As filed with U.S. Securities and Exchange Commission on April 1, 2024

Registration No: 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________________

(Exact name of registrant as specified in its charter)

__________________________________

| | 6770 | N/A | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

Tel:

(Address, including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive offices)

__________________________________

Prabhu Antony

One World Trade Center

Suite 8500

New York, New York 10007

Tel: (646) 314-3555

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

__________________________________

Copies to:

Winston & Strawn LLP

Tel:

__________________________________

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date hereof.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act.

____________

* Upon the closing of the business combination referred to in this registration statement, the name of the registrant is expected to change to DigiAsia Corp.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION |

DATED APRIL 1, 2024 |

StoneBridge Acquisition Corporation

Up to 22,825,115 Ordinary Shares

Up to 7,700,000 Private Warrants

_____________________________________________

This prospectus relates to (i) the issuance of (a) up to 10,000,000 Ordinary Shares (as defined herein) issuable upon the exercise of 10,000,000 Public Warrants (as defined herein) (the “Public Warrant Shares”); (b) up to 30,000 Ordinary Shares issuable to Kenneth Sommer pursuant to a Director Offer Letter; (c) up to 30,000 Ordinary Shares issuable to Andreas Gregori pursuant to a Director Offer Letter; and (d) up to 65,115 Ordinary Shares issuable to Rudiantara pursuant to a Director Offer Letter (collectively, with the above-mentioned shares issuable to Kenneth Sommer and Andreas Gregori, the “Director Offer Shares”) and (ii) the offer and resale, from time to time, by the selling securityholders named in this prospectus or their permitted transferees (the “Selling Securityholders”) of up to an aggregate of 12,825,115 Ordinary Shares and 7,700,000 Private Warrants (as defined herein) (together with the Public Warrants, the “Warrants”) comprising: (a) up to 4,750,000 Ordinary Shares held by StoneBridge Acquisition Sponsor LLC, a Delaware limited liability company (the “Sponsor”), upon the consummation of the Business Combination as a result of a one-for-one conversion of 4,750,000 StoneBridge Class B ordinary shares, par value $0.0001 per share (the “Founder Shares”), which were issued to the Sponsor in connection with the StoneBridge’s initial public offering at a purchase price equivalent to approximately $0.0043 per Founder Share; (b) up to 50,000 Ordinary Shares issuable to Sylvia Barnes pursuant to a Sponsor Commitment Letter; (c) up to 50,000 Ordinary Shares issuable to Shamla Naidoo pursuant to a Sponsor Commitment Letter; (d) up to 50,000 Ordinary Shares issuable to Richard Saldanha pursuant to a Sponsor Commitment Letter; (e) up to 50,000 Ordinary Shares issuable to Jeff Najarian pursuant to a Sponsor Commitment Letter; (f) up to 50,000 Ordinary Shares issuable to Naresh Kothari pursuant to a Sponsor Commitment Letter; (g) up to Ordinary Shares (the “CF&CO Shares”) issued to Cantor Fitzgerald & Co. (“CF&CO”) as deferred underwriting commission pursuant to (x) that certain Underwriting Agreement, dated as of July 15, 2021, between StoneBridge and CF&CO, as representative of the underwriters, and (y) that certain Fee Reduction Agreement, dated as of June 13, 2023 (as amended by that certain First Amendment to Fee Reduction Agreement, dated as of March 29, 2024) by and among the StoneBridge and CF&CO; and (h) up to 7,700,000 Ordinary Shares (the “Private Warrant Shares,” and together with the Public Warrant Shares, the “Warrant Shares”) issuable upon the exercise of 7,700,000 Private Warrants consisting of (x) 7,000,000 Private Warrants issued to the Sponsor and (y) 700,000 Private Warrants issued to CF&CO as representative of the underwriters, in a private placement in connection with the initial public offering of StoneBridge Acquisition Corporation (the “Company” or “StoneBridge,” and upon the consummation of the Business Combination (as defined herein), “PubCo”).

We are registering the offer and resale of these securities to satisfy certain registration rights we have granted. The Selling Securityholders may offer all or part of the securities for resale from time to time through public or private transactions, in amounts, at prices and on terms determined at the time of offering. The Selling Securityholders may offer and sell these securities directly to purchasers, through agents in ordinary brokerage transactions, directly to market makers of our shares or through any other means described in the section entitled “Plan of Distribution” herein. In connection with any sales of securities offered hereunder, the Selling Securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”).

We will bear all costs, expenses and fees in connection with the registration of the Ordinary Shares and will not receive any proceeds from the sale of the Ordinary Shares. However, we could receive up to an aggregate of $203,550,000 from the exercise of all Warrants, assuming the exercise in full of such Warrants for cash. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their respective sales of the Ordinary Shares.

StoneBridge’s units, Ordinary Shares, and Public Warrants are publicly traded on the Nasdaq Capital Market (“Nasdaq”) under the symbols “APACU,” “APAC” and “APACW,” respectively. Each unit consists of one Class A Ordinary Share and one-half of one redeemable warrant. Upon consummation of the Business Combination, any units then outstanding will automatically separate into its constituent ordinary shares and warrants. On March 28, 2024, the closing price of StoneBridge’s units, Class A Ordinary Shares and Public Warrants on Nasdaq was $9.39, $8.98 and $0.05, respectively. Because the price of our Ordinary Shares remains below the exercise price of our Warrants of $11.50 per share,

it is unlikely that any warrant holder will exercise their Warrants. As a result, we are unlikely to receive any proceeds from the exercise of our Warrants in the near future, if at all. StoneBridge has applied for listing, to be effective at the time of the Business Combination, of Ordinary Shares and Warrants on Nasdaq under the proposed symbol “FAAS” and “FAASW.” It is a condition of the consummation of the Business Combination that StoneBridge receive confirmation from Nasdaq that Ordinary Shares and Warrants have been conditionally approved for listing on Nasdaq, but there can be no assurance such listing condition will be met or that StoneBridge will obtain such confirmation from Nasdaq. If such listing condition is not met or if such confirmation is not obtained, the Business Combination will not be consummated unless the Nasdaq condition set forth in the Business Combination Agreement is waived by the applicable parties.

Due to the significant number of Ordinary Shares that were redeemed in connection with the Business Combination, the number of shares of that the Selling Securityholders can sell into the public markets pursuant to this prospectus may exceed our public float. As a result, the resale of Ordinary Shares pursuant to this prospectus could have a significant negative impact on the trading price of Ordinary Shares. This impact may be heighted by the fact that certain of the Selling Securityholders purchased, or are able to purchase, Ordinary Shares at prices that are well below the current trading price of Ordinary Shares. The 22,825,115 Ordinary Shares that may be resold and/or issued into the public markets pursuant to this prospectus could represent approximately 29.3% of Ordinary Shares outstanding immediately after the closing of the Business Combination (assuming the maximum redemption scenario and after giving effect to the issuance of Earnout Shares (as defined herein), Director Offer Shares and Warrant Shares).

We are an “emerging growth company” and a “foreign private issuer” as those terms are defined under the U.S. federal securities laws and, as such, are subject to certain reduced public company disclosure and reporting requirements. See “Prospectus Summary — Emerging Growth Company” and “Prospectus Summary — Foreign Private Issuer.”

Investing in our securities is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 20 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 1, 2024

table of contents

|

Page |

||

|

ii |

||

|

iv |

||

|

v |

||

|

ix |

||

|

1 |

||

|

20 |

||

|

74 |

||

|

STONEBRIDGE MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

75 |

|

|

80 |

||

|

DIGIASIA MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

96 |

|

|

111 |

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

156 |

|

|

159 |

||

|

165 |

||

|

179 |

||

|

181 |

||

|

183 |

||

|

183 |

||

|

183 |

||

|

184 |

||

|

F-1 |

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. By using a shelf registration statement, the Selling Securityholders may, from time to time, sell the securities offered by them described in this prospectus (the “Resale Shares”) in one or more offerings as described in this prospectus. We will not receive any proceeds from the sale of Resale Shares by the Selling Securityholders.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment, as the case may be, may add, update or change information contained in this prospectus with respect to such offering. You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with information different from or in addition to that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, we rely on and refer to information and statistics regarding our industry. We obtained this statistical, market and other industry data and forecasts from publicly available information. While we believe that the statistical data, market data and other industry data and forecasts are reliable, we have not independently verified the data. Before purchasing any of the Resale Shares, you should carefully read this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, together with the additional information described under “Where You Can Find More Information.”

Neither we, nor the Selling Securityholders, have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, prepared by or on behalf of us or to which we have referred you. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the Selling Securityholders will not make an offer to sell Resale Shares in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, is accurate only as of the date on the respective cover. Our business, prospects, financial condition or results of operations may have changed since those dates. This prospectus contains, and any prospectus supplement or post-effective amendment may contain, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable. Accordingly, investors should not place undue reliance on this information.

On December 19, 2023, StoneBridge held an extraordinary general meeting of shareholders (the “Business Combination Meeting”) in connection with the proposed Business Combination as described in (i) the Business Combination Agreement and (ii) the Company’s final proxy statement/prospectus filed with the SEC on November 28, 2023 (the “Definitive Proxy Statement/Prospectus”) and mailed to the shareholders of record on or about November 28, 2023. At the Business Combination Meeting, StoneBridge’s shareholders approved, among other things, the Business Combination and certain other related transactions and proposals, as more described more fully in the Definitive Proxy Statement/Prospectus. On December 15, 2023, the deadline to elect to redeem Ordinary Shares in connection with the Business Combination Meeting, shareholders holding 2,393,307 StoneBridge Class A Ordinary Shares (or approximately 98.5% of the Company’s outstanding StoneBridge Class A Ordinary Shares) exercised their right to redeem such shares for a pro rata portion of the funds in the Company’s trust account (the “Trust Account”), which left the Company with 32,662 StoneBridge Class A Ordinary Shares outstanding after redemptions. As of December 22,

ii

2023, after receiving and granting certain redemption reversals, the Company has 37,429 StoneBridge Class A Ordinary Shares outstanding after redemptions. Prior to the closing of the Business Combination, the Company may consider additional requests from shareholders to grant further requests for redemption reversals.

Pursuant to, and subject to the terms and conditions set forth in, the Business Combination Agreement, upon closing the Business Combination, DigiAsia and Amalgamation Sub will amalgamate in accordance with the Companies Act 1967 of Singapore, with DigiAsia surviving the Amalgamation as a wholly owned subsidiary of PubCo. Upon the consummation of the Business Combination, PubCo will change its name to “DigiAsia Corp.”

On December 28, 2023, the parties to the Business Combination Agreement entered into the Second Amendment to Business Combination Agreement, pursuant to which the parties agreed to extend the Termination Date (as defined in the Business Combination Agreement) from December 29, 2023, to January 20, 2024; provided, that, if StoneBridge extends the deadline for completing a business combination, the Termination Date will be extended until April 30, 2024.

On January 17, 2024, StoneBridge held an extraordinary general meeting of shareholders (the “Extension Meeting”) at which StoneBridge shareholders approved, proposals to amend the Company’s Amended and Restated Memorandum and Articles of Association (i) to remove the net tangible asset requirement in order to expand the methods that the Company may employ so as to not become subject to the “penny stock” rules of the United States Securities and Exchange Commission and (ii) to give the Company the right to extend the date by which it must consummate a business combination up to 6 times for an additional one month each time, from January 20, 2024 up to July 20, 2024, by depositing into the Company’s trust account, for each one-month extension, $0.025 for each StoneBridge Class A Ordinary Share outstanding after giving effect to redemptions. As of the date of this prospectus, the Sponsor has exercised three of its six options to extend the period for StoneBridge to consummate an initial business combination, such that StoneBridge currently has until April 20, 2024 (subject to further extensions by the Sponsor or its affiliates or designees) to complete its initial business combination. In connection with such extensions, the Sponsor has deposited an aggregate of approximately $166,136 into the Trust Account as of the date of this prospectus/prospectus, in exchange for non-interest bearing, unsecured promissory notes issued by StoneBridge to the Sponsor that will not be repaid in the event that StoneBridge is unable to close a business combination unless there are funds available outside the Trust Account to do so.

iii

Presentation of Financial Statements

StoneBridge/PubCo

The audited financial statements of StoneBridge as of December 31, 2022, and 2021, for the year ended December 31, 2022, and for the period from February 2, 2021 (inception) to December 31, 2021, and the unaudited condensed financial statements of StoneBridge as of June 30, 2023, and for the three months and six months ended June 30, 2023 and 2022, in each case, included in this prospectus, were prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) and are denominated in U.S. Dollars.

The Business Combination (as defined herein) is made up of the series of transactions outlined within the Business Combination Agreement (as defined herein), as described elsewhere within this prospectus. The Business Combination will be accounted for as a reverse recapitalization in conformity with U.S. GAAP. Under this method of accounting, PubCo will be treated as the “acquired” company for financial reporting purposes. Accordingly, for accounting purposes, the financial statements of PubCo will represent a continuation of the financial statements of DigiAsia with the Business Combination treated as the equivalent of DigiAsia issuing shares for the net assets of StoneBridge, accompanied by a recapitalization whereby no goodwill or other intangible assets are recorded. Operations prior to the Business Combination will be those of DigiAsia in future reports of PubCo. This determination was primarily based on the following facts and circumstances, under each of the scenario assuming no further redemptions (the “No Further Redemption Scenario”), the scenario assuming 50% redemptions (the “50% Redemption Scenario”) and the scenario assuming maximum redemptions (the “Maximum Redemption Scenario”):

• Existing DigiAsia equityholders will comprise a relative majority of the voting power of PubCo;

• Existing DigiAsia equityholders will have the ability to nominate the majority of the members of the board of directors of PubCo;

• DigiAsia’s senior management will comprise a majority of the senior management of PubCo and be responsible for the day-to-day operations of PubCo;

• The relative size of DigiAsia is significantly larger compared to StoneBridge;

• PubCo will assume the DigiAsia name; and

• The intended strategy and operations of PubCo will continue DigiAsia’s current strategy and operations.

DigiAsia

DigiAsia’s audited consolidated financial statements as of, and for the years ended, December 31, 2022 and 2021, included in this prospectus, have been prepared in accordance with U.S. GAAP and are denominated in U.S. Dollars.

iv

FREQUENTLY USED TERMS

Unless otherwise stated in this prospectus, the terms, “we,” “us,” “our,” the “Company” or “StoneBridge” refer to StoneBridge Acquisition Corporation, a Cayman Islands exempted company limited by shares. Further, unless otherwise stated or unless the context otherwise requires, in this document:

• “2023 Incentive Plan” means the DigiAsia Corp. 2023 Omnibus Incentive Plan;

• “ACRA” means the Accounting and Corporate Regulatory Authority of Singapore;

• “Amalgamation” means the amalgamation of DigiAsia and Amalgamation Sub in accordance with Section 215A of the Companies Act 1967 of Singapore, with DigiAsia surviving the amalgamation as a wholly owned subsidiary of PubCo;

• “Amalgamation Sub” means StoneBridge Acquisition Pte. Ltd., a Singapore private company limited by shares with company registration number 202239721R and a direct, wholly owned subsidiary of StoneBridge;

• “amended and restated memorandum and articles of association” means the second amended and restated memorandum and articles of association of StoneBridge, currently in effect, and as may be further amended or amended and restated, from time to time.

• “Business Combination” means the Amalgamation and the other transactions contemplated by the Business Combination Agreement;

• “Business Combination Agreement” means the business combination agreement, dated as of January 5, 2023 (as amended (i) on June 22, 2023 by that certain First Amendment to Business Combination Agreement and (ii) on December 28, 2023 by that certain Second Amendment to Business Combination Agreement, and as may be further amended, supplemented, or otherwise modified from time to time), by and among StoneBridge, Amalgamation Sub, DigiAsia and Prashant Gokarn (solely in his capacity as Management Representative);

• “Cayman Islands Companies Act” means the Companies Act (As Revised) of the Cayman Islands;

• “Closing” means the closing of the Amalgamation;

• “Closing Date” means the date of the Closing;

• “Code” means the U.S. Internal Revenue Code, as amended;

• “Continental” means Continental Stock Transfer & Trust Company;

• “Definitive Proxy Statement/Prospectus” means definitive proxy statement/final prospectus filed by StoneBridge with the SEC on November 28, 2023;

• “DigiAsia” means DigiAsia Bios Pte. Ltd., a Singapore private company limited by shares with company registration number 201730295C;

• “DigiAsia Founder” means Alexander Rusli;

• “DigiAsia Group” means, collectively, (i) DigiAsia, (ii) PT DAB, (iii) PT Tri Digi Fin, a company organized under the laws of the Republic of Indonesia, (iv) PT Digital Distribusi Logistik Nusantara, a company organized under the laws of the Republic of Indonesia, (v) PT Solusi Pasti, a company organized under the laws of the Republic of Indonesia, (vi) PT Reyhan Putera Mandiri, a company organized under the laws of the Republic of Indonesia and (vii) Migrant Lifeline Technologies Private Limited, a company organized under the laws of Singapore;

• “DigiAsia Ordinary Shares” means ordinary shares of DigiAsia;

• “DigiAsia Shareholder Lock-Up Agreement” means the shareholder lock-up agreement dated January 5, 2023 between StoneBridge and the shareholders of DigiAsia party thereto;

v

• “DigiAsia Shareholder Support Agreement” means the shareholder support agreement dated as of January 5, 2023, by and among StoneBridge, Amalgamation Sub and the shareholders of DigiAsia party thereto;

• “Director Nomination Agreement” means the director nomination agreement to be entered into in connection with the Closing, by and among StoneBridge, the Sponsor and the DigiAsia Founder;

• “Earnout Escrow Agreement” means the earnout escrow agreement to be entered into in connection with the Closing, by and among StoneBridge, the Sponsor, Prashant Gokarn (in his capacity as the Management Representative) and Continental;

• “Earnout Shares” means the aggregate of 5,000,001 Ordinary Shares to be issued to the Management Earnout Group upon the achievement of certain revenue milestones, pursuant to the Business Combination Agreement and Earnout Escrow Agreement;

• “Effective Time” means the effective time of the Amalgamation;

• “Exchange Act” means the U.S. Securities and Exchange Act of 1934, as amended;

• “Existing Letter Agreement” means the letter agreement dated July 15, 2021, executed by the Sponsor, the members of the board of directors of StoneBridge and the executive officers of StoneBridge, for the benefit of StoneBridge, in connection with StoneBridge’s initial public offering and in accordance with the underwriting agreement between StoneBridge and Cantor Fitzgerald & Co. (as representative of the underwriters) relating to StoneBridge’s initial public offering;

• “Existing StoneBridge Charter” means the amended and restated memorandum and articles of association of StoneBridge in effect immediately prior to the Business Combination;

• “Extraordinary General Meeting” means the Extraordinary General Meeting of shareholders of StoneBridge scheduled to be held on , 2023;

• “Final Redemption Date” means July 20, 2024, and assumes the exercise, in full, of all the Sponsor’s (or its affiliates’ or designees’) existing options to extend the deadline by which StoneBridge must consummate an initial business combination;

• “IFRS” means the International Financial Reporting Standards, as issued by the International Accounting Standards Board;

• “Initial Projections” means the financial projections prepared by the management of DigiAsia in connection with the Business Combination;

• “IRS” means the U.S. Internal Revenue Service;

• “JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended;

• “Management Earnout Group” means, collectively, Alexander Rusli, Prashant Gokarn, Subir Lohani, Hermansjah Haryono and Rully Hariwinata;

• “Management Representative” means Prashant Gokarn, in his capacity as the representative and attorney-in-fact of the Management Earnout Group with respect to certain matters relating to the Earnout Shares pursuant to the Business Combination Agreement;

• “Management Representative Deed” means the management representative deed, dated January 5, 2023, by and among the Management Representative and each member of the Management Earnout Group;

• “Minimum Cash Condition” means the requirement that the aggregate cash available to StoneBridge at the Closing from the Trust Account and the Transaction Financing (after giving effect to the redemption of any Ordinary Shares in connection with the vote on the Business Combination but prior to the payment of the Outstanding StoneBridge Expenses and Outstanding DigiAsia Expenses) must equal or exceed $20.0 million;

• “Nasdaq” means the Nasdaq Capital Market or the Nasdaq Stock Market LLC, as the context requires;

vi

• “New PubCo Charter” means the second amended and restated memorandum and articles of association of PubCo upon completion of the Business Combination, the form of which is attached to this prospectus as Annex B;

• “Ordinary Shares” means, prior to the consummation of the Business Combination, Class A ordinary shares, par value $0.0001 per share, of StoneBridge, and after the consummation of the Business Combination, ordinary shares, par value $0.0001 per share, of PubCo.

• “Outstanding DigiAsia Expenses” means the following fees and expenses, incurred by or on behalf of DigiAsia or DigiAsia shareholders in connection with the conduct of DigiAsia’s sale process (including the evaluation and negotiation of business combinations with other third parties) and preparation, negotiation and execution of the Business Combination Agreement and the consummation of the Business Combination, which remain unpaid as of the close of business on the business day immediately preceding the Closing Date: (i) the fees and disbursements of outside counsel to DigiAsia or its shareholders incurred in connection with the Business Combination and (ii) the fees and expenses of any other agents, advisors, consultants, experts and financial advisors employed by DigiAsia in connection with the Business Combination;

• “Outstanding StoneBridge Expenses” means all unpaid fees and disbursements of StoneBridge, Amalgamation Sub or the Sponsor for outside counsel and fees and expenses of StoneBridge, Amalgamation Sub or the Sponsor or for any other agents, advisors, consultants, experts and financial advisors employed by or on behalf of StoneBridge, Amalgamation Sub or the Sponsor in connection with StoneBridge’s initial public offering (including any deferred underwriter fees), the Business Combination or other proposed business combinations with other third parties;

• “Per Share Amalgamation Consideration” means a number of Ordinary Shares equal to (i) $500.0 million divided by the total number of DigiAsia Ordinary Shares outstanding immediately prior to the Effective Time (after giving effect to the Preferred Shares Conversion), divided by (ii) $10.00;

• “Preferred Shares Conversion” means the conversion, immediately prior to the Sponsor Share Conversion, of each then outstanding preferred share of DigiAsia into such number of DigiAsia Ordinary Shares as is in accordance with the governing documents of DigiAsia;

• “Private Warrants” means the 8,000,000 redeemable warrants originally issued by StoneBridge in a private placement in connection with its initial public offering at a purchase price of $1.00 per warrant, each of which entitles the holder thereof to purchase one Ordinary Share at an exercise price of $11.50 per share, in accordance with its terms;

• “PT DAB” means PT Digi Asia Bios, a company organized under the laws of the Republic of Indonesia; “PubCo” means StoneBridge after the Effective Time (the name of which will change to DigiAsia Corp.);

• “public StoneBridge shareholder” means any holder of StoneBridge’s public shares, other than the Sponsor or an officer or director of StoneBridge;

• “Public Warrants” means the redeemable warrants originally included in the units sold in StoneBridge’s initial public offering, each of which entitles the holder thereof to purchase one Ordinary Share at an exercise price of $11.50 per share, in accordance with its terms.

• “Registration Rights Agreement” means the registration rights agreement dated as of January 5, 2023 by and among StoneBridge, DigiAsia and the shareholders party thereto;

• “SEC” means the U.S. Securities and Exchange Commission;

• “Securities Act” means the U.S. Securities Act of 1933, as amended;

• “SFRS” means the financial reporting standards issued by the Singapore Accounting Standards Council, consistently applied;

• “Sponsor” means StoneBridge Acquisition Sponsor LLC, a Delaware limited liability company;

vii

• “Sponsor Share Conversion” means the conversion, immediately prior to the Effective Time, of each Founder Share into one Ordinary Share, on a one-for-one basis;

• “Sponsor Support Agreement” means the sponsor support agreement, dated as of January 5, 2023, by and between the Sponsor and DigiAsia;

• “StoneBridge” means StoneBridge Acquisition Corporation, a Cayman Islands exempted company limited by shares, prior to the Effective Time;

• “StoneBridge Class A Ordinary Shares” means Class A ordinary shares, par value $0.0001 per share, of StoneBridge;

• “StoneBridge Class B Ordinary Shares” means Class B ordinary shares, par value $0.0001 per share, of StoneBridge;

• “StoneBridge Ordinary Shares” means, collectively, StoneBridge Class A Ordinary Shares and StoneBridge Class B Ordinary Shares;

• “Transaction Financing” means transaction financing to be obtained by StoneBridge, to DigiAsia’s satisfaction, in the form of a firm written commitment to provide equity, convertible debt or equity-linked financing to PubCo, from investors, to be agreed by StoneBridge and DigiAsia, in the amount of at least $30.0 million, which shall be made up of a combination of non-redeemed funds in the Trust Account, equity financing in the form of a private investment in public equity by institutions and family offices, convertible debt and a pre-paid advance on convertible debt, and at least $20.0 million of which amount shall be funded at the Closing, with the remaining $10.0 million to be funded within three months after the Closing;

• “Trust Account” means the trust account established at the consummation of StoneBridge’s initial public offering;

• “U.S. GAAP” means generally accepted accounting principles in the United States; and

• “VWAP” means, for any security as of any date(s), the dollar volume-weighted average price for such security on the principal securities exchange or securities market on which such security is then traded during the period beginning at 9:30:01 a.m., New York time, and ending at 4:00 p.m., New York time, as reported by Bloomberg through its “HP” function (set to weighted average) or, if the foregoing does not apply, the dollar volume-weighted average price of such security in the over-the-counter market on the electronic bulletin board for such security during the period beginning at 9:30:01 a.m., New York time, and ending at 4:00 p.m., New York time, as reported by Bloomberg, or, if no dollar volume-weighted average price is reported for such security by Bloomberg for such hours, the average of the highest closing bid price and the lowest closing ask price of any of the market makers for such security as reported by OTC Markets Group Inc. If the VWAP cannot be calculated for such security on such date(s) on any of the foregoing bases, the VWAP of such security on such date(s) shall be the fair market value per share on such date(s) as mutually determined by StoneBridge and DigiAsia, each acting reasonably.

viii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes statements that express StoneBridge’s and DigiAsia’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results of operations or financial condition and therefore are, or may be deemed to be, “forward-looking statements.” These forward-looking statements can generally be identified by the use of forward- looking terminology, including the terms “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should” or “will” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this prospectus and include statements regarding StoneBridge’s and DigiAsia’s intentions, beliefs or current expectations concerning, among other things, the Business Combination, the benefits and synergies of the Business Combination, including anticipated cost savings, results of operations, financial condition, liquidity, prospects, growth, strategies, future market conditions or economic performance and developments in the capital and credit markets and expected future financial performance, the markets in which DigiAsia operates as well as any information concerning possible or assumed future results of operations of PubCo after the consummation of the Business Combination. Such forward-looking statements are based on available current market material and management’s expectations, beliefs and forecasts concerning future events impacting StoneBridge, DigiAsia and PubCo. Factors that may impact such forward-looking statements including:

• developments related to the COVID-19 pandemic, including, among others, with respect to stay-at- home orders, social distancing measures, the success of vaccine rollouts, numbers of COVID-19 cases and the occurrence of new COVID-19 strains that might evade existing control measures and lead

• to the worsening or extension of adverse economic or movement control measures;

• DigiAsia’s ability to grow market share in its existing markets or any new markets it may enter;

• DigiAsia’s ability to execute its growth strategy, manage growth and maintain its corporate culture as it grows;

• the regulatory environment and changes in laws, regulations or policies in the jurisdictions in which DigiAsia operates;

• political instability in the jurisdictions in which DigiAsia operates;

• anticipated technology trends and developments and DigiAsia’s ability to address those trends and developments with its products and offerings;

• the ability to protect information technology systems and platforms against security breaches or otherwise protect confidential information or platform users’ personally identifiable information;

• the risk that the Business Combination disrupts current plans and operations of DigiAsia as a result of the announcement and consummation of the Business Combination;

• man-made or natural disasters, including war, acts of international or domestic terrorism, civil disturbances, occurrences of catastrophic events and acts of God such as floods, earthquakes, wildfires, typhoons and other adverse weather and natural conditions that affect DigiAsia’s business or assets;

• the loss of key personnel and the inability to replace such personnel on a timely basis or on acceptable terms;

• PubCo’s ability to raise financing in the future;

• exchange rate fluctuations;

• legal, regulatory and other proceedings;

• changes in interest rates or rates of inflation;

• tax laws and the interpretation and application thereof by tax authorities in the jurisdictions where DigiAsia operates;

ix

• the number and percentage of StoneBridge shareholders voting against the proposals at the Extraordinary General Meeting and/or seeking redemption;

• StoneBridge’s ability to successfully secure the Transaction Financing and/or equity line of credit;

• the occurrence of any event, change or other circumstances that could give rise to the termination of the Business Combination Agreement;

• PubCo’s ability to initially list, and once listed, maintain the listing of its securities on Nasdaq following the Business Combination; and

• other factors detailed under the section entitled “Risk Factors.”

The forward-looking statements contained in this prospectus are based on StoneBridge’s and DigiAsia’s current expectations and beliefs concerning future developments and their potential effects on the Business Combination and PubCo. There can be no assurance that future developments affecting StoneBridge, DigiAsia and/or PubCo will be those that StoneBridge or DigiAsia has anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond either StoneBridge’s or DigiAsia’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. All subsequent written and oral forward-looking statements concerning the Business Combination or other matters addressed in this prospectus and attributable to StoneBridge, DigiAsia or PubCo or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this prospectus. StoneBridge, DigiAsia and PubCo do not and will not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

x

PROSPECTUS SUMMARY

This summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our Ordinary Shares and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our Ordinary Shares, you should read the entire prospectus carefully, including “Risk Factors” beginning on page 20 and the financial statements and related notes included in this prospectus.

This prospectus includes trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included in this prospectus are the property of their respective owners.

Corporate Information

StoneBridge/PubCo

StoneBridge (which will become PubCo upon consummation of the Business Combination) is a blank check company incorporated on February 2, 2021, as a Cayman Islands exempted company limited by shares for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities. Based on its business activities, StoneBridge is a “shell company,” as defined under the Exchange Act, because it has no operations and nominal assets consisting almost entirely of cash.

On July 20, 2021, StoneBridge consummated its initial public offering of 20,000,000 units. Each unit consists of one StoneBridge Class A Ordinary Share and one-half of one Public Warrant, with each whole Public Warrant entitling the holder thereof to purchase one StoneBridge Class A Ordinary Share for $11.50 per share. The units were sold at a price of $10.00 per unit, generating gross proceeds to StoneBridge of $200.0 million.

The Public Warrants will become exercisable 30 days after StoneBridge completes an initial business combination and will expire five years after StoneBridge completes an initial business combination or earlier upon redemption or liquidation. Pursuant to its terms, upon StoneBridge’s consummation of the Business Combination, any then outstanding units will automatically separate into its constituent ordinary shares and warrants.

Simultaneously with the closing of the initial public offering, StoneBridge completed a private sale of an aggregate of 8,000,000 Private Warrants to the Sponsor and the representative of the underwriters, CF&CO. 7,000,000 Private Warrants were sold to the Sponsor and 1,000,000 Private Warrants were sold to CF&CO. The Private Warrants were sold at a purchase price of $1.00 per Private Warrant, generating gross proceeds to StoneBridge of $8.0 million.

Following the closing of StoneBridge’s initial public offering, a total of $202.0 million, comprising the proceeds from the initial public offering after expenses and the proceeds of the sale of the Private Warrants, was placed in the Trust Account maintained by Continental, acting as trustee.

At an extraordinary general meeting of the shareholders of StoneBridge held on January 20, 2023, StoneBridge’s shareholders approved a proposal to amend StoneBridge’s amended and restated memorandum and articles of association to give StoneBridge the right to extend the date by which it has to consummate an initial business combination from January 20, 2023 up to six times for an additional one month each time up to July 20, 2023 (that is, for a period of time ending up to 24 months after the consummation of StoneBridge’s initial public offering). In connection with that extraordinary general meeting, StoneBridge shareholders properly elected to redeem an aggregate of 16,988,575 StoneBridge Class A Ordinary Shares at a redemption price of approximately $10.32 per share for an aggregate redemption amount of approximately $175.3 million, following which redemptions approximately $31.0 million remained in the Trust Account.

At an extraordinary general meeting of the shareholders of StoneBridge held on July 19, 2023, StoneBridge’s shareholders approved a proposal to further amend StoneBridge’s amended and restated memorandum and articles of association to give StoneBridge the right to further extend the date by which it has to consummate an initial business combination from July 20, 2023 up to six times for an additional one month each time up to January 20, 2024 (that is, for a period of time ending up to 30 months after the consummation of StoneBridge’s initial public offering), by depositing into the StoneBridge Trust Account for each one-month extension, $0.025 for each StoneBridge Class A Ordinary Share outstanding after giving effect to redemptions. In connection with that extraordinary general meeting,

1

StoneBridge shareholders properly elected to redeem an aggregate of 585,456 StoneBridge Class A Ordinary Shares at a redemption price of approximately $10.92 per share for an aggregate redemption amount of approximately $6.4 million, following which redemptions approximately $26.5 million remained in the Trust Account.

At an extraordinary general meeting of the shareholders of StoneBridge held on December 19, 2023, StoneBridge shareholders approved, among other things, the Business Combination and other transactions contemplated by, and StoneBridge’s entry into, the Business Combination Agreement, as more described more fully in the Definitive Proxy Statement/Prospectus.

On December 28, 2023, the parties to the Business Combination Agreement entered into the Second Amendment to Business Combination Agreement, pursuant to which the parties agreed to extend the Termination Date (as defined in the Business Combination Agreement) from December 29, 2023, to January 20, 2024; provided, that, if StoneBridge extends the deadline for completing a business combination, the Termination Date will be extended until April 30, 2024.

At an extraordinary general meeting of the shareholders of StoneBridge held on January 17, 2024, StoneBridge’s shareholders approved a proposal to further amend StoneBridge’s amended and restated memorandum and articles of association (i) to remove the net tangible asset requirement in order to expand the methods that the Company may employ so as to not become subject to the “penny stock” rules of the United States Securities and Exchange Commission and (ii) to give StoneBridge the right to extend the date by which it has to consummate an initial business combination up to 6 times for an additional one month each time, from January 20, 2024 up to July 20, 2024, by depositing into the Company’s trust account, for each one-month extension, $0.025 for each StoneBridge Class A Ordinary Share outstanding after giving effect to redemptions. As of the date of this prospectus, the Sponsor has exercised three of its six options to extend the period for StoneBridge to consummate an initial business combination, such that StoneBridge currently has until April 20, 2024 (subject to further extensions by the Sponsor or its affiliates or designees) to complete its initial business combination. In connection with such extensions, the Sponsor has deposited an aggregate of approximately $166,136 into the Trust Account as of the date of this prospectus/prospectus, in exchange for non-interest bearing, unsecured promissory notes issued by StoneBridge to the Sponsor that will not be repaid in the event that StoneBridge is unable to close a business combination unless there are funds available outside the Trust Account to do so.

Except with respect to interest earned on the funds held in the Trust Account that may be released to StoneBridge to pay its taxes, if any, and up to $100,000 of interest that may be needed to pay dissolution expenses, the funds held in the Trust Account will not be released from the Trust Account until the earliest of (i) the completion of StoneBridge’s initial business combination, (ii) the redemption of any of StoneBridge’s public shares properly tendered in connection with a shareholder vote to amend StoneBridge’s amended and restated memorandum and articles of association (a) to modify the substance or timing of StoneBridge’s obligation to allow redemption in connection with StoneBridge’s initial business combination or to redeem 100% of StoneBridge’s public shares if it does not complete its initial business combination by July 20, 2024 or (b) with respect to any other provision relating to shareholder’s rights or pre-business combination activity and (iii) the redemption of all of StoneBridge’s public shares if it is unable to complete its initial business combination by July 20, 2024, subject to applicable law.

StoneBridge’s units, the StoneBridge Class A Ordinary Shares and the Public Warrants are publicly traded on the Nasdaq Capital Market under the symbols “APACU,” “APAC” and “APACW,” respectively.

At the Effective Time, StoneBridge will become PubCo, the continuing public company, and change its name to “DigiAsia Corp.” Upon consummation of the Business Combination, any StoneBridge units then outstanding will automatically separate into its constituent ordinary shares and warrants. StoneBridge has applied for listing, to be effective at the time of the Business Combination, of PubCo Ordinary Shares on Nasdaq under the proposed symbol “FAAS.” It is a condition of the consummation of the Business Combination that StoneBridge receive confirmation from Nasdaq that the PubCo Ordinary Shares have been conditionally approved for listing on Nasdaq, but there can be no assurance such listing condition will be met or that StoneBridge will obtain such confirmation from Nasdaq. If such listing condition is not met or if such confirmation is not obtained, the Business Combination will not be consummated unless the Nasdaq condition set forth in the Business Combination Agreement is waived by the applicable parties.

StoneBridge’s principal executive offices are located at One World Trade Center, Suite 8500, New York, New York, 10007, and its telephone number is (646) 314-3555. StoneBridge’s corporate website address is http://stonebridgespac.com/index.html. StoneBridge’s website and the information contained on, or that can be accessed through, the website is not deemed to be incorporated by reference in, and is not considered part of, this prospectus.

2

After the consummation of the Business Combination, the mailing address of PubCo’s principal executive offices will be One Raffles Place #28-02, Singapore 048616, and its telephone number at such address will be +65-6333-8813.

DigiAsia

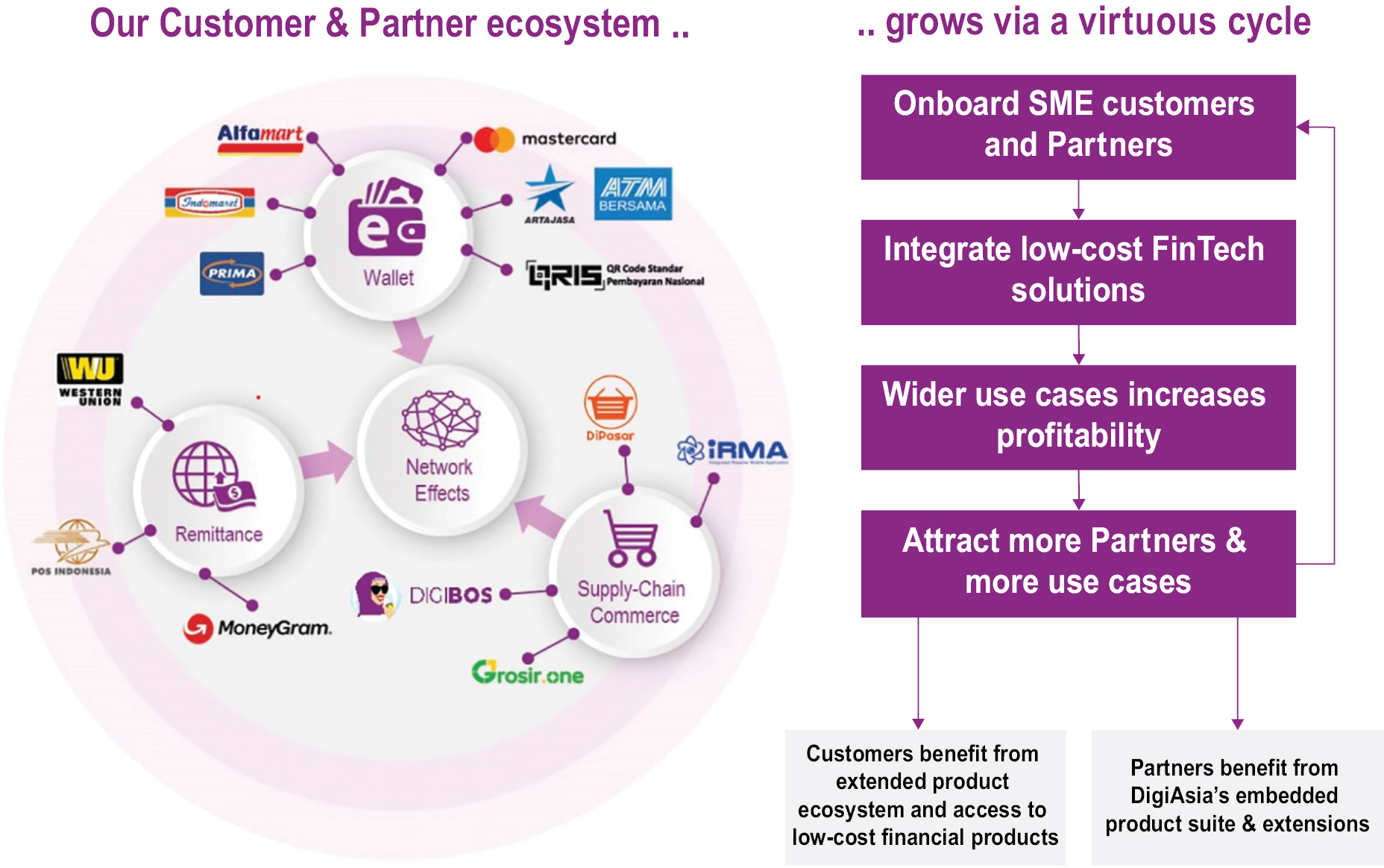

DigiAsia was incorporated under the laws of Singapore on October 23, 2017, as a holding company. Through its majority-owned entities, controlled entities (including variable interest entities for which DigiAsia is the primary beneficiary) and corporate joint venture, DigiAsia is among the first embedded fintech as a service (“EFaaS”) companies in Indonesia serving business-to-business-to-consumer (“B2B2C”) customers, such as large corporations and state-owned enterprises, as well as business-to-business (“B2B”) customers, such as MSME merchants across various industry segments. DigiAsia aims to be a leading fintech-enabling platform in Southeast Asia by accelerating financial inclusion through its licenses and technology stack and combining the benefits of technological innovation with traditional financial services. DigiAsia offers various embedded financial products through a set of open access application programming interfaces (“APIs”) that can be embedded in the mobile applications and web interfaces of its partner customers. Partnership is the nature of DigiAsia’s core product marketing strategy as an EFaaS provider in developing ready-to-use cases for enterprise customers.

Currently, DigiAsia, under its suite of license and technology stack, offers services and products through the following business verticals:

• Fintech as a Service (“FaaS”), pursuant to which DigiAsia offers products such as open-loop and closed-loop digital wallets for peer-to-peer (“P2P”) transfers, transportation ticket and ride payments, bills payments, e-commerce and supply chain payments, merchant QR payments and customer loyalty programs, as well as merchant-operated ATM/branch banking functionality and virtual bank accounts services;

• Banking as a Service (“BaaS”), pursuant to which DigiAsia provides partner customers, including banks and non-banks, products such as digital and cash-based remittance, P2P lending platform and a lending platform connecting institutional investors to borrowers; and

• Wallet as a Service (“WaaS”), pursuant to which DigiAsia provides e-wallet services, which is offered as open- or closed-loop e-wallets, and deep analytics for revenue optimization to B2B2C customers.

By leveraging its consolidation strategy and technology platform, and the extensive expertise of its management team, DigiAsia has emerged as one of the foremost players in its geographies of operations in terms of ecosystem and B2B offerings. For more information, see “DigiAsia’s Business.”

The mailing address of DigiAsia’s principal executive offices is at One Raffles Place #28-02, Singapore 048616, and its phone number is +65-6333-8813.

DigiAsia’s corporate website address is https://www.digiasia.asia. The information contained on, or that can be accessed through, DigiAsia’s website is not deemed to be incorporated by reference in, and is not considered part of, this prospectus. After the consummation of the Business Combination, DigiAsia will become a wholly owned subsidiary of PubCo.

Amalgamation Sub

Amalgamation Sub is a wholly owned, direct subsidiary of StoneBridge, formed on November 8, 2022, for the sole purpose of consummating the Amalgamation. Amalgamation Sub owns no material assets and does not operate any business.

The mailing address of Amalgamation Sub’s principal executive offices is One World Trade Center, Suite 8500, New York, NY 10007, Attention Bhargav Marepally, and its telephone number at such address is (646) 314-3555.

In the Amalgamation, DigiAsia and Amalgamation Sub will amalgamate in accordance with the Companies Act 1967 of Singapore, with DigiAsia surviving the Amalgamation. As a result, Amalgamation Sub will cease to exist, and DigiAsia will become a wholly owned subsidiary of PubCo.

3

The Business Combination

On January 5, 2023, StoneBridge, Amalgamation Sub, DigiAsia and the Management Representative (solely in his capacity as the Management Representative) entered into the Business Combination Agreement (as amended (i) on June 22, 2023 by that certain First Amendment to Business Combination Agreement and (ii) on December 28, 2023 by that certain Second Amendment to Business Combination Agreement, and as may be further amended, supplemented, or otherwise modified from time to time), pursuant to which, subject to the terms and conditions set forth therein, DigiAsia and Amalgamation Sub will amalgamate in accordance with the Companies Act 1967 of Singapore, with DigiAsia surviving the Amalgamation as a wholly owned subsidiary of PubCo. Upon the consummation of the Business Combination, PubCo will change its name to “DigiAsia Corp.”

At an extraordinary general meeting of the shareholders of StoneBridge held on December 19, 2023, StoneBridge shareholders approved, among other things, the Business Combination and other transactions contemplated by, and StoneBridge’s entry into, the Business Combination Agreement, as more described more fully in the Definitive Proxy Statement/Prospectus.

Subject to the terms and conditions of the Business Combination Agreement, the following transactions will occur in connection with the Business Combination:

(i) immediately prior to the Sponsor Share Conversion, each then issued and outstanding preferred share of DigiAsia will convert into such number of DigiAsia Ordinary Shares as shall be in accordance with the governing documents of DigiAsia;

(ii) immediately prior to the Effective Time, each StoneBridge Class B Ordinary Share will automatically convert, on a one-for-one basis, into one StoneBridge Class A Ordinary Share;

(iii) at the Effective Time, (a) DigiAsia and Amalgamation Sub will amalgamate in accordance with the Companies Act 1967 of Singapore, with DigiAsia surviving the Amalgamation as a wholly owned subsidiary of PubCo, (b) each then issued and outstanding DigiAsia Ordinary Share will be converted into the right to receive, such number of PubCo Ordinary Shares equal to the applicable Per Share Amalgamation Consideration and (c) each then outstanding and unexercised option to purchase DigiAsia Ordinary Shares (other than options to purchase DigiAsia Ordinary Shares held by the DigiAsia Founder or his controlled affiliates), whether or not then vested or exercisable, will be assumed by PubCo and converted into an option to purchase such number of PubCo Ordinary Shares as determined in accordance with the Business Combination Agreement, and will otherwise be subject to substantially the same terms and conditions as applied to such option prior to the Effective Time.

The Per Share Amalgamation Consideration to be paid for each DigiAsia Ordinary Share held as of immediately prior to the Effective Time will be a number of PubCo Ordinary Shares equal to (i) $500.0 million divided by the total number of DigiAsia Ordinary Shares outstanding immediately prior to the Effective Time (after giving effect to the Preferred Shares Conversion), divided by (ii) $10.00. Notwithstanding the foregoing, no fractional PubCo Ordinary Shares will be issued. Instead of the issuance of any fractional share, each person or entity that would otherwise be entitled to a fraction of a PubCo Ordinary Share (after aggregating all fractional shares of PubCo Ordinary Shares that otherwise would be received by such person or entity) shall have the number of PubCo Ordinary Shares issued to such person or entity rounded up in the aggregate to the nearest whole number of PubCo Ordinary Shares.

In addition, at the Closing, the Management Earnout Group will be entitled to up to an aggregate of 5,000,001 Earnout Shares upon the achievement of certain revenue milestones, as follows:

(i) an aggregate of 2,500,000 Earnout Shares will be issued to the Management Earnout Group in proportions as set forth in the Business Combination Agreement if the total revenue achieved by the Company equals or exceeds USD $25,000,000 for any fiscal quarter; and

(ii) the remaining aggregate of 2,500,001 Earnout Shares will be issued to the Management Earnout Group in proportions as set forth in the Business Combination Agreement if the total revenue achieved by the Company equals or exceeds USD $30,000,000 for any fiscal quarter.

4

If any of the conditions specified in clauses (i) and (ii) above have not been met within five years following the Closing Date, the Earnout Shares relating to such unsatisfied condition shall be automatically released back to PubCo for cancellation.

As a result of the Business Combination, the Existing StoneBridge Charter will be amended and restated to read in their entirety as set forth in the New PubCo Charter, the form of which is attached to the proxy statement/prospectus filed with the SEC on November 28, 2023, as Annex B.

Conditions to Closing

In addition to certain shareholder approvals obtained by the Company at its extraordinary general meeting on December 19, 2023, including, among other things, shareholder approval of the Business Combination Agreement, unless waived by the parties to the Business Combination Agreement, the closing of the Business Combination is subject to a number of conditions set forth in the Business Combination Agreement. For more information about the closing conditions to the Business Combination, see the Definitive Proxy Statement/Prospectus section titled “The Business Combination Proposal — The Business Combination Agreement — Conditions to Closing.”

Transaction Financing and Equity Line of Credit

The Business Combination Agreement includes a covenant for StoneBridge to obtain, to DigiAsia’s satisfaction, transaction financing, in the form of a firm written commitment to provide equity, convertible debt or equity-linked financing to PubCo, from investors to be agreed by StoneBridge and DigiAsia, in the amount of at least $30.0 million, which amount must be made up of a combination of non-redeemed funds in the Trust Account, equity financing in the form of a private investment in public equity by institutions and family offices, convertible debt and a pre-paid advance on convertible debt. At least $20.0 million of such amount must be funded at the Closing and the remaining $10.0 million must be funded within three months after the Closing. In connection with the transaction financing, the Sponsor has, pursuant to the Sponsor Support Agreement, agreed to assign for the benefit of investors to be identified in the transaction financing, 50% of the Private Warrants held by the Sponsor as of the date of the Sponsor Support Agreement.

In addition, pursuant to the terms of the Business Combination Agreement, StoneBridge is required to obtain, to DigiAsia’s satisfaction, a further equity line of credit in the amount of $100.0 million, which can be drawn down over a period of 24 months from the Closing, at PubCo’s option, subject to the terms and conditions of such equity line of credit.

Related Agreements

In connection with the Business Combination, certain related agreements have been entered into, or will be entered prior to the Closing, including the Sponsor Support Agreement, the DigiAsia Shareholder Lock-Up Agreement, the DigiAsia Shareholder Support Agreement, the Director Nomination Agreement, the Registration Rights Agreement, the Earnout Escrow Agreement and the Management Representative Deed. Further, in connection with StoneBridge’s initial public offering, the Sponsor, the members of the board of directors of StoneBridge and the executive officers of StoneBridge entered into the Existing Letter Agreement.

Sponsor Support Agreement

Substantially concurrently with the execution and delivery of the Business Combination Agreement, the Sponsor entered into an agreement with DigiAsia, pursuant to which the Sponsor has irrevocably and unconditionally agreed that at the Extraordinary General Meeting, at any other meeting of StoneBridge and in connection with any written consent of the shareholders of StoneBridge, the Sponsor will (i) appear at such meeting or otherwise cause all of its StoneBridge Ordinary Shares to be counted as present at such meeting for purposes of establishing a quorum, (ii) vote (or execute and return an action by written consent) or cause to be voted at such meeting (or validly execute and return or cause such consent to be granted with respect to), all of the StoneBridge Ordinary Shares owned by the Sponsor as of the record date for such meeting in favor of each proposal and any other matters necessary or reasonably requested by DigiAsia for consummation of the Business Combination and (iii) vote (or execute and return an action by written consent), or cause to be voted at such meeting (or validly execute and return and cause such consent to be granted with respect to), all of its StoneBridge Ordinary Shares against any business combination proposal and any other action that would reasonably be expected to materially impede, interfere with, delay, postpone or adversely

5

affect the Business Combination or result in a breach of any covenant, representation or warranty or other obligation or agreement of StoneBridge and/or Amalgamation Sub under the Business Combination Agreement or result in a breach of any covenant, representation or warranty or other obligation or agreement of the Sponsor contained in the Sponsor Support Agreement.

The Sponsor has also agreed, pursuant to the Sponsor Support Agreement, to use reasonable best efforts to take or do, or cause to be taken or done, all actions and/or things reasonably necessary to consummate the Business Combination and to refrain from taking any action that would reasonably be expected to delay or prevent the satisfaction of the conditions to the Amalgamation.

In addition, the Sponsor has agreed (i) to the terms of the Sponsor Share Conversion, (ii) to not assert or perfect any and all rights to adjustment or other anti-dilution protections that the Sponsor has or will have under the organizational documents of StoneBridge, (iii) to not redeem any of its StoneBridge Class A Ordinary Shares and (iv) to not commence or participate in, and to take all necessary actions to opt out of any class in any class action with respect to, any claim, derivative or otherwise, against StoneBridge, DigiAsia, any affiliate or designee of the Sponsor acting in his or her capacity as director or any of their respective successors and assigns relating to the negotiation, execution or delivery of the Sponsor Support Agreement, the Business Combination Agreement or the consummation of the transactions contemplated by the Business Combination Agreement or the Sponsor Support Agreement. In the event the Business Combination is terminated, the foregoing covenants of the Sponsor will be null and void.

Pursuant to the Sponsor Support Agreement, the Sponsor has also agreed to assign for the benefit of investors to be identified in the Transaction Financing, 50% of the Private Warrants held by the Sponsor as of the date of the Sponsor Support Agreement.

The Sponsor also agreed, pursuant to the Sponsor Support Agreement, to exercise its second option pursuant to StoneBridge’s amended and restated memorandum and articles of association (having already exercised its first option) to extend the period within which StoneBridge must consummate a business combination by an additional three months (from January 20, 2023 to April 20, 2023) and, in connection with such exercise and deadline extension, to deposit $1.0 million into the Trust Account in exchange for the issuance by StoneBridge to the Sponsor or its affiliates or designees, a non-interest bearing, unsecured promissory note equal to the amount of the deposit. On October 13, 2022, the Sponsor exercised the aforementioned second option and deposited $1.0 million into the Trust Account, and in exchange therefor, StoneBridge issued a non-interest bearing, unsecured promissory note in the amount of $1.0 million to the Sponsor.

StoneBridge had until January 20, 2023, 18 months from the closing of its initial public offering, to consummate an initial business combination. Pursuant to an approval of a proposal by StoneBridge shareholders on January 20, 2023, the Sponsor or its designees had the option to extend the deadline by which StoneBridge must consummate an initial business combination by up to six times by an additional month each time, provided that, for each extension, the Sponsor or its affiliates or designees, were required to deposit into the Trust Account, $0.05 for each StoneBridge Class A Ordinary Share then outstanding (not to exceed $150,000 per extension), on or prior to the date of the applicable deadline, in exchange for StoneBridge’s issuance to the Sponsor or its affiliates or designees a non-interest bearing, unsecured promissory note equal to the amount of any such deposit. Such promissory note will not be repaid in the event that StoneBridge is unable to consummate a business combination unless there are funds available outside the Trust Account to do so. The Sponsor exercised all of its options to extend the period for StoneBridge to consummate an initial business combination from January 20, 2023 to July 20, 2023, and in connection with such extensions, the Sponsor deposited an aggregate of $1.9 million into the Trust Account, in exchange for non-interest bearing, unsecured promissory notes issued by StoneBridge to the Sponsor that will not be repaid in the event that StoneBridge is unable to close a business combination unless there are funds available outside the Trust Account to do so.

Pursuant to a subsequent approval by StoneBridge shareholders at the extraordinary general meeting held on July 19, 2023, the Sponsor or its affiliates or designees have the option to further extend the deadline by which StoneBridge must consummate an initial business combination by up to six times by an additional month each time, provided that, for each extension, the Sponsor or its affiliates or designees, are required to deposit into the Trust Account, $0.025 for each StoneBridge Class A Ordinary Share then outstanding, on or prior to the date of the applicable deadline, in exchange for StoneBridge’s issuance to the Sponsor or its affiliates or designees a non-interest bearing, unsecured promissory note equal to the amount of any such deposit. Such promissory note will not be repaid

6

in the event that StoneBridge is unable to consummate a business combination unless there are funds available outside the Trust Account to do so. The Sponsor exercised all of its options to extend the date by which StoneBridge must consummate an initial business combination from July 20, 2023 to January 20, 2024.

Pursuant to a subsequent approval by StoneBridge shareholders at the extraordinary general meeting held on January 17, 2024, the Sponsor or its affiliates or designees have the option to further extend the deadline by which StoneBridge must consummate an initial business combination by up to six times by an additional month each time up to July 20, 2024, provided that, for each extension, the Sponsor or its affiliates or designees, are required to deposit into the Trust Account, $0.025 for each StoneBridge Class A Ordinary Share then outstanding, on or prior to the date of the applicable deadline, in exchange for StoneBridge’s issuance to the Sponsor or its affiliates or designees a non-interest bearing, unsecured promissory note equal to the amount of any such deposit. Such promissory note will not be repaid in the event that StoneBridge is unable to consummate a business combination unless there are funds available outside the Trust Account to do so.

As of the date of this prospectus, the Sponsor has exercised three of its six options to extend the period for StoneBridge to consummate an initial business combination, such that StoneBridge currently has until April 20, 2024 (subject to further extensions by the Sponsor or its affiliates or designees) to complete its initial business combination. In connection with such extensions, the Sponsor has deposited an aggregate of approximately $166,136 into the Trust Account as of the date of this prospectus/prospectus, in exchange for non-interest bearing, unsecured promissory notes issued by StoneBridge to the Sponsor that will not be repaid in the event that StoneBridge is unable to close a business combination unless there are funds available outside the Trust Account to do so.

Lastly, the Sponsor has agreed, pursuant to the Sponsor Support Agreement, that, subject to certain exceptions, the Sponsor will not, without DigiAsia’s prior approval (i) sell, offer to sell, contract or agree to sell, lend, offer, encumber, donate, hypothecate, pledge, grant any option, right or warrant to purchase or otherwise transfer, dispose of or agree to transfer or dispose of, directly or indirectly, or establish or increase a put equivalent position or liquidate or decrease a call equivalent position, (a) any PubCo Ordinary Shares held by the Sponsor immediately after the Effective Time or (b) any securities convertible into or exercisable or exchangeable for PubCo Ordinary Shares held by the Sponsor immediately after the Effective Time (the securities in sub-clauses (a) and (b) being collectively referred to as the “Sponsor Lock-Up Shares), (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of any of the Lockup Shares or (iii) publicly announce any intention to effect any transaction specified in clauses (i) and (ii) above, until the earlier of (A) (x) with respect to 250,000 of the Lock-Up Shares, nine months after the Closing Date and (y) with respect to the remainder of the Lock-Up Shares, six months after the Closing Date, and (B) subsequent to the Amalgamation, (x) if the last sale price of the PubCo Ordinary Shares equals or exceeds $12.00 per PubCo Ordinary Share (as adjusted for share splits, share consolidations, share capitalizations, rights issuances, subdivisions, reorganizations, recapitalizations and the like) for any 20 trading days within any 30-trading day period commencing at least 150 days after the Amalgamation, or (y) the date on which PubCo completes a liquidation, merger, share exchange, reorganization or other similar transaction that results in all of PubCo’s shareholders having the right to exchange their PubCo Ordinary Shares for cash, securities or other property.

As of the date of this prospectus, the Sponsor owns approximately 67.3% of the issued and outstanding StoneBridge Ordinary Shares (including 100% of the issued and outstanding StoneBridge Class B Ordinary Shares).

DigiAsia Shareholder Lock-Up Agreement

Substantially concurrently with the execution and delivery of the Business Combination Agreement, certain shareholders of DigiAsia entered into an agreement with StoneBridge pursuant to which such DigiAsia shareholders severally agreed that, subject to certain exceptions, each such shareholder will not, without the prior approval of the board of directors of StoneBridge or the board of directors of PubCo, as the case may be, (i) sell, offer to sell, contract or agree to sell, lend, offer, encumber, donate, hypothecate, pledge, grant any option, right or warrant to purchase or otherwise transfer, dispose of or agree to transfer or dispose of, directly or indirectly, or establish or increase a put equivalent position or liquidate or decrease a call equivalent position, (a) any PubCo Ordinary Shares held by such shareholder immediately after the Effective Time or (b) any securities convertible into or exercisable or exchangeable for PubCo Ordinary Shares held by such shareholder immediately after the Effective Time (the securities in sub-clauses (a) and (b) being collectively referred to as the “DigiAsia Shareholder Lock-Up Shares”), (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of any of such shareholder’s DigiAsia Shareholder Lock-Up Shares or (iii) publicly announce any intention to effect

7