Exhibit 99.1

Annual Information Form

For the year ended December 31, 2021

April 1, 2022

TABLE OF CONTENTS

| | |||

| | |||

INTERPRETATION | 5 | |||

Definitions | 5 | |||

CIM Definition Standards | 5 | |||

CAUTIONARY NOTE REGARDING FORWARD LOOKING INFORMATION | 6 | |||

CAUTIONARY NOTE REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES | 10 | |||

OTHER INFORMATION | 10 | |||

Currency | 10 | |||

Third Party Information | 11 | |||

Non-GAAP Measures | 11 | |||

Date of Information | 11 | |||

STRUCTURE OF THE COMPANY | 11 | |||

Name, Address and Incorporation | 11 | |||

Intercorporate Relationships | 12 | |||

GENERAL DEVELOPMENT OF THE BUSINESS | 12 | |||

Overview | 12 | |||

Three Year History | 12 | |||

Operations | 13 | |||

Environmental Social and Governance | 15 | |||

DESCRIPTION OF THE BUSINESS | 20 | |||

Overview | 20 | |||

Lithium Properties | 20 | |||

Royalties | 30 | |||

Life Cycle Analysis and Net Zero Strategy | 31 | |||

Environmental Licensing and Permitting | 31 | |||

Surface Rights and Other Permitting | 32 | |||

Specialized Skills and Knowledge | 32 | |||

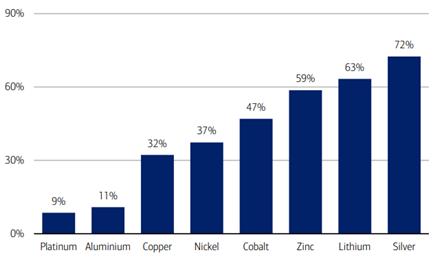

Mineral Price and Economic Cycles | 33 | |||

Economic Dependence | 33 | |||

Bankruptcy and Similar Procedures | 33 | |||

Reorganizations | 33 | |||

Foreign Operations | 33 | |||

Employees | 33 | |||

Environmental Protection | 33 | |||

Social and Environmental Policies | 33 | |||

SUMMARY OF UPDATED FEASIBILITY STUDY REPORT | 33 | |||

PROPERTY DESCRIPTION AND LOCATION | 34 | |||

ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 34 | |||

HISTORY | 34 | |||

GEOLOGICAL SETTING AND MINERALIZATION | 35 | |||

EXPLORATION | 36 | |||

DRILLING | 36 | |||

SAMPLE PREPARATION, ANALYSES AND SECURITY | 36 | |||

DATA VERIFICATION | 38 | |||

MINERAL PROCESSING AND METALLURGICAL TESTING | 38 | |||

First Mine | 38 | |||

Second Mine | 39 | |||

MINERAL RESOURCE ESTIMATES | 39 | |||

MINERAL RESERVE ESTIMATES | 43 | |||

MINING METHODS | 44 | |||

First Mine | 44 | |||

Second Mine | 44 | |||

RECOVERY METHODS | 45 | |||

Processing Plant Description | 45 | |||

Design Criteria and Utilities Requirements | 45 | |||

PROJECT INFRASTRUCTURE | 46 | |||

Buildings, Roads, Fuel Storage, Power Supply and Water Supply | 46 | |||

Waste Rock and Tailings Disposal and Stockpiles | 46 | |||

Control Systems and Communication | 47 | |||

MARKET STUDIES AND CONTRACTS | 47 | |||

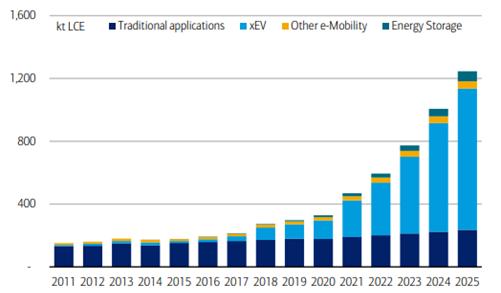

Demand and Consumption | 47 | |||

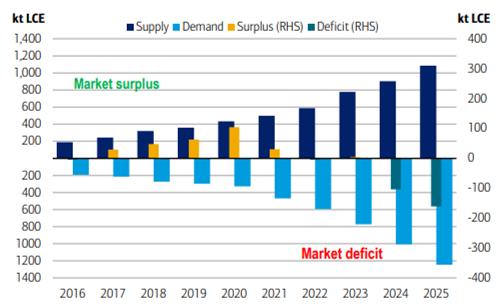

Supply | 47 | |||

Contracts | 47 | |||

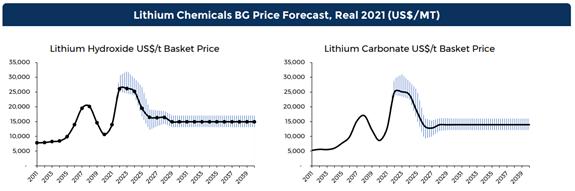

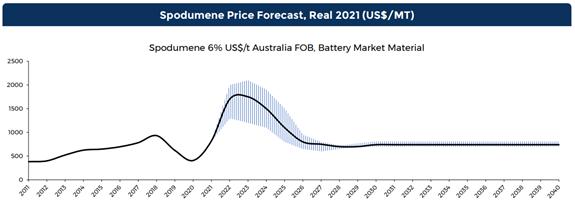

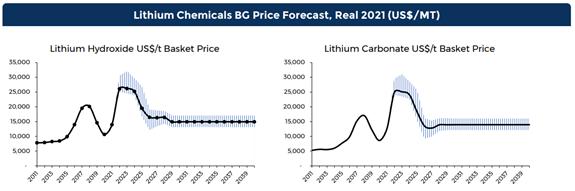

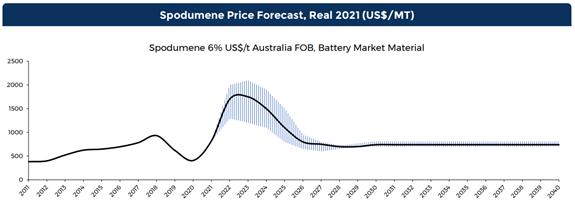

Price Forecast | 48 | |||

ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 48 | |||

Applicable Legal Requirements for Project Environmental Permitting | 48 | |||

Current Project Environmental Permitting Status | 48 | |||

Authorizations | 49 | |||

Land Access | 49 | |||

Social License Considerations | 49 | |||

Rehabilitation, Closure Planning and Post-Closure Monitoring | 50 | |||

Second Mine Environmental Work to Date | 50 | |||

CAPITAL AND OPERATING COSTS | 50 | |||

Capital Costs First Mine | 50 | |||

Operating Costs First Mine | 51 | |||

Plant CAPEX and OPEX Second Mine | 51 | |||

Mining Capital Costs Second Mine | 51 | |||

Mining Operating Costs Second Mine | 52 | |||

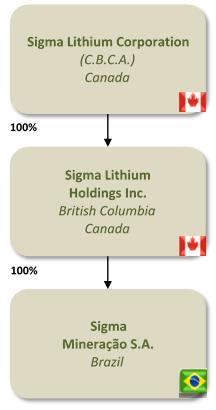

ECONOMIC ANALYSIS | 52 | |||

Production Phase 1 | 52 | |||

Production Phase 2 | 56 | |||

INTERPRETATION AND CONCLUSIONS | 58 | |||

Risk Assessment | 58 | |||

Opportunities | 58 | |||

RECOMMENDATIONS | 59 | |||

Geology and Resources | 59 | |||

First Mine Recommendations | 59 | |||

Second Mine Project Recommendations | 59 | |||

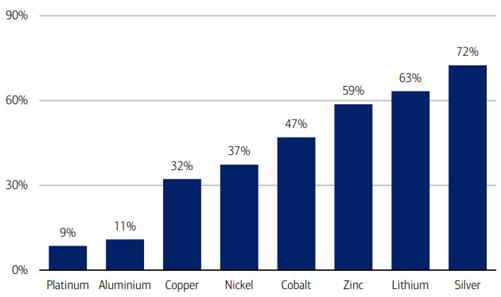

Competitive Conditions and Anticipated Trends | 60 | |||

Emerging Market Disclosure | 62 | |||

RISK FACTORS | 64 | |||

Risk Factors | 64 | |||

Risks Related to Resource Development | 65 | |||

DESCRIPTION OF CAPITAL STRUCTURE | 79 | |||

Common Shares | 79 | |||

DIVIDENDS AND DISTRIBUTIONS | 80 | |||

MARKET FOR SECURITIES | 80 | |||

Market | 80 | |||

Trading Price and Volume | 80 | |||

| | |||

PRIOR SALES | 81 | |||

DIRECTORS AND OFFICERS | 81 | |||

Name and Occupation | 81 | |||

Shareholdings of Directors and Officers | 85 | |||

Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 85 | |||

Committees of the Board | 85 | |||

Conflicts of Interest | 86 | |||

AUDIT COMMITTEE INFORMATION | 86 | |||

Audit Committee Charter | 86 | |||

Composition of the Audit Committee | 86 | |||

Relevant Education and Experience | 87 | |||

Audit Committee Oversight | 87 | |||

Reliance on Certain Exemptions | 87 | |||

Pre-Approval Policies and Procedures | 87 | |||

Audit Fees | 88 | |||

LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 88 | |||

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 88 | |||

TRANSFER AGENT AND REGISTRAR | 88 | |||

MATERIAL CONTRACTS | 88 | |||

INTERESTS OF EXPERTS | 88 | |||

ADDITIONAL INFORMATION | 89 | |||

SCHEDULE “A” AUDIT COMMITTEE CHARTER | 90 | |||

EXHIBIT “A” TO THE AUDIT COMMITTEE CHARTER | 95 | |||

SCHEDULE “B” DEFINITIONS | 97 | |||

| | |||

INTERPRETATION

Definitions

For a description of defined terms and other reference information used in this Annual Information Form (this “AIF”), please refer to Schedule “B”.

CIM Definition Standards

The disclosure included in this AIF uses mineral resources and mineral reserves classification terms that comply with reporting standards in Canada. All mineral resource and mineral reserve estimates are made in accordance with the CIM Definition Standards and NI 43-101, which is a set of rules developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects and operations. The following definitions are reproduced from the CIM Definition Standards:

A mineral resource is a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Mineral resources are sub-divided, in order of increasing geological confidence, into inferred, indicated and measured categories, which are defined as follows:

· | An inferred mineral resource is that part of a mineral resource for which quantity, grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. |

· | An indicated mineral resource is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of modifying factors (as defined below) in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An indicated mineral resource has a lower level of confidence than that applying to a measured mineral resource and may only be converted to a probable mineral reserve. |

· | A measured mineral resource is that part of a mineral resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of modifying factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A measured mineral resource has a higher level of confidence than that applying to either an indicated mineral resource or an inferred mineral resource. It may be converted to a proven mineral reserve or to a probable mineral reserve. |

“Modifying factors” are considerations used to convert mineral resources to mineral reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors.

A mineral reserve is the economically mineable part of a measured and/or indicated mineral resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level as appropriate that include application of modifying factors. Such studies demonstrate that, at the time of reporting, extraction

| 5 |

2021 ANNUAL INFORMATION FORM | |

could reasonably be justified. Mineral reserves are sub-divided, in order of increasing geological confidence, into probable and proven categories, which are defined as follows:

· | A probable mineral reserve is the economically mineable part of an indicated, and in some circumstances, a measured mineral resource. The confidence in the modifying factors applying to a probable mineral reserve is lower than that applying to a proven mineral reserve. |

· | A proven mineral reserve is the economically mineable part of a measured mineral resource. A proven mineral reserve implies a high degree of confidence in the modifying factors. |

CAUTIONARY NOTE REGARDING FORWARD LOOKING INFORMATION

Certain information and statements in this AIF may constitute “forward looking information” within the meaning of Canadian securities legislation and “forward looking statements” within the meaning of U.S. securities legislation (collectively, “Forward Looking Information”), which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such Forward Looking Information. All statements, other than statements of historical fact, may be Forward Looking Information, including, but not limited to, mineral resource or mineral reserve estimates (which reflect a prediction of mineralization that would be realized by development). When used in this AIF, such statements generally use words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate” and other similar terminology. These statements reflect management’s current expectations regarding future events and operating performance and speak only as of the date of this AIF. Forward Looking Information involves significant risks and uncertainties, should not be read as guarantees of future performance or results, and does not necessarily provide accurate indications of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the Forward Looking Information, which is based upon what management believes are reasonable assumptions, and there can be no assurance that actual results will be consistent with the Forward Looking Information.

In particular (but without limitation), this AIF contains Forward Looking Information with respect to the following matters: statements regarding anticipated decision making with respect to the Project; capital expenditure programs; estimates of mineral resources and mineral reserves; development of mineral resources and mineral reserves; government regulation of mining operations and treatment under governmental and taxation regimes; the future price of commodities, including lithium; the realization of mineral resource and mineral reserve estimates, including whether mineral resources will ever be developed into mineral reserves; the timing and amount of future production; currency exchange and interest rates; expected outcome and timing of environmental surveys and permit applications and other environmental matters; the Company’s ability to raise capital and obtain project financing; expected expenditures to be made by the Company on its properties; successful operations and the timing, cost, quantity, capacity and quality of production; capital costs, operating costs and sustaining capital requirements, including the cost of construction of the processing plant for the Project; and competitive conditions and anticipated trends post-COVID-19 pandemic and the ongoing uncertainties and effects in respect of the COVID-19 pandemic and the military conflict in Ukraine.

Forward Looking Information does not take into account the effect of transactions or other items announced or occurring after the statements are made. Forward Looking Information is based upon a number of expectations and assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company’s control, that could cause actual results to differ materially from those disclosed in or implied by such Forward

Looking Information. With respect to the Forward Looking Information, the Company has made assumptions regarding, among other things:

· | General economic and political conditions (including but not limited to the impact of the continuance or escalation of the military conflict between Russia and Ukraine, and economic sanctions in relation thereto). |

· | Stable and supportive legislative, regulatory and community environment in the jurisdictions where the Company operates. |

| 6 |

2021 ANNUAL INFORMATION FORM | |

· | Stability and inflation of the Brazilian Real, including any foreign exchange or capital controls which may be enacted in respect thereof, and the effect of current or any additional regulations on the Company’s operations. |

· | Anticipated trends and effects in respect of the COVID-19 pandemic and post-pandemic. |

· | Demand for lithium, including that such demand is supported by growth in the electric vehicle (“EV”) market. |

· | Estimates of, and changes to, the market prices for lithium. |

· | The impact of increasing competition in the lithium business and the Company’s competitive position in the industry. |

· | The Company’s market position and future financial and operating performance. |

· | The Company’s estimates of mineral resources and mineral reserves, including whether mineral resources will ever be developed into mineral reserves. |

· | Anticipated timing and results of exploration, development and construction activities. |

· | Reliability of technical data. |

· | The Company’s ability to develop and achieve production at the Project. |

· | The Company’s ability to obtain financing on satisfactory terms to develop the Project. |

· | The Company’s ability to obtain and maintain mining, exploration, environmental and other permits, authorizations and approvals for the Project. |

· | The timing and outcome of regulatory and permitting matters for the Project. |

· | The exploration, development, construction and operational costs for the Project. |

· | The accuracy of budget, construction and operations estimates for the Project. |

· | Successful negotiation of definitive commercial agreements, including off-take agreements for the Project. |

· | The Company’s ability to operate in a safe and effective manner. |

Although management believes that the assumptions and expectations reflected in such Forward Looking Information are reasonable, there can be no assurance that these assumptions and expectations will prove to be correct. Since Forward Looking Information inherently involves risks and uncertainties, undue reliance should not be placed on such information.

The Company’s actual results could differ materially from those anticipated in any Forward Looking Information as a result of various known and unknown risk factors, including (but not limited to) the risk factors referred to under the heading “Risk Factors” in this AIF. Such risks relate to, but are not limited to, the following:

· | The Company may not develop the Project into a commercial mining operation. |

· | There can be no assurance that market prices for lithium will remain at current levels or that such prices will improve. |

· | The market for electric vehicles (“EVs”) and other large format batteries currently has limited market share and no assurances can be given for the rate at which this market will develop, if at all, which could affect the success of the Company and its ability to develop lithium operations. |

· | Changes in technology or other developments could result in preferences for substitute products. |

· | New production of lithium hydroxide or lithium carbonate from current or new competitors in the lithium markets could adversely affect prices. |

| 7 |

2021 ANNUAL INFORMATION FORM | |

· | The Project is at development stage and the Company’s ability to succeed in progressing through development to commercial operations will depend on a number of factors, some of which are outside its control. |

· | The Company’s financial condition, operations and results of any future operations are subject to political, economic, social, regulatory and geographic risks of doing business in Brazil. |

· | Violations of anti-corruption, anti-bribery, anti-money laundering and economic sanctions laws and regulations could materially adversely affect the Company’s business, reputation, results of any future operations and financial condition. |

· | The Company is subject to regulatory frameworks applicable to the Brazilian mining industry which could be subject to further change, as well as government approval and permitting requirements, which may result in limitations on the Company’s business and activities. |

· | The Company’s operations are subject to numerous environmental laws and regulations and expose the Company to environmental compliance risks, which may result in significant costs and have the potential to reduce the profitability of operations. |

· | Physical climate change events and the trend toward more stringent regulations aimed at reducing the effects of climate change could have an adverse effect on the Company’s business and future operations. |

· | As the Company does not have any experience in the construction and operation of a mine, processing plants and related infrastructure, it is more difficult to evaluate the Company’s prospects, and the Company’s future success is more uncertain than if it had a more proven history of developing a mine. |

· | The Company’s future production estimates are based on existing mine plans and other assumptions which change from time to time. No assurance can be given that such estimates will be achieved. |

· | The Company may experience unexpected costs and cost overruns, problems and delays during construction, development, mine start-up and operations for reasons outside of the Company’s control, which have the potential to materially affect its ability to fully fund required expenditures and/or production or, alternatively, may require the Company to consider less attractive financing solutions. |

· | The Company’s capital and operating cost estimates may vary from actual costs and revenues for reasons outside of the Company’s control. |

· | The Company’s operations are subject to the high degree of risk normally incidental to the exploration for, and the development and operation of, mineral properties. |

· | Insurance may not be available to insure against all such risks, or the costs of such insurance may be uneconomic. Losses from uninsured and underinsured losses have the potential to materially affect the Company’s financial position and prospects. |

· | The Company is subject to risks associated with securing title and property interests. |

· | The Company is subject to strong competition in Brazil and in the global mining industry. |

· | The Company may become subject to government orders, investigations, inquiries or other proceedings (including civil claims) relating to health and safety matters, which could result in consequences material to its business and operations. |

· | The Company’s mineral resource and mineral reserve estimates are estimates only and no assurance can be given that any particular level of recovery of minerals will in fact be realized or that identified mineral resources or mineral reserves will ever qualify as a commercially mineable (or viable) deposit. |

· | The Company’s operations and the development of its projects may be adversely affected if it is unable to maintain positive community relations. |

· | The Company is exposed to risks associated with doing business with counterparties, which may impact the Company’s operations and financial condition. |

| 8 |

2021 ANNUAL INFORMATION FORM | |

· | Any limitation on the transfer of cash or other assets between the Company and the Company’s subsidiaries, or among such entities, could restrict the Company’s ability to fund its operations efficiently. |

· | The Company is subject to risks associated with its reliance on consultants and others for mineral exploration and exploitation expertise. |

· | The current COVID-19 pandemic could have a material adverse effect on the Company’s business, operations, financial condition and stock price. |

· | The current military conflict in Ukraine and the economic or other sanctions imposed may impact global markets in such a manner as to have a material adverse effect on the Company’s business, operations, financial condition and stock price. |

· | If the Company is unable to ultimately generate sufficient revenues to become profitable and have positive cash flows, it could have a material adverse effect on its prospects, business, financial condition, results of operations or overall viability as an operating business. |

· | The Company is subject to liquidity risk and therefore may have to include a “going concern” note in its financial statements. |

· | The Company may not be able to obtain sufficient financing in the future on acceptable terms, which could have a material adverse effect on the Company’s business, results of operations and financial condition. In order to obtain additional financing, the Company may conduct additional (and possibly dilutive) equity offerings or debt issuances in the future. |

· | The Company may be unable to achieve cash flow from operating activities sufficient to permit it to pay the principal, premium, if any, and interest on the Company’s indebtedness, or maintain its debt covenants. |

· | The Company has not declared or paid dividends in the past and may not declare or pay dividends in the future. |

· | The Company will incur increased costs as a result of being a public company both in Canada listed on the TSXV and in the United States listed on the Nasdaq Capital Market (“Nasdaq”), and its management will be required to devote further substantial time to United States public company compliance efforts. |

· | If the Company does not maintain adequate and appropriate internal controls over financial reporting as outlined in accordance with NI 52-109 or the Rules and Regulations of the SEC, the Company will have to report a material weakness and disclose that the Company has not maintained appropriate internal controls over financial reporting. |

· | As a foreign private issuer, the Company is subject to different U.S. securities laws and rules than a domestic U.S. issuer, which may limit the information publicly available to its shareholders. |

· | Failure to retain key officers, consultants and employees or to attract and, if attracted, retain additional key individuals with necessary skills could have a materially adverse impact upon the Company’s success. |

· | The Company is subject to currency fluctuation risks. |

· | From time to time, the Company may become involved in litigation, which may have a material adverse effect on its business financial condition and prospects. |

· | Certain directors and officers of the Company are, or may become, associated with other natural resource companies which may give rise to conflicts of interest. |

· | The market price for the Company’s shares may be volatile and subject to wide fluctuations in response to numerous factors beyond its control, and the Company may be subject to securities litigation as a result. |

· | If securities or industry analysts do not publish research or reports about the Company’s business, or if they downgrade the Common Shares, the price of the Common Shares could decline. |

· | The Company will have broad discretion over the use of the net proceeds from offerings of its securities. |

· | There is no guarantee that the Common Shares will earn any positive return in the short term or long term. |

| 9 |

2021 ANNUAL INFORMATION FORM | |

· | The Company has a major shareholder which owns 47.2% of the outstanding Common Shares and, as such, for as long as such shareholder directly or indirectly maintains a significant interest in the Company, it may be in a position to affect the Company’s governance, operations and the market price of the Common Shares. |

· | As the Company is a Canadian corporation but most of its directors and officers are not citizens or residents of Canada or the U.S., it may be difficult or impossible for an investor to enforce judgements against the Company and its directors and officers outside of Canada and the U.S. which may have been obtained in Canadian or U.S. courts or initiate court action outside Canada or the U.S. against the Company and its directors and officers in respect of an alleged breach of securities laws or otherwise. Similarly, it may be difficult for U.S. shareholders to effect service on the Company to realize on judgments obtained in the United States. |

· | The Company is governed by the Canada Business Corporations Act and by the securities laws of the province of Ontario, which in some cases have a different effect on shareholders than U.S. corporate laws and U.S. securities laws. |

· | The Company is subject to risks associated with its information technology systems and cyber-security. |

· | The Company may be a Passive Foreign Investment Company, which may result in adverse U.S. federal income tax consequences for U.S. holders of Common Shares. |

Readers are cautioned that the foregoing lists of assumptions and risks is not exhaustive. The Forward Looking Information contained in this AIF is expressly qualified by these cautionary statements. All Forward Looking Information in this AIF speaks as of the date of this AIF. The Company does not undertake any obligation to update or revise any Forward Looking Information, whether as a result of new information, future events or otherwise, except as required by applicable securities law. Additional information about these assumptions, risks and uncertainties is contained in the Company’s filings with securities regulators, including the Company’s most recent annual and interim MD&A, which are available on SEDAR at www.sedar.com.

CAUTIONARY NOTE REGARDING MINERAL RESOURCE

AND MINERAL RESERVE ESTIMATES

Technical disclosure regarding the Company’s properties included in this AIF, and in the documents incorporated herein by reference has not been prepared in accordance with the requirements of U.S. securities laws. Without limiting the foregoing, such technical disclosure uses terms that comply with reporting standards in Canada and estimates are made in accordance with NI 43-101. Unless otherwise indicated, all mineral reserve and mineral resource estimates contained in the technical disclosure have been prepared in accordance with NI 43-101 and the CIM Definition Standards.

Under the SEC rules regarding disclosure of technical information, the definitions of “proven mineral reserves” and “probable mineral reserves” are substantially similar to the corresponding CIM Definition Standards, and the SEC recognizes “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” which are also substantially similar to the corresponding CIM Definition Standards. However, there are still differences in the definitions and standards under the SEC rules and the CIM Definition Standards. Therefore, the Company’s mineral resources and reserves as determined in accordance with NI 43-101 may be significantly different than if they had been determined in accordance with the SEC rules.

OTHER INFORMATION

Currency

This AIF contains references to United States dollars, Canadian dollars and Brazilian Reais. All dollar amounts referenced, unless otherwise indicated, are expressed in Canadian dollars “Cdn$”. United States dollars are referred to as “US$”. Brazilian Reais are referred to as “R$”.

| 10 |

2021 ANNUAL INFORMATION FORM | |

The following table sets forth the high and low, average and period-end exchange rates for one US dollar expressed in Canadian dollars and Brazilian Reais for each period indicated, based upon the daily exchange rates provided by the Bank of Canada and FactSet:

|

| 2021 |

| 2020 |

High |

| Cdn$1.29/R$5.81 |

| Cdn$1.45/R$5.93 |

Low |

| Cdn$1.20/R$4.92 |

| Cdn$1.27/R$4.02 |

Rate at end of period |

| Cdn$1.27/R$5.57 |

| Cdn$1.27/R$5.19 |

Average rate for period |

| Cdn$1.25/R$5.40 |

| Cdn$1.34/R$5.15 |

On April 1, 2022, the rate for Canadian dollars (as quoted by the Bank of Canada) and Brazilian Reais in terms of the United States dollar was US$1.00 = Cdn$1.25/R$4.66.

Third Party Information

This AIF includes market, industry and economic data and projections obtained from various publicly available sources and other sources believed by the Company to be true. Although the Company believes these to be reliable, it has not independently verified the information from third party sources, or analyzed or verified the underlying reports relied upon or referred to by the third parties, or ascertained the underlying economic and other assumptions relied upon by the third parties. The Company believes that the market, industry and economic data and projections are accurate and that the estimates and assumptions are reasonable, but there can be no assurance as to their accuracy or completeness. The accuracy and completeness of the market, industry and economic data and projections in this AIF are not guaranteed and the Company does not make any representation as to the accuracy or completeness of such information.

Non-GAAP Measures

This AIF and the Updated Feasibility Study Report incorporated by reference herein contains certain non-GAAP measures. The non-GAAP measures do not have any standardized meaning within IFRS and therefore may not be comparable to similar measures presented by other companies. These measures provide information that is customary in the mining industry and that is useful in evaluating the Project. This data should not be considered as a substitute for measures of performance prepared in accordance with IFRS.

Qualified Person

Mr. Wes Roberts, P.Eng., a member of the technical committee of the Company, is the “qualified person” under NI 43-101 who reviewed and approved the technical information disclosed in this AIF and the documents incorporated by reference herein.

Date of Information

Except as otherwise indicated, all information disclosed in this AIF is as of April 1, 2022.

STRUCTURE OF THE COMPANY

Name, Address and Incorporation

Sigma Lithium Corporation (the “Company” or “Sigma”) is domiciled in Canada and was incorporated under the Canada Business Corporations Act on June 8, 2011 originally under the name Margaux Red Capital Inc. The current business of Sigma was acquired through a reverse take-over transaction on April 30, 2018 pursuant to which the Company acquired Sigma Lithium Resources Inc (“Sigma Holdings”) which held (and continues to hold) the Grota do Cirilo Project, located in the state of Minas Gerais in Brazil (the “Project”) through a Brazilian wholly-owned subsidiary, Sigma Mineração S.A. (“Sigma Brazil”). On completion of the reverse take-over transaction, the Company implemented a share consolidation. On July 5, 2021, the Company changed its name from “Sigma Lithium Resources Corporation” to “Sigma Lithium Corporation”.

| 11 |

2021 ANNUAL INFORMATION FORM | |

The registered office of the Company is at Suite 2200, HSBC Building, 885 West Georgia St. Vancouver, BC V6C 3E8 Canada and the head office of the Company is Avenida Nove de Julho 4939, 9th Floor, Torre Europa, Itaim, Sao Paulo, Sao Paulo, 01407-200. The Company’s web site is www.sigmalithium.ca.

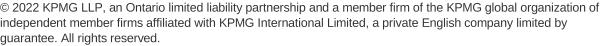

Intercorporate Relationships

The corporate structure of the Company, its subsidiaries, the jurisdiction of incorporation of such corporations and the percentage of equity ownership are set out in the following chart:

GENERAL DEVELOPMENT OF THE BUSINESS

Overview

Sigma is a Canadian mineral processing and development company, focused on advancing, with an environmental sustainability directed strategy, one of the largest hardrock lithium projects in the Americas - its wholly-owned Grota do Cirilo Project in Brazil, with the goal of participating in the rapidly expanding lithium-ion battery supply chain for EVs. For further information on the business of the Company, please refer to “Description of the Business”.

Three Year History

The following is a summary of the key developments that have generally influenced the development of the Company’s business and projects over the last three years.

| 12 |

2021 ANNUAL INFORMATION FORM | |

Operations

The Company continues to advance toward initiating commercial production in 2023. On December 6, 2021, the Company announced the commencement of construction on site to build the foundation and infrastructure installation for its greentech DMS Production Plant, which was completed at the end of the first quarter of 2022. This stage comprised the earthworks necessary for installation of the Production Plant and infrastructure foundations. Approximately one million cubic meters of soil/subsoils was moved, employing a workforce of approximately 300 personnel.

The Company successfully completed several workstreams involved in the pre-construction of the Production Plant within its schedule and budget parameters. In 2021, the Company reached major milestones towards engineering and construction, despite challenging circumstances created by the COVID-19 pandemic.

The Company is managing three interconnected workstreams aimed to develop the Project as a whole:

· | the completion of Front-End Engineering and Design (“FEED”) and commencement of execution and management of construction activities for Production Phase 1 and the Production Plant; |

· | the completion of the pre-feasibility study of Production Phase 2, aimed at a potential production expansion; and |

· | the continued exploration and expansion of the Project’s estimated mineral resources, with the objective of increasing the Project’s mine life and/or a potential Production Phase 3 expansion scenario. |

For further information on Production Phase 1, Production Phase 2 and Production Phase 3, please refer to “Description of the Business – Current Status of the Project”.

In relation to the Production Phase 1 workstream, the FEED was finalized in December 2021. The final capital expenditure (“CAPEX”) budget with a Project Execution Plan (“PEP”) was also completed in December 2021. The Company issued letters of intent (“LOIs”) for long lead items to vendors in order to start vendor design and detailed design by Primero Group Ltd (“Primero”) and Promon Engenharia Ltda. (“Promon”).

Following the successful conclusion of the first phase of FEED, Promon and Primero will remain engaged by the Company and continue to focus on negotiating and securing long lead items for the construction of the Production Plant. The Company is currently negotiating an agreement for the engineering, procurement, and construction management (“EPCM”) of the Production Plant and associated infrastructure with both engineering firms. The Company is also in negotiations with two finalist mining contractors to build and operate the First Mine.

The Company continued to demonstrate the unique extent and high-purity quality of its hard rock lithium mineralization for the Project and its commercial and market relevance by having significantly advanced its strategic goals on three fronts: short term production scheduled for 2023, the viability of a near-term production expansion contemplated for 2024, and the determination of the ultimate extent of mineral resources at the Project, all while maintaining its strategic leadership in ESG in the lithium supply chain.

For further information on the Project, please refer to “Description of the Business – Current Status of the Project”.

On December 1, 2021, the Company filed on SEDAR the Updated Feasibility Study Report in respect of its preliminary economic assessment on Production Phase 2 of the Project. The Updated Feasibility Study Report was prepared by leading mining consultancies and the professional services firms Primero, SGS Canada Lakefield (“SGS”), and GE21 Consultoria Mineral (“GE21”). Please refer to “Description of the Business – Current Status of the Project” and “Summary of Updated Feasibility Study Report”. This approach was the result of a thorough review of the Company´s strategic priorities, with the objective of potentially responding to a significant increase in demand from its customers and solidifying its unique market position as a future supplier of high purity 6% battery grade lithium concentrate (“Battery Grade Green and Sustainable Lithium”). It also aims to significantly increase both the scale of the Project and its commercial and market importance on three fronts: (i) future production, (ii) scale of mineral reserves and (iii) scale of mineral resources, all while maintaining its battery grade green lithium products and the Company’s strategic leadership in ESG in the lithium supply chain.

| 13 |

2021 ANNUAL INFORMATION FORM | |

The Company (prior to the severe second wave of COVID-19) revised its strategy regarding certain international third-party engineering service providers and replaced them with Brazil-based specialists, anticipating the severely restrictive global travel bans that followed in the fourth quarter of 2020 as a result of the second wave. This pre-emptive change enabled the Company to successfully complete all field activities on time and on budget, and to continue to execute engineering activities during the rest of 2021.

In that regard, the Company has also made significant progress in further strengthening its project team, aligning and defining scope requirements as well as advancing the Project’s execution strategy. The Company has added several senior professionals as part of its project implementation team. Key Project consultants include a mix of experienced Brazilian and international engineers actively engaged on or off site to work alongside its existing team of GE21, MDGeo Hidrogeologia e Meio Ambiente (“MDGEO”), APL Engenharia (“APL”), Primero, SGS, Metso-Outotec (“Metso”) and SRK Consulting Inc (“SRK”).

The Company added two senior project management professionals to lead the Project Management Office (“PMO”): a senior mineral processing engineer and a senior geotechnical geologist. They report to Calvyn Gardner, one of the Company’s co-CEOs, who has primary responsibility for all technical workstreams and has been based full time at the Project since August 2020. This core team has been providing valuable oversight on project delivery, while interfacing with the detailed engineering team, construction contractors, equipment vendors and other stakeholders, aligning them to the Project objectives. The PMO has established standard management processes and strategies regarding project execution, contract management, project delivery and document controls.

In addition, following the listing on the Nasdaq, the corporate finance and business development teams were also strengthened with the addition of two senior professionals: the company appointed a new CFO and a Director of Business Development and Investor Relations.

Overall, although working under a strict COVID-19 Protocol (the “Protocol”), the Company made significant progress in 2021. The Protocol was developed in conjunction with Brazilian health advisors, who are consulted on a regular basis to refine and adapt the Protocol to respond to the evolving COVID-19 situation in Brazil. An average of 86 people worked at the Project site, of which only 20 tested positive for COVID-19. They received prompt medical assistance and have fully recovered. Since the implementation of the Protocol, the Company has not reported any new cases on site. Nevertheless, the COVID-19 situation in Brazil remains challenging. The Company has been actively monitoring any additional impacts on pre-construction activities and the pre-construction schedule. Mandatory mask wearing on site and premises, physical distancing requirements and additional sanitary measures, along with testing measures for workers accessing the site, have brought delays to the previously expected timing to commence production of the fourth quarter of 2022. In addition, the Company continues to support the municipalities of Itinga and Araçuaí in their ongoing response to the pandemic (please refer to “Environmental Social and Governance”).

Further to the information referenced above regarding Production Phase 1, based on the design considered by the Updated Feasibility Study Report, the Production Plant will have the capacity to process 1.5 million metric tonnes of mineralized spodumene material per year from the Project. The Production Plant design is projected to produce 220,000 tonnes of Battery Grade Green and Sustainable Lithium per annum, with one of the lowest reported levels of impurities in the world. The Updated Feasibility Study Report assumes: (i) conventional open-pit mining operation; (ii) a low risk approach, building a commercial production plant utilizing conventional lithium Dense Media Separation (“DMS”) and attributing a conservative recovery rate of 60%, (iii) average annual production of 220,000 tonnes of Battery Grade Green and Sustainable Lithium, (iv) a mine life of 9.2 years, (v) projected cash operating costs of US$238 per tonne of Battery Grade Green and Sustainable Lithium (cash cost CIF China of US$ 342 per tonne of Battery Grade Green and Sustainable Lithium), among the lowest reported costs globally. The Updated Feasibility Study Report estimates were prepared using a cut-off grade of 0.5% Li2O and include: (i) a Mineral Reserves estimate of 10.27 million tonnes of proven reserves with average 1.45% Li2O content and 3.52 million tonnes of probable reserves with 1.47% Li2O content, and (ii) a Mineral Resources estimate of 26.34 million tonnes of measured resources with average 1.39% Li2O content, 19.44 million tonnes of indicated resources with average 1.37% Li2O content and 6.6 million tonnes of inferred resources (representing approximately 1,560,919 tonnes of LCE in the measured and indicated categories, with a further 220,070 tonnes LCE in the inferred category).

The positive economics reflected in the Updated Feasibility Study Report provides a strong platform to continue developing the Company’s extensive mineral properties at the Project, which includes nine past-producing lithium mines.

| 14 |

2021 ANNUAL INFORMATION FORM | |

On November 6, 2019, the Company filed the Feasibility Study Report on Production Phase 1 and the Production Plant.

Since the fourth quarter of 2018, the Company has been producing low carbon high purity lithium concentrate at an on-site demonstration pilot plant and has shipped samples to potential customers for product certification and testing (the “Demonstration Plant”). The production from the Demonstration Plant has been an important part of the Company’s successful commercial strategy for its Battery Grade Green and Sustainable Lithium.

On March 23, 2018, Sigma Holdings published a technical report relating to the Project titled “Technical Report, Northern and Southern Complexes Project, Araçuaí and Itinga, Brazil” with an effective date of January 29, 2018 and prepared by Marc-Antoine Laporte, P. Geo, of SGS.

Environmental, Social and Governance

In March 2022, Ana Cabral-Gardner, the co-CEO of the Company, presented at the Bank of America Securities 2022 Global Agriculture and Materials Conference and at the BMO 31st Global Metals & Mining Conference on the growing demand for lithium and how projects such as the Project can play a key role in the energy transition and future of clean mobility.

In November 2021, Ana Cabral-Gardner was nominated by a national focal point (“NFP”) as a representative to the United Nations (“UN”) Convention on Climate Change. She actively participated in the event as a speaker, including a panel on the theme “Circular Economy and the 21st Century City: Unlocking the Social & Environmental Benefits of the Sustainable City,” presenting the Company’s project to recycle tailings from its greentech plant and the ensuing economic development impact for the region. Ana also spoke at the main event/Blue Zone regarding “The Future of ESG Investing: Enabling the Energy Transition to a Net Zero World.”

In September 2021, the Company announced the constitution of an environmental sustainability and social impact committee (the “ESG Committee”), created to assist the Board with its ESG centric strategy. Ana Cabral-Gardner and Marcelo Paiva were appointed as co-Chairs of the ESG Committee. Maria Salum, Chief Sustainability Officer will act as senior advisor to the ESG Committee. The purpose of the committee is to advise and support co-CEOs Ana Cabral-Gardner and Calvyn Gardner in determining and implementing the Company’s wide range

environmental and social sustainability initiatives, based on the selected sustainable development goals (the “Mission Critical SDGs”) for each of the two aspects of ESG: “E” environmental and “S” social. There are two key initiatives that will be the focus of the Committee: (i) establishing the Investment Agency which encompasses the coordination of the social programs of the Company; and (ii) overseeing strategy and coordinating with Board’s Technical Committee to drive the Company to its ambitious net zero 2024 targets (measured as emissions minus carbon credits), within this Decade of Action and 26 years ahead of United Nations’ 2050 targets.

In September 2021, Ana Cabral-Gardner, co-CEO, was invited to the UN High-Level Dialogue on Energy Transition that took place in tandem with the UN General Assembly in New York. The Company demonstrated its alignment with the Paris Climate Accord and submitted an Energy Compact proposal committing to supply the production levels of lithium materials to enable energy transition. The Company targeted to reach net zero carbon emissions after its second year of production in 2024 (26 years ahead of UN targets for net zero emissions in 2050 and six years ahead of UN Decade of Action targets outlined at 2030 Agenda for Sustainable Development and the Paris Agreement on climate change).

Earlier in 2021, the Company commissioned two assessments of its net carbon footprint. It conducted an independent ISO 14000 compliant audit of its life cycle analysis, and is in process to complete an independent expert validation of its carbon credits generated by its internal preservation, reforestation, and compensation forestry programs.

Following the principles of the United Nations Sustainable Development Goals (“UN-SDGs”), in particular UN-SDG #11 (sustainable cities) and UN-SDG #8 (decent work and economic growth), the Company is leading the creation, structuring and operations of an independent agency to promote private investment and economic diversification of the Vale do Jequitinhonha region, where the Project is located (the “Investment Agency”). The Investment Agency aims to transform the region with organized activities to stimulate

| 15 |

2021 ANNUAL INFORMATION FORM | |

development, contributing to the diversification of the business environment through the attraction of investments to the two municipalities of Araçuaí and Itinga in Brazil.

The Company has successfully obtained institutional support for the Investment Agency from the government of Minas Gerais and the Secretary of Special Development Projects (“INDI”) and from the mayors of Araçuaí and Itinga, following the principles of UN-SDG #17 (partnership for the goals). The Company engaged TSX Advisors Ltda (“TSX Advisors”), a specialist consulting firm, to lead the project to structure and implement the Investment Agency. TSX Advisors has a successful track record of executing similar projects for Brazil´s largest mining companies. At a ceremony presided over by the Vice Governor of Minas Gerais, the Investment Agency was launched in September 2021, during the week celebrating the 150 years of establishment of the town of Araçuai.

In 2021, consistent with the Company’s ESG-centric strategy and commitment to the social objective UN-SDG #8 of “decent work and economic growth”, the Company was actively engaged through multiple ESG initiatives in supporting the communities where the Project is located in the Vale do Jequitinhonha, in Brazil, one of the poorest areas in the world. The Company is committed to strengthening of the regional socioeconomic environment for the two municipalities. The Company has a strong working relationship with the municipalities of Itinga and Araçuaí and conducts regular and meaningful engagement and consultation with them.

The Company is contributing to the sustainable development of the region as it advances the construction of the Production Plant towards commercial production. The Company has been executing the following ESG initiatives:

| ● | “Zero Hunger Action”: The Company has extended humanitarian relief action for an additional 10-months pledging 7,000 more food baskets, which is expected to enable approximately 2.4 million meals. This is in addition to the 7,000 food baskets already delivered over the last 10- months at the height of the COVID-19 pandemic for the vulnerable families in the Vale do Jequitinhonha region. |

| ● | “Homecoming Employment Program (Volta Ao Lar)”: Over 300 people are currently employed on site, with approximately 72% coming from the Vale do Jequitinhonha region, setting the stage for significant social economic impact in a destitute region. The Company is reuniting families through its “Homecoming Program” (Volta Ao Lar)”, bringing back home qualified workers that had migrated out of the region, due to lack of employment opportunities. |

| ● | “Education Program for Mining Technicians”: The Company’s Chief Sustainability Officer organized an educational partnership between the UFVJM (Campus Janauba) and the Federal Institute of Education of Araçuaí, creating the first program to prepare mining technicians in the region. |

| ● | “OMICRON COVID-19 Prevention Program”: The Company has also expanded its “OMICRON COVID-19 Prevention Program” in the Vale do Jequitinhonha region delivering an additional 6,000 liters of sodium hypochlorite and 3,225 liters of gel alcohol, together with the Company’s COVID-19 prevention education booklet. In aggregate, the program provided necessary supplies for sixteen institutions administering over 20,000 medical appointments per month (over 240,000 appointments per year). Additionally, the Company also provided sodium hypochlorite for disinfection of six public places essential to the local community, such as the municipal food market. |

| ● | “Re-Opening of Childcare Centers Initiative”: The Company sponsored an initiative to support the re-opening of two childcare centers serving 560 children in the municipalities where the Compnay operates. The Company launched a program for the sponsorship of two-day childcare facilities, one in each of the municipalities where the Project is located. The objective of the program is to assist 560 children in need over a year. The campaign totaled 217 liters of liquid soap, 543 liters of shampoo, 490 toothbrushes, 29,700 diapers and 62,600 napkins. |

| ● | “Disaster Relief During Floods”: The Company has provided first response disaster relief supplying food and water for 400 victims who lost their homes as a result of the floods in the Vale do Jequitinhonha region during the unusually rainy season throughout New Year holidays and the month of January. Since the fourth quarter of 2021, the Company distributed over 11,000 liters of potable water to serve the distressed towns of Araçuaí and Itinga due to the unusual floods in the region. This action helped 5,000 families (more than 20,000 people) who did not have, or had only partial, access to potable water. |

| 16 |

2021 ANNUAL INFORMATION FORM | |

Also, following the principles of UN-SDG #17 “partnership for the goals”, the Company inaugurated the independent agency for private investment promotion and economic diversification of the region (the “Sustainability Council”) in partnership with the towns of Itinga and Araçuaí, on the week of the 150th anniversary of the town of Araçuaí.

The Sustainability Council aims to transform the territory with organized activities to stimulate development, contributing to the diversification of the business environment through the attraction of investments to the two municipalities.

The Company has successfully obtained institutional support for this initiative from the State of Minas Gerais and its various development bodies, including the secretary of special development (“SEDE”), the State investment agency (formerly “INDI”, renamed “Invest Minas”). Since May 2021, the Company has been working with TSX Advisors, a specialist consulting firm, to lead the project to structure and implement the Sustainability Council. The consultant has a successful track record of executing similar projects for Brazil’s largest mining companies.

Methodological challenges to address socio-economic impact matters in a way that converges with the Company’s strategy and core business will be addressed by applying the methodology proposed by the World Bank for similar Sustainability Council globally, with the Company acting as broader development catalyst (not as principal). This workstream was approached as follows

| ● | Definition of the framework for the Sustainability Council, including: (i) mapping and approaching stakeholders; (ii) evaluation of the region's “maturity” and “economic engagement” indices; (iii) definition of the Agency Model for the region; (iv) consolidation of governance and management models; (v) modulation of the economic sustainability plan; and (vi) defining priority sustainability areas to receive investments. |

| o | Workstreams (i), (ii), and (iii) have been completed and the remaining ones are expected by early 2022 |

| o | Workstream (v) has been achieved with the participation of the towns of Aracuai and Itinga at COP26 in person in Glasgow. Each town appointed a technical external representative to join the Company in Glasgow and participate in the Investment COP (sponsored by the World Climate Summit), amongst other various ESG educational seminars around the COP26 |

| ◾ | Considering that both towns will have representatives on the Sustainability Council’s board of directors, their participation was considered critical in order to be exposed to the latest developments in climate change as they will participate in the agency's planning on a sustainable basis |

| o | Workstream (vi) is intended to be completed by first half of 2022, once all members of the Sustainability Council has been appointed. |

In line with UN-SDG #3 (Good Health and Well Being), the Company continues to follow strict COVID-19 protocols, as previously disclosed, and no new cases were reported at the Project site during the fourth quarter of 2021.

In addition to the initiatives described above, the Company has ongoing comprehensive environmental and social programs in process, consistent with its leadership role in ESG in the lithium mining sector and its commitment to sustainable mining.

The mitigating social and environmental programs already initiated or to commence during the construction phase aim to establish actions to proactively mitigate, prevent, control and compensate for the environmental impacts that could be caused by mining and processing activities to be carried out by the Company once it commences production. These programs and actions, which are described below, are also based on the UN-SDGs:

· | Programs and actions commenced in the fourth quarter of 2021: the Company expects to complete a program for the implementation and maintenance of rain drainage systems and containment of erosion processes; noise and vibration levels control and monitoring program; and a monitoring program for domestic and industrial effluents. |

· | Programs and actions initiated in the second half of 2021: air emissions control and air quality monitoring programs and surface water quality monitoring program. |

· | Programs and actions initiated in the first half of 2021: program to rescue and drive away the local fauna from industrial site; program to rescue threatened and endemic flora; and a fauna monitoring program. |

| 17 |

2021 ANNUAL INFORMATION FORM | |

· | Programs and Actions initiated in 2020: solid waste management program; waste reuse plan; environmental education program; program for the prioritization and professional training of local suppliers; accident prevention and public health program; social communication program; maintenance and conservation program for permanent preservation areas and legal reserves; environmental management and supervision plan; monitoring program for vegetation planted; program for visual monitoring of environmental impacts and mitigating measures; and specific conservation and monitoring programs for endangered species. |

On November 8, 2019, Ana Cabral-Gardner addressed the World Climate Summit during the UN Climate Change Conference COP-25 in Madrid and presented a case study for the Company as an ESG “green mining” company and the role played by its investors in providing the capital and leadership to drive the implementation of environmental and social best practices in developing the Project.

Corporate

On December 23, 2021, the Company announced the closing of a non-brokered private placement (the “December 2021 Offering”) of 11,634,137 Common Shares at a price of Cdn$11.75 per Common Share for aggregate gross proceeds of Cdn$136.7 million (approximately US$106 million). Given the strong investor interest, the December 2021 Offering was twice-upsized, first by approximately 42% and then subsequently by an incremental 60%. As part of the December 2021 Offering, funds and accounts managed by BlackRock purchased 4,372,766 Common Shares for an aggregate subscription price of approximately Cdn$51.4 million. Additionally, BlackRock purchased 1,093,191 Common Shares at the same offering price on a secondary basis from the largest shareholder of the Company, A10 Fund, for an aggregate purchase price to the A10 Fund of approximately Cdn$12.8 million.

On December 2, 2021, the Company filed a short form base shelf prospectus (the “Canadian Base Shelf”) to qualify the distribution, from time to time over a 25-month period, of up to US$250 million in Common Shares, debt securities, subscription receipts, or warrants, in amounts, at prices, and on terms to be determined based on market conditions at the time of sale and set forth in an accompanying prospectus supplement. The Canadian Base Shelf was filed in each province and territory of Canada, other than the Province of Quebec. The Company also filed a corresponding shelf registration statement on Form F-10 (the “U.S. Base Shelf”) with the U.S. Securities and Exchange Commission (the “SEC”) under the Multijurisdictional Disclosure System.

On October 5, 2021, the Company announced the signing of a binding term sheet (the “LGES Term Sheet”) for offtake arrangements on a “take or pay” basis (the “LGES Offtake”) for the sale of Battery Grade Green and Sustainable Lithium to LG Energy Solution, Ltd (“LGES”), one of the world’s largest manufacturers of advanced lithium-ion batteries for electric vehicles. The six-year LGES Offtake for Battery Grade Green and Sustainable Lithium is to scale from 60,000 tonnes per year in 2023 to 100,000 tonnes per year from 2024 to 2027 subject to the Company and LGES executing mutually acceptable definitive documentation to implement the LGES Offtake. The Company and LGES also agreed to negotiate each year, an additional optional supply of Battery Grade Green and Sustainable Lithium, not otherwise committed in other Sigma Lithium offtake arrangements. The purchase price for the Battery Grade Green and Sustainable Lithium under the LGES Offtake will be linked to market prices for the high purity lithium hydroxide during the term.

On September 13, 2021, the Company completed its dual-listing process and the Common Shares began trading in the U.S. on the Nasdaq. The Company is pleased to report that its corporate governance policies and the make up of the Board are compliant with required Nasdaq and SEC governance standards, including Nasdaq’s diversity requirement for a company’s board to have at least one female director and at least one additional diverse director.

On September 8, 2021, the Company announced the appointment of Ana Cabral-Gardner as Co-CEO, joining Calvyn Gardner, who was previously CEO and also became Co-CEO as well as the new management appointment of Felipe Peres as Chief Financial Officer. The Company also announced the constitution of an ESG Board Committee resulting from the program intended to achieve net zero emissions by 2024 and the issuance of performance-based RSUs to the Co-CEOs.

On June 29, 2021, the Company held the annual and special meeting of the Company’s shareholders. At such meeting, the Company’s shareholders approved: (i) the election of Gary Litwack (independent), Frederico Marques (independent), Calvyn Gardner, Marcelo Paiva, and Ana Cabral-Gardner as the directors of the Company; (ii) the re-appointment of KPMG LLP as the auditors of the Company for the financial year ended December 31, 2021; (iii) a special resolution authorizing and approving the amendment to the Company’s

| 18 |

2021 ANNUAL INFORMATION FORM | |

articles to effect the change of the Company’s name from “Sigma Lithium Resources Corporation” to “Sigma Lithium Corporation”; (iv) an ordinary resolution approving the repeal and replacement of the existing by-laws of the Company with a new By-Law No. 1; and (v) a special resolution approving the amendment to the articles of the Company to effect a consolidation of the Common Shares on the basis of one (1) post-consolidation common share for up to ten (10) pre-consolidation common shares, as determined by the Board at its sole discretion (no further action has been taken to date related to such share consolidation).

On February 12, 2021, the Company announced the closing of a non-brokered private placement (the “February 2021 Offering”) of 9,545,455 Common Shares at a price of Cdn$4.40 per Common Share for aggregate gross proceeds of Cdn$42.0 million. The size of the February 2021 Offering reflected a significant upsizing due to strong institutional investor demand.

On December 7, 2020, the Company announced that it received a binding commitment for a Cdn$18,750,000 (R$75,000,000) credit line (“Development Credit Line”) from Banco de Desenvolvimento de Minas Gerais. The closing of the Development Credit Line is subject to the negotiation of definitive documentation and other customary closing conditions, followed by final credit approval for draw-downs.

On September 25, 2020, the Company announced a management appointment and updates to the Board. The Company appointed Maria Jose Salum as its Chief Sustainability Officer. The Company also announced the constitution of a Technical Board Committee with Wes Roberts and Vicente Lobo as the Co-Chairs. Ana Cabral-Gardner was appointed as Co-Chairman of the Board, joining Calvyn Gardner, who was previously Chairman and also became Co-Chairman of the Board.

On August 13, 2020, the Company announced the closing of a non-brokered private placement (the “2020 Offering”) of 8,250,200 Common Shares at a price of Cdn$2.15 per Common Share for aggregate gross proceeds of US$13.3 million (approximately Cdn$17.8 million). The size of the 2020 Offering reflected an upsizing by one-third from the original intended amount announced on July 27, 2020, due to strong institutional investor demand.

On June 29, 2020, the Company announced the signing of a term sheet for a US$45 million senior secured project finance facility (the “Bank Project Finance Facility”) to be led by Societe Generale. The consummation of the Bank Project Finance Facility remains subject to completion of due diligence, credit approval, the negotiation of definitive documentation and other customary closing conditions.

A10 Group has supported the Company´s liquidity needs without additional equity incentives on two occasions, both in connection with then challenging capital markets conditions:

1) | On November 29, 2019, in order to fund its working capital, the Company entered into an agreement with the A10 Group providing for a Cdn$6.6 million (US$5.0 million) revolving credit facility (the “Unsecured Credit Facility Agreement”), bearing interest at 11% per annum, calculated from the day funds were drawn. The Unsecured Credit Facility Agreement did not include any warrants or other incentives. It had a one-year term, which was the maturity for all funds drawn, and allowed funding for lender-approved expenses. Its term was extended twice by A10 Group, for both principal and accrued interest, without any penalties or additional charges until September 2021, when it was repaid in full. |

2) | During March of 2018, A10 Group, provided several bridge loans to the Company in the aggregate amount of R$1,747,600 (US$595,932) with interest calculated pursuant to the CDI (Brazilian Interbank Rate) plus a 4% per year spread, accrued from the date of each disbursement. The bridge loans had due dates on April 30 and May 30, 2018 and were automatically renewable on a rolling basis. On July 18, 2018, the loans were repaid in full. |

On April 5, 2019, the Company announced the execution of a binding heads of agreement (the “Mitsui HOA”) with Mitsui & Co. Ltd. (“Mitsui”). In accordance with the Mitsui HOA, Mitsui would prepay the Company the amount of US$30,000,000 for Battery Grade Green and Sustainable Lithium supply of up to 80,000 tonnes annually over six years, extendable for another five years at the option of Mitsui. The initial tranche payment of US$3,000,000 was received by the Company on April 4, 2019 and recorded as deferred revenue. The consummation of the transactions contemplated by the Mitsui HOA remain subject to the negotiation of definitive documentation (for either the prepayment arrangement of another mutually acceptable role for Mitsui, depending upon whether Sigma ultimately determines to accept the balance of the prepayment) and other customary conditions.

| 19 |

2021 ANNUAL INFORMATION FORM | |

On January 9, 2019, the Company announced an increase in mineral resource at the Project, and certain other updates to the Board and management of the Company.

On April 30, 2018, the Sigma Merger Transaction was completed. In connection with the Sigma Merger Transaction, Sigma Holdings completed a $20,040,000 private placement offering of subscription receipts, which were exchanged for pre-consolidation Common Shares upon the implementation of the Sigma Merger Transaction.

DESCRIPTION OF THE BUSINESS

Overview

Sigma is a Canadian mineral processing and development company, focused on advancing, with an environmental sustainability directed strategy, one of the largest hardrock lithium projects in the Americas – its wholly-owned Grota do Cirilo Project, located in Minas Gerais in Brazil – with the goal of participating in the rapidly expanding lithium-ion battery supply chain for EVs.

In order to secure a leading position supplying environmentally sustainable lithium for the next generation of EV supply chains, the Company has adhered consistently to the highest principles and standards of ESG practices, which were established as part of its core purpose at inception in 2012. As a result, the Company has undertaken an ESG-centric management strategy, whereby its environmental and social sustainability purposes determine its strategic steps.

Sigma´s Common Shares are listed and trade on the TSXV and Nasdaq under the symbol SGML.

Lithium Properties

The Project comprises four properties owned by Sigma Brazil: Grota do Cirilo (the area of the Project where the First Mine and Second Mine are located), and the Sao Jose, Genipapo and Santa Clara properties. The Project consists of 27 mineral rights (which include mining concessions, applications for mining concessions, exploration authorizations and applications for mineral exploration authorizations) spread over 191 km2. Within the Project area there are nine past producing lithium mines and 11 first-priority development targets.

The Project is located in the northeastern part of the state of Minas Gerais, in the municipalities of Araçuaí́ and Itinga, approximately 25 km east of the town of Araçuaí́ and 600 km northeast of Belo Horizonte, the state capital. The Project is approximately 500km from the Port of Ilheus, from where samples have been shipped for product certification and testing and from where future produced concentrates are planned to be shipped.

Current Status of the Project

The Project will be vertically integrated, as the Company´s own mining operations will supply mineralized spodumene material with exceptional mineralogy to its lithium production and processing plant (the “Production Plant”). The Production Plant is designed to be environmentally friendly, fully automated and digitally controlled. It will separate, purify and concentrate the spodumene in an environmentally friendly process to produce Battery Grade Green and Sustainable Lithium, engineered to the specifications of the Company’s customers in the rapidly expanding lithium-ion battery supply chain for EVs.

The Production Plant is planned to have two separate production lines with similar processing flowsheets, which are projected to share certain elements of a common plant infrastructure. The first phase of production for the Project (“Production Phase 1”) is the subject of the feasibility study analysis included in the Updated Feasibility Study Report. It will initially utilize feedstock spodumene from the Project’s Xuxa deposit (the “First Mine”), mining an average of 1.50 million tonnes per year during approximately 9.2 years of projected mine life. Its detailed design has been completed and the capital expenditures have been confirmed with quotes by each respective supplier to reach FEL-3 stage of precision. Based on the Updated Feasibility Study Report, the Company plans to produce 220,000 tonnes per year of Battery Grade Green and Sustainable Lithium, equivalent to 33,000 tonnes per year of lithium carbonate equivalent (“LCE”), in Production Phase 1 and expects to be amongst the world’s lowest cost producers.

| 20 |

2021 ANNUAL INFORMATION FORM | |

The next production phase of the Project (“Production Phase 2”) has been the subject of the preliminary economic assessment (the “PEA”) included in the Updated Feasibility Study Report, and could potentially increase production utilizing feedstock from the Project’s Barreiro deposit (the “Second Mine”). GE21, based on the Mineral Resource, prepared the PEA for the Second Mine. The Company completed the PEA with the objective of potentially responding to a significant increase in demand from its customers and solidifying its unique market position as a future supplier of Battery Grade Green and Sustainable Lithium. As reflected in the Updated Feasibility Study Report, the PEA projects significant economies of scale for Production Phase 2 (if warranted, following completion of the ongoing pre-feasibility study and a feasibility study), resulting from the low capital expenditure (“CAPEX”) of adding a second environmentally-friendly lithium processing line and vertically integrating it to the Project, mining an average of 1.68 million tonnes (“Mt”) per year during approximately 12.7 years of projected mine life.

The PEA is preliminary in nature and includes inferred mineral resources that are too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. It is noted that the Company has not yet made a production decision in respect of the Second Mine. The Company expects that it will assess the results of a pre-feasibility study and a feasibility study before making a production decision in respect of the Second Mine. All statements regarding mine development or production in respect of the Second Mine in this AIF are expressly qualified by this statement.

The Company also commenced a further pre-feasibility study for Production Phase 2 contemplating the addition of a second processing line with similar capacity of 220,000 tonnes per year of Battery Grade Green and Sustainable Lithium from Production Phase 1 (once onstream in 2023), therefore potentially doubling the Project total capacity to 440,000 tonnes per year (66,000 tonnes per year of LCE) of Battery Grade Green and Sustainable Lithium. Production Phase 2 is expected to benefit from economies of scale by utilizing most of the Production Plant infrastructure established for Production Phase 1.

This approach is the result of a thorough review of the Company´s strategic priorities in light of the significant change in lithium market conditions and aims to significantly increase both the scale of the Project and its commercial and market importance on three fronts: future production, scale of mineral resources and of mineral reserves, all the while maintaining Battery Grade Green and Sustainable Lithium products and the Company’s strategic leadership in environmental, social and governance (“ESG”) in the lithium supply chain.

The Company is accelerating its site exploration activities for the Project with the goal of increasing the Project mine life or potentially increasing production by either expanding production levels in Production Phase 2, if warranted after completing the ongoing pre-feasibility study (and feasibility study) or studying the potential of a third production expansion phase (“Production Phase 3”).

The Production Plant has a lithium processing design that includes DMS technology which does not utilize hazardous chemicals in the separation and purification of the lithium. The Company will apply a customized algorithm developed to contemplate the specificities of the mineralogy in each of the Company’s mines to digitally control the dense media levels in the Production Plant.

In addition, the Production Plant will be 100% powered by clean energy and it will use water efficiently, while preserving land ecosystems. As a result of state-of-the-art recirculation and tailings management circuits:

· | the tailings will be dry stacked (and therefore will not create an earth-fill embankment tailings dam). Because the DMS technology of the Production Plant does not utilize hazardous chemicals, the dry-stacked tailings materials could also be entirely recyclable as feed for ancillary industries, such as ceramics; and |

· | the water utilized in the production process is 100% recirculated to the Production Plant. Approximately 10% of the water is either lost or evaporates, with 90% of water consumed in the production process reutilized back into the Production Plant, achieving a high level of water efficiency. |

Since the fourth quarter of 2018, Sigma Brazil has been producing low carbon high purity lithium concentrate at an on-site Demonstration Plant and has shipped samples to potential customers for product certification and testing. This demonstration production has been an important part of the successful commercial strategy of the Company for its Battery Grade Green and Sustainable Lithium.

| 21 |

2021 ANNUAL INFORMATION FORM | |

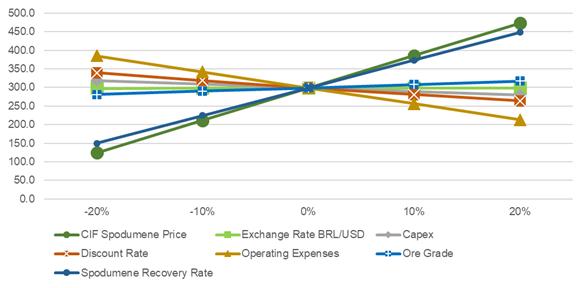

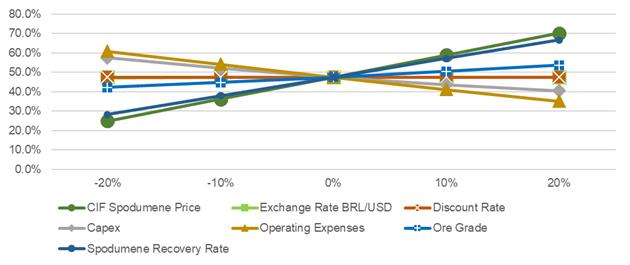

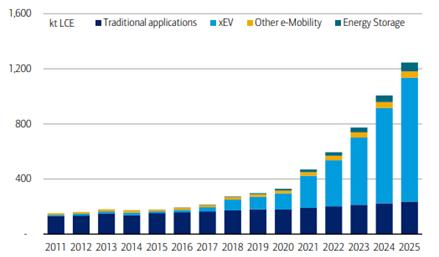

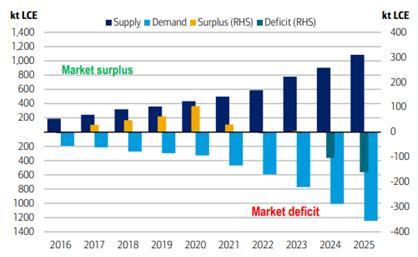

The Company expects to submit a net zero execution plan to achieve its emission reduction targets after its first year of full operations, expected to be in 2024, partly as a result of its strategic decision to decrease emissions through the introduction of biofuels for haulage trucks and other heavy equipment of the mining fleet starting in the second year of production. The Company also plans to pursue generation of carbon credits through “in-setting” strategies such as preserving water streams and developing the agroforestry systems within its regional ecosystem. As part of that strategy, the Company is studying future partnerships with generators of renewable power for self-generation of the electricity required to power the Production Plant.