[ ● ], 2022

Dear Ligand Stockholder:

On November 9, 2021, we announced we were pursuing plans to split our company into two separate, publicly traded companies, with one featuring the OmniAb business and the other featuring Ligand’s remaining businesses. We considered multiple ways to pursue a separation with the goals of ensuring a smooth transition of operations, a healthy balance sheet for both OmniAb and Ligand, and support from investors. On February 17, 2022, we announced our intention to accomplish this separation via a distribution to our stockholders of outstanding shares of common stock of OmniAb, Inc. held by Ligand. Subsequently, we received an offer from Avista Public Acquistion Corp. II (“APAC”) to complete a business combination. The APAC team is comprised of high-quality healthcare operators and investors with an excellent track record. They have done extensive due diligence and see the potential and value of OmniAb, a highly competitive, leading platform with strong momentum given recent major clinical and regulatory successes. We are very pleased to partner with APAC and its shareholders to take OmniAb public.

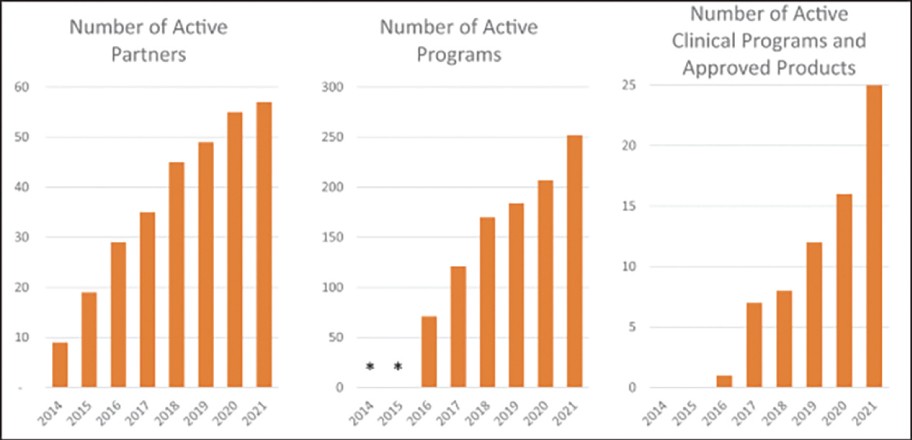

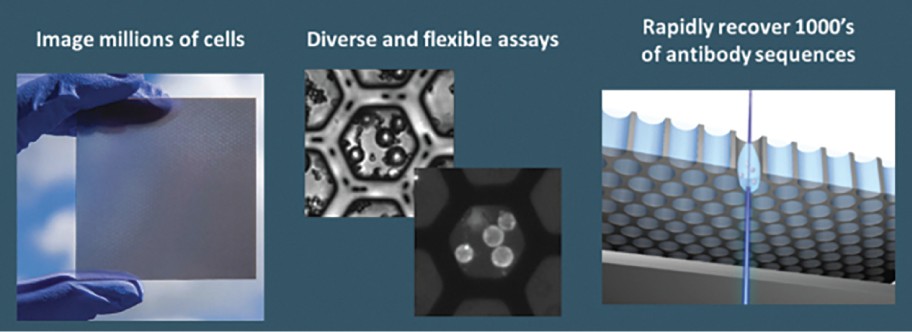

The spin-off of OmniAb through the business combination with APAC is intended to create two companies with dedicated operational focus, business-specific capital allocation, agility to meet partner needs, and compelling focused investment profiles. OmniAb’s business will include the Ab Initio computational antigen design technology, Icagen’s ion channel technology, the xPloration high-throughput screening technology, and the suite of OmniAb transgenic animals used for antibody discovery. Ligand will continue to focus on its existing collection of core royalties and technologies, pipeline and contracts associated with the Pelican protein expression platform and the Captisol business. We believe more than ever that OmniAb offers one of the industry’s leading antibody discovery platforms and that the business is primed for success for years to come. We believe we have been operating two distinct, high-growth companies within Ligand. We are excited to create two independent companies and accelerate investment into the OmniAb platform and technologies to further drive value for our stockholders.

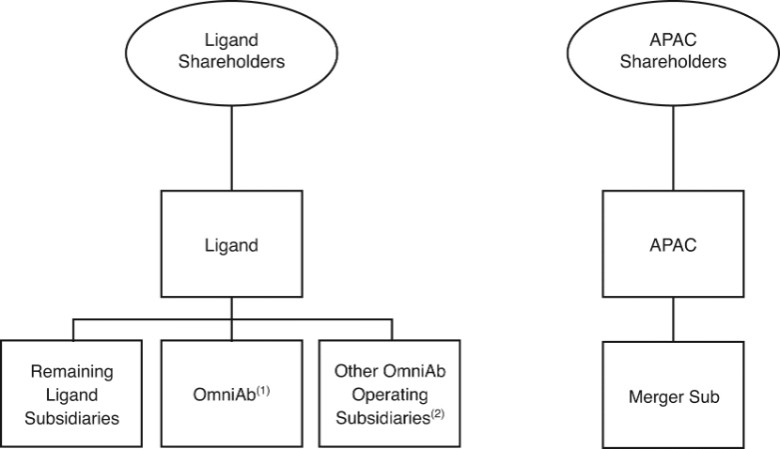

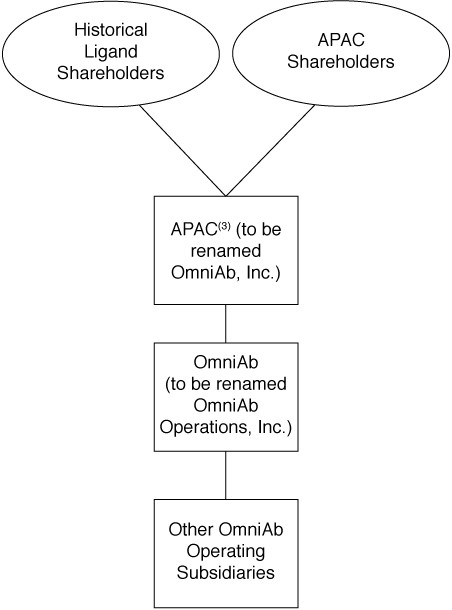

The separation will provide current Ligand stockholders with ownership interests in both Ligand and OmniAb. The principal transactions described in this document include the following:

| ● | Separation — Ligand and certain of Ligand’s subsidiaries will engage in a series of transactions to transfer OmniAb’s business, including certain related subsidiaries of Ligand, to OmniAb, Inc. and make a contribution to the capital of OmniAb of $15,000,000, less certain transaction and other expenses |

| ● | Distribution — Ligand will distribute to Ligand stockholders 100% of the common stock of OmniAb on a pro rata basis; |

| ● | Merger — Immediately after the distribution, OmniAb will merge with an APAC subsidiary and continue as a wholly owned subsidiary of APAC. As a result of the merger, the existing shares of OmniAb common stock will automatically convert into the right to receive shares of APAC common stock in accordance with an exchange ratio described below. |

You do not need to take any action to receive the shares of OmniAb common stock to which you are entitled as a Ligand stockholder. You also do not need to pay any consideration or surrender or exchange any shares of Ligand common stock.

I encourage you to read the proxy statement/prospectus/information statement. The proxy statement/prospectus/information statement describes the separation, the distribution and the merger in detail and contains important business and financial information about OmniAb and APAC as well as the combined company.