As filed with the Securities and Exchange Commission on April 9, 2024

Registration No. 333-276422

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

TO

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_____________________

_____________________

| | 6770 | 86-1671207 | ||

| (State or Other Jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

60 Walnut Avenue, Suite 400

Clark, New Jersey 07066

(732) 340-0700

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

_____________________

Vikas Desai

Chief Executive Officer

60 Walnut Avenue, Suite 400

Clark, NJ 07066

Telephone: (732) 340-0700

(Name, address, including zip code and telephone number, including area code, of agent for service)

_____________________

Copies to:

|

William S. Rosenstadt |

_____________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after (i) this registration statement is declared effective and (ii) upon completion of the applicable transactions described in the enclosed joint proxy statement/prospectus.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||

|

| ☒ | Smaller reporting company | | |||||

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the SEC, acting pursuant to said section 8(a), may determine.

The information in this joint proxy statement/prospectus is not complete and may be changed. Achari Ventures Holdings Corp. I may not issue the securities offered by this joint proxy statement/prospectus until the registration statement filed with the Securities and Exchange Commission, of which this joint proxy statement/prospectus is a part, is declared effective. This joint proxy statement/prospectus does not constitute an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale of these securities is not permitted.

PROXY STATEMENT FOR

EXTRAORDINARY GENERAL MEETING OF THE STOCKHOLDERS OF

ACHARI VENTURES HOLDINGS CORP. I

PROSPECTUS FOR UP TO 17,600,000 SHARES OF CLASS A COMMON STOCK OF

ACHARI VENTURES HOLDINGS CORP. I

(WHICH WILL BE RENAMED VASO HOLDING CORPORATION IN CONNECTION

WITH THE BUSINESS COMBINATION DESCRIBED HEREIN)

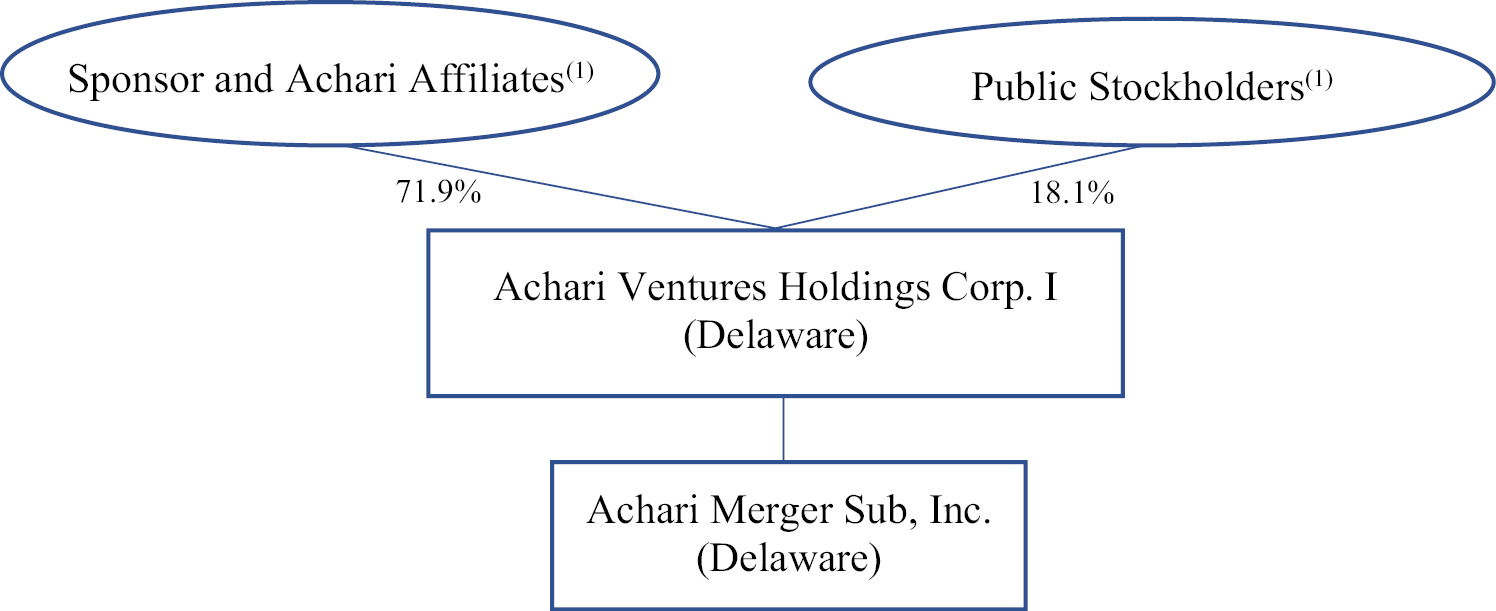

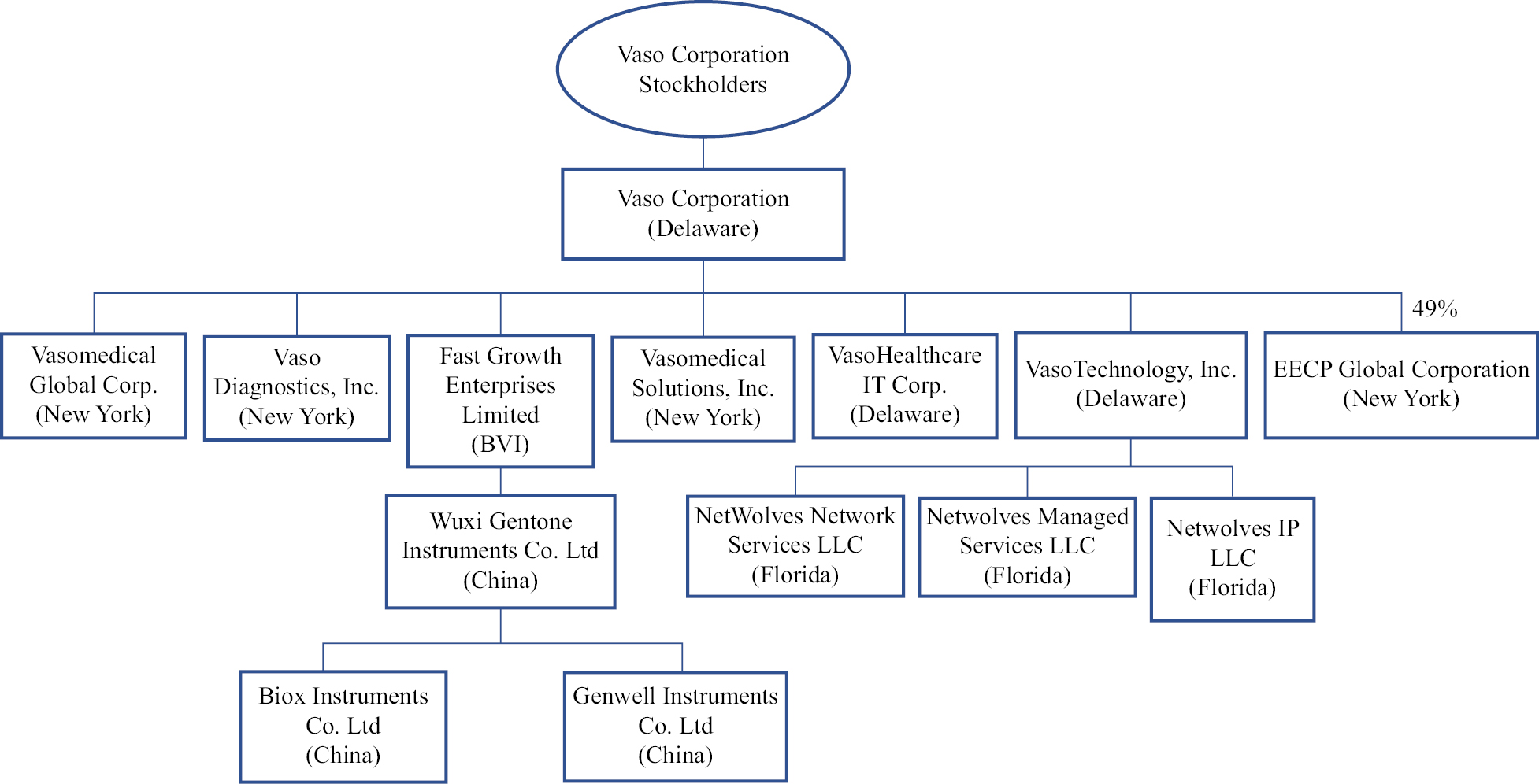

The board of directors (the “Board”) of Achari Ventures Holdings Corp. I, a Delaware corporation (“Achari”), has approved the transactions (collectively, the “Business Combination”) contemplated by that certain Business Combination Agreement, dated as of December 6, 2023 (the “Business Combination Agreement”), by and among Achari, Achari Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Achari (“Merger Sub”), and Vaso Corporation, a Delaware corporation (“Vaso”), a copy of which is attached to this joint proxy statement/prospectus as Annex A.

As described in this joint proxy statement/prospectus, Achari’s stockholders are being asked to consider and vote upon the following proposals, including with respect to approval of the Business Combination, among other items. Capitalized terms used but not defined herein shall have their respective meanings as set forth in the Business Combination Agreement.

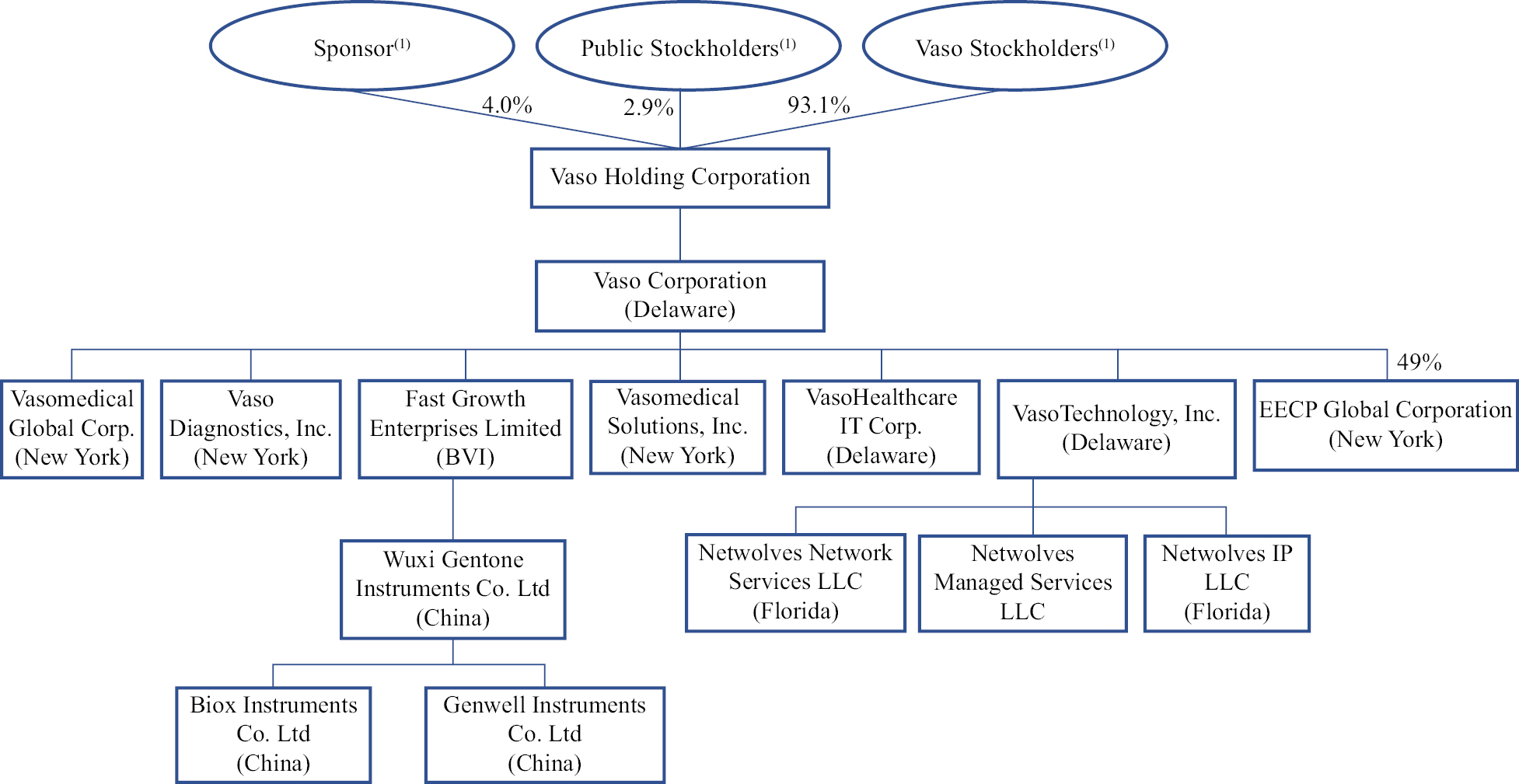

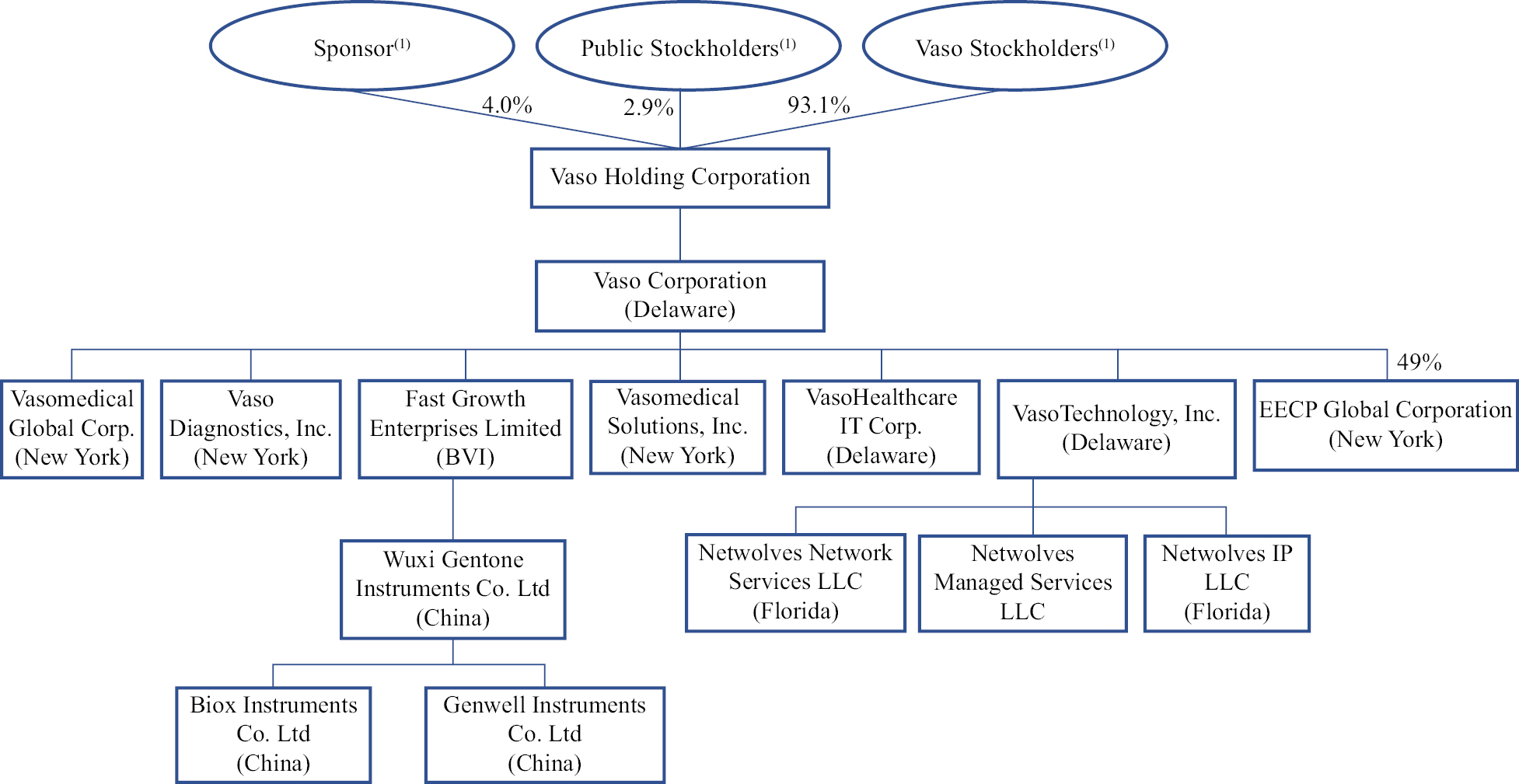

Proposal 1 — The Business Combination Proposal — To consider and vote upon a proposal to adopt and approve the Business Combination Agreement, dated as of December 6, 2023, by and among Achari, Achari Merger Sub, and Vaso, pursuant to which, among other things, Merger Sub shall merge with and into Vaso (the “Merger”), with Vaso being the surviving corporation of the Merger, and, as a result of which, it will become a wholly owned subsidiary of Achari, a copy of the Business Combination Agreement being attached to the accompanying joint proxy statement/prospectus as Annex A, and the transactions contemplated thereby and by the Ancillary Agreements (as defined in the Business Combination Agreement”).

Proposal 2 — The Charter Amendment Proposals — To consider and vote upon the approval of the amendment and restatement of Achari’s Fifth Amended and Restated Certificate of Incorporation (the “Current Charter”), in its entirety, and adopt the proposed certificate of incorporation, attached to the accompanying joint proxy statement/prospectus as Annex B (the “SPAC A&R CoI”), in connection with the Business Combination in order to, among other matters, (i) change the post-Business Combination corporate name from “Achari Ventures Holdings Corp. I” to “Vaso Holding Corporation” and (ii) remove various provisions of the Current Charter applicable only to a blank check company that will no longer be applicable to Achari upon consummation of the Business Combination.

Proposal 3 — The Governance Proposal — To consider and vote upon, on a non-binding advisory basis, a governance provision in the SPAC A&R CoI, presented separately in accordance with the U.S. Securities and Exchange Commission requirements, to increase the Company’s authorized common stock from (i) 100,000,000 shares of common stock, par value $0.0001 per share, pre-Business Combination (the “SPAC Shares”) to (ii) 110,000,000 shares of common stock post-Business Combination (which shall be divided into 100,000,000 authorized shares of Class A common stock, each with par value $0.0001 per share (the “Class A Common Stock”) and 10,000,000 authorized shares of Class B common stock, each with par value $0.0001 per share (the “Current Charter”).

Proposal 4 — The 2024 Equity Incentive Plan Proposal — To consider and vote upon a proposal to approve and adopt the Vaso Holding Corporation 2024 Equity Incentive Plan (the “2024 Equity Incentive Plan”), substantially in the form attached to the accompanying joint proxy statement/prospectus as Annex C, including the authorization of the initial share reserve under the 2024 Equity Incentive Plan as contemplated by the Business Combination Agreement.

Proposal 5 — The Nasdaq 20% Proposal — To consider and vote upon a proposal to approve the issuance of shares constituting more than 20% of Achari’s issued and outstanding common stock pursuant to the terms of the Business Combination Agreement, as required by Nasdaq Listing Rules 5635(a), (b) and (d).

Proposal 6 — The Director Election Proposal — To consider and vote upon a proposal to elect Joshua Markowitz, David Lieberman, Jun Ma, Jane Moen, Edgar Rios, Behnam Movaseghi, Leon Dembo, [independent director nominee to be named] and [independent director nominee to be named] to serve as directors on Achari’s board of directors until the next annual meeting of Achari’s stockholders or until their respective successors are elected and qualified.

Proposal 7 — The Adjournment Proposal — To approve the adjournment of the Stockholders’ Meeting, if necessary, (i) to permit further solicitation and voting of proxies if, based upon the tabulated vote at the time of the Stockholders’ Meeting, there are not sufficient votes received to pass the resolution to approve the aforementioned proposals at the Stockholders’ Meeting, or (ii) because a quorum for the Stockholders’ Meeting has not been established.

On the date of the closing of the Business Combination (the “Closing”), Merger Sub will merge with and into Vaso (the “Merger”), with Vaso being the surviving corporation of the Merger (the date and time that the Merger becomes effective being referred to herein as the “Effective Time”), and, as a result of which, Vaso will become a wholly owned subsidiary of Achari.

At the Effective Time, the SPAC A&R CoI which shall have been filed with the Secretary of State of the State of Delaware (which will amend and restate, in its entirety Achari’s Current Charter) will authorize two classes of Common Stock: the Class A Common Stock and the Class B Common. Pursuant to the SPAC A&R, CoI, holders of Class A Common Stock are entitled to one vote per share of the same, while holders of Class B Common Stock are entitled to one-hundred votes per share of the same, and all such holders will vote together as a single class except as otherwise required by applicable law. Further, pursuant to the SPAC A&R CoI, each share of Class B Common Stock held of record shall automatically, without any further action, convert into one fully paid and nonassessable share of Class A Common Stock on the first calendar day after the fifth anniversary of its issuance. No shares of Class B Common Stock will be outstanding following the consummation of the Business Combination. However, if such shares of Class B Common Stock are issued in the future, the holders of Class B Common Stock, will collectively likely hold a substantial majority of the voting power of our outstanding capital stock, and may therefore be able to control matters submitted to our common stockholders for approval. This concentrated control of common stock voting power may limit or preclude the ability of holders of our Class A Common Stock to influence certain corporate matters. We believe that it is important for the post-Business Combination company to have available for issuance shares of Class B Common Stock to provide necessary flexibility for future corporate needs. No Class B Common Stock or preferred stock will be outstanding upon completion of the Business Combination. However, such Class B Common Stock or preferred stock may be issued in the future, for example to investors in situations where we are not able to conduct a fundraising through the issuance of Class A Common Stock or in certain other circumstances. See section entitled “Risk Factors — The dual class structure of our Common Stock after the Business Combination will have the effect of concentrating voting control with the holders of our Class B Common Stock; this will limit or preclude your ability to influence corporate matters.”

Pursuant to the SPAC A&R CoI, except as required by applicable law, beginning on the date on which there are no longer any Achari Put Shares (as defined in that certain Put Option Agreement, to be entered into simultaneously with the Closing by and among Achari, Vaso and Achari Sponsor Holdings I LLC, a Delaware limited liability company and the sponsor of Achari (the “Sponsor”) (such agreement, the “Put Option Agreement”)) that remain outstanding (the “Put Option Deadline”), each share of Class B Common Stock shall be convertible, at the option of the holder thereof, at any time after the Put Option Deadline, without the payment of additional consideration by the holder thereof, into one fully paid and nonassessable share of Class A Common Stock.

At the Effective Time, by virtue of the Merger and without any action on the part of any Person, each share of common stock, par value $0.001 per share, of Vaso (the “Vaso Shares”) (excluding any dissenting shares and cancelled treasury stock) issued and outstanding as of immediately prior to the Effective Time will be automatically cancelled and extinguished and converted into shares of Class A Common Stock based on an exchange ratio of approximately 0.0998 shares of Class A Common Stock for each Vaso Share.

The SPAC Shares are currently listed on the Nasdaq Global Market (The Nasdaq Stock Market LLC (including any of the tiers thereof, “Nasdaq”) under the symbol “AVHI”. For risks regarding our listing on Nasdaq see “Risk Factors — Achari was previously notified by Nasdaq that it was not in compliance with certain standards that Nasdaq requires listed companies to meet for their securities to continue to be listed and traded on its exchange. On December 7, 2023, Achari presented a plan of compliance to the Nasdaq Hearings Panel with respect to such deficiencies and which involved consummating the Business Combination with Vaso as part of the compliance plan. Nasdaq subsequently granted Achari an extension, until April 2, 2024, to consummate the Business Combination. On April 5, 2024, Achari received a letter from Nasdaq indicating that Achari did not meet the terms of the Panel’s extension by because Achari and Vaso had not consummated their Business Combination by April 2, 2024. As a result, the letter stated that Achari’s securities will be delisted from the Nasdaq exchange, with trading in Achari’s shares suspended as of April 9, 2024. Achari intends to request that the Nasdaq Listing and Hearing Review Council review the decision to delist Achari’s securities. The delisting of Achari’s securities may adversely affect their liquidity and trading price, or otherwise limit investors’ ability to make transactions with respect to Achari’s securities, and may further delay or prevent the consummation of the Business Combination with Vaso.”

Prior to Closing, Achari will use its reasonable best efforts to cause the Class A Common Stock to be issued in connection with the Business Combination to be approved for listing on Nasdaq, including by submitting, prior to the Closing, an initial listing application with Nasdaq (the “Stock Exchange Listing Application”) with respect to such shares, subject to official notice of issuance. In connection with the Closing, the Class A Common Stock and the then issued and outstanding warrants entitling the holder thereof to purchase three quarters of one (1) SPAC Share at a price of $11.50 per share (subject to adjustment as described in the Warrant Agreement attached as Exhibit 4.1 to this joint proxy statement/prospectus)), issued pursuant to the Warrant Agreement (such warrants, the “SPAC Warrants”) will trade publicly on Nasdaq under the ticker symbols “VASO” and “VASOW”, respectively (or alternative ticker symbols chosen by Vaso and reasonably acceptable to Achari).

It is a condition of the consummation of the Business Combination that Achari’s Stock Exchange Listing Application shall have been conditionally approved, and immediately following the Effective Time, Achari must satisfy any applicable initial and continuing listing requirements of Nasdaq, and the Class A Common Stock issued in connection with the Business Combination shall have been approved for listing on Nasdaq. However, there can be no assurance that such listing condition will be met or that Achari will obtain such approval from Nasdaq. If such listing condition is not met or if such approval is not obtained, the Business Combination will not be consummated unless such stock exchange approval condition set forth in the Business Combination Agreement is waived by the applicable parties.

Achari reserves the right to postpone or adjourn the extraordinary general meeting of the holders of SPAC Shares (the “Stockholders’ Meeting”) on one or more occasions in accordance with the terms and conditions of the Business Combination Agreement.

This joint proxy statement/prospectus provides stockholders of Achari with detailed information about the Business Combination and other matters to be considered at the Stockholders’ Meeting. It also includes information about Achari and Vaso. We encourage you to read this entire joint proxy statement/prospectus, including the Annexes hereto and the other documents referred to therein, carefully and in their entirety. You should also carefully consider the risk factors described in the section titled “Risk Factors” in this joint proxy statement/prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS JOINT PROXY STATEMENT/PROSPECTUS, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURES IN THIS JOINT PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

This joint proxy statement/ prospectus is dated ________, 2024, and is first being mailed to

Achari’s stockholders on or about ________, 2024.

Achari Ventures Holdings Corp. I

60 Walnut Avenue, Suite 400

Clark, New Jersey 07066

Dear Stockholders:

You are cordially invited to attend the extraordinary general meeting (the “Stockholders’ Meeting”) of the stockholders of Achari Ventures Holdings Corp. I (“Achari”) to be held on , ___ 2024, which we intend to hold virtually at https://www.cstproxy.com/[--------------]. Achari is a Delaware corporation incorporated as a blank check company for the purpose of entering into a merger, share exchange, asset acquisition, share purchase, recapitalization, reorganization or similar business combination with one or more businesses or entities.

Holders of the common stock of Achari will be asked to approve, among other things, the Business Combination Agreement, dated as of December 6, 2023, by and among Achari, Vaso Corporation, a Delaware corporation (“Vaso”), and Achari Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Achari (“Merger Sub”) (as amended from time to time in accordance with its terms, the “Business Combination Agreement”), pursuant to which Merger Sub will merge (the “Merger”) with and into Vaso, with Vaso surviving the merger (the transactions contemplated by the Business Combination Agreement, including, without limitation, the Merger, the “Business Combination”). As a result, Vaso will become a wholly-owned subsidiary of Achari. The holders of the capital stock of Vaso will be entitled to receive up to an aggregate of 17,600,000 shares of Class A Common Stock, par value $0.0001 per share, of Achari (the “Class A Common Stock”) in exchange for all of the outstanding shares of Vaso’s capital stock.

An amended and restated certificate of incorporation of Achari, to be filed with the Secretary of State of the State of Delaware on the date of the consummation of the Merger (the “SPAC A&R CoI”), will authorize two classes of common stock of Achari, $0.0001 par value per share (the “Common Stock”): the Class A Common Stock and the Class B Common Stock, par value $0.0001 per share (the “Class B Common Stock”).

Pursuant to the SPAC A&R CoI, holders of Class A Common Stock are entitled to one vote per share of the same, while holders of Class B Common Stock are entitled to one hundred votes per share of the same, and all such holders will vote together as a single class except as otherwise required by applicable law. Further, pursuant to the SPAC A&R CoI, each share of Class B Common Stock held of record shall automatically, without any further action, convert into one fully paid and nonassessable share of Class A Common Stock on the first calendar day after the fifth anniversary of its issuance. No shares of Class B Common Stock will be outstanding following the consummation of the Business Combination. However, if such shares of Class B Common Stock are issued in the future, the holders of Class B Common Stock, will collectively likely hold a substantial majority of the voting power of our outstanding capital stock, and may therefore be able to control matters submitted to our common stockholders for approval. This concentrated control of common stock voting power may limit or preclude the ability of holders of our Class A Common Stock to influence certain corporate matters. The Achari board of directors (the “Achari Board”) believes that it is important for the post-Business Combination company to have available for issuance shares of Class B Common Stock to provide necessary flexibility for future corporate needs. No Class B Common Stock or preferred stock will be outstanding upon completion of the Business Combination. However, such Class B Common Stock or preferred stock may be issued in the future, for example to investors in situations where we are not able to conduct a fundraising through the issuance of Class A Common Stock or in certain other circumstances. See section entitled “Risk Factors — The dual class structure of our Common Stock after the Business Combination will have the effect of concentrating voting control with the holders of our Class B Common Stock; this will limit or preclude your ability to influence corporate matters.”

Pursuant to the SPAC A&R CoI, except as required by applicable law, beginning on the date on which there are no longer any Achari Put Shares (as defined in that certain Put Option Agreement, to be entered into simultaneously with the consummation of the Business Combination, by and among Achari, Vaso and Achari Sponsor Holdings I LLC, a Delaware limited liability company and the sponsor of Achari (the “Sponsor”) (such agreement, the “Put Option Agreement”)) that remain outstanding (the “Put Option Deadline”), each share of Class B Common Stock shall be convertible, at the option of the holder thereof, at any time after the Put Option Deadline, without the payment of additional consideration by the holder thereof, into one fully paid and nonassessable share of Class A Common Stock.

Pursuant to Achari’s Fifth Amended and Restated Certificate of Incorporation (the “Current Charter”), a holder of issued and outstanding shares of common stock, par value $0.0001 per share, of Achari (the “SPAC Shares”) may request that Achari redeem all or a portion of such SPAC Shares for cash if the Business Combination is consummated. A “Public Stockholder” as used herein means a holder of SPAC Shares, other than our Sponsor (or any other holder of our Founder Shares) and our officers and directors. To exercise such redemption rights, a Public Stockholder must identify itself in writing as a beneficial holder of the applicable SPAC Shares and provide its legal name, phone number and address to Achari’s transfer agent in order to validly redeem such SPAC Shares. Public Stockholders may elect to redeem their respective SPAC Shares whether they vote “For” or “Against” the Business Combination Proposal (as hereinafter described in the accompanying joint proxy statement/prospectus) or abstain from voting. If the Business Combination is not consummated, the SPAC Shares will be returned to the respective holders, broker or bank, as applicable. If the Business Combination is consummated, and if a Public Stockholder properly exercises its right to redeem all or a portion of the SPAC Shares that it holds and timely tenders or delivers such SPAC Shares to Achari’s transfer agent, Achari will redeem such SPAC Shares for a per share price, payable in cash, equal to the pro rata portion of the trust account established at the consummation of Achari’s initial public offering, calculated as of two business days prior to the consummation of the Business Combination, including interest earned on the funds held in such trust account (net of taxes payable).

Notwithstanding the foregoing, a Public Stockholder, together with any such stockholder’s affiliates or any other person or entity with whom such stockholder is acting in concert or as a “group” (as defined in Section 13 of the Securities Exchange Act of 1934, as amended), will be restricted from seeking redemption rights with respect to more than an aggregate of 15% of the SPAC Shares sold in Achari’s initial public offering.

For illustrative purposes, as of __________, 2024, the most recent practicable date prior to the date of the accompanying joint proxy statement/prospectus, the redemption price per share would have amounted to approximately $__________, based on the aggregate amount on deposit in the aforementioned trust account of approximately $__________ as of _________, 2024 (including interest earned on the funds held in such trust account and not previously released to Achari to pay its taxes), divided by the total number of then outstanding shares of Achari’s common stock which were originally sold in its initial public offering (whether they were purchased in the initial public offering or thereafter in the open market) and for the avoidance of doubt, excluding our Founder Shares, the “Public Shares”). If a Public Stockholder exercises its redemption rights in full, then it will be electing to exchange its SPAC Shares for cash and, upon the consummation of the Business Combination, will no longer own any SPAC Shares. See “Stockholders’ Meeting — Redemption Rights” in the accompanying joint proxy statement/prospectus for a detailed description of the procedures to be followed if you wish to redeem your SPAC Shares for cash. A Public Stockholder must complete the procedures for electing to redeem its SPAC Shares in the manner described in the accompanying joint proxy statement/prospectus prior to 5:00 p.m., Eastern Time, on _________, 2024 (i.e., two business days before the initially scheduled date of the Stockholders’ Meeting) in order for its SPAC Shares to be redeemed.

The percentage of the issued and outstanding shares of Common Stock immediately following the consummation of the Business Combination that will be held by our Public Stockholders will depend on how many of those stockholders redeem their respective SPAC Shares in connection with the Business Combination. For example, if our Public Stockholders redeem none of the redeemable SPAC Shares, our remaining current Public Stockholders will own approximately 2.9% of the issued and outstanding shares of Common Stock following the Business Combination (assuming no warrants have been exercised), whereas, if such redemption were 40% of all redeemable SPAC Shares, then the current Public Stockholders would own approximately 1.8% of the issued and outstanding shares of Common Stock immediately following the consummation of the Business Combination (assuming no warrants have been exercised).

Upon the consummation of the Merger, the SPAC A&R CoI, which shall have been filed with the Secretary of State of the State of Delaware (the SPAC A&R CoI will amend and restate, in its entirety, the Current Charter), will reflect that Achari (i) has changed its name to Vaso Holding Corporation, and (ii) the reclassification of all of Achari’s then authorized shares of Common Stock (as described herein). The issuance of shares of Class A Common Stock to the securityholders of Vaso is being registered on a registration statement on Form S-4 of which this joint proxy statement/prospectus forms a part.

To vote its Public Shares at the Stockholders’ Meeting on the Business Combination Proposal (as defined in Proposal 1 of the accompanying joint proxy statement/prospectus), a stockholder must be a stockholder of Achari as of ______, 2024, the record date for the Stockholders’ Meeting (the “Record Date”). Accordingly, if you purchase

Public Shares after the Record Date, you will not be able to redeem your shares upon consummation of the Business Combination unless you have either (i) obtained a written agreement from the seller/transferor of such Public Shares whereby such seller/transferor agrees to vote such shares in accordance with your instructions, or (ii) obtained a proxy from such seller/transferor which authorizes you to vote the Public Shares held in record name of such seller/transferor, and you must actually vote such Public Shares on the Business Combination Proposal.

On April 1, 2024, the trust account established at the consummation of Achari’s initial public offering held approximately $6,172,959. On March 28, 2024, the closing price of Achari’s common stock as reported by Nasdaq was $11.02, and the closing price of Achari’s warrants as reported by Nasdaq was $0.0201. As of December 31, 2023, Achari held approximately $48,395 in cash outside of the Trust Account (as hereinafter defined) and was available for working capital purposes.

Each stockholder’s vote is important. Whether or not you plan to attend the Stockholders’ Meeting virtually, please submit your proxy card without delay. Stockholders may revoke proxies at any time before they are voted at the Stockholders’ Meeting. Voting by proxy will not prevent a stockholder from voting virtually at the Stockholders’ Meeting if such stockholder subsequently chooses to attend the Stockholders’ Meeting.

If you plan to attend the Stockholders’ Meeting and are a beneficial holder of SPAC Shares who owns your shares through a bank or broker, you will need to contact Continental Stock Transfer & Trust Company to receive a control number. Please read carefully the sections in the accompanying joint proxy statement/prospectus regarding attending and voting at the Stockholders’ Meeting to ensure that you comply with these requirements.

We encourage you to read this joint proxy statement/prospectus carefully. In particular, you should review the matters discussed under the caption “Risk Factors” herein.

Achari’s Board of Directors unanimously recommends that Achari stockholders vote “FOR” approval of each of the proposals set forth herein. Achari’s directors and officers may have financial interests in the Business Combination that differ from, or are in addition to, their respective interests, if any, as stockholders of Achari and the interests of stockholders of Achari generally. The existence of financial and personal interests of one or more of Achari’s directors may result in a conflict of interest on the part of such director(s) between what they may believe is in the best interests of Achari and its stockholders and what they may believe is best for themselves in determining to recommend that Achari’s stockholders vote “FOR” approval of each of the proposals set forth herein. See the section of this joint proxy statement/prospectus entitled “Proposal 1 — The Business Combination Proposal — Interests of Achari’s Directors and Officers and Others in the Business Combination.”

|

Very truly yours, |

||

|

|

||

|

Vikas Desai |

||

|

Chief Executive Officer |

||

|

Achari Ventures Holdings Corp. I |

Achari Ventures Holdings Corp. I

60 Walnut Avenue, Suite 400

Clark, New Jersey 07066

NOTICE OF EXTRAORDINARY GENERAL MEETING OF STOCKHOLDERS

TO BE HELD ON ________, 2024

TO THE STOCKHOLDERS OF ACHARI VENTURES HOLDINGS CORP. I:

NOTICE IS HEREBY GIVEN that an extraordinary general meeting of stockholders (the “Stockholders’ Meeting”) of Achari Ventures Holdings Corp. I, a Delaware corporation (“Achari”), will be held at ____ a.m. Eastern Time, on _________, 2024. The Stockholders’ Meeting will be a completely virtual meeting of Achari’s stockholders, which will be conducted via live webcast. You will be able to attend the Stockholders’ Meeting online and vote during the Stockholders’ Meeting by visiting https://www.cstproxy.com [_______]. You are cordially invited to attend the Stockholders’ Meeting online, which will be held for the following purposes (capitalized terms used but not defined herein shall have their respective meanings as set forth in the Business Combination Agreement (as hereinafter defined)):

(1) To consider and vote upon a proposal to approve the Business Combination Agreement (as amended from time to time in accordance with its terms, the “Business Combination Agreement”), dated as of December 6, 2023, by and among Achari, Achari Merger Sub, Inc., a Delaware corporation (“Merger Sub”), and Vaso Corporation, a Delaware corporation (“Vaso”), pursuant to which, among other things, Merger Sub shall merge with and into Vaso (the “Merger”), with Vaso being the surviving corporation of the Merger, and, as a result of which, it will become a wholly owned subsidiary of Achari, a copy of the Business Combination Agreement being attached to the accompanying joint proxy statement/prospectus as Annex A, and the transactions contemplated thereby and by the Ancillary Agreements (as defined in the Business Combination Agreement”), including the Merger (collectively referred to herein as the “Business Combination”). This proposal is referred to as the “Business Combination Proposal” or “Proposal 1”.

(2) To consider and vote upon the approval of the amendment and restatement of Achari’s Fifth Amended and Restated Certificate of Incorporation (the “Current Charter”), in its entirety, and adopt the proposed certificate of incorporation, attached to the accompanying joint proxy statement/prospectus as Annex B (the “SPAC A&R CoI”), in connection with the Business Combination in order to, among other matters, (i) change the post-Business Combination corporate name from “Achari Ventures Holdings Corp. I” to “Vaso Holding Corporation” and (ii) remove various provisions of the Current Charter applicable only to a blank check company that will no longer be applicable to Achari upon consummation of the Business Combination. This proposal is collectively referred to as the “Charter Amendment Proposals” or “Proposal 2”.

(3) To consider and vote upon, on a non-binding advisory basis, a governance provision in the SPAC A&R CoI, presented separately in accordance with the U.S. Securities and Exchange Commission (“SEC”) requirements, to increase the Company’s authorized common stock from (i) 100,000,000 shares of common stock, par value $0.0001 per share, pre-Business Combination to (ii) 110,000,000 shares of common stock post-Business Combination (which shall be divided into 100,000,000 authorized shares of Class A common stock and 10,000,000 authorized shares of Class B common stock, each with par value $0.0001 per share). This proposal is referred to as the “Governance Proposal” or “Proposal 3”.

(4) To consider and vote upon a proposal to approve and adopt the approve the Vaso Holding Corporation 2024 Equity Incentive Plan (the “2024 Equity Incentive Plan”), substantially in the form attached to the accompanying joint proxy statement/prospectus as Annex C, including the authorization of the initial share reserve under the 2024 Equity Incentive Plan as contemplated by the Business Combination Agreement. This proposal is referred to as the “2024 Equity Incentive Plan Proposal” or “Proposal 4”.

(5) To consider and vote upon a proposal to approve the issuance of shares constituting more than 20% of Achari’s issued and outstanding common stock pursuant to the terms of the Business Combination Agreement, as required by Nasdaq Listing Rules 5635(a), (b), and (d). This proposal is referred to as the “Nasdaq 20% Proposal” or “Proposal 5”.

(6) To consider and vote upon a proposal to elect Joshua Markowitz, David Lieberman, Jun Ma, Jane Moen, Edgar Rios, Behnam Movaseghi, Leon Dembo, [independent director nominee to be named] and [independent director nominee to be named] to serve as directors on Achari’s board of directors until the next annual meeting of Achari’s stockholders or until their respective successors are elected and qualified. This proposal is referred to as the “Director Election Proposal” or “Proposal 6”.

(7) To approve the adjournment of the Stockholders’ Meeting, if necessary, (i) to permit further solicitation and voting of proxies if, based upon the tabulated vote at the time of the Stockholders’ Meeting, there are not sufficient votes received to pass the resolution to approve the aforementioned proposals at the Stockholders’ Meeting, or (ii) because a quorum for the Stockholders’ Meeting has not been established. This proposal is called the “Adjournment Proposal” or “Proposal 7”.

The above matters are more fully described in the accompanying joint proxy statement/prospectus. We urge you to read carefully the accompanying joint proxy statement/prospectus in its entirety, including the Annexes and accompanying financial statements of Achari and Vaso.

Proposals 1 through 7 above are sometimes collectively referred to herein as the “Proposals”. Unless waived by the parties to the Business Combination Agreement, the closing of the Business Combination is conditioned upon the approval by our stockholders of the Business Combination Proposal, the Charter Amendment Proposals, the 2024 Equity Incentive Plan Proposal, the Nasdaq 20% Proposal and the Director Election Proposal (collectively, the “Condition Precedent Proposals”). Each of the Business Combination Proposal, the Charter Amendment Proposals, the 2024 Equity Incentive Plan Proposal, the Nasdaq 20% Proposal and the Director Election Proposal is interdependent upon the others and must be approved in order for Achari to complete the Business Combination as contemplated by the Business Combination Agreement. The closing of the Business Combination is also conditioned, as set out herein, on matters that are outside of our control, including, without limitation, the approval of the Business Combination by the Vaso stockholders.

It is important for you to note that, in the event that the Business Combination Proposal is not approved by our stockholders, then Achari will not consummate the Business Combination. If Achari does not consummate the Business Combination and fails to complete an initial business combination by July 19, 2024 (assuming Achari exercises its Fifth CoI Monthly Extension Options (as defined herein)) or fails to obtain the approval of Achari’s board of directors and its stockholders to extend the deadline beyond such date, then Achari will be required to dissolve and liquidate.

As of April 1, 2024, there were 3,050,941 shares of common stock of Achari issued and outstanding and entitled to vote. Only Achari stockholders who hold common stock of record as of the close of business on ________, 2024 (the “Record Date”), are entitled to vote at the Stockholders’ Meeting or any adjournment thereof. This joint proxy statement/prospectus is first being mailed to Achari’s stockholders on or about _______, 2024.

Achari has determined that the Stockholders’ Meeting will be a virtual meeting conducted exclusively via live webcast. You or your proxyholder will be able to attend such virtual meeting online, vote, view the list of stockholders entitled to vote at such meeting and submit questions during such meeting by visiting [-----------------------------] and using a control number assigned by Continental Stock Transfer & Trust Company, our transfer agent, where you will be able to listen to such meeting live and vote during such meeting. Additionally, you have the option to listen to such meeting by dialing +[-----------------] (toll-free within the U.S. and Canada) or +[------------------] (outside of the U.S. and Canada, standard rates apply). The passcode for telephone access to such meeting is [------------], but please note that you cannot vote or ask questions if you choose to participate telephonically. Please note that you will only be able to access such meeting by means of remote communication. To register and receive access to such meeting, registered stockholders and beneficial stockholders (those holding shares through a stock brokerage account or by a bank or other holder of record) will need to follow the instructions applicable to them provided in this joint proxy statement/prospectus. Only stockholders of record at the close of business on the Record Date may vote at the Stockholders’ Meeting or any adjournment thereof. A complete list of our stockholders of record entitled to vote at the Stockholders’ Meeting will be available for ten days before the Stockholders’ Meeting at our principal executive offices for inspection by stockholders during ordinary business hours for any purpose germane to the Stockholders’ Meeting.

Approval of the Business Combination Proposal, the Governance Proposal (which is a non-binding, advisory vote), the 2024 Equity Incentive Plan Proposal, the Nasdaq 20% Proposal and the Adjournment Proposal will each require the affirmative vote of a majority of the issued and outstanding shares of our common stock present or

represented by proxy and entitled to vote at the Stockholders’ Meeting or any adjournment thereof. Abstentions will have no effect on the vote count for each of these Proposals. Achari does not expect there to be any broker non-votes on any of these Proposals.

The approval of the Charter Amendment Proposals requires the affirmative vote (virtually or by proxy) of the holders of sixty-five percent of all then issued and outstanding shares of our common stock entitled to vote thereon at the Stockholders’ Meeting. Accordingly, abstentions will have the same effect as a vote AGAINST this Proposal. Achari does not expect there to be any broker non-votes in connection with this Proposal.

The Director Election Proposal is decided by a plurality of the votes cast by the stockholders present virtually or represented by proxy at the Stockholders’ Meeting and entitled to vote on the election of Achari’s directors. This means that the director nominees will be elected if they receive more affirmative votes than any other nominee for the same position. Stockholders may not cumulate their votes with respect to the election of directors. Abstentions will have no effect on the vote count for this Proposal. Achari does not expect there to be any broker non-votes on this Proposal. The presence virtually or by proxy of a majority of the outstanding shares of Achari’s common stock entitled to vote at the Stockholders’ Meeting is necessary to constitute a quorum at the Stockholders’ Meeting. A stockholder’s failure to vote by proxy or to vote virtually at the Stockholders’ Meeting (which would include voting at the virtual Stockholders’ Meeting) will not be counted towards the number of shares of Achari’s common stock required to validly establish a quorum. Votes of stockholders of record who participate in the Stockholders’ Meeting or by proxy will be counted as present for purposes of determining whether a quorum exists, whether or not such holder abstains from voting on all of the Proposals. If you are a beneficial owner (as defined below) of shares of Achari’s common stock and you do not instruct your bank, broker or other nominee how to vote your shares on any of the Proposals, your shares will not be counted as present at the Stockholders’ Meeting for purposes of determining whether a quorum exists.

Our Board of Directors unanimously recommends that you vote “FOR” each of these Proposals and “FOR” each of the director nominees. Achari’s directors and officers may have financial interests in the Business Combination that differ from, or are in addition to, their respective interests, if any, as stockholders of Achari and the interests of stockholders of Achari generally. The existence of financial and personal interests of one or more of Achari’s directors may result in a conflict of interest on the part of such director(s) between what they may believe is in the best interests of Achari and its stockholders and what they may believe is best for themselves in determining to recommend that Achari’s stockholders vote for the Proposals. See the section of this joint proxy statement/prospectus entitled “Proposal 1 — The Business Combination Proposal — Interests of Achari’s Directors and Officers and Others in the Business Combination”.

Achari currently has authorized share capital of 100,000,000 shares of common stock of which 3,050,941 are issued and outstanding as of April 1, 2024, with a par value of $0.0001 per share, and 1,000,000 shares of preferred stock with a par value of $0.0001 per share, none of which are issued or outstanding.

Holders of Achari’s common stock will not be entitled to appraisal rights under Delaware law in connection with the Business Combination Proposal or any other Proposal.

Pursuant to the Current Charter, we are providing our Public Stockholders with the opportunity to redeem, upon the Closing, shares of common stock of Achari then held by them for a per share price, payable in cash, equal to a pro rata portion of the aggregate amount then on deposit in the Trust Account in accordance with the Current Charter (as equitably adjusted for stock splits, stock dividends, combinations, recapitalizations and the like after the Closing) (the “Redemption Price”). The Redemption Price will be calculated two days prior to the completion of the Business Combination in accordance with the Current Charter. The per share amount that we will distribute to stockholders who properly redeem their respective shares will not be reduced by the deferred underwriting commission that we will pay to the underwriters of Achari’s initial public offering pursuant to the registration statement on Form S-1 declared effective by the SEC on October 14, 2021 (File No. 333-258476) (the “IPO”) or transaction expenses incurred in connection with the Business Combination. For illustrative purposes and, based on the funds held in the Trust Account of approximately $6,172,959 as of April 1, 2024, the estimated per share redemption price would be approximately $11.20, net of taxes payable as of such date. Public Stockholders may elect to redeem their respective Public Shares even if they vote for the Business Combination.

You will be entitled to receive cash for any Public Shares to be redeemed only if you vote your Public Shares in favor of the Business Combination Proposal and:

(i) (a) hold Public Shares, or (b) hold Public Shares through units and you elect to separate your units into the underlying Public Shares and warrants (the “Public Warrants”) prior to exercising your redemption rights with respect to the Public Shares; and

(ii) prior to 5:00 p.m., Eastern time, on ______, 2024, (a) submit a written request to the Transfer Agent that Achari redeem your Public Shares for cash, and (b) deliver your Public Shares to the Transfer Agent physically or electronically through the Depository Trust Company.

To vote its Public Shares on the Business Combination Proposal at the Stockholders’ Meeting, a stockholder must be a stockholder of Achari as of the Record Date. Accordingly, if you purchase Public Shares after the Record Date, you will not be able to redeem your shares upon consummation of the Business Combination unless you have either (i) obtained a written agreement from the seller/transferor of the Public Shares whereby such seller/transferor agrees to vote such shares in accordance with your instructions, or (ii) obtained a proxy from such seller/transferor which authorizes you to vote the Public Shares held in record name of such seller/transferor, and you must actually vote such Public Shares on the Business Combination Proposal.

Holders of units must elect to separate the underlying Public Shares and Public Warrants prior to exercising their respective redemption rights with respect to Public Shares. Any demand for redemption, once made, may be withdrawn at any time until the deadline for exercising redemption requests and thereafter, with our consent, until the Closing.

A Public Stockholder, together with any of his, her or its affiliates or any other Person with whom it is acting in concert or as a “group” (as defined under Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), will be restricted from redeeming in the aggregate, his, her or its shares or, if part of such a group, the group’s shares, in excess of 15% of the shares of common stock included in the units sold in our IPO without the prior consent of Achari. We have no specified maximum redemption threshold under the Current Charter, other than the aforementioned 15% threshold. Every share of common stock that is redeemed by our Public Stockholders will reduce the amount in the Trust Account, which was approximately $6,172,959 as of April 1, 2024. Holders of our outstanding Public Warrants do not have redemption rights in connection with the Business Combination. Unless otherwise specified, the information in the accompanying joint proxy statement/prospectus assumes that none of our Public Stockholder exercise their respective redemption rights with respect to Public Shares.

Achari Sponsor Holdings I LLC, a Delaware limited liability company and the sponsor of Achari (the “Sponsor”), and our officers and directors have agreed to waive their respective redemption rights with respect to any Public Shares they may hold in connection with the consummation of the Business Combination, and the shares of Achari’s common stock held by them will be excluded from the pro rata calculation used to determine the per share redemption price. The Sponsor, certain members of the Sponsor and our directors and officers have agreed to vote any shares of Achari’s common stock owned by them in favor of the Business Combination. Currently, the Sponsor, certain members of the Sponsor and Achari’s directors and our officers collectively own approximately 81.9% of our issued and outstanding shares of common stock.

Whether or not you plan to attend the Stockholders’ Meeting virtually, please submit your proxy card without delay. Voting by proxy will not prevent you from voting your shares virtually if you subsequently choose to attend the Stockholders’ Meeting. If you fail to return your proxy card and do not attend such meeting virtually, the effect will be that your shares will not be counted for purposes of determining whether a quorum is present at the Stockholders’ Meeting. You may revoke a proxy at any time before it is voted at the Stockholders’ Meeting by executing and returning a proxy card dated later than the previous one, by attending the Stockholders’ Meeting virtually and casting your vote by ballot or by submitting a written revocation that is received by us before we take the vote at the Stockholders’ Meeting to the Secretary, Achari Ventures Holdings Corp. I, 60 Walnut Avenue, Suite 400, Clark, New Jersey 07066; telephone: (732) 340-0700. If you hold your shares through a bank, broker or other nominee, you should follow the instructions of your bank, broker or other nominee regarding revocation of proxies.

Achari’s Board of Directors unanimously recommends that Achari’s stockholders vote “FOR” approval of each of the Proposals. Achari’s directors and officers may have financial interests in the Business Combination that differ from, or are in addition to, their respective interests, if any, as stockholders of Achari and the interests of stockholders of Achari generally. The existence of financial and personal interests of one or more of Achari’s directors may result in a conflict of interest on the part of such director(s) between what they may believe is in the best interests of Achari and its stockholders and what they may believe is best for themselves in determining to recommend that Achari’s stockholders vote for the Proposals. See the section of this joint proxy statement/prospectus entitled “Proposal 1 — The Business Combination Proposal — Interests of Achari’s Directors and Officers and Others in the Business Combination”.

|

By Order of the Board of Directors |

||

|

|

||

|

Vikas Desai |

||

|

Chief Executive Officer |

___________, 2024

IF YOU RETURN YOUR PROXY CARD SIGNED AND WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS. YOU MAY EXERCISE YOUR RIGHTS TO DEMAND THAT ACHARI REDEEM YOUR SHARES FOR A PRO RATA PORTION OF THE FUNDS HELD IN THE TRUST ACCOUNT WHETHER YOU VOTE FOR OR AGAINST THE PROPOSALS OR DO NOT VOTE ON THE PROPOSALS AND WHETHER OR NOT YOU ARE THE HOLDER OF SHARES AS OF THE RECORD DATE OR YOU ACQUIRED YOUR SHARES AFTER THE RECORD DATE. TO EXERCISE YOUR REDEMPTION RIGHTS, YOU MUST TENDER YOUR SHARES TO ACHARI’S TRANSFER AGENT AT LEAST TWO (2) BUSINESS DAYS PRIOR TO THE STOCKHOLDERS’ MEETING. YOU MAY TENDER YOUR SHARES FOR REDEMPTION BY EITHER DELIVERING YOUR SHARE CERTIFICATE(S) TO THE TRANSFER AGENT OR BY DELIVERING YOUR SHARES ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DEPOSIT/WITHDRAWAL AT CUSTODIAN (“DWAC”) SYSTEM. IF THE BUSINESS COMBINATION IS NOT CONSUMMATED, THEN SUCH TENDERED SHARES WILL NOT BE REDEEMED FOR CASH AND WILL BE RETURNED TO THE APPLICABLE STOCKHOLDER. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BROKER OR BANK TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS. SEE THE SECTION ENTITLED “STOCKHOLDERS’ MEETING — REDEMPTION RIGHTS” FOR MORE SPECIFIC INSTRUCTIONS.

TABLE OF CONTENTS

|

Page |

||

|

iii |

||

|

iii |

||

|

iv |

||

|

vii |

||

|

viii |

||

|

ix |

||

|

1 |

||

|

20 |

||

|

37 |

||

|

38 |

||

|

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

39 |

|

|

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL |

44 |

|

|

48 |

||

|

49 |

||

|

78 |

||

|

90 |

||

|

136 |

||

|

138 |

||

|

140 |

||

|

146 |

||

|

148 |

||

|

151 |

||

|

152 |

||

|

DIRECTORS, OFFICERS, EXECUTIVE COMPENSATION AND CORPORATE GOVERNANCE OF ACHARI |

156 |

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF ACHARI |

164 |

|

|

169 |

||

|

170 |

||

|

172 |

||

|

175 |

||

|

179 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF VASO |

186 |

|

|

193 |

||

|

216 |

||

|

218 |

||

|

220 |

||

|

221 |

||

|

SECURITIES ACT RESTRICTIONS ON RESALE OF ACHARI’S SECURITIES |

226 |

|

|

228 |

||

|

228 |

||

|

228 |

||

|

228 |

||

|

229 |

||

|

229 |

||

|

229 |

i

|

Page |

||

|

229 |

||

|

230 |

||

|

230 |

||

|

F-1 |

||

|

A-1 |

||

|

ANNEX B — Sixth Amended and Restated Certificate of Incorporation |

B-1 |

|

|

C-1 |

||

|

D-1 |

||

|

E-1 |

||

|

F-1 |

ii

ABOUT THIS JOINT PROXY STATEMENT/PROSPECTUS

This document, which forms part of a registration statement (the “Registration Statement”) on Form S-4 filed with the U.S. Securities and Exchange Commission (the “SEC”) by Achari (File No. 333-276422), constitutes a prospectus of Achari under Section 5 of the U.S. Securities Act of 1933, as amended, with respect to certain securities of Achari to be issued in connection with the Business Combination described below. This document also constitutes a notice of meeting and a proxy statement under Section 14(a) of the Securities Exchange Act of 1934, as amended, for the Stockholders’ Meeting to be held in connection with the Business Combination and at which Achari’s stockholders will be asked to consider and vote upon a proposal to adopt the Business Combination Agreement and approve the Business Combination, among other matters.

ADDITIONAL INFORMATION

You may request copies of this joint proxy statement/prospectus and any other publicly available information concerning Achari, without charge, by written request to Achari Ventures Holdings Corp. I, 60 Walnut Avenue, Suite 400, Clark, New Jersey 07066, or by telephone request at (732) 340-0700; or Morrow Sodali LLC, our proxy solicitor, by calling at (203) 658-9400 (call collect), (800) 662-5200 (call toll-free), or by sending an email to AVHI.info@investor.morrowsodali.com, or from the SEC through the SEC website at http://www.sec.gov.

In order for an Achari stockholder to receive timely delivery of the applicable documents in advance of the Stockholders’ Meeting to be held on ______, 2024, such stockholder must request the information no later than five business days prior to the date of the Stockholders’ Meeting (i.e., by ______, 2024).

iii

FREQUENTLY USED TERMS

Definitions

Unless otherwise stated or unless the context otherwise requires, the terms “we”, “us”, “our” and “Achari” refer to Achari Ventures Holdings Corp. I, which is a corporation incorporated under the laws of the State of Delaware.

In addition to the definitions given to certain capitalized terms elsewhere in this document or in the Business Combination Agreement, in this document, the following capitalized terms shall have the following meanings:

“Achari Board” means the board of directors of Achari.

“Bylaws” mean the amended and restated bylaws of Achari to be adopted by the Achari Board and in effect immediately following the Business Combination.

“Chardan” means Chardan Capital Markets, LLC, the representative of the underwriters in the IPO.

“Company Support Agreement” means that certain Company Support Agreement, dated as of December 6, 2023, and entered into concurrently with the execution and delivery of the Business Combination Agreement, by and among Achari, Vaso and certain security holders of Vaso.

“Code” means the Internal Revenue Code of 1986, as amended.

“Condition Precedent Proposals” means collectively the Business Combination Proposal, the Charter Amendment Proposals, the 2024 Equity Incentive Plan Proposal and the Director Election Proposal, the approval upon which the closing of the Business Combination is conditioned upon, unless otherwise waived by the parties to the Business Combination Agreement.

“Current Charter” means Achari’s Fifth Amended and Restated Certificate of Incorporation.

“DGCL” means the Delaware General Corporation Law, as amended.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“EBITDA” means earnings before interest, taxes, depreciation and amortization.

“Enterprise Value” means market capitalization plus debt plus other long-term liabilities minus cash.

“EV/EBITDA” means Enterprise Value divided by EBITDA.

“EV/Revenue” means Enterprise Value divided by Revenue.

“Founder Shares” means the 2,500,000 SPAC Shares issued by Achari to the Sponsor (including those that have been subsequently transferred), which amount shall be reduced to 750,000 SPAC Shares immediately prior to the Business Combination.

“GAAP” means U.S. generally accepted accounting principles.

“Group Companies” means, collectively, Vaso and Vaso’s Subsidiaries.

“Insider Letter” means that certain letter agreement, dated as of October 14, 2021, by and between Achari and the Sponsor.

“IPO” means Achari’s initial public offering pursuant to the registration statement on Form S-1 declared effective by the SEC on October 14, 2021 (File No. 333-258476).

“Nasdaq” means The Nasdaq Stock Market LLC (including any of the tiers thereof).

“Private Placement” means the private placement consummated simultaneously with the IPO in which Achari issued to the Sponsor and Chardan certain private placement warrants.

“Private Placement Warrants” means the 7,133,333 warrants sold to the Sponsor and to be reduced to 1,000,000 warrants at the time of the Business Combination.

iv

“Public Shares” means Achari’s shares of common stock sold in the IPO (whether they were purchased in the IPO or thereafter in the open market), in each case, excluding Founder Shares.

“Public Stockholders” means the holders of Achari’s shares of common stock that were sold in the IPO (whether they were purchased in the IPO or thereafter in the open market), in each case, excluding Founder Shares.

“Public Warrants” means Achari’s warrants sold in the IPO (whether they were purchased in the IPO or thereafter in the open market).

“Redemption” means the redemption of Public Shares for the Redemption Price.

“Redemption Rights” means the right of the Public Stockholders to demand Redemption of their Public Shares into cash in accordance with the procedures set forth in the Current Charter and this joint proxy statement/prospectus.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002, as amended.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“SPAC A&R CoI” means Achari’s Sixth Amended and Restated Certificate of Incorporation, which shall have been filed with the Secretary of State of the State of Delaware at the Effective Time and which will amend and restate, in its entirety the Current Charter),

“Subsidiaries” of any person means any corporation, association, partnership, limited liability company, joint venture or other business entity of which more than fifty percent (50%) of the voting power or equity is owned or controlled, directly or indirectly, by such person or one (1) or more of the direct or indirect subsidiaries of such person or a combination thereof.

“Transfer Agent” means Continental Stock Transfer & Trust Company.

“Trust Account” means the trust account of Achari, which holds the net proceeds from the IPO and the sale of the Private Placement Warrants, together with interest earned thereon, less amounts released to pay taxes and pay redemptions.

“Units” means the units sold in the IPO (including pursuant to the overallotment option) consisting of one share of common stock of Achari and one redeemable warrant to purchase three-quarters of a SPAC Share, with each whole warrant entitling the holder thereof to purchase three-quarters of one SPAC Share for $11.50 per share; provided, however, that such warrants may be exercised only for a whole number of SPAC Shares.

“Vaso Restricted Share Award” means any restricted share award granted by Vaso pursuant to any of (a) the Vasomedical, Inc. 2013 Stock Plan, (b) the Vasomedical, Inc. 2016 Stock Plan, (c) the Vaso Corporation 2019 Stock Plan, and (d) each other plan that provides for the award to any current or former director, manager, officer, employee, individual independent contractor or other service provider of any Group Company of rights of any kind to receive Equity Interests of any Group Company or benefits measured in whole or in part by reference to Equity Interests of any Group Company.

“Warrant Agreement” means the Warrant Agreement, dated as of October 14, 2021, by and between Achari and the Transfer Agent, which governs Achari’s outstanding warrants.

Share Calculations and Ownership Percentages

Unless otherwise specified (including in the sections entitled “Unaudited Pro Forma Condensed Combined Financial Information” and “Beneficial Ownership of Securities”), the share calculations and ownership percentages set forth in this joint proxy statement/prospectus with respect to Achari’s stockholders following the Business Combination are for illustrative purposes only and assume the following (certain capitalized terms below are defined elsewhere in this joint proxy statement/prospectus):

1. No Public Stockholders exercise their respective Redemption Rights in connection with the consummation of the Business Combination, and the balance of the Trust Account as of the Closing was approximately $6.3 million. Please see the section entitled “Stockholders’ Meeting — Redemption Rights”.

v

2. No Achari warrant holders exercise any of the Achari warrants (including any of the 10,000,000 Public Warrants and 1,000,000 Private Placement Warrants) that will remain outstanding immediately following the Business Combination.

3. The total number of post-Merger shares of Common Stock issued to the former Vaso stockholders will be 17,600,000.

4. The total number of post-Merger shares of Common Stock retained by the Achari stockholders will be 1,300,941 shares, which assumes that the Founder Shares are reduced to 750,000 at the consummation of the Business Combination (in accordance with the terms of the Business Combination) and that no Public Shares are redeemed.

5. The Redemption Price will be approximately $____ per share as of the consummation of the Business Combination.

vi

MARKET AND INDUSTRY DATA

Information contained in this joint proxy statement/prospectus concerning the market and the industry in which Vaso competes, including its market position, general expectations of market opportunity and market size, is based on information from various third-party sources, on assumptions made by Vaso based on such sources and Vaso’s knowledge of the markets for its services and solutions. Any estimates provided herein involve numerous assumptions and limitations, and you are cautioned not to give undue weight to such information. Third-party sources generally state that the information contained in such sources has been obtained from sources believed to be reliable but that there can be no assurance as to the accuracy or completeness of such information. Notwithstanding the foregoing, we are liable for the information provided in this joint proxy statement/prospectus. The industry in which Vaso operates is subject to a high degree of uncertainty and risk. As a result, the estimates and market and industry information provided in this joint proxy statement/prospectus are subject to change based on various factors, including those described in the section entitled “Risk Factors Risks Related to Vaso’s Business and Industry” and elsewhere in this joint proxy statement/prospectus.

vii

TRADEMARKS

This joint proxy statement includes a description of the trademarks of Vaso, such as “Vaso”, which are protected under applicable intellectual property laws and are the property of Vaso or its subsidiaries. This joint proxy statement/prospectus also contains trademarks, service marks, trade names and copyrights of other entities, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this joint proxy statement/prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names. Achari does not intend its use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of it by, any other companies.

viii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This joint proxy statement/prospectus contains forward-looking statements. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for our business, and the timing and ability for Achari and Vaso to complete the Business Combination. Specifically, forward-looking statements may include statements relating to:

• the benefits of the Business Combination;

• the future financial performance of Achari following the Business Combination;

• the timing of, expected benefits from and ability to execute on expansion plans and opportunities; and

• other statements preceded by, followed by or that include the words “may”, “can”, “should”, “will”, “estimate”, “plan”, “project”, “forecast”, “intend”, “expect”, “anticipate”, “believe”, “seek”, “target” or similar expressions.

These forward-looking statements are based on information available as of the date of this joint proxy statement/prospectus and Achari’s and Vaso’s managements’ current expectations, forecasts and assumptions, and involve a number of judgments, known and unknown risks and uncertainties and other factors, many of which are outside the control of Achari, Vaso and their respective directors, officers and affiliates. Accordingly, forward-looking statements should not be relied upon as representing Achari’s views as of any subsequent date. Achari does not undertake any obligation to update, add or otherwise correct any forward-looking statements contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date hereof or otherwise, except as may be required under applicable securities laws.

You should not place undue reliance on these forward-looking statements in deciding how your vote should be cast or in voting your shares or warrants on the Proposals. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

• the occurrence of any event, change or other circumstances that could delay the Business Combination or give rise to the termination of the Business Combination Agreement;

• the outcome of any legal proceedings that may be instituted against Vaso or Achari following announcement of the proposed Business Combination and transactions contemplated thereby;

• the inability to complete the Business Combination, including due to the failure to obtain approval of the Achari or Vaso stockholders or Achari’s failure to retain sufficient cash in the Trust Account or the failure to meet other conditions to Closing in the Business Combination Agreement;

• the inability to maintain the listing of the applicable securities of Achari on Nasdaq following the Business Combination;

• the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, and the ability of Achari to grow and manage growth profitably;

• costs related to the Business Combination;

• changes in the markets in which Vaso operates;

• the possibility that Achari or Vaso may be adversely affected by other economic, business, and/or competitive factors;

• the risk that the Business Combination disrupts current plans and operations of Vaso as a result of the announcement and consummation of the Business Combination;

• the inability to execute Vaso’s growth strategies, including identifying and executing acquisitions;

• the inability to develop and maintain effective internal controls;

ix

• cost of complying with current laws and regulations and any changes in applicable laws or regulations;

• business interruptions resulting from geographical actions, including war and terrorism;

• difficulties managing our anticipated growth or the possibility that we may not grow at all;

• failure to obtain and maintain the third-party relationships that are necessary to further our business plans;

• failure to obtain necessary funding in order to continue our operations as planned, either at all or on favorable terms;

• cost of protecting and defending against intellectual property claims;

• failure to attract and retain the current senior management team and Vaso’s scientific advisors as well as qualified scientific, technical and business personnel; and

• other risks and uncertainties indicated in this joint proxy statement/prospectus, including those set forth under the section entitled “Risk Factors”.

Although we believe that these forward-looking statements fall within the protection of the “bespeaks caution” doctrine, which holds that forward-looking statements are not misleading if they are accompanied by adequate risk disclosure to caution readers about specific risks that may materially impact the forecasts, any court analyzing such forward-looking statements could find that such doctrine is not applicable to the joint proxy statement/prospectus or that these statements do not qualify for such protection.

x

SUMMARY OF THE JOINT PROXY STATEMENT/PROSPECTUS

This summary highlights selected information from this joint proxy statement/prospectus but does not contain all of the information that may be important to you. To better understand the Proposals to be considered at the Stockholders’ Meeting, including the Business Combination Proposal, whether or not you plan to attend such meeting, we urge you to read this joint proxy statement/prospectus (including the Annexes) carefully, including the section entitled “Risk Factors” herein. See also the section entitled “Where You Can Find More Information”.

Parties to the Business Combination

Achari

Achari was incorporated in Delaware on January 25, 2021. Achari is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. Although Achari’s initial focus was on identifying acquisition opportunities in the cannabis industry, it has decided that pursuing the Business Combination with Vaso, a company involved in the medical device and medical sales industry, is in the best interest of its stockholders.

Achari is an early stage and emerging growth company and, as such, it is subject to all of the risks associated with early stage and emerging growth companies.

General

As of the date hereof, Achari had not commenced any operations other than activities related to its formation, its IPO, and, subsequent to its IPO, the process of identifying a target company for a business combination and the execution of the Business Combination. Achari does not anticipate that it will generate any operating revenues until after the completion of the Business Combination, at the earliest. The registration statement for Achari’s IPO was declared effective on October 14, 2021. On October 19, 2021, Achari consummated its IPO of 10,000,000 Units. Each such Unit consisted of one share of one SPAC Share and one redeemable warrant, with each whole warrant entitling the holder thereof to purchase three quarters of one SPAC Share for $11.50 per share; provided, however, that such warrants may be exercised only for a whole number of SPAC Shares. The Units were sold at a price of $10.00 per Unit, generating gross proceeds to Achari of $100,000,000.

Simultaneously with the closing of the IPO, pursuant to the Private Placement, Achari sold the Private Placement Warrants to the Sponsor at a purchase price of $0.75 per Private Placement Warrant, generating gross proceeds of $5,350,000. The Private Placement Warrants are identical to the warrants included in the Units sold as part of the Units in the IPO, except as otherwise disclosed in Achari’s Registration Statement on Form S-1 relating to the IPO. No underwriting discounts or commissions were paid with respect to such sale. The issuance of the Private Placement Warrants was made pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act.

Following the closing of the IPO, $101,500,000 (or approximately $10.15 per Unit) from the net proceeds of the sale of the Units and the Private Placement Warrants was placed in the Trust Account, maintained by Continental Stock Transfer & Trust Company, acting as trustee (the “Trustee”). Except with respect to interest earned on the funds held in the Trust Account that may be released to Achari to pay its taxes (less up to $100,000 interest to pay dissolution expenses), the funds held in the Trust Account will not be released from the Trust Account until the earliest of (i) the completion of Achari’s initial business combination, (ii) the redemption of any Public Shares properly submitted in connection with a stockholder vote to amend Achari’s certificate of incorporation (a) to modify the substance or timing of its obligation to redeem 100% of Public Shares if it does not complete its initial business combination on or prior to July 19, 2024 (or such earlier applicable date if we opt not to continue to exercise our remaining Fifth CoI Monthly Extension Options (as defined below) and further described herein), or (b) with respect to any other provision relating to stockholders’ rights or pre-initial business combination activity, and (iii) the redemption of Public Shares if it is unable to complete its initial business combination on or prior to July 19, 2024 (or such earlier applicable date if we opt not to continue to exercise our remaining Fifth CoI Monthly Extension Options), subject to applicable law. Prior to the 24-month anniversary of our IPO Registration Statement, the funds placed in the Trust Account were invested in U.S. government securities, within the meaning set forth in Section 2(a)(16) of the Investment Company Act of 1940, as amended (the “Investment Company Act”), with a maturity of

1