As filed with the U.S. Securities and Exchange Commission on July 23, 2021.

Registration No. 333-254668

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SPARTAN ACQUISITION CORP. IV

(Exact Name of Registrant as Specified in its Charter)

|

Cayman Islands |

|

6770 |

|

98-1585352 |

|

(State or other Jurisdiction of |

|

(Primary Standard Industrial |

|

(IRS Employer |

9 West 57th Street, 43rd Floor

New York, NY 10019

(212) 515-3200

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

Geoffrey Strong

Chief Executive Officer

9 West 57th Street, 43rd Floor

New York, NY 10019

(212) 515-3200

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

Copies to:

|

E. Ramey Layne Brenda Lenahan New York, NY 10036 (212) 237-0000 |

|

David Peinsipp Peter Byrne Cooley LLP 101 California Street, 5th Floor San Francisco, California 94111 (415) 693-2177

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

Emerging growth company |

|

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. No securities may be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated July 23, 2021PROSPECTUS

$300,000,000

Spartan Acquisition Corp. IV

30,000,000 Units

Spartan Acquisition Corp. IV is a blank check company newly incorporated as a Cayman Islands exempted company for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities, which we refer to throughout this prospectus as our initial business combination. We have not selected any business combination target and we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any business combination target. We intend to focus our search on a target business in the energy value chain in North America.

This is an initial public offering of our securities. Each unit has an offering price of $10.00 and consists of one Class A ordinary share and one-fifth of one redeemable warrant. Each whole warrant entitles the holder thereof to purchase one Class A ordinary share at a price of $11.50 per share, subject to adjustment as described in this prospectus, and only whole warrants are exercisable. The warrants will become exercisable 30 days after the completion of our initial business combination, and will expire five years after the completion of our initial business combination or earlier upon redemption or liquidation, as described in this prospectus. Subject to the terms and conditions described in this prospectus, we may redeem the warrants for cash once the warrants become exercisable. No fractional warrants will be issued upon separation of the units and only whole warrants will trade. We have also granted the underwriters a 30-day option to purchase up to an additional 4,500,000 units.

We will provide our public shareholders with the opportunity to redeem all or a portion of their Class A ordinary shares upon the completion of our initial business combination at a per-share price described herein, payable in cash, subject to the limitations described herein. If we have not completed our initial business combination within 24 months from the closing of this offering (or 27 months from the closing of this offering if we have executed a letter of intent, agreement in principle or definitive agreement for a business combination within 24 months from the closing of this offering), we will redeem 100% of the public shares at a per-share price described herein, payable in cash, subject to applicable law and as further described herein.

Our sponsor, Spartan Acquisition Sponsor IV LLC, has committed to purchase an aggregate of 6,000,000 warrants (or 6,600,000 warrants if the option to purchase additional units is exercised in full) at a price of $1.50 per warrant ($9,000,000 in the aggregate, or $9,900,000 if the option to purchase additional units is exercised in full), each exercisable to purchase one whole Class A ordinary share at a price of $11.50 per share, in a private placement that will close simultaneously with the closing of this offering.

Our initial shareholders own an aggregate of 8,625,000 Class B ordinary shares (up to 1,125,000 of which are subject to forfeiture depending on the extent to which the underwriters’ option to purchase additional units is exercised). The Class B ordinary shares will automatically convert into Class A ordinary shares at the time of our initial business combination on a one-for-one basis, subject to adjustment and forfeiture as provided herein.

Currently, there is no public market for our units, Class A ordinary shares or warrants. We intend to apply to have our units listed on the NASDAQ Capital Market (the “NASDAQ”) under the symbol “SRTN.U” on or promptly after the date of this prospectus. We cannot guarantee that our securities will be approved for listing on the NASDAQ. We expect the Class A ordinary shares and warrants comprising the units will begin separate trading on the 52nd day following the date of this prospectus (or, if such date is not a business day, the following business day) unless Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC and J.P. Morgan Securities LLC inform us of their decision to allow earlier separate trading, subject to our filing a Current Report on Form 8-K with the Securities and Exchange Commission (the “SEC”), containing an audited balance sheet reflecting our receipt of the gross proceeds of this offering and issuing a press release announcing when such separate trading will begin. Once the securities comprising the units begin separate trading, we expect that the Class A ordinary shares and warrants will be listed on the NASDAQ under the symbols “SRTN” and “SRTN.WS,” respectively.

We are an “emerging growth company” and a “smaller reporting company” under applicable federal securities laws and will be subject to reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 38.

Investors will not be entitled to protections normally afforded to investors in Rule 419 blank check offerings.

No offer or invitation to subscribe for securities may be made to the public in the Cayman Islands.

|

|

Per Unit |

|

Total |

|

||

|

$ |

10.00 |

|

$ |

300,000,000 |

|

|

|

Underwriting discounts and commissions(1) |

$ |

0.55 |

|

$ |

16,500,000 |

|

|

Proceeds to us (before expenses) |

$ |

9.45 |

|

$ |

283,500,000 |

|

|

(1) |

Includes $0.35 per unit, or $10,500,000 (or $12,075,000 if the underwriters’ option to purchase additional units is exercised in full), payable to the underwriters for deferred underwriting discounts and commissions to be placed in a trust account located in the United States as described herein and released to the underwriters only upon the completion of an initial business combination, as described in this prospectus. See the section of this prospectus entitled “Underwriting” for a description of compensation and other items of value payable to the underwriters. |

Of the proceeds we receive from this offering and the sale of the private placement warrants described in this prospectus, $300.0 million, or $345.0 million if the underwriters’ option to purchase additional units is exercised in full ($10.00 per unit in either case), will be deposited into a U.S.-based trust account with Continental Stock Transfer & Trust Company acting as trustee.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters are offering the units for sale on a firm commitment basis. The underwriters expect to deliver the units to the purchasers on or about , 2021.

Goldman Sachs & Co. LLCCitigroupCredit SuisseJ.P. Morgan

Barclays RBC Capital Markets

Sole Co-Manager

Siebert Williams Shank

Prospectus dated , 2021.

TABLE OF CONTENTS

We are responsible for the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the units offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

|

1 |

|

|

36 |

|

|

74 |

|

|

75 |

|

|

79 |

|

|

80 |

|

|

82 |

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

83 |

|

89 |

|

|

117 |

|

|

131 |

|

|

134 |

|

|

137 |

|

|

157 |

|

|

170 |

|

|

177 |

|

|

177 |

|

|

177 |

|

|

F-1 |

This summary only highlights the more detailed information appearing elsewhere in this prospectus. As this is a summary, it does not contain all of the information that you should consider in making an investment decision. You should read this entire prospectus carefully, including the information under “Risk Factors” and our financial statements and the related notes included elsewhere in this prospectus, before investing.

Unless otherwise stated in this prospectus or the context otherwise requires, references to:

|

|

• |

“we,” “us,” “our,” “company” or “our company” are to Spartan Acquisition Corp. IV; |

|

|

• |

“Apollo” are to Apollo Global Management, Inc. (NYSE: APO), a Delaware corporation, and its consolidated subsidiaries; |

|

|

• |

“Apollo Funds” are to private equity, credit and real assets funds (including parallel funds and alternative investment vehicles) for which Apollo provides investment management or advisory services; |

|

|

• |

“ANRP II” are to Apollo Natural Resources Partners II, L.P., a Delaware limited partnership; |

|

|

• |

“amended and restated memorandum and articles of association” are to the amended and restated memorandum and articles of association that the company will adopt prior to the consummation of this offering; |

|

|

• |

“Companies Law” are to the Companies Act (2021 Revision) of the Cayman Islands as the same may be amended from time to time; |

|

|

• |

“equity-linked securities” are to any securities of our company or any of our subsidiaries which are convertible into, or exchangeable or exercisable for, equity securities of our company or such subsidiary, including any private placement of equity or debt; |

|

|

• |

“founder shares” are to our Class B ordinary shares initially purchased by, and issued to, our sponsor in a private placement prior to this offering and the Class A ordinary shares that will be issued upon the automatic conversion thereof at the time of our initial business combination as described herein; |

|

|

• |

“initial shareholders” are to our sponsor and other holders who are the recipients of the founder shares (as transferred by the sponsor) prior to this offering (if any); |

|

|

• |

“management” or our “management team” are to our officers and directors; |

|

|

• |

“ordinary resolution” are to a resolution of the company adopted by the affirmative vote of at least a majority of the votes cast by the holders of the issued shares present in person or represented by proxy at a general meeting of the company and entitled to vote on such matter, and such resolution may not be effected by unanimous written resolution of the shareholders other than with respect to our Class B ordinary shares; |

|

|

• |

“ordinary shares” are to our Class A ordinary shares and our Class B ordinary shares, collectively; |

|

|

• |

“private placement warrants” are to the warrants issued to our sponsor in a private placement simultaneously with the closing of this offering; |

|

|

• |

“public shareholders” are to the holders of our public shares, including our initial shareholders and management team to the extent our initial shareholders and/or members of our management team purchase |

1

|

|

public shares, provided that each initial shareholder’s and member of our management team’s status as a “public shareholder” only exists with respect to such public shares; |

|

|

• |

“public shares” are to our Class A ordinary shares sold as part of the units in this offering (whether they are purchased in this offering or thereafter in the open market), but specifically excludes all of our Class A ordinary shares that are issued upon conversion of our Class B ordinary shares; |

|

|

• |

“public warrants” are to the warrants sold as part of the units in this offering (whether they are purchased in this offering or thereafter in the open market, including warrants that may be acquired by our sponsor or its affiliates in this offering or thereafter in the open market); |

|

|

• |

“special resolution” are to a resolution of the company adopted by the affirmative vote of at least a two-thirds (2/3) majority (or such higher threshold as specified in the company's amended and restated memorandum and articles of association) of the votes cast by the holders of the issued shares present in person or represented by proxy at a general meeting of the company and entitled to vote on such matter, or a resolution approved in writing by all of the holders of the issued shares entitled to vote on such matter; |

|

|

• |

“sponsor” are to Spartan Acquisition Sponsor IV LLC, a Delaware limited liability company, and an indirect subsidiary of ANRP II; and |

|

|

• |

“warrants” are to our public warrants and private placement warrants, as well as any warrants issued upon conversion of working capital loans upon or following the consummation of our initial business combination, collectively. |

Each unit consists of one Class A ordinary share and one-fifth of one warrant for each unit purchased. Each whole warrant entitles the holder thereof to purchase one Class A ordinary share at a price of $11.50 per share, subject to adjustment as described in this prospectus, and only whole warrants are exercisable. No fractional warrants will be issued upon separation of the units and only whole warrants will trade. Accordingly, unless you purchase at least five units, you will not be able to receive or trade a whole warrant.

All references in this prospectus to shares of the company being forfeited shall take effect as surrenders for no consideration of such shares as a matter of Cayman Islands law. Any conversion of the Class B ordinary shares described in this prospectus will take effect as a compulsory redemption of Class B ordinary shares and an issuance of Class A ordinary shares, or as otherwise permitted by our amended and restated memorandum and articles of association, as a matter of Cayman Islands law. Any share dividends described in this prospectus will take effect as share capitalizations (that is, an issuance of shares from share premium) or a distribution in kind in the form of shares as a matter of Cayman Islands law.

Registered trademarks referred to in this prospectus are the property of their respective owners. Unless we tell you otherwise, the information in this prospectus assumes that the underwriters will not exercise its option to purchase additional units.

We are a blank check company newly incorporated as a Cayman Islands exempted company for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities, which we refer to throughout this prospectus as our initial business combination. We intend to focus our search for a target business in the energy value chain in North America, with a particular focus on opportunities aligned with energy transition and sustainability themes. To date, our efforts have been limited to organizational activities as well as activities related to our offering. We have not selected any potential business combination target and we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any potential business combination target.

Our sponsor is an affiliate of a private investment fund managed by Apollo. Apollo is led by Joshua Harris and Marc Rowan, who have worked together for more than 34 years and lead a team of 1,725 employees, including 546 investment professionals (as of March 31, 2021), in New York, Los Angeles, San Diego, Houston, Bethesda, London, Frankfurt, Madrid, Luxembourg, Mumbai, Delhi, Singapore, Hong Kong, Shanghai and Tokyo, among

2

other locations throughout the world. Apollo’s team possesses a broad range of transaction, financial, managerial and investment skills. Apollo operates its businesses in an integrated manner, which we believe distinguishes Apollo from other alternative asset managers. Apollo’s investment professionals frequently collaborate and share information across disciplines including market insight, management, banking and consultant contacts as well as potential investment opportunities. This collaboration contributes to Apollo’s library of industry knowledge and we believe enables Apollo managed funds to invest successfully across a company’s capital structure.

Although we may pursue an acquisition opportunity in any business or industry, we intend to capitalize on the Apollo platform to identify, acquire and operate a business in the energy value chain that may provide opportunities for attractive risk-adjusted returns, with a particular focus on opportunities aligned with energy transition and sustainability themes. Specifically, we intend to focus on opportunities across the renewable energy, energy storage, mobility, advanced fuels and carbon mitigation sectors, as well as other adjacent services, industrials, and technologies, while remaining opportunistic across the energy value chain, including select opportunities within the traditional power generation and energy production verticals. We believe this area of focus represents a favorable and highly fragmented market opportunity to consummate a business combination.

We intend to identify and acquire a business that could benefit from a hands-on owner with extensive transactional, financial, managerial and investment experience in the energy value chain that presents potential for an attractive risk-adjusted return profile under our stewardship. Even fundamentally sound companies can often underperform their potential due to underinvestment, a temporary period of dislocation in the markets in which they operate, over-levered capital structures, excessive cost structures, incomplete management teams and/or inappropriate business strategies. Apollo has extensive experience in identifying and executing acquisitions across the entire energy value chain and a long-standing commitment to fostering environmental, social and governance (“ESG”) performance in its portfolio.

We believe that we are well positioned to identify attractive risk-adjusted returns in the marketplace and that our contacts and transaction sources, ranging from industry executives, private owners, private equity funds, and investment bankers, in addition to the energy value chain reach of ANRP II, which is further supported by the broader Apollo platform, will enable us to pursue a broad range of opportunities.

We will seek to capitalize on Apollo’s energy expertise and industry relationships to source and complete an initial business combination. From 2001 through June 30, 2021, Apollo Funds have invested or committed to invest approximately $14.0 billion across 49 natural resources-related opportunities, producing an attractive rate of return. Apollo has extensive experience investing across a variety of commodity price cycles and a track record of identifying high-quality assets, businesses and management teams with significant resources, capital and optimization potential.

Apollo recognizes the importance of ESG issues, and has a long history of taking these issues into account. Apollo believes responsible investment considers how ESG issues impact the firm, the funds it manages and their portfolio companies, the communities in which it and they operate, and the world at large. As one of the world’s largest alternative investment managers, Apollo believes that consideration of ESG issues is essential to companies’ success, by enhancing their ability to manage risks and by identifying areas for cost savings and for growth.

Apollo’s ESG program rests on three pillars: thorough ESG diligence; meaningful and tailored engagement with companies post-acquisition; and a commitment to transparency and periodic reporting of qualitative and quantitative ESG information. Apollo believes the processes underlying these three pillars better position company management teams and investment professionals to improve performance on ESG issues. Apollo has endorsed the American Investment Council’s Guidelines for Responsible Investing, and in 2020, Apollo adopted a comprehensive Responsible Investing and ESG Policy with specific policies for each asset class. Apollo also built upon its existing governance infrastructure: firm-wide decisions on ESG issues are now made at the most senior level, led by a steering committee chaired by its Global Head of ESG that includes certain members of Apollo’s senior management. This committee draws on recommendations from crossfunctional teams of Apollo professionals across its credit, private equity, and real assets businesses.

An affiliate of Apollo sponsored Spartan Energy Acquisition Corp. (“Spartan I”), a special purpose acquisition company that completed its initial public offering in August 2018, in which it sold 55,200,000 units, each consisting of one share of Class A common stock and one-third of one warrant, with each whole warrant entitling the holder

3

thereof to purchase one share of Class A common stock, for an offering price of $10.00 per unit, generating gross proceeds of $552 million. In July 2020, Spartan I announced its initial business combination with Fisker Inc., a Delaware corporation (“Fisker”), which is building a technology-enabled, asset-light automotive business model that it believes has the potential to be among the first of its kind and aligned with the future state of the automotive industry. The transaction closed on October 29, 2020 and the combined entity is listed on the NYSE. We believe that we will benefit from the valuable experience gained by our management team during the launch and operation of Spartan I, including the process of evaluating numerous target companies and industry sectors, selecting Fisker as its business combination partner and negotiating the terms of the business combination agreement and all of the related financing transactions.

Additionally, an affiliate of Apollo sponsored Spartan Acquisition Corp. II (“Spartan II”), a special purpose acquisition company that completed its initial public offering in November 2020, in which it sold 34,500,000 units, each consisting of one share of Class A common stock and one-half of one warrant, with each whole warrant entitling the holder thereof to purchase one share of Class A common stock, for an offering price of $10.00, generating gross proceeds of $345 million. In January 2021, Spartan II announced its entry into a definitive business combination agreement with Sunlight Financial LLC (“Sunlight”), a premier U.S. residential solar financing platform that provides residential solar contractors with seamless point-of-sale financing capabilities and delivers unique, attractive assets to capital providers. The transaction closed on July 9, 2021 and the combined company is listed on the NYSE. We believe that we have further benefited from the valuable experience gained by our management team during the launch and operation of Spartan II, including the process of evaluating numerous target companies and industry sectors, selecting Sunlight as its business combination partner and negotiating the terms of the business combination agreement and all of the related financing transactions.

Additionally, an affiliate of Apollo sponsored Spartan Acquisition Corp. III (“Spartan III”), a special purpose acquisition company that completed its initial public offering in February 2021, in which it sold 55,200,000 units, each consisting of one share of Class A common stock and one-fifth of one warrant, with each whole warrant entitling the holder thereof to purchase one share of Class A common stock, for an offering price of $10.00, generating gross proceeds of $552 million. We believe that we have further benefited from the valuable experience gained by our management team during the launch and operation of Spartan III.

We believe that potential sellers of target businesses will view the fact that our management team has successfully negotiated a business combination as a positive factor in considering whether or not to enter into a business combination with us. However, past performance of Apollo, the Apollo Funds, Spartan I, Spartan II, Spartan III and our management team is not a guarantee either (i) that we will be able to identify a suitable candidate for our initial business combination or (ii) of success with respect to any business combination we may consummate. You should not rely on the historical record of Apollo’s, the Apollo Funds’, our management’s, Spartan I’s, Spartan II’s or Spartan III’s performance as indicative of our future performance. An investment in us is not an investment in Apollo Funds.

We have received an indication of interest from ANRP II, which is a private investment fund managed by Apollo, to purchase securities in a private placement that will close simultaneously with the closing of our business combination, although there is no assurance they will do so.

Business Strategy

Our acquisition and value creation strategy will be to identify, acquire and, after our initial business combination, build a company in the energy value chain in North America. Specifically, we intend to focus on opportunities across the renewable energy, energy storage, mobility, advanced fuels, and carbon mitigation sectors, as well as other adjacent services, industrials, and technologies, while remaining opportunistic across the energy value chain, including select opportunities within the traditional power generation and energy production verticals. Our acquisition strategy will leverage Apollo’s network of potential proprietary and public transaction sources where we believe a combination of our relationships, knowledge and experience in the energy value chain could effect a positive transformation or augmentation of existing businesses or properties. Our goal is to build a focused business with multiple competitive advantages that have the potential to improve the target business’s overall value proposition. We plan to utilize the network and industry experience of our management team and Apollo, as well as ANRP II, in seeking an initial business combination and employing our acquisition strategy. Over the course of their careers, the members of our management team have developed a broad network of contacts and corporate

4

relationships that we believe will serve as a useful source of acquisition opportunities. In addition to industry and lending community relationships, we plan to leverage relationships with management teams of public and private companies, investment bankers, restructuring advisers, attorneys and accountants, which we believe should provide us with a number of business combination opportunities. Upon completion of this offering, members of our management team will communicate with their networks of relationships to articulate the parameters for our search for a target business and a potential business combination and begin the process of pursuing and reviewing potentially interesting leads.

Acquisition Criteria

Consistent with our business strategy, we have identified the following general criteria and guidelines that we believe are important in evaluating prospective targets for our initial business combination. We will use these criteria and guidelines in evaluating acquisition opportunities, but we may decide to enter into our initial business combination with a target that does not meet these criteria and guidelines. We intend to acquire target businesses that we believe:

|

|

• |

are fundamentally sound but that we believe can improve results by leveraging the transactional, financial, managerial and investment experience of our management team and Apollo, as well as ANRP II; |

|

|

• |

can utilize the extensive networks and insights that our management team and Apollo, as well as ANRP II, have built in the energy value chain; |

|

|

• |

are at an inflection point, such as requiring additional management expertise, are able to innovate through new operational techniques, or where we believe we can drive improved financial performance; |

|

|

• |

exhibit unrecognized value or other characteristics, desirable returns on capital, and a need for capital to achieve the company’s growth strategy, that we believe have been misevaluated by the marketplace based on our analysis and due diligence review; and |

|

|

• |

will offer an attractive risk-adjusted return for our shareholders. |

Potential upside from growth in the target business and an improved capital structure will be weighed against any identified downside risks.

These criteria are not intended to be exhaustive. Any evaluation relating to the merits of a particular initial business combination may be based, to the extent relevant, on these general guidelines as well as other considerations, factors and criteria that our management may deem relevant. In the event that we decide to enter into our initial business combination with a target business that does not meet the above criteria and guidelines, we will disclose that the target business does not meet the above criteria in our shareholders communications related to our initial business combination, which, as discussed in this prospectus, would be in the form of proxy solicitation or tender offer materials that we would file with the SEC.

Initial Business Combination

The NASDAQ listing rules require that we must complete one or more business combinations having an aggregate fair market value of at least 80% of the value of the trust account (excluding any deferred underwriter fees and taxes payable on the income earned on the trust account) at the time of the agreement to enter into the initial business combination. Our board will make the determination as to the fair market value of a target business or businesses. If our board is not able to independently determine the fair market value of a target business or businesses, we will obtain a valuation opinion from an independent investment banking firm that is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”), or another independent entity that commonly renders valuation opinions with respect to the satisfaction of such criteria.

Our amended and restated memorandum and articles of association will require the affirmative vote of a majority of our board of directors, which must include a majority of our independent directors and each of the non-independent directors nominated by our sponsor, to approve our initial business combination.

5

We may pursue an acquisition opportunity jointly with our sponsor, Apollo, or one or more of its affiliates, one or more Apollo Funds and/or investors in the Apollo Funds, which we refer to as an “Affiliated Joint Acquisition.” Any such parties may co-invest with us in the target business at the time of our initial business combination, or we could raise additional proceeds to complete the acquisition by issuing to such parties a class of equity or equity-linked securities. Any such issuance of equity or equity-linked securities would, on a fully diluted basis, reduce the percentage ownership of our then-existing shareholders. Notwithstanding the foregoing, pursuant to the anti-dilution provisions of our Class B ordinary shares, issuances or deemed issuances of Class A ordinary shares or equity-linked securities would result in an adjustment to the ratio at which Class B ordinary shares shall convert into Class A ordinary shares such that our initial shareholders and their permitted transferees, if any, would retain their aggregate percentage ownership at 20% of the sum of the total number of all ordinary shares outstanding upon completion of this offering plus all Class A ordinary shares and equity-linked securities issued or deemed issued in connection with the business combination (excluding any shares or equity-linked securities issued, or to be issued, to any seller in the business combination), unless the holders of a majority of the then-outstanding Class B ordinary shares agreed to waive such adjustment with respect to such issuance or deemed issuance at the time thereof. Our sponsor and its affiliates have no obligation to make any such investment, and may compete with us for potential business combinations.

We anticipate structuring our initial business combination so that the post-transaction company in which our public shareholders own shares will own or acquire 100% of the equity interests or assets of the target business or businesses. We may, however, structure our initial business combination such that the post-transaction company owns or acquires less than 100% of such interests or assets of the target business in order to meet certain objectives of the target management team or shareholders, or for other reasons, including an Affiliated Joint Acquisition as described above. However, we will only complete a business combination if the post-transaction company owns or acquires 50% or more of the outstanding voting securities of the target or otherwise is not required to register as an investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”). Even if the post-transaction company owns or acquires 50% or more of the voting securities of the target, our shareholders prior to the business combination may collectively own a minority interest in the post-transaction company, depending on valuations ascribed to the target and us in the business combination transaction. For example, we could pursue a transaction in which we issue a substantial number of new shares in exchange for all of the outstanding capital stock, shares or other equity interests of a target. In this case, we would acquire a 100% controlling interest in the target. However, as a result of the issuance of a substantial number of new shares, our shareholders immediately prior to our initial business combination could own less than a majority of our outstanding shares subsequent to our initial business combination. If less than 100% of the equity interests or assets of a target business or businesses are owned or acquired by the post-transaction company, the portion of such business or businesses that is owned or acquired is what will be valued for purposes of the 80% of value test. If the business combination involves more than one target business, the 80% of value test will be based on the aggregate value of all of the transactions and we will treat the target businesses together as the initial business combination for seeking shareholder approval or for purposes of a tender offer, as applicable.

Our Acquisition Process

In evaluating a prospective target business, we expect to conduct a thorough due diligence review that will encompass, among other things, meetings with incumbent management and employees, document reviews, inspection of facilities, as well as a review of financial and other information that will be made available to us. We will also utilize our transactional, financial, managerial and investment experience.

We are not prohibited from pursuing an initial business combination with a company that is affiliated with Apollo, our sponsor, officers or directors. In the event we seek to complete our initial business combination with a company that is affiliated with Apollo, our sponsor, officers or directors, we, or a committee of independent directors, will obtain an opinion from an independent investment banking firm which is a member of FINRA or an independent accounting firm that our initial business combination is fair to our company from a financial point of view.

Apollo, Apollo Funds, members of our management team and our independent directors will directly or indirectly own founder shares and/or private placement warrants following this offering and, accordingly, may have a conflict of interest in determining whether a particular target business is an appropriate business with which to effectuate our initial business combination. Further, each of our officers and directors may have a conflict of interest

6

with respect to evaluating a particular business combination if the retention or resignation of any such officers and directors was included by a target business as a condition to any agreement with respect to our initial business combination.

All of the members of our management team are employed by Apollo. Apollo is continuously made aware of potential business opportunities, one or more of which we may desire to pursue for a business combination; we have not, however, selected any specific business combination target and we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any business combination target.

Each of our officers and directors presently has, and any of them in the future may have additional, fiduciary or contractual obligations to other entities pursuant to which such officer or director is or will be required to present a business combination opportunity. Accordingly, if any of our officers or directors becomes aware of a business combination opportunity which is suitable for an entity to which he or she has then-current fiduciary or contractual obligations, he or she will honor his or her fiduciary or contractual obligations to present such opportunity to such other entity. We do not believe, however, that the fiduciary duties or contractual obligations of our officers or directors will materially affect our ability to complete our business combination. In addition, we may pursue an Affiliated Joint Acquisition opportunity with an entity to which an officer or director has a fiduciary or contractual obligation. Any such entity may co-invest with us in the target business at the time of our initial business combination, or we could raise additional proceeds to complete the acquisition by issuing to such entity a class of equity or equity-linked securities. Our amended and restated memorandum and articles of association will provide that we renounce our interest in any corporate opportunity offered to any director or officer unless such opportunity is expressly offered to such person solely in his or her capacity as a director or officer of our company and such opportunity is one we are legally and contractually permitted to undertake and would otherwise be reasonable for us to pursue.

In addition, our officers and directors are not required to commit any specified amount of time to our affairs, and, accordingly, will have conflicts of interest in allocating management time among various business activities, including identifying potential business combinations and monitoring the related due diligence. Moreover, our officers and directors have and will have in the future time and attention requirements for current and future investment funds, accounts, co-investment vehicles and other entities managed by Apollo or its affiliates. Apollo manages a significant number of Apollo Funds and will raise additional funds and/or accounts in the future, which will be during the period in which we are seeking our initial business combination. These Apollo investment entities may be seeking acquisition opportunities and related financing at any time. We may compete with any one or more of them on any given acquisition opportunity. To the extent any conflict of interest arises between, on the one hand, us and, on the other hand, investment funds, accounts, co-investment vehicles and other entities managed by Apollo or its affiliates (including, without limitation, arising as a result of certain of our officers and directors being required to offer acquisition opportunities to Apollo or investment funds, accounts, co-investment vehicles and other entities), Apollo and its affiliates will resolve such conflicts of interest in their sole discretion in accordance with their then existing fiduciary, contractual and other duties and there can be no assurance that such conflict of interest will be resolved in our favor.

In addition, Apollo or its affiliates, as well as Apollo Funds, may sponsor other blank check companies similar to ours during the period in which we are seeking an initial business combination, and members of our management team may participate in such blank check companies. For example, certain of our officers and directors currently serve in similar roles for Spartan III. Mr. Strong is the Chief Executive Officer and a director of Spartan III, and each of Ms. Wassenaar, Mr. Handler, Ms. Hommes, Mr. Romeo, Ms. Wilson and Mr. Stice are directors of Spartan III, and each such officer and director owes fiduciary duties under the DGCL to Spartan III. Any such companies may present additional conflicts of interest in pursuing an acquisition target, particularly in the event there is overlap among the management teams.

Prior to the effectiveness of the registration statement of which this prospectus forms a part, we have filed a Registration Statement on Form 8-A with the SEC to voluntarily register our securities under Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a result, we are subject to the rules and regulations promulgated under the Exchange Act. We have no current intention of filing a Form 15 to suspend our reporting or other obligations under the Exchange Act prior or subsequent to the consummation of our initial business combination.

7

Corporate Information

Our executive offices are located at 9 West 57th Street, 43rd Floor, New York, NY 10019, and our telephone number is (212) 515-3200. Upon completion of this offering, our corporate website address will be www.spartanspaciv.com. Our website and the information contained on, or that can be accessed through, the website is not deemed to be incorporated by reference in, and is not considered part of, this prospectus. You should not rely on any such information in making your decision whether to invest in our securities.

We are a Cayman Islands exempted company. Exempted companies are Cayman Islands companies conducting business mainly outside the Cayman Islands and, as such, are exempted from complying with certain provisions of the Companies Law. As an exempted company, we have applied for and received a tax exemption undertaking from the Cayman Islands government that, in accordance with Section 6 of the Tax Concessions Act (2018 Revision) of the Cayman Islands, for a period of 30 years from the date of the undertaking, no law which is enacted in the Cayman Islands imposing any tax to be levied on profits, income, gains or appreciations will apply to us or our operations and, in addition, that no tax to be levied on profits, income, gains or appreciations or which is in the nature of estate duty or inheritance tax will be payable (i) on or in respect of our shares, debentures or other obligations or (ii) by way of the withholding in whole or in part of a payment of dividends or other distribution of income or capital by us to our shareholders or a payment of principal or interest or other sums due under a debenture or other obligation of us.

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We intend to take advantage of the benefits of this extended transition period.

We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.07 billion (as adjusted for inflation pursuant to SEC rules from time to time), or (c) in which we are deemed to be a large accelerated filer, which means the market value of our Class A ordinary shares that is held by non-affiliates equals or exceeds $700 million as of that year’s second fiscal quarter, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period. References herein to emerging growth company shall have the meaning associated with it in the JOBS Act.

Exempted companies are Cayman Islands companies incorporated with limited liability wishing to conduct business outside the Cayman Islands and, as such, are exempted from complying with certain provisions of the Companies Act.

Additionally, we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of the fiscal year in which (i) the market value of our ordinary shares held by non-affiliates equals or exceeds $250 million as of the end of that year’s second fiscal quarter or (ii) our annual revenues equaled or exceeded $100 million during such completed fiscal year and the market value of our ordinary shares held by non-affiliates equals or exceeds $700 million as of the end of that year’s second fiscal quarter.

8

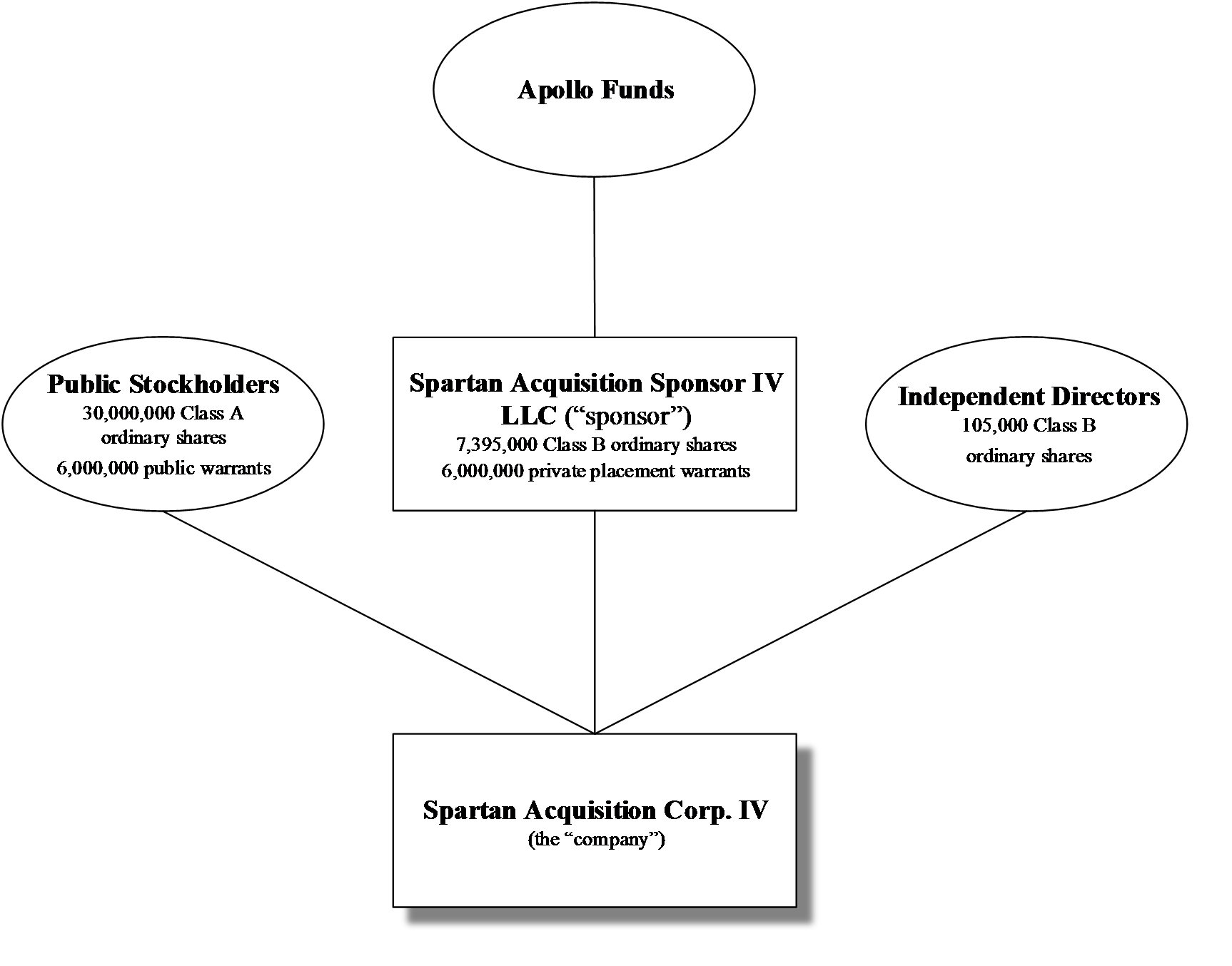

The following diagram illustrates our simplified ownership structure after giving effect to this offering (assuming that the underwriters’ option to purchase additional units is not exercised).

9

The Offering

In making your decision on whether to invest in our securities, you should take into account not only the backgrounds of the members of our management team, but also the special risks we face as a blank check company and the fact that this offering is not being conducted in compliance with Rule 419 promulgated under the Securities Act. You will not be entitled to protections normally afforded to investors in Rule 419 blank check offerings. You should carefully consider these and the other risks set forth in the section below entitled “Risk Factors”.

10

|

Separate trading of the Class A ordinary shares and warrants is prohibited until we have filed a Current Report on Form 8-K |

|

In no event will the Class A ordinary shares and warrants be traded separately until we have filed with the SEC a Current Report on Form 8-K that includes an audited balance sheet reflecting our receipt of the gross proceeds at the closing of this offering. We will file the Current Report on Form 8-K promptly after the closing of this offering, which is anticipated to take place three business days from the date of this prospectus. If the underwriters’ option to purchase additional units is exercised following the initial filing of such Current Report on Form 8-K, a second or amended Current Report on Form 8-K will be filed to provide updated financial information to reflect the exercise of the underwriters’ option to purchase additional units. |

|

|

|

|

|

Units: |

|

|

|

|

|

|

|

Number outstanding before this offering |

|

0 |

|

|

|

|

|

Number outstanding after this offering |

|

30,000,000(1) |

|

|

|

|

|

Ordinary Shares: |

|

|

|

|

|

|

|

Number outstanding before this offering |

|

8,625,000 Class B ordinary shares(2)(3) |

|

|

|

|

|

Number outstanding after this offering |

|

37,500,000 Class A ordinary shares and Class B ordinary shares(1)(3) |

|

|

|

|

|

Warrants: |

|

|

|

|

|

|

|

Number of private placement warrants |

|

|

|

to be sold in a private placement |

|

|

|

simultaneously with this offering |

|

6,000,000(1) |

|

|

|

|

|

Number of warrants to be outstanding after |

|

|

|

this offering and the private placement |

|

12,000,000(1) |

|

|

|

|

|

Exercisability |

|

Each whole warrant offered in this offering is exercisable to purchase one Class A ordinary share. Only whole warrants are exercisable. No fractional warrants will be issued upon separation of the units and only whole warrants will trade. |

|

|

|

|

|

Exercise price |

|

$11.50 per whole share, subject to adjustment as described herein. |

|

(1) |

Assumes no exercise of the underwriters’ option to purchase additional units and the forfeiture by our sponsor of 1,125,000 founder shares. |

|

(2) |

Includes up to 1,125,000 shares that are subject to forfeiture by our sponsor depending on the extent to which the underwriters’ option to purchase additional units is exercised. |

|

(3) |

The ordinary shares included in the units are Class A ordinary shares. Founder shares are classified as Class B ordinary shares, which shares are convertible into Class A ordinary shares on a one-for-one basis, subject to adjustment as described below adjacent to the caption “Founder shares conversion and anti-dilution rights.” We refer to our Class A ordinary shares and our Class B ordinary shares collectively herein as our ordinary shares. |

11

|

Exercise period |

|

The warrants will become exercisable 30 days after the completion of our initial business combination; provided that we have an effective registration statement under the Securities Act covering the Class A ordinary shares issuable upon exercise of the warrants and a current prospectus relating to them is available and such shares are registered, qualified or exempt from registration under the securities, or blue sky, laws of the state of residence of the holder (or we permit holders to exercise their warrants on a “cashless basis” under the circumstances specified in the warrant agreement including as a result of a notice of redemption described under “Redemption of warrants when the price per Class A ordinary share equals or exceeds $18.00”). |

|

|

|

|

|

|

|

|

|

|

|

We have agreed that as soon as practicable, but in no event later than 15 business days, after the closing of our initial business combination, we will use our commercially reasonable efforts to file with the SEC a post-effective amendment to the registration statement for this offering or a new registration statement for the registration, under the Securities Act, of the Class A ordinary shares issuable upon exercise of the warrants. We will use our commercially reasonable efforts to cause the same to become effective within 60 business days after the closing of the initial business combination and to maintain the effectiveness of such registration statement, and a current prospectus relating thereto, until the expiration or redemption of the warrants in accordance with the provisions of the warrant agreement. Notwithstanding the above, if our Class A ordinary shares are at the time of any exercise of a warrant not listed on a national securities exchange such that they satisfy the definition of a “covered security” under Section 18(b)(1) of the Securities Act, we may, at our option, require holders of public warrants who exercise their warrants to do so on a “cashless basis” in accordance with Section 3(a)(9) of the Securities Act and, in the event we so elect, we will not be required to file or maintain in effect a registration statement. We will be required to use our commercially reasonable efforts to register or qualify the shares under applicable blue sky laws to the extent an exemption is not available. |

|

|

|

|

|

|

|

The warrants will expire at 5:00 p.m., New York City time, five years after the completion of our initial business combination or earlier upon redemption or liquidation. On the exercise of any warrant, the warrant exercise price will be paid directly to us and not placed in the trust account. |

|

|

|

|

|

Redemption of warrants when the price per |

|

|

|

$18.00 |

|

Once the warrants become exercisable, we may redeem the outstanding public warrants for cash: |

|

|

|

|

|

|

|

• in whole and not in part; |

|

|

|

|

|

|

|

• at a price of $0.01 per warrant; |

|

|

|

|

|

|

|

• upon a minimum of 30 days’ prior written notice of redemption, which we refer to as the “30-day redemption period”; and |

|

|

|

|

12

|

|

|

• if, and only if, the last reported sale price of our Class A ordinary shares equals or exceeds $18.00 per share (as adjusted and described under “Description of Securities – Warrants — Public Shareholders’ Warrants — Anti-dilution Adjustments”) for any 20 trading days within a 30 trading day period ending on the third trading day prior to the date on which we send the notice of redemption to the warrantholders. |

|

|

|

|

|

|

|

We will not redeem the warrants as described above unless a registration statement under the Securities Act covering the issuance of the Class A ordinary shares issuable upon exercise of the warrants is effective and a current prospectus relating to those Class A ordinary shares is available throughout the 30-day redemption period, except if the warrant may be exercised in a cashless basis and such cashless exercise is exempt from registration under the Securities Act. If and when the public warrants become redeemable by us, we may exercise our redemption right even if we are unable to register or qualify the underlying securities for sale under all applicable state securities laws. |

|

|

|

|

|

|

|

None of the private placement warrants will be redeemable by us. |

|

|

|

|

|

|

|

|

|

Appointment of directors; voting rights |

|

Prior to our initial business combination, only holders of our Class B ordinary shares will have the right to vote on the appointment and removal of directors. Holders of our Class A ordinary shares will not be entitled to vote on the appointment or removal of directors during such time. In addition, in a vote to continue the Company in a jurisdiction outside the Cayman Islands (including, but not limited to, the approval of the organizational documents of the company in such other jurisdiction), which requires the approval of at least two thirds of the votes of all ordinary shares, holders of our Class B ordinary shares will have ten votes for every Class B ordinary share and holders of our Class A ordinary shares will have one vote for every Class A ordinary share and, as a result, our initial shareholders will be able to approve any such proposal without the vote of any other shareholder. These provisions of our amended and restated memorandum and articles of association may only be amended by a special resolution passed by a majority of at least 90% of our ordinary shares voting at a general meeting. With respect to any other matter submitted to a vote of our shareholders, including any vote in connection with our initial business combination, except as required by applicable law or stock exchange rule, holders of our Class A ordinary shares and holders of our Class B ordinary shares will vote together as a single class, with each share entitling the holder to one vote. |

|

|

|

|

13

|

Founder shares |

|

On February 19, 2021, 11,500,000 founder shares were issued to our sponsor in exchange for the payment of $25,000 of certain offering expenses on our behalf, or approximately $0.002 per share. In July 2021, our sponsor surrendered to us for no consideration an aggregate of 2,875,000 founder shares, which we accepted and cancelled. In 2021, our sponsor will forfeit 105,000 founder shares, and we will issue 35,000 founder shares to each of our independent director nominees at their original purchase price. Prior to the initial investment in the company of $25,000 by our sponsor, the company had no assets, tangible or intangible. The per share price of the founder shares was determined by dividing the amount of cash contributed to the company by the number of founder shares issued. If we increase or decrease the size of this offering, we will effect an issuance of share premium, a distribution in kind in the form of shares, a share repurchase or a surrender of shares, as applicable, with respect to our Class B ordinary shares, immediately prior to the consummation of this offering in such amount as to maintain the number of founder shares at 20% of the issued and outstanding ordinary shares upon the consummation of this offering. Up to 1,125,000 founder shares are subject to forfeiture by our sponsor (or its permitted transferees) depending on the extent to which the underwriters’ option to purchase additional units is not exercised so that the number of founder shares will remain equal to 20% of our ordinary shares after this offering. |

|

|

|

|

|

|

|

|

|

The founder shares are identical to the Class A ordinary shares included in the units being sold in this offering, except that: |

|

|

|

|

|

|

|

|

|

• the founder shares are Class B ordinary shares that automatically convert into our Class A ordinary shares at the time of our initial business combination on a one-for-one basis, subject to adjustment pursuant to certain anti-dilution rights, as described herein; |

|

|

|

|

|

|

|

|

|

• only holders of the founder shares have the right to vote on the appointment and removal of directors prior to our initial business combination; |

|

|

|

|

|

|

|

|

|

• in a vote to continue the company in a jurisdiction outside the Cayman Islands (including, but not limited to, the approval of the organizational documents of the company in such other jurisdiction), which requires the approval of at least two thirds of the votes of all ordinary shares, holders of our Class B ordinary shares will have ten votes for every founder share and holders of our Class A ordinary shares will have one vote for every Class A ordinary share; |

|

|

|

|

|

|

|

|

|

• the founder shares are subject to certain transfer restrictions, as described in more detail below; |

|

|

|

|

|

|

14

|

|

|

• our sponsor, officers and directors will not be entitled to (i) redemption rights with respect to any founder shares and any public shares held by them in connection with the completion of our initial business combination, (ii) redemption rights with respect to any founder shares and public shares held by them in connection with a shareholder vote to amend our amended and restated memorandum and articles of association in a manner that would affect the substance or timing of our obligation to redeem 100% of our public shares if we have not consummated an initial business combination within 24 months from the closing of this offering (or 27 months from the closing of this offering if we have executed a letter of intent, agreement in principle or definitive agreement for a business combination within 24 months from the closing of this offering) or (iii) liquidating distributions from the trust account with respect to any founder shares held by them if we fail to complete our initial business combination within 24 months from the closing of this offering (or 27 months from the closing of this offering if we have executed a letter of intent, agreement in principle or definitive agreement for a business combination within 24 months from the closing of this offering) (although they will be entitled to liquidating distributions from the trust account with respect to any public shares they hold if we fail to complete our initial business combination within the prescribed time frame). For purposes of seeking approval of the requisite majority of our outstanding ordinary shares voted, abstentions and non-votes will have no effect on the approval of our initial business combination once a quorum is obtained. As a result, in addition to our initial shareholders’ founder shares, in respect of an ordinary resolution, we would need 11,250,001, or 37.5% (assuming all outstanding shares are voted and the underwriter’s option to purchase additional units is not exercised), of the 30,000,000 public shares sold in this offering to be voted in favor of an initial business combination in order to have our initial business combination approved, subject to any higher consent threshold as may be required by Cayman Islands or other applicable law; and |

|

|

|

|

|

|

|

• the founder shares are entitled to registration rights. |

|

|

|

|

|

Transfer restrictions on founder shares |

|

Our initial shareholders have agreed not to transfer, assign or sell any founder shares held by them until one year after the date of the consummation of our initial business combination or earlier if, subsequent to our initial business combination, (i) the last sale price of our Class A ordinary shares equals or exceeds $12.00 per share (as adjusted for share subdivisions, share dividends, reorganizations, recapitalizations and the like) for any 20 trading days within any 30-trading day period commencing at least 150 days after our initial business combination or (ii) we consummate a subsequent liquidation, merger, share exchange or other similar transaction which results in all of our shareholders having the right to exchange their ordinary shares for cash, securities or other property (except as described herein under “Principal Shareholders — Transfers of Founder Shares and Private Placement Warrants”). |

|

|

|

|

|

|

|

We refer to such transfer restrictions throughout this prospectus as the lock-up. Any permitted transferees would be subject to the same restrictions and other agreements of our initial shareholders with respect to any founder shares. |

15

|

|

|

|

|

Founder shares conversion and |

|

|

|

anti-dilution rights |

|

We have issued 11,500,000 Class B ordinary shares, par value $0.0001 per share. In July 2021, our sponsor surrendered 2,875,000 Class B ordinary shares to us for no consideration, resulting in a decrease in the total number of Class B ordinary shares outstanding from 11,500,000 to 8,625,000. The Class B ordinary shares will automatically convert into Class A ordinary shares at the time of our initial business combination on a one-for-one basis, subject to adjustment for share subdivisions, share dividends, reorganizations, recapitalizations and the like and subject to further adjustment as provided herein. In the case that additional Class A ordinary shares, or equity-linked securities, are issued or deemed issued in excess of the amounts sold in this offering and related to the closing of our initial business combination, the ratio at which Class B ordinary shares shall convert into Class A ordinary shares will be adjusted (unless the holders of a majority of the outstanding Class B ordinary shares agree to waive such adjustment with respect to any such issuance or deemed issuance) so that the number of Class A ordinary shares issuable upon conversion of all Class B ordinary shares will equal, in the aggregate, on an as-converted basis, 20% of the sum of the total number of all ordinary shares outstanding upon the completion of this offering plus all Class A ordinary shares and equity-linked securities issued or deemed issued in connection with the business combination (excluding any shares or equity-linked securities issued, or to be issued, to any seller in the initial business combination). |

|

|

|

|

|

Indication of Interest |

|

We have received an indication of interest from ANRP II, which is a private investment fund managed by Apollo, to purchase securities in a private placement that will close simultaneously with the closing of our business combination, although there is no assurance they will do so. |

|

|

|

|

16

|

Private placement warrants |

|

Our sponsor has committed to purchase an aggregate of 6,000,000 private placement warrants (or 6,600,000 private placement warrants if the underwriters’ option to purchase additional units is exercised in full), each exercisable to purchase one Class A ordinary share at $11.50 per share, at a price of $1.50 per warrant ($9,000,000 in the aggregate or $9,900,000 in the aggregate if the underwriters’ option to purchase additional units is exercised in full) in a private placement that will close simultaneously with the closing of this offering. Each whole private placement warrant is exercisable to purchase one whole Class A ordinary share at $11.50 per share, subject to adjustment as provided herein. A portion of the purchase price of the private placement warrants will be added to the proceeds from this offering to be held in the trust account such that at the time of closing $300.0 million (or approximately $345.0 million if the underwriters exercise their option to purchase additional units in full) will be held in the trust account. If we do not complete our initial business combination within 24 months from the closing of this offering (or 27 months from the closing of this offering if we have executed a letter of intent, agreement in principle or definitive agreement for a business combination within 24 months from the closing of this offering), the proceeds from the sale of the private placement warrants held in the trust account will be used to fund the redemption of our public shares (subject to the requirements of applicable law) and the private placement warrants will expire without value to the holder. The private placement warrants will be non-redeemable and exercisable for cash or on a “cashless basis”. |

|

|

|

|

|

Transfer restrictions on private placement |

|

|

|

warrants |

|

If holders of private placement warrants elect to exercise them on a “cashless basis”, each holder would pay the exercise price by surrendering the warrants in exchange for a number of Class A ordinary shares equal to the quotient obtained by dividing (x) the product of the number of Class A ordinary shares underlying the warrants, multiplied by the excess of the “10-day average closing price” (as defined below), as of the date prior to the date on which notice of exercise is sent or given to the warrant agent less the warrant price by (y) the 10-day average closing price. The “10-day average closing price” shall mean, as of any date, the average last reported sale price of the Class A ordinary shares as reported during the 10 trading day period ending on the trading day prior to such date. If the holders of private placement warrants are affiliated with us, their ability to sell our securities in the open market will be significantly limited. We expect to have policies in place that prohibit insiders from selling our securities except during specific periods of time. Even during such periods of time when insiders will be permitted to sell our securities, an insider cannot trade in our securities if he or she is in possession of material non-public information. Accordingly, unlike public shareholders who could sell the Class A ordinary shares issuable upon exercise of the warrants freely in the open market, the insiders could be significantly restricted from doing so. As a result, we believe that allowing the holders to exercise such warrants on a “cashless basis” is appropriate. |

|

|

|

|

17

|

Proceeds to be held in trust account |

|

The rules of the NASDAQ provide that at least 90% of the gross proceeds from this offering and the sale of the private placement warrants be deposited in a trust account. Of the proceeds we will receive from this offering and the sale of the private placement warrants described in this prospectus, $300.0 million, or $10.00 per unit (approximately $345.0 million, or $10.00 per unit, if the underwriters’ option to purchase additional units is exercised in full) will be deposited into a U.S.-based trust account with Continental Stock Transfer & Trust Company acting as trustee and $9.0 million will be used to pay expenses in connection with the closing of this offering and for working capital following this offering. The proceeds to be placed in the trust account include approximately $10.5 million (or approximately $12.1 million if the underwriters’ option to purchase additional units is exercised in full) in deferred underwriting discounts and commissions. |

|

|

|

|

|

|

|

Except with respect to interest earned on the funds held in the trust account that may be released to us to pay our tax obligations, the proceeds from this offering and the sale of the private placement warrants will not be released from the trust account until the earliest of (a) the completion of our initial business combination (including the release of funds to pay any amounts due to any public shareholders who properly exercise their redemption rights in connection therewith), (b) the redemption of any public shares properly submitted in connection with a shareholder vote to approve an amendment to our amended and restated memorandum and articles of association in a manner that would affect the substance or timing of our obligation to redeem 100% of our public shares if we have not consummated an initial business combination within 24 months from the closing of this offering (or 27 months from the closing of this offering if we have executed a letter of intent, agreement in principle or definitive agreement for a business combination within 24 months from the closing of this offering), or (c) the redemption of our public shares if we are unable to complete our initial business combination within 24 months from the closing of this offering (or 27 months from the closing of this offering if we have executed a letter of intent, agreement in principle or definitive agreement for a business combination within 24 months from the closing of this offering), subject to applicable law. The proceeds deposited in the trust account could become subject to the claims of our creditors, if any, which could have priority over the claims of our public shareholders. |

|

|

|

|

18

|

Anticipated expenses and funding sources |

|

Unless and until we complete our initial business combination, no proceeds held in the trust account will be available for our use, except the withdrawal of interest to pay our taxes or to redeem our public shares as described herein. The proceeds held in the trust account will be invested only in U.S. government treasury obligations with a maturity of 185 days or less or in money market funds meeting certain conditions under Rule 2a-7 under the Investment Company Act which invest only in direct U.S. government treasury obligations. We will disclose in each quarterly and annual report filed with the SEC prior to our initial business combination whether the proceeds deposited in the trust account are invested in U.S. government treasury obligations or money market funds or a combination thereof. We estimate the interest earned on the trust account will be approximately $150,000 per year, assuming an interest rate of 0.05% per year; however, we can provide no assurances regarding this amount. Unless and until we complete our initial business combination, we may pay our expenses only from: |

|

|

|

|

|

|

|

• the net proceeds of this offering and the sale of the private placement warrants not held in the trust account, which will be approximately $2,000,000 in working capital after the payment of approximately $1.0 million in expenses relating to this offering; and |

|

|

|

|

|

|

|