0001841925True2023FY00018419252023-01-012023-12-3100018419252023-06-30iso4217:USD0001841925us-gaap:CommonClassAMember2024-02-26xbrli:shares0001841925indi:CommonClassVMember2024-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________________

FORM 10-K/A

__________________________________________________________________

(Mark One) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ______________

Commission file number 001-40481

__________________________________________________________________

INDIE SEMICONDUCTOR, INC.

__________________________________________________________________

(Exact name of registrant as specified in its charter) | | | | | |

Delaware | 88-1735159 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

32 Journey Aliso Viejo, California | 92656 |

(Address of Principal Executive Offices) | (Zip Code) |

(949) 608-0854

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on

which registered |

| Class A common stock, par value $0.0001 per share | | INDI | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the Registrant on June 30, 2023, based on the closing price of $9.40 for shares of the Registrant’s Class A common stock as reported by the Nasdaq Stock Market LLC, was approximately $1.3 billion. Shares of common stock beneficially owned by each executive officer, director, and holder of more than 10% of our common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the registrant’s Class A and Class V common stock as of February 26, 2024, was 164,524,940 (excluding 1,725,000 Class A shares held in escrow and 52,127 Class A shares subject to restricted stock awards) and 18,694,328, respectively.

DOCUMENTS INCORPORATED BY REFERENCE

None.

| | | | | | | | | | | | | | | | | | | | | | | |

| Auditor Firm ID: | 185 | | Auditor Name: | KPMG LLP | | Auditor Location: | Irvine, CA |

TABLE OF CONTENTS

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (“Amendment No. 1”) amends the Annual Report on Form 10-K of indie Semiconductor, Inc. (the “Company,” “we,” “our” or “us”) for the fiscal year ended December 31, 2023 as filed with the Securities and Exchange Commission (the “SEC”) on February 29, 2024 (the “Original Report”). The Company is filing Amendment No. 1 to include the information required by Part III (Items 10, 11, 12, 13 and 14) of Form 10-K. This information was previously omitted from the Original Report in reliance on General Instruction G(3) to the Annual Report on Form 10-K, which permits the above-referenced Items to be incorporated in the Original Report by reference from a definitive proxy statement filed no later than 120 days after December 31, 2023. The reference on the cover page of the Original Report to the incorporation by reference to portions of our definitive proxy statement into Part III of the Original Report has been deleted. This Amendment No. 1 amends and restates in their entirety Items 10 through 14 of the Original Report.

As required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), new certificates of our chief executive officer and chief financial officer required by Rule 13a-14(a) under the Exchange Act are being filed as exhibits to this Amendment No. 1. We are amending Item 15 of Part IV of the Original Report to reflect the inclusion of these certifications. We are also amending Item 15 of Part IV to correct certain hyperlinks that were incorrect in the Original Report.

Except as otherwise expressly noted herein, this Amendment No. 1 does not amend, modify or update any other information set forth in the Original Report. Furthermore, this Amendment No. 1 does not change any previously reported financial results, nor does it reflect events occurring after the filing date of the Original Report. Information not affected by this Amendment No. 1 remains unchanged and reflects the disclosures made at the time the Original Report was filed. Accordingly, this Amendment No. 1 should be read in conjunction with the Original Report and our other filings with the SEC. Certain capitalized terms used and not otherwise defined in this Amendment No. 1 have the meanings given to them in the Annual Report.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The following table and biographical descriptions provide information regarding our executive officers and directors as of the date of this Amendment No. 1.

| | | | | | | | | | | | | | |

Name | | Age | | Position |

Donald McClymont | | 55 | | Chief Executive Officer and Director |

Ichiro Aoki | | 59 | | President and Director |

Thomas Schiller | | 53 | | Chief Financial Officer & Executive Vice President of Strategy |

Kanwardev Raja Singh Bal | | 48 | | Chief Accounting Officer |

Steven Machuga * | | 59 | | Chief Operating Officer |

David Aldrich | | 67 | | Director |

Diane Biagianti | | 61 | | Director |

Diane Brink | | 65 | | Director |

Peter Kight | | 67 | | Director |

Karl-Thomas Neumann | | 62 | | Director |

Jeffrey Owens | | 69 | | Director |

Sonalee Parekh | | 50 | | Director |

* Mr. Machuga retired as Chief Operating Officer effective June 30, 2023.

Directors

Our Board of Directors (“Board”) is divided into three classes, each serving staggered, three-year terms:

•our Class I directors are Ichiro Aoki, Jeffrey Owens, and Sonalee Parekh, and their current terms expire at the 2025 Annual Meeting of Stockholders;

•our Class II directors are Diane Biagianti, Diane Brink and Karl-Thomas Neumann and their current terms expire at the 2026 Annual Meeting of Stockholders; and

•our Class III directors are David Aldrich, Peter Kight and Donald McClymont and their current terms expire at the 2024 Annual Meeting of Stockholders.

Selected biographical information for each of our directors, including their principal occupation and employment and period of service as a director of indie, as well as information regarding the specific experience, qualifications, attributes or skills that led to the conclusion that each director listed below should serve as a member of the Board, are set forth below.

Class I Directors

Ichiro Aoki serves as indie’s President and as a member of the Board of Directors. He works closely with indie’s executive team and Board to create, update and manage execution of indie’s strategies and technical roadmaps. Prior to co-founding indie in 2007, Dr. Aoki was a co-founder, Board Member and Chief Architect of Axiom Microdevices, which was subsequently sold to Skyworks Solutions. Previously, Dr. Aoki founded and served as co-CEO of PST Eletronica Ltd. in Brazil, which was later sold to Stoneridge, Inc. Dr. Aoki has developed 35 patents worldwide and has authored numerous IEEE papers, two of them having over 400 citations. He is fluent in Japanese, Portuguese and English. Dr. Aoki holds a Ph.D. and Masters in Electrical Engineering from the California Institute of Technology and a Bachelor of Science in Electrical Engineering from the University of Campinas, Sao Paulo, Brazil. He serves as a California Institute of Technology Electrical Engineering Advisory Council Member and is also a Scientific Advisory Board Member with the California Institute of Technology Space-based Solar Power Project. Dr. Aoki’s extensive knowledge of technology and indie’s products qualifies him for membership on our Board.

Jeffrey Owens has been our director since June 2021 and is a retired automotive technology executive. He served as Executive Vice President and CTO of Delphi Automotive PLC, until his retirement in 2017. During his over 40-year career at Delphi, Mr. Owens served in a variety of technology, engineering and operating leadership roles, including as President of Delphi’s Electronics and Safety Division and President of Delphi Asia Pacific. Mr. Owens also has served as a director of Rogers Corporation (NYSE: ROU) since 2017 and previously served a director of Cypress Semiconductor Corporation from 2017 to 2020. Mr. Owens serves on the Board of Trustees for Kettering University, including as past Chairman. Mr. Owens received a Master’s in Business Administration from Ball State University and a Bachelor’s Degree in Mechanical/Electrical Engineering from Kettering University. He has also completed the Global Executive Program from Duke’s Fuqua School of Business and a Corporate Governance Program from Northwestern’s Kellogg School of Management. Mr. Owens brings to the Board deep experience as a technology and operating executive of a global automotive technology company, which qualifies him for membership on our Board.

Sonalee Parekh has been our director since June 2021 has served since May 2022 as Chief Financial Officer of RingCentral, Inc. (NYSE: RNG), a provider of business cloud communications and contact center solutions. From September 2019 to April 2022, Ms. Parekh served as the Senior Vice President of Corporate Development and Investor Relations at Hewlett Packard Enterprise (“HPE”), a Fortune 500 technology company with approximately $30 billion in revenues. As Senior Vice President. of Corporate Development, Ms. Parekh was responsible for corporate strategy, mergers and acquisitions, strategic investments, business integration and performance management. In her role as Senior Vice President of Investor Relations, Ms. Parekh worked directly with many of the world’s largest institutional investors and asset managers and led HPE’s quarterly earnings process and socially responsible investing strategy. Prior to HPE, Ms. Parekh held senior leadership roles at several global investment banks, including Goldman Sachs, Barclays Capital and Jefferies International. From July 2016 to April 2019, Ms. Parekh was a Managing Director at Jefferies International, and from July 2014 to July 2016 she was an Executive Director at the Royal Bank of Canada. She currently serves as a board advisor to Bidstack Group. Ms. Parekh earned a Bachelor of Commerce from McGill University and holds a Chartered Accountancy designation and is an alumna of PricewaterhouseCoopers. Ms. Parekh’s experience with operations, management and strategic planning for large global organizations qualifies her for membership on our Board.

Class II Directors

Diane Biagianti has been our director since April 2022 and serves as senior vice president, governance of Glaukos Corporation (NYSE:GKOS), a publicly-traded medical technology and pharmaceutical company since August 2023. She previously served as senior vice president, general counsel of Glaukos from June 2020 to August 2023. From May 2011 to May 2020, Ms. Biagianti was Chief Responsibility Officer for Edwards Lifesciences, a global leader in patient-focused medical innovations for structural heart disease and critical care and surgical monitoring, where she was responsible for global ethics and compliance, corporate sustainability and information security. From 2009 to 2011, she served as division vice president, legal section head, upon Abbott Laboratories’ acquisition of Advanced Medical Optics, and from 2002 to 2009, she served in various leadership positions at Advanced Medical Optics, including senior vice president and general counsel. From 1997 to 2002, she served as vice president and assistant general counsel for Experian Information Solutions, Inc. She has also worked as a labor and

employment attorney for O’Melveny & Myers LLP and a senior accountant for M.J. Seby & Associates, Ltd., CPAs. Ms. Biagianti earned a juris doctorate from Cornell University and a bachelor’s degree in business administration from the University of Arizona. Ms. Biagianti’s legal and senior management experience with public technology companies qualifies her for membership on our Board.

Diane Brink has been our director since June 2021 and is currently an Independent Director for Belden Inc. (NYSE: BDC), where she chairs both the Nominating and Corporate Governance Committee and the Cybersecurity Committee. Ms. Brink also serves as an independent director for Altus Power, Inc. (NYSE: AMPS), a developer, owner and operator of commercial-scale solar facilities, where she is chair of the Compensation Committee and a member of the Audit Committee. Ms. Brink is also a Senior Fellow and Adjunct Professor at the Kellogg School of Management, Northwestern University. Ms. Brink retired from IBM in February 2015 after a successful 35-year career. She served as IBM’s Chief Marketing Officer for Global Technology Services from September 2008 to January 2015. Her market-centric approach led to the redesign of the legacy infrastructure services business to a cloud-based, analytics driven services model, establishing market leadership in cloud computing, security, resiliency, and mobility. Ms. Brink has held a variety of senior leadership positions, including leading World Wide Integrated Marketing Communications, managing, promoting and generating demand for the IBM brand. Her leadership in advancing the digital transformation of IBM through digital marketing, social media and e-commerce enabled new revenue sources, new methods of client engagement, and new approaches to sales and marketing. She was Vice President of Marketing and Strategy for IBM Americas, Vice President of Distribution Channels Management, Systems Group and General Manager, IBM Middle Markets, Midwest. In addition to her public company board roles, she has board experience with nonprofit industry institutions including the Association of National Advertisers, the Advanced Energy Research & Technology Center, and the Iona Preparatory School. Ms. Brink currently serves on the Dean’s Council for the College of Engineering & Applied Sciences at Stony Brook University. She is a Governance Fellow with the National Association of Corporate Directors. Ms. Brink holds an MBA in Finance from Fordham University and a BS in Computer Science from Stony Brook University. Ms. Brink’s extensive experience leading, advising and managing public companies qualifies her for membership on our Board.

Karl-Thomas Neumann has been our director since June 2021 and has been the CEO and Founder of KTN Investment and Consulting since March 2018. From April 2018 to June 2019, he held a management position at Canoo Inc., an electric vehicles company, where his responsibilities included technology and marketing. From March 2013 to March 2018 he was Executive Vice President & President Europe for General Motors Company, where he was also a member of the GM Executive Committee. Dr. Neumann was previously with Volkswagen AG, where he was CEO and Vice President of Volkswagen Group China in Beijing from September 2010 to August 2012. Prior to that he held a number of management positions at Volkswagen, beginning in 1999 as Head of Research and Director of Electronics Strategy. From 2004 to 2009, Dr. Neumann was a member of the Executive Board at German automotive supplier Continental AG, responsible for the Automotive Systems Division. From August 2008 to September 2009, he was Chairman of the Executive Board of Continental AG. In December 2009, he returned to Volkswagen AG and took over company-wide responsibility for electric propulsion. Since March 2019, he has served as a member of the board of directors of South Korea based Hyundai-Mobis where he serves on the audit committee, the compensation committee and the nominating and corporate governance committee. Dr. Karl-Thomas Neumann holds a Ph.D. in Microelectronics from the University of Duisburg, Germany, as well as a diploma in Electrical Engineering from the University of Dortmund, Germany. He began his professional career at the Fraunhofer Institute as a research engineer before moving to Motorola Semiconductor, where he worked as an engineer and strategy director responsible for the automobile industry. Dr. Neumann’s deep experience with tech and automotive companies and strategic and operational insights qualify him for service on our Board.

Class III Directors

David Aldrich has been our Chairman since June 2021 and was Chairman of the Board of Skyworks Solutions, Inc., a position he held between 2014 and 2018. Mr. Aldrich also served as Executive Chairman of Skyworks from May 2016 to May 2018. Prior to his appointment as Executive Chairman, Mr. Aldrich had served as Chief Executive Officer of Skyworks since its formation in 2002 via a merger between Alpha Industries and Conexant Systems’ wireless business. Before the creation of Skyworks, he served as President and CEO of Alpha Industries, a position he held since April 2000. He joined Alpha Industries in 1995 as Vice President and Chief Financial Officer and held various management positions in the ensuing years, including President and Chief Operating Officer. Prior to this, he held senior management positions at Adams-Russell and M/A-COM. Mr. Aldrich received a Bachelor of Arts in Political Science from Providence College and a Master’s in Business Administration from the University of Rhode Island. In 2004, he was named Ernst & Young New England Entrepreneur of the Year in the Semiconductor category. In 2014, he was named CEO of the Year by the Massachusetts Technology Leadership Council. In addition, Mr. Aldrich is a board member of Belden (NYSE: BDC), a publicly traded provider of end-to-end signal transmission solutions. He also serves as a board member of Allegro Microsystems, Inc. (Nasdaq: ALGM), a sensing and power semiconductor technology company and Mobix Laboratories, Inc. (MOBX), a global connectivity solutions provider for mmWave 5G and high bandwidth cable networks. From 2017 until its acquisition by Cisco Systems, Inc. in 2021, Mr. Aldrich served as a member of the board of directors of Acacia Communications, Inc., a publicly traded optical networking strategy and technology company. Mr. Aldrich’s leadership and management experience as well as his service on boards of directors of public companies qualify him for membership on our Board.

Peter J. Kight has been our director since June 2021 and served as senior special advisor to Thunder Bridge II. Since 2020, he has been a senior special advisor of Thunder Bridge Capital Partners III Inc. From 2018 to 2019, he was a director of Thunder Bridge Acquisition, Ltd. (Nasdaq: TBRG), a blank check company which in July 2019 consummated its initial business combination with Hawk Parent Holdings, LLC, or Repay, an omnichannel payments technology provider; upon such consummation, Mr. Kight remained with the combined company, Repay Holdings Corporation (Nasdaq: RPAY) as chairman of the board of directors. Previously, he was the founder, chairman and CEO of CheckFree (Nasdaq: CKFR), a provider of financial services technology, from 1981 until it was acquired by Fiserv (Nasdaq: FISV) in 2007. He also served as director and vice chairman (2007 to 2010) of Fiserv until 2012. Prior to CheckFree, Mr. Kight was co-chairman, managing partner and senior advisor at Comvest Partners. Since May 2019, he is a board member of Bill.com Holdings, Inc. (NYSE: BILL), a provider of software that digitizes and automates back-office financial operations. Mr. Kight previously served on the boards of directors of Blackbaud (Nasdaq: BLKB), a supplier of software and services specifically designed for nonprofit organizations, from 2014 to 2020, Huntington Bancshares Incorporated (Nasdaq: HBAN), a regional bank holding company, from 2012 to 2020, Akamai Technologies, Inc. (Nasdaq: AKAM), distributor of computing solutions and services, from 2004 to 2012, and Manhattan Associates, Inc., (Nasdaq: MANH) a provider of supply chain planning and execution solutions, from 2007 to 2011. Mr. Kight holds more than a dozen patents and publications for electronic banking and payment systems. Mr. Kight’s technical knowledge and extensive experience managing and advising developing and growing companies and experience with public companies qualify him for membership on our Board.

Donald McClymont serves as indie’s Chief Executive Officer and is responsible for formulating our strategic vision, ensuring execution of business plans and creating shareholder value. Mr. McClymont also serves on indie’s Board of Directors. Prior to co-founding indie in 2007, he was Vice President of Marketing at Axiom Microdevices, tasked with driving company strategy, developing sales engagements and building key industry partnerships. Prior to Axiom, he was a Product Line Director at Skyworks Solutions/Conexant and a Marketing Manager at Fujitsu. Previously, he was with Thesys (now X-FAB/Melexis), and Wolfson (now Cirrus Logic), as a design engineer. Mr. McClymont holds five patents worldwide and earned a Masters in Engineering Electronics and Electrical from the University of Glasgow. Mr. McClymont’s technical knowledge and his unique understanding of indie Semiconductor’s technology and operations qualify him for membership on our Board.

Executive Officers

Please see “Part I., Item 1. Business, Information About Our Executive Officers” in the Original Report for information regarding our executive officers.

Code of Ethics

We have adopted a Code of Ethics that applies to our principal officers, including our Chief Executive Officer, Chief Financial Officer, controller and other persons performing similar functions. The full text of our Code of Ethics is available on our website at investors.indiesemi.com under “Governance.” Our Code of Ethics is a “code of ethics” as defined in Item 406(b) of Regulation S-K. We will make any legally required disclosures regarding amendments to, or waivers of, provisions of our Code of Ethics on our website.

Audit Committee

The Board has a standing Audit Committee, which currently consists of three directors. The current members of the Audit Committee are David Aldrich, Jeffrey Owens and Sonalee Parekh. Ms. Parekh serves as Chairman of the Audit Committee. Each of the members of our Audit Committee satisfy the requirements for independence and financial literacy under the applicable rules and regulations of the SEC and rules of The Nasdaq Stock Market LLC (“Nasdaq”). The Board has determined that Ms. Parekh is an “Audit Committee financial expert,” as that term is defined in SEC rules.

ITEM 11. EXECUTIVE COMPENSATION

We disclosed executive compensation during our fiscal years ended on December 31, 2021 and 2022 under the scaled reporting rules applicable to emerging growth companies. Beginning on January 1, 2024, we are no longer an emerging growth company and we now include additional detailed information about our executive compensation program as follows:

•The “Compensation Discussion and Analysis” below discussing the compensation of our executive officers appearing in the compensation tables, which executive officers we refer to as our “named executive officers”;

•An additional year of reporting history, and reporting on compensation for a larger group of named executive officers in our Summary Compensation Table; and

•Additional compensation disclosure tables for “Grants of Plan-Based Awards in Our Fiscal Year Ended on December 31, 2023,” “Options Exercised and Stock Vested During Our Fiscal Year Ended on December 31, 2023,” and “Potential Payments Upon Termination or Change of Control” which appear following the Compensation Discussion and Analysis.

Compensation Discussion and Analysis

This section explains our executive compensation program in general and how it operates with respect to our executive officers and, in particular, our named executive officers. For fiscal 2023, our named executive officers consisted of: our Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”) and Executive Vice President of Strategy, President, Chief Accounting Officer, and our former Chief Operating Officer, who retired effective June 30, 2023.

These named executive officers are as follows:

•Donald McClymont, Chief Executive Officer;

•Thomas Schiller, Chief Financial Officer and Executive Vice President of Strategy

•Ichiro Aoki, President;

•Kanwardev Raja Singh Bal, Chief Accounting Officer; and

•Steven Machuga, our former Chief Operating Officer.

Management Transition

In June 2023, Mr. Machuga retired as our Chief Operating Officer and currently serves in an advisory role for the Company. Following Mr. Machuga’s departure, Mr. McClymont, our Chief Executive Officer, assumed the responsibilities of principal operating officer. In January 2024, the Company appointed Michael Wittmann as Chief Operating Officer. For more information about Mr. Wittmann, please see our Current Report on Form 8-K filed with the Securities and Exchange Commission on January 28, 2024 and Part I., Item 1. Business, Information About Our Executive Officers in the Original Report.

Executive Summary

Fiscal 2023 Business Highlights

We achieved success on many fronts during fiscal 2023, including doubling revenues over the prior fiscal year and making strides in advancing our Autotech focused product portfolio. Our key financial and business highlights from fiscal 2023 were as follows:

•Overall net revenues were $223.2 million, up 101% from the prior fiscal year, despite general weakness in the automotive and semiconductor markets;

•Recognized by Morgan Stanley as the fastest growing semiconductor company in the world over the past two years, among 224 global suppliers;

•Introduced breakthrough fully integrated 240 GHz radar front-end silicon receiver, automotive wireless power charging system-on-chip, and computer vision processors enabling viewing and sensing capability at the vehicle’s edge;

•Ramped advanced lighting solutions for enhanced in-cabin applications;

•Secured program and design wins at vehicle OEMs for ADAS Computer Vision, Qi2.0 Wireless Charging, in-cabin monitoring programs and smart connectivity products;

•Entered a development and strategic partnership contracts to accelerate LiDAR and AI-based automotive camera solutions;

•Released first ESG report highlighting adherence to environmental sustainability, social commitments and disciplined corporate governance; and

•Launched and completed warrant exchange program to minimize future equity dilution.

Fiscal 2023 Compensation Highlights

Fiscal 2023 was a significant year for us with respect to compensation actions and decisions. The Compensation Committee took the following compensation actions with respect to our named executive officers:

•Base salaries – Maintained the annual base salary of Mr. McClymont at $400,000 and increased the annual base salaries of our other named executive officers in amounts ranging from 4% to 15%. We also adopted a new program where each of our named executive officers could elect to receive up to 75% of his base salary in equity in lieu of cash.

•Target annual cash incentive opportunities – Increased the target annual cash incentive compensation opportunity for Mr. McClymont by 20% to an amount equal to 100% of his annual base salary and increased the target annual cash incentive compensation opportunity for our other named executive officers in amounts ranging from 5% to 25% of their annual base salaries. Based on the performance outcomes with respect to revenue growth as compared to a peer group predetermined by the Compensation Committee (“Revenue Growth Component”) and non-GAAP operating income (“Operating Income Component”) during fiscal 2023, neither Mr. McClymont nor any of the other named executive officers earned his annual cash incentive payment as even though the Revenue Growth Component was achieved, the Operating Income Component was not.

•Long-term incentive compensation – Granted our named executive officers long-term incentive compensation in the form of performance-based and time-based restricted stock unit (“RSU”) awards effective in January 2023, which are settled for shares of our Class A common stock as they vest. Mr. McClymont received a performance-based RSU award (“PRSU”) and a time-based RSU award with an aggregate target value of $4.3 million, while our other named executive officers received PRSUs and time-based RSU awards with aggregate target values ranging from $400,000 to $3.4 million. In addition, Mr. McClymont and certain other named executive officers received strategic unique stock-price-based RSU grants as more fully described below.

The PRSUs granted to our named executive officers during fiscal 2023 may vest subject to the attainment of two (2) performance-based metrics, including (i) Operating Income and (ii) Revenue Growth. The PRSUs will vest over a three (3) year term. 50% of the PRSUs will be earned based on the achievement of non-GAAP operating income versus target over 1 year, while the remaining 50% of the PRSUs will be earned based on the achievement of Revenue Growth versus peers over 2 years. The shares earned will vest over three years, with half vesting upon the completion of each of the one (1) and two (2) year performance periods, with the remaining half of the earned shares vesting after 3 years.

The stock-price-based RSUs (“Stock Price RSUs”) granted to certain of our named executive officers during fiscal 2023, including Mr. McClymont, shall be earned and become vested, if at all, based on the achievement of the stock price targets set at $20, $30 and $40 per share of our Class A common stock prior to the expiration of a four-year performance period ending on December 31, 2026.

Pay-for-Performance Analysis

Our executive compensation program is designed to motivate, engage and retain a talented leadership team and to appropriately reward them for their contributions to our business. Our performance measurement framework consists of a combination of financial and operational performance measures that provide a balance between short-term results and drivers of long-term value.

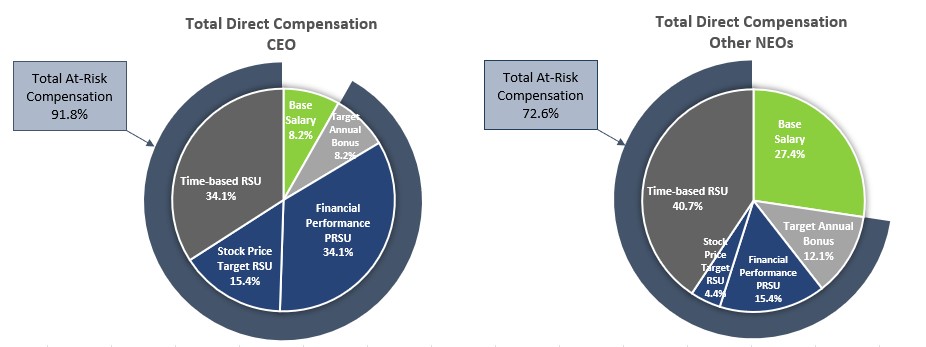

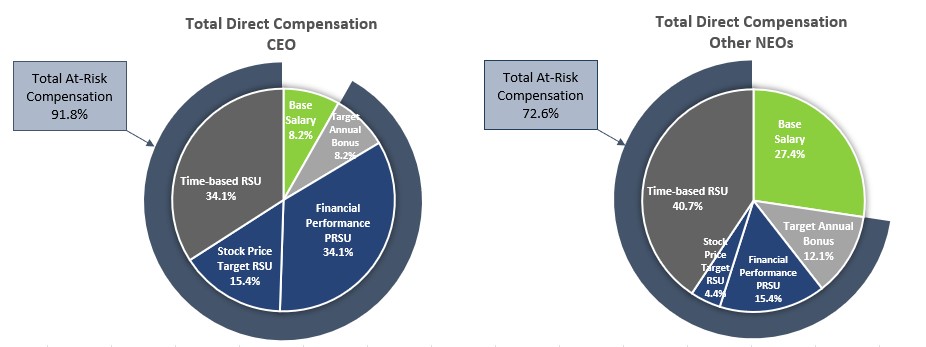

We provide our executive officers with three primary elements of pay: base salary, annual cash incentive compensation and long-term incentive compensation in the form of equity awards. The variable compensation components, consisting of an annual cash incentive and annual equity awards, together constitute the largest portion of the target total direct compensation for our executive officers. The percentages below exclude the All Other Compensation amounts set forth in our Summary Compensation Table.

•Base salary – Base salary accounts for approximately 8.2% of our Chief Executive Officer’s target total compensation and, on average, approximately 27.4% of our other named executive officers’ target total compensation.

•Annual cash incentive compensation – Annual short-term cash incentive compensation opportunity accounts for approximately 8.2% of our Chief Executive Officer’s target total compensation and, on average, approximately 12.1% of our other named executive officers’ target total compensation. Annual cash incentive compensation awards are based on corporate performance relative to pre-established financial objectives selected by the Compensation Committee and an evaluation of each named executive officer’s individual performance.

•Long-term incentive compensation – Long-term incentive compensation consists of PRSU awards, Stock Price RSU awards and time-based RSU awards, and accounts for approximately 83.6% of our Chief Executive Officer’s target total compensation and, on average, approximately 60.5% of our other named executive officers’ target total compensation.

The following charts show the fiscal 2023 pay mix for (i) Mr. McClymont and (ii) our other named executive officers, in the aggregate:

The foregoing percentages were calculated using annual base salary, target annual cash incentive compensation, and the grant date fair value of equity awards as reported for fiscal 2023 in the Summary Compensation Table below, except for Mr. Machuga for whom we calculated the percentages based on a full-year base salary and target bonus. As shown in the above charts, our named executive officers’ compensation is weighted heavily toward “at-risk” compensation, which consists of (1) performance-based cash and equity awards that align each named executive officer’s interests with those of the Company and our stockholders and (2) time-based equity awards whose value is tied to the creation of long-term stockholder value.

Governance Policies and Practices

We maintain several policies and practices to help ensure that our overall executive compensation program reflects sound governance standards and drives financial performance. We have also made the decision not to implement some practices that many companies have historically followed because we believe they would not serve the long-term interests of our stockholders.

| | | | | | | | | | | | | | |

| | | | |

What We Do | | What We Don’t Do |

þ | Fully-Independent Compensation Committee. The Compensation Committee determines our compensation strategy for executive officers and consists solely of independent directors. | | ý | Excise Tax Gross-Ups Related to a Change of Control. We do not provide excise tax gross-ups related to a change of control of the Company. |

| | | | |

þ | Independent Compensation Advisor. The Compensation Committee engages an independent compensation consultant to provide independent analysis, advice and guidance on executive compensation. | | ý | Perquisites. We do not generally provide perquisites to officers other than benefits with broad-based employee participation that are standard in the technology sector, except when specifically determined to be appropriate in light of the executive officer’s circumstances. |

| | | | |

þ | Annual Executive Compensation Review. The Compensation Committee performs an annual review of our executive compensation strategy, including a review of our compensation peer group and a review of our compensation-related risk profile. | | ý | Hedging. We prohibit employees, including our executive officers, from engaging in transactions or arrangements that are intended to increase in value based on a decrease in value of Company securities. |

| | | | |

þ | Pay-for-Performance Philosophy. Our cash incentive compensation and long-term equity programs for executives are based on the Company’s and individual executive’s performance. | | ý | Pledging. We prohibit our employees, including executive officers, from pledging Company stock or holding it in a margin account. |

| | | | |

þ | At-Risk Compensation. A significant portion of compensation for our executives is based on the performance of both the Company and the individual executive. | | ý | Option Repricing. Our 2021 Equity Plan prohibits repricing of out-of-the-money options or stock appreciation rights to a lower exercise or strike price without approval of our stockholders. |

| | | | |

þ | Robust Stock Ownership Guidelines. We have executive stock ownership guidelines and holding requirements that cover our executive officers. | | ý | Dividends or Dividend Equivalents Payable on Unvested Equity Awards. We do not pay dividends or dividend equivalents on unvested equity awards. |

| | | | |

þ | Clawback Policy. We have a clawback, or recoupment policy, that covers all elements of our incentive compensation program upon a financial restatement. | | ý | SERP or Defined Benefit Plans. We do not provide a Supplemental Executive Retirement Plan (SERP) or a defined benefit plan. |

| | | | |

þ | Double-Trigger Change-of-Control Benefits. Change-of control benefits require a change in control and termination of employment (double trigger) rather than benefits triggered solely on the change of control (single trigger). | | | |

Compensation Objectives and Decision-Making Process

Role of the Compensation Committee

The Compensation Committee is responsible for establishing our compensation and benefits philosophy and strategy, working in consultation with our Chief Executive Officer for our executive officers (other than himself). The Compensation Committee also oversees our general compensation policies and sets specific compensation levels for our Chief Executive Officer and other executive officers. In determining our compensation strategy, the Compensation Committee reviews competitive market data to ensure that we are able to attract, motivate, reward and retain talented executive officers and other employees. The Compensation Committee engages its own independent advisors to assist in carrying out its responsibilities, but is not permitted to delegate its authority to such advisors.

The primary objectives of the Compensation Committee with respect to determining executive compensation are to attract, motivate and retain talented employees and to align the interests of our executive officers with those of our stockholders, with the ultimate objective of enhancing stockholder value. It is the philosophy of the Compensation Committee that the best way to achieve this is to provide our executive officers with compensation that is based on their level of performance against specific goals, which are aligned with our overall strategy, thereby compensating executives on a “pay-for-performance” basis.

To achieve these objectives, the Compensation Committee has implemented compensation plans that tie a significant portion of our executive officers’ overall compensation to our financial performance, including Revenue Growth, and Operating Income. Overall, the total compensation opportunity of our executive officers is intended to create an executive compensation program that is competitive with comparable companies.

Role of the Compensation Consultant

In fiscal 2022, the Compensation Committee retained Aon, a national compensation consulting firm, to serve as its compensation consultant. Aon reports directly to the Committee and provides the Compensation Committee with general advice on compensation matters, including reviewing the composition of the compensation peer group, providing compensation data related to executives at the selected companies in the peer group and providing advice on our executive officers’ compensation generally.

Aon did not provide any additional services to us other than the services for which it was retained by the Compensation Committee, and the Compensation Committee is not aware of any conflict of interest that exists that would otherwise prevent Aon from having been independent during fiscal 2023. We pay the costs for Aon’s services. Based on the above and its review of the factors set forth under SEC rules and in the Nasdaq listing requirements, the Compensation Committee assessed the independence of Aon and concluded that no conflict of interest exists that would prevent Aon from independently advising the Compensation Committee during fiscal 2023.

In fiscal 2023, the Compensation Committee met regularly in executive session with Aon without management present.

Use of Compensation Peer Group

Each year, the Compensation Committee directs its compensation consultant to develop a group of peer companies for purposes of evaluating, determining and setting compensation for our executive officers. The criteria for determining which companies to include in the peer group include some or all of the following criteria: (i) they operate in a similar industry to ours; (ii) they are of approximately similar size (as measured by revenues and aggregate market capitalization); (iii) they have profitability similar to ours; and (iv) they are companies with whom we compete for executive talent.

After receiving and discussing the compensation consultant’s report, the Compensation Committee approved the peer group companies for fiscal 2023 in the second half of fiscal 2022. The compensation peer group for fiscal 2023 consisted of the following companies:

| | | | | | | | | | | | | | |

| • Aeva Technologies, Inc. | | • CEVA, Inc. | | • Silicon Laboratories |

| • Aeye, Inc. | | • Credo Technology Group Holding | | • SiTime Corporation |

| • Allegro MicroSystems | | • Luminar Technologies | | • SkyWater Technology, Inc. |

| • Ambarella, Inc. | | • Ouster, Inc. | | • Velodyne Lidar, Inc. |

| • Cepton, Inc. | | • Rambus Inc. | | |

This compensation peer group was used by the Compensation Committee during fiscal 2023 as a reference for understanding the competitive market for executive positions in our industry sector.

A summary of the four-quarter trailing revenue by quartile and market capitalization of the peer companies at the time the Compensation Committee approved the compensation peer group for use in fiscal 2023 is as follows:

| | | | | | | | | | | | | | |

| Peer Twelve Months Revenue and Market Capitalization for Fiscal Year 2023 Compensation Decisions |

| | | | |

| | Peer Group Financials (1) |

Quartile | | Twelve Months Trailing Revenue ($ in millions) | | Market Capitalization ($ in millions) |

75th Percentile | | 339.8 | | 2,639.9 |

50th Percentile | | 138.8 | | 1,301.5 |

25th Percentile | | 41.9 | | 330.7 |

indie Semiconductor | | 96.7 | | 1,129.9 |

(1) Data is based on available market information as of November 2022.

Based on the foregoing, our revenue was approximately in the 43rd percentile of the peer group companies and our market capitalization was approximately in the 49th percentile of the peer group companies as of November 2022.

Data on the compensation practices of the peer group was generally gathered through searches of publicly available information, including publicly available databases. In preparing its report, the compensation consultant reviewed data from the Radford Global Compensation Database including a custom analysis of the companies in the compensation peer group, as well as the proxy statements filed by each of the peer group companies. Peer group data was gathered with respect to base salary, bonus targets and equity awards. When the peer group data yielded insufficient data, the compensation consultant used a custom data analysis of the companies in the compensation peer group and/or a cross-section of technology companies in autotech, semiconductor, semiconductor equipment and systems software with revenue up to $200 million and market capitalization between $400 million and $3.4 billion.

In determining adjustments to executive compensation, the Compensation Committee not only considers the compensation advice and analysis provided by its compensation consultant and publicly available information of compensation offered by the applicable comparative market data, but also reviews the Radford survey data and takes into consideration other relevant factors as described in this Compensation Discussion and Analysis. While the Compensation Committee considers external market data (both the Radford survey data and peer company data), it does not target any specific pay percentile within those companies for purposes of setting cash and equity compensation levels. Rather, the Committee uses this information merely as a guide to determine whether we are generally competitive in the market.

Compensation Determination for Chief Executive Officer

Each year, the Compensation Committee reviews the performance of our Chief Executive Officer and approves his compensation in light of the goals and objectives of our executive compensation program. The review of the performance and compensation of our CEO and our other executive officers is conducted annually. The Compensation Committee uses both objective data from peer group companies and subjective policies and practices, including an assessment of our CEO’s achievements and contribution, to determine his compensation. In determining the long-term equity incentive component of our CEO’s compensation, the Compensation Committee considers a number of factors, including our performance and relative stockholder return, the value of similar awards to CEOs at the companies in the compensation peer group, the equity awards granted to our CEO in prior years and feedback from the independent members of our Board of Directors.

To provide further assurance of independence, the Compensation Committee’s compensation consultant provides its own recommendation regarding CEO compensation. The compensation consultant prepares an analysis showing competitive CEO compensation at the companies in the compensation peer group for the individual elements of compensation and total direct compensation. Next, the compensation consultant provides the Committee with a range of recommendations for any change in our CEO’s base salary, target annual cash incentive compensation and equity award value. These recommendations take into account the peer group competitive pay analysis, expected future pay trends and, importantly, the position of our CEO in relation to other senior executives and proposed pay actions for all our other key employees. The range allows the Committee to exercise its discretion based on our CEO’s individual performance and other factors.

Compensation Determination for Other Executive Officers

Our Chief Executive Officer works with the Compensation Committee in establishing the compensation and benefits philosophy and strategy for our other executive officers and makes specific recommendations to the Committee with respect to the individual compensation for each of such executive officers. Each year, the Compensation Committee reviews with our CEO each executive officer’s performance in light of our goals and objectives and approves their compensation. The Compensation Committee also considers other relevant factors in approving the level of such compensation, including the executive officer’s performance during the year, focusing on his or her accomplishments, areas of strength and areas of development, scope of responsibility and contributions, and experience and tenure in the position.

Our Chief Executive Officer evaluates each executive officer’s performance during the year based on a review of his or her performance and an individual self-assessment. Our CEO also reviews compensation prepared by Aon and from other publicly-available information and identifies trends and competitive factors to consider in adjusting compensation levels of our executive officers. Our CEO then makes a recommendation to the Compensation Committee as to each element of each executive officer’s compensation, which the Compensation Committee takes into account when it approves each executive officer’s compensation.

Compensation Elements

Our executive compensation program consists of three principal elements: base salary, performance-based cash incentive compensation and long-term incentive compensation in the form of equity awards. The following table summarizes these elements of compensation:

| | | | | | | | | | | | | | |

| | Objectives | | Key Features |

| | | | |

Base Salary | | Provides a fixed baseline level of compensation earned during the fiscal year. | | Fixed cash compensation is based on scope of responsibility, breadth of knowledge, experience, tenure in the position, competitive market-based considerations and individual performance. |

| | | | |

Performance-Based Incentive Cash Compensation | | Rewards achievement of corporate performance objectives and serves to attract and retain highly-qualified executives. | | Calculated as a percentage of the executive officer’s annual base salary. Payouts are based on achievement of pre-established corporate objectives goals. |

| | | | |

Long-Term Equity Incentive Awards | | Establishes a corporate culture that supports strong long-term corporate performance and provides an important retention tool through vesting of equity awards over several years. | | Performance-based and stock-price-based RSUs are granted in amounts that take into account a range of payouts to reflect company performance against pre-established goals, and vest over a multi-year period. Time-based RSUs are granted in fixed amounts and vest over a four-year period. |

Base Salary

Over the second half of 2022, the Compensation Committee reviewed the base salaries of our executive officers, focusing on the competitiveness of their salaries. After comparing their current salaries to the base salary levels based on the data drawn from the companies in our compensation peer group and the Aon prepared survey data, as well as considering the roles and responsibilities and potential performance of our executive officers and the recommendations of our Chief Executive Officer (with respect to our executive officers other than himself), the Compensation Committee determined to increase the base salaries of our named executive officers other than our CEO in December 2022, effective for fiscal 2023.

In the case of our Chief Executive Officer, the Compensation Committee determined to maintain his base salary. In light of his role as both our CEO and a co-founder of the Company, the Compensation Committee wanted to affirm his unique role with a greater emphasis on equity grants which are aligned with driving stockholder value rather than increasing base salary. As a result, for 2023 our CEO’s base salary was maintained at a level that is at or below the 25th percentile relative to our peer group. With respect to our other named executive officers, the Compensation Committee determined to increase their base salaries in response to its review of competitive market data for individuals in comparable positions at other technology companies, including companies in our peer group, to recognize the increase in each individual’s scope of responsibilities and expected deliverables in the current year and to acknowledge their individual contributions to our outstanding performance in fiscal 2022.

As a result of the base salary increases for 2023, we believe the base salaries for our other named executive officers range from the 25th to 50th percentile relative to our peer group.

The fiscal 2022 and 2023 base salaries of our named executive officers were as follows:

| | | | | | | | | | | | | | | | | | | | |

|

| | | | | | |

Named Executive Officer | | Fiscal Year 2022 Base Salary ($) | | Fiscal Year 2023 Base Salary ($) | | Percentage Increase (%) |

Donald McClymont | | 400,000 | | 400,000 | | — |

Thomas Schiller | | 300,000 | | 345,000 | | 15.0 |

Ichiro Aoki | | 275,000 | | 300,000 | | 9.1 |

Kanwardev Raja Singh Bal (1) | | — | | 287,500 | | N/A |

Steve Machuga (2) | | 330,000 | | 343,200 | | 4.0 |

(1)Mr. Bal was not a named executive officer in fiscal 2022.

(2)Mr. Machuga retired as our Chief Operating Officer effective June 30, 2023 and received salary only through such date.

These base salary adjustments were effective January 1, 2023. In June 2023, the Compensation Committee approved a voluntary program to allow our named executive officers (except for Mr. Machuga) to elect to receive a portion of their base salary (up to 75%) in fully-vested RSUs on a quarterly basis starting in August 2023. This stock in lieu of cash would further align the interests of our executive officers with the interests of our stockholders. The number of underlying RSUs awarded is equal to the amount of the forgone salary, divided by the closing trading price of our Class A common stock on the date of grant. Each of our current named executive officers elected to receive 75% of their base salary in RSUs, the highest rate possible under the program.

Annual Cash Incentive Compensation

In March 2023, our Compensation Committee approved a cash incentive compensation framework for fiscal 2023, the 2023 Short Term Incentive Bonus Plan (the “2023 Incentive Plan”). The 2023 Incentive Plan was designed to link the annual cash incentives of our executive officers to the company-wide achievement of pre-established financial objectives involving annual revenue growth and operating income. The way these components factor into the annual cash incentive compensation is illustrated in the following chart:

Target Annual Cash Incentives

In connection with the review of base salaries for our named executive officers, the Compensation Committee reviewed their target annual cash incentives, focusing on the competitiveness of their target total cash compensation opportunities. After comparing their current target annual cash incentives to the target cash incentive levels at the companies in our compensation peer group and the Radford survey data, as well as considering the roles and responsibilities and potential performance of our executive officers and the recommendations of our CEO (with respect to our executive officers other than himself), the Compensation Committee increased the target annual cash incentives of our CEO and our other executive officers for fiscal 2023.

The fiscal 2022 and 2023 target annual cash incentives of our named executive officer were as follows:

| | | | | | | | | | | | | | |

Named Executive Officer Fiscal 2022 and 2023 Target Annual Cash Incentive |

| | | | |

| Named Executive Officer | | Fiscal 2022 Target Annual Cash Incentive (as % of base salary) | | Fiscal 2023 Target Annual Cash Incentive (as % of base salary) |

| Donald McClymont | | 80% | | 100% |

| Thomas Schiller | | 45% | | 70% |

| Ichiro Aoki | | 35% | | 40% |

| Kanwardev Singh Raja Bal (1) | | - | | 40% |

| Steve Machuga (2) | | 45% | | 50% |

(1)Mr. Bal was not a named executive officer in fiscal 2022.

(2)Mr. Machuga retired as our Chief Operating Officer effective June 30, 2023 and, accordingly, did not earn a cash incentive payment for fiscal 2023

Performance Components

Under the 2023 Incentive Plan, annual cash incentive payments for our executive officers were determined using two components, each with equal weighting:

•Revenue Growth Component: revenue growth versus a predetermined company peer group weighted at 50%; and

•Operating Income Component: non-GAAP operating income, weighted at 50%. We calculate non-GAAP operating income by excluding from GAAP operating income (loss), any (i) acquisition-related expenses (including acquisition-related professional fees and legal expenses, deemed compensation expense and expenses recognized in relation to changes in contingent consideration obligations), (ii) amortization of acquisition-related intangibles and certain license rights, (iii) inventory cost realignments and (iv) share-based compensation.

The nominal thresholds for each of the two components must be achieved for any cash incentive payment to be awarded under the 2023 Incentive Plan. For each of our executive officers, the 2023 Incentive Plan award was to be paid on an annual basis. The Compensation Committee generally has discretion to exclude extraordinary or one-time charges for purposes of calculating annual cash incentive payments under the 2023 Incentive Plan, but no such exclusions were made in fiscal 2023.

For purposes of the 2023 Incentive Plan, the Revenue Growth Component and Operating Income Component were designed as follows:

Revenue Growth Component. The Revenue Growth Component was designed to reward our year-over-year revenue growth relative to a peer group as predetermined by the Compensation Committee (the “Revenue Peer Group”). In light of the importance of achieving revenue growth for fiscal 2023, the weighting of the Revenue Growth Component was established at 50%. The Revenue Growth Component was subject to a threshold or nominal performance level for achievement and a multiplier that increased or decreased the target payout depending on our actual performance. The Revenue Growth Component was measured and paid on an annual basis. The Revenue Peer Group was determined by the Compensation Committee in December 2022, and includes all companies in the compensation peer group for fiscal 2023 as set forth above, except for Aeva Technologies, Inc., Aeye, Inc. and Cepton, Inc. These three companies were excluded due to their significantly lower revenue amounts, which the Compensation Committee believed would make the Revenue Growth Component unreasonably difficult to achieve and be a more meaningful measure of our relative revenue growth.

The following table summarizes the terms of the Revenue Growth Component multiplier for fiscal 2023:

Revenue Growth Component Scale

| | | | | | | | | | | | | | |

Goal | | Revenue Growth vs. Revenue Peer Group FY2023 | | Revenue Growth Component Multiplier) |

Stretch | | 80th percentile | | 200% |

Target | | 65th percentile | | 100% |

| | | | | | | | | | | | | | |

Nominal | | 50th percentile | | 50% |

Below Nominal | | <50th percentile | | 0% |

During fiscal 2023, our revenue growth versus our Revenue Peer Group was at the 100th percentile and was achieved at the Stretch level.

Operating Income Component. The Operating Income Component was determined by a formula that rewarded our achievement of targeted non-GAAP operating income. For purposes of the 2023 Incentive Plan, the Operating Income Component was calculated using the financial results for the fourth quarter of fiscal 2023. The Operating Income Component was designed to emphasize the importance of continually managing costs, increasing efficiencies and achieving break-even non-GAAP operating income. The Operating Income Component was subject to a nominal performance level for any payout and a multiplier between 0% to 200% of the target payout depending on our actual performance. Our target performance level was set at break-even non-GAAP operating income in the fourth quarter of fiscal year 2023, which we did not meet.

Annual Cash Incentive Payments for Fiscal 2023

The target and actual annual cash incentive payments for fiscal 2023 for our named executive officers, based on their achievement against our financial goals, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Named Executive Officer Incentive Cash Awards for Fiscal 2023 | |

Named

Executive

Officer | | Annual Base

Salary

($) | | Target Annual Cash Incentive (as a percentage of base salary) | | Target Annual Cash Incentive Payment

($) | | | |

| Actual Annual Cash Incentive Payment Paid

($) | |

| Donald McClymont | | 400,000 | | | 100% | | 400,000 | | | | — | | |

| Thomas Schiller | | 345,000 | | | 70% | | 241,500 | | | | — | | |

| Ichiro Aoki | | 300,000 | | | 40% | | 120,000 | | | | — | | |

| Kanwardev Raja Singh Bal | | 287,500 | | | 40% | | 115,000 | | | | — | | |

| Steve Machuga (1) | | 343,200 | | | 50% | | 171,600 | | | | N/A | |

(1) Mr. Machuga retired as our Chief Operating Officer effective June 30, 2023 and, accordingly, did not earn a cash incentive payment for fiscal 2023.

Although the Revenue Growth Component was achieved at the Stretch level, because the Operating Income Component was not achieved at the Nominal level, no payments were awarded under the 2023 Incentive Plan. In prior years, the Company has paid the annual cash incentive compensation awards in fully-vested stock awards, with the number of shares determined by dividing the amount of the cash incentive award by the market close price for our Class A common stock on the date of the Compensation Committee’s approval of the cash incentive award amount.

Long-Term Equity Incentive Compensation

The Compensation Committee believes that long-term incentive compensation in the form of equity awards provide a strong alignment between the interests of our named executive officers and our stockholders. We regularly monitor the environment in which we operate and review and make changes to our long-term equity incentive compensation program as necessary to help us meet our goals, including generating long-term stockholder value and attracting, motivating and retaining talent. We also consider the value of an executive’s current equity holdings and the retention power of unvested equity awards. The Compensation Committee believes that performance-based and stock-price-based RSUs are an important means of aligning pay with performance, but also believes that time-based RSUs serve as a retention tool while still aligning the interests of our executive officers with the interests of our stockholders. In general, we prefer to grant our executive officers time based and performance-based RSUs rather than stock options, as the higher value of RSU awards allows us to issue fewer shares of our common stock, thereby reducing dilution to our stockholders.

Fiscal 2023 Equity Awards

For fiscal 2023, the Committee granted a mix of performance-based, stock-price-based and time-based RSUs to our named executive officers, with performance-based and stock-price-based RSUs making up the bulk of the equity awards granted to our named executive officers. For fiscal 2023, as set forth in the Summary Compensation Table, the mix consisted of 40.8% performance-based RSUs, 18.4% stock-price-based RSUs and 40.8% time-based RSUs for our Chief Executive Officer. For our other named executive officers, the mix consisted of 37.8% performance-based RSUs, 12.1% stock-price-based RSUs and 50.1% time-based RSUs.

All of our equity awards are subject to vesting. Subject to the named executive officer’s continuous service over the vesting period, the vested awards or units are settled for shares of our Class A common stock. Our executive officers are required to retain 50% of the shares of our common stock issued in settlement of these RSU awards until their respective stock ownership requirements are satisfied.

Fiscal 2023 Time-Based RSU Awards

In December 2022, the Compensation Committee approved the grant of time-based RSU awards to our executive officers, effective January 3, 2023. The following table sets forth the number of units that may be settled for shares of our Class A common stock awarded to each of our named executive officers in fiscal 2023 with respect to their time-based RSU awards:

Named Executive Officer Fiscal 2023 Time-Based RSU Awards

| | | | | | | | |

Named Executive Officer | | Shares Subject to Time-Based RSU Award (1) |

Donald McClymont | 286,500 |

Thomas Schiller | 226,500 |

Ichiro Aoki | 37,500 |

Kanwardev Raja Singh Bal | 37,500 |

Steve Machuga (2) | 56,250 |

(1) These RSU awards vest in four equal annual installments, the first of which occurs on the first anniversary of the effective date of the grant.

(2) Mr. Machuga retired as our Chief Operating Officer effective June 30, 2023, at which time he forfeited the RSU awards granted to him effective January 3, 2023.

Fiscal 2023 Performance-Based RSU Awards

In December 2022, the Compensation Committee also approved grants of PRSUs to our executive officers, effective January 3, 2023. The PRSUs will vest over a three-(3) year term, as more fully described below. The units subject to the PRSUs were to be earned based on our achievement of pre-established financial goals over predetermined performance periods. The number of earned units could increase with over-achievement of the applicable performance goals, to an aggregate maximum of 200% of the target number of units subject to the awards, or could decrease for under-achievement of the performance goals, with the possibility of no units being earned.

The two performance components applicable to the fiscal 2023 PRSUs were:

•operating income (the “PRSU Operating Income Component”), weighted at 50%; and

•revenue growth versus a predetermined company peer group (the “PRSU Revenue Growth Component”), weighted at 50%.

The operating income metric is measured over the five-quarter period ending at the end of the first quarter of fiscal 2024. The revenue growth versus peers metric is tied to cumulative revenue performance beginning at the start fiscal 2023 and ending upon the completion of fiscal 2024. Although, these equity performance metrics are substantially similar to the performance metrics under our 2023 Incentive Plan, given our stage in the Company’s lifecycle, these goals represent the key drivers of delivering stockholder value and the use of them as both equity and cash incentive performance goals was intended to focus the Company’s efforts.

The two performance components operated as follows:

PRSU Operating Income Component. The PRSU Operating Income Component was designed to reward the Company’s ability to reach breakeven (on a non-GAAP basis) by the end of fiscal 2023. The PRSU Operating Income Component is primarily measured over the one-year period of fiscal 2023, with target level set at break-even non-GAAP operating income in the fourth quarter of fiscal year 2023, in that for the maximum or target level to be met, the metric must be achieved by the end of fiscal 2023. However, because the measurement period for threshold achievement ends at the end of the first quarter of fiscal 2024, should the threshold level be attained, the resulting payment would be 50% of target level. 50% of the units related to the PRSU Operating Income Component become earned and vested upon certification of the metric by the Compensation Committee, and the remaining 50% of the units earned based on performance vest upon the third anniversary of the date of grant. Operating income for the PRSU Operating Income Component is defined in the same manner as under our 2023 Incentive Plan. This PRSU Operating Income Component was selected as a metric because it was considered an efficient way to measure the Company’s operating performance and will be awarded based on performance level achieved (without interpolation).

PRSU Revenue Growth Component. The PRSU Revenue Growth Component is tied to cumulative revenue performance and was designed to measure and reward achievement of our total overall revenue growth versus as compared to a peer group predetermined by the Compensation Committee. The revenue growth peer group for the PRSU Revenue Growth Component is the same as the peer group used for the Revenue Growth Component described above. The PRSU Revenue Growth Component was selected as a metric because of its importance to our achieving our overall revenue results and driving stockholder value, and will be awarded based on performance level achieved (with interpolation on a straight-line basis between threshold and target, as well as between target and maximum) as follows:

| | | | | | | | | | | | | | |

| Achievement Level | | PRSU Revenue Growth Component | | Multiplier |

| Maximum | | 80th percentile and above | | 200% |

| Target | | 65th percentile | | 100% |

| Threshold | | 50th percentile | | 50% |

| Below Threshold | | < 50th percentile | | 0% |

The PRSU Revenue Growth Component is measured over a two-year period, specifically beginning at the start fiscal 2023 and ending upon the completion of fiscal 2024. 50% of the units related to PRSU Revenue Growth Component become earned with 50% vesting upon certification of the metric by the Compensation Committee, and the remaining 50% of the units earned based on performance vesting upon the third anniversary of the date of grant.

Upon vesting, the PRSUs are settled for shares of our Class A common stock. Our executive officers are required to retain 50% of the shares of our Class A common stock issued in settlement of these PRSU awards until their respective stock ownership requirements are satisfied.

The following table sets forth the number of units that may be settled for shares of our Class A common stock granted to each of our named executive officers in fiscal 2023 with respect to their PRSU awards based on the above criteria:

Named Executive Officer Fiscal 2023 Performance-Based RSU Awards

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Named Executive Officer | | Below Threshold Number of Shares | | Threshold Number of Shares | | Target

Number of Shares | | Maximum Number of Shares |

| Donald McClymont | | — | | 143,250 | | 286,500 | | 573,000 |

| Thomas Schiller | | — | | 113,250 | | 226,500 | | 453,000 |

| Ichiro Aoki | | — | | 6,250 | | 12,500 | | 25,000 |

| Kanwardev Raja Singh Bal | | — | | 6,250 | | 12,500 | | 25,000 |

| Steve Machuga (1) | | — | | 9,375 | | 18,750 | | 37,500 |

(1) Mr. Machuga retired as our Chief Operating Officer effective June 30, 2023, at which time he forfeited the PRSU awards granted to him effective January 3, 2023.

Given that the performance periods for the PRSU Operating Income Component and the PRSU Revenue Growth Component have not yet been completed, neither metric has yet been achieved. However, given our fiscal 2023 performance, the PRSU Operating Income Component will not be met at the Maximum or Target achievement level.

In December 2022, the Compensation Committee also approved grants of Stock Price RSUs to our executive officers, effective January 3, 2023. The Compensation Committee considers these Stock Price RSUs as a strategic unique grant to address significant gaps in equity holdings of our CEO and CFO and are intended to strengthen retention efforts and further align their interests with those of our stockholders with the ultimate objective of enhancing stockholder value. The units subject to the Stock Price RSUs are to be earned based on our achievement of the stock price hurdles of $20.00, $30.00 and $40.00 per share of our Class A common stock. These stock price hurdles were ambitious, given that our Class A common stock closed at $5.79 on the date of grant. Our Class A common stock price must average above each applicable stock price for sixty (60) calendar days for the performance hurdle to be satisfied. The Stock Price RSUs have a four-(4) year performance period, with one year vesting upon achievement of a stock price hurdle, as more fully described below. The following table sets forth the number of units that may be settled for shares of our Class A common stock for our named executive officers in fiscal 2023 with respect to their stock-price based RSU awards:

Named Executive Officer Fiscal 2023 Stock-Price RSU Awards

| | | | | | | | | | | | | | | | | | | | |

| Named Executive Officer | | $20.00/Share Stock Price Hurdle | | $30.00/Share Stock Price Hurdle | | $40.00/Share Stock Price Hurdle |

| Donald McClymont | | 500,000 | | 350,000 | | 150,000 |

| Thomas Schiller | | 250,000 | | 250,000 | | 250,000 |

| Ichiro Aoki | | — | | — | | — |

| Kanwardev Raja Singh Bal | | 16,666 | | 16,666 | | 16,668 |

| Steve Machuga (1) | | 33,333 | | 33,333 | | 33,334 |

(1) Mr. Machuga retired as our Chief Operating Officer effective June 30, 2023, at which time he forfeited the Stock Price RSU awards granted to him effective January 3, 2023.

The Stock Price RSUs shall be earned and become vested, if at all, based on the achievement of the stock price hurdles for the Company’s Class A common stock set forth above prior to the expiration of a four-year performance period. 50% of the Stock Price RSUs earned for each price hurdle vest upon achievement and certification of the achievement of the stock price hurdle by the Compensation Committee, and the remaining 50% of the Stock Price RSUs earned for each price hurdle vesting upon the earlier of (i) one year from the date of achievement, or (ii) upon the fourth anniversary of the date of grant. For the avoidance of doubt, if the Company’s Class A common stock achieves a certain price target, the named executive officer shall be entitled to the number of shares at such price hurdle, plus any shares listed at any price target below the achieved price target. For example, should the Company achieve the $40.00 price hurdle, the named executive officer shall receive the number of shares for the $40.00, $30.00, and $20.00 price hurdles. To date, none of the stock price hurdles have been achieved.

Agreements with Named Executive Officers

We have entered into employment agreements with each of our named executive officers (the “Employment Agreements”). These agreements govern the terms of their compensation and, in addition, provide for certain payments and benefits in the event of certain qualifying terminations of employment, including a termination of employment in connection with a change in control of the Company. The employment agreements provide each named executive officer with a base salary and a target bonus. The Employment Agreements also provide for certain payments and benefits in the event of certain qualifying terminations of employment, including a termination of employment in connection with a change in control of the Company. The terms of the Employment Agreements are discussed in greater detail below in the section entitled “Potential Payments upon Termination or Change in Control.”

Generally Available Benefit Plans

We maintain generally available benefit programs in which our executive officers may participate. For example, we maintain a tax-qualified 401(k) plan for employees in the U.S., which provides for broad-based employee participation. Under the provisions of our plan, we match 100% of the first 3% of an employee’s contribution and a 50% match of each additional 1% of an employee’s contribution up to a maximum of 5%. We also provide a “true-up” for participants who did not receive their maximum matching contribution during a 401(k) plan year as a result of meeting their contribution limits early in the year. We

make matching contributions to help attract and retain employees, and to provide an additional incentive for our employees to save for their retirement in a tax-favored manner. We do not maintain any guaranteed pension plan or other defined benefit plan.

We also offer a number of other benefits to our executive officers pursuant to benefits programs that provide for broad-based employee participation, which includes medical, dental and vision insurance, disability insurance, various other insurance programs, health and dependent care flexible spending accounts, educational assistance, employee assistance and certain other benefits. The terms of these benefits are essentially the same for all eligible employees. Also, our named executive officers participate in an executive medical cost reimbursement program.

Perquisites and Other Personal Benefits

We generally do not provide perquisites or other personal benefits to our executive officers other than described above except in situations where we believe it is appropriate to assist an individual in the performance of his or her duties, to make him or her more efficient and effective and for recruitment and retention purposes.