Dave Inc.

Dave, a Delaware corporation, offers a suite of innovative financial products aimed at helping its Members improve their financial health. Dave’s products include (i) a budgeting tool to helps Members manage their upcoming bills to avoid overspending, (ii) cash advances through its flagship 0% interest ExtraCash product to help Members avoid punitive overdraft fees, (iii) a Side Hustle product, where Dave helps connect Members with supplemental work opportunities, and (iv) Dave Banking, a modern checking account experience with valuable tools for building long-term financial health. Dave has a limited operating history and since inception, it has experienced net losses and contemplates that it may incur losses again in the future. Accumulated deficit for the six months ended June 30, 2021 was approximately $9.8 million and accumulated deficit for the year ended December 31, 2020 was approximately $12.9 million.

For more information about Dave, please see the sections titled “,” “” and “.”

Information About Dave

Management’s Discussion and Analysis of Financial Condition and Results of Operations of Dave

Management After the Business Combination

The Business Combination and the Merger Agreement

On June 7, 2021, VPCC entered into the Merger Agreement, by and among VPCC, First Merger Sub, Second Merger Sub and Dave, pursuant to which, among other things: (a) First Merger Sub will merge with and into Dave, with Dave being the surviving corporation of the First Merger and (b) immediately following the First Merger and as part of the same overall transaction as the First Merger, Dave will merge with and into Second Merger Sub, with Second Merger Sub being the surviving company of the Second Merger.

For more information about the transactions contemplated by the Merger Agreement, please see the section titled “

The Business Combination and the Merger Agreement

.” A copy of the Merger Agreement is attached to this proxy statement/prospectus as

Annex

A

.

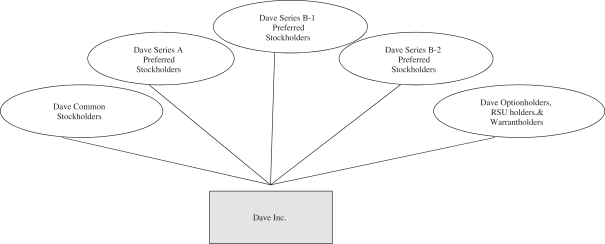

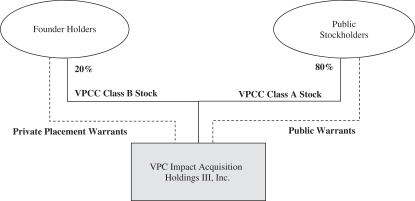

The following diagrams illustrate in simplified terms the current structure of VPCC and Dave and the expected structure of the Combined Company upon the Closing.

Simplified

Pre-Combination

Structure VPCC

Pre-Combination

Structure

18