Exhibit 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of the financial condition and results of operations of PSQ Holdings Inc., a Delaware corporation, should be read together with our unaudited condensed consolidated financial statements for the three and six months ended June 30, 2023 and 2022, our audited financial statements as of the year ended December 31, 2022 and for the period from February 25, 2021 (inception) through December 31, 2021, and our pro forma financial information as of and for the six-month period ended June 30, 2023 included as exhibits to the amendment (“Amendment No. 1”) to our Current Report on Form 8-K, which was originally filed with the Securities and Exchange Commission (the “SEC”) on July 25, 2023 (as originally filed, the “Original Report”). This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from such forward-looking statements. Factors that could cause or contribute to those differences include, but are not limited to, those identified below and those discussed in the sections titled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” included elsewhere in Company’s final and definitive proxy statement (the “Proxy Statement/Prospectus”). Additionally, our historical results are not necessarily indicative of the results that may be expected in any future period. Amounts are presented in U.S. dollars. Capitalized terms included below but not defined in this Exhibit 99.2 have the same meaning as terms defined and included elsewhere in the Original Report (as amended by Amendment No.1) and, if not defined in the Original Report (as amended by Amendment No.1), and the Proxy Statement/Prospectus filed with the SEC on June 30, 2023.

Unless the context otherwise requires, references in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” to “PSQ,” “we”, “us”, “our”, and the “Company” are intended to refer to (i) following the Business Combination, the business and operations of PSQ Holdings, Inc. and its consolidated subsidiaries, and (ii) prior to the Business Combination, Private PSQ (the predecessor entity in existence prior to the consummation of the Business Combination) and its consolidated subsidiaries.

Overview

PSQ is a values-aligned platform where consumers with traditional American values can connect with and patronize business members whose values align with their own. PSQ is free-to-use for consumer members, who can use its platform to search for and shop from values-aligned business members both locally, online, and nationally. Since our nationwide launch in July 2022, we have become the largest values-aligned platform of pro-America businesses and consumers.

We incorporated PSQ Holdings, Inc. in February of 2021, began development of our digital platform (mobile app and website) in May 2021, and launched our initial product regionally in San Diego County, California in October 2021 on iOS, Android, and on our website. After 10 months of testing in various markets and courting member feedback, we launched the PSQ platform nationwide on July 4, 2022. As of July 31, 2023, on our platform we have more than 1,400,000 active consumer members (defined as unique consumer membership accounts for which we have received all required contact information and which have not been deactivated or deleted since our reception) and more than 65,000 business members from a wide variety of industries. Since we began tracking on January 18, 2023 of our average daily unique sessions, which refers to the average number of unique IP addresses accessing our platform on mobile and desktop devices in a single day, our average daily unique sessions have grown 404% to an average of 453,225 sessions per day for the month of July 2023, compared to an average of 89,843 sessions per day for the period from January 18, 2023 through January 31, 2023.

Private PSQ raised $1.8 million in our seed round of funding, which closed in July 2021. We then raised an additional $1.1 million in a bridge round of funding, which closed in February 2022. From February 2022 through February 2023, we raised $12.0 million and closed our Series A round. From March through June 2023, Private PSQ issued $22.5 million in convertible promissory notes.

On February 23, 2023, Private PSQ completed a stock-for-stock transaction to purchase 100% of the outstanding shares of EveryLife, Inc. (“EveryLife”), a Delaware corporation, in exchange for 55,000 shares of Private PSQ Common Stock.

The mailing address of PSQ’s principal executive office is 222 Lakeview Avenue, Suite 800 West Palm Beach, Florida 33401.

Recent Developments

Business Combination

On February 27, 2023, PublicSq. Inc. (f/k/a PSQ Holdings, Inc.) entered into the Agreement and Plan of Merger (the “Merger Agreement”) with Colombier-Liberty Acquisition, Inc. (“Merger Sub”), Colombier Sponsor LLC (“Sponsor”) and PSQ Holdings, Inc. (f/k/a Colombier Acquisition Corp.) (“Colombier”).

On July 19, 2023 (the “Closing Date”), we consummated the Business Combination, pursuant to the terms of the Merger Agreement.

The Merger (as defined in the Merger Agreement) was accounted for as a reverse recapitalization in accordance with United States Generally Accepted Accounting Principles (“GAAP”). Under this method of accounting, Colombier was treated as the “acquired” company for financial reporting purposes and Private PSQ was treated as the “acquirer”.

Upon the closing of the transaction, Michael Seifert possessed approximately 52.62% of the voting power of PSQ (depending on the number of outstanding shares of Class A Common Stock and Class C Common Stock at such time) through the issuance to him of shares of Class C Common Stock in connection with the Business Combination.

Asset Acquisition — EveryLife Inc.

On February 23, 2023, we acquired the assets of EveryLife by way of a stock for stock exchange. Pursuant to that agreement, we acquired a brand name in exchange for 55,000 shares of Private PSQ Common Stock. Through the stock for stock exchange agreement, we acquired EveryLife’s marketing related intangibles which consist of a brand name.

Convertible Promissory Notes

During the six months ended June 30, 2023, we issued convertible promissory notes (the “Notes”) in the total amount of $22,500,000 that accrue interest at the rate of 5% per annum until converted. As described above, on July 19, 2023, we consummated the Business Combination and became a publicly-traded company at which time the entire outstanding principal and accrued interest (the “Balance”) under each Note converted automatically into shares of Private PSQ Common Stock at a conversion price per share based upon an implied $100 million fully diluted pre-money valuation, excluding the Notes. The Notes are required to be recorded at their initial fair value on the date of issuance under ASC 480-10-25-14, and each balance sheet date thereafter. Changes in the estimated fair value of the Notes are recognized as non-cash gains or losses in the condensed consolidated statements of operations.

2

Upon the conversion and before giving effect to the Merger, 204,570 shares of the Private PSQ Common Stock were issued in respect of the aggregate Balances under all the Notes which represented approximately 18.5% of the total outstanding shares of Private PSQ Common Stock.

Inflation and the Global Supply Chain

Currently the U.S. economy is experiencing a bout of increased inflation, resulting in rising prices. The U.S. federal reserve, as well as its counterparts in other countries, have engaged in a series of interest rate hikes in an effort to combat rising inflation. Although inflation did not have a significant impact on our results of operations for the three and six months ended June 30, 2023, we anticipate that inflation will have an impact on our business going forward, including through a material increase in our cost of revenue and operating expenses for the remainder of 2023 and possibly into the following years, if not permanently. Continued or permanent rises in core costs could impact our growth negatively.

Components of Results of Operations

During the three months ended June 30, 2023 and 2022, our net loss was $20.7 million and $1.6 million, respectively and during the six months ended June 30, 2023 and 2022, our net loss was $27.4 million, and $2.6 million, respectively. Our net loss increased in 2023 from 2022, largely due to the $14.6 million increase in fair value of the convertible notes, as well as $3.6 million related to expenses incurred due to the going public transaction (“Net Loss Contribution”). Our expenses will likely increase in the future as we develop and launch new offerings and platform features, expand in existing and new markets, increase our sales and marketing efforts and continue to invest in our platform, as well as a result of us becoming a public company. We have not been profitable since inception, and as of June 30, 2023 and December 31, 2022, our accumulated deficit was $36.3 million and $8.9 million, respectively, including our Net Loss Contribution. Since inception, we have financed our operations primarily through private placements of our securities.

Revenues

To date, substantially all of our revenue has been derived from the advertising of products and services on the PSQ platform. A very small percentage of our revenue to date has been derived from the payment to us of fees for facilitating business relationships through our Business to Business (“B2B”) network.

Our advertising revenues are derived from multi-month fixed price contracts for advertising subscription arrangements. Revenues from subscription contracts are recognized using the “over-time” method of revenue recognition. Accordingly, we recognize revenues over-time as the advertisements are displayed over the subscription period and the service is being consumed by the business member simultaneously over the period of service. Over-time revenue recognition is based on an input measure of progress based on costs incurred compared to estimated total costs at completion. Each advertisement has a contractual revenue value and an estimated cost. The over-time revenue is recognized monthly.

3

We recognize advertising revenue from push notifications and email blasts at the point of delivery. Push notifications and email blasts are considered delivered when an advertisement is displayed to users. When a customer enters into an advertising subscription arrangement that includes push notifications and/or email blasts, we allocate a portion of the total consideration to the push notification and email blast performance obligations based on the residual approach, if the standalone selling price (“SSP”) is not observable. We use the residual approach, which is a method to allocate revenue to a remaining performance obligation. We have stand-alone selling prices for all other services in the advertising package. After allocating revenue per package to those other services based on their stand-alone selling price, the email blasts and push notifications are allocated the remaining revenue for that package. We are able to determine the SSP based on the cost charged to a customer for each service. If the level of service includes multiple performance obligations, the incremental difference attributed to the additional service represents its standalone selling price. We calculate the SSP of the push notification or email blast, and record the revenue when the advertisement is displayed to users.

Advertising revenue is generated by displaying ad products and services on our platform. Marketers enter into advertising subscription arrangements. We recognize revenues over-time as the ads are displayed over the subscription period so we are providing a service and the service is being consumed by the business member simultaneously over the period of service. In general, we report advertising revenue on a gross basis, since we control the advertising inventory before it is transferred to our customers. Our control is evidenced by our sole ability to monetize the advertising inventory before it is transferred to our customers.

In the future, in addition to greater levels of advertising revenue expected as a result of the growth of our business, we also expect to realize increased amounts of B2B revenue and to begin realizing e-commerce transactional revenue and revenue from Direct to Customer (“D2C”) sales of our own branded consumer products as we expand our business operations into those areas.

See Note 3, Summary of Significant Accounting Policies, to Private PSQ’s unaudited condensed consolidated interim financial statements for the three (3)- and six (6)-months ended June 30, 2023 and 2022 included in Exhibit 99.1 to Amendment No. 1.

Cost of Revenue (exclusive of depreciation and amortization)

Cost of revenue (exclusive of depreciation and amortization) consists of the direct costs incurred in building and running subscription-based software services. We recognize the cost of revenue associated with personnel costs, general administrative expenses, and fees related to servers that assist in hosting our platform.

Upon the rollout of our D2C consumer product business, our cost of revenue will also include the cost of finished goods inventory. We expect our cost of revenue per unit to decrease over time as we achieve economies of scale.

4

We expect our cost of revenue to increase in absolute dollars and as a percentage of revenue in the near term as we launch our D2C products. After launching our first D2C product, we expect our cost of revenue as a percentage of revenue to decrease over time as we grow and continue to scale our business.

Operating Expenses

Operating expenses primarily include general and administrative, research and development, sales and marketing, and depreciation and amortization. The most significant component of our operating expenses are personnel-related costs such as salaries, benefits, and bonuses. We expect our personnel-related costs as a percentage of total costs to decrease over time.

We expect to continue to invest substantial resources to support our growth. We anticipate that each of the following categories of operating expenses will increase in absolute dollar amounts and decrease as a percentage of revenue for the foreseeable future.

General and Administrative Expenses

General and administrative expenses consist primarily of personnel-related expenses for our finance, legal, human resources and administrative personnel, as well as the costs of information technology, professional services, insurance, travel, and other administrative expenses. We expect to invest in our corporate organization and incur additional expenses associated with transitioning to, and operating as, a public company, including increased legal, audit, tax and accounting costs, investor relations costs, higher insurance premiums and compliance costs. As a result, we expect that general and administrative expenses will increase in absolute dollars in future periods but decline as a percentage of total revenue over time. Our inability to scale our expenses could negatively impact gross margin and profitability.

Sales and Marketing Expenses

Sales and marketing expenses consist primarily of salaries, employee benefits, consultant fees, commissions, and direct marketing costs related to the promotion of PSQ’s platforms/solutions and certain costs related to the acquisition of both consumer and business members on our platform. As a result, we expect that sales expenses will increase in absolute dollars in future periods as we increase marketing activities, grow our operations, and continue to build our brand awareness. but decline as a percentage of total revenue over time. Our inability to scale our expenses could negatively impact gross margin and profitability.

Research and Development Expenses

Research and development expenses consist primarily of salaries, employee benefits and consultant fees related to our development activities to originate, develop, and enhance our platform. We expect research and development expenses to increase over time due to growth in our engineering and product teams, especially related to the continued development of e-commerce functionality.

5

Depreciation and Amortization Expense

Depreciation and amortization expense consists primarily of amortization of capitalized software development costs.

Non-Operating Income and Other Items

Other Income, Net

Other income, net primarily relates to unrealized gains on our available for sale investments for the six months ended June 30, 2023 and Employee Retention Tax Credit (“ERTC”) and the Research and Development Tax Credit (“R&D Tax Credit”) for the six months ended June 30, 2022.

Change in fair value of convertible promissory notes

Changes in the fair value of the Notes are recorded in the condensed consolidated statement of operations. The Notes represent a financial instrument other than an outstanding share that embodies a conditional obligation that the issuer must or may settle by issuing a variable number of its equity shares. We record the convertible note liability at its fixed monetary amount by measuring and recording a premium, as applicable, on the Notes date with a charge to expense.

Interest Expense

Interest expense incurred consists of interest accrued on Notes issued.

Income Tax Expense

We are subject to income taxes in the United States, but due to our net operating loss (“NOL”) position, we have recognized a minimal provision or benefit in recent years. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is provided when it is more likely than not that the deferred tax assets will not be realized. We have established a full valuation allowance to offset our U.S. net deferred tax assets due to the uncertainty of realizing future tax benefits from our NOL carryforwards and other deferred tax assets.

Key Business Metrics and Selected Financial Data

We use certain key metrics and financial measures not prepared in accordance with GAAP to evaluate and manage our business.

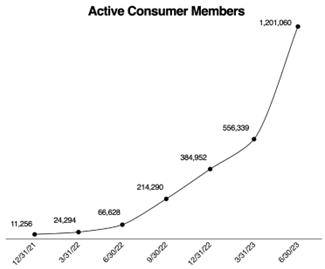

Total Active Consumer Members on Platform

We perform calculations utilizing total active consumer members on our platform as a measure of the reach of our app and website over time. Total active members, as defined by us, are unique consumer membership accounts for which we have received all required contact information, and which have not been deactivated or deleted. These numbers are based on data provided directly from our database. Total active consumer members on our platform do not include unique visitors to the site nor individuals who download the app but do not create an account to login. Our definition of total active consumer members may differ from similar definitions and metrics used by other companies.

6

Total active consumer members on our platform were over 1,200,000 at June 30, 2023, an increase of 1,703% from June 30, 2022. Our total active consumer members were over 1,400,000 at July 31, 2023. We believe that significant growth in our total active consumer members is attributable to earned media, word of mouth referrals, our outreach program and consumer interest in our platform.

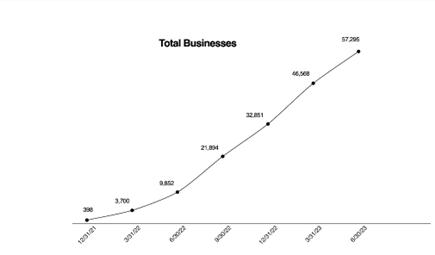

Total Business Members on Platform

We calculate the total business members on our platform as a measure of the reach of our app and website over time. Total business members represent unique business members who have been verified and added to the platform by our team. Total business members do not include business members that were not approved by our team to be on our platform. Our definition of total business members on our platform may differ from similar definitions and metrics used by other companies.

Total business members increased to 57,295 at June 30, 2023, an increase of 482% from June 30, 2022. Total business members were over 65,000 at July 31, 2023. We believe that the significant growth in the total business members on our platform is attributable to earned media, word of mouth referrals, and our Outreach Program.

7

Average Daily Unique Sessions

We calculate the average daily unique sessions on our platform as a measure of access and use of our app and website over time, taking into account business members, consumer members, advertisers and other potential members. Average daily unique sessions refers to the average number of unique IP addresses accessing our application and website on mobile (iOS and Android) and desktop devices in a single day over an indicated period.

Since we began tracking the average daily unique sessions on January 18, 2023, our sessions have increased to an average of 259,097 sessions per day for the month of June 2023, from an average of 89,843 sessions per day for the period from January 18, 2023 through January 31, 2023, an increase of 188%. We believe that the significant growth in the average daily unique sessions on our platform has largely been attributable to earned media (publicity gained through promotional efforts other than paid advertising), word of mouth referrals and our Outreach Program.

Results of Operations

The results of operations presented below should be reviewed in conjunction with Private PSQ’s unaudited condensed consolidated interim financial statements for the three (3)- and six (6)-months ended June 30, 2023 and 2022 included in Exhibit 99.1 to Amendment No. 1.

8

The following table sets forth our condensed consolidated statement of operations for the three and six months ended June 30, 2023 and 2022, and the dollar and percentage change between the two periods:

| For the three months ended June 30, | ||||||||||||||||

| 2023 | 2022 | Variance, $ | Variance, % | |||||||||||||

| Revenue | $ | 529,707 | $ | 72,941 | 456,766 | 626 | % | |||||||||

| Costs and expenses: | ||||||||||||||||

| Cost of revenue (exclusive of depreciation and amortization shown separately below) | 432,934 | 154,746 | 278,188 | 180 | % | |||||||||||

| General and administrative | 3,837,946 | 857,579 | 2,980,367 | 348 | % | |||||||||||

| Sales and marketing | 2,460,305 | 406,487 | 2,053,818 | 505 | % | |||||||||||

| Research and development | 288,483 | 102,278 | 186,205 | 182 | % | |||||||||||

| Depreciation and amortization | 699,237 | 166,083 | 533,154 | 321 | % | |||||||||||

| Total costs and expenses | 7,718,905 | 1,687,173 | 6,031,732 | 358 | % | |||||||||||

| Operating loss | (7,189,198 | ) | (1,614,232 | ) | (5,574,966 | ) | 345 | % | ||||||||

| Other income: | ||||||||||||||||

| Other income, net | 48,549 | — | 48,549 | NM* | % | |||||||||||

| Changes in fair value of convertible promissory notes | (13,423,204 | ) | — | (13,423,204 | ) | NM* | % | |||||||||

| Interest expense | (155,854 | ) | — | (155,854 | ) | NM* | % | |||||||||

| Loss before income tax expense | (20,719,707 | ) | (1,614,232 | ) | (19,105,475 | ) | 1,184 | % | ||||||||

| Income tax expense | (1,600 | ) | (713 | ) | (887 | ) | 124 | % | ||||||||

| Net loss | (20,721,307 | ) | (1,614,945 | ) | (19,106,362 | ) | 1,183 | % | ||||||||

| For the six months ended June 30, | ||||||||||||||||

| 2023 | 2022 | Variance, $ | Variance,% | |||||||||||||

| Revenue | $ | 907,741 | $ | 72,941 | 834,800 | 1,144 | % | |||||||||

| Costs and expenses: | ||||||||||||||||

| Cost of revenue (exclusive of depreciation and amortization shown separately below) | 795,907 | 273,393 | 522,514 | 191 | % | |||||||||||

| General and administrative | 7,987,317 | 1,327,784 | 6,659,533 | 502 | % | |||||||||||

| Sales and marketing | 3,068,840 | 525,046 | 2,543,794 | 484 | % | |||||||||||

| Research and development | 536,984 | 314,691 | 222,293 | 71 | % | |||||||||||

| Depreciation and amortization | 1,244,574 | 273,916 | 970,658 | 354 | % | |||||||||||

| Total costs and expenses | 13,633,622 | 2,714,830 | 10,918,792 | 402 | % | |||||||||||

| Operating loss | (12,725,881 | ) | (2,641,889 | ) | (10,083,992 | ) | 382 | % | ||||||||

| Other income: | ||||||||||||||||

| Other income, net | 53,687 | 7,846 | 45,841 | 584 | % | |||||||||||

| Changes in fair value of convertible promissory notes | (14,571,109 | ) | - | (14,571,109 | ) | NM* | ||||||||||

| Interest expense | (163,855 | ) | - | (163,855 | ) | NM* | ||||||||||

| Loss before income tax expense | (27,407,158 | ) | (2,634,043 | ) | (24,773,115 | ) | 940 | % | ||||||||

| Income tax expense | (1,789 | ) | (713 | ) | (1,076 | ) | 151 | % | ||||||||

| Net loss | (27,408,947 | ) | (2,634,756 | ) | (24,774,191 | ) | 940 | % | ||||||||

NM* — Percentage change not meaningful.

9

Revenues

Revenues increased by $0.5 million for the three months ended June 30, 2023 compared to the three months ended June 30, 2022. The increase was driven by an increase in the business member base and introduction of new advertising features on our platform, which resulted in advertising revenues of $0.5 million.

Revenues increased by $0.8 million for the six months ended June 30, 2023 compared to the six months ended June 30, 2022. The increase was driven by an increase in the business member base and introduction of new advertising features on our platform, which resulted in advertising revenues of $0.8 million.

Cost of Revenue (exclusive of depreciation and amortization)

Cost of revenue (exclusive of depreciation and amortization) increased by $0.3 million, or 180%, for the three months ended June 30, 2023 compared to the three months ended June 30, 2022. The increase was mainly due to an increase in personnel expenses of $0.3 million.

Cost of revenue (exclusive of depreciation and amortization) increased by $0.5 million, or 191%, for the six months ended June 30, 2023 compared to the six months ended June 30, 2022. The increase was mainly due to an increase in personnel expenses of $0.4 million.

General and Administrative Expense

General and administrative expense increased by $3.0 million, or 348%, for the three months ended June 30, 2023 compared to the three months ended June 30, 2022. The increase was due to a $0.9 million increase in staffing-related costs, as well as a $2.1 million increase in other administrative expenses, which include accounting, legal, and other administrative services.

General and administrative expense increased by $6.7 million, or 502%, for the six months ended June 30, 2023 compared to the six months ended June 30, 2022. The increase was due to a $1.6 million increase in staffing-related costs, as well as a $5.1 million increase in other administrative expenses, which include accounting, legal, and other administrative services.

Sales and Marketing Expense

Sales and marketing expense increased by $2.1 million, or 505%, for the three months ended June 30, 2023 compared to the three months ended June 30, 2022. The increase was due to a $2.0 million increase in other marketing and public relation activities.

Sales and marketing expense increased by $2.5 million, or 484%, for the six months ended June 30, 2023 compared to the six months ended June 30, 2022. The increase was due to a $2.5 million increase in other marketing and public relation activities.

Research and Development Expense

Research and development expense increased by $0.2 million, or 182%, for the three months ended June 30, 2023 compared to the three months ended June 30, 2022. The increase was due to an increase in staffing-related costs in our product and engineering teams, as well as costs related to computer software, hardware, and other administrative expenses.

Research and development expense increased by $0.2 million, or 71%, for the six months ended June 30, 2023 compared to the six months ended June 30, 2022. The increase was due to an increase in staffing-related costs in our product and engineering teams, as well as costs related to computer software, hardware, and other administrative expenses.

10

Depreciation and amortization

Depreciation and amortization expense increased $0.5 million, or 321%, for three months ended June 30, 2023 compared to the three months ended June 30, 2022. The increase was primarily related to the amortization of capitalized software development costs.

Depreciation and amortization expense increased $1.0 million, or 354%, for six months ended June 30, 2023 compared to the six months ended June 30, 2022. The increase was primarily related to the amortization of capitalized software development costs.

Other Income, net

Other income, net increased by $0.05 million for the three and six months ended June 30, 2023 compared to the three and six months ended June 30, 2022. The increase was primarily related to the unrealized gain on short term investments.

Changes in the Fair Value of Convertible Promissory Notes

For the three and six months ended June 30, 2023, the change in fair value of the Notes was $13,423,204 and $14,571,109, respectively. Total principal balance of the Notes increased by $2,050,000 and $22,500,000 for the three and six months ended June 30, 2023.

Interest Expense

Interest expense increased by $0.2 million for the three and six months ended June 30, 2023 compared to the three and six months ended June 30, 2022. The increase was due to the interest payable in relation to the Notes recorded as of June 30, 2023.

Income Tax Expense

Income tax expense increased by an insignificant amount for the three and six months ended June 30, 2023 compared to the three and six months ended June 30, 2022.

Liquidity and Capital Resources

Historically, we have financed operations primarily through cash generated from equity raises and operating activities. Our primary short-term requirements for liquidity and capital are to fund general working capital and capital expenditures. Our principal long-term working capital uses include: increasing our advertising and marketing exposure, expanding our internal engineering and product teams, developing and launching D2C products, and developing and rolling out e-commerce capabilities.

In connection with the expected launch of our first D2C branded products, we intend to fund initial inventory requirements with cash on hand. Longer term, our expected liquidity and capital requirements will likely consist of research and development needed to identify additional D2C opportunities. We do not currently anticipate that growth and expansion into new areas, such as D2C consumer products, will require us to make significant capital investments in our business, as we plan to employ an “asset light” business model and rely on third party manufacturers and other outsourced third party relationships as we build this part of our business.

11

As of June 30, 2023 and December 31, 2022, cash and cash equivalents balance was $6.2 million, and $2.3 million, respectively. Cash and cash equivalents consist of interest-bearing deposit accounts managed by third-party financial institutions, and highly liquid investments with maturities of three months or less.

From March through June 2023, we issued $22.5 million in Notes, of which $22.5 million has been received as of June 30, 2023, as part of a Permitted Financing under the Merger Agreement. The Notes are unsecured obligations and bear interest at a rate of 5% per annum, which interest will accrue and be added to the principal amount of the Notes. In July 2023, in connection with the consummation of the Business Combination, the Notes automatically converted into shares of Private PSQ Common Stock immediately prior to completion of the Business Combination at a conversion rate based upon an implied $100 million fully diluted pre-money valuation of Private PSQ, excluding the Notes. Upon such conversion and before giving effect to the Merger, the shares of Private PSQ Common Stock issued in respect of the aggregate balances under all Notes represented approximately 18.4% of the total outstanding shares of Private PSQ Common Stock. The Notes were issued in a private placement transaction exempt from registration under the Securities Act of 1933, as amended.

In conjunction with the consummation of the Business Combination, we received proceeds totaling $34,938,880 in July 2023, after giving effect to Colombier’s stockholder redemptions and before payment of transaction expenses, which will be utilized to fund our operations and growth plans. We believe that as a result of the Business Combination our existing cash and short-term investments, as well as, proceeds received from the Business Combination will be sufficient to fund operations and capital needs for the next year from the date the condensed consolidated financial statements were issued for the quarterly period ended June 30, 2023.

Our future capital requirements will depend on many factors, including our revenue growth rate, the timing and extent of spending by us to support further sales and marketing and research and development efforts, the degree to which we are successful in launching new business initiatives such as our contemplated e-commerce and D2C business initiatives and the cost associated with these initiatives, and the growth of our business generally. In order to finance these opportunities and associated costs, it is possible that we will need to raise additional financing if the proceeds realized by us from the Merger are insufficient to support our business needs. While we believe that the proceeds realized by us through the Merger will be sufficient to meet our currently contemplated business needs, we cannot assure you that this will be the case. If additional financing is required by us from outside sources, we may not be able to raise it on terms acceptable to us or at all. If we are unable to raise additional capital on acceptable terms when needed, our business, results of operations and financial condition would be materially and adversely affected.

Comparison of the Six Months Ended June 30, 2023 and 2022

The following table shows our cash flows provided by (used in) operating activities, investing activities and financing activities for the stated periods:

| For the six months ended June 30, | |||||||||

| 2023 | 2022 | Variance | |||||||

| Net cash used in operating activities | $ | (10,017,651 | ) | $ | (1,956,945 | ) | (8,060,706 | ) | |

| Net cash used in investing activities | (11,242,002 | ) | (710,070 | ) | (10,531,932 | ) | |||

| Net cash provided by financing activities | 25,099,725 | 2,300,345 | 22,799,380 | ||||||

Net Cash Used in Operating Activities

Net cash used in operating activities for the six months ended June 30, 2023 was $10.0 million compared to $2.0 million used in operating activities during the six months ended June 30, 2022. The increase in cash used in operating activities was due to an overall increase in operating expenses, resulting in an increased net loss of $24.8 million (which includes the change in fair value of Notes of $14.6 million). This was coupled with the expense increase in depreciation and amortization of $1.0 million, the increase in fair value of Notes of $14.6 million, net increases in operating assets of $0.7 million and net increases in operating liabilities of $1.8 million from prior year.

12

Net Cash Used in Investing Activities

Net cash used in investing activities for the six months ended June 30, 2023 was $11.2 million, an increase of $10.5 million from cash used in investing activities of $0.7 million for the six months ended June 30, 2022. The increase was primarily due to additional costs incurred with the internally developed software totaling $1.0 million compared to $0.7 million in the prior year (the gross capitalized software development costs included in intangible assets as of June 30, 2023 were $3.2 million) and purchase of $10.0 million of short-term investments.

Net Cash Provided by Financing Activities

Net cash provided by financing activities for six months ended June 30, 2023 was $25.1 million compared to $2.3 million provided by financing activities for the six months ended June 30, 2022. The increase was primarily due to $22.5 million of proceeds from the issuance of Notes and $2.6 million of proceeds from the issuance of Private PSQ Common Stock.

Off-Balance Sheet Arrangements

None.

Quantitative and Qualitative Disclosures about Market Risk

We are exposed to market risks in the ordinary course of our business. Market risk represents the risk of loss that may impact our financial position due to adverse changes in financial market prices and rates. Our market risk exposure is primarily interest rates, access to credit and funds to run day-to-day operations and the result of fluctuations in foreign currency exchange rates if we expand internationally. Failure to mitigate these risks could have a negative impact on revenue growth, gross margin and profitability.

Interest Rate Risk

Our cash and cash equivalents are comprised of operating and short-term investment accounts. We do not enter into investments for trading or speculative purposes and have not used any derivative financial instruments to manage our interest rate risk exposure.

Credit Risk

As of June 30, 2023 and December 31, 2022, our cash and cash equivalents were maintained with one financial institution in the United States in an IntraFi Network Deposit account, which will allow us to spread our cash across multiple banks and thereby mitigate the risk associated with having uninsured funds. We have reviewed the financial statements of our banking institution and believe we currently have sufficient assets and liquidity to conduct our operations in the ordinary course of business with little or no credit risk to us.

As of June 30, 2023 and December 31, 2022, there was no one customer that represented a material majority or in excess of 5% of accounts receivable.

Emerging Growth Company Status

In April 2012, the JOBS Act was enacted. Section 107(b) of the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. Thus, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the extended transition period to comply with new or revised accounting standards and to adopt certain of the reduced disclosure requirements available to emerging growth companies. As a result of the accounting standards election, we will not be subject to the same implementation timing for new or revised accounting standards as other public companies that are not emerging growth companies which may make comparison of our financials to those of other public companies more difficult.

13

Critical Accounting Policies and Significant Management Estimates

We prepare our financial statements in accordance with GAAP. The preparation of financial statements also requires we make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, costs and expenses and related disclosures. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results could differ significantly from the estimates made by our management. To the extent that there are differences between our estimates and actual results, our future financial statement presentation, balance sheet, results of operations and cash flows will be affected. We believe that the accounting policies discussed below are critical to understanding our historical and future performance, as these policies relate to the more significant areas involving our management’s judgments and estimates. Critical accounting policies and estimates are those that we consider the most important to the portrayal of our balance sheet and results of operations because they require our most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effects of matters that are inherently uncertain.

The preparation of our financial statements in conformity with GAAP requires us to make estimates and judgments that affect the amounts reported in those financial statements and accompanying notes. Although we believe that the estimates we use are reasonable, due to the inherent uncertainty involved in making those estimates, actual results reported in future periods could differ from those estimates. Our significant accounting policies are described in Note 3 to Private PSQ’s unaudited condensed consolidated interim financial statements for the three (3)- and six (6)-months ended June 30, 2023 and 2022 included in Exhibit 99.1 to Amendment No. 1. Our critical accounting policies are described below.

Revenue Recognition

At inception, we adopted ASC Topic 606 - Revenue from Contracts with Customers. To determine revenue recognition for contractual arrangements that we determine we are within the scope of ASC 606, we perform the following five steps: (1) identify each contract with a business member; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to performance obligations in the contract; and (5) recognize revenue when (or as) the relevant performance obligation is satisfied. We only apply the five-step model to contracts when it is probable that we will collect the consideration we are entitled to in exchange for the goods or services we provide to the business member.

We recognize revenue when it satisfies its obligation by providing the benefits of the service to the business member, either over time or at a point in time. A performance obligation is satisfied over time if one of the following criteria are met:

a. the business member simultaneously receives and consumes the benefits as the entity performs; or

b. the entity’s performance creates or enhances an asset that the business member controls as the asset is created or enhanced; or

c. the entity’s performance does not create an asset with an alternative use to the entity, and the entity has an enforceable right to payment for performance completed to date.

Our revenue is currently derived primarily from advertising when we display ad products and services on our platform.

Our revenues are derived from multi-month fixed price contracts by marketers for advertising subscription arrangements. Revenues from long-term contracts are recognized using the “over-time” method of revenue recognition. Accordingly, we recognize revenues over-time as the ads are displayed over the subscription period and the service is being consumed by the business member simultaneously over the period of service. Over-time revenue recognition is based on an input measure of progress based on costs incurred compared to estimated total costs at completion. Each advertisement has a contractual revenue value and an estimated cost. The over-time revenue is recognized based on the percentage of the total project cost that has been realized.

Moreover, we recognize advertising revenues over-time as the ads are displayed over the subscription period so we are providing a service and the service is being consumed by the business member simultaneously over the period of service. In general, we report advertising revenue on a gross basis, since we control the advertising inventory before it is transferred to our business members.

14

We recognize advertising revenue from push notifications and email blasts at a point in time when delivered. Push notifications and email blasts are considered delivered when an ad is displayed to members. When a business member enters into an advertising subscription arrangement that includes push notifications and/or email blasts, we allocate a portion of the total consideration to the push notification and email blast performance obligations based on the residual approach, if the standalone selling price (“SSP”) is not observable. We are able to determine the SSP based on the cost charged to a business member for each service. If the level of service includes multiple performance obligations, the incremental difference attributed to the additional service represents its standalone selling price. We calculate the SSP of the push notification or email blast, and record the revenue when the ad is displayed to members.

Advertising revenue is generated by displaying ad products and services on our platform. Marketers enter into advertising subscription arrangements. We recognize revenues over-time as the ads are displayed over the subscription period so we are providing a service and the service is being consumed by the customer simultaneously over the period of service. In general, we report advertising revenue on a gross basis, since we control the advertising inventory before it is transferred to our customers. Our control is evidenced by our sole ability to monetize the advertising inventory before it is transferred to our customers.

Capitalized Software

We capitalize costs related to the development of our internal accounting software and certain projects for internal use in accordance with ASC 350 - Intangibles — Goodwill and Other. We capitalize costs to develop our mobile application and website when preliminary development efforts are successfully completed, management has authorized and committed project funding, and it is probable that the project will be completed, and the software will be used as intended. Costs incurred during the preliminary planning and evaluation stage of the project and during the post implementation operational stage, including maintenance, are expensed as incurred. Costs incurred for enhancements that are expected to result in additional functionality are capitalized and expensed over the estimated useful life of the upgrades on a per project basis. Amortization is computed on an individual product basis over the estimated economic life of the product using the straight-line method.

Convertible Promissory Notes

We have issued Notes, which contain fixed rate conversion features, whereby the outstanding principal and accrued interest will be converted, into common shares at a fixed discount to the market price of the common stock at the time of conversion. The Notes represent a financial instrument other than an outstanding share that embodies a conditional obligation that the issuer must or may settle by issuing a variable number of its equity shares. We record the convertible notes liability at its fixed monetary amount by measuring and recording a premium, as applicable, on the convertible notes date with a charge to expense in accordance with ASC-480 — Distinguishing Liabilities from Equity.

Fair Value of Financial Instruments

Fair value is the price that would be received to sell an asset, or the amount paid to transfer a liability in an orderly transaction between market participants at the measurement date. There is a fair value hierarchy that prioritizes the inputs used to measure fair value. The hierarchy gives the highest priority to quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurement). We classify fair value balances based on the observability of those inputs. The three levels of the fair value hierarchy are as follows:

| Level 1 — | Inputs based on unadjusted quoted market prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date. | |

| Level 2 — | Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets or liabilities in active markets or quoted prices for identical or similar instruments in markets that are not active or for which all significant inputs are observable or can be corroborated by observable market data. | |

| Level 3 — | Inputs reflect management’s best estimate of what market participants would use in pricing the asset or liability at the measurement date. The inputs are both unobservable for the asset and liability in the market and significant to the overall fair value measurement. |

15

On February 23, 2023, we acquired the assets of EveryLife by way of a stock for stock exchange (See Note 4 “Asset Acquisition” to Private PSQ’s unaudited condensed consolidated interim financial statements for the three (3)- and six (6)-months ended June 30, 2023 and 2022). The assets acquired have been recorded at their relative fair value based on a valuation obtained by us using the market approach.

In some circumstances, the inputs used to measure fair value might be categorized within different levels of the fair value hierarchy. In those instances, the fair value measurement is categorized in its entirety in the fair value hierarchy based on the lowest level input that is significant to the fair value measurement. We establish the fair value of our assets and liabilities using the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date and establishes a fair value hierarchy based on the inputs used to measure fair value. The recorded amounts of certain financial instruments, including accounts receivable, accounts payable, accrued expenses, debt at fixed interest rates, and other liabilities approximate fair value due to their relatively short maturities.

The fair value of the Notes (See Note 12 “Convertible Promissory Notes” in Private PSQ’s unaudited condensed consolidated interim financial statements for the three (3)- and six (6)-months ended June 30, 2023 and 2022) as of June 30, 2023 required the use of an option pricing method and equity allocation. Our Notes are considered a Level 3 financial instrument and are reviewed quarterly to determine their fair value. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments between levels.

The fair values of U.S. treasury bonds are based on quoted market prices in active markets, and are included in the Level 1 fair value hierarchy. We believe the market for U.S. treasury bonds is an actively traded market given the high level of daily trading volume.

Income Taxes

We use the asset and liability method of accounting for income taxes. Under this method, deferred tax assets and liabilities are recognized by applying the statutory tax rates in effect in the years in which the differences between the financial reporting and tax filing bases of existing assets and liabilities are expected to reverse. Valuation allowances are established when necessary to reduce deferred tax assets to the amounts expected to be realized.

We utilize a two-step approach to recognizing and measuring uncertain income tax positions (tax contingencies). The first step is to evaluate the tax position for recognition by determining if the weight of available evidence indicates it is more likely than not that the position will be sustained on audit, including resolution of related appeals or litigation processes. The second step is to measure the tax benefit as the largest amount which is more than 50% likely of being realized upon ultimate settlement. We make estimates, assumptions and judgments to determine our provision for income taxes and also for deferred tax assets and liabilities and any valuation allowances recorded against deferred tax assets. Actual future operating results and the underlying amount and type of income could differ materially from our estimates, assumptions and judgments thereby impacting our financial position and results of operations.

Recent Accounting Pronouncements

See Note 3, “Summary of Significant Accounting Policies”, to Private PSQ’s unaudited condensed consolidated interim financial statements for the three (3)- and six (6)-months ended June 30, 2023 and 2022 included in Exhibit 99.1 to Amendment No. 1 as well as Private PSQ’s financial statements for the year ended December 31, 2022.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Internal Control over Financial Reporting

During the audit of the Private PSQ financial statements for the year ended December 31, 2022, its independent registered accounting firm noted deficiencies relating to segregation of duties that constitute a material weakness in our internal control over financial reporting which remains as of June 30, 2023. We have taken and intends to continue to take steps to remediate this material weakness, including enlisting the help of external advisors to provide assistance in the areas of internal controls in the short term, and evaluating the longer-term resource needs of our accounting staff. To date in 2023, in response to the material weakness identified above, we have upgraded our accounting software to a system with stronger IT controls as well as hired additional personnel to the finance team which have improved controls relating to segregation of duties. These remediation measures will continue to be time consuming and costly, and place significant demands on our financial, accounting, and operational resources.

16