UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________________ to ____________________

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

( State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|||

|

☒ |

|

Smaller reporting company |

|

||

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filingreflect the correctionof an error to previouslyissued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

The aggregate market value of Class A common stock held by non-affiliates of the Registrant on June 30, 2022, the last business day of the Registrant's most recently completed second fiscal quarter was approximately $

As of March 20 2023, there were

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement relating to its 2023 annual meeting of stockholders (the “2023 Proxy Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The 2023 Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

Auditor Firm Id: |

Auditor Name: |

Auditor Location: |

|

Table of Contents

|

|

Page |

|

|

|

Item 1. |

5 |

|

Item 1A. |

35 |

|

Item 1B. |

64 |

|

Item 2. |

64 |

|

Item 3. |

64 |

|

Item 4. |

64 |

|

|

|

|

|

|

|

Item 5. |

65 |

|

Item 6. |

66 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

67 |

Item 7A. |

84 |

|

Item 8. |

86 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

124 |

Item 9A. |

124 |

|

Item 9B. |

124 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

124 |

|

|

|

|

|

|

Item 10. |

125 |

|

Item 11. |

125 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

125 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

125 |

Item 14. |

125 |

|

|

|

|

|

|

|

Item 15. |

126 |

|

Item 16. |

129 |

|

|

130 |

This Annual Report on Form 10-K ("Form 10-K") includes certain information regarding the historical performance of our specialized investment vehicles, which include specialized funds and customized separate accounts. An investment in shares of our Class A common stock is not an investment in our specialized investment vehicles. In considering the performance information relating to our specialized investment vehicles contained herein, prospective Class A common stockholders should bear in mind that the performance of our specialized investment vehicles is not indicative of the possible performance of shares of our Class A common stock and is also not necessarily indicative of the future results of our specialized investment vehicles, even if fund investments were in fact liquidated on the dates indicated, and there can be no assurance that our specialized investment vehicles will continue to achieve, or that future specialized investment vehicles will achieve comparable results.

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. In addition, our names, logos and website names and addresses are owned by us or licensed by us. We also own or have the rights to copyrights that protect the content of our solutions. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Form 10-K are listed without the ©,® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks, trade names and copyrights.

This Form 10-K may include trademarks, service marks or tradenames of other companies. Our use or display of other parties’ trademarks, service marks, trade names or products is not intended to, and does not imply a relationship with, or endorsement or sponsorship of us by, the trademark, service mark or tradename owners.

Unless otherwise indicated, information contained in this Form 10-K concerning our industry and the markets in which we operate is based on information from independent industry and research organizations, other third- party sources (including industry publications, surveys and forecasts), and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and markets that we believe to be reasonable. Although we believe the data from these third-party sources is reliable, we have not independently verified any third-party information. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

Our principal operating brands are RCP Advisors 2, LLC (“RCP 2”) and RCP Advisors 3, LLC (“RCP3”, and collectively with RCP 2, “RCP Advisors”), TrueBridge Capital Partners LLC (“TrueBridge”), Five Points Capital, Inc. (“Five Points”), Enhanced Capital Group, LLC (“ECG” or “Enhanced”), Bonaccord Capital Partners, LLC ("Bonaccord"), Hark Capital Advisors, LLC ("Hark"), P10 Advisors, LLC (“P10 Advisors”), and Westech Investment Advisors LLC (“WTI”).

Unless otherwise indicated or the context otherwise requires, all references in this Form 10-K to “we, ”“us,” “our,” the “Company,” “P10”and similar terms refer (i) for periods prior to giving effect to the reorganization transactions described under “Organizational Structure,” to P10 Holdings, Inc. and its subsidiaries and (ii) for periods beginning on the date of and after giving effect to such reorganization transactions, to P10, Inc. and its subsidiaries. As used in this Form 10-K, (i) the term “P10 Holdings” refers to P10 Holdings, Inc. for all periods and (ii) the term “P10, Inc.” refers solely to P10, Inc., a Delaware corporation, and not to any of its subsidiaries.

FORWARD-LOOKING STATEMENTS

This Form 10-K contains forward-looking statements, which reflect our current views with respect to, among other things, future events and financial performance, our operations, strategies and expectations. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “plan” and similar expressions are intended to identify forward-looking statements. Any forward-looking statements contained in this Form 10-K are based upon our historical performance and on our current plans, estimates and expectations. The inclusion of this or any forward-looking information

2

should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. Such forward-looking statements are subject to various risks, uncertainties and assumptions, including but not limited to global and domestic market and business conditions, our successful execution of business and growth strategies and regulatory factors relevant to our business, as well as assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include, but are not limited to, those described under “Risk Factors.” These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Form 10-K. We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

SUMMARY RISK FACTORS

Investing in our Class A common stock involves numerous risks, including the risks described in “Part I, Item 1A. Risk Factors” of this Annual Report. Below are some of these risks, any one of which could materially adversely affect our business, financial condition, results of operations, and prospects.

3

4

PART I

Item 1. Business.

Our Company

We are a leading multi-asset class private market solutions provider in the alternative asset management industry. Our mission is to provide our investors differentiated access to a broad set of investment solutions that address their diverse investment needs within private markets. We structure, manage and monitor portfolios of private market investments, which include specialized funds and customized separate accounts within primary investment funds, secondary investments, direct investments and co-investments, (collectively, “specialized investment vehicles”) across highly attractive asset classes and geographies in the middle and lower middle markets that generate superior risk-adjusted returns. Our existing portfolio of private solutions include Private Equity, Venture Capital, Impact Investing and Private Credit. Our deep industry relationships, differentiated investment access and structure, proprietary data analytics, and our portfolio monitoring and reporting capabilities provide our investors the ability to navigate the increasingly complex and difficult to access private markets investments.

Our revenue is composed almost entirely of recurring management and advisory fees, with the vast majority of fees earned on committed capital that is typically subject to ten to fifteen year lock up agreements. We have an attractive business model that is underpinned by highly recurring, diversified management and advisory fee revenues, and strong free cash flow. The nature of our solutions and the integral role that our solutions play in our investors’ investment decisions have translated into high revenue visibility and investor retention. As of December 31, 2022, we had FPAUM of $21.2 billion.

We are differentiated by the scale, depth, diversity and investment performance of our solutions, which are bolstered by the investment expertise of our investment team, our long-standing access to leading fund managers, our robust and constantly expanding data capabilities and our disciplined investment process. We market our solutions under well-established brands within the specialized markets in which we operate. These include RCP Advisors, Bonaccord Capital, and P10 Advisors, our Private Equity solutions; TrueBridge, our Venture Capital solution; Enhanced, our Impact Investing solution; and Five Points, Hark Capital, and WTI our Private Credit solutions (which Five Points also offers certain private equity solutions). We believe adding new asset class solutions will foster deeper manager relationships, enabling managers and portfolio companies alike to benefit from our offering and expect to expand within other asset classes and geographies through additional acquisitions and future planned organic growth by providing additional specialized investment vehicles within our existing investment asset class solutions. As of the date of this filing, we are pursuing additional acquisitions and are in discussions with certain target companies, however the Company does not currently have any agreements or commitments with respect to any acquisitions. Refer to “—Our Growth Strategy” for additional information.

Our success and growth have been driven by our long history of strong performance and our position in the private markets ecosystem. We believe our growing scale in the middle and lower-middle market provides us a competitive advantage with investors and fund managers. In addition, our senior investment professionals have developed strong and long-tenured relationships with leading middle and lower middle market private equity and venture capital firms, which we believe provides us with differentiated access to the relationship-driven middle and lower-middle market private equity and venture capital sectors. As we expand our offerings, our investors entrust us with additional capital, which strengthens our relationships with our fund managers, drives additional investment opportunities, sources more data, enables portfolio optimization and enhances returns, and in turn attracts new investors. We believe this powerful feedback process will continue to strengthen our position within the private markets ecosystem. In addition, our multi-asset class solutions are

5

highly synergistic, and coupled with our vast network of general partners and portfolio companies, drive cross-solution sourcing opportunities.

Our global investor base includes some of the world’s largest institutional investors, including pension funds, endowments, foundations, corporate pensions and financial institutions. In addition, we have a strong footprint within some of the most prominent family offices and high net worth individuals. We have a significant presence within the middle and lower middle-market private markets industry in North America, where the majority of our capital is currently being deployed as we leverage our differentiated solutions to serve our global investors.

As of December 31, 2022, we had 234 employees, including 107 investment professionals across 11 offices located in 9 states. Over 100 of our employees have an equity interest in P10, collectively owning approximately 63% of the Company on a fully-diluted basis as of December 31, 2022.

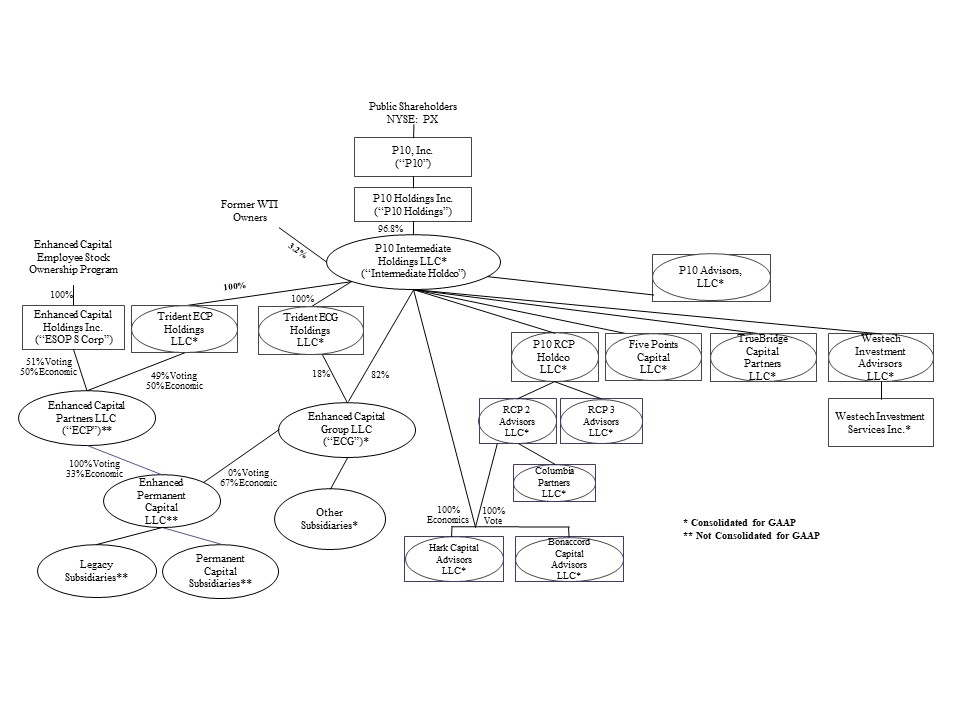

We managed $21.2 billion in FPAUM from which we earn management and advisory fees as of December 31, 2022. In addition, our FPAUM has grown at a CAGR of 17% from December 31, 2018 to December 31, 2022, determined on a pro

6

forma basis as if the acquisitions of Five Points, TrueBridge, Enhanced, Bonaccord, Hark, and WTI were completed as of January 1, 2018.

1. Organic FPAUM is calculated on a pro forma basis assuming the acquisitions of WTI, Five Points, TrueBridge, Enhanced, Bonaccord, and Hark were completed as of January 1, 2018.

2. Q4’22 organic FPAUM growth is the pro forma FPAUM growth from Q4’21 to Q4’22.

Note: “PF” refers to calculations made on a pro forma basis. “A” refers to calculations made on an actual basis.

Our Solutions

We operate and invest across private markets through a number of specialized investment solutions. We offer the following solutions to our investors:

Private Equity Solutions "PES"

Under PES, we make direct and indirect investments in middle and lower-middle market private equity across North America. PES also makes minority equity investments in a diversified portfolio of mid-sized managers across private equity, private credit, real estate and real assets. The PES investment team, which is comprised of 39 investment professionals with an average of 25+ years of experience, has deep and long-standing investor and fund manager relationships in the middle and lower-middle market which it has cultivated over the past 20 years, including over 1,900+ investors, 260+ fund managers, 490+ private market funds and 2,000+ portfolio companies. We have 48 active investment vehicles. PES occupies a differentiated position within the private markets ecosystem helping our investors access, perform due diligence, analyze and invest in what we believe are attractive middle and lower-middle market private equity opportunities. We are further differentiated by the scale, depth, diversity and accuracy of our constantly expanding proprietary private markets database

7

that contains comprehensive information on more than 5,000 investment firms, 9,000 funds, 38,000 individual transactions, 30,000 private companies and 250,000 financial metrics. As of December 31, 2022, PES managed $10.8 billion of FPAUM.

Venture Capital Solutions "VCS"

Under VCS, we make investments in venture capital funds across North America and specialize in targeting high-performing, access-constrained opportunities. The VCS investment team, which is comprised of 15 investment professionals with an average of 22+ years of experience, has deep and long-standing investor and fund manager relationships in the venture market which it has cultivated over the past 14+ years, including over 1,000+ investors, 65+ fund managers, 74 direct investments, 300+ private market funds and 8,000+ portfolio companies. We have 18 active investment vehicles. Our VCS solution is differentiated by our innovative strategic partnerships and our vantage point within the venture capital and technology ecosystems, maximizing advantages for our investors. In addition, since 2011, we have partnered with Forbes to publish the Midas List, a ranking of the top value-creating venture capitalists. As of December 31, 2022, VCS managed $5.4 billion of FPAUM.

Impact Investing Solutions "IIS"

Under IIS, we make equity, tax equity, and debt investments in impact initiatives across North America. IIS primarily targets investments in renewable energy development and historic building renovation projects, as well as providing capital to small businesses that are women or minority owned or operating in underserved communities. The IIS investment team, which is comprised of 15 investment professionals with an average of 22+ years of experience, has deep and long-standing relationships in the impact market which it has cultivated over the past 20 years, including deploying capital on behalf of over 100 investors. We currently have 32 active investment vehicles. We are differentiated in both the breadth of impact areas served, the type of capital deployed and the duration of our track record. We have collectively deployed over $3.3 billion into 850+ projects and businesses across 39 states since 1999. We have invested $2.6 billion in Impact Assets across our Small Business Lending, Impact Real Estate and Climate Finance Strategies. Investments in solar assets have generated over 1.6 billion KWh of renewable energy over the lifetime of the portfolio. As of December 31, 2022, IIS managed $1.9 billion of FPAUM.

Private Credit Solutions "PCS"

Under PCS, we primarily make debt investments across North America, targeting lower middle market companies owned by leading financial sponsors and also offer certain private equity solutions. PCS also provides loans to mid-life, growth equity, venture and other funds backed by the unrealized investments at the fund level and provide financing for companies that would otherwise require equity. The PCS investment team, which is comprised of 38 investment professionals with an average of 24+ years of experience, has deep and long-standing relationships in the private credit market which it has cultivated over the past 22 years, including 300+ investors across 12 active investment vehicles and 1,600+ portfolio companies with over $9.7 billion capital deployed. Our PCS is differentiated by our relationship-driven sourcing approach providing capital solutions for growth-oriented companies. We are further synergistically strengthened by our PES network of fund managers, characterized by more than 520 credit opportunities annually. We currently maintain 50+ active sponsor relationships and have 45+ platform investments. As of December 31, 2022, PCS managed $3.1 billion of FPAUM.

Our Vehicles

We have a flexible business model whereby our investors engage us across multiple specialized private market solutions through different specialized investment vehicles. Our vehicles have traditional, stable fee structures that generate performance fees, which are not accrued to P10 due to our structure. P10’s revenue associated with the funds are from the management fees while employees of P10 receive the performance fees directly from the vehicles. Our average annual fee rates remain stable at approximately 1%. We offer the following vehicles for our investors:

8

Primary Investment Funds

Primary investment funds refer to investment vehicles which target investments in new private markets funds, which in turn invest directly in portfolio companies. P10’s primary investment funds include both commingled investment vehicles with multiple investors, as well as our customized separate accounts, which typically include one investor. P10’s primary investments are made during a fundraising period in the form of capital commitments, which are called upon by the fund manager and utilized to finance its investments in portfolio companies during a predefined investment period. We receive a fee stream that is typically based on our investors’ committed, locked-in capital. Capital commitments typically average ten to fifteen years, though they may vary by fund and strategy. We offer primary investment funds across our private equity and venture capital solutions. Our primary funds comprise approximately $11.7 billion of our FPAUM as of December 31, 2022.

Direct and Co-Investment Funds

Direct and co-investments involve acquiring an equity interest in or making a loan to an operating company, project, property or asset, typically by co-investing alongside an investment by a fund manager or by investing directly in the underlying asset. P10’s direct and co-investment funds include both commingled investment vehicles with multiple investors as well as our customized separate accounts, which typically include one investor. Capital committed to direct investments and co-investments is typically invested immediately, thereby advancing the timing of expected returns on investment. We typically receive fees from investors based upon committed capital, with some funds receiving fees based on invested capital; capital commitments which typically average ten to fifteen years, though they may vary by fund. We offer direct and co-investment funds across our private equity, venture capital, impact investing and private credit solutions. Our direct investing platform comprises approximately $8.0 billion of our FPAUM as of December 31, 2022.

Secondaries

Secondaries refer to investments in existing private markets funds through the acquisition of an existing interest by one investor from another in a negotiated transaction. In so doing, the buyer agrees to take on future funding obligations in exchange for future returns and distributions. Because secondary investments are generally made when a primary investment fund is three to seven years into its investment period and has deployed a significant portion of its capital into portfolio companies, these investments are viewed as more mature. We typically receive fees from investors on committed capital for a decade, the typical life of the fund. We currently offer secondaries funds across our private equity solutions. Our secondary funds comprise approximately $1.5 billion of our FPAUM as of December 31, 2022.

Our Investors

9

We believe our comprehensive value proposition across our private market solutions, vehicles offering, data analytics, portfolio monitoring and reporting has enabled us to build strong relationships with our existing investors and to attract new high-quality investors. We leverage our differentiated approach to serve a broad set of investors across multiple geographies. As of December 31, 2022, we have a global investor base of over 3,100 investors, across 50 states, 59 countries and 6 continents – including some of the world’s largest pension funds, endowments, foundations, corporate pensions and financial institutions. In addition, we have a strong footprint within some of the most prominent family offices and high net worth individuals.

The following chart illustrates the diversification of our investor base as of December 31, 2022:

Our Distribution and Marketing

We continuously seek to strengthen and expand our relationships with our current and prospective investors. We have a dedicated team of business development and investor relations professionals who maintain an active and transparent dialogue with an expansive list of existing and prospective investors and while we have a significant presence in North America, we have cultivated relationships with a number of international investors

Our business development and investor relations professionals frequent dialogue with existing and prospective investors, enable us to monitor investor preferences and tailor future product offerings to meet investor demand. Prospective investors that wish to learn more about us often visit our offices to conduct in-depth due diligence of our firm. Our business development and investor relations professionals lead this process, coordinate meetings, and continue to be the prospective investor’s principal point of contact throughout their decision-making process. Our business development and investor relations professionals are also responsible for being the principal points of contact for our existing investors, and for our customized separate accounts, we work with each investor to design and implement a specific strategic plan in accordance with the investment guidelines agreed to by us and the investor.

10

Our Investment Performance

We believe our investment performance acts as a key retention mechanism for our existing investors and a primary attribute for prospective investors. We attribute our strong investment performance to several factors, including: our broad private market relationships and access, our diligent and responsible investment process, our tenured investing experience and our premier data capabilities. In concert, these factors enable us to purse attractive, risk-adjusted investment opportunities to meet our investors’ investment objectives.

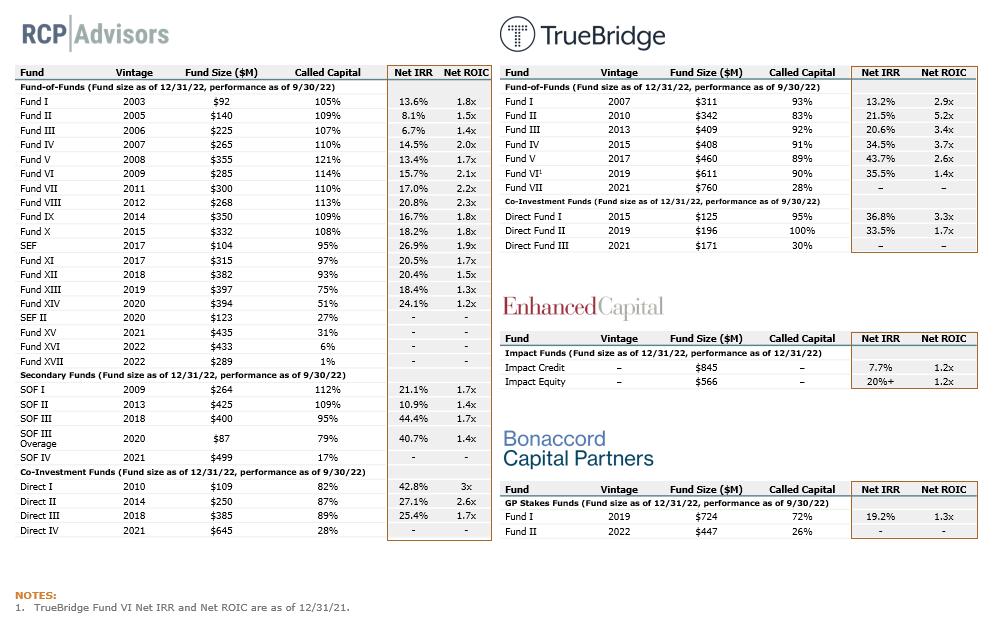

The following table displays our Fund size as of December 31, 2022 and investment performance, which is presented from the inception date of each fund through September 30, 2022:

11

For the purposes of the tables above:

When considering the data presented above, you should note that the historical results of our investments are not indicative of the future results you should expect from such investments, from any future funds we may raise or from your investment in our Class A common stock, in part because:

Net IRR reflects limited partner returns after allocation of management fees, general fund expenses, investment expenses, income earned on cash and cash equivalents, any carried interest to the general partner, and any other fees and expenses. Not all limited partners pay the same management fee or carried interest. Furthermore, limited partners’ IRRs may vary based on the dates of their admittance to the fund. There can be no assurance that unrealized investments will be realized at the valuations used to calculate the IRRs contained herein and additional fund expenses and investment related expenses to be incurred during the remainder of the fund’s term remain unknown and, therefore, are not factored into the calculations. Any anticipated carried interest reduces the net returns of unrealized investments. Calculations used herein which incorporate estimations of the net “unrealized value” of remaining investments represent valuation estimates made by the companies using the most recent valuation data provided by the general partners of the underlying funds. Such estimates are subject to numerous variables which change over time and therefore amounts actually realized in the future will vary (in some cases materially) from the estimated net “unrealized values” used in connection with calculations referenced herein.

Our History

P10’s mission is to be the premier private markets solutions provider focused on the middle and lower middle market. We provide global institutional investors differentiated access to a broad set of solutions and specialized investment vehicles across attractive asset classes and geographies generating competitive risk-adjusted returns. As of December 31, 2022, we

12

have $21.2 billion in fee paying assets under management. We offer a comprehensive set of investment strategies to clients, including both commingled funds and customized separate accounts within our primary investment funds, secondary, direct investment, co-investment vehicles, and advisory solutions. Since October 2017, we have been focused on building best-in-class solutions aimed at growing our fee paying assets under management. Prior to October 2017, the Company took strategic actions designed to lay the foundation for what is now known as P10.

The Company's history began with founding P10 Holdings as a Texas corporation in 1992 and reincorporating in Delaware in 2000. On November 19, 2016, P10 Holdings completed the sale of substantially all of its assets and liabilities and operations and became a non-operating company focused on monetizing our retained intellectual property and acquiring profitable businesses and our business primarily consisted of cash, certain retained intellectual property assets and our net operating losses and other tax benefits. In March 2017, P10 Holdings filed for re-organization under Chapter 11 of the Federal Bankruptcy Code, using a prepackaged plan of reorganization. In connection with the filing, P10 Holdings entered into a Restructuring Support Agreement with 210/P10 Investment LLC, as well as a Restructuring Support Agreement with the 2016 purchaser of our assets. P10 Holdings emerged from bankruptcy on May 3, 2017. A key feature of the Restructuring Support agreement included 210/P10 Investment LLC providing capital and management for the company post-bankruptcy.

Our entry into the alternative asset management industry originated with the acquisitions of RCP Advisors (RCP 2 and RCP 3). RCP Advisors was founded in 2001 and is a leading sponsor of private equity, funds-of-funds, secondary funds and co-investment funds. On October 5, 2017, we closed on the acquisition of RCP 2 and entered into a purchase agreement to acquire RCP 3 on January 2018. On January 3, 2018, we closed on the acquisition of RCP 3. RCP 2 and RCP 3 are registered investment advisors with the United States Securities and Exchange Commission.

On April 1, 2020, we completed the acquisition of Five Points Capital, Inc., a leading lower middle market alternative investment manager focused on providing equity and debt capital to private, growth-oriented companies and limited partner capital to other private equity funds. Five Points is focused exclusively in the U.S. lower middle market. Five Points is a registered investment advisor with the United States Securities and Exchange Commission.

On October 2, 2020, we completed the acquisition of TrueBridge, an investment firm focused on investing in venture capital through fund-of-funds, co-investments, and separate accounts. TrueBridge is a registered investment advisor with the United States Securities and Exchange Commission.

On December 14, 2020, the Company completed the acquisition of 100% of the equity interest in ECG, and a non-controlling interest in Enhanced Capital Partners, LLC (“ECP”, and collectively with ECG, “Enhanced”). Enhanced undertakes and manages equity and debt investments in impact initiatives across North America, targeting underserved areas and other socially responsible end markets including renewable energy, historic building renovations, and affordable housing. ECP is a registered investment advisor with the United States Securities and Exchange Commission.

On September 30, 2021, we completed the acquisitions of Hark Capital and Bonaccord Capital Partners. Hark provides loans to mid-life private equity, growth equity, venture and other funds. These loans are backed by the unrealized investments at the fund level and provide financing for companies that would otherwise require equity. Bonaccord acquires minority equity investments in a diversified portfolio of alternative markets asset managers with a focus on mid-sized managers across private equity, private credit and real assets.

During 2021, the Company began exploring the benefits of going public on a listed exchange and raising additional capital through an equity issuance. On October, 18, 2021, the Company announced an Initial Public Offering ("IPO") and corporate reorganization that would make P10 Holdings a wholly-owned subsidiary of P10, Inc. The IPO priced on October 20, 2021, and P10’s Class A common stock began trading on the NYSE on October 21, 2021 under the ticker “PX”. Investors purchased 23,000,000 Class A shares in conjunction with the IPO and the Company gained a top-tier set of institutional investors. The IPO process is described in more detail below.

In June 2022, the Company formed P10 Advisors, a fully consolidated subsidiary, to manage investment opportunities that are sourced across the P10 platform but do not fit within an existing investment mandate.

13

On October 13, 2022, the Company completed the acquisition of all of the issued and outstanding membership interests of WTI. WTI provides senior secured financing to early-stage and emerging stage life sciences and technology companies. WTI is a registered investment advisor with the United States Securities and Exchange Commission.

Simultaneously with the acquisition of WTI, the Company completed a restructuring of P10 Intermediate and subsidiaries to LLC entities that are considered disregarded entities for federal income tax purposes. This allowed the WTI sellers to obtain a partnership interest in P10 Intermediate and all of its subsidiaries. As a result of the acquisition, the WTI sellers obtained 3,916,666 membership units of P10 Intermediate, which can be exchanged into 3,916,666 shares of P10 class A common stock, following applicable restrictive periods.

The results of WTI’s operations have been included in the consolidated financial statements effective October 13, 2022. The Company reports noncontrolling interest related to the partnership interests which are owned by the WTI sellers. This is recorded as noncontrolling interest on the Consolidated Balance Sheets. Noncontrolling interest is allocated a share of income or loss in the respective consolidated subsidiaries in proportion to their relative ownership interest. Additionally, the Company makes periodic distributions to the WTI sellers for tax related and other agreed upon expenses as disclosed in the purchase agreement.

As we reflect on 2022, we are exceptionally proud of our accomplishments. We believe we have assembled a premier group of solutions that offer superior risk adjusted returns to global clients. We benefit from strong operating leverage driven by the quality and stability of our revenue base, the strong alignment we have with our respective investment teams, and the leveragability of our platform and back-office operations across our multiple solutions, which together allow us to generate strong contribution margins and free cash flow.

ORGANIZATIONAL STRUCTURE

We completed an offering in connection with our IPO and concurrent listing on the New York Stock Exchange. On October 21, 2021, we issued 11,500,000 shares of our Class A common stock to the purchasers in the offering and selling stockholders sold 8,500,000 shares of our Class A common stock. Pursuant to our issuance of Class A common stock, we received net proceeds of approximately $129.4 million after deducting underwriting discounts and commissions but before expenses based on the initial public offering price of $12.00 per share. On November 19, 2021, we announced that the underwriters of the public offering fully exercised their option to acquire an additional 3,000,000 shares of Class A common stock at the public offering price of $12 per share, less underwriting discounts and commissions. These shares were sold by certain stockholders of P10 and P10 did not receive any proceeds from the sale.

Simultaneously with the acquisition of WTI, the Company completed a restructuring of P10 Intermediate and subsidiaries to LLC entities that are considered disregarded entities for federal income tax purposes. This allowed the sellers to obtain a partnership interest in P10 Intermediate and all of its subsidiaries. As a result of the acquisition, the WTI sellers obtained 3,916,666 membership units of P10 Intermediate, which can be exchanged into 3,916,666 shares of P10 class A common stock, following applicable restrictive periods.

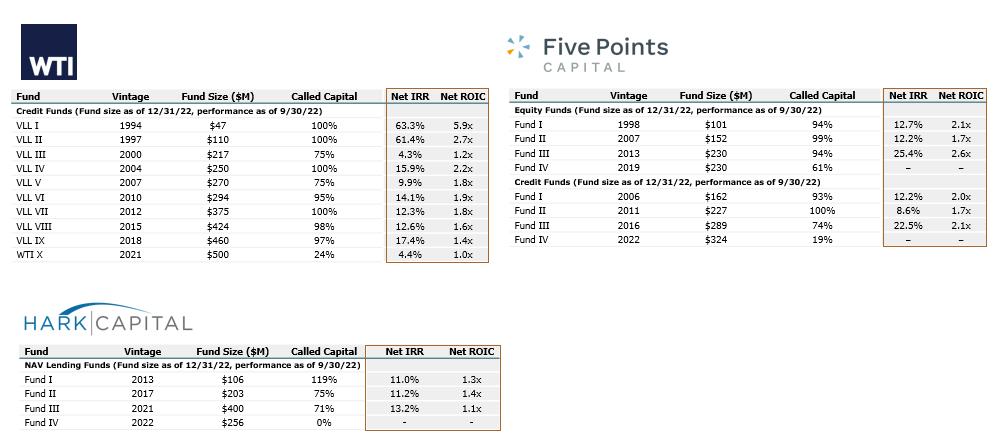

The diagram below illustrates our structure and does not include all unconsolidated entities in which we hold non-controlling equity method investments.

14

Our Class B Common Stock

We have 73,008,374 outstanding shares of Class B common stock held of record by 2,930 stockholders as of December 31, 2022. Each share of our Class B common stock entitles its holder to ten votes per share until a Sunset ("Sunset") becomes effective. A Sunset is triggered by any of the earlier of the following (a) the Sunset Holders cease to maintain direct or indirect beneficial ownership of 10% of the outstanding shares of Class A Common Stock (determined assuming all outstanding shares of Class B Common Stock have been converted into Class A Common Stock) (b) the Sunset Holders collectively cease to maintain direct or indirect beneficial ownership of at least 25% of the aggregate voting power of the outstanding shares of Common Stock and (c) upon the tenth anniversary of the effective date of our amended and restated certificate of incorporation. After a Sunset becomes effective, each share of Class B common stock will automatically convert into Class A common stock. In addition, each share of Class B common stock will automatically convert into Class A common stock upon any transfer except to certain permitted holders. See “—Voting Rights of Class A and Class B Common Stock.”

Because a Sunset may not take place for some time, it is expected that the Class B common stock will continue to entitle its holders to ten votes per share, and the Class B Holders will continue to exercise voting control over the Company, for the near future. The Class B Holders have approximately 95% of the combined voting power of our common stock.

Upon any transfer, Class B common stock converts automatically on a one-for-one basis to shares of Class A common stock, except in the case of transfers to certain permitted transferees. In addition, holders of Class B common stock may elect to convert shares of Class B common stock on a one-for-one basis into Class A common stock at any time.

15

Our current stockholders believe that the contributions of the current ownership group and management team have been critical in P10’s growth to date. We have a history of employee equity participation and believe that this practice has been instrumental in attracting and retaining a highly experienced team and will continue to be an important factor in maximizing long-term stockholder value. We believe that ensuring that our key decision-makers will continue to guide the direction of P10 results in a high degree of alignment with our stockholders, and that issuing to our continuing voting members the Class B common stock with ten votes per share will help maintain this continuity.

Our Class A Common Stock

The Class A common stock have one vote per share and share ratably with our Class B common stock in all distributions.

Stockholders Agreement and Registration Rights

P10, Inc. entered into a stockholders agreement (the “Stockholders Agreement”) with certain investors, including employees, pursuant to which the investors were granted piggyback and demand registration rights prior to the IPO.

NYSE Controlled Company Agreement

P10, Inc. entered into a controlled company agreement (the “Controlled Company Agreement”) on October 20, 2021, with principals of 210 Capital, L.L.C.(“210 Capital”) and certain of their affiliates (the “210 Group”), RCP Advisors and certain of their affiliates (the “RCP Group”) and TrueBridge and certain of their affiliates (the “TrueBridge Group”), granting each party certain board designation rights. So long as the 210 Group continues to collectively hold a combined voting power of (A) at least 10% of the shares of common stock outstanding immediately following the closing date of the IPO (the “Closing Date”), P10, Inc. shall include in its slate of nominees two (2) directors designated by the 210 Group and (B) less than 10% but at least 5% of the shares of common stock outstanding immediately following the Closing Date, one (1) director designated by the 210 Group. So long as the RCP Group and any of their permitted transferees who hold shares of common stock as of the applicable time continue to collectively hold a combined voting power of at least 5% of the shares of common stock outstanding immediately following the IPO, P10, Inc. shall include in its slate of nominees one (1) director designated by the RCP Stockholders. So long as TrueBridge and any of its permitted transferees who hold shares of common stock as of the applicable time continue to collectively hold a combined voting power of at least 5% of the shares of common stock outstanding immediately following the IPO, P10, Inc. shall include in its slate of nominees one (1) director designated by the TrueBridge Group.

The 210 Group, the RCP Group and TrueBridge Group have the right to designate two, one and one directors, respectively. In addition, the parties to our Controlled Company Agreement will agree to elect three directors who are not affiliated with any party to our Controlled Company Agreement and who satisfy the independence requirements applicable to audit committee members established pursuant to Rule 10A-3 under the Exchange Act. These board designation rights are subject to certain limitations and exceptions.

The Controlled Company Agreement provides that, without the prior written consent of P10, Inc., the 210 Group, the RCP Group and the TrueBridge Group will not, and will not publicly disclose an intention to, during the period commencing on the date of the Controlled Company Agreement and ending three years after the date thereof (the “Restricted Period”), (a) offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any shares of common stock beneficially owned (as such term is used in Rule 13d-3 of the Exchange Act) by the 210 Group, RCP Group or the TrueBridge Group or any other Equity Securities (as defined therein) or (b) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the Equity Securities, whether any such transaction described in clause (a) or (b) above is to be settled by delivery of shares of common stock or any such other securities, in cash or otherwise. One-third of the original holdings of Equity Securities of each of the 210 Group, RCP Group and TrueBridge Group will be released from the Lock-Up Restrictions, on the first, second and third anniversary of the consummation of the public offering (the “Lock-Up Restrictions Release”).

Company Lock-Up Agreements

16

Certain stockholders, including Messrs. Alpert, Webb and Souder, are subject to Lock-Up Restrictions pursuant to a separate agreement with us (the “Company Lock-Up Agreement”), which Lock-Up Restrictions shall be released in accordance with the Lock-Up Restrictions Release. Collectively, approximately 39.8% of our common stock outstanding are subject to such Lock-Up Restrictions pursuant to the Controlled Company Agreement and the Company Lock-Up Agreements.

Voting Rights of Class A and Class B Common Stock

Except as provided in our amended and restated certificate of incorporation or by applicable law, holders of Class A common stock and Class B common stock vote together as a single class. Each share of our Class A common stock will entitle its holder to one vote per share. Each share of our Class B common stock will entitle its holder to ten votes until a Sunset becomes effective. After a Sunset becomes effective, each share of Class B common stock will automatically convert into Class A common stock. In addition, each share of Class B common stock will automatically convert into Class A common stock upon any transfer except to certain permitted holders.

A “Sunset” is triggered by the earlier of the following: (a) the Sunset Holders cease to maintain direct or indirect beneficial ownership of 10% of the outstanding shares of Class A Common Stock (determined assuming all outstanding shares of Class B Common Stock have been converted into Class A Common Stock); (b) the Sunset Holders collectively cease to maintain direct or indirect beneficial ownership of at least 25% of the aggregate voting power of the outstanding shares of Common Stock; and (c) upon the tenth anniversary of the effective date of the amended and restated certificate of incorporation.

Our Class B common stockholders collectively hold approximately 95% of the combined voting power of our common stock.

Our Market Opportunity

We operate in the large and growing private markets industry, which we believe represents one of the most attractive segments within the broader asset management landscape. Specifically, we operate in the Private Equity, Venture Capital, Impact Investing and Private Credit markets, which we believe represent particularly attractive asset classes and puts us at the center of several favorable trends, including the following:

Accelerating Demand for Private Markets Solutions

We believe the composition of public markets is fundamentally shifting and will drive investment growth in private markets as fewer companies elect to become public corporations or return to being privately held. According to the 2021 Annual US PE Breakdown PitchBook Report, private equity capital raised has increased 376% from $63.3 billion to $301.3 billion from 2011 to 2021. The report states that elevated multiples in public markets mean many models are predicting significantly lower returns from public equities going forward, further reinforcing LPs’ shift to alternatives.

Furthermore, investors continue to increase their exposure to passive strategies in search of lower fee alternatives as relative returns in active public market strategies have compressed. We believe the continued move away from active public market strategies into passive strategies will support growth in private market solutions as investors seek higher risk-adjusted returns.

Attractive Historical Private Markets Growth

The private markets have exhibited robust growth. Since 2010, assets under management have grown by 3.1 times from $2.4 trillion in 2010 to $9.8 trillion in 2022, according to the 2022 McKinsey Report. While private markets saw record levels of fund-raising in 2021 and private markets in 2022 experienced a predictable pullback in their pace of growth, private markets have remained resilient, with about $3 trillion of dry powder available for deployment, a stable pool of locked-in capital, and an active market for secondaries, according to the 2022 McKinsey Report. From 2010 to 2020, the deal value in the lower middle markets has grown by 2.5 times, investments in venture capital have grown by 4.9 times and assets under

17

management of PRI Signatories in impact growth has grown by 4.9 times, according to the 2021 PitchBook Middle Market Report, the 2021 PwC Report, and the Bain & Company Reports, respectively. In addition, capital targeted in private credit has grown by 2.5 times from January 2016 to July 2021, according to the 2021 Preqin Report. This private credit growth maintained into 2022, with $172 billion raised in the first three quarters of 2022 which is 80% of last year’s record amount, according to the 2022 Preqin report. According to the 2021 PitchBook Private Fund Strategy Report, fundraising has continued to remain strong with nearly a trillion dollars of total capital raised in 2020. According to the 2020 McKinsey Report, global private markets are expected to continue their strong growth trajectory. According to a recent Preqin Ltd. forecast, global private markets assets under management are expected to grow at an approximate 10% CAGR through 2027. This growth is underpinned by investors search for yield in a lower-for-longer rate environment, in which investors increasingly view allocations to private markets as essential for obtaining diversified exposure to global growth.

Favorable Middle / Lower Middle Market Dynamics

As more companies choose to remain private, we believe smaller companies will continue to dominate market supply, with significantly less capital in pursuit. According to S&P Global Market Intelligence Report for 2022; S&P Capital IQ Estimates and PitchBook Data Inc., only $124 billion of capital is available to U.S. Private Equity Funds between $250 million and $1 billion, versus the $589 billion available to Private Equity funds over $1 billion. In contrast, there are only approximately 11,000 companies with revenues greater than $250 million, versus the more than 151,000 companies with revenues between $10 million and $250 million. We believe this favorable middle and lower-middle market dynamic implies a larger pool of opportunities at compelling purchase price valuations with significant return potential. P10 has robust and proprietary data collected over a twenty-year history that is difficult to replicate that allows investment teams to efficiently scope and dimension out middle and lower middle market private equity fund managers.

Increasing Private Markets Investor Allocations

18

We believe that alongside growth in the private markets in which we invest, long-term investor allocations are expected to significantly grow over the next several years, which will serve as a tailwind in growing our business. In a survey conducted by Preqin Ltd., 96% and 90% of long-term investors indicated that they were planning to maintain or increase their allocation to Private Equity and Private Credit, respectively. Additionally, according to the Global Impact Investing Network’s 2020 report 2020 Annual Impact Investor Survey, 64% of polled investors noted that they were expecting to increase their allocations to impact investing by more than 5%. Moreover, according to the Global Impact Investing Network 2022 report, the size of the impact investing market currently stands at $1.164 trillion in AUM – a significant psychological milestone for an industry still maturing and growing in sophistication. In combination with the broader growth in private markets we believe the increase in long-term investor allocations towards private market asset classes will further drive demand of private market solutions across the investor universe.

Democratization of Private Markets

According to a 2020 PwC Report, the growing wealth of high-net-worth and mass affluent individuals, and the shift in retirement savings from defined benefit to defined contribution plans, have propelled significant growth in the asset management industry over the last decade. At the same time, both high-net-worth and mass affluent investors continue to remain significantly under-allocated to the private markets in comparison with institutional investors.

As defined contribution plans in the United States continue to grow and become increasingly familiar with private markets, we believe defined contribution plans will be a significant driver of growth in private markets in the future. In addition, on June 3, 2020, the United States Department of Labor issued an information letter confirming that investments in private equity vehicles may be appropriate for 401(k) and other defined contribution plans as a component of the investment alternatives made available under these plans. These plans hold trillions of dollars of assets, and the guidance in the letter may help significantly expand the market for private equity investments over time.

Importance of Asset Class Access

The purview of private markets has meaningfully broadened over the last decade. As investors increase their allocations to private markets, we believe the demand for asset class diversification will rise. Furthermore, as part of this evolution we believe investors will seek out private market solutions providers with scale and an ability to deliver multiple asset classes and vehicle solutions to streamline relationships and pursue cost efficiency.

Proliferation of Private Market Choices

According to research and data from the SEC and Principles for Responsible Investment (PRI), from 2013 to 2021, the number of managers across private markets has increased dramatically. From 2013 to 2021, the number of Private Equity firms, Venture Capital firms, Impact Investing firms and Private Credit firms have more than doubled. We believe that the growing number of private markets focused fund managers increases the operational burden on investors and will lead to a greater reliance on highly trusted advisers to help investors navigate the complexity associated with multi-asset class manager selection.

Rise of ESG and Impact Investing in Private Markets

According to the PRI Annual Report, the total assets under management of PRI signatories, the cohort of asset managers that have committed to upholding ESG principles, a barometer for the ESG industry, has increased roughly five-fold since 2010, from $21 trillion to $121.3 trillion by March 31, 2022. According to the 2020 McKinsey Report, an ESG approach to private markets has been one of the most talked about developments of the past several years. According to the 2020 McKinsey Report, as public awareness of and activism relating to ESG driven investing have increased, many prominent investors in Private Equity have followed suit, often requiring general partners to pass an ESG screen as part of their diligence processes – demanding transparency into ESG policies, procedures and performance of portfolio assets. These trends have all held true as the McKinsey Report for the 2022 Annual Review of Private Market reemphasizes these movements. In response and in conjunction with regulatory influence, we believe the adoption of ESG and the growth of impact investing will continue to proliferate in private markets.

Investor Demand for Data, Analytics and Technology

19

We believe many investors do not have an adequate technology and data infrastructure to respond to increasingly complex demands for private market investments. As a result, we believe investors will seek to partner with firms that not only have a proven track record, but also offer tech-enabled non-investment functions, including GP-level reports, enhanced portfolio monitoring, customized performance benchmarking and associated compliance, administrative and tax capabilities. According to the 2022 Global Private Equity Survey by Ernst & Young, 26% of the private equity fund managers surveyed reported middle- and back-office process enhancement as one of their top three priorities to support growth in assets and to meet the needs of new investors. In the same report, 43% of investors surveyed believe investments in digital infrastructure would be beneficial or required to support investors’ needs.

Our Competitive Strengths

Specialized Multi-Asset Class Solutions and Comprehensive Vehicle Offering

We believe our specialized multi-asset class solutions offering, distinct market access and wide-ranging relationships continue to be key competitive differentiators for our investors. Our solutions across private equity, venture capital, impact investing and private credit, coupled with our vehicle offerings across primaries, secondaries, direct and co-investments, we believe, provide our investors with a comprehensive framework to successfully navigate and gain exposure to private markets. Our value proposition and solutions offering continue to position us well to compete and win new investor relationships and mandates.

Distinct Middle and Lower-Middle Market Expertise

We believe the private markets exhibit compelling investment opportunities with significant return potential. Our investment expertise in private markets, coupled with our scale, distinctly positions our business within the private markets ecosystem. Our investment talent across our different private market solutions is led by senior investment professionals with sustained track records of successful private markets investing. Our investment team consists of 107 investment professionals with deep industry expertise across middle and lower middle market private equity, venture capital, impact investing and private credit. Our leadership team has an average of over 22 years of experience and our investment professionals across the different solutions have a long track record of working together.

Differentiated Access to Middle and Lower Middle Market Private Equity and Venture Capital Firms

We believe our investors increasingly seek exposure to the middle and lower-middle markets private equity and venture capital firms but may not have the necessary tools to analyze, diligence and gain access to opportunities offered. Due to our scale and tenure within middle and lower-middle market private equity and venture capital, we have cultivated long-standing relationships with leading middle and lower-middle market private equity and venture capital general partners. We have established relationships with over 265 general partners, which provides us with differentiated access to investment opportunities within private markets, benefiting our investors.

Highly Diversified Investor Base with High Quality Institutions and Deep High-Net-Worth Channel

We believe we are a leading provider of private market solutions for a highly diverse global investor base. Our investors include some of the world’s largest and most prominent public pension funds, family offices, wealth managers, endowments, foundations, corporate pensions and financial institutions. We believe our multi-asset class solutions have allowed our investors to increase and expand allocations across our various solutions and vehicles, thereby deepening existing and new investor relationships. Our business is well-positioned to continue to service and grow our investor base with a team of professionals dedicated to investor relations and business development.

Premier Data Analytics with Proprietary Database

Our premier data and analytic capabilities, driven by our proprietary database, supports our robust and disciplined sourcing criteria, which fuels our highly selective investment process. Our database stores and organizes a universe of managers and opportunities with powerful tracking metrics that we believe drive optimal portfolio management and monitoring and enable a portfolio grading system as well as repository of investment evaluation scorecards. In particular, our

20

proprietary database offers our investors a highly transparent, versatile and informative platform through which they can track, monitor and diligence portfolios, and we believe the expansive data set within our proprietary database, harvested from our robust network of general partners, enables us to make more informed investment decisions and, in turn, drive strong investment performance. As of December 31, 2022, our database contains comprehensive information on more than 4,900 investment firms, 9,800 funds, 44,000 individual transactions, 29,000 private companies and 276,000 financial metrics.

Strong Investment Performance Track Record

We believe our investment performance track record is a key differentiator for our business relative to our competitors and acts as a key retention mechanism for our investors and selling tool for prospective investors. We attribute our strong investment performance track record to several factors, including: our broad private market relationships and access, our diligent and responsible investment process, our tenured investing experience and our premier data capabilities. In concert, these factors enable us to pursue attractive, risk-adjusted investment opportunities to meet our investors’ investment objectives.

Attractive, Recurring Fee-based Financial Profile

We believe our financial profile and revenue model have the following important attributes:

Highly Predictable Fee-based Revenue Model

Virtually all of our revenue is derived from management and advisory fees based on committed capital typically subject to multi-year commitment periods, usually between ten and fifteen years. As a result, we believe our revenue stream is contractual and highly predictable. The weighted average duration of remaining capital under management is 6.1 years as of December 31, 2022.

Well Diversified Revenue and Investor Base

As of December 31, 2022, we had 118 revenue generating vehicles across our solutions with over 3,100 investors across public pensions, family offices, wealth managers, endowments, foundations, corporate pension and financial institutions, across 50 states, 59 countries and 6 continents. We therefore believe our business model is highly diversified across both revenue and investor bases.

Attractive Profitability Profile and Operating Margin

We believe our scaled business model, differentiated solutions across middle and lower-middle markets as well as an efficient back-office model has allowed us to achieve a highly competitive profitability profile and operating margin.

Exceptional Management and Investing Teams with Proven M&A Track Records

Our biggest asset is our people and we therefore focus on recruiting, nurturing and retaining top talent, all of whom are proven leaders in their respective field. Our management team has a successful track record of sourcing and executing mergers and acquisitions and is supported by a deep bench of talent consisting of 107 investment professionals.

Ownership Structure Aligned with Investors

The alignment between our stockholders, investors and investment professionals is one of our core tenets and is, we believe, imperative for value creation. Our revenue is comprised almost entirely of recurring management and advisory fees is earned largely on committed capital, which is typically subject to ten to fifteen year lock up agreements. We believe this offers our investors an attractive, highly predictable revenue stream. Furthermore, we have structured carried interest to stay with investment professionals to maximize economic incentive for investment professionals to outperform on behalf of investors. Ultimately, we believe FPAUM follows investment performance and the more aligned our investment professionals are to the performance of investor capital, the better our company performance will be. Over 100 of our

21

employees have an equity interest in us, collectively owning approximately 63% of the Company on a fully diluted basis as of December 31, 2022. In addition, our employees have committed separately to our investment vehicles as of December 31, 2022, as part of our General Partner commitment, which is typically 1% of total commitments of each fund.

22

Our Growth Strategy

We aim to utilize our differentiated positioning and our core principles and values to continue to grow and expand our business. Our growth strategy includes the following key elements:

Maximize Investor Relationships

Enhance Existing Investor Mandates

We believe our current investor base presents a large opportunity for growth as we continue to expand our broad set of solutions and vehicles. As existing and prospective investors reduce the number of managers with whom they work across asset classes, we believe there are significant opportunities to have investors invest with a consistent, single-source multi-asset class private market solutions provider, positioning us to be a platform of choice. As such, our comprehensive solutions, we believe, will lend itself well to compelling cross-selling opportunities with existing investors. Furthermore, as our investors continue to grow their asset bases and expand utilization of our solutions and vehicles, the number of touchpoints with our investors will broaden, deepening our investor relationships even further.

Capture New Investors and Allocations to Private Markets

We believe we are well positioned to capitalize on the growth in private markets and capture additional investors and market share through our differentiated middle and lower-middle market sourcing capabilities, our attractive multi-asset class solutions and vehicles, and our strong investment performance track record. Our long-standing, established relationships across our broad set of solutions provide us extensive access to fund managers and investment opportunities across these asset classes and we remain highly committed to leveraging our best practices from serving our existing investors to similarly situated prospective investors that may benefit from our experience and broad set of private market solutions.

Expand Distribution Channels

We believe we are well positioned in some of the most sought-after segments of the private markets and we believe our differentiated private market solutions will continue to attract both new institutional and private wealth investors. In particular, investible assets of high-net-worth individuals are expected to increase significantly and compared to institutional investors, high-net-worth individuals tend to have lower private market allocations. Our investment platform is designed to

23

provide high-net-worth investors access to private markets and we currently serve over 1,820 high-net-worth investors, which we believe positions us well to continue to capture increasing demand from private wealth investors.

Expand Asset Class Solutions, Broaden Geographic Reach and Grow Private Markets Network Effect

Expand Asset Class Solutions

Our scalable business model is well positioned to expand our multi-asset class offering and we have the capacity and desire to explore adjacent asset classes, broaden our private market solutions capabilities and diversify our business mix. For example, our business development team actively explores the launch of new specialized investment vehicles across both our Venture Capital and Impact Investing solutions to meet increasing investor demand to access middle and lower-middle market venture capital as well as to gain exposure to impact investing trends in private markets. By doing so, we believe we will be able to grow our footprint, continue to develop our position within the private markets ecosystem and further leverage our synergistic solutions offering with additional manager relationships and sourcing opportunities.

Broaden Geographic Reach

We have a significant presence in North America – where a majority of our capital is currently being deployed. We believe expanding our presence in Europe and Asia can be a significant growth driver for our business as investors continue to seek a geographically diverse private market exposure. We believe our global investor base will facilitate such potential market penetration and our robust investment process, existing relationships and proven investment capabilities will continue to be core tenets of an international growth strategy.

Grow Private Markets Network Effect

Expanding into additional asset class solutions will enable us to further enhance our integrated network effect across private markets. We believe adding new asset class solutions will foster deeper manager relationships, enabling managers and portfolio companies alike to benefit from our offerings. As an example, our PCS solution is able to capitalize on the sourcing advantages presented by PES’s expansive network of GPs and portfolio companies. Similarly, a portfolio company held by a manager in our PES solution may benefit directly from our IIS solution.

Leverage Data Capabilities

Our proprietary database provides access to valuable data and analytical tools that are the foundation of our investing process. We believe our experience and insights will be increasingly impactful to the decision making processes of our investment team and our investors. Moreover, we believe our differentiated data capabilities allow us to further support the private markets activities of our investors, enhance our investors experience and drive new innovative solutions.

Selectively Pursue Strategic Acquisitions and Relationships

We focus on growing organically but may complement our growth with selective strategic acquisition opportunities that expand our footprint, broaden our investor base, and further strengthen our solutions offering. Specifically, we target opportunities with a market leading differentiated platform, an established and committed investor base, strong margins with operating leverage, management and advisory fee-based revenue, strong investment performance and a proven management team. Our leadership team has a proven track record of identifying, acquiring and integrating companies to drive long-term value creation, and we will continue to maintain a highly disciplined approach to pursuing accretive acquisitions. In September 2021, Enhanced entered into a strategic relationship with Crossroads, parent company of CPF, to promote impact credit. See “Related Party Transactions—Strategic Relationship with Crossroads Systems, Inc.” On September 30, 2021, P10 Holdings closed on the purchases of Hark and Bonaccord from the global investment company and asset manager Aberdeen Capital Management LLC and certain related parties. The Bonaccord APA provided for the acquisition of certain assets related to the business of acquiring minority equity interests in alternative asset management companies focused on private market strategies which may include private equity, private credit, real estate and real assets strategies, for total consideration of approximately $56 million. In addition, the Bonaccord APA provides for potential earn-out payments of up to $20 million, during the 72-month period beginning on October 1, 2021, subject to the satisfaction of certain terms and conditions. The

24

Hark APA provided for the acquisition of certain assets related to the business of making loans to portfolio companies that are owned or controlled by financial sponsors, such as private equity funds or venture capital funds, and which do not meet traditional direct lending underwriting criteria, but where the repayment of the loan by the portfolio company is guaranteed by its financial sponsor, for a purchase price of approximately $5 million. In addition, the Hark APA provides for potential earn-out payments of up to $5.4 million, during the 60-month period beginning on October 1, 2021, subject to the satisfaction of certain terms and conditions. We believe these acquisitions further strengthened our position as a premier private markets solutions provider and added approximately $900 million in FPAUM. The aggregate purchase price was paid using existing cash on balance sheet plus an additional draw on our credit facility of $35 million, plus potential future cash earn-outs based upon operating performance. Consistent with this strategy, we continue to evaluate ongoing opportunities, some of which may be significant. In October 2022, we acquired all of the outstanding membership interests of WTI through its subsidiary for total consideration of $105.2 million and an aggregate of 3,916,666 membership units of P10 Intermediate Holdings, LLC, which can be exchanged into 3,916,666 shares of P10 class A common stock, following applicable restrictive periods. Further, the purchase agreement includes additional earnout milestones as EBITDA grows, with a total of $70 million available in earnout payments, in the form of cash or shares of P10 common stock, if EBITDA builds to $25 million and if the eligible employees are still employed by the Company.

As a pioneer in venture debt, WTI has deployed $7.8 billion in loan commitments across more than 1,400 venture-backed companies since its founding in 1980. Many leading publicly traded technology companies, representing over $1 trillion in aggregate market capitalization, count WTI as an early lender and partner. Adding WTI to our solutions portfolio strengthens our market position by adding a strategy capable of delivering growth, and good fund performance, in various market cycles. Consistent with this strategy, we continue to evaluate ongoing opportunities, some of which may be significant.

Our Investment Process

We maintain rigorous investment, monitoring and risk management processes across each of our specialized private market solutions, all unified by a common philosophy and a focus on comprehensive analysis of fund managers and/or portfolio companies.

We believe our investment performance is attributable to a number of factors, including most notably our seasoned, dedicated investment teams and our methodical approach to investing that help us consistently source and analyze opportunities effectively. Our investment professionals are responsible for sourcing, selecting, evaluating, underwriting, diligencing, negotiating, executing, managing and exiting our investments. In addition, our investment professionals regularly develop new investor relationships and networks of industry insiders to proactively source new investments. Our ability to access top-tier, capacity constrained fund managers through a proactive and systematic sourcing process we believe is a significant differentiating factor for our investors.

Our investment committee members across our solutions have significant private markets experience and fully participate in the diligence process, which ensures consistent application of investment strategy, process, diversification and portfolio construction. In addition, the investment committees of our respective solutions review and evaluate investment opportunities through a comprehensive framework that includes both a qualitative and a quantitative assessment of the key risks of investments.

The details of our investment process are outlined below:

25

Opportunities Tracked