|

Carbon Revolution Limited

Geelong Technology Precinct

75 Pigdons Road

Waurn Ponds, 3216

Australia

ABN: 96 128 274 653

|

|

| • |

4 programs awarded for the financial year – along with two further awards in FY24 to date – takes all-time total awarded programs to 18 with six global OEMs.

|

| • |

Backlog2 has more than doubled to US$680 (AU$970) million since October 2022, due primarily to new program awards. Almost 50% of backlog is for Electric Vehicles.

|

| • |

Jaguar Land Rover revealed the 2024 Range Rover Sport SV, the first vehicle in the SUV segment featuring Carbon Revolution’s carbon fiber wheels. Ford also revealed the Mustang Dark Horse, marking Carbon

Revolution’s first core vehicle program with Ford3,

|

| • |

Exited the year with strong production cost improvement following Mega-line commissioning and increased volumes.

|

| • |

Merger announced with Twin Ridge Capital Acquisition Corp. (“TRCA”) and a US$60 (AU$85.8) million debt program completed.

|

| • |

Ford launched the new Mustang ‘Dark Horse’ with Carbon Revolution’s carbon fiber wheels. This marks Carbon Revolution's first core vehicle program with Ford, demonstrating broader adoption of our lightweight wheel technology.

|

| • |

General Motors’ Chevrolet Corvette E-Ray, the second Corvette model will also feature Carbon Revolution wheels as announced early in the second half of the financial year. The E-Ray will be the first Corvette to utilize electric power in

addition to its V8 engine, and the first all-wheel drive Corvette.

|

| • |

Jaguar Land Rover revealed the 2024 Range Rover Sport SV with Carbon Revolution carbon fiber wheels. This is Carbon Revolution’s debut in the SUV carbon fiber wheel sector, highlighting an important expansion of our advanced lightweight

wheel technology into the SUV segment.

|

Investors@carbonrev.com

Media@carbonrev.com

|

Carbon Revolution Limited (ASX:CBR)

|

|

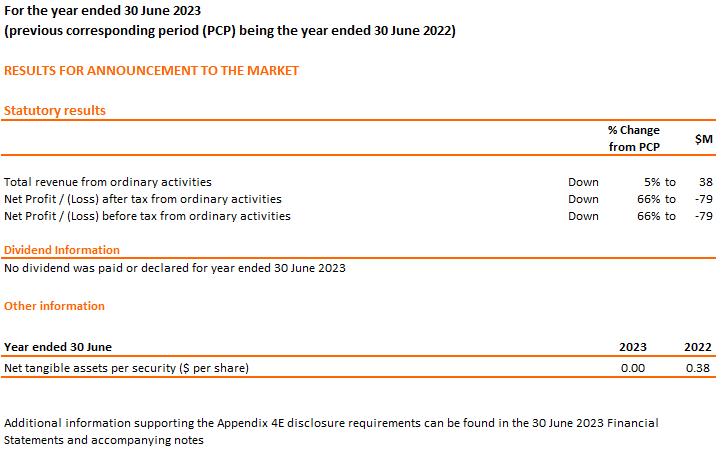

Appendix 4E Preliminary Final Report

|

| 1. |

Reporting period.

|

| 2. |

Results for announcement to the market.

|

| 3. |

Statement of comprehensive income.

|

| 4. |

Statement of financial position.

|

| 5. |

Statement of cash flows.

|

| 6. |

Statement of changes in equity.

|

| 7. |

Dividends.

|

|

Carbon Revolution Limited (ASX:CBR)

|

|

Appendix 4E Preliminary Final Report

|

| 8. |

Dividend or distribution reinvestment plans.

|

| 9. |

Net tangible assets per security.

|

| 10. |

Details of entities over which control has been gained or lost during the period.

|

| 11. |

Details of associates and joint venture entities.

|

| 12. |

Any other significant information needed by an investor to make an informed assessment of the entity’s financial performance and financial position.

|

| 13. |

For foreign entities, which set of accounting standards is used in compiling the report (e.g. International Financial reporting Standards).

|

| 14. |

Commentary on the results for the period.

|

|

Carbon Revolution Limited (ASX:CBR)

|

|

Appendix 4E Preliminary Final Report

|

| • |

Ford launched the new Mustang ‘Dark Horse’ with Carbon Revolution’s carbon fibre wheels. This marks Carbon Revolution's first core vehicle program with Ford, demonstrating broader adoption of our

lightweight wheel technology.

|

| • |

General Motors’ Chevrolet Corvette E-Ray, the second Corvette model will also feature Carbon Revolution wheels as announced early in the second half of the financial year. The E-Ray will be the first

Corvette to utilise electric power in addition to its V8 engine, and the first all-wheel drive Corvette.

|

| • |

Jaguar Land Rover revealed the 2024 Range Rover Sport SV with Carbon Revolution carbon fibre wheels. This is Carbon Revolution’s debut in the SUV carbon fibre wheel sector, highlighting an important

expansion of our advanced lightweight wheel technology into the SUV segment.

|

|

Carbon Revolution Limited (ASX:CBR)

|

|

Appendix 4E Preliminary Final Report

|

| 15. |

Audit Status.

|

| 16. |

Description of likely emphasis of matter.

|

|

CARBON REVOLUTION LIMITED

ABN 96 128 274 653

|

|

|

FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2023

Preliminary and Unaudited

|

|

|

Consolidated statement of profit or loss and other comprehensive income

|

3 | |

|

Consolidated statement of financial position

|

4 | |

|

Consolidated statement of changes in equity

|

5 | |

|

Consolidated statement of cash flows

|

6 | |

|

Notes to the financial statements

|

8 |

|

Consolidated statement of profit or loss and other comprehensive income

For the Year Ended 30 June 2023

|

|

|

Note

|

2023

$’000

|

2022

$’000

|

||||||||

|

Sale of wheels

|

37,477

|

38,276

|

|||||||||

|

Engineering services

|

530

|

464

|

|||||||||

|

Sale of tooling

|

253

|

1,596

|

|||||||||

|

Revenue

|

2.1

|

38,260

|

40,336

|

||||||||

|

Cost of goods sold

|

3.2.1

|

(55,094

|

)

|

(57,445

|

)

|

||||||

|

Gross loss

|

(16,834

|

)

|

(17,109

|

)

|

|||||||

|

Other income

|

2.2

|

3,096

|

4,320

|

||||||||

|

Operational expenses

|

(2,997

|

)

|

(2,013

|

)

|

|||||||

|

Research and development expenses

|

2.4

|

(16,180

|

)

|

(16,933

|

)

|

||||||

|

Administrative expenses

|

(14,566

|

)

|

(13,146

|

)

|

|||||||

|

Marketing expenses

|

(1,494

|

)

|

(1,550

|

)

|

|||||||

|

Capital raising transaction costs

|

4.7

|

(24,746

|

)

|

-

|

|||||||

|

Finance costs

|

2.4

|

(5,502

|

)

|

(1,390

|

)

|

||||||

|

Loss before income tax expense

|

(79,223

|

)

|

(47,821

|

)

|

|||||||

|

Income tax expense

|

5

|

-

|

-

|

||||||||

|

Loss for the year after income tax

|

(79,223

|

)

|

(47,821

|

)

|

|||||||

|

Other comprehensive loss

|

|||||||||||

|

Items that may be reclassified subsequently to profit or loss:

|

|||||||||||

|

Foreign currency translation differences – foreign operations

|

(62

|

)

|

(147

|

)

|

|||||||

|

Other comprehensive loss

|

(62

|

)

|

(147

|

)

|

|||||||

|

Total comprehensive loss for the year, net of tax

|

(79,285

|

)

|

(47,968

|

)

|

|||||||

|

Earnings per share

|

|||||||||||

|

Basic

|

2.5

|

$

|

(0.38

|

)

|

$

|

(0.23

|

)

|

||||

|

Diluted

|

2.5

|

$

|

(0.38

|

)

|

$

|

(0.23

|

)

|

||||

|

Consolidated statement of financial position

As at 30 June 2023

|

|

|

Note

|

30 June 2023

$’000

|

30 June 2022

$’000

|

||||||||

|

Current assets

|

|||||||||||

|

Cash and cash equivalents

|

4.1

|

19,582

|

22,693

|

||||||||

|

Restricted trust fund

|

4.1

|

14,677

|

-

|

||||||||

|

Receivables

|

3.1

|

6,430

|

14,483

|

||||||||

|

Contract assets

|

2.1

|

8,239

|

5,909

|

||||||||

|

Inventories

|

3.2

|

22,173

|

20,164

|

||||||||

|

Other current assets

|

378

|

1,587

|

|||||||||

|

Total current assets

|

71,479

|

64,836

|

|||||||||

|

Non-current assets

|

|||||||||||

|

Property, plant and equipment

|

3.3

|

62,638

|

57,616

|

||||||||

|

Right-of-use assets

|

3.4

|

7,446

|

7,564

|

||||||||

|

Intangible assets

|

3.5

|

16,774

|

14,364

|

||||||||

|

Total non-current assets

|

86,858

|

79,544

|

|||||||||

|

Total assets

|

158,337

|

144,380

|

|||||||||

|

|

|||||||||||

|

Current liabilities

|

|||||||||||

|

Payables

|

3.6

|

15,474

|

9,502

|

||||||||

|

Borrowings

|

4.2

|

13,829

|

18,686

|

||||||||

|

Lease liability

|

3.4

|

645

|

579

|

||||||||

|

Contract liability

|

2.1

|

748

|

458

|

||||||||

|

Deferred income

|

3.7

|

1,919

|

1,028

|

||||||||

|

Provisions

|

3.8

|

12,957

|

4,161

|

||||||||

|

Total current liabilities

|

45,572

|

34,414

|

|||||||||

|

Non-current liabilities

|

|||||||||||

|

Borrowings

|

4.2

|

70,833

|

4,333

|

||||||||

|

Lease liability

|

3.4

|

7,368

|

7,461

|

||||||||

|

Contract liability

|

2.1

|

1,755

|

323

|

||||||||

|

Deferred income

|

3.7

|

15,235

|

5,211

|

||||||||

|

Provisions

|

3.8

|

1,843

|

713

|

||||||||

|

Total non-current liabilities

|

97,034

|

18,041

|

|||||||||

|

Total liabilities

|

142,606

|

52,455

|

|||||||||

|

Net assets

|

15,731

|

91,925

|

|||||||||

|

|

|||||||||||

|

Equity

|

|||||||||||

|

Contributed equity

|

4.4

|

386,432

|

383,822

|

||||||||

|

Reserves

|

4.6

|

7,166

|

6,747

|

||||||||

|

Accumulated losses

|

(377,867

|

)

|

(298,644

|

)

|

|||||||

|

Total equity

|

15,731

|

91,925

|

|||||||||

|

Consolidated statement of changes in equity

As at 30 June 2023

|

|

|

Note

|

Contributed

equity

|

Share

buyback

reserve

|

Share

based

payment

reserve

|

Accumulated

losses

|

Foreign

currency

translation

reserve

|

Total

equity

|

|||||||||||||||||||||

|

|

|

$’000

|

|

$’000

|

|

$’000

|

|

$’000

|

|

$’000

|

|

$’000

|

||||||||||||||||

|

Balance as at 30 June 2021

|

381,890

|

(311

|

)

|

5,979

|

(250,823

|

)

|

(9

|

)

|

136,726

|

|||||||||||||||||||

|

Net loss after tax for the full year

|

-

|

-

|

-

|

(47,821

|

)

|

-

|

(47,821

|

)

|

||||||||||||||||||||

|

Other comprehensive loss for the full year

|

-

|

-

|

-

|

-

|

(147

|

)

|

(147

|

)

|

||||||||||||||||||||

|

Total comprehensive loss for the full year

|

-

|

-

|

-

|

(47,821

|

)

|

(147

|

)

|

(47,968

|

)

|

|||||||||||||||||||

|

Transactions with owners in their capacity as owners

|

||||||||||||||||||||||||||||

|

Share-based payments

|

4.4

|

1,932

|

-

|

1,235

|

-

|

-

|

3,167

|

|||||||||||||||||||||

|

Total transactions with owners in their capacity as owners

|

1,932

|

-

|

1,235

|

-

|

-

|

3,167

|

||||||||||||||||||||||

|

Balance as at 30 June 2022

|

383,822

|

(311

|

)

|

7,214

|

(298,644

|

)

|

(156

|

)

|

91,925

|

|||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Balance as at 30 June 2022

|

383,822

|

(311

|

)

|

7,214

|

(298,644

|

)

|

(156

|

)

|

91,925

|

|||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Net loss after tax for the full year

|

-

|

-

|

-

|

(79,223

|

)

|

-

|

(79,223

|

)

|

||||||||||||||||||||

|

Other comprehensive loss for the full year

|

-

|

-

|

-

|

-

|

(62

|

)

|

(62

|

)

|

||||||||||||||||||||

|

Total comprehensive loss for the full year

|

-

|

-

|

-

|

(79,223

|

)

|

(62

|

)

|

(79,285

|

)

|

|||||||||||||||||||

|

Transactions with owners in their capacity as owners

|

||||||||||||||||||||||||||||

|

Share-based payments

|

4.4

|

2,610

|

-

|

481

|

-

|

-

|

3,091

|

|||||||||||||||||||||

|

Total transactions with owners in their capacity as owners

|

2,610

|

-

|

481

|

-

|

-

|

3,091

|

||||||||||||||||||||||

|

Balance as at 30 June 2023

|

386,432

|

(311

|

)

|

7,695

|

(377,867

|

)

|

(218

|

)

|

15,731

|

|||||||||||||||||||

|

Consolidated statement of cash flows

As at 30 June 2023

|

|

Note

|

2023

$’000

|

2022

$’000

|

|||||||||

|

Cash flow from operating activities

|

|||||||||||

|

Receipts from customers

|

45,742

|

33,643

|

|||||||||

|

Receipt of grants and research and development incentives

|

3.7

|

15,446

|

3,767

|

||||||||

|

Payments to suppliers and employees

|

(80,215

|

)

|

(81,005

|

)

|

|||||||

|

Interest received

|

61

|

94

|

|||||||||

|

Capital raising transaction costs

|

4.7

|

(9,030

|

)

|

-

|

|||||||

|

Borrowing costs

|

4.2

|

(20,676

|

)

|

-

|

|||||||

|

Finance costs

|

(3,810

|

)

|

(2,475

|

)

|

|||||||

|

Net cash used in operating activities

|

4.1.2

|

(52,482

|

)

|

(45,976

|

)

|

||||||

|

Cash flow from investing activities

|

|||||||||||

|

Payments for property, plant and equipment

|

3.3

|

(13,082

|

)

|

(15,634

|

)

|

||||||

|

Payments for intangible assets

|

3.5

|

(4,874

|

)

|

(6,007

|

)

|

||||||

|

Sale proceeds from sale of property, plant and equipment

|

3.3

|

3

|

-

|

||||||||

|

Net cash used in investing activities

|

(17,953

|

)

|

(21,641

|

)

|

|||||||

|

Cash flow from financing activities

|

|||||||||||

|

Proceeds from third party borrowings

|

4.2

|

124,963

|

33,657

|

||||||||

|

Repayment of third-party borrowings

|

4.2

|

(43,212

|

)

|

(29,370

|

)

|

||||||

|

Reclass to restricted trust fund

|

4.2

|

(14,677

|

)

|

-

|

|||||||

|

Capital raising transaction costs

|

-

|

(422

|

)

|

||||||||

|

Repayment of lease liability

|

(604

|

)

|

(596

|

)

|

|||||||

|

Net cash provided by financing activities

|

66,470

|

3,269

|

|||||||||

|

Net decrease in cash held

|

(3,965

|

)

|

(64,348

|

)

|

|||||||

|

Cash at beginning of financial year

|

22,693

|

87,257

|

|||||||||

|

Effects of exchange rate changes on cash and cash equivalents

|

854

|

(216

|

)

|

||||||||

|

Cash at end of financial year

|

19,582

|

22,693

|

|||||||||

|

Notes to the financial statements

|

|

1

|

BASIS OF PREPARATION

|

8 | |

|

1.1

|

Corporate information

|

8 | |

|

1.2

|

Basis of preparation

|

8 | |

|

1.3

|

Going concern

|

8 | |

|

1.4

|

Basis of consolidation

|

11 | |

|

1.5

|

Significant accounting judgements, estimates and assumptions

|

12 | |

|

1.6

|

Goods and Services Tax (“GST”)

|

12 | |

|

2

|

OPERATING PERFORMANCE

|

13 | |

|

2.1

|

Revenue from contracts with customers

|

13 | |

|

2.2

|

Other income

|

14 | |

|

2.3

|

Segments

|

15 | |

|

2.4

|

Expenses

|

16

|

|

|

2.5

|

Earnings per share

|

17

|

|

|

3

|

OPERATING ASSETS AND LIABILITIES

|

19 | |

|

3.1

|

Receivables

|

19 | |

|

3.2

|

Inventories

|

20 | |

|

3.3

|

Property, plant and equipment

|

21 | |

|

3.4

|

Leases

|

22

|

|

|

3.5

|

Intangible assets

|

23 | |

|

3.6

|

Payables

|

24 | |

|

3.7

|

Deferred income

|

25 | |

|

3.8

|

Provisions

|

26 | |

|

4

|

CAPITAL STRUCTURE AND FINANCING

|

28 | |

|

4.1

|

Cash and cash equivalents, restricted cash

|

28 | |

|

4.2

|

Borrowings and other financial liabilities

|

29 | |

|

4.3

|

Financial risk management

|

31 | |

|

4.4

|

Contributed equity

|

34 | |

|

4.5

|

Share-based payment plan arrangements

|

35 | |

|

4.6

|

Reserves

|

37 | |

|

4.7

|

Transaction costs

|

38 | |

|

5

|

TAXES

|

39 | |

|

5.1

|

Income tax expense

|

39 | |

|

5.2

|

Deferred taxes

|

39 | |

|

5.3

|

Recognised deferred tax assets and liabilities in statement of financial position

|

40 | |

|

5.4

|

Carry forward unrecognised tax losses and R&D tax credits

|

40 | |

|

6

|

OTHER NOTES

|

41 | |

|

6.3

|

Information about subsidiaries

|

41 | |

|

6.4

|

Deed of cross guarantee

|

41 | |

|

6.5

|

Directors and Key management personnel

|

43 | |

|

6.6

|

Transactions with related parties

|

43 | |

|

6.7

|

Parent entity disclosures

|

43 | |

|

6.8

|

Auditor’s remuneration

|

44 | |

|

6.9

|

Unrecognised items

|

44 | |

|

6.10

|

Changes in accounting policies

|

44 | |

|

6.11

|

Adoption of new and revised Australian Accounting Standards

|

44 | |

|

6.12

|

Subsequent events

|

45 | |

|

Notes to the financial statements

|

| 1 |

Basis of preparation

|

| 1.1 |

Corporate information

|

| 1.2 |

Basis of preparation

|

| • |

Have been prepared in accordance with the Corporations Act 2001, Australian Accounting Standards, and other authoritative pronouncements of the Australian

Accounting Standards Board (“AASB”);

|

| • |

Have adopted all accounting policies in accordance with Australian accounting standards, and where a standard permits a choice in accounting policy, the policy adopted by the Group has been disclosed in

these financial statements;

|

| • |

Do not early adopt any accounting standards or interpretations that have been issued or amended but are not yet effective;

|

| • |

Comply with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”);

|

| • |

Have been prepared for a for profit entity under the historical cost convention;

|

| • |

Are presented in Australian dollars, which is the Group’s functional and presentation currency;

|

| • |

Have been rounded to the nearest thousand dollars, unless otherwise stated, in accordance with ASIC Corporations (Rounding in Financial/Director’s Reports) Instrument 2016/191;

|

| • |

The Group has elected to present the statement of profit or loss and other comprehensive income using the function of expense method.

|

| 1.3 |

Going concern

|

|

Notes to the financial statements

|

| • |

transaction costs related to the Business Combination of approximately A$35.7 million (of which A$4.4 million is expected to be payable prior to closing of the Business Combination, A$23.4 million on

completion and A$7.9 million after completion); and

|

| • |

net cash outflows in the 12-month period unrelated to the Business Combination of approximately A$78.4 million, being cash inflows from customers (and grants), less operating costs, research and

development costs, working capital needs and capital expenditure.

|

| • |

Craig-Hallum has been engaged by Twin Ridge to act as placement agent and capital markets advisor to support the Group in raising new capital. Craig-Hallum has in particular been engaged to identify and

contact potential investors, formulate a strategy, coordinate due diligence and assist in preparing any offering documents;

|

| • |

Separately, Carbon Revolution is seeking to obtain a Structured Rquity Facility (“SEF”), which would involve the issue of SEF Preference Shares and SEF Warrants by MergeCo in exchange for up to US$100

million which is likely to be conditional and available in tranches; and

|

| • |

In addition, the Committed Equity Financing is in place under which Yorkville Advisors has agreed to purchase up to US$60 million in MergeCo Ordinary shares, subject to the terms of the Equity Purchase

Agreement, including the CEF Ownership Restriction. Given this ownership restriction in particular, MergeCo is planning to use the CEF in combination with other funding sources.

|

|

Notes to the financial statements

|

| • |

the Group may not receive the customer support it may require, or management of capital expenditure may not be possible without impacting supply obligations to customers and its ability to meet the

financial projections;

|

| • |

the Business Combination may not be completed, or may be materially delayed;

|

| • |

there may be no cash remaining in the Trust Account upon completion of the Business Combination if redemptions of Twin Ridge Class A Ordinary Shares are 100%;

|

| • |

there may be a delay in the availability of the Committed Equity Financing (the Committed Equity Financing will not be available until after the closing of the Business Combination and the filing by

MergeCo with the SEC of a registration statement for the resale of the MergeCo Ordinary Shares, and such registration statement being declared effective by the SEC);

|

| • |

as the terms of the Committed Equity Financing will not require the Yorkville Advisors to purchase additional shares under the Committed Equity Financing beyond the CEF Ownership Restriction, the Group

may have access to materially less than the US$60 million (A$90.3 million) Committed Equity Financing capital;

|

| • |

the Group may not be able to raise further equity funds from sources other than the Committed Equity Financing, in the amounts and within the timeframes necessary for the Group to remain solvent and to

comply with its liquidity covenants, on satisfactory terms, or at all;

|

| • |

the relevant advisers may not agree to the Transaction Cost Deferrals; and

|

| • |

the 12 Month Cash Flow Projection is subject to achievement of the financial projections of Carbon Revolution for CY23 and CY24 (as relevant) detailed in the accompanying assumptions and risks

applicable to these financial projections.

|

|

Notes to the financial statements

|

| 1.4 |

Basis of consolidation

|

| • |

assets and liabilities are translated at the closing rate at the reporting date;

|

| • |

income and expenses are translated at average exchange rates throughout the course of the year (unless this is not a reasonable approximation of the cumulative effect of the rates prevailing on the

transaction dates, in which case income and expenses are translated at the rates on the dates of the transactions); and

|

| • |

all resulting exchange differences are recognised in other comprehensive income and accumulated in the foreign currency translation reserve, a separate component of equity.

|

|

Notes to the financial statements

|

| 1.5 |

Significant accounting judgements, estimates and assumptions

|

|

Note 3.2 Inventories

|

Note 3.5 Intangible assets

|

|

Note 3.3 Property, plant and equipment

|

Note 5.5 Income tax

|

|

Note 3.7 Deferred income

|

Note 4.7 Transaction costs

|

|

Note 4.2 Borrowings and other financial liabilities

|

| 1.6 |

Goods and Services Tax (“GST”)

|

| 1. |

Revenues, expenses and assets are recognised net of the amount of associated GST, unless the GST incurred is not recoverable from the taxation authority;

|

| 2. |

Receivables and payables are stated inclusive of the amount of GST receivable or payable;

|

| 3. |

The net amount of GST recoverable from, or payable to, the taxation authority is included with other receivables or payables in the consolidated balance sheet;

|

| 4. |

Cash flows are presented on a gross basis. The GST components of cash flows arising from investing and financing activities are presented as operating cash flows; and

|

| 5. |

Commitments are disclosed net of GST.

|

|

Notes to the financial statements

|

| 2 |

Operating performance

|

| 2.1 |

Revenue from contracts with customers

|

|

2023

$’000

|

2022

$’000

|

|||||||

|

External revenue by product line

|

||||||||

|

Sale of wheels

|

37,477

|

38,276

|

||||||

|

Engineering services

|

530

|

464

|

||||||

|

Sale of tooling

|

253

|

1,596

|

||||||

|

Total revenue

|

38,260

|

40,336

|

||||||

|

2023

$’000

|

2022

$’000

|

|||||||

|

External revenue by timing of revenue

|

||||||||

|

Goods transferred at a point in time

|

19,307

|

15,730

|

||||||

|

Goods transferred over time

|

18,170

|

22,546

|

||||||

|

Services transferred at a point in time

|

253

|

1,277

|

||||||

|

Services transferred over time

|

530

|

783

|

||||||

|

Total revenue

|

38,260

|

40,336

|

||||||

|

2023

$’000

|

2022

$’000

|

|||||||

|

Contract asset

|

||||||||

|

Opening balance

|

5,909

|

-

|

||||||

|

Additions

|

24,821

|

5,909

|

||||||

|

Advance payments

|

(13,064

|

)

|

-

|

|||||

|

Transfer to trade receivables

|

(9,427

|

)

|

-

|

|||||

|

Total contract asset

|

8,239

|

5,909

|

||||||

|

2023

$’000

|

2022

$’000

|

|||||||

|

Contract liability

|

||||||||

|

Opening balance

|

781

|

-

|

||||||

|

Additions

|

2,505

|

781

|

||||||

|

Revenue recognised

|

(783

|

)

|

-

|

|||||

|

Total contract liability

|

2,503

|

781

|

||||||

|

Contract liability – current

|

748

|

458

|

||||||

|

Contract liability – non current

|

1,755

|

323

|

||||||

|

Total contract liability

|

2,503

|

781

|

||||||

|

Notes to the financial statements

|

| 2.2 |

Other income

|

|

2023

$’000

|

2022

$’000

|

|||||||

|

Government grants

|

2,777

|

3,506

|

||||||

|

Interest income

|

61

|

94

|

||||||

|

Foreign exchange gain

|

-

|

448

|

||||||

|

Other income

|

258

|

272

|

||||||

|

Total other income

|

3,096

|

4,320

|

||||||

| 2.2.1 |

Information about revenue and other income

|

| • |

the customer simultaneously receives and consumes the benefits provided by the Group’s performance as the Group performs;

|

| • |

the Group’s performance creates or enhances an asset that the customer controls as the Group performs; or

|

| • |

the Group’s performance does not create an asset with an alternative use to the Group and the Group has an enforceable right to payment for performance completed to date.

|

|

Notes to the financial statements

|

|

2.3

|

Segments

|

|

2023

$’000

|

2022

$’000

|

|||||||

|

Revenue

|

||||||||

|

International

|

38,260

|

40,336

|

||||||

|

Domestic

|

-

|

-

|

||||||

|

38,260

|

40,336

|

|||||||

|

Non-current assets

|

||||||||

|

International

|

-

|

-

|

||||||

|

Domestic

|

86,858

|

79,544

|

||||||

|

86,858

|

79,544

|

|||||||

|

Notes to the financial statements

|

|

2.4

|

Expenses

|

|

Finance costs

|

2023

$’000

|

2022

$’000

|

||||||

|

Interest on third party loans

|

2,676

|

552

|

||||||

|

Interest on lease liabilities

|

297

|

301

|

||||||

|

Finance costs

|

1,448

|

-

|

||||||

|

Supplier financing costs

|

446

|

213

|

||||||

|

Interest other

|

635

|

324

|

||||||

|

5,502

|

1,390

|

|||||||

|

2023

$’000

|

2022

$’000

|

|||||||

|

Wages and salaries

|

39,023

|

33,370

|

||||||

|

Post-employment benefits (defined contribution plans)

|

3,379

|

2,838

|

||||||

|

Share-based payments expense

|

3,091

|

3,167

|

||||||

|

45,493

|

39,375

|

|||||||

|

Property, plant and equipment

|

7,382

|

6,919

|

||||||

|

Right of use assets

|

696

|

656

|

||||||

|

Capitalised development costs

|

2,376

|

1,307

|

||||||

|

Patents and trademarks

|

89

|

84

|

||||||

|

10,543

|

8,966

|

|

Research and development

|

|

16,180

|

|

16,933

|

| 2.4.1 |

Information about expenses

|

|

Notes to the financial statements

|

|

Class of fixed asset

|

Depreciation period

|

Depreciation method

|

|

|

Leasehold improvements

|

Shorter of 20 years

or the remaining term of the lease

|

Straight line

|

|

|

Manufacturing plant and equipment

|

2 to 10 years

|

Diminishing value

|

|

|

Tooling

|

3 to 10 years

|

Diminishing value

|

|

|

Other equipment

|

3 to 5 years

|

Diminishing value

|

| 2.5 |

Earnings per share

|

|

2023

$’000

|

2022

$’000

|

|||||||

|

The following reflects the income used in the basic and diluted earnings per share computations:

|

||||||||

|

a) Earnings used in calculating earnings per share

|

||||||||

|

Net loss attributable to ordinary equity holders of the parent

|

(79,223

|

)

|

(47,821

|

)

|

||||

|

b) Weighted average number of shares

|

||||||||

|

Weighted average number of ordinary shares for the purposes of basic earnings per share

|

208,504

|

205,938

|

||||||

|

Effect of dilution

|

||||||||

|

Share options

|

-

|

-

|

||||||

|

Weighted average number of ordinary shares adjusted for the effect of dilution

|

208,504

|

205,938

|

||||||

|

Loss per share (basic and diluted in cents)

|

$

|

(0.38

|

)

|

$

|

(0.23

|

)

|

||

|

Notes to the financial statements

|

|

|

2023

No.

|

2022

No.

|

||||||

|

ESOP

|

4,945,959

|

4,996,896

|

||||||

|

LTIP

|

3,151,950

|

3,334,183

|

||||||

|

Total

|

8,097,909

|

8,331,079

|

||||||

|

|

2023

No.

|

2022

No.

|

||||||

|

NED Plan

|

43,033

|

43,033

|

||||||

|

LTIP

|

688,142

|

718,345

|

||||||

|

STI

|

851,613

|

595,363

|

||||||

|

TESP

|

233,248

|

321,803

|

||||||

|

SRS

|

42,298

|

113,780

|

||||||

|

Total

|

1,858,334

|

1,792,324

|

||||||

|

Notes to the financial statements

|

|

3

|

Operating assets and liabilities

|

| 3.1 |

Receivables

|

|

2023

$’000

|

2022

$’000

|

|||||||

|

Trade receivables

|

||||||||

|

Not past due

|

4,220

|

7,591

|

||||||

|

Past due 1 – 30 days

|

623

|

3,433

|

||||||

|

Past due 31 – 90 days

|

443

|

1,445

|

||||||

|

Past due 90 days and over

|

216

|

684

|

||||||

|

5,502

|

13,153

|

|||||||

|

Allowance for impairment losses

|

(119

|

)

|

-

|

|||||

|

Trade receivables

|

5,383

|

13,153

|

||||||

|

Apprenticeship grant funding

|

25

|

479

|

||||||

|

Other receivables

|

267

|

236

|

||||||

|

GST recoverable

|

755

|

615

|

||||||

|

Trade and other receivables

|

6,430

|

14,483

|

||||||

| 3.1.1 |

Information about receivables

|

|

Notes to the financial statements

|

| 3.2 |

Inventories

|

|

2023

$’000

|

2022

$’000

|

|||||||

|

Current

|

||||||||

|

Raw materials

|

13,301

|

7,646

|

||||||

|

Work in progress

|

5,772

|

9,688

|

||||||

|

Finished goods

|

3,649

|

4,318

|

||||||

|

Consumables and spare parts

|

2,560

|

3,276

|

||||||

|

Provision for impaired wheels

|

(3,109

|

)

|

(4,764

|

)

|

||||

|

Inventories at the lower of cost and net realisable value

|

22,173

|

20,164

|

||||||

| 3.2.1 |

Information about inventories and significant estimates

|

| • |

Raw materials – recorded at standard cost, reassessed against actual costs quarterly;

|

| • |

Finished goods and work-in-progress – cost of direct materials, labour, outsourced processing costs and a proportion of manufacturing overheads based on normal operating capacity but excluding finance

costs.

|

| • |

Consumables and spare parts – recorded at purchase price. Consumables and spares are assessed for ongoing usefulness and written off if they are no longer likely to be of use.

|

|

Notes to the financial statements

|

| 3.3 |

Property, plant and equipment

|

|

Capital works

in progress

$’000

|

Leasehold

improve-

ments

$’000

|

Manufacturing

equipment

$’000

|

Tooling

$’000

|

Other

equipment

$’000

|

Total

$’000

|

|||||||||||||||||||

|

Gross cost

|

18,950

|

5,649

|

40,454

|

14,326

|

2,784

|

82,163

|

||||||||||||||||||

|

Less accumulated depreciation

|

-

|

(1,355

|

)

|

(14,070

|

)

|

(7,618

|

)

|

(1,504

|

)

|

(24,547

|

)

|

|||||||||||||

|

At 30 June 2022

|

18,950

|

4,294

|

26,384

|

6,708

|

1,280

|

57,616

|

||||||||||||||||||

|

Gross cost

|

18,048

|

5,839

|

51,687

|

16,034

|

2,960

|

94,568

|

||||||||||||||||||

|

Less accumulated depreciation

|

-

|

(1,642

|

)

|

(18,467

|

)

|

(9,964

|

)

|

(1,857

|

)

|

(31,930

|

)

|

|||||||||||||

|

At 30 June 2023

|

18,048

|

4,197

|

33,220

|

6,070

|

1,103

|

62,638

|

||||||||||||||||||

|

Movement in carrying amounts

|

||||||||||||||||||||||||

|

Balance at 30 June 2021

|

18,950

|

5,649

|

40,454

|

14,326

|

2,784

|

82,163

|

||||||||||||||||||

|

Additions

|

17,496

|

-

|

-

|

-

|

-

|

17,496

|

||||||||||||||||||

|

Transfer into/ (out of) capital WIP

|

(5,684

|

)

|

109

|

947

|

4,231

|

397

|

-

|

|||||||||||||||||

|

Depreciation expense

|

-

|

(281

|

)

|

(4,089

|

)

|

(2,173

|

)

|

(376

|

)

|

(6,919

|

)

|

|||||||||||||

|

Disposals/write-offs

|

-

|

-

|

(190

|

)

|

(87

|

)

|

(3

|

)

|

(280

|

)

|

||||||||||||||

|

Balance at 30 June 2022

|

18,950

|

4,294

|

26,384

|

6,708

|

1,280

|

57,616

|

||||||||||||||||||

|

Additions

|

11,478

|

-

|

-

|

-

|

-

|

11,478

|

||||||||||||||||||

|

Transfer of maintenance spares

|

953

|

953

|

||||||||||||||||||||||

|

Transfer into/ (out of) capital WIP

|

(13,306

|

)

|

189

|

11,233

|

1,709

|

175

|

-

|

|||||||||||||||||

|

Depreciation expense

|

-

|

(286

|

)

|

(4,397

|

)

|

(2,347

|

)

|

(352

|

)

|

(7,382

|

)

|

|||||||||||||

|

Disposals/write-offs

|

(27

|

)

|

-

|

-

|

-

|

-

|

(27

|

)

|

||||||||||||||||

|

Balance at 30 June 2023

|

17,095

|

4,197

|

34,173

|

6,070

|

1,103

|

62,638

|

||||||||||||||||||

| 3.3.1 |

Information about how the Group accounts for property, plant and equipment

|

|

Notes to the financial statements

|

| 3.4 |

Leases

|

|

Right-of-use assets

|

2023

$’000

|

2022

$’000

|

||||||

|

Cost at start of year

|

9,863

|

9,626

|

||||||

|

Additions

|

577

|

237

|

||||||

|

Closing balance at end of year

|

10,440

|

9,863

|

||||||

|

Accumulated depreciation at start of year

|

(2,299

|

)

|

(1,643

|

)

|

||||

|

Depreciation charge for the year

|

(695

|

)

|

(656

|

)

|

||||

|

Closing balance at end of year

|

(2,994

|

)

|

(2,299

|

)

|

||||

|

Carrying amount

|

7,446

|

7,564

|

||||||

|

Lease liabilities

|

||||||||

|

Current

|

645

|

579

|

||||||

|

Non-current

|

7,368

|

7,461

|

||||||

|

8,013

|

8,040

|

|||||||

|

|

2023

$’000 |

2022

$’000

|

||||||

|

|

||||||||

|

Depreciation charge of right of use assets

|

695

|

656

|

||||||

|

|

||||||||

|

Interest expense

|

297

|

301

|

||||||

|

|

||||||||

|

Expense relating to short-term leases (included in costs of goods sold and administrative expenses)

|

181

|

246

|

||||||

| 3.4.1 |

Information about leases and significant estimates

|

|

Notes to the financial statements

|

| 3.5 |

Intangible assets

|

|

Development

costs

$’000

|

Patents and

trademarks

$’000

|

Total

$’000

|

||||||||||

|

Gross cost

|

15,750

|

1,354

|

17,104

|

|||||||||

|

Less accumulated amortisation

|

(2,247

|

)

|

(493

|

)

|

(2,740

|

)

|

||||||

|

At 30 June 2022

|

13,503

|

861

|

14,364

|

|||||||||

|

Gross cost

|

20,442

|

1,537

|

21,979

|

|||||||||

|

Less accumulated amortisation

|

(4,623

|

)

|

(582

|

)

|

(5,205

|

)

|

||||||

|

At 30 June 2023

|

15,819

|

955

|

16,774

|

|||||||||

|

Movement in carrying amounts

|

||||||||||||

|

Balance at 1 July 2021

|

8,890

|

859

|

9,749

|

|||||||||

|

Additions

|

5,920

|

86

|

6,006

|

|||||||||

|

Amortisation

|

(1,307

|

)

|

(84

|

)

|

(1,391

|

)

|

||||||

|

Balance at 30 June 2022

|

13,503

|

861

|

14,364

|

|||||||||

|

Additions

|

4,692

|

183

|

4,875

|

|||||||||

|

Amortisation

|

(2,376

|

)

|

(89

|

)

|

(2,465

|

)

|

||||||

|

Balance at 30 June 2023

|

15,819

|

955

|

16,774

|

|||||||||

| 3.5.1 |

Information about intangible assets and significant estimates

|

|

Notes to the financial statements

|

| 3.6 |

Payables

|

|

2023

$’000

|

2022

$’000

|

|||||||

|

Current

|

||||||||

|

Unsecured liabilities

|

||||||||

|

Trade payables

|

3,828

|

5,128

|

||||||

|

Accruals

|

10,836

|

3,746

|

||||||

|

Interest accrued

|

427

|

118

|

||||||

|

Other payables

|

383

|

510

|

||||||

|

15,474

|

9,502

|

|||||||

| 3.6.1 |

Information about payables

|

| 3.6.2 |

Accruals

|

|

Notes to the financial statements

|

| 3.7 |

Deferred income

|

|

Deferred income – government grants

|

2023

$’000

|

2022

$’000

|

||||||

|

Balance as at 1 July

|

6,239

|

5,842

|

||||||

|

Received during the year

|

13,000

|

3,202

|

||||||

|

Released to the statement of profit or loss

|

(2,085

|

)

|

(2,805

|

)

|

||||

|

Balance as at 30 June

|

17,154

|

6,239

|

||||||

|

Current

|

1,919

|

1,028

|

||||||

|

Non-current

|

15,235

|

5,211

|

||||||

|

17,154

|

6,239

|

|||||||

|

Notes to the financial statements

|

| 3.8 |

Provisions

|

|

Employee

benefits

$’000

|

Make good

provision

$’000

|

Warranty

claims

$’000

|

Transaction

costs

$’000

|

Total

$’000

|

||||||||||||||||

|

Current

|

2,666

|

-

|

1,495

|

-

|

4,161

|

|||||||||||||||

|

Non-current

|

479

|

234

|

-

|

-

|

713

|

|||||||||||||||

|

At 30 June 2022

|

3,145

|

234

|

1,495

|

-

|

4,874

|

|||||||||||||||

|

Employee

benefits

$’000

|

Make good

provision

$’000

|

Warranty

claims

$’000

|

Transaction

costs

$’000

|

Total

$’000

|

||||||||||||||||

|

Current

|

2,903

|

-

|

595

|

9,459

|

12,957

|

|||||||||||||||

|

Non-current

|

531

|

247

|

1,065

|

-

|

1,843

|

|||||||||||||||

|

At 30 June 2023

|

3,434

|

247

|

1,660

|

9,459

|

14,800

|

|||||||||||||||

|

Make good

provision

$’000

|

Warranty

claims

$’000

|

Total

$’000

|

||||||||||

|

Movement in carrying amounts

|

||||||||||||

|

Balance at 1 July 2021

|

218

|

1,159

|

1,377

|

|||||||||

|

Provided for/ (released) during the year

|

16

|

336

|

352

|

|||||||||

|

Balance at 30 June 2022

|

234

|

1,495

|

1,729

|

|||||||||

|

Provided for/(released) during the year

|

13

|

165

|

178

|

|||||||||

|

Balance at 30 June 2023

|

247

|

1,660

|

1,907

|

|||||||||

| 3.8.1 |

Information about individual provisions and significant estimates

|

|

Notes to the financial statements

|

|

Notes to the financial statements

|

|

4

|

Capital structure and financing

|

|

4.1

|

Cash and cash equivalents, restricted trust fund

|

|

4.1.1

|

Restricted trust fund

|

|

4.1.2

|

Notes to the consolidated statement of cash flow

|

|

2023

$’000

|

2022

$’000

|

|||||||

|

Loss after income tax

|

(79,223

|

)

|

(47,821

|

)

|

||||

|

Non‑cash items from ordinary activities

|

||||||||

|

Depreciation and amortisation

|

10,543

|

8,966

|

||||||

|

Share based payment expenses

|

3,091

|

3,167

|

||||||

|

Loss/ (Profit) on sale of plant and equipment

|

2

|

-

|

||||||

|

Movement in inventory provision

|

(1,656

|

)

|

(4,216

|

)

|

||||

|

Write off of property, plant and equipment

|

-

|

280

|

||||||

|

Financing activity in prior financial year

|

-

|

(422

|

)

|

|||||

|

Other

|

||||||||

|

Borrowing costs

|

(20,676

|

)

|

-

|

|||||

|

Changes in assets and liabilities

|

||||||||

|

(Increase)/decrease in assets:

|

||||||||

|

- Receivables

|

8,053

|

(8,240

|

)

|

|||||

|

- Contract assets

|

(2,330

|

)

|

-

|

|||||

|

- Inventories

|

(1,306

|

)

|

2,231

|

|||||

|

- Other assets

|

1,209

|

(533

|

)

|

|||||

|

Increase/(decrease) in liabilities:

|

||||||||

|

- Payables

|

7,229

|

(1,174

|

)

|

|||||

|

- Contract liabilities

|

1,722

|

781

|

||||||

|

- Deferred income

|

10,915

|

397

|

||||||

|

- Provisions

|

9,926

|

608

|

||||||

|

Cash used in operating activities

|

(52,482

|

)

|

(45,976

|

)

|

||||

|

Notes to the financial statements

|

| 4.2 |

Borrowings and other financial liabilities

|

|

Interest rate %

|

Maturity

|

2023

$’000

|

2022

$’000

|

||||||||||

|

Current borrowings at amortised cost

|

|||||||||||||

|

Secured

|

|||||||||||||

|

Working capital facility

|

7.44

|

%

|

May 2023

|

-

|

6,843

|

||||||||

|

Term loan

|

6.15

|

%

|

May 2023

|

-

|

2,889

|

||||||||

|

Letter of credit facility

|

6.45

|

%

|

May 2023

|

-

|

4,000

|

||||||||

|

-

|

13,732

|

||||||||||||

|

Unsecured

|

|||||||||||||

|

Term loan with customer

|

10.0

|

%

|

May 203

|

4,523

|

-

|

||||||||

|

Supplier finance arrangement

|

6% + RBA cash rate

|

9,306

|

4,954

|

||||||||||

|

13,829

|

18,686

|

||||||||||||

|

Non-current borrowings at amortised cost

|

|||||||||||||

|

Secured

|

|||||||||||||

|

Term loan

|

6.15

|

%

|

December 2024

|

-

|

4,333

|

||||||||

|

Term loan (USD)

|

8.50

|

%

|

May 2027

|

70,833

|

-

|

||||||||

|

70,833

|

4,333

|

||||||||||||

|

Notes to the financial statements

|

| • |

agreed thresholds for revenue, assessed monthly on a rolling trailing six month basis with specific agreed targets for each testing period, with the first testing period being the 6 months expiring June

30, 2023;

|

| • |

agreed thresholds for EBITDA, assessed monthly on a rolling trailing six month basis with specific agreed targets for each testing period, with the first testing period being the 6 months expiring June

30, 2023;

|

| • |

maximum capital expenditure (capex) limits, assessed monthly and initially assessed on a rolling trailing six month basis with specific agreed maximum capex for each testing period with the first

testing period being the 6 months expiring June 30, 2023, and moving to a rolling trailing 12 month basis in January 2024; and

|

| • |

liquidity ratios based on remaining months of liquidity (assessed monthly based on the monthly Adjusted EBITDA for the 3 most recent months) until the Adjusted EBITDA of the Group becomes positive,

following which the measure will be based on a current ratio.

|

|

Notes to the financial statements

|

| • |

failure to make a payment due under the agreement by the due date;

|

| • |

existence of circumstances which could result in a Material Adverse Effect;

|

| • |

a change in control of the Carbon Revolution Group (prior to the Business Combination);

|

| • |

events of insolvency, judgment debt, asset seizure and impairment of security;

|

| • |

material misrepresentation; and

|

| • |

if any portion of the guaranty ceases to be in full force and effect.

|

| 4.3 |

Financial risk management

|

| 4.3.1 |

Market risk

|

| a) |

Foreign currency risk

|

|

Notes to the financial statements

|

|

2023

|

EUR

$’000

|

USD

$’000

|

||||||

|

Cash and cash equivalent

|

1,037

|

11,213

|

||||||

|

Restricted trust fund

|

-

|

14,285

|

||||||

|

Trade receivables

|

2,409

|

400

|

||||||

|

Trade payables

|

(823

|

)

|

(961

|

)

|

||||

|

Supplier finance arrangement

|

(4,709

|

)

|

(414

|

)

|

||||

|

Borrowing

|

-

|

(90,645

|

)

|

|||||

|

Balance sheet exposure

|

(2,086

|

)

|

(66,122

|

)

|

||||

|

2022

|

EUR

$’000

|

USD

$’000

|

||||||

|

Trade receivables

|

5,650

|

-

|

||||||

|

Trade payables

|

(343

|

)

|

(233

|

)

|

||||

|

Supplier finance arrangement

|

(3,253

|

)

|

(13

|

)

|

||||

|

Balance sheet exposure

|

2,054

|

(246

|

)

|

|||||

|

2023

$’000

|

2022

$’000

|

|||||||

|

Net foreign exchange gain/(loss) included in other income/administration expense

|

(305

|

)

|

448

|

|||||

|

+/- 5% exchange rate

|

2023

$’000

|

2022

$’000

|

||||||

|

Impact on profit after tax

|

3,410

|

90

|

||||||

|

Impact on equity

|

(3,410

|

)

|

(90

|

)

|

||||

|

Notes to the financial statements

|

| b) |

Interest rate risk

|

|

Variable interest rate

|

Fixed interest rate

|

Total

|

||||||||||||||||||||||

|

2023

$’000

|

2022

$’000

|

2023

$’000

|

2022

$’000

|

2023

$’000

|

2022

$’000

|

|||||||||||||||||||

|

Financial assets

|

||||||||||||||||||||||||

|

Cash

|

19,582

|

22,301

|

-

|

-

|

19,582

|

22,301

|

||||||||||||||||||

|

Restricted trust fund

|

14,285

|

-

|

-

|

-

|

14,285

|

-

|

||||||||||||||||||

|

Short term deposits

|

-

|

-

|

392

|

392

|

392

|

392

|

||||||||||||||||||

|

Total financial assets

|

33,867

|

22,301

|

392

|

392

|

34,259

|

22,693

|

||||||||||||||||||

|

Financial liabilities

|

||||||||||||||||||||||||

|

Working capital facility

|

-

|

6,843

|

-

|

-

|

-

|

6,843

|

||||||||||||||||||

|

Term loan

|

-

|

-

|

4,523

|

-

|

4,523

|

-

|

||||||||||||||||||

|

Supplier finance arrangement

|

9,306

|

-

|

-

|

4,954

|

9,306

|

4,954

|

||||||||||||||||||

|

Letter of credit facility

|

-

|

4,000

|

-

|

-

|

-

|

4,000

|

||||||||||||||||||

|

Term loan

|

-

|

7,222

|

-

|

-

|

-

|

7,222

|

||||||||||||||||||

|

Term loan (USD)

|

-

|

-

|

90,645

|

90,645

|

-

|

|||||||||||||||||||

|

Total financial liabilities

|

9,306

|

18,065

|

95,168

|

4,954

|

104,474

|

23,019

|

||||||||||||||||||

| c) |

Price risk

|

| 4.3.2 |

Credit risk

|

| 4.3.3 |

Liquidity risk

|

|

Notes to the financial statements

|

|

On demand

$’000

|

< 3 months

$’000

|

3-12 months

$’000

|

1-5 years

$’000

|

> 5 years

$’000

|

Total

$’000

|

|||||||||||||||||||

|

2023

|

||||||||||||||||||||||||

|

Supplier finance arrangement

|

9,130

|

-

|

-

|

-

|

-

|

9,130

|

||||||||||||||||||

|

Term loan

|

-

|

-

|

4,523

|

-

|

-

|

4,523

|

||||||||||||||||||

|

Lease liabilities

|

-

|

158

|

487

|

2,830

|

4,538

|

8,013

|

||||||||||||||||||

|

Term loan (USD)

|

-

|

-

|

-

|

90,645

|

-

|

90,645

|

||||||||||||||||||

|

9,130

|

158

|

5,010

|

93,475

|

4,538

|

112,311

|

|||||||||||||||||||

|

2022

|

||||||||||||||||||||||||

|

Working capital facility

|

-

|

6,843

|

-

|

-

|

-

|

6,843

|

||||||||||||||||||

|

Supplier finance arrangement

|

4,954

|

-

|

-

|

-

|

-

|

4,954

|

||||||||||||||||||

|

Letter of credit facility

|

-

|

-

|

4,000

|

-

|

-

|

4,000

|

||||||||||||||||||

|

Term loan

|

-

|

-

|

2,889

|

4,333

|

-

|

7,222

|

||||||||||||||||||

|

Lease liabilities

|

-

|

95

|

483

|

2,541

|

4,921

|

8,040

|

||||||||||||||||||

|

4,954

|

6,938

|

7,372

|

6,874

|

4,921

|

31,059

|

|||||||||||||||||||

| 4.3.4 |

Fair value risk

|

| 4.4 |

Contributed equity

|

|

30 June 2023

# Ordinary shares

|

30 June 2022

# Ordinary shares

|

30 June 2023

$’000

|

30 June 2022

$’000

|

|||||||||||||

|

Ordinary shares – fully paid

|

211,877,653

|

206,326,138

|

386,432

|

383,822

|

||||||||||||

|

Ordinary shares – restricted

|

274,852

|

527,889

|

-

|

-

|

||||||||||||

|

Total share capital

|

212,152,505

|

206,854,027

|

386,432

|

383,822

|

||||||||||||

|

2022

|

Date

|

# Shares

|

Issue Price

|

|

$’000

|

|||||||||

|

Balance

|

1 July 2021

|

205,421,449

|

381,890

|

|||||||||||

|

Shares issued under Employee Share Plan

|

904,689

|

1,932

|

||||||||||||

|

Balance of fully paid shares

|

30 June 2022

|

206,326,138

|

383,822

|

|||||||||||

|

2023

|

Date

|

# Shares

|

Issue Price

|

|

$’000

|

|||||||||

|

Balance

|

1 July 2022

|

206,326,138

|

383,822

|

|||||||||||

|

Shares issued under Employee Share Plan

|

5,551,515

|

2,610

|

||||||||||||

|

Balance of fully paid shares

|

30 June 2023

|

211,877,653

|

386,432

|

|||||||||||

|

Notes to the financial statements

|

| 4.4.1 |

Information about contributed equity

|

| 4.5 |

Share-based payment plan arrangements

|

| a) |

Elapse of three years from the date of grant; or

|

| b) |

Listing of the Company’s shares on the ASX or earlier release of exercise restrictions by the board.

|

|

2023

|

2022

|

|||||||

|

Grant date

|

-

|

Dec 2021

|

||||||

|

Number of employees granted shares

|

-

|

266

|

||||||

|

Value of shares granted per employee (on FTE and length of service pro-rata basis)

|

-

|

$

|

279-$1,000

|

|||||

|

Total number of shares

|

-

|

255,281

|

||||||

|

Fair value at grant date

|

-

|

$

|

1.01

|

|||||

|

Notes to the financial statements

|

| • |

Issue date 23 December 2019

|

| • |

Exercise price $2.60 (IPO price)

|

| • |

Vesting date – 23 December 2022

|

| • |

Term of 5 years (exercise window from 23 December 2022 to 23 December 2024)

|

|

Notes to the financial statements

|

| • |

Issue date 20 December 2021

|

| • |

Exercise price $1.60

|

| • |

Vesting date – 28 October 2024

|

| • |

Term of 5 years (exercise window from 28 October 2024 to 28 October 2026)

|

| 4.6 |

Reserves

|

|

2023

$’000

|

2022

$’000

|

|||||||

|

Share-based payments

|

7,695

|

7,214

|

||||||

|

Share buyback

|

(311

|

)

|

(311

|

)

|

||||

|

Foreign currency translation

|

(218

|

)

|

(156

|

)

|

||||

|

7,166

|

6,747

|

|||||||

| 4.6.1 |

Information about reserves

|

|

Notes to the financial statements

|

| 4.7 |

Transaction costs

|

|

2023

$’000

|

2022

$’000

|

|||||||

|

Transaction costs recognised in the profit and loss statement

|

24,746

|

-

|

||||||

|

Transaction costs recognised in trade payables

|

541

|

-

|

||||||

|

Transaction costs recognised in accruals

|

5,716

|

-

|

||||||

|

Transaction costs recognised in provisions

|

9,459

|

-

|

||||||

|

Transaction costs recognised in the operating cash flow

|

9,030

|

-

|

||||||

|

Notes to the financial statements

|

|

5

|

Taxes

|

| 5.1 |

Income tax expense

|

|

2023

$’000

|

2022

$’000

|

|||||||

|

Consolidated statements of profit or loss

|

||||||||

|

Current income tax charge/benefit

|

-

|

-

|

||||||

|

Adjustment for current tax relating to prior periods

|

-

|

-

|

||||||

|

Deferred income tax relating to the origination and reversal of temporary differences

|

-

|

-

|

||||||

|

-

|

-

|

|||||||

|

2023

$’000

|

2022

$’000

|

|||||||

|

The prima facie tax benefit on loss before tax differs from the income tax expense as follows:

|

||||||||

|

Accounting loss before tax

|

(79,223

|

)

|

(47,821

|

)

|

||||

|

Benefit at the Australian statutory income tax rate of 30% (2022: 30%)

|

23,767

|

14,346

|

||||||

|

Tax impact of:

|

||||||||

|

Non-deductible expenses

|

(4,859

|

)

|

(5,083

|

)