|

Name of Investor:

|

|||

|

By:

|

| |

|

|

Name:

|

| |

|

|

Title:

|

| |

|

|

|

| |

|

|

Name in which Shares are to be registered (if different):

|

|||

|

Investor’s EIN:

|

|||

|

Business Address-Street:

|

|||

|

City, State, Zip:

|

|||

|

Attn:

|

| |

|

|

Telephone No.:

|

|||

|

Facsimile No.:

|

|||

|

Number of Shares subscribed for:

|

|||

|

Aggregate Subscription Amount: $

|

|||

|

Cayman Islands*

|

| |

6770

|

| |

98-1575727

|

|

(State or other jurisdiction of

incorporation or organization)

|

| |

(Primary Standard Industrial

Classification Code Number)

|

| |

(I.R.S. Employer

Identification Number)

|

|

Paul T. Schnell, Esq.

Gregg A. Noel, Esq.

Maxim O. Mayer-Cesiano, Esq.

Michael J. Schwartz, Esq.

Skadden, Arps, Slate,

Meagher & Flom LLP

One Manhattan West

New York, NY 10001

(212) 735-3000

|

| |

R. Scott Shean, Esq.

B. Shayne Kennedy, Esq.

Andrew Clark, Esq.

Phillip S. Stoup, Esq.

Latham & Watkins LLP

650 Town Center Drive,

20th Floor

Costa Mesa, CA 92626

(714) 540-1235

|

| |

Daniel J. Espinoza, Esq.

W. Stuart Ogg, Esq.

Goodwin Procter LLP

601 Marshall Street

Redwood City, California

94062

(650) 752-3100

|

|

Large accelerated filer

|

| |

☐

|

| |

Accelerated filer

|

| |

☐

|

|

Non-accelerated filer

|

| |

☒

|

| |

Smaller reporting company

|

| |

☐

|

|

Emerging growth company

|

| |

☒

|

| |

|

| |

|

|

•

|

Proposal No. 1(a) — The Obagi Merger Proposal — to consider and vote upon a proposal

to approve by ordinary resolution and adopt the Agreement and Plan of Merger, dated as of November 15, 2021, by and among Waldencast, Obagi Merger Sub, Inc., a Cayman Islands exempted company limited by shares (“Merger Sub”), and Obagi

Global Holdings Limited, a Cayman Islands exempted company limited by shares (“Obagi”), a copy of which is attached to this proxy statement/prospectus statement as Annex A (as may be amended from time to time, the “Obagi Merger

Agreement”). The Obagi Merger Agreement provides, among other things, for the merger of Merger Sub with and into Obagi (the “Obagi Merger”), with Obagi surviving the Obagi Merger as a wholly owned subsidiary of Holdco 2 and an indirect

wholly owned subsidiary of Waldencast plc, in accordance with the terms and subject to the conditions of the Obagi Merger Agreement as more fully described elsewhere in this proxy statement/prospectus (the “Obagi Merger Proposal”);

|

|

•

|

Proposal No. 1(b) — The Milk

Transaction Proposal — to consider and vote upon a proposal to approve by ordinary resolution and adopt the Equity Purchase Agreement, dated as of November 15, 2021, by and among Waldencast, Obagi Holdco 1 Limited, a

limited company incorporated under the laws of Jersey (“Holdco 1”), Waldencast Partners LP, a Cayman Islands exempted limited partnership (“Waldencast LP” and together with Holdco 1, the “Milk Purchasers”), Milk, the members of Milk

(the “Milk Members”) and Shareholder Representative Services, LLC, a Colorado limited liability company, solely in its capacity as representative, agent and attorney-in-fact of the Milk Members (the “Equityholder Representative”), a

copy of which is attached to this proxy statement/prospectus as Annex B (as may be amended from time to time, the “Milk Equity Purchase Agreement”). The Milk Equity Purchase Agreement provides, among other things, for the purchase of

all of the issued and outstanding membership interests of Milk by the Milk Purchasers (the “Milk Transaction”), in accordance with the terms and subject to the conditions of the Milk Equity Purchase Agreement as more fully described

elsewhere in this proxy statement/prospectus (the “Milk Transaction Proposal” and together with the Obagi Merger Proposal, the “BCA Proposal”);

|

|

•

|

Proposal No. 2 — The Domestication Proposal — to consider and vote upon a proposal

to approve by special resolution, the change of Waldencast’s jurisdiction of incorporation by deregistering as an exempted company in the Cayman Islands and continuing and domesticating as a public limited company under the laws of

Jersey (the “Domestication” and, together with the Obagi Merger and Milk Transaction, the “Business Combination”) (the “Domestication Proposal”);

|

|

•

|

Organizational Documents Proposals — to consider and vote upon the following four

separate proposals (collectively, the “Organizational Documents Proposals”) to approve by special resolution, in the case of Organizational Documents Proposals A and D, and by ordinary resolution in the case of Organizational Documents

Proposals B and C, the following material differences between Waldencast’s Amended and Restated Memorandum and Articles of Association (as may be amended from time to time, the “Cayman Constitutional Documents”) and the proposed new

memorandum and articles of association of Waldencast plc (a public limited company incorporated in Jersey following the Domestication) upon the effective date of the Domestication attached to this proxy statement/prospectus as Annex G

(the “Proposed Constitutional

|

|

(A)

|

Proposal No. 3 — Organizational Documents Proposal A — to authorize

the change in the authorized share capital of Waldencast from 500,000,000 Class A ordinary shares, par value $0.0001 per share (the “Waldencast Class A ordinary shares”), 50,000,000 Class B ordinary shares, par value $0.0001 per share

(the “Waldencast Class B ordinary shares” and, together with the Class A ordinary shares, the “ordinary shares”), and 5,000,000 preferred shares, par value $0.0001 per share (the “Waldencast preferred shares”), to Class A ordinary

shares, par value $0.0001 per share, of Waldencast plc (the “Waldencast plc Class A ordinary shares”), Class B ordinary shares, par value $0.0001 per share, of Waldencast plc (the “Waldencast plc Non-Economic ordinary shares”) and

preference shares of a par value of $0.0001 per share of Waldencast plc (the “Waldencast plc preferred stock”) (“Organizational Documents Proposal A”);

|

|

(B)

|

Proposal No. 4 — Organizational Documents Proposal B — to provide that the board of directors of Waldencast plc (the “Waldencast plc Board”) be divided into three classes, with each class made up of, as nearly as may be possible, one-third of the total

number of directors constituting the entire Waldencast plc Board, with only one class of directors being elected in each year and each class serving a three-year term (“Organizational Documents Proposal B”);

|

|

(C)

|

Proposal No. 5 — Organizational Documents Proposal C — to provide that certain provisions of the Proposed Constitutional Document will be subject to the Investor Rights Agreement (as defined herein), including provisions governing the appointment, removal

and replacement of directors, with respect to which Cedarwalk Skincare Ltd., a Cayman Islands exempted company limited by shares, will have certain rights pursuant to the Investor Rights Agreement (“Organizational Documents Proposal

C”);

|

|

(D)

|

Proposal No. 6 — Organizational Documents

Proposal D — to authorize all other changes in connection with the replacement of the Cayman Constitutional Documents with the Proposed Constitutional Document in

connection with the consummation of the Business Combination (a copy of which is attached to this proxy statement/prospectus as Annex G), including (1)

changing the corporate name from “Waldencast Acquisition Corp.” to “Waldencast plc,” (2) making Waldencast plc’s existence for an unlimited duration and (3) removing certain provisions related to Waldencast plc’s

status as a blank check company that will no longer be applicable upon consummation of the Business Combination, all of which Waldencast’s board of directors believes is necessary to adequately address the needs of

Waldencast plc after the Business Combination (“Organizational Documents Proposal D”);

|

|

•

|

Proposal No. 7 — The Director Election Proposal — to consider and vote upon a

proposal to approve by ordinary resolution of the holders of Waldencast Class B ordinary shares, assuming the BCA Proposal, the Domestication Proposal and the Organizational Documents Proposals are approved, to elect nine directors who,

upon consummation of the Business Combination, will be the directors of Waldencast plc (the “Director Election Proposal”);

|

|

•

|

Proposal No. 8 — The Stock Issuance Proposal — to consider and vote upon a

proposal to approve by ordinary resolution for purposes of complying with the applicable provisions of The Nasdaq Stock Market Listing Rule 5635, the issuance of (a) Waldencast plc Class A ordinary shares to the PIPE Investors

(as defined herein) pursuant to the PIPE Investment (as defined herein) and the shareholders of Obagi (“Obagi Shareholders”) pursuant to the Obagi Merger Agreement and (b) units of Waldencast plc to each of Burwell Mountain Trust,

Dynamo Master Fund and Beauty Ventures LLC (the “Forward Purchasers”) pursuant to the Forward Purchase Transaction (as defined herein) (the “Stock Issuance Proposal”);

|

|

•

|

Proposal No. 9 — The Milk Issuance Proposal – to consider and vote upon a proposal

to approve by ordinary resolution the issuance of Waldencast plc Non-Economic ordinary shares and the reservation for issue of Waldencast plc Class A ordinary shares in exchange for Waldencast LP Common Units, in each case, to the Milk

Members (the “Milk Issuance Proposal”);

|

|

•

|

Proposal No. 10 — The Incentive Award Plan Proposal — to consider and vote upon a

proposal to approve by ordinary resolution, the Waldencast plc 2022 Incentive Award Plan, which is the omnibus equity incentive plan of Waldencast plc (the “Incentive Award Plan Proposal”, and together with the BCA Proposal, the

Domestication Proposal, the Organizational Documents Proposals, the Director Election Proposal, the Stock Issuance Proposal and the Milk Issuance Proposal, the “Condition Precedent Proposals”); and

|

|

•

|

Proposal No. 11 — The Adjournment Proposal — to consider and vote upon a proposal to

approve the adjournment of the extraordinary general meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for the approval of one or more

proposals at the extraordinary general meeting (the “Adjournment Proposal”).

|

|

(i)

|

(a) hold public shares, or (b) hold public shares through units and you elect to separate your units into the underlying

public shares and public warrants prior to exercising your redemption rights with respect to the public shares;

|

|

(ii)

|

submit a written request to Continental Stock Transfer & Trust Company (“Continental”), Waldencast’s transfer agent, that

Waldencast plc redeem all or a portion of your public shares for cash; and

|

|

(iii)

|

deliver your public shares to Continental, Waldencast’s transfer agent, physically or electronically through The Depository

Trust Company (“DTC”).

|

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | |

|

•

|

“affiliate” or “Affiliate” means, with respect to any specified Person, any Person that, directly or indirectly, controls, is

controlled by, or is under common control with, such specified Person, whether through one or more intermediaries or otherwise. The term “control” (including the terms “controlling,” “controlled by” and “under common control with”)

means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise;

|

|

•

|

“Affiliate Agreements” means contracts (other than offer letters, employment agreements, bonus agreements, severance

agreements, separation agreements, employee non-competition agreements, employee confidentiality and invention assignment agreements, non-competition agreements, separation agreements, or any other agreement entered into in the ordinary

course or equity or incentive equity documents and Governing Documents) between Obagi and its subsidiaries, on the one hand, and Affiliates of Obagi or any of Obagi’s subsidiaries (other than Obagi Hong Kong, Clinactiv or any of their

respective subsidiaries), the officers and managers (or equivalents) of Obagi or any of Obagi’s subsidiaries, the shareholders of Obagi or any of Obagi’s subsidiaries, any employee of Obagi or any of Obagi’s subsidiaries, a member of

the immediate family of the foregoing Persons, or Obagi Hong Kong, Clinactiv or any of their respective subsidiaries;

|

|

•

|

“Aggregate Fully Diluted Milk Common Units” means, without duplication, the aggregate number of shares of Milk Common Units

that are (i) issued and outstanding immediately prior to the Milk Transaction Effective Time, (ii) issuable upon the exchange of Milk Preferred Units that are outstanding immediately prior to the Milk Transaction Effective Time,

(iii) issuable upon the exercise of Milk Options and Milk UARs (whether or not then vested or exercisable) that are outstanding immediately prior to the Milk Transaction Effective Time and (iv) issuable upon the exercise of the Milk

Warrants that are outstanding immediately prior to the Milk Transaction Effective Time; provided that any Milk Option and Milk UAR with an exercise or strike price, as applicable, equal to or greater than the Milk Per Unit Transaction

Consideration shall not be counted for purposes of determining the number of Aggregate Fully Diluted Milk Common Units;

|

|

•

|

“Aggregate Fully Diluted Obagi Common Shares” means, without duplication, (a) the aggregate number of shares of Obagi Common

Stock that are (i) issued and outstanding immediately prior to the Obagi Merger Effective Time, or (ii) issuable upon the exercise of Obagi Options (whether or not then vested or exercisable) that are outstanding immediately prior to

the Obagi Merger Effective Time or (iii) issuable upon the settlement of Obagi RSUs (whether or not then vested) that are outstanding immediately prior to the Obagi Merger Effective Time, minus

(b) any shares of Obagi Common Stock held in the treasury of Obagi as of immediately prior to the Obagi Merger Effective Time; provided that any Obagi Option with an exercise price equal to or greater than the product obtained by multiplying (A) the Obagi Exchange Ratio by (B) $10.00 (the “Obagi Per Share Merger Consideration”) shall not be counted for purposes of determining the number of Aggregate Fully Diluted Obagi Common

Shares;

|

|

•

|

“Aggregate Milk Option Exercise Price” means the aggregate amount that would have been received by Milk if each Milk Option

outstanding immediately prior to the Milk Transaction Effective Time had been exercised as of such time;

|

|

•

|

“Aggregate Milk Transaction Consideration” means the Milk Equity Consideration plus

the Milk Cash Consideration plus the Waldencast plc Non-Economic ordinary shares;

|

|

•

|

“Aggregate Milk UAR Strike Price” means the aggregate grant date fair market value of shares subject to the Milk UARs;

|

|

•

|

“Aggregate Milk Warrant Exercise Price” means the aggregate amount that would have been received by Milk if each Milk Warrant

outstanding immediately prior to the Milk Transaction Effective Time had been exercised as of such time;

|

|

•

|

“Aggregate Obagi Option Exercise Price” means the aggregate amount that would have been received by Obagi if each Obagi

Option outstanding immediately prior to the Obagi Merger Effective Time had been exercised as of such time;

|

|

•

|

“Amended and Restated Waldencast Partners LP Agreement” means the amended and restated limited partnership agreement of

Waldencast LP;

|

|

•

|

“Antitrust Authorities” means the Antitrust Division of the U.S. Department of Justice, the U.S. Federal Trade Commission or

the antitrust or competition law authorities of any other jurisdiction (whether the U.S., foreign or multinational);

|

|

•

|

“Beauty Ventures” means Beauty Ventures LLC, which is managed by the Sponsor;

|

|

•

|

“Business Combination” means the Obagi Merger, the Milk Transaction and the Domestication;

|

|

•

|

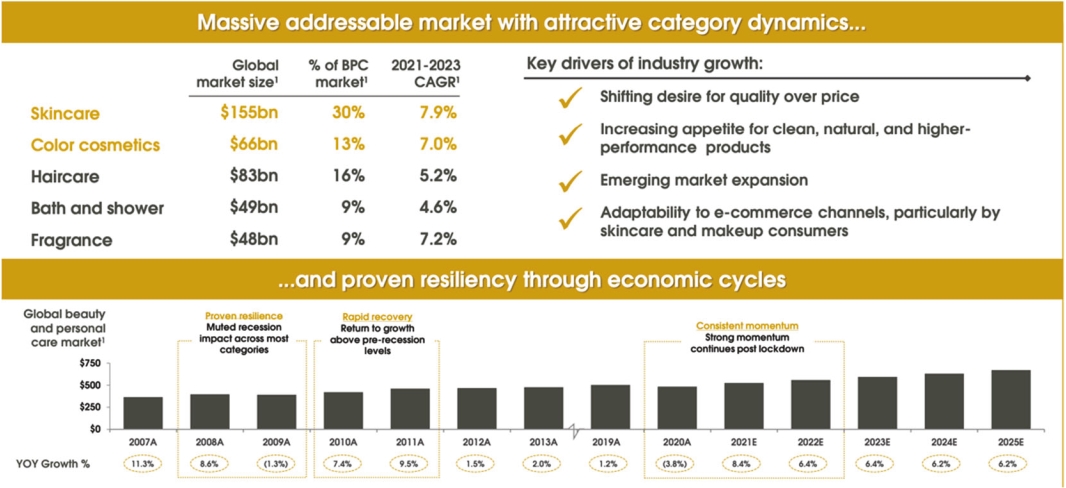

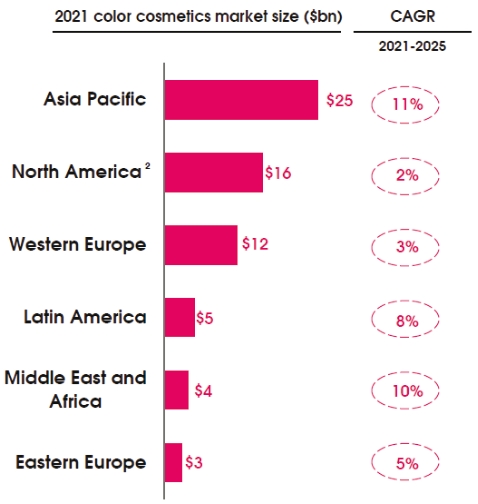

“CAGR” means compound annual growth rate;

|

|

•

|

“Cayman Constitutional Documents” means Waldencast’s amended and restated memorandum and articles of association (as the same

may be amended from time to time as permitted hereby prior to the Domestication);

|

|

•

|

“Cayman Islands Companies Act” means the Cayman Islands Companies Act (As Revised);

|

|

•

|

“Cayman Registrar” means the Cayman Registrar of Companies under the Companies Act (As Revised) of the Cayman Islands;

|

|

•

|

“Cedarwalk” means Cedarwalk Skincare Ltd., a Cayman Islands exempted company limited by shares;

|

|

•

|

“cGMP” means current good manufacturing practices;

|

|

•

|

“China Region” means the People’s Republic of China, inclusive of the Hong Kong Special Administrative Region, the Macau

Special Administrative Region, and Taiwan;

|

|

•

|

“Clinactiv” means Clinactiv Technology Limited, a Cayman Islands exempted company limited by shares;

|

|

•

|

“Clinactiv Consent” means any consent required under the Obagi Existing Credit Agreement in order for Obagi to consummate the

Clinactiv Distribution without causing an event of default or mandatory prepayment event occurring thereunder;

|

|

•

|

“Clinactiv Distribution” means the distribution of all of the outstanding equity interests of Clinactiv to Cedarwalk in

accordance with a distribution agreement in a customary form by and among Obagi, Cedarwalk and Waldencast;

|

|

•

|

“Closing” means the Milk Closing and the Obagi Closing, together;

|

|

•

|

“Closing Date” means the Obagi Closing Date and the Milk Closing Date, together;

|

|

•

|

“Code” means the U.S. Internal Revenue Code of 1986, as amended;

|

|

•

|

“Condition Precedent Proposals” means, collectively, the BCA Proposal, the Domestication Proposal, the Organizational

Documents Proposals, the Director Election Proposal, the Stock Issuance Proposal, the Milk Issuance Proposal and the Incentive Award Plan Proposal;

|

|

•

|

“Continental” means Continental Stock Transfer & Trust Company;

|

|

•

|

“contracts” means all legally binding contracts, agreements, arrangements or undertakings (including memorandums of

understanding and letters of understanding), subcontracts, leases, licenses, subleases, deeds, commitments, mortgages, purchase orders, work orders, task orders and guaranties, in each case, whether written or oral;

|

|

•

|

“COVID-19” means SARS-CoV-2 or COVID-19, and any evolutions or mutations thereof or related or associated epidemics,

pandemics or disease outbreaks;

|

|

•

|

“Dai Family” means Yumin Dai, Sijue (Steven) Dai, Sicong (Simon) Dai, any of their spouses, lineal descendants or ancestors,

and the respective heirs, executors and controlled investment affiliates of each of the foregoing;

|

|

•

|

“Distribution Agreements” means the distribution agreement between Obagi Holdings and Obagi, and the distribution agreement

between Obagi and Cedarwalk, in each case, pursuant to the Obagi China Distribution;

|

|

•

|

“Dollars” or “$” means lawful money of the U.S.;

|

|

•

|

“Domestication” means the domestication by way of continuance of Waldencast as a Jersey public limited company and

deregistration in the Cayman Islands in accordance with Part 18C of the Jersey Companies Law and the Cayman Islands Companies Act;

|

|

•

|

“DTC” means The Depository Trust Company;

|

|

•

|

“Equityholder Representative” means Shareholder Representative Services LLC, a Colorado limited liability company;

|

|

•

|

“Exchange Act” means the Securities Exchange Act of 1934, as amended;

|

|

•

|

“Financing Expenses” has the meaning specified in the definition of Waldencast Transaction Expenses;

|

|

•

|

“Forward Purchaser” means each of Burwell Mountain Trust, Dynamo Master Fund, and Beauty Ventures;

|

|

•

|

“Forward Purchase Agreements” means the Third-Party Forward Purchase Agreement and the Sponsor Forward Purchase Agreement,

together;

|

|

•

|

“Forward Purchase Amount” means $333.0 million;

|

|

•

|

“Forward Purchase Transaction” means the transactions pursuant to the Third-Party Forward Purchase Agreement and the Sponsor

Forward Purchase Agreement, together;

|

|

•

|

“founder shares” means the Waldencast Class B ordinary shares purchased by the Sponsor in a private placement prior to the

initial public offering, and the Waldencast Class A ordinary shares that will be issued upon the conversion thereof;

|

|

•

|

“GAAP” means generally accepted accounting principles in the U.S.;

|

|

•

|

“Governing Documents” means the legal document(s) by which any Person (other than an individual) establishes its legal

existence or which govern its internal affairs. For example, the “Governing Documents” of a corporation are its certificate of incorporation and by-laws, the “Governing Documents” of a limited partnership are its limited partnership

agreement and certificate of limited partnership, the “Governing Documents” of a limited liability company are its operating agreement and certificate of formation, the “Governing Documents” of an exempted company are its memorandum and

articles of association and the “Governing Documents” of a Jersey company are its memorandum and articles of association;

|

|

•

|

“Governmental Authority” means any federal, state, provincial, municipal, local or foreign government, governmental

authority, regulatory or administrative agency, governmental commission, department, board, bureau, agency or instrumentality, court or tribunal, or arbitrator;

|

|

•

|

“Governmental Order” means any order, judgment, injunction, decree, writ, stipulation, determination or award entered by or

with any Governmental Authority;

|

|

•

|

“Holdco 1” means Obagi Holdco 1 Limited, a private limited company incorporated under the laws of Jersey;

|

|

•

|

“Holdco 2” means Obagi Holdco 2 Limited, a private limited company incorporated under the laws of Jersey;

|

|

•

|

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations

promulgated thereunder;

|

|

•

|

“indebtedness” means with respect to any Person, without duplication, any obligations, contingent or otherwise, in respect of

(a) the principal of and premium (if any) in respect of any indebtedness for borrowed money, including accrued interest and any per diem interest accruals or cost associated with prepaying any such indebtedness solely to the extent such

indebtedness is prepaid, (b) amounts drawn on letters of credit, bank guarantees, bankers’ acceptances and other similar instruments (solely to the extent such amounts have actually been drawn), (c) the principal of and premium (if any)

in respect of obligations evidenced by bonds, debentures, notes and similar instruments, (d) the termination value of interest rate protection agreements and currency obligation swaps, hedges or similar arrangements (without duplication

|

|

•

|

“Initial PIPE Investment” means the purchase of Waldencast plc Class A ordinary shares pursuant to the Initial

Subscription Agreements;

|

|

•

|

“initial public offering” means Waldencast’s initial public offering that was consummated on March 18, 2021;

|

|

•

|

“Initial Subscription Agreements” means the subscription agreements executed on or prior to November 14, 2021, pursuant to

which the Initial PIPE Investment will be consummated;

|

|

•

|

“Investor Directors” means Sarah Brown, Juliette Hickman, Lindsay Pattison and Zach Werner;

|

|

•

|

“Investor Rights Agreement” means the Investor Rights Agreement, to be entered into by and among Waldencast, Cedarwalk, the

Sponsor and the guarantor of Cedarwalk’s obligations thereunder;

|

|

•

|

“IP License Agreement” means the intellectual property license agreement, and side letter to the same agreement, to be

entered by and among Obagi China Distribution, Obagi Worldwide and Obagi Hong Kong;

|

|

•

|

“IPO Registration Statement” means the Registration Statement on Form S-1 (333-253370) filed by Waldencast in connection with

its initial public offering, which became effective on March 15, 2021;

|

|

•

|

“IRS” means the U.S. Internal Revenue Service;

|

|

•

|

“Jersey Companies Law” means the Companies (Jersey) Law 1991, as amended;

|

|

•

|

“Jersey Registrar” means the Registrar of Companies in Jersey under the Jersey Companies Law;

|

|

•

|

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012;

|

|

•

|

“Letter Agreement” means that Letter Agreement, dated as of March 15, 2021, by and among Waldencast, the Sponsor and

certain other shareholders of Waldencast;

|

|

•

|

“Lock-Up Agreements” means the Obagi Lock-Up Agreement and the Milk Lock-Up Agreement, together;

|

|

•

|

“Merger Sub” means Obagi Merger Sub, Inc., a Cayman Islands exempted company limited by shares;

|

|

•

|

“Milk” means Milk Makeup LLC, a Delaware limited liability company;

|

|

•

|

“Milk Appreciation Rights Plan” means the Milk Makeup LLC Appreciation Rights Plan;

|

|

•

|

“Milk Award” means a Milk Option or a Milk UAR;

|

|

•

|

“Milk Cash Consideration” means an amount equal to $140.0 million, minus

the Milk Cash Consideration Reduction Amount, if any, minus $2.5 million, minus $0.05 million, to the extent actually paid

at Closing; provided that in no event will the Milk Cash Consideration equal less than zero dollars ($0.00);

|

|

•

|

“Milk Cash Consideration Reduction Amount” means:

|

|

(a)

|

if the Milk Closing Available Cash is equal to or greater than $630.0 million, an amount equal to zero dollars ($0.00); or

|

|

(b)

|

if the Milk Closing Available Cash is less than $630.0 million and greater than $615.0 million, an amount equal to (i) $630.0

million minus (ii) the Milk Closing Available Cash; or

|

|

(c)

|

if the Milk Closing Available Cash is equal to or less than $615.0 million and greater than $565.0 million, an amount equal

to (i) $15.0 million, plus (ii) 25% of the amount equal to (A) $615.0 million, minus (B) the Milk Closing Available Cash; or

|

|

(d)

|

if the Milk Closing Available Cash is equal to or less than $565.0 million, an amount equal to (i) $27.5 million, plus (ii) 50% of the amount equal to (A) $565.0 million, minus (B) the Milk Closing Available Cash; provided, however, that under no circumstance shall the

Milk Cash Consideration Reduction Amount be negative;

|

|

•

|

“Milk Closing” means the closing of the transactions contemplated by the Milk Equity Purchase Agreement;

|

|

•

|

“Milk Closing Available Cash” means the sum of (w) the cash remaining in the Trust Account (after giving effect to the

Waldencast/Milk Share Redemptions (if any)), plus (x) the PIPE Investment Amount actually received by Waldencast prior to or substantially concurrently with the Closing, plus (y) the Forward Purchase Amount actually received by Waldencast prior to or substantially concurrently with the Milk Closing, plus (z) the cash and cash

equivalents of Waldencast, Milk and Obagi and their respective subsidiaries, including the proceeds of any indebtedness incurred after the date hereof (other than any indebtedness of up to $125.0 million to refinance the Obagi Existing

Credit Agreement) or convertible note or other offering (in the case of Waldencast and its subsidiaries, excluding any cash already covered by clauses (w), (x) or (y) above), in each case, as of the Milk Closing;

|

|

•

|

“Milk Closing Date” means the date on which the Milk Closing actually occurs;

|

|

•

|

“Milk Common Units” means the authorized issued and outstanding common units of Milk;

|

|

•

|

“Milk Confidentiality Agreement” means the Confidentiality Agreement, dated as of June 27, 2021, between Waldencast and Milk,

as amended by the Confidentiality Agreement Side Letter, dated as of August 11, 2021, between Waldencast and Milk;

|

|

•

|

“Milk Equity Consideration” means a number of Waldencast LP Common Units equal to (x) the Total Implied Milk Equity

Consideration, minus (y) a number of units of Waldencast LP Common Units equal to the quotient obtained by dividing (A) the Milk Cash Consideration by (B) $10.00;

|

|

•

|

“Milk Equity Interests” means the Milk Awards, Milk Membership Units and the Milk Warrants, collectively;

|

|

•

|

“Milk Equity Purchase Agreement” means the Equity Purchase Agreement, dated as of November 15, 2021, by and among Waldencast,

Waldencast LP, Holdco 1, Milk, the Milk Members and the Equityholder Representative, a copy of which is attached to this proxy statement/prospectus as Annex B;

|

|

•

|

“Milk Exchange Ratio” means the ratio equal to (i) the number of Waldencast ordinary shares equal to the number of Waldencast

LP Common Units constituting the Total Implied Milk Equity Consideration divided by (ii) the number of Aggregate Fully Diluted Milk Common Units;

|

|

•

|

“Milk Existing Credit Agreement” means the Loan and Security Agreement, dated as of October 10, 2019 (as amended by that

certain First Amendment and Waiver to Loan and Security Agreement, dated as of May 4, 2020, that certain Second Amendment to Loan and Security Agreement, dated as of November 27, 2020, that certain Third Amendment to Loan and Security

Agreement, dated as of February 25, 2021, and that certain Fourth Amendment to Loan and Security Agreement, dated as of April 8, 2021), by and between Milk, as borrower, and PWB;

|

|

•

|

“Milk LLC Agreement” means the Fifth Amended and Restated Operating Agreement of Milk, dated as of November 5, 2021;

|

|

•

|

“Milk Lock-Up Agreement” means each of the lock-up agreements to be entered into between Waldencast plc and each of the

Milk Members entering into such lock-up agreements;

|

|

•

|

“Milk Members” means the preferred and common members of Milk;

|

|

•

|

“Milk Membership Units” means the Milk Common Units and the Milk Preferred Units, collectively;

|

|

•

|

“Milk Option” means an option to purchase a Milk Common Unit;

|

|

•

|

“Milk Per Unit Transaction Consideration” means the product obtained by multiplying

(i) the Milk Exchange Ratio by (ii) $10.00;

|

|

•

|

“Milk Pre-Closing Restructuring” means certain distribution by direct and indirect holders of certain Milk Membership Units

to occur prior to the Milk Closing;

|

|

•

|

“Milk Preferred Units” means the authorized preferred units of Milk, comprised of the Milk Series A Preferred Units, Milk

Series B Preferred Units, Milk Series C Preferred Units and Milk Series D Preferred Units;

|

|

•

|

“Milk Purchasers” means Waldencast LP and Holdco 1 together;

|

|

•

|

“Milk Series A Preferred Units” means the authorized, issued and outstanding Milk Preferred Units designated as Series A

Preferred Units pursuant to the Milk LLC Agreement;

|

|

•

|

“Milk Series B Preferred Units” means the authorized, issued and outstanding Milk Preferred Units designated as Series B

Preferred Units pursuant to the Milk LLC Agreement;

|

|

•

|

“Milk Series C Preferred Units” means the authorized, issued and outstanding Milk Preferred Units designated as Series C

Preferred Units pursuant to the Milk LLC Agreement;

|

|

•

|

“Milk Series D Preferred Units” means the authorized, issued and outstanding Milk Preferred Units designated as Series D

Preferred Units pursuant to the Milk LLC Agreement;

|

|

•

|

“Milk Sponsor Support Agreement” means that certain Sponsor Support Agreement, dated as of the date of the Milk Equity

Purchase Agreement, by and among the Sponsor, Waldencast and Milk, as amended or modified from time to time;

|

|

•

|

“Milk Transaction” means the Milk Purchasers’ acquisition from the Milk Members, and the Milk Members’ sale to the Milk

Purchasers, of all of the issued and outstanding Milk Membership Units representing all of the issued and outstanding membership interests of Milk in exchange for the Milk Cash Consideration, the Milk Equity Consideration and the

Waldencast plc Non-Economic ordinary shares;

|

|

•

|

“Milk Transaction Effective Time” means the time at which the Milk Closing shall be deemed effective;

|

|

•

|

“Milk Transaction Expenses” means the following out-of-pocket fees and expenses paid or payable by Milk or any of its

subsidiaries (whether or not billed or accrued for) as a result of or in connection with the negotiation, documentation and consummation of the transactions contemplated hereby: (a) all documented fees, costs, expenses, brokerage fees,

commissions, finders’ fees and disbursements of financial advisors, investment banks, data room administrators, attorneys, accountants and other advisors and service providers, (b) change-in-control payments, transaction bonuses,

retention payments, severance or similar compensatory payments payable by Milk or any of its subsidiaries to any current or former employee, independent contractor, officer or director of Milk or any of its subsidiaries as a result of

the transactions contemplated hereby (and not tied to any subsequent event or condition, such as a termination of employment), including the employer portion of payroll taxes arising therefrom, (c) the filing fees payable by Milk or any

of its subsidiaries to the Antitrust Authorities specified in Section 8.1(e) of the Milk Equity Purchase Agreement and (d) amounts owing or that may become owed, payable or otherwise due, directly or indirectly, by Milk or any of its

subsidiaries to any Affiliate of Milk or any of its subsidiaries in connection with negotiation, documentation or the consummation of the transactions contemplated hereby, including fees, costs and expenses related to the termination of

any Affiliate Agreement. For the avoidance of doubt, Milk Transaction Expenses shall not include any fees and expenses of the Milk Members or any expenses of Milk or its subsidiaries to the extent attributable to advice solely for the

benefit of Milk’s direct or indirect equityholders (rather than Milk or its subsidiaries);

|

|

•

|

“Milk UARs” means a unit appreciation right in respect of Milk Common Units issued pursuant to the Milk Appreciation Rights

Plan;

|

|

•

|

“Milk Warrants” means (i) the warrants to purchase the series of units issued on October 10, 2019, by Milk to PWB (as the

warrantholder), pursuant to which PWB was provided the right to exercise such warrants for 10,297 Milk Series C Preferred Units and (ii) the warrant to purchase the series of units issued on October 10, 2019, by Milk to PWB (as the

warrantholder), pursuant to which PWB was provided the right to exercise such warrants for 6,139 Milk Series D Preferred Units;

|

|

•

|

“Minimum Available Waldencast Cash Amount” means $50.0 million;

|

|

•

|

“Nasdaq” means The Nasdaq Stock Market LLC;

|

|

•

|

“Obagi” means Obagi Global Holdings Limited, a Cayman Islands exempted company limited by shares;

|

|

•

|

“Obagi Cash Consideration” means an amount equal to $380.0 million minus

the Obagi Cash Consideration Reduction Amount;

|

|

•

|

“Obagi Cash Consideration Reduction Amount” means

|

|

(a)

|

if (i) the Obagi Closing Available Cash is greater than $670.0 million and (ii) the amount of Obagi Transaction Expenses

exceeds $26.0 million (any excess, the “Obagi Transaction Expenses Overage”), an amount equal to the Obagi Transaction Expenses Overage;

|

|

(b)

|

if the Obagi Closing Available Cash is equal to or less than (i) $670.0 million, and greater than (ii) $630.0 million, an

amount equal to (A) $380.0 million, minus (B) the Obagi Closing Available Cash, plus (C) the Total Obagi Transaction Expenses, minus (D) the sum of the Waldencast Transaction Expenses and the Milk Transaction Expenses, plus (E) $35.0 million, plus

(F) $89.0 million, plus (G) $140.0 million, plus (H) the amount by which the Obagi Transaction Expenses are less than $26.0 million, if any;

|

|

(c)

|

if the Obagi Closing Available Cash is equal to or less than $630.0 million and greater than $615.0 million, an amount equal

to (i) $40.0 million, plus (ii) the Obagi Transaction Expenses Overage;

|

|

(d)

|

if the Obagi Closing Available Cash is equal to or less than $615.0 million and greater than $565.0 million, an amount equal

to (i) $40.0 million, plus (ii) the Obagi Transaction Expenses Overage, if any, plus (iii) 25% of the amount equal to (A) $340.0 million, minus (B) the Obagi Transaction Expenses Overage, if any, minus (C) the Obagi Closing Available Cash, plus (D)

the Total Obagi Transaction Expenses, plus (E) $89.0 million, plus (F) $140.0 million, minus (G) $15.0

million, minus (H) the sum of the Waldencast Transaction Expenses and the Milk Transaction Expenses, plus (I) $35.0 million, plus (J) the amount by which the Obagi Transaction Expenses are less than $26.0 million, if any; or

|

|

(e)

|

if the Obagi Closing Available Cash is equal to or less than $565.0 million, an amount equal to (i) $52.5 million, plus (ii) the Obagi Transaction Expenses Overage, if any, plus (iii) 50% of the amount equal to (A) $327.5 million, minus

(B) the Obagi Transaction Expenses Overage, if any, minus (C) the Obagi Available Cash, plus (D) the Total Obagi Transaction Expenses, plus (E) $89.0 million, plus (F) $140.0 million, minus (G) $52.5 million, minus

(H) the sum of the Waldencast Transaction Expenses and the Milk Transaction Expenses, plus (I) $35.0 million, plus (J) the amount by which the

Obagi Transaction Expenses are less than $26.0 million, if any;

|

|

•

|

“Obagi China Distribution” means collectively (a) the pre-Obagi Closing distribution by Obagi Holdco to Obagi and the

distribution by Obagi to Cedarwalk of all of the issued and outstanding shares of capital stock of Obagi Hong Kong and certain related assets pursuant to the Distribution Agreements, (b) the provision of certain transition services by

Obagi Cosmeceuticals and certain of its affiliates to Obagi Hong Kong, and the transactions related thereto, pursuant to the Transition Services Agreement, (c) the supply of products to Obagi Hong Kong for distribution and sale in the

China Region, and the transactions related thereto, pursuant to the Supply Agreement, (d) certain governance and stock purchase rights granted to Cedarwalk and Waldencast, as applicable, pursuant to the Investor Rights Agreement and

(e) the exclusive license of intellectual property pertaining to the Obagi brand by Obagi Worldwide to Obagi Hong Kong, and the transactions related thereto, pursuant to the IP License Agreement;

|

|

•

|

“Obagi Closing” means the closing of the transactions contemplated by the Obagi Merger Agreement;

|

|

•

|

“Obagi Closing Available Cash” means the sum of (w) the cash remaining in the Trust Account (after giving effect to the

Waldencast/Obagi Share Redemption (if any)), plus (x) the PIPE Investment Amount actually received by Waldencast prior to or substantially concurrently with the Obagi Closing, plus (y) the Forward Purchase Amount actually received by Waldencast prior to or substantially concurrently with the

|

|

•

|

“Obagi Closing Date” means the date on which the Obagi Closing actually occurs;

|

|

•

|

“Obagi Common Stock” means the shares in the capital of Obagi of par value US $0.50 each per share;

|

|

•

|

“Obagi Cosmeceuticals” means Obagi Cosmeceuticals LLC, a Delaware limited liability company;

|

|

•

|

“Obagi Exchange Ratio” means the ratio equal to (i) the number of Waldencast plc Class A ordinary shares constituting the

Total Implied Obagi Equity Consideration divided by (ii) the number of Aggregate Fully Diluted Obagi Common Shares;

|

|

•

|

“Obagi Existing Credit Agreement” means the Financing Agreement, dated as of March 16, 2021, by and among Obagi, as ultimate

parent, Obagi Holdco, as parent, Obagi Cosmeceuticals, as borrower, the subsidiary guarantors party thereto, the lenders from time to time party thereto and TCW Asset Management Company LLC, as collateral agent and administrative agent,

a copy of which is attached to this Registration Statement as Exhibit 10.29;

|

|

•

|

“Obagi Existing Credit Agreement Consent” means the consent to financing agreement, dated as of the date of Obagi Merger

Agreement, by and among, inter alia, the lenders party thereto, TCW Asset Management Company LLC, as collateral agent and administrative agent, Obagi Holdings, as parent, and Obagi Cosmeceuticals, as borrower;

|

|

•

|

“Obagi Group” means the shareholders or holders of other equity interests of Obagi and/or any of their respective directors,

members, partners, officers, employees or affiliates (other than Obagi);

|

|

•

|

“Obagi Holdco” means Obagi Holdings Company Limited, a Cayman Islands exempted company limited by shares;

|

|

•

|

“Obagi Hong Kong” means Obagi Hong Kong Limited;

|

|

•

|

“Obagi Lock-Up Agreement” means each of the lock-up agreements to be entered into between Waldencast plc and each of the

Obagi Shareholders entering into such lock-up agreements;

|

|

•

|

“Obagi Merger” means the merger of Merger Sub with and into Obagi, with Obagi surviving the merger as a wholly owned

subsidiary of Holdco 2;

|

|

•

|

“Obagi Merger Agreement” means that certain Agreement and Plan of Merger, dated as of November 15, 2021, by and among

Waldencast, Merger Sub and Obagi, a copy of which is attached to this proxy statement/prospectus as Annex A;

|

|

•

|

“Obagi Merger Effective Time” means the date and time the Obagi Merger becomes effective;

|

|

•

|

“Obagi Netherlands” means Obagi Netherlands B.V., a Netherlands private limited company (besloten

vennootschapand);

|

|

•

|

“Obagi Option” means an option to purchase Obagi Common Stock granted under the Obagi Stock Plan;

|

|

•

|

“Obagi Per Share Merger Consideration” means the product obtained by multiplying

(i) the Obagi Exchange Ratio by (ii) $10.00;

|

|

•

|

“Obagi Pre-Closing Restructuring” means the Obagi China Distribution and the Clinactiv Distribution;

|

|

•

|

“Obagi RSU” means a restricted stock unit issued in respect of Obagi Common Stock granted pursuant to the Obagi Stock Plan;

|

|

•

|

“Obagi Shareholders” means the shareholders of Obagi;

|

|

•

|

“Obagi Sponsor Support Agreement” means that certain Sponsor Support Agreement, dated November 15, 2021, by and among the

Sponsor, Waldencast, the Investor Directors and Obagi, as amended and modified from time to time;

|

|

•

|

“Obagi Stock Consideration” means a number of Waldencast plc ordinary shares equal to (x) the Total Implied Obagi Equity

Consideration, minus (y) a number of Waldencast plc ordinary shares equal to the quotient obtained by dividing (A) the Obagi Cash

Consideration by (B) $10.00;

|

|

•

|

“Obagi Stock Plan” means the Obagi Global Holdings Limited 2021 Stock Incentive Plan to be assumed by Waldencast at the Obagi

Merger Effective Time;

|

|

•

|

“Obagi Transaction Expenses” means the following out-of-pocket fees and expenses paid or payable by Obagi or any of its

subsidiaries (whether or not billed or accrued for) as a result of or in connection with the negotiation, documentation or consummation of the transactions contemplated by the Obagi Merger Agreement: (a) all documented fees, costs,

expenses, brokerage fees, commissions, finders’ fees and disbursements of financial advisors, investment banks, data room administrators, attorneys, accountants and other advisors and service providers; (b) change-in-control payments,

transaction bonuses, retention payments, severance or similar compensatory payments payable by Obagi or any of its subsidiaries to any current or former employee, independent contractor, officer or director of Obagi or any of its

subsidiaries as a result of the transactions contemplated by the Obagi Merger Agreement (and not tied to any subsequent event or condition, such as a termination of employment), including the employer portion of payroll taxes arising

therefrom; (c) the filing fees payable by Obagi or any of its subsidiaries to the Antitrust Authorities specified in Section 8.1(e) of the Obagi Merger Agreement; and (d) amounts owing or that may become owed, payable or otherwise due,

directly or indirectly, by Obagi or any of its subsidiaries to any affiliate of Obagi or any of its subsidiaries in connection with the negotiation, documentation or consummation of the transactions contemplated hereby, including fees,

costs and expenses related to the termination of any Affiliate Agreement. For the avoidance of doubt, Obagi Transaction Expenses shall not include any fees and expenses of Obagi’s Shareholders, any Up-C Transaction Expenses, any

Financing Expenses or any expenses of Obagi or its subsidiaries to the extent attributable to advice solely for the benefit of Obagi’s direct or indirect shareholders (rather than Obagi or its subsidiaries);

|

|

•

|

“Obagi Worldwide” means Obagi Cosmeceuticals and Obagi Holdings;

|

|

•

|

“ordinary shares” means the Waldencast Class A ordinary shares and the Waldencast Class B ordinary shares, collectively;

|

|

•

|

“Osibao Note” means the promissory noted dated July 30, 2021, of Osibao Cosmetics International Limited payable to the order

of Obagi Cosmeceuticals, LLC in the principal amount of $2.5 million;

|

|

•

|

“Person” means any individual, firm, corporation, partnership, exempted limited partnership, limited liability company,

exempted company, incorporated or unincorporated association, joint venture, joint stock company, Governmental Authority or instrumentality or other entity of any kind;

|

|

•

|

“PFIC” means a passive foreign investment company;

|

|

•

|

“PIPE Investment” means the purchase of shares of Waldencast plc pursuant to the Subscription Agreements;

|

|

•

|

“PIPE Investment Amount” means the aggregate gross purchase price received by Waldencast substantially concurrently with or

immediately following Closing for the shares in the PIPE Investment;

|

|

•

|

“PIPE Investors” means those certain investors participating in the purchase of shares of Waldencast plc pursuant to the

Subscription Agreements;

|

|

•

|

“private placement warrants” means the Waldencast plc private placement warrants outstanding as of the date of this proxy

statement/prospectus and the warrants of Waldencast plc issued as a matter of law upon the conversion thereof at the time of the Domestication;

|

|

•

|

“Proposed Constitutional Document” means the proposed memorandum and articles of association of Waldencast plc upon the

effective date of the Domestication attached to this proxy statement/prospectus as Annex G;

|

|

•

|

“public shareholders” means holders of public shares, whether acquired in Waldencast’s initial public offering or acquired in

the secondary market;

|

|

•

|

“public shares” means the Waldencast Class A ordinary shares (including those underlying the units) that were offered and

sold by Waldencast in its initial public offering and registered pursuant to the IPO Registration Statement or the Waldencast plc Class A ordinary shares issued as a matter of law upon the conversion thereof at the time of the

Domestication, as context requires;

|

|

•

|

“public warrants” means the redeemable warrants (including those underlying the units) that were offered and sold by

Waldencast in its initial public offering and registered pursuant to the IPO Registration Statement or the redeemable warrants of Waldencast plc issued as a matter of law upon the conversion thereof at the time of the Domestication, as

context requires;

|

|

•

|

“PWB” means Pacific Western Bank;

|

|

•

|

“Record Date” means , 2022;

|

|

•

|

“redemption” means each redemption of public shares for cash pursuant to the Cayman Constitutional Documents and the Proposed

Constitutional Document;

|

|

•

|

“Registration Rights Agreement” means the Amended and Restated Registration Rights Agreement to be entered into by and among

Waldencast plc, Sponsor, the Target Holders, the Investor Directors and the parties set forth on Schedule 2 thereto;

|

|

•

|

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002, as amended;

|

|

•

|

“SEC” means the U.S. Securities and Exchange Commission;

|

|

•

|

“Securities Act” means the Securities Act of 1933, as amended;

|

|

•

|

“Sponsor” means Waldencast Long-Term Capital LLC, a Cayman Islands limited liability company;

|

|

•

|

“Sponsor Forward Purchase Agreement” means the Forward Purchase Agreement initially entered into on February 22, 2021, by and

among Waldencast, the Sponsor and Dynamo Master Fund (a member of the Sponsor). On December 20, 2021, the Sponsor and Burwell Mountain Trust (a member of the Sponsor) entered into an assignment and assumption agreement, pursuant to

which the Sponsor assigned, and Burwell Mountain Trust assumed, all of the Sponsor’s rights and benefits as purchaser under the Sponsor Forward Purchase Agreement, including the right to purchase the Waldencast plc Units subscribed for

by the Sponsor;

|

|

•

|

“Sponsor Support Agreements” means the Obagi Sponsor Support Agreement and the Milk Sponsor Support Agreement, together;

|

|

•

|

“Stockholder Support Agreement” means that certain Support Agreement, dated November 15, 2021, by and among Waldencast,

Cedarwalk and Obagi, as amended and modified from time to time;

|

|

•

|

“Subscription Agreements” means the Initial Subscription Agreements and Subsequent Subscription Agreements pursuant to which

the PIPE Investment will be consummated;

|

|

•

|

“Subsequent PIPE Investment” means the purchase of Waldencast plc Class A ordinary shares pursuant to the Subsequent

Subscription Agreements;

|

|

•

|

“Subsequent Subscription Agreements” means the subscription agreements, if any, executed after November 15, 2021, and on or

prior to the Closing Date pursuant to which the Subsequent PIPE Investment will be consummated;

|

|

•

|

“subsidiary” means, with respect to any Person, any corporation, company, exempted company, limited liability company,

partnership, exempted limited partnership, association or other business entity of which the first Person: (a) owns, directly or indirectly, more than fifty percent (50%) of the equity securities or equity interests; (b) owns, directly

or indirectly, a majority of the total voting power of the equity securities or equity interests entitled to vote in the election of directors, managers or trustees thereof or other Persons performing similar functions; or (c) has a

right to appoint fifty percent (50%) or more of the directors or managers.

|

|

•

|

“Supply Agreement” means the Global Supply Services Agreement substantially in the form attached to the Obagi Merger

Agreement as Exhibit D (with such changes as may be agreed in writing by Obagi and Waldencast), to be entered into by and between Obagi Cosmeceuticals and Obagi Hong Kong;

|

|

•

|

“Target Holders” means, as of the date of the Registration Rights Agreement, the former shareholders and members,

respectively, of Obagi and Milk as set forth on Schedule 1 thereto;

|

|

•

|

“Third-Party Forward Purchase Agreement” means the Forward Purchase Agreement by and between Waldencast and Beauty

Ventures whereby, among other things, Beauty Ventures agreed to acquire Waldencast plc Units. The Sponsor is the managing member of Beauty Ventures. Members of the Sponsor or their affiliates will begin to receive a twenty percent

(20%) performance fee allocation on the return of the forward purchase securities in excess of the hurdle rate, calculated on the total return generated from forward purchase securities (whether by dividend, transfer or increase in

value as measured from date of issuance), when the return of such securities (less the expenses of Beauty Ventures) underlying the Third-Party Forward Purchase Agreement exceeds a hurdle rate of five percent (5%) accrued annually

until the fifth anniversary of the issuance of such securities. In the event of a transfer and subsequent sale of any forward purchase securities prior to such fifth anniversary, the performance fee for the period between such

transfer and such fifth anniversary will be calculated based on the proceeds generated by such sale;

|

|

•

|

“Total Implied Milk Equity Consideration” means a number of Waldencast LP Common Units equal to the quotient obtained by dividing (i) $340.0 million plus the Aggregate Milk Option Exercise Price plus

the Aggregate Milk UAR Strike Price plus the Aggregate Milk Warrant Exercise Price by (ii) $10.00;

|

|

•

|

“Total Implied Obagi Equity Consideration” means a number of Waldencast plc ordinary shares equal to the quotient obtained by

dividing (i) $655.0 million plus the Aggregate Obagi Option Exercise Price by (ii) $10.00;

|

|

•

|

“Total Obagi Transaction Expenses” means the Waldencast Transaction Expenses plus

the Obagi Transaction Expenses plus the Milk Transaction Expenses;

|

|

•

|

“Transaction Agreements” means the Obagi Merger Agreement together with the Milk Equity Purchase Agreement;

|

|

•

|

“Transaction Proposals” means, collectively, the Condition Precedent Proposals and the Adjournment Proposal;

|

|

•

|

“Transactions” means the Obagi Merger together with the Milk Transaction;

|

|

•

|

“transfer agent” means Continental, acting as transfer agent;

|

|

•

|

“Transition Services Agreement” means the transition services agreement to be entered by and among Obagi Cosmeceuticals,

certain of its affiliates, and Obagi Hong Kong;

|

|

•

|

“trust account” or “Trust Account” means the trust account established at the consummation of Waldencast’s initial public

offering at J.P. Morgan Chase Bank, N.A. and maintained by Continental, acting as trustee;

|

|

•

|

“Trust Agreement” means the Investment Management Trust Agreement, dated as of March 15, 2021, between Waldencast and

Continental, as trustee;

|

|

•

|

“Up-C Contributions” means Holdco 1’s contribution of its equity interests in (a) Milk to Waldencast LP in exchange for

limited partnership units in Waldencast LP and (b) Holdco 2 in exchange for limited partnership units in Waldencast LP;

|

|

•

|

“Up-C Transaction” means any action required to collectively structure the Obagi Merger and the Milk Transaction as what is

commonly referred to as an “Up-C transaction”;

|

|

•

|

“Up-C Transaction Expenses” means any documented fees and expenses, both internal or external, including those payable to

consultants, advisors (financial or otherwise), accountants, attorneys and service providers, incurred by the Company in connection with the Up-C Transaction;

|

|

•

|

“U.S. Holder” means a beneficial owner of Waldencast Class A ordinary shares or Waldencast plc Class A ordinary shares (as

the case may be) who or that is, for U.S. federal income tax purposes: (a) an individual citizen or resident of the U.S., (b) a corporation (or other entity that is treated as a corporation for U.S. federal income tax purposes) that is

created or organized (or treated as created or organized) in or under the laws of the U.S. or any state thereof or the District of Columbia, (c) an estate whose income is subject

|

|

•

|

“Waldencast” and the “Registrant” mean Waldencast Acquisition Corp., a Cayman Islands exempted company limited by shares,

prior to its migration and domestication as a public limited company incorporated under the laws of Jersey;

|

|

•

|

“Waldencast Class A ordinary shares” means Waldencast’s Class A ordinary shares, par value $0.0001 per share;

|

|

•

|

“Waldencast Class B ordinary shares” means Waldencast’s Class B ordinary shares, par value $0.0001 per share;

|

|

•

|

“Waldencast LP” means Waldencast Partners LP, a Cayman Islands exempted limited partnership;

|

|

•

|

“Waldencast LP Common Units” means limited partnership units of Waldencast LP that, in the case of such units issued as part

of, or in respect of, the Milk Equity Consideration, are redeemable at the option of the holder of such units and, if such option is exercised, exchangeable at the option of Waldencast plc for Waldencast plc Class A ordinary shares or

cash in accordance with the terms of the Amended and Restated Waldencast Partners LP Agreement;

|

|

•

|

“Waldencast/Milk Share Redemptions” means the election of an eligible (as determined in accordance with the Cayman

Constitutional Documents) holder of Waldencast Class A ordinary shares to redeem all or a portion of the ordinary shares held by such holder at a per-share price, payable in cash, equal to a pro rata share of the aggregate amount on

deposit in the Trust Account (including any interest earned on the funds held in the Trust Account) (as determined in accordance with the Cayman Constitutional Documents) in connection with the Transaction Proposals;

|

|

•

|

“Waldencast/Obagi Share Redemptions” means the election of an eligible (as determined in accordance with the Cayman

Constitutional Documents) holder of Waldencast Class A ordinary shares to redeem all or a portion of the ordinary shares held by such holder at a per-share price, payable in cash, equal to a pro rata share of the aggregate amount on

deposit in the Trust Account (including any interest earned on the funds held in the Trust Account) (as determined in accordance with the Cayman Constitutional Documents) in connection with the Transaction Proposals;

|

|

•

|

“Waldencast plc” means Waldencast after the Domestication and its name change from Waldencast Acquisition Corp. to Waldencast

plc;

|

|

•

|

“Waldencast plc 2022 Incentive Award Plan” means the omnibus equity incentive plan of Waldencast plc to be approved and

adopted by the board of directors of Waldencast, subject to the shareholders of Waldencast approving the BCA Proposal and the Domestication Proposal at the extraordinary general meeting to be effective prior to the Closing Date;

|

|

•

|

“Waldencast plc Board” means the board of directors of Waldencast plc;

|

|

•

|

“Waldencast plc Class A ordinary shares” means shares of Waldencast plc common stock, par value $0.0001 per share;

|

|

•

|

“Waldencast plc Non-Economic ordinary shares” means, after the Milk Closing, Class B ordinary fully paid shares in the

capital of Waldencast plc, par value $0.0001 per share, with such shares entitled to one vote per share, and no additional rights, including no economic rights;

|

|

•

|

“Waldencast plc Option” means an option to purchase Waldencast plc Class A ordinary shares;

|

|

•

|

“Waldencast plc ordinary shares” means the Waldencast plc Class A ordinary shares and the Waldencast plc Non-Economic

ordinary shares;

|

|

•

|

“Waldencast plc RSU” means a restricted stock unit with respect to Waldencast plc Class A ordinary shares;

|

|

•

|

“Waldencast plc SAR” means a stock appreciation right with respect to Waldencast plc Class A ordinary shares;

|

|

•

|

“Waldencast plc Units” means units of Waldencast plc;

|

|

•

|

“Waldencast plc warrant” means a warrant to acquire one Waldencast plc Class A ordinary share;

|

|

•

|

“Waldencast Transaction Expenses” means the following out-of-pocket fees and expenses paid or payable by Waldencast or any of

its affiliates (whether or not billed or accrued for) as a result of or in connection with the negotiation, documentation or consummation of the Obagi Merger: (a) all fees, costs, expenses, brokerage fees, commissions, finders’ fees and

disbursements of financial advisors, investment banks, data room administrators, attorneys, accountants and other advisors and service providers; (b) the filing fees payable by Waldencast or any of its subsidiaries to the Antitrust

Authorities as specified in Section 8.1(e) of the Obagi Merger Agreement; (c) all fees and expenses incurred in connection with preparing and filing this proxy statement/prospectus and obtaining approval of the Nasdaq under Section 7.3

of the Obagi Merger Agreement; (d) repayment of any Working Capital Loans; (e) any fees and expenses incurred in connection with the PIPE Investment; (f) any deferred underwriting commissions and other fees and expenses relating to

Waldencast’s initial public offering or operations; (g) any other fees and expenses as a result of or in connection with the negotiation, documentation or consummation of the transactions contemplated hereby; (h) the Up-C Transaction

Expenses; and (i) any other fees and expenses incurred in connection with (x) obtaining the consent of TCW Asset Management Company LLC and any other parties required under the terms of the Obagi Existing Credit Agreement to (A) enter

into and consummate the Obagi Merger and the transactions contemplated thereby or (B) permit any indebtedness outstanding under the Obagi Existing Credit Agreement to remain outstanding following the Closing, (y) any amendment to, or

refinancing of, the Obagi Existing Credit Agreement or (z) the incurrence of any new indebtedness, if requested by Waldencast (the “Financing Expenses”). Waldencast Transaction Expenses shall not include any fees and expenses of

Waldencast’s shareholders (other than Working Capital Loans);

|

|

•

|

“Waldencast units” and “units” mean the units of Waldencast, each unit representing one Waldencast Class A ordinary share and

one-third of one redeemable warrant to acquire one Waldencast Class A ordinary share, that were offered and sold by Waldencast in its initial public offering and registered pursuant to the IPO Registration Statement (less the number of

units that have been separated into the underlying public shares and underlying warrants upon the request of the holder thereof);

|

|

•

|

“warrants” means the public warrants and the private placement warrants; and

|

|

•

|

“Working Capital Loans” means any loan made to Waldencast by any of the Sponsor, an affiliate of the Sponsor, or any of

Waldencast’s officers or directors, and evidenced by a promissory note, for the purpose of financing costs incurred in connection with a Business Combination.

|

|

•

|

Waldencast’s ability to complete the Business Combination or, if Waldencast does not consummate such Business Combination,

any other initial business combination;

|

|

•

|

satisfaction or waiver (if applicable) of the conditions to the Obagi Merger, including, among other things:

|

|

•

|

the satisfaction or waiver of certain customary closing conditions, including, among others, (i) approval of the Obagi

Merger and related agreements and transactions by the respective shareholders of Waldencast and Obagi; (ii) effectiveness of the registration statement of which this proxy statement/prospectus forms a part (the “Registration

Statement”); (iii) obtainment, expiration or termination of the waiting period under the HSR Act, as applicable; (iv) the absence of any Governmental Order (as defined in the Obagi Merger Agreement) enjoining or otherwise prohibiting

the consummation of the Obagi Merger in the certain specified governing jurisdictions; provided that the Governmental Authority (as defined in the Obagi Merger Agreement) issuing such Governmental Order has jurisdiction over the

parties thereto with respect to the transactions contemplated thereby, or any law or regulation in such governing jurisdictions that would result in the consummation of the Obagi Merger being illegal or otherwise prohibited; (v) the

satisfaction of all closing conditions in the Milk Equity Purchase Agreement and the completion of the transactions contemplated thereby; (vi) that Waldencast have at least $5,000,001 of net tangible assets (inclusive of the PIPE

Investment Amount and the Forward Purchase Amount, in each case, actually received by Waldencast prior to or substantially concurrently with the Closing (as defined herein)) upon Closing; (vii) the completion of the domestication by

way of continuance of Waldencast as a Jersey public limited company and deregistration in the Cayman Islands in accordance with Part 18C of the Companies (Jersey) Law 1991, as amended (the “Jersey Companies Law”), and the Cayman

Islands Companies Act (As Revised) (the “Cayman Islands Companies Act”) (such domestication, the “Domestication”); (viii) the completion of the Obagi China Distribution and (ix) customary bringdown of the representations, warranties

and covenants of the parties therein;

|

|

•

|

the Obagi Cash Consideration equals or exceeds $327.5 million, minus the Obagi

Transaction Expenses Overage; and

|

|

•

|

the Minimum Available Waldencast Cash Amount equals or exceeds $50.0 million;

|

|

•

|

satisfaction or waiver (if applicable) of the conditions to the Milk Equity Purchase Agreement, including, among other

things:

|

|

•

|

the satisfaction or waiver of certain customary closing conditions, including, among others, (i) approval of the Milk

Transaction and related agreements and transactions by the shareholders of Waldencast; (ii) effectiveness of the Registration Statement (iii) obtainment, expiration or termination

|

|

•

|

the Milk Cash Consideration equals or exceeds $112.5 million; and

|

|

•

|

the Minimum Available Waldencast Cash Amount equals or exceeds $50.0 million;

|

|

•

|

the occurrence of any other event, change or other circumstances that could give rise to the termination of the Obagi Merger

Agreement or the Milk Equity Purchase Agreement;

|

|

•

|

the amount of redemptions by Waldencast’s public shareholders;

|

|

•

|

our ability to raise financing in the future;

|

|

•

|

the Sponsor and Waldencast’s directors and executive officers potentially having conflicts of interest with regard to the

Business Combination with Obagi and Milk;

|

|

•

|

exposure to unknown or contingent liabilities associated with Obagi and/or Milk;

|

|

•

|

the Sponsor’s election to purchase shares or warrants from public shareholders prior to the consummation of the Business

Combination;

|

|

•

|

the impact of the COVID-19 pandemic on our, Obagi’s and Milk’s ability to consummate the Business Combination, and on

Waldencast plc’s operations following the Business Combination;

|

|

•

|

our ability to develop and maintain an effective system of internal control over financial reporting and accurately report

our financial results in a timely manner;

|

|

•

|

the ability of Obagi and Milk to maintain and enhance their products and brands and to attract customers;

|

|

•

|

the ability of Obagi and Milk to execute their business models, including market acceptance of their planned products and

sufficient production volumes at acceptable quality levels and prices, protecting their proprietary rights and the success of strategic relationships with third parties; and

|

|

•

|

other factors detailed in the section entitled “Risk Factors.”

|

|

Q:

|

Why am I receiving this proxy statement/prospectus?

|

|

A:

|

Waldencast shareholders are being asked to consider and vote upon, among other proposals, a proposal to approve and adopt the

Transaction Agreements and approve the Business Combination. The Obagi Merger Agreement provides for, among other things, the merger of Merger Sub with and into Obagi, with Obagi surviving the merger as wholly owned subsidiary of Holdco

2 and an indirect wholly owned subsidiary of Waldencast plc, in accordance with the terms and subject to the conditions of the Obagi Merger Agreement as more fully described elsewhere in this proxy statement/prospectus. The Milk Equity

Purchase Agreement provides, among other things, for the purchase of all of the issued and outstanding membership interests of Milk by the Milk Purchasers, in accordance with the terms and subject to the conditions of the Milk Equity

Purchase Agreement as more fully described elsewhere in this proxy statement/prospectus. See the section entitled “BCA Proposal” for more detail.

|

|

Q:

|

What is the transaction structure?

|

|

A:

|

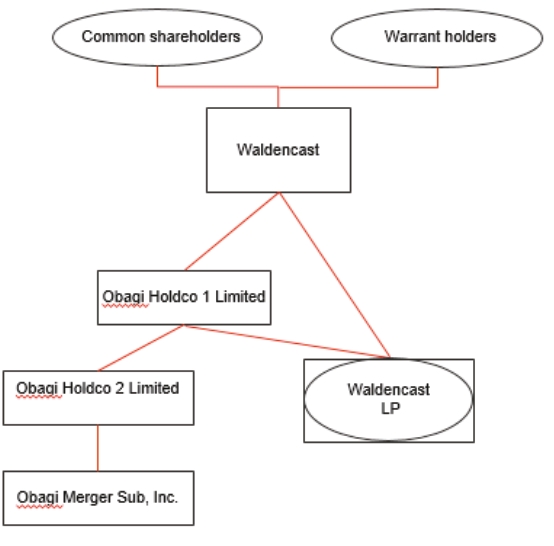

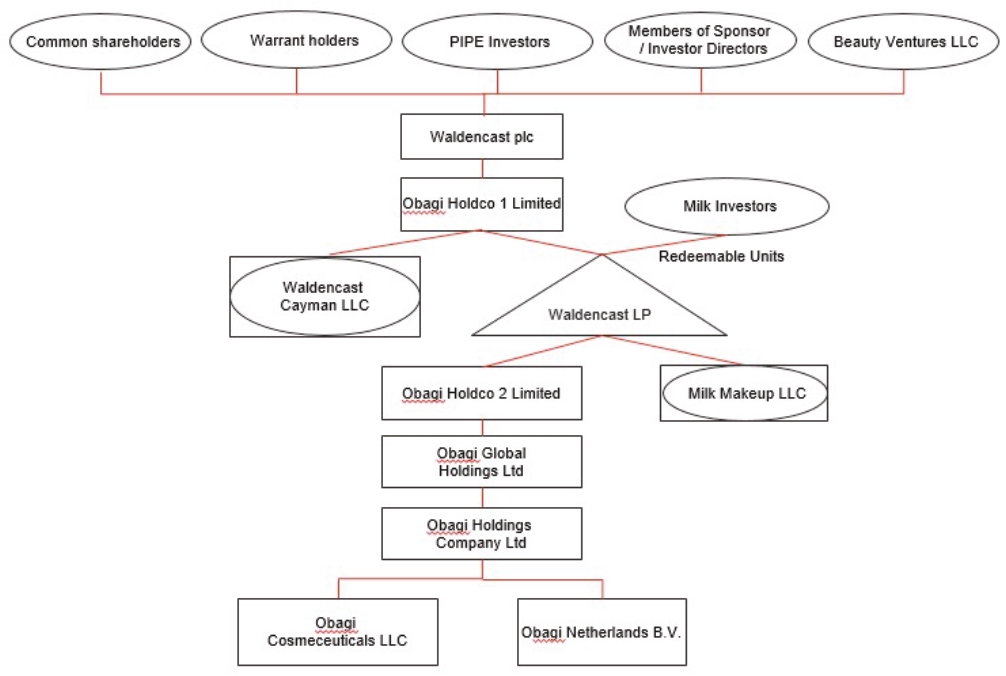

The current organizational structure of Waldencast is as follows:

|

|

Q:

|

What proposals are shareholders of Waldencast being asked to vote upon?

|

|

A:

|

At the extraordinary general meeting, Waldencast is asking holders of ordinary shares to consider and vote upon:

|

|

•

|

proposals to approve by ordinary resolution and adopt the Transaction Agreements;

|

|

•

|

a proposal to approve by special resolution the Domestication;

|

|

•

|

the following four separate proposals to approve by special resolution and ordinary resolution, as applicable and as more

fully described elsewhere in this proxy statement/prospectus, the following material differences between the Cayman Constitutional Documents and the Proposed Constitutional Document:

|

|

•

|

to authorize the change in the authorized share capital of Waldencast from (i) 500,000,000 Waldencast Class A ordinary

shares, 50,000,000 Waldencast Class B ordinary shares and 5,000,000 preferred shares, par value $0.0001 per share, to (ii) Waldencast plc Class A ordinary shares, Waldencast plc Non-Economic ordinary shares and shares of

Waldencast plc preferred stock, respectively;

|

|

•

|

to provide that the Waldencast plc Board be divided into three classes, with each class made up of, as nearly as may be

possible, one-third of the total number of directors constituting the entire Waldencast plc Board, with only one class of directors being elected in each year and each class serving a three-year term;

|

|

•

|

to provide that certain provisions of the Proposed Constitutional Document will be subject to the Investor Rights Agreement,

including provisions governing the appointment, removal and replacement of directors, with respect to which Cedarwalk will have certain rights pursuant to the Investor Rights Agreement; and

|

|

•

|

to authorize all other changes in connection with the replacement of the Cayman Constitutional Documents with the Proposed

Constitutional Document as part of the Domestication, including (1) changing the corporate name from “Waldencast Acquisition Corp.” to “Waldencast plc,” (2) making Waldencast plc’s existence for an unlimited duration and (3) removing

certain provisions related to Waldencast’s status as a blank check company that will no longer be applicable upon consummation of the Business Combination, all of which Waldencast’s board of directors believes is necessary to adequately