| 1 |

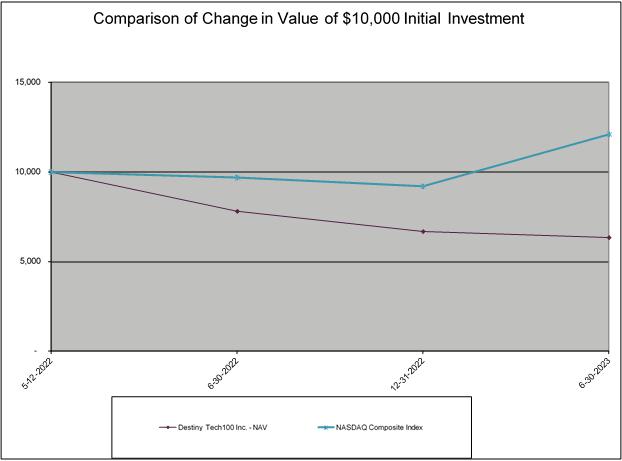

Fund/Index | One-Year | Annualized Since Inception (a) | ||||||

Destiny Tech100 Inc. - NAV | (46.52 | )% | (32.02 | )% | ||||

Fund Benchmark | ||||||||

NASDAQ Composite Index (b) | 21.92 | % | 18.69 | % | ||||

* | The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Returns are calculated using the traded net asset value or "NAV" on June 30, 2023. |

(a) | The Fund commenced operations on May 12, 2022. The performance is based on average annual returns. |

(b) | The Nasdaq Composite is a market cap-weighted index, simply representing the value of all its listed stocks. The set of eligible securities includes common stocks, ordinary shares, and common equivalents such as ADRs. However, convertible debentures, warrants, Nasdaq-listed closed-end funds, exchange traded funds (ETFs), preferred stocks, and other derivative securities are excluded. |

| 2 |

Shares/ Principal Amount | Security | Acquisition Date | Cost | Fair Value | ||||||||||||

Private Investments, at fair value | ||||||||||||||||

Agreement for Future Delivery of Common Shares | ||||||||||||||||

Financial Technology | ||||||||||||||||

Plaid, Inc. (a)(b)(c)(d) | $ | $ | ||||||||||||||

Stripe, Inc. (a)(b)(c)(e) | ||||||||||||||||

Total Agreement for Future Delivery of Common Shares | ||||||||||||||||

Common Stocks | ||||||||||||||||

Aviation/Aerospace | ||||||||||||||||

Relativity Space, LLC (a)(b)(c)(f) | ||||||||||||||||

Space Exploration Technologies Corp., Series A (a)(b)(c)(f) | ||||||||||||||||

Space Exploration Technologies (a)(b)(c)(g) | ||||||||||||||||

Space Exploration Technologies Corp., Class A and Class C (a)(b)(c)(f) | ||||||||||||||||

Education Services | ||||||||||||||||

ClassDojo, Inc. (a)(b)(c) | ||||||||||||||||

Enterprise Software | ||||||||||||||||

Automation Anywhere, Inc. (a)(b)(c) | ||||||||||||||||

SuperHuman Labs, Inc. (a)(b)(c) | ||||||||||||||||

Financial Technology | ||||||||||||||||

CElegans Labs, Inc. (a)(b)(c) | ||||||||||||||||

Klarna Bank AB (a)(b)(c) | ||||||||||||||||

Public Holdings, Inc. (a)(b)(c) | ||||||||||||||||

Revolut Group Holdings Ltd. (a)(b)(c) | ||||||||||||||||

Brex, Inc. (a)(b)(c)(f) | ||||||||||||||||

Gaming/Entertainment | ||||||||||||||||

Epic Games, Inc. (a)(b)(c)(f) | ||||||||||||||||

Mobile Commerce | ||||||||||||||||

Maplebear, Inc. (a)(b)(c) | ||||||||||||||||

Social Media | ||||||||||||||||

Discord, Inc. (a)(b)(c) | ||||||||||||||||

Supply Chain/Logistics | ||||||||||||||||

Flexport, Inc. (a)(b)(c) | ||||||||||||||||

Total Common Stocks | ||||||||||||||||

| 3 |

|

Shares/ Principal Amount |

|

|

Security |

|

Acquisition Date |

|

|

Cost |

|

|

Fair Value |

|

||||

|

|

|

|

|

Convertible Notes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aviation/Aerospace |

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

|

|

|

Boom Technology, Inc., (b)(c) |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

Total Convertible Notes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aviation/Aerospace |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Axiom Space, Inc. Series C Preferred Stock (a)(b)(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Axiom Space, Inc. Series C-1 Preferred Stock (a)(b)(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Technology |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bolt Financial, Inc., Series C Preferred Stock (a)(b)(c)(f)(h) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chime Financial Inc. - Series A Preferred Stock (a)(b)(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jeeves, Inc. - Series C Preferred Stock (a)(b)(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food Products |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impossible Foods, Inc. - Series A Preferred Stock (a)(b)(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impossible Foods, Inc. - Series H Preferred Stock (a)(b)(c)(f) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobile Commerce |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maplebear, Inc. - Series B Preferred Stock (a)(b)(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Media |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discord, Inc. - Series G Preferred Stock (a)(b)(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Preferred Stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-Term Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST AM TREAS OBLI-X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Short-Term Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments, at fair value — |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

Other Assets Less Liabilities — |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

Net Assets — |

|

|

|

|

|

|

|

|

|

$ |

|

|

| 4 |

Shares/ Principal Amount | Security | Acquisition Date | Cost | Fair Value | ||||||||||||

Securities by Country as a Percentage of Investments Fair Value | ||||||||||||||||

United States | ||||||||||||||||

Common Stocks | $ | $ | ||||||||||||||

Convertible Notes | ||||||||||||||||

Preferred Stocks | ||||||||||||||||

Agreement for Future Delivery of Common Shares | ||||||||||||||||

Money Market | ||||||||||||||||

Total United States | $ | $ | ||||||||||||||

United Kingdom | ||||||||||||||||

Common Stocks | ||||||||||||||||

Total United Kingdom | $ | $ | ||||||||||||||

Sweden | ||||||||||||||||

Common Stocks | ||||||||||||||||

Total Sweden | $ | $ | ||||||||||||||

(a) |

(b) |

(c) |

(d) | Investment is a SPV that holds multiple forward agreements that represent common shares of Plaid, Inc. Forward contracts involve the future delivery of shares of a portfolio company upon such securities becoming freely transferable or the removal of restrictions on transfer. The counterparties are shareholders of the portfolio company. The aggregate total of the forward contracts for each SPV represents less than 5% of Fund's net assets. |

(e) | Investment is a SPV that holds multiple forward agreements that represent common shares of Stripe, Inc. Forward contracts involve the future delivery of shares of a portfolio company upon such securities becoming freely transferable or the removal of restrictions on transfer. The counterparties are shareholders of the portfolio company. The aggregate total of the forward contracts for each SPV represents less than |

(f) |

(g) | These securities have been purchased through a SPV in which the Fund has a direct investment of ownership units. The shares, cost basis and fair value stated are determined based on the underlying securities purchased by the SPV and the Fund’s ownership percentage of the SPV. The SPV holds approximately |

(h) |

| 5 |

|

Assets |

|

|

|

|

|

Investments, at fair value (Cost – $ ) |

|

$ |

|

|

|

Prepaid Insurance |

|

|

|

|

|

Interest receivable |

|

|

|

|

|

Total Assets |

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

Management fee payable |

|

|

|

|

|

Fund administration fee payable |

|

|

|

|

|

Due to Organizer |

|

|

|

|

|

Offering cost payable to Organizer |

|

|

|

|

|

Professional fees payable |

|

|

|

|

|

Organization cost payable to Organizer |

|

|

|

|

|

Trustee fees payable |

|

|

|

|

|

Other fees payable |

|

|

|

|

|

Warrant liabilities, at fair value * |

|

|

|

|

|

Total Liabilities |

|

|

|

|

|

Net Assets |

|

$ |

|

|

|

|

|

|

|

|

|

Net Assets Consist Of: |

|

|

|

|

|

Paid-in-capital ( |

|

|

|

|

|

Total distributable losses |

|

|

( |

) |

|

Net Assets applicable to Common Shareholders |

|

$ |

|

|

|

|

|

|

|

|

|

Net Asset Value Per Share |

|

|

|

|

|

Net assets applicable to Common Shareholders |

|

$ |

|

|

|

Common Shares outstanding of beneficial interest outstanding, at $ |

|

|

|

|

|

Net Asset Value Per Share applicable to Common Shareholders |

|

$ |

|

|

|

* |

After consultation with the SEC in March 2023, the Warrants that were issued as part of our private offering of SAFEs were revised, in the second quarter of 2023, as expired following our registration as an investment company pursuant to Section 18 of the 1940 Act. As such, management has determined the fair value of the warrants to be $ |

| 6 |

|

Investment Income |

|

|

|

|

|

Interest Income |

|

$ |

|

|

|

Dividend Income |

|

|

|

|

|

Total investment income |

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

Management fees |

|

|

|

|

|

Pricing fees |

|

|

|

|

|

Audit and tax fees |

|

|

|

|

|

Legal fees |

|

|

|

|

|

Trustee fees |

|

|

|

|

|

Offering costs |

|

|

|

|

|

Chief compliance and principal financial officer fees |

|

|

|

|

|

Other accrued expenses |

|

|

|

|

|

Total Expenses |

|

|

|

|

|

|

|

|

|

|

|

Net Investment Loss |

|

|

( |

) |

|

|

|

|

|

|

|

Change in unrealized fair value of warrants * |

|

|

|

|

|

Change in unrealized fair value on investments |

|

|

( |

) |

|

Net Realized and Unrealized Loss on Securities |

|

|

( |

) |

|

|

|

|

|

|

|

Net Decrease in Net Assets from Operations |

|

$ |

( |

) |

|

* |

After consultation with the SEC in March 2023, the Warrants that were issued as part of our private offering of SAFEs were revised, in the second quarter of 2023, as expired following our registration as an investment company pursuant to Section 18 of the 1940 Act. As such, management has determined the fair value of the warrants to be $ |

| 7 |

|

|

|

For the Six Months Ended June 30, 2023 (Unaudited) |

|

|

For the Year Ended December 31, 2022 |

|

||

|

Operations |

|

|

|

|

|

|

|

|

|

Net investment gain/(loss) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Recognition of conversion of SAFE note liabilities to Common Shares |

|

|

|

|

|

|

|

|

|

Change in unrealized fair value of warrants * |

|

|

|

|

|

|

|

|

|

Change in unrealized fair value on SAFE note liabilities |

|

|

|

|

|

|

|

|

|

Change in unrealized fair value on investments |

|

|

( |

) |

|

|

( |

) |

|

Increase/(decrease) in net assets resulting from operations |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

Distributions to Shareholders |

|

|

|

|

|

|

|

|

|

From distributable earnings |

|

|

|

|

|

|

|

|

|

Total distributions to Fund shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Share Transactions |

|

|

|

|

|

|

|

|

|

Conversion to SAFE notes |

|

|

|

|

|

|

|

(1) |

|

Increase/(decrease) in net assets from capital share transactions |

|

|

|

|

|

|

|

|

|

Total increase/(decrease) in net assets |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets |

|

|

|

|

|

|

|

|

|

Beginning of period |

|

|

|

|

|

|

( |

) |

|

End of period |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Share Activity |

|

|

|

|

|

|

|

|

|

Conversion to SAFE notes |

|

|

|

|

|

|

|

(1) |

|

Reverse stock split |

|

|

|

|

|

|

( |

) |

|

Net increase in shares outstanding |

|

|

|

|

|

|

|

|

|

Shares outstanding, beginning of period |

|

|

|

|

|

|

|

|

|

Shares outstanding, end of period |

|

$ |

|

|

|

$ |

|

|

|

* |

After consultation with the SEC in March 2023, the Warrants that were issued as part of our private offering of SAFEs were revised, in the second quarter of 2023, as expired following our registration as an investment company pursuant to Section 18 of the 1940 Act. As such, management has determined the fair value of the warrants to be $ |

|

(1) |

On May 11, 2022, each SAFE holder received from the Fund a number of shares of common stock equal to the total amount invested by such investor in the private offering divided by $ |

| 8 |

|

Cash Flows From Operating Activities |

|

|

|

|

|

Net decrease in net assets from operations |

|

$ |

( |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

Change in unrealized fair value of warrants* |

|

|

( |

) |

|

Change in unrealized fair value on investments |

|

|

|

|

|

Purchase of investments |

|

|

( |

) |

|

Return of capital from investments |

|

|

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Increase in management fee payable |

|

|

|

|

|

Increase in fund administration fee payable |

|

|

|

|

|

Increase in professional fees payable |

|

|

|

|

|

Increase in trustee fees payable |

|

|

|

|

|

Decrease in other fees payable |

|

|

( |

) |

|

Decrease in interest receivable |

|

|

|

|

|

Decrease in deferred offering costs |

|

|

|

|

|

Increase in prepaid insurance |

|

|

( |

) |

|

Increase in payable to Shareholder |

|

|

|

|

|

Decrease due to Organizer |

|

|

( |

) |

|

Net cash used in operating activities |

|

|

( |

) |

|

Cash, beginning of period |

|

|

|

|

|

|

|

|

|

|

|

Cash, end of period |

|

$ |

|

|

|

* |

After consultation with the SEC in March 2023, the Warrants that were issued as part of our private offering of SAFEs were revised, in the second quarter of 2023, as expired following our registration as an investment company pursuant to Section 18 of the 1940 Act. As such, management has determined the fair value of the warrants to be $ |

| 9 |

|

|

|

For the Six Months Ended June 30, 2023 (Unaudited) |

|

|

For the Year Ended December 31, 2022 (1)(2) |

|

||

|

Net Asset Value, Beginning of Period |

|

$ |

|

|

|

$ |

( |

) |

|

|

|

|

|

|

|

|

|

|

|

Income from Investment Operations |

|

|

|

|

|

|

|

|

|

Net investment income/(loss) (3) |

|

|

( |

) |

|

|

( |

) |

|

Recognition of conversion of SAFE note liabilities to Common Shares |

|

|

|

|

|

|

|

|

|

Change in unrealized fair value of warrants* |

|

|

|

|

|

|

|

|

|

Change in unrealized fair value on SAFE note liabilities |

|

|

|

|

|

|

|

|

|

Change in unrealized fair value on investments |

|

|

( |

) |

|

|

( |

) |

|

Total income/(loss) from investment operations and recognition of conversion of SAFE note liabilities to Common Shares |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

Distributions to Shareholders |

|

|

|

|

|

|

|

|

|

From net investment income |

|

|

|

|

|

|

|

|

|

From return of capital |

|

|

|

|

|

|

|

|

|

Total distributions |

|

|

|

|

|

|

|

|

|

Effect of shares issued from SAFE note conversion to Common Shares |

|

|

|

|

|

|

|

|

|

Increase/(Decrease) in Net Asset Value |

|

|

( |

) |

|

|

|

|

|

Net Asset Value, End of Period |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Return (4) |

|

|

( |

)% |

|

|

|

% (5) |

|

|

|

|

|

|

|

|

|

|

|

Supplemental Data and Ratios |

|

|

|

|

|

|

|

|

|

Net assets attributable to common shares, end of period (000s) |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratio of expenses to average net assets (6) |

|

|

( |

)% |

|

|

( |

)% |

|

Ratio of net investment income to average net assets (6) |

|

|

( |

)% |

|

|

( |

)% |

|

Portfolio turnover rate (7) |

|

|

|

|

|

|

|

% |

|

(1) |

The Fund commenced operations on January 25, 2021. For the period from January 25, 2021 to May 11, 2022, the Organizer was the sole owner of the Fund’s shares of common stock of . |

|

(2) |

On May 11, 2022, each SAFE holder received from the Fund a number of shares of common stock equal to the total amount invested by such investor in the private offering divided by $ |

|

(3) |

Calculated using the average shares method. |

|

(4) |

Returns do not reflect the deduction of taxes the shareholder would pay on fund distributions or redemptions of Fund shares. Returns for period less than a year are not annualized. |

|

(5) |

Total return has been calculated using the absolute value of the initial Net Asset Value due to a negative Net Asset Value as of January 1, 2022. The total return for the fund has been calculated for shareholders owning shares for the entire period and does not represent the return for holders of SAFE notes that converted to common stock during the year ended December 31, 2022. |

|

(6) |

Ratios do not include expenses of underlying private investments in which the Fund invests. |

|

(7) |

Portfolio turnover rate is calculated using the lesser of year-to-date sales or year-to-date purchases over the average of the invested assets at fair value for the periods reported. Ratio is not annualized. |

|

* |

After consultation with the SEC in March 2023, the Warrants that were issued as part of our private offering of SAFEs were revised, in the second quarter of 2023, as expired following our registration as an investment company pursuant to Section 18 of the 1940 Act. As such, management has determined the fair value of the warrants to be $ |

| 10 |

(1) | Organization |

(2) | Summary of Significant Accounting Policies |

(a) | Investments |

| 11 |

(b) | Income Taxes |

| 12 |

(c) | Cash and Cash Equivalents |

(d) | Income and Expenses |

| 13 |

(e) | Use of Estimates |

(f) | Concentrations of Credit Risk |

(g) | Risks and Uncertainties |

| 14 |

(h) | Restricted securities |

| 15 |

Investments | Initial Acquisition Date | Cost | Fair Value | % of Net Assets | ||||||||||||

Automation Anywhere, Inc. | $ | $ | % | |||||||||||||

Axiom Space, Inc. Series C Preferred Stock | % | |||||||||||||||

Axiom Space, Inc. Series C-1 Preferred Stock | % | |||||||||||||||

Bolt Financial, Inc., Series C Preferred Stock | % | |||||||||||||||

Boom Technology, Inc. | % | |||||||||||||||

Brex Inc. | % | |||||||||||||||

CElegans Labs, Inc. | % | |||||||||||||||

Chime Financial Inc. - Series A Preferred Stock | % | |||||||||||||||

ClassDojo, Inc. | % | |||||||||||||||

Discord, Inc. | % | |||||||||||||||

Discord, Inc. - Series G Preferred Stock | % | |||||||||||||||

Epic Games, Inc. | % | |||||||||||||||

Flexport, Inc. | % | |||||||||||||||

Impossible Foods - Series A Preferred Stock | % | |||||||||||||||

Impossible Foods, Inc. - Series H Preferred Stock | % | |||||||||||||||

Jeeves, Inc. - Series C Preferred Stock | % | |||||||||||||||

Klarna Bank AB | % | |||||||||||||||

Maplebear, Inc. | % | |||||||||||||||

Maplebear, Inc. - Series B Preferred Stock | % | |||||||||||||||

Plaid, Inc. | % | |||||||||||||||

Public Holdings, Inc. | % | |||||||||||||||

Relativity Space, LLC | % | |||||||||||||||

Revolut Group Holdings Ltd | % | |||||||||||||||

Space Exploration Technologies Corp., Class A | % | |||||||||||||||

Space Exploration Technologies Corp., Class A and Class C | % | |||||||||||||||

Space Exploration Technologies Corp., Class A | % | |||||||||||||||

Stripe, Inc. | % | |||||||||||||||

Superhuman Labs, Inc. | % | |||||||||||||||

Total Investments | $ | $ | % | |||||||||||||

(3) | Fair Value Measurements |

| 16 |

| 17 |

| 18 |

|

|

|

|

|

|

|

|

|

|

|

|

Practical |

|

|

|

|

|||||

|

Investment |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Expedient |

|

|

Total |

|

|||||

|

Agreement for Future Delivery of Common Shares (a) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

|

|

|

Common Stocks |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Convertible Notes |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stocks |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money Market |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Total |

|

$ |

|

|

|

$ |

— |

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

(a) |

Certain investments are held through SPVs that holds forward contracts. Forward contracts involve the future delivery of shares of a portfolio company upon such securities becoming freely transferable or the removal of restrictions on transfer. The counterparties are shareholders of the portfolio company. See Schedule of Investments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Change |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Balance |

|

|

|

|

|

|

|

|

Net Realized |

|

|

in Unrealized |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

as of |

|

|

|

|

|

Proceeds |

|

|

Gain |

|

|

Appreciation |

|

|

Note |

|

|

|

|

|

Balance as |

|

||||||||

|

|

|

December |

|

|

Purchase of |

|

|

from Sale of |

|

|

(Loss) on |

|

|

(Depreciation) |

|

|

Converted |

|

|

Transfers out |

|

|

of June 30, |

|

||||||||

|

Investments |

|

31, 2022 |

|

|

Investments |

|

|

Investments (a) |

|

|

Investments |

|

|

on Investments |

|

|

to Stock |

|

|

of Level 3 (c) |

|

|

2023 |

|

||||||||

|

Agreement for Future Delivery of Common Shares (b) |

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

Common Stocks |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Convertible Notes |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

|

|

|

Preferred Stocks |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

Total |

|

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

|

|

|

(a) |

Sale proceeds from investments is comprised entirely of returned funds held within an SPV. |

|

(b) |

Certain investments are held through SPVs that holds forward contracts. Forward contracts involve the future delivery of shares of a portfolio company upon such securities becoming freely transferable or the removal of restrictions on transfer. The counterparties are shareholders of the portfolio company. See Schedule of Investments. |

|

(c) |

Level 3 transfers are done using fair market value as of June 30, 2023. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Change |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Net Realized |

|

|

in Unrealized |

|

|

|

|

||||||

|

|

|

Balance as of |

|

|

|

|

|

Conversion of |

|

|

Gain (Loss) on |

|

|

Appreciation |

|

|

|

|

||||||

|

|

|

December 31, |

|

|

Issuance of |

|

|

SAFE Notes to |

|

|

Conversion of |

|

|

(Depreciation) on |

|

|

Balance as of |

|

||||||

|

|

|

2022 |

|

|

Liabilities |

|

|

Common Stock |

|

|

Liabilities |

|

|

Liabilities |

|

|

June 30, 2023 |

|

||||||

|

Warrants * |

|

|

( |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

|

|

|

Total |

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

$ |

|

|

|

* |

After consultation with the SEC in March 2023, the Warrants that were issued as part of our private offering of SAFEs were revised, in the second quarter of 2023, as expired following our registration as an investment company pursuant to Section 18 of the 1940 Act. As such, management has determined the fair value of the warrants to be $ |

| 19 |

|

|

|

Fair Value |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

as of June |

|

|

Valuation |

|

|

|

|

|

Ranges of |

|

||||

|

Level 3 Investments |

|

30, 2023 |

|

|

Technique |

|

|

Unobservable Input |

|

|

Inputs/(Average) |

|

||||

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Agreement for Future Delivery of Common Shares |

|

$ |

|

|

|

|

|

|

|

|

|

|

N/A |

|

||

|

Common Stocks |

|

$ |

|

|

|

|

|

|

|

|

|

|

N/A |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

($ |

|||

|

Convertible Notes |

|

$ |

|

|

|

|

|

|

|

|

|

|

N/A |

|

||

|

Preferred Stocks |

|

$ |

|

|

|

|

|

|

|

|

|

N/A |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N/A |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

$

($ |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Total |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

Certain investments are held through an SPV that holds forward contracts. Forward contracts involve the future delivery of shares of a portfolio company upon such securities becoming freely transferable or the removal of restrictions on transfer. The counterparties are shareholders of the portfolio company. See Schedule of Investments. |

|

(4) |

Capital Transactions |

| 20 |

· | with respect to the first |

· | with respect to an additional |

· | with respect to the last |

| 21 |

(5) | Related Party Transactions |

(a) | Management Fee |

(b) | Administrator |

(c) | Service Providers |

| 22 |

(d) | Affiliated Partners |

(6) | Commitments and Contingencies |

(7) | Investment Transactions |

(8) | Tax |

| 23 |

(9) | Recent Accounting Standards |

(10) | Subsequent Events |

| 24 |

(b) | Not applicable. |

(a) | Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form. |

(b) | Not Applicable. |

| 26 |

a) | Evaluation of Disclosure Controls and Procedures |

b) | Change in Internal Controls |

| 27 |

(a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable for semi-annual reports. |

| 28 |

| 29 |