can constitute a prize for purposes of gambling legislation. While no other court has adopted a similar definition of prize and there has been opposition to the idea that virtual items can be prizes under gambling laws from the European Parliament and others, it is possible that other courts or regulatory agencies will adopt similarly broad definitions of prize. Additionally, after being restricted in Belgium and the Netherlands, the United Kingdom House of Lords has recently issued a report recommending that loot boxes be regulated within the remit of gambling legislation and regulation.

In some of our games, certain mechanics may be deemed to be loot boxes. New regulations by the FTC, U.S. states or other international jurisdictions, which may vary significantly across jurisdictions and with which we may be required to comply, could require that these game mechanics be modified or removed from games, increase the costs of operating our games due to disclosure or other regulatory requirements, impact player engagement and monetization, or otherwise harm our business performance. It is difficult to predict how existing or new laws may be applied to these or similar game mechanics. If we become liable under these laws or regulations, we could be directly harmed, and we may be forced to implement new measures to reduce our exposure to this liability. This may require us to expend substantial resources, to modify our games or to discontinue game offerings in certain jurisdictions, which would harm our business, financial condition and results of operations. In addition, the increased attention focused upon liability issues as a result of lawsuits and legislative proposals could harm our reputation or otherwise impact the growth of our business. Any costs incurred as a result of this potential liability could harm our business, financial condition or results of operations.

Our online offerings are part of new and evolving industries, which presents significant uncertainty and business risks.

The online gaming and interactive entertainment industries are relatively new and continue to evolve. Whether these industries grow and whether our online business will ultimately succeed, will be affected by, among other things, developments in social networks, mobile platforms, legal and regulatory developments (such as the passage of new laws or regulations or the extension of existing laws or regulations to online gaming and related activities), taxation of gaming activities, data and information privacy and payment processing laws and regulations, and other factors that we are unable to predict and which are beyond our control. Given the dynamic evolution of these industries, it can be difficult to plan strategically, including as it relates to product launches in new or existing jurisdictions that may be delayed or denied, and it is possible that competitors will be more successful than we are at adapting to change and pursuing business opportunities. Additionally, as the online gaming industry advances, including with respect to regulation in new and existing jurisdictions, we may become subject to additional compliance-related costs, including as it relates to licensing and taxes. For example, we have recently received a notification from regulatory authorities in Vietnam that we should obtain certain licenses in order to able to continue offering our games in Vietnam. There can be no assurance that we will be not required to cease offering our games on certain platforms in Vietnam pending receipt of the relevant licenses. Consequently, we cannot provide assurance that our online and interactive offerings will grow at the rates expected, or be successful in the long term. If our products do not obtain popularity or maintain popularity, or if they fail to grow in a manner that meets its expectations, or if we cannot offer our product offerings in particular jurisdictions that may be material to our business, our business, results of operations and financial condition could be harmed.

The recent COVID-19 pandemic and similar health epidemics, contagious disease outbreaks and public perception thereof, could significantly disrupt our operations and adversely affect our business, results of operations, cash flows or financial condition.

The recent COVID-19 pandemic, epidemics, medical emergencies and other public health crises outside of our control could have a negative impact on our business. Large-scale medical emergencies can take many forms and can cause widespread illness and death. In particular, the global spread and impact of the COVID-19 pandemic is complex, unpredictable and continuously evolving. The COVID-19 pandemic has led governments and other authorities around the world to impose measures intended to control its spread, including restrictions on large gatherings of people, travel bans, border closings and restrictions, business closures, quarantines, shelter-in-place orders, social distancing measures and vaccine requirements. While the outbreak recently appeared to be trending downward as vaccination rates increased, resulting in the easing of restrictions, new variants of COVID-19 continue

9

emerging, including the highly transmissible Delta variant and the newly-discovered Omicron variant, spreading globally and causing significant uncertainty.

Although the full extent of the impact from the COVID-19 pandemic on our business is unknown at this time, it could affect the health of our employees, or otherwise impact the productivity of our employees, third-party organizations with which we partner, or regulatory agencies we rely on, which may prevent us from delivering content in a timely manner or otherwise executing our business strategies. We have followed guidance by the Cypriot government and the governments of other relevant jurisdictions in which we operate to protect our employees and our operations during the pandemic and have implemented a remote environment for certain of our employees, and, as a result, may experience inefficiencies in our employees’ ability to collaborate.

The COVID-19 pandemic could also affect the health of our consumers, which may affect sales of our virtual items in our games. In addition, the COVID-19 pandemic has caused an economic recession, high unemployment rates and other disruptions, both in the United States and the rest of the world. Any of these impacts, including the prolonged continuation of these impacts, could adversely affect our business.

We cannot predict the other potential impacts of the COVID-19 pandemic on our business or operations, and there is no guarantee that any near-term trends in our results of operations will continue, particularly if the COVID-19 pandemic and the adverse consequences thereof continue for a long period of time. A continuation of the current environment, or any further adverse impacts caused by the COVID-19 pandemic could further deteriorate employment rates and the economy, detrimentally affecting our consumer base and divert player discretionary income to other uses, including for essential items. These events could adversely impact our cash flows, results of operations and financial conditions and heighten many of the other risks described in these “Risk Factors.” Furthermore, while we saw increased consumer interest and engagement in online gaming during the year ended December 31, 2020, which we in part attribute to the travel restrictions, lockdowns and other social distancing measures implemented by governments to combat the COVID-19 pandemic, there can be no assurance that a re-imposition of any such restrictive measures in a renewed effort to control the spread of COVID-19 variants will result in a similar increase, or that interest or engagement will generally continue or can be sustained with the easing of restrictions. Any resulting decrease in user activity or spending could adversely impact our cash flows, operating results, and financial condition. In addition, while we may take actions as may be required to reduce the risks posed by COVID-19, there is no certainty that such measures will be sufficient to mitigate the risks posed by COVID-19.

Legal or regulatory restrictions could adversely impact our business and limit the growth of our operations.

There is significant opposition in some jurisdictions to interactive social gaming. In September 2018, the World Health Organization added “gaming disorder” to the International Classification of Diseases, defining the disorder as a pattern of behavior characterized by impaired control over gaming and an increase in the priority of gaming over other interests and daily activities. Additionally, the public has become increasingly concerned with the amount of time spent using phones, tablets and computers per day, and these concerns have increased as people spend more time at home and on their devices over the course of the stay-at-home orders caused by, as well as the increasing work-from-home flexibility granted by employers as a consequence of, the COVID-19 pandemic. Such opposition could lead these jurisdictions to adopt legislation or impose a regulatory framework to govern interactive social gaming specifically. These could result in a prohibition on interactive social gaming altogether, restrict our ability to advertise our games, or substantially increase our costs to comply with these regulations, all of which could have an adverse effect on our results of operations, cash flows and financial condition. We cannot predict the likelihood, timing, scope or terms of any such legislation or regulation or the extent to which they may affect our business.

Consumer protection concerns regarding games such as ours have been raised in the past and may again be raised in the future. These concerns include: (i) methods to limit the ability of children to make in-game purchases, and (ii) a concern that mobile game companies are using big data and advanced technology to predict and target “vulnerable” users who may spend significant time and money on mobile games in lieu of other activities. Such concerns could lead to increased scrutiny over the manner in which our games are designed, developed, distributed and presented. We cannot predict the likelihood, timing or scope of any concern reaching a level that will impact our business, or whether we would suffer any adverse impacts to our results of operations, cash flows and financial condition.

10

Legal proceedings may materially adversely affect our business and our results of operations, cash flows and financial condition.

We have been party to, and in the future may become subject to, legal proceedings in the operation of our business, including in respect of the implementation of our mergers and acquisitions strategy. Such legal proceedings include, but not limited to, those relating to advertising, consumer protection, employee matters, tax matters, alleged service and system malfunctions, alleged intellectual property infringement and claims relating to our contracts, licenses and strategic investments, as well as claims by or against our shareholders (present or past), directors, officers and employees.

Legal proceedings targeting our games and claiming violations of laws could occur based on the unique and particular laws of each jurisdiction, particularly as litigation claims and regulations continue to evolve. Defending ourselves against claims by third parties, or the initiation of litigation to enforce any rights that we may have against third parties, could result in substantial costs and diversion of our resources, causing a material adverse effect on our business, financial condition and results of operations.

Given the nature of our business, we may from time to time be party to various legal, administrative and regulatory inquiries, investigations, proceedings and claims that arise in the ordinary course of business. Because the outcome of such legal matters is inherently uncertain, they could have a material adverse effect on our results of operations, cash flows or financial condition.

We rely on a limited number of geographies for a significant portion of our revenues.

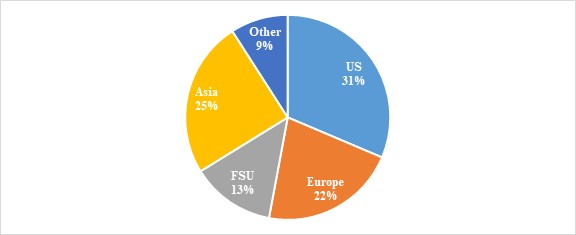

Although we have players across the globe, we derive a significant portion of our revenues from a limited number of countries and are dependent on access to those markets. For example, for the year ended December 31, 2021, 31.5% of our revenues were derived from users located in the United States, 24.5% of our revenues were derived from users located in Asia, with Japan and South Korea being the key drivers, and 21.6% of our revenues were derived from users located in Europe. Our ability to retain paying players depends on our success in these geographies, and if we were to lose access to these markets or experience a decline in players in these geographies for any reason, it would have a material adverse effect on our business, financial condition and results of operations.

If general economic conditions decline, demand for our games could decline. In addition, our business is vulnerable to changing economic conditions and to other factors that adversely affect the gaming industry, which could negatively impact our business.

In-game purchases involve discretionary spending on the part of consumers. Consumers are generally more willing to make discretionary purchases, including purchases of games and services like ours, during periods in which favorable economic conditions prevail. As a result, our games may be sensitive to general economic conditions and economic cycles. A reduction or shift in domestic or international consumer spending could result in an increase in our marketing and promotional expenses, in an effort to offset that reduction, and could negatively impact our business. Discretionary spending on entertainment activities could further decline for reasons beyond our control, such as natural disasters, acts of war, pandemics, terrorism, transportation disruptions or the results of adverse weather conditions. Additionally, disposable income available for discretionary spending may be reduced by unemployment, higher housing, energy, interest, or other costs, or where the actual or perceived wealth of customers has decreased because of circumstances such as lower residential real estate values, increased foreclosure rates, inflation, increased tax rates, or other economic disruptions. Any prolonged or significant decrease in consumer spending on entertainment activities could result in reduced play levels in decreased spending on our games, and could adversely impact our results of operations, cash flows and financial condition.

Our systems and operations are vulnerable to damage or interruption from natural disasters, power losses, telecommunications failures, cyber-attacks, terrorist attacks, acts of war, human errors, break-ins and similar events.

We may experience disruption as a result of catastrophic events such as natural disasters, power losses, telecommunications failures, cyber-attacks, terrorist attacks, acts of war, human errors, break-ins and similar events. In the occurrence of a catastrophic event, including a global pandemic like the ongoing COVID-19 pandemic, we may be unable to continue our operations and may endure system interruptions, reputational harm, delays in application development, lengthy interruptions in our services, breaches of data security and loss of critical data, such as player, customer and billing data as well as trade secret or other confidential information, software versions or other relevant data regarding operations, and we do not maintain insurance policies to compensate us for any resulting losses, which could have a material adverse effect on our business, financial condition and results of operations. As a result of the COVID-19 pandemic, we grant our employees the choice to work remotely. If a natural disaster, power outage,

11

connectivity issue or other event occurred that impacted our employees’ ability to work remotely, it may be difficult or, in certain cases, impossible, for us to continue our business for a substantial period of time.

We primarily rely on skilled employees with creative and technical backgrounds. The loss of one or more of our key employees, or our failure to attract and retain other highly qualified employees in the future, could significantly harm our business.

We primarily rely on our highly skilled, technically trained and creative employees to develop new technologies and create innovative games. Such employees, particularly game designers, engineers and project managers with desirable skill sets are in high demand, and we devote significant resources to identifying, hiring, training, successfully integrating and retaining these employees. The loss of employees or the inability to hire additional skilled employees as necessary could result in significant disruptions to our business, and the integration of replacement personnel could be time-consuming and expensive and cause additional disruptions to our business.

We are highly dependent on the continued services and performance of our key personnel, including, in particular Andrey Fadeev and Boris Gertsovskiy, our co-founders, and our other executive officers and senior management team. Moreover, our success is highly dependent on the abilities of our co-founders’ decision-making process with respect to the day-to-day and ongoing needs of our business, as well as their more fundamental understanding of our Company as its co-founders. Although we have entered into employment agreements with our co-founders, either co-founder can terminate his employment, subject to certain agreed notice periods and post-termination restrictive covenants. We do not maintain key-man insurance for any executive officer or member of our senior management team.

In addition, our games are created, developed, enhanced and supported in our in-house game studios. The loss of key game studio personnel, including members of management as well as key engineering, game development, artists, product, marketing and sales personnel, could disrupt our current games, delay new game development or game enhancements, and decrease player retention, which would have an adverse effect on our business.

As we continue to grow, we cannot guarantee we will continue to attract the personnel we need to maintain our competitive position. In particular, we expect to face significant competition from other companies in hiring such personnel as well as recruiting well-qualified staff in multiple international jurisdictions. Furthermore, our competitors may lure away our existing personnel by offering them employment terms that our personnel view as more favorable. As we mature, the incentives to attract, retain and motivate our staff provided by our equity awards or by future arrangements, such as through cash bonuses, may not be as effective as in the past. If we do not succeed in attracting, hiring and integrating excellent personnel, or retaining and motivating existing personnel, we may be unable to grow effectively.

We track certain performance metrics with internal and third-party tools and do not independently verify such metrics. Certain of our performance metrics are subject to inherent challenges in measurement, and real or perceived inaccuracies in such metrics may harm our reputation and adversely affect our business.

We track certain performance metrics, including the number of active and paying players of our games using a combination of internal and third-party analytics tools, including such tools provided by Apple, Facebook and Google. Our performance metrics tools have a number of limitations, including limitations placed on third-party tools, such as (i) the complicated and time consuming process of the validation of our data by comparison to the third-party data due to (a) differences between calendar periods used in our systems and billing periods used in the third-party tools and (b) differences in foreign exchange rates applied in our systems, which use the rates at the date of each in-game purchase, and certain third-party tools that use the exchange rates as at the date of the invoice; (ii) incomplete data in our system that was used prior to mid-2018; (iii) inconsistencies of definitions of metrics in our current system compared with the system that we used prior to mid-2018; and (iv) untimely updates of the master data in our system regarding the platform commission fees and indirect taxes, due to numerous changes of these parameters that we may not always be able to identify and process. Such tools are subject to change unilaterally by the relevant third parties and our methodologies for tracking these metrics or access to these metrics may change over time, which could result in unexpected changes to our metrics, including the metrics we report. If the internal or external tools we use to track these metrics under-count or over-count performance or contain technical errors, the data we report may not be accurate, and we may not be able to detect such inaccuracies, particularly with respect to third-party analytics tools. In addition, limitations or errors with respect to how we measure data (or how third parties present that data to us) may affect our understanding of certain details of our business, which could affect our long-term strategies. We also may not have access to comparable quality data for games we acquire with respect to periods before integration, which may impact our ability to rely on such

12

data. Furthermore, such limitations or errors could cause players, analysts or business partners to view our performance metrics as unreliable or inaccurate. If our performance metrics are not accurate representations of our business, player base or traffic levels, if we discover material inaccuracies in our metrics or if the metrics we rely on to track our performance do not provide an accurate measurement of our business or otherwise change, our reputation may be harmed and our business, prospects, financial condition and results of operations could be materially and adversely affected.

Our business depends on our ability to collect and use data to deliver relevant content and advertisements, and any limitation on the collection and use of this data could cause us to lose revenues.