As filed with the Securities and Exchange Commission on November 4, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

Delaware |

| 3690 |

| 85-1873463 |

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer |

1190 Trademark Drive #108

Reno, Nevada 89521

(775) 622-3448

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Denis Phares

Dragonfly Energy Holdings Corp.

1190 Trademark Drive #108

Reno, Nevada 89521

(775) 622-3448

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jeeho M. Lee, Esq.

Tai Vivatvaraphol, Esq.

O’Melveny & Myers LLP

7 Times Square Tower

New York, NY 10036

(212) 326-2000

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 4, 2022

PRELIMINARY PROSPECTUS

DRAGONFLY ENERGY HOLDINGS CORP.

38,132,989 Shares of Common Stock

18,308,414 Warrants to Purchase Shares of Common Stock

18,308,414 Shares of Common Stock Underlying Warrants

This prospectus relates to the offer and sale, from time to time, by the selling securityholders named in this prospectus (the “selling securityholders”) of up to 38,132,989 shares of our common stock, par value $0.0001 per share (“common stock”), 18,308,414 warrants to purchase shares of common stock and 18,308,414 shares of common stock that are issuable upon the exercise of such warrants, consisting of:

| ● | up to 31,290,514 shares of common stock that were issued as consideration in connection with the consummation of the transactions contemplated by the Business Combination Agreement (as defined below) at a per share value of $10.00 per share (the “Consideration Shares”); |

| ● | up to 3,664,975 shares of common stock subject to vesting and/or exercise of Legacy Dragonfly (as defined below) equity awards that were assumed in connection with the Business Combination (the “Option Shares”). Upon exercise of the applicable Legacy Dragonfly equity awards, the applicable selling securityholders will acquire the Option Shares at prices ranging from $0.372 to $4.08 per share of common stock; |

| ● | up to 3,162,500 shares of common stock (the “Founder Shares”) that were originally issued in a private placement at the time of the CNTQ IPO (as defined below). The Founder Shares were acquired at a purchase price equivalent to approximately $0.0079 per share of common stock; |

| ● | up to 4,627,858 warrants (“Private Warrants”) that were originally issued in a private placement at the time of the CNTQ IPO. The Private Warrants were acquired at a purchase price of $0.93 per Private Warrant; |

| ● | the $10 Warrants (as defined below) to initially acquire 1,600,000 shares of common stock that were originally issued to the Term Loan Lenders (as defined below); |

| ● | the Penny Warrants (as defined below) to initially acquire 2,593,056 shares of common stock that were originally issued to the Term Loan Lenders (as defined below); |

| ● | 4,627,858 shares of common stock (the “Private Warrant Shares”) issuable upon the exercise of the Private Warrants that were originally issued in a private placement at the time of the CNTQ IPO; |

| ● | 1,600,000 shares of common stock (the “$10 Warrant Shares”) issued upon the exercise of the $10 Warrants (as defined below) issued as part of the Term Loan (as defined below); |

| ● | 2,593,056 shares of common stock (the “Penny Warrant Shares”) issuable upon the exercise of the Penny Warrants (as defined below) issued as part of the Term Loan; and |

| ● | 15,000 shares of common stock (the “PIPE Investment Shares”) purchased by CCM (as defined below) in the PIPE Investment (as defined below). |

This prospectus also relates to the issuance by us of up to 18,308,414 shares of common stock (the “Warrant Shares”), comprised of (i) 9,487,500 shares of common stock (the “Public Warrant Shares”) that are issuable by us upon the exercise of the public warrants sold as part of the units in the CNTQ IPO (the “Public Warrants”), (ii) the 4,627,858 Private Warrant Shares, (iii) the 1,600,000 $10 Warrant Shares and (iv) the 2,593,056 Penny Warrant Shares. The Public Warrants and Private Warrants entitle the holder thereof to purchase one share of our common stock for $11.50 per share. The $10 Warrants and Penny Warrants entitle the holder thereof to purchase one share of our common stock for $10 per share and $0.01 per share, respectively, subject to weighted average anti-dilution protection.

We are registering the offer and sale of these securities to satisfy certain registration rights we have granted. The selling securityholders may offer, sell or distribute all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the shares of our common stock or warrants, except with respect to amounts received by us upon the exercise of the warrants. Because the exercise price of the Public Warrants and Private Warrants substantially exceeds the current trading price of our common stock, it is unlikely that holders of our warrants will be able to exercise such warrants in the near future, if at all. As a result, we are unlikely to receive any proceeds from the exercise of our warrants in the near future, if at all. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The selling securityholders will bear all commissions and discounts, if any, attributable to their sale of shares of our common stock or warrants. See section entitled “Plan of Distribution” beginning on page 114 of this prospectus.

Due to the significant number of shares of our common stock that were redeemed in connection with the Business Combination, the number of shares of common stock that the selling securityholders can sell into the public markets pursuant to this prospectus may exceed our public float. As a result, the resale of shares of our common stock pursuant to this prospectus could have a significant negative impact on the trading price of our common stock.

This impact may be heightened by the fact that, as described above, certain of the selling securityholders purchased, or are able to purchase, shares of our common stock at prices that are well below the current trading price of our common stock. The 56,441,403 shares that may be resold and/or issued into the public markets pursuant to this prospectus represent approximately 131% of the shares of our common stock outstanding as of October 26, 2022 (after giving effect to the issuance of the Option Shares, Public Warrant Shares and Private Warrant Shares).

Our common stock is currently listed on the Nasdaq Global Market (“Nasdaq”) under the symbol “DFLI” and our public warrants are currently listed on the Nasdaq Capital Market under the symbol “DFLIW”. As of November 3, 2022, the closing price of our common stock and warrants was $8.22 and $0.2174, respectively.

We are an “emerging growth company” under applicable federal securities laws and will be subject to reduced public company reporting requirements.

INVESTING IN OUR SECURITIES INVOLVES RISKS THAT ARE DESCRIBED IN THE “RISK FACTORS” SECTION BEGINNING ON PAGE 11 OF THIS PROSPECTUS.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.

You should rely only on the information contained in this prospectus. No one has been authorized to provide you with information that is different from that contained in this prospectus. This prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information contained in this prospectus is accurate as of any date other than that date.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

INTRODUCTORY NOTE

On October 7, 2022 (the “Closing” and such date the “Closing Date”), Chardan NexTech Acquisition 2 Corp., a Delaware corporation (“CNTQ”), and Bronco Merger Sub, Inc., a Nevada corporation and newly formed wholly-owned subsidiary of CNTQ (“Merger Sub”), consummated the previously announced Business Combination (as defined below) pursuant to the terms of the Business Combination Agreement (as defined below).

On the Closing Date, (i) CNTQ changed its name to “Dragonfly Energy Holdings Corp.” (“Dragonfly” or the “Company”); (ii) Merger Sub merged with and into Dragonfly Energy Corp., a Nevada corporation (“Legacy Dragonfly”), with Legacy Dragonfly surviving the Merger as a direct, wholly-owned subsidiary of the Company (the “Merger”); and (iii) the parties to the Business Combination Agreement consummated the other transactions contemplated thereby.

1

FREQUENTLY USED TERMS

Unless the context otherwise requires, references in this prospectus to “Dragonfly,” the “Company,” “us,” “we,” “our” and any related terms are intended to mean Dragonfly Energy Holdings Corp. and its consolidated subsidiaries.

“$10 Warrants” means warrants to initially acquire 1,600,000 shares of common stock at an initial $10.00 per share exercise price issued at Closing in connection with the Term Loan.

“Amended and Restated Charter” means the amended and restated certificate of incorporation of Dragonfly, in effect as of the date of this prospectus.

“Business Combination” means the Merger and the other transactions contemplated by the Business Combination Agreement.

“Business Combination Agreement” means that certain Agreement and Plan of Merger, dated May 15, 2022, as amended on July 12, 2022, by and among CNTQ, Merger Sub and Dragonfly.

“CCM” means Chardan Capital Markets LLC, a New York limited liability company.

“Closing” means the closing of the Business Combination.

“CNTQ” means Chardan NexTech Acquisition 2 Corp., a Delaware corporation, which was renamed “Dragonfly Energy Holdings Corp.” in connection with the Closing.

“CNTQ Common Stock” means, prior to consummation of the Business Combination, to CNTQ common stock, par value $0.0001 per share, and, following consummation of the Business Combination, to the common stock, par value $0.001 per share, of Dragonfly.

“CNTQ IPO” means the initial public offering by CNTQ, which closed on August 13, 2021.

“DGCL” means the General Corporation Law of the State of Delaware, as amended.

“Dragonfly” means Dragonfly Energy Holdings Corp., a Delaware corporation.

“Dragonfly Board” means the board of directors of Dragonfly.

“Earnout Shares” means up to an additional 40,000,000 shares of Company common stock that may be issued to the Legacy Dragonfly stockholders at Closing if certain financial metrics or trading price metrics are achieved and other conditions are satisfied.

“Founder Shares” means the shares of CNTQ common stock held by the Sponsor, CNTQ’s directors, and affiliates of CNTQ’s management team.

“Legacy Dragonfly” means Dragonfly Energy Corp., a Nevada corporation, and includes the surviving corporation after the Merger. References herein to Dragonfly will include its subsidiaries, including Legacy Dragonfly, to the extent reasonably applicable.

“Merger” means the merger of Merger Sub with and into Legacy Dragonfly, with Legacy Dragonfly continuing as the surviving corporation and as a wholly-owned subsidiary of CNTQ (which changed its name to Dragonfly Energy Holdings Corp. upon the Closing), in accordance with the terms of the Business Combination Agreement.

“Merger Sub” means Bronco Merger Sub, Inc., a Nevada corporation.

“Penny Warrants” means warrants to initially acquire 2,593,056 shares of common stock at an exercise price of $0.01 per share issued at Closing in connection with the Term Loan.

“Private Warrants” means warrants to acquire shares of common stock at an $11.50 per share exercise price issued to an affiliate of the Sponsor in a private placement simultaneously with the closing of the CNTQ IPO.

2

“Public Warrants” means warrants to acquire shares of common stock at an $11.50 per share exercise price sold as part of the units in the CNTQ IPO (whether they were purchased in the CNTQ IPO or thereafter in the open market).

“Sponsor” means Chardan NexTech Investments 2 LLC, a Delaware limited liability company and an affiliate of CCM.

“Term Loan” means the $75 million aggregate principal amount senior secured term loan facility entered into at Closing.

“Transactions” means the Merger, and the other transactions contemplated by the Business Combination Agreement.

“Trust Account” means the trust account of CNTQ that held the proceeds from the CNTQ IPO.

“Warrants” means the Public Warrants, the Private Warrants, the Penny Warrants and the $10 Warrants of Dragonfly.

“Warrant Holdings” means Chardan NexTech 2 Warrant Holdings LLC, a Delaware limited liability company.

3

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus may constitute “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target,” “designed to” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. We caution readers of this prospectus that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, that could cause the actual results to differ materially from the expected results. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics, projections of market opportunity and market share, potential benefits and the commercial attractiveness to our customers of our products and services, the potential success of our marketing and expansion strategies, the potential for us to achieve design awards, and the potential benefits of the Business Combination (including with respect to shareholder value). These statements are based on various assumptions, whether or not identified in this prospectus, and on the current expectations of our management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. These forward-looking statements are subject to a number of risks and uncertainties, including:

| ● | our inability to recognize the anticipated benefits of our recent Business Combination, which may be affected by, among other things, the factors listed below; |

| ● | our ability to successfully increase market penetration into target markets; |

| ● | the addressable markets that we intend to target do not grow as expected; |

| ● | the loss of any members of our senior management team or other key personnel; |

| ● | the loss of any relationships with key suppliers including suppliers in China; |

| ● | the loss of any relationships with key customers; |

| ● | the inability to protect our patents and other intellectual property; |

| ● | the failure to successfully optimize solid state cells or to produce commercially viable solid state cells in a timely manner or at all, or to scale to mass production; |

| ● | changes in applicable laws or regulations; |

| ● | our ability to maintain the listing of common stock on the Nasdaq; |

| ● | the possibility that we may be adversely affected by other economic, business and/or competitive factors (including an economic slowdown or inflationary pressures); |

| ● | the impact of the novel coronavirus disease pandemic, including any mutations or variants thereof, and its effect on business and financial conditions; |

| ● | the inability of the Company to sell the desired amounts of shares of common stock to CCM at desired prices under the ChEF Equity Facility; |

| ● | the potential for events or circumstances that result in the Company’s failure to timely achieve the anticipated benefits of the Company’s customer arrangements with THOR and its affiliate brands (including Keystone); |

4

| ● | our ability to raise additional capital to fund our operations; |

| ● | our ability to generate revenue from future product sales and our ability to achieve and maintain profitability; |

| ● | the accuracy of our projections and estimates regarding our expenses, capital requirements, cash utilization, and need for additional financing; |

| ● | changes in financial estimates and recommendations by securities analysts concerning us or the market in general; |

| ● | the potential scope and value of our intellectual property and proprietary rights; |

| ● | developments relating to our competitors and our industry; |

| ● | our ability to engage target customers and successfully convert these customers into meaningful orders in the future; |

| ● | the reliance on two suppliers for our LFP cells and a single supplier for the manufacture of our battery management system; |

| ● | the likely dependence on a single manufacturing facility; |

| ● | the increasing reliance on software and hardware that is highly complex and technical; and |

| ● | other risks and uncertainties indicated in this prospectus, including those under the heading “Risk Factors.” |

If any of these risks materialize or any of our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that we are not presently aware of or that we currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect our expectations, plans or forecasts of future events and views as of the date of this prospectus. We anticipate that subsequent events and developments will cause our assessments to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our assessments as of any date subsequent to the date of this prospectus. Accordingly, undue reliance should not be placed upon the forward-looking statements. Actual results, performance or achievements may, and are likely to, differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements were based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance as projected financial information and other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond our control.

5

SUMMARY OF THE PROSPECTUS

This summary highlights selected information from this prospectus and does not contain all of the information that is important to you in making an investment decision. This summary is qualified in its entirety by the more detailed information included in this prospectus. Before making your investment decision with respect to our securities, you should carefully read this entire prospectus, including the information under “Risk Factors,” “Dragonfly’s Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Condensed Combined Financial Information and Other Data” and the financial statements included elsewhere in this prospectus.

The Company

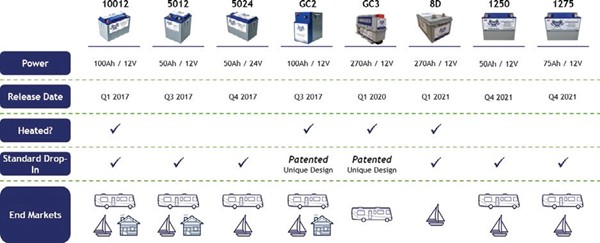

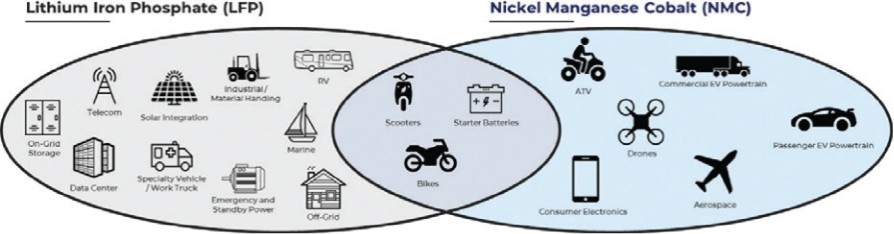

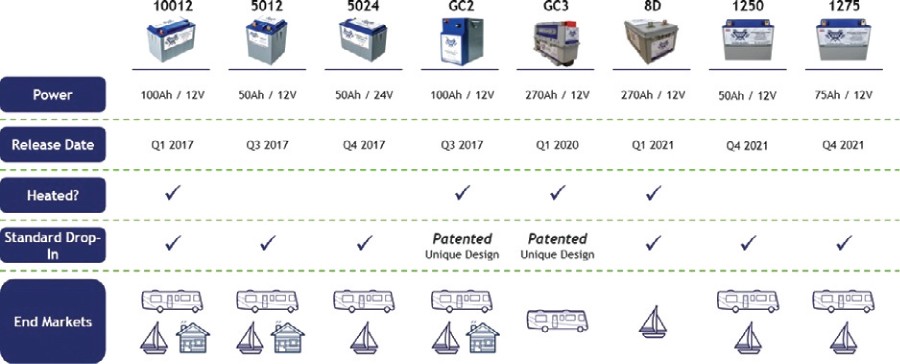

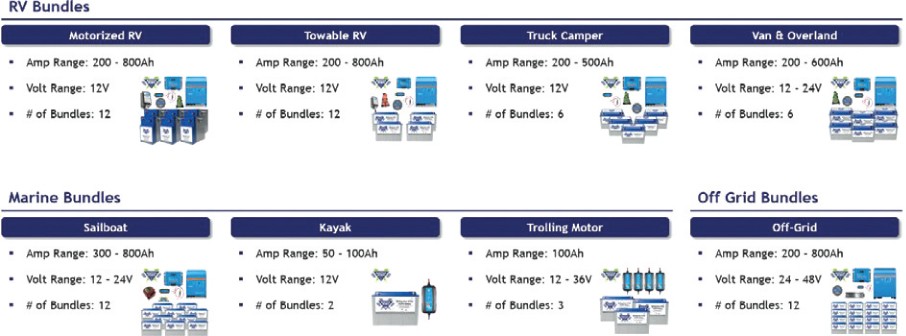

Our business was founded in 2012. Based in Reno, Nevada, we are a manufacturer of non-toxic deep cycle lithium-ion batteries that are designed to displace lead acid batteries in a number of different storage applications and end markets including recreational vehicle (“RV”), marine vessel, and solar and off-grid industries, with disruptive solid-state cell technology currently under development. Our mission is to develop technology to deliver environmentally impactful and affordable solutions for energy storage to everyone globally.

To supplement our battery offerings, we are also a reseller of accessories for battery systems. These include chargers, inverters, monitors, controllers and other system accessories from brands such as Victron Energy, Progressive Dynamics, Magnum Energy and Sterling Power.

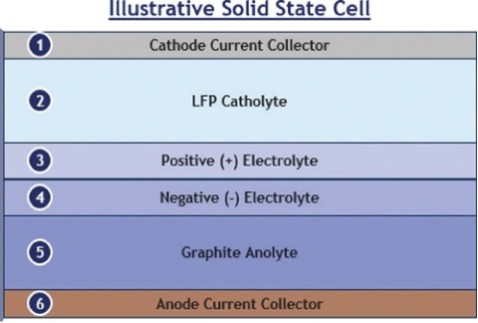

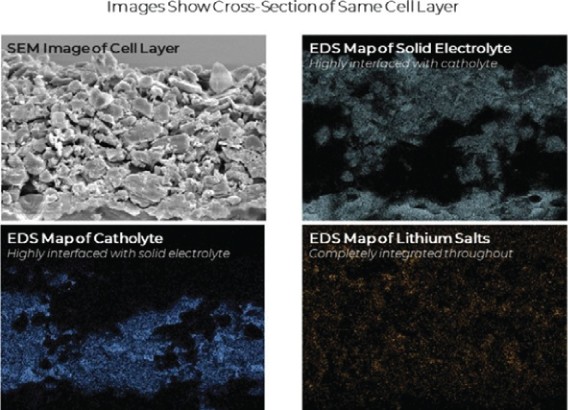

In addition to our conventional LFP batteries, our experienced research and development team, headed by our co-founder and CEO, is currently developing the next generation of LFP solid-state cells. Since our founding, we have been developing proprietary solid-state cell technology and manufacturing processes for which we have issued patents and pending patent applications, where appropriate.

The mailing address of our principal executive office is 1190 Trademark Dr. #108, Reno, Nevada 89521, and our telephone number is (775) 622-3448.

For more information about us, see the sections entitled “Business” and “Dragonfly’s Management’s Discussion and Analysis of Financial Condition and Results of Operation.”

Emerging Growth Company

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

We will remain an emerging growth company until the earlier of: (1) the last day of the fiscal year (a) ending December 31, 2026, (b) in which we have total annual gross revenue of at least $1.235 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the end of the prior fiscal year’s second fiscal quarter; and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. References herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

Smaller Reporting Company

Additionally, we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of the fiscal year in which (i) the market value of our common stock held by non-affiliates exceeds $250 million as of the prior June 30, or (ii) our annual revenues exceeded

6

$100 million during such completed fiscal year and the market value of our common stock held by non-affiliates exceeds $700 million as of the prior June 30.

Risk Factors Summary

You should consider all the information contained in this prospectus before making a decision to invest in our common stock or warrants. In particular, you should consider the risk factors described under “Risk Factors” beginning on page 11. Such risks include, but are not limited to, the following risks:

Risks Related to this Offering

| ● | Due to the significant number of shares of our common stock that were redeemed in connection with the Business Combination, the number of shares of common stock that the selling securityholders can sell into the public markets pursuant to this prospectus may exceed our public float. As a result, the resale of shares of our common stock pursuant to this prospectus could have a significant negative impact on the trading price of our common stock. |

Risks Related to our Existing Lithium-Ion Battery Operations

| ● | Our business and future growth depends on the needs and success of our customers. |

| ● | We operate in a competitive industry. We expect that the level of competition will increase and the nature of our competitors will change as we develop new LFP battery products for, and enter into, new markets, and as the competitive landscape evolves. |

| ● | We may not succeed in our medium- and long-term strategy of entering into new end markets for LFP batteries and our success depends, in part, on our ability to successfully develop and manufacture new products for, and acquire customers in, these new markets and successfully grow our operations and production capabilities (including, in time, our ability to manufacture solid-state cells in-house). |

| ● | We currently rely on two suppliers to provide our LFP cells and a single supplier for the manufacture of our battery management system. Any disruption in the operations of these key suppliers could adversely affect our business and results of operations. |

| ● | We are currently, and likely will continue to be, dependent on a single manufacturing facility. If our facility becomes inoperable for any reason, or our automation and expansion plans do not yield the desired effects, our ability to produce our products could be negatively impacted. |

Risks Related to our Solid-State Technology Development

| ● | We face significant engineering challenges in our attempts to develop and manufacture solid-state battery cells and these efforts may be delayed or fail which could negatively impact our business. |

| ● | We expect to make significant investments in our continued research and development of solid-state battery technology development, and we may be unable to adequately control the costs associated with manufacturing our solid-state battery cells. |

| ● | If our solid-state batteries fail to perform as expected, our ability to further develop, market and sell our solid-state batteries could be harmed. |

Risks Related to Intellectual Property

| ● | We rely heavily upon our intellectual property portfolio. If we are unable to protect our intellectual property rights, our business and competitive position would be harmed. |

7

| ● | We may need to defend ourselves against intellectual property infringement claims, which may be time- consuming and could cause us to incur substantial costs. |

General Risk Factors

| ● | The uncertainty in global economic conditions, including as a result of the COVID-19 pandemic and the Russia-Ukraine conflict, could reduce consumer spending and disrupt our supply chain which could negatively affect our results of operations. |

| ● | The loss of one or more members of our senior management team, other key personnel or our failure to attract additional qualified personnel may adversely affect our business and our ability to achieve our anticipated level of growth. |

| ● | If we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of customer service, or adequately address competitive challenges. |

Risks Related to our Financial Position and Capital Requirements

| ● | Our business is capital intensive, and we may not be able to raise additional capital on attractive terms, if at all. Any further indebtedness we incur may limit our operational flexibility in the future. |

| ● | Restrictions imposed by our outstanding indebtedness and any future indebtedness may limit our ability to operate our business and to finance our future operations or capital needs or to engage in acquisitions or other business activities necessary to achieve growth. |

Risks Related to Ownership of our Common Stock

| ● | Future issuances of debt securities and equity securities may adversely affect us, including the market price of the common stock and may be dilutive to existing stockholders. |

| ● | Insiders continue to have substantial influence over us, which could limit your ability to affect the outcome of key transactions, including a change of control. |

| ● | We may issue additional shares of our common stock or other equity securities without your approval, which would dilute your ownership interests and may depress the market price of your shares. |

8

THE OFFERING

Issuer | Dragonfly Energy Holdings Corp. |

Resale of common stock | |

Securities offered by the selling securityholders | We are registering the resale by the selling securityholders named in this prospectus, or their permitted transferees, of an aggregate of 38,132,989 shares of common stock, 18,308,414 warrants to purchase shares of common stock and 18,308,414 shares of common stock issuable upon exercise of warrants, which includes up to: ● 31,290,514 Consideration Shares; ● 3,664,975 Option Shares; ● 3,162,500 Founder Shares; ● 4,627,858 Private Warrants; ● $10 Warrants; ● Penny Warrants; ● 4,627,858 Private Warrant Shares; ● 1,600,000 $10 Warrant Shares; ● 2,593,056 Penny Warrant Shares; and ● 15,000 PIPE Investment Shares. |

Use of proceeds | We will not receive any of the proceeds from the sale of the common stock or warrants by the selling securityholders. See “Use of Proceeds” for additional information. |

Issuance of common stock | |

Shares of common stock offered by us | ● 9,487,500 shares of common stock issuable upon exercise of the Public Warrants; ● 4,627,858 shares of common stock issuable upon exercise of the Private Warrants; ● 1,600,000 shares of common stock issued upon exercise of the $10 Warrants; and ● 2,593,056 shares of common stock issuable upon exercise of the Penny Warrants. |

Common stock issued and outstanding immediately after this offering | On a pro forma basis after giving effect to the Business Combination and the other transactions contemplated thereby: ● 44,848,686 shares of common stock prior to the exercise of the Warrants; and ● 63,157,100 shares of common stock assuming the issuance of 18,308,414 shares of common stock upon the exercise of the Warrants. |

9

Use of proceeds | We will receive up to an aggregate of approximately $178.35 million from the exercise of the Warrants, assuming the exercise in full of all of Warrants for cash. We expect to use the net proceeds, if any, from the exercise of the Warrants for research and development, working capital and general corporate purposes. Because the exercise price of the Public Warrants and Private Warrants substantially exceeds the current trading price of our common stock, we are unlikely to receive any proceeds from the exercise of our warrants in the near future, if at all. See “Use of Proceeds” for additional information. |

Lock-Up Restrictions | The securities that are owned by certain of the selling securityholders, including the parties to the Amended and Restated Registration Rights Agreement, are subject to lock-up provisions, which provide for certain restrictions on transfer until the termination of applicable lock-up periods. |

Nasdaq ticker symbols | Our common stock is currently listed on the Nasdaq under the symbol “DFLI” and our public warrants are currently listed on the Nasdaq Capital Market under the symbol “DFLIW”. |

Risk factors | Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” and elsewhere in this prospectus. The resale of shares of our common stock pursuant to this prospectus could have a significant negative impact on the trading price of our common stock. This impact may be heightened by the fact that certain of the selling securityholders purchased, or are able to purchase, shares of our common stock at prices that are well below the current trading price of our common stock. |

Unless we specifically state otherwise or the context otherwise requires, the information above is as of the Closing Date, does not give effect to issuances of our common stock, warrants or options to purchase shares of our common stock, or the exercise of warrants or options after such date, and excludes:

| ● | 2,785,950 shares initially reserved under the Dragonfly Energy Holdings Corp. 2022 Equity Incentive Plan (the “2022 Plan”); |

| ● | 2,464,400 shares initially reserved under the Dragonfly Energy Holdings Corp. Employee Stock Purchase Plan (the “ESPP”); |

| ● | 40,000,000 Earnout Shares; |

| ● | up to $150.0 million of shares of common stock we may sell to CCM pursuant to a purchase agreement between us and CCM, dated October 7, 2022 (the “Purchase Agreement”) establishing an equity facility (the “ChEF Equity Facility”); and |

| ● | 627,498 shares of common stock underlying outstanding options. |

10

RISK FACTORS

Investment in our securities involves risk. You should carefully consider the following risk factors in addition to the other information included in this prospectus, including matters addressed in the section entitled “Cautionary Note Regarding Forward-Looking Statement.” Please see the section entitled “Where You Can Find More Information” in this prospectus. These risk factors are not exhaustive, and investors are encouraged to perform their own investigation with respect to our business, financial condition and prospects. We may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial, which may also impair our business or financial condition. The following discussion should be read in conjunction with “Unaudited Pro Forma Condensed Combined Financial Information and Other Data,” the financial statements and notes to the financial statements included herein.

Risks Related to this Offering

Due to the significant number of shares of our common stock that were redeemed in connection with the Business Combination, the number of shares of common stock that the selling securityholders can sell into the public markets pursuant to this prospectus may exceed our public float. As a result, the resale of shares of our common stock pursuant to this prospectus could have a significant negative impact on the trading price of our common stock.

Due to the significant number of shares of our common stock that were redeemed in connection with the Business Combination, the number of shares of common stock that the selling securityholders can sell into the public markets pursuant to this prospectus may exceed our public float. As a result, the resale of shares of our common stock pursuant to this prospectus could have a significant negative impact on the trading price of our common stock. This impact may be heightened by the fact that, as described in the table below, certain of the selling securityholders purchased, or are able to purchase, shares of our common stock at prices that are well below the current trading price of our common stock. The 56,441,403 shares that may be resold and/or issued into the public markets pursuant to this prospectus represent approximately 131% of the shares of our common stock outstanding as of October 26, 2022 (after giving effect to the issuance of the Option Shares, Public Warrant Shares, Private Warrant Shares, $10 Warrant Shares and Penny Warrant Shares).

The selling securityholders will determine the timing, pricing and rate at which they sell such shares into the public market. Although the current trading price of our common stock is significantly below $10.00 per share, which was the sales price for units in the CNTQ IPO, as shown in the table above, certain of the selling securityholders have an incentive to sell because they purchased shares and/or warrants at prices below the initial public offering price and/or below the recent trading prices of our securities. Sales by such investors may prevent the trading price of our securities from exceeding the initial public offering price and may cause the trading prices of our securities to experience a further decline.

Risks Related to Our Existing Lithium-Ion Battery Operations

Our business and future growth depends on the needs and success of our OEMs and similar customers.

The demand for our products, including sales to original equipment manufacturers (“OEMs”), ultimately depends on consumers in our current end markets (primarily owners of RVs, marine vessels and off-grid residences). The performance and growth of these markets is impacted by numerous factors, including macro-economic conditions, consumer spending, travel restrictions, fuel costs and energy demands (including an increasing trend towards the use of green energy). Increases or decreases in these variables may significantly impact the demand for our products. If we fail to accurately predict demand, we may be unable to meet our customers’ needs, resulting in the loss of potential sales, or we may produce excess products, resulting in increased inventory and overcapacity in our production facilities, increasing our unit production cost and decreasing our operating margins.

An increasing proportion of our revenue has been and is expected to continue to be derived from sales to RV OEMs. Our RV OEM sales have been on a purchase order basis, without firm revenue commitments, and we expect that this will likely continue to be the case. For example, under our supply arrangement with Keystone RV Company (“Keystone”), the largest manufacturer of towable RVs in North America, Keystone has agreed to fulfill certain of its LFP battery requirements exclusively through us for at least one year, with potential annual renewals. However, although in time we expect Keystone to be a significant contributor to our projected growth in RV OEM battery sales, this arrangement may not deliver the anticipated benefits, as there are no firm purchase commitments, sales will continue to be made on a purchase order basis, Keystone is permitted to purchase other LFP batteries from third parties and this arrangement may not be renewed. In addition, in July 2022, we agreed to a strategic investment by THOR Industries (“THOR”), which, among other things, contemplates a future, mutually agreed exclusive distribution agreement with

11

THOR in North America. Although we expect that THOR will be a be significant contributor to our projected growth in RV OEM battery sales, this arrangement may not deliver the anticipated benefits and this distribution agreement may, in the future, preclude us from dealing with other large RV OEMs and their associated brands in North America or otherwise could negatively impact our relationships with those RV OEMs to whom we may be permitted to supply our batteries. Increased overall RV OEM sales may not materialize as expected or at all and we may fail to achieve our targeted sales levels. Future RV OEM sales are subject to a number of risks and uncertainties, including the number of RVs that these OEMs manufacture and sell (which can be impacted by a variety of events including those disrupting our OEM customers’ operations due to supply chain disruptions or labor constraints); the degree to which our OEM customers incorporate/design-in our batteries into their RV product lines; the extent to which RV owners, if applicable, opt to purchase our batteries upon initial purchase of their RV or in the aftermarket; and our continued ability to successfully develop and introduce reliable and cost-effective batteries meeting evolving industry standards and customer specifications and preferences. Our failure to adequately address any of these risks may result in lost sales which could have a material adverse effect on our business, financial condition and results of operations.

In addition, our near-term growth depends, in part, on the continued growth of the end markets in which we currently operate. Although the total addressable market for RVs, marine vessels and off-grid residences is estimated to reach $12 billion by 2025, these markets may not grow as expected or at all, and we may be unable to maintain existing customers and/or attract new customers in these markets. Our failure to maintain or expand our share of these growing markets could have a material adverse effect on our business, financial condition and results of operations.

We may not be able to engage target customers successfully and convert these customers into meaningful orders in the future.

Our success, and our ability to increase sales and operate profitably, depends on our ability to identify target customers and convert these customers into meaningful orders, as well as our continued development of existing customer relationships. Although we have developed a multi-pronged sales and marketing strategy to penetrate our end markets and reach a range of customers, this strategy may not continue to be effective in reaching or converting target customers into orders, or as we expand into additional markets. Recently, we have also dedicated more resources to developing relationships with certain key RV OEMs, such as Keystone, which we aim to convert into collaborations on custom designs and/or long-term contractual arrangements. We may be unable to convert these relationships into meaningful orders or renew these arrangements going forward, which may require us to expend additional cost and management resources to engage other target customers.

Our sales to any future or current customers may decrease for reasons outside our control, including loss of market share by customers to whom we supply products, reduced or delayed customer requirements, supply and/or manufacturing issues affecting production, reputational harm or continued price reductions. Furthermore, in order to attract and convert customers we must continue to develop batteries that address our current and future customers’ needs. Our failure to achieve any of the foregoing could have a material adverse effect on our business, financial condition and results of operations.

We operate in a competitive industry. We expect that the level of competition will increase and the nature of our competitors will change as we develop new LFP battery products for, and enter into, new markets, and as the competitive landscape evolves. These competitive and other factors could result in lost potential sales and lower average selling prices and profitability for our products.

We compete with traditional lead-acid battery manufacturers and lithium-ion battery manufacturers, who primarily either import their products or components or manufacture products under a private label. As we continue to expand into new markets, develop new products and move towards production of our solid- state cells, we will experience competition with a wider range of companies. These include companies focused on solid-state cell production, vertically integrated energy companies and other technology-focused energy storage companies. We believe our main competitive advantage in displacing incumbent lead-acid batteries is that we produce a lighter, safer, higher performing, cost-effective battery with a longer lifespan. We believe our go-to-market strategy, established brand, proven reliability and relationships with OEMs and end consumers both (i) enable us to compete effectively against other battery manufacturers and (ii) position us favorably to expand into new addressable markets. However, OEM sales typically result in lower average selling prices and related margins, which could result in overall margin erosion, affect our growth or require us to raise our prices. As a result, we may be unable to maintain this competitive advantage given the rapidly developing nature of the industry in which we operate.

Our current competitors have, and future competitors may have, greater resources than we do. Our competitors may be able to devote greater resources to the development of their current and future technologies. These competitors may also be able to devote greater resources to sales and marketing efforts, affording them great access to customers, and may be able to establish cooperative or strategic relationships amongst themselves or with third parties that may further enhance their competitive positioning. In addition,

12

foreign producers may be able to employ labor at significantly lower costs than producers in the United States, expand their export capacity and increase their marketing presence in our major end markets. We expect actual and potential competitors to continue their efforts to develop alternative battery technologies and introduce new products with more desirable, attractive features. These new technologies and products may be introduced sooner than our offerings and could gain greater market acceptance. Although we believe we are a leader in developing solid-state battery technology (particularly for the RV, marine vessel and off-grid residence markets which require cost-effective batteries with a long-life span), new competitors may emerge, alternative approaches to solid-state battery technology may be developed and competitors may seek to market solid- state battery technologies better suited for other applications (such as electric vehicles (“EVs”)) to our target markets.

Additional competitive and other factors may result in lost sales opportunities and declines in average sales prices and overall product profitability. These include rapidly evolving technologies, industry standards, economic conditions and end-customer preferences. Our failure to adapt to or address these factors as they arise could have a material adverse effect on our business, financial condition and results of operations.

We may not succeed in our medium- and long-term strategy of entering into new end markets for LFP batteries and our success depends, in part, on our ability to successfully develop and manufacture new products for, and acquire customers in, these new markets and successfully grow our operations and production capabilities (including, in time, our ability to manufacture solid-state cells in-house).

Our future success depends, in part, upon our ability to expand into additional end markets identified by us as opportunities for our LFP batteries. These markets include industrial, specialty and work vehicles, material handling, solar integration, and emergency and standby power in the medium term, and data centers, rail, telecom and distributed on-grid storage in the longer term. Our ability to expand into these markets depends on a number of factors, including the continued growth of these markets, having sufficient capital to expand our product offerings (including in the longer term batteries incorporating, once developed, our solid- state cells) and manufacturing capacity, developing products adapted to customer needs and preferences in these markets, our successful expansion of our manufacturing capabilities in order to meet customer demand, our ability to identify and convert potential customers within these markets and our ability to attract and retain qualified personnel to assist in these efforts. Although we intend to devote resources and management time to understanding these new markets, we may face difficulties in understanding and accurately predicting the demographics, preferences and purchasing habits of customers and consumers in these markets. If we fail to execute on our growth strategies in accordance with our expectations, our sales growth would be limited to the growth of existing products and existing end markets, and this could have a material adverse effect on our business, financial condition and results of operations.

Further, if we are unable to manage the growth of our operations effectively to match the growth in sales, we may incur unexpected expenses and be unable to meet our customers’ requirements, which could materially adversely affect our business, financial condition and results of operations. A key component of our growth strategy is the expansion and automation of our manufacturing sales capacity to address expected growing product demand and to accommodate our production of solid-state cells at scale. We have experienced supply delays in obtaining the necessary components to implement our automated adhesive application systems, as well as our pilot production line for our solid-state cells, and we may continue to experience component shortages in the future, which may negatively impact our ability to achieve these aspects of our growth strategy on time or at all. The costs of our expansion and automation efforts may be greater than expected, and we may fail to achieve anticipated cost efficiencies, which could have a material adverse effect on our business, financial condition and results of operations. We must also attract, train and retain a significant number of skilled employees, including engineers, sales and marketing personnel, customer support personnel and management, and the availability of such personnel may be constrained. Failure to effectively manage our growth could also lead us to over- invest or under-invest in development and operations; result in weaknesses in our infrastructure, systems or controls; give rise to operational mistakes, financial losses, loss of productivity or business opportunities; and result in loss of employees and reduced productivity of remaining employees, any of which could have a material adverse effect on our business, financial condition and results of operations.

We currently rely on two suppliers to provide our LFP cells and a single supplier for the manufacture of our battery management system. Any disruption in the operations of these key suppliers could adversely affect our business and results of operations.

We currently rely on two carefully selected cell manufacturers located in China, and a single supplier, also located in China, to manufacture our proprietary battery management system, and we intend to continue to rely on these suppliers going forward.

Our dependence on a limited number of key third-party suppliers exposes us to challenges and risks in ensuring that we maintain adequate supplies required to produce our LFP batteries. Although we carefully manage our inventory and lead-times, we may

13

experience a delay or disruption in our supply chain and/or our current suppliers may not continue to provide us with LFP cells or our battery management systems in our required quantities or to our required specifications and quality levels or at attractive prices. Our close working relationships with our China-based LFP cell suppliers to-date, reflected in our ability to increase our purchase order volumes (qualifying us for related volume-based discounts) and to order and receive delivery of cells in advance of required demand, has helped us moderate or offset increased supply-related costs associated with inflation, currency fluctuations and tariffs imposed on our battery cell imports by the U.S. government and avoid potential shipment delays. If we are unable to enter into or maintain commercial agreements with these suppliers on favorable terms, or if any of these suppliers experience unanticipated delays, disruptions or shutdowns or other difficulties ramping up their supply of products or materials to meet our requirements, our manufacturing operations and customer deliveries would be seriously impacted, potentially resulting in liquidated damages and harm to our customer relationships. Although we believe we could locate alternative suppliers to fulfill our needs, we may be unable to find a sufficient alternative supply in a reasonable time or on commercially reasonable terms.

Further, our dependence on these third-party suppliers entails additional risks, including:

| ● | inability, failure or unwillingness of third-party suppliers to comply with regulatory requirements; |

| ● | breach of supply agreements by the third-party suppliers; |

| ● | misappropriation or disclosure of our proprietary information, including our trade secrets and know- how; |

| ● | relationships that third-party suppliers may have with others, which may include our competitors, and failure of third-party suppliers to adequately fulfill contractual duties, resulting in the need to enter into alternative arrangements, which may not be available, desirable or cost-effective; and |

| ● | termination or nonrenewal of agreements by third-party suppliers at times that are costly or inconvenient for us. |

We may not be able to accurately estimate future demand for our LFP batteries, and our failure to accurately predict our production requirements could result in additional costs or delays.

We seek to maintain an approximately nine-month supply of LFP cells and six-month supply of all other critical components by pre-ordering components in advance of expected demand. However, our business and customer product demand is impacted by trends and factors that may be outside our control. Therefore, our ability to predict our manufacturing requirements is subject to inherent uncertainty. Lead times for materials and components that our suppliers order may vary significantly and depend on factors such as the specific supplier, contract terms and demand for each component at a given time. If we fail to order sufficient quantities of product components in a timely manner, the delivery of our batteries to our customers could be delayed, which would harm our business, financial condition and results of operations.

To meet our delivery deadlines, we generally make significant decisions on our production level and timing, procurement, facility requirements, personnel needs and other resources requirements based on our estimate of demand, our past dealings with such customers, economic conditions and other relevant factors. Although we monitor our slow-moving inventory, if customer demand declines significantly, we may have excess inventory which could result in unprofitable sales or write-offs as our products are susceptible to obsolescence and price declines. Expediting additional material to make up for any shortages within a short time frame could result in increased costs and a delay in meeting orders, which would result in lower profits and negatively impact our reputation. In either case, our results of operations would fluctuate from period to period.

In addition, certain of our competitors may have long-standing relationships with suppliers, which may provide them with a competitive pricing advantage for components and reduce their exposure to volatile raw material costs, including due to inflation. As a result, we may face market-driven downward pricing pressures in the future, which may run counter to the cost of the components required to produce our products. During 2022, in particular, we have seen rising materials costs due to inflation, which we have had to counteract through increases in our product prices, where we believe it is prudent. Our customers may not view this favorably and expect us to cut our costs further and/or to lower the price of our products. We may be unable to increase our sales volumes to offset lower prices (if we choose to implement lower prices), develop new or enhanced products with higher selling prices or margins, or reduce our costs to levels enabling us to remain competitive. Our failure to accomplish any of the foregoing could have a negative impact on our profitability and our business, financial condition and results of operations may ultimately be materially adversely affected.

14

We are currently, and will likely continue to be, dependent on a single manufacturing facility. If our facility becomes inoperable for any reason, or our automation and expansion plans do not yield the desired effects, our ability to produce our products could be negatively impacted.

All of our battery assembly currently takes place at our 99,000 square foot headquarters and manufacturing facility located in Reno, Nevada. We currently operate two LFP battery production lines, which has been sufficient to meet customer demand. If one or both production lines were to be inoperable for any period of time, we would face delays in meeting orders, which could prevent us from meeting demand or require us to incur unplanned costs, including capital expenditures.

Our facility may be harmed or rendered inoperable by natural or man-made disasters, including earthquakes, flooding, fire and power outages, utility and transportation infrastructure disruptions, acts of war or terrorism, or by public health crises, such as the ongoing COVID-19 pandemic, which may render it difficult or impossible for us to manufacture our products for an extended period of time. The inability to produce our products or the backlog that could develop if our manufacturing facility is inoperable for even a short period of time may result in increased costs, harm to our reputation, a loss of customers or a material adverse effect on our business, financial condition or results of operations. Although we maintain property damage and business interruption insurance, this insurance may not be sufficient to cover all of our potential losses and may not continue to be available to us on acceptable terms, if at all.

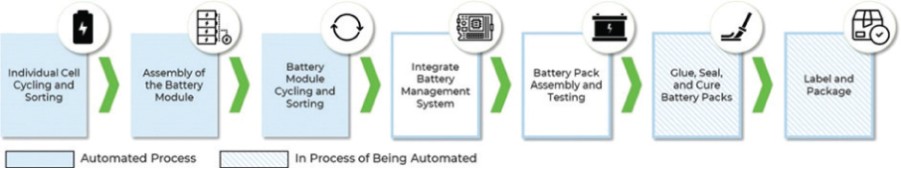

Over the next several years we plan to automate additional aspects of existing LFP battery production lines, add additional LFP battery production lines (as required) and construct and operate a pilot production line for our solid-state cells, all designed to maximize the capacity of our manufacturing facility. Our plans for automation and expansion may experience delays, incur additional costs or cause disruption to our existing production lines. For example, we have experienced supply delays in obtaining the necessary components to implement our automated adhesive application systems, as well as our pilot production line for our solid-state cells, and we may continue to experience component shortages in the future. The costs to successfully achieve our expansion and automation goals may be greater than we expect, and we may fail to achieve our anticipated cost efficiencies, which could have a material adverse effect on our business, financial condition and results of operations. Furthermore, while we are generally responsible for delivering products to the customer, we do not maintain our own fleet of delivery vehicles and outsource this function to third parties. Any shortages in trucking capacity, any increase in the cost thereof or any other disruption to the highway systems could limit our ability to deliver our products in a timely manner or at all.

Lithium-ion battery cells have been observed to catch fire or release smoke and flame, which may have a negative impact on our reputation and business.

Our LFP batteries use lithium iron phosphate (LiFePO4) as the cathode material for lithium-ion cells. LFP is intrinsically safer than other battery technologies due to its thermal and chemical stability and LFP batteries are less flammable than lead-acid batteries or lithium-ion batteries using different chemistries. On rare occasions, however, lithium-ion cells can rapidly release the energy they contain by releasing smoke and flames in a manner that can ignite nearby materials and other lithium-ion cells. This faulty result could subject us to lawsuits, product recalls, or redesign efforts, all of which would be time consuming and expensive. Further, negative public perceptions regarding the suitability or safety of lithium-ion cells or any future incident involving lithium-ion cells, such as a vehicle or other fire, even if such incident does not involve our products, could seriously harm our business and reputation.

To facilitate an uninterrupted supply of battery cells, we store a significant number of lithium-ion cells at our facility. While we have implemented enhanced safety procedures related to the handling of the cells, any mishandling, other safety issue or fire related to the cells could disrupt our operations. In addition, any accident, whether occurring at our manufacturing facility or from the use of our batteries, may result in significant production interruption, delays or claims for substantial damages caused by personal injuries or property damage. Such damage or injury could lead to adverse publicity and potentially a product recall, which could have a material adverse effect on our brand, business, financial condition and results of operations.

We may be subject to product liability claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims.

Product liability claims, even those without merit or that do not involve our products, could result in adverse publicity or damage to our brand, decreased partner and end-customer demand, and could have a material adverse effect on our business, financial condition and results of operations. The occurrence of any defects in our products could make us liable for damages and legal claims. In addition, we could incur significant costs to correct such issues, potentially including product recalls. We face an inherent risk of exposure to claims in the event that our products do not perform or are claimed not to have performed as expected. We also face risk

15

of exposure to claims because our products may be installed on vehicles (including RVs and marine vessels) that may be involved in crashes or may not perform as expected resulting in death, personal injury or property damage. Liability claims may result in litigation, the occurrence of which could be costly, lengthy and distracting and could have a material adverse effect on our business, financial condition and results of operations.

In the future, we may voluntarily or involuntarily initiate a recall if any products prove to be defective or non-compliant with then-applicable safety standards. Such recalls may involve significant expense and diversion of management attention and other resources, which could damage our brand image in our target end markets, as well as have a material adverse effect on our business, financial condition and results of operations.

A successful product liability claim against us could require us to pay a substantial monetary award. While we maintain product liability insurance, the insurance that we carry may not be sufficient or it may not apply to all situations. Moreover, a product liability claim against us or our competitors could generate substantial negative publicity about our products and business and could have a material adverse effect on our brand, business, financial condition and results of operations.

We currently rely on software and hardware that is complex and technical, and we expect that our reliance will increase in the future with the introduction of future products. If we are unable to manage the risks inherent in these complex technologies, or if we are unable to address or mitigate technical limitations in our systems, our business could be adversely affected.

Each of our batteries include our proprietary battery management system, which relies on software and hardware manufactured by third parties that is complex and technical. In addition, our battery communications system, expected to launch in the first half of 2023, will utilize third-party software and hardware to store, retrieve, process and manage data. The software and hardware utilized in these systems may contain errors, bugs, vulnerabilities or defects, which may be difficult to detect and/or manage. Although we attempt to remedy any issues that we observe in our products as effectively and rapidly as possible, such efforts may not be timely, may hamper production, or may not be to the satisfaction of our customers. If we are unable to prevent or effectively remedy errors, bugs, vulnerabilities or defects in the software and hardware that we use, we may suffer damage to our brand, loss of customers, loss of revenue or liability for damages, any of which could adversely affect our business, financial condition and results of operations.

Risks Related to Our Solid-State Technology Development

We face significant engineering challenges in our attempts to develop and manufacture solid-state battery cells and these efforts may be delayed or fail which could reduce consumer spending which could negatively impact our business.

Our solid-state battery development efforts are still ongoing, and we may fail to meet our goal of commercially selling LFP batteries incorporating our manufactured solid-state cells. We may encounter delays in the design, manufacture and launch of our solid-state battery cells, and in increasing production to scale.

Development and engineering challenges could delay or prevent our production of solid-state battery cells. These difficulties may arise in connection with current and future efforts to optimize the chemistry or physical structure of our solid-state batteries with the goal of enhancing conductivity and power; maximizing cycling capabilities and power results; reducing costs; and developing related mass production manufacturing processes. If we are unable to overcome developmental and engineering challenges, our solid-state battery efforts could fail.

We currently purchase the battery cells incorporated into our LFP batteries and have no experience in manufacturing battery cells. To cost-effectively and rapidly manufacture our solid-state cells at scale for incorporation into our LFP batteries, we plan to utilize currently available spray powder deposition equipment and other commercially available equipment modified to utilize our proprietary dry spray deposition and other technologies and processes. We may experience delays or additional costs in adapting our facility, existing production equipment and LFP battery manufacturing processes (for example, designing a dry room to accommodate our dry spraying processes) to manufacture solid-state cells. Even if we achieve the development and volume production of our solid-state battery that we anticipate, if the cost, cycling and power results or other technology or performance characteristics of the solid-state battery fall short of our targets, our business and results of operations would likely be materially adversely affected.

16

We expect to make significant investments in our continued research and development of solid-state battery technology development, and we may be unable to adequately control the costs associated with manufacturing our solid-state battery cells.

We will require significant capital to fund our solid-state cell research and development activities, pilot line construction and expansion of our manufacturing capabilities to accommodate large-scale production of solid-state cells. We have not yet produced any solid-state battery cells at volume and our forecasted cost advantage for the production of these cells at scale, compared to conventional lithium-ion cells, will require us to achieve rates of throughput, use of electricity and consumables, yield, and rate of automation demonstrated for mature battery, battery material, and ceramic manufacturing processes, that we have not yet achieved. We may not be able to achieve our desired cost benefits and, in turn, we may not be able to provide our solid-state cells at a cost that is attractive to customers. If we are unable to cost-efficiently design, manufacture, market, sell and distribute our solid-state batteries and services, our margins, profitability and prospects would be materially and adversely affected.

If our solid-state batteries fail to perform as expected, our ability to further develop, market and sell our solid- state batteries could be harmed.

Our solid-state battery cells may contain defects in design and manufacture that may cause them to not perform as expected or that may require repairs, recalls and design changes. Our solid-state batteries will incorporate components that have not been used individually or in combination in the same manner as the design of our solid-state cells, and that may result in defects and errors, particularly when produced at scale. We may be unable to detect and fix any defects in our solid-state battery cells prior to their incorporation into our solid-state LFP batteries and sale to potential consumers. If our solid-state batteries fail to perform as expected, we could lose customers, or be forced to delay deliveries, terminate orders or initiate product recalls, each of which could adversely affect our sales and brand and would have a material adverse effect on our business, financial condition and results of operations.

We expect to rely on machinery used in other large-scale commercial applications, modified to incorporate our proprietary technologies and processes, in order to mass produce solid-state battery cells, which exposes us to a significant degree of risk and uncertainty in terms of scaling production, operational performance and costs.

We expect to rely on machinery used in other large-scale commercial applications to mass produce our solid-state battery cells. Doing so will require us to work closely with the equipment provider to modify this machinery to effectively integrate our proprietary solid-state technology and processes in order to create the equipment we need for the production of solid-state cells. This integration work will involve a significant degree of uncertainty and risk and may result in delays in scaling up production of our solid-state cells or result in additional cost to us.

Such machinery is likely to suffer unexpected malfunctions from time to time and will require repairs and spare parts to resume operations, which may not be available when needed. Unexpected malfunctions may significantly affect the intended operational efficiency of, and therefore expected cost-efficiency associated with, our production equipment. In addition, because this machinery has not been used to manufacture and assemble solid-state battery cells, the operational performance and costs associated with repairing and maintaining this equipment can be difficult to predict and may be influenced by factors outside of our control, including failures by suppliers to deliver necessary components of our products in a timely manner and at prices acceptable to us, the risk of environmental hazards and the cost of any required remediation and damages or defects already present in the machinery.

Operational problems with our manufacturing equipment could result in personal injury to or death of workers, the loss of production equipment or damage to our manufacturing facility, which could result in monetary losses, delays and unanticipated fluctuations in production. In addition, we may be subject to administrative fines, increased insurance costs or potential legal liabilities. Any of these operational problems could have a material adverse effect on our business, financial condition and results of operations.

Risks Related to Our Intellectual Property

We rely heavily upon our intellectual property portfolio. If we are unable to protect our intellectual property rights, our business and competitive position would be harmed.

We may not be able to prevent unauthorized use of our intellectual property, which could harm our business and competitive position. We rely upon a combination of the intellectual property protections afforded by patent, copyright, trademark and trade secret laws in the United States and other jurisdictions to establish, maintain and enforce rights in our proprietary technologies. In addition, we seek to protect our intellectual property rights through non-disclosure and invention assignment agreements with our employees

17

and consultants, and through non-disclosure agreements with business partners and other third parties. Despite our efforts to protect our proprietary rights, third parties may attempt to copy or otherwise obtain and use our intellectual property. Monitoring unauthorized use of our intellectual property is difficult and costly, and the steps we have taken or will take to prevent unauthorized use may not be sufficient. Any enforcement efforts we undertake, including litigation, could be time-consuming and expensive and could divert management’s attention, which could harm our business, results of operations and financial condition.

In addition, available intellectual property laws and contractual remedies in some jurisdictions may afford less protection than needed to safeguard our intellectual property portfolio. Intellectual property laws vary significantly throughout the world. The laws of a number of foreign countries do not protect intellectual property rights to the same extent as do the laws of the United States. Therefore, our intellectual property rights may not be as strong, or as easily enforced, outside of the United States, and efforts to protect against the unauthorized use of our intellectual property rights, technology and other proprietary rights may be more expensive and difficult to undertake outside of the United States. In addition, while we have filed for and obtained certain intellectual property rights in commercially relevant jurisdictions, we have not sought protection for our intellectual property rights in every possible jurisdiction. Failure to adequately protect our intellectual property rights could result in competitors using our intellectual property to make, have made, use, import, develop, have developed, sell or have sold their own products, potentially resulting in the loss of some of our competitive advantage and a decrease in our revenue, which would adversely affect our business, prospects, financial condition and operating results.