Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

Global Crossing Airlines Group Inc.

(Name of Registrant as Specified In Its Charter)

Payment of filing fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Table of Contents

Global Crossing Airlines Group Inc.

Bldg. 5A, Miami International Airport, 4th floor

4200 NW 36th Street, Miami, FL 33166

October 28, 2022

Dear Fellow Stockholders:

You are cordially invited to attend the 2022 Annual Meeting of Stockholders of Global Crossing Airlines Group Inc. on Thursday, December 8, 2022, at 10:00 a.m. Eastern Standard Time held at Bldg. 5A, Miami International Airport, 4th floor, 4200 NW 36th Street, Miami, FL 33166.

Details about the business to be conducted at the Annual Meeting and other information can be found in the attached Notice of Annual Meeting of Stockholders and Proxy Statement. As a stockholder, you will be asked to vote on five proposals as well as any other business that properly comes before the Annual Meeting.

Your vote is important. After reading the attached Notice of Annual Meeting of Stockholders and Proxy Statement, please submit your proxy or voting instructions promptly.

On behalf of the management team and your Board of Directors, thank you for your continued support and interest in Global Crossing Airlines Group Inc.

| Sincerely, |

| /s/ Edward Wegel |

| Edward Wegel |

| Chief Executive Officer and Chairman |

Table of Contents

Global Crossing Airlines Group Inc.

Bldg. 5A, Miami International Airport, 4th floor

4200 NW 36th Street, Miami, FL 33166

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on December 8, 2022

The 2022 Annual Meeting of Stockholders of Global Crossing Airlines Group Inc. (the “Company”) will be held on Thursday, December 8, 2022, at 10:00 a.m. Eastern Standard Time (“EST”) held at Bldg. 5A, Miami International Airport, 4th floor, 4200 NW 36th Street, Miami, FL 33166 (the “Annual Meeting”).

You are entitled to participate in the Annual Meeting if you were a stockholder of the Company as of the close of business on October 14, 2022, the record date for the Annual Meeting. The Notice of Annual Meeting , Proxy Statement and 2021 Annual Report are available on the Company’s website at www.globalairlinesgroup.com under “Investor Relations – SEC Filings”. The Annual Meeting is being held for the following purposes:

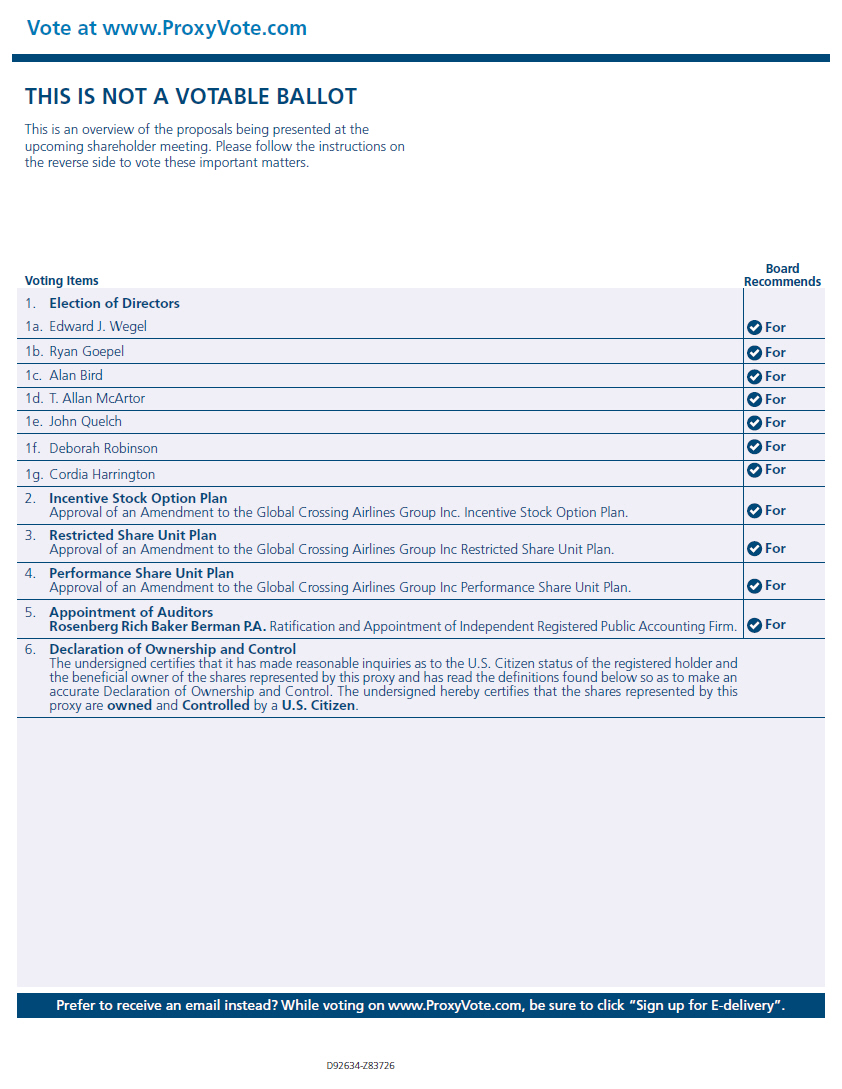

| 1. | To elect Edward Wegel, Ryan Goepel, Alan Bird, T. Allan McArtor, John Quelch, Deborah Robinson, and Cordia Harrington as members of our Board of Directors, each to serve for a one-year term; |

| 2. | To approve an amendment to the Global Crossing Airlines Group Inc. Incentive Stock Option Plan; |

| 3. | To approve an amendment to the Global Crossing Airlines Group Inc. Restricted Share Unit Plan; |

| 4. | To approve an amendment to the Global Crossing Airlines Group Inc. Performance Share Unit Plan; |

| 5. | To ratify the appointment of Rosenberg Rich Baker Berman P.A. as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and |

| 6. | To transact any other business that properly comes before the Annual Meeting and any adjournment or postponement thereof. |

The Company urges stockholders to vote and submit proxies in advance of the Annual Meeting by one of the methods described in these proxy materials for the Annual Meeting. Stockholders who attend the Annual Meeting by following the instructions in these proxy materials will have an opportunity to vote and to submit questions during the meeting.

Only stockholders of record as of the close of business on October 14, 2022 are entitled to receive notice of and to vote at the Annual Meeting and any and all adjournments or postponements thereof. Stockholders who hold shares in street name may vote through their brokers, banks or other nominees.

Regardless of the number of shares you own and whether you plan to attend the Annual Meeting, please vote. All stockholders of record can vote (i) over the Internet by accessing the Internet website specified on the enclosed proxy card or voting instruction form and following the instructions provided to you, (ii) by calling the toll-free telephone number specified on the enclosed proxy card or voting instruction form and following the instructions when prompted, (iii) by written proxy by signing and dating the enclosed proxy card and returning it, or (iv) by attending the Annual Meeting in accordance with the instructions provided in the proxy statement.

We encourage you to receive all proxy materials in the future electronically to help us save printing costs and postage fees, as well as natural resources in producing and distributing these materials. If you wish to receive these materials electronically in the future, please follow the instructions on the proxy card or voting instruction form.

| By Order of the Board of Directors, |

| /s/ Edward Wegel |

| Edward Wegel |

| Chief Executive Officer and Chair |

| October 28, 2022 |

Table of Contents

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE |

| ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 8, 2022 |

| This Notice of Annual Meeting and Proxy Statement and our 2021 Annual Report are available on our website at www.globalairlinesgroup.com under “Investor Relations — SEC Filings” |

Table of Contents

| QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING |

1 | |||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

19 | |||

| 21 | ||||

| 22 | ||||

| 31 | ||||

| 38 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 49 | ||||

| 49 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

Table of Contents

Global Crossing Airlines Group Inc.

Bldg. 5A, Miami Int’l Airport, 4th floor

4200 NW 36th Street, Miami, FL 33166

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on December 8, 2022

——————————————————-

This Proxy Statement is being furnished to our stockholders of record as of the close of business on October 14, 2022 in connection with the solicitation by our Board of Directors of proxies for the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at Bldg. 5A, Miami International Airport, 4th floor, 4200 NW 36th Street, Miami, FL 33166 on Thursday, December 8, 2022, at 10:00 am. EST, or at any and all adjournments or postponements thereof, for the purposes stated in the Notice of Annual Meeting of Stockholders. The approximate date of mailing of this Proxy Statement and the enclosed form of proxy is October 26, 2022.

Unless we state otherwise or the context otherwise requires, references in this proxy statement to “we,” “our,” “us,” or the “Company” are to Global Crossing Airlines Group Inc., a Delaware corporation.

THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because our Board of Directors (our “Board”) is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions on your proxy card or voting instruction form to vote over the telephone or through the Internet.

How do I attend the Annual Meeting?

The Annual Meeting will be held in person only at Bldg. 5A, Miami Int’l Airport, 4th floor, 4200 NW 36th Street, Miami, FL 33166 on Thursday, December 8, 2022, at 10:00 a.m. EST.

All attendees will be asked to present a government-issued photo identification, such as a driver’s license or passport. If you are a stockholder of record, the name on your photo identification will be verified against the October 14, 2022 list of stockholders of record prior to your being admitted to the Annual Meeting. If you are the beneficial owner of shares held in “street name” by a broker, bank or nominee, you must present both proof of ownership and valid photo identification to attend the Annual Meeting. If you hold shares through an account with a bank, broker or other nominee, contact your bank, broker or other nominee to request a legal proxy to vote your shares in person at the Annual Meeting. Such legal proxy will serve as proof of your ownership. A recent brokerage statement or letter from your bank, broker or other nominee showing that you owned common stock as of October 14, 2022 also serves as proof of ownership for purposes of attending the Annual Meeting, but will not allow you to actually vote your shares at the Annual Meeting.

If you do not have valid photo identification and we are unable to verify ownership of your shares as of October 14, 2022, you will not be admitted into the Annual Meeting.

1

Table of Contents

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on October 14, 2022, the record date for the Annual Meeting, and beneficial owners on the record date, who request and obtain a valid proxy from your broker, bank or other agent, will be entitled to vote at the Annual Meeting. As of October 14, 2022, there were 31,702,242 shares of common stock outstanding and entitled to vote. For ten days prior to the Annual Meeting, during normal business hours, a complete list of all stockholders on the record date will be available for examination by any stockholder at the Company’s offices at Bldg. 5A, Miami International Airport, 4th floor, 4200 NW 36th Street, Miami, FL 33166. The list of stockholders will also be available electronically during the Annual Meeting.

Stockholder of Record: Shares Registered in Your Name

If at the close of business on October 14, 2022 your shares were registered directly in your name with our transfer agent, Computershare Investor Services Inc., then you are a stockholder of record. As a stockholder of record, you may vote at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or through the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If at the close of business on October 14, 2022 your shares were held in an account at a brokerage firm, bank, dealer or similar organization, rather than in your own name, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker, bank or other agent.

What am I voting on?

| There | are five matters scheduled for a vote: |

| 1. | To elect Edward Wegel, Ryan Goepel, Alan Bird, T. Allan McArtor, John Quelch, Deborah Robinson and Cordia Harrington as members of our Board of Directors, each to serve for a one-year term; |

| 2. | To approve an amendment to the Global Crossing Airlines Group Inc. Incentive Stock Option Plan; |

| 3. | To approve an amendment to the Global Crossing Airlines Group Inc. Restricted Share Unit Plan; |

| 4. | To approve an amendment to the Global Crossing Airlines Group Inc. Performance Share Unit Plan; and, |

| 5. | To ratify the appointment of Rosenberg Rich Baker Berman P.A. as our independent registered public accounting firm for the fiscal year ending December 31, 2022. |

What are the recommendations of our Board?

Unless you give other instructions on your proxy card, or by telephone or on the Internet, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of our Board. Our Board recommends a vote:

| • | FOR the election of the nominated slate of directors (see Proposal 1); |

| • | FOR the approval of an amendment to the Global Crossing Airlines Group Inc. Incentive Stock Option Plan (see Proposal 2); |

| • | FOR the approval of an amendment to the Global Crossing Airlines Group Inc. Restricted Share Unit Plan (see Proposal 3); |

| • | FOR the approval of an amendment to the Global Crossing Airlines Group Inc. Performance Share Unit Plan (see Proposal 4); and |

2

Table of Contents

| • | FOR the ratification of the appointment of Rosenberg Rich Baker Berman P.A. as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (see Proposal 5). |

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If you have submitted a proxy and any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his/her best judgment.

How do I vote?

For Proposal 1, you may either vote “For” all the nominees to be a member of the Board or you may “Withhold” your vote for any one or more nominees you specify. For Proposal 2, Proposal 3, Proposal 4, and Proposal 5 you may vote “For” or “Against” or abstain from voting. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote at the Annual Meeting by following the procedures set forth below, vote by proxy using the enclosed proxy card, vote by proxy over the telephone or vote by proxy through the Internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

| • | To vote at the Annual Meeting we will give you a ballot or such other procedures described by us. |

| • | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

| • | To vote by proxy over the telephone or by internet, follow the instructions on the proxy card you received. If voting by telephone or internet, your vote must be received by 11:59 p.m. EST on December 7, 2022 to be counted. |

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or through the Internet as instructed by your broker or bank. To vote at the Annual Meeting, you must obtain a legal proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a legal proxy.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned at the close of business on October 14, 2022.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the Internet or in person at the Annual Meeting, your shares will not be voted, and your shares will count as “not present” for purposes of the establishment of a quorum for the meeting.

3

Table of Contents

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the proposal is considered to be a “routine” matter.

See below under “What are broker non-votes?” for more information. At the Annual Meeting, only Proposal 5 is considered a routine matter. Accordingly, without your instructions, your broker or nominee may not vote your shares on Proposal 1 or Proposal 2 or Proposal 3 or Proposal 4, but may vote your shares on Proposal 5.

What if I return a signed proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of the seven nominees to our Board, “For” the approval of the amendment to the Global Crossing Airlines Group Inc. Incentive Stock Option Plan, “For” the approval of the amendment to the Global Crossing Airlines Group Inc. Restricted Share Unit Plan, “For” the approval of the amendment to the Global Crossing Airlines Group Inc. Performance Share Unit Plan, and “For” the ratification of the appointment of Rosenberg Rich Baker Berman P.A. as our independent registered public accounting firm for the fiscal year ending December 31, 2022. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his/her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the proxy card in the proxy materials to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| • | You may submit another properly completed proxy card with a later date. |

| • | You may grant a subsequent proxy by telephone or through the Internet. |

| • | You may send a timely written notice that you are revoking your proxy to our General Counsel at Bldg. 5A, Miami Int’l Airport, 4th floor, 4200 NW 36th Street, Miami, FL 33166. |

| • | You may attend the Annual Meeting and vote there. Simply attending the meeting will not, by itself, revoke your proxy. Your most recent proxy card or telephone or Internet proxy is the one that is counted. |

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank for changing your vote.

4

Table of Contents

When are stockholder proposals and director nominations due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 30, 2022 to our General Counsel at Bldg. 5A, Miami International Airport, 4th floor, 4200 NW 36th Street, Miami, FL 33166. All proposals must comply with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which lists the requirements for the inclusion of stockholder proposals in company-sponsored proxy materials.

If you wish to submit a proposal to be acted on at next year’s annual meeting but not included in next year’s proxy materials, or if you wish to nominate a director, you must provide written notice as required by our bylaws no earlier than the opening of business on August 10, 2023 and no later than the close of business on September 9, 2023 to our General Counsel at Bldg. 5A, Miami International Airport, 4th floor, 4200 NW 36th Street, Miami, FL 33166. If next year’s annual meeting is called for a date that is before November 9, 2023 or February 16, 2023, written notice of such proposal or nomination must be provided to our General Counsel at Bldg. 5A, Miami International Airport, 4th floor, 4200 NW 36th Street, Miami, FL 33166 no earlier than the opening of business on the 120th day before the date of next year’s annual meeting and no later than the later of (a) the close of business on the 90th day before next year’s annual meeting or (b) the close of business on the 10th day following the day on which public announcement of the date of next year’s annual meeting is first made by the Company.

You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, (i) for the election of directors (Proposal 1), votes “For,” “Withhold” and broker non-votes, (ii) for the approval of the amendment to increase the number of shares available under the Global Crossing Airlines Group Inc. Incentive Stock Option Plan (Proposal 2), votes “For,” “Against,” abstentions and, if applicable, broker non-votes, (iii) for the approval of the amendment to increase the number of shares available under the Global Crossing Airlines Group Inc. Restricted Share Unit Plan (Proposal 3), votes “For,” “Against,” abstentions and, if applicable, broker non-votes, (iv) for the approval of the amendment to increase the number of shares available under the Global Crossing Airlines Group Inc. Performance Share Unit Plan (Proposal 4), votes “For,” “Against,” abstentions and, if applicable, broker non-votes, and (v) for the ratification of the appointment of our independent registered public accounting firm (Proposal 5), votes “For,” “Against,” abstentions and, if applicable, broker non-votes. Broker non-votes, if applicable, will have no effect on the outcome of Proposal 1. Abstentions and broker non-votes, if applicable, will not be counted towards the vote total for Proposal 2, Proposal 3, Proposal 4 and Proposal 5, and thus will have no effect on the outcome of such proposals.

What are “broker non-votes”?

Your broker, bank, or nominee cannot vote your shares with respect to non-discretionary matters unless you provide instructions on how to vote in accordance with the information and procedures provided to you by your broker, bank or nominee. Proposal 1, Proposal 2, Proposal 3 and Proposal 4 will be considered non-discretionary and therefore your broker, bank or nominee cannot vote your shares without your instruction. If you do not provide instructions with your proxy, your bank, broker, or other nominee may deliver a proxy card expressly indicating that it is NOT voting your shares; this indication that a bank, broker, or nominee is not voting your shares is referred to as a “broker non-vote.” Because banks, brokers and nominees are permitted to vote uninstructed shares on Proposal 5, broker non-votes will be counted for the purpose of determining the existence of a quorum at the Annual Meeting, but will not count for purposes of determining the number of votes cast on Proposal 1, Proposal 2, Proposal 3 or Proposal 4. You should instruct your broker to vote your shares in accordance with directions you provide.

How many votes are needed to approve each proposal?

| • | For Proposal 1, directors are elected by a plurality of the votes cast, which means that the seven nominees for director receiving the most votes cast (from the holders of shares present in person or represented by proxy and entitled to vote on the election of directors) will be elected as members of the Board. Only votes “For” will affect the outcome. |

5

Table of Contents

| • | To be approved, Proposal 2, the approval of an amendment to the Global Crossing Airlines Group Inc. Incentive Stock Option Plan, must receive “For” votes from the holders of a majority of the votes cast. Abstentions and broker non-votes will have no effect on the outcome of this proposal. |

| • | To be approved, Proposal 3, the approval of an amendment to the Global Crossing Airlines Group Inc. Restricted Share Unit Plan, must receive “For” votes from the holders of a majority of the votes cast. Abstentions and broker non-votes will have no effect on the outcome of this proposal. |

| • | To be approved, Proposal 4, the approval of an amendment to the Global Crossing Airlines Group Inc. Performance Share Unit Plan, must receive “For” votes from the holders of a majority of the votes cast. Abstentions and broker non-votes will have no effect on the outcome of this proposal. |

| • | To be approved, Proposal 5, the ratification of the appointment of Rosenberg Rich Baker Berman P.A. as our independent registered public accounting firm for the fiscal year ending December 31, 2022, must receive “For” votes from the holders of a majority of the votes cast. Abstentions will have no effect on the outcome of this proposal. |

What is the quorum requirement?

Holders of one-third of the voting power of the Company’s issued and outstanding capital stock entitled to vote at the Annual Meeting, present in person or represented by proxy, constitute a quorum. In the absence of a quorum, the chairman of the Annual Meeting will have the power to adjourn the Annual Meeting.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results may be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on Form 8-K (a “Form 8-K”) that we expect to file with the U.S. Securities and Exchange Commission (the “SEC”) within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K, within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What proxy materials are available on the Internet?

The Notice of Annual Meeting and Proxy Statement and 2021 Annual Report are available on our website at www.globalairlinesgroup.com under “Investor Relations — SEC Filings.”

6

Table of Contents

ELECTION OF DIRECTORS

Our Board currently consist of ten directors as a single class. The term of each directorship is one year, so that one class of directors is elected each year. All directors are elected for a one-year term and until their successors are elected and qualified, or, if sooner, until the director’s death, resignation or removal.

At the Annual Meeting, our stockholders will vote to elect the seven directors, Edward Wegel, Ryan Goepel, Alan Bird, T. Allan McArtor, John Quelch, Deborah Robinson and Cordia Harrington. The directors will have a term expiring at the 2023 Annual Meeting of Stockholders. Information concerning each nominee for director is set forth below under “Directors and Executive Officers.”

Directors are elected by a plurality of the votes cast. The seven nominees for director receiving the most votes cast “FOR” such director (from the holders of shares present or represented by proxy and entitled to vote on the election of directors) will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the seven nominees named below. Broker non-votes, if applicable, will have no effect on the outcome of this proposal. If any nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of a substitute nominee proposed by us. Each person nominated for election has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve.

The Board has adopted a policy (“Majority Voting Policy”) stipulating that if the shares voted in favor of the election of a director nominee at a meeting of the Company’s stockholders represent less than a majority of the total shares voted for and voted as withheld at the meeting, the director nominee will submit his resignation promptly after such meeting to the Corporate Governance and Nominating Committee’s consideration. After reviewing the matter, the Corporate Governance and Nominating Committee will make a recommendation to the Board, and the Board’s subsequent decision to accept or reject the resignation offer will be publicly disclosed.

With the exception of exceptional circumstances that would warrant the continued service of the subject director on the Board, the Compensation and Corporate Governance Committee shall be expected to accept and recommend acceptance of the resignation by the Board of Directors. Within 90 days following the applicable meeting of the Company’s stockholders, the Board shall make its decision, on the Corporate Governance and Nominating Committee’s recommendation and in making its decision the Board shall be required to accept the resignation of the subject director nominee, absent exceptional circumstances. The director nominee will not participate in any Corporate Governance and Nominating Committee or Board deliberations regarding the resignation offer. The Majority Voting Policy does not apply in circumstances involving contested director elections.

OUR BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF EDWARD WEGEL, RYAN GOEPEL, ALAN BIRD, T. ALLAN MCARTOR, JOHN QUELCH, DEBORAH ROBINSON AND CORDIA HARRINGTON AS MEMBERS OF OUR BOARD.

DIRECTORS AND EXECUTIVE OFFICERS

DIRECTOR NOMINEES

For Terms Expiring at the Next Annual Meeting of Stockholders

Edward J. Wegel, 64, Director since June 2020

Edward J. Wegel serves as our Chair and Chief Executive Officer. Mr. Wegel is a seasoned airline executive with 35 years of broad experience in financing, operations, and distribution. Mr. Wegel has served as a board member of public and private airlines, including Atlantic Coast Airlines, BWIA International Airlines and Eastern Airlines. Mr. Wegel is an experienced deal-maker who has led initial public offerings, privatizations, major aircraft orders, and alliance negotiations. He has extensive company restructuring experience. He served as the President and CEO of Eastern Air Lines Group from April 2008 through December 2016, Founder and President of Avi8 air capital, an aviation consulting practice from January 2017 through today before his current role of Chairman and CEO of the Company in September 2019.

7

Table of Contents

Other accomplishments include: drafted the first business plan for JetBlue; focused on the then relatively new Airbus A320s and chose JFK as its base of operations; created Republic Airways with an industry-leading order for 80 EMB 145 aircraft in 1998; oversaw the acquisition of Chautauqua Airlines (where he served as Chief Executive Officer); and conceived and led the privatization and financing of BWIA International Airways, Trinidad, operating 20 L1011 and MD-80 aircraft and serving as National Airline for Trinidad, Guyana, St. Lucia, and Barbados, among and other island nations. As Chief Executive Officer, in 1995, Mr. Wegel achieved BWIA’s first ever profit in 57 years (BWIA International Airways now operates as Caribbean Airlines); co-founded Atlantic Coast Airlines/United Express in 1990, one of the first United Airlines regional airlines. Mr. Wegel served as head of finance and as a board member for Atlantic Coast Airlines, leading over $100 million in financing for operations and aircraft finance. Mr. Wegel served as a commissioned officer in the U.S. Army and received an MBA from the University of Northern Colorado after graduating from the United States Military Academy at West Point.

We believe that Mr. Wegel’s qualifications to serve on our Board include his more than 35 years’ experience in aircraft financing, operations and distributions; and his experience serving as an executive officer or director on the boards of directors of other publicly-traded and privately-held aviation companies.

Ryan Goepel, 48, Director since June 2020

Ryan Goepel serves as our Chief Financial Officer. Mr. Goepel is the Chief Financial Officer of Avi8. He is also the Chief Financial Officer of Global Crossing Airlines, Inc. since February 2020, and was elected to the board of directors of the Company in June 2020. Mr. Goepel is a seasoned finance and operations executive with over 20 years of experience, most recently serving as Chief Financial Officer for Flair Airlines Canada from August 2018 to November 2019 to transition from a Boeing 737 charter operator to a profitable, low-cost scheduled service carrier. Profitability was achieved at Flair through the modernization of the fleet, optimization of the flight schedule to focus and grow profitable routes, revamping key personnel, and the installation of a data driven, cost conscious operating mentality while preserving best-in-class safety, reliability and on time performance. Prior to Flair, Mr. Goepel served as Chief Financial Officer for Viking Exploration, an international oil and gas company, from December 2016 to August 2018, where he raised seed capital from a broad group of investors. Prior to Viking Exploration, Mr. Goepel served as Chief Financial Officer of CC Reservoirs, a Geoscience software company, from April 2015 to December 2016, where he was responsible for the accounting, compliance, treasury, tax, and strategic planning functions and was instrumental in establishing new offices and entities in South America, the Middle East and the Far East. Prior to CC Reservoirs, Mr. Goepel served as Chief Financial Officer of ZEiTECS, an artificial lift technology company, from December 2010 to April 2015, where he oversaw its sale to Schlumberger; KBR Services Business Unit Finance Leader overseeing 12,000 employees growing revenue from $300 million to $3 billion. In addition, Mr. Goepel served as the Director of Global Finance during the Burger King turnaround that culminated with its first ever public debt raise and successful initial public offering. He is a Certified Management Accountant, with an MBA from Texas A&M University and Bachelor of Arts from the University of British Columbia.

We believe that Mr. Goepel’s qualifications to serve on our Board include his extensive experience as an executive with major airlines, his accounting expertise and his knowledge and understanding of the aviation industry.

Alan Bird, 60, Director since June 2020

Alan Bird was elected to the Board in June 2020. Mr. Bird has over 25 years of experience in the airline finance industry, holding senior financial and advisory positions, including executive positions with VivaAerobus, Tiger Airways, and British Midland. From 2017 to the present, Mr. Bird has served as an advisor to Irelandia Aviation with respect to Viva Air, Viva Columbia and Viva Peru. From 2012 to 2017 he was the Chief Financial Officer for VivaAerobus where he helped build one of the most efficient airlines in the world. Previously, Mr. Bird was the Chief Financial Officer at Tiger Airways, a low-cost airline in Asia. Prior to his role with Tiger Airways, he was the Finance Director at British Midland Airlines for over a decade. Mr. Bird is also a Project Advisor to Irelandia Aviation, a low-cost carrier. Mr. Bird is a Chartered Accountant and holds an honors degree in Mathematical Economics from Birmingham University.

8

Table of Contents

We believe that Ms. Bird’s qualifications to serve on our Board include his extensive experience as an executive with major airlines, his accounting expertise and his knowledge and understanding of the aviation industry.

T. Allan McArtor, 80, Director since January 2021

Allan McArtor was elected to the GlobalX board in January 2021 and serves as Vice Chairman. He served as Chairman of Airbus Americas, Inc. from 2001 to 2018, retiring as Chairman Emeritus. Before joining Airbus he was founder chairman and CEO of Legend Airlines, a regional airline based at Dallas Love Field, Texas. He was appointed by President Ronald Reagan and served as the FAA Administrator from 1987 to 1989.

Mr. McArtor served on the senior management team of Federal Express from 1979 to 1987 and 1989 to 1994, first as Senior Vice President Telecommunications during the development of FedEx’s extensive satellite-based digital network and subsequently as Senior Vice President Air Operations for FedEx, where he oversaw all of the airline operations including maintenance, strategic planning. and flight operations, as well as aircraft fleet acquisition. Mr. McArtor was an active duty Air Force officer from 1964 to 1974 during which he served as a combat fighter pilot, an Associate Professor of Engineering Mechanics at the Air Force Academy, and a pilot with the U.S. Air Force’s Thunderbirds Aerial Demonstration Team. He is a 1964 graduate of the U.S. Air Force Academy (BSE) where he was Cadet Wing Commander and he holds a master’s degree MSE from Arizona State University.

We believe that Ms. McArtor’s qualifications to serve on our Board include his extensive experience as an executive with a major airline manufacturer, his regulatory expertise and his knowledge and understanding of the aviation industry.

John Quelch, 69, Director since January 2021

John Quelch was elected to the Board in January 2021. Mr. Quelch has served as the dean and senior associate dean at three internationally-recognized business schools. He is currently Dean and Professor of the University of Miami Business School since July 2017. Prior to joining the University of Miami, Mr. Quelch was a Professor of Business Administration at Harvard Business School. He also held a joint appointment as professor of health policy and management at the Harvard T.H. Chan School of Public Health. Prior to his most recent time at Harvard, Mr. Quelch was dean, vice president and distinguished professor of international management of the China Europe International Business School (CEIBS) from 2011 until 2013. From 1998 to 2001, Mr. Quelch served as dean of the London Business School, where he helped transform the school into a globally competitive institution, and launched seed capital funds to invest in student and alumni start-ups. He served as senior associate dean of Harvard Business School from 2001 to 2010.

Mr. Quelch is the author, co-author or editor of 25 books, as well as numerous business case studies on leading international organizations. Mr. Quelch has served on numerous corporate, non-profit and public agency boards, including a nine-year term as chairman of the Massachusetts Port Authority and service on the corporate boards of directors including easyJet and Reebok. He is a member of both the Trilateral Commission and the Council on Foreign Relations. Mr. Quelch earned his B.A. and an M.A. from Exeter College, Oxford University; an MBA from the Wharton School of the University of Pennsylvania; an SM from the Harvard T.H. Chan School of Public Health; and a DBA in business from Harvard Business School. He was appointed a Commander of the Order of the British Empire (CSE) in 2011 and, in 2017, was elected a member of the American Academy of Arts and Sciences.

We believe that Mr. Quelch’s qualifications to serve on our Board include his academic tenure at leading business schools; and his experience serving as a director on the boards of directors of other publicly-traded and privately held companies in the retail and transportation industries.

Deborah Robinson, 58, Director since June 2020

Deborah Robinson was elected to the Board in June 2020. Ms. Robinson founded Bay Street HR in 2001, an outsourced human resources service provider to start-ups and mid-sized companies and remains on as Managing Partner. Prior to founding Bay Street HR, Ms. Robinson was Executive Director at CIBC World Markets from November 1995 until December 2000 where she oversaw human resources for Global Investment Banking. She also

9

Table of Contents

held senior HR positions at Fidelity Investments and American Express Travel in Boston and New York City. Ms. Robinson has been a Director and Chair of Park Lawn Corporation (PLC-tsx) since June 2019 and a Director of Timbercreek Financial (TF-tsx) since November 2021. Ms. Robinson also serves on the board of Best Buddies Canada, a global charitable organization dedicated to supporting individuals with intellectual disabilities. She is a graduate of the University of Toronto, Rotman School Directors Education Program (2010) and holds an ICD designation.

We believe that Ms. Robinson qualifications to serve on our Board include her extensive human resources experience; and her experience serving as a director on the boards of directors of other publicly-traded and privately held companies.

Cordia Harrington, 68, Director since June 2021

Cordia Harrington has served on our Board since June 2021. Since 1996, Ms. Harrington has served as Chief Executive Officer and Founder of Crown Bakeries, a manufacturer in the wholesale baking, frozen dough and storage industries. From 1990 to 1998, Ms. Harrington owned and operated three McDonald’s franchises. From 2007 to 2013, she served on the Board of Directors of the Federal Reserve Bank of Atlanta, Nashville Branch. Ms. Harrington served on the Emergent Cold Board of Directors and the Tennessee Education Lottery Board. She is a member of the Chief Executives Organization Board of Directors (Past President), American Bakers Association Board of Directors (President), the Belmont University Board of Trustees, and the Women Corporate Directors. She holds a BSHE from the University of Arkansas at Fayetteville and Doctorate from the University of Arkansas.

We believe that Ms. Harrington’s qualifications to serve on our Board include her over 26 years as a senior executive; and her experience serving as a director on the boards of directors of other regulatory agencies and privately-held companies.

Our current executive officers are as follows:

| Name |

Age |

Title | ||

| Edward Wegel | 64 | Chief Executive Officer and Chair | ||

| Ryan Goepel | 48 | Executive Vice President and Chief Financial Officer | ||

| Juan Nunez | 51 | Chief Operating Officer, VP Flight Operations and Director of Operations | ||

| George Hambrick | 75 | Chief Safety Officer | ||

| Indyara Andion | 47 | Vice President & General Counsel | ||

| Sheila Paine | 68 | Corporate Secretary | ||

Mr. Wegel’s and Mr. Goepel’s biographical information is set forth above. The following is biographical information for our executive officers.

Juan Nunez, 51, Chief Operating Officer, VP Flight Operations, and Director of Operations

Mr. Nunez has over 25 years of airline experience and has served as Chief Pilot and assistant Director of Operations for Eastern Air Lines and a Chief Pilot for 21 Air. He has logged over 3,500 Pilot in Command (“PIC”) hours under Part 121 and 12,000+ hours as a Pilot, Check Pilot, and Instructor. He is type rated on Boeing 737/757/767/747 aircraft and has operated charters worldwide under ETOPS (Atlantic & Pacific) and CAT II-III operating conditions.

10

Table of Contents

George Hambrick, 75, Chief Safety Officer

Mr. Hambrick has over 53 years of experience in military and commercial aviation as an Army aviator, major airline Captain flying 777s, and as a senior FAA Inspector. Mr. Hambrick has over 4,500 hours flying rotary wing aircraft and over 12,000 flying fixed wing commercial jet aircraft. He has flown off-shore helicopter operations and retired after twenty years in the United States Army and Air Force. He then joined American Airlines, where he flew multiple aircraft types including the 777, and after retirement he worked for the Federal Aviation Administration (FAA) as both a Senior Aviation Analyst and an Aviation Safety Inspector and Manager. Mr. Hambrick is an industry wide recognized aircraft safety expert with deep knowledge of the Safety Management System (SMS), OSHA, ICAO, IATA and FAA. He has worked with domestic and foreign governments and operators in many safety-related fields. Mr. Hambrick graduated from Louisiana Tech University with a BS in Aviation Technology and from the US Air Command and Staff College. He also attended the University of Southern California (USC) Flight Safety Degree Program.

Indyara Andion, 47, Vice President & General Counsel

Ms. Andion is a seasoned attorney with more than 15 years of experience in the aviation industry and supporting multinational companies with a variety of legal matters in the United States and abroad. She joins GlobalX from Amerijet International, Inc., an all-cargo U.S. air carrier, where she most recently held the position of Corporate Secretary and Assistant General Counsel. Prior to Amerijet, Ms. Andion was a Partner at Piquet Law Firm P.A., a Miami-based boutique law firm, and served as Corporate Secretary and Senior Attorney for Embraer, one of the largest aircraft manufacturers in the world. Indyara graduated from the Florida International University College of Law and of the Florida International University College of Business.

Sheila Paine, 68, Corporate Secretary

For the past 13 years, Ms. Paine has acted as Corporate Secretary for a number of public companies trading on various stock exchanges. Ms. Paine has over 30 years’ experience as a senior paralegal/legal assistant, specializing in corporate, securities and regulatory matters. Ms. Paine was the long-time corporate secretary of Canada Jetlines before its reorganization as GlobalX. Ms. Paine is also employed by King & Bay West Management Corp. in British Columbia.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Pursuant to NEO Exchange listing standards, a majority of the members of our Board must qualify as “independent,” as affirmatively determined by our Board. Consistent with this requirement, based on the review and recommendation of our Nominating and Corporate Governance Committee, our Board reviewed the relevant identified transactions or relationships between each of our directors, or any of their family members, and us, our senior management and our independent registered public accounting firm, and has affirmatively determined that each of Messrs. Bird, McArtor, Quelch, Ross and Shuster and Mmes. Robinson and Harrington meets the standards of independence under the applicable NEO Exchange listing standards. In making this determination, our Board found all of our directors (other than Mr. Wegel, our Chief Executive Officer, Mr. Goepel, our Chief Financial Officer, and Mr. Surintas, due to the Company’s contractual relationships with Smartlynx) to be free of any relationship that would impair his or her individual exercise of independent judgment with regard to us. Our Board has also determined that each member of its Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee is independent under NEO Exchange rules.

Our Board believes it is important to maintain flexibility as to the Board’s leadership structure, but supports maintaining a non-management director in a leadership role at all times, whether as Vice Chairman or Lead Director. Under our current structure, Mr. Wegel currently serves as the Chair of the Company’s Board. The Chair is not independent. The Chair’s responsibilities include, without limitation, ensuring that the Board works together as a cohesive team with open communication and works to ensure that a process is in place by which the effectiveness of the Board, its committees and its individual directors can be evaluated on a regular basis. The Chair also acts as the primary spokesperson for the Company’s Board, ensuring that management is aware of concerns of the Company’s Board, stockholders, other stakeholders and the public and, in addition, ensures that management strategies, plans and performance are appropriately represented to the Board.

11

Table of Contents

The Board of Directors considers that management is effectively supervised by the independent directors on an informal basis, as the independent directors are actively and regularly involved in reviewing the operations of the Company and have regular and full access to management. The independent directors of the Company meet separately in “in-camera” sessions at Board meetings when considered appropriate. The independent directors are also able to meet at any time without any members of management, including the non-independent directors, being present. In addition, due to the fact the Chair is not independent, the Company has appointed T. Allan McArtor as Vice Chair of the Board. The Vice Chair acts as Chair when the Chair is not present at meetings and is responsible for ensuring the Board functions independently of management.

Role of the Board in Risk Oversight

One of the Board’s key functions is informed oversight of our risk management process. The Board directly oversees our risk management function as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, while our Board is responsible for monitoring and assessing strategic risk exposure, our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Our Audit Committee also monitors compliance with legal and regulatory requirements. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board. The Chair has the responsibility of coordinating between the Board and management with regard to the determination and implementation of responses to any problematic risk management issues.

Meetings of the Board of Directors

Our business, property and affairs are managed under the supervision of our Board. Members of our Board are kept informed of our business through discussions with our Chair and Chief Executive Officer and other officers and employees, by reviewing materials provided to them during visits to our offices and by participating in meetings of the Board and its committees.

The Board held a total of 6 meetings in 2021. The standing committees of the Board are the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, and the Safety Committee. The charter for each of our standing Board committees is posted on our website at www.globalairlinesgroup.com under “Investor Relations — Charters & Policies”. All directors attended 75% or more of the combined total number of meetings of the Board and each of the Board committees on which they served during 2021.

The following table provides membership and meeting information for 2021 for each of our Board committees. In 2021 the committees conducted their business by way of written consent resolution:

12

Table of Contents

| Name |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

Safety Committee |

||||||||||||

| Edward Wegel |

X | |||||||||||||||

| Ryan Goepel |

||||||||||||||||

| Joseph Dagrosa, Jr. (1) |

X | X | ||||||||||||||

| Alan Bird |

X | * | ||||||||||||||

| T. Allan McArtor |

X | X | * | |||||||||||||

| John Quelch |

X | |||||||||||||||

| David Ross |

X | |||||||||||||||

| Deborah Robinson |

X | * | ||||||||||||||

| Cordia Harrington |

X | X | * | |||||||||||||

| William Shuster |

||||||||||||||||

| Zygimantas Surintas |

X | |||||||||||||||

| Total meetings by committee in 2021(2) |

0 | 0 | 0 | 0 | ||||||||||||

| * | Committee Chair |

| (1) | Mr. Dagrosa Jr. resigned from the Board effective March 31, 2022. |

| (2) | In 2021 committee actions were conducted by written consent resolution. |

Below is a description of each committee of our Board.

Each member of the Audit Committee is financially literate and our Board has determined that Alan Bird qualifies as an “audit committee financial expert” as defined in applicable SEC rules because she meets the requirement for past employment experience in finance or accounting, requisite professional certification in accounting or comparable experience. The responsibilities of our Audit Committee include, among other things:

| • | reviewing and discussing with management and the independent auditor the annual audited financial statements; |

| • | reviewing analyses prepared by management or the independent auditor concerning significant financial reporting issues and judgments made in connection with the preparation of our financial statements; |

| • | discussing with management major risk assessment and risk management policies; |

| • | monitoring the independence of the independent auditor; |

| • | assuring the regular rotation of the lead audit partner having primary responsibility for the audit and the audit partner responsible for reviewing the audit required by law; |

| • | reviewing and approving all related party transactions; |

13

Table of Contents

| • | pre-approving all audit services and permitted non-audit services to be performed by our independent auditor, including the fees and terms of the services to be performed; |

| • | appointing or replacing (subject to stockholder ratification, if deemed advisable by the Board) the independent auditor; and |

| • | establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters. |

The Compensation Committee is responsible for overseeing matters relating to compensation of our Chief Executive Officer and other executive officers and employees, including the administration of incentive-based and equity-based compensation plans. The functions of our Compensation Committee include, among other things:

| • | reviewing and advising the Board regarding our compensation philosophies and policies; |

| • | establishing criteria for the Board’s annual performance evaluation of the Chief Executive Officer and reviewing and making recommendations to the Board regarding all compensation of our Chief Executive Officer; |

| • | approving grants of options and other equity awards to our Chief Executive Officer and all other executive officers, directors and all other eligible individuals; |

| • | making recommendations to the Board regarding director compensation; and |

| • | monitoring and assessing risks associated with our compensation policies. |

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for overseeing the selection of persons to be nominated to serve on our Board and to assist the Board in developing and ensuring compliance with the Company’s foundational and corporate governance documents. The functions of our Nominating and Corporate Governance Committee include, among other things:

| • | identifying and recommending to the Board individuals qualified to serve as directors of the Company; |

| • | advising the Board with respect to the Board composition, procedures and committees, including establishing criteria for annual performance evaluations of the Board committees by the Board; |

| • | advising the Board with respect to proposed changes to the Company’s certificate of incorporation, bylaws and corporate governance policies; |

| • | reviewing the Company’s Code of Ethics; |

| • | advising the Board with respect to communications with the Company’s stockholders; and |

| • | evaluating any requests for waivers from the Company’s Code of Ethics and considering questions of conflicts of interest of Board members and the Company’s senior executives. |

The Safety Committee is responsible for oversight of: the Company’s policies, positioning and practices concerning safety (including workplace safety and security). The Safety Committee assess risks to our airline operations to enhance the safety of our employees, our customers and our aircraft.

14

Table of Contents

The Board has delegated to the Nominating and Corporate Governance Committee the responsibility of identifying, screening and recommending candidates to the Board. Potential candidates are interviewed by the Chair and Chief Executive Officer and the Chair of the Nominating and Corporate Governance Committee prior to their nomination, and may be interviewed by other directors and members of senior management. The Nominating and Corporate Governance Committee then meets to consider and approve the final candidates, and either makes its recommendation to the Board to fill a vacancy, add an additional member, or recommend a slate of candidates to the Board for nomination for election to the Board. The selection process for candidates is intended to be flexible, and the Nominating and Corporate Governance Committee, in the exercise of its discretion, may deviate from the selection process when particular circumstances warrant a different approach.

The Nominating and Corporate Governance Committee will consider candidates proposed by stockholders to be potential director nominees. Stockholders wishing to nominate a candidate for consideration by the Nominating and Corporate Governance Committee as a director nominee should provide the name of any recommended candidate, together with a brief biographical sketch, a document indicating the candidate’s willingness to serve, if elected, and evidence of the nominating stockholder’s ownership of Company stock to the attention of the General Counsel of the Company at Bldg. 5A, Miami Int’l Airport, 4th floor, 4200 NW 36th Street, Miami, FL 33166, and otherwise follow the Company’s nominating process summarized above under “Questions and Answers about these Proxy Materials and Voting — When are stockholder proposals and director nominations due for next year’s annual meeting?” and more fully described in the Company’s bylaws. The Nominating and Corporate Governance Committee’s policy is to evaluate director nominees proposed by stockholders in the same manner that all other director nominees are evaluated. The general criteria the Nominating and Corporate Governance Committee considers important in evaluating director candidates are: (i) senior-level management and decision-making experience; (ii) a reputation for integrity and abiding by exemplary standards of business and professional conduct; (iii) ability to devote time and attention necessary to fulfill the duties and responsibilities of a director; (iv) a record of accomplishment in their respective fields, with leadership experience in a corporation or other complex organization, including government, educational and military institutions; (v) independence and the ability to represent all of the Company’s stockholders; (vi) compliance with legal and NEO Exchange listing requirements; (vii) sound business judgment; (viii) candor; (ix) judgment, skills, geography and other measures to ensure that the Board as a whole reflects a range of viewpoints, backgrounds, skills, experience and expertise; and (x) the needs of the Board among others. The Nominating and Corporate Governance Committee seeks to have a Board that reflects diversity in background, education, business experience, gender, race, ethnicity, culture, skills, business relationships and associations and other factors that will contribute to the Board’s governance of the Company, and reviews its effectiveness in achieving such diversity when assessing the composition of the Board.

The Company may, in the future, pay a third-party a fee to assist it in the process of identifying and/or evaluating director candidates.

Securityholder Communications with the Board

Securityholders who wish to communicate with the Board or an individual director may send a written communication to the Board or such director addressed to our General Counsel at Bldg. 5A, Miami Int’l Airport, 4th floor, 4200 NW 36th Street, Miami, FL 33166. Each communication must set forth:

| • | the name and address of the securityholder on whose behalf the communication is sent; and |

| • | the number of our shares that are owned beneficially by such securityholder as of the date of the communication. |

Each communication will be reviewed by our General Counsel to determine whether it is appropriate for presentation to the Board or such director. Examples of inappropriate communications include advertisements, solicitations or hostile communications. Communications determined by our General Counsel to be appropriate for presentation to the Board or such director will be submitted to the Board Chair, the Board or such director on a periodic basis.

15

Table of Contents

We have adopted a code of ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. The code of conduct and ethics is available on our website at www.globalairlinesgroup.com under “Investor Relations — Corporate Governance — Charters & Policies.”

We have adopted a compensation program for non-employee directors. The non-employee director compensation program is intended to fairly compensate each of our non-employee directors with cash and equity compensation for the time and effort necessary to serve as a member of our Board.

Cash compensation. Our non-employee directors were entitled to receive annual cash compensation of $24,000 in 2021 for their services on the Board, provided that in 2021 only certain directors were paid fees. All payments are made in arrears. If requested, all director expenses incurred in attending the Board of Directors or committee meetings are reimbursed by the Company. Messrs. Wegel and Goepel, the Company’s Chief Executive Officer and Chief Financial Officer, do not receive compensation for serving as a member of the Board of Directors.

Equity compensation. Our non-employee directors are eligible to receive equity-based awards as compensation for their services as directors. Historically, our non-employee directors were typically granted 50,000 stock options upon their initial election or appointment to the Board.

The table below provides summary information concerning compensation paid or accrued by us to or on behalf of our non-executive directors for services rendered for the fiscal year ended December 31, 2021.

| Name |

Fees Earned or Paid in Cash(1) ($) |

Stock Awards(2) ($) |

All Other Compensation ($) |

Total ($) | ||||||||||||

| Joseph Dagrosa, Jr. (3) |

— | 21,047 | — | 21,047 | ||||||||||||

| Alan Bird (4) |

15,000 | 21,047 | — | 36,047 | ||||||||||||

| T. Allan McArtor (5) |

— | 48,392 | — | 48,392 | ||||||||||||

| John Quelch (6) |

— | 31,509 | — | 31,509 | ||||||||||||

| David Ross |

— | — | — | — | ||||||||||||

| Deborah Robinson (7) |

— | 21,047 | — | 21,047 | ||||||||||||

| Cordia Harrington |

— | — | — | — | ||||||||||||

| Zygimantas Surintas(8) |

— | 16,937 | — | 16,937 | ||||||||||||

| William Shuster (9) |

16,000 | 14,311 | — | 30,311 | ||||||||||||

| (1) | $6,000 per quarter |

| (2) | The amounts reported in the “Stock Awards” column represent grant date fair value of the restricted stock granted to the NEOs during the fiscal year ended December 31, 2021 as computed in accordance with FASB Accounting Standards Codification Topic 718. Note that the amounts reported in this column reflect the accounting cost for these stock options and do not correspond to the actual economic value that may be received by the NEOs from the restricted stock. |

| (3) | Mr. Dagrosa Jr. resigned from the Board on March 31, 2022. Mr. Dagrosa, Jr. was granted: (i) 35,000 RSUs granted on 2021-06-11 with closing price of underlying security on date of grant of $1.991 (Cdn$2.41) and vesting 50% on each 2nd and 3rd anniversaries of the grant; (ii) 15,000 RSUs granted on 2020-10-28 with closing price of underlying security on date of grant of $0.668 (Cdn$0.88) and vesting 50% on each 2nd and 3rd anniversaries of the grant; and (iii) 50,000 stock options on 2020-06-23 with an exercise price of $0.25 expiring 2025-06-23 with one-fourth vesting every 6 months over a 24 month period. |

16

Table of Contents

| (4) | Mr. Bird was granted: (i) 35,000 RSUs granted on 2021-06-11 with closing price of underlying security on date of grant of $1.991 (Cdn$2.41) and vesting 50% on each 2nd and 3rd anniversaries of the grant; (ii) 15,000 RSUs granted on 2020-10-28 with closing price of underlying security on date of grant of $0.668 (Cdn$0.88) and vesting 50% on each 2nd and 3rd anniversaries of the grant; and (iii) 50,000 stock options on 2020-06-23 with an exercise price of $0.25 expiring 2025-06-23 with one-fourth vesting every 6 months over a 24 month period. |

| (5) | Mr. McArtor was granted 100,000 RSUs granted on 2021-06-11 with closing price of underlying security on date of grant of $1.991 (Cdn$2.41) and vesting 50% on each 2nd and 3rd anniversaries of the grant. |

| (6) | Mr. Quelch was granted: (i) 50,000 RSUs granted on 2021-06-11 with closing price of underlying security on date of grant of $1.991 (Cdn$2.41) and vesting 50% on each 2nd and 3rd anniversaries of the grant; and (ii) 50,000 stock options on 2020-09-23 with an exercise price of Cdn$0.78 expiring 2025-09-23 with one-fourth vesting every 6 months over a 24 month period. |

| (7) | Ms. Robinson was granted: (i) 35,000 RSUs granted on 2021-06-11 with closing price of underlying security on date of grant of $1.991 (Cdn$2.41) and vesting 50% on each 2nd and 3rd anniversaries of the grant; (ii) 15,000 RSUs granted on 2020-10-28 with closing price of underlying security on date of grant of $0.668 (Cdn$0.88) and vesting 50% on each 2nd and 3rd anniversaries of the grant; and (iii) 50,000 stock options on 2020-06-23 with an exercise price of $0.25 expiring 2025-06-23 with one-fourth vesting every 6 months over a 24 month period. |

| (8) | Mr. Surintas was granted: (i) 35,000 RSUs granted on 2021-06-11 with closing price of underlying security on date of grant of $1.991 (Cdn$2.41) and vesting 50% on each 2nd and 3rd anniversaries of the grant; and (ii) 15,000 RSUs granted on 2020-10-28 with closing price of underlying security on date of grant of $0.668 (Cdn$0.88) and vesting 50% on each 2nd and 3rd anniversaries of the grant. |

| (9) | Mr. Shuster was granted 100,000 RSUs granted on 2021-11-01 with closing price of underlying security on date of grant of $1.61 (Cdn$2.06) and vesting 50% on each 2nd and 3rd anniversaries of the grant. |

The following tables and accompanying narrative disclosure set forth information about the compensation earned by our named executive officers during the year ended December 31, 2021. Our named executive officers, who are our principal executive officer and the two most highly compensated executive officers (other than our principal executive officer) serving as executive officers as of December 31, 2021 are named in the table below. We refer to each of them in this section as our “Named Executive Officer” or “NEO.”

Summary Compensation Table for 2021

The following table sets forth the annual base salary and other compensation paid to each of the NEOs for the fiscal years ended December 31, 2020 and 2021:

| Name and Principal Position |

Fiscal Year |

Salary | Stock Awards ($)(1) |

Option Awards ($)(2) |

Nonequity Incentive Plan ($) |

Bonus | Total ($) | |||||||||||||||||||||

| Edward J. Wegel |

2020 | $ | 180,000 | $ | 1,159 | $ | 13,232 | $ | — | $ | — | $ | 194,392 | |||||||||||||||

| 2021 | $ | 158,750 | $ | 127,946 | $ | 26,465 | $ | — | $ | — | $ | 313,161 | ||||||||||||||||

| Chairman and Chief Executive Officer |

||||||||||||||||||||||||||||

| Ryan Goepel |

2020 | $ | 118,726 | $ | 5,992 | $ | 8,835 | $ | — | — | $ | 133,553 | ||||||||||||||||

| 2021 | $ | 161,875 | $ | 247,403 | $ | 17,671 | $ | — | $ | — | $ | 426,949 | ||||||||||||||||

| Executive Vice President, Chief Financial Officer |

||||||||||||||||||||||||||||

| Juan Nunez |

2020 | $ | 85,500 | $ | 1,159 | $ | 4,109 | $ | — | — | $ | 90,769 | ||||||||||||||||

| 2021 | $ | 142,445 | $ | 40,557 | $ | 8,219 | $ | — | $ | — | $ | 191,221 | ||||||||||||||||

| Chief Operating Officer |

||||||||||||||||||||||||||||

17

Table of Contents

| (1) | The amounts reported in the “Stock Awards” column represent grant date fair value of the restricted stock granted to the NEOs during the fiscal year ended December 31, 2020 and 2021 as computed in accordance with FASB Accounting Standards Codification Topic 718. Note that the amounts reported in this column reflect the accounting cost for these stock options and do not correspond to the actual economic value that may be received by the NEOs from the restricted stock. |

| (2) | The amounts reported in the “Option Awards” column represent the grant date fair value of the stock options granted to the NEOs during the fiscal year ended December 31, 2020 as computed in accordance with FASB Accounting Standards Codification Topic 718. Note that the amounts reported in this column reflect the accounting cost for these stock options and do not correspond to the actual economic value that may be received by the NEOs from the stock options. |

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth specified information concerning unexercised stock options and restricted stock units for each of the NEOs outstanding as of December 31, 2021.

| Option Awards | Stock Awards | |||||||||||||||||||||||||||

| Name |

Grant Date(1) | Number of Securities Underlying Unexercised Options Exercisable |

Number of Securities Underlying Unexercised Options Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

Number of Restricted Share Units That Have Not Vested (#) |

Market Value of Restricted Share Units That Have Not Vested ($)(2) |

|||||||||||||||||||||

| Edward J. Wegel |

6/23/2020 | 214,667 | (3) | 107,333 | 0.25 | 6/23/2025 | — | — | ||||||||||||||||||||

| 10/28/2020 | — | — | — | — | 25,000 | (4) | $ | 35,500 | ||||||||||||||||||||

| 6/11/2021 | — | — | — | — | 250,000 | (4) | $ | 355,000 | ||||||||||||||||||||

| Ryan Goepel |

6/23/2020 | 143,334 | (3) | 71,666 | 0.25 | 6/23/2025 | — | — | ||||||||||||||||||||

| 10/28/2020 | — | — | — | — | 75,000 | (4) | $ | 106,500 | ||||||||||||||||||||

| 12/14/2020 | — | — | — | — | 75,000 | (4) | $ | 106,500 | ||||||||||||||||||||

| 6/11/2021 | — | — | — | — | 250,000 | (4) | $ | 355,000 | ||||||||||||||||||||

| Juan Nunez |

6/23,2020 | 83,334 | (3) | 16,666 | 0.25 | 6/23/2025 | — | — | ||||||||||||||||||||

| 10/28/2020 | — | — | — | — | 25,000 | (4) | $ | 35,500 | ||||||||||||||||||||

| (1) | All outstanding options were granted under our Amended Option Plan and all outstanding restricted share units were granted under our Restricted Share Unit Plan. |

| (2) | The closing market price of our common stock on the OTCQB on December 31, 2021 was $1.42 per share. |

| (3) | This option vests monthly over 24 months, subject to the executive’s continued service to us. These options are also subject to acceleration of vesting upon a qualifying change in control if the surviving corporation fails to continue or assume the obligations with respect to such options or fails to provide for the conversion or replacement of such options with an equivalent award. |

| (4) | 50% of the restricted share units vests on each of the second and third anniversaries of the vesting commencement date, subject to the executive’s continued service to us. These restricted share units are also subject to acceleration of vesting upon a qualifying change in control if the surviving corporation fails to continue or assume the obligations with respect to such restricted share units or fails to provide for the conversion or replacement of such restricted share units with an equivalent award. |

Executive Compensation

Our performance-driven compensation program for our NEOs consists of the following main components:

| • | base salary; |

| • | performance-based incentives; |

| • | equity-based incentives; |

| • | benefits; and |

| • | perquisites. |

18

Table of Contents

We will continue to build our executive compensation program around each of these elements because each individual component is useful in furthering our compensation philosophy and we believe that, collectively, they are effective in achieving our overall objectives.

Base Salary. We provide our NEOs with a base salary to compensate them for their service to our Company during each fiscal year. The base salary payable to each NEO is intended to provide a fixed component of compensation that adequately reflects the executive’s qualifications, experience, role and responsibilities. Base salary amounts are established based on consideration of, among other factors, the scope of the NEO’s position, responsibilities and years of service and our compensation committee’s general knowledge of the competitive market, based on, among other things, experience with other similarly situated companies and our industry and market data.

Employment Agreements

On September 1, 2021, the Company entered into an employment agreement with Ryan Goepel, the Company’s EVP and Chief Financial Officer (the “Goepel Employment Agreement”). The Goepel Employment Agreement is for a three year term and provides for an annual base salary of $225,000 and a target bonus of 100% of his base salaries subject to the Company’s Board approval. Mr. Goepel is entitled to receive severance payments, including one years of his then base salary and other benefits in the event of a change of control, termination by the Company without cause, termination for good reason by the executive or non-renewal by the Company. The above description of the terms of the Goepel Employment Agreement is not complete and is qualified by reference to the complete document.

On September 1, 2021, the Company entered into an employment agreement with Juan Nunez, the Company’s Chief Operating Officer (the “Nunez Employment Agreement”). The Nunez Employment Agreement is for a three year term and provides for an annual base salary of $175,000 and a target bonus of 100% of his base salaries subject to the Company’s Board approval. Mr. Nunez is entitled to receive severance payments, including one years of his then base salary and other benefits in the event of a change of control, termination by the Company without cause, termination for good reason by the executive or non-renewal by the Company. The above description of the terms of the Nunez Employment Agreement is not complete and is qualified by reference to the complete document.

Equity Incentive Plans

Description of our Incentive Stock Option Plan, Restricted Share Unit Plan and Performance Share Unit Plan are included in Proposals 2, 3 and 4, respectively.