Electrovaya Inc.: Exhibit 99.84 - Filed by newsfilecorp.com

---------------------- www.electrovaya.com

ELECTROVAYA INC.

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED SEPTEMBER 30, 2022

December 5, 2022

- 1 -

ELECTROVAYA INC.

ANNUAL INFORMATION FORM

TABLE OF CONTENT S

ELECTROVAYA INC.

ANNUAL INFORMATION FORM

Unless otherwise indicated herein, the information set out in this annual information form ("AIF") is current to December 5, 2022 and is presented in US dollars.

This AIF contains forward-looking statements including statements with respect to the effect of the global COVID-19 novel coronavirus pandemic and its impact on the Company's supply chain, customer demand and order flow, its health implications on employees and other stakeholders, and its effect on the Company's delivery schedule, other factors impacting revenue, the competitive position of the Company's products, global trends in technology supply chains, the Company's strategic objectives and financial plans, including the operations and strategic direction of Electrovaya Labs, the Company's products, including E-bus and electric lift truck applications and the potential for revenue from new applications (including the e-bus market), cost implications, continually increasing the Company's intellectual property portfolio, additional capital raising activities, the adequacy of financial resources to continue as a going concern, and also with respect to the Company's markets, objectives, goals, strategies, intentions, beliefs, expectations and estimates generally. Forward-looking statements can generally be identified by the use of words such as "may", "will", "could", "should", "would", "likely", "possible", "expect", "intend", "estimate", "anticipate", "believe", "plan", "objective" and "continue" (or the negatives thereof) and words and expressions of similar import. Readers and investors should note that any announced estimated and forecasted orders and volumes provided by customers and potential customers to Electrovaya also constitute forward-looking information and Electrovaya does not have (a) knowledge of the material factors or assumptions used by the customers or potential customers to develop the estimates or forecasts or as to their reliability and (b) the ability to monitor the performance of the business its customers and potential customers in order to confirm that the forecasts and estimates initially represented by them to Electrovaya remain valid. If such forecasts and estimates do not remain valid, or if firm irrevocable orders are not obtained, the potential estimated revenues of Electrovaya could be materially and adversely impacted.

Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, the outcome of such statements involve and are dependent on risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. Material assumptions used to develop forward-looking information in this AIF include, among other things, that that current customers will continue to make and increase orders for the Company's products; that the Company's alternate supply chain will be adequate to replace material supply and manufacturing; that the Company's products will remain competitive with currently-available alternatives in the market; that the alternative energy market will continue to grow and the impact of that market on the Company; the purchase orders actually placed by customers of Electrovaya; customers not terminating or renewing agreements; general business and economic conditions (including but not limited to currency rates and creditworthiness of customers); the relative effect of the global COVID-19 public health emergency on the Company's business, its customers, and the economy generally; the Company's technology enabling a new category of solid state battery that meets the requirements for broader market adoption; the Company's liquidity and capital resources, including the availability of additional capital resources to fund its activities; the Company's ability to consolidate its shares in contemplation of listing on NASDAQ; the Company's ability to list its common shares on NASDAQ; industry competition; changes in laws and regulations; contemplated transactions with SEJ (as defined herein); legal and regulatory proceedings; the ability to adapt products and services to changes in markets; the ability to retain existing customers and attract new ones; the ability to attract and retain key executives and key employees; the granting of additional intellectual property protection; and the ability to execute strategic plans. Information about risks that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found herein under the heading "Risk Factors", and in other public disclosure documents filed with Canadian securities regulatory authorities. The Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements contained or incorporated by reference in this document, whether as a result of new information, future events or otherwise, except as required by law.

1. Corporate Structure

1.1 Name, Address and Incorporation

The company's full corporate name is Electrovaya Inc. (the "Company" or "Electrovaya"), which, as used herein, refers to Electrovaya Inc., its predecessor corporations and all of its subsidiaries (unless the context otherwise requires).

Our registered and head office is located at 6688 Kitimat Road, Mississauga, Ontario L5N 1P8. Our telephone number and website address are (905) 855-4610 and www.electrovaya.com, respectively.

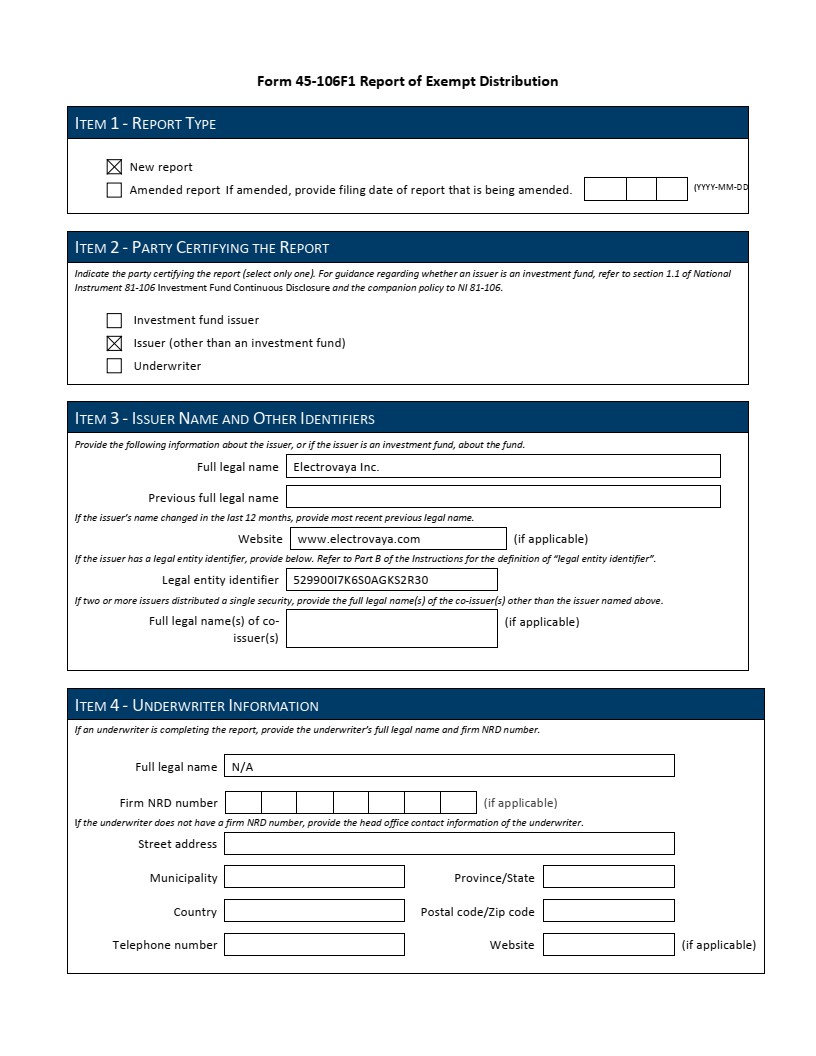

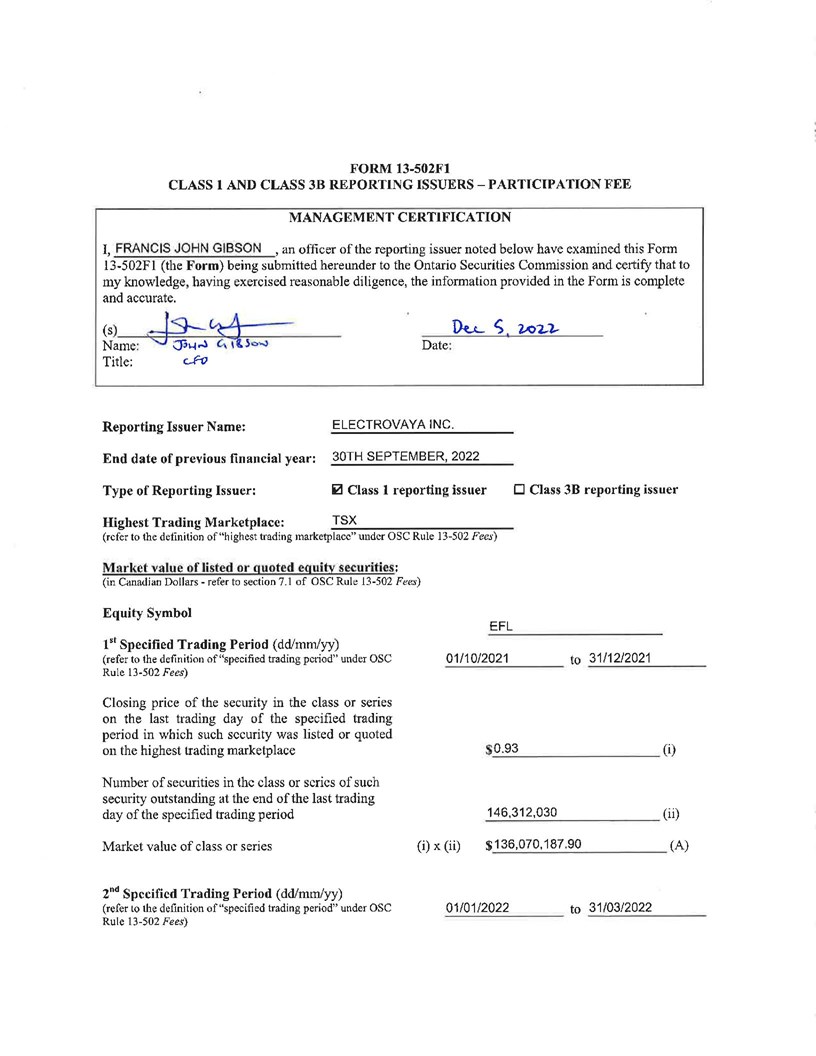

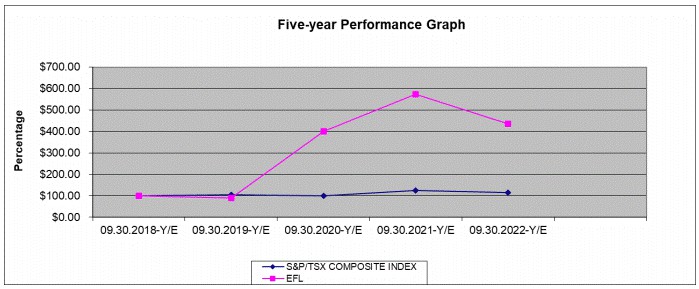

Electrovaya was incorporated under the Business Corporations Act (Ontario) in September 1996. With the approval of our shareholders, we split our common shares on a three for one basis on September 18, 2000. We were listed on the Toronto Stock Exchange under the ticker symbol "EFL" in November 2000. On March 26, 2002, our shareholders approved the change of our name to "Electrovaya Inc." from "Electrofuel Inc.". We also trade on the OTCQB market under the ticker symbol EFLVF. The Company has also covenanted with certain institutional investors to use its best efforts to complete a listing of its Common Shares on the Nasdaq Capital Market by April 30, 2023. The Company is in the process of applying to list on Nasdaq.

On February 17, 2021 at a Special Meeting of the Shareholders, a resolution was passed to amend the articles of the Corporation to change the number of issued and outstanding common shares of the Corporation by consolidating the issued and outstanding common shares on the basis of one new common share for every 5 existing common shares (or such lower consolidation ratio as may be determined by the Board). Such consolidation would ultimately only become effective at a future date determined by the Board if the Board determined it was in the best interests of the Corporation to implement a consolidation. There is no assurance that the Board will decide to implement a share consolidation and the Common Shares may remain unconsolidated indefinitely.

The Company designs, develops and manufactures lithium-ion batteries and systems for materials handling electric vehicles, primarily warehouse forklifts, as well as for other electric transportation applications and electric stationary storage and other battery markets. The Company has a team of mechanical, electrical, electrochemical, materials science, battery and system engineers able to provide clients with a "complete solution" for their energy and power requirements.

1.2 Our Mission and Values

Our Mission is to accelerate the energy transition from fossil fuels to renewable sources with safer and better batteries through technology advancement. We strive to provide valuable and innovative solutions to our customers globally, create rewarding opportunities for our team, provide extraordinary value to our shareholders and power energy transformation to clean technology. We intend to accomplish this through the use of our lithium ion battery expertise to deliver a series of products which focus on maximising the cycle-life of the battery for mission critical and intensive use applications. We developed cells, modules, battery management systems, software and firmware necessary to deliver systems for discerning users.

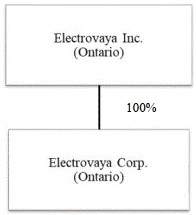

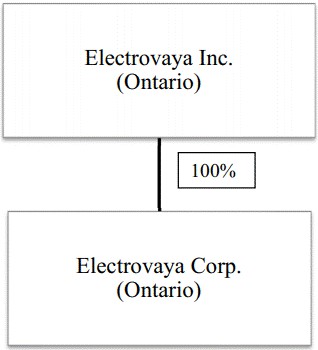

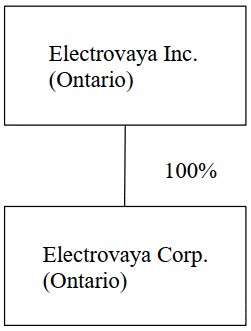

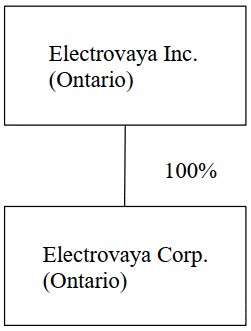

1.3 Intercorporate Relationships

The following diagram illustrates the intercorporate relationships between the Company and its material subsidiaries, and the percentage of votes attached to all voting securities of the material subsidiary owned, controlled, or directed, directly or indirectly, by the Company, and the subsidiary's respective jurisdiction of formation.

2. General Development of the Business

2.1 Summary of the Business

We design, develop and manufacture lithium-ion batteries and systems for Materials Handling Electric Vehicles ("MHEVs") and other electric transportation applications, as well for electric stationary storage and other battery markets. Our main businesses include:

● lithium-ion batteries to power MHEVs including forklifts and Automated Guided Vehicles as well as accessories such as battery chargers to charge the batteries;

● electromotive power products for electric trucks, electric buses and other transportation applications;

● industrial products for energy storage; and

● specialty applications which require complex power solutions, including competencies in building systems for third parties.

Electrovaya has a team of mechanical, electrical, electrochemical, materials science, battery and system engineers able to give clients a "complete solution" for their energy and power requirements. Electrovaya also has substantive intellectual property in the lithium-ion battery sector.

We believe that our battery and battery systems contain a unique combination of characteristics that enable us to offer battery and energy solutions that are competitive with currently available advanced lithium-ion and non-lithium-ion battery technologies. These characteristics include:

● Safety: We believe our batteries provide an industry leading level of safety in a lithium-ion battery. Safety in lithium-ion batteries is becoming an important performance factor and original equipment manufacturers ("OEMs") and users of lithium-ion batteries prefer to have the highest level of safety possible in such batteries.

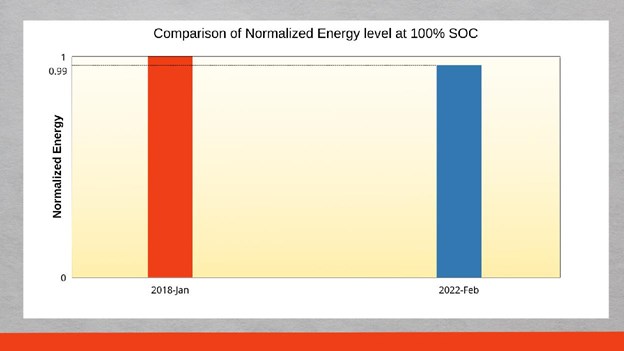

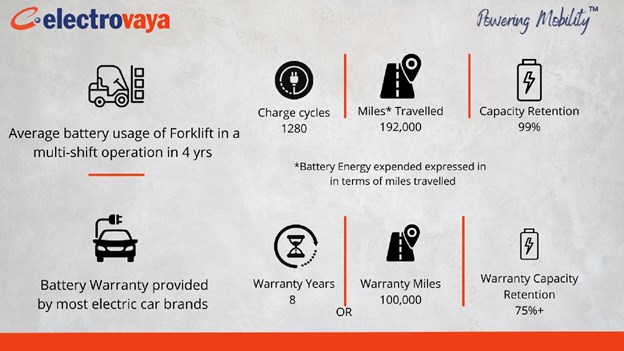

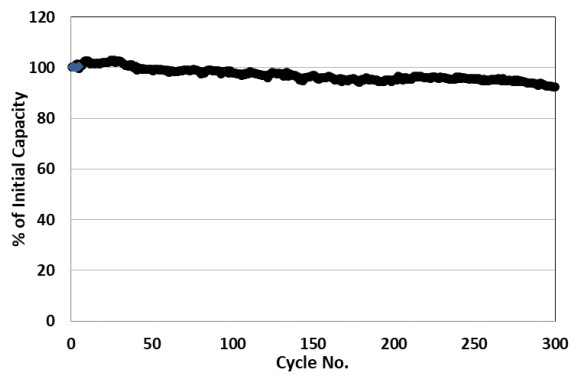

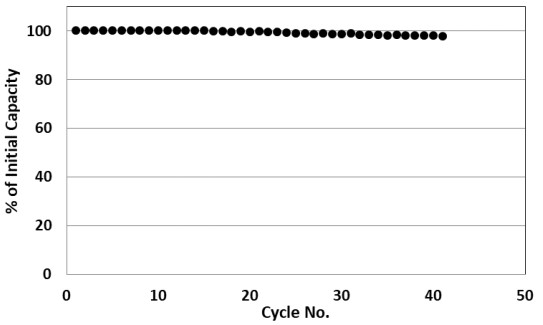

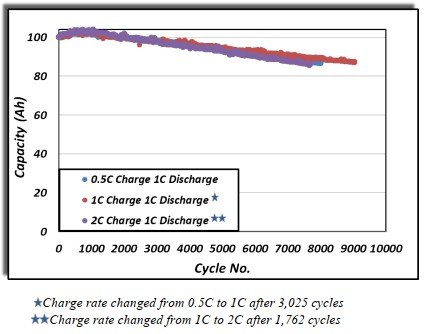

● Cycle life: Our cells are in the forefront of battery manufacturers with respect to cycle life, with excellent rate capabilities. Cycle life is generally controlled by the parasitic reactions inside the cell and these reactions have to be reduced in order to deliver industry leading cycle life. Higher cycle life is critical and necessary in many intensive applications such as e-forklifts, e-bus, e-taxi, e-trucks, energy storage and of important value to less intensive applications such as e-passenger cars. In general, the greater the cycle life, the lower the total cost of ownership is for heavy duty applications.

● Energy, Power and form factor: Electrovaya's technology focus is optimised to provide batteries of superior energy density, packing density, high power and fast charging capabilities.

● Battery management system: Our latest 5th generation battery management system has developed over the years, and provides excellent control and monitoring of the battery with advanced features as well as communication to chargers and electric vehicles, as well as "internet of things" and remote monitoring functionality.

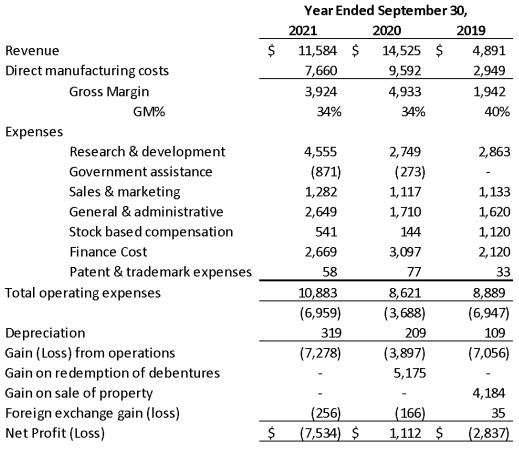

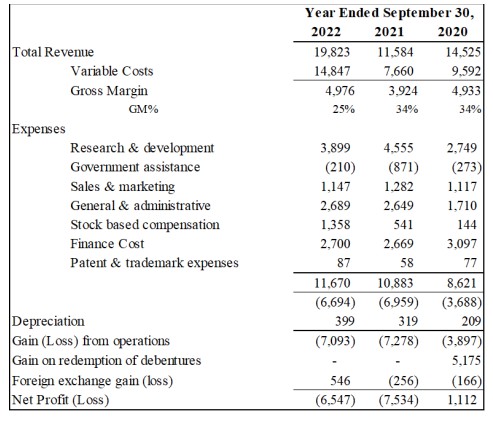

Additional information can be found in the Company's Management's Discussion and Analysis for the year ended September 30, 2022.

2.2 Three-Year History

During the last three years, Electrovaya has developed advanced lithium-ion battery cells and systems with unique performance attributes for use in a variety of applications. The majority of systems are being utilized in the material handling industry as this market requires solutions with higher degrees of safety and cycle life and is thus ideal for Electrovaya's technology. The Company demonstrated continuous improvements in the energy density of its commercial cell technologies and also has launched an increasing list of battery systems. These include battery systems for multiple classes of material handling vehicles, customized systems for autonomous guided vehicles and high voltage battery systems. Many of these systems have also gone through UL safety testing certification and the Company also achieved ISO9001 certification in 2022. Finally, the company continues research and development activities for new battery systems, advances in battery management system technology and next generation solid state battery technology.

Material Handling OEM Partner Sales Channel

In May 2019, after an extensive qualifying review, Raymond Corp., a wholly owned subsidiary of Toyota Material Handling North America and one of the largest material handling OEMs in North America, and Electrovaya entered into a Raymond Dealer Network Sales Agreement. This allowed Electrovaya to sell directly through the extensive Raymond dealer network.

In November 2020 Electrovaya received UL2580 ("Underwriters Laboratories" or "UL") listing for its full line of 24v and 36v material handling batteries. In December 2020 Electrovaya and Raymond signed a Strategic Supply Agreement. The agreement provides Raymond with exclusively distributed Raymond branded "Energy Essentials" lithium-ion batteries that are UL 2580 Listed and compatible with most class I, II and III Raymond lift trucks.

During 2021 and 2022, the Company received increasing orders through the OEM sales channel and believes it is well positioned to grow sales through this strategic alignment with the market leader in material handling. Since the launch of the Strategic Supply Agreement, Electrovaya has delivered over $25 Million in battery systems through the OEM channel.

Other Material Handling Sales Channels

The Company also sells battery systems directly to some customers and through partnered dealers. Direct sales are generated by the Company's own direct sales team and are focused on a few large key accounts including, but not limited to, Walmart and Mondelez. These sales channels have been responsible for over 10% of material handling revenue over the past 3 years The Company's first sale of lithium ion batteries for the material handling sector was in July 2017 to Mondelez. Walmart's first major order was in September 2017 for the conversion of one distribution centre. Subsequently Walmart has converted two further distribution centres to the Company's Lithium ion batteries. This sales channel is distinct from the OEM partner sales channel as these customers are generally ordering batteries for vehicles supplied by non-Raymond OEMs. This therefore represents a complementary sales channel to our OEM partner sales channel.

Other Sales

The Company has also made sales in other markets and is continuing to develop new markets for products based on its Infinity Battery Technology platform. This includes sales of cells for specialized applications, high voltage battery systems, battery systems for autonomous guided vehicle OEMs and research and development contracts.

2.3 Narrative Description of the Business

2.3.1 Overview of Products & Services Electric Vehicle

The electric vehicle sector is quickly growing with increased global pressure on reducing carbon emissions and includes everything from electric forklifts, electric buses, electric trucks and electric passenger vehicles. Our focus is addressing applications where a lithium-ion battery will be used intensively, as intensive users tend to place a higher value on higher performance and safer technology and also get clear lower cost of ownership with a higher performing and longer cycle life product. Examples of intensive use of lithium-ion batteries in the electric vehicle space include electric trucks, electric forklifts, electric buses and other industrial vehicle systems. These vehicles are generally driven 16 to 24 hours per day as opposed to a passenger vehicle whose average usage is about 1-4 hours a day. Intensive use vehicles need fast charging and in the case of forklifts operating 24/7, can be working over 100,000 miles/year, on a work equivalency basis, and require high performance lithium ion batteries.

To meet the needs of the electric vehicle market the Company has two battery platforms, the Infinity Platform and the Solid State Platform.

Infinity Platform

This technology platform is based on some key IP that Electrovaya owns including but not limited to ceramic separators, electrolytes and the final lithium-ion cell design. Management believes that this technology platform provides significantly improved safety and cycle life performance when compared to other available lithium ion battery chemistries and types. Due to these advantages, products based on this technology platform are well suited to heavy duty applications that Electrovaya prioritizes including material handling, robotics and electric heavy duty vehicles. Nearly all Electrovaya's current commercial products are based on this technology platform.

Solid State Platform

This technology platform is under development, is not currently revenue generating and would be considered as a next-generation battery technology for electric vehicles and other applications. Management believes that our technology may enable a new category of battery that meets the requirements for broader market adoption. The lithium-metal solid-state battery and solid-state hybrid battery technology that we are developing is being designed to offer greater energy density and higher performance when compared to today's conventional lithium-ion batteries used in the electric vehicle industry.

2.3.2 Sale of Products

In the last three years, Electrovaya has focused its sales efforts primarily on the electric forklift and material handling market but we have recently added the e-bus and e-truck sectors as key focus areas. Our primary geographical focus is North America, however we have had recent sales activities in South America, Europe and Australia.

For our batteries powering electric forklifts, there are two main market sales channels as detailed in section 2.2 Three-Year History; the OEM Partners sales channel and the Direct sales channel. The OEM sales channel generally focuses on the sale of new forklift sales where the new vehicle has to be powered; while the Direct sales channel focuses on the replacement market, as the lead acid batteries in a forklift truck may need to be changed every few years.

Our third sales channel is the e-bus and e-truck market. This is a fast growing market as governments globally push for greener transit solutions. The Company believes it is continuing to make significant progress in the e-bus market and anticipates increased revenue from this segment from the 2024 fiscal year.

Electrovaya has achieved UL2580 listing across its line of 24V and 36V forklift batteries. The safety certification covers more than 25 different models and is a key milestone for the Company. UL certification shows the Company's continued commitment to safety and quality. Our R&D and Engineering teams were responsible for achieving this listing, which also leverages some of the key safety technologies that Electrovaya owns, including critical cell and systems IP. These technologies will be critical for broad implementation of lithium ion battery technology.

2.3.3 Competition

The battery industry is highly competitive. Electrovaya competes with a large number of market participants including pure-play battery providers, diversified technology and industrial vendors and strategic joint ventures. Our primary competitors are included in the following summary below:

● MHEVs including forklifts and Automated Guided Vehicles. Competition in this group includes alternative power sources such as lithium ion batteries, lead acid batteries, hydrogen fuel cells and other power sources including fossil fuels. Our lead acid battery competitors include EnerSys, East Penn Manufacturing Company and Exide Technologies Inc. Our hydrogen fuel cell competitors include Plug Power, Ballard as well as forklift manufacturers Hyster Yale and Linde. Competitors in the lithium ion battery sector include Navitas Systems, Green Cubes, and Flux Power as well as EnerSys.

● Stationary Energy Storage. Competition includes manufacturers and system integrators. We compete primarily with LG Chem, Panasonic, Tesla, SAFT, BYD,, Samsung, SK Innovation, Toshiba, Leclanche, and others.

● Other Electric Vehicle Battery Systems. We compete primarily with LG Chem, Johnson Controls, SAFT, Samsung, SK Innovation, BYD, CATL, Enersys, Panasonic, and others.

To compete successfully, we intend to continue to build on the advantages offered by our technology.

2.3.4 Research and Development

Electrovaya continues to research, develop and commercialize improved lithium-ion batteries and associated technologies with longer life, higher energy density and increased safety. The Company primarily uses "NCM" (nickel cobalt manganese) anode based cells. The NCM cathode is a lithiated nickel and mixed metal oxide based system that distinguishes itself with 50% or more higher energy density compared to phosphate based lithium-ion batteries, resulting in more stable chemistry than some higher-energy chemistries. When combined with other Electrovaya technologies including specialized electrolytes and composite separators, the end result is a cell with competitive advantages in performance, cycle life and safety.

Electrovaya is committed to investing in developing better products for our customers and pursuing research activities that prepare us for the future. To date, Electrovaya has invested more than $80 million (Cdn $100 million) in research & development and manufacturing advances, and 20% of our revenues during the 2022 fiscal year were reinvested in research and development.

At the system level, our team of engineers in Mississauga continues to develop the mechanical, thermal, electrical, and control systems for innovative battery systems for our clients, enabling us to offer a complete solution for their specific power or energy requirements. Electrovaya has expanded its engineering team in the current fiscal year.

The Electrovaya Labs division continues research into next generation cells and batteries in the areas of solid-state cells, electrode production and higher energy density batteries, and will generate additional intellectual property and patent applications in connection with the same. Electrovaya expanded the team at this division in 2022.

2.3.5 Intellectual Property

Electrovaya has a program to enhance its intellectual properties and owns many patents. These patents cover our fundamental structural technology innovations, our system level designs including our intelligent battery management system for transportation, as well as some nanomaterial developments. Our patents are issued globally and typically across the United States and Canada. In some cases we do file into other jurisdictions such as Europe, India, China, Japan and other countries where potential markets and/or manufacturing activities make patent protection desirable and economically justifiable. Electrovaya recently also acquired about 30 patents mainly on ceramic composite separators and lithium ion cells.

We seek to protect our intellectual property, including our technological innovations, products, software, manufacturing processes, business methods, know-how, trade secrets, trademarks and trade dress by law through patents, copyright and trademark law, by contract through non- disclosure agreements, and through safeguarding of trade secrets.

Our patent portfolio, trade secrets and proprietary know-how are an important component in protecting our battery innovations and our manufacturing processes. We further protect our trade secrets and proprietary know-how by keeping our facilities physically secure, disclosing relevant information only on a need-to-know basis and entering into non-disclosure agreements with our potential customers, employees, consultants and potential strategic partners, and by treating and marking the confidential information as confidential.

We will continue to apply for patents resulting from ongoing research and development activities, acquire, or license patents from third parties, if appropriate, and further develop the trade secrets related to our manufacturing processes and the design and operation of the equipment we use in our manufacturing processes.

2.3.6 Employees

As of September 30, 2022 we had approximately 77 full-time employees as well as contract employees and consultants. We believe we enjoy a good and productive relationship with our employees.

2.3.7 Impact of COVID-19 Pandemic

Electrovaya was deemed an essential business in Ontario, Canada and operated without major interruption during the height of the COVID-19 pandemic. The Company's customers include large global firms in industries such as grocery, logistics and e-commerce that continued to provide critical services during the most difficult periods. The crisis highlighted Electrovaya's important role in helping its customers execute mission-critical applications under highly challenging conditions. Electrovaya's major customers continued to generate revenue, and, in some cases, experienced an increase in demand for their essential services. However, the COVID-19 pandemic did disrupt the Company's supply chain from many of its global vendors with resultant delays in delivery of the Company's products to its customers, slowing the Company's growth trajectory during 2021 and 2022 to some degree.

Electrovaya considers the health and safety of its employees and other stakeholders to be of the highest priority. To mitigate the spread of COVID-19, the Company has implemented a number of common-sense initiatives at its headquarters, including increased sanitization of frequently touched surfaces, use of masks, and social distancing guidelines, air-purifiers at many locations and UV-C lamps inside air handling heating and cooling systems. COVID related activities and precautions may reduce operational efficiency.

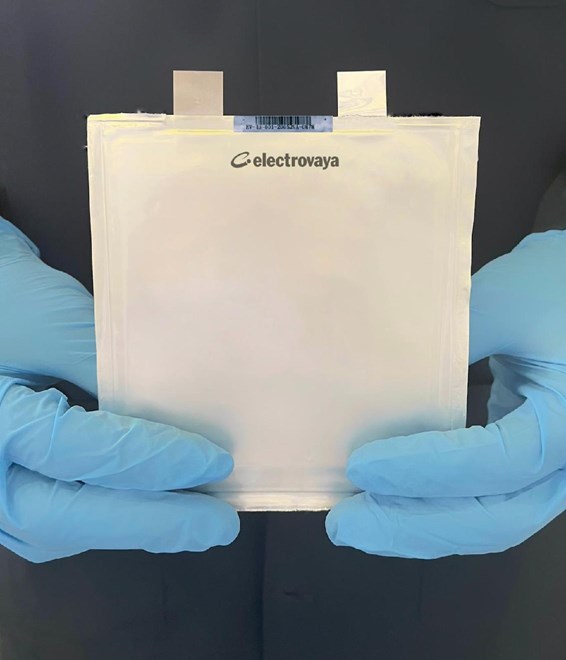

2.3.8 Manufacturing

The Company has a battery and battery systems research and manufacturing facility in Mississauga, Ontario. The location comprises approximately 62,000 square feet and is designed to enhance the Company's productivity and efficiency. The facilities are focused on lithium ion battery production, which includes the assembly, integration and testing of lithium ion batteries as well as development and testing of new products and enhancements by our engineering team.

2.3.9 Safety

Safety is of paramount importance to the Company not only for our products but more importantly for our people. We have robust safety protocols in all areas. We have a Joint Health and Safety Committee which includes employees across disciplines and at all levels. This Committee regularly meets to ensure safety protocols are followed and updated when necessary.

Our products are designed and manufactured with safety as the primary concern. All components are vigorously tested prior to being included in the manufacturing process. Our products are assembled to the highest standard and are subject to a comprehensive end of line testing to ensure they adhere to our demanding safety standards.

Electrovaya recently achieved the UL2580 certification, with UL LLC completing multiple system level tests on Electrovaya's batteries, including fire propagation at both ambient and elevated temperatures, and other electrical and mechanical tests. Furthermore, UL completed full functional testing and provided UL991 and UL1998 certifications relating to Electrovaya's fifth generation proprietary Battery Management System.

2.3.10 Quality

Quality is also an integral part of our culture and processes. We believe we have differentiated ourselves in the market by having the highest quality and safest product available.

Electrovaya received ISO9001:2015 Quality Management certification in 2022.Furthermore, our quality assurance management system has been tested and validated by a number of third parties including Toyota Material Handling and Raymond Corporation.

Our processes and systems are focused on ensuring that every product that is shipped to our customers conforms to our rigorous quality standards while being produced in a safe and environmentally conscious manner.

2.3.11 Sustainability

Our Company was founded 20 years ago with the express purpose to develop clean technology for a greener planet. Electrovaya is focused on contributing to the prevention of climate change through supplying the safest and longest lasting Li-Ion batteries in the marketplace. Our goal is to be a global leader in the supply of advanced lithium ion battery technologies.

Our processes and facilities embody our focus on sustainability. Waste is minimized and recycled where possible. Steps have been introduced to reduce our energy and water use.

3. Capital Structure and Market for Shares

Our authorized share capital consists of an unlimited number of common shares. Holders of common shares are entitled to receive notice of any meetings of our shareholders, to attend and to cast one vote per common share at all such meetings. The holders of our common shares are entitled to vote at all meetings of our shareholders, and each common share carries the right to one vote in person or by proxy. The holders of the common shares are also entitled to receive any dividends we may declare, and to receive our remaining property upon liquidation, dissolution or wind-up.

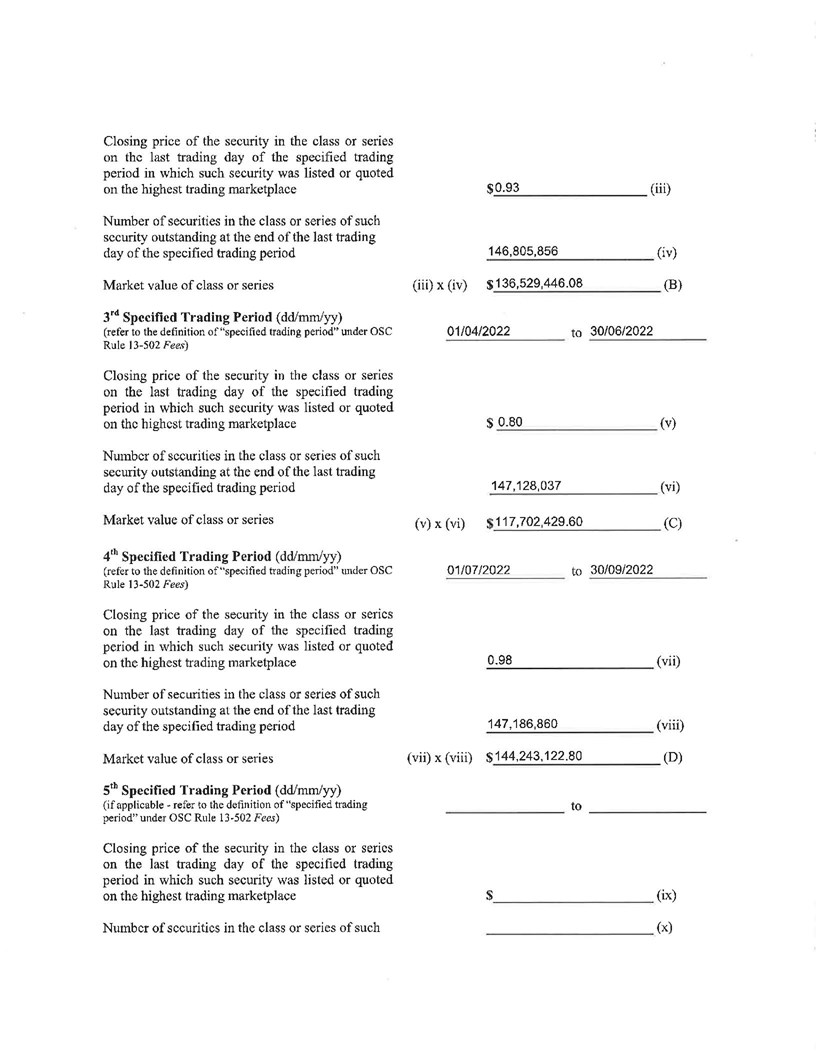

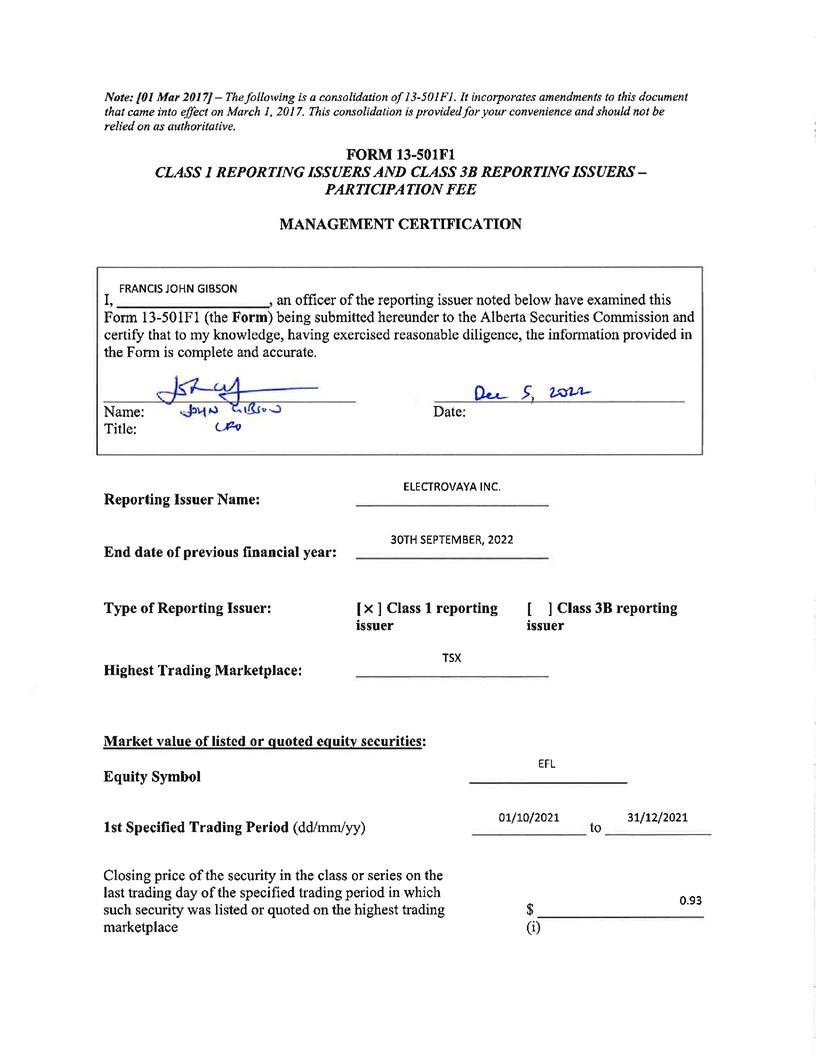

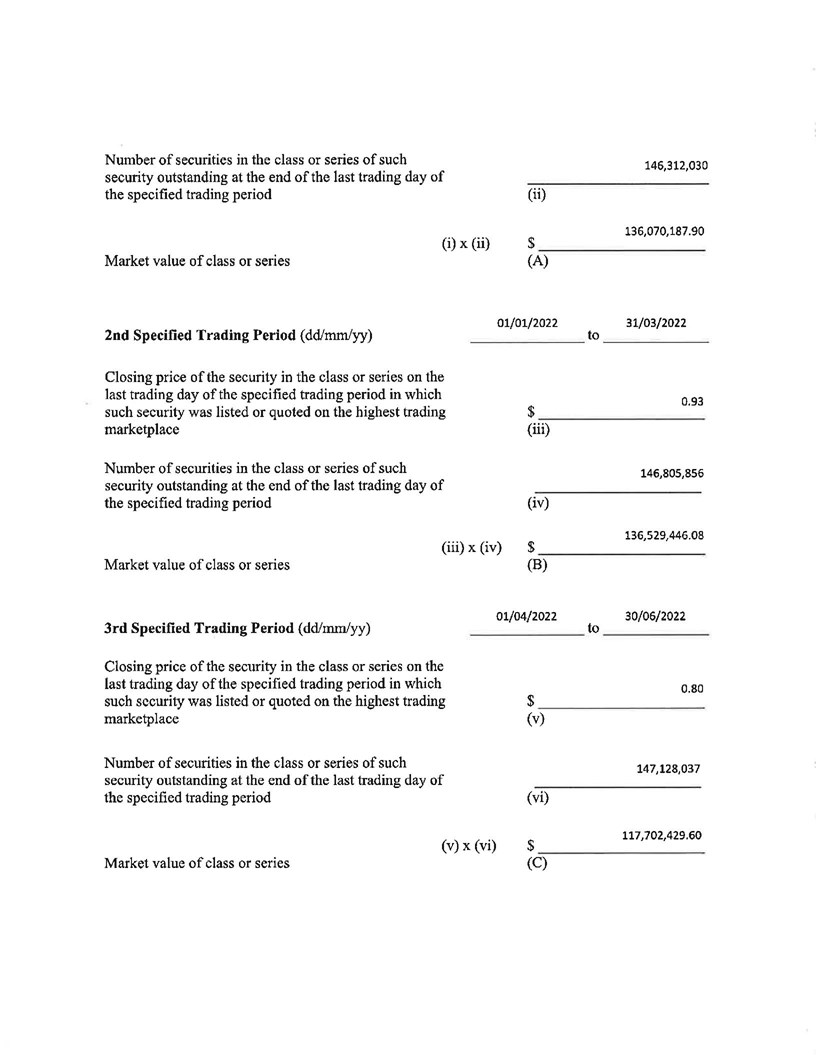

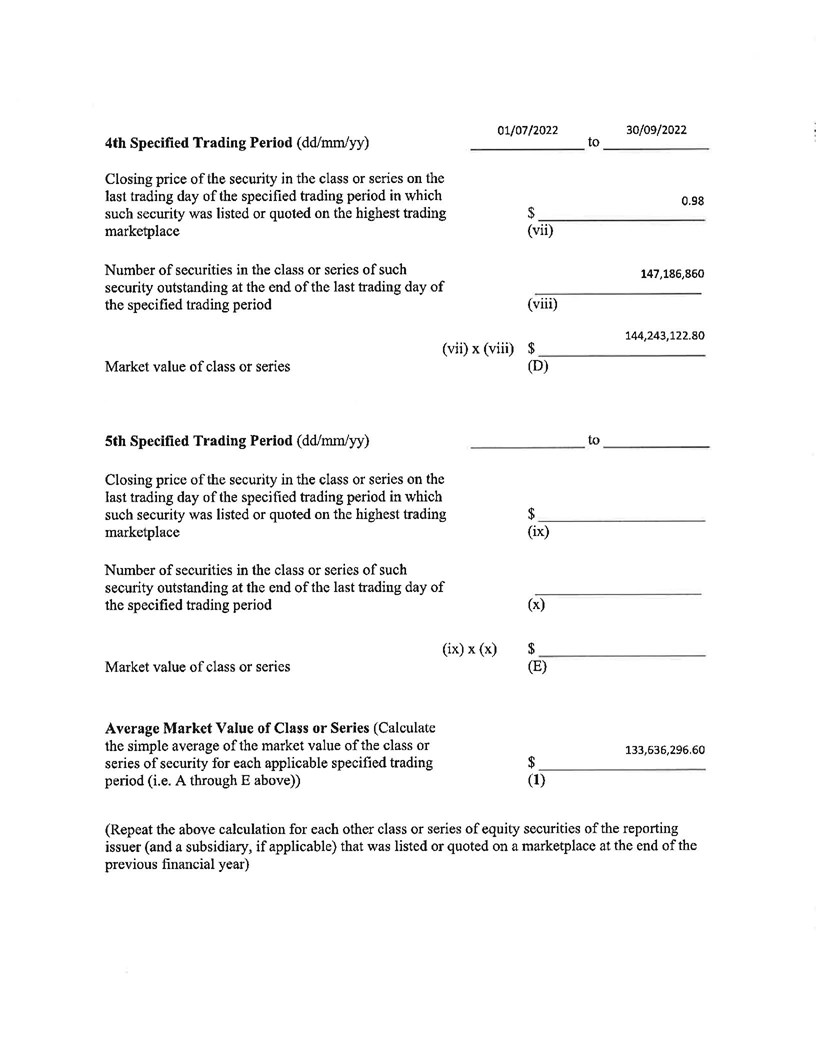

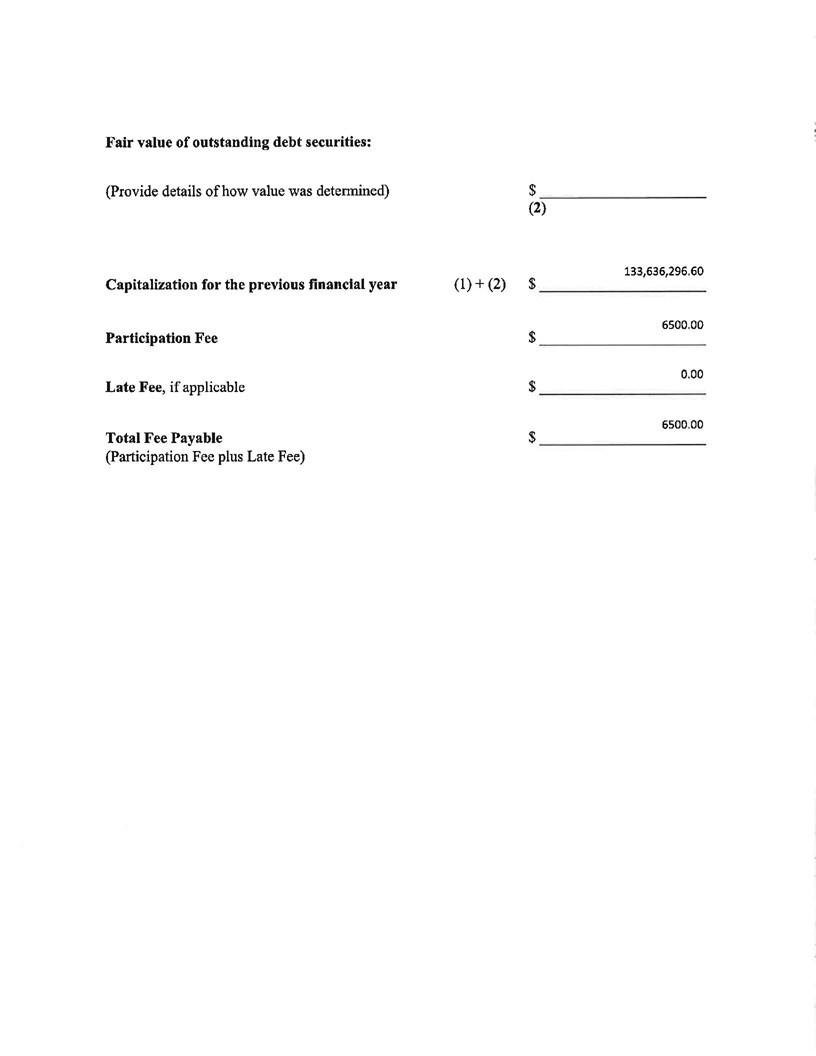

Our common shares are listed for trading on the Toronto Stock Exchange under the symbol "EFL" and are quoted for trading on the OTCQB International market under the symbol "EFLVF". The table below sets forth information relating to the trading of the common shares on the TSX for the months indicated.

| Month |

High (C$) |

Low (C$) |

Volume Traded |

| 2022/09 |

1.30 |

0.92 |

2,459,202 |

| 2022/08 |

1.13 |

0.90 |

1,830,322 |

| 2022/07 |

0.95 |

0.71 |

1,313,707 |

| 2022/06 |

0.81 |

0.53 |

2,175,580 |

| 2022/05 |

0.82 |

0.58 |

1,573,635 |

| 2022/04 |

1.04 |

0.72 |

1,734,197 |

| 2022/03 |

1.15 |

0.73 |

2,355,667 |

| 2022/02 |

0.93 |

0.70 |

1,103,203 |

| 2022/01 |

0.96 |

0.70 |

1,733,837 |

| 2021/12 |

1.10 |

0.92 |

2,496,745 |

| 2021/11 |

1.35 |

1.02 |

2,663,065 |

| 2021/10 |

1.43 |

1.05 |

5,693,830 |

The Company has also covenanted with certain institutional investors to use its best efforts to complete a listing of its Common Shares on the Nasdaq Capital Market by April 30, 2023. The Company is in the process of applying to list on Nasdaq.

4. Dividend Policy

We have never declared or paid any dividends on our common shares in the past; however, we may declare and pay dividends on our common shares in the future depending upon our financial performance.

5. Escrowed Securities and Securities Subject to Contractual Restrictions on Transfer

Pursuant to a financing completed November 9, 2022, each director and officer of the Company agreed with the certain investors and the placement agent thereunder not to offer, sell, contract to sell, hypothecate, pledge or otherwise dispose of, or enter into any transaction which is designed to, or might reasonably be expected to, result in the disposition (whether by actual disposition or effective economic disposition due to cash settlement or otherwise) by such director or officer, or any affiliate thereof, directly or indirectly, or undertake certain derivative transactions with respect to any Common Shares of the Company or securities convertible, exchangeable or exercisable into, Common Shares of the Company such director or officer beneficially owned, until February 7, 2023, being the date that is 90 days from the closing of the financing. Such contractual restrictions are subject to certain customary exceptions.

| Designation of class |

Number of securities held in escrow or

that are subject to a contractual

restriction on transfer |

Percentage of class |

| Common Shares |

56,652,010 |

approx 40% |

6. Directors and Officers

The following table sets forth the names and municipalities of residence of our directors and officers, the position they hold with us and their principal occupation during the last five years:

Name, Office (if any) and

Principal Occupation |

Director

Since |

Common Shares

Beneficially Owned |

Stock Options Held |

Warrants |

| |

|

|

|

|

Dr. Sankar Das Gupta,

Mississauga, Ontario,

Canada

Executive Chairman |

1996 |

51,653,754 |

3,500,000 |

7,100,000 |

| |

|

|

|

|

Dr. Bejoy Das Gupta

Washington, D.C., U.S.A.

Director

Chief Economist,

eCurrency |

1999 |

1,206,867 |

203,000 |

144,781 |

| |

|

|

|

|

Dr. Carolyn M.

Hansson(1)(2)

Waterloo, Ontario, Canada

Director

Professor of Materials

Engineering, Department

of Mechanical and

Mechatronics Engineering,

University of Waterloo |

2017 |

250,000 |

150,000 |

- |

| |

|

|

|

|

Dr. James K. Jacobs(1)(2),

Toronto, Ontario, Canada

Director

Retired |

2018 |

2,390,536 |

95,000 |

- |

Name, Office (if any) and

Principal Occupation |

Director

Since |

Common Shares

Beneficially Owned |

Stock Options Held |

Warrants |

| |

|

|

|

|

Kartick Kumar(1)(2)

San Francisco, California,

USA

Director

Managing Director,

Climate Investments,

King Philanthropies |

2021 |

11 |

25,000 |

- |

| |

|

|

|

|

Dr. Rajshekar Das Gupta

Mississauga, Ontario,

Canada

Director, Chief Executive

Officer |

2022 |

1,150,842 |

8,309,000 |

194,421 |

| |

|

|

|

|

John Gibson

Mississauga, Ontario,

Canada

Secretary and Chief

Financial Officer |

N/A |

- |

200,000 |

- |

(1) Audit Committee member.

(2) Nominating, Corporate Governance and Compensation Committee member.

All directors hold office until the close of the next annual meeting of the shareholders or until their successors are duly elected or appointed

As of September 30, 2022, the directors and officers of the Company, as a group, beneficially own, directly or indirectly, or exercise control or direction over, an aggregate of 56,263,168 or approximately 40% of the issued and outstanding common shares of the Company.

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

Except as described below, to the best of management's knowledge, no officer or director:

(a) is, as at the date of this AIF, or has been, within 10 years before the date of this AIF, a director, chief executive officer or chief financial officer of any company (including the Company) that:

(i) was subject to an order that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or

(ii) was subject to an order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer; or

(b) is, as at the date of this AIF, or has been within 10 years before the date of the AIF, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or

(c) has, within the 10 years before the date of the AIF, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the officer or director.

On January 25, 2018, Litarion GmbH ("Litarion"), a former subsidiary of Electrovaya, commenced a voluntary structured insolvency process and an Administrator was put in place for the sale of the business. On April 30, 2018, the Administrator commenced insolvency proceedings and assumed control of the assets of Litarion. Sankar Das Gupta, President and Chief Executive Officer of the Corporation was a managing director of Litarion until the Administrator's appointment.

In June, 2021, the administrator of Litarion and the Company and its officers agreed to mutually settle all claims as part of the termination of the insolvency proceedings.

Except as described below, to the best of management's knowledge, no officer or director has been subject to:

(a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or

(b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to make an investment decision in the Company's common shares.

On June 30, 2017, the Company and Sankar Das Gupta, Executive Chairman of the Corporation, entered into a Settlement Agreement (the "Agreement") with Staff of the Ontario Securities Commission ("OSC") resolving issues the OSC identified with respect to the Company's continuous disclosure between December 2015 and September 2016 (the "Time Period"). The Agreement settled allegations by the OSC regarding unbalanced news releases that did not adequately disclose the nature and risks of newly-announced business arrangements issued by the Company during the Time Period, that the Company did not update previously announced forward-looking information in its Management Discussion and Analysis during the Time Period, and that the Company did not provide an accurate description of its business in its annual information form filed during the Time Period.

The Company did not face a financial penalty in relation to the Agreement. Dr. Das Gupta agreed to pay an administrative penalty and upgrade his personal knowledge of continuous disclosure standards. Under the terms of the Agreement, the Company agreed to additional steps to comply with continuous disclosure requirements, including

● a review of the Company's corporate governance framework by an independent consultant and adopting all recommended changes that are accepted by OSC Staff;

● instituting a disclosure committee comprising 4 directors (2 of whom were required to be independent) for a period of 20 months, which committee was to approve all public disclosure made by the Corporation;

● naming an independent director as Chair of the disclosure committee for a period of 20 months; and

● naming an independent director as Chair of the Board for a period of 20 months.

Under the terms of the Settlement Agreement, Dr. Das Gupta agreed to:

● pay an administrative penalty of Cdn$250,000;

● a prohibition on acting as a director or officer of any reporting issuer, other than the Company or an affiliate, for a period of one year;

● pay the costs of the corporate governance consultant's review; and

● participate in, and pay for, a corporate governance course on disclosure issues acceptable to staff of the OSC.

7. Transfer Agent and Registrar

The transfer agent and registrar for the common shares of the Company is TSX Trust Company at its principal office in Toronto, Ontario.

8. Legal Proceedings and Regulatory Actions

The Company is not involved in any legal proceeding or regulatory action which it expects would have a material effect on the Company.

9. Interest of Management and Others in Material Transactions

Other than as disclosed in this AIF, no director, executive officer, person or company that beneficially owns or controls more than 10% of any class of the Company's outstanding voting securities, or any associates or affiliates of persons had any material interest, direct or indirect, in any transaction within the three most recently completed financial years or during the current financial year that has materially affected or is reasonably expected to materially affect the company.

Purchase of Jamestown Property

On October 15, 2021, the Company, as purchaser, agreed to purchase the property municipally known as 1 Precision Way, Jamestown, NY 14701 (the "Property") for a purchase price of $5 million. Among other factors, the Property was of interest to the Company for various reasons, including access to Government incentives, increased capacity, and access to the US market.

Prior to closing, it was determined that the Company would not have access to sufficient capital to finance the building purchase. The vendor had another buyer, therefore, in May 2022, prior to closing, the Company, as assignor, and Sustainable Energy Jamestown LLC ("SEJ"), as assignee, entered into an agreement to assign the agreement of purchase and sale for the Property to SEJ, with the intention that SEJ would complete the purchase of the Property. SEJ completed the purchase of the property in May 2022.

On November 1, 2022, the Company entered into an agreement with Sustainable Energy Jamestown ("SEJ"), a party related to shareholders of the Company for the purchase of the building at 1 Precision Way, Jamestown, NY. The purchase agreement sets the purchase price at $5,500 less any expenses incurred on behalf of the related party to date and the repayment of the deposit of $550. The purchase is expected to be finalized on or about June 30, 2023.

Personal Guarantees

The Company's Cdn$6 million principal promissory note is guaranteed by the personal guarantee of Dr. Sankar Das Gupta, Executive Chairman and the controlling shareholder of the Company, as well as secured by a pledge of 25,700,000 Common Shares by Dr. Das Gupta in favour of the lender.

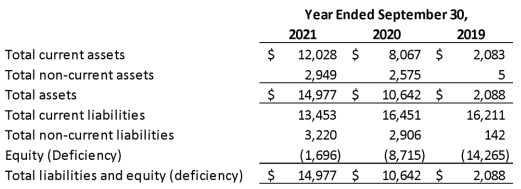

| |

|

September 30, |

|

| |

|

|

|

|

|

|

| |

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

| Promissory Note |

$ |

4,363,000 |

|

$ |

4,734,000 |

|

In June 2020, as consideration for the significant personal risk involved in granting the Company's lenders personal guarantees and share pledges, the Company's independent directors approved the issuance to Dr. Das Gupta of 4,000,000 Common Shares at a price of $0.13 (Cdn $0.18), and 7,100,000 warrants to purchase Common Shares, each exercisable at a price of $0.13 (Cdn $0.18) until April 2, 2030 as consideration for the guarantees and pledges described above. Both the shares and warrants vesting only after July 1, 2023.

Electrovaya Labs - Facility Usage Agreement

In May 2021 Electrovaya entered a month to month Facility Usage Agreement for the use of space and allocated staff of a third party research firm providing access to laboratory facilities, primarily for research associated with its Electrovaya Labs segment. The term of the agreement was for six months and could be terminated by either party upon 90 days notice.

In July 2021 the facility was acquired by an investor group controlled by the family of Dr. Das Gupta, the Chairman of the Company and a controlling shareholder, and which group included the Company's current CEO, Dr. Raj Das Gupta. The Facility Usage Agreement was not changed on the change of ownership and remains in effect between the Company and the owner, such that the monthly payment of $25,000 is now with a related party of Electrovaya.

In December 2021 the Facility Usage Agreement was renewed for a further 12 months on the same terms and conditions.

Performance Option Grants

In September 2021, on the recommendation of the Compensation Committee of the Corporation, a committee composed entirely of independent directors, the Board of Directors of the Corporation determined that it is advisable and in the best interests of the Corporation to amend the terms of the compensation of certain key personnel to incentivize future performance, to encourage retention of their services, and to align their interests with those of the Corporation's shareholders.

Dr. Sankar Das Gupta was granted two million options which vest in two tranches of one million options each based on reaching specific target market capitalization thresholds. As the target market capitalization thresholds have not yet been reached, none of these options have vested.

Dr. Rajshekar Das Gupta was granted four million and five hundred thousand options which vest in three tranches of one million and five hundred thousand options based on reaching specific target market capitalization thresholds. As the target market capitalization thresholds have not yet been reached, none of these options have vested.

10. Material Contracts

The Company does not have any material contracts that were required to be filed under section 12.2 of National Instrument 51-102 - Continuous Disclosure Obligations.

11. Interests of Experts

The auditor of the Company is Goodman and Associates LLP ("Goodman and Associates"), Chartered Accountants, Suite 200, 45 St. Clair Ave. West, Toronto, Ontario M4V 1K6. There are no registered or beneficial interests, direct or indirect, in any securities or other property of the Company or any of its subsidiaries held or received by Goodman and Associates. Goodman and Associates is independent in accordance with the auditors' rules of Professional conduct in Canada. Our business of designing, developing and manufacturing lithium-ion advanced battery and battery systems for the transportation, electric grid stationary storage and mobile markets faces many risks of varying degrees of significance, which could affect our ability to achieve our strategic objectives. The risk factors described below are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. These risk factors could materially affect our future operating results and could cause actual events to differ materially from those described in our forward-looking statements. Additional risks the Company faces are disclosed in the Company' Management's Discussion and Analysis for the year ended September 30, 2022.

12. Risk Factors

Our business of designing, developing and manufacturing lithium-ion advanced battery and battery systems for the transportation, electric grid stationary storage and mobile markets faces many risks of varying degrees of significance, which could affect our ability to achieve our strategic objectives. The risk factors described below are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. These risk factors could materially affect our future operating results and could cause actual events to differ materially from those described in our forward-looking statements. Additional risks the Company faces are disclosed in the Company' Management's Discussion and Analysis for the year ended September 30, 2022.

There is no assurance that we will be able to produce or generate and fulfill orders for large quantities of our products.

Electrovaya may not be able to establish anticipated levels of high-volume production on a timely, cost-effective basis, or at all. It has never manufactured batteries in substantially large quantities and it may not be able to maintain future commercial production at planned levels. As a result of the risks discussed within this AIF, among others, Electrovaya may not be able to generate or fulfill new sales orders or deliver them in a timely manner, which could have a material effect on its business and results of operations.

Our ability to generate positive cash flow is uncertain.

To rapidly develop and expand our business, we have made significant up-front investments in our manufacturing capacity and incurred research and development, sales and marketing and general and administrative expenses. In addition, our growth has required a significant investment in working capital and significant debt finance over the last several years. We have had negative cash flow in multiple fiscal periods in our recent history and we may continue to have negative cash flow in the future as we continue to incur debt service costs, increased research and development, sales and marketing, and general and administrative expenses, as well as acquisition expenses. Our business will continue to require significant amounts of working capital to support our growth. Therefore, we may not achieve sufficient revenue growth to generate positive future cash flow and may need to raise additional capital from investors or other finance sources to achieve our future growth. An inability to generate positive cash flow for the foreseeable future or raise additional capital on reasonable terms may decrease our viability.

Our failure to raise additional capital necessary to expand our operations and invest in our products and manufacturing facilities could reduce our ability to compete successfully.

We regularly require additional capital and we may not be able to obtain additional debt or equity financing on favorable terms, if at all. If we raise additional equity financing, our shareholders may experience significant dilution of their ownership interests, and the per-share value of our common shares could decline. If we engage in debt financing, we may be required to accept terms that restrict our ability to incur additional indebtedness and force us to maintain specified liquidity or other ratios. We also seek Canadian and U.S. federal, provincial and state grants, loans and tax incentives, some of which we intend to use to expand our operations. We may not be successful in obtaining these funds or incentives. If we need additional capital and cannot raise or otherwise obtain it on acceptable terms, we may not be able to, among other things:

● develop or enhance our products or introduce new products;

● continue to expand our development, sales and marketing and general and administrative organizations and manufacturing operations;

● attract top-tier companies as customers or as our technology and product development partners;

● acquire complementary technologies, products or businesses;

● expand our operations, in Canada, U.S. or internationally;

● expand and maintain our manufacturing capacity;

● hire, train and retain employees;

● respond to competitive pressures or unanticipated working capital requirements: or

● continue as a going concern.

Financial outlooks are inherently forward-looking and the Company's actual financial results may differ, possibly materially, from any expected results presented in a financial outlook.

From time to time, the Company may disclose financial outlooks. Financial outlooks constitute forward-looking information, which is necessarily based on certain assumptions about future circumstances and results of operations. The Company believes it bases its financial outlooks from time to time on assumptions that are reasonable in the circumstances, but the achievement of actual results is subject to a number of risks that could cause the information in the forward-looking statement to differ from the statements as presented, possibly materially.

There is no guarantee that actual results will be as presented in any financial outlook, and may materially differ. Investors and other market participants may base their expectations on a financial outlook provided by management. Differences in financial and operating results as compared to any financial outlook may cause the trading price of the Common Shares to decrease, possibly materially.

Sales under the Raymond Strategic Supply Agreement

In December 2020, the Company entered into the Raymond Strategic Supply Agreement. The Strategic Supply Agreement includes a provision where Raymond can have an exclusive arrangement with the Company if it makes purchases with a value of at least $15 million in an annual period. The Company based its financial outlook (including revenue forecasts) in its base shelf prospectus dated December 7, 2021 on the basis that Raymond would be incentivized to maintain the exclusive relationship and provide purchase orders in at least an amount required to maintain exclusivity, given feedback on the products received to date, interpretation of such a clause, and an evaluation of Raymond's financial capability to complete such orders and the materiality of the value of such orders in the context of Raymond's enterprise as a whole. While the Company believes it is reasonable to assume that the minimum quantity required to maintain exclusivity under the Strategic Supply Agreement will be purchased, there is no guarantee these sales will be made and the achievement of such sales is subject to a number of assumptions and factors including those described in the section "Cautionary Note Regarding Forward-Looking Information. The failure of Raymond to fulfill a material amount of orders under the Strategic Supply Agreement could have a material adverse effect on the Company's ability to meet the sales and revenue projections in any financial outlook provided herein, and on the Company's results of operations.

We manufacture a complex product including components from various suppliers. Failures in components or the finished product could result in product recalls, and rework of the product could lead to claims and additional costs. Our products carry warranties, and this exposes us to undeterminable cost should product failures occur.

While we have in place quality controls for ourselves and our suppliers, there is no assurance that a fault will not occur occasionally. As such there is a risk of a warranty claim and recall of products, that could have a negative effect on our business and results of operations.

Our principal competitors have, and any future competitors may have, greater financial and marketing resources than we do, and may develop batteries or other technologies similar or superior to ours or otherwise compete more successfully than we do.

Competition in the battery industry is intense. The industry consists of major domestic and international companies, most of which have existing relationships in the markets into which we sell as well as financial, technical, marketing, sales, manufacturing, scaling capacity, distribution and other resources, and name recognition substantially greater than ours. With respect to large energy storage systems specifically, this is a relatively new product offering for the Company, and competition for sales of such products includes both battery companies listed elsewhere and large multinational companies such as General Electric, Siemens, and Hitachi, and Electrovaya may not be able to compete with such entities due to inability to match scale, expertise, geographical reach, or other factors. These companies may develop batteries or other technologies that perform as well as or better than our batteries, activities into which the Company has limited knowledge and visibility. We believe that our primary battery competitors are existing suppliers of cylindrical lithium-ion, nickel cadmium, nickel metal-hydride and in some cases, non- starting/lighting/ignition lead-acid batteries. Potential customers may choose to do business with our more established competitors, because of their perception that our competitors are more stable, are more likely to complete various projects, can scale operations more quickly, have greater manufacturing capacity, are more likely to continue as a going concern, and may lend greater credibility to any joint venture. If we are unable to compete successfully against manufacturers of other batteries or technologies in any of our targeted applications, our business could suffer, and we could lose or be unable to gain market share.

The demand for batteries for transportation and in other markets depends on the continuation of current trends resulting from dependence on fossil fuels. Low gasoline prices could adversely affect demand for electric and hybrid-electric vehicles.

We believe that much of the present and projected demand for advanced batteries in the transportation and other markets results from the price of oil, the dependency of the United States on oil from unstable or hostile countries, government regulations and economic incentives promoting fuel efficiency and alternate forms of energy, as well as the belief that climate change results in part from the burning of fossil fuels. If the cost of oil decreased significantly, the outlook for the long-term supply of oil to the United States improved, the government eliminated or modified its regulations or economic incentives related to fuel efficiency and alternate forms of energy, or if there is a change in the perception that the burning of fossil fuels negatively impacts the environment, the demand for our batteries could be reduced, and our business and revenue may be harmed.

Gasoline prices have been volatile, and this continuing volatility is expected to persist. Lower gasoline prices over extended periods of time may lower the perception in government and the private sector that cheaper, more readily available energy alternatives should be developed and produced. If gasoline prices deflate and remain deflated for extended periods of time, the demand for hybrid and electric vehicles may decrease, which would have an adverse effect on our business.

From time to time, the Company may enter into contracts or other arrangements with customers, and may disclose estimates of future sales and revenue associated with such contracts or arrangements. Contracts with our customers typically do not provide for firm price or volume commitments, or "take or pay" arrangements with respect to product orders. As a result, our business development and partnering efforts may fail to generate revenue in meaningful amounts, or at all, and actual revenue generated from any such contracts may be materially less than estimated and announced.

From time to time, the Company will negotiate sales or supply contracts for its products. Typically, such contracts provide for a master framework for sales to a customer under which product will be sold pursuant to purchase orders, but without any minimum volumes or other purchase or payment obligations under the contract. Therefore the Company is subject to the requirements of such customers as to if, as, when, and in what volume they wish to ultimately purchase the product.

From time to time, the Company may estimate future revenue expectations based on forecasts for orders during the life of such contract provided to the Company by the customers, and may announce such expectations publicly. However, execution of the orders remains solely at the discretion of the customers. Accordingly, Electrovaya's actual revenues under any contract or other customer arrangement could be materially less than initially estimated or announced. Any such customer order forecasts constitute forward-looking information of the customer, and the Company does not have knowledge of the material factors or assumptions used by the customers to develop the order forecasts, and cannot assess their reliability. The Company also does not have the ability to monitor the performance of the customers' business in order to confirm that the volumes initially represented by them in any forecasts remain valid. If such forecasts do not remain valid, or if firm irrevocable orders are not obtained, the Company's potential estimated revenues could be materially and adversely impacted, which could have a material effect on its business and results of operations.

The Company's actual results of operations may differ materially from the expected results announced based on arrangements with customers that are not definitive agreements. The Company may not be able to fulfill certain requirements of customer arrangements.

From time to time, the Company may enter into and announce understandings or other arrangements other than contracts with customers. Any understandings or other arrangements may be subject to additional risks including that the arrangements may still be subject to negotiation and there is no assurance a definitive agreement will be reached, or that if such agreement is reached, such agreement will be on the same terms as disclosed in the understanding. For example, product specifications may not yet have been agreed to and therefore a definitive agreement cannot be entered into, nor deliveries commenced until product specifications are agreed and a definitive arrangement is signed. Any definitive agreement with a customer, if entered into at all, may be on terms materially different than as disclosed in any announcement of an understanding or other arrangement that is not a definitive agreement. The actual results of the Company's business may be materially different than as expected pursuant to any understanding that is not a definitive agreement, therefore undue reliance should not be placed on any agreement that is not a definitive agreement.

Electrovaya occasionally receives purchase orders that contain a series of milestones or deliverables, all or a portion of which may need to be completed in serial fashion before each subsequent activity and revenue generating milestones can be achieved. If each required milestone is not achieved, the entire amount of the purchase order may not be realized.

The ongoing global COVID-19 pandemic may have significant and far-reaching negative effects on our operations and our customers.

The ongoing global COVID-19 global pandemic created a number of risks in the Company's business, not all of which may be quantifiable to or immediately identifiable by the Company. To date, the impact of the virus on the Company's operations and workforce has been mitigated as the Company was exempt from government lockdown orders, as manufacturing has generally been deemed an essential service in Ontario and the Company has continued to operate throughout the most severe periods pandemic.

While the efficiency of the Company's day-to-day operations has not to date been negatively impacted by the need for physical separation and increased sanitation, depending on future outbreaks and their severity, there may be a risk of such negative impacts on efficiency and productivity in the future. Social distancing restrictions to protect the safety of our employees may limit the volume of product the Company is able to manufacture and distribute. In addition, some employees may be affected in their ability to travel on public transit or otherwise work due to safety fears, or may be subjected to lockdowns or quarantines, particularly if exposed to the virus, even if not infected themselves, which could lead to absenteeism and impacts on productivity. Any on-site exposure to the virus could result in complete shutdowns to operations.

The Company has not experienced significant detrimental effects on productivity or costs due to mitigation strategies, including the implementation of social distancing (including work-from- home policies for those employees who could work from home), personal protective equipment requirements, employee education, and sanitation measures, particularly as knowledge of the risk profile for viral infection has increased throughout 2020 and 2021 and targeted sanitation measures were adjusted accordingly. Through the early phases of the COVID-19 pandemic, the Company understood, based on information available at the time, that the virus had a high possibility of airborne transmission through respiration of aerosol droplets. Therefore in addition to mandatory masking, social distancing, increased hand washing, and increased surface sanitary precautions, the Company also installed UV-C devices which flooded the workplace air ducts with UV radiation, and installed several portable UV-C devices with HEPA filters in the workplace. The Company can infer these precautions were effective as the Company did not experience any instances of workplace COVID-19 transmission. However, the Company is located in a designated "hot" zone for COVID-19 in Ontario, Canada, and there is no certainty the effectiveness of these measures will persist during future or variant outbreaks.

The Company's principal operations consist of manufacturing, engineering and research, and prior to the COVID-19 outbreak, most Company personnel worked on the Company's premises. After the outbreak, the Company implemented a work-from-home policy where any individual who could work from home, did so. The Company encouraged all its employees to vaccinate as early as possible and supported the vaccination drive by providing employees information on vaccine availability. The Company also gave time off with pay for employees to take vaccinations or COVID-19 tests. However, while the Company has not experienced any substantial COVID-19- related employee turnover or absenteeism to date, there is no certainty that the Company will not experience such negative effects during future or variant outbreaks that may occur.

The virus also disrupted the Company's global supply chain, as lockdowns in many countries may affect some of its suppliers' ability to produce needed components. These supply constraints and increases in shipping costs may have resulted, and may still result, in increased component costs to the Company. Transport of the Company's products both domestically and across international borders may be affected by the impact of COVID-19 on workers in the transportation industry, and border closures or other travel restrictions. At the beginning of the outbreak, some of the Company's component suppliers from Asia, Europe and North America faced difficulties in supplying production components on time, due to material availability and transport restrictions. To mitigate these effects, the Company changed its purchasing patterns to purchase critical components in greater amounts and prior to their need, instituted risk purchasing policies, and sought out and developed multiple alternative sources and suppliers. The Company believes these mitigation strategies have been effective to date, and critical components including microprocessor chips, electrical and electronic components, steel parts and other items have been made available on time to the Company's production team, however the Company has experienced marginal inflation of production costs. The costs in designing and implementing the COVID-19 mitigation efforts are recognized as general overhead costs and are not segregated in the Company's financial statements. However, despite what the Company believes is the institution of successful mitigation efforts on supply chain disruption to date, there is no certainty the effectiveness of these supply- chain disruption mitigation measures will persist during future outbreaks or variant outbreaks.

During the pandemic, the Company's customers and potential customers, especially those from outside Canada, could not visit the Company's operations, nor could they meet with the Company at trade shows and product exhibitions. It is possible, but not quantifiable, that these restrictions could have led to reduction in revenues during the course of the pandemic from foregone sales.

Costs related to COVID-19 and potential revenue reduction as a result was mitigated through certain government assistance programs, described in the financial statements for the year ended September 30, 2022 and 2021 and corresponding MD&A.

The Company currently depends on a relatively small number of significant customers for a large percentage of its overall revenue. Its customers include end users of material handling electric vehicles (primarily forklifts) who purchase its battery products through the Company's direct sales channel, and the customer base has more recently expanded to include forklift manufacturers who distribute the Company's products to their own customers through the manufacturer's distribution channels under the manufacturer's brand. COVID-19 has had and may continue to have unanticipated consequences on the Company's business, overall revenue, and the timing for revenue as a result of effects on the Company's customers, as delivery schedules under supply agreements with manufacturers have been subject to a high degree of variability as compared to the parties' negotiated intentions. In particular, global supply chain effects, particularly for semiconductors, a key components of forklifts, has resulted in an inability on the part of the Company's forklift manufacturing customers to obtain necessary components for their manufacturing operations and therefore disrupted their ability to deliver their products to customers, and in turn disrupted expected ordering patterns and volumes of the Company's batteries for sales through the manufacturer's channels. This effect was not foreseeable at the time of negotiating the supply agreement, and the Company depends on communications from its customers to understand external impacts on their ordering patterns, which either may not be apparent to the customer or not shared with the Company. The Company is in contact with its customers to optimize purchasing patterns under the supply relationships and understand the pressures its customers face to mitigate these effects and create more predictable revenue patterns.

COVID-19 may also have other general and unquantifiable effects on the Company as global retail sales of goods have been affected by restrictions on store openings, and global shipping of goods has been constrained through capacity issues. Such global impacts on retail sales of goods may have an effect on the Company, as customers have less volume of orders to fulfill and therefore less need to purchase the Company's products. However the Company believes this effect may be offset by higher e-commerce volumes and changing consumer behaviour patterns and an increasing dependence on e-commerce while subject to government-order restrictions on mobility and commercial activity.

We may not be able to successfully recruit and retain skilled employees, particularly scientific, technical and management professionals.

We believe that our future success will depend in large part on our ability to attract and retain highly skilled technical, managerial and marketing personnel who are familiar with our key customers and experienced in the battery industry. Industry demand for such employees, especially employees with experience in battery chemistry and battery manufacturing processes, exceeds the number of personnel available, and the competition for attracting and retaining these employees is intense. This competition will intensify if the advanced battery market continues to grow, possibly requiring increases in compensation for current employees over time. We compete in the market for personnel against numerous companies, including larger, more established competitors who have significantly greater financial resources than we do and may be in a better financial position to offer higher compensation packages to attract and retain human capital. We cannot be certain that we will be successful in attracting and retaining the skilled personnel necessary to operate our business effectively in the future. Because of the highly technical nature of our batteries and battery systems, the loss of any significant number of our existing engineering and project management personnel could have a material adverse effect on our business and operating results.

Our working capital requirements involve estimates based on demand expectations and may decrease or increase beyond those currently anticipated, which could harm our operating results and financial condition.

In order to fulfill the product delivery requirements of our customers, we plan for working capital needs in advance of customer orders. As a result, we base our funding and inventory decisions on estimates of future demand. If demand for our products does not increase as quickly as we have estimated or drops off sharply, our inventory and expenses could rise, and our business and operating results could suffer. Alternatively, if we experience sales in excess of our estimates, our working capital needs may be higher than those currently anticipated. Our ability to meet this excess customer demand depends on our ability to arrange for additional financing for any ongoing working capital shortages, since it is likely that cash flow from sales will lag behind these investment requirements.

Laws regulating the manufacture or transportation of batteries may be enacted which could result in a delay in the production of our batteries or the imposition of additional costs that could harm our ability to be profitable.

Laws and regulations exist today, and additional laws and regulations may be enacted in the future, which impose environmental, health and safety controls on the storage, use and disposal of certain chemicals and metals used in the manufacture of lithium-ion batteries. Complying with any laws or regulations could require significant time and resources from our technical staff and possible redesign of one or more of our products, which may result in substantial expenditures and delays in the production of one or more of our products, all of which could harm our business and reduce our future profitability. The transportation of lithium and lithium-ion batteries is regulated both domestically and internationally. Compliance with these regulations, when applicable, increases the cost of producing and delivering our products.

Electrovaya does not have a collaborative partner to assist it in the development of its batteries, which may limit its ability to develop and commercialize its products on a timely basis.

Electrovaya believes that the formation of strategic partnerships will be critical for the Company to meet its business objectives. It will continue to seek arrangements with potential partners to mitigate development and commercialization risks going forward, balanced by its objective to maximize market share and penetration by not entering into exclusivity arrangements with a single partner.

The Company expects to continue to incur significant costs and invest considerable resources designing and testing batteries for use with, or incorporation into, specific products, which may not translate into revenue for long periods of time, or ever.

The development by the Company of new applications for its rechargeable batteries is a complex and time-consuming process. New battery designs and enhancements to existing battery models can require long development and testing periods. Significant delays in new product releases or significant problems in creating new products could negatively impact the Company's revenues. Significant revenue from these investments may not be achieved for a number of years, if at all. Moreover, these applications may never be profitable and even if they are profitable, operating margins may be low.

We depend on contract manufacturing.

There are many risks associated with contract manufacturing. Trade wars and associated tariffs, as well as other associated factors, such as Russia's invasion of Ukraine could make contract manufacturing too expensive to operate. Our intellectual property is more difficult to control in contract manufacturing. Contract manufacturing could lead to products with inferior quality, especially as we will have to depend on the quality practices of the contract manufacturer. There is also potential loss of control of the supply chain, potential supplier credit risk, and third-party product and financial liability.

Our products depend on intellectual property, which may be subject to challenge or failures to adequately protect it.

Our success depends, in part, on our ability to protect our proprietary methodologies, processes, know-how, tools, techniques and other intellectual property that we use to manufacture and sell our products. If we fail to protect our proprietary technology, we may lose any competitive advantage it provides. Others may claim that the Company's products infringe on their intellectual property rights, which could result in significant expenses for litigation, developing new technology or licensing existing technologies from third parties. If we are unable to maintain registration of our trademarks, or if our trademarks or trade name are found to violate the rights of others, the Company may have to change its trademarks or name and lose any associated goodwill.

We have had a history of losses, and we may be unable to achieve or sustain profitability.