UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2023

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ________ to _______

Commission file number: 001-40244

(Exact name of registrant as specified in its charter)

(State of incorporation) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip code) | |||||||

Registrant's telephone number, including area code | ||||||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbols | Name of each exchange on which registered | ||||||||||||

of Class A common stock, each at an exercise price of $11.50 per share | ||||||||||||||

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | |||||||||

Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b) ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

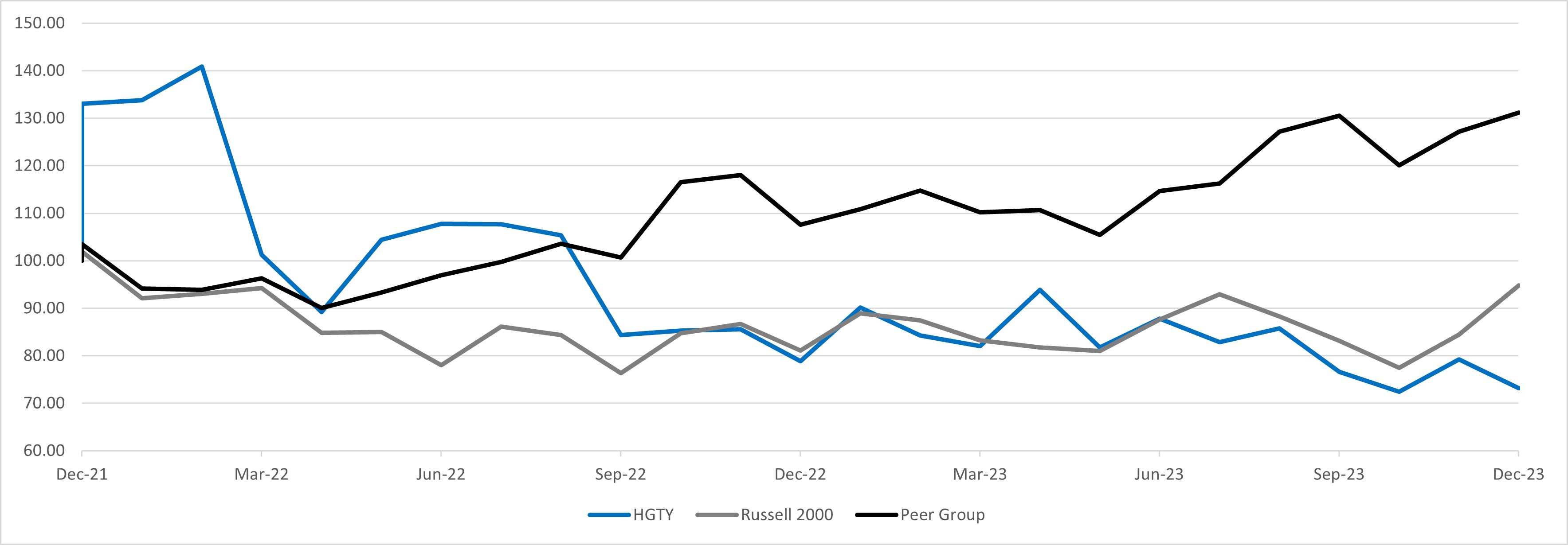

The aggregate market value of voting stock held by non-affiliates of the Registrant on June 30, 2023, based on the closing price of $9.36 for shares of the Registrant’s Class A Common Stock as reported by the New York Stock Exchange, was approximately $231.8 million. Shares of common stock beneficially owned by each executive officer, director, and holders of more than 10% of our common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The registrant had 84,655,539 shares of Class A Common Stock outstanding and 251,033,906 shares of Class V Common Stock outstanding as of March 1, 2024.

Documents incorporated by reference:

2

Table of Contents

Title | Page | ||||

3

Where You Can Find More Information

In this Annual Report on Form 10-K (this "Annual Report"), "we," "our," "us," "Hagerty," "HGTY," and the "Company" refer to Hagerty, Inc., formerly known as Aldel Financial Inc. ("Aldel"), and its consolidated subsidiaries including The Hagerty Group, LLC ("The Hagerty Group"), unless the context requires otherwise. We file annual, quarterly, and current reports, proxy statements and other information with the United States Securities and Exchange Commission (the "SEC"). General information about us can be found at investor.hagerty.com. Our Annual Report, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as any amendments to those reports, are available free of charge through our website at investor.hagerty.com as soon as reasonably practicable after we file them with, or furnish them to, the SEC. The SEC also maintains a website at www.sec.gov that contains reports, proxy statements, and other information regarding SEC registrants, including Hagerty, Inc.

We use our investor relations website, investor.hagerty.com, as a means of disclosing information which may be of interest or material to our investors and for complying with disclosure obligations under Regulation FD. Accordingly, investors should monitor our investor relations website, in addition to following our press releases, SEC filings, public conference calls, webcasts, and social media channels. Information contained on or accessible through, including any reports available on, our website or social media channels is not a part of, and is not incorporated by reference into, this Annual Report or any other report or document we file with the SEC. Any reference to our website in this Form 10-K is intended to be an inactive textual reference only.

4

Cautionary Statement Regarding Forward-Looking Statements

This Annual Report, as well as information included in oral statements or other written statements made by us, contain statements that constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this Annual Report other than statements of historical fact, are forward-looking statements, including statements regarding our future operating results and financial position, our business strategy and plans, products, services, and technology offerings, market conditions, growth and trends, expansion plans and opportunities, and our objectives for future operations. Forward-looking statements can be identified by words such as "anticipate," "believe," "envision," "estimate," "expect," "intend," "may," "plan," "predict," "project," "target," "potential," "will," "would," "could," "should," "continue," "ongoing," "contemplate," and other similar expressions, although not all forward-looking statements contain these identifying words.

We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in Part I, Item 1A. "Risk Factors" in this Annual Report. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Annual Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements include, among other things, our ability to:

•compete effectively within our industry and attract and retain our insurance policyholders and paid HDC subscribers (collectively, "Members");

•maintain key strategic relationships with our insurance distribution and underwriting carrier partners;

•prevent, monitor, and detect fraudulent activity;

•manage risks associated with disruptions, interruptions, outages or other issues with our technology platforms or our use of third-party services;

•accelerate the adoption of our membership products as well as any new insurance programs and products we offer;

•manage the cyclical nature of the insurance business, including through any periods of recession, economic downturn or inflation;

•address unexpected increases in the frequency or severity of claims;

•comply with the numerous laws and regulations applicable to our business, including state, federal and foreign laws relating to insurance and rate increases, privacy, the internet, and accounting matters;

•manage risks associated with being a controlled company; and

•successfully defend any litigation, government inquiries, and investigations.

You should not rely on forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, performance, or events and circumstances reflected in the forward-looking statements will occur. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the effect of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. The forward-looking statements in this Annual Report represent our views as of the date of this Annual Report. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this Annual Report or to conform these statements to actual results or revised expectations.

5

PART I

ITEM 1: BUSINESS

Company Overview

We are a market leader in providing insurance for classic cars and enthusiast vehicles. Through our insurance model, we act as a Managing General Agent ("MGA") by underwriting, selling and servicing classic car and enthusiast vehicle insurance policies. Then, due to our consistent track record of delivering strong underwriting results, we reinsure a large portion of the risks written by our MGA subsidiaries through our wholly owned subsidiary, Hagerty Reinsurance Limited ("Hagerty Re"). In addition, we offer Hagerty Drivers Club ("HDC") memberships, which can be bundled with our insurance policies and give subscribers access to an array of products and services, including Hagerty Drivers Club Magazine, automotive enthusiast events, our proprietary vehicle valuation tool, emergency roadside assistance, and special vehicle-related discounts. Lastly, to complement our insurance and membership offerings, we also offer Hagerty Marketplace ("Marketplace"), where car enthusiasts can buy, sell, and finance collector cars. Through these offerings, our goal is to be the world's most trusted and preferred brand for enthusiasts to protect, buy and sell, and enjoy the special cars that are their passion.

The backbone of our ecosystem is our fast-growing insurance business. People take excellent care of the things they love, and we take great pride in protecting and preserving their treasured vehicles. For almost 40 years, we have consistently grown our insurance business and currently insure approximately 2.4 million classic cars and enthusiast vehicles. We have built a strong reputation for providing excellent customer service through our passionate member service center, resulting in a Net Promoter Score ("NPS") of at least 82 in recent years, an insurance policy retention rate close to 90%, and a typical policy life of approximately nine years.

HDC and Marketplace, as well as our media and entertainment platforms, work synergistically with our insurance business to drive retention and loyalty and enable auto enthusiasts to protect, buy and sell, and enjoy their special cars, whether it be on the road, on the track, in the garage, at an event, or through our media content. We believe the combination of these complementary offerings creates an enthusiast-centered ecosystem of products and services, generating multiple points of monetization, resulting in an attractive recurring revenue business model with relatively low customer acquisition costs that benefit from increasing scale.

With a rich heritage spanning over 40 years, the first Hagerty company was founded in 1984. Hagerty, Inc., a Delaware corporation, was formed in 2020 and became a public company traded on the New York Stock Exchange ("NYSE") in 2021.

Industry and Market Opportunity

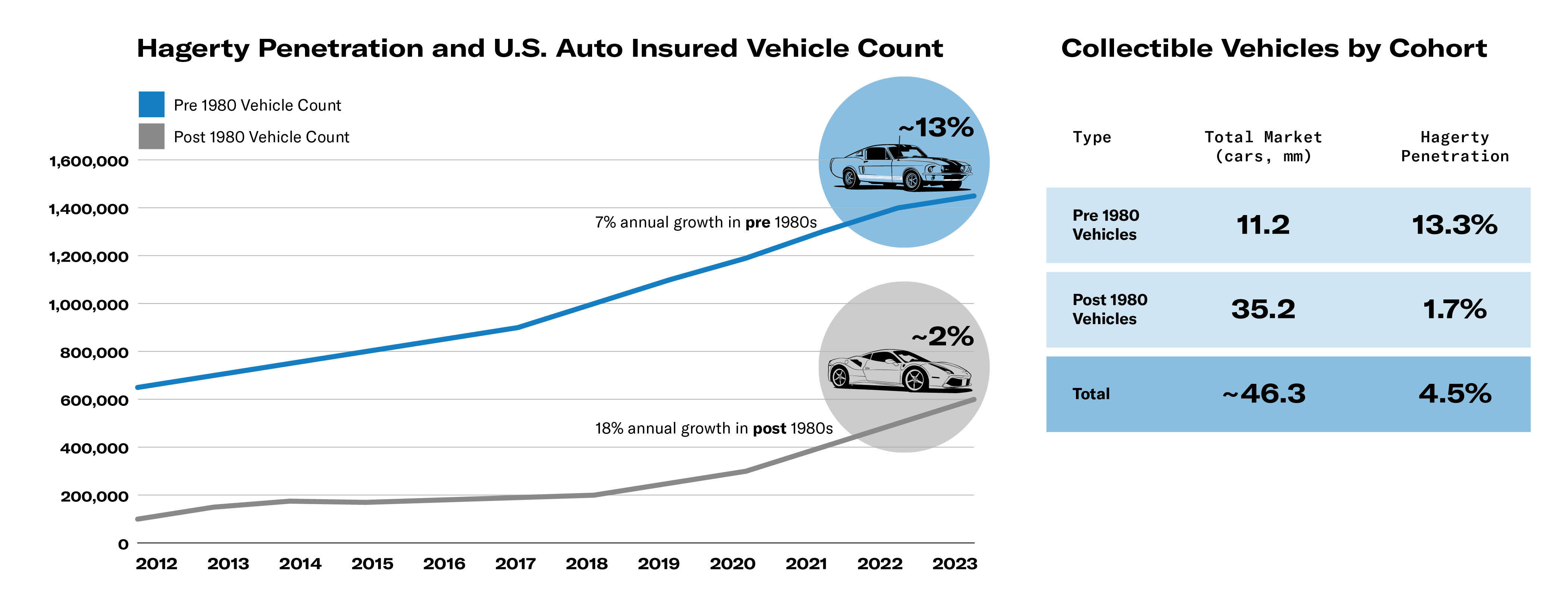

We love cars and we are not alone, as evidenced by the large and growing collector car market. We estimate that there are approximately 46 million insurable collector cars in the United States ("U.S."), of which approximately 11 million are pre-1981 and 35 million are post-1980 collectibles. On this basis, we estimate that the U.S. market translates into $18 billion of annual premium for insurable collector cars based on our average vehicle premium of approximately $381 per year. Over the last decade, we have increased our written premium by a compound annual growth rate ("CAGR") of 13%, powered primarily by strong growth in the number of our insurance policies in force. While we have become one of the leading providers of insurance for pre-1981 classics, with an estimated market share of 13.3% in that cohort, we estimate our market share for post-1980 collectibles is only 1.7%, resulting in an overall collector car market share of under 5%. We believe that our strong brand and value proposition focused on our "Guaranteed Value" insurance policies position us well to capture a larger share of this growing market over the coming decade.

6

In order to fully capitalize on this opportunity, we perform a data-driven Member and vehicle analysis to understand vehicle ownership data, demographic data, vehicle usage, and values. Based upon this analysis, we are able to identify key vehicle markets, explore additional opportunities within these markets, overlay demographic and usage data to enrich our approach and leverage the information to better serve the auto enthusiast community.

Business Model and Competitive Strengths

The Hagerty brand has been carefully curated over the last four decades by providing Members with excellent customer service through our passionate team of automotive experts. We have become known as an auto enthusiast brand for car people, by car people. We believe that consumers who feel a part of an enthusiast community or club are more engaged and have higher renewal rates than those who simply purchase a good or service. With an insurance policy retention rate of nearly 90% and an average policy life of nine years, we have demonstrated a strong recurring revenue model that benefits from a combination of high insurance policy retention, new Member growth, and increases in premium rates driven, in part, by increasing valuation.

The enthusiast community created by our insurance, membership and Marketplace offerings is enhanced by our media and entertainment platforms, as well as our renowned car events, which generate positive ongoing engagement with current Members, as well as interest from prospective members, in our brand, products and services. Our media content features the work of talented automotive content creators, journalists, and storytellers who bring the automotive world to life in exciting and unexpected ways across a variety of digital, print, and video media formats. Our media team covers entertainment, news, market information, and vehicle valuation trends, all of which helps generate an engaged audience that drives retention and brings new Members into our ecosystem.

Our enthusiast-centered ecosystem is built for car lovers, enabling them to protect, buy and sell, and enjoy the special cars that are their passion, thereby increasing our share of their discretionary spending. We believe that this enthusiast-centered business model, with a focus on community and engagement, is a significant advantage over competitors who, without strong affinity or engagement, are left to compete mainly on price.

7

Insurance

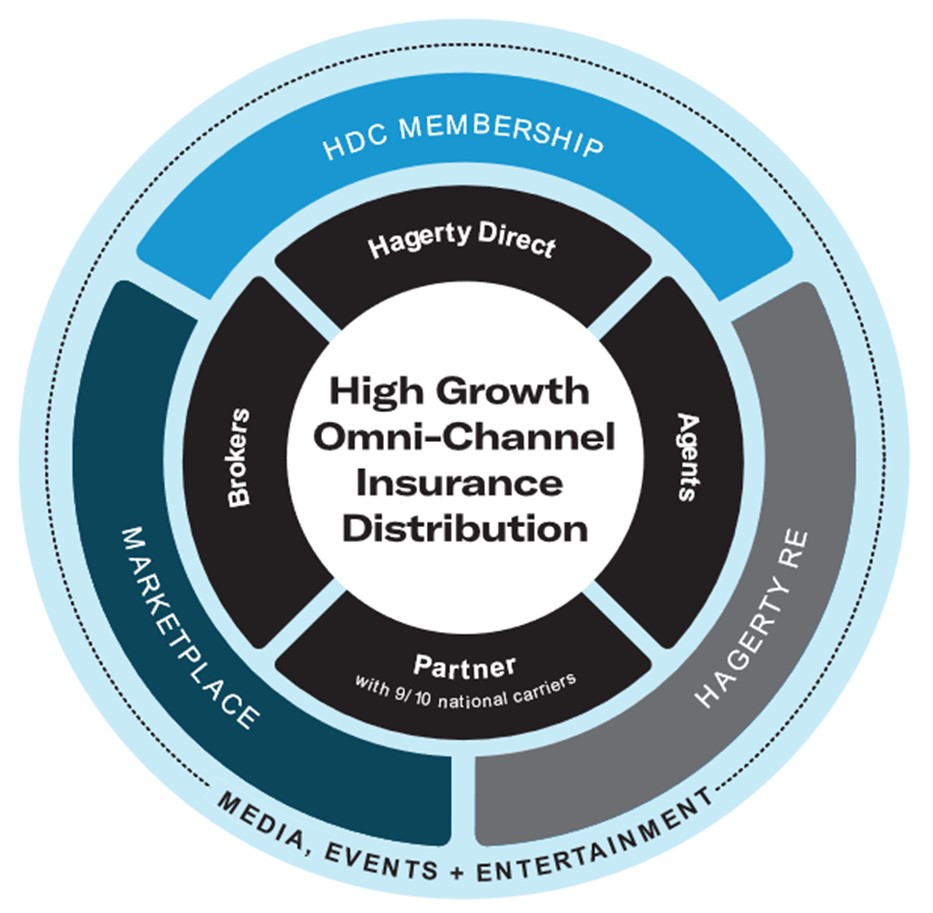

We provide insurance for approximately 2.4 million classic cars and enthusiast vehicles. Our insurance business model positions us to control the pricing and underwriting of the insurance policies, benefit from steady commission income and engage directly with consumers. We operate an omnichannel distribution model, including our direct sales channel serviced by our employee agents, our vast network of independent agents and brokers, and our insurance distribution partners. We believe this system of cooperation and partnership creates a win-win situation that allows us to capture more of the collector car and enthusiast vehicle insurance market.

Our insurance business generates two types of revenue: (1) commissions and fees earned by our MGA subsidiaries from the underwriting, sale and servicing of classic car and enthusiast vehicle insurance policies, and (2) insurance premiums earned for the risk assumed by Hagerty Re.

We utilize our data science capabilities to benefit both our MGA activities, as well as our risk-taking activities through Hagerty Re. Some examples of how we utilize data science include:

•Underwriting and Risk Assessment: Decades of data allow us to accurately assess the risk associated with insuring collector cars through actuarial analysis, which leads to more efficient underwriting and appropriate pricing.

•Market Analysis: Machine learning algorithms are designed to analyze data on collector car sales and values to identify trends and initiate automated marketing, sales and servicing workflows.

•Customer Service: AI-powered tools provide instant and accurate responses to Member inquiries, freeing up our member service agents to handle more complex issues and improve the Member experience.

•Claims Processing: Streamlining the claims process by automating routine tasks and flagging potential fraud.

We are investing substantial resources in research and development to enhance our platform, develop new products and features, and improve the speed, scalability, and security of our platform infrastructure. Our research and development organization consists of world-class engineering, product, data, and design teams. These teams work collaboratively to bring our products to life, from conception and validation to implementation.

Managing General Agent

We earn commission revenue from the underwriting, sale, and servicing of classic car and enthusiast vehicle insurance policies on behalf of our insurance carrier partners. Our insurance products are unique due to our omnichannel distribution approach, meaning we sell our insurance wherever our policyholders need us. This omnichannel approach allows us to offer our insurance products across three channels: (1) directly to consumers; (2) through independent agents and brokers; and (3) through strategic distribution partnerships with large traditional auto insurers. Historically, our MGA subsidiaries have earned a base commission of approximately 32% of written premium, as well as an additional contingent

8

underwriting commission ("CUC") of up to 10%. In December 2023, our alliance agreement and associated agency agreement with Markel Group, Inc. ("Markel"), which generated approximately 95% of our total commission revenue in 2023, was amended to increase the base commission rate on our personal lines U.S. auto business to 37% and to adjust the profit share commission factors to scale annually from -5% to a maximum of +5% of written premium, with 80% of the expected CUC being paid monthly, beginning in 2024. Refer to the section titled "Markel Alliance" below. Markel is a related party to the Company. Refer to Note 23 — Related-Party Transactions in Item 8 of Part II of this Annual Report for additional information.

Our insurance offerings are centered around our "Guaranteed Value" insurance policy which differentiates our coverage from the standard auto insurance market by insuring covered vehicles at their agreed upon value, rather than the depreciated value typically provided by standard auto coverage. We work closely with our Members to determine the right amount of coverage for their vehicle, utilizing Hagerty Valuation Tools ("HVT"), which has been built over decades of collecting vehicle sales information. If a vehicle experiences a covered total loss, we pay the full amount of the vehicle's insured value without any depreciation.

In addition, our MGA subsidiaries also handle the claims for our insurance products to ensure our Members receive a high level of service focused on the unique requirements of repairing vintage and rare vehicles.

For the years ended December 31, 2023, 2022, and 2021, MGA commission and fee revenue represented 37%, 39%, and 44%, respectively, of our total revenue.

Direct Sales Channel

Our direct sales channel is serviced by our employee agents working across all 50 states and three countries to drive new business flow. Approximately 45% of our total U.S. auto written premium is generated through direct sales. As discussed above under "Business Model and Competitive Strengths", we have created an auto enthusiast ecosystem that connects with Members across multiple points of engagement whereas typical insurance companies engage with their customers only at the point of purchase and upon renewal.

Independent Agent and Broker Channel

Approximately 33% of our total U.S. auto written premium is generated by our relationships with over 49,000 independent agents and brokers, including the independent agents in our partnership channel, as discussed below. These independent agents and brokers represent all top 10 brokers in the U.S. by revenue. We are often told by agents and brokers that partnering with us brings value and joy to their enthusiast clients that is unmatched in the industry. Our high-engagement and experiential approach to the market is often co-branded by independent agents and brokers to deliver auto enthusiasts an experience the agent or broker could not deliver themselves. As a result, both brands benefit symbiotically through longer-lasting and more intimate customer relationships.

Partnership Channel

We also market our insurance products through our insurance distribution partners, who account for approximately 22% of our U.S. auto total written premium. This channel consists of partnerships with 9 of the top 10 largest auto insurers, as ranked by the National Association of Insurance Commissioners based upon 2022 direct premiums written, including State Farm Mutual Automobile Insurance Company ("State Farm"). Under these arrangements, we generally make our specialty insurance products and related services available to the carrier's agents, who then refer or present Hagerty to their customers. Our track record of expertise and growth creates opportunities for cultivating strong, mutually beneficial partnerships that allow us to continue to meaningfully grow our share of the collector car market in the U.S.

Most insurance companies offer and compete for multi-line insurance: auto, homeowners, umbrella, watercraft, aircraft, and other exclusive collectibles. Our focus on collector car products and services reduces competitive threats for partners and raises their confidence in transacting with us. Furthermore, we focus our investments on developing capabilities that serve the interests of the car enthusiast market. This depth and discipline of focus has enabled us to maintain a "neutral" and non-threatening partner of choice position with the highest quality automobile insurance companies in the market as we help them reduce the risk of losing a customer and the total value of the bundled insurance and membership offerings.

Our approach to partnerships enables complementary growth. Our business model is attractive to our partners because we offer a full-service solution for their customers and their special cars. We handle product development and pricing, sales and service, underwriting, and claims services on behalf of our carrier partners, and we offer Member benefits tailored to the enthusiast all through our proprietary technology and by our sales and service teams. For partners, our focus on the collector car space allows them to focus on other parts of their business portfolios. We then align financial interests so both parties benefit from the relationship, which creates strong and more durable institutional bonds. When our partners win and grow, we do as well. We take great care to build partnerships with companies who share our intense focus on customer service.

9

Strategic Agreements

State Farm Alliance

Hagerty has a 10-year master alliance agreement with State Farm under which State Farm's customers, through State Farm agents, are able to access Hagerty's features and services. This program began issuing policies in four initial states in September 2023. Under this agreement, State Farm paid Hagerty an advanced commission of $20.0 million in 2020, which is being recognized as "Commission and fee revenue" over the remaining life of the arrangement.

In conjunction with the master alliance agreement, the Company also entered into a managing general underwriter agreement whereby the State Farm Classic+ policy is offered through State Farm Classic Insurance Company, a wholly owned subsidiary of State Farm. The State Farm Classic+ policy is available to new and existing State Farm customers through their agents on a state-by-state basis. Hagerty is paid a commission under the managing general underwriter agreement and ancillary agreements for servicing the State Farm Classic+ policies. Additionally, we have the opportunity to offer HDC membership to State Farm Classic+ customers which provides Hagerty an additional revenue opportunity.

State Farm is a related party to the Company. Refer to Note 23 — Related-Party Transactions in Item 8 of Part II of this Annual Report for additional information.

Markel Alliance

Markel is the ultimate parent company of Essentia Insurance Company ("Essentia"), which serves as the dedicated carrier for the specialty classic and collector vehicle insurance policies sold by our U.S. MGA subsidiaries. Essentia is exclusive to our U.S. MGA subsidiaries and only writes insurance policies we produce. Under this arrangement, we are licensed and appointed as Essentia’s MGA and are authorized to develop insurance products, underwrite, bill, and perform claims services for policies written through Essentia. State laws govern many of the activities under this relationship and our MGA subsidiaries must maintain the appropriate licensing as a producer and, where required, as an MGA, plus additional requirements in some states for claims adjusting.

Essentia cedes premiums and risk through quota share reinsurance agreements to three of our key insurance distribution partners with the remaining retained premium being ceded to its affiliate, Evanston Insurance Company ("Evanston"). Evanston, in turn, cedes a portion of the business it reinsures from Essentia to Hagerty Re. For Evanston to take credit for reinsurance under applicable state law, Hagerty Re maintains funds in trust for the benefit of Evanston.

On December 18, 2023, the Markel Alliance Agreement was amended to, among other things, (i) include a new definition of "Enthusiast Business", and remove Enthusiast Business from both definitions of "Restricted Business" and "Alliance Business"; (ii) delay the Company's acquisition rights to Essentia until 2026 at the earliest and 2030 at the latest and; (iii) grant the Company a new waiver to pursue a strategic opportunity with a third party insurance company. In connection with the amendments to the Markel Alliance Agreement, the Company and Markel also amended the agency agreement referenced in the Markel Alliance Agreement to increase the base commission rate on our personal lines U.S. auto business to 37% and to adjust the profit share commission factors to scale annually from -5% to a maximum of +5% of written premium, with 80% of the expected CUC being paid monthly, beginning in 2024. The Markel and Hagerty agreements governing the relationship expire at the end of 2030 and include extension periods.

Markel is a related party to the Company. Refer to Note 23 — Related-Party Transactions in Item 8 of Part II of this Annual Report for additional information.

Aviva Canada Alliance

Aviva Canada Inc. ("Aviva") is the parent company of Elite Insurance Company which serves as the carrier for our Canadian MGA subsidiary ("Hagerty Canada") collector vehicle insurance program. The relationship with Aviva in Canada is exclusive with respect to specialty, enthusiast, classic, and collector vehicle insurance, with the exception of the Quebec province, where a third-party insurance agency carries the appropriate licenses and authority to submit business to Elite Insurance Company. Elite Insurance Company and Hagerty Re have a reinsurance quota share agreement. The terms of the Aviva agreements expire in 2030 and include a 5-year extension. Canadian provincial laws govern many of the activities under this relationship and, in addition to appropriate carrier licensing requirements, Hagerty Canada must maintain the appropriate licensing.

Hagerty Re

Because we have confidence in the risks underwritten by our MGA subsidiaries, we reinsure a large portion of that risk and share in the underwriting profit through Hagerty Re, which is registered as a Class 3A reinsurer under the Bermuda Insurance Act of 1978. For the years ended December 31, 2023, 2022, and 2021, Hagerty Re's U.S. quota share, or assumed risk, was approximately 80 %, 70 %, and 60 %, respectively. We anticipate that Hagerty Re's U.S. quota share will remain at 80 % going forward.

10

Hagerty Re allows us to efficiently deploy capital and create steady, consistent underwriting results due to our deliberate approach to managing risk and employing actuarial discipline to the underwriting process, which has resulted in an attractive average loss ratio of 43% over the last three years. This compares favorably to the overall auto insurance industry average of approximately 69%, excluding loss adjustment expenses.

For the years ended December 31, 2023, 2022, and 2021, Hagerty Re earned premium represented 53%, 51%, and 48%, respectively, of our total revenue.

Membership

We offer HDC memberships to our insurance policyholders as a way to strengthen the bonds of those relationships. As of December 31, 2023, approximately three-quarters of new insurance policyholders also purchase a subscription to HDC. In addition, we offer HDC memberships as a stand-alone product to continue to build the broader enthusiast community. Our focus on HDC membership offerings is intended to build a community of car lovers that are loyal to the Hagerty brand due to the multiple valuable points of engagement we provide.

Typical insurance businesses engage with their customers only a few times a year. Through our diverse Membership offerings, we deploy an ecosystem of engagement, including both physical (through events and social functions) and digital platforms (through media content, social media engagement, market news and valuation data) that can result in numerous touchpoints with Members each year. We believe our leading NPS and strong retention rates reflect the effectiveness of our enthusiast ecosystem.

Marketplace

The market for buying and selling collector cars is substantial, encompassing live and time-based online auctions, as well as private sales. We estimate that there are approximately 46 million insurable collector cars in the U.S., valued at approximately $1.0 trillion. In 2023, we observed approximately 300,000 buy/sell collector car transactions representing approximately $14.2 billion in total value trading hands in our U.S. insurance book, or approximately 1.4% of the estimated U.S. market value. We believe we can differentiate ourselves from other platforms and services by injecting a higher level of trust into this marketplace by using our existing size, scale, improved processes, and trusted brand status.

Marketplace leverages the power of our ecosystem by providing a platform where enthusiasts can buy, sell, and finance collector cars. At the high-end of the collector car market, where values typically exceed $100,000, our wholly owned subsidiary, Broad Arrow Group, Inc. ("Broad Arrow"), helps collectors and enthusiasts buy and sell at live auctions and also facilitates private sales. At lower price points, typically below $100,000, Hagerty Marketplace offers time-based online auctions, as well as classified listings through Hagerty Classifieds, which enables collectors and enthusiasts to buy and sell collector cars through our digital platform. Lastly, through Broad Arrow Capital LLC ("BAC"), we provide financing solutions to qualified collectors and businesses in the U.S., Canada, the U.K., and certain European countries by structuring loans secured by their collector cars. Loans underwritten by BAC are typically $250,000 or higher, with a focus on classic and collector cars that are typically not financed by traditional banks and lenders.

Marketplace utilizes HVT, our valuation tool used by over three million people each year to access current and historic pricing data on more than 48,000 collector vehicle models based on our robust proprietary database.

Business Attributes

Intellectual Property

We believe our intellectual property rights are valuable and important to our business. We rely on trademarks, patents, copyrights, trade secrets, license agreements, intellectual property assignment agreements, confidentiality procedures, non-disclosure agreements, and electronic and physical security measures to establish and protect our proprietary rights. Though we rely in part upon these legal, contractual, and other protections, we believe that factors such as the skill and ingenuity of our employees and the functionality and frequent enhancements to our platform are large contributors to our success. We intend to pursue additional intellectual property protection on such enhancements to the extent we believe it would be beneficial and cost-effective.

As of December 31, 2023, we have two issued patents in the U.S. and one in Canada. The issued patents generally relate to (i) our vehicle information number decoder, which allows us to determine vehicle configuration details and associated vehicle values and (ii) our method and system for storage and selective sharing of vehicle data. The issued patents are expected to expire in August 2030, May 2031, and May 2033, respectively. We continually review our development efforts to assess the existence and the ability to protect new intellectual property.

11

We have trademark rights in our name, our logo, and other brand indicia, and have trademark registrations for select markets in the U.S., Canada, U.K., European Union ("E.U."), and Australia. We have copyrights for our media and entertainment content and registered copyrights for our vehicle information tools in the U.S. We also have registered various domain names related to our brand for websites that we use in our business, including Hagerty.com.

Although we believe our intellectual property rights are valuable and strong, intellectual property rights are sometimes subject to invalidation or circumvention. Refer to the section titled "Risk Factors — Risks Related to Our Business — Our intellectual property rights are extremely valuable and if they are not properly protected, our products, services, and brand could be adversely impacted." within Part I, Item IA — Risk Factors, in this Annual Report for additional information.

Seasonality

Due to our significant North American footprint, our revenue streams, and in particular, commission and fee revenue, exhibit seasonality, with a larger percentage of revenue derived in the second and third quarters, while the first and fourth quarters generate lower revenue and profitability. This seasonality is due to the fact that more vehicles are driven and purchased during the second and third quarters, and our twelve-month insurance policies renew during those same quarters. We expect to experience seasonal fluctuations in our quarterly operating results, which may not fully reflect the underlying performance of our business.

Competition

We believe that our business model of integrated products and services is unique. While there are a number of other specialty insurance companies that offer collector car insurance, we believe our enthusiast-centered ecosystem, with a focus on community and engagement, is a significant competitive advantage over competitors who, without strong affinity or engagement, are left to compete primarily based on price. We experience some competition in the larger standard auto insurance market as the majority of collectible vehicles are currently insured through national carriers. However, in lieu of competing directly with standard auto insurance carriers, we have formed relationships with many of them to offer their customers our membership subscription model coupled with our specialty insurance products. These relationships with the largest auto insurance carriers allows us to provide a high-touchpoint experience resulting in more appropriate levels of cost coverage and higher overall service satisfaction of Members.

Government Regulation

We operate across jurisdictions in North America and Europe and our businesses (in particular, insurance) are subject to comprehensive and detailed regulation and supervision. Each jurisdiction in which we operate has established supervisory agencies with broad administrative powers for various business practices (for example, financial services consumer protection and data protection). While we are not aware of any proposed or recently enacted domestic or international regulation that would have a material impact on our operations, earnings, or competitive position, we cannot predict the effect that future regulatory changes might have on us.

Investments

As of December 31, 2023, the substantial majority of our portfolio of investable assets was held by Hagerty Re, which holds only cash and cash equivalents and Canadian Sovereign and Provincial fixed income securities. As we continue to grow and strengthen our track record, Hagerty Re intends to prudently diversify its portfolio, while maintaining a low tolerance for risk. Hagerty Re manages its investment portfolio in accordance with an investment policy approved by its Board of Directors, which seeks to generate an attractive total return on an after-tax basis on its investment assets, over the long-term, subject to compliance with all of the following constraints and objectives: (i) comply with certain portfolio-level and asset-level class constraints; (ii) preserve capital by assuming only a modest amount of risk of principal loss; (iii) ensure sufficient liquidity to meet obligations; (iv) comply with all legal, regulatory, and contractual requirements; and (v) employ an efficient portfolio in terms of assumed risk and relative to expected return.

Human Capital

Our performance-based culture is shaped by our people, and their engagement, accountability and alignment with our key objectives as an organization. Our strategy involves hiring great people, providing challenging and meaningful work, and investing in their professional and personal development, and we believe this creates a strategic advantage for us. In 2022, we transitioned to a "remote-first" work model, which we believe enables us to attract top talent and provide employees the flexibility they increasingly seek. Our objectives include effectively identifying, recruiting, retaining, incentivizing, and integrating our existing and additional employees. As of December 31, 2023, we had 1,732 total employees, 1,726 of which were full-time employees. None of our employees are represented by a labor union or covered by collective bargaining agreements.

12

Compensation

Our compensation programs are designed to attract, retain and motivate talented, deeply qualified and committed individuals who believe in our mission, while rewarding employees for long-term value creation. We have a pay-for-performance culture in which employee compensation is aligned to company performance, as well as individual contributions and impacts. The potential for stock-based compensation awards through our equity incentive plan, as well as the opportunity to participate in the Employee Stock Purchase Plan are designed to align employee compensation to the long-term interests of our stockholders, while encouraging them to think and act like owners. We strive for a fair, competitive, transparent and equitable approach in recognizing and rewarding our employees.

Health and Wellness

The health and wellness of our employees and their families is integral to our success. We have a comprehensive benefits program to support the physical, mental and financial well-being of our employees. We have a self-insured medical plan in which our employees pay up to 29% of the monthly estimated premiums. In addition to core medical benefits, we offer maternity and paternity benefits, as well as employee assistance programs to support the mental health of our employees. Additionally, aside from our competitive paid time off program, we offer caregiver time off, which provides employees 40 hours each year of paid time off for caregiver responsibilities.

Diversity, Equity, and Inclusion

Our diversity, equity, and inclusion objective is to be a company where each employee genuinely belongs, is respected and valued, and can do their best work. We take this to heart not just within our Company, but also within the broader automotive enthusiast community.

To help achieve our goals, we ensure fair and transparent processes in talent assessment and hiring, performance management and career progression and retention. We are creating a stronger sense of inclusion and belonging for our employees in general with a lens on representation. Engagement and belonging are fueled by having a meaningful connection to others and opportunities to grow and develop careers. Across these dimensions, we are building programs, systems and tools that foster greater belonging.

We intend to continue to invest and further develop our leadership training and support to ensure that all leaders — those promoted, developing or hired — understand how to lead, keeping our diversity and inclusion principles top of mind in every aspect of their role.

Business Combination

On December 2, 2021, The Hagerty Group, LLC completed a business combination with Aldel Financial Inc. ("Aldel"), and Aldel Merger Sub LLC ("Merger Sub"), a Delaware limited liability company and wholly owned subsidiary of Aldel (the "Business Combination"). In connection with the closing, (i) Aldel changed its name from Aldel Financial Inc. to Hagerty, Inc., and (ii) we were organized in what is commonly known as an "Up-C" structure in which substantially all of the assets and liabilities of Hagerty, Inc. are held by The Hagerty Group.

Refer to Note 8 — Business Combination in Item 8 of Part II of this Annual Report for additional information on the Business Combination.

ITEM 1A. RISK FACTORS

Described below are certain risks and uncertainties that we believe are applicable to our business and the industry in which we operate, and some of which are beyond our control. The following factors are not the only risks and uncertainties we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us. You should carefully read the following risks as well as the cautionary statements referred to in "Cautionary Statement Regarding Forward-Looking Statements" herein. If any of the risks and uncertainties described below or elsewhere in this Annual Report actually occur, our business, financial condition or results of operations could be materially adversely affected, the trading price of our securities could decline, and you might lose all or part of your investment.

Risk Factors Summary

Our business is subject to numerous risks and uncertainties of which you should be aware. Among others, these risks relate to:

•our ability to attract and retain Members and compete effectively within our industry;

•our dependence on a limited number of insurance distribution and underwriting carrier partners;

13

•our ability to prevent, monitor and detect fraudulent activity;

•our reliance on a limited number of payment processing services;

•our reliance on a highly skilled and diverse management team and workforce and a unique culture;

•our ability to successfully execute and integrate future acquisitions, partnerships and investments;

•issues with our technology platforms and our ability to anticipate or prevent cyberattacks;

•the limited operating history of some or our membership products and the success of any new insurance programs and products we offer;

•our susceptibility to inflation, interest rate, and foreign currency exchange rate fluctuations;

•our ability to continue to develop, implement, and maintain the confidentiality of our proprietary technology and prevent the misappropriation of our data;

•the cyclical nature of the insurance business and our dependence on our ability to collect vehicle usage and driving data;

•compliance with the numerous laws and regulations applicable to our business, including state, federal and foreign laws relating to insurance and rate increases, privacy, the internet, accounting matters, tax, and economic sanctions;

•unexpected increases in the frequency or severity of claims, including increases caused by catastrophic events;

•our reinsurers may not pay claims on a timely basis, or at all, which may materially adversely affect our business, financial condition, and results of operations;

•unexpected changes in the interpretation of our coverage or provisions, including loss limitations and exclusions;

•significant fluctuations in the collector car market and asset values may materially impact our ability to obtain and sell consigned property within our Marketplace business;

•our only material asset is our interest in The Hagerty Group, and, accordingly, we will depend on distributions from The Hagerty Group to pay our taxes, including payments under the Tax Receivable Agreement ("TRA");

•whether investors or securities analysts view our stock structure unfavorably, particularly our dual-class structure;

•Hagerty Holding Corp. ("HHC") controls us, and its interests may conflict with ours or yours in the future;

•we are a "controlled company" within the meaning of the NYSE listing requirements, as a result, we will qualify for, and intend to rely on, exemptions from certain corporate governance requirements; and

•our common stock, including trading price declines from missed earnings guidance, trading volatility, lack of dividends, and anti-takeover provisions in our governing documents.

Risks Related to Our Business

We have experienced significant Member growth over the past several years, and our continued business and revenue growth are dependent on our ability to continuously attract and retain Members and we cannot be sure we will be successful in these efforts, or that Member retention levels will not materially decline.

If consumers do not perceive our service offerings to be of value, including if we introduce new or adjust existing features, adjust pricing, coverage or service offerings, or change the mix of offerings in a manner that is not favorably received by consumers, we may not be able to attract and retain Members. We may, from time to time, adjust the pricing or the pricing model itself, which may not be well received by consumers, and which may result in existing Members canceling their membership or obtaining services from a competitor and may result in fewer new Members joining our programs. In addition, many of our Members are referred to us through word-of-mouth from existing Members. If our efforts to satisfy our existing Members are not successful, we may not be able to attract new Members, and as a result, our ability to maintain and/or grow our business will be adversely affected.

A large percentage of our revenues are derived from sales through direct-to-consumer sales, including through digital channels. If we fail to meet consumer expectations for the Member experience through digital or other sales channels, our growth may be impacted through the loss of existing Members or inability to attract new Members.

14

A large percentage of our products and services are distributed through a few relationships and the loss of business provided by any one of them could have an adverse effect on us.

In addition to our direct sales efforts and independent channels, we market our insurance products through several insurance distribution partners. For the year ended December 31, 2023, approximately 16% of our commission revenues were attributable to four distribution partner marketing relationships. For two of these distribution partners, we have long-term arrangements, one of which has an expiration date in 2029 and the other in 2030. The other relationships have shorter durations. Upon expiration or termination of these agreements, these partners may decide not to continue to distribute our products and services or may be unwilling to do so on terms acceptable to us. If we are not successful in maintaining existing relationships and in continuing to expand our distribution relationships, or if we encounter regulatory, technological, or other impediments to delivering our services to Members through these relationships, our ability to retain Members and grow our business could be adversely impacted. In addition, the broker/agent relationships with many of the partners we work with may change and their own internal strategy about how products are marketed may change, and, where we do not have exclusivity, we face competition by providers who seek to build or strengthen the relationships without distribution partners, which could cause a loss of focus on or exposure to our products and services, adversely impacting new sales.

We may not be able to prevent, monitor, or detect fraudulent activity, including transactions with insurance policies or payments of claims as well as transactions through our Marketplace business.

If we fail to maintain adequate systems and processes to prevent, monitor, and detect fraud, including employee fraud, agent fraud, fraudulent policy acquisitions, vendor fraud, buyer or seller marketplace sales fraud, fraudulent claims activity, or if an inadvertent error occurs because of human or system error, our business could be materially adversely impacted. Fraud schemes have become increasingly more sophisticated and are ever evolving into different avenues of fraudulent activity. While we believe that any past incidents of fraudulent activity have been relatively isolated, we cannot be certain that our systems and processes will always be adequate as fraudulent activity and schemes continue to evolve. Our employees are required to take anti-fraud training, and we use a variety of tools to protect against fraud, but the trainings and these tools may not always be successful at preventing fraud.

Instances of fraud may result in increased costs, including possible settlement and litigation expenses, and could have a material adverse effect on our business and reputation. In addition, failure to monitor and detect fraud and otherwise comply with state Special Investigation Unit requirements can result in regulatory fines or penalties.

We rely on the expertise of our Chief Executive Officer, senior management team, and other key employees. If we are unable to attract, retain, or motivate key personnel, our business may be severely impacted.

Our success depends on the ability to attract, retain, and motivate a highly skilled and diverse management team and workforce. Our Chief Executive Officer is well known and respected in our industry. He is an integral part of our brand and his departure would likely create difficulty with respect to both the perception and execution of our business. Additionally, the loss of a member of our senior management team, specialized insurance experts or key personnel might significantly delay or prevent the achievement of our strategic business objectives and could harm our business. We rely on a small number of highly specialized insurance experts, the loss of any one of whom could have a disproportionate impact on our business. Our compensation arrangements, such as our equity award programs, may not always be successful in attracting new employees and retaining and motivating our existing employees. Moreover, if and when our equity awards are substantially vested, employees under such equity arrangements may be more likely to leave, particularly if the underlying shares have seen a significant appreciation in value.

Our inability to ensure that we have the depth and breadth of management and personnel with the necessary skills and experience could impede our ability to deliver growth objectives and execute our operational strategy. As we continue to expand and grow, we will need to promote or hire additional staff, and it may be difficult to attract or retain such individuals in a timely manner and without incurring significant additional costs. If we are not able to integrate new team members or if they do not perform adequately, our business may be harmed.

Our unique culture has contributed to our success, and if we are not able to maintain this culture in the future, our business could be harmed.

Our culture supports a high level of employee engagement, which translates into a service model that produces a high level of Member satisfaction and retention. We face a number of challenges that may affect our ability to sustain our culture, including:

•failure to identify, attract, reward, and retain people in leadership positions in our organization who share and further our culture, values, and mission;

•the size and geographic diversity of our workforce and our ability to promote a uniform and consistent culture across all our offices and employees working remotely;

15

•competitive pressures to move in directions that may divert us from our mission, vision, and values;

•the continued challenges of a rapidly evolving industry; and

•the increasing need to develop expertise in new areas of business needed to execute our growth plans and strategy.

If we are not successful in instilling our culture in new employees, or maintaining our culture as we grow, our operations may be disrupted, and our financial performance may suffer.

Our future growth and profitability may be affected by new entrants into the market or current competitors developing preferred offerings.

Our business is rapidly growing and evolving, and we have many competitors across our different offerings. The markets in which we operate are highly competitive and we may not continue to compete effectively within our industry. We face competition from large, well-capitalized national and international companies, including other insurance providers, technology companies, automotive media companies, automotive auction and marketplace providers, other well-financed companies seeking new opportunities, or new competitors with technological or other innovations. Many of our competitors have substantial resources, experienced management, strong marketing, underwriting, and pricing capabilities. Because collector auto insurance constitutes a significant portion of our overall business, we may be more sensitive than other providers of insurance to, and more adversely affected by, trends that could decrease auto insurance rates or reduce demand for auto insurance over time, such as industry advances in mileage-based or usage-based insurance offerings, changes in vehicle technology, autonomous or semi-autonomous vehicles, or vehicle sharing arrangements. In addition, there are limited barriers to entry in the automotive lifestyle business. Accordingly, more established brands with significantly more resources may compete against us in the automotive lifestyle business in the future. If we are unable to compete effectively, we may not be able to grow our business and our financial condition and results of operations may be adversely affected.

As a result of a number of factors, including increasing competition, negative brand or reputational impact, changes in geographic mix or product mix, and the continued expansion of our business into a variety of new areas, we may not be able to continue to grow our revenues at a high rate or at all. We may also experience a decline in our revenue growth rate as our revenues increase to higher levels. Our revenue growth may be impacted if there is a deceleration or decline in demand for our products and services due to changing market dynamics or demographic shifts.

Future acquisitions or investments contain inherent strategic, execution, and compliance risks that could disrupt our business and harm our financial condition.

We may pursue acquisitions or investments to grow our business in line with our strategic objectives. Any acquisition or investment (whether for service offerings, technology, or product offerings, or for other external uses) may not achieve the desired return sought. These acquisitions or investments may also result in unforeseen liabilities or expenses, such as higher than expected costs due to market competition, regulatory approval requirements, delays in implementation, lost opportunities that could have been pursued with cash being used, litigation or regulatory enforcement post-acquisition or investment, contingent liabilities, implementation cost, misalignment of culture, loss of technology through theft or trade secrets exchanged, loss of key partners/vendors, currency exchange rate for foreign investment, timing within overall economic environment, carrying costs, and tax liabilities. Additionally, the risks from future acquisitions or investments could result in impairment charges against goodwill and intangible assets or increases in the liabilities on our Consolidated Balance Sheets, as well as missed earnings results.

16

We may be subject to cyberattacks, and our reliance on third party providers for technology and service mean our operations could be disrupted due to the lack of resiliency in the operations of other companies, or a breach in their obligations to us, and could impair the operability of our website and other technology-based operations.

Cyberattacks, denial-of-service attacks, ransomware attacks, business email compromises, computer malware, viruses, social engineering (including phishing) and other malicious internet-based activity are prevalent in our industry and such attacks continue to increase. We also utilize third-party providers to host, transmit, or otherwise process electronic data in connection with our business activities. We or our vendors and business partners may experience attacks, unavailable systems, unauthorized access, or disclosure due to employee or other theft or misuse, denial-of-service attacks, sophisticated attacks by nation-state and nation-state supported actors, and advanced persistent threat intrusions. Despite our efforts to ensure the security, privacy, integrity, confidentiality, availability, and authenticity of information technology networks and systems, processing and information, we may not be able to anticipate, or to implement, preventive and remedial measures effective against all data security and privacy threats. The recovery systems, security protocols, network protection mechanisms, and other security measures that we have integrated into our systems, networks, and physical facilities, may not be adequate to prevent or detect service interruption, system failure, data loss or theft, or other material adverse consequences. No security solution, strategy, or measures can address all possible security threats or block all methods of penetrating a network or otherwise perpetrating a security incident. The risk of unauthorized circumvention of our security measures, or those of our third-party providers, clients, and partners has been heightened by advances in computer and software capabilities and the increasing sophistication of hackers who employ complex techniques, including without limitation, the theft or misuse of personal and financial information, counterfeiting, "phishing" or social engineering incidents, ransomware, extortion, publicly announcing security breaches, account takeover attacks, denial or degradation of service attacks, malware, fraudulent payment, and identity theft.

In 2021, we experienced an unauthorized access into our online insurance quote feature whereby attackers used personal information already in their possession to obtain additional consumer data, including driver’s license numbers. While none of our systems or databases were compromised or significantly disrupted as part of this incident and the costs associated with the incident and our remediation efforts were not material, we could be subject to litigation or regulatory enforcement actions. In 2023, the Company accrued an estimated liability related to this incident based on the facts known by management and developed through its assessment of the current status of ongoing dialog with the regulatory investigators. The amount of the estimated liability is not material to our Consolidated Financial Statements, though any actual fines, penalties, or settlements may differ from our estimates and the amounts accrued.

Any regulatory enforcement actions, or future cyberattacks on our systems, could cause irreparable harm to our reputation and lead our current and prospective Members away from using our services. Further, we may be required to expend significant financial and operational resources in response to a security breach, including repairing system damage, increasing security protection costs by deploying additional personnel and protection technologies, and defending against and resolving legal and regulatory claims, all of which could be costly and divert resources and the attention of our management and key personnel away from our business operations.

Some of our membership products are newer and have limited operating history, which makes it difficult to forecast operating results. We may not show profitability from these newer products as quickly as we anticipate or at all.

The success of new product and service introductions depends on a number of factors, including timely and successful development, market acceptance, our ability to manage the risks associated with new product production ramp-up issues, the availability of application software for new products, the effective management of purchase commitments and vendor relationships in line with anticipated product demand, the availability of products in appropriate quantities and at expected costs to meet anticipated demand, and the risk that new products and services may have quality or other defects or deficiencies. Accordingly, we cannot determine in advance the ultimate effect of new product and service introductions and transitions. If our new products or services are not well received, or if we are unable to introduce them in a cost-effective manner, we may not be able to realize a profit on those products and services and may, in fact, recognize losses for some time. This could have an adverse effect on our financial condition and results of operations.

We are subject to payment processing risks which could adversely affect our results of operations.

We currently rely on a limited number of payment processing services, including the processing of payments from credit cards and debit cards, and our business would be disrupted if any of the vendors become unwilling or unable to provide these services to us, and we are unable to find a suitable replacement on a timely basis. If we or our processing vendors fail to maintain adequate systems for the authorization and processing of credit card transactions, it could cause one or more of the major credit card companies to disallow our continued use of their payment products. In addition, if these systems fail to work properly and, as a result, we do not charge our customers’ credit cards on a timely basis, or at all, our business, financial condition and results of operations could be harmed.

17

The payment methods that we offer also subject us to potential fraud and theft by criminals, who are becoming increasingly more sophisticated, seeking to obtain unauthorized access to, or exploit weaknesses that may exist in the payment systems. There are potential legal, contractual, and regulatory risks if we are not able to properly process payments. If we are unable to comply with applicable rules or requirements for the payment methods that we accept, or if payment-related data is compromised due to an incident or a breach, we may be liable for significant costs incurred by payment card issuing banks and other third parties, subject to fines and higher transaction fees, subject to potential litigation or enforcement action, or our ability to accept or facilitate certain types of payments may be impaired.

In addition, our customers could lose confidence in certain payment types, which may result in a shift to other payment types or potential changes to our payment systems that may result in higher costs. If we fail to adequately control fraudulent credit card transactions, we could face civil liability, diminished public perception of our security measures, and significantly higher credit card-related costs, each of which could harm our business, financial condition and results of operations.

Rising inflation and interest rates may affect demand for our products and services.

Global economic conditions, including increases in inflation and interest rates, have resulted in uncertainty in consumer discretionary spending, employment rate fluctuations and overall volatility in the financial markets. These unfavorable economic conditions have led, and in the future may lead, consumers to reduce their spending on collectible cars and related services, which in turn could lead to a decrease in the demand for our products and services. Our sensitivity to economic cycles and any related fluctuation in consumer demand may have a material adverse effect on our business, results of operations, and financial condition.

Rising interest rates increase our cost of borrowing and could adversely affect our results of operations.

The Federal Reserve Board significantly increased the federal funds rate in 2023 and while it has indicated that rates are expected to decrease in 2024, there is no certainty how significant, if any, such rate cuts will be. A sustained elevated interest rate environment will have a corresponding impact to our costs of borrowing and may have an adverse impact on our ability to raise funds through the offering of our securities or through the issuance of debt due to higher debt capital costs, diminished credit availability, and less favorable equity markets. Any significant additional federal fund rate increases may have a material adverse effect on our business, financial condition, and results of operations.

As we continue to grow operations in different geographic locations, additional risk related to foreign currencies may have an impact on revenue and our results of operations.

We have foreign operations, and in some instances, collect from customers in foreign currencies. The exchange rates we use to consolidate our foreign entities may be less favorable to us than the actual exchange rates used to convert the funds into U.S. dollars. These foreign exchange risks could have a material negative impact on our financial condition and results of operations.

Our technology platforms may not function properly, which might subject us to loss of business and revenue, breach of contractual obligations, and place us out of compliance with state and federal rules and regulations.

We utilize numerous technology platforms throughout our business for various functions, including to gather Member data in order to determine whether or not to write and how to price our insurance products, to process many of our claims, to issue and service our membership products, and to provide valuation services. We use proprietary artificial intelligence algorithms in certain circumstances within our underwriting processes for efficiency. Our technology platforms are expensive and complex. The continuous development, maintenance, and operation of our technology platforms may entail unforeseen difficulties, including material performance problems or undetected defects or errors. We may encounter technical obstacles, and it is possible that we may discover additional problems that prevent our technology from operating properly. If our platforms do not function reliably, we may incorrectly select our Members, bill our Members, price insurance products, or incorrectly pay or deny insurance claims made by our Members. These errors could result in inadequate insurance premiums paid relative to claims made, resulting in increased financial losses. These errors could also cause Member dissatisfaction with us, which could cause Members to cancel or fail to renew their insurance policies with us or make it less likely that prospective Members obtain new insurance policies from us. Additionally, technology platform errors may lead to unintentional bias and discrimination in the underwriting process, which could subject us to legal or regulatory liability and harm our brand and reputation. Any of these eventualities could result in a material adverse effect on our business, financial condition and results of operations.

18

Our future success depends on the ability to continue to develop and implement technology to transform or replace legacy technology, and to maintain the security and confidentiality of this technology in compliance with evolving privacy laws.

Our future success depends on our ability to continue to develop, implement, and maintain the security and confidentiality of our proprietary technology in compliance with evolving privacy laws. Changes to existing laws, their interpretation or implementation, or the introduction of new laws could impede our use of this technology or require that we disclose our proprietary technology to our competitors, which could negatively impact our competitive position and result in a material adverse effect on our business, financial condition and results of operations.

We rely on internet and mobile technologies and applications to market our products and services. Any future legal or regulatory requirements impacting these applications or that restricts our ability to collect or use personal data may impact how we interact with our Members and prospective Members, and could potentially have an adverse effect on our business, financial condition and operations.

We rely in part on internet and mobile applications to execute our business strategy. We are subject to domestic and international laws and regulations governing our activity and transactions both offline and online through the internet and mobile applications, including (i) how personal data can be collected, used, shared, transferred, stored, or otherwise processed ("Privacy Laws"), (ii) cybersecurity and data security obligations, and (iii) protections relating to our marketing and advertising activities (together with Privacy Laws, "Internet Laws"). Existing and future Internet Laws may impede our use of the internet to interact with current and future Members and to effectively market our products and services. In particular, an increasing number of Privacy Laws regulate our ability to use personal data for targeted or cross-context behavioral advertising, as well as give individuals the ability to opt out of such advertising.

It is possible that (i) the Internet Laws or general business laws and regulations may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices; (ii) as new Internet Laws and consumer expectations are adopted, our compliance obligations may increase; (iii) government regulatory authorities may interpret and amend their Internet Laws and may require us to incur substantial costs to comply, and we may be penalized or precluded from carrying on our current activities; (iv) we may be subject to individual or class action claims by plaintiffs using both new and pre-existing Internet Laws based on new technologies, some of which are part of our marketing efforts, and; (v) our practices have not historically complied, do not currently comply, or will not fully comply in the future with all Internet Laws.

Any failure, or perceived failure, by us to comply with any Internet Laws could result in: (i) damage to our reputation, including consumer trust, (ii) a loss in business potentially leading to lower revenue and Member growth; (iii) proceedings or actions against us by governmental entities or private litigants including, for example, the Data Security Incident referenced in Note 24 — Commitments and Contingencies in Item 8 of Part II of this Annual Report; (iv) significant additional expense and time in defending regulatory proceedings or legal actions; (v) imposition of monetary liability; (vi) disgorgement of personal data and any algorithms trained on, or products or services derived from, such personal data; (vii) regulatory proceedings or legal actions distracting management; (viii) increased cost of doing business; (ix) decreased use of our mobile applications or websites by current and future Members; (x) contractual liability to indemnify and hold harmless third parties from the costs or consequences of non-compliance with the Internet Laws. In addition, our insurance coverage relating to any damages or expenses may not be sufficient to compensate for the liabilities we may incur. Any legal or regulatory requirements that restrict how we interact with our Members and future Members, or our actual or perceived failure to comply with Internet Laws, could have a material adverse effect on our business, financial condition and results of operations.

We may not be able to prevent or address the misappropriation of Hagerty-owned data.

From time to time, third parties may misappropriate our data through website scraping, bots, or other means and aggregate this data on their websites with data from other companies. In addition, copycat websites or mobile apps may misappropriate data and attempt to imitate our brand or the functionality of our website or our mobile app. If we become aware of such websites or mobile apps, we intend to employ technological or legal measures in an attempt to halt their operations. However, we may be unable to detect all such websites or mobile apps in a timely manner and, even if we could, technological and legal measures may be insufficient to halt their operations.

In some cases, particularly in the case of websites operating outside of the U.S., our available remedies may not be adequate to protect us against the effect of the operation of such websites or mobile apps. Regardless of whether we can successfully enforce our rights against the operators of these websites or mobile apps, any measures that we may take could require us to expend significant financial or other resources, which could harm our business, financial condition or results of operations. In addition, to the extent that such activity creates confusion among consumers or advertisers, our brand and business could be harmed.

19

Changes in social attitudes may make ownership of collector vehicles less desirable, leading to a decline in demand for our products and services.

Changing consumer preferences and social attitude toward options such as electric vehicles and/or autonomous driving could have a material impact on our business. The traditional business model of car sales is starting to be complemented by a range of diverse, on-demand mobility solutions, especially in dense urban environments that proactively discourage private-car use. This shift, along with a significant rise in the annual growth of car sharing members and autonomous and electric vehicles in the markets we currently conduct business, could have a trickle-down effect to the collector car space and create a drop in demand for our products and services, which could have a material adverse effect on our business, financial condition and results of operations.

An inadequate strategy to address and respond to issues of diversity, equity, and inclusion could leave us insufficiently prepared for significant cultural shifts affecting our marketplace and may create a negative brand image, leading to the alienation of our employees and clients.