( a ) |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1) |

| 1 |

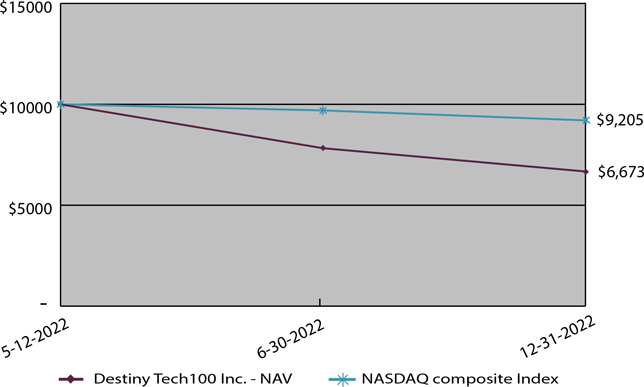

Fund/Index | Since Inception (a) | |||

| Destiny Tech100 Inc. - NAV | (33.27 | )% | ||

Fund Benchmark | ||||

NASDAQ Composite Index (b) | (7.95 | )% | ||

| * | The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when sold may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the sale of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Returns are calculated using the traded net asset value or “NAV” on December 31, 2022. |

| (a) | The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. |

| (b) | The Nasdaq Composite is a market cap-weighted index, simply representing the value of all its listed stocks. The set of eligible securities includes common stocks, ordinary shares, and common equivalents such as ADRs. However, convertible debentures, warrants, Nasdaq-listed closed-end funds, exchange traded funds (ETFs), preferred stocks, and other derivative securities are excluded. |

| 2 |

Shares/ Principal |

Acquisition |

||||||||||||||

Amount |

Security |

Date |

Cost |

Fair Value |

|||||||||||

|

|

|

|

|

Private Investments, at fair value |

|

|

|

|

|

|

|

|

|

|

|

Agreement for Future Delivery of Common Shares |

|||||||||||||||

Financial Technology |

|||||||||||||||

Plaid, Inc. (a)(b)(c)(f) |

$ | $ | |||||||||||||

| Stripe, Inc. (a)(b)(c)(f) |

|||||||||||||||

Total Agreement for Future Delivery of Common Shares - (Cost $ |

|||||||||||||||

Common Stocks |

|||||||||||||||

Aviation/Aerospace |

|||||||||||||||

| Relativity Space, LLC (a)(b)(c)(d) |

|||||||||||||||

Space Exploration Technologies Corp., Series A (a)(b)(c)(d) |

|||||||||||||||

Space Exploration Technologies Corp. (a)(b)(c)(g) |

|||||||||||||||

Space Exploration Technologies Corp., Class A and Class C (a)(b)(c)(d) |

|||||||||||||||

Education Services |

|||||||||||||||

| ClassDojo, Inc. (a)(b)(c) |

|||||||||||||||

Enterprise Software |

|||||||||||||||

| Automation Anywhere, Inc. (a)(b)(c) |

|||||||||||||||

| SuperHuman Labs, Inc. (a)(b)(c) |

|||||||||||||||

Financial Technology |

|||||||||||||||

| CElegans Labs, Inc. (a)(b)(c) |

|||||||||||||||

Klarna Bank AB (a)(b)(c) |

|||||||||||||||

| Public Holdings, Inc. (a)(b)(c) |

|||||||||||||||

Revolut Group Holdings Ltd. (a)(b)(c) |

|||||||||||||||

Brex, Inc. (a)(b)(c)(d) |

|||||||||||||||

Gaming/Entertainment |

|||||||||||||||

| Epic Games, Inc. (a)(b)(c)(d) |

|||||||||||||||

Mobile Commerce |

|||||||||||||||

| Maplebear, Inc. (a)(b)(c) |

|||||||||||||||

Social Media |

|||||||||||||||

| Discord, Inc. (a)(b)(c) |

|||||||||||||||

| 3 |

Shares/ Principal | Acquisition | |||||||||||||

Amount | Security | Date | Cost | Fair Value | ||||||||||

Supply Chain/Logistics | ||||||||||||||

Flexport, Inc. (a)(b)(c) | $ | $ | ||||||||||||

Total Common Stocks - | ||||||||||||||

(Cost $ | ||||||||||||||

Convertible Notes | ||||||||||||||

Aviation/Aerospace | ||||||||||||||

| $ | Axiom Space, Inc. PIK, (b)(c)(e) | |||||||||||||

| $ | Boom Technology, Inc., (b)(c) | |||||||||||||

Total Convertible Notes - | ||||||||||||||

(Cost $ | ||||||||||||||

Preferred Stocks | ||||||||||||||

Financial Technology | ||||||||||||||

Bolt Financial, Inc., Series C Preferred Stock (a)(b)(c)(d) | ||||||||||||||

| Chime Financial Inc. - Series A Preferred Stock (a)(b)(c) | ||||||||||||||

Jeeves, Inc. - Series C Preferred Stock (a)(b)(c) | ||||||||||||||

Food Products | ||||||||||||||

Impossible Foods, Inc. - Series A Preferred Stock (a)(b)(c) | ||||||||||||||

Impossible Foods, Inc. - Series H Preferred Stock (a)(b)(c)(d) | ||||||||||||||

Mobile Commerce | ||||||||||||||

Maplebear, Inc. - Series B Preferred Stock (a)(b)(c) | ||||||||||||||

Social Media | ||||||||||||||

| Discord, Inc. - Series G Preferred Stock (a)(b)(c) | ||||||||||||||

Total Preferred Stocks - | ||||||||||||||

(Cost $ | ||||||||||||||

Total Investments, at fair value – | ||||||||||||||

(Cost $ | $ | |||||||||||||

Other Assets Less Liabilities - 12.61 % | ||||||||||||||

Net Assets - | $ | |||||||||||||

| 4 |

Shares/ Principal | Acquisition | |||||||||||||

Amount | Security | Date | Cost | Fair Value | ||||||||||

Securities by Country as a Percentage of Investments Fair Value | ||||||||||||||

United States | ||||||||||||||

| Common Stocks | $ | $ | ||||||||||||

| Convertible Notes | ||||||||||||||

| Preferred Stocks | ||||||||||||||

| Agreement for Future Delivery of | ||||||||||||||

| Common Shares | ||||||||||||||

Total United States | $ | $ | ||||||||||||

United Kingdom | ||||||||||||||

| Common Stocks | ||||||||||||||

Total United Kingdom | $ | $ | ||||||||||||

Sweden | ||||||||||||||

| Common Stocks | ||||||||||||||

Total Sweden | $ | $ | ||||||||||||

(a) | Non-income producing security. |

(b) | Level 3 securities fair valued using significant unobservable inputs. (See Note 3) |

(c) | Restricted investments as to resale. (See Note 2) |

(d) | These securities have been purchased through Special Purpose Vehicles (“SPVs”) in which the Fund has a direct investment of ownership units. The shares, cost basis and fair value stated are determined based on the underlying securities purchased by the SPV and the Fund’s ownership percentage. |

(e) | Paid in kind security which may pay interest in additional par. |

(f) | Investment is an SPV that holds multiple forward agreements that represent common shares of Stripe, Inc. and Plaid, Inc. Forward contracts involve the future delivery of shares of a portfolio company upon such securities becoming freely transferable or the removal of restrictions on transfer. The counterparties are shareholders of the portfolio company. The aggregate total of the forward contracts for each SPV represents less than Fund’s net assets . |

(g) | These securities have been purchased through a SPV in which the Fund has a direct investment of ownership units. The shares, cost basis and fair value stated are determined based on the underlying securities purchased by the SPV and the Fund’s ownership percentage of the SPV. The SPV holds approximately |

| 5 |

Assets | ||||

| Investments, at fair value (Cost - $ | $ | |||

| Cash | ||||

| Deferred offering costs (See Note 2) | ||||

| Interest Receivable | ||||

| Total Assets | ||||

Liabilities | ||||

| Warrant liabilities, at fair value | ||||

| Professional fees payable | ||||

| Management fee payable (See Note 5) | ||||

| Offering cost payable to Organizer (See Notes 2 and 5) | ||||

| Fund administration fee payable | ||||

| Payable to Shareholder | ||||

| Organization cost payable to Organizer (See Notes 2 and 5) | ||||

| Due to Organizer (See Note 5) | ||||

| Other fees payable | ||||

| Total Liabilities | ||||

Net Assets | $ | |||

| Commitments and contingencies (See Note 6) | ||||

Net Assets Consist Of: | ||||

| Paid-in-capital ( | ||||

| Total distributable losses | ( | ) | ||

| Net Assets a ttri able to Common Shareholdersbu t | $ | |||

Net Asset Value Per Share | ||||

| Net assets applicable to Common Shareholders | $ | |||

| Common Shares outstanding of beneficial interest outstanding, at $ | ||||

| Net Asset Value Per Share applicable to Common Shareholders | $ | |||

| 6 |

Investment Income | ||||

| Interest Income | $ | |||

| Total investment income | ||||

Expenses | ||||

| Management fees (See Note 5) | ||||

| Audit and tax fees | ||||

| Pricing fees | ||||

| Legal fees | ||||

| Offering costs (See Notes 2 and 5) | ||||

| Trustee fees | ||||

| Fund administration fees (See Note 5) | ||||

| Chief compliance and principal financial officer fees (See Note 5) | ||||

| Research fees | ||||

| Custody fees | ||||

| Other accrued expenses | ||||

| Total Expenses | ||||

Net Investment Loss | ( | ) | ||

| Recognition of conversion of SAFE note liabilities to Common Shares | ||||

| Change in unrealized fair value on investments | ( | ) | ||

| Change in unrealized appreciation on SAFE note liabilities | ||||

| Change in unrealized appreciation on fair value of warrants | ||||

Net Decrease in Net Assets from Operations | $ | ( | ) | |

| 7 |

For the Year Ended December 31, 2022 | For the period of January 25, 2021 (commencement of operations) to December 31, 2021 | |||||||

Operations | ||||||||

| Net investment gain/(loss) | $ | ( | ) | $ | ( | ) | ||

| Recognition of conversion of SAFE note liabilities to Common Shares | ||||||||

| Net change in unrealized appreciation/depreciation on investments, SAFE note liabilities and warrants | ( | ) | ( | ) | ||||

| Increase/(Decrease) in net assets resulting from operations | ( | ) | ( | ) | ||||

Distributions to Shareholders | ||||||||

| From distributable earnings | ||||||||

| Total distributions to Fund shareholders | ||||||||

Capital Share Transactions | ||||||||

| Proceeds from shareholder subscriptions | (1) | |||||||

| Conversion of SAFE Notes | (2) | |||||||

| Increase/(Decrease) in net assets from capital share transactions | ||||||||

| Total increase/(decrease) in net assets | ( | ) | ||||||

Net Assets | ||||||||

| Beginning of period | ( | ) | ||||||

| End of period | $ | $ | ( | ) | ||||

Capital Share Activity | ||||||||

| Shares sold | (1) | |||||||

| Conversion to SAFE Notes | (2) | |||||||

| Reverse stock split | ( | ) | ||||||

| Net increase in shares outstanding | ||||||||

| Shares outstanding, beginning of period | ||||||||

| Shares outstanding, end of period | ||||||||

(1) | On January 25, 2021, the Organizer purchased |

(2) | On May 11, 2022, each SAFE holder received from the Fund a number of shares of common stock equal to the total amount invested by such investor in the private offering divided by $ |

| 8 |

Cash Flows From Operating Activities | ||||

| Net decrease in net assets from operations | $ | ( | ) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||

| Recognition of conversion of SAFE note liabilities to Common Shares | ( | ) | ||

| Net unrealized depreciation of investments | ||||

| Purchases of investments | ( | ) | ||

| Return of capital from investments | ||||

| Net unrealized appreciation on SAFE note liabilities | ( | ) | ||

| Net unrealized appreciation on warrants | ( | ) | ||

| Changes in operating assets and liabilities: | ||||

| Increase in interest receivable | ( | ) | ||

| Decrease in deferred offering cost payable to Organizer | ||||

| Increase in Due to Organzier | ||||

| Increase in professional fees payable | ||||

| Increase in fund administration fee payable | ||||

| Increase in other fees payable | ||||

| Decrease in investment fee payable | ( | ) | ||

| Decrease in management fee payable | ( | ) | ||

| Increase in payable to Shareholder | ||||

| Decrease in payable for investments purchased | ( | ) | ||

| Net cash used in operating activities | ( | ) | ||

Cash Flows from Financing Activities | ||||

| Proceeds from issuance of SAFE notes | ||||

| Proceeds from issuance of warrants | ||||

| Net cash provided by financing activities | ||||

Net Decrease in cash | ( | ) | ||

| Cash, beginning of period | ||||

Cash, end of period | $ | |||

Supplemental disclosure of cash flow information: | ||||

Non-cash financing activities | ||||

| SAFE notes conversion to common stock | $ | |||

Total non-cash financing activities | ||||

| 9 |

For the Year |

||||

Ended December 31, |

||||

2022 (1)(2) |

||||

Net Asset Value, Beginning of Year |

$ | ( |

) | |

Income from Investment Operations |

||||

| Net investment income/(loss) (3) |

( |

) | ||

| Recognition of conversion of SAFE note liabilities to Common Shares | ||||

| Change in unrealized fair value on investments and warrants | ( |

) | ||

| Total income/(loss) from investment operations and recognition of conversion of SAFE | ||||

| Note liabilities to Common Shares | ( |

) | ||

Distributions to Shareholders |

||||

| From net investment income | ||||

| From return of capital | ||||

| Total distributions | ||||

Effect of shares issued from SAFE note conversion to Common Shares |

||||

Increase/(Decrease) in Net Asset Value |

||||

Net Asset Value, End of Year |

$ | |||

Total Return (4) |

% (6) |

|||

Supplemental Data and Ratios |

||||

| Net assets attributable to common shares, end of period (000s) | $ | |||

| Ratio of expenses to average net assets (5) |

( |

)% | ||

| Ratio of net investment income to average net assets (5) |

( |

)% | ||

| Portfolio turnover rate | % | |||

(1) |

The Fund commenced operations on January 25, 2021. For the period from January 25, 2021 to May 11, 2022, the Organizer was the sole owner of the Fund’s shares of common stock of |

(2) |

On May 11, 2022, each SAFE holder received from the Fund a number of shares of common stock equal to the total amount invested by such investor in the private offering divided by $ |

(3) |

Calculated using the average shares method. |

(4) |

Returns do not reflect the deduction of taxes the shareholder would pay on fund distributions or redemptions of Fund shares. |

(5) |

Ratios do not include expenses of underlying private investments in which the Fund invests. |

(6) |

Total return has been calculated using the absolute value of the initial Net Asset Value due to a negative Net Asset Value as of January 1, 2022. The total return for the fund has been calculated for shareholders owning shares for the entire period and does not represent the return for holders of SAFE notes that converted to common stock during the year ended December 31, 2022. |

| 10 |

| 11 |

| 12 |

| 13 |

| 14 |

| 15 |

Initial | ||||||||||||||

Acquisition | ||||||||||||||

Investments | Date | Cost | Fair Value | % of Net Assets | ||||||||||

| Automation Anywhere, Inc. | % | |||||||||||||

| Axiom Space, Inc. | % | |||||||||||||

| Bolt Financial, Inc., Series C Preferred Stock | % | |||||||||||||

| Boom Technology, Inc. | % | |||||||||||||

| Brex Inc. | % | |||||||||||||

| CElegans Labs, Inc. | % | |||||||||||||

| Chime Financial Inc. - Series A Preferred Stock | % | |||||||||||||

| ClassDojo, Inc. | % | |||||||||||||

| Discord, Inc. | % | |||||||||||||

| Discord, Inc. - Series G Preferred Stock | % | |||||||||||||

| Epic Games, Inc. | % | |||||||||||||

| Flexport, Inc. | % | |||||||||||||

| Impossible Foods - Series A Preferred Stock | % | |||||||||||||

| Impossible Foods, Inc. - Series H Preferred Stock | % | |||||||||||||

| Jeeves, Inc. - Series C Preferred Stock | % | |||||||||||||

| Klarna Bank AB | % | |||||||||||||

| Maplebear, Inc. | % | |||||||||||||

| Maplebear, Inc. - Series B Preferred Stock | % | |||||||||||||

| Plaid, Inc. | % | |||||||||||||

| Public Holdings, Inc. | % | |||||||||||||

| Relativity Space, LLC | % | |||||||||||||

| Revolut Group Holdings Ltd | % | |||||||||||||

| Space Exploration Technologies Corp., Class A | % | |||||||||||||

| Space Exploration Technologies Corp., Class A and Class C | % | |||||||||||||

| Space Exploration Technologies Corp., Class A | % | |||||||||||||

| Stripe, Inc. | % | |||||||||||||

| Superhuman Labs, Inc. | % | |||||||||||||

| Total Investments | $ | $ | % | |||||||||||

| 16 |

| 17 |

Investments |

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||

Agreement for Future Delivery of Common Shares (a) |

$ | $ | $ | $ | ||||||||||||

Common Stocks |

— | — | $ | |||||||||||||

Convertible Notes |

— | — | ||||||||||||||

Preferred Stocks |

— | — | ||||||||||||||

Total |

$ | — | $ | — | $ | $ | ||||||||||

Liabilities |

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||

Warrants |

— | — | ( |

) | ( |

) | ||||||||||

Total |

$ | — | $ | — | $ | ( |

) | $ | ( |

) | ||||||

(a) |

Certain investments are held through SPV s that holds forward contracts. Forward contracts involve the future delivery of shares of a portfolio company upon such securities becoming freely transferable or the removal of restrictions on transfer. The counterparties are shareholders of the portfolio company. See Schedule of Investments. |

| 18 |

Investments |

Balance as of December 31, 2021 |

Purchase of Investments |

Proceeds from Sale of Investments (a) |

Net Realized Gain (Loss) on Investments |

Net Change in Unrealized Appreciation (Depreciation) on Investments |

Balance as of December 31, 2022 |

||||||||||||||||||

Agreement for Future Delivery of Common Shares (b) |

$ |

$ |

$ |

— |

$ |

— |

$ |

( |

) |

$ |

||||||||||||||

Common Stocks |

( |

) |

— |

( |

) |

$ |

||||||||||||||||||

Convertible Notes |

— |

— |

||||||||||||||||||||||

Preferred Stocks |

( |

) |

— |

( |

) |

|||||||||||||||||||

Total |

$ |

$ |

$ |

( |

) |

$ |

— |

$ |

( |

) |

$ |

|||||||||||||

(a) |

Sale proceeds from investments is comprised entirely of returned funds held within an SPV. |

(b) |

Certain investments are held through SPV s that holds forward contracts. Forward contracts involve the future delivery of shares of a portfolio company upon such securities becoming freely transferable or the removal of restrictions on transfer. The counterparties are shareholders of the portfolio company. See Schedule of Investments. |

|

Balance as of December 31, 2021 |

Issuance of Liabilities |

Conversion of SAFE Notes to Common Stock |

Net Realized Gain (Loss) on Conversion of Liabilities |

Net Change in Unrealized Appreciation (Depreciation) on Liabilities |

Balance as of December 31, 2022 |

|||||||||||||||||||

SAFE Notes |

$ |

( |

) |

$ |

( |

) |

$ |

$ |

$ |

$ |

||||||||||||||

Warrants |

( |

) |

( |

) |

— |

— |

( |

) |

||||||||||||||||

Total |

$ |

( |

) |

$ |

( |

) |

$ |

$ |

$ |

$ |

( |

) |

||||||||||||

Level 3 Investments |

Fair Value as of December 31, 2022 |

Valuation Technique |

Unobservable Input |

Ranges of Inputs/(Average) |

||||

Assets |

||||||||

Agreement for Future Delivery of Common Shares (a) |

$ |

$ |

||||||

$ |

||||||||

Common Stocks |

$ |

N/A |

||||||

$ |

||||||||

$ |

||||||||

Convertible Notes |

$ |

N/A |

||||||

| 19 |

Level 3 Investments |

Fair Value as of December 31, 2022 |

Valuation Technique |

Unobservable Input |

Ranges of Inputs/(Average) |

||||

N/A |

||||||||

Preferred Stocks |

$ |

N/A |

||||||

N/A |

||||||||

$ |

||||||||

$ |

||||||||

|

|

||||||||

Total |

$ |

Liabilities |

||||||||

Warrants |

( |

( |

||||||

Total |

$( |

|||||||

(a) |

Certain investments are held through an SPV that holds forward contracts. Forward contracts involve the future delivery of shares of a portfolio company upon such securities becoming freely transferable or the removal of restrictions on transfer. The counterparties are shareholders of the portfolio company. See Schedule of Investments. |

| 20 |

· | with respect to the first |

· | with respect to an additional |

· | with respect to the last |

| 21 |

| 22 |

Income at U.S. statutory rate | % | |||

State taxes, net of federal benefit | % | |||

Permanent differences | % | |||

Temporary differences | % | |||

Valuation allowance | - | % | ||

Income tax provision/(benefit) | % |

Net Operating Losses | $ | |||

Accrued Expenses & Other | ||||

Management Fees | ||||

Amortization | ||||

Unrealized losses | ||||

SPV Income/Losses | ||||

Total deferred tax assets | $ | |||

Valuation allowance | ||||

Net deferred tax assets (liability) | $ |

| 23 |

| 24 |

| 25 |

| 26 |

FACTS | WHAT DOES DESTINY TECH100 INC. DOWITH YOUR PERSONAL INFORMATION? |

Why ? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: |

• Name, Address, Social Security number | |

• Proprietary information regarding your beneficiaries | |

• Information regarding your earned wages and other sources of income | |

When you are no longer our customer, we continue to share your information as described in this notice. | |

How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Destiny Tech100 Inc. chooses to share; and whether you can limit this sharing. |

Reasons we can share your personal information | Does the Fund share? | Can you limit this sharing? |

For our everyday business purposes — such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

For our marketing purposes - to offer our products and services to you | No | We don’t share |

For joint marketing with other financial companies | No | We don’t share |

For our affiliates to support everyday business functions – information about your transactions supported by law | Yes | No |

For our affiliates’ everyday business purposes - Information about your creditworthiness | No | We don’t share |

For non-affiliates to market to you | No | We don’t share |

| 27 |

Who are we | |

Who is providing this notice? | Destiny Tech100 Inc. |

What we do | |

How does Destiny Tech100 Inc. protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |

Why does Destiny Tech100 Inc. collect my personal information? | We collect your personal information, for example · To know investors’ identities and thereby prevent unauthorized access to confidential information; · Design and improve the products and services we offer to investors; · Comply with the laws and regulations that govern us. |

Why can’t I limit all sharing? | Federal law gives you the right to limit only · sharing for affiliates’ everyday business purposes - information about your creditworthiness · affiliates from using your information to market to you · sharing for non-affiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

Definitions | |

Affiliates | Companies related by common ownership or control. They can be financial and non-financial companies. • Destiny Tech100 Inc. has affiliates. |

Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. • Destiny Tech100 Inc. does not share with nonaffiliates so they can market to you. |

Joint Marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. • Destiny Tech100 Inc. doesn’t jointly market. |

| 28 |

Name and Age | Position(s) Held with Company | Term at Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Director | Other Directorships Held by Director | |||||

Interested Directors | ||||||||||

Sohail Prasad, 29 | Director and Chief Executive Officer | Director since November 2020; Term expires 2025 | Founder, Chairman of the Board and Chief Executive Officer, Destiny XYZ (2020 present); Chief Executive Officer, Destiny Advisors LLC (2020 present); Chief Executive Officer, Forge (2014 2018); Founding Partner, S2 Capital (2012 – present) | 1 | None | |||||

Independent Directors | ||||||||||

Travis Mason, 38 | Director | Director since April 2022; Term expires 2023 | Operating Partner, 776 Fund Management (2021 2022); Fellow, Massachusetts Institute of Technology (2020 – 2021); Vice President, Certification and Regulation, Airbus (2017 – 2020) | 1 | None | |||||

Eric Patterson, 39 | Director | Director since April 2022; Term expires 2024 | Managing Member and Chief Investment Officer, Three Bell Capital LLC (2012 – present) | 1 | None | |||||

Executive Officers |

| 29 |

Name and Age | Position(s) Held with Company | Term at Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Director | Other Directorships Held by Director | |||||

Ethan Silver, 47 | Chief Operating Officer | Chief Operating Officer since May 2021 | Partner, Lowenstein Sandler LLP (2016 - present) | N/A | N/A | |||||

Peter Sattelmair, 45 | Chief Financial Officer | Chief Financial Officer since April 2022 | Director, PINE Advisor Solutions (2021 - present); Director of Fund Operations and Assistant Treasurer, Transamerica Asset Management (2015 - 2022) | N/A | N/A | |||||

Cory Gossard, 50 | Chief Compliance Officer | Chief Compliance Officer since April 2022 | Director, PINE Advisor Solutions (2021 - present); Chief Compliance Officer, SS&C ALPS | N/A | N/A |

| 30 |

| 31 |

| 32 |

| 33 |

| (a) | (1) Code of Ethics. Incorporated by reference from the Registrant’s annual report on Form N-CSR for the fiscal year ended December 31, 2022 filed on March 30, 2023. |

| (2) | Certifications for each principal executive officer and principal financial officer as required by Rule 30a-2(a) under the Investment Company Act of 1940. Filed herewith. |

(3) | Not applicable. |

(4) | Not applicable. |

| (b) | Certifications for each principal executive officer and principal financial officer as required by Rule 30a-2(b) under the Investment Company Act of 1940. Furnished herewith. |

| 1 |

(Registrant) | Destiny Tech100 Inc. | ||

By | (Signature and Title)* | /s/ Sohail Prasad | |

Sohail Prasad, Principal Executive Officer | |||

Date | September 28, 2023 | ||

By | (Signature and Title) * | /s/ Sohail Prasad | |

Sohail Prasad, President/Principal Executive Officer | |||

Date | September 28, 2023 | ||

By | (Signature and Title)* | /s/ Peter Sattelmair | |

Peter Sattelmair, Treasurer/Principal Financial Officer | |||

Date | September 28, 2023 | ||

| 2 |