Filed Pursuant to Rule 424(b)(5)

Registration No. 333-279753

PROSPECTUS SUPPLEMENT

(To Prospectus dated May 28, 2024)

MicroCloud Hologram Inc.

$28,000,000 Principal Amount of Unsecured Promissory Notes Due 2025

and

Ordinary Shares Underlying Unsecured Convertible Promissory Notes Due 2025

We are offering by this prospectus supplement (i) $28,000,000 aggregate principal amount of a series of Unsecured Convertible Promissory Notes (the “Notes”) to certain investors (the “Investors”) convertible into our ordinary shares, and (ii) the ordinary shares issuable from time to time upon conversion of the Notes.

On July 8, 2024, the Company entered into Convertible Note Purchase Agreements (the “CNPAs”) with the Investors pursuant to which the Investors will purchase from the Company convertible notes in the aggregate principal amount of $28,000,000. All outstanding principal and accrued interest (if any) on the Notes, once issued, will become due and payable 360 days after the effective date of each of the Notes. For a more detailed description of the CNPAs and the Notes, please see our Form 6-K furnished to the SEC on July 10, 2024, which we incorporate herein by reference.

The registration of the issuance of our ordinary shares hereunder does not necessarily mean that the Investors will convert the Notes into ordinary shares. We will not receive any of the proceeds from the issuance from time to time of the shares upon conversion to the Investors, but we agreed to pay certain registration expenses relating to the registration of such shares with the U.S. Securities and Exchange Commission, or the SEC. See section titled “Plan of Distribution” in this prospectus supplement.

Our ordinary shares are listed on the Nasdaq Capital Market under the symbol “HOLO.” On April 22, 2024, the highest closing price of our ordinary shares during the last 60 days was $3.88 per share on April 2, 2024, and the aggregate market value of our total outstanding ordinary shares held by non-affiliates was approximately $93,323,936 based on 24,052,561 outstanding ordinary shares held by non-affiliates. The Company is therefore currently not subject to the limitations under General Instruction I.B.5 of Form F-3 until the filing date of Form 20-F for the fiscal year ending December 31, 2024.

The securities offered by this prospectus involve a high degree of risk. See “Supplement Risk Factors” beginning on page S-16 of this prospectus supplement and “Risk Factors” on page 13 of the accompanying prospectus, as well as our other filings that are incorporated by reference into this prospectus supplement and the accompanying prospectus.

On September 16, 2022, Golden Path Acquisition Corporation, a Cayman Islands Special Purpose Acquisition Corporation, completed its business combination with MC Hologram Inc., a Cayman Islands holding company. After the business combination, the Company changed its name to MicroCloud Hologram Inc. References to “MicroCloud”, “the Company”, “we”, “our” or “us” are to MicroCloud Hologram Inc., our Cayman Islands holding company, its predecessor entity and its subsidiaries, as the context requires.

The Company conducts its business operations in China primarily through its PRC subsidiaries. The Company owns and exerts control over its PRC subsidiaries through direct equity ownership. Nonetheless, given the Company’s holding structure, investors should be aware that investing in the Cayman holding company’s ordinary shares is not the same as purchasing equity interest in the Company’s Chinese operating entities. Instead, investors are purchasing equity interest in a Cayman Islands holding company whose revenues are derived from the operations conducted primarily by its PRC subsidiaries. For more information, please refer to the section titled “Corporate Information” in the summary section of this prospectus below.

As a Cayman Islands holding company with operating subsidiaries in China, we face various legal and operational risks and uncertainties associated with the complex and evolving PRC laws and regulations. The Chinese government exerts significant oversight and discretion over the conduct of our business - we described these associated risks in our Annual Report on Form 20-F for 2023 in “Part I, Item 3. Key Information — Risk Factors Relating to Doing Business in China.” For instance, the PRC government recently initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. In sum, the Chinese government may intervene or influence our PRC operations at any time, which could result in a material change to our operations and/or the value of your securities or the securities we are registering for sale under this prospectus.

Notably, the PRC government has recently indicated an intent to exert more oversight and control over overseas securities offerings and other capital markets activities and foreign investment in China-based companies like us. See subheading below and “Risk Factors—We are required to file with the CSRC within 3 working days after the subsequent securities offering is completed and we might face warnings or fines if we fail to fulfill related filing procedure. We may become subject to more stringent requirements with respect to matters including cross-border investigation and enforcement of legal claims.” Any such action, once taken by the PRC government, could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or in extreme cases, become worthless.

Regulatory Measures Implemented By the China Securities Regulatory Commission (“CSRC”) Affecting Our Securities Offerings

On February 17, 2023, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”), which came into effect on March 31, 2023. The Trial Measures apply to overseas securities offerings and/or listings conducted by (1) companies incorporated in the PRC, or PRC domestic companies, directly and (2) companies incorporated overseas with operations primarily in the PRC and valued on the basis of interests in PRC domestic companies, or indirect offerings. The Trial Measures requires (i) the filings of the overseas offering and listing plan by the PRC domestic companies with the CSRC under certain conditions, and (ii) the filing of their underwriters or placement agents with the CSRC under certain conditions and the submission of an annual report to the CSRC within the required timeline. On the same day, the Provisions on Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies (the “Confidentiality and Archives Administration Provisions”) promulgated by the CSRC came into effect. Confidentiality and Archives Administration Provisions stipulate that the PRC companies seeking overseas offerings and listings, either directly or indirectly, as well as securities firms and securities service providers (both the PRC and overseas) involved in relevant businesses, must not disclose any state secrets or confidential information of government agencies, nor harm national security and public interests. Additionally, if a domestic company provides accounting archives or copies of such archives to any entities, including securities firms, securities service providers, overseas regulators and individuals, it must comply with due procedures in accordance with applicable regulations. We believe that offerings under this prospectus do not involve the disclosure of any state secret or confidential information of government agencies, nor does it harm national security and public interests. However, we may need to perform additional procedures concerning the provision of accounting archives. The specific requirements of these procedures are currently unclear, and we cannot guarantee our ability to execute them.

According to the Notice on the Administrative Arrangements for the Filing of Overseas Securities Offering and Listing by Domestic Enterprises (the “Notice on Overseas Listing Measures”) published by the CSRC on February 17, 2023, issuers that had already been listed in an overseas market by March 31, 2023, the date the Trial Measures became effective, are not required to make any immediate filing and are only required to comply with the filing requirements under the Trial Measures when it subsequently seeks to conduct a follow-on offering. Therefore, we are required to go through filing procedures with the CSRC within three working days after the completion of an offering made pursuant to this prospectus or any accompanying prospectus supplement and for our future offerings of our securities in an overseas market, including Nasdaq, under the Trial Measures. Other than the CSRC filing procedure we are required to make within three working days after the completion of an offering made pursuant to this prospectus or any accompanying prospectus supplement, we and our PRC subsidiaries, as advised our PRC legal counsel, Fawan Law Firm, (1) are not required to obtain permissions from the CSRC, and (2) have not been required to obtain or denied such and other permissions by the CSRC, CAC, or any PRC government authority, under current PRC laws, regulations and rules in connection with a potential offering made pursuant to this prospectus or any accompanying prospectus supplement as of the date of this prospectus.

Permissions Required from the PRC Authorities for Our Operations

As of the date of this prospectus, our Company and our PRC subsidiaries have not been involved in any investigations or review initiated by any PRC regulatory authority, not has any of them received any inquiry, notice or sanction for our operations or our issuance of securities to investors. Nevertheless, the Standing Committee of the National People’s Congress (“SCNPC”) or PRC regulatory authorities may in the future promulgate laws, regulations or implementing rules that requires us and our subsidiaries to obtain permissions from PRC regulatory authorities to conduct business operations in China.

In addition, as advised by the Company’s PRC counsel, Fawan Law Firm, as of the date of this prospectus, except for business license, foreign investment information report to the commerce administrative authority and foreign exchange registration or filing, our consolidated affiliated Chinese entities do not have to obtain any requisite licenses and permits from the PRC government authorities that are material for the business operations of our holding company and our subsidiaries in China. However, given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by government authorities, we may be required to obtain certain licenses, permits, filings or approvals for the functions and services that we provided in the future.

The Holding Foreign Companies Accountable Act

In addition, our ordinary shares may be prohibited from trading on a national exchange or over-the-counter under the Holding Foreign Companies Accountable Act (“HFCA Act”) if the Public Company Accounting Oversight Board (United States) (the “PCAOB”) is unable to inspect our auditor for two consecutive years. Our current auditor, Assentsure PAC (“Assentsure”), and our prior auditor for our 2022 annual report, Marcum LLP, the independent registered public accounting firms that issue the financial reports included elsewhere in this prospectus or our most recent annual report on Form 20-F, are registered with the PCAOB. The PCAOB conducts regular inspections to assess their compliance with the applicable professional standards. Assentsure and Marcum LLP are headquartered in Singapore and New York, respectively. On December 16, 2021, the PCAOB issued a report notifying the SEC of its determinations (the “PCAOB Determinations”) that they are unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong. The report sets forth lists identifying the registered public accounting firms headquartered in mainland China and Hong Kong, respectively, that the PCAOB is unable to inspect or investigate completely, and as of the date of this prospectus, Assentsure and Marcum LLP are not included in the list of PCAOB Identified Firms in the PCAOB Determinations issued on December 16, 2021. On August 26, 2022, the China Securities Regulatory Commission (the “CSRC”), the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”), governing inspections and investigations of audit firms based in China and Hong Kong. Pursuant to the Protocol, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the U.S. Securities and Exchange Commission. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate completely registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations issued in December 2021. As such, we do not expect to be identified as a “Commission-Identified Issuer” under the HFCA Act for the fiscal year ended December 31, 2022. Notwithstanding the foregoing, in the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor, then such lack of inspection could cause our securities to be delisted from Nasdaq Stock Market. In addition, whether the PCAOB will continue be able to conduct inspections and investigations completely to its satisfaction of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control, including positions taken by authorities of the PRC. The PCAOB is expected to continue to demand complete access to inspections and investigations against accounting firms headquartered in mainland China and Hong Kong in the future and states that it has already made plans to resume regular inspections in early 2023 and beyond. The PCAOB is required under the HFCA Act to make its determination on an annual basis with regards to its ability to inspect and investigate completely accounting firms based in the mainland China and Hong Kong. The possibility of being a “Commission-Identified Issuer” and risk of delisting could continue to adversely affect the trading price of our securities. Should the PCAOB again encounter impediments to inspections and investigations in mainland China or Hong Kong as a result of positions taken by any authority in either jurisdiction, the PCAOB will make determinations under the HFCA Act as and when appropriate. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act was enacted, which amended the Holding Foreign Companies Accountable Act, by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. See “Risk Factors—Risks Related to Doing Business in China—If the PCAOB is unable to inspect our auditors as required under the Holding Foreign Companies Accountable Act, the SEC will prohibit the trading of our shares. A trading prohibition for our shares, or the threat of a trading prohibition, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct inspections of our auditors, if any, would deprive our investors of the benefits of such inspections.” of this prospectus.

Investing in our securities involves risks. See the “Risk Factors” section contained in this prospectus supplement and the documents we incorporate by reference in this prospectus supplement, including our annual report on Form 20-F for year ended in 2023 filed with the SEC on April 2, 2024 (as amended on May 21, 2024), to read about factors you should consider before investing in these securities.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus Supplement dated July 10, 2024

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts, this prospectus supplement and the accompanying base prospectus, both of which are part of a registration statement on Form F-3 (File No. 333-279753) that we filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf” registration process.

The two parts of this document include: (1) this prospectus supplement, which describes the specific terms of this offering and also supplements and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus; and (2) the accompanying base prospectus, which provides a general description of the securities that we may offer, some of which may not apply to this offering. Generally, when we refer to this “prospectus,” we are referring to both documents combined. You should rely only on the information contained in this prospectus supplement and the accompanying base prospectus. We have not authorized anyone else to provide you with additional or different information. If information in this prospectus supplement is inconsistent with the accompanying base prospectus, you should rely on this prospectus supplement. You should read this prospectus supplement together with the additional information described below under the heading “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

Any statement made in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus supplement or in any other subsequently filed document that is also incorporated by reference into this prospectus supplement modifies or supersedes that statement. Any statements so modified or superseded will be deemed not to constitute a part of this prospectus supplement except as so modified or superseded. In addition, to the extent of any inconsistencies between the statements in this prospectus supplement and similar statements in any previously filed report incorporated by reference into this prospectus supplement, the statements in this prospectus supplement will be deemed to modify and supersede such prior statements.

The registration statement that contains this prospectus supplement, including the exhibits to the registration statement and the information incorporated by reference, contains additional information about the securities offered under this prospectus supplement. That registration statement can be read on the SEC’s website or at the SEC’s offices mentioned below under the heading “Where You Can Find More Information.”

We are responsible for the information contained and incorporated by reference in this prospectus supplement, the accompanying base prospectus and any related free writing prospectus that we prepare or authorize. We have not authorized anyone to provide you with different or additional information, and we take no responsibility for any other information that others may give you. If you receive any other information, you should not rely on it.

We are offering the Note, convertible into our ordinary shares, directly to the investor in the Notes pursuant to this prospectus supplement and accompanying base prospectus only in jurisdictions where such offers and sales are permitted. This prospectus supplement and the accompanying base prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which this prospectus supplement relates, nor do this prospectus supplement and the accompanying base prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. No action is being taken in any jurisdiction outside the United States to permit a public offering of the ordinary shares or possession or distribution of this prospectus supplement or the accompanying base prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement or the accompanying base prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus supplement and the accompanying base prospectus applicable to that jurisdiction.

You should not assume that the information in this prospectus supplement and the accompanying base prospectus is accurate at any date other than the date indicated on the cover page of this prospectus supplement or that any information that we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference. Our business, financial condition, results of operations or prospects may have changed since that date.

You should not rely on or assume the accuracy of any representation or warranty in any agreement that we have filed in connection with this offering or that we may otherwise publicly file in the future because any such representation or warranty may be subject to exceptions and qualifications contained in separate disclosure schedules, may represent the applicable parties’ risk allocation in the particular transaction, may be qualified by materiality standards that differ from what may be viewed as material for securities law purposes or may no longer continue to be true as of any given date.

S-1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, contain forward-looking statements. These are based on our management’s current beliefs, expectations and assumptions about future events, conditions and results and on information currently available to us. Discussions containing these forward-looking statements may be found, among other places, in “Prospectus Supplement Summary,” “Use of Proceeds,” or “Risk Factors” in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference including our 2023 Annual Report filed with the SEC on April 2, 2024, as well as any amendments thereto, filed with the SEC.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” as well as statements in the future tense or the negative or plural of those terms, and similar expressions intended to identify statements about the future, although not all forward- looking statements contain these words. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements.

Any statements in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein and therein about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. Within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act, these forward-looking statements include, without limitation, statements regarding:

| ● | our future business development, financial condition and results of operations; | |

| ● | expected changes in our revenues, costs or expenditures; | |

| ● | our estimates regarding revenues, cash flows, capital requirements and our need for additional financing; | |

| ● | our expectations regarding demand for and market acceptance of our services; | |

| ● | competition in our industry; and | |

| ● | government policies and regulations relating to our industry. |

The ultimate correctness of these forward-looking statements depends upon a number of known and unknown risks and events. Many factors could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Consequently, you should not place undue reliance on these forward-looking statements. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

The forward-looking statements speak only as of the date on which they are made; and, except as required by law we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

You should refer to “Supplemental Risk Factors” in this prospectus supplement, the accompanying prospectus and Part I, Item 3 Key Information – Risk Factors to our 2023 Annual Report incorporated by reference, for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. Given these risks, uncertainties and other factors, many of which are beyond our control, we cannot assure you that the forward-looking statements in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein and therein will prove to be accurate, and you should not place undue reliance on these forward-looking statements. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all.

S-2

You should read this prospectus supplement, together with the accompanying prospectus and the documents we have filed with the SEC that are incorporated by reference, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein may contain market data and industry forecasts that were obtained from industry publications. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we believe the market position, market opportunity and market size information included in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein is generally reliable, such information is inherently imprecise.

S-3

This summary highlights certain information about us, this offering and other selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus supplement. It does not contain all of the information that may be important to you and your investment decision. Before investing in the securities that we are offering, you should carefully read this entire prospectus supplement and the accompanying prospectus, including our historical financial statements and the notes thereto, which are incorporated herein by reference. You should read “Supplemental Risk Factors” beginning on page S-16 of this prospectus supplement, “Part I, Item 3 Key Information. Risk Factors” in our 2023 Annual Report, and elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein or therein, for more information about important risks that you should consider before making a decision to invest in our securities.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus or incorporated by reference in this prospectus, and does not contain all the information that you need to consider in making your investment decision. We urge you to read this entire prospectus (as supplemented or amended), including our consolidated financial statements, notes to the consolidated financial statements and other information incorporated by reference in this prospectus from our other filings with the SEC, before making an investment decision.

Company Overview

We are committed to providing leading holographic technology services to our customers worldwide. Our holographic technology services include high-precision holographic light detection and ranging (“LiDAR”) solutions, based on holographic technology, exclusive holographic LiDAR point cloud algorithms architecture design, breakthrough technical holographic imaging solutions, holographic LiDAR sensor chip design and holographic vehicle intelligent vision technology to service customers that provide reliable holographic advanced driver assistance systems (“ADAS”). We also provide holographic digital twin technology services for customers and have built a proprietary holographic digital twin technology resource library. Our holographic digital twin technology resource library captures shapes and objects in 3D holographic form by utilizing a combination of our holographic digital twin software, digital content, spatial data-driven data science, holographic digital cloud algorithm, and holographic 3D capture technology. Our holographic digital twin technology and resource library have the potential to become the new norm for the digital twin augmented physical world in the near future. We are also a distributer of holographic hardware and generates revenue through resale.

We provide a broad range of holographic technology services in the holographic industry. Our holographic solutions and technology services are capable of meeting the complex and multi-faceted holographic technology needs of our customers.

Our cutting-edge holographic LiDAR system is used in ADAS, allowing equipped automobiles and other vehicles to capture high-resolution 3D holograms and achieve ultra-long detection distance. Our holographic LiDAR solutions allow the automotive industry to break free from bulky mechanical rotating scanning systems and traditional sensors to solid-state LiDAR sensor with more components and smaller dimensions that can meet the demanding performance, safety, and cost requirements of our customers.

Our holographic ADAS provide a rich and safe set of autonomous control programs for vehicles. The point cloud algorithm for holographic LiDAR can detect and track obstacles, thereby avoiding and mitigating automotive collisions with both moving and static objects, including pedestrians and other vulnerable road obstacles and vehicles. By predicting and monitoring collision, our holographic LiDAR system calculates effective collusion mitigation plans by comparing the trajectory of an object with the trajectory of the moving vehicle to identify and avoid emergency situations while providing optimal comfort and safety to the driver. Due to its effectiveness, our holographic ADAS are being deployed at an increasing rate in the automotive industry.

S-4

As automakers and leading mobile and technology companies seek comprehensive digital perceptual solutions to accelerate and scale production for their autonomous driving programs, we believe that our holographic LiDAR can take advantage of this market trend to achieve excellent solutions for mass production of large-scale autonomous driving programs and vehicles.

Moreover, we are aligned to the rapid development of the Internet of Things, machine learning, and artificial intelligence (“AI”). Our holographic LiDAR solution is not only applicable to the field of intelligent vehicles but also applicable to robots, unmanned aerial vehicles (“UAVs”), advanced security systems, intelligent city development, industrial automation, environment, and mapping.

Our holographic digital twin technology resource library is built upon extensive holographic data modelling, simulation and bionics technology, culminating in a comprehensive holographic digital twin resource library which holographic developers and designers count on. Our digital twin resource library integrates holographic bionics and simulation digital models, as well as various holographic software technologies about holographic spatial positioning, dynamic capture, holographic image synthesis, which are open to all our users. We also provide customized holographic digital twin technology integration services for enterprise customers with unique commercial demands.

With each technological advancement and product iteration, we continue to lay a solid foundation for increased competitiveness and long-term strategic development. We aim to continually provide customers with high-quality holographic technology services by dedicating significant resources to research and development in advanced holographic technology so as to achieve steady growth of revenue and improvement of market share for the benefit of shareholders.

S-5

Risk Factors

Investing in our Ordinary Shares entails a significant level of risk.

The company faces various legal and operational risks and uncertainties as a company which its principal subsidiaries based in and primarily operating in the PRC. Most of the company’s subsidiaries operations are conducted in the PRC, and are governed by PRC laws, rules, and regulations. Because PRC laws, rules, and regulations are relatively new and quickly evolving, and because of the limited number of published decisions and the non-precedential nature of these decisions, and because the laws, rules and regulations often give the relevant regulator certain discretion in how to enforce them, the interpretation and enforcement of these laws, rules and regulations involve uncertainties and can be inconsistent and unpredictable. The PRC government has the power to exercise significant oversight and discretion over the conduct of our business, and the regulations to which we are subject may change rapidly. As a result, the application, interpretation, and enforcement of new and existing laws and regulations in the PRC are often uncertain. In addition, these laws and regulations may be interpreted and applied inconsistently by different agencies or authorities, and inconsistently with our current policies and practices.

See “Risk Factors — Risks Related to Doing Business in China — Because all of our operations are in China, our business is subject to the complex and rapidly evolving laws and regulations there. The Chinese government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of our Ordinary Shares,” and “— Adverse changes in China’s economic, political or social conditions, laws, regulations or government policies could have a material adverse effect on our business, financial condition and results of operations..” as set forth in this prospectus and our Annual Report on Form 20-F, as filed with the SEC on April 2, 2024 (as amended on May 20).

In addition, the PRC government has significant oversight and discretion over the conduct of our business, and may intervene in or influence our operations through adopting and enforcing rules and regulatory requirements. For example, in recent years the PRC government, has enhanced regulation in areas such as anti-monopoly, anti-unfair competition, cybersecurity and data privacy. See “Item 3 Key Information — D. Risk Factors — Risks Related to Our Business and Industry — The PRC government exerts substantial influence over the manner in which we and our PRC subsidiaries must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S. exchanges, however, if we or our PRC subsidiaries were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange, which would materially affect the interest of the investors.”; and “— We may be materially and adversely affected by the complexity, uncertainties and changes in the PRC laws and regulations governing Internet-related industries and companies,” as set forth in the our annual report on Form 20-F filed with the Commission on April 2, 2024 (as amended on May 20, 2024).

Before investing in the Ordinary Shares, you should carefully consider the risks and uncertainties described in this prospectus and as summarized below, the risks described under the “Risk Factors,” in addition to all of the other information in this prospectus and documents that are incorporated in this prospectus by Table of Contents reference, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, if applicable, in any accompanying prospectus supplement or documents incorporated by reference. The occurrence of one or more of the events or circumstances described in the section titled “Risk Factors,” alone or in combination with other events or circumstances, may adversely affect our business, results of operations and financial condition. Such risks include, but are not limited to:

S-6

Risk Factors Relating to Our Business and Industry

Below is a summary of the risk factors relating to our business and industry. You may read more about these risks in the “Risk Factors” section in this prospectus and in our Annual Report on Form 20-F for the year ended 2023 as filed with the SEC on April 2, 2024.

| ● | The holographic technology service industry is developing rapidly and affected by continuous technological changes, with the risk that we cannot continue to make the correct strategic investment and develop new products to meet customer needs. |

| ● | Our competitive position and results of operations could be harmed if we do not compete effectively. |

| ● | Adverse conditions in the related industries, such as the automotive industry, or the global economy in general could have adverse effects on our results of operations. |

| ● | The market adoption of LiDAR, especially holographic LiDAR technology, is uncertain. If market adoption of LiDAR does not continue to develop, or develops more slowly than we expect, our business will be adversely affected. |

| ● | Our results of operations could materially suffer in the event of insufficient pricing to enable us to meet profitability expectations. |

| ● | We expect to incur substantial research and development costs and devote significant resources to identifying and commercializing new products, which could significantly reduce our profitability, and there is no guarantee that such efforts would eventually generate revenue for us. |

| ● | We may need to raise additional capital in the future in order to execute our business plan, which may not be available on terms acceptable to us, or at all. |

| ● | Market share of our holographic LiDAR products will be materially adversely affected if such products are not adopted by the automotive original equipment manufacturers (OEMs) or their supplier for ADAS applications. |

| ● | We have material customer concentration, with a limited number of customers accounting for a material portion of our revenues for the years ended December 31, 2023 and 2022. | |

| ● | We and our subsidiaries depend on a limited number of vendors for a significant portion of our purchase which may result in heightened concentration risk. |

| ● | The period of time from a “design win” to implementation is long, and we are subject to the risks of cancellation or postponement of the contract or unsuccessful implementation |

| ● | The complexity of our products could result in unforeseen delays or expenses from undetected defects, errors or bugs in hardware or software which could reduce the market adoption of our new products, damage our reputation with current or prospective customers, result in product returns or expose us to product liability and other claims and adversely affect our operating costs. |

| ● | Failure in cost control may negatively impact the market adoption and profitability of our products. |

| ● | Continued pricing pressures may result in low profitability, or even losses to us. |

| ● | We have a limited operating history, and we may not be able to sustain rapid growth, effectively manage growth or implement business strategies. |

| ● | If we fail to attract, retain and engage appropriately-skilled personnel, including senior management and technology professionals, our business may be harmed. |

S-7

| ● | Our business depends substantially on the market recognition of our brand, and negative media coverage could adversely affect our business. |

| ● | Failure to maintain, protect, and enhance our brand or to enforce our intellectual property rights may damage the results of our business and operations. |

| ● | We may be vulnerable to intellectual property infringement charges filed by other companies. |

| ● | We may not be able to protect our source code from copying if there is an unauthorized disclosure. |

| ● | Third parties may register trademarks or domain names or purchase internet search engine keywords that are similar to our trademarks, brand or websites, or misappropriate our data and copy our platform, all of which could cause confusion to our users, divert online customers away from our products and services or harm our reputation. |

| ● | Our business is highly dependent on the proper functioning and improvement of our information technology systems and infrastructure. Our business and operating results may be harmed by service disruptions, or by our failure to timely and effectively scale up and adjust our existing technology and infrastructure. |

| ● | Our operations depend on the performance of the Internet infrastructure and fixed telecommunications networks in China, which may experience unexpected system failure, interruption, inadequacy or security breaches. |

| ● | We use third-party services and technologies in connection with our business, and any disruption to the provision of these services and technologies to us could result in adverse publicity and a slowdown in the growth of our users, which could materially and adversely affect our business, financial condition and results of operations. |

| ● | Our insurance policies may not provide adequate coverage for all claims associated with our business operations. |

| ● | We may be subject to claims, disputes or legal proceedings in the ordinary course of our business. If the outcome of these proceedings is unfavorable to us, then our business, results of operations and financial condition could be adversely affected. |

| ● | We may need additional capital to support or expand our business, and we may be unable to obtain such capital in a timely manner or on acceptable terms, if at all. |

| ● | Our management has limited experience in operating a public company and the requirements of being a public company may strain our resources, divert management’s attention and affect the ability to attract and retain qualified board members and officers. |

| ● | We may be materially and adversely affected by the complexity, uncertainties and changes in the PRC laws and regulations governing Internet-related industries and companies. |

| ● | Our business may be exposed to Internet data, and we are required to comply with PRC laws and regulations relating to cyber security. These laws and regulations could create unexpected costs, subject us to enforcement actions for compliance failures, or restrict portions of our business or cause us to change our data practices or business model. |

Risks Factors Relating to Finance and Accounting

We had previously identified certain material weaknesses which may continue to cause our failure to maintain an effective system of internal control over financial reporting and may result in material misstatements of the consolidated financial statements or cause us to fail to meet our periodic reporting obligations.

We may be required to record a significant charge to earnings when we reassess our goodwill or amortizable intangible assets.

S-8

Risk Factors Relating to Doing Business in China

| ● | Adverse changes in China’s economic, political or social conditions, laws, regulations or government policies could have a material adverse effect on our business, financial condition and results of operations. |

| ● | A severe or prolonged downturn in the PRC or global economy and political tensions between the United States and China could materially and adversely affect our business and our financial condition. |

| ● | The recent joint statement by the SEC and the PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies, including companies based in China, upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. |

| ● | Uncertainties in the promulgation, interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us. |

| ● | We may be subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. |

| ● | If our equity ownership is challenged by the PRC authorities, it may have a significant adverse impact on our operating results and your investment value. |

| ● | You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against us or our management based on foreign laws. |

| ● | Under the PRC enterprise income tax law, we may be classified as a “PRC resident enterprise”, which could result in unfavorable tax consequences to we and our shareholders and have a material adverse effect on our results of operations and the value of your investment. |

| ● | We may not be able to obtain certain benefits under relevant tax treaties on dividends paid by our PRC subsidiaries to us through our Hong Kong subsidiaries. |

| ● | Our PRC subsidiaries may face uncertainties relating to special preferential income tax rate in connection with PRC high and new technology enterprise and tax exempt status. |

| ● | We face uncertainty with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies. |

| ● | If the chops of our PRC subsidiaries are not kept safely, are stolen or are used by unauthorized persons or for unauthorized purposes, the corporate governance of these entities could be severely and adversely compromised. |

S-9

| ● | Implementation of labor laws and regulations in China may adversely affect our business and results of operations. |

| ● | The M&A Rules and certain other PRC regulations may make it more difficult for us to pursue growth through acquisitions. |

| ● | The approval of the China Securities Regulatory Commission may be required in connection with our offerings under a regulation adopted in August 2006, and, if required, we cannot assure you that we will be able to obtain such approval. |

| ● | PRC regulations relating to offshore investment activities by PRC residents may limit our PRC subsidiaries’ ability to increase their registered capital or distribute profits to us or otherwise expose us to liability and penalties under PRC law. |

| ● | PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds we receive from offshore financing activities to make loans to or make additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand business. |

| ● | Our PRC subsidiaries are subject to restrictions on paying dividends or making other payments to us, which may restrict our ability to satisfy liquidity requirements, conduct business and pay dividends to holders of our ordinary shares. |

| ● | Fluctuations in exchange rates could have a material adverse effect on our results of operations and the value of your investment. |

| ● | Governmental control of currency conversion may limit our ability to utilize revenues effectively and affect the value of your investment. |

| ● | Failure to comply with PRC regulations regarding the registration requirements for employee stock ownership plans or share option plans may subject the PRC plan participants or us to fines and other legal or administrative sanctions. |

| ● | Our leased property interests may be defective and our rights to lease the properties affected by such defects may be challenged, which could adversely affect our business. |

| ● | The PRC government exerts substantial influence over the manner in which we and our PRC subsidiaries must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S. exchanges, however, if we or our PRC subsidiaries were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange, which would materially affect the interest of the investors. |

S-10

Risk Factors Relating to an Investment in Our Ordinary Shares

| ● | We are a Cayman Islands company and, because judicial precedent regarding the rights of shareholders is more limited under Cayman Islands law than under U.S. law, you may have less protection for your shareholder rights than you would under U.S. law. |

| ● | Certain judgments obtained against us by our shareholders may not be enforceable. |

| ● | Our share price may be volatile and could decline substantially. |

| ● | We do not intend to pay cash dividends for the foreseeable future. |

| ● | We may be subject to securities litigation, which is expensive and could divert management attention. |

| ● | The sale or availability for sale of substantial amounts ordinary shares could adversely affect our market price. |

| ● | If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about us or our business, our ordinary shares price and trading volume could decline. |

| ● | We may redeem your unexpired warrants prior to their exercise at a time that is disadvantageous to you, thereby making your warrants worthless. |

| ● | If we cannot satisfy, or continue to satisfy, the requirements and rules of Nasdaq, our securities may may be delisted, which could negatively impact the price of our securities and your ability to sell them. |

| ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law. |

| ● | We are an emerging growth company within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure requirements available to emerging growth companies, this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies. |

| ● | We will continue to incur increased costs as a result of being a public company, particularly after we cease to qualify as an “emerging growth company.” |

| ● | We may be or become a PFIC, which could result in adverse U.S. federal income tax consequences to U.S. Holders. |

S-11

Corporate History and Structure

MicroCloud Hologram Inc. (f/k/a Golden Path Acquisition Corporation) is an exempted company incorporated under the laws of Cayman Islands on May 9, 2018.

On December 16, 2022, MicroCloud consummated the previously announced business combination pursuant to the Merger Agreement, by and among Golden Path, Golden Path Merger Sub, and MC. Pursuant to the Merger Agreement, MC merged with Golden Path Merger Sub, survived the merger and continued as the surviving company and a wholly owned subsidiary of Golden Path (the “Merger”, and, collectively with the other transactions described in the Merger Agreement, the “Business Combination”). Upon the closing of the Business Combination, Golden Path changed its name to MicroCloud Hologram Inc.

Our ordinary shares and Public Warrants are listed on the Nasdaq Stock Market LLC (the “Nasdaq”) under the symbols “HOLO” and “HOLOW,” respectively.

MicroCloud is not an operating company, but a holding company incorporated in the Cayman Islands. MicroCloud operates its business through its subsidiaries in the PRC in which it owns equity interests.

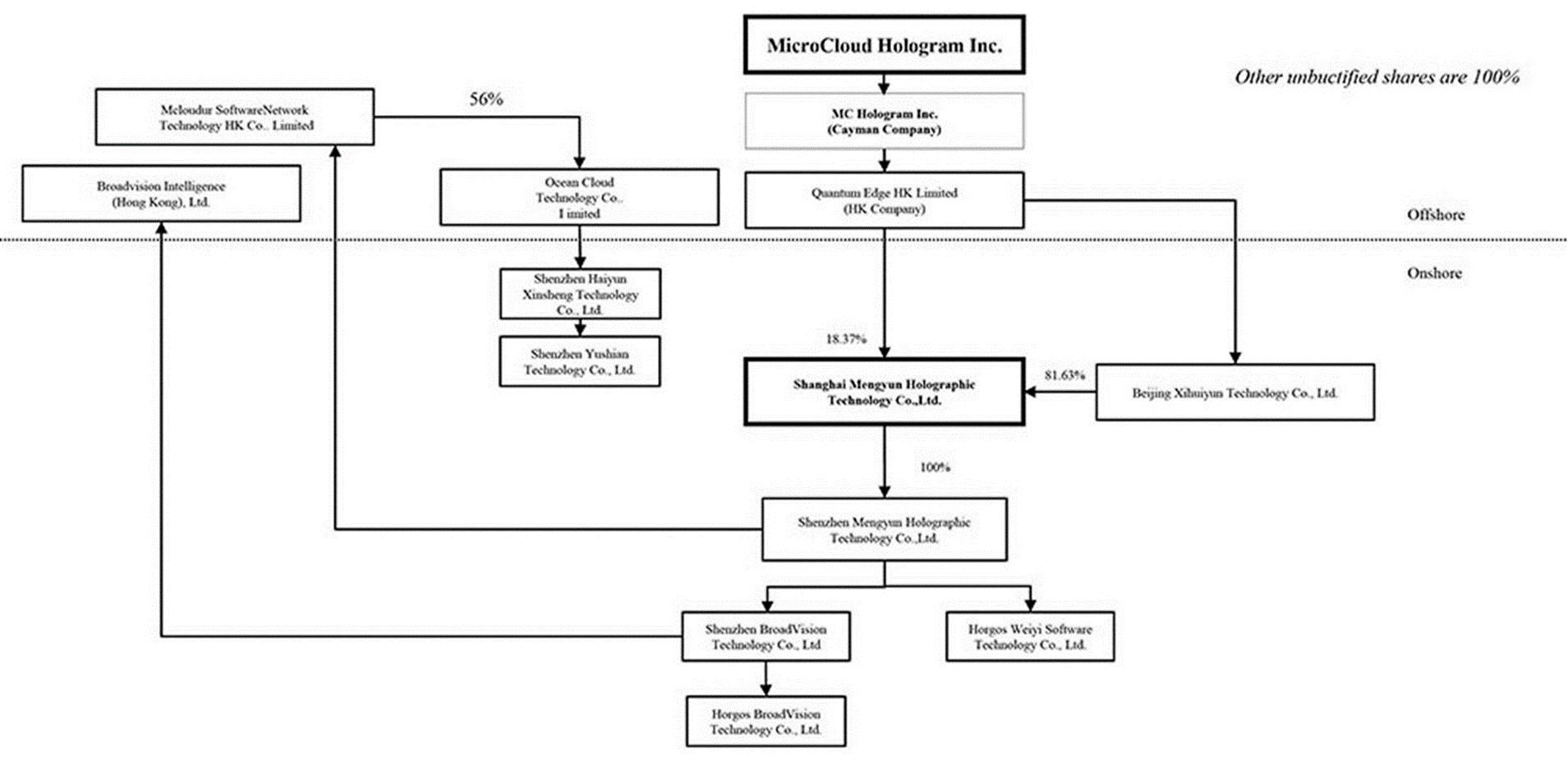

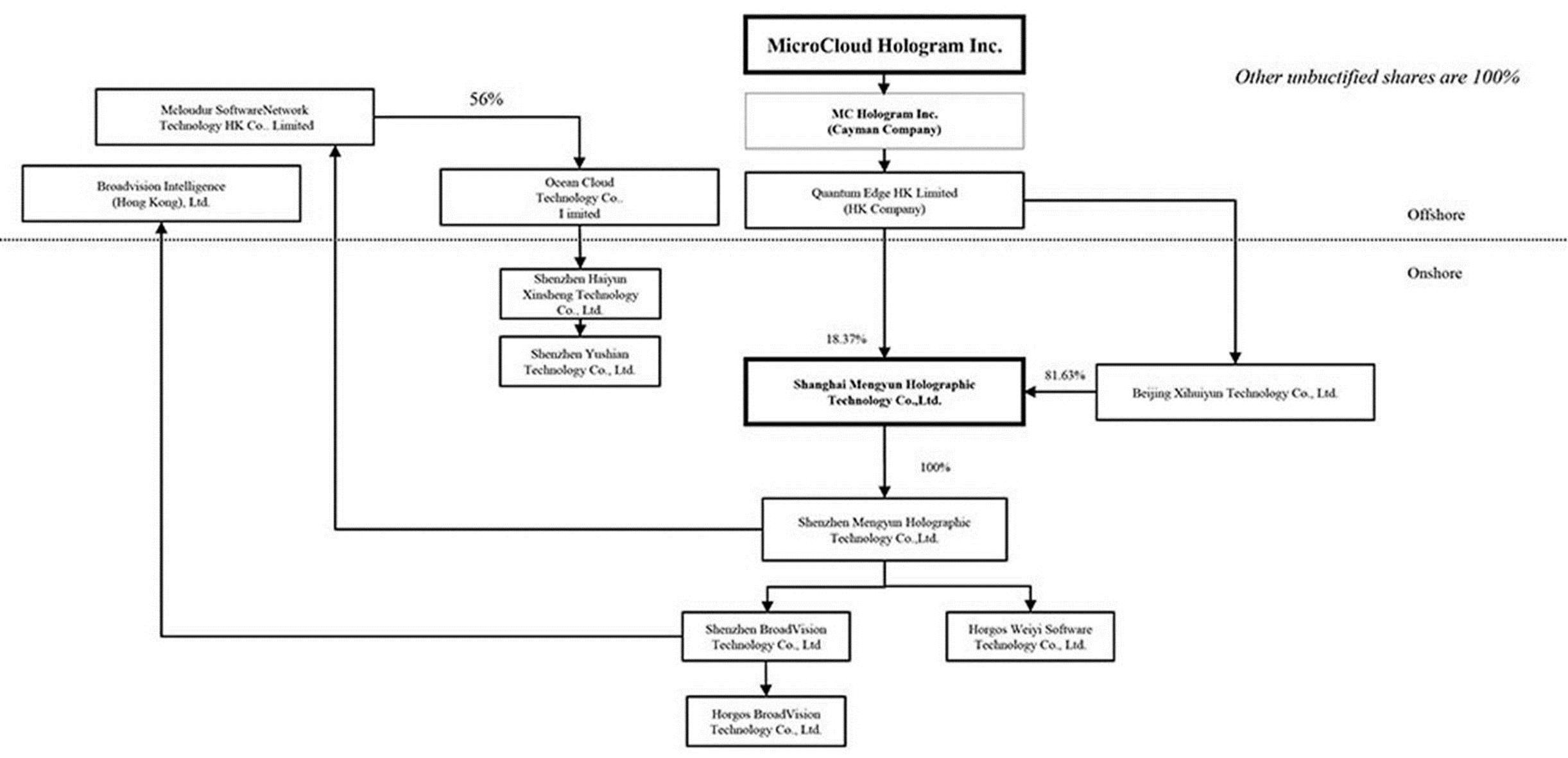

The following diagram illustrates MicroCloud’s corporate structure as of the date of this prospectus.

Cash and Asset Flows through Our Organization

The Company is a holding company with no material operations of its own. We conduct our operations primarily through our subsidiaries in China. As a result, the Company’s ability to pay dividends depends upon dividends paid by our subsidiaries in China. If our existing PRC subsidiaries or any newly formed ones incur debt on their own behalf in the future, the instruments governing their debt may restrict their ability to pay dividends to us.

S-12

Funding PRC Subsidiaries

We are permitted under PRC laws and regulations as an offshore holding company to provide fundings to our wholly foreign-owned subsidiary in China only through loans or capital contributions, subject to the record-filing and registration with government authorities and limit on the amount of loans. Subject to satisfaction of the applicable government registration requirements, we may extend inter-company loans to our wholly foreign-owned subsidiaries in China or make additional capital contributions to the wholly foreign-owned subsidiaries to fund their capital expenditures or working capital. If we provide fundings to our wholly foreign-owned subsidiaries through loans, the total amount of such loans may not exceed the difference between the entity’s total investment as registered with the foreign investment authorities and our registered capital. Such loans must also be registered with SAFE (as defined herein) or their local branches. For more detailed information and risks associated with a transfer of funds by the Company to our PRC subsidiaries in the form of a loan or capital injection, please refer to our Annual Report on Form 20-F for 2023 in the section “Risk Factors — Risk Factors Relating to Doing Business in China — PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds we receive from offshore financing activities to make loans to or make additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand business.”

Dividends

Under PRC law, our PRC subsidiaries are permitted to pay dividends to us only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Pursuant to the Company Law of the People’s Republic of China, or the PRC Company Law, our PRC subsidiaries are required to make contribution of at least 10% of their after-tax profits calculated in accordance with the PRC GAAP to the statutory common reserve. Contribution is not required if the reserve fund has reached 50% of the registered capital of our subsidiaries. As of December 31, 2023, our PRC subsidiaries had restricted amount of approximately RMB33 million the reserve fund. These reserves are not distributable as cash dividends. See “Risk Factors — Risk Factors Relating to Doing Business in China — our PRC subsidiaries are subject to restrictions on paying dividends or making other payments to us, which may restrict our ability to satisfy liquidity requirements, conduct business and pay dividends to holders of our ordinary shares.

None of our PRC subsidiaries has issued any dividends or distributions to respective holding companies or any investors as of the date of this prospectus. Our PRC subsidiaries generate and retain cash generated from operating activities and re-invested it in our business. We do not have any present plan to pay any cash dividends on our ordinary shares in the foreseeable future after any offerings under this prospectus. We have, from time to time, transferred cash between our PRC subsidiaries to fund their operations, and we do not anticipate any difficulties or limitations on our ability to transfer cash between such subsidiaries. As of the date of this prospectus, no cash generated from our PRC subsidiaries has been used to fund operations of any of our non-PRC subsidiaries. We may encounter difficulties in our ability to transfer cash between PRC subsidiaries and non-PRC subsidiaries largely due to various PRC laws and regulations imposed on foreign exchange. However, so long as we are compliant with the procedures for approvals from foreign exchange authorities and banks in China, the relevant laws and regulations in China do not impose limitations on the amount of funds that we can transfer out of China. See “Risk Factor—Risk Factors Relating to Doing Business in China—Governmental control of currency conversion may limit our ability to utilize revenues effectively and affect the value of your investment.” of our annual report on Form 20-F for 2023.

We currently do not have any cash management policy that dictates the transfer of cash between our subsidiaries. See “Item 3 Key Information—PRC Laws and Regulations relating to Foreign Exchange” of our annual report on Form 20-F for details of such procedures.

Corporate Information

We are a Cayman Islands exempted company, and our principal executive office is located at Room 302, Building A, Zhong Ke Na Neng Building, Yue Xing Sixth Road, Nanshan District, Shenzhen, People’s Republic of China. Our registered office address in the Cayman Islands is located at PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. Information contained on, or that can be accessed through, our website does not constitute a part of this prospectus and is not incorporated by reference herein. We have included our website address in this prospectus solely for informational purposes. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers, such as we, that file electronically, with the SEC at www.sec.gov. Our agent for service of process in the United States is Puglisi & Associates, 850 Library Avenue, Suite 204, Newark, Delaware 19715.

S-13

Implications of Being an Emerging Growth Company

As a company with less than US$1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012, and may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in our filings with the SEC; |

| ● | not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting; |

| ● | reduced disclosure obligations regarding executive compensation in periodic reports, proxy statements and registration statements; and |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our Class A ordinary shares pursuant to this offering. However, if certain events occur before the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed US$1.235 billion or we issue more than US$1.0 billion of non- convertible debt in any three-year period, we will cease to be an emerging growth company before the end of such five-year period.

In addition, Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. We have elected to take advantage of the extended transition period for complying with new or revised accounting standards and acknowledge such election is irrevocable pursuant to Section 107 of the JOBS Act.

Implications of Being a Foreign Private Issuer

We are a foreign private issuer within the meaning of the rules under the Exchange Act. As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| ● | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; | |

| ● | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; | |

| ● | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; | |

| ● | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; | |

| ● | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and | |

| ● | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

S-14

| Issuer: | MicroCloud Hologram Inc. | |

| Securities offered by us: |

Notes with an aggregate principal amount of $28,000,000. For a more detailed description of the CNPAs and the Notes, please see our Form 6-K furnished to the SEC on July 10, 2024, which we incorporate herein by reference.

This prospectus supplement also relates to the offering of ordinary shares issuable from time to time upon conversion under the Note. | |

| Original Principal Amount | $28,000,000 in the aggregate, once fully issued | |

| Conversion Right | Subject to a Ownership Limitation, each Investor has the right to elect to convert all or a portion of the outstanding balance under the Note into ordinary shares of the Company pursuant to the following formula: conversion shares equals amount being converted divided by the conversion price, which is calculated as (A) the lowest market closing price of the Company’s ordinary shares in the sixty (60) trading days preceding the date of conversion request (B) multiplied by 70% and (C) rounded down to the nearest 2 decimal places. The conversion is subject to adjustment in the event of a stock split, stock dividend, recapitalization, or similar transaction. | |

| Ownership Limitation | The Company may at it option decline to effect any conversion of the outstanding balance under the Note to the extent that after giving effect to such conversion would cause the Investors (on an individual basis) to beneficially own a number of shares exceeding 9.99% of the number of shares outstanding on such date. | |

| Prepayment | We may prepay all or a portion of the Note at an amount equal to 100% of the outstanding balance of each of the Notes. | |

| Event of Default | If an event of default on the Note occurs, interest shall accrue on the outstanding balance at the rate equal to the lesser of 10% per annum or the maximum rate permitted under applicable law until paid. | |

| Use of proceeds: | We intend to use the net proceeds from this offering for working capital and other general corporate purposes. See “Use of Proceeds” on page S-20 of this prospectus supplement. | |

| Risk factors: | Investing in our securities involves a high degree of risk. For a discussion of factors you should consider carefully before deciding to invest in our ordinary shares, see the information contained in or incorporated by reference under the heading “Supplemental Risk Factors” beginning on page S-16 of this prospectus supplement, and “Risk Factors” on page 13 of the accompanying prospectus, and in the other documents incorporated by reference into this prospectus supplement. | |

| NASDAQ Capital Market Symbol: | HOLO |

S-15

The following is a summary of certain risks that should be carefully considered along with the other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. You should carefully consider the risk factors described below and in our 2023 Annual Report incorporated by reference in this prospectus supplement and the accompanying prospectus, any amendment or update thereto reflected in subsequent filings with the SEC, including in our annual report on Form 20-F (as amended), and all other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus, as updated by our subsequent filings under the Exchange Act. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

Risk Factors Relating to This Offering

A substantial number of our ordinary shares may be issued pursuant to the terms of the Notes, which could cause the price of our ordinary shares to decline.

The Notes are convertible into our ordinary shares immediately after issuance at a conversion price that is 70% of the lowest market price within 60 trading days of the conversion request. We are unable to predict if and when the Investors will convert their Notes into ordinary shares or the time or manner in which the Investors may sell those shares.

The sale by the Investors of a significant number of our ordinary shares could have a material adverse effect on the market price of our ordinary shares. In addition, the perception in the public markets that the Investors may sell all or a portion of their shares being registered in this registration statement could also in and of itself have a material adverse effect on the market price of our ordinary shares. We cannot predict the effect, if any, that market sales of those ordinary shares or the availability of those ordinary share for sale will have on the market price of our ordinary shares.

Since we have broad discretion in how we use the proceeds from this offering, we may use the proceeds in ways with which you disagree.

We intend to use the net proceeds from this offering for general corporate purposes and working capital. As a result, our management will retain broad discretion in the allocation and use of the net proceeds of this offering, and investors will be relying on the judgment of our management with regard to the use of these net proceed, and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our ordinary shares. The failure by management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business, cause the price of our ordinary shares to decline and delay the development of our Company.

The number of shares being registered for sale is significant in relation to our trading volume.

All of the ordinary shares underlying the Notes being registered are owned by the Investors. Despite an ownership limitation, all such shares were sold into the market all at once or at about the same time, it could depress the market price of our stock during the period the registration statement remains effective and also could affect our ability to raise equity capital.

The Note is unsecured obligation and is subordinated to all of our existing and future secured indebtedness.

The Note is unsecured obligation and effectively subordinated in right of payment to all of our existing and future secured indebtedness, to the extent of the value of the assets securing such indebtedness The Note does not restrict our ability to incur additional indebtedness, including secured indebtedness generally, which would have a prior claim on the assets securing that indebtedness. In the event of our insolvency, bankruptcy, liquidation, reorganization, dissolution or winding up, our assets that serve as collateral for any secured indebtedness would be made available to satisfy the obligations to our secured creditors before any payments are made on the notes.

S-16

There is no established public trading market for the Note being offered in this offering, and we do not expect a market to develop for the Note.

There is no established public trading market for the Note being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply for listing of the Note on any securities exchange or for inclusion of the Note in any automated quotation system. Without an active market, the liquidity of the securities will be limited.

Investor of the Note will not be entitled to any rights with respect to our ordinary share, but will be subject to all changes made with respect to our Ordinary shares.

Investor of the Note will not be entitled to any rights with respect to our Ordinary Share (including, without limitation, voting rights or rights to receive any dividends or other distributions on our ordinary share), but will be subject to all changes affecting our ordinary share. Investor will only be entitled to rights in respect of our ordinary share if and when we deliver ordinary share upon conversion for the Note. In the event that an amendment is proposed to our memorandum and articles of associations requiring shareholders approval and the record date for determining the shareholders of record entitled to vote on the amendment occurs prior to a holder’s conversion of Notes, the holder will not be entitled to vote on the amendment, although the holder will nevertheless be subject to any changes in the powers, preferences or rights of our Ordinary Share that result from such amendment.

Future sales of our ordinary shares, whether by us or our shareholders, could cause our stock price to decline.

If our existing shareholders sell, or indicate an intent to sell, substantial amounts of our ordinary shares in the public market, the trading price of our ordinary shares could decline significantly. Similarly, the perception in the public market that our shareholders might sell shares of our ordinary shares could also depress the market price of our ordinary shares. A decline in the price of ordinary shares might impede our ability to raise capital through the issuance of additional ordinary shares or other equity securities. In addition, the issuance and sale by us of additional ordinary shares or securities convertible into or exercisable for ordinary shares, or the perception that we will issue such securities, could reduce the trading price for our ordinary shares as well as make future sales of equity securities by us less attractive or not feasible. The sale of ordinary shares issued upon the exercise of our outstanding options and warrants could further dilute the holdings of our then existing shareholders.

You may experience future dilution as a result of future equity offerings or other equity issuances.

We may in the future issue additional ordinary shares or other securities convertible into or exchangeable for shares of our ordinary shares. We cannot assure you that we will be able to sell our ordinary shares or other securities in any other offering or other transactions at a price per share that is equal to or greater than the price per share paid by investors in this offering. The price per share at which we sell additional ordinary shares or other securities convertible into or exchangeable for our ordinary shares in future transactions may be higher or lower than the price per share in this offering.

The price of our ordinary shares may be volatile or may decline, which may make it difficult for investors to resell shares of our ordinary shares at prices they find attractive.

The trading price of our ordinary shares may fluctuate widely as a result of a number of factors, many of which are outside our control. In addition, the stock market is subject to fluctuations in the share prices and trading volumes that affect the market prices of the shares of many companies. These broad market fluctuations could adversely affect the market price of our ordinary shares. Among the factors that could affect our stock price are:

| ● | actual or anticipated fluctuations in our quarterly operating results; |

| ● | changes in financial estimates by securities research analysts; |

S-17

| ● | negative publicity, studies or reports; |

| ● | changes in the economic performance or market valuations of other microcredit companies; |

| ● | announcements by us or our competitors of acquisitions, strategic partnerships, joint ventures or capital commitments; |

| ● | addition or departure of key personnel; |

| ● | changes in revenue or earnings estimates or publication of research reports and recommendations by financial analysts; |

| ● | failure to meet analysts’ revenue or earnings estimates; |

| ● | speculation in the press or investment community; |

| ● | strategic actions by us or our competitors, such as acquisitions or restructurings; |

| ● | actions by institutional shareholders; |

| ● | fluctuations in the stock price and operating results of our competitors; |

| ● | general market conditions and, in particular, developments related to market conditions for the financial services industry; |

| ● | proposed or adopted regulatory changes or developments; or |

| ● | domestic and international economic factors unrelated to our performance. |

The stock market has experienced significant volatility recently. As a result, the market price of our ordinary shares may be volatile. In addition, the trading volume in our ordinary shares may fluctuate more than usual and cause significant price variations to occur. The trading price of the shares of ordinary shares and the value of our other securities will depend on many factors, which may change from time to time, including, without limitation, our financial condition, performance, creditworthiness and prospects, future sales of our equity or equity related securities, and other factors identified above in “Forward-Looking Statements.”

Accordingly, the ordinary shares that an investor purchases, whether in this offering or in the secondary market, may trade at a price lower than that at which they were purchased, and, similarly, the value of our other securities may decline. Current levels of market volatility are unprecedented. The capital and credit markets have been experiencing volatility and disruption for more than a year. In some cases, the markets have produced downward pressure on stock prices and credit availability for certain issuers without regard to those issuers’ underlying financial strength.

A significant decline in our stock price could result in substantial losses for individual shareholders and could lead to costly and disruptive securities litigation.

Volatility in our ordinary shares price may subject us to securities litigation.

The market for our ordinary shares may have, when compared to seasoned issuers, significant price volatility and we expect that our share price may continue to be more volatile than that of a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

S-18

Risks Related to Doing Business in China