As filed with the Securities and Exchange Commission on April 14, 2022.

Registration No. 333-257629

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

Post-Effective Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

___________________________

(Exact Name of Registrant as Specified in its Charter)

___________________________

| | 3674 | 87-0913788 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial | (I.R.S. Employer |

32 Journey

Aliso Viejo, California 92656

Telephone: (949) 608-0854

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

___________________________

Thomas Schiller

Chief Financial Officer and EVP of Strategy

indie Semiconductor, Inc.

32 Journey

Aliso Viejo, California 92656

Telephone: (949) 608-0854

(Name, address, including zip code, and telephone number, including area code, of agent for service)

___________________________

Copies to:

Jonathan H. Talcott

E. Peter Strand

Nelson Mullins Riley & Scarborough LLP

101 Constitution Avenue NW, Suite 900

Washington, DC 20001

Telephone: (202) 689-2800

___________________________

Approximate date of commencement of the proposed sale of the securities to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| | ☒ | Smaller reporting company | | |||

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Pursuant to Rule 429 under the Securities Act, the prospectus contained in this Registration Statement on Form S-1 (this “Registration Statement”) is a combined prospectus relating to (i) the issuance and sale of 10,150,000 shares of Class A common stock, (ii) the resale of 10,150,000 warrants and (iii) the resale of 70,846,446 shares of Class A common stock being newly registered under this Registration Statement, and the issuance and sale of 17,250,000 shares of Class A common stock upon the exercise of outstanding warrants previously registered under the Prior Registration Statement. This Registration Statement also constitutes a Post-Effective Amendment to the Prior Registration Statement. Such Post-Effective Amendment shall become effective concurrently with the effectiveness of this Registration Statement in accordance with Section 8(c) of the Securities Act.

EXPLANATORY NOTE

On July 2, 2021, we filed a registration statement with the Securities and Exchange Commission (the “SEC”), on Form S-1 (File No. 333- 257629) (the “Registration Statement”). The Registration Statement was declared effective by the SEC on July 13, 2021 to initially relating to (i) the issuance and sale of 10,150,000 shares of Class A common stock, (ii) the resale of 10,150,000 warrants and (iii) the resale of 70,846,446 shares of Class A common stock being newly registered under this Registration Statement, and the issuance and sale of 17,250,000 shares of Class A common stock upon the exercise of outstanding warrants previously registered under the Prior Registration Statement. This post-effective amendment is being filed pursuant to the undertakings in Item 17 of the Registration Statement to (i) include information contained in the Registrant’s Current Report on Form 10-K that was filed with the SEC on April 8, 2022 and (ii) update certain other information in the Registration Statement.

No additional securities are being registered under this post-effective amendment. All applicable registration and filing fees were paid at the time of the original filing of the Registration Statement on July 13, 2021.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 14, 2022

indie Semiconductor, Inc.

Primary Offering of

27,400,000 shares of Class A Common Stock

Issuable Upon Exercise of Warrants

Secondary Offering of

70,846,446 shares of Class A Common Stock and

10,150,000 Warrants to Purchase Class A Common Stock

This prospectus relates to the issuance by us of up to 27,400,000 shares of our Class A common stock, par value $0.0001 per share (“Class A common stock”). Of these shares:

• 17,250,000 shares are issuable upon the exercise of warrants (the “public warrants”) initially issued as part of the units issued in the initial public offering of Thunder Bridge Acquisition II, Ltd. (“Thunder Bridge II”);

• 8,650,000 shares are issuable upon the exercise of warrants (the “private placement warrants”) initially issued to Thunder Bridge Acquisition II LLC (the “Sponsor”) in a private placement that occurred simultaneously with the initial public offering of Thunder Bridge II; and

• 1,500,000 shares are issuable upon the exercise of warrants issued to an affiliate of the Sponsor in connection with loans it made to Thunder Bridge II prior to the closing of the Business Combination (as defined below) (the “sponsor warrants” and collectively with the public warrants and the private placement warrants, the “warrants”).

Each warrant entitles the holder thereof to purchase one share of our Class A common stock at a price of $11.50 per share. We will receive the proceeds from the exercise of the warrants, but not from the sale of the underlying shares of Class A common stock.

In addition, the Selling Securityholders identified in this prospectus may, from time to time in one or more offerings, offer and sell up to 70,846,446 shares of our Class A common stock, of which:

• 8,625,000 shares were exchanged in our Business Combination for shares of Class A common stock issued to the Sponsor in a private placement prior to Thunder Bridge II’s initial public offering (the “sponsor shares”);

• 37,071,446 shares are issuable upon the exchange of an equal number of units (the “LLC Units”) representing limited liability company interests in Ay Dee Kay LLC, d/b/a indie Semiconductor (“ADK LLC”), our direct subsidiary;

• 15,000,000 shares were issued in private placements in connection with our business combination with ADK LLC, which we completed on June 10, 2021 (the “Business Combination”);

• 8,650,000 shares are issuable upon the exercise of private placement warrants; and

• 1,500,000 shares are issuable upon the exercise of sponsor warrants.

The Selling Securityholders may also, from time to time in one or more offerings, offer and sell up to 8,650,000 private placement warrants and 1,500,000 sponsor warrants.

We will not receive any proceeds from the sale of our Class A common stock or the sale of the private placement warrants or sponsor warrants by Selling Securityholders, but we are required to pay certain offering fees and expenses in connection with the registration of the Selling Securityholders’ securities and to indemnify certain Selling Securityholders against certain liabilities.

This prospectus describes the general manner in which these securities may be offered and sold. If necessary, the specific manner in which these securities may be offered and sold will be described in one or more supplements to this prospectus. Any prospectus supplement may add, update or change information contained in this prospectus. You should carefully read this prospectus, and any applicable prospectus supplement, before you invest in any of our securities.

The Selling Securityholders may offer and sell our Class A common stock, private placement warrants and sponsor warrants to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. In addition, certain Selling Securityholders may offer and sell these securities from time to time, together or separately. If the Selling Securityholders use underwriters, dealers or agents to sell such securities, we will name them and describe their compensation in a prospectus supplement. The price to the public of those securities and the net proceeds any Selling Securityholders expect to receive from that sale will also be set forth in a prospectus supplement.

Our Class A common stock and our public warrants are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbols “INDI” and “INDIW,” respectively. On April 8, 2022, the closing price of our Class A common stock was $7.05 and the closing price for our public warrants was $1.67.

We are an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company.”

See the section entitled “Risk Factors” beginning on page 8 of this prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.

Table of Contents

|

Page |

||

|

i |

||

|

ii |

||

|

iii |

||

|

1 |

||

|

9 |

||

|

32 |

||

|

Market Information for Class A Common Stock and Dividend Policy |

33 |

|

|

Unaudited Pro Forma Condensed Combined Financial Information |

34 |

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

40 |

|

|

51 |

||

|

61 |

||

|

68 |

||

|

75 |

||

|

81 |

||

|

84 |

||

|

88 |

||

|

97 |

||

|

101 |

||

|

104 |

||

|

104 |

||

|

104 |

||

|

F-1 |

You should rely only on the information provided in this prospectus. Neither we nor the Selling Securityholders have authorized anyone to provide you with different information. Neither we nor the Selling Securityholders are making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus is accurate as of any date other than the date hereof. Since the date of this prospectus, our business, financial condition, results of operations and prospects may have changed.

About This Prospectus

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the Selling Securityholders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by such Selling Securityholders of the securities offered by them described in this prospectus. This prospectus also relates to the issuance by us of the shares of Class A common stock issuable upon the exercise of warrants. We will receive the proceeds from any exercise of the warrants for cash.

Neither we nor the Selling Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Securityholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Securityholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus entitled “Where You Can Find More Information.”

i

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this prospectus may constitute “forward-looking statements” for purposes of the federal securities laws. The Company’s forward-looking statements include, but are not limited to, statements regarding its or its management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “appear,” “approximate,” “believe,” “continue,” “could,” “estimate,” “expect,” “foresee,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “would” and similar expressions (or the negative version of such words or expressions) may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this prospectus may include, for example, statements about:

• the expected benefits of the Business Combination;

• our financial performance following the Business Combination;

• changes in our strategy, future operations, financial position, estimated revenues and losses, projected costs, margins, cash flows, prospects and plans;

• the impact of health epidemics, including the COVID-19 pandemic, on our business and the actions we may take in response thereto;

• expansion plans and opportunities; and

• the outcome of any known and unknown litigation and regulatory proceedings.

These forward-looking statements are based on information available as of the date of this prospectus, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

• our future capital requirements and sources and uses of cash;

• our ability to obtain funding for its operations and future growth;

• changes in the market for our products and services;

• expansion plans and opportunities;

• the above-average industry growth of product and market areas that indie has targeted;

• our plan to increase revenue through the introduction of new products within its existing product families as well as in new product categories and families;

• the cyclical nature of the semiconductor industry;

• our ability to successfully introduce new technologies and products;

• the demand for the goods into which our products are incorporated;

• our ability to accurately estimate demand and obtain supplies from third-party producers;

• our ability to win competitive bid selection processes;

• the outcome of any legal proceedings that may be instituted against us following the Business Combination and transactions contemplated thereby;

ii

• the inability to maintain the listing of our Class A common stock or the public warrants on Nasdaq following the Business Combination;

• the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, and our ability to grow and manage growth profitably; and

• other risks and uncertainties set forth in the section entitled “Risk Factors” included elsewhere in this prospectus.

Frequently Used Terms

Unless the context indicates otherwise, references in this prospectus to “indie,” the “Company,” “we,” “us,” “our” and similar terms refer to indie Semiconductor, Inc. and its consolidated subsidiaries.

“ADK LLC” means Ay Dee Kay, LLC d/b/a indie Semiconductor, a California limited liability company, our controlled subsidiary.

“Amended Operating Agreement” means the Eighth Amended and Restated Limited Liability Company Agreement of ADK LLC entered into by ADK LLC, the Company and certain holders of Post-Merger indie Units.

“Business Combination” means the series of transactions that resulted in the combination of Thunder Bridge II with ADK LLC pursuant to the MTA.

“Class A common stock” means Class A common stock of the Company, par value $0.0001 per share.

“Class V common stock” means Class V common stock of the Company, par value $0.0001 per share.

“Closing” means the closing of the Business Combination.

“Exchange Agreement” means the Exchange Agreement dated June 10, 2021 between the Company and certain indie Equity Holders, which provides for the exchange of such holders’ Post-Merger indie Units into shares of Class A common stock.

“indie Equity Holder” means a member of ADK LLC prior to the Closing of the Business Combination.

“LLC Units” means units representing limited liability company interests of ADK LLC.

“Lock-Up Agreements” means lock-up agreements dated as of the Closing, with certain indie Equity Holders, pursuant to which such indie Equity Holders agreed not to offer, sell, contract to sell, pledge or otherwise dispose of any shares of Class A common stock received as consideration in connection with the Business Combination, for a period of six months from the Closing.

“MTA” means the Master Transactions Agreement, dated effective as of December 14, 2020 (as amended on May 3, 2021) by and among: (a) Thunder Bridge II Surviving Pubco, Inc., a Delaware corporation (“Surviving Pubco”); (b) Thunder Bridge II; (c) TBII Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of Surviving Pubco (“TBII Merger Sub”); (d) ADK Merger Sub LLC, a Delaware limited liability company and a wholly-owned subsidiary of Surviving Pubco (“ADK Merger Sub”); (e) ADK Service Provider Merger Sub LLC, a Delaware limited liability company and wholly-owned subsidiary of Surviving Pubco (“ADK Service Provider Merger Sub”); (f) ADK Blocker Merger Sub LLC, a Delaware limited liability company and wholly-owned subsidiary of Surviving Pubco (“ADK Blocker Merger Sub,” and collectively with TBII Merger Sub, ADK Merger Sub and ADK Service Provider Merger Sub, the “Merger Subs”); (g) ADK LLC; (h) the corporate entities listed in the MTA (the “ADK Blocker Group”); (i) ADK Service Provider Holdco, LLC, a Delaware limited liability company (“ADK Service Provider Holdco”); and (j) solely in his capacity as the indie securityholder representative thereunder, Donald McClymont.

“Post-Merger indie Units” means LLC Units following the merger of ADK Merger Sub LLC with and into ADK LLC.

“private placement warrants” means 8,650,000 warrants to purchase Class A common stock at an exercise price of $11.50 per share that were originally sold to the Sponsor in a private placement consummated simultaneously with the initial public offering of Thunder Bridge II.

iii

“public warrants” means 17,250,000 warrants to purchase Class A common stock at an exercise price of $11.50 per share that were originally sold in the initial public offering of Thunder Bridge II.

“Registration Rights Agreement” means the Registration Rights Agreement entered into by the Company as of Closing, with Donald McClymont, Ichiro Aoki, Scott Kee, David Kang, Tom Schiller and Bison Capital Partners IV, L.P. pursuant to which the Company has agreed to register for resale under the Securities Act shares of Class A common stock issued to such persons in connection with the Business Combination, and to provide them with certain rights relating to the registration of the securities held by them.

“Sponsor” means Thunder Bridge Acquisition II LLC, a Delaware limited liability company.

“sponsor shares” means the 8,625,000 Class B ordinary shares of Thunder Bridge II owned by the Sponsor, which were exchanged for shares of Class A common stock in connection with the Business Combination.

“sponsor warrants” means 1,500,000 warrants to purchase Class A common stock at an exercise price of $11.50 per share that were issued to an affiliate of the Sponsor in connection with loans made by it to Thunder Bridge II prior to the closing of the Business Combination.

“Tax Receivable Agreement” means the Tax Receivable Agreement entered into between the Company and certain indie Equity Holders upon the completion of the Business Combination.

“Thunder Bridge II” means Thunder Bridge Acquisition II, Ltd.

“warrants” means, collectively, the public warrants, the private placement warrants and the sponsor warrants.

iv

PROSPECTUS SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that may be important to you. To understand this offering fully, you should read this entire prospectus, the registration statement of which this prospectus is a part carefully, including the information set forth under the heading “Risk Factors” and our financial statements.

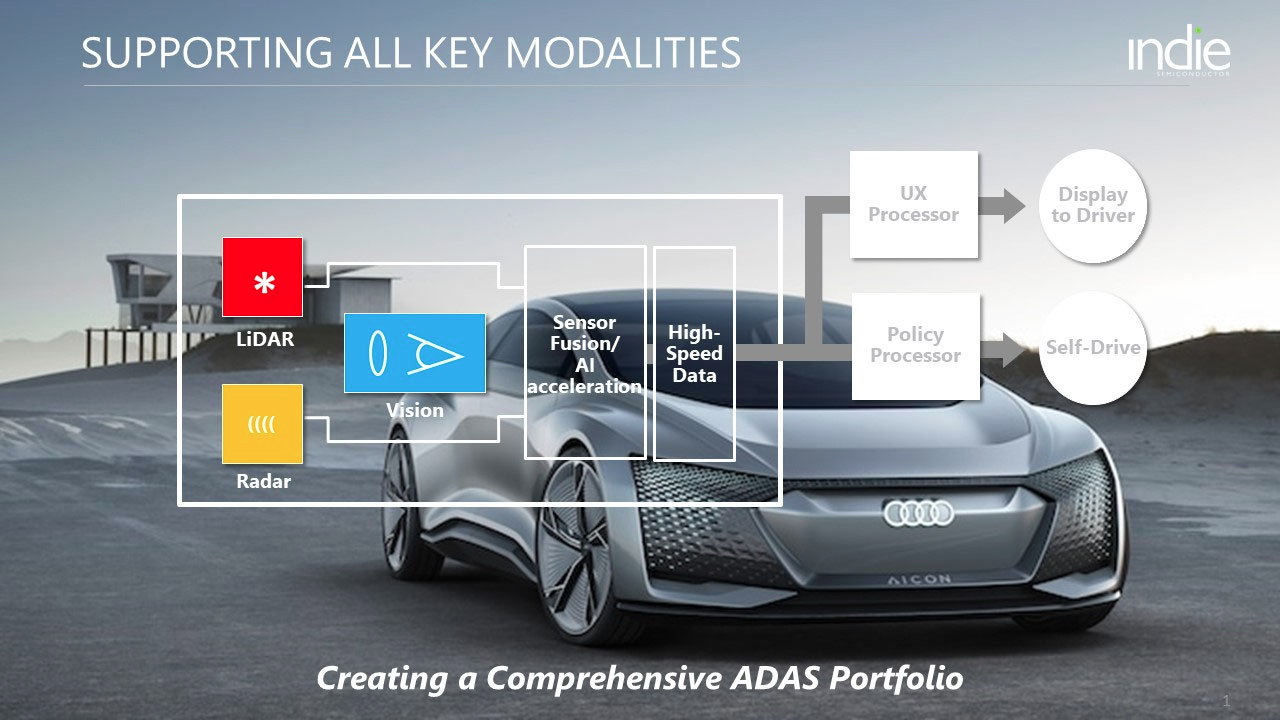

The Company

indie is empowering the Autotech revolution with next generation automotive semiconductors and software platforms. We focus on edge sensors for Advanced Driver Assistance Systems including LiDAR, connected car, user experience and electrification applications. These technologies represent the core underpinnings of both electric and autonomous vehicles, while the advanced user interfaces transform the in-cabin experience to mirror and seamlessly connect to the mobile platforms we rely on every day. We are an approved vendor to Tier 1 partners who provide parts or systems directly to original equipment manufacturers (“OEMs”), and as a result, our solutions can be found in marquee automotive OEMs around the world. Headquartered in Aliso Viejo, CA, indie has design centers and sales offices in Austin, TX; Boston, MA; Detroit, MI; Phoenix, AZ; San Francisco and San Jose, CA; Budapest, Hungary; Dresden, Germany; Edinburgh, Scotland; Haifa, Israel; Quebec City, Canada; Tokyo, Japan; and several locations throughout China.

Recent Developments

On October 12, 2021, indie completed the acquisition (the “Acquisition”) of all of the outstanding capital stock of TeraXion Inc., a Canadian company (“TeraXion”), from the existing stockholders of TeraXion. The Acquisition was consummated pursuant to a Share Purchase Agreement dated August 27, 2021 (the “Purchase Agreement”). The total consideration paid for the Acquisition consisted of: (i) the payment by indie of approximately $75.3 million in cash (including debt paid at closing and net of cash acquired); (ii) the issuance by indie of 5,805,144 shares of indie Class A common stock with a fair value of $65.2 million; and (iii) the assumption by indie of TeraXion options, which after the closing of the Acquisition, became exercisable to purchase up to 1,542,332 shares of indie Class A common stock with a fair value of $17.2 million. Pursuant to the Purchase Agreement, indie has also agreed to file this Registration Statement on Form S-1 with the Securities and Exchange Commission (the “SEC”) to register for resale the shares of indie Class A common stock issued to the TeraXion stockholders in connection with the Acquisition.

In addition, on October 22, 2021, we entered into a definitive agreement with Analog Devices, Inc., a Massachusetts corporation (“ADI”), pursuant to which our wholly-owned German subsidiary will purchase all of the capital stock of Symeo GmbH for an aggregate purchase price of up to $30 million. Symeo is ADI’s Munich-based radar division consisting of approximately 35 team members, which specializes in radar hardware and software development for emerging safety system applications. Symeo’s industry-leading RF and sensor technology enables real-time position detection and distance measurement for high precision radar solutions. The transaction was closed on January 4, 2022

On October 1, 2021, we entered into a definitive agreement and completed the acquisition of ON Design Israel Ltd. (“ON Design Israel”), for $5.0 million in cash at closing (net of cash acquired), $7.5 million of cash in 2022 and up to $7.5 million of cash payable upon achievement of certain milestones.

For more information on our recent acquisitions, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Recent Acquisitions.”

Background

On June 10, 2021, Thunder Bridge II domesticated into a Delaware corporation and consummated a series of transactions that resulted in the combination (the “Business Combination”) of Thunder Bridge II with Ay Dee Kay, LLC d/b/a indie Semiconductor (“ADK LLC”) pursuant to a Master Transactions Agreement, dated December 14, 2020, as amended on May 3, 2021, by and among Thunder Bridge II, Thunder Bridge II Surviving Pubco, Inc. (“Surviving Pubco”), ADK LLC, and the other parties named therein, following the approval at the extraordinary general meeting of the shareholders of Thunder Bridge II held on June 9, 2021 (the “Special Meeting”).

1

On December 14, 2020, Thunder Bridge II entered into subscription agreements (the “Subscription Agreements”) with the investors named therein (the “PIPE Investors”), including Mr. Kight and an affiliate of the Sponsor, pursuant to which Thunder Bridge II agreed to issue and sell to the PIPE Investors an aggregate of 15,000,000 of Thunder Bridge II Class A ordinary shares, at a price of $10.00 per Class A ordinary share, simultaneously with or immediately prior to the Closing (the “PIPE Financing”). Upon the closing of the Business Combination, the shares issued pursuant to the PIPE Financing were automatically exchanged for 15,000,000 shares of our Class A common stock (the “PIPE Shares”). Effective upon the closing of the Business Combination, Surviving Pubco changed its name to indie Semiconductor, Inc.

Our Class A common stock and our public warrants are currently traded on Nasdaq under the symbols “INDI” and “INDIW,” respectively.

The rights of holders of our Class A common stock and warrants are governed by our amended and restated certificate of incorporation, our bylaws and the Delaware General Corporation Law (the “DGCL”), and in the case of the warrants, the Warrant Agreement, dated August 8, 2019, by and between Thunder Bridge II and Continental Stock Transfer & Trust Company, as amended by the Assignment, Assumption and Amendment Agreement, dated as of June 10, 2021, by and among Thunder Bridge II, Surviving Pubco and Continental Stock Transfer & Trust Company (as amended, the “Warrant Agreement”). See the sections entitled “Description of Securities” and “Selling Securityholders — Certain Relationships with the Selling Securityholders.”

Our Corporate Structure

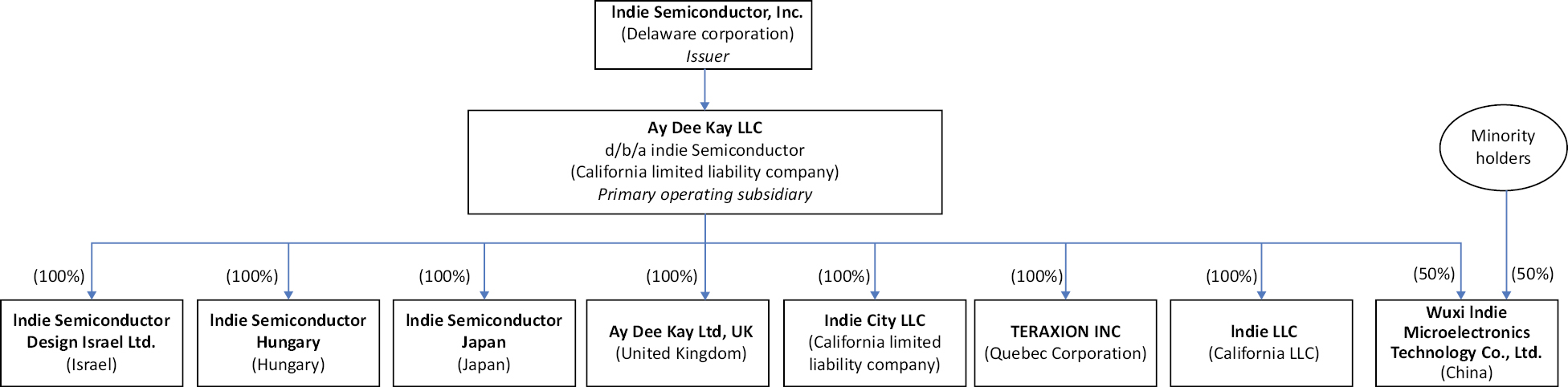

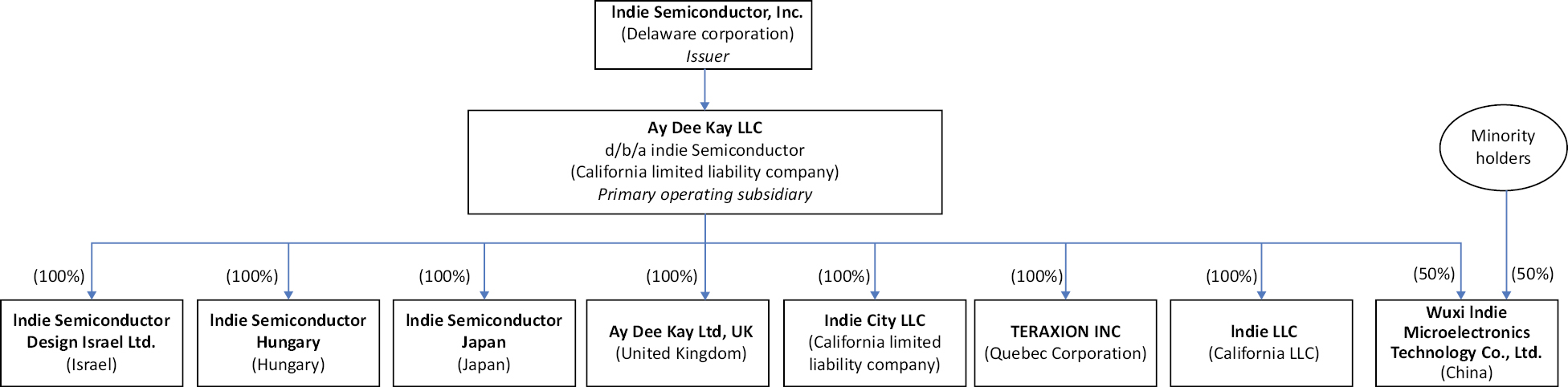

We are a Delaware corporation that is a holding company for ADK LLC, a California limited liability company. ADK LLC is our primary operating entity, and its consolidated subsidiaries include its wholly-owned subsidiaries indie Services Corporation, indie LLC and indie City LLC, all California entities, Ay Dee Kay Limited, a private limited company incorporated under the laws of the United Kingdom, indie Semiconductor GmbH, a private limited liability company incorporated under the laws of Germany, indie Semiconductor Hungary, a limited liability company incorporated under the laws of Hungary, TeraXion Inc., a wholly-owned subsidiary incorporated under the laws of Canada, indie Semiconductor Japan, a wholly-owned subsidiary incorporated under the laws of Japan, indie Semiconductor Design Israel Ltd., a private limited company incorporated under the laws of Israel, and 50%-owned subsidiary that it controls, Wuxi indie Microelectronics Technology Co., Ltd., an entity in China controlled by ADK LLC, and its wholly-owned subsidiaries, indie Semiconductor HK, Ltd and Shanghai Ziying Microelectronics Co., Ltd.

As of December 31, 2021, our corporate structure is as follows:

We are headquartered in Aliso Viejo, California and a majority of our operations are based in the United States. A majority of our employees are located in the United States and Canada.

Permission Required from the PRC Authorities for Our Operations and to Issue Securities

indie is a Delaware corporation that operates through a California LLC, and as a result, neither indie nor any of its subsidiaries, other than the China subsidiary, require permissions or approval from any PRC government agency for its operations and neither indie nor its subsidiaries have ever had any permissions denied by the PRC. If indie or its subsidiaries do not receive or maintain any required PRC permissions or approvals, incorrectly conclude that such

2

permissions or approvals are not required, applicable laws, regulations or interpretations change and we are required to obtain such permissions or approvals in the future, we may incur costs associated with obtaining required permissions or approvals, be forced to relocate our operations, or completely cease operations of our China subsidiary. See “Risk Factors — Risks Related to Doing Business in China.”

Our China subsidiary is required to obtain certain permits and licenses from the PRC government agencies to operate its business in China, such as business licenses and registration with China’s State Administration of Foreign Exchange (“SAFE”) for the issuance of equity incentives granted to employees in China. As the date of this prospectus, our China subsidiary has obtained the required business licenses from the State Administration for Market Regulation (“SAMR”) and complied with registration requirements of China’s SAFE.

As a designer and manufacturer of autotech components, we are not subject to the PRC Cybersecurity Law, the Cyber Administration of China (“CAC”), and other regulations and regulatory agencies that regulate storage, collection and security of personal information and important data collected and generated by operators of critical information infrastructure in the course of their operations in the PRC Online platform or website operators of certain industries may be identified as critical information infrastructure operators by the CAC if they meet the threshold as stated in the Revised Cybersecurity Measures and such operators may be subject to cybersecurity review. We believe we would not be subject to the cybersecurity review by the CAC, given that (i) we and our China subsidiary possess and will possess personal information of a relatively small number of users in our business operations as of the date of this prospectus, significantly less than the one million user threshold set for a data processing operator applying for listing on a foreign exchange that is required to pass such cybersecurity review; and (ii) data processed in our business and the business of our China subsidiary does not have a bearing on national security and thus should not be classified as core or important data by the authorities. However, there remains uncertainty as to how the cybersecurity measures may be interpreted or implemented and whether the PRC regulatory agencies, including the CAC, may adopt new rules and regulations related to the Revised Cybersecurity Measures. Failure to comply with the effective cybersecurity, data privacy and internet data security regulatory requirements in a timely manner, or at all, may subject us to government enforcement actions and investigations, fines, penalties, suspension or disruption of our operations, among other things.

Cash Flows, Dividends and Other Asset Transfers between the U.S. Holding Company and Our Subsidiaries

In order for us to pay dividends or other distributions to our stockholders, we will rely on payments from our domestic operating subsidiary, ADK LLC. All revenue generated by shipment to China that is earned by ADK LLC is paid directly to ADK LLC, primarily in U.S. dollars. Any revenue generated by our China subsidiary is collected locally and is held in Chinese bank accounts.

Our China subsidiary has kept and intends to keep any future earnings to re-invest in and finance its operations and expansion, and we do not anticipate that it will pay cash dividends in the foreseeable future. Current PRC regulations permit Chinese operating subsidiaries to pay dividends to foreign parent companies only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. Our China subsidiary may be restricted from making dividends or distributions on equity by conditions on future debt or PRC rules or regulation.

ADK LLC and our China subsidiary also are parties to intercompany agreements for various intercompany services, including sales & marketing, non-recurring engineering projects and other administrative tasks. Service fees are paid on a cost-plus basis and paid between the entities without net settlement.

As of the date of this prospectus, we have not paid, and do not anticipate paying in the foreseeable future, dividends or other distributions to our stockholders. There have not been any dividends or other distributions from our China subsidiary and our China subsidiary has never paid any dividends or distributions outside of China. We presently intend to retain all earnings to fund our operations and business expansions.

For more information, see our condensed consolidated financial statements and the related notes included elsewhere in the registration statement to which this prospectus forms a part.

3

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may benefit from specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include, but are not limited to:

• presentation of only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations in this prospectus;

• reduced disclosure about our executive compensation arrangements;

• no non-binding stockholder advisory votes on executive compensation or golden parachute arrangements;

• exemption from any requirement of the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); and

• exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting.

We may benefit from these exemptions until December 31, 2024 or such earlier time that we are no longer an emerging growth company. We will cease to be an emerging growth company upon the earliest of: (1) December 31, 2024; (2) the first fiscal year after our annual gross revenues are $1.07 billion or more; (3) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; or (4) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We may choose to benefit from some but not all of these reduced disclosure obligations in future filings. If we do, the information that we provide stockholders may be different than you might get from other public companies in which you hold stock.

Summary of Risks

An investment in shares of our Class A common stock and warrants involves substantial risks and uncertainties that may adversely affect the value of your investment. Some of the more significant challenges and risks relating to an investment in our company include, among other things, the following:

Risks Related to Our Operations and Industry

• The semiconductor industry is highly cyclical.

• The semiconductor industry is highly competitive.

• Average selling prices in the markets we serve have decreased over time.

• Much of our business depends on winning competitive bid selection processes.

• The demand for our products depends on the demand for our customers’ end products.

• Any downturn in the automotive market could significantly harm our financial results.

• We depend on third parties to manufacture, assemble, test and/or package our products.

• We rely on the timely supply of materials that may only be available from a limited number of suppliers.

• We must develop new products with acceptable profit margins.

• “Strategic backlog” and “design win pipeline” estimations may not result in revenue or profits.

• Mergers, acquisitions, investments and joint ventures could adversely affect our results of operations.

• We must effectively manage future growth.

• We may seek additional capital, which may result in dilution to our stockholders.

4

• We may rely on strategic partnerships, joint ventures and alliances for outside of our control.

• We may not be successful in exiting certain programs or businesses or in restructuring our operations.

• Disruptions in our relationships with any one of our key customers could adversely affect our business.

• Conflict minerals disclosure requirements may cause us to incur additional expenses.

• Our existing and future indebtedness could adversely affect our ability to operate our business.

• We have historically incurred losses and may continue to incur losses.

Risks Related to Our Organizational Structure

• We are dependent upon distributions made by our subsidiaries to make certain payments.

• We are party to a Tax Receivable Agreement, which requires us to make certain payments.

Risks Related to Macroeconomic Conditions

• Geopolitical uncertainty could impact end customer demand and disrupt our supply chain.

• Downturns or volatility in general economic conditions could harm our business.

• Rising interest rates and higher borrowing costs could impair our ability to raise sufficient capital to capitalize on our business plans.

• Fluctuations in foreign exchange rates could harm our business.

• Political, economic and health risks and natural disasters could harm our business.

• Fluctuations in foreign exchange rates could have an adverse effect on our results of operations.

• Our worldwide operations are subject to political, economic and health risks and natural disasters, including the ongoing effects of the COVID-19 pandemic, which could have a material adverse effect on our business operations.

Risks Related to our Intellectual Property, Technology, Privacy and Security.

• We may not be able to protect our proprietary intellectual property against improper use.

• Intellectual property claims or litigation could significantly harm our business.

• We rely on certain third-party software that may not be available to us in the future.

• Interruptions in information technology systems could adversely affect our business.

• Security breaches and other cybersecurity incidents could adversely impact our business.

Risks Related to Regulatory Compliance and Legal Matters

• We must comply with a large body of laws and regulations.

• We may be adversely affected by product defects and product liability or warranty claims.

• Significant litigation could impair our reputation and cause us to incur substantial costs.

• Securities litigation and stockholder activism could adversely affect our business.

• We are subject to export restrictions and laws affecting trade and investments.

• Changes in tax rates or laws or additional tax liabilities could adversely affect our business.

• Failure to comply with anti-corruption laws or our ethics policies could adversely affect our business.

• We must comply with environmental and occupational health and safety laws and regulations.

5

Risks Related to Doing Business in China.

• Uncertainties with respect to the PRC legal system could adversely affect our China subsidiary.

• China’s economic, political and social conditions may change rapidly with little advance notice.

• Our China subsidiary may be limited in its ability to make distributions to us.

• Government control of currency conversion may affect the value of our securities.

• Failure to comply with certain regulations may subject us or our PRC employees to fines or sanctions.

• We may be subject to a variety of PRC laws and other obligations regarding data protection.

Risks Related to Financial Reporting, Internal Controls and Being a Public Company

• Inadequate internal controls could result in inaccurate financial reporting.

• We may not be able to timely and effectively implement and maintain controls and procedures required by Section 404 of the Sarbanes-Oxley Act that are applicable to us.

• We will incur significant increased expenses and administrative burdens as a public company.

• Use of exemptions available to emerging growth companies could make our securities less attractive to investors and may make it difficult to compare our performance to that of other public companies.

• Our actual operating results may differ significantly from our guidance.

Risks Related to Ownership of Our Class A Common Stock and Warrants, and Organizational Documents

• We must comply with the continued listing standards of Nasdaq for our Class A common stock.

• We may redeem unexpired warrants prior to their exercise at a time that is disadvantageous to the holder, thereby making such warrants worthless.

• Our warrants may have an adverse effect on the market price of our Class A common stock.

• An investment in our Class A common stock may be diluted by future issuances of our Class A common stock or LLC Units.

• There may be sales of a substantial amount of Class A common stock by our stockholders.

• Provisions in our Certificate of Incorporation and Bylaws limit the ability of stockholders to take certain actions and could delay or discourage takeover attempts.

• Our Certificate of Incorporation designates the Court of Chancery of the State of Delaware as the sole and exclusive forum for certain types of actions and proceedings.

General Risk Factors

• The market price of our securities may fluctuate or decline.

• Shares of Autotech public companies have been severely depressed over the past year and may not recover.

• Loss of personnel, or an inability to attract personnel, could adversely affect our business.

• Our operating results are subject to substantial quarterly and annual fluctuations.

Please see “Risk Factors” for a discussion of these and other factors you should consider before making an investment in our securities.

Corporate Information

Our principal executive offices are located at 32 Journey, Aliso Viejo, California 92656. Our telephone number is (949) 608-0854. Our website address is www.indiesemi.com. Information contained on our website or connected thereto does not constitute part of, and is not incorporated by reference into, this prospectus or the registration statement of which it forms a part.

6

The Offering

|

Issuer |

indie Semiconductor, Inc. |

|

|

Shares of Class A Common Stock Offered by us |

|

|

|

Shares of Class A Common Stock Offered by the Selling |

|

|

|

Warrants Offered by the Selling Securityholders |

|

|

|

Exercise Price of Warrants |

$11.50 per share, subject to adjustment as defined herein. |

|

|

Shares of Class A Common Stock Outstanding Prior to Exercise of All Warrants as of December 31, 2021 |

|

|

|

Shares of Class A Common Stock Outstanding Assuming Exercise of All Warrants as of December 31, 2021 |

|

|

|

Use of Proceeds |

We will not receive any proceeds from the sale of shares of Class A common stock by the Selling Securityholders. We will receive up to an aggregate of approximately $315.1 million from the exercise of the warrants, assuming the exercise in full of all of such warrants for cash. We expect to use the net proceeds from the exercise of the warrants for general corporate purposes. See “Use of Proceeds.” |

|

|

Dividend Policy |

The declaration, amount and payment of any future dividends will be at the sole discretion of our board of directors. Our board of directors may take into account general economic and business conditions, our financial condition and operating results, our available cash and current and anticipated cash needs and capital requirements and implications on the payment of dividends by us to our stockholders or by our subsidiaries (including ADK LLC) to us, and such other factors as our board of directors may deem relevant. Shares of Class V common stock will not entitle their holders to any dividends. |

|

|

indie Semiconductor, Inc. is a holding company and has no material assets other than its equity interest in ADK LLC. We intend to cause ADK LLC to make distributions to us in an amount sufficient to cover cash dividends, if any, declared by us. If ADK LLC makes such distributions to indie Semiconductor, Inc., other holders of LLC Units will be entitled to receive equivalent pro rata distributions. |

||

|

Market for Common Stock and |

|

|

|

Risk Factors |

See “Risk Factors” and other information included in this prospectus for a discussion of factors you should consider before investing in our securities. |

____________

(1) Includes 30,448,081 shares of Class A common stock to be issued upon the exchange of LLC Units. See “Certain Relationships and Related Persons Transactions — Exchange Agreement.”

7

In this prospectus, unless otherwise indicated, the number of shares of Class A common stock outstanding as of December 31, 2021 and the other information based thereon does not include:

• 30,448,081 shares of Class V common stock, which vote together as a single class with our Class A common stock;

• 27,400,000 shares of Class A common stock issuable upon exercise of publicly-traded indie warrants;

• Up to 1,084,790 shares of Class A common stock issuable upon vesting of phantom stock units outstanding as of December 31, 2021;

• Any of the following (collectively, the “Earn-Out Securities”):

• 5,000,000 Earn-Out Securities, in the aggregate, in the event that the average trading price of our Class A common stock is $15.00 or greater for any 20 trading days within a period of 30 consecutive trading days prior to December 31, 2027 (the date when the foregoing is first satisfied, the “Second Earn-Out Achievement Date”).

• Such Earn-Out Securities will also be issued under certain circumstances if an agreement with respect to a sale of the Company is entered into prior to December 31, 2027. If the Second Earn-Out Achievement Date or a sale of the Company that results in the issuance such shares has not occurred prior to December 31, 2027, the applicable Earn-Out Securities will not be issuable.

• 1,725,000 shares of Class A common stock (the “Sponsor Escrow Shares”) held by the Sponsor that are issued but not outstanding and are held in escrow subject to forfeiture in accordance with the following terms and conditions:

• Upon the Second Earn-Out Achievement Date (should it occur), 50% of the Sponsor Escrow Shares as of immediately prior to the Closing will be released from escrow to the Sponsor; and

• Such Sponsor Escrow Shares will also be released from escrow to the Sponsor under certain circumstances if an agreement with respect to a sale of the Company is entered into prior to December 31, 2027. If the First Earn-Out Achievement Date or the Second Earn-Out Achievement Date, as applicable, or a sale of the Company that results in release of such shares from escrow to the Sponsor has not occurred prior to December 31, 2027, the applicable Sponsor Escrow Shares that were subject to escrow will be forfeited, returned to the Company and cancelled.

• 1,354,181shares of Class A common stock that are issued but are not deemed to be outstanding as they are restricted stock, subject to forfeiture and have not yet been earned.

• Up to 6,311,665 shares of Class A common stock reserved for issuance under the 2021 Omnibus Equity Incentive Plan.

In this prospectus, unless otherwise indicated, the number of shares of Class A common stock outstanding as of December 31, 2021 and the other information based thereon does include:

• 5,000,000 Earn-Out Securities, in the aggregate, that were earned and issued upon First Earn-Out Achievement Date, November 9, 2021 (the “First Earn-Out Achievement Date”).

• 1,725,000 Sponsor Escrow Shares that were earned and released from escrow on or about the First Earn-Out Achievement Date.

For additional information concerning the offering see “Plan of Distribution.”

8

RISK FACTORS

An investment in our Class A common stock involves risks. You should carefully consider each of the following risks and all of the information set forth in this prospectus before deciding to invest in our Class A common stock. These risk factors are not exhaustive, and investors are encouraged to perform their own investigation with respect to our business, financial condition and prospects. You should carefully consider the following risk factors in addition to the other information included in this prospectus, including matters addressed in the section entitled “Cautionary Note Regarding Forward-Looking Statements.” We may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial, which may also impair our business or financial condition. If any of the following risks and uncertainties develops into actual events, our business, financial condition, results of operations and cash flows could be materially adversely affected and the price of our Class A common stock could decline and you may lose all or part of your investment. The following discussion should be read in conjunction with the financial statements and notes to the financial statements included herein.

Risks Related to Our Operations and Industry

The cyclical nature of the semiconductor industry may limit our ability to maintain or improve our net sales and profitability.

The semiconductor industry is highly cyclical and is prone to significant downturns from time to time. Cyclical downturns can result in substantial declines in semiconductor demand, production overcapacity, high inventory levels and accelerated erosion of average selling prices. Such downturns result from a variety of market forces including constant and rapid technological change, quick product obsolescence, price erosion, evolving standards, short product life cycles and wide fluctuations in product supply and demand.

Commencing in 2020, downturns in the semiconductor industry have been attributed to a variety of factors including the ongoing COVID-19 pandemic, ongoing trade disputes between the United States and China, weakness in demand and pricing for semiconductors across applications, and excess inventory. During the second half of fiscal year 2020, customer manufacturing facilities re-opened and demand increased through fourth quarter of 2021. Currently, the Company does not anticipate significant adverse effects on its operations in the near- or mid-term. However, the future effects of the virus are difficult to predict, due to uncertainty about the course of the virus, different variants that may evolve, and the supply of the vaccine on a local, regional, and global basis, as well as the ability to implement vaccination programs in a short time frame.

Conversely, significant upturns could cause us to be unable to satisfy demand in a timely and cost-efficient manner, and could result in increased competition for access to third-party foundry, assembly and testing capacity. In the event of such an upturn, we may not be able to expand our workforce and operations in a sufficiently timely manner, procure adequate resources and raw materials, or locate suitable suppliers or other subcontractors to respond effectively to changes in demand for our existing products or to the demand for new products. Accordingly, our business, financial condition and results of operations could be materially and adversely affected.

The semiconductor industry is highly competitive. If we fail to introduce new technologies and products in a timely manner, it could adversely affect business.

The semiconductor industry is highly competitive and characterized by constant and rapid technological change, short product lifecycles, significant price erosion, and evolving standards for quality. Accordingly, the success of our business depends, to a large extent, on our ability to meet evolving industry requirements, introduce new products and technologies designed to satisfy those evolving requirements, and see our products and technologies accepted in the marketplace, both in a timely manner and at prices that are acceptable to customers.

Moreover, the costs related to the research and development necessary to develop new technologies and products are significant and some of our competitors may have greater resources than us. If they significantly increase the resources that they devote to developing and marketing their products, we may not be able to compete effectively. Our competitors’ products, services and technologies may be less costly or may offer superior functionality or better features than ours, which may result in lower than expected selling prices for our products. Additionally, some of our competitors operate and maintain their own fabrication facilities, have longer operating histories, larger customer bases, more comprehensive intellectual property portfolios and greater financial resources.

9

Further, the semiconductor industry has experienced, and may continue to experience, significant consolidation among companies and vertical integration among customers. Larger competitors resulting from consolidations may have certain advantages over us, including, but not limited to: more efficient cost structures; substantially greater financial and other resources with which to withstand adverse economic or market conditions and pursue development, engineering, manufacturing, marketing and distribution of their products; longer independent operating histories; presence in key markets; intellectual property protection; large purchase quantities; and greater name recognition. In addition, we may be at a competitive disadvantage to our peers if we fail to identify or are unable to finance attractive opportunities to acquire companies to expand our business. Consolidation among our competitors and integration among our customers could erode our market share, negatively impact our capacity to compete and require us to restructure our operations, any of which would have a material adverse effect on our business.

As a result of these competitive pressures, we may face declining sales volumes or lower prices for our products, and may not be able to reduce total costs in line with declining revenue. If any of these risks materialize, they could have a material adverse effect on our business, financial condition and results of operations.

The average selling prices of products in our markets have historically decreased over time and could do so in the future, which could adversely impact our revenue and profitability.

Average selling prices of semiconductor products in the markets we serve have historically decreased over time. Profit margins and financial results may suffer if we are unable to offset any reductions in average selling prices by reducing costs, developing new or enhanced products on a timely basis with higher selling prices or profit margins, or increasing sales volumes. Although we have contractual agreements with customers, there is no assurance that those price agreements will be honored. As a result, our average selling prices may decline faster than forecasted.

Much of our business depends on winning competitive bid selection processes, and the failure to be selected could adversely affect business in those market segments.

The competitive selection processes often require an investment of significant time and capital resources, with no guarantee of winning the contract and generating revenue. In the automotive semiconductor market in which we compete, due to the longer design cycles involved, failure to win a design-in could prevent access to a customer for several years. Our failure to win a significant number of these bids could result in reduced revenues, and hurt our competitive position for future selection processes, which could have a material adverse effect on our business, financial condition and results of operations.

The demand for our products depends on the demand for our customers’ end products.

The vast majority of our revenue is derived from sales to manufacturers in the automotive industry. Demand in this market fluctuates significantly, driven by consumer spending, consumer preferences, the development of new technologies and prevailing economic conditions. In addition, the end products in which our semiconductors are incorporated may not be successful, or may experience price erosion or other competitive factors that could affect the price manufacturers are willing to pay. Such customers have in the past, and may in the future, vary order levels significantly from period to period, request postponements of scheduled delivery dates, modify their orders or reduce lead times. This is particularly common during periods of low demand. This can make managing business difficult, as it limits the predictability of future revenue. It can also affect the accuracy of our financial forecasts.

Furthermore, developing industry trends, including customers’ use of outsourcing and new and revised supply chain models, may affect our revenue, costs and working capital requirements.

Our sales are made primarily to Tier 1 suppliers. Any downturn in the automotive market could significantly harm our financial results.

This automotive concentration of sales exposes us to the risks associated with the automotive market. For example, our anticipated future growth is highly dependent on the adoption of ADAS, user interface, connectivity and electrification technologies, which are expected to have increased sensor and power product content. A downturn in the automotive market could delay automakers’ plans to introduce new vehicles with these features, which would negatively impact the demand for products and our ability to grow our business.

10

The automotive industry continues to undergo consolidation and reorganization. Further, such changes in the automotive market could have a material adverse effect on our business, financial condition and results of operations.

Moreover, governmental actions to contain the spread of COVID-19 adversely affected the automotive industry, including manufacturers, dealers, distributors and third-party suppliers. For example, in early 2020, many automotive manufacturers were forced to suspend manufacturing operations for a period of time. Starting in second half of fiscal year 2020, customer manufacturing facilities re-opened and demand increased through fourth quarter of 2021. Currently, the Company does not anticipate significant adverse effects on its operations in the near- or mid-term. However, the future effects of the virus are difficult to predict, due to uncertainty about the course of the virus, different variants that may evolve, and the supply of the vaccine on a local, regional, and global basis, as well as the ability to implement vaccination programs in a short time frame.

The foregoing operational and economic impacts and other adverse effects on the automotive industry could have a material adverse effect on our business, financial condition and results of operations.

We depend on third parties and their technology to manufacture, assemble, test and/or package our products, which exposes us to risks.

The manufacture of our products, including the fabrication of semiconductor wafers, and the assembly and testing of our products, involve highly complex processes. For example, minute levels of contaminants in the manufacturing environment, difficulties in the wafer fabrication process or other factors can cause a substantial portion of the components on a wafer to be nonfunctional. These problems may be difficult to detect at an early stage of the manufacturing process and often are time-consuming and expensive to correct.

From time to time, we have experienced problems achieving acceptable yields at our third-party wafer fabrication partners, resulting in delays in the availability of components. Moreover, an increase in the rejection rate of products during the quality control process before, during or after manufacture and/or shipping of such products, results in lower yields and margins.

In addition, changes in manufacturing processes required as a result of changes in product specifications, changing customer needs and the introduction of new product lines have historically significantly reduced manufacturing yields, resulting in low or negative margins on those products. Poor manufacturing yields over a prolonged period of time could adversely affect our ability to deliver products on a timely basis and harm relationships with our customers, which could materially and adversely affect our business, financial condition and results of operations.

We rely on the timely supply of materials and our business could be adversely affected if suppliers fail to meet their delivery obligations or raise prices. Certain materials needed in our manufacturing operations are only available from a limited number of suppliers.

We have a fabless business model, which outsources our manufacturing operations to third party foundries. The manufacturing operations depend on deliveries of materials in a timely manner and, in some cases, on a just-in-time basis. From time to time, suppliers may extend lead times, limit the amounts supplied or increase prices due to capacity constraints or other factors. Supply disruptions may also occur due to shortages in critical materials or components. Because our products are complex, it is frequently difficult or impossible to substitute one type of material with another. A failure by suppliers to deliver requirements could result in disruptions to our third-party manufacturing operations. Our business, financial condition and results of operations could be harmed if we are unable to obtain adequate supplies of materials in a timely manner or if there are significant increases in the costs of materials.

The semiconductor industry is characterized by continued price erosion, especially after a product has been on the market for a period of time, and we may be unsuccessful in advancing our product technologies, improving efficiencies or developing and selling new products with product margins similar or better than what we have experienced in the past.

One of the results of the rapid innovation in the semiconductor industry is that pricing pressure, especially on products containing older technology, can be intense. Product life cycles are relatively short, and as a result, products tend to be replaced by more technologically advanced substitutes on a regular basis. In turn, demand for older technology falls, causing the price at which such products can be sold to drop, in some cases precipitously.

11

In order to continue profitably supplying these products, continuous development of new technology, processes and product innovations is necessary. If we cannot advance our process technologies or improve our efficiencies to a degree sufficient to maintain required margins, we will no longer be able to make a profit from the sale of these products. Moreover, we may not be able to cease production of such products, either due to contractual obligations or for customer relationship reasons, and as a result we may be required to bear a loss on such products. We cannot guarantee that competition in our core product markets will not lead to price erosion, lower revenue or lower margins in the future. Should reductions in our manufacturing costs fail to keep pace with reductions in market prices for the products we sell, this could have a material adverse effect on our business, financial condition and results of operations. Further, we have invested and will continue to invest significant resources in our product and technology development efforts. Our development efforts carry inherent risk due to the challenges of foreseeing changes or developments in technology, predicting changes in customer requirements or preferences or anticipating the adoption of new industry standards, and we may be unable to meet our customers’ requirements or gain market acceptance. Should we fail to develop and introduce sufficiently unique products with profit margins similar to or better than what we have experienced in the past or should our product development fail to keep pace with the changing needs of our customers and industry, our business, financial condition and results of operations could be materially and adversely affected.

We may pursue mergers, acquisitions, investments and joint ventures, which could adversely affect our results of operations.

Our growth strategy includes acquiring or investing in businesses that offer complementary products, services and technologies, or enhance our market coverage or technological capabilities. Any acquisitions we undertake, and their integration involve risks and uncertainties. There could be unexpected delays, challenges and related expenses, and disruption of our business. Inaccuracies in our estimates and assumptions used to assess a transaction or missteps or delays in integrating our acquisitions may result in us not realizing the expected financial or strategic benefits of any such transaction. In addition, U.S. and foreign regulatory approvals required in connection with an acquisition may take longer than anticipated to obtain, may not be forthcoming or may contain burdensome conditions, which may jeopardize, delay or reduce the anticipated benefits to us of the transaction.

If we do not effectively manage future growth, our resources, systems and controls may be strained, and our results of operations may suffer.

Future growth could strain our resources, management, information and telecommunication systems and operating and financial controls. To manage future growth effectively, we must be able to improve and expand our systems and controls, which we may not be able to do in a timely or cost-effective manner. A failure to manage any growth we may experience or improve or expand our existing systems and controls, or unexpected difficulties in doing so, could harm our business and results of operations.

We may seek additional capital to take advantage of business opportunities and support the further expansion of our business, which capital might not be available on acceptable terms, if at all, or may result in dilution to our stockholders.

While we believe that the net proceeds from the Transaction continue to be sufficient to meet our current capital requirements, we may seek additional equity or debt financing to pursue strategic opportunities, acquire complementary businesses, products or technologies or to fund the further expansion of our business. If additional funds are raised through the issuance of equity or debt securities, the percentage ownership of our existing stockholders would be reduced, and such securities may have rights, preferences or privileges senior to those of the holders of our Class A common stock.

From time to time, we may rely on strategic partnerships, joint ventures and alliances for manufacturing and research and development. However, we do not control these partnerships and joint ventures, and actions taken by any of our partners or the termination of these partnerships or joint ventures could adversely affect our business.

As part of our strategy, we may enter into a number of long-term strategic partnerships and alliances, including mergers and acquisitions. There can be no assurances that they will be successful. If any of our current strategic partners or alliances we may engage with in the future were to encounter financial difficulties or change their business strategies, they may no longer be able or willing to participate in these groups or alliances, which could have a material adverse effect on our business, financial condition and results of operations.

12

We may from time-to-time desire to exit certain programs or businesses, or to restructure our operations, but may not be successful in doing so.

From time to time, we may decide to divest certain businesses or restructure our operations, including through the contribution of assets to joint ventures. However, our ability to successfully exit businesses, or to close or consolidate operations, depends on a number of factors, many of which are outside of our control. For example, if we are seeking a buyer for a particular business, none may be available, or we may not be successful in negotiating satisfactory terms with prospective buyers. In some cases, particularly with respect to our European operations, there may be laws or other legal impediments affecting our ability to carry out such sales or restructuring.

If we are unable to exit a business in a timely manner, or to restructure our operations in a manner we deem to be advantageous, this could have a material adverse effect on our business, financial condition and results of operations. Even if a divestment is successful, we may face indemnity and other liability claims by the acquirer or other parties.

Disruptions in our relationships with any one of our key customers could adversely affect our business.

A substantial portion of our revenue is derived from top customers. We cannot guarantee that we will be able to generate similar levels of revenue from our largest customers in the future. If one or more of these customers substantially reduces its purchases from us, it could have a material adverse effect on our business, financial condition and results of operations. Sales to Aptiv, a leading Tier 1 automotive supplier, represented approximately 39% and 57% of our total revenue for the years ended December 31, 2021 and 2020, respectively. The loss of this customer would have a material impact on our consolidated financial results. However, as we continue to grow our customer base organically and through business combinations, the revenue concentration with Aptiv may decrease over time.

Conflict minerals disclosure regulations may require us to incur additional expenses, may result in damage to our business reputation and may adversely impact our ability to conduct our business.

The U.S. Congress has enacted laws, and the SEC has adopted rules regarding enhanced disclosure requirements for companies that use specified minerals known as “conflict minerals” in their products. Some of these metals are commonly used in semiconductor devices, including our products. These SEC rules require companies to investigate, disclose and report whether or not such metals originated from the Democratic Republic of Congo or adjoining countries. We have numerous foreign suppliers, many of whom are not obligated by law to investigate their own supply chains. As a result, we may incur significant costs to comply with the diligence and disclosure requirements, including costs related to determining the source of any of the relevant metals used in our products. In addition, because our supply chain is with third parties, we may not be able to sufficiently verify the origin of all the relevant metals used in our products through the due diligence procedures we implement. We may also face difficulties in satisfying our customers if they require that we prove or certify that our products are “conflict free.” Key components and parts that can be shown to be “conflict free” may not be available to us in sufficient quantity, or at all, or may only be available at significantly higher cost to us. If we are not able to meet customer requirements, customers may discontinue purchasing from us. Any of these outcomes could adversely impact our business, financial condition or operating results.

Our existing and future indebtedness could adversely affect our ability to operate our business.

As of December 31, 2021, our total consolidated indebtedness was $7.9 million. We may also incur additional indebtedness to meet future financing needs. We may be subject to debt covenants and payment obligations that may limit our ability to operate our business. Any outstanding indebtedness, including any additional future indebtedness, combined with our other financial obligations and contractual commitments could have significant adverse consequences, including:

• requiring us to dedicate a portion of our cash resources to the payment of interest and principal, reducing money available to fund working capital, capital expenditures, product candidate development and other general corporate purposes;

• increasing our vulnerability to adverse changes in general economic, industry and market Conditions, such as interest rate fluctuations;

• subjecting us to restrictive covenants that may reduce our ability to take certain corporate actions or obtain further debt or equity financing;

13

• acceleration of payment of our debt obligations upon a default of payment;

• potential loss of collateral for secured indebtedness;

• limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we compete; and

• placing us at a competitive disadvantage compared to our competitors that have less debt or better debt servicing options.

We have historically incurred losses and may continue to incur losses.

We have incurred a net loss since our inception. Our ability to achieve profitability will depend on increased revenue growth from, among other things, increased demand for our product offerings. We may not be successful in these pursuits, and we may never achieve profitability or sustain profitability if achieved.

Risks Related to Our Organizational Structure

We are a holding company and our only material asset is our interest in ADK LLC, and we are accordingly dependent upon distributions made by our subsidiaries to pay taxes, make payments under the Tax Receivable Agreement and pay dividends.