UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

Or

For the fiscal year ended

OR

OR

Commission file number:

(Exact name of Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Telephone: +

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

per share | The | |||

Ordinary Shares | The |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close of business covered by this annual report.

On December 31, 2023, the issuer had

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||

| ☒ | Emerging growth company |

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the

Exchange Act.

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that

prepared or issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

No

TABLE OF CONTENTS

i

EXPLANATORY NOTE

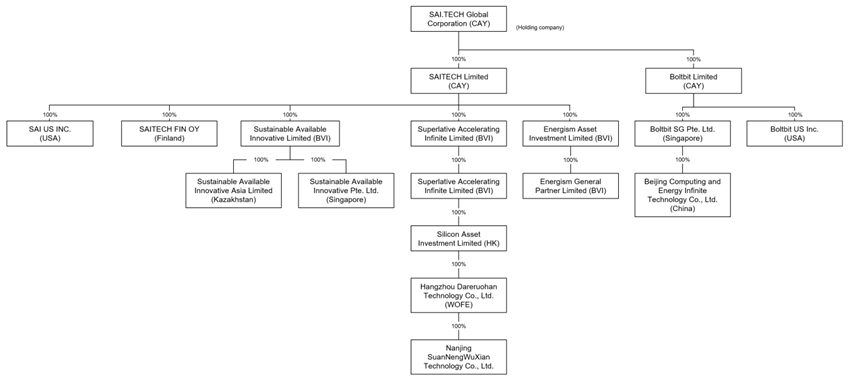

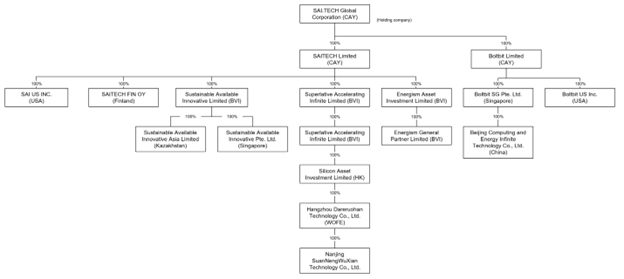

Unless otherwise indicated or the context otherwise requires, all references in this annual report on Form 20-F (the “Annual Report”) to the terms “SAI,” the “Company,” “we,” “us” and “our” refer to SAI.TECH Global Corporation, a Cayman Islands exempted holding company, together as a group with its subsidiaries.

Our consolidated financial statements are presented in U.S. dollars. All references in this Annual Report to “$,” “U.S. $,” “U.S. dollars” and “dollars” mean U.S. dollars, unless otherwise noted.

ii

SELECTED DEFINITIONS

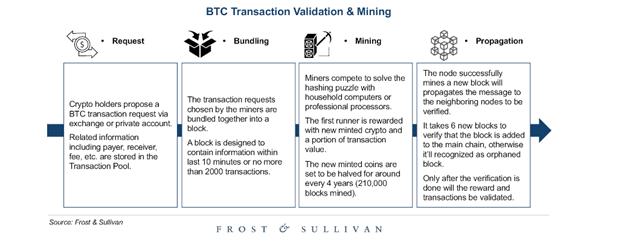

| ● | “bitcoin” means the type of virtual currency based on an open source cryptographic protocol existing on the Bitcoin Network. |

| ● | “Business Combination” means the transactions contemplated by the Business Combination Agreement, including, the merger; |

| ● | “Business Combination Agreement” means the Business Combination Agreement, as amended dated as of September 27, 2021, among TradeUP, Merger Sub and Old SAI, as amended as of October 20, 2021, and January 26, 2022, and March 22, 2022; |

| ● | “Class A Ordinary Shares” means the Class A ordinary shares, par value $0.0001 per share, of SAI; |

| ● | “Class B Ordinary Shares” means the Class B ordinary shares, par value $0.0001 per share, of SAI; |

| ● | “Closing” means the closing of the Business Combination; |

| ● | “Code” means the Internal Revenue Code of 1986, as amended; |

| ● | “Companies Act” means the Companies Act (As Revised) of the Cayman Islands, as amended, modified, re-enacted or replaced; |

| ● | “current memorandum and articles of association” means the amended and restated certificate memorandum and articles of association of TradeUP, effective April 28, 2021; |

| ● | “Exchange Act” means the Securities Exchange Act of 1934, as amended; |

| ● | “GAAP” means generally accepted accounting principles in the United States; |

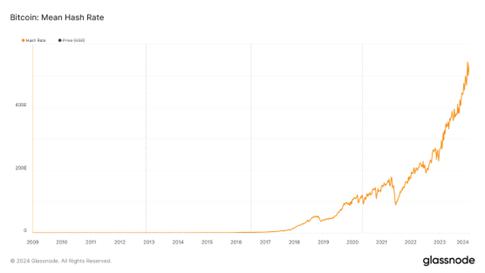

| ● | “hash rate” means a measure of the computational power per second used when mining; |

| ● | “Investment Company Act” means the U.S. Investment Company Act of 1940, as amended; |

| ● | “IPO Warrants” means the warrants issued upon the exchange of TradeUP Warrants in connection with the closing of the Business Combination, each of which is exercisable for one Class A Ordinary Share, in accordance with its terms. |

| ● | “IRS” means the U.S. Internal Revenue Service; |

| ● | “Letter Agreement” means the letter agreement by and among TradeUP, the Sponsor and three directors of TradeUP, as amended by the letter agreement amendment dated September 27, 2021 and further amended by the letter agreement dated January 26, 2022; |

| ● | “Lock-Up Agreements” means (1) the SAI Lock-Up Agreements and (2) the TradeUP Lock-Up Agreement; |

| ● | “Merger” means the merger of Merger Sub with SAI, with SAI surviving such merger and SAI becoming a wholly owned subsidiary of TradeUP, pursuant to the Business Combination Agreement; |

| ● | “Merger Sub” means TGC Merger Sub, a Cayman Islands exempted company incorporated with limited liability; |

| ● | “MOFCOM” means the Ministry of Commerce of the People’s Republic of China; |

| ● | “M&A Rules” means the Rules on Mergers and Acquisitions of Domestic Enterprise by Foreign Investors (《(關於外國投資者併購境內企業的規定》), which was jointly issued by six PRC regulatory authorities, including the MOFCOM and other government authorities on August 8, 2006 and was effective as of September 8, 2006 and amended on June 22, 2009. |

iii

| ● | “Nasdaq” means The Nasdaq Stock Market LLC; |

| ● | “Old SAI” means SAITECH Limited, a Cayman Islands exempted company, before the Merger Effective Time; |

| ● | “ordinary resolution” means an ordinary resolution under Cayman Islands law, being the affirmative vote of the holders of a majority of the issued ordinary shares of the company that are present in person or represented by proxy and entitled to vote thereon and who vote at the general meeting; |

| ● | “Ordinary Shares” means the Class A Ordinary Shares; |

| ● | “PBOC” means People’s Bank of China; |

| ● | “PRC” or “China” means the People’s Republic of China; |

| ● | “private shares” are to the aggregate 224,780 Class A Ordinary Shares, at a price of $10.00 per share, issued to the Sponsor in a private placement simultaneously with the closing of the TradeUP IPO and the partial exercise of the underwriters’ over-allotment option to purchase additional units, as were converted in connection with the Closing; |

| ● | “proxy statement/prospectus” means the proxy statement/prospectus included in the Registration Statement on Form F-4 filed with the SEC; |

| ● | “public shares” means TradeUP Class A ordinary shares included in the units issued in the TradeUP IPO; |

| ● | “redemption” means the right of public shareholders to have their public shares redeemed in accordance with the procedures set forth in the proxy statement on From F-4/A filed on March 29, 2022; |

| ● | “Registration Rights Agreement” means the registration rights agreement, dated as of April 28, 2021, among TradeUP and TradeUP initial shareholders; |

| ● | “SAI” means SAI.TECH Global Corporation (formerly named TradeUP Global Corporation) following the consummation of the Business Combination; |

| ● | “SAI Affiliate Lock-Up Agreement” means the lock-up agreement to be entered into by SAI Founder, certain affiliates of SAI and SAI Founder, and the other persons party thereto at the closing; |

| ● | “SAI Founder” means Energy Science Artist Holding Limited, a wholly owned entity controlled by Risheng Li; |

| ● | “SAI Incentive Plan” means SAI.TECH Global Corporation 2021 Equity Incentive Plan; |

| ● | “SAI Shareholder Lock-Up Agreement” means the lock-up agreement entered into by the shareholders of SAI at the closing other than shareholders party to the SAI Affiliate Lock-Up Agreement; |

| ● | “Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002; |

| ● | “SEC” means the U.S. Securities and Exchange Commission; |

| ● | “Securities Act” means the U.S. Securities Act of 1933, as amended; |

| ● | “special resolution” means a special resolution under Cayman Islands law, being the affirmative vote of the holders of at least a two-thirds majority of the issued ordinary shares of the company that are present in person or represented by proxy and entitled to vote thereon and who vote at the general meeting; |

| ● | “Sponsor” means TradeUP Global Sponsor LLC, a Cayman Islands limited liability company; |

| ● | “Stablecoin” means a kind of crypto asset that is designed to minimize price volatility, and to track the price of an underlying asset such as fiat money or an exchange-traded commodity (such as precious metals or industrial metals), while other stablecoins utilize algorithms that are designed to maintain a relative stable price of the asset. Stablecoins can be backed by fiat money, physical commodities, or other crypto assets. |

iv

| ● | “TradeUP Class A ordinary shares” means the Class A ordinary shares, par value $0.0001 per share, of TradeUP; |

| ● | “TradeUP Class B Ordinary Shares” means the Class B ordinary shares, par value $0.0001 per share, of TradeUP, which shares were converted automatically in connection with the merger into TradeUP Class A Ordinary Shares and cease to be outstanding; such shares are also referred to and defined herein as the “founder shares”; |

| ● | “TradeUP initial shareholders” means the Sponsor and each of TradeUP’s directors and officers that hold founder shares; |

| ● | “TradeUP IPO” means TradeUP’s initial public offering, consummated on May 3, 2021, through the sale of 4,488,986 units (including the 488,986 units sold pursuant to the underwriters’ partial exercise of their over-allotment option at $10.00 per unit); |

| ● | “TradeUP Lock-Up Agreement” means the lock-up agreement entered into by the Sponsor, certain affiliates of TradeUP and the other persons party thereto at the; |

| ● | “TradeUP Support Agreement” means the support agreement, dated as of September 27, 2021, among the Sponsor certain affiliates of TradeUP and the Sponsor and the other persons party thereto; |

| ● | “TradeUP Warrant(s)” means the warrants included in the units issued in the TradeUP IPO, each of which is exercisable for one TradeUP Class A ordinary share, in accordance with its terms. |

| ● | “Trust Account” means the trust account that holds a portion of the proceeds of the TradeUP IPO and the sale of the private shares; and |

| ● | “units” means one TradeUP Class A ordinary share and one-half of one warrant, whereby each warrant entitles the holder thereto to purchase one TradeUP Class A ordinary share at an exercise price of $11.50 per share, sold in the TradeUP IPO; |

v

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report includes statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, “forward-looking statements.” These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,” “may,” “will” or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this Annual Report and include statements regarding our intentions, beliefs or current expectations. Such forward-looking statements are based on available current market material and management’s expectations, beliefs and forecasts concerning future events impacting SAI.TECH Global Corporation. Factors that may impact such forward-looking statements include:

| ● | our financial performance; |

| ● | the ability to maintain the listing of our Class A Ordinary Shares and IPO Warrants on the Nasdaq Capital Market; |

| ● | our continued growth strategy, future operations, financial position, estimated revenues and losses, projected capex, prospects and plans; |

| ● | our strategic advantages and the impact those advantages will have on future financial and operational results; |

| ● | the implementation, market acceptance and success of the Company’s platform and new offerings; |

| ● | our approach and goals with respect to technology; |

| ● | our expectations regarding our ability to continue to obtain and maintain intellectual property protection and not infringe on the rights of others; |

| ● | the continued impact of the COVID-19 pandemic on the Company’s business; |

| ● | changes in applicable laws or regulations; |

| ● | the outcome of any known and unknown litigation and regulatory proceedings; |

| ● | the outcome of any legal proceedings that may be instituted against the Company; |

| ● | the ability to continue to implement business plans, forecasts, and other expectations after the completion of the Business Combination, and identify and realize additional opportunities; |

| ● | our ability to attract and retain users; |

| ● | our dependence upon third-party licenses; |

| ● | the continued risk that we may never achieve or sustain profitability; |

| ● | the continued risk that we will need to raise additional capital to execute our business plan, which may not be available on acceptable terms or at all; |

| ● | the continued risk that we may experience difficulties in managing our growth and expanding operations; |

| ● | that we have identified material weaknesses in our internal control over financial reporting which, if not corrected, could affect the reliability of our financial statements; |

| ● | the possibility that we may be adversely affected by other economic, business, and/or competitive factors; and |

| ● | other risks disclosed in the Annual Report (as defined below). |

vi

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors discussed under the “Risk Factors” section of this Annual Report. Accordingly, you should not rely on these forward-looking statements, which speak only as of the date of this Annual Report. We undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this Annual Report or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks described in the reports we will file from time to time with the United States Securities and Exchange Commission (the “SEC”) after the date of this Annual Report.

Although we believe the expectations reflected in the forward-looking statements were reasonable at the time made, we cannot guarantee future results, level of activity, performance, or achievements. Moreover, neither we nor any other person assume responsibility for the accuracy or completeness of any of these forward-looking statements. You should carefully consider the cautionary statements contained or referred to in this section in connection with the forward-looking statements contained in this Annual Report and any subsequent written or oral forward-looking statements that may be issued by us or persons acting on our behalf.

vii

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our securities carries a significant degree of risk. You should carefully consider the following risks and other information in this Annual Report, including our consolidated financial statements and related notes included herein, in connection with your ownership of our securities. If any of the events described below occur, our business and financial results could be adversely affected in a material way. This could cause the trading price of our securities to decline, perhaps significantly, and you therefore may lose all or part of your investment. The risks set out below are not exhaustive and do not comprise all of the risks associated with an investment in the Company. Additional risks and uncertainties not currently known to us or which we currently deem immaterial may also have a material adverse effect on our business, financial condition, results of operations, and prospects.

Summary Risk Factors

The below summary risks provide an overview of the material risks we are exposed to in the normal course of our business activities. The below summary risks do not contain all of the information that may be important to you, and you should read the summary risks below together with the more detailed discussion of risks set forth following this section under the heading “Risk Factors,” as well as elsewhere in this Annual Report. The summary risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not currently known to us or that we currently deem less significant may also affect our business operations or financial results. Consistent with the foregoing, we are exposed to a variety of risks, including those associated with the following:

| ● | We have a limited operating history in an evolving and highly volatile industry and are undergoing a business transition, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful. |

| ● | Our IPO Warrants may never be in the money, and they may expire worthless. |

| ● | Our operating results may fluctuate due to the highly volatile nature of cryptocurrencies in general and, specifically, bitcoin. |

| ● | Bitcoin mining activities are energy-intensive, which may restrict the geographic locations of mining machines and have a negative environmental impact. Government regulators may potentially restrict the ability of electricity suppliers to provide electricity to mining operations, such as ours. |

1

| ● | If bitcoin or other cryptocurrencies are determined to be investment securities, and we hold a significant portion of its assets in such cryptocurrency, investment securities or non-controlling equity interests of other entities, we may inadvertently violate the Investment Company Act. We could incur large losses to modify our operations to avoid the need to register as an investment company or could incur significant expenses to register as an investment company or could terminate operations altogether. |

| ● | If regulatory changes or interpretations of our activities require our registration as a money services business (“MSB”) under the regulations promulgated by The Financial Crimes Enforcement Network (“FinCEN”) under the authority of the U.S. Bank Secrecy Act, or otherwise under state laws, we may incur significant compliance costs, which could be substantial or cost-prohibitive. If we become subject to these regulations, our costs in complying with them may have a material negative effect on our business and the results of our operations. |

| ● | There is no one unifying principle governing the regulatory status of cryptocurrency nor whether cryptocurrency is a security in each context in which it is viewed. Regulatory changes or actions in one or more countries may alter the nature of an investment in us or restrict the use of crypto assets, such as cryptocurrencies, in a manner that adversely affects our business, prospects or operations. |

| ● | The loss or destruction of any private keys required to access our digital wallet may be irreversible. If we are unable to access our private keys (whether due to loss, destruction, security incident or otherwise), it could cause direct financial loss, regulatory scrutiny and reputational harm. |

| ● | Distributing crypto assets in connection with our mining pool business involves risks, which could result in loss of customer assets, customer disputes and other liabilities, adversely impact our business, results of operations and/or financial condition. |

| ● | If we are unable to protect the confidentiality of our trade secrets, our business and competitive position could be harmed. |

| ● | Significant contributors to all or a network for any particular crypto asset, such as bitcoin, could propose amendments to the respective network’s protocols and software that, if accepted and authorized by such network, could adversely affect our business. |

| ● | The supply of bitcoin is limited, and production of bitcoin is negatively impacted by the bitcoin halving protocol expected every four years. |

| ● | Any periodic adjustments to the crypto asset networks, such as bitcoin, regarding the difficulty for block solutions, with reductions in the aggregate hash rate or otherwise, could have a material adverse effect on our business, prospects, financial condition, and operating results. If the award of new bitcoin for solving blocks and transaction fees for recording transactions are not sufficiently high to incentivize miners, miners may cease expending processing power, or hash rate, to solve blocks and confirmations of transactions on the bitcoin blockchain could be slowed. |

| ● | Bitcoin and any other cryptocurrencies that could be held by us are not insured and not subject to FDIC or SIPC protections. |

| ● | As a company with operations and opportunities outside of the U.S., we may face additional burdens and be subject to a variety of additional risks or considerations associated with companies operating in an international setting that may negatively impact our operations. |

| ● | If relations between the United States and foreign governments deteriorate, they could affect our operations and cause our goods and services to become less attractive. |

| ● | Though we have a Singapore-based auditor and a U.S. based predecessor auditor that are registered with the PCAOB and currently subject to PCAOB inspection, if it is later determined that the PCAOB is unable to inspect or investigate completely the company’s auditors because of a position taken by an authority in a foreign jurisdiction, trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act and as a result an exchange may determine to delist our securities. |

2

| ● | The PRC government may exert, at any time, with little to no notice, substantial interventions and influences over the manner in which a business must conduct its business operations that cannot always be expected nor anticipated, if such business has some presence/operations in China. If the PRC government at any time substantially intervenes, influences, or establishes new policies, regulations, rules, or laws in a business’s industry, such substantial intervention or influence may result in adverse impact on such business’s operations and the value of such business’s securities, including causing the value of such securities to decline. |

| ● | PRC regulations relating to offshore investment activities by PRC residents may expose us or our PRC resident beneficial owners to liability and penalties under PRC law. |

| ● | As a result of our plans to expand operations, including to jurisdictions in which the tax laws may not be favorable, our tax rate may fluctuate, our tax obligations may become significantly more complex and subject to greater risk of examination by taxing authorities or we may be subject to future changes in tax law, the impacts of which could adversely affect our after-tax profitability and financial results. |

| ● | Unfavorable global economic, business or political conditions, such as the global COVID-19 pandemic and the disruption caused by various countermeasures to reduce its spread, could adversely affect our business, prospects, financial condition, and operating results. |

| ● | We are obligated to develop and maintain proper and effective internal controls over financial reporting, and any failure to maintain the adequacy of these internal controls may adversely affect investor confidence in the Company and, as a result, the value of our Ordinary Shares. |

In addition to the other information contained in this Annual Report, we have identified the following risks and uncertainties that may have a material adverse effect on our business, financial condition, or results of operation. Investors should carefully consider the risks described below together with all of the other information in this Annual Report, including our consolidated financial statements and related notes thereto included elsewhere in this Annual Report and in our other filings with the SEC, before making an investment decision. The trading price of our securities could decline due to any of these risks, and investors may lose all or part of their investment. In this section, unless the context otherwise requires, “SAI,” “Company,” “we,” “us” and “our” refer to SAI.TECH Global Corporation, a Cayman Islands exempted holding company, together as a group with its subsidiaries including the Operating Subsidiaries.

3

Risks Related to Our Business, Industry and Operations

We have a limited operating history in an evolving and highly volatile industry and are undergoing a business transition, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

We began our operations in 2019 and since then our business model has continued to evolve. We are undergoing a transformation and began bitcoin mining in late 2021. Our bitcoin mining business is in its early stages, and bitcoin, energy pricing and bitcoin mining economics are volatile and subject to uncertainties. Our current strategy will continue to expose it to the numerous risks and volatility associated with the bitcoin mining and power generation sectors, including fluctuating bitcoin prices, the costs of bitcoin mining machines, the number of market participants mining bitcoin, the availability of other power generation facilities to expand operations and regulatory changes.

As crypto assets and blockchain technologies become more widely available, we expect the services and products associated with them to evolve, including as part of evolution in their regulatory treatment on the international markets and the countries where we operate. Furthermore, from time to time we may modify aspects of our business model or engage in various strategic initiatives, which may be complimentary to our mining operations. We cannot offer any assurance that these or any other modifications will be successful or will not result in harm to the business, damage our reputation and limit our growth. Additionally, any such changes to our business model or strategy could cause us to become subject to additional regulatory scrutiny and a number of additional requirements, including licensing and permit requirements. All of the abovementioned factors may impose additional compliance costs on our business and higher expectations from regulators regarding risk management, planning, governance and other aspects of our operations.

If, among other things, the price of bitcoin declines or mining economics become prohibitive, we could incur future losses. Such losses could be significant as it incurs costs and expenses associated with recent investments and potential future acquisitions, as well as legal and administrative related expenses. While we closely monitor our cash balances, cash needs and expense levels, significant expense increases may not be offset by a corresponding increase in revenue or a significant decline in bitcoin prices could significantly impact our financial performance.

Our operating results may fluctuate due to the highly volatile nature of cryptocurrencies in general and, specifically, bitcoin.

All of our sources of revenue are dependent on cryptocurrencies and, specifically, bitcoin, and the broader blockchain and bitcoin mining ecosystem. Due to the highly volatile nature of the cryptocurrency markets and the prices of cryptocurrency assets, our operating results may fluctuate significantly from quarter to quarter in accordance with market sentiments and movements in the broader cryptocurrency ecosystem. Our operating results may fluctuate as a result of a variety of factors, many of which are unpredictable and in certain instances are outside of our control, including:

| ● | changes in the legislative or regulatory environment, or actions by governments or regulators that impact the cryptocurrency industry generally, or our operations specifically; |

| ● | difficulty in obtaining new hardware and related installation costs; |

| ● | access to cost-effective sources of electrical power; |

| ● | adverse legal proceedings or regulatory enforcement actions, judgments, settlements or other legal proceeding and enforcement-related costs; |

| ● | increases in operating expenses that we expect to incur to grow and expand our operations and to remain competitive; |

| ● | system errors, failures, outages and computer viruses, which could disrupt our ability to continue operating; |

4

| ● | power outages and certain other events beyond our control, including natural disasters and telecommunication failures; |

| ● | breaches of security or privacy; |

| ● | macroeconomic conditions; |

| ● | our ability to attract and retain talent; and |

| ● | our ability to compete with our existing and new competitors. |

As a result of these factors, it may be difficult for us to forecast growth trends accurately and our business and future prospects are difficult to evaluate, particularly in the short term. In view of the rapidly evolving nature of our business and the bitcoin mining ecosystem, period-to-period comparisons of our operating results may not be meaningful, and you should not rely upon them as an indication of future performance. Quarterly and annual expenses reflected in our financial statements may be significantly different from historical or projected rates, and our operating results in one or more future quarters may fall below the expectations of securities analysts and investors. As a result, the trading price of our Class A Ordinary Shares may increase or decrease significantly.

Bitcoin mining activities are energy-intensive, which may restrict the geographic locations of mining machines and have a negative environmental impact. Government regulators may potentially restrict the ability of electricity suppliers to provide electricity to mining operations, such as ours.

Mining bitcoin requires massive amounts of electrical power, and electricity costs are expected to account for a significant portion of our overall costs. The availability and cost of electricity will restrict the geographic locations of our mining activities. Any shortage of electricity supply or increase in electricity costs in any location where we plan to operate may negatively impact the viability and the expected economic return for bitcoin mining activities in that location.

Further, our business model can only be successful, and our mining operations can only be profitable if the costs, including electrical power costs, associated with bitcoin mining are lower than the price of bitcoin itself. As a result, any mining operation we establish can only be successful if we can obtain sufficient electrical power for that site on a cost-effective basis, and our establishment of new mining data centers requires us to find sites where that is the case. Even if our electrical power costs do not increase, significant fluctuations in, and any prolonged periods of, low bitcoin prices may also cause our electrical supply to no longer be cost-effective.

If we are unable to successfully enter into those definitive agreements with power providers or our counterparties fail to perform their obligations under such agreements, we may be forced to look for alternative power providers. There is no assurance that we will be able to find such alternative suppliers on acceptable terms in a timely manner or at all.

Furthermore, there may be significant competition for suitable cryptocurrency mining sites, and government regulators, including local permitting officials, may potentially restrict our ability to set up cryptocurrency mining operations in certain locations. They can also restrict the ability of electricity suppliers to provide electricity to mining operations in times of electricity shortage or may otherwise potentially restrict or prohibit the provision of electricity to mining operations. For example, at the beginning of January 2022, surges in fuel prices triggered national unrest throughout Kazakhstan, which subsequently resulted in significant disruptions to the nation’s bitcoin mining operations’ access to reliable sources of energy and internet access. From January 24, 2022 to January 31, 2022, the state-run Kazakhstan Electricity Grid Operating Company additionally cut off the nation’s electricity to bitcoin and cryptocurrency mining companies. As a result, during this time period, bitcoin and cryptocurrency miners will not have access to power for bitcoin and cryptocurrency mining purposes and will be required to halt their operations. The power cut-off to our and others bitcoin mining company operations during January 2022 negatively impacted our operations for the period, though we have resumed power supply and agreement currently. New ordinances and other regulations at the federal, state and local levels can also be introduced at any time. For example, on June 25, 2021, Kazakhstani President Kassym-Zhomart Tokaev signed legislation officially legalizing crypto-mining in Kazakhstan. As part of this law, Kazakhstan introduced and enforced a new tax, stipulating a fee of one tenge per 1 kilowatt-hour (kW/h) for miners, starting on January 1, 2022. In the first quarter of 2022, our legal counsel in Kazakhstan advised us that the Kazakhstan government partially supports a few amendments to the existing tax code applying to crypto asset mining companies in the country, including improving the fee rate based on electricity consumption per kWh that the government charges crypto asset miners from the current 1 tenge (about $0.0023 US dollar) per kWh to a higher rate, based on different types of electricity they consume and/or different level of total power consumption scale they consume. The amendments proposal also includes enhancing regulation to crypto asset mining activities and control of the power supply. As the date of this Annual Report, the government is still in discussion and drafting of the final amendments to the Tax Code and any laws related to crypto asset mining activities and have not brought any of such amendments into enforcement. However, such new orders and regulations could be introduced any time in the country and similarly, in any other countries we plan to expand our mining operations into. Specifically, those can be triggered by certain adverse weather conditions or natural disasters, see “Risk Factors — Risks Related to Our Business, Industry, and Operations — We will be vulnerable to severe weather conditions and natural disasters, including earthquakes, fires, floods, hurricanes, as well as power outages and other industrial incidents, which could severely disrupt the normal operation of our business and adversely affect our results of operations.”

5

Furthermore, if cryptocurrency mining becomes more widespread, government scrutiny related to restrictions on cryptocurrency mining facilities and their energy consumption may significantly increase. The considerable consumption of electricity by mining operators may also have a negative environmental impact, including contribution to climate change, which could set the public opinion against allowing the use of electricity for bitcoin mining activities. This, in turn, could lead to governmental measures restricting or prohibiting the use of electricity for bitcoin mining activities. Any such development in the jurisdictions where we plan to operate could increase our compliance burdens and have a material adverse effect on our business, prospects, financial condition, and operating results.

Additionally, our mining operations could be materially adversely affected by power outages and similar disruptions. Given the power requirements for our mining equipment, it would not be feasible to run this equipment on back-up power generators in the event of a government restriction on electricity or a power outage. If we are unable to receive adequate power supply and are forced to reduce our operations due to the availability or cost of electrical power, it would have a material adverse effect on our business, prospects, financial condition, and operating results.

We may be affected by price fluctuations in the wholesale and retail power markets.

While we anticipate that the majority our power and hosting arrangements will contain fixed power prices, we expect that they may contain certain price adjustment mechanisms in case of certain events. Furthermore, some portion of our power and hosting arrangements is expected to have merchant power prices, or power prices reflecting market movements.

Market prices for power, generation capacity and ancillary services, are unpredictable. Depending upon the effectiveness of any price risk management activity undertaken by us, an increase in market prices for power, generation capacity, and ancillary services may adversely affect our business, prospects, financial condition, and operating results. Long- and short-term power prices may fluctuate substantially due to a variety of factors outside of our control, including, but not limited to:

| ● | increases and decreases in generation capacity; |

| ● | changes in power transmission or fuel transportation capacity constraints or inefficiencies; |

| ● | volatile weather conditions, particularly unusually hot or mild summers or unusually cold or warm winters; |

| ● | technological shifts resulting in changes in the demand for power or in patterns of power usage, including the potential development of demand-side management tools, expansion and technological advancements in power storage capability and the development of new fuels or new technologies for the production or storage of power; |

| ● | federal and state power, market and environmental regulation and legislation; and |

| ● | changes in capacity prices and capacity markets. |

If we are unable to secure power supply at prices or on terms acceptable to us, it would have a material adverse effect on our business, prospects, financial condition, and operating results.

6

Our business is dependent on a small number of crypto asset mining equipment suppliers.

Our business is dependent upon crypto asset mining equipment suppliers such as Bitmain Technologies, Ltd (“Bitmain”) providing an adequate supply of new generation crypto asset mining machines at economical prices to customers intending to purchase our hosting and other solutions. The growth in our business is directly related to increased demand for hosting services and crypto assets such as bitcoin which is dependent in large part on the availability of new generation mining machines offered for sale at a price conducive to profitable crypto asset mining, as well as the trading price of crypto assets such as bitcoin. The market price and availability of new mining machines fluctuates with the price of bitcoin and can be volatile. Higher bitcoin prices increase the demand for mining equipment and increases the cost. In addition, as more companies seek to enter the mining industry, the demand for machines may outpace supply and create mining machine equipment shortages. There are no assurances that crypto asset mining equipment suppliers, such as Bitmain, will be able to keep pace with any surge in demand for mining equipment. Further, manufacturing mining machine purchase contracts are not favorable to purchasers, and we may have little or no recourse in the event a mining machine manufacturer defaults on its mining machine delivery commitments. If we and our customers are not able to obtain a sufficient number of crypto asset mining machines at favorable prices, our growth expectations, liquidity, financial condition and results of operations will be negatively impacted.

Our business is capital intensive, and failure to obtain the necessary capital when needed may force us to delay, limit or terminate our expansion efforts or other operations, which could have a material adverse effect on our business, financial condition and results of operations.

The costs of constructing, developing, operating and maintaining crypto asset mining and hosting facilities, and owning and operating a large fleet of the latest generation mining equipment are substantial. Our mining operations can only be successful and ultimately profitable if the costs, including hardware and electricity costs, associated with mining crypto assets are lower than the price of the crypto assets we mine when we sell them. Our mining machines experience ordinary wear and tear from operation and may also face more significant malfunctions caused by factors which may be beyond our control. Additionally, as the technology evolves, we may acquire newer models of mining machines to remain competitive in the market. Over time, we replace those mining machines which are no longer functional with new mining machines purchased from third-party manufacturers, who are primarily based in China.

As mining machines become obsolete or degrade due to ordinary wear and tear from usage or are lost or damaged due to factors outside of our control, these mining machines will need to be repaired or replaced along with other equipment from time to time for us to stay competitive. This upgrading process requires substantial capital investment, and we may face challenges in doing so on a timely and cost-effective basis based on availability of new mining machines and our access to adequate capital resources. If we are unable to obtain adequate numbers of new and replacement mining machines at scale, we may be unable to remain competitive in our highly competitive and evolving industry.

Moreover, in order to grow our hosting business, we need additional hosting facilities to increase our capacity for more mining machines. The costs of constructing, developing, operating and maintaining hosting facilities and growing our hosting operations may increase in the future, which may make it more difficult for us to expand our business and to operate our hosting facilities profitably.

We will need to raise additional funds through equity or debt financings in order to meet our operating and capital needs. Additional debt or equity financing may not be available when needed or, if available, may not be available on satisfactory terms. An inability to generate sufficient cash from operations or to obtain additional debt or equity financing would adversely affect our results of operations. Additionally, if this happens, we may not be able to mine crypto assets as efficiently or in similar amounts as our competition and, as a result, our business and financial results could suffer.

Our success depends in large part on our ability to mine crypto assets profitably in the future and to attract customers for our hosting capabilities. Increases in power costs or our inability to mine crypto assets efficiently and to sell crypto assets at favorable prices will reduce our operating margins, impact our ability to attract customers for our services and harm our growth prospects and could have a material adverse effect on our business, financial condition and results of operations.

Our growth depends in large part on our ability to successfully mine crypto assets in the future and to attract customers for our hosting capabilities. We may not be able to attract customers to our hosting capabilities for a number of reasons, including if:

| ● | there is a reduction in the demand for our services due to macroeconomic factors in the markets in which we operate; |

| ● | we fail to provide competitive pricing terms or effectively market them to potential customers; |

7

| ● | we provide hosting services that are deemed by existing and potential customers or suppliers to be inferior to those of our competitors, or that fail to meet customers’ or suppliers’ ongoing and evolving program qualification standards, based on a range of factors, including available power, preferred design features, security considerations and connectivity; |

| ● | businesses decide to host internally as an alternative to the use of our services; |

| ● | we fail to successfully communicate the benefits of our services to potential customers; |

| ● | we are unable to strengthen awareness of our brand; |

| ● | we are unable to provide services that our existing and potential customers’ desire; or |

| ● | our customers are unable to secure an adequate supply of new generation crypto asset mining equipment to host with us. |

If we are unable to obtain hosting customers at favorable pricing terms or at all, it could have a material adverse effect on our business, financial condition and results of operations.

If we do not accurately predict our hosting and self-mining facility requirements and percentage of capacity that utilizes waste heat to save energy cost, it could have a material adverse effect on our business, financial condition and results of operations.

The costs of building out, leasing and maintaining our hosting and self-mining facilities constitute a significant portion of our capital and operating expenses. In order to manage growth and ensure adequate capacity for our digital mining operations and new and existing hosting customers while minimizing unnecessary excess capacity costs, we continuously evaluate our short- and long-term data center capacity requirements. Our chip liquid cooling and waste heat recovery technology and our products were first tested in our pilot programs in China, which was terminated in June 2021. We began operating a heating demonstration project in our first North American distribution center located in Chesterland, Ohio, in August 2022, as our global expansion has progressed. In August 2023, we completed the development of SAI US R&D Center, SAI NODE Marietta, and have deployed 712 bitcoin mining machines for self-mining operation as of the date of this Annual Report. Although we have made progress to install SAIHUB CAB data centers in North American countries, and are also in active discussions with local potential heat user partners, there is no guarantee of immediate, large-scale operation of such data centers due to the required process of market research, due diligence and business negotiation of these potential installation projects. If we overestimate our business’ capacity requirements or the demand for our heat supply data centers and secure less data center capacity, our operating margins could be materially reduced. If we underestimate our data center capacity requirements, we may not be able to service the expanding needs of our existing customers and may be required to limit new customer acquisition, which could have a material adverse effect on our business, financial condition and results of operations.

Our projections are subject to significant risks, assumptions, estimates and uncertainties, including assumptions regarding the demand for our hosting services and the adoption of bitcoin and other crypto assets. As a result, our projected revenues, market share, expenses and profitability may differ materially from our expectations in any given quarter or fiscal year.

We operate in a rapidly changing and competitive industry and our projections are subject to the risks and assumptions made by management with respect to our industry. Operating results are difficult to forecast as they generally depend on our assessment of the timing of adoption and use of bitcoin and other crypto assets, which is uncertain. Furthermore, as we invest in the development of our hosting and self-mining business in the future, whether because of competition or otherwise, we may not recover the often-substantial up-front costs of constructing, developing and maintaining our hosting facilities and purchasing the latest generation of mining machines or recover the opportunity cost of diverting management and financial resources away from other opportunities. Additionally, our business may be affected by reductions in miner demand for hosting facilities and services and the price of bitcoin and other crypto assets as a result of a number of factors which may be difficult to predict. Similarly, our assumptions and expectations with respect to margins and the pricing of our hosting services and market price of bitcoin or other crypto assets we mine may not prove to be accurate. This may result in decreased revenue, and we may be unable to adopt measures in a timely manner to compensate for any unexpected shortfall in revenue. This inability could cause our operating results in a given quarter or year to be higher or lower than expected. If actual results differ from our estimates, analysts or investors may negatively react and our stock price could be materially impacted.

8

We have experienced difficulties in establishing relationships with banks, leasing companies, insurance companies and other financial institutions that are willing to provide us with customary financial products and services, which could have a material adverse effect on our business, financial condition and results of operations.

As an early stage company with operations focused in the crypto asset transaction processing industry, we have in the past experienced, and may in the future experience, difficulties in establishing relationships with banks, leasing companies, insurance companies and other financial institutions that are willing to provide us with customary leasing and financial products and services, such as bank accounts, lines of credit, insurance and other related services, which are necessary for our operations. Such difficulties may be exacerbated by proposed regulations under the America COMPETES Act of 2022 which grant the Secretary of Treasury the authority to permanently suspend, without public notice, financial services or accounts for any entity deemed to be of money laundering concern. Such enhanced authority, or other similar future regulations, may be used to prevent entities associated with cryptocurrency, including us, from access to financial services in the United States or other jurisdictions.

To the extent that a significant portion of our business consists of crypto asset transaction mining, processing or hosting, we may in the future continue to experience difficulty obtaining additional financial products and services on customary terms, which could have a material adverse effect on our business, financial condition and results of operations.

Changes in tariffs or import restrictions could have a material adverse effect on our business, financial condition and results of operations.

Equipment necessary for crypto asset mining is almost entirely manufactured in Asian countries, especially from Southeast Asian countries. There is currently significant uncertainty about the future relationship between these Asian countries and various other countries, including Kazakhstan, the United States, the European Union, Canada, and Mexico, with respect to trade policies, treaties, tariffs and customs duties, and taxes. For example, since 2019, the U.S. government has implemented significant changes to U.S. trade policy with respect to China. These tariffs have subjected certain crypto asset mining equipment manufactured overseas to additional import duties of up to 25%. The amount of the additional tariffs and the number of products subject to them has changed numerous times based on action by the U.S. government. These tariffs have increased costs of crypto asset mining equipment, and new or additional tariffs or other restrictions on the import of equipment necessary for crypto asset mining could have a material adverse effect on our business, financial condition and results of operations when we expand to global market.

Our historical financial results may not be indicative of our future performance.

We had a net loss of $16.7 million for the fiscal year ended December 31, 2021, net loss of $8.8 million for the fiscal year ended December 31, 2022, and net loss of $6.1 million for the fiscal year ended December 31, 2023. As of December 31, 2023, our accumulated deficit was $31.3 million. Our historical results are not indicative of our future performance. If we are not able to successfully develop our business, it will have a material adverse effect on our business, financial condition and results of operations.

We will be vulnerable to severe weather conditions and natural disasters, including earthquakes, fires, floods, hurricanes, as well as power outages and other industrial incidents, which could severely disrupt the normal operation of our business and adversely affect our results of operations.

Our business is subject to the risks of severe weather conditions and natural disasters, including earthquakes, fires, floods, hurricanes, as well as power outages and other industrial incidents, any of which could result in system failures, power supply disruptions and other interruptions that could harm our business.

9

We are exposed to risk of nonperformance by counterparties, including our counterparties under the planned power and hosting arrangements.

We are exposed to risk of nonperformance by counterparties, whether contractual or otherwise. Risk of nonperformance includes inability or refusal of a counterparty to perform because of a counterparty’s financial condition and liquidity or for any other reason. For example, our counterparties under the planned power and hosting arrangements may be unable to deliver the required amount of power for a variety of technical or economic reasons. Furthermore, there is a risk that during a period of power price fluctuations or prolonged or sharp power price increases on the market, our counterparties may find it economically preferable to refuse to supply power to us, despite the contractual arrangements. Any significant nonperformance by counterparties, could have a material adverse effect on our business, prospects, financial condition, and operating results.

Mining machines rely on components and raw materials that may be subject to price fluctuations or shortages, including ASIC chips that have been subject to an ongoing significant shortage.

In order to build and sustain our self-mining operations, we are dependent on third parties to provide us with ASIC chips and other critical components for our mining equipment, which may be subject to price fluctuations or shortages. For example, the ASIC chip is the key component of a mining machine as it determines the efficiency of the device. The production of ASIC chips typically requires highly sophisticated silicon wafers, which currently only a small number of fabrication facilities, or wafer foundries, in the world are capable of producing. We believe that the current microchip shortage that the entire industry is experiencing leads to price fluctuations and disruption in the supply of key miner components. Specifically, the ASIC chips have recently been subject to a significant price increases and shortages.

There is also a risk that a manufacturer or seller of ASIC chips or other necessary mining equipment may adjust the prices according to bitcoin, other cryptocurrency prices or otherwise, so the cost of new machines could become unpredictable and extremely high. As a result, at times, we may be forced to obtain mining machines and other hardware at premium prices, to the extent they are even available. Such events could have a material adverse effect on our business, prospects, financial condition, and operating results.

We are exposed to risks related to disruptions or other failures in the supply chain for cryptocurrency hardware and difficulties in obtaining new hardware.

Manufacture, assembly and delivery of certain components and products for mining operations could be complex and long processes, in the course of which various problems could arise, including disruptions or delays in the supply chain, product quality control issues, as well other external factors, over which we have no control.

Our mining operations can only be successful and ultimately profitable if the costs associated with bitcoin mining, including hardware costs, are lower than the price of bitcoin itself. In the course of the normal operation of our cryptocurrency mining facilities, our mining machines and other critical equipment and materials related to data center construction and maintenance, such as containers, switch gears, transformers and cables, will experience ordinary wear and tear and may also face more significant malfunctions caused by a number of extraneous factors beyond our control. Declines in the condition of our mining machines and other hardware will require us, over time, to repair or replace those mining machines. Additionally, as the technology evolves, we may be required to acquire newer models of mining machines to remain competitive in the market. Any replacement of hardware may require substantial capital investment, and we may face challenges in doing so on a timely and cost-effective basis.

Our business is subject to limitations inherent within the supply chain of certain of our components, including competitive, governmental, and legal limitations, and other events. For example, we expect that we will significantly rely on foreign imports to obtain certain equipment and materials. We anticipate that the cryptocurrency mining machines for our operations will be imported from Southeast Asian countries, and other parts of equipment and materials, including ASIC chips, will be manufactured in and imported from South Korea or Taiwan. Any global trade disruption, introductions of tariffs, trade barriers and bilateral trade frictions, together with any potential downturns in the global economy resulting therefrom, could adversely affect our necessary supply chains. Our third-party manufacturers, suppliers and subcontractors may also experience disruptions by worker absenteeism, quarantines, restrictions on employees’ ability to work, office and factory closures, disruptions to ports and other shipping infrastructure, border closures, or other travel or health-related restrictions, such as those that were triggered by the COVID-19 pandemic, for example. Depending on the magnitude of such effects on our supply chain, shipments of parts for our mining machines, or any new mining machines that we order, may be delayed.

10

The properties in our mining network may experience damages, including damages that are not covered by insurance.

Cryptocurrency mining sites are subject to a variety of risks relating to physical condition and operation, including:

| ● | the presence of construction or repair defects or other structural or building damages; |

| ● | any noncompliance with, or liabilities under, applicable environmental, health or safety regulations or requirements or building permit requirements; |

| ● | any damage resulting from extreme weather conditions or natural disasters, such as hurricanes, earthquakes, fires, floods and snow or windstorms; and |

| ● | claims by employees and others for injuries sustained at our properties. |

For example, our cryptocurrency mining facilities could be rendered inoperable, temporarily or permanently, as a result of, among others, a fire or other natural disasters. The security and other measures we anticipate to take in order to protect against these risks may not be sufficient.

Additionally, our mining operation could be adversely affected by a power outage or loss of access to the electrical grid or loss by the grid of cost-effective sources of electrical power generating capacity.

The loss of any member of our management team, our inability to execute an effective succession plan, or our inability to attract and retain qualified personnel, could adversely affect our business.

We have limited operating history, and our success and future growth depend on the skills and services of our management, including our Chief Executive Officer, Chief Financial Officer, and Chief Operating Officer. We will need to continue to grow our management in order to alleviate pressure on our existing team and in order to set up and develop our business. If our management, including any new hires that we may make, fails to work together effectively and to execute our plans and strategies on a timely basis, our business could be significantly harmed. Furthermore, if we fail to execute an effective contingency or succession plan with the loss of any member of management, the loss of such management personnel may significantly disrupt our business.

Furthermore, the loss of key members of our management could inhibit our growth prospects. Our future success depends, in large part, on our ability to attract, retain and motivate key management and operating personnel. As we continue to develop and expand our operations, we may require personnel with different skills and experiences, who have a sound understanding of our business and the cryptocurrency industry, for example, specialists in power contract negotiations and management, as well as data center specialists. As cryptocurrency, and specifically bitcoin, mining, is a new and developing field, the market for highly qualified personnel in this industry is particularly competitive and we may be unable to attract such personnel. If we are unable to attract such personnel, it could have a material adverse effect on our business, prospects, financial condition, and operating results.

We may experience difficulties in effectively managing our expansion of hosting capacity and, subsequently, managing our growth and expanding our operations.

We expect to experience significant growth in the scope of our operations. Our ability to manage our hosting capacity and our plan to expand our self-mining capacity require us to build upon and to continue to improve our operational, financial and management controls, compliance programs and reporting systems. We may not be able to implement improvements in an efficient or timely manner and may discover deficiencies in existing controls, programs, systems and procedures, which could have a material adverse effect on our business, prospects, financial condition, and operating results.

Additionally, rapid growth in our business may place a strain on our managerial, operational and financial resources and systems. We may not grow as we expect, if we fail to manage our growth effectively or to develop and expand our managerial, operational and financial resources and systems, our business, prospects, financial condition and operating results could be adversely affected.

11

Unfavorable global economic, business or political conditions, such as the global COVID-19 pandemic and the disruption caused by various countermeasures to reduce its spread, could adversely affect our business, prospects, financial condition, and operating results.

Our results of operations could be adversely affected by general conditions in the global economy and in the global financial markets, including conditions that are outside of our control, such as the impact of the coronavirus disease (“COVID-19”). The COVID-19 pandemic that was declared on March 11, 2020 has since caused significant economic dislocation in the United States and globally as governments of more than 80 countries across the world, including the United States, introduced measures aimed at preventing the spread of COVID-19, including, amongst others, travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, quarantines and the imposition of both local and more widespread “work from home” measures. The spread of COVID-19 and the imposition of related public health measures have resulted in, and are expected to continue to result in, increased volatility and uncertainty in the cryptocurrency space. Any severe or prolonged economic downturn, as result of the COVID-19 pandemic or otherwise, could result in a variety of risks to our business and we cannot anticipate all the ways in which the current economic climate and financial market conditions could adversely impact our business.

We may experience disruptions to our business operations resulting from supply interruptions, quarantines, self-isolations, or other movement and restrictions on the ability of our employees to perform their jobs. For example, we may experience delays in construction and delays in obtaining necessary equipment in a timely fashion. If we are unable to effectively set up and service our mining machines, our ability to mine bitcoin will be adversely affected. The future impact of the COVID-19 pandemic is still highly uncertain and there is no assurance that the COVID-19 pandemic or any other pandemic, or other unfavorable global economic, business or political conditions, will not materially and adversely affect our business, prospects, financial condition, and operating results.

We operate in a fast-growing industry, and we compete against unregulated or less regulated companies and companies with greater financial and other resources, and our business, operating results, and financial condition may be adversely affected if we are unable to respond to our competitors effectively.

The cryptocurrency ecosystem is highly innovative, rapidly evolving, and characterized by healthy competition, experimentation, changing customer needs, frequent introductions of new products and services, and subject to uncertain and evolving industry and regulatory requirements. In the future, we expect competition to further intensify with existing and new competitors, some of which may have substantially greater liquidity and financial resources than we do. We compete against a number of companies operating within Kazakhstan, the United States and other countries in the global cryptocurrency mining market. We may not be able to compete successfully against present or future competitors. We may not have the resources to compete with larger providers of similar services and, consequently, may experience great difficulties in expanding and improving our operations to remain competitive.

Competition from existing and future competitors could result in our inability to secure acquisitions and partnerships that we may need to expand our business in the future. This competition from other entities with greater resources, experience and reputations may result in our failure to maintain or expand our business, as we may never be able to successfully execute our business model. Furthermore, we anticipate encountering new competition if we expand our operations to new locations geographically and into wider applications of blockchain, cryptocurrency mining and mining farm operations. If we are unable to expand and remain competitive, our business, prospects, financial condition and operating results could be adversely affected.

We may acquire other businesses, form joint ventures, or make other investments that could negatively affect our operating results, dilute our shareholders’ ownership, increase our debt or cause us to incur significant expenses.

From time to time, we may consider potential acquisitions, joint venture, or other investment opportunities. We cannot offer any assurance that acquisitions of businesses, assets and/or entering into strategic alliances or joint ventures will be successful. We may not be able to find suitable partners or acquisition candidates and may not be able to complete such transactions on favorable terms, if at all. If we make any acquisitions, we may not be able to integrate these acquisitions successfully into the existing business and could assume unknown or contingent liabilities.

Any future acquisitions also could result in the issuance of stock, incurrence of debt, contingent liabilities or future write-offs of intangible assets or goodwill, any of which could have a negative impact on our cash flows, financial condition and results of operations. Integration of an acquired company may also disrupt ongoing operations and require management resources that otherwise would be focused on developing and expanding our existing business. We may experience losses related to potential investments in other companies, which could harm our financial condition and results of operations. Further, we may not realize the anticipated benefits of any acquisition, strategic alliance or joint venture if such investments do not materialize.

12

To finance any acquisitions or joint ventures, we may choose to issue shares of common stock, preferred stock or a combination of debt and equity as consideration, which could significantly dilute the ownership of our existing shareholders or provide rights to such preferred stockholders in priority over our common stock holders. Additional funds may not be available on terms that are favorable to us, or at all. If the price of our common stock is low or volatile, we may not be able to acquire other companies or fund a joint venture project using stock as consideration.

If we fail to develop, maintain, and enhance our brand and reputation, our business, operating results, and financial condition may be adversely affected.

Our brand and reputation, particularly in the cryptocurrency ecosystem, is an important factor in success and development of our business. As part of our strategy, we seek to structure our relationships with our power suppliers and other potential partners as long-term partnerships. Thus, maintaining, protecting, and enhancing our reputation is also important to our development plans and relationships with our power suppliers, service providers and other counterparties.

Furthermore, we believe that the importance of our brand and reputation may increase as competition further intensifies. Our brand and reputation could be harmed if we fail to perform under our agreements or if our public image were to be tarnished by negative publicity, unexpected events or actions by third parties. Unfavorable publicity about us, including our technology, personnel, and bitcoin and crypto assets generally could have an adverse effect on the engagement of our partners and suppliers and may result in our failure to maintain or expand our business and successfully execute our business model.

Our compliance and risk management methods might not be effective and may result in outcomes that could adversely affect our reputation, operating results, and financial condition.

Our ability to comply with applicable complex and evolving laws, regulations, and rules is largely dependent on the establishment and maintenance of our compliance, audit, and reporting systems, as well as our ability to attract and retain qualified compliance and other risk management personnel. While we plan to devote significant resources to develop policies and procedures to identify, monitor and manage our risks, we cannot assure you that our policies and procedures will always be effective against all types of risks, including unidentified or unanticipated risks, or that we will always be successful in monitoring or evaluating the risks to which we are or may be exposed in all market environments.

We may not be able to adequately protect our intellectual property rights and other proprietary rights, which could have a material adverse effect on business, financial condition and results of operations.

We may not be able to obtain broad protection in Kazakhstan or internationally for all of our existing and future intellectual property and other proprietary rights, and we may not be able to obtain effective protection for our intellectual property and other proprietary rights in every country in which we operate. Protecting our intellectual property rights and other proprietary rights may require significant expenditure of our financial, managerial and operational resources. Moreover, the steps that we may take to protect our intellectual property and other proprietary rights may not be adequate to protect such rights or prevent third parties from infringing or misappropriating such rights. Any of our intellectual property rights and other proprietary rights, whether registered, unregistered, issued or unissued, may be challenged by others or invalidated through administrative proceedings and/or litigation.

We may be required to spend significant resources to secure, maintain, monitor and protect our intellectual property rights and other proprietary rights. Despite our efforts, we may not be able to prevent third parties from infringing upon, misappropriating or otherwise violating our intellectual property rights and other proprietary rights. We may initiate claims, administrative proceedings and/or litigation against others for infringement, misappropriation or violation of our intellectual property rights or other proprietary rights to enforce and/or maintain the validity of such rights. Any such action, if initiated, whether or not it is resolved in our favor, could result in significant expense to us, and divert the efforts of our technical and management personnel, which may have a material adverse effect on our business, financial condition and results of operations.

13

If we are unable to protect the confidentiality of our trade secrets, our business and competitive position could be harmed.

To protect all of our confidential and proprietary information, we plan to rely upon trademarks, copyright and trade secret protection, as well as potentially patents, non-disclosure agreements and invention assignment agreements with employees, consultants and third parties. Some elements of our business model are based on unpatented trade secrets and know-how that are not publicly disclosed. In addition to contractual measures, we plan to protect the confidential nature of our proprietary information using physical and technological security measures. Such measures may not, for example, in the case of misappropriation of a trade secret by an employee or third party with authorized access, provide adequate protection for our proprietary information.

The security measures may not prevent an employee or consultant from misappropriating our trade secrets and providing them to a competitor, and the recourse we take against such misconduct may not provide an adequate remedy to protect our interests fully. Enforcing a claim that a party illegally disclosed or misappropriated a trade secret can be difficult, expensive and time consuming, and the outcome is unpredictable. If any of our confidential or proprietary information, such as our trade secrets, were to be disclosed or misappropriated, or if any such information was independently developed by a competitor, our competitive position could be harmed, which could have an adverse effect on our business, operating results, and financial condition.

Third Parties may claim that we are infringing upon their intellectual property rights, which may prevent of inhibit our operations and cause us to suffer significant litigation expense even if these claims have no merit.