As filed with the U.S. Securities and Exchange Commission on November 13, 2023

Registration No. 333-274931

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

–––––––––––––––––––––––––––––

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

–––––––––––––––––––––––––––––

_____________________________

| | 6770 | 86-1314502 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

5858 Horton Street, Suite 370

Emeryville, California, 95608

Telephone: (510) 318-9098

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

–––––––––––––––––––––––––––––

Cheng Liu

Chief Executive Officer

5858 Horton Street, Suite 370

Emeryville, California, 95608

Telephone: (510) 318-9098

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

–––––––––––––––––––––––––––––

Copies to:

Michael J. Blankenship

Winston & Strawn LLP

800 Capitol Street, Suite 2400

Houston, TX 77002-2925

Telephone: (713) 651-2600

–––––––––––––––––––––––––––––

Approximate date of commencement of proposed sale to public:

From time to time after the effective date hereof.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||

| | ☒ | Smaller reporting company | | |||||

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION |

DATED NOVEMBER 13, 2023 |

ESTRELLA IMMUNOPHARMA, INC.

3,829,338 Shares of Common Stock

Up to 7,036,726 Shares of Common Stock

Up to 2,215,000 Shares of Common Stock Issuable Upon Exercise of Warrants

__________________________________

This prospectus relates to the offer, sale and resale from time to time of certain shares of common stock (“Common Stock”) of Estrella Immunopharma, Inc. (“we,” “us,” “our” the “Company” and “Estrella”) issued or that may be issued from time to time pursuant to certain agreements described below entered into in connection with the consummation of the transactions contemplated by that certain Agreement and Plan of Merger, dated September 30, 2022, (the “Merger Agreement”) by and among TradeUP Acquisition Corp., a Delaware Corporation (“UPTD”), Estrella Biopharma, Inc., a Delaware corporation (“Estrella Operating”) and Tradeup Merger Sub, Inc. (“Merger Sub”), a wholly-owned subsidiary of UPTD. Pursuant to the Merger Agreement, Merger Sub merged with and into Estrella Operating and UPTD was renamed Estrella Immunopharma, Inc. (the “Business Combination”). The Business Combination was completed (the “Closing”) on September 29, 2023 (“Closing Date”).

This prospectus relates to the offer and resale from time to time of an aggregate of 3,829,338 shares of Common Stock including (a) 1,107,500 shares of Common Stock (the “Private Shares”) originally purchased by certain investors on July 19, 2021 (the “IPO Date”) pursuant a subscription agreement dated July 19, 2021 (the “Private Placement Agreement”) in connection with UPTD’s initial public offering (the “TradeUP IPO”) at a price of $10.00 per Private Placement Share (b) 312,200 shares of common stock (the “Founder Shares”) that were originally issued to initial shareholders in conjunction with the TradeUP IPO at a purchase price equivalent to approximately $0.022 per Founding Share, and (c) shares that are issued or that will be issued pursuant to subscription agreements (the “Subscription Agreements”) with each of Plentiful Limited, a Samoan limited company (“Plentiful Limited”) and Lianhe World Limited, a company incorporated in the People’s Republic of China (“Lianhe World” and together with Plentiful Limited, the “Subscribers”, and each a “Selling Stockholder”). Under each Subscription Agreement, in consideration of $5,000,000 delivered concurrently with the closing of the Business Combination, each Subscriber (a) was issued 500,000 shares of Common Stock immediately prior to the Closing; and (b) will be issued 704,819 shares of Common Stock within 30 days of the Closing Date. The Subscription Agreements further provide that the Selling Stockholders may receive additional shares of Common Stock on a contingent basis 24 months following September 29, 2023, subject to certain conditions and adjustments as described in more detail in this prospectus. We are not registering any shares of Common Stock that may be issued to the Subscribers pursuant to such contingent provision at this time.

This prospectus also relates to the potential offer and sale from time to time of up to 7,036,726 shares of Common Stock that may be issued by us to White Lion Capital, LLC (“White Lion”) pursuant to a Common Stock Purchase Agreement, dated as of April 20, 2023, as amended by the Amendment to the Common Stock Purchase Agreement, dated April 26, 2023 UPTD and White Lion (the “Common Stock Purchase Agreement”), in which White Lion has committed to purchase from us, at our sole discretion, up to the lesser of (i) $50.0 million in aggregate gross purchase price of newly issued shares of Common Stock (such shares, the “Equity Line Shares”) and (ii) the maximum number of shares of our Common Stock that we can issue or sell to White Lion under the Common Stock Purchase Agreement pursuant to the applicable rules of Nasdaq (the “Exchange Cap”) without approval by a majority of our stockholders. 7,036,726 represents 19.99% of the outstanding shares of Common Stock of Estrella as of the Closing Date of the Business Combination, which is the maximum number of shares of our Common Stock that we can issue under the Common Stock Purchase Agreement without approval from our stockholders.

This prospectus also relates to the offer and sale by us of up to 2,215,000 shares of Common Stock issuable upon the exercise of the 2,215,000 redeemable warrants, which are exercisable at a price of $11.50 per share (the “Warrants”). However, on November 10, 2023, the last reported sale price of our common stock on the Nasdaq Capital Market was $1.29 per share. This means that the Warrants are currently out of the money and the warrant holders have no incentive to exercise them. Therefore, there is a high likelihood that the warrant holders will not exercise their Warrants unless the market price of our Common Stock increases substantially above the exercise price of the Warrants. The cash proceeds associated with the exercise of the Warrants are dependent on the stock price and the number of Warrants exercised. If the warrant holders do not exercise their Warrants, we may not receive any additional proceeds from the Warrants.

The shares being registered for resale by this prospectus represent approximately 37.2% of our total outstanding shares as of the Closing Date. The sale or availability for sale of these shares could adversely affect the prevailing market price of our common stock and could impair our ability to raise capital through future sales of our securities. In addition, 467,122 shares of UPTD common stock were redeemed in connection with the Business Combination, resulting in a reduced public float and lower trading volume of our Common Stock. As a result, the market price of our Common Stock may be more volatile, and the sale of a substantial number of the shares being registered for resale by this prospectus in the public market could cause the market price of our Common Stock to decline.

We will bear all costs, expenses and fees in connection with the registration of the Common Stock and will not receive any proceeds from the sale of the Common Stock. White Lion is an underwriter within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”), and any broker-dealers or agents that participate in distribution of the securities will also be underwriters within the meaning of Section 2(a)(11) of the Securities Act, and any profit on sale of the securities by them and any discounts, commissions or concessions received by them will be underwriting discounts and commissions under the Securities Act. White Lion may offer, sell or distribute all or a portion of the shares of Common Stock hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will bear all costs, expenses and fees in connection with the registration of such shares of Common Stock, including with regard to compliance with state securities or “blue sky” laws. The timing and amount of any sale are within the sole discretion of White Lion. There can be no assurances that the selling stockholders will sell any or all of the securities offered under this prospectus.

We provide more information about how the selling stockholders and White Lion may sell the shares of Common Stock in the section titled “Plan of Distribution.”

Estrella’s Common Stock and Warrants are traded on the Nasdaq Capital Market (“Nasdaq”) under the symbols “ESLA,” and “ESLAW,” respectively. On November 10, 2023, the closing price of Estrella’s Common Stock was $1.29.

We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

We are a “controlled company” within the meaning of the corporate governance rules of the Nasdaq Capital Market. Eureka Therapeutics, Inc., is our controlling shareholder. As of the time of this offering, Eureka Therapeutics, Inc. holds approximately 72% of the outstanding Common Stock and approximately 72% of the total voting power of the Company. See the section titled “Management of Estrella — Controlled Company.”

Investing in our Common Stock is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 7.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023

Table of Contents

|

Page |

||

|

iii |

||

|

iii |

||

|

iii |

||

|

iv |

||

|

vi |

||

|

1 |

||

|

SELECTED SUMMARY HISTORICAL FINANCIAL INFORMATION OF ESTRELLA |

6 |

|

|

7 |

||

|

72 |

||

|

74 |

||

|

75 |

||

|

UNAUDITED PRO FORMA CONDENSED COMBINED AND CONSOLIDATED FINANCIAL INFORMATION |

76 |

|

|

83 |

||

|

92 |

||

|

141 |

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

152 |

|

|

153 |

||

|

155 |

||

|

161 |

||

|

163 |

||

|

165 |

||

|

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS |

167 |

|

|

171 |

||

|

171 |

||

|

171 |

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with information different from or in addition to that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, we rely on and refer to information and statistics regarding our industry. We obtained this statistical, market and other industry data and forecasts from publicly available information. While we believe that the statistical data, market data and other industry data and forecasts are reliable, we have not independently verified the data.

i

INTRODUCTORy note regarding the business combination

On September 29, 2023 (the “Closing” and such date, the “Closing Date”), we consummated the business combination pursuant to that certain Agreement and Plan of Merger, dated as of September 30, 2022 (as amended from time to time, the “Merger Agreement”), by and among TradeUP Acquisition Corp., a Delaware corporation (“UPTD”), Tradeup Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of UPTD (“Merger Sub”), and Estrella Biopharma, Inc., a Delaware corporation (“Estrella Operating”), pursuant to which Merger Sub merged with and into Estrella, with Estrella Operating surviving as a wholly-owned subsidiary of UPTD (collectively, the “Business Combination”). Effective from the Closing, UPTD changed its name to “Estrella Immunopharma, Inc.”

Prior to the Closing, we entered into that certain Common Stock Purchase Agreement with White Lion Capital, LLC (“White Lion”), dated as of April 20, 2023, as amended by the Amendment to the Common Stock Purchase Agreement, dated April 26, 2023 (the “Common Stock Purchase Agreement”), pursuant to which White Lion has committed to purchase from us, at our discretion, up to the lesser of (i) $50.0 million in aggregate gross purchase price of newly issued shares of Common Stock and (ii) the Exchange Cap (as defined herein), subject to the terms and conditions specified in the Common Stock Purchase Agreement (the “Equity Subscription Line”). In consideration for the commitments of White Lion, Estrella Operating issued to White Lion, immediately prior to the Closing, an aggregate of 250,000 shares of Series A Preferred Stock pursuant to the Series A Preferred Stock Purchase Agreement, pursuant to which Estrella Operating issued the 250,000 shares of Estrella Operating’s Series A Preferred Stock comprising the Commitment Fee immediately prior to Closing. Additionally, White Lion purchased 500,000 shares of Series A Preferred Stock for $500,000 in cash immediately prior to the Closing. The 750,000 shares of Series A Preferred Stock issued to White Lion automatically converted into 750,000 shares of Estrella Operating common stock and then into Common Stock based on the exchange ratio determined by the total number of shares of Estrella Operating common stock outstanding at the Closing.

On September 14, 2023, UPTD entered into certain Subscription Agreements, dated as of September 14, 2023, by and between UPTD, on the one hand, and certain investors (“Subscribers”) on the other hand (collectively, the “Subscription Agreements”), pursuant to which, among other things, concurrent with the Closing, UPTD issued and sold to the Subscribers an aggregate of 1,000,000 shares of Common Stock on the terms and subject to the conditions set forth therein. Within thirty days following the date of the Closing, each Investor will also be entitled to receive 704,819 Shares. Within five days following the date that is 24 months following the Closing (the “24-Month Date”), if the volume weighted average price (“VWAP”) of the Shares for the fifteen trading days prior to the 24-Month Date (the “24-Month Date VWAP”) is less than $8.30, then each Investor will be entitled to a number of shares equal to (i) (A) 8.30 minus (B) the 24-Month Date VWAP multiplied by (ii) (A) the number of Shares held by the Investor on the 24-Month Date minus (B) the number of Shares acquired by the Investor following the Closing divided by 10.00. We refer to this mechanism in this prospectus as the “24 Month Reset”.

In addition, immediately prior to the Closing, Estrella Operating consummated equity financing transactions with six unrelated third party investors for gross proceeds of $9.25 million and raised $0.3 million from issuing a 30-day unsecured promissory note at an interest rate of 12% per annum to an unrelated third party. On the Closing Date, Estrella also entered into a Lock-Up Agreement with Eureka Therapeutics, Inc., its controlling shareholder, with respect to all of the shares of Estrella Common Stock held by Eureka on the terms set forth in the Merger Agreement.

The descriptions of the agreements set forth above are not complete and are subject to and qualified in their entirety by reference to the full text of the applicable agreement, copies of which are filed as exhibits to the registration statement of which this prospectus forms a part and are incorporated herein by reference. For additional information regarding the transactions and agreements discussed above, see the sections entitled “Unaudited Pro Forma Condensed Combined Financial Information,” “Certain Relationships and Related Party Transactions,” “Description of Securities” and “Securities Eligible for Future Sale.”

ii

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC using a “shelf” registration process. By using a shelf registration statement, the Selling Stockholders may sell up to 3,829,338 shares of Estrella’s Common Stock (the “Resale Shares”) from time to time in one or more offerings as described in this prospectus. We may also, from time to time, offer and sell up to 7,036,726 shares of Common Stock that may be issued to White Lion pursuant to the Common Stock Purchase Agreement, which White Lion may, from time to time, sell in one or more offerings. We may also, from time to time, offer and sell up to 2,215,000 shares of common stock issuable upon exercise of the Warrants. We will not receive any proceeds from the sale of Resale Shares by the Selling Stockholders. We may receive proceeds from White Lion in connection with sales of our shares of Common Stock to White Lion that we may, in our discretion, elect to make, from time to time in accordance with the Common Stock Purchase Agreement after the date of this prospectus. We may receive up to an aggregate of approximately $25,472,500 from the exercise of the outstanding warrants, assuming the exercise in full of all such warrants at an exercise price of $11.50 per share. However, the $11.50 exercise price is significantly higher than the closing price of $1.29 per share of our Common Stock on November 10, 2023, and there can be no assurance that the holders of the warrants will elect to exercise any of the warrants.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment, as the case may be, may add, update or change information contained in this prospectus with respect to such offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any of the Resale Shares, you should carefully read this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, together with the additional information described under “Where You Can Find More Information.”

Neither we, nor the Selling Stockholders, have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, prepared by or on behalf of us or to which we have referred you. We and the Selling Stockholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the Selling Stockholders will not make an offer to sell Resale Shares in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, is accurate only as of the date on the respective cover. Our business, prospects, financial condition or results of operations may have changed since those dates. This prospectus contains, and any prospectus supplement or post-effective amendment may contain, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable. Accordingly, investors should not place undue reliance on this information.

MARKET, RANKING AND OTHER INDUSTRY DATA

Certain information contained in this document relates to or is based on studies, publications, surveys, and other data obtained from third-party sources and Estrella’s own internal estimates and research. While we believe these third-party sources to be reliable as of the date of this prospectus, we have not independently verified the market and industry data contained in this prospectus or the underlying assumptions relied on therein. Finally, while we believe our own internal research is reliable, such research has not been verified by any independent source. These estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus.

TRADEMARKS

This prospectus contains references to trademarks, trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

iii

Frequently used terms

Unless otherwise stated in this prospectus, the terms, the “Company,” “we,” “us,” or “our,” refer to Estrella Immunopharma, Inc., a Delaware corporation. Further, in this document:

• “Amended Charter” means Estrella’s Second Amended and Restated Certificate of Incorporation.

• “Board” means the board of directors of Estrella.

• “Business Combination” means the merger contemplated by the Merger Agreement.

• “Certificate of Incorporation” means Estrella’s Amended and Restated Certificate of Incorporation, as amended on September 29, 2023.

• “Closing” means the consummation of the Business Combination.

• “Closing Date” means September 29, 2023, the date of the consummation of the Business Combination.

• “Co-sponsors” means UPTD Sponsor and Tradeup, INC.

• “Code” means the Internal Revenue Code of 1986, as amended.

• “Closing Share Price” means $10.00 per share.

• “Common Stock” means the shares of common stock, par value $0.0001 per share of Estrella.

• “Effective Time” means the time at which the Business Combination became effective.

• “Estrella Operating” means Estrella Biopharma, Inc., a Delaware corporation and wholly-owned subsidiary of Estrella.

• “Estrella” means Estrella Immunopharma, Inc., a Delaware corporation.

• “Exchange Act” means the Securities Exchange Act of 1934, as amended.

• “Founder Shares” means the shares of Common Stock sold to the initial shareholders of UPTD for a price of $0.022 per share.

• “GAAP” means accounting principles generally accepted in the United States of America.

• “Incentive Award Plan” means the Estrella Immunopharma, Inc. 2023 Incentive Award Plan.

• “IPO” means the initial public offering of 4,000,000 Units of UPTD consummated on July 19, 2021, including the additional 430,000 Units sold to cover the over-allotment option on July 21, 2021.

• “IRS” means the United States Internal Revenue Service.

• “Meeting” means the special meeting of the stockholders of UPTD, held at 10:00 a.m., Eastern time, on July 31, 2023.

• “Merger Agreement” means that certain Merger Agreement, dated as of September 30, 2022, by and among UPTD, Merger Sub and Estrella Operating.

• “Merger Sub” means Tradeup Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of UPTD.

• “Minimum Cash Condition” means the aggregate cash available to UPTD at Closing from the Trust Account and the PIPE Investment (after giving effect to the redemption and the payment of all expenses) shall equal or exceed $20,000,000.

• “Public Stockholders” means holders of Public Common Stock.

• “Public Common Stock” means Common Stock sold in the IPO as part of the Units, whether they were purchased in the IPO or thereafter in the open market.

iv

• “Public Warrants” means warrants sold in the IPO as part of the Units, whether they were purchased in the IPO or thereafter in the open market.

• “Private Shares” means the aggregate 1,107,500 shares of common stock at a price of $10.00 per share, issued to the Tradeup INC. in a private placement simultaneously with the closing of the IPO.

• “Private Warrants” mean the 319,000 warrants issued to the Sponsor, in a private placement in connection with the consummation of the IPO.

• “Representatives” means US Tiger Securities, Inc., EF Hutton, division of Benchmark Investments, LLC (previously known as Kingswood Capital Markets, division of Benchmark Investments, Inc.) (“EF Hutton”) and R.F. Lafferty & Co., Inc., the representative of the underwriters in UPTD’s initial public offering.

• “SEC” means the U.S. Securities and Exchange Commission.

• “Securities Act” means the Securities Act of 1933, as amended.

• “Trust Account” means UPTD’s trust account maintained by VStock.

• “Units” means the units of UPTD, each consisting of one share of common stock, and one-half of one redeemable warrant.

• “UPTD Sponsor” means TradeUP Acquisition Sponsor LLC, an entity affiliated with certain of UPTD’s directors and officers.

• “UPTD Warrants” or “Warrants” means the Private Warrants and Public Warrants, which entitle the holder thereof to purchase one share of common stock at a price of $11.50 per share.

• “VStock” means VStock Transfer, LLC, UPTD’s transfer agent.

v

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements about the anticipated benefits of the Business Combination and the financial condition, results of operations, earnings outlook, and prospects of Estrella. Forward-looking statements appear in a number of places in this prospectus including, without limitation, in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

These risks and uncertainties include, but are not limited to, those factors described in “Risk Factors,” those discussed and identified in public filings made with the SEC by UPTD and the following:

• the projected financial information, anticipated growth rate, and market opportunities of Estrella;

• the ability to maintain the listing of the Common Stock on Nasdaq;

• Estrella’s public securities’ potential liquidity and trading;

• Estrella’s ability to raise financing in the future;

• Estrella’s success in retaining or recruiting, or changes required in, officers, key employees, or directors;

• potential effects of extensive government regulation;

• Estrella’s future financial performance and capital requirements;

• the impact of supply chain disruptions;

• high inflation rates and interest rate increases;

• the impact of the 2022 Russian invasion of Ukraine;

• the impact of pandemics, including on preclinical studies and potential future clinical trials; and

• factors relating to the business, operations, and financial performance of Estrella, including:

• Estrella’s ability to operate as a standalone company;

• the initiation, cost, timing, progress, and results of research and development activities, preclinical studies, or clinical trials with respect to Estrella’s current and potential future product candidates;

• Estrella’s ability to advance research on EB103 and its use in conjunction with CF33-CD19t;

• Estrella’s ability to identify, develop, and commercialize product candidates;

• Estrella’s ability to advance its current and potential future product candidates into, and successfully complete, preclinical studies and clinical trials;

• Estrella’s or Eureka’s ability to obtain and maintain regulatory approval of Estrella’s current and potential future product candidates, and any related restrictions, limitations, and/or warnings in the label of an approved product candidate;

• Estrella’s ability to obtain funding for its operations;

• Estrella’s and Eureka’s ability to obtain, maintain and enforce intellectual property protection for their technologies and product candidates;

vi

• Estrella’s ability to successfully commercialize its current and any potential future product candidates;

• the rate and degree of market acceptance of Estrella’s current and any potential future product candidates;

• regulatory developments in the United States and international jurisdictions;

• Estrella’s and Eureka’s ability to attract and retain key scientific and management personnel;

• Estrella’s ability to effectively manage the growth of its operations;

• Estrella’s ability to maintain its current licenses and contractual arrangements with Eureka;

• potential liability lawsuits and penalties related to Estrella’s licensed or acquired technologies, product candidates, and current and future relationships with third parties;

• Estrella’s ability to continue to contract with third-party suppliers and manufacturers and their ability to perform adequately under those arrangements; and

• Estrella’s ability to compete effectively with existing competitors and new market entrants.

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of Estrella prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

Except to the extent required by applicable law or regulation, Estrella undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

vii

PROSPECTUS SUMMARY

This summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our common stock, you should read the entire prospectus carefully, including “Risk Factors” beginning on page 7 and the financial statements and related notes included in this prospectus.

This prospectus includes trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included in this prospectus are the property of their respective owners.

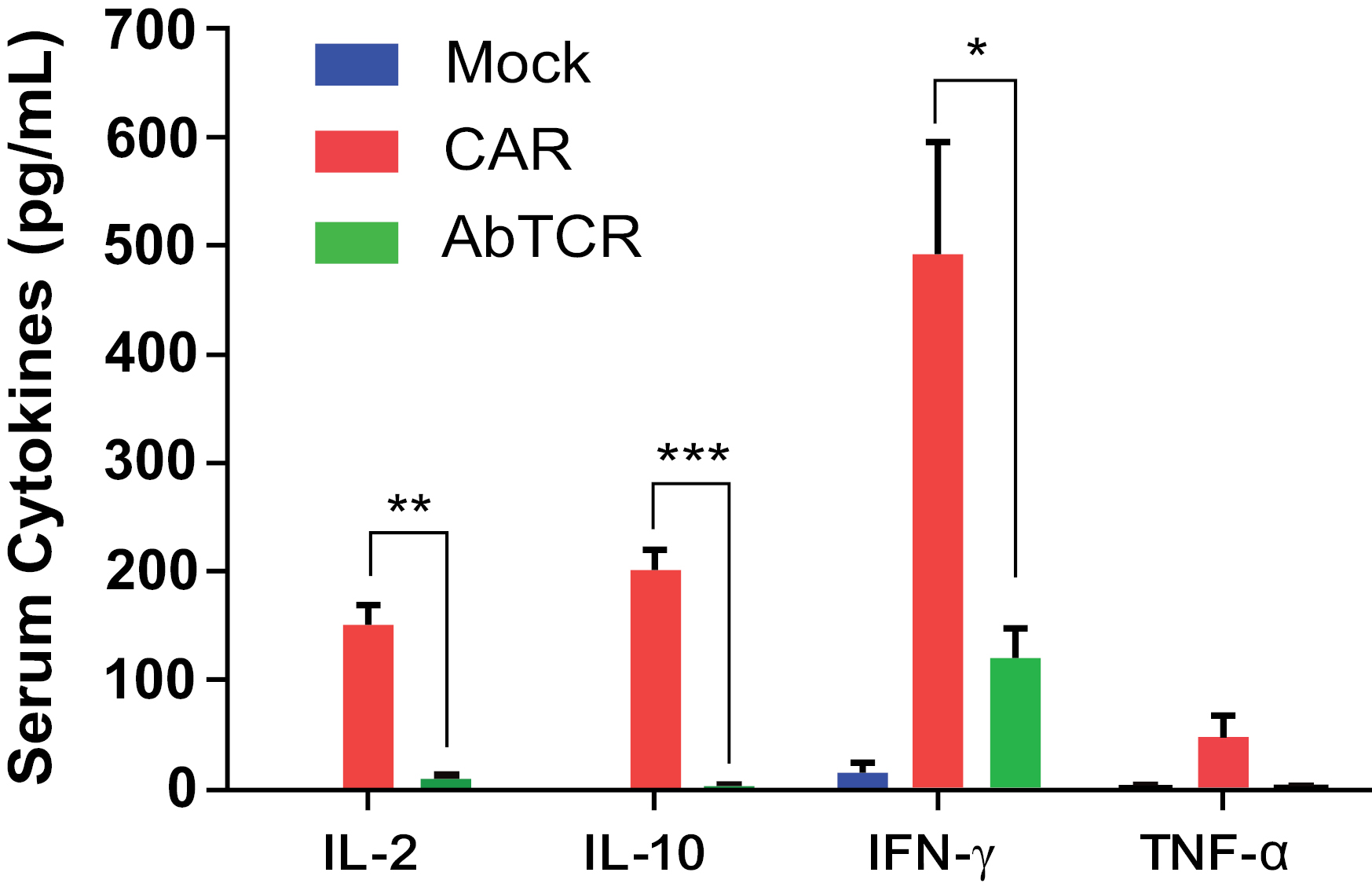

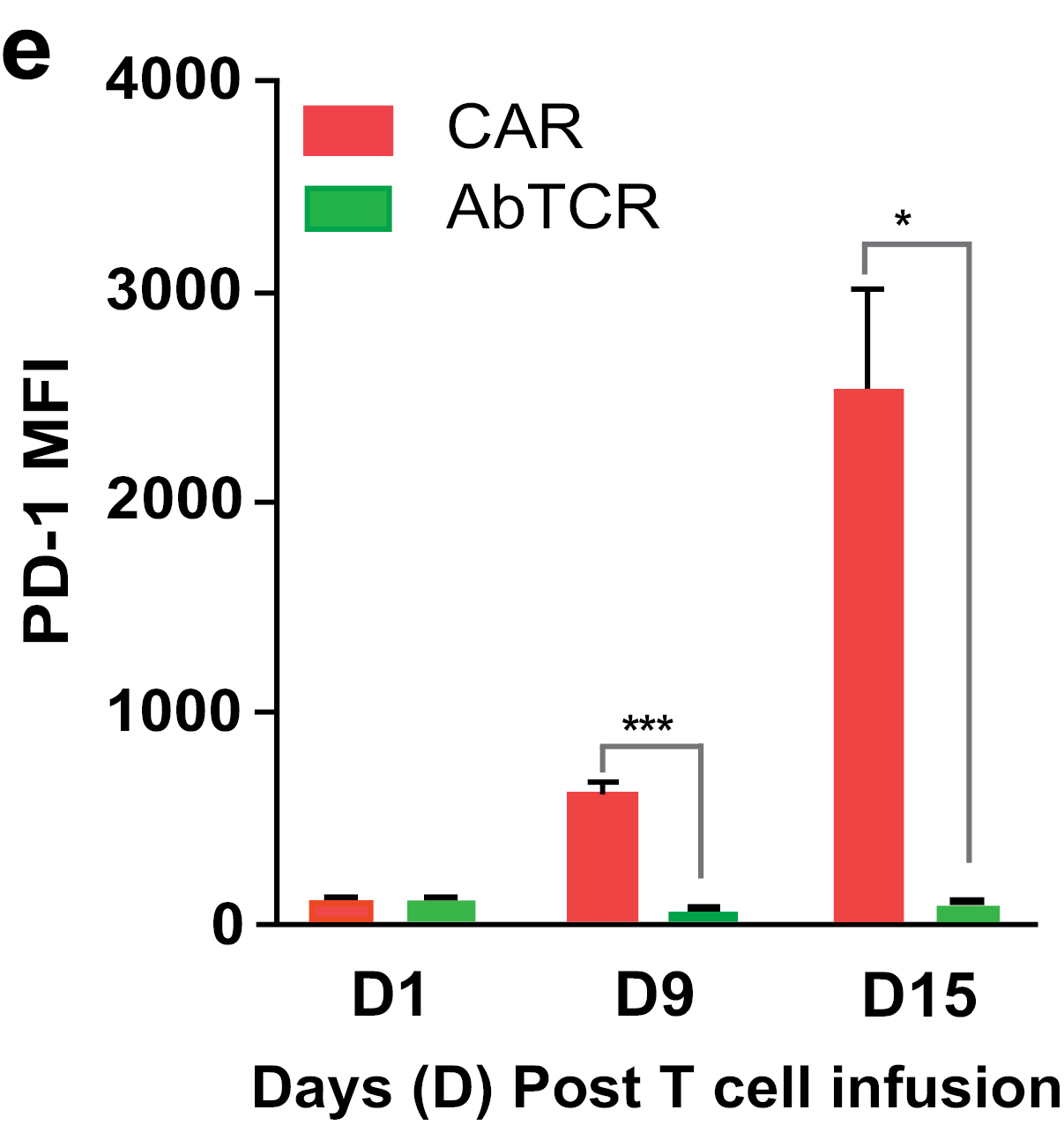

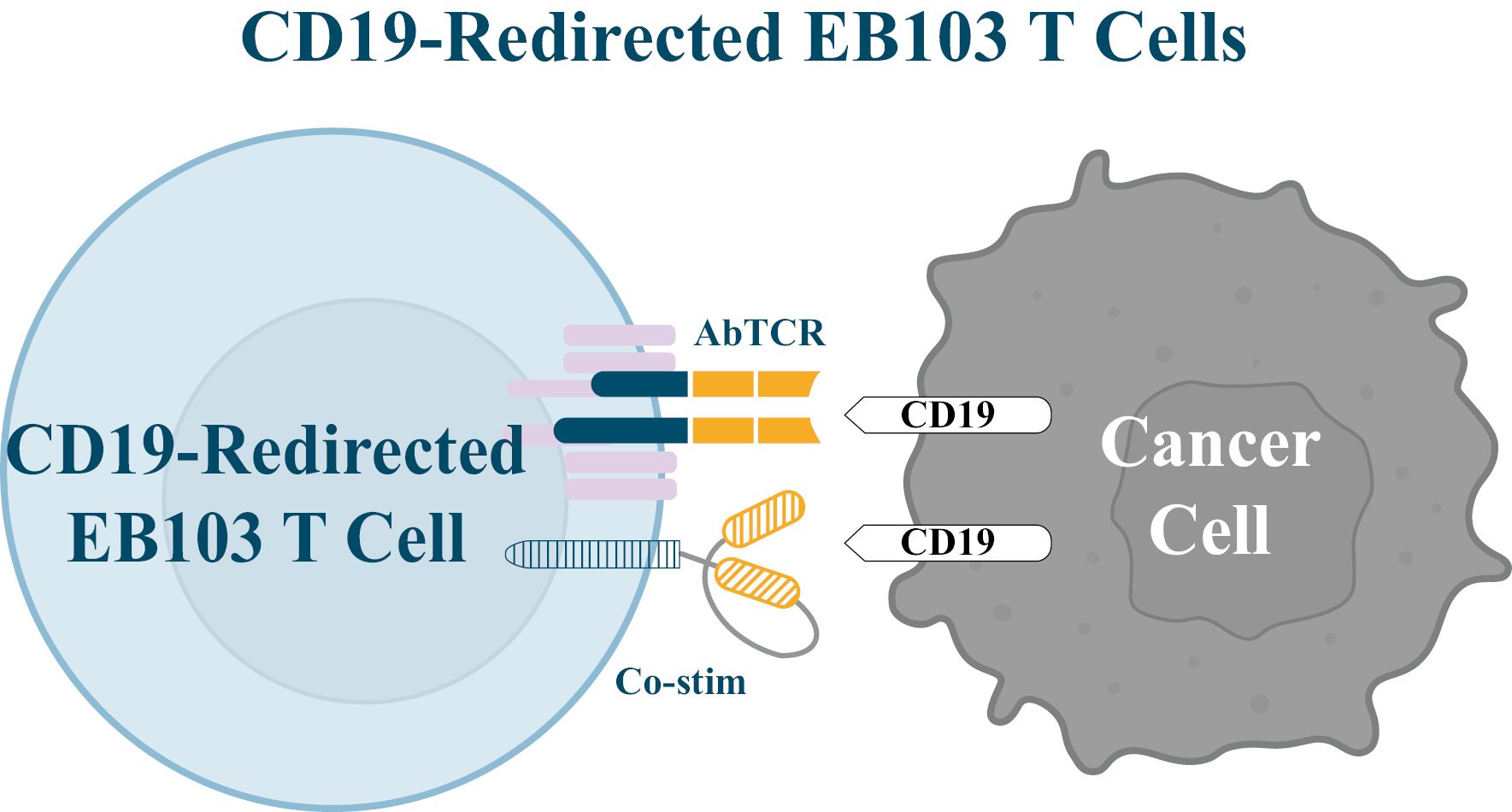

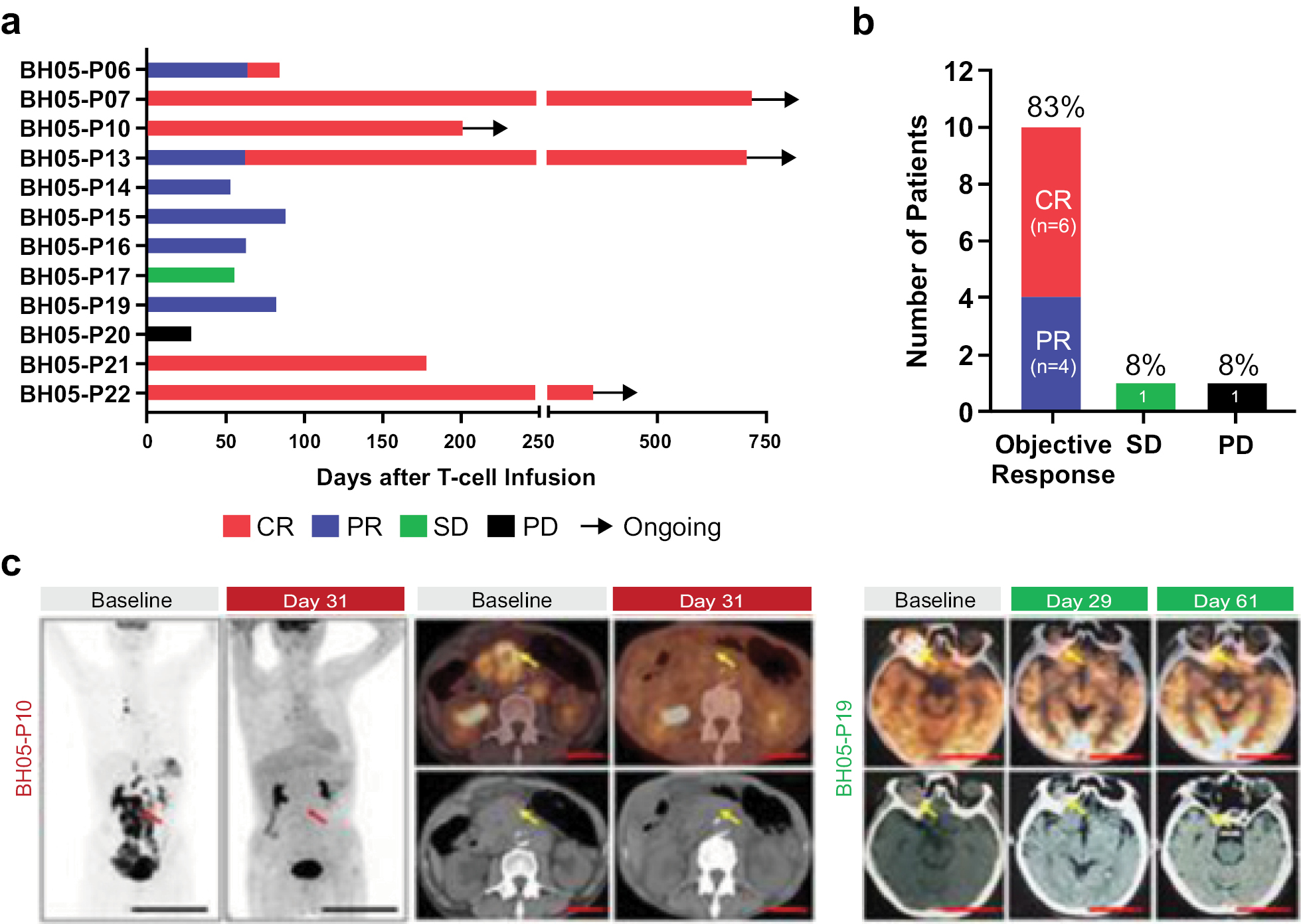

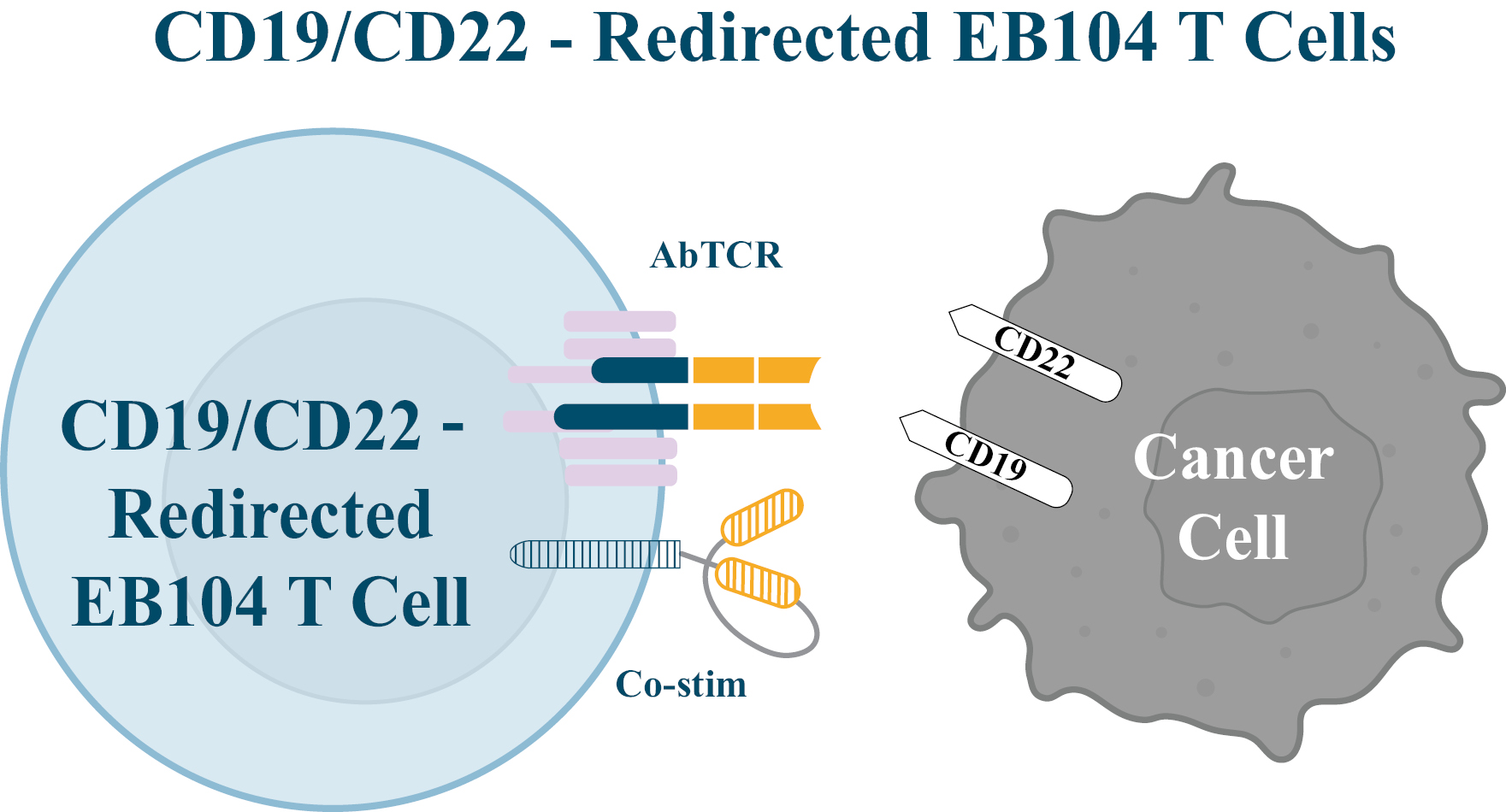

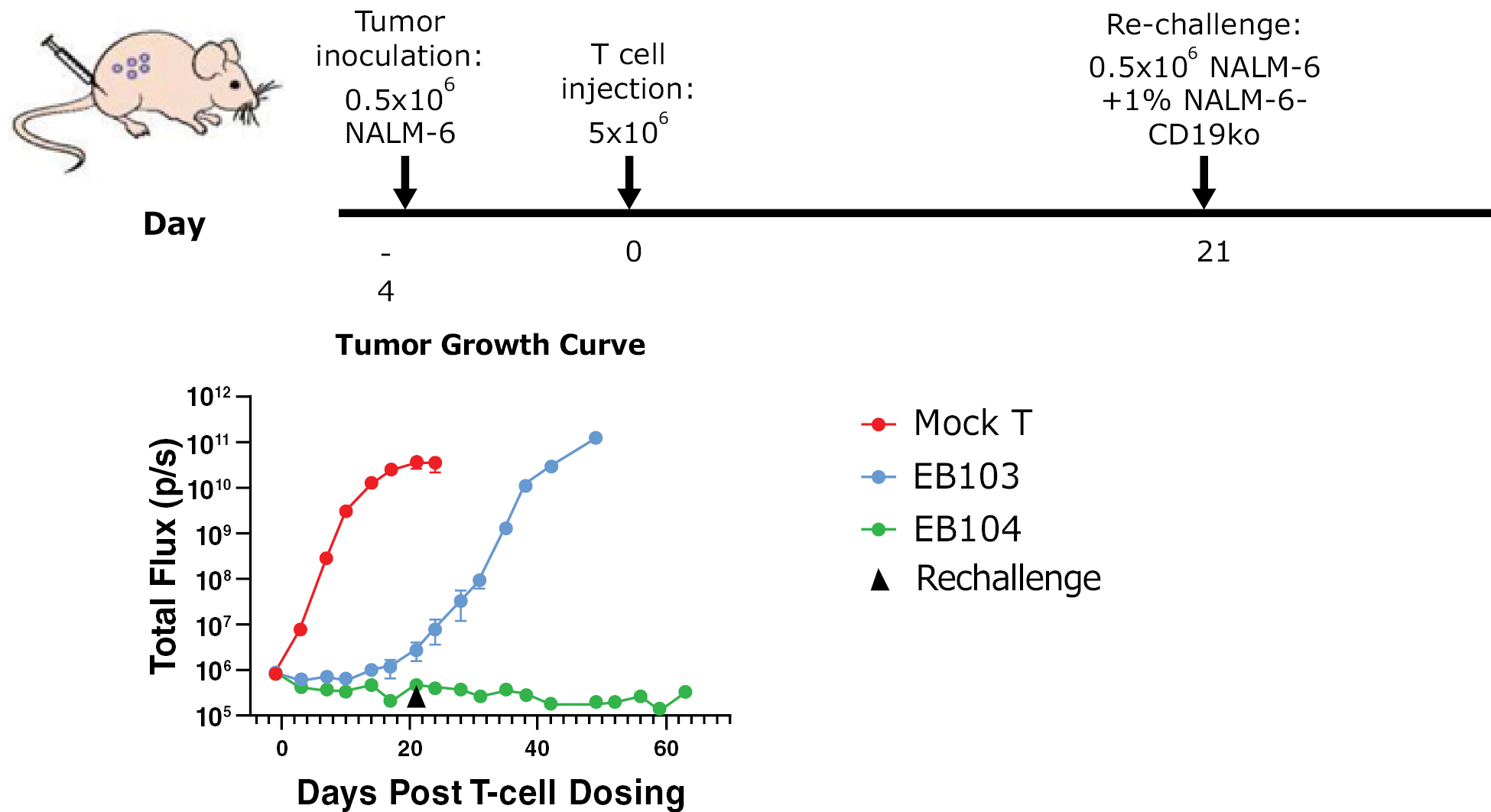

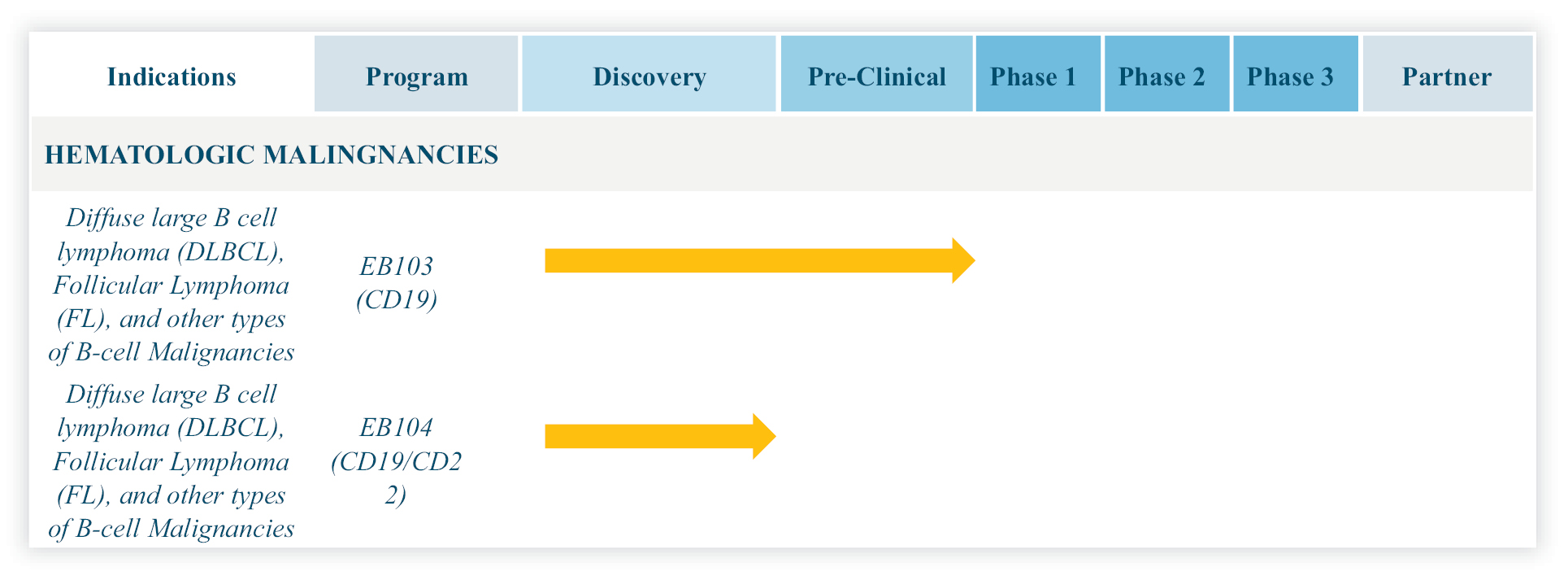

Estrella

Estrella, through its subsidiary, Estrella Operating (collectively referred to in this section as “Estrella”), is a preclinical-stage biopharmaceutical company developing T-cell therapies with the capacity to address treatment challenges for patients with blood cancers and solid tumors. Estrella Operating believes that T-cell therapy continues to represent a revolutionary step towards providing a potential solution for many forms of cancer, including cancers poorly addressed by current approaches. Estrella’s mission is to harness the evolutionary power of the human immune system to transform the lives of patients fighting cancer with safe, effective therapies. To accomplish this mission, Estrella’s lead product candidate, EB103, which is a T-cell therapy also called “CD19-Redirected ARTEMIS® T-Cell Therapy,” utilizes Eureka’s ARTEMIS® technology to target CD19, a protein expressed on the surface of almost all B-cell leukemias and lymphomas. Estrella Operating is also developing EB104, a T-cell therapy also called “CD19/22 Dual-Targeting ARTEMIS® T-Cell Therapy.” Like EB103, EB104 utilizes Eureka’s ARTEMIS® technology to target not only CD19, but also CD22, a protein that, like CD19, is expressed on the surface of most B-cell malignancies. Estrella Operating is also collaborating with Imugene Limited (“Imugene”) and its product candidate, CF33-CD19t an oncolytic virus (“CF33-CD19t”), to research the use of EB103 in conjunction with CF33-CD19t to treat solid tumors using a “mark and kill” strategy.

Estrella Operating was incorporated as a Delaware corporation on March 30, 2022. On June 28, 2022, pursuant to a Contribution Agreement between Estrella Operating and Eureka (the “Contribution Agreement”), Eureka contributed certain assets related to T-cell therapies targeting CD19 and/or CD22 to Estrella Operating in exchange for 105,000,000 shares of Estrella Operating Series A Preferred Stock of Estrella Operating (the “Separation”). Eureka determined that the Separation would allow for the flexibility to create a capital structure tailored to Estrella’s strategic goals, provide increased access to capital markets, allow for greater focus on strategic goals surrounding the product candidates contributed to Estrella, and result in a dedicated management team.

As part of the Separation, Estrella Operating entered into a License Agreement (the “License Agreement”) with Eureka and Eureka Therapeutics (Cayman) Ltd., an affiliate of Eureka, and a Services Agreement (the “Services Agreement”) with Eureka, and Eureka contributed and assigned the Collaboration Agreement between Eureka and Imugene (the “Collaboration Agreement”) to Estrella. The License Agreement grants Estrella Operating an exclusive license relating to targeted T-cell therapies, which Estrella Operating is developing using Eureka’s platform technology in the territories of the world excluding Greater China and the ASEAN Countries (the “Licensed Territory”). Under the Services Agreement, Eureka has agreed to perform certain services for Estrella Operating in connection with the development of Estrella’s product candidates. The Collaboration Agreement establishes the collaboration between Estrella Operating and Imugene related to the investigation of solid tumor treatments using Imugene’s product candidate, CF33-CD19t, in conjunction with EB103. These agreements are discussed in further detail in the section entitled “Business.”

Estrella Operating has a history of losses. Since its inception, Estrella Operating has devoted substantially all of its resources to preparing for the Business Combination, drafting regulatory filings (including INDs), planning preclinical studies, and building its management team, and it has incurred significant operating losses. Estrella Operating’s net losses were approximately $11.1 million and $1.7 million for the years ended June 30, 2023 and June 30, 2022, respectively. Estrella Operating had an accumulated deficit of approximately $12.2 million and $1.1 million as of June 30, 2023 and June 30, 2022, respectively.

The mailing address of Estrella’s principal executive office is 5858 Horton Street, Suite 370, Emeryville, CA 94608, and its telephone number is (510) 318-9098.

1

For additional information about Estrella, see the section entitled “Information about Estrella.”

Subscription Agreements

On September 14, 2023, UPTD entered into subscription agreements (the “Subscription Agreements”) with each of Plentiful Limited, a Samoan limited company (“Plentiful Limited”) and Lianhe World Limited (“Lianhe World,” together with Plentiful Limited, collectively, the “PIPE Investors”). Concurrently with the Closing, UPTD issued 500,000 shares of Common Stock to each of Plentiful Limited and Lianhe World, respectively.

Within thirty days following the date of the Closing, each PIPE Investor will also be entitled to receive 704,819 shares of Common Stock. In addition, within five days following the date that is 24 months following the Closing (the “24-Month Date”), if the VWAP of Common Stock for the fifteen trading days prior to the 24-Month Date (the “24-Month Date VWAP”) is less than $8.30, then each of them will be entitled to a number of shares of Common Stock equal to (i) (A) 8.30 minus (B) the 24-Month Date VWAP multiplied by (ii) (A) the number of Shares held by the Investor on the 24-Month Date minus (B) the number of shares acquired by the Investor following the Closing divided by 10.00.

The Equity Subscription Line

On April 20, 2023, UPTD entered into a common stock purchase agreement (as amended on April 26, 2023 and from time to time, the “Common Stock Purchase Agreement”) and a related registration rights agreement (the “White Lion RRA”) with White Lion Capital LLC (“White Lion”).

Pursuant to the Common Stock Purchase Agreement, following the Closing, Estrella has the right, but not the obligation to require White Lion to purchase, from time to time, up to the lesser of (i) $50,000,000 in aggregate gross purchase price of newly issued shares of Common Stock and (ii) the Exchange Cap (as defined below), in each case, subject to certain limitations and conditions set forth in the Common Stock Purchase Agreement.

Estrella’s right to sell shares to White Lion will commence on the effective date of the Registration Statement of which this prospectus forms a part (the “Commencement”) and extend until December 31, 2024. During such term, subject to the terms and conditions of the Common Stock Purchase Agreement, Estrella shall notify White Lion when Estrella exercises its right, in its sole discretion, to sell shares (the effective date of such notice, a “Notice Date”).

The purchase price to be paid by White Lion for any Equity Line Shares will equal (i) until an aggregate of $25,000,000 in shares have been purchased under the Common Stock Purchase Agreement, 97% of the lowest daily volume-weighted average price of Common Stock during the three consecutive trading days following the Notice Date, and (ii) thereafter, 98% of the lowest daily volume-weighted average price of Common Stock during the three consecutive trading days following the Notice Date.

The Common Stock Purchase Agreement will terminate automatically on the earliest of (i) December 30, 2024; (ii) the date when White Lion buys all the Equity Line Shares it agreed to buy under the Common Stock Purchase Agreement; or (iii) the date when Estrella files for bankruptcy, has a bankruptcy case filed against it, has a custodian appointed for it or its property, or assigns its assets to its creditors.

In consideration for the commitments of White Lion, Estrella issued to White Lion, immediately prior to the Closing, an aggregate of 250,000 shares of Series A Preferred Stock, which the parties have acknowledged has a value of $250,000 (the “Commitment Fee”) pursuant to the Series A Preferred Stock Purchase Agreement (the “White Lion Joinder” or “Joinder”), pursuant to which Estrella issued the 250,000 shares of Series A Preferred Stock comprising the Commitment Fee immediately prior to Closing. Additionally, pursuant to the Joinder, White Lion purchased 500,000 shares of Series A Preferred Stock for $500,000 in cash immediately prior to the Closing. The 750,000 shares of Series A Preferred Stock issued to White Lion automatically converted into 750,000 shares of Common Stock immediately prior to the Effective Time and then into Merger Consideration Shares based on the exchange ratio determined by the total number of shares of Estrella Common Stock outstanding at the Effective Time in accordance with the Merger Agreement.

Concurrently with the Common Stock Purchase Agreement, UPTD entered into the White Lion RRA with White Lion in which, within 30 days following the Closing, Estrella agreed to file the Registration Statement of which this prospectus forms a part with the SEC covering the resale by White Lion of the maximum number of Equity Line Shares permitted to be included thereon in accordance with applicable SEC rules, regulations and interpretations.

2

For more detailed information regarding the Common Stock Purchase Agreement, see the section entitled “Equity Subscription Line.”

Lock-up Agreement and Arrangements. In connection with the Closing, we have entered into a lock-up agreement (the “Eureka Lock-up Agreement) with Eureka Therapeutics, Inc., our controlling shareholder, pursuant to which Eureka has agreed, subject to certain customary exceptions, not to:

(i) offer, sell, contract to sell, pledge or otherwise dispose of, directly or indirectly, any shares of our Common Stock received as merger consideration and held by it immediately after the Effective Time (the “Lock-Up Shares”), or enter into a transaction that would have the same effect;

(ii) enter into transaction that would have the same effect, or enter into any swap, hedge or other arrangement that transfers, in whole or in part, any of the economic consequences of ownership of any of such shares, whether any of these transactions are to be settled by delivery of such shares, in cash or otherwise; or

(iii) publicly disclose the intention to make any offer, sale, pledge or disposition, or to enter into any transaction, swap, hedge or other arrangement, or engage in any “Short Sales” (as defined in Eureka Lock-up Agreement) with respect to any security of UPTD;

during a “Lock-Up Period” under the Eureka Lock-Up Agreement.

Under Eureka’s Lock-up Agreement, the Lock-Up period means the date that falls six months after the Closing Date; provided, that, 50% of the Lock-Up Shares shall be automatically released on the date on which the closing price of the Estrella Common Stock equals or exceeds $12.50 per share for any 20 trading days within any 30-trading day period, commencing after the Closing Date; provided that the restrictions set forth in Eureka’s Lock-up Agreement do not apply to (1) transfers or distributions to such stockholders current or former general or limited partners, managers or members, stockholders, other equity holders or other direct or indirect affiliates (within the meaning of Rule 405 under the Securities Act of 1933, as amended) or to the estates of any of the foregoing; (2) transfers by bona fide gift to a member of the stockholder’s immediate family or to a trust, the beneficiary of which is the stockholder or a member of the stockholder’s immediate family for estate planning purposes; (3) by virtue of the laws of descent and distribution upon death of the stockholder; (4) pursuant to a qualified domestic relations order, in each case where such transferee agrees to be bound by the terms of this Agreement; (5) transfers or distributions of, or other transactions involving, securities other than the Lock-up Shares (including, without limitation, securities acquired in the PIPE or in open market transactions).

3

THE REGISTERED SHARES

|

Issuer |

Estrella Immunopharma, Inc., a Delaware corporation |

|

|

Nasdaq Symbol for our Common Stock |

ESLA |

|

|

Nasdaq Symbol for our Warrants |

ESLAW |

|

|

Common Stock to be issued upon exercise of all Warrants |

|

|

|

Exercise Price of Warrants |

$11.50 per share of Common Stock, subject to adjustment as described herein. |

|

|

Shares of Common Stock that may be offered and sold from time to time by the Selling Stockholders named |

|

|

|

Use of proceeds |

All of the shares of Common Stock offered by the Selling Stockholders pursuant to this prospectus will be sold by the Selling Stockholders for their respective accounts. We will not receive any of the proceeds from these sales. We will receive up to an aggregate of approximately $25,472,500 from the exercise of all Warrants, assuming the exercise in, if any, full of all of the Warrants for cash. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes. Because the exercise price of the Warrants substantially exceeds the current trading price of our Common Stock, we are unlikely to receive any proceeds from the exercise of our Warrants in the near future, if at all. See the section titled “Use of Proceeds” appearing elsewhere in this prospectus for more information. |

|

|

Risk Factors |

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 7 and the other information in this prospectus for a discussion of the factors you should consider carefully before you decide to invest in our common stock. |

Summary Risk Factors

Risks Related to the Business, Operations and Financial Performance of Estrella

• We are a preclinical stage biotechnology company and expect to incur significant losses for the foreseeable future and may never achieve or maintain profitability.

Our ability to continue as a going concern requires that we obtain sufficient funding to finance our operations.

• Our current or potential future product candidates may not demonstrate the safety, purity, or efficacy necessary to become approvable or commercially viable.

• Although we intend to explore other therapeutic opportunities in addition to the product candidates we are currently pursuing, we may fail to identify viable new product candidates for clinical development, which could materially harm our business.

• Clinical development includes a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results.

4

• We rely on third parties to conduct our preclinical studies, and plan to rely on third parties to conduct clinical trials, and those third parties may not perform satisfactorily. If third parties on which we intend to rely to conduct certain preclinical and clinical studies do not perform as contractually required, fail to satisfy regulatory or legal requirements or miss expected deadlines, our development program could be delayed or unsuccessful, and we may not be able to obtain regulatory approval for or commercialize our product candidates when expected, or at all.

• We may not be able to maintain our existing strategic partnerships and collaboration arrangements or enter into new strategic partnerships and collaborations for the development, manufacturing, and commercialization of product candidates on terms that are acceptable to us, or at all.

• The manufacturing of our product candidates is complex. If Eureka, or other third parties, encounter difficulties in production, our ability to supply our product candidates for clinical trials or, if approved, for commercial sale, could be delayed or halted entirely.

• We face competition from companies that have developed or may develop product candidates for the treatment of the diseases that we may target, including companies developing novel therapies and platform technologies. If these companies develop platform technologies or product candidates more rapidly than we do, or if their platform technologies or product candidates are more effective or have fewer side effects, our ability to develop and successfully commercialize product candidates may be adversely affected.

• Our future success depends on our ability and Eureka’s ability to retain key employees, directors, and advisors and to attract, retain, and motivate qualified personnel.

• Our business, operations, and clinical development plans and timelines could be adversely affected by the ongoing COVID-19 pandemic, including business interruptions, staffing shortages and supply chain issues arising from the pandemic on the manufacturing, clinical trial, and other business activities performed by us or by third parties with whom we may conduct business, including our anticipated contract manufacturers, contract research organizations (“CROs”), suppliers, shippers, and others.

• The anticipated benefits of the Separation may not be achieved.

• If we are unable to obtain or protect intellectual property rights related to our in-licensed technology, future technologies, and current or future product candidates, or if our intellectual property rights are inadequate, our competitors could develop and commercialize products and technology similar or identical to ours, and we may not be able to compete effectively in our market or successfully commercialize any product candidates we may develop.

• We may be unable to obtain U.S. or foreign regulatory approval and, as a result, be unable to commercialize our current or potential future product candidates.

• Even if we are able to commercialize any product candidate, such product candidate may become subject to unfavorable pricing regulations or third-party coverage and reimbursement policies, which would harm our business.

• We or the third parties we depend on may be adversely affected by natural disasters, including earthquake, flood, fire, explosion, extreme weather conditions, or epidemics.

• If any negative data were to arise with respect to the use of our licensed technology in territories where such technology is licensed to a third party, it could negatively affect our ability to develop our product candidates in territories where we license such technology.

5

SELECTED SUMMARY HISTORICAL FINANCIAL INFORMATION OF ESTRELLA OPERATING

The following tables summarize Estrella Operating’s historical financial information for the periods and as of the dates indicated. The summary of statements of operations for the year ended June 30, 2023, for the period from March 30, 2022 (inception) through June 30, 2022, and for the period from July 1, 2021 through March 29, 2022 (predecessor) and the summary balance sheets as of June 30, 203 and 2022 are derived from Estrella’s financial statements, which have been prepared in accordance with U.S. GAAP and audited in accordance with the standards of the Public Company Accounting Oversight Board (United States), and included elsewhere in this prospectus. The financial statements include all adjustments, consisting only of normal and recurring adjustments, that we consider necessary for a fair representation of Estrella’s financial position and operating results for the periods presented. Estrella’s financial statements are prepared and presented in accordance with U.S. GAAP. Estrella’s historical results are not necessarily indicative of the results that may be expected in the future. The following summary financial information should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Estrella Operating and Estrella Operating’s financial statements included elsewhere in this prospectus.

|

Statements of operations |

For the |

For the |

For the |

|||||||||

|

Total operating expenses |

$ |

11,114,402 |

|

$ |

1,074,151 |

|

$ |

611,196 |

|

|||

|

Loss from Operations |

|

(11,114,402 |

) |

|

(1,074,151 |

) |

|

(611,196 |

) |

|||

|

Net loss |

$ |

(11,114,402 |

) |

$ |

(1,074,151 |

) |

$ |

(611,196 |

) |

|||

|

Net loss applicable to common stock per share, basic and diluted |

$ |

(8.75 |

) |

$ |

(160.15 |

) |

$ |

(611.20 |

) |

|||

|

Weighted average common shares outstanding, basic and diluted |

|

1,270,041 |

|

|

6,707 |

|

|

1,000 |

|

|||

|

Balance sheets |

June 30, |

June 30, |

||||||

|

Current assets |

$ |

2,752,212 |

|

$ |

4,921,666 |

|

||

|

Total assets |

$ |

3,028,399 |

|

$ |

4,921,666 |

|

||

|

Current liabilities |

$ |

9,758,224 |

|

$ |

946,684 |

|

||

|

Total liabilities |

$ |

9,770,949 |

|

$ |

961,509 |

|

||

|

Preferred stock |

$ |

5,000,000 |

|

$ |

5,000,000 |

|

||

|

Total Stockholders’ deficit |

$ |

(11,742,550 |

) |

$ |

(1,039,843 |

) |

||

6

RISK FACTORS

You should carefully review and consider the following risk factors and the other information contained in this prospectus, including the consolidated financial statements and the accompanying notes and matters addressed in the section titled “Cautionary Note Regarding Forward-Looking Statements,” in evaluating an investment in Estrella Common Stock. The following risk factors apply to the business and operations of Estrella Operating and Estrella. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may adversely affect the ability to realize the anticipated benefits of the Business Combination and may have an adverse effect on the business, cash flows, financial condition and results of operations of Estrella. We may face additional risks and uncertainties that are not presently known to us or that we currently deem immaterial, which may also impair our business, cash flows, financial condition and results of operations.

Risks Related to the Equity Subscription Line

It is not possible to predict the actual number of shares of Common Stock, if any, we will sell under the Common Stock Purchase Agreement to White Lion or the actual gross proceeds resulting from those sales.

On April 14, 2023, we entered into the Common Stock Purchase Agreement, pursuant to which White Lion has committed to purchase up to the lesser of (i) $50,000,000 in aggregate gross purchase price of newly issued shares of Common Stock and (ii) the Exchange Cap, in each case, subject to certain limitations and conditions set forth in the Common Stock Purchase Agreement.

Subject to the satisfaction of certain customary conditions including, the Estrella’s right to sell shares to White Lion commenced on July 11, 2023 and extend until December 31, 2024. During such term, subject to the terms and conditions of the Common Stock Purchase Agreement, the Estrella shall notify White Lion when the Estrella exercises its right, in its sole discretion, to sell shares.

We generally have the right to control the timing and amount of any sales of our shares of Common Stock to White Lion under the Common Stock Purchase Agreement. Sales of our shares of Common Stock, if any, to White Lion under the Common Stock Purchase Agreement will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to White Lion all, some or none of the shares of Common Stock that may be available for us to sell to White Lion pursuant to the Common Stock Purchase Agreement.

Because the purchase price per share of Common Stock to be paid by White Lion for the shares of Common Stock that we may elect to sell to White Lion under the Common Stock Purchase Agreement, if any, will fluctuate based on the market prices of our Common Stock at the time we elect to sell shares of Common Stock to White Lion pursuant to the Common Stock Purchase Agreement, if any, it is not possible for us to predict, as of the date of this prospectus and prior to any such sales, the number of shares of Common Stock that we will sell to White Lion under the Common Stock Purchase Agreement, the purchase price per share that White Lion will pay for shares of Common Stock purchased from us under the Common Stock Purchase Agreement, or the aggregate gross proceeds that we will receive from those purchases by White Lion under the Common Stock Purchase Agreement.

The number of shares of Common Stock ultimately offered for sale by White Lion is dependent upon the number of shares of Common Stock, if any, we ultimately elect to sell to White Lion under the Common Stock Purchase Agreement. However, even if we elect to sell shares of Common Stock to White Lion pursuant to the Common Stock Purchase Agreement, White Lion may resell all, some or none of such shares at any time or from time to time in its sole discretion and at different prices.

Because the market price of our shares of Common Stock may fluctuate from time to time after the date of this prospectus and, as a result, the actual purchase price to be paid by White Lion for our shares of Common Stock that we elect to sell to White Lion under the Common Stock Purchase Agreement, if any, also may fluctuate because they will be based on such fluctuating market price of our shares of Common Stock, it is possible that we would need to issue and sell more than the number of shares of Common Stock being registered for resale by White Lion under this registration statement in order to receive aggregate gross proceeds of $50.0 million under the Common Stock Purchase Agreement.

7

Accordingly, if it becomes necessary for us to issue and sell to White Lion under the Common Stock Purchase Agreement more than the 7,036,726 shares of Common Stock being registered for resale under the registration statement of which this prospectus forms a part in order to receive aggregate gross proceeds equal to $50.0 million under the Common Stock Purchase Agreement, in addition to obtaining stockholder approval to exceed the Exchange Cap in accordance with Nasdaq listing rules, we must file with the SEC one or more additional registration statements to register under the Securities Act the resale by White Lion of any such additional shares of Common Stock we wish to sell from time to time under the Common Stock Purchase Agreement, which the SEC must declare effective, in each case before we may elect to sell any additional shares of Common Stock to White Lion under the Common Stock Purchase Agreement. Any issuance and sale by us under the Common Stock Purchase Agreement of a substantial amount of shares of Common Stock in addition to the 7,036,726 shares of Common Stock being registered for resale by White Lion under this prospectus could cause additional substantial dilution to our stockholders.

The sale and issuance of shares of Common Stock to White Lion will cause dilution to our existing securityholders, and the resale of the shares of Common Stock by White Lion, or the perception that such resales may occur, could cause the price of our securities to fall.

The purchase price per share of Common Stock to be paid by White Lion for the shares of Common Stock that we may elect to sell to White Lion under the Common Stock Purchase Agreement, if any, will fluctuate based on the market prices of our shares of Common Stock at the time we elect to sell shares of Common Stock to White Lion pursuant to the Common Stock Purchase Agreement. Depending on market liquidity at the time, resales of such shares of Common Stock by White Lion may cause the trading price of our shares of Common Stock to fall.

If and when we elect to sell shares of Common Stock to White Lion, sales of newly issued shares of Common Stock by us to White Lion could result in substantial dilution to the interests of existing holders of our shares of Common Stock. If all of the 7,036,726 shares of Common Stock offered for resale by White Lion under this prospectus (without regard to the $50.0 million aggregate purchase price limit pursuant to the Common Stock Purchase Agreement) were issued and outstanding as of the Closing, such shares of Common Stock would represent approximately 19.99% of the total number of our shares of Common Stock outstanding as of the Closing Date. Additionally, the sale of a substantial number of shares of Common Stock to White Lion, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales.

Investors who buy shares of Common Stock from White Lion at different times will likely pay different prices.

Pursuant to the Common Stock Purchase Agreement, we will have discretion to vary the timing, price and number of shares sold to White Lion, if any. If and when we elect to sell shares of Common Stock to White Lion pursuant to the Common Stock Purchase Agreement, after White Lion has acquired such shares of Common Stock, White Lion may resell all, some or none of such shares at any time or from time to time in its sole discretion and at different prices. As a result, investors who purchase shares from White Lion in this offering at different times will likely pay different prices for those shares, and so may experience different levels of dilution and in some cases substantial dilution and different outcomes in their investment results. Investors may experience a decline in the value of the shares they purchase from White Lion in this offering as a result of future sales made by us to White Lion at prices lower than the prices such investors paid for their shares in this offering. In addition, if we sell a substantial number of shares to White Lion under the Common Stock Purchase Agreement, or if investors expect that we will do so, the actual sales of shares or the mere existence of our arrangement with White Lion may make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect such sales.

Sales of a substantial number of our securities in the public market by the Selling Stockholders or by our other existing securityholders could cause the price of our Common Stock and Warrants to fall.

The shares being registered for resale by this prospectus represent approximately 37.2% of our total outstanding shares as of the Closing Date. The sale or availability for sale of these shares could adversely affect the prevailing market price of our Common Stock and could impair our ability to raise capital through future sales of our securities. In addition, the PIPE investors who acquired the shares being registered pursuant to the Subscription Agreements purchased their shares at a price of $4.15 per share, and the initial shareholders who acquired the Founder Shares purchased their shares at a price of $0.022 per share, which is significantly lower than the initial public offering price of $10.00 per share of TradeUP Acquisition Corp., our predecessor entity. Therefore, these investors may have an

8

incentive to sell their shares before the public investors who purchased shares in the initial public offering, because they could still realize a profit even if the market price of our Common Stock is below the initial public offering price. This could create additional downward pressure on the market price of our Common Stock and could cause our stock price to decline.

Risks Related to Estrella’s Operating History and Financial Condition

We are a preclinical stage biotechnology company with a history of losses. We expect to continue to incur significant losses for the foreseeable future and may never achieve or maintain profitability.

We are a preclinical-stage biotechnology company with a history of losses. Since our inception, we have devoted substantially all of our resources to preparing for the Business Combination, drafting regulatory filings (including the INDs), planning preclinical studies, and building our management team, and we have incurred significant operating losses. Our net losses were approximately $11.1 million and $1.7 million for the years ended June 30, 2023 and 2022, respectively. As of June 30, 2023, and June 30, 2022, we had an accumulated deficit of approximately $12.2 million and $1.1 million, respectively. Substantially all of our losses have resulted from expenses incurred in connection with preparing for the Business Combination, regulatory filings, and from general and administrative costs associated with our operations. To date, we have not generated any revenue from product sales, and we have not sought or obtained regulatory approval for any product candidate. Furthermore, we do not expect to generate any revenue from product sales for the foreseeable future, and we expect to continue to incur significant operating losses for the foreseeable future due to the cost of research and development, preclinical studies, clinical trials, and the regulatory approval process for our current and potential future product candidates.

We expect our net losses to increase substantially as we:

• commence clinical trials of EB103;

• continue preclinical development of EB104;

• acquire and license technologies, if any are discovered, that are aligned with our product candidates;

• seek regulatory approval of current EB103 and EB104;

• incur expenses related to the discovery and development of any potential future product candidates;

• expand our operational, financial, and management systems and increase personnel, including personnel to support our preclinical and clinical development and commercialization efforts;

• continue to develop, perfect, and defend our intellectual property portfolio; and

• incur additional legal, accounting, or other expenses in operating our business, including the additional costs associated with operating as a public company.

However, the amount of our future losses is uncertain. Our ability to achieve or sustain profitability, if ever, will depend on, among other things, successfully developing product candidates, obtaining regulatory approvals to market and commercialize product candidates, manufacturing any approved products on commercially reasonable terms, entering into potential future alliances, establishing a sales and marketing organization or suitable third-party alternatives for any approved product, and raising sufficient funds to finance business activities. If we, or our potential future collaborators, are unable to commercialize one or more of our product candidates, or if sales revenue from any product candidate that receives approval is insufficient, we will not achieve or sustain profitability, which could have a material adverse effect on our business, financial condition, results of operations, and prospects.

We will need substantial additional funds to advance development of product candidates, and we cannot guarantee that we will have sufficient funds available in the future to develop and commercialize our current or potential future product candidates and technologies.

The development of biotechnology product candidates is capital-intensive. If any of our current or potential future product candidates enter and advance through preclinical studies and clinical trials, we will need substantial additional funds to expand our development, regulatory, manufacturing, marketing, and sales capabilities. We will require significant funds to continue to develop our product candidates and conduct further research and development, including preclinical studies and clinical trials. In addition, we expect to incur significant additional costs associated with operating as a public company.

9

As of June 30, 2023 and June 30, 2022, we had approximately $2.5 million and $4.1 million, respectively, in cash and cash equivalents. At the Closing, we received gross proceeds of approximately $23.11 million. Our future capital requirements and the period for which our existing resources will support our operations may vary significantly from what we expect. Because the length of time and activities associated with successful research and development of platform technologies and product candidates is highly uncertain, we are unable to estimate the actual funds we will require for development and any approved marketing and commercialization activities. The timing and amount of our operating expenditures will depend largely on:

• the timing and progress of preclinical and clinical development of our current and potential future product candidates;

• the timing and progress of our research of the use of EB103 in conjunction with CF33-CD19t;

• the number and scope of preclinical and clinical programs we decide to pursue;

• the terms of any third-party manufacturing contract or biomanufacturing partnership we may enter into;

• our ability to maintain our current licenses and collaborations, conduct our research and development programs and establish new strategic partnerships and collaborations;

• the progress of the development efforts of our existing strategic partners and third parties with whom we may in the future enter into collaboration and research and development agreements;

• the costs involved in obtaining, maintaining, enforcing, and defending patents and other intellectual property rights;

• the impact of the COVID-19 pandemic on our business;

• the cost and timing of regulatory approvals; and

• our efforts to enhance operational systems and hire additional personnel, including personnel to support development of our product candidates and satisfy our obligations as a public company.

To date, we have primarily financed our operations through the sale of equity securities. We may seek to raise any necessary additional capital through a combination of public or private equity offerings, debt financings, collaborations, strategic alliances, licensing arrangements, grants, and other marketing and distribution arrangements. We cannot assure you that we will be successful in acquiring additional funding at levels sufficient to fund our operations or on terms favorable to us. If we are unable to obtain adequate financing when needed, we may have to delay, reduce the scope of or suspend one or more of our preclinical studies, clinical trials, research and development programs or commercialization efforts. Because of the numerous risks and uncertainties associated with the development and commercialization of our current and potential future product candidates and the extent to which we may enter into collaborations with third parties to participate in their development and commercialization, we are unable to estimate the amounts of increased capital outlays and operating expenditures associated with our current and anticipated preclinical studies and clinical trials, including related manufacturing costs. To the extent that we raise additional capital through collaborations, strategic alliances, or licensing arrangements with third parties, we may have to relinquish valuable rights to our current and potential future product candidates, future revenue streams or research programs or grant licenses on terms that may not be favorable to us. If we do raise additional capital through public or private equity or convertible debt offerings, the ownership interest of our existing stockholders will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect our stockholders’ rights. If we raise additional capital through debt financing, we may be subject to covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures, or declaring dividends.

We do not expect to realize revenue from product sales or royalties from licensed products for the foreseeable future, if at all, and unless and until our current and potential future product candidates are clinically tested, approved for commercialization, and successfully marketed.

Members of our management team have limited experience in managing the day-to-day operations of a public company and, as a result, we may incur additional expenses associated with the management of our company.

Members of our management team have limited experience in managing the day-to-day operations of a public company. As a result, we may need to obtain outside assistance from legal, accounting, investor relations, or other professionals that could be more costly than planned. We may also hire additional personnel to comply with additional

10

SEC reporting requirements. These compliance costs will make some activities significantly more time-consuming and costly. If we lack cash resources to cover these costs in the future, our failure to comply with reporting requirements and other provisions of securities laws could negatively affect our stock price and adversely affect our potential results of operations, cash flow and financial condition.

Our financial statements expressing substantial doubt about our ability to continue as a going concern due to our history of recurring losses and our expectation that negative cash flows from operations will continue until we can generate sufficient revenue. Our ability to continue as a going concern requires that we obtain sufficient funding to finance our operations.

We have incurred significant operating losses to date, and it is possible we may never generate a profit. Our consolidated financial statements included elsewhere in this prospectus have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the ordinary course of business. These consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of these uncertainties related to our ability to operate on a going concern basis.